West Virginia Car Insurance (Coverage, Companies, & More)

West Virginia car insurance requirements are 25/50/25 for minimum liability, but you may choose to drive with a full coverage policy instead. This can raise your West Virginia car insurance rates, but our guide finds that USAA and State Farm are the top two cheapest West Virginia car insurance companies. Enter your ZIP code below and start comparing West Virginia car insurance quotes from multiple companies to find the best coverage for you.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Licensed Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health insuran...

Rachael Brennan

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated February 2025

| West Virginia Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 38,770 Vehicle Miles Driven: 19.83 billion |

| Vehicles Registered | Registered: 1,554,579 Stolen: 2,239 |

| Population | 1,792,147 |

| Most Popular Vehicle | Silverado 1500 |

| % Uninsured / % Underinsured % | 10% State rank: 32 |

| Total Driving-Related Deaths | 2009-2018 Speeding: 1,007 Drunk Driving: 828 |

| Average Annual Premiums | Liability: $501.44 Collision: $319.10 Comprehensive: $195.04 |

| Cheapest Providers | State Farm, USAA |

Welcome to West Virginia, the wild and wonderful Mountain State. With miles and miles of country roads, it’s important that you know all about the driving laws and culture so you can stay safe and ticket/accident-free. A big part of that is making sure you have the right car insurance.

How do you find good coverage at a reasonable price? We know this can be overwhelming, so we’ve put together the information you need to make informed decisions regarding your coverage. Read on to learn more. If you want to start shopping right now, enter your ZIP code to get a FREE quote on car insurance.

West Virginia Car Insurance Coverage and Rates

If you’re seeking coverage in West Virginia, this is your one-stop-shop. We work hard to provide you with up-to-date information about your state’s individual laws, policy rates, types of coverage, and more.

Read on to see much West Virginians pay for coverage compared to the national average.

| West Virginia | National Average | Percent Difference |

|---|---|---|

| $2,518.00 | $1,311 | +48% |

As you can see in the table above, West Virginians can expect to pay 48 percent more than the average American for car insurance.

Read more: West Virginia Insurance Co. Car Insurance Review

West Virginia Car Culture

West Virginia drivers prefer hardy vehicles to carry them over rough, mountainous terrain. Plus, if you take part in outdoor activities like biking, kayaking, and mountain climbing, it’s even more important that your car is protected with the necessary coverage. As a West Virginia resident, you’ll need a car insurance policy that fits your specific needs.

Although Amtrack offers options for travel through West Virginia, most residents rely on their cars. For drivers commuting from rural to more populated cities, the biggest concern is probably wildlife, as the deer population in West Virginia is always growing.

In 2014, the National Highway Traffic Safety Association (NHTSA) reported that rural crashes accounted for 61 percent of accidents in the state. This is a fairly high number, as the national average for rural accidents is just 50 percent.

Whether you’re mostly an urban or rural driver in West Virginia, knowing the best coverage options for your needs will help keep you and your vehicle safe and protected.

West Virginia Minimum Coverage

Like every state, West Virginia has minimum insurance requirements that you must meet in order to drive there legally. These requirements are there to ensure that medical costs and damages will be paid for in the event of an accident.

| Insurance Required | Minimum Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person $50,000 per accident |

| Property Damage Liability | $25,000 |

The table above shows the minimum funds needed for two types of coverage: bodily injury and property damage liability. To drive legally in West Virginia, you need a policy that guarantees your insurance company will cover $25,000 per person and $50,000 per accident for injuries/medical costs, along with $25,000 in property damage.

Forms of Financial Responsibility

If you’re in an accident or you get pulled over, law enforcement will ask you to show proof that you have the required insurance.

According to the West Virginia State Legislature, “proof of financial responsibility” means proof of ability to pay the damages for liability if one is in an accident involving their own vehicle. Basically, owning, operating, or maintaining a vehicle carries an added level of responsibility for drivers.

The table below shows the kinds of financial responsibility that are accepted in West Virginia.

| Forms of Financial Responsibility | Minimum Limits |

|---|---|

| Single-limit Coverage | $50,000 |

| Split-limit Coverage | Bodily Injury Liability of $25,000 per person $50,000 for any two persons Property Damage Liability of at least $10,000 |

Single-limit coverage is the amount required to fulfill all expenses involved in an accident.

Split-limit coverage has different maximum dollar amounts the insurer will pay for different parts of a claim. You can see that these are $50,000 for single-limit and $25,000-$50,000 for split-limit coverage.

Premiums as a Percentage of Income

How much are West Virginians spending on car insurance?

Take a look at the table below, which shows the percentage of their annual income the average West Virginia resident spent on their insurance policy from 2012-2014.

| Averages | 2012 | 2013 | 2014 |

|---|---|---|---|

| West Virginia Average | 3.18% | 3.26% | 3.20% |

| National Average | 2.32% | 2.39% | 2.29% |

| Percent Difference | 37% | 36% | 40% |

Over three years, West Virginians spent an average of 3.21 percent of their incomes on car insurance. This is higher than the national average of 2.33 percent over the same period. In 2014, residents of neighboring states like Pennsylvania, Virginia, and Ohio only spent, on average, 2.06 percent of their annual incomes on insurance.

Read more: Virginia Car Insurance (Coverage, Companies & More)

Average Monthly Car Insurance Rates in WV (Liability, Collision, Comprehensive)

Want to make an informed decision about which insurance company and policy will fit your needs?

Getting to know the main kinds of coverage available, as well as how each of these different options will affect your wallet, is sure to help you with your search.

| Coverage Type | Average Cost in WV |

|---|---|

| Liability | $501.44 |

| Collision | $319.10 |

| Comprehensive | $195.04 |

| Combined | $1,015.57 |

In the table above, we’ve provided the average cost of each coverage type (liability, collision, comprehensive, and all combined) from data over five years.

Additional Coverage

You also have the option to add additional liability coverage beyond the standard policies shown in the table.

This might include:

- Personal injury protection, also known as no-fault insurance, which helps cover medical expenses for all individuals involved in an accident, regardless of who was at fault.

- Medical payments (MedPay) coverage, which pays for costs incurred by the insured driver and any passengers in the insured’s vehicle for injuries sustained in an accident, regardless of who was at fault.

- Uninsured/underinsured motorist coverage, which will pay for medical expenses or damage if you’re involved in an accident with an uninsured or underinsured individual.

Now that we have listed the types of additional protections, it’s time to explain loss ratio.

How is loss ratio relevant?

A company’s loss ratio reflects the percentage of premiums that a company pays out in claims. A loss ratio over 100 percent means that the carrier didn’t collect enough premiums to pay for all its claims, which could lead to a rate increase. A loss ratio under 45 percent means that the carrier may have overpriced its policies, collecting more premiums than it needs for the claims being filed.

While the NAIC does not currently have data on personal injury protection, they do provide data on the average loss ratio for the other two liability coverage options available in West Virginia.

Check out the table below:

| Loss Ratio | 2015 | 2014 | 2013 |

|---|---|---|---|

| MedPay | 65% | 66% | 66% |

| Uninsured Motorist | 50% | 52% | 58% |

The table above displays loss ratios in the healthy range for insurance companies in West Virginia.

Add-Ons, Endorsements, and Riders

You can also consider the following supplemental coverage options for your policies:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

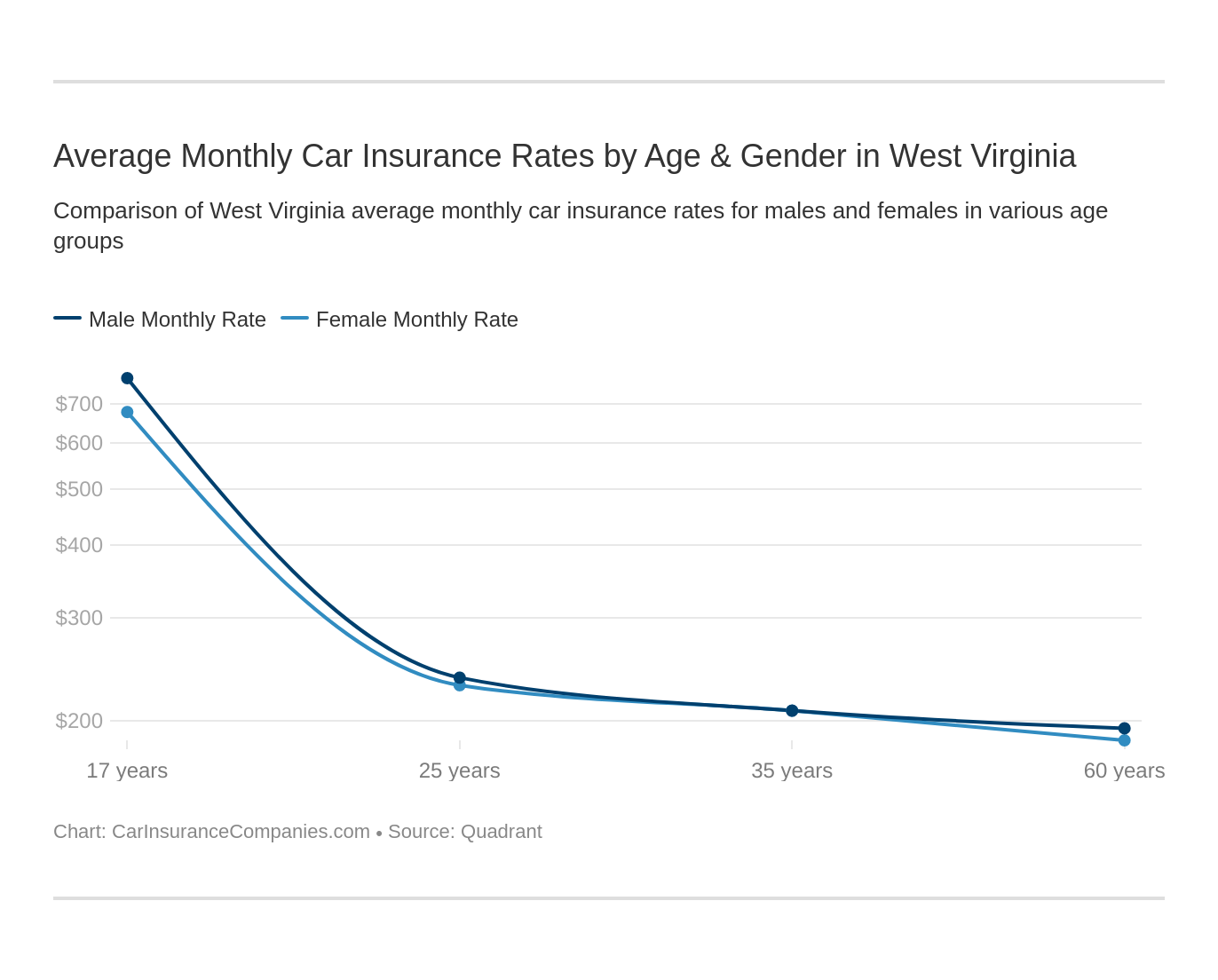

Average Monthly Car Insurance Rates by Age & Gender in WV

A few states have passed legislation prohibiting car insurance companies from charging different rates to men and women, but West Virginia is not one of them. When applying for your policy, your age and gender may be taken into account.

Take a look at the table below to see average rates for different demographics.

| Company | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $10,480.93 | $10,920.44 | $3,247.28 | $3,253.31 | 2933.38 | 2724.76 | $2,620.92 | $2,627.69 |

| Geico General | $6,862.60 | $8,279.02 | $2,682.48 | $2,796.00 | 2789.69 | 2751.21 | $2,655.37 | $2,573.55 |

| Nationwide Mutual | $14,459.89 | $16,320.56 | $3,981.38 | $4,388.29 | 3850.36 | 4184.55 | $3,092.94 | $3,766.95 |

| Progressive Max | $5,477.19 | $6,941.22 | $2,371.35 | $2,541.49 | 2101.13 | 2135.83 | $1,908.82 | $2,004.02 |

| Safeco Ins Co of America | $9,871.04 | $11,125.46 | $2,731.41 | $2,821.68 | 2269.67 | 2185.59 | $2,090.92 | $2,088.98 |

| State Farm Mutual Auto | $3,855.91 | $4,979.67 | $2,049.92 | $1,620.39 | 1734.04 | 1734.04 | $1,557.19 | $1,557.19 |

| USAA | $5,831.46 | $6,456.12 | $2,277.84 | $2,448.74 | 1760.92 | 1736.48 | $1,635.09 | $1,649.46 |

If you’re a teenager, or your policy insures a teen driver, then State Farm is the best option for you. Their average rates for teen drivers are significantly lower than their competitors. If you’re over the age of 25, you can expect your rates to remain fairly consistent, regardless of gender or marital status.

