Vermont Car Insurance (Coverage, Companies, & More)

Vermont is among the cheapest New England with the average Vermont rate being $66 per month. You will need to meet Vermont requirements order to legally drive, so read our guide to learn everything you need to know about Vermont laws, companies, coverage, and more.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 15, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 15, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Vermont State Statistics | Details |

|---|---|

| Annual Road Miles | Total In State: 14,238 Vehicle Miles Driven: 7.1 Billion |

| Vehicles | Registered In State: 582,331 Total Stolen: 244 |

| Population | 626,299 |

| Most Popular Vehicle | Toyota RAV4 |

| Uninsured Motorists | 6.80% State Rank: 47th |

| Total Driving Fatalities | 2008-2017 Speeding: 241 Drunk Driving: 184 |

| Average Premiums (Annual) | Liability: $343.12 Collision: $295.42 Comprehensive: $125.48 Combined Premium: $764.02 |

| Cheapest Providers | Nationwide and USAA |

Welcome to the Green Mountain State!

Vermont is home to some of the nation’s most beautiful and quaint towns — with a population of just under 9,000 people, Montpelier is the smallest state capital in the United States. But it’s also home to some of the most beautiful mountains in America — Mount Mansfield, in northern Vermont, is the highest peak in the state at 4,395 feet above sea level.

With the largest number of dairy cows per capita and the production of more maple syrup than anywhere else, there’s a lot to love about the great state of Vermont.

Whether you’re a long-time Vermonter, new to the state, or just a leaf peeper passing through to look at fall foliage, do you know what kind of car insurance you need in the Green Mountain State?

Read More: The Average Cost of Car Insurance by State

We’ve created this comprehensive guide to help you find the best coverage for you, your family, and your vehicles. So how do you choose the right car insurance? What kind of car insurance do you even need in Vermont?

Enter your ZIP code above and read on to find out.

Vermont Car Insurance Coverage and Rates

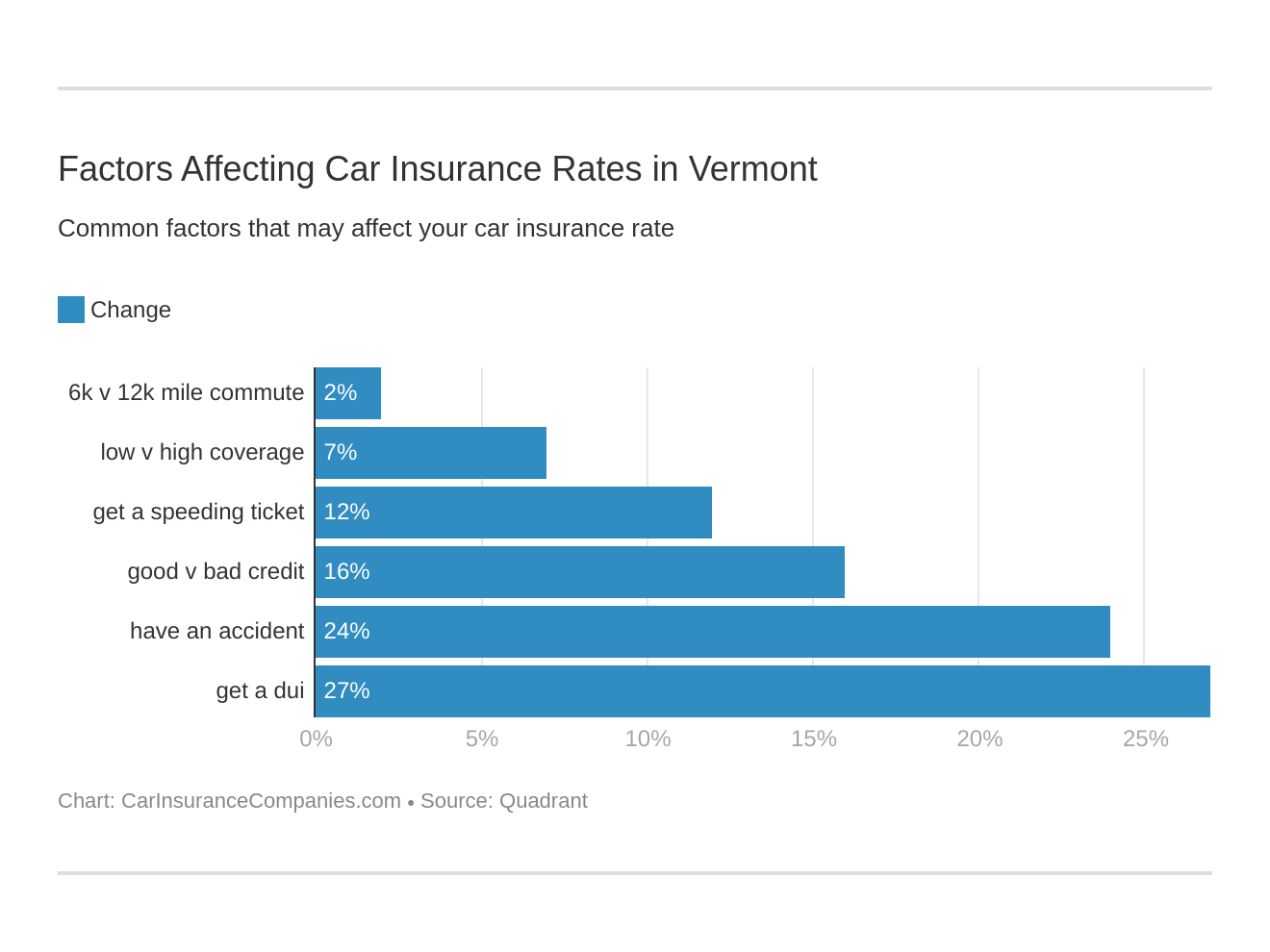

As you might know, there are a lot of factors that affect your car insurance premium.

From age to gender to credit score, from where you live to the type of vehicle you drive, you need to know how companies figure out how much you’ll owe them for car insurance. We’re here to help.

So, how much does auto insurance cost?

The average cost of a minimum coverage car insurance policy in the U.S. is 1,062.23 per year, according to the NAIC. Vermonters have one of the cheapest average rates for car insurance at $790.37 annually.

But does finding the best car insurance for you and your family still stress you out? Don’t worry — we’re experts in the field and have compiled this guide of things to know before buying or changing your car insurance in Vermont. (For more information, read our “Vermont Accident Insurance Company, Inc. Car Insurance Review“).

Let’s get started.

Vermont’s Car Culture

Vermonters love a lot of things: supporting public education, Ben & Jerry’s ice cream, and cross-country skiing.

We’re not saying citizens of the Green Mountain State don’t love cars, but with only 229,570 vehicles registered in 2016, the state doesn’t have a lot of them.

Vermont Minimum Coverage

What car insurance is required in Vermont?

Vermont’s minimum requirements for car insurance are fairly comparable to other states across the nation.

Find yourself buying car insurance in the Green Mountain State, and you’ll need at least:

- Bodily injury liability coverage – $25,000 per person and $50,000 per accident

- Property damage liability coverage – $10,000

- Uninsured motorist bodily injury coverage – $50,000 per person and $100,000 per accident

- Uninsured motorist property damage coverage – $10,000 with a $150 deductible

Remember though, this is just the state’s required minimum coverage.

In the sections below we’ll cover some great add-ons that can be easily added to your insurance policy so that you, your family, and your vehicles are well-protected in the case of an accident or other vehicular incidents.

But first things first. How do you prove you have insurance in the Green Mountain State?

Forms of Financial Responsibility

How do you prove you have the minimum insurance Vermont requires?

You do this through a legally recognized form of financial responsibility, usually by carrying a valid insurance ID card or a copy of your insurance policy.

But what if you leave your house without your insurance ID or a copy of your insurance policy?

If you get pulled over in Vermont but don’t have proof of insurance at the time of a traffic stop, you have 15 days to provide proof. This can be accompanied by a fine of up to $100.

Premiums as a Percentage of Income

In 2014, Vermonters had an average disposable household income of $42,267, of which they spent they spent an average of $746, or 1.77 percent, on car insurance premiums for the year.

This means Vermont residents paid significantly less of their income to car insurers than the national average of 2.29 percent.

Insurance costs in Vermont are staying pretty steady. Here’s the average of Vermont’s car insurance premiums as a percentage of income between 2012–2014:

- 2012 – 1.78 percent

- 2013 – 1.79 percent

- 2014 – 1.77 percent

Use the handy tool below to calculate what percentage of income your insurance premium might be.

Average Monthly Car Insurance Rates in VT (Liability, Collision, Comprehensive)

It’s good to know that experts agree — the better insured you are, the better prepared you will be to deal with an accident, whether or not you are at fault.

The following table covers how much you can expect to pay for liability, collision, and comprehensive car insurance coverage in Vermont versus the national average.

| TYPE OF COVERAGE | AVERAGE COST IN VERMONT | AVERAGE COST NATIONALLY |

|---|---|---|

| Liability | $343.12 | $538.73 |

| Collision | $295.42 | $322.61 |

| Comprehensive | $125.48 | $148.04 |

| Combined | $764.02 | $1,009.38 |

We gathered these rates from the National Association of Insurance Commissioners (NAIC), who bases them on state minimum requirements by law.

Additional Coverage

Anything above the minimum liability insurance limits offered above is optional in Vermont. But remember, stronger coverage can help you avoid financial hardship should the bills stack up after a run-in with a deer on one of Vermont’s many rural roadways.

So how do you know if a car insurance company is good for you? Knowing a company’s loss ratio can help you determine if they can provide you the car insurance you need.

But wait, you’re probably wondering: unless you have an MBA, what is a loss ratio?

A loss ratio simply shows how much an insurer spends on claims compared to how much they receive in premiums.

Here’s an example: If a company spends $60 in payouts for claims for every $100 they receive in premiums, they have a loss ratio of 60 percent. Loss ratios over 100 percent mean an insurer is probably losing money. But note — abnormally low loss ratios mean a company isn’t paying out much in claims, which could mean they don’t have the best service.

If that still doesn’t make sense, this short video provides a good overview of loss ratios.

For 2017, the National Association of Insurance Commissioners (NAIC) found the national average for loss ratios was 73 percent. Our research shows that the “sweet spot” for loss ratios is a bit lower than this 2017 average, between 60 and 70 percent.

Add-ons, Endorsements, and Riders

We know that great coverage at a low premium is likely your top priority in shopping for car insurance for you and your family. That just makes sense.

But luckily, there are a lot of cheap but powerful extras you can add to your Vermont car insurance policy.

These extras ensure you are better-covered in case of an accident or other events involving you or your vehicle. The following is a list of add-on coverage that you can add to the required car insurance you need in the Green Mountain State:

- Guaranteed auto protection (GAP)

- Personal umbrella policy (PUP)

- Rental reimbursement

- Emergency roadside assistance

- Mechanical breakdown insurance

- Non-owner car insurance

- Modified car insurance coverage

- Classic car insurance

- Pay-as-you-drive (Usage-based insurance)

Personal injury protection, or PIP, might be a good option for you, too. PIP, often referred to as “no-fault insurance,” covers medical bills incurred from an accident, regardless of who is at fault, who is driving, or who owns the vehicle.

