Washington D.C. Car Insurance

All drivers in DC are required to have both liability and uninsured/underinsured motorist coverage. Average Washington DC car insurance rates are $122 per month, but your rates may vary based on your age and your vehicle. Enter your ZIP code below to get your free Washington DC car insurance quotes.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 16, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 16, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- The District of Columbia is home to many of America’s most important monuments and what better state to have no-fault car insurance laws in than one where politicians are never to blame

- Currently, all drivers in DC are required to have both liability and uninsured/underinsured motorist coverage in place while owning a vehicle

- The secret to finding the best DC car insurance rates is to learn about coverage including policy deductibles, car insurance discounts, and types of coverage

The District of Columbia is home to many of America’s most important monuments and what better state to have no-fault car insurance laws in than one where politicians are never to blame.

Car insurance in DC operates under no-fault car insurance laws where drivers in a car accident are responsible for their own damage regardless of who was at fault.

This helps minimize nuisance lawsuits, provide faster claims processing and lower car insurance rates, however, no fault car insurance is a set of laws and not actual car insurance coverage.

All drivers in DC are required to obtain car insurance from a State licensed car insurance company or be subject to fines and/or suspension of a driver license suspension and/or vehicle registration tags.

Need DC Car Insurance Quotes? Find DC car insurance companies’ quotes by entering your zip code above.

DC Car Insurance Requirements

Currently, all drivers in DC are required to have both liability and uninsured/underinsured motorist coverage in place while owning a vehicle.

Should your car insurance coverage terminate you are required to notify the District of Columbia DMV immediately or be subject to heavy fines.

However, it should be noted that regardless of whether or not you notify the DMV all licensed car insurance companies are obligated by law to report any lapse or termination of coverage to the state. (For more information, read our “Best Car Insurance by State“).