We’re here to provide you with the best options for your age range and personal needs, regardless of gender.

Quadrant data is based on actual purchased coverage by the state population and includes rates for high-risk drivers and drivers who choose to purchase add-ons.

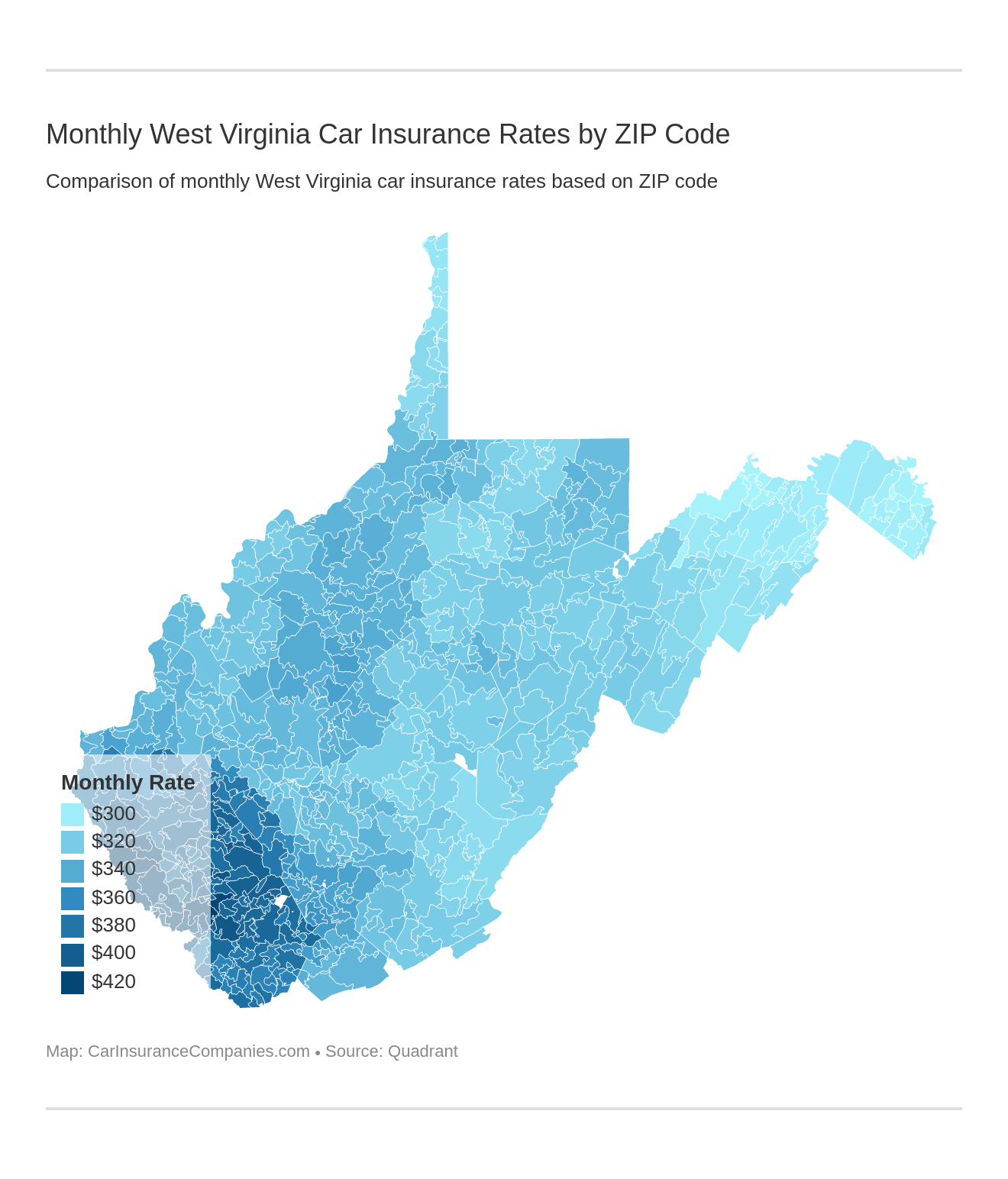

Cheapest Rates by ZIP Code

Regardless of where you live, choosing the right car insurance is a big endeavor. Knowing how your ZIP code affects your insurance rates can be a great tool throughout the process.

Check out the data below to find your specific ZIP code:

| City | Zipcode | Average Annual Rate | Zipcode | Average | Allstate P&C | Geico General | Safeco Ins Co of America | Nationwide Mutual | Progressive Max | State Farm Mutual Auto | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GILBERT | 24701 | $3,987.96 | 25621 | $5,111.14 | $6,268.89 | $4,664.68 | $7,966.57 | $4,426.69 | $5,947.92 | $3,045.55 | $3,457.68 |

| KERMIT | 24712 | $3,988.82 | 25674 | $5,100.15 | $6,297.92 | $4,664.68 | $7,966.57 | $4,426.69 | $5,943.58 | $2,915.23 | $3,486.42 |

| LENORE | 24714 | $4,201.98 | 25676 | $5,070.93 | $6,268.89 | $4,664.68 | $7,966.57 | $4,426.69 | $5,801.65 | $2,910.36 | $3,457.68 |

| WILLIAMSON | 24715 | $4,063.11 | 25661 | $5,061.69 | $6,268.89 | $4,664.68 | $7,966.57 | $4,426.69 | $5,659.20 | $2,959.38 | $3,486.42 |

| BAISDEN | 24716 | $4,396.72 | 25608 | $5,055.41 | $6,268.89 | $4,664.68 | $7,966.57 | $4,426.69 | $5,553.38 | $3,049.98 | $3,457.68 |

| MATEWAN | 24719 | $4,393.75 | 25678 | $5,049.64 | $6,268.89 | $4,664.68 | $7,966.57 | $4,426.69 | $5,615.76 | $2,947.21 | $3,457.68 |

| WHARNCLIFFE | 24724 | $4,009.38 | 25651 | $5,043.28 | $6,268.89 | $4,664.68 | $7,966.57 | $4,426.69 | $5,496.47 | $3,021.95 | $3,457.68 |

| DINGESS | 24726 | $4,654.76 | 25671 | $5,038.17 | $6,268.89 | $4,664.68 | $7,966.57 | $4,426.69 | $5,541.31 | $2,941.34 | $3,457.68 |

| BREEDEN | 24729 | $4,087.74 | 25666 | $5,031.81 | $6,268.89 | $4,664.68 | $7,966.57 | $4,426.69 | $5,450.64 | $2,958.80 | $3,486.42 |

| VERNER | 24731 | $3,981.79 | 25650 | $5,031.00 | $6,278.81 | $4,664.68 | $7,966.57 | $4,426.69 | $5,481.25 | $2,941.34 | $3,457.68 |

| DELBARTON | 24732 | $3,901.22 | 25670 | $5,029.67 | $6,268.89 | $4,664.68 | $7,966.57 | $4,426.69 | $5,448.38 | $2,974.77 | $3,457.68 |

| OMAR | 24733 | $4,006.89 | 25638 | $4,906.37 | $6,268.89 | $4,664.68 | $7,966.57 | $3,755.44 | $5,346.07 | $2,885.27 | $3,457.68 |

| MAN | 24736 | $4,202.48 | 25635 | $4,904.28 | $6,278.81 | $4,664.68 | $7,966.57 | $3,755.44 | $5,333.23 | $2,873.55 | $3,457.68 |

| JUSTICE | 24738 | $3,859.31 | 24851 | $4,891.82 | $6,278.81 | $4,664.68 | $6,525.89 | $4,426.69 | $5,947.62 | $2,941.34 | $3,457.68 |

| NAUGATUCK | 24739 | $3,901.22 | 25685 | $4,890.40 | $6,268.89 | $4,664.68 | $6,525.89 | $4,426.69 | $5,947.62 | $2,941.34 | $3,457.68 |

| RAGLAND | 24740 | $4,009.51 | 25690 | $4,890.40 | $6,268.89 | $4,664.68 | $6,525.89 | $4,426.69 | $5,947.62 | $2,941.34 | $3,457.68 |

| AMHERSTDALE | 24747 | $3,978.99 | 25607 | $4,878.44 | $6,268.89 | $4,664.68 | $7,966.57 | $3,755.44 | $5,147.88 | $2,887.96 | $3,457.68 |

| MOHAWK | 24751 | $3,859.31 | 24862 | $4,867.02 | $6,268.89 | $4,664.68 | $7,966.57 | $3,689.60 | $5,133.64 | $2,888.12 | $3,457.68 |

| HANOVER | 24801 | $4,588.45 | 24839 | $4,855.96 | $6,278.81 | $4,664.68 | $7,966.57 | $3,857.99 | $5,380.49 | $2,878.25 | $2,964.93 |

| NEWTOWN | 24808 | $4,413.54 | 25686 | $4,846.38 | $6,268.89 | $4,664.68 | $6,525.89 | $4,426.69 | $5,639.46 | $2,941.34 | $3,457.68 |

| CHATTAROY | 24811 | $4,388.83 | 25667 | $4,841.76 | $6,268.89 | $4,664.68 | $6,525.89 | $4,426.69 | $5,578.38 | $2,941.34 | $3,486.42 |

| RAWL | 24813 | $4,437.88 | 25691 | $4,837.65 | $6,268.89 | $4,664.68 | $6,525.89 | $4,426.69 | $5,578.38 | $2,941.34 | $3,457.68 |

| RED JACKET | 24815 | $4,621.60 | 25692 | $4,834.18 | $6,268.89 | $4,664.68 | $6,525.89 | $4,426.69 | $5,548.23 | $2,947.21 | $3,457.68 |

| EDGARTON | 24816 | $4,510.23 | 25672 | $4,833.34 | $6,268.89 | $4,664.68 | $6,525.89 | $4,426.69 | $5,548.23 | $2,941.34 | $3,457.68 |

Does your ZIP code appear in the top 25?

Let’s compare these rates to the average premiums in the bottom 25 ZIP codes.

| ZIP | Cost |

|---|---|

| 25827 | $3519.10 |

| 26722 | $3553.33 |

| 26743 | $3553.71 |

| 26234 | $3557.91 |

| 26757 | $3559.56 |

| 26138 | $3560.50 |

| 26384 | $3561.19 |

| 26717 | $3562.86 |

| 26137 | $3563.40 |

| 26377 | $3564.15 |

| 25164 | $3568.96 |

| 25177 | $3572.62 |

| 26581 | $3580.46 |

| 25530 | $3581.03 |

| 25019 | $3583.73 |

| 26714 | $3583.90 |

| 25437 | $3584.55 |

| 25820 | $3584.93 |

| 25043 | $3588.15 |

| 26170 | $3593.99 |

| 25444 | $3595.37 |

| 25831 | $3603.04 |

| 25430 | $3605.04 |

| 25141 | $3607.19 |

| 25421 | $3607.24 |

If you happen to live in the ZIP code 25401, you will be paying 31 percent less than someone living in ZIP code 25621. That’s a difference of $1,592.

Cheapest Rates by City

Of the many cities in West Virginia, you can certainly expect some areas to cost more than others when it comes to paying for car insurance. Let’s take a look at the top 25 most expensive cities for car insurance premiums.

| City | Average Cost |

|---|---|

| GILBERT | $5,111.14 |

| KERMIT | $5,100.15 |

| LENORE | $5,070.93 |

| WILLIAMSON | $5,061.69 |

| BAISDEN | $5,055.41 |

| MATEWAN | $5,049.64 |

| WHARNCLIFFE | $5,043.27 |

| DINGESS | $5,038.16 |

| VERNER | $5,031.81 |

| BREEDEN | $5,031.00 |

| DELBARTON | $5,029.67 |

| JUSTICE | $4,906.37 |

| NAUGATUCK | $4,904.28 |

| RAGLAND | $4,891.82 |

| OMAR | $4,890.40 |

| MAN | $4,890.40 |

| AMHERSTDALE | $4,878.44 |

| MOHAWK | $4,867.02 |

| NEWTOWN | $4,855.96 |

| CHATTAROY | $4,846.37 |

| HANOVER | $4,841.75 |

| RAWL | $4,837.65 |

| EDGARTON | $4,834.18 |

| NORTH MATEWAN | $4,833.34 |

You can see that some cities have higher insurance premiums than others. If you live in the small mountain village of Gilbert, WV (which has a population of 399), you will pay an average of $5,111 for car insurance.

