Minnesota Car Insurance (Coverage, Companies, & More)

More than 11 percent of Minnesota drivers are on the road without insurance. Don't take that risk. Minnesota car insurance requirements include a 30/60/10 minimum liability policy, but we recommend driving with full coverage even though it may raise your premiums. The average Minnesota car insurance rate is $73/mo, but you can save more money by comparison shopping online. Enter your ZIP code below to get started.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 16, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 16, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Minnesota Statistics Summary | Details |

|---|---|

| Miles of Roadway: | 138,767 |

| Vehicle Miles Driven | 57,395 million |

| Registered Vehicles | 4,985,782 |

| Population | 5,611,179 |

| Most Popular Vehicle | Ford F-150 |

| Uninsured Motorist Rate | 11.5% |

| Total Driving-Related Deaths in 2017 | 357 |

| Speeding Fatalities in 2017 | 89 |

| DUI Fatalities in 2017 | 85 |

| Average Annual Car Insurance Cost | Liability $456.82 Collision $234.40 Comprehensive $184.27 |

| Cheapest Provider | AMCO |

Each state has its own reputation. Minnesota is known for its unique accents and politeness, a state we’re proud to have in the union. Its many lakes make for excellent fishing and boating, and its snowy winters while freezing make for picturesque winter holidays.

All that said, finding insurance in the Land of 10,000 Lakes isn’t as easy as you might think. After all, you’ve got to keep yourself safe while driving down those wintery highways. Where, though, are you supposed to start?

Researching car insurance companies take a long, long time. Not only do you have to determine which company covers you as you’d like, but you’ll need to compare the rates that each one can make available to you. When there’s that much research involved, why not just close your eyes, point, and choose?

Don’t go for that strategy just yet. Instead, take a gander through our guide to car insurance in Minnesota. Here, we’ve done most of your research for you. We’ll discuss Minnesota’s available rates, discounts, roadways legalities, and more so that you can make an informed decision while searching for car insurance.

Ready to get started? Enter your ZIP code into our FREE online tool to start comparing the rates available in your area.

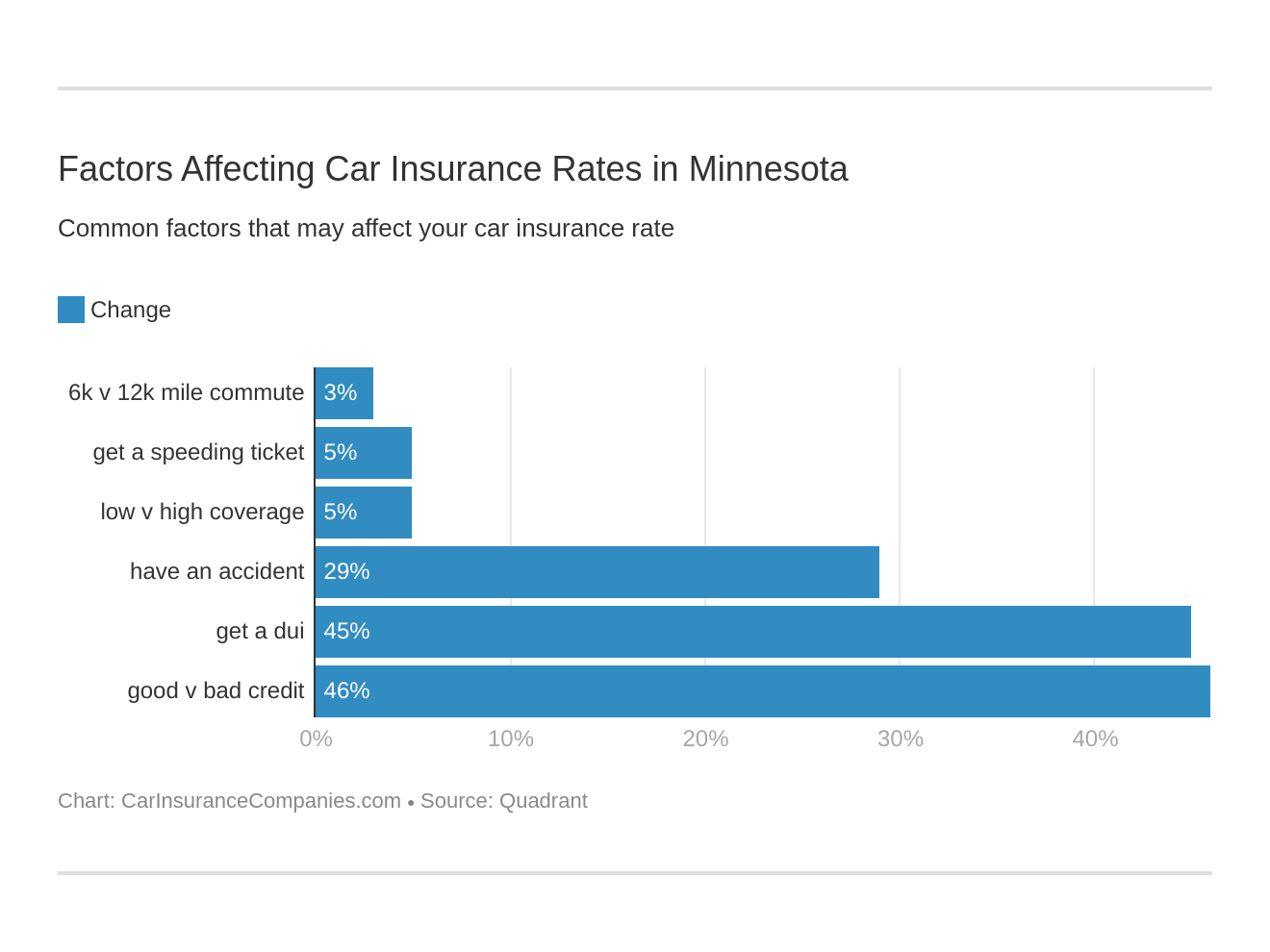

How much are auto insurance rates in Minnesota?

Let’s get started with the basics. In this section, we’ll go over Minnesota’s required minimum liability insurance, the optional coverage available to you, and the different forms you’re going to need on hand when registering your vehicle.

Not only that, but we’ll touch on some of the factors that may influence the initial rate a car insurance company offers you and we’ll look at average rates based on a variety of circumstances.

Ready to get started? Let’s go!

How much coverage is required for Minnesota’s minimum coverage?

Minnesota is a no-fault state. This means that when two parties get into a car accident, each party is responsible for their own expenses. Even if one party is distinctly at fault, no one will be shouldering the financial responsibility of the entire accident.

As a result, Minnesota state law requires all residents to carry Personal Injury Protection, or PIP. This protection helps keep you and your bank account safe in case the post-accident expenses would compromise your savings. If your expenses exceed a certain point, and you’re not the party at-fault for the accident, then the law states that the at-fault party must pay for the overages you’re facing.

Do note, though, that this ruling only applies to personal injury. It does not apply to property damage.

PIP in Minnesota also include:

- Covered medical expenses, wage loss, and child care

- $2,000 for funeral services

PIP isn’t the only kind of car insurance you’ll be expected to have as a Minnesota resident. Take a look at the table below to learn more about Minnesota’s minimum required liability coverage:

| Type of Coverage | Minimum Limits |

|---|---|

| Personal Injury Protection (PIP) | $40,000 per person per accident. ($20,000 for medical expenses and $20,000 for non-medical expenses) |

| Bodily Injury Liability | $30,000 per person $60,000 for two or more people (per incident) |

| Property Damage Liability | $10,000 |

| Uninsured Motorist Bodily Injury | $25,000 per person $50,000 for two or more people (per incident) |

| Underinsured Motorist Bodily Injury | $25,000 per person $50,000 for two or more people (per incident) |

Do note that Minnesota law also requires that each resident have at least $35,000 in property damage liability for rental vehicles. This requirement ensures that you don’t have to take out a collision damage waiver if you ever rent a car in-state.

What is a form of financial responsibility in Minnesota?

Once you’ve procured your basic insurance, you’re going to need a form of financial responsibility to prove to law enforcement that you have it. Valid forms of financial responsibility in Minnesota include:

- A paper insurance ID card signed and released by your provider

- Electric versions of the same information

How much percentage of income are premiums in Minnesota?

Every year, you’ll need to set aside a percentage of your income to pay for your car insurance. But what percentage should you be saving?

The average Minnesota resident brings home an annual per capita disposable income of $42,516. This chunk of change can be spent on groceries, utilities, mortgages, and more. On a monthly basis, the average household has $3,543 to spend.

The annual cost of an average car insurance coverage plan in Minnesota is $856.62. On a monthly basis, Minnesota residents will pay $71.39 to keep their cars insured. That’s 2.01 percent of a resident’s annual per capita disposable income.

That said, the rate you’re awarded by your car insurance provider will vary based on a few factors, which we’ll detail below.

What are the core coverages in Minnesota?

You don’t have to work solely with Minnesota’s minimum liability and PIP coverage.

There are different forms of coverage available to you, as you can see in the table below:

| Coverage Type | Minnesota Average | National Average |

|---|---|---|

| Liability | $456.82 | $538.73 |

| Collision | $234.40 | $322.61 |

| Comprehensive | $184.27 | $148.04 |

| Total | $875.49 | $1009.38 |

Unlike many states, comprehensive coverage in Minnesota actually costs less than many individual coverage types on their own. Minnesota residents also pay less for their car insurance than the national average — for most forms of coverage, that is.

What additional liability is available in Minnesota?

You may also want to consider adding additional coverage to your plan. While PIP isn’t considered an option, as it’s required by state law, you can optionally choose to invest in uninsured/underinsured motorist coverage.

There are 11.5 percent of Minnesota’s residents that take to the road every day without car insurance.

Uninsured/underinsured motorist coverage protects you if you happen to insure expenses after getting into an accident with a driver who has no insurance.

Want to learn more about loss ratios? Check out the video below:

You’ll want to decide what kind of optional coverage to invest in based on available loss ratios.

Loss ratios reflect a policy’s likelihood of paying out. The higher a loss ratio is, the more likely a company is to pay out on that applicable type of insurance. However, a higher loss ratio also reflects a company’s financial instability. Comparably, low loss ratios as a sign that your company may not pay out on an applicable claim but that they’re more financially secure than their peers.