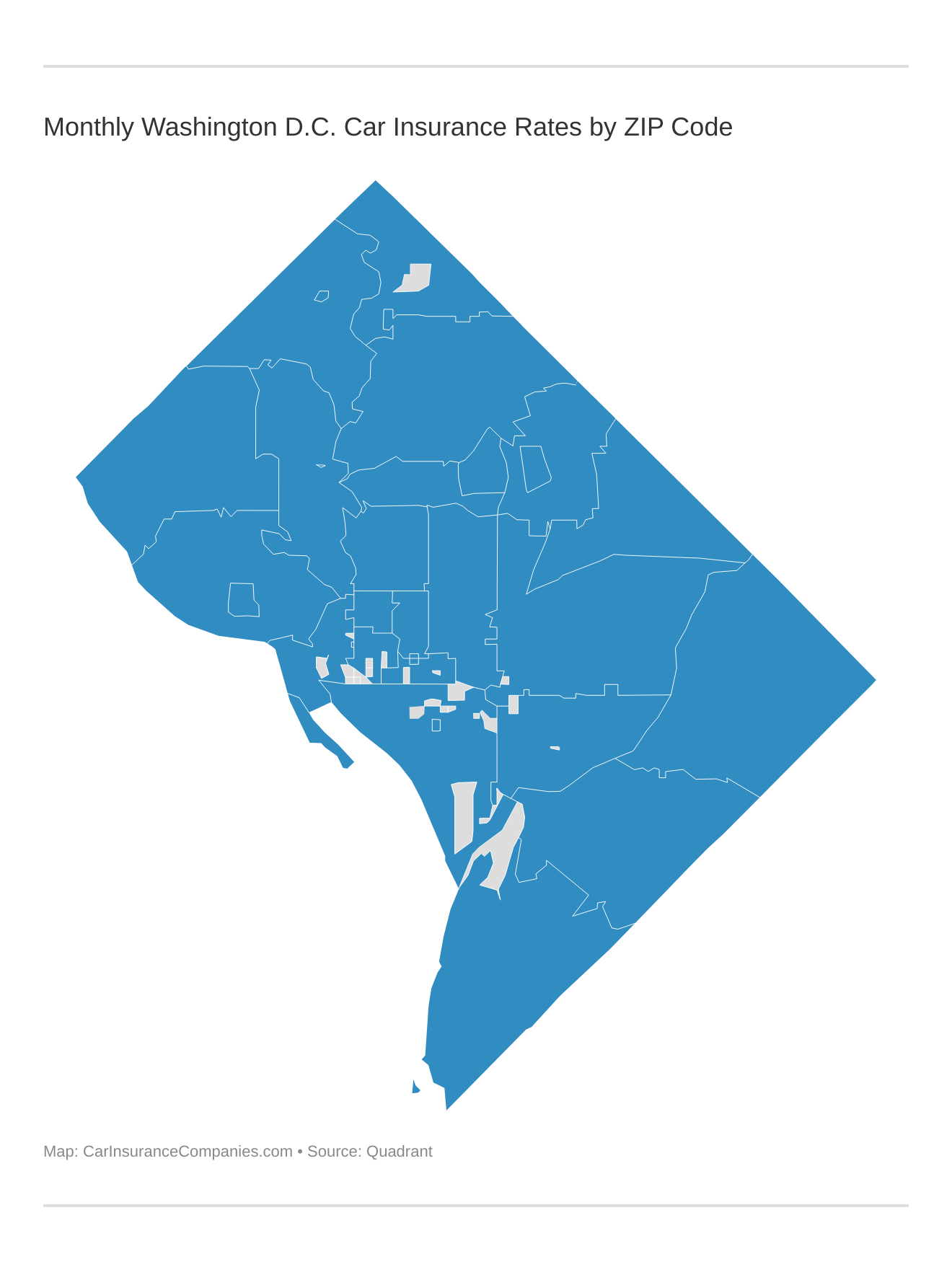

Monthly Washington D.C. Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your car insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly Washington D.C. auto insurance rates by ZIP Code below:

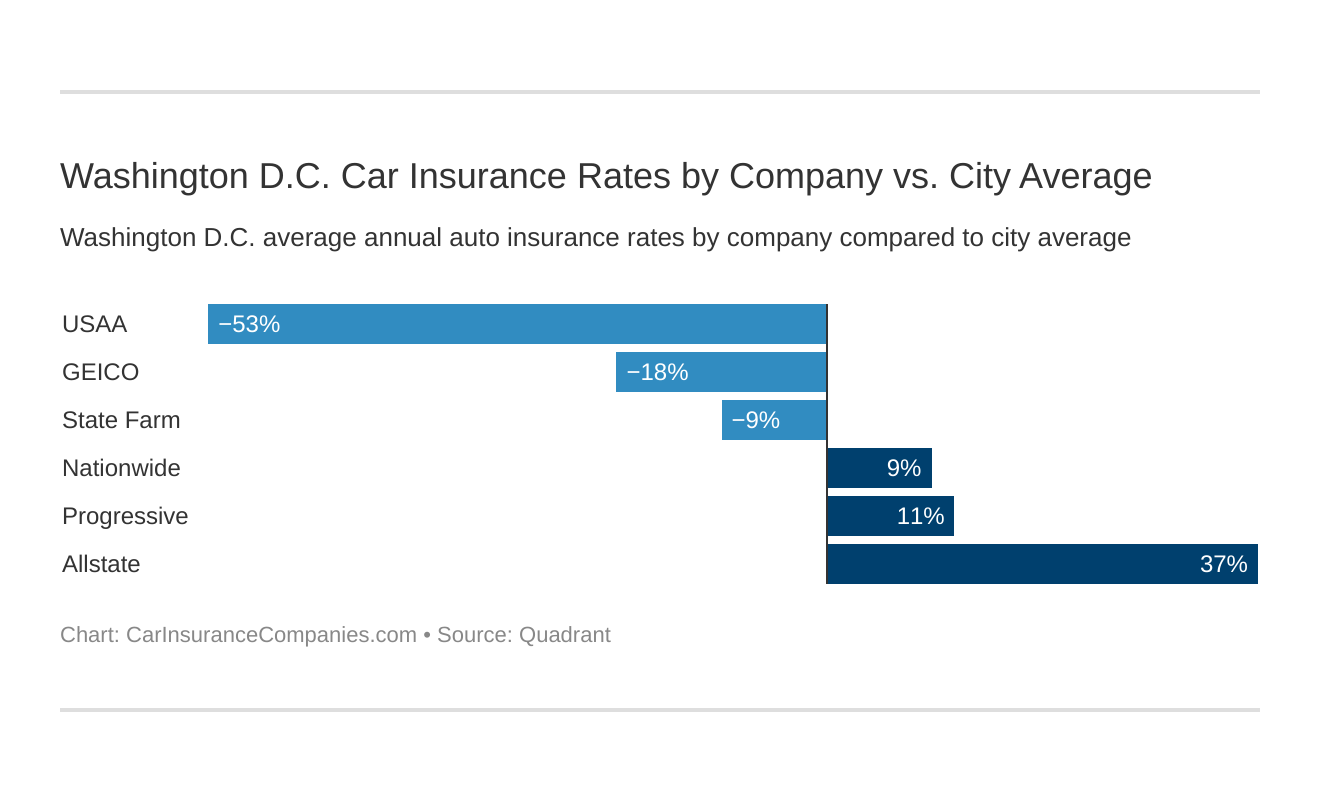

Washington D.C. Car Insurance Rates by Company vs. City Average

Which Washington D.C. car insurance company has the best rates? And how do those rates compare against the average District of Columbia car insurance company rates? We’ve got the answers below.