Check out the lowest 25 average rates for cities:

| City | Cost of Premiums |

|---|---|

| MIDWAY | $3519.10 |

| GREEN SPRING | $3553.33 |

| NEW CREEK | $3553.71 |

| ROCK CAVE | $3557.91 |

| ROMNEY | $3559.56 |

| BROHARD | $3560.50 |

| LINN | $3561.19 |

| ELK GARDEN | $3562.86 |

| SMITHVILLE | $3563.4 |

| JACKSONBURG | $3564.15 |

| PROCIOUS | $3568.96 |

| SAINT ALBANS | $3572.62 |

| LITTLETON | $3580.46 |

| KENOVA | $3581.03 |

| BICKMORE | $3583.73 |

| DELRAY | $3583.90 |

| POINTS | $3584.55 |

| CAMP CREEK | $3584.93 |

| CLAY | $3588.15 |

| SAINT MARYS | $3593.99 |

| SLANESVILLE | $3595.37 |

| DANESE | $3603.04 |

| KEARNEYSVILLE | $3605.04 |

| NEBO | $3607.19 |

| GLENGARY | $3607.24 |

If you live in Martinsburg, WV (which, according to the U.S. Census Bureau, has a population of 17,465) you will pay around on average $3,519.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best West Virginia Car Insurance Companies

With so many options for insurance coverage in the Mountain State, how will you decide which is best?

Price is only one factor you should consider when choosing car insurance. In this section, we’ll focus on some other factors. Which companies in West Virginia have the best customer service? Which is the largest? Which are the most financially solvent? Keep reading to find out what is the best car insurance company in West Virginia!

The Largest Companies’ Financial Ratings

Ever wonder about the financial health of your insurance company?

Below, we have listed the AM Best rankings for the top 10 insurance companies in West Virginia.

| Company | Rating | Outlook |

|---|---|---|

| Allstate | A+ | Stable |

| Erie | A+ | Stable |

| Geico | A++ | Stable |

| Hartford | A+ | Stable |

| Liberty Mutual | A | Stable |

| Nationwide | A+ | Negative |

| Progressive | A+ | Stable |

| State Farm | A++ | Stable |

| USAA | A++ | Stable |

| Westfield | A | Stable |

As you can see, some companies rank higher than others. You can think of the AM best rankings as a financial “report card”. For a company to be considered stable, it must have a positive future outlook. Even though a company has a good ranking, financial predictions can affect whether or not it is considered to be “stable.”

Companies with Best Ratings

Customer service is another factor to consider when you’re shopping around. According to a 2019 press release by J.D. Power, customer satisfaction with car insurance is high.

The companies with the best J.D. Power customer satisfaction ratings for the Mid-Atlantic Region (Deleware, District of Columbia, Maryland, New Jersey, Pennsylvania, Virginia, and West Virginia) are shown below.

J.D. Power U.S. Car Insurance Study Mid-Atlantic Region

| Car Insurance Company | Score (based on a 1,000 point scale) |

|---|---|

| 624 | |

| 667 |

| 713 |

| 610 | |

| 647 | |

| 634 |

| 654 |

| 642 |

| 711 | |

| 619 |

| 624 | |

| 652 | |

| 648 |

| 628 | |

| 743 |

As you can see, USAA, NJM, and Erie Insurance all have superior rankings (five stars). Falling just below these are companies like Geico and the Hartford, which earned four stars. Companies with a ranking of two or three stars are considered to be average in their customer satisfaction.

Companies with Most Complaints in West Virginia

Do you ever wonder if you’re the only one who phones a company to complain? You’re not alone. Knowing how many complaints insurance companies receive can help you narrow down your list of potential providers.

| Insurance Company | Direct Premiums Written | Complaint Ratio | Loss Ratio | Market Share |

|---|---|---|---|---|

| Allstate | $92,007 | 0.63 | 43.68% | 7.43% |

| Erie | $182,120 | 0.91 | 61.97% | 14.71% |

| Geico | $124,709 | 0.92 | 66.00% | 10.07% |

| Nationwide | $145,858 | 0.43 | 48.02% | 11.78% |

| Progressive | $84,332 | 1.04 | 54.33% | 6.81% |

| State Farm | $329,651 | 0.57 | 56.63% | 26.62% |

| USAA | $48,434 | 0.84 | 63.07% | 3.91% |

| Westfield | $30,163 | 1.83 | 48.25% | 2.44% |

The complaint ratio tells us how well a company is performing in terms of customer satisfaction. All complaint ratios start at 1.0 as the baseline. If a company is performing better and has fewer complaints, they will also have a lower ratio.

State Farm has the largest dollar amount of premiums written at $329,651, and a market share of 26.6 percent. There is an 11.9 percent difference between State Farm’s market share and that of its next largest competitor, Erie Insurance. Please note that smaller companies may have an inflated complaint ratio, depending on their market share and number of complaints.

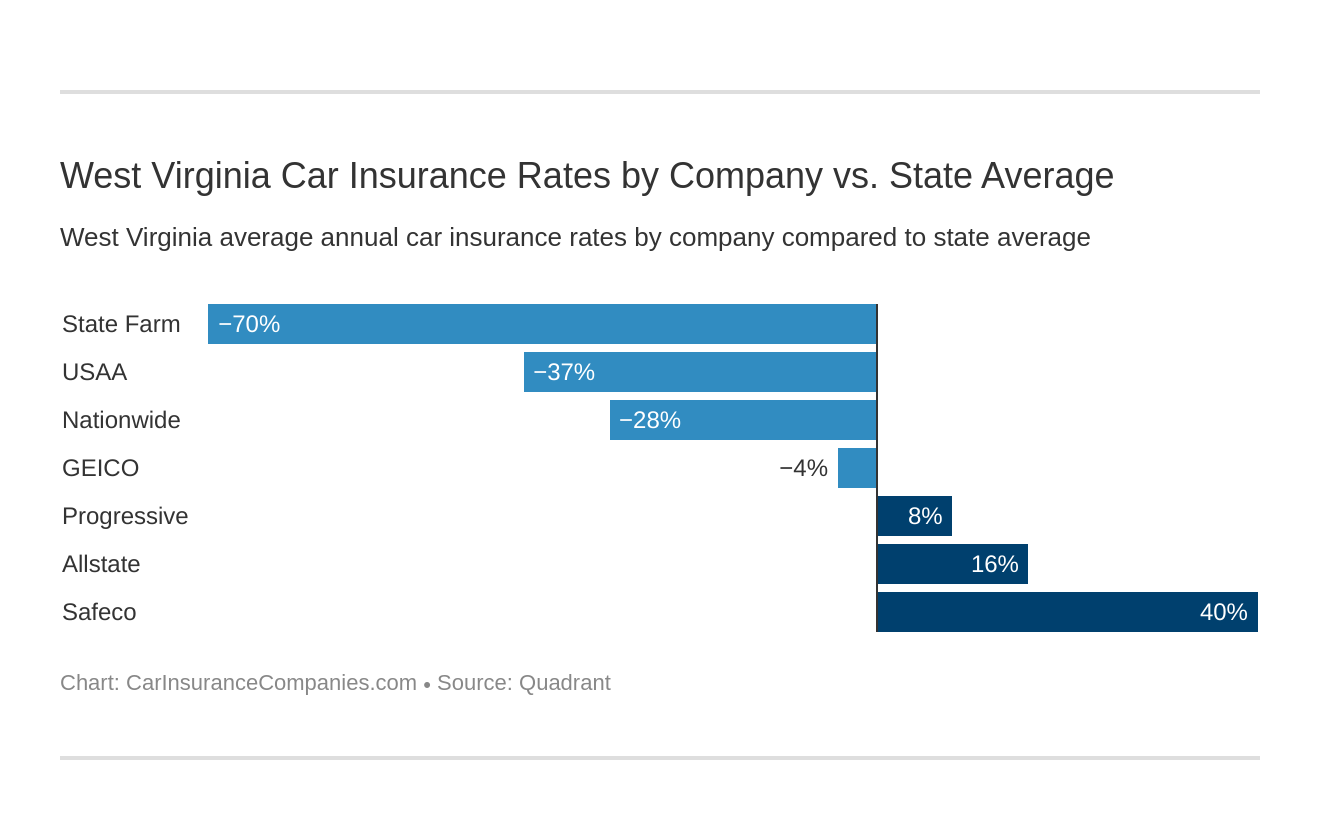

Cheapest Companies in West Virginia

Now that we’ve covered which companies receive the most complaints, let’s check out how West Virginia companies do in terms of affordability. The premium rates listed below will likely be a key component in your decision-making process.

| Company | Average Annual Rate | +/- Compared to State Average (Rate) | +/- Compared to State Average (%) |

|---|---|---|---|

| Allstate P&C | $4,851.09 | $783.34 | 16.15% |

| Geico | $3,923.74 | -$144.01 | -3.67% |

| Nationwide | $6,755.62 | $2,687.87 | 39.79% |

| Progressive | $3,185.13 | -$882.62 | -27.71% |

| Safeco | $4,398.09 | $330.35 | 7.51% |

| State Farm | $2,386.04 | -$1,681.70 | -70.48% |

| USAA | $2,974.52 | -$1,093.23 | -36.75% |

The cheapest rates are offered by State Farm, at $2,386.04 on average. Coming in next are USAA and Progressive, though it’s worth noting that USAA only insures members of the U.S. military and their families. The most expensive company on the list is Nationwide, with rates about 40 percent higher than the state average.

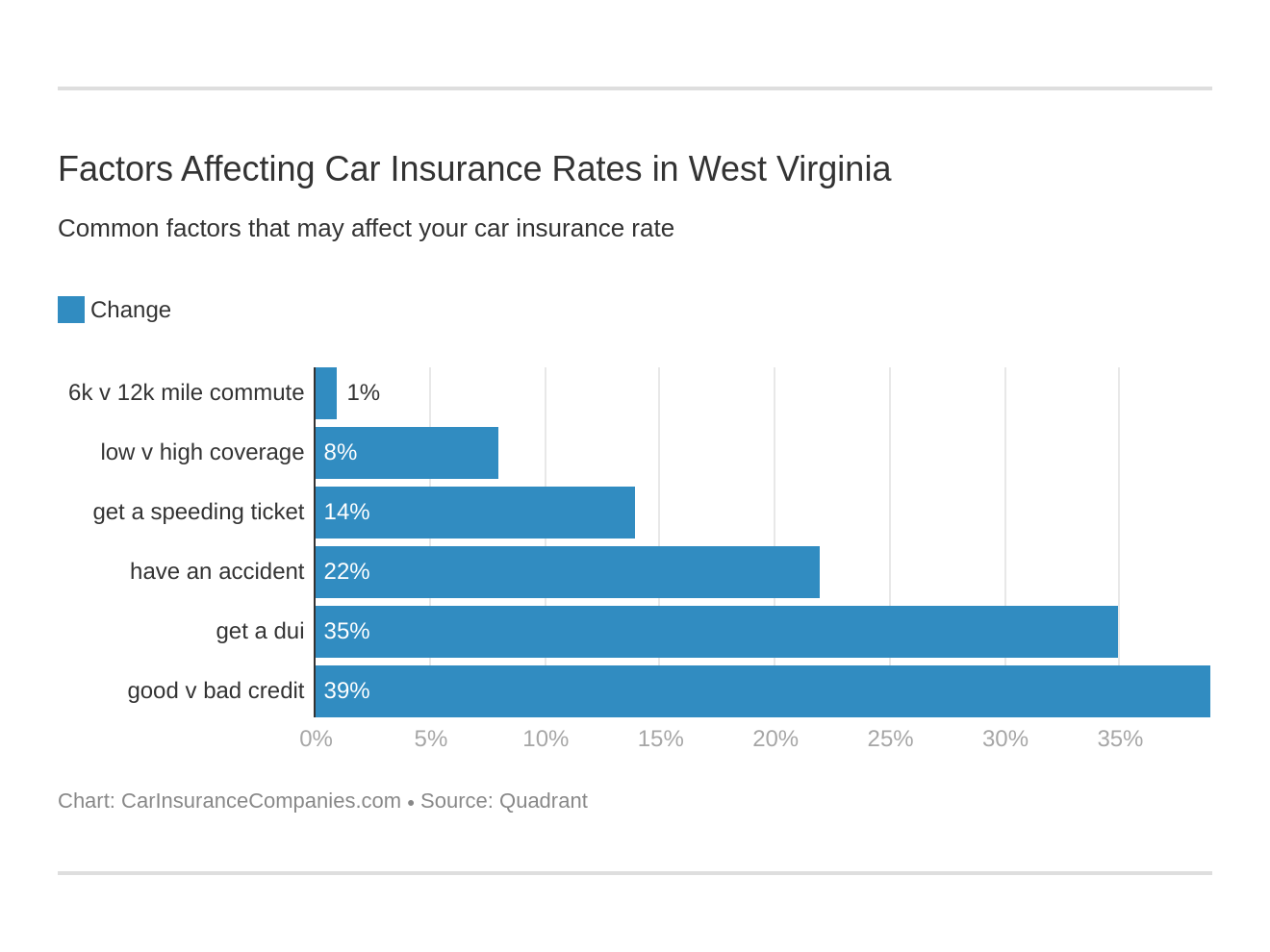

Have you ever wondered how insurance companies come up with these rates?