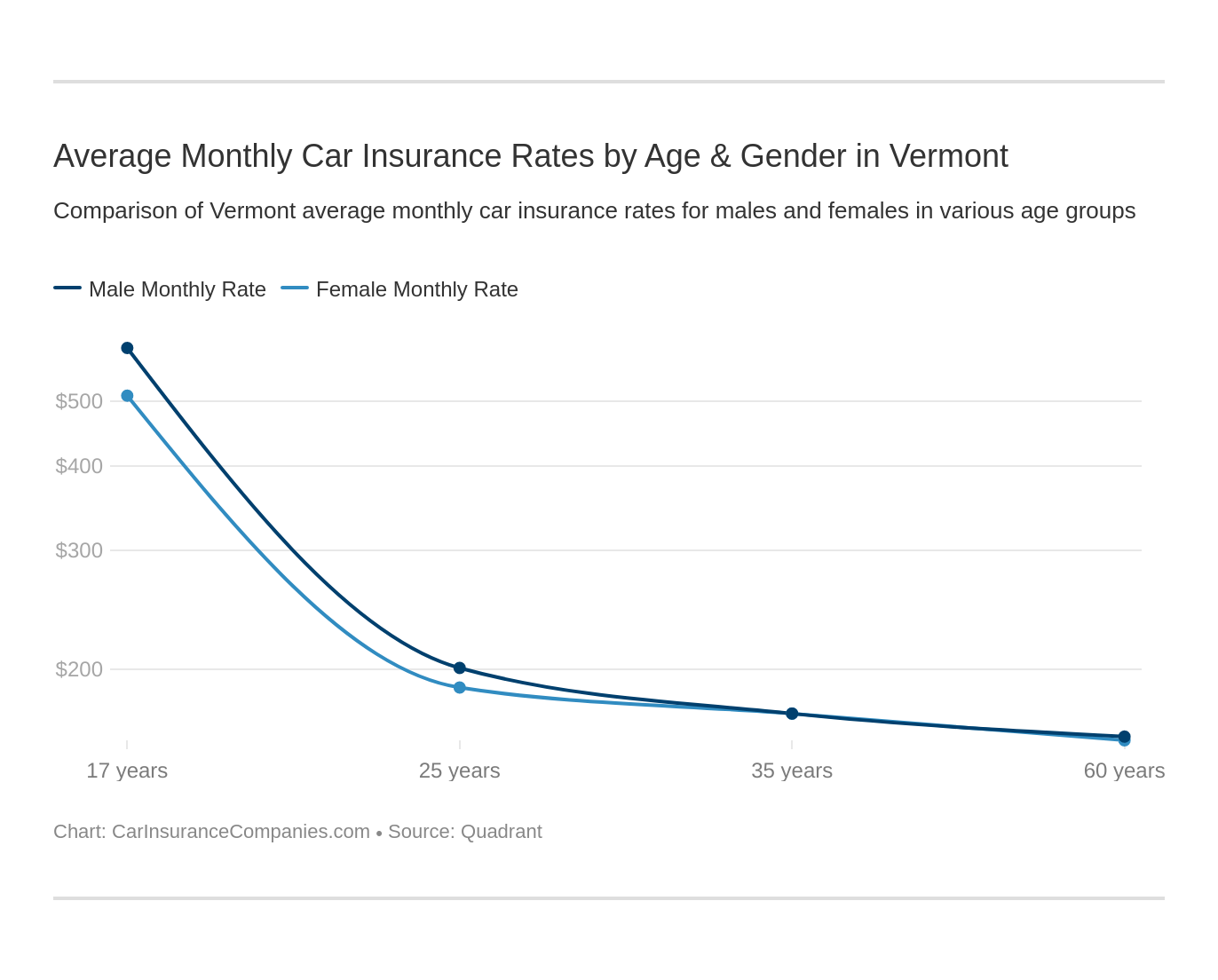

Average Monthly Car Insurance Rates by Age & Gender in VT

You’ve likely heard that insurance companies discriminate on the basis of gender in calculating insurance premiums. And to some extent, this is true. That’s why six states — California, Hawaii, Massachusetts, Michigan, Montana, Pennsylvania, and North Carolina — have outlawed gender bias for car insurance premiums.

Read more: Where can I get 7-day car insurance in Michigan?

Though Vermont has yet to act on this legally, rates for men and women don’t differ greatly, except for teens. Young men can expect to pay significantly more than young women.

What is more significant to car insurance providers in determining your premium? Age and marital status.

The following table provides the average annual car insurance premiums for Vermonters of different demographics for the state’s top car insurers.

| Company | Single 17-year-old female annual rate | Single 17-year-old male annual rate | Single 25-year-old female annual rate | Single 25-year-old male annual rate | Married 35-year-old female annual rate | Married 35-year-old male annual rate | Married 60-year-old female annual rate | Married 60-year-old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate | $5,154.27 | $6,803.81 | $2,449.28 | $2,688.80 | $2,156.27 | $2,156.27 | $2,057.16 | $2,057.16 |

| Geico | $3,848.67 | $4,488.09 | $1,420.67 | $1,390.28 | $1,684.84 | $1,566.30 | $1,657.04 | $1,509.79 |

| Nationwide | $3,515.58 | $4,474.30 | $1,657.72 | $1,786.24 | $1,446.33 | $1,472.29 | $1,300.39 | $1,372.80 |

| Progressive | $10,429.81 | $11,415.82 | $3,448.68 | $3,670.58 | $3,373.74 | $3,347.85 | $3,018.68 | $3,031.96 |

| State Farm | $8,041.71 | $10,326.54 | $3,030.29 | $3,369.84 | $2,718.93 | $2,718.93 | $2,428.22 | $2,428.22 |

| USAA | $3,710.69 | $3,881.09 | $1,568.30 | $1,637.38 | $1,145.98 | $1,150.47 | $1,070.48 | $1,064.01 |

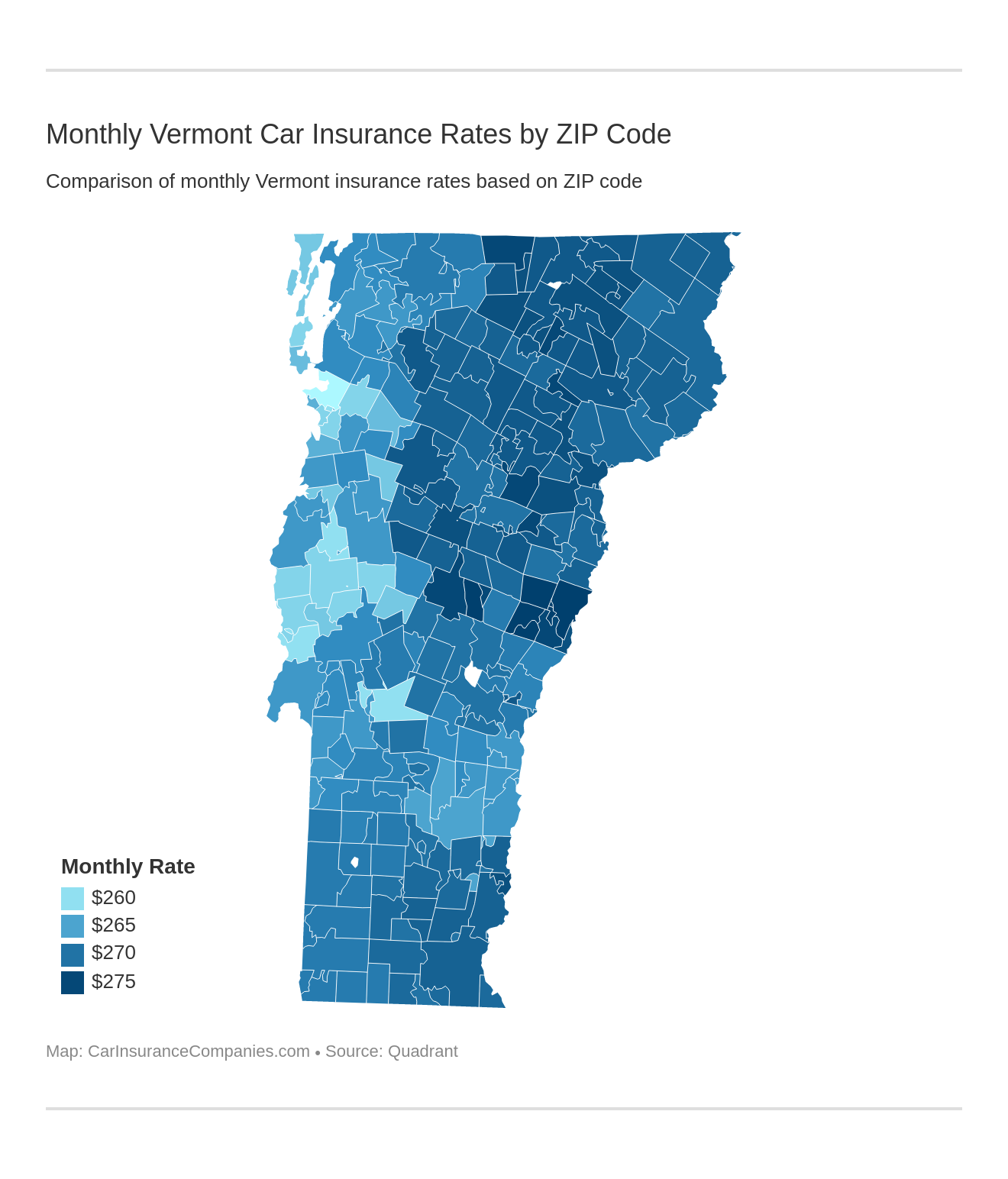

Cheapest Rates by ZIP Code

Did you know that car insurance rates vary not only by what state you live in but also by where you live in your state?

In Vermont, car insurance premiums aren’t that variable based on where you live in this fairly homogenous state.

The cheapest average rate by ZIP code — $3,314.44 in 05079, or Vershire, a small town in central Vermont just west of the New Hampshire border — is only $215.78 more per year than they are for the cheapest average rate by ZIP code — $3,098.66 in 05446, or Colchester, a suburb just north of Burlington on the shores of Lake Champlain.