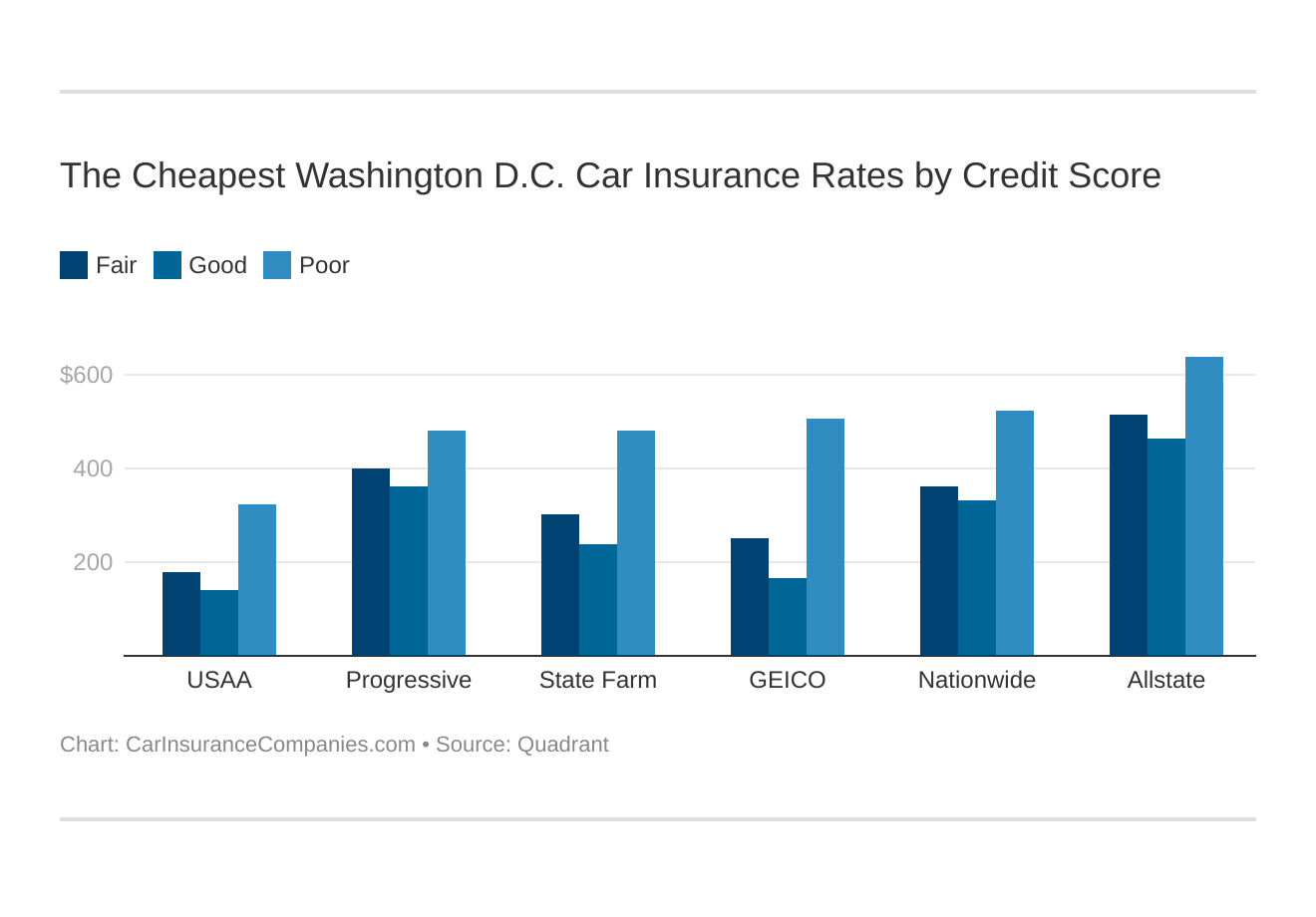

The Cheapest Washington D.C. Car Insurance Rates by Credit Score

Your credit score will play a significant role in your Washington D.C. car insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, Massachusetts, and North Carolina. Find the cheapest Washington D.C. car insurance rates by credit score below.

