Illinois Car Insurance (Coverage, Companies, & More)

The top Illinois car insurance companies are Safeco and State Farm, but you may find more affordable Illinois car insurance rates with another company. Start comparison shopping now because your Illinois car insurance rates can vary based on your age and the kind of car you drive. Enter your ZIP code below to compare Illinois car insurance quotes and read our guide for more ways to save on your Illinois car insurance coverage.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Licensed Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health insuran...

Rachael Brennan

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated November 2024

| Illinois Statistics Summary | Details |

|---|---|

| Population | 39,557,045 |

| Road Miles | Roadway Miles: 94,481 Vehicle Miles Driven: 104.9 billion |

| Driving Deaths | Speeding – 462 Drunk Driving –349 |

| Vehicles | Registered: 10,042,205 Total Stolen: 17,451 |

| Most Popular Vehicle | Honda CR-V |

| Average Premiums (Annual) | Liability – $446.72 Collision – $309.71 Comprehensive – $128.13 Combined Premiums – $884.56 |

| Percent of Motorists Uninsured | 13.7% State Rank: 18th |

| Cheapest Provider | Safeco |

We know that hunting down the right car insurance can be an extremely tedious task. That’s why we’re here to help—we’ve done all the hard work for you and put together this comprehensive guide to get you on your way.

We want you to get out on the roads of beautiful Illinois, so in this guide, we’ll cover all the things you’ll want to know to get the best car insurance.

Ready to take the leap? Use our FREE online tool now! All you need is your zip code to get started!

How to get Illinois car insurance coverage and rates

We’ll start with the car insurance coverage you’ll need to legally drive in Illinois, as well as some of the rates you can expect.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s Illinois minimum coverage?

Most states in the nation require that you have something known as minimum liability coverage. This coverage helps to ensure that if you’re ever in an accident, you have the coverage to help pay for it. This especially comes in handy considering that Illinois is considered an “at-fault” accident state.

An “at-fault” state is a state in which the person responsible for an accident is the one held responsible for any personal injuries or property damages incurred during the accident.

According to the Insurance Information Institute (III), Illinois has the following minimum liability coverage requirements:

| Insurance Required | Minimum Limits: 25/50/20 |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per one person $50,000 per accident |

| Property Damage Liability Coverage | $20,000 minimum |

Let’s break that down a little further to help you understand these limits:

- $20,000 – for the payment of any property damaged in an accident that you caused

- $25,000 – for the payment of an injury/death to one person in an accident that you caused

- $50,000 – for the combined payment of injury/death to multiple people in an accident that you caused

In addition to this, Illinois has made Uninsured Motorist Coverage (UIM) automatic for every policy, meaning every policy sold to a customer automatically comes with this coverage.

These values may seem like a good chunk of change, but in a severe accident, these funds can quickly run out. That’s why getting more than the minimum coverage can be extremely important, and definitely worth the investment.

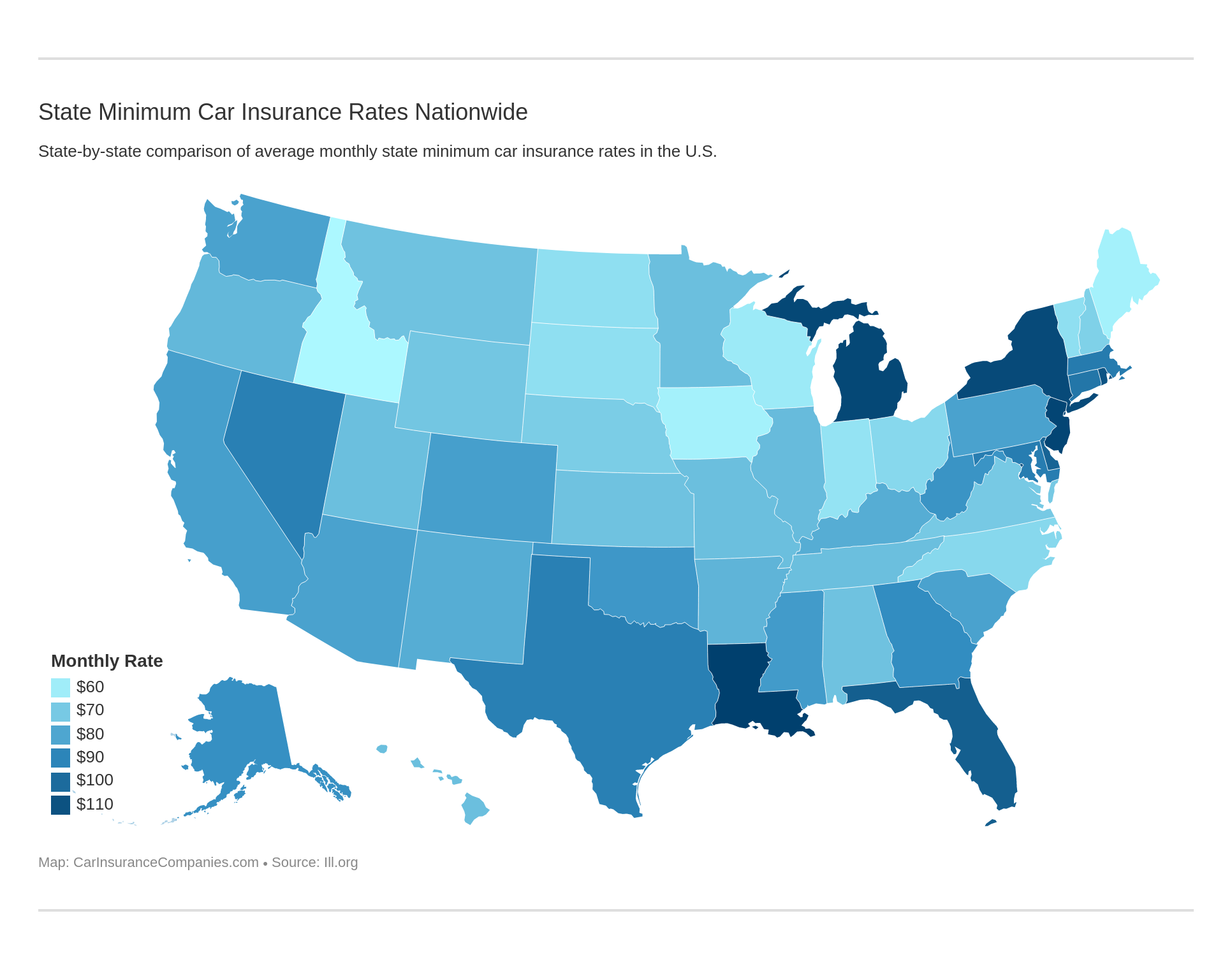

Minimum coverage costs vary from state to state.

What is the form of financial responsibility?

Now, with this insurance requirement, you’ll want to have some kind of proof of insurance; this is what you’ll provide if you’re ever pulled over by a police officer or are in an accident.

So what form of financial responsibility will be valid in Illinois?

- Insurance ID Card

- Copy of your insurance policy

Illinois passed a law in 2013 stating it is acceptable for drivers to provide proof of coverage electronically. If you have your provider’s app on your phone, you can use that as a form of financial responsibility.

Think you might get lucky and not get in an accident or get pulled over without needing to provide proof? Think again! In Illinois, drivers are selected at random via a letter in the mail and must verify their insurance coverage within 30 days of receiving the letter.

Don’t risk it! Make sure you have an updated form of financial responsibility on you at all times.

What percentage of income are insurance premiums?

The premium that you pay can be affected by something known as per capita disposable income. What exactly does this mean?

Disposable personal income (DPI) is the amount of money you are left with after taxes.