In general, you want to work with a provider or invest in a type of insurance with a loss ratio between 60 and 80 percent. Take a look at the table below to see how the loss ratios of Minnesota’s optional (and not-so-optional) coverage types play out:

| Loss Ratio | Minnesota (2014) | Nationwide (2014) | Minnesota (2015) | Nationwide (2015) |

|---|---|---|---|---|

| Personal Injury Protection | 63.53 | 69.50 | 68.34 | 85.68 |

| Medical Payments | 47.73 | 74.07 | 11.11 | 75.72 |

| Uninsured/Underinsured Motorist | 55.81 | 67.33 | 56.97 | 75.11 |

What add-ons, endorsements, and riders are available in Minnesota?

Want to learn more your car insurance a la carte options? Take a look at the video below to learn more about GAP insurance:

If you’re interested, you can expand your coverage with add-ons and other types of coverage, in addition to the plan you eventually decide on. You can explore additional, optional coverage by considering the add-ons below:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive (Usage-Based Insurance)

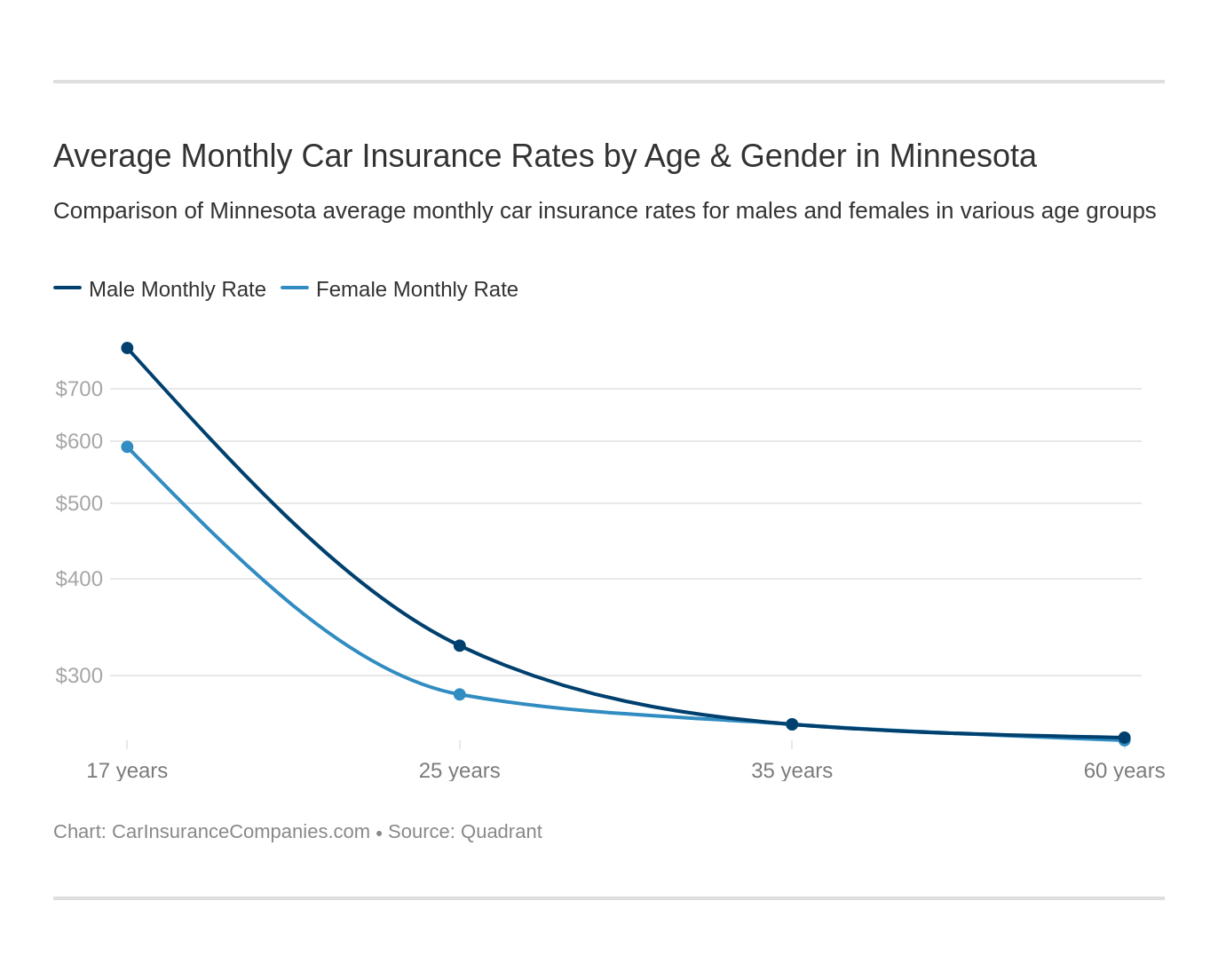

Average Monthly Car Insurance Rates by Age & Gender in MN

The myths surrounding gender and car insurance tend to vary based on the teller. Some myths claim that men always have to pay more for their car insurance, while others claim that it’s women who do.

Take a look at the table below to see how things really play out:

| Company | Married 35-year-old female annual rate | Married 35-year-old male annual rate | Married 60-year-old female annual rate | Married 60-year-old male annual rate | Single 17-year-old female annual rate | Single 17-year-old male annual rate | Single 25-year-old female annual rate | Single 25-year-old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate Indemnity | $3,023.30 | $3,023.30 | $2,908.43 | $2,908.43 | $6,885.00 | $9,968.67 | $3,677.99 | $3,860.95 |

| American Family Mutual | $2,233.79 | $2,233.79 | $2,025.26 | $2,025.26 | $6,086.73 | $8,812.61 | $2,233.79 | $2,519.05 |

| Illinois Farmers Ins | $2,041.64 | $2,038.65 | $1,965.24 | $2,076.17 | $5,820.43 | $5,872.48 | $2,672.81 | $2,612.21 |

| Geico General | $2,661.52 | $2,641.10 | $2,544.82 | $2,473.72 | $5,545.67 | $7,047.50 | $2,494.27 | $2,579.67 |

| Liberty Mutual Fire | $9,604.65 | $9,604.65 | $9,510.34 | $9,510.34 | $18,911.44 | $28,385.86 | $9,604.65 | $13,376.94 |

| AMCO Insurance | $2,017.55 | $2,020.31 | $1,797.28 | $1,903.55 | $5,210.96 | $6,308.92 | $2,375.80 | $2,463.90 |

As you can see, age has a more impressive impact on car insurance premiums than gender. The younger a person is, the more they’re going to have to pay to stay covered.

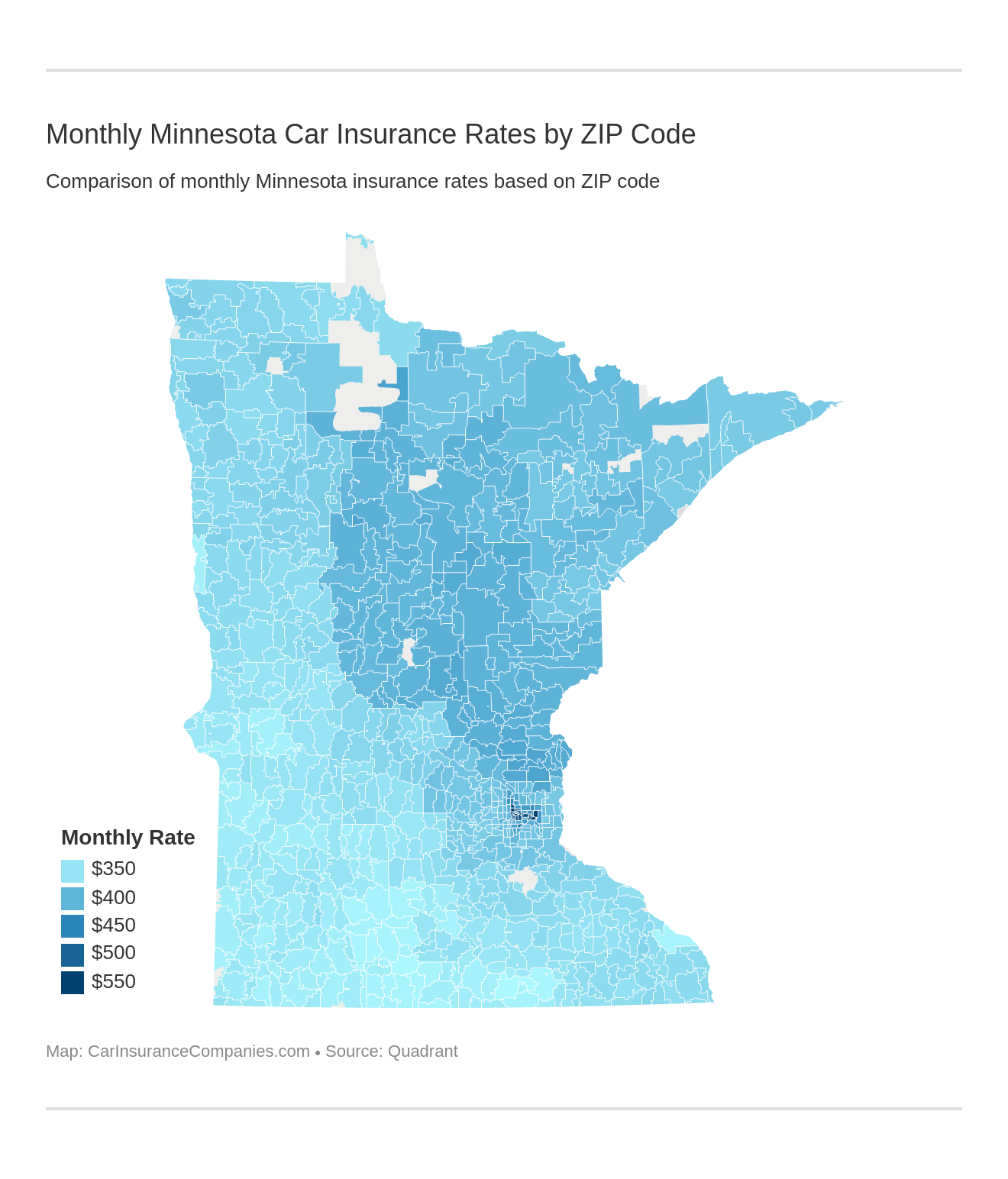

What are the cheapest rates by ZIP code in Minnesota?

Your ZIP code can also have a significant impact on your initial rate, as you can see in the following tables.