The searchable table below provides a breakdown of the average car insurance premiums by ZIP code, and by insurers within that ZIP code.

| Zip Code | Average Annual Rate | Allstate | Geico | Nationwide Mutual | Progressive | State Farm | USAA |

|---|---|---|---|---|---|---|---|

| 05446 | $3,098.66 | $3,119.27 | $2,193.17 | $2,106.04 | $4,928.23 | $4,000.89 | $1,765.93 |

| 05760 | $3,117.06 | $3,124.41 | $2,193.17 | $2,177.68 | $4,978.33 | $3,917.02 | $1,947.32 |

| 05404 | $3,120.61 | $3,119.27 | $2,195.56 | $2,106.04 | $4,937.23 | $3,969.66 | $1,674.01 |

| 05701 | $3,121.52 | $3,124.41 | $2,122.10 | $2,256.74 | $5,037.40 | $4,053.34 | $1,945.28 |

| 05765 | $3,122.86 | $3,124.41 | $2,122.10 | $2,256.74 | $5,037.40 | $4,062.69 | $1,945.28 |

| 05472 | $3,124.23 | $3,124.41 | $2,193.17 | $2,177.68 | $4,958.77 | $3,899.75 | $1,947.32 |

| 05458 | $3,129.69 | $3,119.27 | $2,193.09 | $2,079.78 | $4,945.10 | $3,923.49 | $1,868.29 |

| 05753 | $3,131.51 | $3,124.41 | $2,193.17 | $2,177.68 | $4,958.77 | $3,950.72 | $1,947.32 |

| 05403 | $3,131.99 | $3,119.27 | $2,195.56 | $2,106.04 | $4,928.23 | $4,058.33 | $1,674.01 |

| 05452 | $3,133.35 | $3,442.59 | $2,195.56 | $2,106.04 | $4,963.87 | $3,974.28 | $1,674.01 |

| 05766 | $3,134.71 | $3,124.41 | $2,193.17 | $2,177.68 | $4,958.77 | $3,973.08 | $1,947.32 |

| 05401 | $3,134.75 | $3,119.27 | $2,195.56 | $2,106.04 | $5,027.91 | $3,977.96 | $1,674.01 |

| 05734 | $3,136.29 | $3,124.41 | $2,193.17 | $2,177.68 | $4,958.77 | $3,984.16 | $1,947.32 |

| 05769 | $3,136.29 | $3,124.41 | $2,193.17 | $2,177.68 | $4,958.77 | $3,984.16 | $1,947.32 |

| 05770 | $3,136.29 | $3,124.41 | $2,193.17 | $2,177.68 | $4,958.77 | $3,984.16 | $1,947.32 |

| 05473 | $3,138.82 | $3,124.41 | $2,193.17 | $2,177.68 | $4,958.77 | $4,001.84 | $1,947.32 |

| 05440 | $3,140.08 | $3,119.27 | $2,193.09 | $2,079.78 | $4,945.10 | $3,996.27 | $1,868.29 |

| 05748 | $3,141.61 | $3,124.41 | $2,193.17 | $2,177.68 | $4,978.33 | $4,001.84 | $1,947.32 |

| 05778 | $3,141.61 | $3,124.41 | $2,193.17 | $2,177.68 | $4,978.33 | $4,001.84 | $1,947.32 |

| 05463 | $3,142.08 | $3,119.27 | $2,193.09 | $2,079.78 | $4,945.10 | $4,010.22 | $1,868.29 |

| 05462 | $3,144.61 | $3,072.81 | $2,193.17 | $2,079.78 | $5,139.48 | $4,090.19 | $1,868.29 |

| 05474 | $3,148.56 | $3,119.27 | $2,193.09 | $2,079.78 | $4,998.86 | $4,001.84 | $1,868.29 |

| 05465 | $3,150.62 | $3,072.81 | $2,193.17 | $2,079.78 | $5,119.92 | $4,143.22 | $1,868.29 |

| 05486 | $3,151.83 | $3,119.27 | $2,193.09 | $2,079.78 | $4,998.86 | $4,024.76 | $1,868.29 |

| 05466 | $3,152.92 | $3,442.59 | $2,193.17 | $2,079.78 | $5,003.24 | $4,001.84 | $1,868.29 |

| 05490 | $3,168.55 | $3,442.59 | $2,193.17 | $2,079.78 | $5,112.66 | $4,001.84 | $1,868.29 |

| 05405 | $3,169.63 | $3,119.27 | $2,195.56 | $2,106.04 | $5,027.91 | $4,027.86 | $1,868.29 |

| 05460 | $3,170.34 | $3,119.27 | $2,193.09 | $2,079.78 | $5,113.66 | $4,001.84 | $1,905.94 |

| 05408 | $3,171.28 | $3,119.27 | $2,195.56 | $2,106.04 | $5,027.91 | $4,039.37 | $1,868.29 |

| 05482 | $3,172.92 | $3,442.59 | $2,193.17 | $2,106.04 | $5,119.92 | $4,005.69 | $1,765.93 |

| 05485 | $3,176.26 | $3,119.27 | $2,193.09 | $2,079.78 | $5,155.13 | $4,001.84 | $1,905.94 |

| 05481 | $3,177.17 | $3,119.27 | $2,193.09 | $2,079.78 | $5,161.52 | $4,001.84 | $1,905.94 |

| 05143 | $3,181.88 | $3,124.41 | $2,147.79 | $2,128.25 | $4,958.77 | $4,485.88 | $1,828.94 |

| 05149 | $3,184.68 | $3,124.41 | $2,147.79 | $2,128.25 | $4,978.33 | $4,485.88 | $1,828.94 |

| 05161 | $3,185.01 | $3,124.41 | $2,147.79 | $2,128.25 | $4,958.77 | $4,507.78 | $1,828.94 |

| 05736 | $3,186.45 | $3,124.41 | $2,122.10 | $2,256.74 | $5,037.40 | $4,507.78 | $1,945.28 |

| 05089 | $3,186.54 | $3,124.41 | $2,147.79 | $2,128.25 | $4,958.77 | $4,518.47 | $1,828.94 |

| 05156 | $3,186.54 | $3,124.41 | $2,147.79 | $2,128.25 | $4,958.77 | $4,518.47 | $1,828.94 |

| 05487 | $3,187.25 | $3,499.85 | $2,193.17 | $2,177.68 | $4,978.33 | $3,945.89 | $1,947.32 |

| 05357 | $3,187.51 | $3,124.41 | $2,147.79 | $2,128.25 | $4,976.28 | $4,507.78 | $1,828.94 |

| 05037 | $3,188.75 | $3,124.41 | $2,147.79 | $2,128.25 | $4,958.77 | $4,533.99 | $1,828.94 |

| 05151 | $3,188.75 | $3,124.41 | $2,147.79 | $2,128.25 | $4,958.77 | $4,533.99 | $1,828.94 |

| 05495 | $3,190.14 | $3,442.59 | $2,193.17 | $2,106.04 | $5,119.92 | $4,126.21 | $1,765.93 |

| 05030 | $3,190.45 | $3,124.41 | $2,147.79 | $2,128.25 | $4,996.85 | $4,507.78 | $1,828.94 |

| 05456 | $3,190.53 | $3,499.85 | $2,193.17 | $2,177.68 | $4,958.77 | $3,988.41 | $1,947.32 |

| 05774 | $3,191.04 | $3,124.41 | $2,193.17 | $2,177.68 | $5,037.40 | $4,297.67 | $2,025.48 |

| 05491 | $3,191.52 | $3,499.85 | $2,193.17 | $2,177.68 | $4,978.33 | $3,975.75 | $1,947.32 |

| 05150 | $3,191.55 | $3,124.41 | $2,147.79 | $2,128.25 | $4,978.33 | $4,533.99 | $1,828.94 |

| 05777 | $3,191.69 | $3,124.41 | $2,122.10 | $2,256.74 | $5,046.29 | $4,535.63 | $1,945.28 |

| 05443 | $3,191.92 | $3,499.85 | $2,193.17 | $2,177.68 | $4,958.77 | $3,998.15 | $1,947.32 |

| 05478 | $3,193.27 | $3,119.27 | $2,193.09 | $2,079.78 | $5,364.83 | $3,911.19 | $1,905.94 |

| 05445 | $3,193.77 | $3,442.59 | $2,193.17 | $2,079.78 | $5,119.92 | $4,075.48 | $1,868.29 |

| 05743 | $3,193.90 | $3,124.41 | $2,193.17 | $2,177.68 | $5,046.29 | $4,308.75 | $2,025.48 |

| 05448 | $3,195.51 | $3,119.27 | $2,193.09 | $2,079.78 | $5,335.51 | $3,956.24 | $1,905.94 |

| 05775 | $3,195.70 | $3,124.41 | $2,193.17 | $2,177.68 | $5,037.40 | $4,330.27 | $2,025.48 |

| 05142 | $3,196.07 | $3,124.41 | $2,147.79 | $2,128.25 | $4,958.77 | $4,585.20 | $1,828.94 |

| 05764 | $3,196.14 | $3,124.41 | $2,193.17 | $2,177.68 | $5,037.40 | $4,333.37 | $2,025.48 |

| 05439 | $3,196.85 | $3,442.59 | $2,193.17 | $2,106.04 | $5,003.24 | $3,922.10 | $1,868.29 |

| 05455 | $3,197.71 | $3,119.27 | $2,193.09 | $2,079.78 | $5,364.83 | $3,942.28 | $1,905.94 |

| 05062 | $3,198.86 | $3,124.41 | $2,147.79 | $2,128.25 | $4,978.33 | $4,585.20 | $1,828.94 |

| 05153 | $3,198.86 | $3,124.41 | $2,147.79 | $2,128.25 | $4,978.33 | $4,585.20 | $1,828.94 |

| 05747 | $3,199.20 | $3,499.85 | $2,193.17 | $2,177.68 | $4,958.77 | $4,049.11 | $1,947.32 |

| 05461 | $3,199.68 | $3,442.59 | $2,193.17 | $2,079.78 | $5,139.48 | $4,105.90 | $1,868.29 |

| 05494 | $3,200.11 | $3,442.59 | $2,193.17 | $2,079.78 | $5,119.92 | $4,128.50 | $1,868.29 |

| 05454 | $3,201.50 | $3,119.27 | $2,193.09 | $2,079.78 | $5,335.51 | $3,998.15 | $1,905.94 |

| 05735 | $3,203.02 | $3,124.41 | $2,193.17 | $2,177.68 | $5,037.40 | $4,381.48 | $2,025.48 |

| 05477 | $3,203.09 | $3,442.59 | $2,193.17 | $2,079.78 | $5,147.27 | $4,121.99 | $1,868.29 |

| 05459 | $3,203.58 | $3,119.27 | $2,193.09 | $2,079.78 | $5,335.51 | $4,012.67 | $1,905.94 |

| 05488 | $3,204.38 | $3,119.27 | $2,193.09 | $2,079.78 | $5,364.83 | $3,988.99 | $1,905.94 |

| 05483 | $3,206.22 | $3,119.27 | $2,193.09 | $2,079.78 | $5,364.83 | $4,001.84 | $1,905.94 |

| 05761 | $3,206.25 | $3,124.41 | $2,193.17 | $2,177.68 | $5,037.40 | $4,404.13 | $2,025.48 |

| 05732 | $3,207.67 | $3,124.41 | $2,193.17 | $2,177.68 | $5,037.40 | $4,414.07 | $2,025.48 |

| 05468 | $3,208.40 | $3,442.59 | $2,193.17 | $2,079.78 | $5,119.92 | $3,976.28 | $1,868.29 |

| 05733 | $3,209.74 | $3,124.41 | $2,193.17 | $2,177.68 | $5,046.29 | $4,419.65 | $2,025.48 |

| 05757 | $3,209.77 | $3,124.41 | $2,193.17 | $2,177.68 | $5,037.40 | $4,428.76 | $2,025.48 |

| 05056 | $3,209.97 | $3,124.41 | $2,147.79 | $2,128.25 | $4,978.33 | $4,662.96 | $1,828.94 |

| 05159 | $3,210.12 | $3,124.41 | $2,147.79 | $2,128.25 | $5,134.56 | $4,507.78 | $1,828.94 |

| 05251 | $3,210.14 | $3,124.41 | $2,193.17 | $2,177.68 | $5,108.65 | $4,360.11 | $2,025.48 |

| 05441 | $3,211.71 | $3,119.27 | $2,193.09 | $2,079.78 | $5,364.83 | $4,040.32 | $1,905.94 |

| 05457 | $3,214.16 | $3,182.29 | $2,193.09 | $2,079.78 | $5,335.51 | $4,023.77 | $1,905.94 |

| 05773 | $3,214.43 | $3,124.41 | $2,193.17 | $2,177.68 | $5,037.40 | $4,461.34 | $2,025.48 |