The average disposable personal income of Illinois citizens is $42,256, which is good, considering that the national average is $40,859. Illinois citizens are making more than the average American citizen.

| Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|---|---|---|---|---|---|---|---|---|

| $854.10 | $42,256.00 | 2.02% | $819.27 | $40,619.00 | 2.02% | $806.21 | $40,143.00 | 2.01% |

You can see from the table above that 2.02 percent of your average disposable income goes to your car insurance coverage. Making sure that you set that money aside each month to pay for your car insurance is very important.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

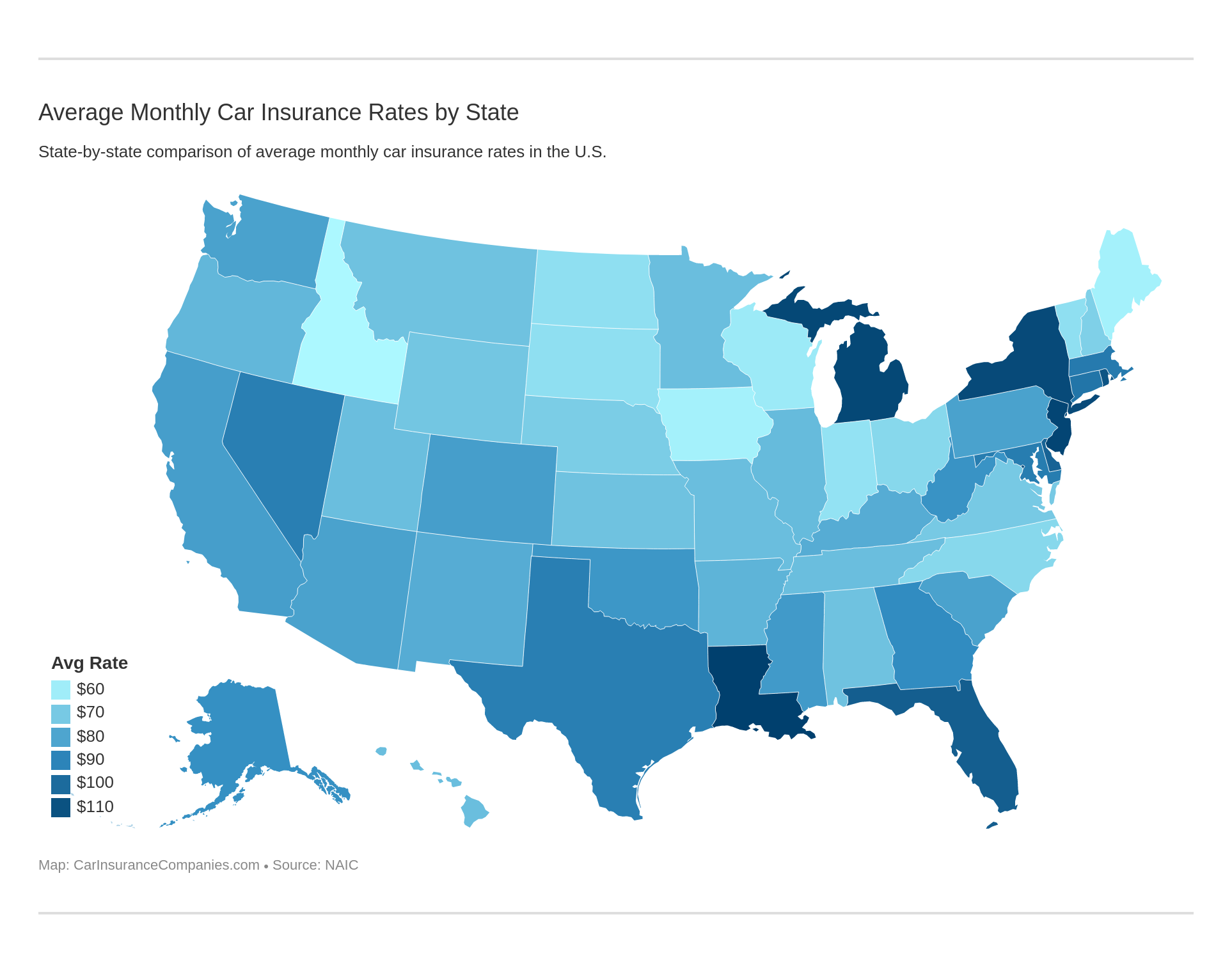

What are the average monthly car insurance rates in IL (liability, collision, comprehensive coverage)

| Coverage Type | Annual Costs in 2015 |

|---|---|

| Liability | $446.72 |

| Collision | $309.71 |

| Comprehensive | $128.13 |

| Combined | $884.56 |

Is there an additional liability?

On top of the minimum liability coverage, two other liability coverage types are very important: medical payments (MedPay) and uninsured/underinsured motorist coverage.

Medical payment coverage helps to pay for any of your medical payments should you ever find yourself in a bad accident.

Uninsured/underinsured motorist coverage helps you if you’re ever in a car accident with someone who doesn’t have car insurance. Which, luckily for Illinois drivers, is a coverage type that comes automatically with your policy.

Considering that, according to the Insurance Information Institute (III), 13.7 percent of Illinois drivers are uninsured (ranking it the 18th worst in the nation), uninsured/underinsured motorist coverage can come in handy.

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Medical Payments (Med Pay) | 77.23% | 77.03% | 75.51% |

| Uninsured/Underinsured Motorist (13.7% and ranked 18th in the nation) | 66.57% | 62.11% | 62.98% |

In the table above, we have given the loss ratios for each of these coverage types. What exactly is a loss ratio?

A loss ratio is the amount of money paid out in claims o the amount of money taken in from insurance premiums.

When it comes to loss ratios, think of it in terms of the story of Goldilocks: you want something not too high (over 75 percent), not too low (under 40 percent), but just right.

If a loss ratio is too high, it means the company isn’t collecting enough premium for the losses it is experiencing. A loss ratio that is too low means that the insurance company might have overpriced their policies.

So as you can see from the table above, both MedPay and uninsured/underinsured motorist coverage have relatively good loss ratios, though the uninsured/underinsured motorist coverage loss ratios are a little lower than you would want. This could be a good thing for customers in the long run, however, as companies will have to lower their insurance premiums to bring their loss ratios up.

Are there any add-ons, endorsements, and riders?

Getting the best coverage for the most affordable rates is always a top priority when shopping for insurance. Did you know that you could be missing out on several extremely useful, and cheap, coverage types because of it?

Check out the list below to see what is available to you in Illinois:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

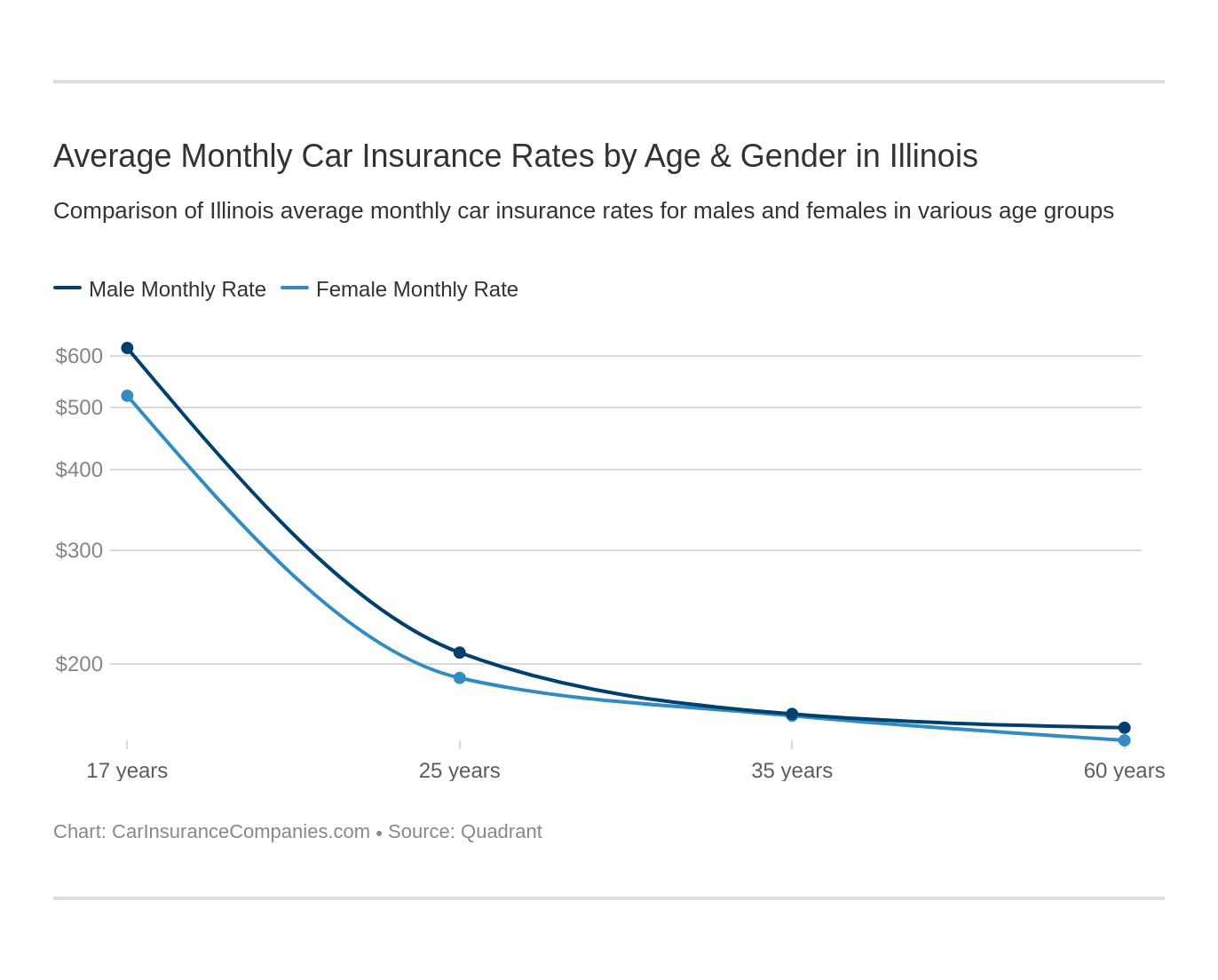

What are the average car insurance rates by age & gender in IL?