This first table shows the 25 ZIP codes with the most expensive rates in Minnesota.

| ZIP Code | Average | Allstate Indemnity | AMCO Insurance | American Family Mutual | Geico General | Illinois Farmers Ins | Liberty Mutual Fire | State Farm Mutual Auto | USAA CIC |

|---|---|---|---|---|---|---|---|---|---|

| 55101 | $6,547.31 | $6,523.85 | $4,626.26 | $4,771.71 | $4,201.38 | $4,318.65 | $20,971.66 | $3,460.84 | $3,504.15 |

| 55102 | $6,187.71 | $5,927.14 | $4,626.26 | $4,176.06 | $4,201.38 | $3,985.05 | $20,346.17 | $2,977.73 | $3,261.85 |

| 55103 | $6,520.89 | $6,523.85 | $4,626.26 | $4,508.12 | $4,201.38 | $4,516.27 | $20,971.66 | $3,315.39 | $3,504.15 |

| 55104 | $6,339.29 | $6,523.85 | $3,903.63 | $4,771.71 | $4,201.38 | $4,607.30 | $20,346.17 | $3,032.21 | $3,328.08 |

| 55106 | $6,563.33 | $6,567.98 | $4,631.79 | $4,534.82 | $4,201.38 | $4,318.65 | $20,971.66 | $3,568.79 | $3,711.58 |

| 55107 | $6,404.50 | $6,136.19 | $4,631.79 | $4,591.24 | $4,201.38 | $4,438.20 | $20,971.66 | $3,003.66 | $3,261.85 |

| 55114 | $6,200.17 | $6,523.85 | $3,903.63 | $4,771.71 | $4,201.38 | $4,023.00 | $20,346.17 | $2,503.54 | $3,328.08 |

| 55130 | $5,798.28 | $6,462.88 | $4,626.26 | $4,771.71 | $4,201.38 | $4,715.17 | $14,314.34 | $3,582.91 | $3,711.58 |

| 55401 | $6,221.82 | $6,370.10 | $4,120.00 | $4,497.42 | $4,003.48 | $3,661.41 | $20,934.87 | $2,859.24 | $3,328.08 |

| 55402 | $6,353.00 | $6,568.73 | $4,126.17 | $4,771.71 | $4,003.48 | $4,266.60 | $20,934.87 | $2,824.38 | $3,328.08 |

| 55403 | $6,252.05 | $6,568.73 | $4,126.17 | $4,771.71 | $4,003.48 | $3,482.58 | $20,934.87 | $2,800.79 | $3,328.08 |

| 55404 | $6,491.18 | $6,588.35 | $4,392.51 | $4,771.71 | $4,003.48 | $5,014.80 | $20,934.87 | $2,895.66 | $3,328.08 |

| 55405 | $6,320.72 | $6,601.34 | $4,126.17 | $4,591.24 | $4,003.48 | $3,795.85 | $20,934.87 | $2,824.38 | $3,688.43 |

| 55406 | $6,257.62 | $6,568.73 | $4,366.11 | $4,591.24 | $4,003.48 | $4,185.07 | $20,346.17 | $2,777.97 | $3,222.20 |

| 55407 | $6,382.19 | $6,595.26 | $4,370.84 | $4,771.71 | $4,003.48 | $4,398.71 | $20,346.17 | $2,988.98 | $3,582.41 |

| 55408 | $6,370.83 | $6,588.35 | $4,370.84 | $4,771.71 | $4,003.48 | $4,219.67 | $20,934.87 | $2,894.22 | $3,183.53 |

| 55409 | $6,109.20 | $6,509.73 | $3,668.29 | $4,591.24 | $4,003.48 | $3,617.16 | $20,346.17 | $2,954.03 | $3,183.53 |

| 55411 | $6,620.56 | $6,404.25 | $4,605.62 | $4,771.71 | $4,003.48 | $5,218.62 | $20,934.87 | $3,337.51 | $3,688.43 |

| 55412 | $6,434.63 | $6,465.92 | $4,605.62 | $4,459.38 | $4,003.48 | $4,022.10 | $20,934.87 | $3,297.21 | $3,688.43 |

| 55413 | $6,248.33 | $6,370.10 | $4,120.00 | $4,508.12 | $4,003.48 | $3,871.62 | $20,934.87 | $2,907.36 | $3,271.06 |

| 55414 | $6,254.15 | $6,531.88 | $4,366.11 | $4,463.19 | $4,003.48 | $4,312.38 | $20,346.17 | $2,681.89 | $3,328.08 |

| 55415 | $6,385.64 | $6,568.73 | $4,120.00 | $4,771.71 | $4,003.48 | $4,496.44 | $20,934.87 | $2,861.81 | $3,328.08 |

| 55450 | $5,758.23 | $5,069.73 | $3,373.74 | $3,823.33 | $3,684.67 | $3,712.46 | $20,934.87 | $2,935.21 | $2,531.82 |

| 55454 | $6,394.17 | $6,568.73 | $4,120.00 | $4,771.71 | $4,003.48 | $4,655.58 | $20,934.87 | $2,770.93 | $3,328.08 |

| 55455 | $6,349.43 | $6,531.88 | $4,120.00 | $4,771.71 | $4,003.48 | $4,170.23 | $20,934.87 | $2,935.21 | $3,328.08 |

In contrast, here are the rates for the 25 cheapest ZIP codes in Minnesota.

| ZIP Code | Average | Allstate Indemnity | AMCO Insurance | American Family Mutual | Geico General | Illinois Farmers Ins | Liberty Mutual Fire | State Farm Mutual Auto | USAA CIC |

|---|---|---|---|---|---|---|---|---|---|

| 55912 | $4,009.81 | $4,094.03 | $2,504.36 | $3,223.07 | $3,443.01 | $2,660.42 | $11,792.33 | $1,858.67 | $2,502.58 |

| 55987 | $4,017.60 | $4,391.76 | $2,489.07 | $3,489.10 | $3,209.71 | $2,550.37 | $11,372.14 | $1,909.06 | $2,729.59 |

| 56001 | $4,043.77 | $4,376.76 | $2,615.86 | $3,210.44 | $2,924.31 | $2,631.51 | $11,927.85 | $2,014.61 | $2,648.87 |

| 56007 | $3,976.80 | $4,039.14 | $2,389.63 | $3,176.87 | $3,129.06 | $2,526.83 | $12,222.48 | $1,827.79 | $2,502.58 |

| 56019 | $4,041.92 | $4,013.12 | $2,717.01 | $3,258.21 | $3,186.49 | $2,828.83 | $12,222.48 | $1,670.30 | $2,438.90 |

| 56027 | $4,022.41 | $4,216.61 | $2,728.50 | $3,176.87 | $3,186.49 | $2,391.86 | $12,222.48 | $1,636.38 | $2,620.07 |

| 56031 | $4,029.28 | $4,013.12 | $2,530.75 | $3,223.07 | $3,186.49 | $2,791.10 | $12,222.48 | $1,647.15 | $2,620.07 |

| 56036 | $4,046.92 | $4,216.61 | $2,728.50 | $3,272.54 | $3,186.49 | $2,408.30 | $12,222.48 | $1,837.88 | $2,502.58 |

| 56039 | $4,018.95 | $4,013.12 | $2,530.75 | $3,166.84 | $3,186.49 | $2,770.69 | $12,222.48 | $1,641.11 | $2,620.07 |

| 56041 | $4,042.96 | $4,007.85 | $2,717.01 | $3,272.54 | $3,186.49 | $2,820.45 | $12,222.48 | $1,677.99 | $2,438.90 |

| 56054 | $4,032.56 | $4,007.85 | $2,717.01 | $3,176.87 | $3,186.49 | $2,585.62 | $12,222.48 | $1,774.45 | $2,589.70 |

| 56062 | $4,029.17 | $4,007.85 | $2,717.01 | $3,166.84 | $3,186.49 | $2,795.29 | $12,222.48 | $1,698.53 | $2,438.90 |

| 56073 | $4,027.34 | $4,007.85 | $2,717.01 | $3,166.84 | $3,186.49 | $2,805.52 | $12,222.48 | $1,673.65 | $2,438.90 |

| 56075 | $4,036.97 | $4,013.12 | $2,530.75 | $3,223.07 | $3,186.49 | $2,618.05 | $12,222.48 | $1,881.71 | $2,620.07 |

| 56081 | $4,032.94 | $4,007.85 | $2,717.01 | $3,078.49 | $3,186.49 | $2,913.89 | $12,222.48 | $1,698.42 | $2,438.90 |

| 56085 | $4,044.59 | $4,007.85 | $2,717.01 | $3,258.21 | $3,186.49 | $2,892.47 | $12,222.48 | $1,633.33 | $2,438.90 |

| 56087 | $4,029.60 | $4,143.10 | $2,717.01 | $3,266.10 | $3,186.49 | $2,555.88 | $12,222.48 | $1,706.84 | $2,438.90 |

| 56088 | $3,983.87 | $4,013.12 | $2,530.75 | $3,176.87 | $3,186.49 | $2,453.16 | $12,222.48 | $1,668.01 | $2,620.07 |

| 56098 | $4,037.01 | $4,216.61 | $2,728.50 | $3,166.84 | $3,186.49 | $2,436.29 | $12,222.48 | $1,718.76 | $2,620.07 |

| 56120 | $4,009.53 | $4,110.95 | $2,717.01 | $3,166.84 | $3,186.49 | $2,542.74 | $12,222.48 | $1,690.81 | $2,438.90 |

| 56127 | $4,029.53 | $4,206.30 | $2,530.75 | $3,258.21 | $3,186.49 | $2,448.45 | $12,222.48 | $1,763.52 | $2,620.07 |

| 56159 | $4,014.86 | $4,206.30 | $2,678.17 | $3,078.49 | $3,186.49 | $2,566.24 | $12,222.48 | $1,741.80 | $2,438.90 |

| 56162 | $4,048.38 | $4,144.34 | $2,530.75 | $3,166.84 | $3,186.49 | $2,634.37 | $12,222.48 | $1,881.71 | $2,620.07 |

| 56171 | $4,047.15 | $4,206.30 | $2,530.75 | $3,239.00 | $3,186.49 | $2,658.14 | $12,222.48 | $1,713.97 | $2,620.07 |

| 56181 | $4,027.96 | $4,144.34 | $2,530.75 | $3,166.84 | $3,186.49 | $2,674.04 | $12,222.48 | $1,678.68 | $2,620.07 |

The wealthier the area you live in is, the higher your rates are likely to be. Urban areas, too, as you can see in the table above, often rack up higher insurance costs than rural ones.