| 05035 | $3,214.53 | $3,124.41 | $2,147.79 | $2,128.25 | $4,958.77 | $4,714.46 | $1,828.94 |

| 05447 | $3,215.22 | $3,182.29 | $2,193.09 | $2,079.78 | $5,364.83 | $4,001.84 | $1,905.94 |

| 05758 | $3,215.93 | $3,124.41 | $2,193.17 | $2,177.68 | $5,001.45 | $4,507.78 | $2,025.48 |

| 05739 | $3,217.13 | $3,124.41 | $2,193.17 | $2,177.68 | $5,037.40 | $4,480.24 | $2,025.48 |

| 05489 | $3,218.39 | $3,442.59 | $2,193.17 | $2,079.78 | $5,119.92 | $4,256.43 | $1,868.29 |

| 05471 | $3,218.67 | $3,119.27 | $2,193.09 | $2,079.78 | $5,335.51 | $4,118.34 | $1,905.94 |

| 05001 | $3,219.23 | $3,499.85 | $2,147.79 | $2,128.25 | $4,958.77 | $4,371.90 | $1,828.94 |

| 05741 | $3,220.01 | $3,124.41 | $2,193.17 | $2,177.68 | $5,030.05 | $4,507.78 | $2,025.48 |

| 05762 | $3,220.16 | $3,124.41 | $2,193.17 | $2,177.68 | $5,001.45 | $4,537.45 | $2,025.48 |

| 05055 | $3,220.87 | $3,499.85 | $2,147.79 | $2,128.25 | $4,958.77 | $4,383.33 | $1,828.94 |

| 05742 | $3,221.06 | $3,124.41 | $2,193.17 | $2,177.68 | $5,037.40 | $4,507.78 | $2,025.48 |

| 05744 | $3,221.06 | $3,124.41 | $2,193.17 | $2,177.68 | $5,037.40 | $4,507.78 | $2,025.48 |

| 05450 | $3,222.30 | $3,182.29 | $2,193.09 | $2,079.78 | $5,364.83 | $4,051.39 | $1,905.94 |

| 05050 | $3,222.81 | $3,119.27 | $2,301.89 | $2,073.91 | $5,112.98 | $4,355.45 | $1,867.75 |

| 05262 | $3,223.73 | $3,124.41 | $2,193.17 | $2,177.68 | $5,108.65 | $4,455.25 | $2,025.48 |

| 05250 | $3,224.09 | $3,124.41 | $2,193.17 | $2,177.68 | $5,108.65 | $4,457.74 | $2,025.48 |

| 05759 | $3,224.46 | $3,124.41 | $2,193.17 | $2,177.68 | $5,037.40 | $4,611.74 | $1,945.28 |

| 05253 | $3,225.67 | $3,124.41 | $2,193.17 | $2,177.68 | $5,108.65 | $4,468.82 | $2,025.48 |

| 05255 | $3,225.67 | $3,124.41 | $2,193.17 | $2,177.68 | $5,108.65 | $4,468.82 | $2,025.48 |

| 05340 | $3,225.67 | $3,124.41 | $2,193.17 | $2,177.68 | $5,108.65 | $4,468.82 | $2,025.48 |

| 05776 | $3,225.67 | $3,124.41 | $2,193.17 | $2,177.68 | $5,108.65 | $4,468.82 | $2,025.48 |

| 05750 | $3,226.99 | $3,124.41 | $2,193.17 | $2,177.68 | $5,078.91 | $4,507.78 | $2,025.48 |

| 05261 | $3,227.90 | $3,124.41 | $2,193.17 | $2,177.68 | $5,108.65 | $4,484.38 | $2,025.48 |

| 05257 | $3,228.39 | $3,124.41 | $2,193.17 | $2,177.68 | $5,108.65 | $4,487.85 | $2,025.48 |

| 05678 | $3,228.76 | $3,072.81 | $2,147.79 | $2,176.30 | $5,162.52 | $4,507.78 | $1,935.00 |

| 05352 | $3,229.43 | $3,124.41 | $2,193.17 | $2,177.68 | $5,108.65 | $4,495.11 | $2,025.48 |

| 05077 | $3,230.11 | $3,072.81 | $2,147.79 | $2,128.25 | $5,246.02 | $4,481.80 | $1,935.00 |

| 05152 | $3,230.33 | $3,124.41 | $2,193.17 | $2,177.68 | $5,108.65 | $4,501.42 | $2,025.48 |

| 05476 | $3,230.46 | $3,182.29 | $2,193.09 | $2,079.78 | $5,364.83 | $4,108.53 | $1,905.94 |

| 05350 | $3,230.47 | $3,124.41 | $2,193.17 | $2,177.68 | $5,108.65 | $4,502.38 | $2,025.48 |

| 05201 | $3,230.61 | $3,124.41 | $2,193.17 | $2,177.68 | $5,108.65 | $4,503.36 | $2,025.48 |

| 05737 | $3,231.03 | $3,124.41 | $2,193.17 | $2,177.68 | $5,037.40 | $4,577.58 | $2,025.48 |

| 05763 | $3,231.03 | $3,124.41 | $2,193.17 | $2,177.68 | $5,037.40 | $4,577.58 | $2,025.48 |

| 05252 | $3,231.24 | $3,124.41 | $2,193.17 | $2,177.68 | $5,108.65 | $4,507.78 | $2,025.48 |

| 05260 | $3,231.24 | $3,124.41 | $2,193.17 | $2,177.68 | $5,108.65 | $4,507.78 | $2,025.48 |

| 05048 | $3,232.76 | $3,499.85 | $2,147.79 | $2,128.25 | $4,958.77 | $4,466.56 | $1,828.94 |

| 05065 | $3,233.30 | $3,499.85 | $2,147.79 | $2,128.25 | $4,958.77 | $4,470.36 | $1,828.94 |

| 05067 | $3,233.30 | $3,499.85 | $2,147.79 | $2,128.25 | $4,958.77 | $4,470.36 | $1,828.94 |

| 05155 | $3,234.55 | $3,124.41 | $2,147.79 | $2,128.25 | $5,327.47 | $4,485.88 | $1,828.94 |

| 05068 | $3,234.93 | $3,499.85 | $2,147.79 | $2,128.25 | $4,958.77 | $4,481.80 | $1,828.94 |

| 05767 | $3,234.99 | $3,499.85 | $2,147.79 | $2,128.25 | $4,958.77 | $4,512.82 | $1,828.94 |

| 05641 | $3,236.57 | $3,072.81 | $2,147.79 | $2,103.76 | $5,480.92 | $4,114.96 | $1,931.15 |

| 05148 | $3,236.77 | $3,124.41 | $2,147.79 | $2,128.25 | $5,327.47 | $4,501.42 | $1,828.94 |

| 05039 | $3,236.98 | $3,072.81 | $2,147.79 | $2,128.25 | $5,246.02 | $4,529.91 | $1,935.00 |

| 05141 | $3,237.68 | $3,124.41 | $2,147.79 | $2,128.25 | $5,327.47 | $4,507.78 | $1,828.94 |

| 05154 | $3,237.68 | $3,124.41 | $2,147.79 | $2,128.25 | $5,327.47 | $4,507.78 | $1,828.94 |

| 05342 | $3,237.68 | $3,124.41 | $2,147.79 | $2,128.25 | $5,327.47 | $4,507.78 | $1,828.94 |

| 05351 | $3,237.68 | $3,124.41 | $2,147.79 | $2,128.25 | $5,327.47 | $4,507.78 | $1,828.94 |

| 05362 | $3,237.68 | $3,124.41 | $2,147.79 | $2,128.25 | $5,327.47 | $4,507.78 | $1,828.94 |

| 05824 | $3,238.10 | $3,182.29 | $2,301.89 | $2,073.91 | $5,299.77 | $4,274.42 | $1,867.75 |

| 05052 | $3,238.64 | $3,499.85 | $2,147.79 | $2,128.25 | $4,958.77 | $4,507.78 | $1,828.94 |

| 05053 | $3,238.64 | $3,499.85 | $2,147.79 | $2,128.25 | $4,958.77 | $4,507.78 | $1,828.94 |

| 05071 | $3,238.64 | $3,499.85 | $2,147.79 | $2,128.25 | $4,958.77 | $4,507.78 | $1,828.94 |

| 05073 | $3,238.64 | $3,499.85 | $2,147.79 | $2,128.25 | $4,958.77 | $4,507.78 | $1,828.94 |

| 05746 | $3,238.64 | $3,499.85 | $2,147.79 | $2,128.25 | $4,958.77 | $4,507.78 | $1,828.94 |

| 05730 | $3,239.71 | $3,124.41 | $2,193.17 | $2,177.68 | $5,037.40 | $4,638.33 | $2,025.48 |

| 05032 | $3,239.94 | $3,499.85 | $2,147.79 | $2,128.25 | $4,978.33 | $4,497.32 | $1,828.94 |

| 05602 | $3,240.76 | $3,072.81 | $2,147.79 | $2,103.76 | $5,510.25 | $4,114.96 | $1,931.15 |

| 05034 | $3,241.44 | $3,499.85 | $2,147.79 | $2,128.25 | $4,978.33 | $4,507.78 | $1,828.94 |

| 05084 | $3,241.44 | $3,499.85 | $2,147.79 | $2,128.25 | $4,978.33 | $4,507.78 | $1,828.94 |

| 05040 | $3,241.50 | $3,072.81 | $2,147.79 | $2,128.25 | $5,299.77 | $4,507.78 | $1,935.00 |

| 05091 | $3,242.39 | $3,499.85 | $2,147.79 | $2,128.25 | $4,958.77 | $4,533.99 | $1,828.94 |

| 05444 | $3,242.85 | $3,442.59 | $2,193.17 | $2,079.78 | $5,335.51 | $4,001.84 | $1,868.29 |

| 05772 | $3,242.88 | $3,499.85 | $2,147.79 | $2,128.25 | $4,958.77 | $4,537.45 | $1,828.94 |

| 05085 | $3,242.96 | $3,119.27 | $2,147.79 | $2,128.25 | $5,263.50 | $4,507.78 | $1,935.00 |

| 05651 | $3,243.13 | $3,072.81 | $2,147.79 | $2,176.30 | $5,444.98 | $4,124.32 | $1,931.15 |

| 05356 | $3,243.32 | $3,124.41 | $2,147.79 | $2,128.25 | $5,327.47 | $4,547.26 | $1,828.94 |

| 05054 | $3,243.46 | $3,499.85 | $2,147.79 | $2,128.25 | $4,886.43 | $4,507.78 | $1,935.00 |

| 05049 | $3,244.08 | $3,499.85 | $2,147.79 | $2,128.25 | $4,996.85 | $4,507.78 | $1,828.94 |

| 05846 | $3,244.42 | $3,182.29 | $2,301.89 | $2,073.91 | $5,355.49 | $4,262.99 | $1,867.75 |

| 05738 | $3,244.50 | $3,124.41 | $2,193.17 | $2,177.68 | $5,046.29 | $4,662.96 | $2,025.48 |

| 05751 | $3,244.50 | $3,124.41 | $2,193.17 | $2,177.68 | $5,046.29 | $4,662.96 | $2,025.48 |

| 05906 | $3,248.00 | $3,182.29 | $2,301.89 | $2,073.91 | $5,299.77 | $4,343.70 | $1,867.75 |

| 05076 | $3,249.46 | $3,072.81 | $2,147.79 | $2,128.25 | $5,355.49 | $4,507.78 | $1,935.00 |