There is an old myth that men tend to pay more than women for their car insurance. We went through the demographic rates in Illinois to see if that were true.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $3,305.50 | $3,320.65 | $3,452.26 | $3,452.26 | $8,547.98 | $11,112.80 | $3,973.25 | $4,293.46 |

| American Family Mutual | $2,369.94 | $2,369.94 | $2,168.97 | $2,168.97 | $6,676.10 | $9,263.85 | $2,369.94 | $3,056.23 |

| Illinois Farmers Ins Co | $2,456.68 | $2,457.73 | $2,179.75 | $2,305.14 | $10,514.80 | $10,961.50 | $2,803.50 | $2,931.88 |

| Geico Cas | $1,691.91 | $1,711.59 | $1,614.70 | $1,892.49 | $5,407.10 | $5,673.56 | $2,074.22 | $2,048.08 |

| Safeco Ins Co of IL | $1,401.51 | $1,512.93 | $1,165.71 | $1,303.12 | $4,621.83 | $5,140.83 | $1,464.07 | $1,543.97 |

| Nationwide Mutual Fire | $1,926.46 | $1,960.52 | $1,713.84 | $1,816.17 | $5,285.82 | $6,786.79 | $2,242.62 | $2,429.53 |

| Progressive Northern | $2,055.34 | $1,946.27 | $1,694.99 | $1,773.48 | $7,336.88 | $8,239.12 | $2,450.28 | $2,647.61 |

| State Farm Mutual Auto | $1,454.19 | $1,454.19 | $1,299.88 | $1,299.88 | $4,229.18 | $5,361.67 | $1,643.58 | $1,887.70 |

| Travelers Standard Fire Ins Co | $1,570.87 | $1,657.44 | $1,431.81 | $1,526.42 | $4,533.18 | $5,685.41 | $1,665.85 | $1,754.69 |

| USAA | $1,647.73 | $1,676.66 | $1,532.32 | $1,509.06 | $5,332.28 | $5,880.44 | $2,170.35 | $2,385.18 |

Read more:

- Nationwide Mutual Fire Insurance Company Car Insurance Review

- Hartford Insurance Company of Illinois Car Insurance Review

As you can see in the table above, married women seem to pay about the same as their spouses do. Younger single males, however, do seem to pay relatively higher insurance rates than their female counterparts.

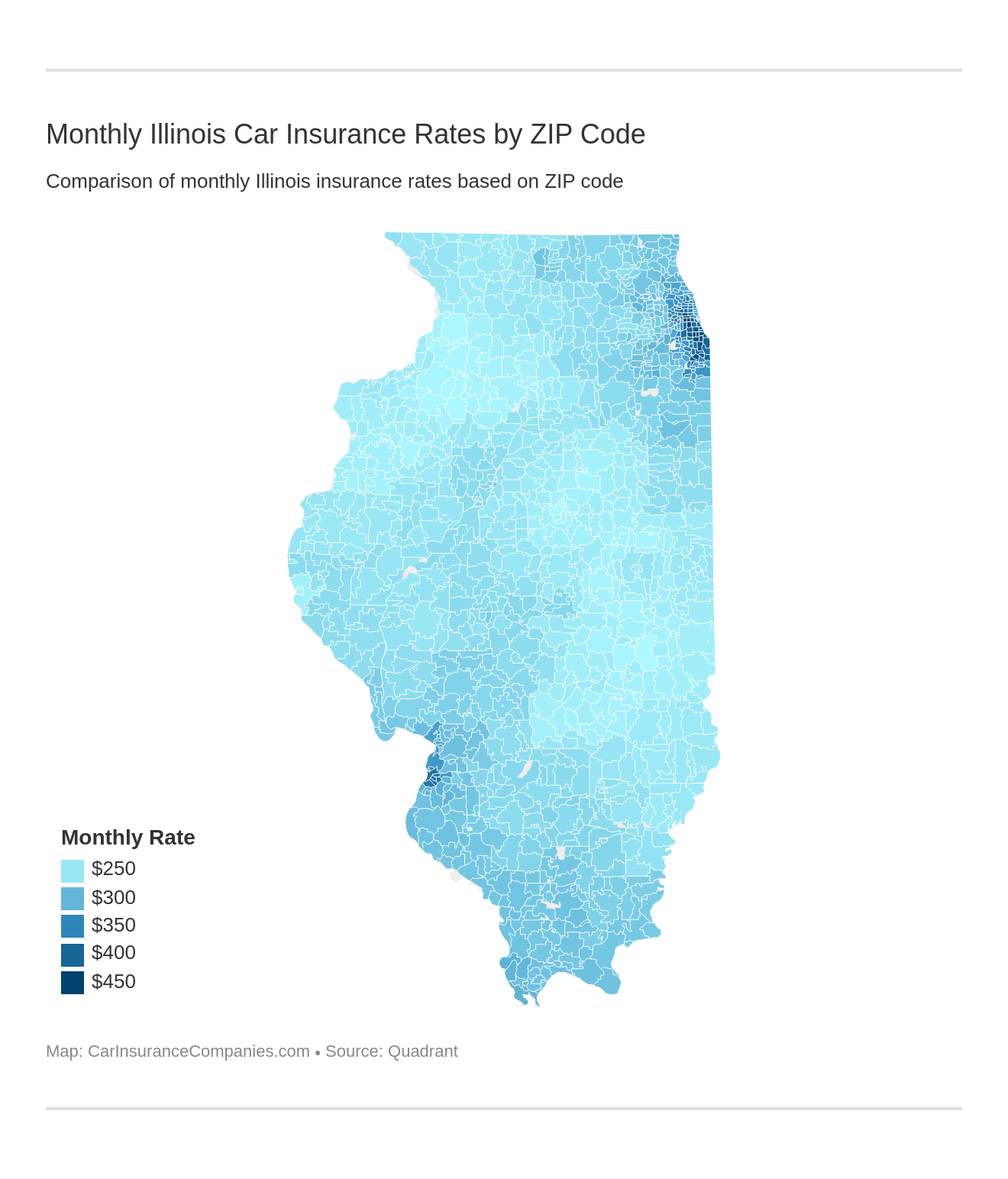

What are the rates by ZIP code?

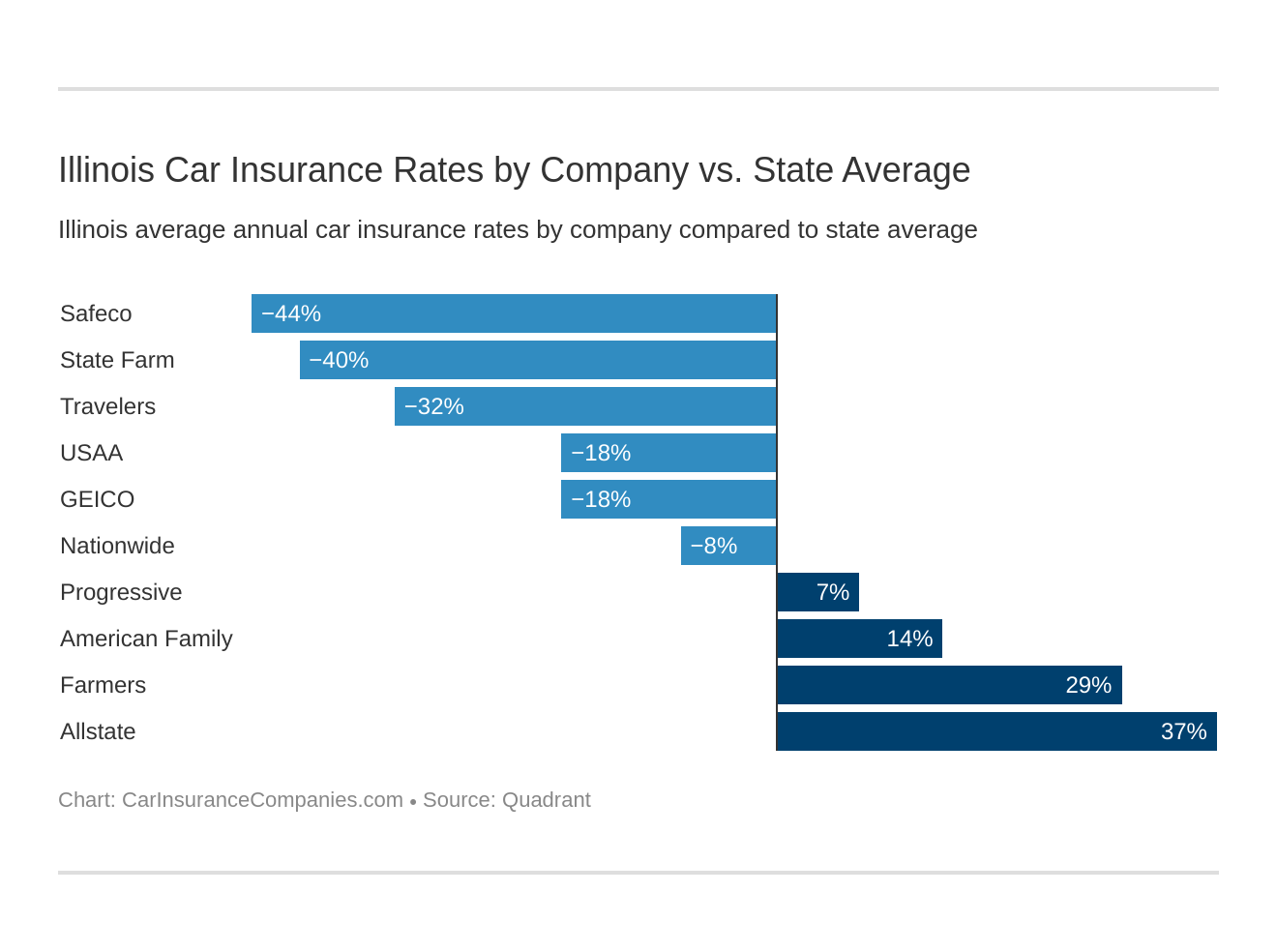

What are the best Illinois car insurance companies?