What are the cheapest rates by city in Minnesota?

Your offered car insurance rate will also vary based on the city you live in.

If you live in one of the 25 cities listed below, your rates are likely to be among the highest in the state.

| City | Average Grand Total |

|---|---|

| Almelund | $4966.16 |

| Andover | $4946.23 |

| Bethel | $4984.06 |

| Cambridge | $4917.15 |

| Cedar | $4988.89 |

| Center City | $4912.1 |

| Dalbo | $4913.94 |

| Forest Lake | $4992.05 |

| Garrison | $4948.9 |

| Grandy | $4945.77 |

| Hillman | $4938.79 |

| Hugo | $4940.45 |

| Isanti | $4955.17 |

| Lake George | $4999.75 |

| Minneapolis | $5318.64 |

| Pierz | $4911.72 |

| Saint Francis | $5003.38 |

| Saint Paul | $5215.37 |

| Scandia | $4914.54 |

| South Saint Paul | $4994.42 |

| Stacy | $5003.33 |

| Swatara | $4945.15 |

| Taylors Falls | $4943.23 |

| Waskish | $5023.66 |

| Wyoming | $4967.20 |

Read more:

- Cedar Insurance Company Car Insurance Review

- Bloomington Compensation Insurance Company Car Insurance Review

Here are the 25 cities in Minnesota that average the lowest rates.

| City | Average Grand Total |

|---|---|

| Albert Lea | $3976.8 |

| Austin | $4009.81 |

| Butterfield | $4009.53 |

| Comfrey | $4041.92 |

| Dunnell | $4029.54 |

| Elmore | $4022.41 |

| Fairmont | $4029.28 |

| Glenville | $4046.92 |

| Granada | $4018.95 |

| Hanska | $4042.96 |

| Lafayette | $4032.56 |

| Lewisville | $4051.00 |

| Madelia | $4029.18 |

| Mountain Lake | $4014.86 |

| New Ulm | $4027.35 |

| Northrop | $4036.97 |

| Ormsby | $4048.38 |

| Saint James | $4032.94 |

| Sherburn | $4047.15 |

| Sleepy Eye | $4044.59 |

| Springfield | $4029.6 |

| Truman | $3983.87 |

| Welcome | $4027.96 |

| Winnebago | $4037.01 |

| Winona | $4017.6 |

As you can see, larger cities in Minnesota tend to have higher car insurance premiums than more rural cities, with Albert Lea having the best rates.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Best Minnesota Car Insurance Companies

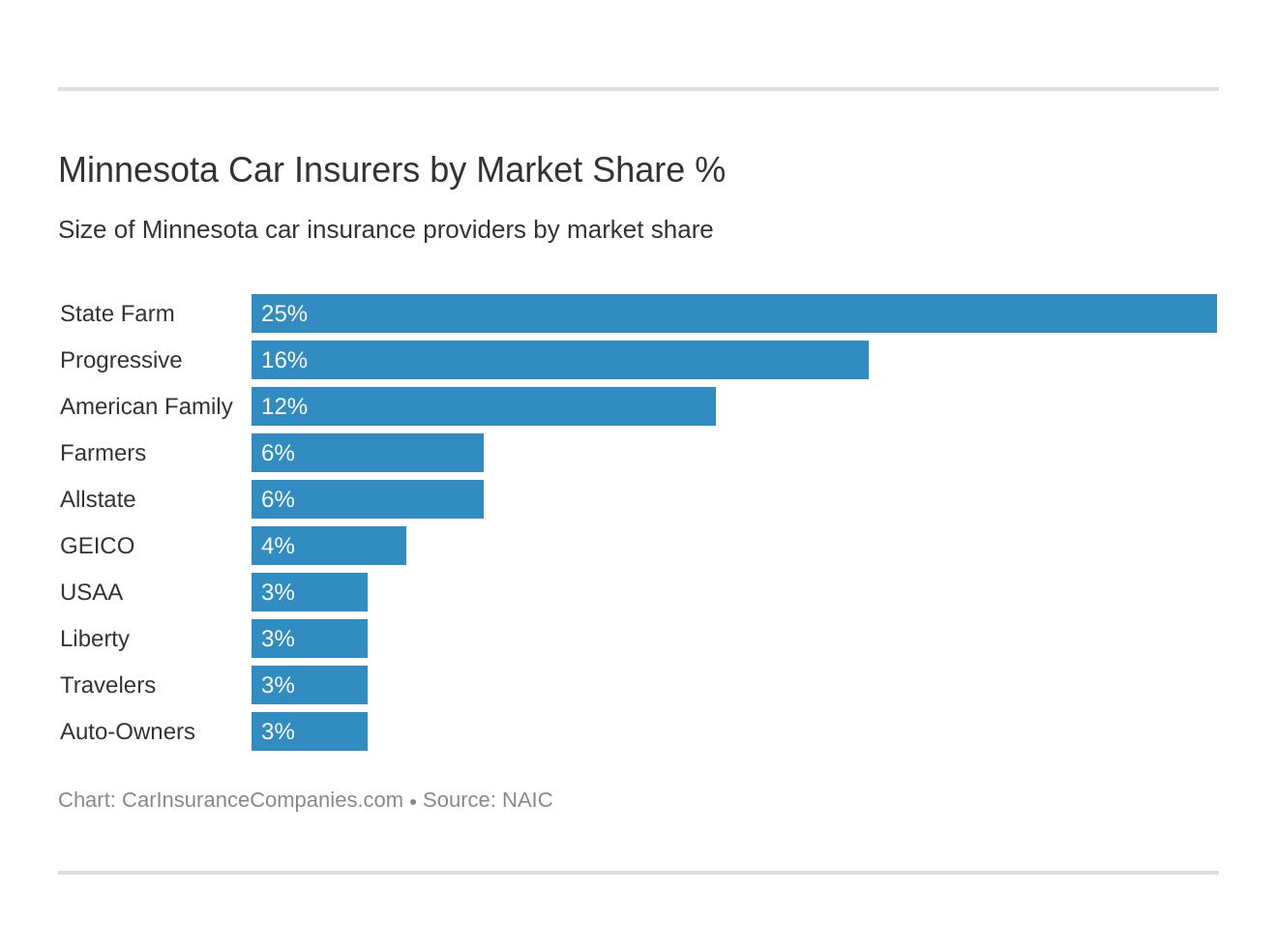

Now that you know a little more about the factors that go into a car insurance premium, as well as Minnesota’s state requirements, let’s look at things in more detail. What companies will you have to work with as a Minnesota resident, and what kind of premiums will they offer? Who are the top 10 companies in MN?

What are the financial ratings of the largest car insurance companies in Minnesota?

Let’s start with an initial rating. A.M. Best releases company financial ratings on a yearly basis, describing how well each company is doing in comparison to the rest of the market.

In the table below, you’ll see a letter grade in addition to each company’s loss ratio:

| Company Name | AM Best Rating | Loss Ratio |

|---|---|---|

| State Farm Group | A++ | 65.52% |

| Progressive Group | A+ | 62.53% |

| American Family Insurance Group | A | 62.97% |

| Farmers Insurance Group | A | 56.43% |

| Allstate Insurance Group | A+ | 60.51% |

| Geico | A++ | 74.00% |

| USAA Group | A++ | 73.57% |

| Liberty Mutual Group | A | 60.04% |

| Travelers Group | A++ | 65.96% |

| Auto-Owners Group | A++ | 61.26% |

As you can see, there are several companies in Minnesota that receive an A++ rating, the best that A.M. Best can award. That said, even companies that merely garner As have loss ratios well within a reasonable range for internationally-based corporations.

Which car insurance companies have the best ratings in Minnesota?

But what do consumers have to say about the way that these companies operate? J.D. Power details each provider’s customer service reputation in the chart below:

Here, Geico asserts itself as a clear customer service leader in Minnesota.

Which car insurance companies have the most complaints in Minnesota?

On the other hand, how do Minnesota’s customer complaints reflect on the aforementioned companies? Let’s take a look:

| Company | Complaint Ratio | Total Number of Complaints |

|---|---|---|

| Farmers | 0.028 | 7 |

| USAA | 0.065 | 5 |

| Progressive | 0.083 | 34 |

| State Farm | 0.151 | 106 |

| Geico | 0.158 | 13 |

| Liberty Mutual | 0.178 | 20 |

| American Family | 0.256 | 86 |

| Auto-Owners | 0.270 | 23 |

| Allstate | 0.286 | 46 |

| Auto Club Insurance Association | 0.416 | 32 |

Do note that even though some of these complaint numbers look high, they’re not so significant. Why? Because the ratio of complaints to drivers will vary based on the size of the company in question.

That’s why companies like Auto Club Insurance Association, with its 32 complaints, still has a higher complaint ratio than State Farm, with its 106 complaints.