Many variables are taken into account, from age and gender as we already discussed, to your credit history, and the length of your commute.

Commute Rates by Companies

Take a look at the table below, which shows the rates companies charge based on two different commute lengths.

| Company | 10 miles commute (6,000 miles/year) | 25 miles commute (25,000 miles/year) | Percent Increase |

|---|---|---|---|

| Allstate | $4,851.09 | $4,851.09 | 0 |

| Geico | $3,881.27 | $3,966.21 | 2.20% |

| Liberty Mutual | $6,755.62 | $6,755.62 | 0 |

| Nationwide | $3,185.13 | $3,185.13 | 0 |

| Progressive | $4,398.09 | $4,398.09 | 0 |

| State Farm | $2,323.16 | $2,448.93 | 5.40% |

| USAA | $2,939.80 | $3,009.23 | 2.36% |

According to our data, State Farm, Geico, and USAA all increase their rates for customers with longer commutes.

The good news is, four out of seven companies will not raise your rates if you commute up to 25 miles each day, or 25,000 miles annually.

Companies like Nationwide and Progressive offer competitive rates in West Virginia and have no increase for a longer commute distance.

Six major factors affect car insurance rates in West Virginia. Which auto insurance factors will affect rates the most? Find out below:

Coverage Level Rates by Companies

You may already have some idea as to the level of coverage you want, in which case you’re probably wondering what the major companies charge for their different coverage tiers.

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $4,677.67 | $4,842.82 | $5,032.78 |

| Geico | $3,702.07 | $3,933.44 | $4,135.71 |

| Liberty Mutual | $6,416.80 | $6,739.44 | $7,110.61 |

| Nationwide | $3,125.26 | $3,170.62 | $3,259.52 |

| Progressive | $4,221.37 | $4,351.48 | $4,621.43 |

| State Farm | $2,249.30 | $2,379.66 | $2,529.17 |

| USAA | $2,870.21 | $2,969.49 | $3,083.84 |

The table above shows the rates for companies’ low, medium, and high levels of coverage. If you’re looking for high coverage, State Farm offers the lowest rate ($2,529). State Farm is also the cheapest option for low-coverage, at $2,249.

Looking at it that way, it’s worth noting that there’s just a 12.4 increase between these two levels. It might be worth upgrading if you can afford it; having the higher coverage could save you thousands if you’re in a serious accident.

Liberty Mutual is the most expensive option for both low and high coverage, topping out at $7,110.

Credit History Rates by Companies

If you’re a driver in West Virginia, your credit score may also affect your rates.

According to an Experian report, the average credit score in the Mountain State is 687. This is below the national average of 703. This ranking places West Virginia on the lower end for national credit scores, coming in at number 41 out of 50 states. The table below shows what the biggest companies charge in West Virginia depending on your credit score.

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $3,991.23 | $4,672.88 | $5,889.16 |

| Geico | $3,192.68 | $3,847.51 | $4,731.03 |

| Liberty Mutual | $4,658.77 | $5,929.53 | $9,678.55 |

| Nationwide | $2,861.73 | $3,063.65 | $3,630.02 |

| Progressive | $3,981.11 | $4,286.12 | $4,927.05 |

| State Farm | $1,638.11 | $2,088.16 | $3,431.87 |

| USAA | $2,015.24 | $2,520.35 | $4,387.96 |

We can see that most of the time, rates go up when credit scores go down. In other words, someone with good credit will pay less than someone with poor credit. In West Virginia, you can expect average rates to look something like this:

- Good credit: $3,191.27

- Fair credit: $3,772.60

- Poor credit: $5,239.38

State Farm is the best option for someone with poor credit. If you fall into this category, your rate from this company may be around $3,432, depending on the other factors we’ve been discussing.

Driving Record Rates by Companies

While some people have spotless driving records, most of us don’t fall into the category of “perfect driver”. It’s important to understand how your unique driving history, including accidents, speeding tickets, and DUIs, can affect your insurance rates in the state of West Virginia.

Check out the table below to see how your driving history may factor into your rates.

| Company | Clean Record | One Speeding Violation | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $4,102.62 | $4,654.26 | $4,857.47 | $5,790 |

| Geico | $2,424.33 | $2,601.64 | $3,903.47 | $6,765.51 |

| Liberty Mutual | $5,535.75 | $6,758.42 | $6,985.26 | $7,743.03 |

| Nationwide | $2,539.67 | $2,835.12 | $3,395.88 | $3,969.85 |

| Progressive | $3,732.27 | $4,387.77 | $5,004.45 | $4,467.89 |

| State Farm | 2192.53 | $2,386.05 | $2,579.56 | $2,386.05 |

| USAA | $2,337.82 | $2,850.58 | $2,764.77 | $3,944.88 |

This table shows the average cost of insurance for someone with a clean driving history, one speeding ticket, one accident, and one DUI. The information is based on each company’s individual rate adjustments.

If you have recently had a DUI, State Farm is your best option. Their rates are not only the cheapest, but they stay low if you have other driving violations. On the other end of the spectrum, Geico raises drivers’ rates by 180 percent if they have a DUI on their record. One speeding violation with Geico will raise your rates by only seven percent.

Largest Car Insurance Companies in West Virginia

On your car insurance quest, you may be wondering if bigger companies are better.

Knowing the size of the company and the percentage of the market that they have cornered, combined with the loss and complaint ratio data we discussed earlier, can provide you with a more complete picture of the company’s financial health (and their ability to pay out if/when you file a claim).

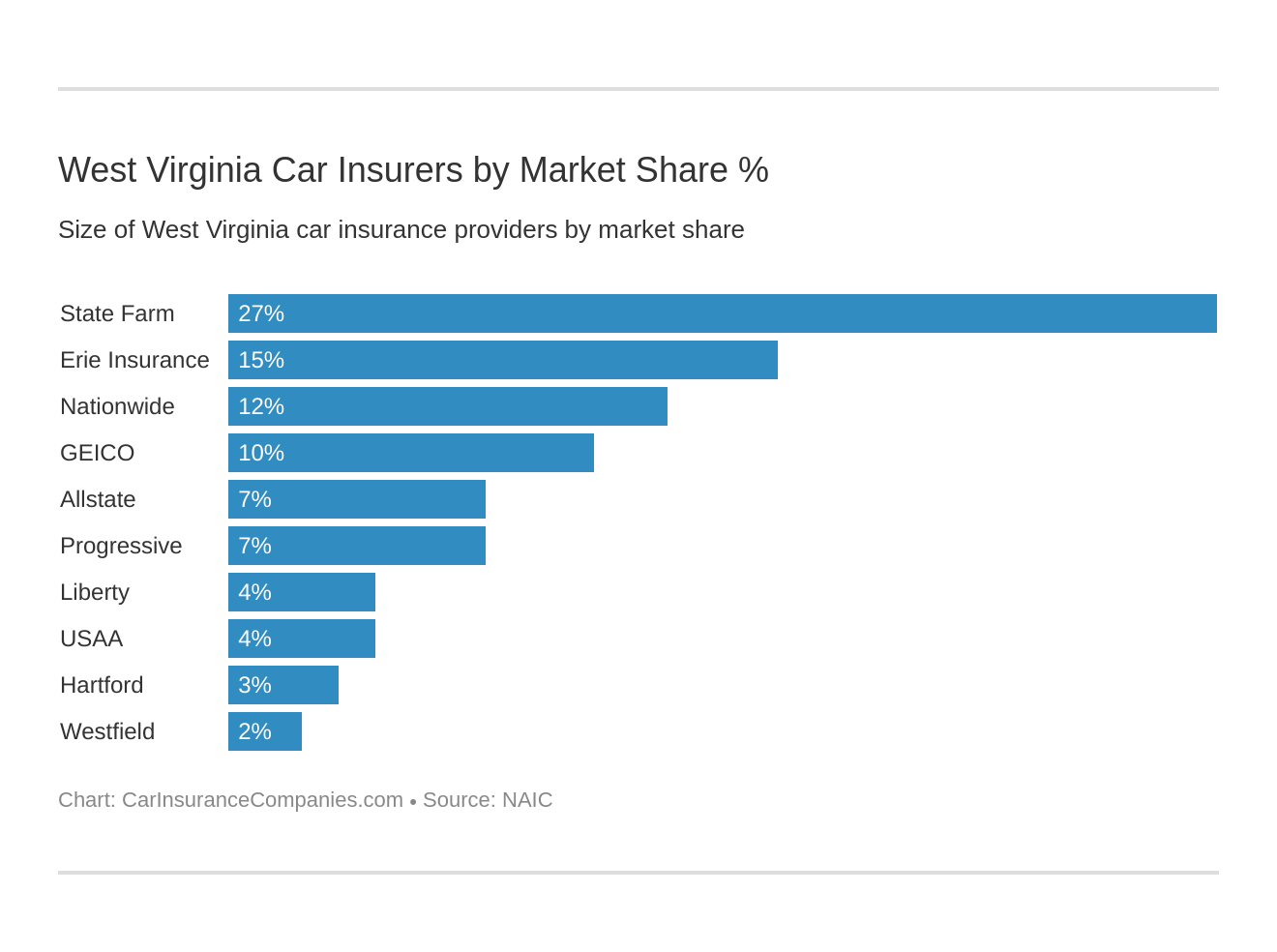

The largest companies in West Virginia and the market share of each are listed in the table below.

| Company | Average Rate | Market Share |

|---|---|---|

| Allstate Insurance Group | $92,007 | 7.43% |

| Erie | $182,120 | 14.71% |

| Geico | $124,709 | 10.07% |

| Hartford | $38,099 | 3.08% |

| Liberty Mutual | $54,356 | 4.39% |

| Nationwide | $145,858 | 11.78% |

| Progressive | $84,332 | 6.81% |

| State Farm | $329,651 | 26.62% |

| USAA | $48,434 | 3.91% |

| Westfield | $30,163 | 2.44% |

As you can see, State Farm is by far the largest insurance provider, with $329,651 in policies and a 27 percent share of the market.

Number of Insurers in West Virginia

There are a total of 812 insurance companies in West Virginia. Only 19 of these are domestic, meaning they are actually based in the state. The other 793 are foreign companies, meaning they are based outside of West Virginia but are licensed to do business in the state.

Every insurance company operating in West Virginia is required to follow the state’s insurance laws, whether they are foreign or domestic. To learn more about these laws, keep reading.

West Virginia Laws

In this section, we’ll discuss how state laws can influence rates and coverage, vehicle licensing procedures, as well as the driving laws you’ll need to know about before you get behind the wheel.

Car Insurance Laws

We’ve already looked at the minimum requirements for insurance so you can drive legally in West Virginia.

We also want to keep you informed about proper vehicle registration, speed limits, and laws unique to the Mountain State, so you can stay safe and ticket-free on the road, and so you can be more informed when shopping for insurance.

How State Laws for Insurance are Determined

The web contains overwhelming amounts of information on local laws, no matter where you live. We’re here to help you learn more about legislative processes in West Virginia.

Luckily, certain legislative procedures are set in place that mandate insurance laws across the board. It’s important to understand how and why these laws are enacted.

West Virginia’s Legislative Code outlines specific guidelines in Article 6, the insurance policy. Here, you can find the backstory for the state’s motor vehicle policy, policy on injuries to passengers, and coverage for loaned or leased motor vehicles. The key takeaways are that following specific state laws for insurance are secondary to owning, operating, and maintaining a vehicle.