We’ll cover topics such as these companies’ financial ratings, which companies have the most complaints, what auto insurance rates you can expect from some of the largest providers in the state, and more.

Let’s start by taking a look at how rates for the biggest companies compare to the state average.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the financial rating of the largest companies?

A provider’s financial rating can tell you a lot about them. A good score can mean the provider is more than likely to pay the appropriate amount to its customers in claims. A poor score can mean that the company is at risk of going bankrupt and losing its customers.

In the table below, we’ve gathered all of the financial ratings for the largest and best companies in Illinois.

| Company | AM Best Rating |

|---|---|

| State Farm | A++ |

| Allstate Insurance | A+ |

| Country Insurance & Financial Service | A+ |

| Geico | A++ |

| Progressive | A+ |

| Farmers | A |

| American Family Insurance | A |

| Liberty Mutual | A |

| USAA | A++ |

| Travelers | A++ |

Which companies have the best ratings?

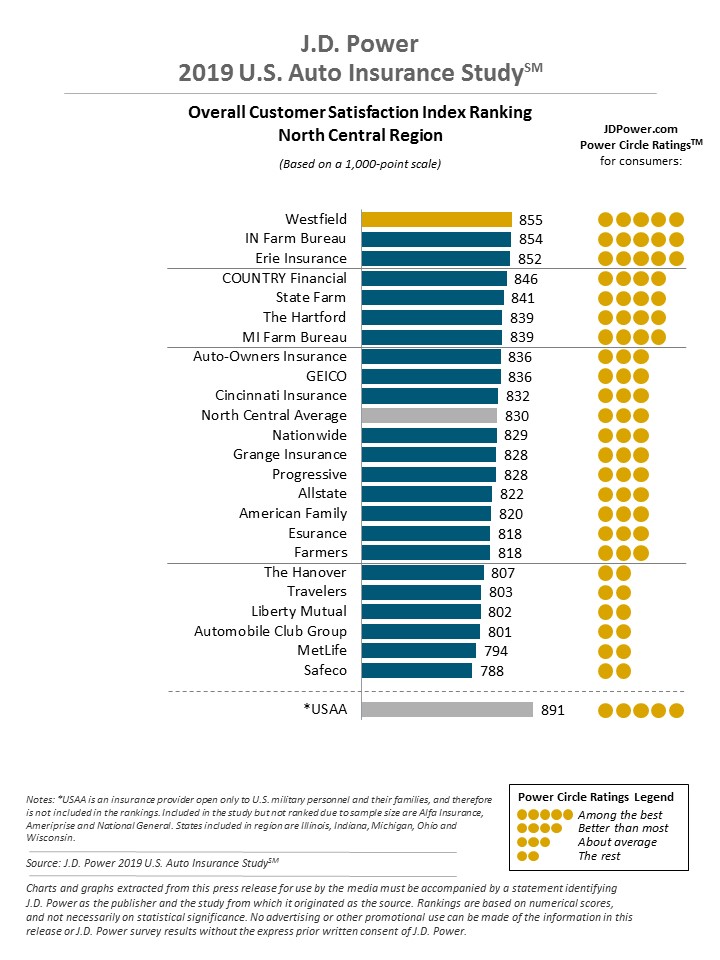

J.D. Power conducted a study to see the overall customer satisfaction ranking for the various auto insurance providers in a region. Illinois falls in the North Central region so below we’ve provided the study rankings for your convenience.

Which companies have the most complaints in Illinois?

While good customer satisfaction is an excellent indicator of a customer’s experience with a company, so is a company’s complaint index.

| Company | Complaint Ratio |

|---|---|

| Country Financial | 0.06 |

| Hanover | 0.1 |

| SafeCo | 0.12 |

| State Farm | 0.13 |

| Farmers | 0.13 |

| Standard Fire Insurance | 0.14 |

| Allstate | 0.18 |

| MetLife | 0.18 |

| USAA | 0.19 |

| Progressive | 0.21 |

| Erie | 0.21 |

| American Family | 0.22 |

| Geico | 0.23 |

| Standard Mutual | 0.24 |

| Hartford | 0.26 |

| AAA | 0.29 |

| Esurance | 0.29 |

| Liberty Mutual | 0.32 |

| Allied | 0.34 |

| Auto Owners | 0.35 |

| Nationwide | 0.4 |

| Bristol West Insurance Company | 0.49 |

| Safe Auto Insurance Company | 0.52 |

| Ameriprise | 0.58 |

| Mendota Insurance | 0.68 |

| Elephant Insurance Company | 1.17 |

| First Acceptance Insurance Company Inc. | 1.46 |

| Safeway Insurance Company | 1.48 |

| American Access Casualty Company | 1.6 |

| Fred Loya Insurance | 1.63 |

| First Chicago Insurance Company | 1.75 |

| Unique Insurance Company | 3.18 |

| Founders Insurance Company | 3.28 |

| Falcon Insurance Company | 3.36 |

| Stonegate Insurance Company | 3.76 |

| American Freedom Insurance Company | 4.24 |

| American Alliance Casualty Company | 4.3 |

| Lighthouse Casualty Company | 4.95 |

| Direct Auto Insurance Company | 5.85 |

| United Equitable Insurance Company | 6.34 |

Read more:

- American Freedom Insurance Company Car Insurance Review

- Elephant Insurance Company Car Insurance Review

- First Acceptance Insurance Company, Inc. Car Insurance Review

- First Chicago Insurance Company Car Insurance Review

- Mendota Insurance Company Car Insurance Review

- Safeway Insurance Company Car Insurance Review

Take a look at the table above. If a complaint index is one or above, it is considered worse than the average insurer in Illinois.

Read more: American Access Casualty Company review

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Illinois car insurance rates by company?

Every company varies in how much they will charge for their coverage. We’ve done the hard part for you and have gathered up the insurance rates by company for the largest insurance providers in the state.

| Company | Annual Average | Compared to State Average | Percent +/- State Average |