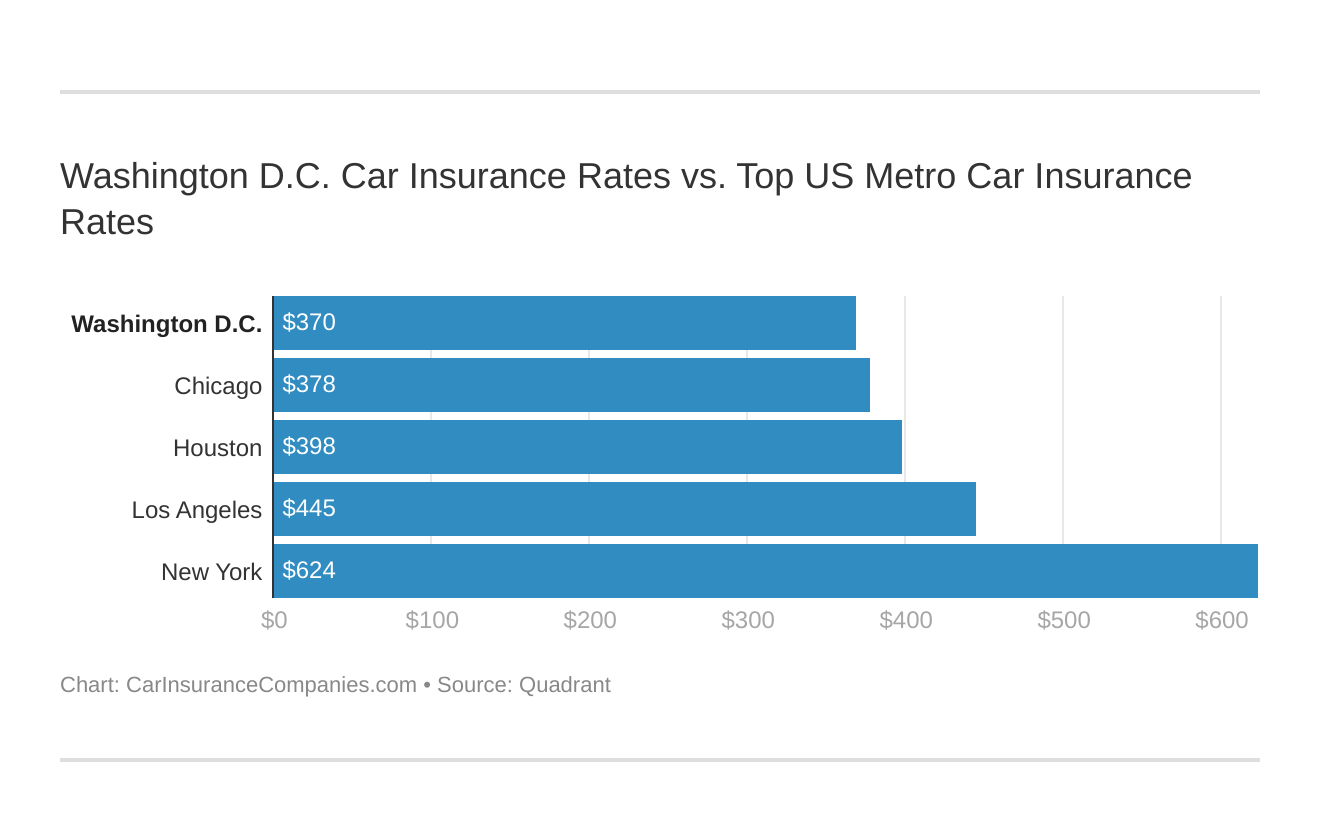

Washington D.C. Car Insurance Rates vs. Top US Metro Car Insurance Rates

You might find yourself asking how does my Washington D.C. stack up against other top US metro areas’ auto insurance rates? We’ve got your answer below.