In short, following your state’s laws for insurance are as important as having insurance itself.

Windshield Coverage

Windshield coverage is a state-specific law that often causes drivers to shake their heads. Luckily, there are no unreasonable laws regarding windshield repair inWest Virginia.

The website CarWindshields states that West Virginia requires cars younger than three years old to have their windshields replaced with Original Equipment Manufacturer (OEM) parts unless the consumer waives this in writing. Are OEM parts better than After Market Manufacturer parts?

Watch the video below to find out!

High-Risk Insurance

Earlier in the article, we learned that West Virginia has minimum liability coverage requirements for drivers within the state. These requirements range from $25,000-$50,000 for property damage and bodily damage liability.

What if you are considered a high-risk driver?

You may have a less-than-perfect driving record, and as a result, have difficulty obtaining an insurance policy through regular means. You’re considered to be a high-risk driver if you have a poor driving record, multiple DUIs, etc.

An SR-22 is a form specifically designed for high-risk drivers. It should be filed by an insurance carrier and sent to the DMV (Department of Motor Vehicles), where state law enforcement officers can verify that driver’s ability to maintain minimum insurance requirements.

Although filing extra forms may be annoying, the extra step can protect you if you’re involved in an automobile accident and need to file a claim.

Low-Cost Insurance

Some states have programs in place that help low-income drivers get car insurance. Unfortunately, West Virginia does not currently have a government-sponsored program for this specific purpose.

Automobile Insurance Fraud in West Virginia

Insurance fraud is a crime in West Virginia, and depending on the severity, may be considered either a misdemeanor or a felony. According to FindLaw.com, If the benefit sought or obtained is $1,000 or more, it is a felony punishable by up to 10 years in prison and up to a $10,000 fine.

Fraud is common, so be mindful. Fraud typically occurs when someone tries to make money from an insurance transaction through lies or deception.

Car insurance fraud includes a wide breadth of actions, but the most common are misrepresenting facts on insurance applications, submitting claim forms for injuries or damage that never occurred, or billing an insurer for a medical procedure that was not performed. Insurance providers can also violate the law by misrepresenting sales or presenting inappropriate cancellation or denial of coverage information.

In West Virginia, insurance fraud can occur in many different ways. Examples of insurance fraud include:

- Casualty fraud: Exaggerating injuries due to an accident to increase the funds you receive from the insurance company, or even faking an accident to file a claim

- Property fraud: Exaggerating the amount of damage incurred to your home, car, or other possession; deliberately damaging possessions for reimbursement by the insurance company, or seeking reimbursement for a lost or stolen item that was neither lost nor stolen.

What is prohibited?

Consumers may be held responsible for insurance fraud if they knowingly misrepresent important facts in relation to an insurance claim or payment or have damaged property to reap insurance benefits.

Insurance providers can be at fault too, issuing fake insurance policies, rate-fixing, misrepresenting insurance when selling it, denying compensation for covered incidents, operating an insurance company in bad faith, etc.

If you live in West Virginia and you want to report insurance fraud, call the Special Investigations Division of the West Virginia Offices of the Insurance State Commissioner. You can report fraud using the NAIC online fraud reporting system, or reach the department by phone: 800-779-6853 or email: [email protected].

Statute of Limitations

How long do you have to file a car accident lawsuit in West Virginia?

The state-specific statute of limitations requires you to settle your claim or file a lawsuit within two years from the date of the car accident for both personal injury and property damage claims.

For other types of cases, there are different time limits. Regardless, it’s important to be aware of the distinct time constraints so that you have ample time to prepare to file a lawsuit.

Are you wondering if you have a viable case? If your car accident case involves an injury or disputed matters, you should consider contacting an experienced car accident attorney in West Virginia. Talking to an attorney can help you take action before it’s too late to file a claim.

State-Specific Laws

You may be familiar with your state’s quirky laws, especially if they have affected you in the past. West Virginia is a rural, mountainous state with its own challenging driving conditions.

The West Virginia Department of Transportation offers its residents many resources for navigating tough conditions, including information on how to check road conditions.

In West Virginia, it’s important to check that your front and rear windshields are completely clear of ice or snow before you drive off. This simple precaution helps ensure your safety and the safety of everyone else on the road.

Vehicle Licensing Laws

Wondering if your license is up-to-snuff with current laws? To avoid fees and potential suspension, you should be aware of the laws in West Virginia associated with registering your vehicle and obtaining and maintaining your driver’s license.

In this section, we’ll cover the different requirements for registering a new vehicle or used vehicle, or registering your vehicle in the state as a new resident.

REAL ID

According to the Department of Homeland Security, West Virginia is compliant with the REAL ID Act. This means that federal agencies can accept West Virginia driver’s licenses as a secure form of identification at federal facilities like the Transportation Security Administration (TSA), the Social Security Administration, or nuclear power plants, should you need access.

Starting October 1, 2020, a REAL ID will be required to enter all federal buildings and to fly on any flight, foreign or domestic.

The REAL ID Act, passed by Congress in 2005, enacted the 9/11 Commission’s recommendation that the Federal Government “set standards for the issuance of sources of identification, such as driver’s licenses.”

If you don’t have a REAL ID now, it’s important to take action as soon as possible, as the process takes time.

In order to get a REAL ID-compliant license in West Virginia, you will need to visit a West Virginia DMV Office. They handle most driver and vehicle services in the state, with the exception of license examinations. You should plan to bring along the following documents to process your REAL ID:

- Verification of identity, such as a certified U.S. birth certificate, a U.S. passport, an employment authorization document, a permanent resident card, or a foreign passport with an approved I-94 form

- Proof of name changes (if applicable)

- Two current residency documents with the applicant’s name, such as a utility bill, rental agreement, deed/title, or a bank statement

- Social Security number

If you have additional questions about the REAL ID, please consult the West Virginia Department of Transportation’s brochure.

Penalties for Driving Without Insurance

Fourteen percent of Missouri drivers do not have car insurance.

West Virginia law requires that all drivers and vehicle owners have some type of motor vehicle liability insurance coverage. This means a motor vehicle liability insurance policy that meets the minimum liability insurance requirements.

So what happens if you’re stopped by law enforcement and can’t provide valid proof of insurance?

According to the WV Department of Transportation, a violation of insurance liability laws can result in the following:

- $200-$5,000 fine

- 30-day license suspension

- Revoking of registration

If you’re able to provide proof of insurance within 30 days, your fine will probably be at the lower end of the spectrum. After a second offense, however, you may face jail time and up to a 90-day license suspension.

To avoid penalties, you must keep some proof of insurance in your vehicle at all times, whether electronic or paper.

Teen Driver Laws

Teens in West Virginia are usually chomping at the bit to gain their driver’s licenses.

To do so, they must first enter the West Virginia Graduated Drivers’ License Program (GDL). To apply, they must be at least 15 years old, but younger than 18 years old. The applicant must have proof of enrollment in a valid Drivers Eligibility Certificate program and also pass a written driver’s test and vision screening. Consent from an authorized guardian is also required.

The minimum age for obtaining an instructional permit is 15, and the permit must be held for at least six months before the driver can obtain an intermediate driver’s permit. In West Virginia, learner’s permit holders younger than 18 may not drive between 10 p.m. and 5 a.m. and may not carry more than two passengers in addition to the supervising driver.

At 16, if the teenager has met the learner’s permit requirement, they can apply for the intermediate license, which allows:

- Driving without a parent or guardian between the hours of 5 a.m. and 10 p.m.

- Driving with a non-family member under the age of 20 (after six months)

An intermediate (or level 2) license can be obtained if the driver has completed the following criteria:

- 50 hours driving form (10 night hours)

- Clean driving record for the past six months

- Passed the road skills test

What is the final step for teen drivers in West Virginia?

The Under-21 Full Driver License is available at age 17. If the applicant has passed the first two stages of licensure and has no alcohol-related offenses or traffic convictions in the last 12 months, they are then permitted to drive as an adult in the state of West Virginia.

Older Driver License Renewal Procedures

Are you over the age of 70 and living in West Virginia?

According to the Insurance Institute for Highway Safety, the same license renewal procedures for the general population apply to older drivers as well. Proof of adequate vision is required at both types of renewals.

The renewal cycle for all drivers in West Virginia is every eight years.

Both mail and online renewal are available through the West Virginia Department of Transportation.

New Residents

If you have recently moved (or are considering relocating) to West Virginia, there will be new requirements and procedures regarding your license.

The good news is, if you have a valid out-of-state license that is not expired, you can transfer that license.

If your driver’s license has expired, you’re required to pass all examinations, including vision and written tests, road skills, and alcohol awareness. A new resident who does not have an out-of-state license, or has an expired license must obtain a certified driving record from the state in which they were previously licensed, less than 30 days old.

New West Virginia residents with an out-of-state driver’s license or nondriver license must provide acceptable documentation of the following:

- Proof of identity

- Date of lawful status

- Proof of Social Security number

- Proof of West Virginia residential address

- Two acceptable documents as proof of West Virginia residency and state of domicile (if you wish to acquire REAL ID, a commercial driver’s license or a commercial learner’s permit

You can find more information on the West Virginia DMV’s website.

License Renewal Procedures

License renewal for the general population in West Virginia is a relatively simple process. When it’s time to renew your license, you will receive a renewal notice in the mail at least 90 days before your license’s expiration date.

Once you’ve received the notice, you can renew online or in person.

If you are an active military member currently stationed out-of-state or outside of the U.S., your driver’s license is extended for a period of six months from the date you’re discharged under honorable circumstances from active duty.

West Virginia Point System

West Virginia’s traffic law enforcement works hard to ensure the safety of everyone on the road. To keep reckless drivers in check, they use a tickets and points system. The system works by adding points to a driver’s record based on the severity of the offense. Points may be added or reduced, with some exceptions.

- Points remain on a driver’s record for two years

- The incident itself (not points) remains on the record for five years

When a certain amount of points have been accumulated, drivers will begin to face license suspensions. They can range from penalties of 30-day suspensions for 12-13 points, to 90-day suspensions for 18-19 points. When a driver accumulates 20+ points, their license will be suspended until the point total is reduced.

It’s important to take the DMV Point System seriously, as infractions all across the U.S. will be counted and put on your record.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Rules of the Road

Understanding the rules of the road is crucial to being a safe driver. In this section, we’ll break down specific laws about device usage, speeding, and more.

Fault vs. No-Fault

West Virginia is an at-fault state. This means that when you’re in an accident, there will be an investigation to discover who caused it.

The person responsible for the accident will then be financially responsible for injuries, damages, and other harms that occurred as a result. It’s important to know about the ways you might be held financially responsible, and the coverage that offers you the necessary protection.

According to WV Department of Transportation, state law requires that all owners and motor vehicle drivers have some type of liability car insurance coverage. Not all states are at-fault states. However, there are other laws that are mostly standardized throughout the nation, like those related to seat belts and car seats.

Seat Belt and Car Seat Laws

The Insurance Institute for Highway Safety (IIHS) notes that seat belts are required for the driver and all front-seat passengers age 18 and older in West Virginia. Violation of the seat belt law is a standard offense.

According to IIHS, seat belts or child passenger safety devices are required for all vehicle occupants under age 18. The state’s car seat and child-seating laws are as follows:

- Children 7 years old or younger and less than 4’9″ require a child safety seat

- Children over 7 years old and 4’9″ or taller may use an adult belt

- Children riding in the backseat face no specific requirements

There will be a $25 fee for failure to buckle-up, especially if you have children aged 8 and under who are not in a proper child safety seat.

West Virginia currently has no state law or restrictions for riding in the back of a pickup truck or in the cargo area of a vehicle.

Keep Right and Move Over Laws

In West Virginia, drivers are required to keep right at all times. The left lane is only to be used for passing a slower vehicle or for turning left.

This specific law may seem severe, but it’s there to make sure drivers do not abuse their road privileges. On steep mountain roads like those in West Virginia, driving with caution and keeping right saves lives. Drivers should also give right-of-way to emergency vehicles, moving into a different lane and slowing their vehicles significantly.

Speed Limits

With all of the rural roads in West Virginia, you may be tempted to speed. The state has set speed limit laws that limit how fast you can drive. If you’re caught driving over the speed limit, you can be ticketed, receive a point against your license, and face monetary fines (along with a potential rate increase from your insurance company).

The maximum speed in the state is 70 MPH. This is for rural interstates; urban interstates have a speed limit of 55 MPH. Other highways and access roads have maximum speed limits of 65 MPH.