|---|---|---|---|

| Allstate F&C | $5,182.27 | $1,911.32 | +36.88% |

| American Family Mutual | $3,805.49 | $534.54 | +14.05% |

| Geico Cas | $2,764.21 | -$506.75 | -18.33% |

| Illinois Farmers Ins Co | $4,576.37 | $1,305.42 | +28.53% |

| Nationwide Mutual Fire | $3,020.22 | -$250.74 | -8.30% |

| Progressive Northern | $3,517.99 | $247.04 | +7.02% |

| Safeco Ins Co of IL | $2,269.25 | -$1,001.71 | -44.14% |

| State Farm Mutual Auto | $2,328.78 | -$942.17 | -40.46% |

| Travelers Standard Fire Ins Co | $2,478.21 | -$792.75 | -31.99% |

| USAA | $2,766.75 | -$504.20 | -18.22% |

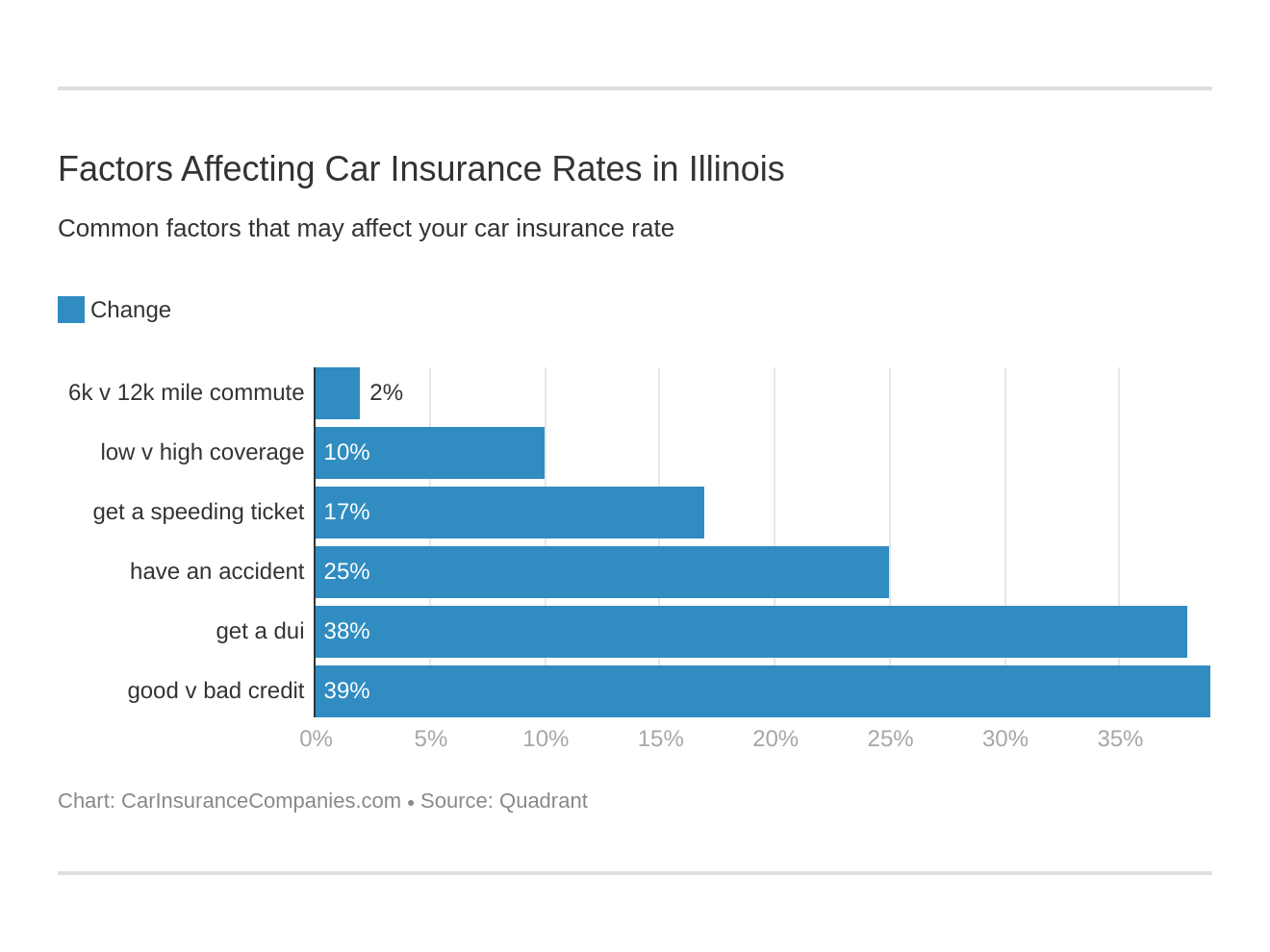

What are the commute rates by company?

Did you know that how far you drive each day can affect what some companies will charge you for your policy? The further you drive, the higher the rate tends to be.

| Company | 10 miles commute or 6,000 annual mileage | 25 miles commute or 12,000 annual mileage |

|---|---|---|

| Allstate | $5,182.27 | $5,182.27 |

| American Family | $3,756.53 | $4,576.37 |

| Farmers | $4,576.37 | $3,854.46 |

| Geico | $2,712.74 | $3,517.99 |

| Liberty Mutual | $2,269.25 | $3,020.22 |

| Nationwide | $3,020.22 | $2,844.44 |

| Progressive | $3,517.99 | $2,815.67 |

| State Farm | $2,270.17 | $2,575.47 |

| Travelers | $2,380.94 | $2,387.40 |

| USAA | $2,689.07 | $2,269.25 |

You can see in the table above that while some companies charge the same rate no matter what your commute distance is, others charge more.

Commute distances do not affect your rates as much as some other companies.

What are the coverage level rates by company?

If you’re trying to save some extra cash while getting your insurance coverage, but still wish to have optimal coverage, your best bet is to start comparing coverage level rates by company.

| Company | Annual Rate with Low Coverage | Annual Rate with Medium Coverage | Annual Rate with High Coverage |

|---|---|---|---|

| Allstate | $5,020.65 | $5,177.14 | $5,349.03 |

| American Family | $3,673.16 | $3,944.42 | $3,798.90 |

| Farmers | $4,353.36 | $4,468.30 | $4,907.46 |

| Geico | $2,529.05 | $2,756.71 | $3,006.86 |

| Liberty Mutual | $2,140.41 | $2,264.25 | $2,403.08 |

| Nationwide | $3,000.83 | $3,045.06 | $3,014.77 |

| Progressive | $3,232.62 | $3,504.03 | $3,817.33 |

| State Farm | $2,200.64 | $2,332.30 | $2,453.41 |

| Travelers | $2,323.26 | $2,475.20 | $2,636.16 |

| USAA | $2,582.81 | $2,764.19 | $2,953.26 |

If you were to compare Liberty Mutual and Nationwide from the data above, you can see that a low-coverage policy with Nationwide costs $3,000.83, while a high-coverage policy with Liberty Mutual only costs $2,403.08.

This means you’d be spending more for a lower coverage level. Make sure to shop around to get the best value.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the credit history rates by company?

The better your credit history, the better your rates tend to be. Just like you want an insurance provider to have good financial health in case you ever need to file an insurance claim, companies want to make sure that you’re able to pay for the policy they are providing you.

| Company | Annual Rate with Poor Credit | Annual Rate with Fair Credit | Annual Rate with Good Credit |

|---|---|---|---|

| Allstate | $6,613.50 | $4,765.11 | $4,168.20 |

| American Family | $5,064.08 | $3,442.45 | $2,909.95 |

| Farmers | $5,201.91 | $4,369.76 | $4,157.45 |

| Geico | $4,439.22 | $2,166.11 | $1,687.28 |

| Liberty Mutual | $3,209.71 | $2,002.97 | $1,595.06 |

| Nationwide | $3,606.83 | $2,908.56 | $2,545.26 |

| Progressive | $4,013.61 | $3,400.36 | $3,140.02 |

| State Farm | $3,384.91 | $2,027.96 | $1,573.47 |

| Travelers | $3,024.35 | $2,433.13 | $1,977.14 |

| USAA | $3,684.79 | $2,530.45 | $2,085.02 |

What are the driving record rates by company?

Your driving record also can play an effect on your car insurance rate. Just like with your credit history, the better your driving record is, the better your rates will be.

| Company | Clean Record | One Speeding Violation | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $3,712.50 | $4,869.92 | $6,295.82 | $5,850.85 |