| 05902 | $3,249.67 | $3,182.29 | $2,301.89 | $2,073.91 | $5,299.77 | $4,355.45 | $1,867.75 |

| 05904 | $3,249.67 | $3,182.29 | $2,301.89 | $2,073.91 | $5,299.77 | $4,355.45 | $1,867.75 |

| 05828 | $3,249.71 | $3,119.27 | $2,301.89 | $2,073.91 | $5,409.24 | $4,247.48 | $1,867.75 |

| 05038 | $3,249.75 | $3,072.81 | $2,147.79 | $2,128.25 | $5,246.02 | $4,619.30 | $1,935.00 |

| 05146 | $3,249.76 | $3,124.41 | $2,147.79 | $2,128.25 | $5,327.47 | $4,592.36 | $1,828.94 |

| 05343 | $3,250.19 | $3,124.41 | $2,147.79 | $2,128.25 | $5,436.94 | $4,485.88 | $1,828.94 |

| 05051 | $3,251.30 | $3,119.27 | $2,147.79 | $2,128.25 | $5,299.77 | $4,529.91 | $1,935.00 |

| 05841 | $3,251.40 | $3,119.27 | $2,301.89 | $2,073.91 | $5,409.24 | $4,259.31 | $1,867.75 |

| 05360 | $3,252.41 | $3,124.41 | $2,147.79 | $2,128.25 | $5,436.94 | $4,501.42 | $1,828.94 |

| 05652 | $3,252.67 | $3,119.27 | $2,193.17 | $2,176.30 | $4,974.43 | $4,735.16 | $2,001.87 |

| 05819 | $3,252.73 | $3,119.27 | $2,301.89 | $2,073.91 | $5,409.24 | $4,268.64 | $1,867.75 |

| 05358 | $3,253.32 | $3,124.41 | $2,147.79 | $2,128.25 | $5,436.94 | $4,507.78 | $1,828.94 |

| 05359 | $3,253.32 | $3,124.41 | $2,147.79 | $2,128.25 | $5,436.94 | $4,507.78 | $1,828.94 |

| 05640 | $3,253.47 | $3,072.81 | $2,147.79 | $2,176.30 | $5,335.51 | $4,507.78 | $1,935.00 |

| 05354 | $3,254.21 | $3,124.41 | $2,147.79 | $2,128.25 | $5,327.47 | $4,623.51 | $1,828.94 |

| 05673 | $3,255.31 | $3,072.81 | $2,147.79 | $2,176.30 | $5,364.83 | $4,491.32 | $1,935.00 |

| 05826 | $3,255.77 | $3,119.27 | $2,301.89 | $2,073.91 | $5,409.24 | $4,289.95 | $1,867.75 |

| 05353 | $3,257.06 | $3,124.41 | $2,147.79 | $2,128.25 | $5,436.94 | $4,533.99 | $1,828.94 |

| 05657 | $3,257.09 | $3,119.27 | $2,193.17 | $2,176.30 | $4,935.28 | $4,805.23 | $2,001.87 |

| 05442 | $3,257.11 | $3,119.27 | $2,193.17 | $2,176.30 | $4,974.43 | $4,766.21 | $2,001.87 |

| 05905 | $3,257.35 | $3,182.29 | $2,301.89 | $2,073.91 | $5,409.24 | $4,299.69 | $1,867.75 |

| 05361 | $3,257.42 | $3,124.41 | $2,147.79 | $2,128.25 | $5,436.94 | $4,536.51 | $1,828.94 |

| 05363 | $3,257.42 | $3,124.41 | $2,147.79 | $2,128.25 | $5,436.94 | $4,536.51 | $1,828.94 |

| 05682 | $3,257.80 | $3,072.81 | $2,147.79 | $2,176.30 | $5,364.83 | $4,508.75 | $1,935.00 |

| 05670 | $3,258.11 | $3,072.81 | $2,147.79 | $2,176.30 | $5,162.52 | $4,507.78 | $1,935.00 |

| 05036 | $3,258.52 | $3,072.81 | $2,147.79 | $2,128.25 | $5,355.49 | $4,571.19 | $1,935.00 |

| 05301 | $3,258.78 | $3,124.41 | $2,147.79 | $2,128.25 | $5,436.94 | $4,546.03 | $1,828.94 |

| 05655 | $3,258.89 | $3,119.27 | $2,193.17 | $2,176.30 | $4,945.10 | $4,807.99 | $2,001.87 |

| 05341 | $3,258.96 | $3,124.41 | $2,147.79 | $2,128.25 | $5,436.94 | $4,547.26 | $1,828.94 |

| 05101 | $3,259.30 | $3,124.41 | $2,147.79 | $2,128.25 | $5,327.47 | $4,659.09 | $1,828.94 |

| 05355 | $3,259.50 | $3,124.41 | $2,147.79 | $2,128.25 | $5,436.94 | $4,551.05 | $1,828.94 |

| 05677 | $3,260.01 | $3,072.81 | $2,147.79 | $2,176.30 | $5,364.83 | $4,524.25 | $1,935.00 |

| 05033 | $3,260.30 | $3,072.81 | $2,147.79 | $2,128.25 | $5,409.24 | $4,529.91 | $1,935.00 |

| 05345 | $3,260.93 | $3,124.41 | $2,147.79 | $2,128.25 | $5,327.47 | $4,670.51 | $1,828.94 |

| 05832 | $3,261.38 | $3,182.29 | $2,301.89 | $2,073.91 | $5,409.24 | $4,266.19 | $1,867.75 |

| 05858 | $3,261.42 | $3,182.29 | $2,301.89 | $2,073.91 | $5,409.24 | $4,328.19 | $1,867.75 |

| 05656 | $3,261.54 | $3,119.27 | $2,193.17 | $2,176.30 | $4,974.43 | $4,797.26 | $2,001.87 |

| 05492 | $3,262.68 | $3,119.27 | $2,193.17 | $2,176.30 | $4,974.43 | $4,805.23 | $2,001.87 |

| 05653 | $3,262.68 | $3,119.27 | $2,193.17 | $2,176.30 | $4,974.43 | $4,805.23 | $2,001.87 |

| 05669 | $3,264.56 | $3,072.81 | $2,147.79 | $2,176.30 | $5,364.83 | $4,586.71 | $1,935.00 |

| 05042 | $3,265.13 | $3,119.27 | $2,301.89 | $2,073.91 | $5,409.24 | $4,355.45 | $1,867.75 |

| 05837 | $3,265.31 | $3,182.29 | $2,301.89 | $2,073.91 | $5,409.24 | $4,355.45 | $1,867.75 |

| 05901 | $3,265.31 | $3,182.29 | $2,301.89 | $2,073.91 | $5,409.24 | $4,355.45 | $1,867.75 |

| 05907 | $3,265.31 | $3,182.29 | $2,301.89 | $2,073.91 | $5,409.24 | $4,355.45 | $1,867.75 |

| 05679 | $3,265.39 | $3,072.81 | $2,147.79 | $2,128.25 | $5,355.49 | $4,619.30 | $1,935.00 |

| 05662 | $3,265.74 | $3,119.27 | $2,193.17 | $2,176.30 | $4,995.85 | $4,805.23 | $2,001.87 |

| 05661 | $3,265.76 | $3,119.27 | $2,193.17 | $2,176.30 | $4,945.10 | $4,856.08 | $2,001.87 |

| 05346 | $3,266.28 | $3,124.41 | $2,147.79 | $2,128.25 | $5,436.94 | $4,598.47 | $1,828.94 |

| 05871 | $3,266.92 | $3,182.29 | $2,301.89 | $2,073.91 | $5,477.66 | $4,236.54 | $1,867.75 |

| 05081 | $3,266.94 | $3,119.27 | $2,147.79 | $2,128.25 | $5,409.24 | $4,529.91 | $1,935.00 |

| 05672 | $3,268.08 | $3,119.27 | $2,193.17 | $2,176.30 | $4,945.10 | $4,872.36 | $2,001.87 |

| 05664 | $3,268.67 | $3,072.81 | $2,147.79 | $2,176.30 | $5,441.88 | $4,507.78 | $1,935.00 |

| 05823 | $3,269.09 | $3,182.29 | $2,301.89 | $2,073.91 | $5,373.93 | $4,355.45 | $1,867.75 |

| 05069 | $3,269.20 | $3,119.27 | $2,301.89 | $2,073.91 | $5,409.24 | $4,383.91 | $1,867.75 |

| 05862 | $3,269.20 | $3,119.27 | $2,301.89 | $2,073.91 | $5,409.24 | $4,383.91 | $1,867.75 |

| 05903 | $3,269.38 | $3,182.29 | $2,301.89 | $2,073.91 | $5,409.24 | $4,383.91 | $1,867.75 |

| 05851 | $3,272.18 | $3,182.29 | $2,301.89 | $2,073.91 | $5,507.25 | $4,243.79 | $1,867.75 |

| 05059 | $3,272.33 | $3,499.85 | $2,147.79 | $2,128.25 | $5,268.41 | $4,433.97 | $1,828.94 |

| 05674 | $3,272.87 | $3,072.81 | $2,147.79 | $2,176.30 | $5,510.25 | $4,468.82 | $1,935.00 |

| 05838 | $3,272.92 | $3,119.27 | $2,301.89 | $2,073.91 | $5,463.78 | $4,355.45 | $1,867.75 |

| 05863 | $3,272.92 | $3,119.27 | $2,301.89 | $2,073.91 | $5,463.78 | $4,355.45 | $1,867.75 |

| 05874 | $3,273.28 | $3,182.29 | $2,301.89 | $2,073.91 | $5,409.24 | $4,349.47 | $1,867.75 |

| 05866 | $3,274.13 | $3,182.29 | $2,301.89 | $2,073.91 | $5,409.24 | $4,355.45 | $1,867.75 |

| 05680 | $3,274.80 | $3,119.27 | $2,193.17 | $2,176.30 | $5,056.51 | $4,807.99 | $2,001.87 |

| 05827 | $3,274.90 | $3,119.27 | $2,301.89 | $2,073.91 | $5,477.66 | $4,355.45 | $1,867.75 |

| 05855 | $3,275.13 | $3,182.29 | $2,301.89 | $2,073.91 | $5,477.66 | $4,294.05 | $1,867.75 |

| 05843 | $3,275.17 | $3,119.27 | $2,301.89 | $2,073.91 | $5,575.67 | $4,259.31 | $1,867.75 |

| 05839 | $3,275.59 | $3,182.29 | $2,301.89 | $2,073.91 | $5,477.66 | $4,297.24 | $1,867.75 |

| 05845 | $3,275.59 | $3,182.29 | $2,301.89 | $2,073.91 | $5,477.66 | $4,297.24 | $1,867.75 |

| 05658 | $3,276.04 | $3,119.27 | $2,147.79 | $2,176.30 | $5,335.51 | $4,619.30 | $1,935.00 |

| 05829 | $3,277.14 | $3,182.29 | $2,301.89 | $2,073.91 | $5,507.25 | $4,278.52 | $1,867.75 |

| 05830 | $3,277.14 | $3,182.29 | $2,301.89 | $2,073.91 | $5,507.25 | $4,278.52 | $1,867.75 |

| 05086 | $3,277.95 | $3,072.81 | $2,147.79 | $2,128.25 | $5,409.24 | $4,653.43 | $1,935.00 |