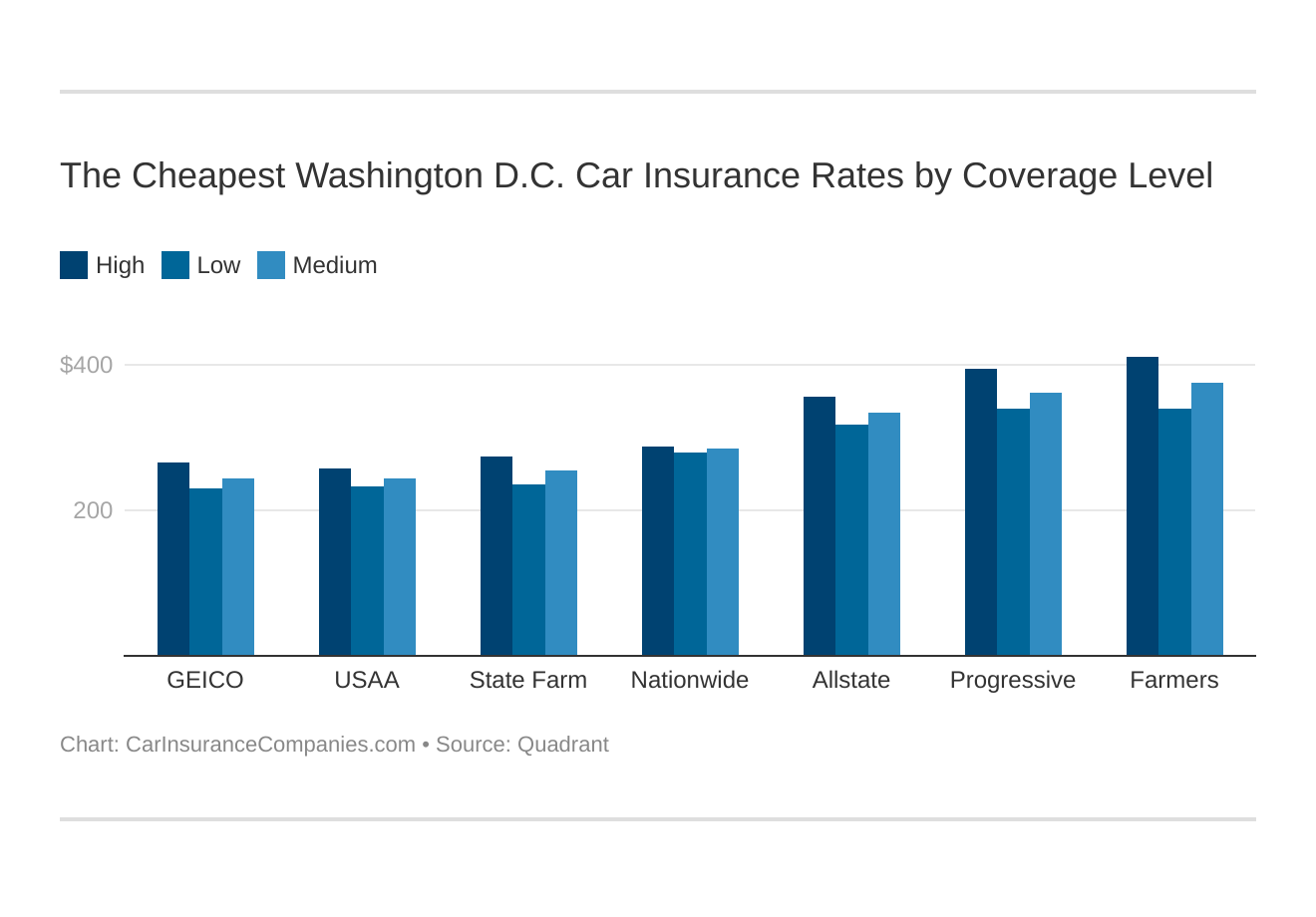

The Cheapest Washington D.C. Car Insurance Rates by Coverage Level

Your coverage level will play a major role in your Washington D.C. car insurance rates. Find the cheapest Washington D.C. car insurance rates by coverage level below:

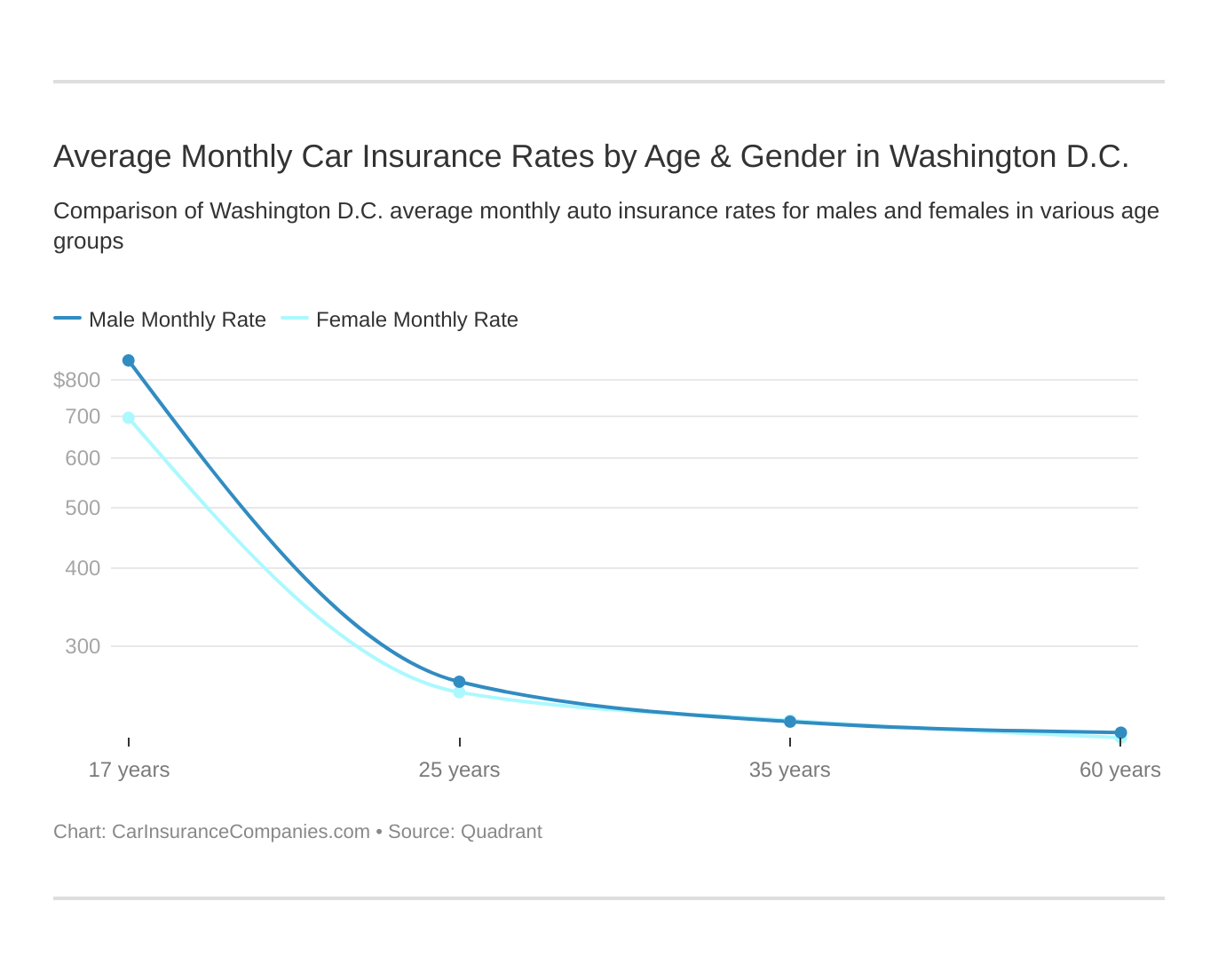

Average Monthly Car Insurance Rates by Age & Gender in Washington D.C.

These states are no longer using gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because young drivers are often considered high-risk. Washington D.C. does use gender, so check out the average monthly car insurance rates by age and gender in Washington D.C..