| American Family | $2,797.36 | $3,173.51 | $3,971.42 | $5,279.69 |

| Farmers | $3,865.35 | $4,601.59 | $4,981.19 | $4,857.36 |

| Geico | $1,980.04 | $2,438.42 | $2,787.85 | $3,850.51 |

| Liberty Mutual | $1,891.37 | $2,146.09 | $2,681.59 | $2,357.92 |

| Nationwide | $2,432.56 | $2,794.56 | $3,149.89 | $3,703.87 |

| Progressive | $2,900.83 | $3,665.72 | $4,293.62 | $3,211.80 |

| State Farm | $2,128.05 | $2,328.78 | $2,529.52 | $2,328.78 |

| Travelers | $1,971.92 | $2,473.62 | $2,583.81 | $2,883.48 |

| USAA | $1,971.53 | $2,378.06 | $2,834.82 | $3,882.60 |

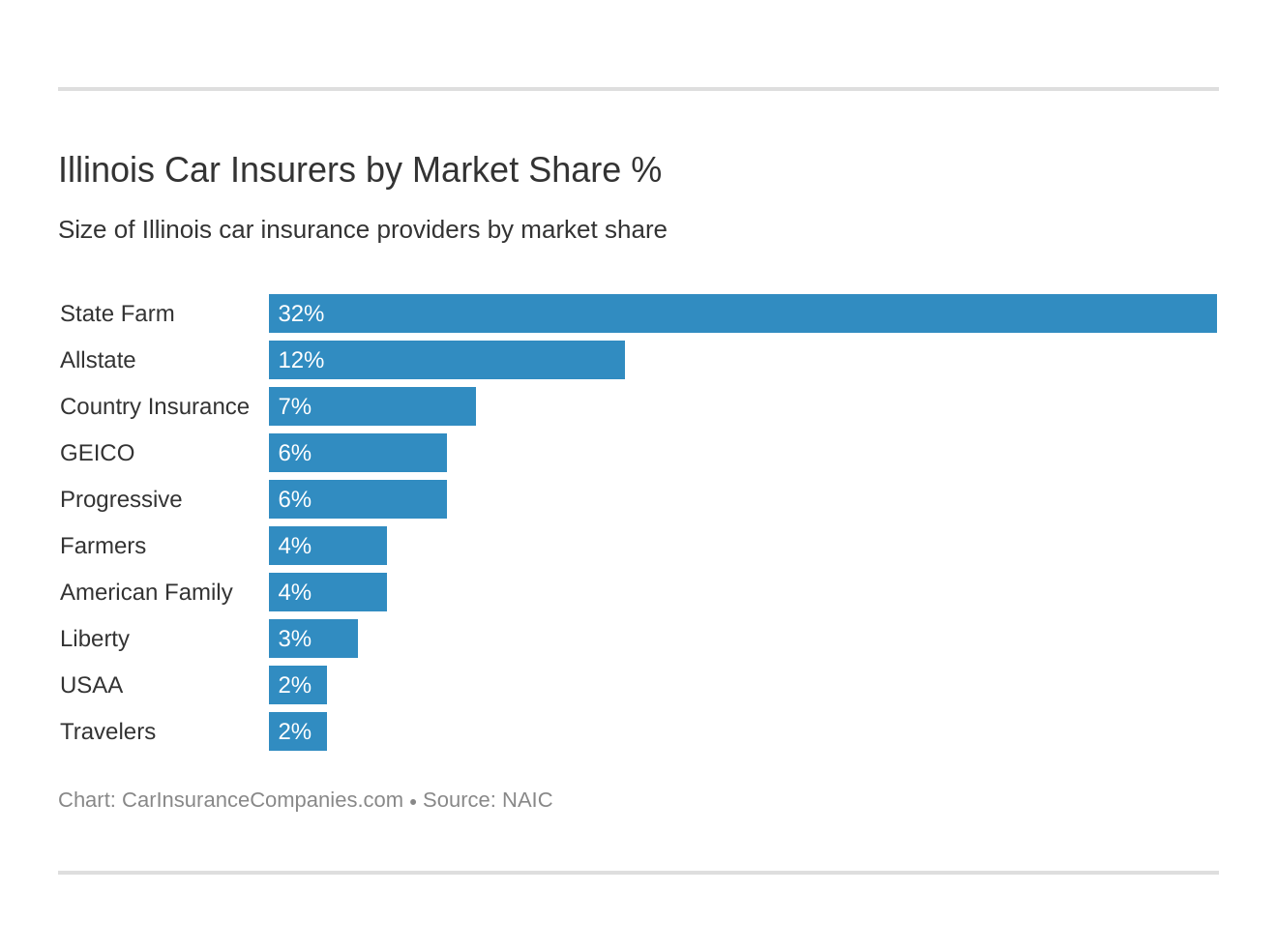

What are the largest car insurance companies in Illinois?

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Allstate Insurance | $854,959 | 51.65% | 11.52% |

| American Family Insurance | $324,588 | 68.65% | 4.37% |

| Country Insurance & Financial Service | $494,300 | 63.70% | 6.66% |

| Farmers | $326,150 | 63.45% | 4.39% |

| Geico | $468,402 | 74.41% | 6.31% |

| Liberty Mutual | $216,617 | 62.03% | 2.92% |

| Progressive | $428,172 | 58.57% | 5.77% |

| State Farm | $2,365,801 | 67.70% | 31.87% |

| Travelers | $119,798 | 63.14% | 1.61% |

| USAA | $175,859 | 76.55% | 2.37% |

What’s the number of insurers?

In every state, there are two distinct types of insurance providers that you will encounter: foreign and domestic. What exactly is the difference between the two?

- Domestic Insurer – an insurance company admitted by and formed under the laws under the state in which insurance is written

- Foreign Insurer – an insurance provider which was formed under the laws of another state, but is still doing business in Illinois

So what can you expect in Illinois?

| Property & Casualty Insurance | Number |

|---|---|

| Domestic | 191 |

| Foreign | 860 |

| Total | 1,051 |

In total, you have 1,051 providers to choose from in Illinois. This can seem extremely overwhelming, but that’s what we’re here to help you with. Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are Illinois state laws?

To keep your driving record squeaky clean, we’ll now discuss some of the state laws in Illinois. The last thing you want is to get a ticket for a law you didn’t even know existed.

What are the car insurance laws?

Car insurance laws vary from state to state, so let’s look at some of the Illinois-specific car insurance laws.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How state laws for insurance are determined

According to the National Association of Insurance Commissioners (NAIC), Illinois state laws are determined in the following way:

“Regarding rate filings, no filing is needed for individual risks that cannot be rated in the normal course of business due to special or unusual characteristics. A company must maintain documentary information regarding rates.”

How to get high-risk insurance

Drivers who are considered high-risk typically have pretty poor driving records, with a history of accidents and traffic violations. With a bad enough record, you might find yourself having a lot of difficulties finding a car insurance provider who is willing to give you coverage.

This is a big problem, as you are legally required to have at least the minimum liability coverage, so what are you to do? Luckily, there is an option.

It’s a program known as the Illinois Automobile Insurance Plan (ILAIP). This program assigns you to a car insurance provider who then has to give you coverage. To qualify, you will have to provide proof that you were unsuccessful in obtaining insurance within 60 days of applying.

But there is a catch, as the provider is allowed to charge you whatever premiums they deem responsible to provide you with this coverage.

How to get low-cost insurance

While there are currently no low-cost insurance programs in Illinois, this shouldn’t discourage you, as there are other ways of reducing insurance costs.

Aside from keeping a clean driving record and good credit history, you can always see if your insurance provider has car insurance discounts that you can qualify for. We’ve gone through and listed some of the most common discounts that you can apply for below.

- Good Driver

- Homeowner

- Anti-Theft / Anti-Lock Systems

- Good Student

- Accident-Free

- Company/School (the company you work for / the school you attend sometimes offers discounts)

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to get windshield coverage

Some states have laws unique to windshields and the coverage for them, though Illinois currently does not.

Should you need to replace or repair your windshield, you can use OEM parts but may have to pay the difference for them. If aftermarket parts are used to fix your windshield, your insurance provider is required to inform you, in writing, and it must appear on the estimate for repairs.

Is there an automobile insurance fraud in Illinois?

Insurance fraud is a big deal across the nation, as it is a criminal offense. According to III.org, insurance fraud accounts for approximately $30 billion in losses each year.

You can commit insurance fraud in the following ways in Illinois:

- Knowingly obtain, attempt to obtain, or cause to be obtained benefits that are not owed

- By deception, control over the property of an insurance company or self-insured entity

- By the making of a false claim

- By causing a false claim to be made on any policy issued by an insurance company

- By intending to deprive an insurance company or self-insured entity permanently of the use and benefit of property

If you are caught committing insurance fraud, you could be facing some of the following penalties:

| Insurance Fraud Crime Classification | Crime Classification Description | Fine | Jail Time |

|---|---|---|---|

| Class A Misdemeanor | if the value of the property obtained is $300 or less | $2,500 | up to a year in jail |

| Class 3 Felony | if the value of the property obtained is more than $300 but less than $10,000 | N/A | 2-5 years in prison |

| Class 2 Felony | if the value of the property obtained is more than $10,000 but less than $100,000 | N/A | 3-7 years in prison |

| Class 1 Felony | if the value of the property obtained is more than $100,000 | N/A | 4-15 years in prison |

So simply put, insurance fraud just isn’t worth the hassle.

What’s the statute of limitations?

Let’s say you’ve been in an accident and you need to file a claim, or, if it’s a bad enough accident, you want to take the other driver to court for the injuries/property damage incurred during an accident. How long do you have to do so?

Well, there’s something known as the statute of limitations that limits the amount of time you have to do this.

In Illinois, you have two years to file for personal injuries, and five years to file for property damages.

Make sure you remember these limits, because your pleas to file a claim will fall on deaf ears if you attempt to do so after the statute is up.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the vehicle licensing laws?

As there are laws with car insurance, there are also laws regarding vehicle licensing.

Keep reading to find out more.

What are the penalties for driving without insurance?

If you are caught without car insurance, you can face some hefty penalties.

- First-Time Offense:

- Fine: $500 minimum

- License plate suspension until $100 reinstatement fee is paid and you’ve shown proof of insurance

- Second-Time Offense:

- Fine: $1,000 minimum

- License plate suspension for four months

- $100 reinstatement fee

It’s safe to say that if you want to avoid paying these fines and having your license plate suspended, it’s better just to make sure you have your insurance.

What are the teen driver laws?

If you’re a teen ready to jump behind the wheel, just know there are a few rules and restrictions you’ll have to adhere to in order to obtain your driver’s license.

In addition, Illinois teens are required to complete the Graduated Driver Licensing (GDL) program.

The program is designed to help young drivers get more comfortable behind the wheel, and it has been made a requirement to help cut down on teen-related driving deaths.

| Young Driver Licensing Laws | Age Restrictions | Passenger Restrictions | Time Restrictions |

|---|---|---|---|

| Learner's Permit: | 15 years | first 12 months—no more than 1 passenger younger than 20 (family member exception) | starts 10 p.m. Sun.-Thur., 11 p.m. Fri.-Sat., ends 6 a.m. |

| Provisional License | 15 years; 9 months holding period; 50 hours supervised driving time, 10 of which must be at night | Restrictions in effect for 12 months or until age 18 (min. age: 17) | Restrictions in effect until age 18 (min. age: 18) |

| Full License | 16 years | None. | None. |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the license renewal procedures?

| Renewal Procedures | General Population | Older Population |

|---|---|---|

| License renewal cycle | 4 years | 2 years for people 81 - 86; 1 year for people 87 and older |

| Mail or online renewal permitted | both, every other renewal | not permitted 75 and older |

| Proof of adequate vision required at renewal | when renewing in person | 75 and older, every renewal |

What’s the procedure for new residents?