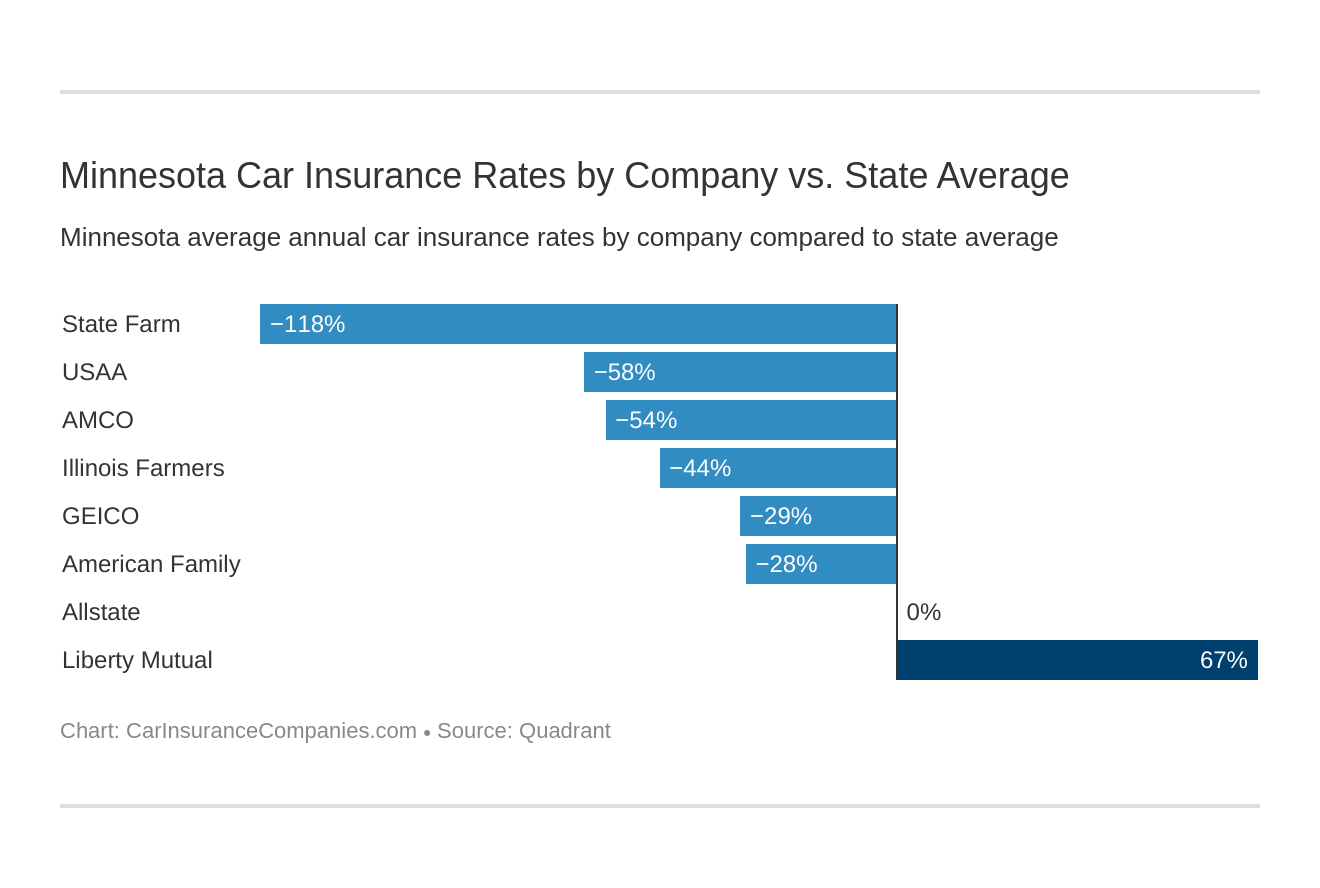

What are the cheapest car insurance companies in Minnesota?

Let’s get real, though. Many of us choose a car insurance provider because we want to save money. With that in mind, which car insurance providers in Minnesota are the most affordable?

| Company | Average | Cost Compared to State Average | Percentage Compared to State Average |

|---|---|---|---|

| Liberty Mutual Fire | $13,563.61 | $9,050.11 | 66.72% |

| Allstate Indemnity | $4,532.01 | $18.51 | 0.41% |

| American Family Mutual | $3,521.29 | -$992.21 | -28.18% |

| Illinois Farmers Ins | $3,137.45 | -$1,376.04 | -43.86% |

| Geico General | $3,498.53 | -$1,014.96 | -29.01% |

| AMCO Insurance | $2,926.49 | -$1,587.01 | -54.23% |

| USAA CIC | $2,861.60 | -$1,651.89 | -57.73% |

| State Farm Mutual Auto | $2,066.99 | -$2,446.51 | -118.36% |

USAA has a reputation for affordability, and it seems it holds to it in the Land of 10,000 Lakes. But remember, USAA is only available to military personnel and their families.

If you’re not in the military, the cheapest car insurance company for you might be State Farm or AMCO.

Does my commute affect my car insurance rate in Minnesota?

All that said, let’s dive into the factors that could influence the amount of money you have to pay to stay covered in Minnesota. Some car insurance providers, for example, change their rates based on the number of miles you drive in a year.

See the table below for the different ways your commute may change your rates:

| Group | Daily Commute and Annual Mileage | Annual Average |

|---|---|---|

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $13,961.85 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $13,165.37 |

| Allstate | 25 miles commute. 12000 annual mileage. | $4,532.01 |

| Allstate | 10 miles commute. 6000 annual mileage. | $4,532.01 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,544.87 |

| Geico | 10 miles commute. 6000 annual mileage. | $3,452.20 |

| American Family | 25 miles commute. 12000 annual mileage. | $3,562.51 |

| American Family | 10 miles commute. 6000 annual mileage. | $3,480.06 |

| Farmers | 25 miles commute. 12000 annual mileage. | $3,137.45 |

| Farmers | 10 miles commute. 6000 annual mileage. | $3,137.45 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $2,926.49 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $2,926.49 |

| USAA | 25 miles commute. 12000 annual mileage. | $2,899.06 |

| USAA | 10 miles commute. 6000 annual mileage. | $2,824.14 |

| State Farm | 25 miles commute. 12000 annual mileage. | $2,122.82 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,011.15 |

While not all companies will up-charge you for having a longer commute, like Nationwide, others, like State Farm, will.

Can coverage level change my car insurance rate with companies in Minnesota?

The amount of coverage you want to invest in will also impact the amount you’re charged by a provider, as you can see below:

| Group | High Coverage | Medium Coverage | Low Coverage |

|---|---|---|---|

| Liberty Mutual | $13,874.92 | $13,574.70 | $13,241.20 |

| Allstate | $4,600.41 | $4,528.59 | $4,467.02 |

| American Family | $3,432.86 | $3,618.33 | $3,512.68 |

| Geico | $3,603.48 | $3,497.28 | $3,394.84 |

| Farmers | $3,239.56 | $3,150.22 | $3,022.58 |

| Nationwide | $3,064.92 | $2,947.12 | $2,767.43 |

| USAA | $2,945.57 | $2,859.57 | $2,779.67 |

| State Farm | $2,141.38 | $2,074.23 | $1,985.35 |

The rates here shouldn’t drive you to pick the most affordable car insurance right off the bat. After all, investing in low-cost car insurance could end up costing you more, personally, upon getting into an accident.

How does my credit history affect my car insurance rate with companies in Minnesota?

Your credit history reflects your ability to pay back on loans and debts. Naturally, a car insurance company is going to take this number into account when offering you a rate, as they want to ensure that you’re a reliable client. With that in mind, let’s see how variable credit histories change the rates different companies are willing to offer you.

| Group | Poor Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Liberty Mutual | $18,908.11 | $12,227.54 | $9,555.18 |

| Allstate | $6,648.80 | $3,603.11 | $3,344.12 |

| American Family | $4,809.31 | $3,190.11 | $2,564.44 |

| USAA | $4,486.70 | $2,192.66 | $1,905.46 |

| Geico | $4,200.64 | $3,433.78 | $2,861.19 |

| Farmers | $3,916.92 | $2,840.59 | $2,654.85 |

| Nationwide | $3,481.91 | $2,807.41 | $2,490.14 |

| State Farm | $3,013.76 | $1,842.99 | $1,344.22 |

As you can see, poor credit history can cost you up to $6,000 or more, when it comes to purchasing car insurance.

How does my driving record change my rates with car insurance companies in Minnesota?

Your driving record, too, reveals how likely you are to get into an accident in the future. All car insurance providers want to know in advance how much they should expect to pay on your claims. As a result, a poor driving history could make your rate more expensive.

| Group | With 1 DUI | With 1 Accident | With 1 Speeding Violation | Clean Record |

|---|---|---|---|---|

| Liberty Mutual | $19,913.12 | $13,646.49 | $10,738.20 | $9,956.63 |

| Allstate | $5,738.97 | $4,780.23 | $4,316.11 | $3,292.72 |

| Geico | $5,500.20 | $3,691.11 | $2,484.09 | $2,318.73 |

| American Family | $4,775.76 | $4,259.41 | $2,682.98 | $2,367.00 |

| USAA | $4,082.21 | $2,706.41 | $2,531.74 | $2,126.06 |

| Nationwide | $3,547.09 | $3,083.13 | $2,753.24 | $2,322.48 |

| Farmers | $3,427.73 | $3,381.83 | $3,053.56 | $2,686.69 |

| State Farm | $2,066.98 | $2,233.53 | $2,066.98 | $1,900.45 |

Liberty Mutual, for example, is willing to charge you nearly $10,000 more for your car insurance if you have a DUI than if you have a clean record. That’s all the more reason, we figure, to try and drive safely.

How many car insurance companies are available in Minnesota?

Car insurance providers are broken down into two categories: domestic and foreign. Domestic providers are providers who solely operate within the state of Minnesota. Comparatively, foreign providers operate nationally and sometimes internationally. Let’s see how your available providers in Minnesota break down:

| Insurer Locality | Number of Property & Casualty Insurers |

|---|---|

| Domestic | 39 |

| Foreign | 816 |

| Total | 855 |

As you can see, there are far more foreign providers to choose from than domestic ones. That said, be sure to choose a provider based on the coverage they can give you, not their base of operations.

Minnesota Driving Laws

With a little more information about rate factors under your belt, let’s dive into the Minnesota laws that’ll dictate the way you drive on the road.

What are the car insurance laws in Minnesota?

Each state has its own litany of car insurance laws that protect driver’s rights and ensure that insurance providers can continue to operate successfully. In this section, we’ll touch on what kinds of coverage the Minnesota government requires its car insurance entities to share with drivers, what rules drivers have to abide by, and more.

Windshield Coverage

In Minnesota, car insurance providers are required by law to provide all drivers with comprehensive coverage no-deductible windshield replacement. That said, if you’re not interested in accepting this coverage, you can decline it upon signing.

Minnesota insurance companies are also able to choose aftermarket windshield parts and OEM parts if you consent to coverage through their comprehensive plan. That said, you can also take your vehicle to a service of your choice, but you’ll be expected to pay the difference between the quote and what your provider is willing to cover.

High-Risk Insurance

If you happen to have a DUI or a significant number of points on your license, you’re in luck. Minnesota offers its Minnesota Automobile Insurance Plan to high-risk drivers. This plan operates through a company called AIPSO, and while they will not take responsibility for your behavior, they will ensure that you meet the Minnesota minimum car insurance requirements, regardless of your driving history.

Low-Cost Insurance

Minnesota does not offer car insurance programs for low-income families. However, drivers can seek out discounts to make the cost of insurance more bearable.

Be sure to ask your provider of choice if you or your family are eligible for any of the following discounts:

- Accident-Free Discount

- Affiliation Discount (this would be any discounts through your employer, school, team, etc.)