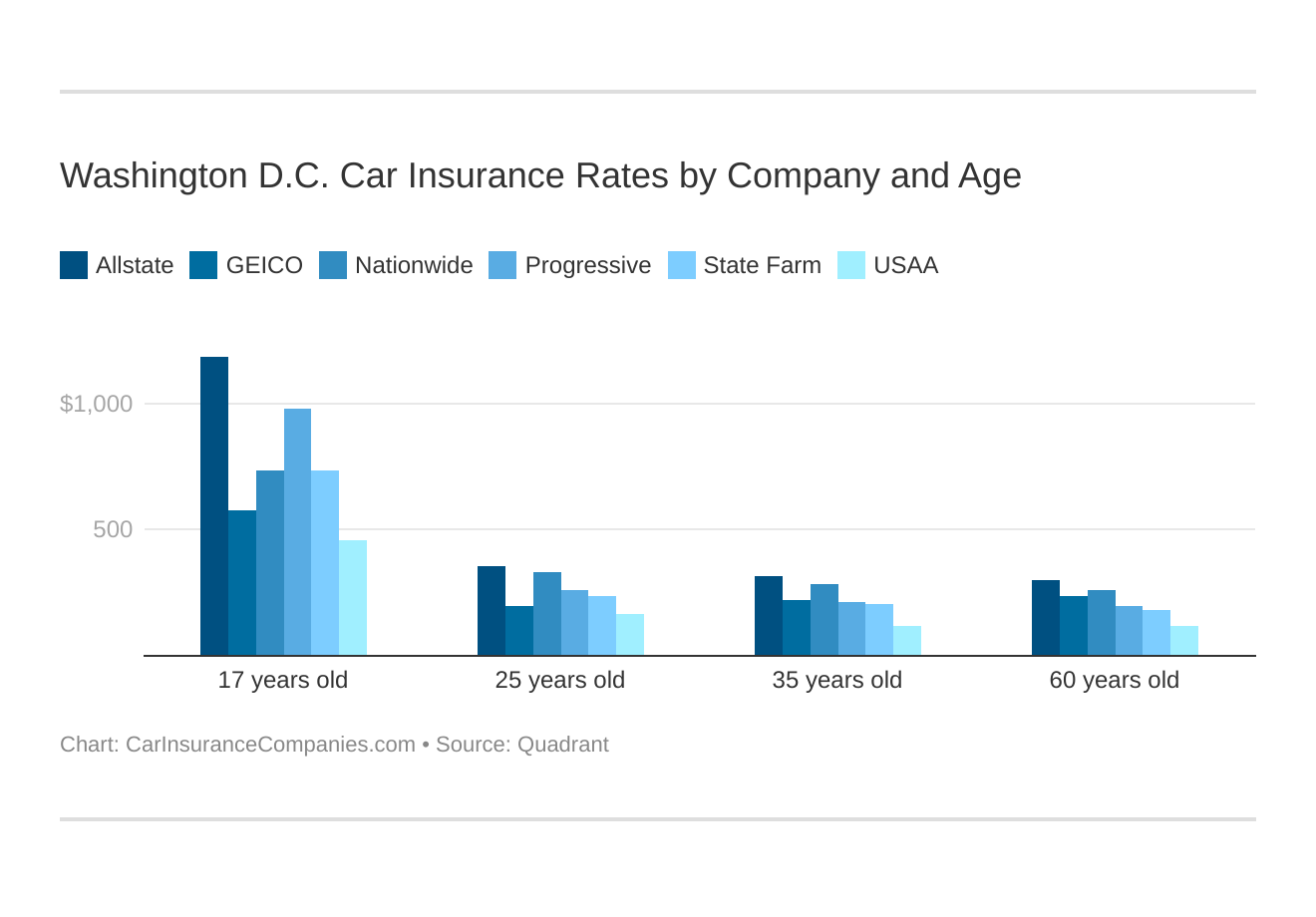

Washington D.C. Car Insurance Rates by Company and Age

Washington D.C. car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

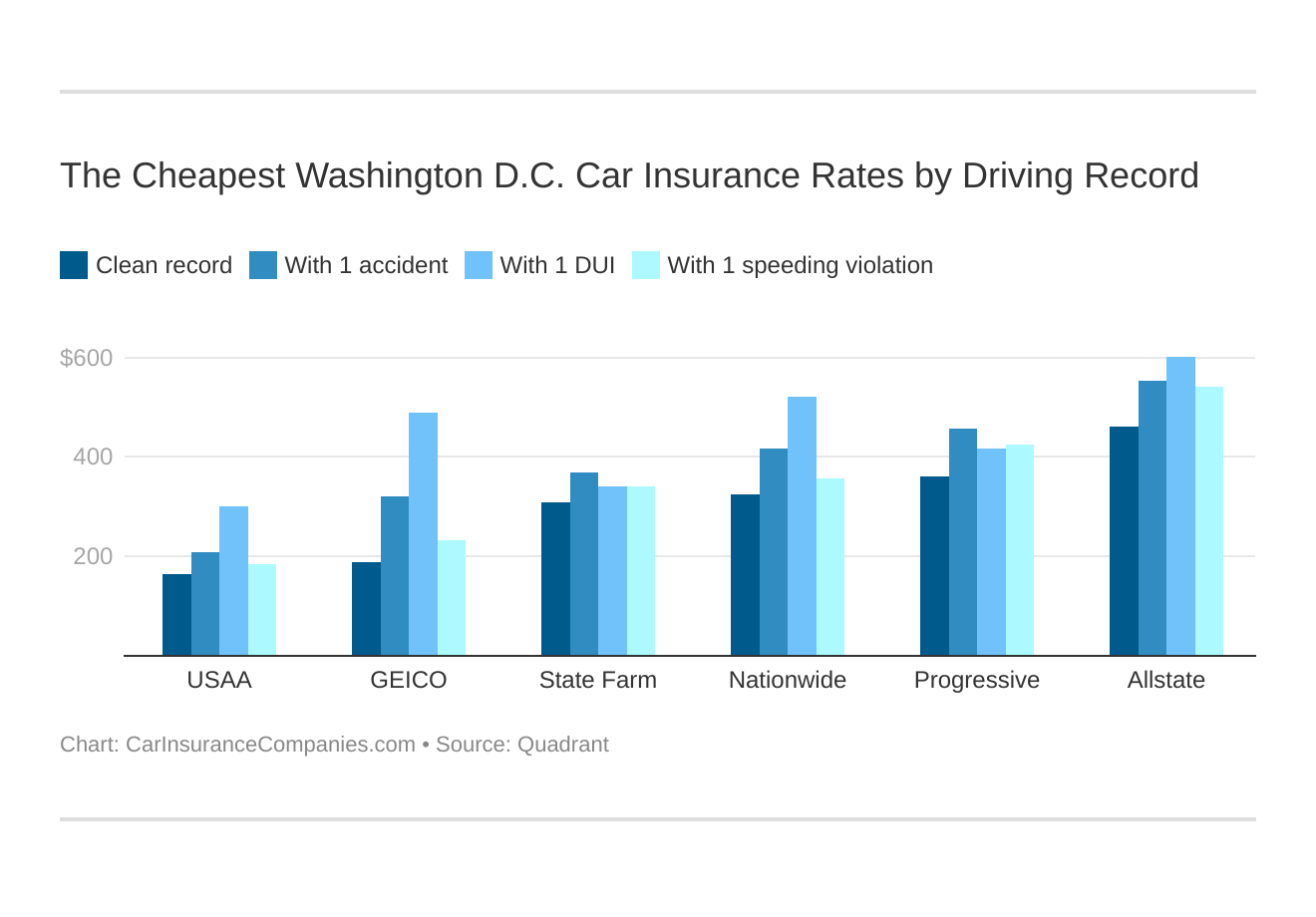

The Cheapest Washington D.C. Car Insurance Rates by Driving Record

Your driving record will play a major role in your Washington D.C. car insurance rates. For example, other factors aside, a Washington D.C. DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest Washington D.C. car insurance rates by driving record.