If you are a new resident to the state of Illinois, you’re going to want to make sure to put these items onto your to-do list:

- Deal with vehicle licensing matters at the Office of the Illinois Secretary of State

- Turn over your other state license(s), provide ID documentation, and have your photo taken to get your new Illinois driver’s license. To do this, you will need to visit a Secretary of State location

- You will also need to pass the vision screening, written and/or driving exams, and pay the fees

- Receive a 90-day paper driver’s license, but you can expect your full license in the mail within 15 business days

- If you are a driver under the age of 21, you will be required to complete a six-hour adult driver education course before you will be able to get a driver’s license

What are the rules of the road?

In order to get cruising, you’ll want to know the rules of the road.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is Illinois at fault or no-fault state?

As we mentioned previously, Illinois is an “at-fault” state.

This means that if you are at fault for an accident, you are the one who is held liable for the costs of that accident. If you don’t have proper coverage, that could be a lot of money out of your pocket.

What are the keep right and move over laws?

Keep Right and Move Over Laws are very easy to understand, so it’ll be easy to avoid any penalties for breaking these laws.

In Illinois, you should only use the left lane if you are passing another vehicle or if you are turning left. There are five exceptions to this, otherwise, make sure you keep in the right lane.

When it comes to moving over, if you see a vehicle with flashing lights, make sure you move over.

Speed Limits

Speed limits are posted for a reason: to keep all drivers on the road safe. Make sure if you’re in Illinois that you follow the known speed limits below:

- Urban Interstates: 55 mph

- Rural Interstates: 70 mph

- Limited Access Roads: 65 mph

- All Other Roads: 55 mph

What are the seatbelt and car seat laws?

There are specific laws regarding seat belts and car seats put in place to keep everyone on the road safe.

Seatbelt laws in Illinois require that everyone eight years and older are required to wear a seatbelt in the front seat of the vehicle. If you are pulled over for violating this law, primary enforcement will give you a fine, starting at $25.

For car seats, children two years and younger must be in rear-facing child seats. The exception to this is if the child is 40 pounds or more or is 40 inches or taller (though new laws have been coming out to further elaborate on this).

Effective June 1, 2019, children seven years and younger will be required to be in a child safety seat.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How does ridesharing work?

Companies like Uber and Lyft are popular and are only increasing in popularity because of their convenience.

If you are considering working for such a company, you’ll want to make sure you have ridesharing insurance coverage, which in Illinois can be provided by any of the following companies:

- Allstate

- Erie

- Farmers

- Geico

- Mercury

- Metlife

- Metromile

- Safeco

- USAA

Read more:

- Safeco Insurance Company of Illinois Car Insurance Review

- Metromile Insurance Company Car Insurance Review

- Mercury Insurance Company of Illinois Car Insurance Review

Is there an automation on the road?

According to the Insurance Institute for Highway Safety (IIHS), automation on the road can be defined as:

“Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. In driving, automation involves using radar, camera and other sensors to gather information about a vehicle’s surroundings, which is then used by computer programs to perform parts or all of the driving task on a sustained basis.”

In Illinois, the use of an automated vehicle is currently being tested. So while you may not see too many self-driving vehicles just yet, you might in the future.

What are the safety laws?

To keep you and other drivers on the road safe, there are a few safety laws that you’ll want to familiarize yourself with.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the DUI laws?

Drinking and driving is a major problem in every state across the nation. Because of this, many states have put down some pretty hefty penalties should you ever be caught drinking and driving.

The table below displays the laws and penalties in Illinois:

| DUI Offenses | DUI Details |

|---|---|

| BAC Limit | 0.08 |

| HIGH BAC Limit | 0.16 |

| Criminal Status by Offense | 1st-2nd class A misdemeanor, 3rd-4th class 2 felony, 5th class 1 felony, 6th+ class X felony |

| Formal Name for Offense | Driving Under the Influence (DUI) |

| Look Back Period/Washout Period | 10 years |

| 1st Offense-ALS or Revocation | 1 year |

| 1st Offense Imprisonment | no minimum, but up to 1 year |

| 1st Offense-Fine | $500-$2,500 |

| 1st Offense-Other | before driving privileges restored, must complete substance evaluation and treatment program +high-risk auo insurance for 3 years. |

| 2nd Offense-DL Revocation | 5 year min for 2nd conviction in 20 years |

| 2nd Offense-Imprisonment | mandatory 5 days up to 1 year OR 240 hours community service |

| 2nd Offense-Fine | $1,250 to $2500 |

| 3rd Offense-DL Revocation | min 10 years +supsension of vehicle registration |

| 3rd Offense-Imprisonment | 90 days minimum. Possible 3-7 years |

| 3rd Offense-Fine | $2,500 up to $25,000 |

| 4th Offense-DL Revocation | for life +suspension of vehicle registration |

| 4th Offense-Imprisonment | possible 4-15 years |

| 4th Offense-Fine | up to $25,000 |

| 5th Offense | imprisonment of 6-30 years with fines up to $25,000 |

| 6th Offense | Same as fifth |

| Mandatory Interlock | all offenders |

What are the marijuana-impaired driving laws?

A lot of states across the nation have been legalizing marijuana use, calling into question what kinds of vehicle-related laws should be implemented to combat it.

There are currently restrictions on blood toxicity levels when it comes to marijuana, meaning that your blood toxicity levels can be no more than five nanograms of THC per se, or you could find yourself in some trouble.

What are the distracted driving laws?

Don’t get caught driving while distracted in Illinois; this is enforced through primary enforcement, meaning if a cop even sees you using a handheld device, you’ll get in trouble.

Illinois has an all-driver ban on any handheld device. Even blue-tooth conversations are off-limits for those under 19 years of age.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Illinois can’t-miss facts

Now down to the last section. We’ll cover some of the facts and statistics of driving in Illinois that you simply can’t miss.

Is there a vehicle theft in Illinois?

One of the most unfortunate things to happen to a driver is for their vehicle to be stolen; we thought we’d arm you with the information you’ll need to know about vehicle theft in Illinois.

The table below shows the top vehicles stolen in the state with cities with over 25 vehicles stolen.

| Make/Model | Thefts |

|---|---|

| Dodge Caravan | 1,054 |

| Chevrolet Impala | 579 |

| Honda Civic | 566 |

| Honda Accord | 481 |

| Chevrolet Malibu | 442 |

| Chevrolet Pickup (Full Size) | 418 |

| Ford Pickup (Full Size) | 392 |

| Toyota Camry | 383 |

| Jeep Cherokee/Grand Cherokee | 374 |

| Nissan Altima | 326 |

A 2017 crime report done by the FBI found the vehicle theft statistics for each city in the state of Illinois. Check out the table below to find out where your city falls:

| CITY VEHICLE THEFT | POPULATION | MOTOR |

|---|---|---|

| Rockford | 146,770 | 450 |

| Peoria | 114,157 | 334 |

| Springfield | 115,568 | 313 |

| Aurora | 201,599 | 176 |

| Calumet City | 36,663 | 172 |

| Joliet | 148,342 | 165 |

| Cicero | 82,779 | 161 |

| East St. Louis | 26,927 | 144 |

| Champaign | 87,543 | 123 |

| Chicago Heights | 29,967 | 121 |

| Berwyn | 55,594 | 120 |

| Oak Park | 51,753 | 108 |

| Rock Island | 38,079 | 108 |

| Lansing | 28,039 | 95 |

| Granite City | 28,755 | 94 |

| Maywood | 23,697 | 93 |

| Decatur | 72,153 | 92 |

| South Holland | 21,782 | 87 |

| Bloomington | 78,203 | 77 |

| Belleville | 41,511 | 74 |

| Blue Island | 23,348 | 74 |

| Elgin | 112,767 | 74 |

| Forest Park | 13,950 | 72 |

| Danville | 31,368 | 71 |

| Bolingbrook | 74,692 | 70 |

| Alton | 26,693 | 66 |

| Hazel Crest | 13,871 | 66 |

| Evanston | 74,947 | 63 |

| Waukegan | 88,017 | 59 |

| Skokie | 64,167 | 55 |

| Kankakee | 26,265 | 51 |

| Alsip | 19,137 | 49 |

| Riverdale | 13,371 | 49 |

| Schaumburg | 74,471 | 49 |

| Naperville | 147,934 | 47 |

| Moline | 42,042 | 46 |

| Cahokia | 14,105 | 43 |

| Melrose Park | 25,195 | 43 |

| Centreville | 4,988 | 42 |

| Quincy | 40,506 | 42 |

| Park Forest | 21,750 | 41 |

| Tinley Park | 56,823 | 41 |

| Zion | 23,969 | 41 |

| Richton Park | 13,542 | 40 |

| Herrin | 13,020 | 39 |

| Sauk Village | 10,418 | 39 |

| Summit | 11,358 | 39 |

| Country Club Hills | 16,651 | 38 |

| Elk Grove Village | 32,894 | 38 |

| De Kalb | 43,043 | 37 |

| Matteson | 19,107 | 37 |

| East Moline | 21,106 | 36 |

| Centralia | 12,496 | 34 |

| Des Plaines | 58,089 | 32 |

| Sterling | 14,823 | 31 |

| Hoffman Estates | 51,704 | 30 |

| Midlothian | 14,678 | 29 |

| Palatine | 68,792 | 29 |

| Addison | 36,883 | 27 |

| Arlington Heights | 75,586 | 27 |

| Carbondale | 26,127 | 27 |

| Fairview Heights | 16,618 | 27 |

| Urbana | 42,091 | 27 |

| Glendale Heights | 34,128 | 26 |

| Gurnee | 30,902 | 26 |

| Highland Park | 29,618 | 26 |

| Oak Forest | 27,761 | 26 |

| Woodridge | 33,553 | 26 |

| Romeoville | 39,710 | 25 |

Are there any dangers on the road in Illinois?

We’ll now give you some of the road danger statistics in Illinois, according to the National Highway Traffic Safety Administration (NHTSA).

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the number of fatal crashes by weather condition and light condition?

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 450 | 170 | 231 | 30 | 5 | 886 |

| Rain | 31 | 16 | 30 | 5 | 0 | 82 |

| Snow/Sleet | 4 | 0 | 7 | 1 | 0 | 12 |

| Other | 8 | 4 | 5 | 2 | 0 | 19 |

| Unknown | 0 | 1 | 3 | 1 | 1 | 6 |

| TOTAL | 493 | 191 | 276 | 39 | 6 | 1,005 |

What’s the number of traffic fatalities?

| Type | Number of Fatalities |

|---|---|

| Traffic Fatalities | 1,097 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 720 |

| Motorcyclist Fatalities | 162 |

| Drivers Involved in Fatal Crashes | 1,570 |

| Pedestrian Fatalities | 145 |

| Bicyclist and other Cyclist Fatalities | 26 |

What’s the number of fatalities by person type?

| Person Type | Number |

|---|---|

| Occupants (Enclosed Vehicles) | 756 |

| Motorcyclists | 162 |

| Nonoccupants | 179 |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the number of fatalities by crash type?

| Crash Type | Number |

|---|---|

| Single Vehicle | 579 |

| Involving a Large Truck | 149 |

| Involving Speeding | 462 |

| Involving a Rollover | 235 |

| Involving a Roadway Departure | 535 |

| Involving an Intersection (or Intersection Related) | 340 |

5-year trend for the top 10 counties

| County | 2013 Fatalities | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities |

|---|---|---|---|---|---|

| Cook County | 250 | 235 | 239 | 268 | 287 |

| Will County | 48 | 61 | 51 | 45 | 59 |

| Lake County | 34 | 31 | 36 | 50 | 47 |

| Madison County | 28 | 33 | 33 | 21 | 45 |

| Dupage County | 30 | 24 | 36 | 36 | 40 |

| St. Clair County | 45 | 31 | 39 | 40 | 35 |

| Mchenry County | 17 | 19 | 18 | 26 | 33 |

| Kane County | 29 | 21 | 29 | 39 | 31 |

| Winnebago County | 35 | 22 | 29 | 39 | 23 |

| Kankakee County | 14 | 14 | 9 | 23 | 18 |

| Total: Top Ten Counties | 538 | 501 | 530 | 596 | 618 |

| Total: All Other Counties | 453 | 423 | 468 | 482 | 479 |

What’s the number of fatalities involving speeding by county?

| County Name | Speeding Fatalities 2013 | Speeding Fatalities 2014 | Speeding Fatalities 2015 | Speeding Fatalities 2016 | Speeding Fatalities 2017 |

|---|---|---|---|---|---|

| Cook County | 119 | 103 | 88 | 111 | 143 |

| Will County | 15 | 31 | 23 | 22 | 34 |

| Lake County | 14 | 12 | 20 | 15 | 20 |

| Kane County | 13 | 7 | 12 | 16 | 18 |

| Madison County | 9 | 12 | 15 | 5 | 18 |

| Dupage County | 12 | 12 | 14 | 16 | 17 |

| St. Clair County | 20 | 8 | 14 | 13 | 13 |

| Kankakee County | 7 | 4 | 2 | 10 | 11 |

| Vermilion County | 5 | 2 | 5 | 7 | 11 |

| McHenry County | 4 | 8 | 11 | 13 | 9 |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the number of fatalities in crashes involving an alcohol-impaired driver (BAC = .08+) by county?

| County Name | DUI Fatalities 2013 | DUI Fatalities 2014 | DUI Fatalities 2015 | DUI Fatalities 2016 | DUI Fatalities 2017 |

|---|---|---|---|---|---|

| Cook County | 97 | 85 | 66 | 81 | 109 |

| Will County | 17 | 12 | 20 | 15 | 21 |

| Lake County | 7 | 10 | 16 | 16 | 18 |

| St. Clair County | 19 | 14 | 11 | 17 | 15 |

| Madison County | 8 | 14 | 10 | 4 | 14 |

| McHenry County | 6 | 6 | 6 | 8 | 12 |

| Kankakee County | 4 | 3 | 3 | 9 | 8 |

| Dupage County | 7 | 6 | 8 | 8 | 7 |

| Kane County | 9 | 7 | 8 | 13 | 7 |

| La Salle County | 4 | 7 | 8 | 7 | 6 |

What are the teen drinking and driving laws?

The worst part of the statistics above is that they do include teen drivers, though some good news for Illinois is that arrests for teen-related drinking and driving arrests are one of the lowest in the nation.

Illinois is ranked as the 49th state in the nation for teen DUI related arrests.

This is further solidified by statistics from Responsibility, who show the following statistics for Illinois teens:

| Teens and Drunk Driving | Laws |

|---|---|

| Alcohol-Impaired Driving Fatalities Per 100K Population | 0.7 |

| Higher/Lower Than National Average (1.2) | lower (only 9 other states are lower) |

| DUI Arrest (Under 18 years old) | 7 |

| DUI Arrests (Under 18 years old) Total Per Million People | 2.39 |

What’s the average EMS response time?

| Type of Crash | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Rural Fatal Crashes | 2.11 | 9.75 | 53 | 57 |

| Urban Fatal Crashes | 8 | 1 | N/A | N/A |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s transportation like?

In this final section of this guide, we’ll show you the statistics for the various aspects of transportation in the great state of Illinois.

What’s the percentage of car ownership?

According to Data USA, Illinois citizens own an average of two vehicles per household.

What’s the average commute time?

The average national commute time is 25.5 minutes. Illinois, however, has an average commute time of 27.7 minutes, meaning Illinois drivers tend to spend more time in traffic than most drivers in the nation.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the preferred commuter transportation?

Statistically, according to Data USA, most Illinois drivers prefer to drive alone, at a whopping 73 percent.

What’s the top city for traffic congestion?

I’m sure it will come as no surprise to native Illinois citizens, but Chicago has quite a reputation for traffic. So much so that it has made it onto three separate traffic congestion lists.

Chicago was listed on INRIX Scorecard as the 23rd most congested city in the world:

| URBAN AREA | 2018 IMPACT RANK (2017) | HOURS LOST IN CONGESTION | YEAR OVER YEAR CHANGE | COST OF CONGESTION (PER DRIVER) | INNER CITY TRAVEL TIME (MINUTES) | INNER CITY LAST MILE SPEED (MPH) |

|---|---|---|---|---|---|---|

| Chicago, IL | 23 (24) | 138 (64) | 4% | $1,920 | 5 | 12 |

TomTom ranked it with the following data:

| TomTom Traffic Index for Chicago, IL | Details |

|---|---|

| Worldwide Ranking | 122 |

| Congestion Level | 28% |

| Morning Extra Travel Time | +13 min per 30 min trip in the morning |

| Evening Extra Travel Time | +17 min per 30 min trip in the evening |

| Morning Peak | 42% |

| Evening Peak | 58% |

| Highways | 29% |

| Non-highways | 28% |

Numbeo had the following statistics for Chicago congestion:

| Numbeo Traffic Index for Chicago, IL | Details |

|---|---|

| National Ranking | 13 |

| Traffic Index | 183.50 |

| Time Index | 40.99 minutes |

| Inefficiency Index | 193.84 |

That’s it. You’ve made it to the end of this comprehensive guide. We hope that we were able to arm you with the information you’ll need to make the best decision for your car insurance needs.

Think you’re ready to start comparing today? Don’t forget to use our FREE online tool to get started.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.