- Anti-Theft Discounts (i.e. if you have alarms, tracking systems, etc on your vehicle)

- Auto-Pay Discounts (if you were to set up automatic payments from checking – some providers refer to it as a Paper-Saving Discount)

- Good Student Discount

- Homeowner’s Discount

- Multi-car Discount

- Green/Hybrid Car Discount (if you own/lease a hybrid or electric vehicle)

Be sure you shop around in order to find the best coverage for you that is equally cost-effective.

Automobile Fraud in Minnesota

It’s difficult to commit insurance fraud by accident. That said, the insurance industry sees 10 percent of its operating costs go to enduring fraudulent claims or accounts over the course of a year.

There are two different types of automobile fraud.

- Hard fraud sees a driver deliberately falsifying a claim or faking an accident in order to receive compensation

- Soft fraud sees a driver padding a claim or misrepresenting accident information to an insurance provider

Soft fraud is the more common of these two types of fraud.

Even though you may think you’re just telling a white lie, soft fraud is considered a misdemeanor, and lying on your claim is considered a class 5 felony.

Statute of Limitations

A statute of limitations describes the amount of time you have after an accident to file a claim with your car insurance provider. In Minnesota, you have:

- Two years to file for personal injury

- Six years to file for property damage

What are the vehicle licensing laws in Minnesota?

Not only do you have to abide by car insurance laws, but you also need to keep your license up-to-date, according to Minnesota’s vehicle licensing laws. The good news is that it’s possible for you to renew your license and complete similar tasks through Minnesota’s Driver and Vehicle Service’s online portal.

Minnesota does not have an age cap at which drivers cannot renew their driver’s license in the standard method. Each driver must renew her license on a four-year basis. Drivers may submit renewals through the online portal every other year. However, drivers must also submit proof of adequate vision upon every renewal.

REAL ID

What’s the difference between a regular ID and a REAL ID? NBC tells us more:

REAL ID is arriving in 2020. All Minnesota drivers — and drivers throughout the United States — will need to have REAL ID to get on a plane, be the flight domestic or international.

Penalties for Driving Without Insurance

It is illegal to drive in Minnesota without some kind of car insurance. You’ll face serious consequences if you do, including:

- $200 to $1,000 fines

- Community service of varying lengths

- Jail time for up to 90 days

- The revocation of your license

- The revocation of your vehicle registration for 12 months

If you’ve been convicted of driving without insurance means that you’ll need to present proof of insurance to law enforcement within 12 months of your license and registration revocation.

Teen Driving Laws

Most teenagers are excited to get behind the wheel of a car for the first time. However, teenage drivers in Minnesota don’t start out with a full license. Take a look at the table below to see how the different licenses available to beginning drivers break down:

| License Type | Age of Eligibility | Requirements to Obtain | Restrictions |

|---|---|---|---|

| Learners Permit | 15 | Enroll in Driver Ed if under 18 and complete classroom portion Pass written exam | May drive only with parent, guardian, instructor, or licensed driver over 21 |

| Restricted License | 16 | 6 month holding period with permit Complete 50 hours (40 if parent class is completed) of in-car instruction, 15 of these at night Pass road test | No driving between midnight-5 a.m. Only one passenger under 20 for the first six months, three under 20 for the second six months |

| Full License | 17 | Complete 12 months with restricted license | None |

As you can see, teenagers will need to meet the requirements of a number of temporary licenses before they are awarded their full licenses. These same rules apply to anyone receiving their license for the first time.

License Renewal Procedures

Age is not a factor when it comes to the license renewal process in Minnesota. Regardless of your age, you’ll be expected to renew your license on a four-year cycle. Likewise, you must always present an appropriate representative with proof of adequate vision when getting your license renewed.

| License Renewal | Vision Test | Renewal by Mail |

|---|---|---|

| Every 4 years | At every renewal | No |

New Residents

If you’ve recently moved to Minnesota, make sure you complete the following tasks:

- Obtain a Minnesota driver’s license

- Purchase an auto insurance policy

- Register your car with the local DMV

New Minnesota residents must secure a Minnesota license within 30 days of moving to the state. If you’re able to show the DVS proof that you obtained your driver’s license in another state, then you will not have to retake your written and practical driver’s tests. However, if you cannot, you’ll be expected to complete these tests to receive your license.

What are the rules of the road in Minnesota?

What is expected of you as a driver in Minnesota? Let’s dive into the rules of the road so you can keep your fellow drivers safe in traffic.

Fault vs. No-Fault

As mentioned, Minnesota is a no-fault state. This means that each party involved in an accident will be responsible for their own financial deficits. Exceptions, over-extensions, and other delineations will be determined with the National Association of Insurance Commissioners.

Seat Belt and Car Seat Laws

Seat belt and car seat laws in Minnesota are strict – and for good reason. These laws are designed to protect passengers of all ages in case of an accident. As it stands, no child under the age of eight may ride in a vehicle without wearing a seat belt.

You determine the best car seat for children under the age of eight by taking their weight and height into account. While Minnesota law doesn’t prevent children from riding in the passenger seat so long as they’re also seated in a car seat.

Keep Right and Move Over Laws

If you are driving more slowly than the posted speed limit, or if you are not looking to pass a car in front of you, then Minnesota law dictates that you must remain in the right-hand lane of the applicable interstate.

You must also move over for vehicles that have their lights flashing, regardless of whether or not they’re clearly marked as emergency vehicles. These vehicles include but are not limited to:

- Police cruisers

- Ambulances

- Firetrucks

- Tow trucks

- Recovery vehicles

Speed Limits

The speed limits in Minnesota break down as follows:

- Rural Interstates – 70 mph

- Urban Interstates – 65 mph

- Other Limited Access Roads – 65 mph

- Other Roads – 60 mph

Do note that these are the MAXIMUM SPEEDS for these types of roads. When the weather gets bad, as it frequently does in the winter, be sure to take things slower to stay as safe as possible.

Ridesharing

The rise of Uber and Lyft have made it easier than ever for people to get to the places they need to go. These companies have also created a new industry for drivers. If you currently work with either company or one of their competitors, or if you’ve thought about using your vehicle for a job before, you’ll need to get ridesharing insurance.

What are the safety laws in Minnesota?

In this section, we’ll dive into the last of the Minnesota legalities: safety on the road.

DUI Laws

In Minnesota, DUIs are referred to as DWI convictions. If you’re caught driving with a blood-alcohol level over 0.08, you could get a DWI. Most of the time, a DWI will only constitute a misdemeanor. However, additional factors like an increased blood alcohol level and the age of the driver could turn that misdemeanor into a felony.

The other penalties include:

| Type of Penalty | First Offense | Second Offense | Third Offense | Fourth Offense | Fifth and Subsequent Offenses |

|---|---|---|---|---|---|

| License Revocation | 90 days (180 days if under 21-years-old) | One year | One year, unless the revocation occurs within ten years of other revocations, after which a license will be cancelled and denied for three years | Cancelled and revoked for three years, unless the noted to be the fourth offense in ten years - at which point the license will be cancelled and revoked for four years | Cancelled and revoked for six years |

| Imprisonment | No minimum, up to 90 days | 30 days, with 48 consecutive hour served in a jailhouse. Max one year | 90 days incarceration with 30 spent in a jailhouse | 90 days to seven years, with 30 spent consecutively in a jailhouse | One year, with at least 60 consecutive days spent in a jailhouse |

| Fines | $1,000 | $3,000 | $3,000 minimum | $14,000 | N/A |

| Other Penalties | N/A | N/A | Without the imposition of maximum bail, the perpetrator may receive pretrial release if they agree to no alcohol consumption as well as electronic alcohol monitoring at least once a day | Registration and plates will be impounded, and the perpetrator will have to meet weekly with a probation officer and submit to random substance testing | N/A |

Distracted Driver Laws

The legality of driving with a phone in hand varies by state. Minnesota, as of 2019, declared it illegal to operate a hand-held cellphone while behind the wheel of a car.

You will also face legal consequences if you’re caught texting and driving. Use of a hand-held device while behind the wheel of a car is considered a primary offense, meaning that law enforcement representatives can pull you over if they see you using your phone, with no other reasons needed.

Driving in Minnesota

Now you know what kind of legalities you’ll need to operate within while driving in Minnesota. What does an average day on the road look like, though? What are some of the dangers you need to keep an eye out for?

Let’s take a look at the different safety hazards you may encounter in Minnesota.

How many vehicle thefts occur in Minnesota?

You might think that sports cars are at the highest risk of theft in Minnesota. Not so! As it turns out, Hondas are far more likely to go missing than Mustangs.

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Honda Civic | 1998 | 676 |

| Honda Accord | 1997 | 524 |

| Chevrolet Pickup (Full Size) | 1999 | 329 |

| Ford Pickup (Full Size) | 2005 | 246 |

| Toyota Camry | 1999 | 214 |

| Honda CR-V | 1999 | 190 |

| Chevrolet Impala | 2004 | 171 |

| Dodge Caravan | 2003 | 143 |

| Toyota Corolla | 2010 | 109 |

| Acura Integra | 1996 | 95 |

As you can see in the table above, both Hondas and pickup trucks are among the vehicles most frequently stolen in Minnesota. That likelihood of theft is all the more reason for you to consider investing in additional security features upon purchasing your car.