| 05676 | $3,278.05 | $3,072.81 | $2,147.79 | $2,176.30 | $5,510.25 | $4,535.69 | $1,935.00 |

| 05822 | $3,278.78 | $3,182.29 | $2,301.89 | $2,073.91 | $5,507.25 | $4,289.95 | $1,867.75 |

| 05464 | $3,279.04 | $3,119.27 | $2,193.17 | $2,176.30 | $4,974.43 | $4,919.72 | $2,001.87 |

| 05836 | $3,279.13 | $3,119.27 | $2,301.89 | $2,073.91 | $5,507.25 | $4,355.45 | $1,867.75 |

| 05857 | $3,279.79 | $3,182.29 | $2,301.89 | $2,073.91 | $5,477.66 | $4,326.63 | $1,867.75 |

| 05681 | $3,279.94 | $3,119.27 | $2,147.79 | $2,176.30 | $5,474.30 | $4,507.78 | $1,935.00 |

| 05647 | $3,280.12 | $3,119.27 | $2,147.79 | $2,176.30 | $5,400.78 | $4,582.60 | $1,935.00 |

| 05650 | $3,280.12 | $3,119.27 | $2,147.79 | $2,176.30 | $5,400.78 | $4,582.60 | $1,935.00 |

| 05675 | $3,280.39 | $3,072.81 | $2,147.79 | $2,128.25 | $5,409.24 | $4,670.51 | $1,935.00 |

| 05660 | $3,281.11 | $3,072.81 | $2,147.79 | $2,176.30 | $5,474.30 | $4,562.49 | $1,935.00 |

| 05648 | $3,281.86 | $3,119.27 | $2,147.79 | $2,176.30 | $5,364.83 | $4,630.71 | $1,935.00 |

| 05745 | $3,281.97 | $3,124.41 | $2,193.17 | $2,177.68 | $5,463.78 | $4,507.78 | $2,025.48 |

| 05847 | $3,282.03 | $3,182.29 | $2,301.89 | $2,073.91 | $5,507.25 | $4,312.74 | $1,867.75 |

| 05043 | $3,282.03 | $3,499.85 | $2,147.79 | $2,128.25 | $5,246.02 | $4,418.17 | $1,935.00 |

| 05853 | $3,283.91 | $3,182.29 | $2,301.89 | $2,073.91 | $5,477.66 | $4,355.45 | $1,867.75 |

| 05867 | $3,283.91 | $3,182.29 | $2,301.89 | $2,073.91 | $5,477.66 | $4,355.45 | $1,867.75 |

| 05868 | $3,283.91 | $3,182.29 | $2,301.89 | $2,073.91 | $5,477.66 | $4,355.45 | $1,867.75 |

| 05046 | $3,285.37 | $3,119.27 | $2,301.89 | $2,073.91 | $5,477.66 | $4,428.68 | $1,867.75 |

| 05158 | $3,285.81 | $3,124.41 | $2,147.79 | $2,128.25 | $5,436.94 | $4,735.18 | $1,828.94 |

| 05860 | $3,286.92 | $3,182.29 | $2,301.89 | $2,073.91 | $5,575.67 | $4,278.52 | $1,867.75 |

| 05872 | $3,286.92 | $3,182.29 | $2,301.89 | $2,073.91 | $5,575.67 | $4,278.52 | $1,867.75 |

| 05820 | $3,288.13 | $3,182.29 | $2,301.89 | $2,073.91 | $5,507.25 | $4,355.45 | $1,867.75 |

| 05833 | $3,288.13 | $3,182.29 | $2,301.89 | $2,073.91 | $5,507.25 | $4,355.45 | $1,867.75 |

| 05850 | $3,288.13 | $3,182.29 | $2,301.89 | $2,073.91 | $5,507.25 | $4,355.45 | $1,867.75 |

| 05873 | $3,288.90 | $3,119.27 | $2,301.89 | $2,073.91 | $5,575.67 | $4,355.45 | $1,867.75 |

| 05666 | $3,288.91 | $3,119.27 | $2,147.79 | $2,176.30 | $5,335.51 | $4,507.78 | $1,931.15 |

| 05663 | $3,290.17 | $3,072.81 | $2,147.79 | $2,176.30 | $5,480.92 | $4,619.30 | $1,935.00 |

| 05654 | $3,292.69 | $3,072.81 | $2,147.79 | $2,103.76 | $5,480.92 | $4,507.78 | $1,931.15 |

| 05821 | $3,292.97 | $3,119.27 | $2,301.89 | $2,073.91 | $5,575.67 | $4,383.91 | $1,867.75 |

| 05060 | $3,297.50 | $3,499.85 | $2,147.79 | $2,128.25 | $5,299.77 | $4,472.70 | $1,935.00 |

| 05842 | $3,297.91 | $3,182.29 | $2,301.89 | $2,073.91 | $5,575.67 | $4,355.45 | $1,867.75 |

| 05875 | $3,297.91 | $3,182.29 | $2,301.89 | $2,073.91 | $5,575.67 | $4,355.45 | $1,867.75 |

| 05649 | $3,299.21 | $3,072.81 | $2,147.79 | $2,128.25 | $5,335.51 | $4,670.51 | $1,935.00 |

| 05667 | $3,300.03 | $3,119.27 | $2,147.79 | $2,176.30 | $5,400.78 | $4,721.98 | $1,935.00 |

| 05848 | $3,300.29 | $3,119.27 | $2,301.89 | $2,073.91 | $5,655.33 | $4,355.45 | $1,867.75 |

| 05859 | $3,301.97 | $3,182.29 | $2,301.89 | $2,073.91 | $5,575.67 | $4,383.91 | $1,867.75 |

| 05075 | $3,302.10 | $3,499.85 | $2,147.79 | $2,128.25 | $5,355.49 | $4,449.20 | $1,935.00 |

| 05041 | $3,302.51 | $3,499.85 | $2,147.79 | $2,128.25 | $5,299.77 | $4,507.78 | $1,935.00 |

| 05861 | $3,303.91 | $3,119.27 | $2,301.89 | $2,073.91 | $5,680.68 | $4,355.45 | $1,867.75 |

| 05045 | $3,306.76 | $3,499.85 | $2,147.79 | $2,128.25 | $5,355.49 | $4,481.80 | $1,935.00 |

| 05072 | $3,306.76 | $3,499.85 | $2,147.79 | $2,128.25 | $5,355.49 | $4,481.80 | $1,935.00 |

| 05061 | $3,308.97 | $3,499.85 | $2,147.79 | $2,128.25 | $5,355.49 | $4,497.32 | $1,935.00 |

| 05058 | $3,310.47 | $3,499.85 | $2,147.79 | $2,128.25 | $5,355.49 | $4,507.78 | $1,935.00 |

| 05070 | $3,310.47 | $3,499.85 | $2,147.79 | $2,128.25 | $5,355.49 | $4,507.78 | $1,935.00 |

| 05083 | $3,310.47 | $3,499.85 | $2,147.79 | $2,128.25 | $5,355.49 | $4,507.78 | $1,935.00 |

| 05665 | $3,313.69 | $3,119.27 | $2,193.17 | $2,176.30 | $5,331.45 | $4,805.23 | $2,001.87 |

| 05079 | $3,314.44 | $3,499.85 | $2,147.79 | $2,128.25 | $5,409.24 | $4,481.80 | $1,935.00 |

It’s easy to find the cheapest car insurance rates for you. Just enter your ZIP code to get started.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Cheapest Rates by City

The table below allows you to search for the cheapest (and most expensive) car insurance rates by Vermont municipality.