West Virginia speeding law requires drivers to be mindful of the traffic, pedestrians, and wildlife around them. This goes for changing weather conditions such as rain or snow, wherein a driver would need to adjust their speed in accordance with the conditions.

Ridesharing

Rideshare services like Uber and Lyft are available in West Virginia, and if you’d like to work as a driver for one of these companies, you will need special rideshare insurance. In West Virginia, you can get this insurance from State Farm.

Automation on the Road

Automated vehicles are on the horizon for the future, but as of yet, there are no specific laws in place for these vehicles in the state of West Virginia.

Safety Laws

In the Mountain State, roadkill may be taken home for dinner. This law aligns with the outdoor values of the state.

You may not be planning on eating roadkill anytime soon, but most of these next laws are critical when it comes to driving in West Virginia.

DUI Laws

The implications for driving while intoxicated are serious and your risk for having an accident goes up even after one drink. In West Virginia, the BAC limit is 0.08, while 0.15 is considered to be a high BAC.

In a sobering statistic from the CDC, nearly 13 percent of alcohol-related deaths in West Virginia affected individuals aged 21-34. This statistic is 6 percent greater than the national average for the same demographic. More young people are engaging in drunk driving, and the results are disastrous.

This table outlines the penalties for DUIs in West Virginia:

| Penalty | First DUI | Second DUI | Third DUI |

|---|---|---|---|

| Fine | $100-$500 | $1,000-$3,000 | $3,000-$5,000 |

| Jail Time | No minimum, up to 6 months | 6-12 months | 1-3 years |

| License Revoked | 15 day suspension | 1 year revocation due to accumulation of points, if 2nd in 5 years, may receive 5-year license denial | 1 year revocation |

| Mandatory Ignition Interlock Device | IID possible | IID required | IID required |

West Virginia’s DUI laws are tiered and harsher than those in most states. For a first-time DUI offense, note that you can receive up to six months in jail, a license revocation, and a fine of up to $500. For third or fourth-time offenses, penalties include up to a $5,000 fine and three-year imprisonment.

Marijuana-Impaired Driving Laws

Marijuana-specific impaired driving laws in West Virginia prohibit driving with a THC level over three nanograms. If more THC is detected in a driver’s blood, they may face charges of driving under the influence. The DSI’s website reminds us that marijuana has been approved for medical use in the state.

Distracted Driving Laws

According to the IIHS, a handheld ban exist for all drivers in West Virginia. Additionally, the state has taken action by setting laws in place to protect teen drivers. These stricter guidelines prohibit teens from using handheld cell phones or texting devices in any capacity while operating a moving vehicle.

These restrictions are lifted as early as age 17 when a driver acquires their official license. So, adults are able to make calls through BlueTooth or use talk-to-text.

Driving in West Virginia

Now that we’ve learned about state-specific driving laws, it’s time to move on to other factors that may influence your driving in West Virginia.

Where do West Virginia’s crime and fatality statistics rank among national averages? These figures are important to know, both for your safety and because they can factor into your premiums.

Vehicle Theft in West Virginia

Vehicle theft is considered an FBI crime in the U.S. You may not believe that this is something you need to worry about, but car theft can happen anywhere and to anyone.

The table below shows the most popular makes/models stolen in West Virginia.

| Rank | Make/Model | Year of Vehicle | Thefts |

|---|---|---|---|

| 1 | Ford Pickup (Full Size) | 2003 | 87 |

| 2 | Chevrolet Pickup (Full Size) | 2000 | 76 |

| 3 | Jeep Cherokee/Grand Cherokee | 1996 | 36 |

| 4 | Dodge Pickup (Full Size) | 2003 | 29 |

| 4 | Chevrolet Pickup (Small Size) | 1999 | 29 |

| 6 | Chevrolet Impala | 2006 | 24 |

| 7 | Toyota Camry | 2014 | 20 |

| 8 | Ford Taurus | 1995 | 19 |

| 9 | GMC Pickup (Full Size) | 2011 | 18 |

| 10 | Chevrolet Cavalier | 2002 | 17 |

As you can see, the most popular stolen vehicle was the 2003 Ford Pickup truck. The second most popular stolen vehicle was the Chevrolet Pickup.

Vehicle theft by city and state is tracked by the FBI. Take a look at the data below, which shows how many vehicles were stolen in cities throughout West Virginia in 2017.

| City | Population | Motor vehicle theft (2017) |

|---|---|---|

| Alderson | 1,171 | 0 |

| Barboursville | 4,315 | 7 |

| Beckley | 16,862 | 43 |

| Bluefield | 10,148 | 15 |

| Bridgeport | 8,401 | 9 |

| Buckhannon | 5,610 | 16 |

| Ceredo | 1,365 | 1 |

| Charleston | 48,788 | 353 |

| Charles Town | 6,062 | 1 |

| Dunbar | 7,486 | 38 |

| Fairmont | 18,604 | 50 |

| Fayetteville | 2,839 | 3 |

| Glen Dale | 1,433 | 1 |

| Grafton | 5,121 | 0 |

| Huntington | 47,933 | 180 |

| Kenova | 3,029 | 6 |

| Lewisburg | 3,935 | 0 |

| Madison | 2,831 | 5 |

| Martinsburg | 17,761 | 21 |

| Mason | 927 | 0 |

| Moorefield | 2,460 | 2 |

| Morgantown | 31,215 | 23 |

| Moundsville | 8,691 | 9 |

| Mount Hope | 1,341 | 0 |

| Nitro | 6,645 | 16 |

| Oak Hill | 8,490 | 10 |

| Parkersburg | 30,475 | 113 |

| Point Pleasant | 4,219 | 4 |

| Princeton | 5,935 | 10 |

| Ridgeley | 638 | 0 |

| Ripley | 3,243 | 0 |

| Ronceverte | 1,731 | 1 |

| South Charleston | 12,756 | 79 |

| St. Albans2 | 10,476 | 32 |

| Summersville | 3,411 | 5 |

| Vienna | 10,409 | 9 |

| Weirton | 18,870 | 15 |

| Wellsburg | 2,634 | 2 |

| Weston | 4,035 | 2 |

| Wheeling | 27,196 | 24 |

| Williamson | 2,883 | 0 |

The most vehicle thefts (353) occurred in Charleston. This makes sense, as Charleston is the largest city in West Virginia. The second was Huntington, with 180 thefts in 2017.

Road Fatalities in West Virginia

When people step into their vehicles, they rarely think about the fact that driving can be dangerous, and even fatal. Fatalities happen most frequently due to negligent or reckless driving, driving while impaired by a substance, or by other factors such as wet or icy roadways.

Defensive driving can keep you safer while you’re enjoying the scenic roads of West Virginia.

Read more: The 25 Most Dangerous Cities for Drivers [+Car Theft Rates]

Most Fatal Highway in West Virginia

According to the driving data website Geotabs, I-19 is the highway that sees the greatest number of fatal accidents in West Virginia.

Fatal Crashes by Weather Condition and Light Condition

The conditions in which we drive can significantly affect our safety. Changes in light, precipitation, and other weather events are huge factors to look out for. This table provides data on the number of fatalities in 2017 due to light and weather conditions.

Light Conditions West Virginia

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 131 | 12 | 76 | 7 | 0 | 226 |

| Rain | 20 | 5 | 15 | 4 | 0 | 44 |

| Snow/Sleet | 0 | 1 | 2 | 0 | 0 | 3 |

| Other | 0 | 0 | 4 | 1 | 0 | 5 |

| Unknown | 2 | 0 | 0 | 0 | 0 | 2 |

| TOTAL | 153 | 18 | 97 | 12 | 0 | 280 |

As you can see, most crashes happened during daylight hours, in normal roadway conditions. The second-worst time for crashes was during dark hours with normal roadway conditions.

To stay safe, stay focused and drive defensively whenever you’re on the road. When you are having difficulty with visibility, it is always best to slow down, or even pull over.

Fatalities (All Crashes) by County

The NHTSA Crash Report provides a list of the road fatalities in West Virginia by county from 2013-2017. See the table below.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities per 100k population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Barbour | 7 | 2 | 6 | 4 | 3 | 41.41 | 11.78 | 35.84 | 24.24 | 18.14 |