That said, some cities in Minnesota are more prone to theft than others. According to the FBI, Minnesota’s cities break down as follows:

| State | Motor Vehicle Theft |

|---|---|

| Aitkin | 4 |

| Akeley | 1 |

| Albany | 7 |

| Albert Lea3 | 20 |

| Alexandria | 28 |

| Annandale | 3 |

| Anoka | 20 |

| Appleton | 0 |

| Apple Valley | 31 |

| Arlington | 0 |

| Atwater | 0 |

| Austin | 26 |

| Avon | 4 |

| Babbitt | 2 |

| Barnesville | 0 |

| Baxter | 8 |

| Bayport | 1 |

| Becker | 2 |

| Belgrade/Brooten | 2 |

| Belle Plaine | 0 |

| Bemidji | 59 |

| Benson | 0 |

| Big Lake | 8 |

| Blackduck | 1 |

| Blaine | 78 |

| Blooming Prairie | 1 |

| Bloomington | 133 |

| Blue Earth | 3 |

| Bovey | 0 |

| Braham | 0 |

| Brainerd | 14 |

| Breckenridge | 6 |

| Breezy Point | 2 |

| Breitung Township | 1 |

| Brooklyn Center | 111 |

| Brooklyn Park | 158 |

| Brownton | 0 |

| Buffalo | 11 |

| Buffalo Lake | 1 |

| Burnsville | 104 |

| Caledonia | 0 |

| Cambridge | 17 |

| Canby | 0 |

| Cannon Falls3 | 3 |

| Centennial Lakes | 11 |

| Champlin | 8 |

| Chaska | 8 |

| Chisholm | 2 |

| Clara City | 0 |

| Clearbrook3 | 0 |

| Cleveland | 0 |

| Cloquet | 24 |

| Cold Spring/Richmond | 2 |

| Coleraine | 0 |

| Columbia Heights | 44 |

| Coon Rapids | 52 |

| Corcoran | 1 |

| Cosmos | 2 |

| Cottage Grove | 40 |

| Crookston | 2 |

| Crosby | 0 |

| Crosslake | 0 |

| Crystal | 22 |

| Danube | 2 |

| Dawson/Boyd | 1 |

| Dayton | 8 |

| Deephaven | 0 |

| Deer River | 1 |

| Detroit Lakes3 | 24 |

| Dilworth | 8 |

| Duluth | 222 |

| Dundas | 0 |

| Eagan | 42 |

| Eagle Lake | 2 |

| East Grand Forks | 6 |

| East Range | 1 |

| Eden Prairie | 29 |

| Eden Valley | 0 |

| Edina | 30 |

| Elko New Market | 0 |

| Elk River | 17 |

| Elmore | 0 |

| Ely | 2 |

| Eveleth | 7 |

| Fairfax | 1 |

| Fairmont | 2 |

| Falcon Heights | 7 |

| Faribault | 32 |

| Farmington | 11 |

| Fergus Falls3 | 16 |

| Floodwood | 1 |

| Foley | 0 |

| Forest Lake | 49 |

| Fridley | 76 |

| Fulda | 0 |

| Gaylord | 0 |

| Gilbert | 3 |

| Glencoe | 3 |

| Glenwood | 0 |

| Golden Valley | 21 |

| Goodhue3 | 0 |

| Goodview | 2 |

| Grand Rapids | 5 |

| Granite Falls | 3 |

| Hallock | 0 |

| Hancock | 0 |

| Hastings | 25 |

| Hawley | 0 |

| Hector | 1 |

| Henning3 | 0 |

| Hermantown | 12 |

| Hibbing | 10 |

| Hill City | 6 |

| Hilltop | 9 |

| Hokah | 0 |

| Hopkins | 31 |

| Houston | 0 |

| Howard Lake | 0 |

| Hutchinson | 2 |

| International Falls | 6 |

| Inver Grove Heights | 78 |

| Isanti | 4 |

| Isle | 0 |

| Janesville | 1 |

| Jordan | 0 |

| Kasson | 4 |

| Keewatin | 1 |

| Kimball | 0 |

| La Crescent | 2 |

| Lake City | 2 |

| Lake Crystal | 4 |

| Lakefield | 0 |

| Lakes Area | 11 |

| Lake Shore | 0 |

| Lakeville | 20 |

| Lamberton | 0 |

| Lauderdale | 3 |

| Le Center | 0 |

| Lester Prairie | 2 |

| Le Sueur | 1 |

| Lewiston | 1 |

| Lino Lakes | 8 |

| Litchfield | 7 |

| Little Falls | 11 |

| Long Prairie | 3 |

| Lonsdale | 0 |

| Madelia | 0 |

| Madison Lake | 0 |

| Mankato | 51 |

| Maple Grove | 35 |

| Mapleton | 0 |

| Maplewood | 169 |

| Marshall | 7 |

| McGregor | 0 |

| Medina | 2 |

| Melrose | 0 |

| Menahga | 0 |

| Mendota Heights | 13 |

| Milaca | 2 |

| Minneapolis | 2,388 |

| Minneota | 0 |

| Minnesota Lake | 0 |

| Minnetonka | 34 |

| Minnetrista | 3 |

| Montevideo | 6 |

| Montgomery | 8 |

| Moorhead | 104 |

| Moose Lake | 1 |

| Morris | 3 |

| Motley | 0 |

| Mounds View | 29 |

| Mountain Lake | 2 |

| Nashwauk | 0 |

| New Brighton | 47 |

| New Hope | 22 |

| New Prague | 3 |

| New Richland | 0 |

| New Ulm | 10 |

| North Branch | 7 |

| Northfield | 6 |

| North Mankato | 11 |

| North St. Paul | 26 |

| Oakdale | 65 |

| Oak Park Heights | 9 |

| Olivia | 7 |

| Onamia | 0 |

| Orono | 5 |

| Ortonville | 0 |

| Osakis | 2 |

| Osseo | 0 |

| Owatonna | 27 |

| Park Rapids | 8 |

| Paynesville | 5 |

| Pequot Lakes | 3 |

| Pierz | 0 |

| Pike Bay | 0 |

| Pillager | 0 |

| Pine River | 1 |

| Plainview | 1 |

| Plymouth | 28 |

| Preston | 2 |

| Princeton | 9 |

| Prior Lake | 45 |

| Proctor | 4 |

| Ramsey | 17 |

| Randall | 0 |

| Red Wing3 | 24 |

| Redwood Falls | 13 |

| Renville | 3 |

| Rice | 0 |

| Richfield | 67 |

| Robbinsdale | 28 |

| Rochester | 98 |

| Rogers | 14 |

| Roseau | 2 |

| Rosemount | 3 |

| Roseville | 100 |

| Rushford | 0 |

| Sartell | 6 |

| Sauk Centre | 4 |

| Sauk Rapids | 7 |

| Savage | 30 |

| Sebeka | 0 |

| Shakopee | 51 |

| Sherburn | 0 |

| Silver Bay | 0 |

| Silver Lake | 0 |

| Slayton | 0 |

| Sleepy Eye | 1 |

| South Lake Minnetonka | 7 |

| South St. Paul | 72 |

| Springfield | 0 |

| Spring Grove | 1 |

| Spring Lake Park | 27 |

| St. Anthony | 10 |

| Staples | 4 |

| Starbuck | 1 |

| St. Charles | 2 |

| St. Cloud | 181 |

| St. Francis | 6 |

| Stillwater | 21 |

| St. James | 1 |

| St. Joseph | 7 |

| St. Louis Park | 55 |

| St. Paul | 2,084 |

| St. Paul Park | 10 |

| St. Peter | 9 |

| Thief River Falls | 9 |

| Tracy | 3 |

| Tri-City | 1 |

| Trimont | 0 |

| Truman | 0 |

| Twin Valley | 0 |

| Two Harbors | 0 |

| Virginia | 19 |

| Wabasha | 4 |

| Wadena | 7 |

| Waite Park | 12 |

| Walker | 1 |

| Warroad | 0 |

| Waseca | 9 |

| Waterville | 0 |

| Wayzata | 5 |

| Wells | 0 |

| West Concord | 0 |

| West Hennepin | 3 |

| West St. Paul | 57 |

| Wheaton | 1 |

| White Bear Lake | 57 |

| Willmar | 40 |

| Windom | 1 |

| Winnebago | 1 |

| Winona | 16 |

| Winsted | 0 |

| Woodbury | 65 |

| Worthington3 | 13 |

| Wyoming | 11 |

| Zumbrota3 | 2 |

Read more: Cambridge Mutual Fire Insurance Company Car Insurance Review

The more people live in one particular area, the higher the likelihood of vehicle theft there is, as you can see in the above table.

How many road fatalities occur in Minnesota?

You’ll have more to worry about in Minnesota than theft, though. The highways in Minnesota are risky for everyone, and some types of accidents are more common than others. As of 2017, the state saw 357 traffic fatalities. Let’s break those fatalities down so you can be a little safer on the road.

Most Fatal Highway in Minnesota

According to a variety of sources, U.S. 169 is the deadliest highway in Minnesota. Over the course of a year, this highway sees an average of 60 crashes. Over the past 10 years, it has seen 68 fatalities.

Fatal Crashes by Weather Condition and Light Condition

Different weather and light conditions can impact the way that drivers are able to operate on the road. Take a look at how both factors cause fatalities across Minnesota:

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 182 | 40 | 50 | 9 | 3 | 284 |

| Rain | 12 | 9 | 4 | 0 | 0 | 25 |

| Snow/Sleet | 14 | 4 | 5 | 0 | 0 | 23 |

| Other | 0 | 1 | 3 | 0 | 0 | 4 |

| Unknown | 0 | 0 | 3 | 0 | 1 | 4 |

| TOTAL | 208 | 54 | 65 | 9 | 4 | 340 |

Far more accidents take place during the day than at night — a surprising trend, given how much more difficult it is to see at night. That’s all the more reason, though, to keep your eyes peeled while you’re driving to and from work during the day.

Traffic Fatalities

Location also impacts the likelihood of a car accident, as you can see in the table below:

| Year | Urban | Rural | Total |

|---|---|---|---|

| 2009 | 139 | 282 | 421 |

| 2010 | 124 | 287 | 411 |

| 2011 | 121 | 247 | 368 |

| 2012 | 126 | 269 | 395 |

| 2013 | 131 | 256 | 387 |

| 2014 | 99 | 262 | 361 |

| 2015 | 135 | 274 | 411 |

| 2016 | 159 | 232 | 392 |

| 2017 | 148 | 209 | 358 |

| 2018 | 160 | 218 | 381 |

Urban roads see far more accidents than rural roads, meaning that you’ll need to be especially careful when visiting Minnesota’s larger cities.

Fatalities by Person Type

Person type is also likely to impact fatality statistics. “Person type” here refers to a person’s relationship to a vehicle as opposed to any other demographic statistics.

| Person Type | Number of Fatalities |

|---|---|

| Vehicle Occupants (all seats) | 254 |

| Pedestrians | 38 |

| Bicyclist/other Cyclist | 6 |

As you can see, passengers are the people most frequently involved in fatalities. Motorists are also high up on the list of potential fatality victims.

Fatalities by Crash Type

There are also specific crash types that most frequently result in fatalities:

| Crash Type | Fatalities |

|---|---|

| Total Fatalities (All Crashes) | 357 |

| Single Vehicle | 179 |

| Involving a Large Truck | 61 |

| Involving Speeding | 89 |

| Involving a Rollover | 89 |

| Involving a Roadway Departure | 181 |

| Involving an Intersection (or Intersection Related) | 126 |

In Minnesota, single vehicles are more likely to get into accidents than any other vehicle operating on the road today. Roadway departures also account for the vast majority of fatalities in the state.