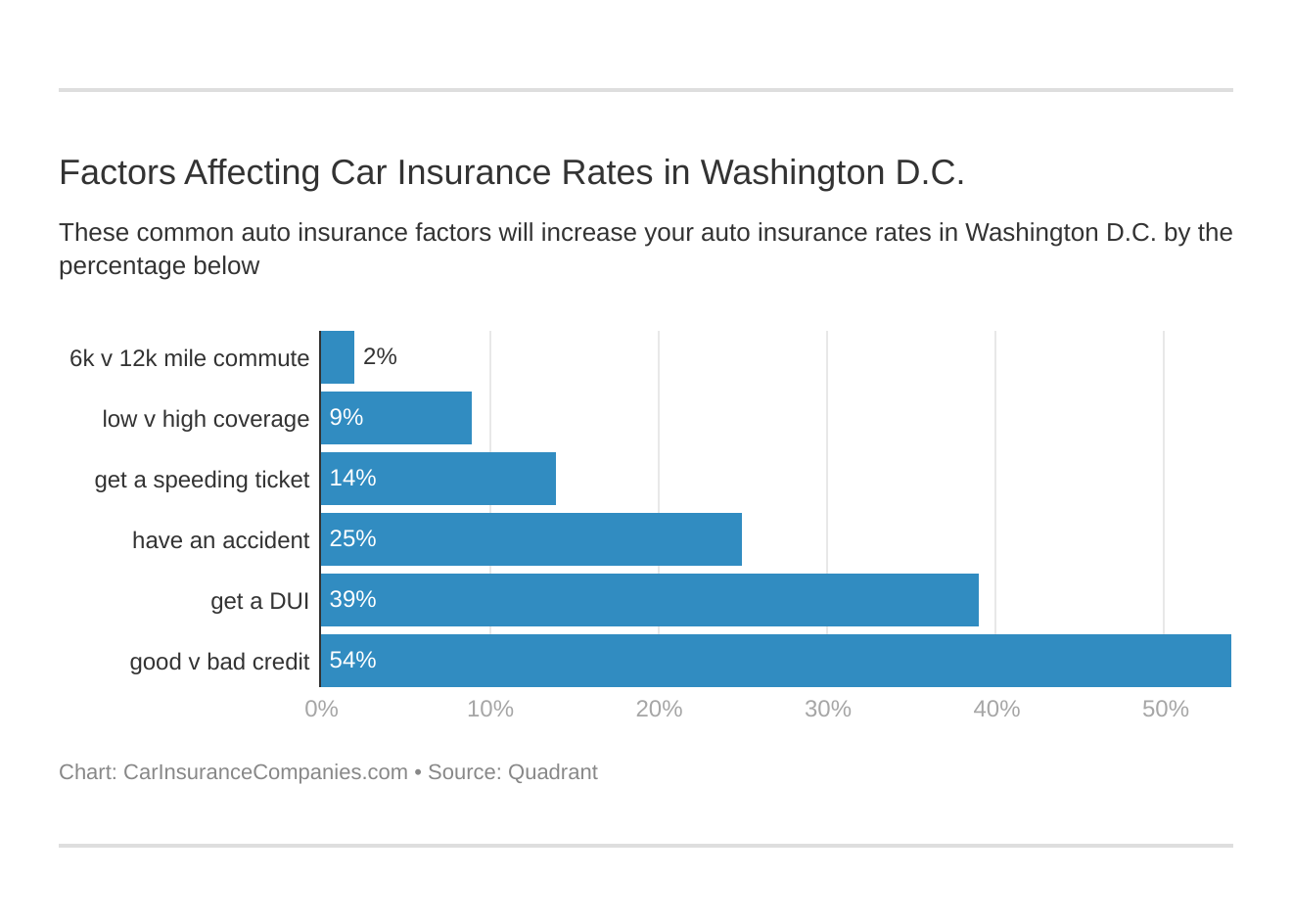

Factors Affecting Car Insurance Rates in Washington D.C.

Factors affecting car insurance rates in Washington D.C. may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Washington D.C. car insurance.

Current (2010) DC car insurance requirements state all drivers must have at least the following minimum levels of coverage:

| Type of Coverage | Minimum Policy Coverage |

| Property Damage | $10,000 |

| 3rd Party Liability Insurance | $25,000 per person / $50,000 per accident |

| Uninsured Motorist Bodily Injury | $25,000 per person / $50,000 per accident |

| Uninsured Motorist Property Damage | $5,000 w / $200 deductible |

DC Car Insurance Companies

DC is one of the highest states for car insurance premiums (in the top 10) so you really need to compare car insurance companies.

Over 70 car insurance companies are licensed to provide auto insurance coverage in the District of Columbia and although this a relatively low number compared to most other states there is still a lot of competition in the marketplace.

Most national brands including Geico, Progressive, and Allstate offer auto insurance coverage in DC along with many regional auto insurance providers who compete fiercely with the national brands in terms of rates and customer service.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Read more: Top 10 Washington DC Car Insurance Companies

DC Car Insurance Quotes

Car insurance is a fairly simple topic to understand as most policies have common terms and types of coverage however many drivers still have little knowledge about the coverage they purchase.

The secret to finding the best DC car insurance rates is to learn about coverage including:

- policy deductibles

- car insurance discounts

- types of coverage

Car insurance is one of the few bills you will always have and learning a little today can save you a lot down the road.

Compare DC car insurance companies and get FREE quotes online!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.