| Berkeley | 12 | 10 | 16 | 10 | 16 | 10.89 | 8.95 | 14.1 | 8.7 | 13.66 |

| Boone | 13 | 1 | 5 | 3 | 5 | 54.83 | 4.3 | 21.93 | 13.41 | 22.78 |

| Braxton | 4 | 7 | 5 | 3 | 7 | 27.77 | 48.71 | 34.91 | 21.09 | 49.68 |

| Brooke | 0 | 0 | 0 | 1 | 3 | 0 | 0 | 0 | 4.47 | 13.51 |

| Cabell | 9 | 15 | 11 | 16 | 11 | 9.31 | 15.53 | 11.5 | 16.93 | 11.8 |

| Calhoun | 1 | 0 | 0 | 1 | 2 | 13.23 | 0 | 0 | 13.66 | 27.57 |

| Clay | 4 | 1 | 2 | 0 | 3 | 45.05 | 11.27 | 22.66 | 0 | 34.75 |

| Doddridge | 1 | 0 | 1 | 3 | 5 | 11.8 | 0 | 11.66 | 35.17 | 59.48 |

| Fayette | 5 | 10 | 4 | 10 | 5 | 11.07 | 22.37 | 9.06 | 22.95 | 11.62 |

| Gilmer | 2 | 0 | 4 | 3 | 1 | 23.54 | 0 | 49.15 | 37.23 | 12.46 |

| Grant | 2 | 3 | 4 | 2 | 5 | 17.18 | 25.7 | 34.42 | 17.17 | 43.01 |

| Greenbrier | 2 | 7 | 6 | 6 | 6 | 5.62 | 19.67 | 16.88 | 17.02 | 17.25 |

| Hampshire | 5 | 8 | 6 | 3 | 5 | 21.33 | 34.31 | 25.73 | 12.82 | 21.42 |

| Hancock | 6 | 1 | 1 | 4 | 1 | 19.84 | 3.34 | 3.37 | 13.59 | 3.44 |

| Hardy | 3 | 5 | 2 | 3 | 6 | 21.5 | 36.15 | 14.48 | 21.68 | 43.56 |

| Harrison | 11 | 6 | 10 | 12 | 8 | 16.02 | 8.75 | 14.63 | 17.67 | 11.84 |

| Jackson | 10 | 6 | 4 | 8 | 10 | 34.33 | 20.57 | 13.71 | 27.67 | 34.84 |

| Jefferson | 6 | 11 | 7 | 7 | 4 | 10.79 | 19.61 | 12.51 | 12.41 | 7.04 |

| Kanawha | 20 | 23 | 21 | 31 | 40 | 10.51 | 12.22 | 11.28 | 16.91 | 22.17 |

| Lewis | 3 | 4 | 9 | 8 | 2 | 18.24 | 24.34 | 55.27 | 49.41 | 12.48 |

| Lincoln | 4 | 3 | 2 | 5 | 5 | 18.59 | 14.1 | 9.47 | 23.95 | 24.27 |

| Logan | 9 | 3 | 4 | 12 | 9 | 25.53 | 8.71 | 11.88 | 36.32 | 27.6 |

| Marion | 4 | 6 | 7 | 7 | 3 | 7.04 | 10.57 | 12.39 | 12.42 | 5.35 |

| Marshall | 1 | 6 | 1 | 5 | 2 | 3.09 | 18.64 | 3.15 | 16.02 | 6.5 |

| Mason | 9 | 5 | 5 | 3 | 3 | 33.15 | 18.46 | 18.57 | 11.19 | 11.23 |

| Mcdowell | 4 | 4 | 7 | 5 | 6 | 19.62 | 20.24 | 36.47 | 27 | 32.93 |

| Mercer | 11 | 7 | 8 | 12 | 15 | 17.81 | 11.45 | 13.2 | 20.07 | 25.37 |

| Mineral | 2 | 3 | 3 | 5 | 4 | 7.26 | 10.96 | 10.97 | 18.4 | 14.85 |

| Mingo | 8 | 8 | 1 | 5 | 2 | 31.08 | 31.6 | 4.04 | 20.71 | 8.41 |

| Monongalia | 10 | 13 | 12 | 7 | 16 | 9.66 | 12.42 | 11.35 | 6.61 | 15.03 |

| Monroe | 3 | 1 | 2 | 5 | 3 | 22.04 | 7.36 | 14.82 | 37.39 | 22.59 |

| Morgan | 3 | 0 | 4 | 1 | 1 | 17.13 | 0 | 22.7 | 5.65 | 5.62 |

| Nicholas | 3 | 1 | 9 | 8 | 6 | 11.66 | 3.91 | 35.46 | 31.83 | 24.15 |

| Ohio | 3 | 7 | 3 | 2 | 2 | 6.93 | 16.28 | 7.03 | 4.76 | 4.79 |

| Pendleton | 4 | 1 | 4 | 0 | 3 | 55.33 | 14.08 | 57.32 | 0 | 42.88 |

| Pleasants | 0 | 3 | 0 | 0 | 1 | 0 | 40.01 | 0 | 0 | 13.32 |

| Pocahontas | 3 | 1 | 1 | 3 | 2 | 34.67 | 11.66 | 11.73 | 35.35 | 23.77 |

| Preston | 4 | 6 | 10 | 4 | 2 | 11.79 | 17.73 | 29.62 | 11.83 | 5.91 |

| Putnam | 9 | 4 | 5 | 10 | 9 | 15.89 | 7.07 | 8.82 | 17.65 | 15.88 |

| Raleigh | 9 | 17 | 14 | 11 | 19 | 11.51 | 21.97 | 18.35 | 14.65 | 25.59 |

| Randolph | 3 | 5 | 8 | 6 | 5 | 10.21 | 17.12 | 27.56 | 20.77 | 17.35 |

| Ritchie | 3 | 2 | 3 | 1 | 2 | 29.77 | 19.84 | 30.11 | 10.19 | 20.57 |

| Roane | 0 | 3 | 3 | 8 | 2 | 0 | 20.87 | 21.26 | 57.1 | 14.36 |

| Summers | 2 | 4 | 1 | 3 | 1 | 15 | 30.46 | 7.71 | 23.27 | 7.84 |

| Taylor | 1 | 0 | 1 | 2 | 0 | 5.85 | 0 | 5.9 | 11.83 | 0 |

| Tucker | 1 | 1 | 0 | 0 | 0 | 14.18 | 14.11 | 0 | 0 | 0 |

| Tyler | 2 | 0 | 4 | 4 | 1 | 22.01 | 0 | 44.68 | 45.42 | 11.43 |

| Upshur | 1 | 7 | 2 | 0 | 3 | 4.05 | 28.31 | 8.11 | 0 | 12.29 |

| Wayne | 7 | 9 | 6 | 13 | 7 | 16.86 | 21.85 | 14.74 | 32.34 | 17.52 |

| Webster | 1 | 3 | 3 | 2 | 0 | 11.43 | 34.74 | 35.06 | 23.91 | 0 |

| Wetzel | 3 | 3 | 0 | 2 | 3 | 18.8 | 19.02 | 0 | 12.97 | 19.65 |

| Wirt | 0 | 1 | 1 | 2 | 1 | 0 | 17.23 | 17.34 | 34.54 | 17.15 |

| Wood | 15 | 8 | 8 | 10 | 7 | 17.35 | 9.27 | 9.33 | 11.75 | 8.31 |

| Wyoming | 4 | 3 | 3 | 3 | 1 | 17.72 | 13.53 | 13.78 | 14.12 | 4.81 |

In 2018, Kanawha County experienced the most crash-related deaths, at 40. The second-highest number by county was Raleigh, at 19 deaths, followed by Berkeley and Monongalia with 16 crash-related deaths each. These numbers are higher than they were in 2017 by about 10 percent.

Traffic Fatalities

Traffic fatalities happen everywhere. They can happen on a heavily trafficked interstate, and they can happen on a lone country road. This table shows the number of urban and rural traffic fatalities in West Virginia from 2014-2018.

| Region | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Rural | 205 | 190 | 169 | 203 | 178 |

| Urban | 67 | 78 | 99 | 98 | 116 |

| Total | 272 | 268 | 268 | 301 | 294 |

We already know that West Virginia’s rural landscape brings some difficult driving conditions. Rural areas experience more traffic fatalities than urban areas in this state — about 53 percent more in 2018.

Fatalities by Person Type

The West Virginia NHTSA Crash Report looks at the number of fatalities for 2014-2018 based on the person and vehicle type.

| Person Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Passenger Car | 99 | 90 | 85 | 105 | 104 |

| Bicyclist and Other Cyclist | 2 | 1 | 1 | 3 | 5 |

| Bicyclist and Other Cyclist | 2 | 1 | 1 | 3 | 5 |

| Large Truck | 6 | 4 | 6 | 9 | 13 |

| Light Truck - Other | 0 | 2 | 1 | 1 | 0 |

| Light Truck - Pickup | 50 | 45 | 47 | 40 | 43 |

| Light Truck - Utility | 48 | 50 | 39 | 66 | 39 |

| Light Truck - Van | 5 | 5 | 14 | 7 | 11 |

| Other/Unknown Nonoccupants | 0 | 0 | 4 | 4 | 4 |

| Other/Unknown Occupants | 17 | 20 | 21 | 19 | 16 |

| Pedestrian | 19 | 19 | 24 | 26 | 22 |

| Pedestrian | 19 | 19 | 24 | 26 | 22 |

| Total | 272 | 268 | 269 | 304 | 294 |

| Total Motorcyclists | 26 | 32 | 29 | 26 | 39 |

| Total Nonoccupants | 21 | 20 | 27 | 31 | 29 |

| Total Occupants | 225 | 216 | 213 | 247 | 226 |

The table above shows fatalities for accidents involving various vehicles, including cars, trucks, motorcycles, bicycles, and buses.

Most crashes in 2018 involved people in passenger car accidents (104). The second-highest group of casualties involved light pickup trucks (43).

Fatalities by Crash Type

Accidents happen unexpectedly, so it can never hurt to be prepared. Whether an accident occurs involving a large truck, a single vehicle, or happens at an intersection, it’s important to know what situations are potentially most dangerous.

| Crash Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Single Vehicle | 164 | 160 | 167 | 189 | 160 |

| Involving a Large Truck | 30 | 22 | 31 | 55 | 52 |

| Involving Speeding | 66 | 66 | 60 | 84 | 88 |

| Involving a Rollover | 91 | 88 | 86 | 86 | 69 |

| Involving a Roadway Departure | 205 | 191 | 179 | 214 | 199 |

| Involving an Intersection | 31 | 30 | 33 | 41 | 35 |

| Total Fatalities (All Crashes) | 272 | 268 | 269 | 304 | 294 |

The table above shows fatalities by crash type, depending on the vehicles involved in the crashes or the scenario of the accident.

An overwhelming majority of crashes occur during a roadway departure; these accidents peaked at 214 in 2017. The second-highest rate of fatalities was for accidents involving a single vehicle.

Five-Year Trend For The Top 10 Counties

Looking at crash data over a five-year period in different parts of the state is another useful tool for your safe-driving arsenal.

We don’t always know why crashes happen. But in the table below, we can see the five-year trend for the top 10 counties in West Virginia.

| Rank | County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|

| 1 | Kanawha County | 20 | 23 | 21 | 31 | 40 |

| 2 | Raleigh County | 9 | 17 | 14 | 11 | 19 |

| 3 | Berkeley County | 12 | 10 | 16 | 10 | 16 |

| 4 | Monongalia County | 10 | 13 | 12 | 7 | 16 |

| 5 | Mercer County | 11 | 7 | 8 | 12 | 15 |

| 6 | Cabell County | 9 | 15 | 11 | 16 | 11 |

| 7 | Jackson County | 10 | 6 | 4 | 8 | 10 |

| 8 | Logan County | 9 | 3 | 4 | 12 | 9 |

| 9 | Putnam County | 9 | 4 | 5 | 10 | 9 |

| 10 | Harrison County | 11 | 6 | 10 | 12 | 8 |

Kanawha County had both the highest number of crashes and the sharpest increase in accidents. Since 2014, that number went up from 20 to 40, a 100 percent increase. All of the top 10 counties, with the exception of Jackson, Logan, Putnam, and Harrison, have shown significant increases in crashes since 2014.

Fatalities Involving Speeding by County

Where in the state should you pay the most attention to speeding? The West Virginia NHTSA Traffic Report provides data on fatalities involving speeding by county for 2014-2018 so you can be more aware.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities per 100k population 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Barbour | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 6.06 | 6.05 | 6.05 |

| Berkeley | 4 | 4 | 4 | 3 | 8 | 3.63 | 3.58 | 3.52 | 2.61 | 6.83 | 6.83 |

| Boone | 3 | 0 | 0 | 0 | 0 | 12.65 | 0 | 0 | 0 | 0 | 0 |

| Braxton | 0 | 2 | 1 | 0 | 1 | 0 | 13.92 | 6.98 | 0 | 7.1 | 7.1 |

| Brooke | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 4.5 | 4.5 |

| Cabell | 1 | 6 | 1 | 1 | 4 | 1.03 | 6.21 | 1.05 | 1.06 | 4.29 | 4.29 |

| Calhoun | 1 | 0 | 0 | 1 | 0 | 13.23 | 0 | 0 | 13.66 | 0 | 0 |

| Clay | 2 | 1 | 2 | 0 | 1 | 22.52 | 11.27 | 22.66 | 0 | 11.58 | 11.58 |

| Doddridge | 0 | 0 | 0 | 2 | 1 | 0 | 0 | 0 | 23.45 | 11.9 | 11.9 |

| Fayette | 0 | 2 | 1 | 2 | 2 | 0 | 4.47 | 2.26 | 4.59 | 4.65 | 4.65 |

| Gilmer | 0 | 0 | 2 | 3 | 1 | 0 | 0 | 24.58 | 37.23 | 12.46 | 12.46 |

| Grant | 1 | 2 | 2 | 1 | 2 | 8.59 | 17.14 | 17.21 | 8.58 | 17.2 | 17.2 |

| Greenbrier | 0 | 0 | 1 | 1 | 1 | 0 | 0 | 2.81 | 2.84 | 2.87 | 2.87 |

| Hampshire | 4 | 1 | 1 | 1 | 1 | 17.07 | 4.29 | 4.29 | 4.27 | 4.28 | 4.28 |

| Hancock | 3 | 1 | 1 | 2 | 1 | 9.92 | 3.34 | 3.37 | 6.8 | 3.44 | 3.44 |

| Hardy | 1 | 0 | 0 | 1 | 3 | 7.17 | 0 | 0 | 7.23 | 21.78 | 21.78 |

| Harrison | 2 | 3 | 1 | 4 | 5 | 2.91 | 4.38 | 1.46 | 5.89 | 7.4 | 7.4 |

| Jackson | 5 | 2 | 1 | 2 | 0 | 17.16 | 6.86 | 3.43 | 6.92 | 0 | 0 |

| Jefferson | 1 | 2 | 3 | 2 | 1 | 1.8 | 3.57 | 5.36 | 3.55 | 1.76 | 1.76 |

| Kanawha | 7 | 8 | 4 | 13 | 11 | 3.68 | 4.25 | 2.15 | 7.09 | 6.1 | 6.1 |

| Lewis | 0 | 3 | 4 | 0 | 0 | 0 | 18.25 | 24.57 | 0 | 0 | 0 |

| Lincoln | 1 | 1 | 0 | 0 | 0 | 4.65 | 4.7 | 0 | 0 | 0 | 0 |

| Logan | 2 | 2 | 1 | 3 | 1 | 5.67 | 5.81 | 2.97 | 9.08 | 3.07 | 3.07 |

| Marion | 2 | 3 | 5 | 1 | 0 | 3.52 | 5.29 | 8.85 | 1.77 | 0 | 0 |

| Marshall | 0 | 2 | 0 | 2 | 0 | 0 | 6.21 | 0 | 6.41 | 0 | 0 |

| Mason | 1 | 2 | 2 | 2 | 1 | 3.68 | 7.39 | 7.43 | 7.46 | 3.74 | 3.74 |

| Mcdowell | 2 | 0 | 1 | 1 | 1 | 9.81 | 0 | 5.21 | 5.4 | 5.49 | 5.49 |

| Mercer | 2 | 1 | 2 | 2 | 5 | 3.24 | 1.64 | 3.3 | 3.34 | 8.46 | 8.46 |

| Mineral | 1 | 0 | 1 | 2 | 3 | 3.63 | 0 | 3.66 | 7.36 | 11.14 | 11.14 |

| Mingo | 1 | 2 | 0 | 2 | 0 | 3.89 | 7.9 | 0 | 8.29 | 0 | 0 |

| Monongalia | 0 | 2 | 3 | 2 | 2 | 0 | 1.91 | 2.84 | 1.89 | 1.88 | 1.88 |

| Monroe | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 7.41 | 0 | 7.53 | 7.53 |