Five-Year Trend for the Top 10 Counties

The table below relays the top 10 counties in Minnesota that happen to see the most accidents over the course of a year.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Hennepin County | 42 | 34 | 33 | 45 | 45 |

| Ramsey County | 12 | 12 | 18 | 15 | 19 |

| Anoka County | 12 | 16 | 11 | 20 | 17 |

| St. Louis County | 19 | 8 | 16 | 19 | 16 |

| Stearns County | 6 | 9 | 12 | 5 | 13 |

| Dakota County | 19 | 10 | 11 | 28 | 11 |

| Sherburne County | 4 | 2 | 11 | 5 | 11 |

| Benton County | 8 | 1 | 7 | 2 | 9 |

| Pine County | 7 | 4 | 9 | 10 | 9 |

| Chisago County | 6 | 8 | 4 | 6 | 8 |

Hennepin County, as the county that houses the majority of Minnesota’s residents, naturally sees more fatalities than any other county in the state.

Fatalities Involving Speeding by County

The temptation to speed on an empty highway is great, no matter how safe of a driver you are. Unfortunately, speeding is a common thing in Minnesota – and it frequently results in accidents. Take a look at the table below to see how speeding-related fatalities play out in the state:

| County | 2017 Fatalities |

|---|---|

| Aitkin County | 0 |

| Anoka County | 6 |

| Becker County | 1 |

| Beltrami County | 1 |

| Benton County | 1 |

| Big Stone County | 0 |

| Blue Earth County | 0 |

| Brown County | 0 |

| Carlton County | 1 |

| Carver County | 0 |

| Cass County | 2 |

| Chippewa County | 0 |

| Chisago County | 2 |

| Clay County | 2 |

| Clearwater County | 0 |

| Cook County | 0 |

| Cottonwood County | 0 |

| Crow Wing County | 1 |

| Dakota County | 2 |

| Dodge County | 1 |

| Douglas County | 1 |

| Faribault County | 0 |

| Fillmore County | 0 |

| Freeborn County | 1 |

| Goodhue County | 0 |

| Grant County | 1 |

| Hennepin County | 15 |

| Houston County | 1 |

| Hubbard County | 1 |

| Isanti County | 0 |

| Itasca County | 3 |

| Jackson County | 0 |

| Kanabec County | 0 |

| Kandiyohi County | 0 |

| Kittson County | 0 |

| Koochiching County | 0 |

| Lac Qui Parle County | 0 |

| Lake County | 3 |

| Lake Of The Woods County | 0 |

| Le Sueur County | 2 |

| Lincoln County | 0 |

| Lyon County | 0 |

| Mahnomen County | 0 |

| Marshall County | 0 |

| Martin County | 1 |

| Mcleod County | 0 |

| Meeker County | 0 |

| Mille Lacs County | 1 |

| Morrison County | 0 |

| Mower County | 0 |

| Murray County | 0 |

| Nicollet County | 0 |

| Nobles County | 0 |

| Norman County | 0 |

| Olmsted County | 0 |

| Otter Tail County | 3 |

| Pennington County | 1 |

| Pine County | 5 |

| Pipestone County | 0 |

| Polk County | 1 |

| Pope County | 0 |

| Ramsey County | 7 |

| Red Lake County | 0 |

| Redwood County | 3 |

| Renville County | 0 |

| Rice County | 0 |

| Rock County | 0 |

| Roseau County | 0 |

| Scott County | 3 |

| Sherburne County | 1 |

| Sibley County | 0 |

| St. Louis County | 3 |

| Stearns County | 4 |

| Steele County | 1 |

| Stevens County | 0 |

| Swift County | 0 |

| Todd County | 0 |

| Traverse County | 0 |

| Wabasha County | 1 |

| Wadena County | 0 |

| Waseca County | 1 |

| Washington County | 1 |

| Watonwan County | 0 |

| Wilkin County | 0 |

| Winona County | 1 |

| Wright County | 2 |

| Yellow Medicine County | 1 |

Again, Hennepin County stands out from the crowd. This doesn’t mean that Hennepin County is dangerous to drive in. Rather, because Hennepin County has a larger population than most counties in Minnesota, it sees a ratio of accidents to residents that is on par with the state’s other counties.

Fatalities in Crashes Involving an Alcohol-Impaired Driver

Even though Minnesota law discourages drinking and driving, there are several recorded incidents of roadway fatalities involving an intoxicated driver. Let’s break those incidents down:

| County | 2017 Fatalities |

|---|---|

| Aitkin County | 0 |

| Anoka County | 2 |

| Becker County | 1 |

| Beltrami County | 1 |

| Benton County | 1 |

| Big Stone County | 0 |

| Blue Earth County | 2 |

| Brown County | 0 |

| Carlton County | 1 |

| Carver County | 0 |

| Cass County | 2 |

| Chippewa County | 0 |

| Chisago County | 1 |

| Clay County | 0 |

| Clearwater County | 1 |

| Cook County | 0 |

| Cottonwood County | 1 |

| Crow Wing County | 0 |

| Dakota County | 0 |

| Dodge County | 0 |

| Douglas County | 2 |

| Faribault County | 0 |

| Fillmore County | 0 |

| Freeborn County | 1 |

| Goodhue County | 0 |

| Grant County | 1 |

| Hennepin County | 15 |

| Houston County | 0 |

| Hubbard County | 0 |

| Isanti County | 1 |

| Itasca County | 2 |

| Jackson County | 0 |

| Kanabec County | 0 |

| Kandiyohi County | 0 |

| Kittson County | 0 |

| Koochiching County | 1 |

| Lac Qui Parle County | 0 |

| Lake County | 0 |

| Lake Of The Woods County | 0 |

| Le Sueur County | 1 |

| Lincoln County | 0 |

| Lyon County | 1 |

| Mahnomen County | 0 |

| Marshall County | 0 |

| Martin County | 1 |

| Mcleod County | 1 |

| Meeker County | 1 |

| Mille Lacs County | 1 |

| Morrison County | 2 |

| Mower County | 0 |

| Murray County | 0 |

| Nicollet County | 0 |

| Nobles County | 0 |

| Norman County | 0 |

| Olmsted County | 3 |

| Otter Tail County | 1 |

| Pennington County | 0 |

| Pine County | 6 |

| Pipestone County | 0 |

| Polk County | 2 |

| Pope County | 0 |

| Ramsey County | 5 |

| Red Lake County | 0 |

| Redwood County | 1 |

| Renville County | 0 |

| Rice County | 1 |

| Rock County | 0 |

| Roseau County | 0 |

| Scott County | 0 |

| Sherburne County | 2 |

| Sibley County | 0 |

| St. Louis County | 5 |

| Stearns County | 1 |

| Steele County | 1 |

| Stevens County | 0 |

| Swift County | 1 |

| Todd County | 0 |

| Traverse County | 0 |

| Wabasha County | 1 |

| Wadena County | 0 |

| Waseca County | 1 |

| Washington County | 1 |

| Watonwan County | 1 |

| Wilkin County | 0 |

| Winona County | 0 |

| Wright County | 4 |

| Yellow Medicine County | 1 |

As you might expect, urbanized counties like Hennepin County see more alcohol-related fatalities than the state’s rural areas. Those numbers make calling ridesharing services after the Sunday football game and tailgate all the more appealing.

Teen Drinking and Driving

The above section does not include the percentage of teenagers who get into fatal accidents after drinking and driving. The good news is that Minnesota’s state average for fatalities involving impaired drivers younger than 21 is well below the national average. Unfortunately, the practice hasn’t stopped completely, as you can see in the table below:

| Teen Drunk Driving Summary | Figures |

|---|---|

| Drunk Driving Arrests of Teens in MN (2016) | 144 |

| Drunk Driving Arrests of Teens, (2016 Nationwide Average) | 102.82 |

| Under 21 Drunk Driving Fatalities (Per 100,000 in MN) | 0.3 |

| Under 21 Drunk Driving Fatalities (Per 100,000 Nationwide) | 1.2 |

2016 was a rough year for teenagers in Minnesota. Even though the state’s average underage intoxication arrests are below the national average, drunk driving arrests of teens in Minnesota outnumbered the average drunk driving arrests of teenagers across the nation in 2016.

EMS Response Time

The good news is that EMS responds to all fatalities in Minnesota with relative haste. Arrival times will vary based on the location of an accident, as you can see in the table below:

| Location of Crash | Rural | Urban |

|---|---|---|

| Time of Crash to EMS Notification | 2.70 | 1.23 |

| EMS Notification to EMS Arrival | 11.55 | 6.25 |

| EMS Arrival at Scene to Hospital Arrival | 38.62 | 27.77 |

| Time of Crash to Hospital Arrival | 49.44 | 35.38 |

No matter where you are in Minnesota, though, EMS will get you from the site of an accident and to a hospital in under an hour’s time.

What is transportation like in Minnesota?

Should you worry about congestion in Minnesota, in addition to all of the factors noted above? Let’s break down the average traffic you might see in Minnesota to determine whether or not you need to leave earlier than usual for work in the morning.

Car Ownership

Nearly half of Minnesota’s car-owning residents keep two cars in their garages. This is the standard for most states in the U.S. However, significantly more drivers in Minnesota own three cars instead of just one, suggesting that car culture in the state is something to behold.

Commute Time

The commutes in Minnesota typically take between 10 and 24 minutes, depending on where you’re coming from.

On average, this puts Minnesota’s commutes below the national average of 25.3 minutes. However, a fair percentage of Minnesota’s residents have to commit to commutes that are half an hour in length. Another 1.8 percent have to deal with the super-commute, or a commute that lasts longer than 90 minutes, both ways.

Commuter Transportation

We can blame some of those increased commute times on the amount of traffic you’ll see in Minnesota. The vast majority of Minnesota residents prefer to drive to work on their own, increasing the number of vehicles you’ll see on the road every day. Just under 10 percent of the state’s residents prefer to carpool in the mornings.

Traffic Congestion in Minnesota

That said, Minnesota is far from the most congested state in the union. According to the INRIX scorecard, Minneapolis, Minnesota only comes in at 132 in terms of the most congested cities in the world. The same city sits at number 24 for the most congested cities in the United States.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Conclusion

And with that, our exploration of Minnesota’s car insurance moguls and car culture comes to an end. Want to start exploring the car insurance rates that are available to you? You can use our FREE online tool to start your research. Just enter your ZIP code to get started.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.