| City | Average Grand Total |

|---|---|

| Adamant | $3,253.47 |

| Albany | $3,288.13 |

| Alburgh | $3,140.08 |

| Arlington | $3,224.09 |

| Ascutney | $3,190.45 |

| Averill | $3,265.31 |

| Bakersfield | $3,211.71 |

| Barnet | $3,292.97 |

| Barre | $3,236.57 |

| Barton | $3,278.78 |

| Beebe Plain | $3,269.09 |

| Beecher Falls | $3,249.67 |

| Bellows Falls | $3,259.30 |

| Belmont | $3,239.71 |

| Belvidere Center | $3,257.11 |

| Bennington | $3,230.61 |

| Bethel | $3,239.95 |

| Bomoseen | $3,207.67 |

| Bondville | $3,225.67 |

| Bradford | $3,260.30 |

| Brandon | $3,209.74 |

| Brattleboro | $3,258.78 |

| Bridgewater | $3,241.44 |

| Bridgewater Corners | $3,214.53 |

| Bridport | $3,136.29 |

| Bristol | $3,191.92 |

| Brookfield | $3,258.52 |

| Brownsville | $3,188.75 |

| Burlington | $3,158.55 |

| Cabot | $3,280.12 |

| Calais | $3,281.86 |

| Cambridge | $3,242.85 |

| Cambridgeport | $3,237.68 |

| Canaan | $3,269.38 |

| Castleton | $3,203.02 |

| Cavendish | $3,196.07 |

| Center Rutland | $3,186.45 |

| Charlotte | $3,193.77 |

| Chelsea | $3,249.76 |

| Chester | $3,181.88 |

| Chittenden | $3,231.03 |

| Colchester | $3,147.76 |

| Concord | $3,238.10 |

| Corinth | $3,236.99 |

| Craftsbury | $3,255.77 |

| Craftsbury Common | $3,274.90 |

| Cuttingsville | $3,244.50 |

| Danby | $3,217.13 |

| Danville | $3,249.71 |

| Derby | $3,277.14 |

| Derby Line | $3,277.14 |

| Dorset | $3,210.14 |

| East Arlington | $3,231.24 |

| East Barre | $3,299.21 |

| East Berkshire | $3,215.22 |

| East Burke | $3,261.38 |

| East Calais | $3,280.12 |

| East Charleston | $3,288.13 |

| East Corinth | $3,241.50 |

| East Dorset | $3,225.67 |

| East Dover | $3,258.96 |

| East Fairfield | $3,195.52 |

| East Hardwick | $3,279.13 |

| East Haven | $3,265.31 |

| East Montpelier | $3,243.13 |

| East Poultney | $3,220.01 |

| East Randolph | $3,302.51 |

| East Ryegate | $3,265.13 |

| East Saint Johnsbury | $3,272.92 |

| East Thetford | $3,282.03 |

| East Wallingford | $3,221.06 |

| Eden | $3,252.67 |

| Eden Mills | $3,262.68 |

| Enosburg Falls | $3,222.30 |

| Essex Junction | $3,133.35 |

| Fair Haven | $3,193.90 |

| Fairfax | $3,201.50 |

| Fairfield | $3,197.71 |

| Fairlee | $3,306.76 |

| Ferrisburgh | $3,190.53 |

| Florence | $3,221.06 |

| Forest Dale | $3,281.97 |

| Franklin | $3,214.17 |

| Gaysville | $3,238.65 |

| Gilman | $3,249.67 |

| Glover | $3,275.59 |

| Grafton | $3,249.76 |

| Grand Isle | $3,129.69 |

| Graniteville | $3,292.68 |

| Granville | $3,199.20 |

| Greensboro | $3,251.39 |

| Greensboro Bend | $3,297.91 |

| Groton | $3,285.37 |

| Guildhall | $3,257.35 |

| Hancock | $3,141.61 |

| Hardwick | $3,275.17 |

| Hartland | $3,232.76 |

| Hartland Four Corners | $3,244.09 |

| Highgate Center | $3,203.58 |

| Highgate Springs | $3,170.34 |

| Hinesburg | $3,199.68 |

| Huntington | $3,144.61 |

| Hyde Park | $3,258.89 |

| Hydeville | $3,226.99 |

| Irasburg | $3,275.59 |

| Island Pond | $3,244.43 |

| Isle La Motte | $3,142.08 |

| Jacksonville | $3,237.68 |

| Jamaica | $3,250.19 |

| Jeffersonville | $3,279.04 |

| Jericho | $3,150.62 |

| Johnson | $3,261.54 |

| Jonesville | $3,152.92 |

| Killington | $3,244.50 |

| Lake Elmore | $3,257.09 |

| Londonderry | $3,236.77 |

| Lowell | $3,282.03 |

| Lower Waterford | $3,300.29 |

| Ludlow | $3,184.68 |

| Lunenburg | $3,248.00 |

| Lyndon Center | $3,288.13 |

| Lyndonville | $3,272.18 |

| Manchester Center | $3,225.67 |

| Marshfield | $3,276.04 |

| McIndoe Falls | $3,222.81 |

| Middlebury | $3,131.51 |

| Middletown Springs | $3,209.77 |

| Milton | $3,208.40 |

| Montgomery Center | $3,218.67 |

| Montpelier | $3,240.76 |

| Moretown | $3,281.11 |

| Morgan | $3,283.91 |

| Morrisville | $3,265.76 |

| Moscow | $3,265.74 |

| Mount Holly | $3,215.92 |

| New Haven | $3,124.23 |

| Newbury | $3,251.30 |

| Newfane | $3,260.93 |

| Newport | $3,275.13 |

| Newport Center | $3,279.79 |

| North Bennington | $3,228.39 |

| North Clarendon | $3,224.46 |

| North Concord | $3,261.42 |

| North Ferrisburgh | $3,138.82 |

| North Hartland | $3,238.65 |

| North Hero | $3,148.56 |

| North Hyde Park | $3,313.69 |

| North Montpelier | $3,288.91 |

| North Pomfret | $3,238.65 |

| North Pownal | $3,231.24 |

| North Springfield | $3,191.55 |

| North Thetford | $3,243.46 |

| North Troy | $3,301.97 |

| Northfield | $3,290.18 |

| Northfield Falls | $3,268.67 |

| Norton | $3,265.31 |

| Norwich | $3,220.87 |

| Orleans | $3,286.92 |

| Orwell | $3,117.06 |

| Passumpsic | $3,303.91 |

| Pawlet | $3,206.25 |

| Peacham | $3,269.20 |

| Perkinsville | $3,188.75 |

| Peru | $3,230.33 |

| Pittsfield | $3,220.16 |

| Pittsford | $3,231.03 |

| Plainfield | $3,300.03 |

| Plymouth | $3,209.97 |

| Post Mills | $3,310.47 |

| Poultney | $3,196.14 |

| Pownal | $3,227.89 |

| Proctor | $3,122.86 |

| Proctorsville | $3,198.86 |

| Putney | $3,266.28 |

| Quechee | $3,272.33 |

| Randolph | $3,297.50 |

| Randolph Center | $3,308.98 |

| Reading | $3,198.86 |

| Readsboro | $3,230.47 |

| Richford | $3,230.46 |

| Richmond | $3,203.09 |

| Ripton | $3,134.71 |

| Rochester | $3,234.99 |

| Roxbury | $3,264.57 |

| Rutland | $3,121.53 |

| Saint Albans | $3,193.27 |

| Saint Albans Bay | $3,177.17 |

| Saint Johnsbury | $3,252.73 |

| Saint Johnsbury Center | $3,272.92 |

| Salisbury | $3,136.29 |

| Saxtons River | $3,237.68 |

| Shaftsbury | $3,223.73 |

| Sharon | $3,233.30 |

| Sheffield | $3,274.13 |

| Shelburne | $3,172.92 |

| Sheldon | $3,206.22 |

| Sheldon Springs | $3,176.26 |

| Shoreham | $3,136.29 |

| South Barre | $3,258.11 |

| South Burlington | $3,131.99 |

| South Hero | $3,151.83 |

| South Londonderry | $3,234.55 |

| South Newfane | $3,237.68 |

| South Pomfret | $3,233.30 |

| South Royalton | $3,234.93 |

| South Ryegate | $3,269.20 |

| South Strafford | $3,310.47 |

| South Woodstock | $3,238.65 |

| Springfield | $3,186.54 |

| Stamford | $3,229.43 |

| Starksboro | $3,187.25 |

| Stockbridge | $3,242.88 |

| Stowe | $3,268.08 |

| Strafford | $3,306.76 |

| Sutton | $3,283.91 |

| Swanton | $3,204.38 |

| Taftsville | $3,238.65 |

| Thetford Center | $3,302.10 |

| Topsham | $3,249.46 |

| Townshend | $3,257.06 |

| Troy | $3,283.91 |

| Tunbridge | $3,230.11 |

| Underhill | $3,218.39 |

| Underhill Center | $3,168.55 |

| Vergennes | $3,191.52 |

| Vernon | $3,254.21 |

| Vershire | $3,314.44 |

| Waitsfield | $3,255.31 |

| Wallingford | $3,214.43 |

| Wardsboro | $3,259.50 |

| Warren | $3,272.87 |

| Washington | $3,280.39 |

| Waterbury | $3,278.05 |

| Waterbury Center | $3,260.01 |

| Waterville | $3,262.68 |

| Websterville | $3,228.76 |

| Wells | $3,191.04 |

| Wells River | $3,266.94 |

| West Burke | $3,266.92 |

| West Charleston | $3,286.92 |

| West Danville | $3,288.91 |

| West Dover | $3,243.32 |

| West Dummerston | $3,187.51 |

| West Fairlee | $3,310.47 |

| West Glover | $3,297.91 |

| West Halifax | $3,253.32 |

| West Hartford | $3,241.44 |

| West Newbury | $3,242.96 |

| West Pawlet | $3,195.70 |

| West Rupert | $3,225.67 |

| West Rutland | $3,191.69 |

| West Topsham | $3,277.95 |

| West Townshend | $3,253.32 |

| West Wardsboro | $3,252.41 |

| Westfield | $3,273.28 |

| Westford | $3,200.11 |

| Westminster | $3,285.81 |

| Westminster Station | $3,210.12 |

| Weston | $3,185.01 |

| White River Junction | $3,219.23 |

| Whiting | $3,141.61 |

| Whitingham | $3,257.42 |

| Williamstown | $3,265.39 |

| Williamsville | $3,237.68 |

| Williston | $3,190.14 |

| Wilmington | $3,257.42 |

| Windsor | $3,186.54 |

| Winooski | $3,120.61 |

| Wolcott | $3,274.81 |

| Woodbury | $3,279.94 |

| Woodstock | $3,242.39 |

| Worcester | $3,257.80 |

Read more: Cambridge Mutual Fire Insurance Company Car Insurance Review

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

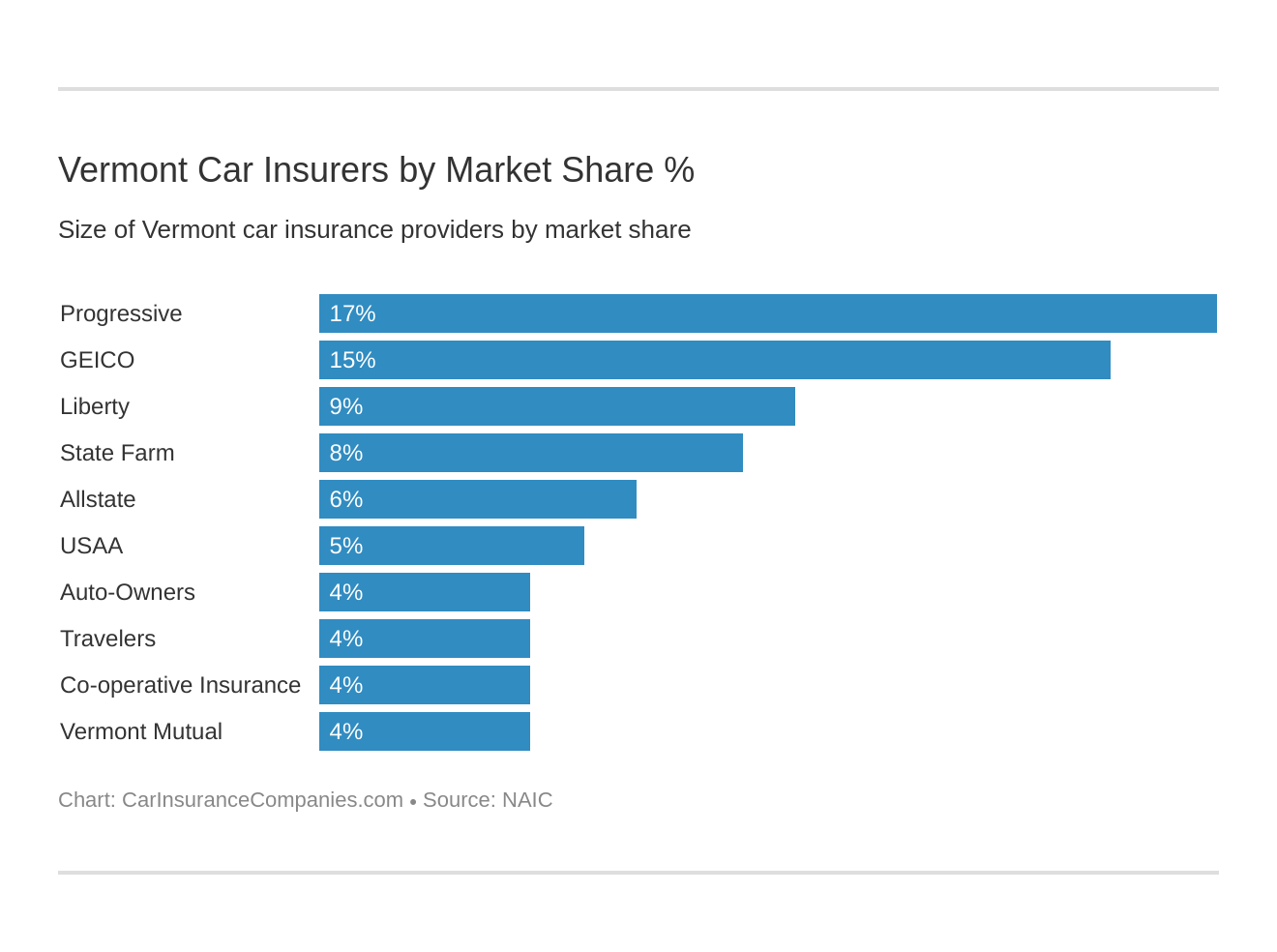

Best Vermont Car Insurance Companies

How do you find the best car insurance company in Vermont for meeting you and your family’s needs?

From company financial ratings to rates for drivers of various histories, you’ll want to consider the pros and cons of each insurer.

The Vermont Department of Motor Vehicles is a great resource for you, as they exist, in part, to protect and serve the state’s insurance consumers.

In the sections below, we’ve compiled the best car insurance companies in Vermont by key factors.

Read more: Top 10 Vermont Car Insurance Companies

The Largest Companies’ Financial Rating

A good insurance company has the ability to cover its customers financially. That’s why considering financial ratings is important.