| Morgan | 1 | 0 | 0 | 1 | 0 | 5.71 | 0 | 0 | 5.65 | 0 | 0 |

| Nicholas | 0 | 0 | 1 | 3 | 2 | 0 | 0 | 3.94 | 11.94 | 8.05 | 8.05 |

| Ohio | 0 | 1 | 2 | 1 | 2 | 0 | 2.33 | 4.69 | 2.38 | 4.79 | 4.79 |

| Pendleton | 1 | 1 | 1 | 0 | 2 | 13.83 | 14.08 | 14.33 | 0 | 28.58 | 28.58 |

| Pleasants | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Pocahontas | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 11.78 | 0 | 0 |

| Preston | 2 | 1 | 1 | 1 | 1 | 5.9 | 2.95 | 2.96 | 2.96 | 2.96 | 2.96 |

| Putnam | 3 | 1 | 1 | 4 | 5 | 5.3 | 1.77 | 1.76 | 7.06 | 8.82 | 8.82 |

| Raleigh | 2 | 4 | 0 | 1 | 5 | 2.56 | 5.17 | 0 | 1.33 | 6.73 | 6.73 |

| Randolph | 1 | 0 | 1 | 0 | 2 | 3.4 | 0 | 3.44 | 0 | 6.94 | 6.94 |

| Ritchie | 1 | 0 | 0 | 0 | 1 | 9.92 | 0 | 0 | 0 | 10.29 | 10.29 |

| Roane | 0 | 2 | 1 | 5 | 0 | 0 | 13.91 | 7.09 | 35.69 | 0 | 0 |

| Summers | 0 | 1 | 0 | 1 | 1 | 0 | 7.61 | 0 | 7.76 | 7.84 | 7.84 |

| Taylor | 1 | 0 | 1 | 0 | 0 | 5.85 | 0 | 5.9 | 0 | 0 | 0 |

| Tucker | 0 | 1 | 0 | 0 | 0 | 0 | 14.11 | 0 | 0 | 0 | 0 |

| Tyler | 0 | 0 | 1 | 1 | 1 | 0 | 0 | 11.17 | 11.35 | 11.43 | 11.43 |

| Upshur | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 8.19 | 8.19 |

| Wayne | 1 | 0 | 2 | 1 | 1 | 2.41 | 0 | 4.91 | 2.49 | 2.5 | 2.5 |

| Webster | 0 | 0 | 1 | 2 | 0 | 0 | 0 | 11.69 | 23.91 | 0 | 0 |

| Wetzel | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 6.48 | 6.55 | 6.55 |

| Wirt | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 17.15 | 17.15 |

| Wood | 5 | 1 | 2 | 4 | 2 | 5.78 | 1.16 | 2.33 | 4.7 | 2.38 | 2.38 |

| Wyoming | 1 | 1 | 0 | 0 | 0 | 4.43 | 4.51 | 0 | 0 | 0 | 0 |

Kanawha County consistently holds the highest spot for speed-related traffic fatalities in West Virginia, with a spike of 13 fatalities in 2017.

Fatalities in Crashes Involving an Alcohol-Impaired Driver

As you can see in the table below (data from the West Virginia NHTSA Crash Report), driving under the influence can be deadly for you and others on the road.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities per 100k population 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Barbour | 1 | 0 | 2 | 2 | 2 | 5.92 | 0 | 11.95 | 12.12 | 12.1 | 12.1 |

| Berkeley | 4 | 2 | 4 | 2 | 6 | 3.63 | 1.79 | 3.52 | 1.74 | 5.12 | 5.12 |

| Boone | 6 | 0 | 0 | 0 | 0 | 25.31 | 0 | 0 | 0 | 0 | 0 |

| Braxton | 1 | 3 | 0 | 0 | 1 | 6.94 | 20.87 | 0 | 0 | 7.1 | 7.1 |

| Brooke | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 4.47 | 0 | 0 |

| Cabell | 4 | 3 | 2 | 6 | 1 | 4.14 | 3.11 | 2.09 | 6.35 | 1.07 | 1.07 |

| Calhoun | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Clay | 0 | 1 | 0 | 0 | 0 | 0 | 11.27 | 0 | 0 | 0 | 0 |

| Doddridge | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Fayette | 0 | 3 | 0 | 0 | 0 | 0 | 6.71 | 0 | 0 | 0 | 0 |

| Gilmer | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 24.58 | 0 | 0 | 0 |

| Grant | 1 | 0 | 0 | 1 | 1 | 8.59 | 0 | 0 | 8.58 | 8.6 | 8.6 |

| Greenbrier | 1 | 2 | 1 | 1 | 2 | 2.81 | 5.62 | 2.81 | 2.84 | 5.75 | 5.75 |

| Hampshire | 1 | 1 | 3 | 1 | 0 | 4.27 | 4.29 | 12.87 | 4.27 | 0 | 0 |

| Hancock | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 3.37 | 0 | 0 | 0 |

| Hardy | 0 | 2 | 0 | 0 | 1 | 0 | 14.46 | 0 | 0 | 7.26 | 7.26 |

| Harrison | 2 | 5 | 1 | 6 | 2 | 2.91 | 7.3 | 1.46 | 8.83 | 2.96 | 2.96 |

| Jackson | 0 | 2 | 1 | 1 | 1 | 0 | 6.86 | 3.43 | 3.46 | 3.48 | 3.48 |

| Jefferson | 2 | 4 | 3 | 1 | 1 | 3.6 | 7.13 | 5.36 | 1.77 | 1.76 | 1.76 |

| Kanawha | 6 | 7 | 7 | 5 | 2 | 3.15 | 3.72 | 3.76 | 2.73 | 1.11 | 1.11 |

| Lewis | 2 | 2 | 1 | 1 | 0 | 12.16 | 12.17 | 6.14 | 6.18 | 0 | 0 |

| Lincoln | 1 | 0 | 0 | 2 | 2 | 4.65 | 0 | 0 | 9.58 | 9.71 | 9.71 |

| Logan | 4 | 2 | 1 | 2 | 2 | 11.35 | 5.81 | 2.97 | 6.05 | 6.13 | 6.13 |

| Marion | 0 | 0 | 3 | 1 | 1 | 0 | 0 | 5.31 | 1.77 | 1.78 | 1.78 |

| Marshall | 0 | 1 | 1 | 2 | 0 | 0 | 3.11 | 3.15 | 6.41 | 0 | 0 |

| Mason | 1 | 2 | 1 | 2 | 0 | 3.68 | 7.39 | 3.71 | 7.46 | 0 | 0 |

| Mcdowell | 2 | 2 | 4 | 1 | 1 | 9.81 | 10.12 | 20.84 | 5.4 | 5.49 | 5.49 |

| Mercer | 4 | 2 | 1 | 1 | 5 | 6.48 | 3.27 | 1.65 | 1.67 | 8.46 | 8.46 |

| Mineral | 0 | 1 | 1 | 1 | 0 | 0 | 3.65 | 3.66 | 3.68 | 0 | 0 |

| Mingo | 4 | 1 | 0 | 3 | 1 | 15.54 | 3.95 | 0 | 12.43 | 4.2 | 4.2 |

| Monongalia | 4 | 4 | 1 | 2 | 4 | 3.87 | 3.82 | 0.95 | 1.89 | 3.76 | 3.76 |

| Monroe | 1 | 0 | 0 | 1 | 2 | 7.35 | 0 | 0 | 7.48 | 15.06 | 15.06 |

| Morgan | 1 | 0 | 1 | 0 | 0 | 5.71 | 0 | 5.67 | 0 | 0 | 0 |

| Nicholas | 3 | 0 | 1 | 1 | 2 | 11.66 | 0 | 3.94 | 3.98 | 8.05 | 8.05 |

| Ohio | 2 | 3 | 1 | 1 | 2 | 4.62 | 6.98 | 2.34 | 2.38 | 4.79 | 4.79 |

| Pendleton | 1 | 1 | 1 | 0 | 1 | 13.83 | 14.08 | 14.33 | 0 | 14.29 | 14.29 |

| Pleasants | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Pocahontas | 1 | 0 | 0 | 2 | 0 | 11.56 | 0 | 0 | 23.57 | 0 | 0 |

| Preston | 2 | 0 | 5 | 2 | 1 | 5.9 | 0 | 14.81 | 5.91 | 2.96 | 2.96 |

| Putnam | 4 | 0 | 1 | 4 | 0 | 7.06 | 0 | 1.76 | 7.06 | 0 | 0 |

| Raleigh | 3 | 3 | 4 | 2 | 3 | 3.84 | 3.88 | 5.24 | 2.66 | 4.04 | 4.04 |

| Randolph | 1 | 1 | 2 | 0 | 1 | 3.4 | 3.42 | 6.89 | 0 | 3.47 | 3.47 |

| Ritchie | 2 | 1 | 1 | 0 | 1 | 19.85 | 9.92 | 10.04 | 0 | 10.29 | 10.29 |

| Roane | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 14.28 | 0 | 0 |

| Summers | 0 | 1 | 0 | 1 | 0 | 0 | 7.61 | 0 | 7.76 | 0 | 0 |

| Taylor | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 11.83 | 0 | 0 |

| Tucker | 1 | 1 | 0 | 0 | 0 | 14.18 | 14.11 | 0 | 0 | 0 | 0 |

| Tyler | 1 | 0 | 3 | 0 | 1 | 11.01 | 0 | 33.51 | 0 | 11.43 | 11.43 |

| Upshur | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Wayne | 3 | 1 | 3 | 2 | 1 | 7.23 | 2.43 | 7.37 | 4.98 | 2.5 | 2.5 |

| Webster | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 11.69 | 0 | 0 | 0 |

| Wetzel | 1 | 2 | 0 | 0 | 1 | 6.27 | 12.68 | 0 | 0 | 6.55 | 6.55 |

| Wirt | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Wood | 5 | 2 | 3 | 3 | 1 | 5.78 | 2.32 | 3.5 | 3.53 | 1.19 | 1.19 |

| Wyoming | 0 | 1 | 0 | 1 | 0 | 0 | 4.51 | 0 | 4.71 | 0 | 0 |

The table shows the number of alcohol-impaired driving fatalities from 2014-2018 for each county in West Virginia. You can also view the fatalities per 100,000 population. Alcohol-impaired deaths in 2018 were highest in Berkeley (six), Mercer (five), and Monongalia counties (four).

Teen Drinking and Driving

Like most states, the legal drinking age in West Virginia is 21. Responsibility.org reports West Virginia’s average for under-21 driving fatalities involving alcohol as 1.1 deaths per 100,000 population, while the national average is 1.2.

According to the FBI, West Virginia ranks 44th in the nation for underage DUI arrests, with just 11 teenagers arrested for DUIs in 2018.

The state law for BAC level is 0.08. However, West Virginia DWI laws prohibit underage drivers from operating a motor vehicle with a BAC of 0.02 percent or over.

EMS Response Time

According to AAA Driving Laws, state law requires drivers approaching and traveling in the same direction as an emergency vehicle displaying flashing lights to change to a non-adjacent lane. Even so, EMS may have a tough time when trying to reach remote areas.

Let’s take a look at EMS response time statistics from NHTSA.

| Region Type | Average Time Of Crash To Ems Notification | Average Ems Notification To Ems Arrival | Average Ems Arrival At Scene To Hospital Arrival | Average Time Of Crash To Hospital Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|

| Rural | 6.05 | 14.57 | 37.38 | 54.78 | 188 |

| Urban | 3.67 | 9.5 | 30 | 42.84 | 89 |

The table above compares the average response times for EMS in rural and urban areas.

Unsurprisingly, there are 111 percent more rural than urban crashes. Emergency response workers must respond accordingly, regardless of location or terrain. The average travel time to the hospital from the crash site nearly doubles between rural and urban areas as well, from 3.6 minutes to six minutes.

Transportation

How do people get around in West Virginia and how long does it take residents to get to work? It’s worth looking at this data as well, as it can also affect the rate you’re charged for insurance.

Car Ownership

According to Data USA, the average West Virginia household owned two cars in 2017.

Commute Time

Data USA also tells us that the average time West Virginia residents spent commuting to work was 25.6 minutes, which right in line with the national average of 25.5 minutes.

Commuter Transportation