A.M. Best ranks America’s insurance companies by financial solvency. What does it mean for a company to receive a high grade? This video explains their methodology and meaning well.

The table below provides the financial ratings for Vermont’s seven largest car insurance providers.

| Company | Direct Premiums Written | AM Best Rating |

|---|---|---|

| Allstate | $22,761 | A+ |

| Auto-Owners | $16,863 | A++ |

| Geico | $55,737 | A++ |

| Liberty Mutual | $35,497 | A |

| Progressive | $63,901 | A+ |

| State Farm | $31,455 | A++ |

| USAA | $17,415 | A++ |

Companies with Best Ratings

According to J.D. Power and Associates’ U.S. Auto Insurance Study, the best-rated insurance company in Vermont is Amica Mutual.

The table below depicts New England’s, including Vermont, insurance providers, and their J.D. Power ratings.

| Company | Points (based on a 1,000-point scale) | Circle Ratings |

|---|---|---|

| Allstate | 834 | 4 |

| Amica Mutual | 879 | 5 |

| Arbella | 800 | 2 |

| Geico | 827 | 3 |

| The Hanover | 795 | 2 |

| Liberty Mutual | 809 | 3 |

| MAPFRE Insurance | 811 | 3 |

| MetLife | 803 | 2 |

| Nationwide | 817 | 3 |

| Plymouth Rock Assurance | 804 | 2 |

| Progressive | 826 | 3 |

| Safeco | 796 | 2 |

| Safety Insurance | 813 | 3 |

| State Farm | 838 | 4 |

| Travelers | 804 | 2 |

| USAA* | 893 | 5 |

| New England Region | 821 | 3 |

Read more:

- Arbella Indemnity Insurance Company Car Insurance Review

- Arbella Mutual Insurance Company Car Insurance Review

- Arbella Protection Insurance Company Car Insurance Review

- Concord Specialty Insurance Company Car Insurance Review

- Concord General Mutual Insurance Company Car Insurance Review

Companies with Most Complaints in Vermont

Knowing how many complaints a company receives is can be an indicator of its quality.

In Vermont, Vermont Mutual has the highest complaint index of any car insurer in the state. When it comes to complaint indexes, an index higher than 1.0 indicates that a company’s complaint counts are higher than average, and an index lower than 1.0 indicates that a company’s complaint counts are lower (better) than average.

The table below provides the 2017 complaint indexes for Vermont’s 10 largest car insurance providers.

| Company | Direct Premiums Written | Complaint Ratio |

|---|---|---|

| Allstate | 21,633,000 | 0.83 |

| Concord General Mutual Insurance | 19,225,000 | 0.31 |

| Geico | $40,343,000 | 0 |

| Hartford | 14,630,000 | 0.68 |

| Liberty Mutual | 26,894,000 | 0.37 |

| Nationwide | 14,528,000 | 0.48 |

| Progressive | 50,729,000 | 0.24 |

| State Farm | 26,467,000 | 0.64 |

| USAA | 13,503,000 | 0.52 |

| Vermont Mutual Insurance | 13,901,000 | 1.08 |

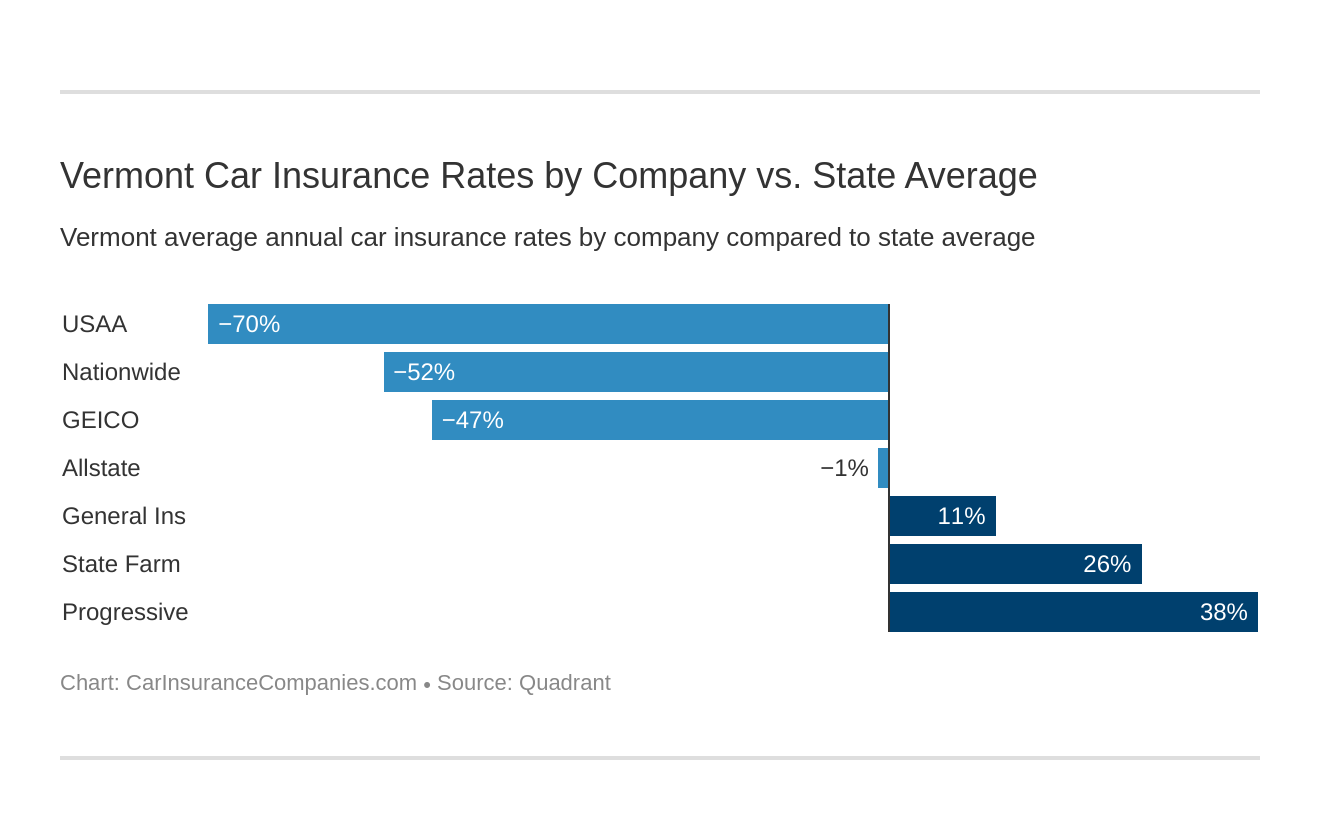

Commute Rates by Companies

As you might already know, how much you drive affects how much you pay for car insurance.

And whether you drive a little or a lot, Nationwide is likely your cheapest insurance provider in the Green Mountain State.

Read more: Green Mountain Insurance Company, Inc Car Insurance Review

The following table lists Vermont’s seven biggest car insurance providers and their corresponding average rates for both a 10- and 25-mile average commute distance.

| Company | 10 Mile Avg Commute | 25 Mile Avg Commute |

|---|---|---|

| Allstate | $3,128.84 | $3,251.92 |

| Geico | $2,164.81 | $2,226.61 |

| Liberty Mutual | $3,621.08 | $3,621.08 |

| Nationwide | $2,128.21 | $2,128.21 |

| Progressive | $5,217.14 | $5,217.14 |

| State Farm | $4,243.86 | $4,521.81 |

| USAA | $1,880.95 | $1,926.15 |

Coverage Level Rates by Companies

Did you know that what coverage level you request affects how much money you will pay in car insurance premiums?

The more extensive the coverage, the more expensive car insurance usually becomes. The less coverage, the cheaper your insurance will likely be.

Below is a table that illustrates the different types of insurance coverage levels and their average yearly rates for Vermont’s biggest insurance providers.

| Company | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $3,261.33 |

| Allstate | Medium | $3,185.94 |

| Allstate | Low | $3,123.87 |

| Geico | High | $2,270.66 |

| Geico | Medium | $2,196.70 |

| Geico | Low | $2,119.78 |

| Liberty Mutual | High | $3,834.47 |

| Liberty Mutual | Medium | $3,609.97 |

| Liberty Mutual | Low | $3,418.81 |

| Nationwide | High | $2,071.84 |

| Nationwide | Medium | $2,134.90 |

| Nationwide | Low | $2,177.89 |

| Progressive | High | $5,538.81 |

| Progressive | Medium | $5,149.50 |

| Progressive | Low | $4,963.11 |

| State Farm | High | $4,592.76 |

| State Farm | Medium | $4,404.37 |

| State Farm | Low | $4,151.38 |

| USAA | High | $1,967.43 |

| USAA | Medium | $1,901.10 |

| USAA | Low | $1,842.12 |

But did you know that your credit history also affects your car insurance premiums?

Credit History Rates by Companies

Credit history is a big factor for insurance companies when they are calculating your insurance premium.

On average, Vermonters have a high credit score. With an average Experian score of 702, Vermonters have of the second-highest average credit scores across the United States. (The national average? 675.)

But what if you have poor credit? Who are the best car insurers in Vermont for you? Likely Nationwide or, if you qualify, USAA will your most affordable options.

The table below shows average rates for those with a good, fair, or poor credit rating for Vermont’s top car insurance providers.

| Company | Good | Fair | Poor |

|---|---|---|---|

| Allstate | $2,669.79 | $2,988.69 | $3,912.65 |

| Geico | $1,164.54 | $1,870.13 | $3,552.46 |

| Liberty Mutual | $2,340.24 | $3,096.92 | $5,426.09 |

| Nationwide | $1,890.83 | $2,038.34 | $2,455.46 |

| Progressive | $4,628.34 | $5,024.74 | $5,998.34 |

| State Farm | $2,150.46 | $3,286.98 | $4,467.44 |

| USAA | $1,318.18 | $1,642.30 | $2,750.18 |

Driving Record Rates by Companies

Do you have a spotless driving record?

Most of us don’t, and we need to be prepared for our car insurance premiums to be affected by our driving histories. If you live in Vermont and have a DUI in your past, for example, Nationwide will likely be your most cost-effective car insurance provider.

The following table shows different insurance companies and their annual averages for people with varying driving records in Vermont.

| Company | Clean Driving Record | One Speeding Citation | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $2,647.26 | $3,019.61 | $3,493.62 | $3,601.03 |

| Geico | $1,412.77 | $1,740.86 | $2,353.00 | $3,276.21 |

| Liberty Mutual | $3,184.72 | $3,442.90 | $3,811.97 | $4,044.73 |

| Nationwide | $1,704.30 | $1,872.03 | $2,187.15 | $2,749.35 |

| Progressive | $4,397.96 | $5,167.34 | $6,363.51 | $4,939.75 |

| State Farm | $3,987.31 | $4,382.83 | $4,778.37 | $4,382.83 |

| USAA | $1,450.28 | $1,612.57 | $1,830.96 | $2,720.40 |

Number of Foreign Versus Domestic Insurers in Vermont

When you hear the phrase “foreign or domestic car insurance company,” what do you think that means?

When it comes to auto insurers, domestic simply means an in-state provider, and foreign, an out-of-state provider.

According to the NAIC, Vermont has 12 domestic car insurance companies and 671 foreign car insurance providers.

Vermont Laws

So you want to drive in Vermont? Who can blame you? The Green Mountain State is one of the most gorgeous places in the United States.

Even if you’re just passing through Vermont, however, it’s important to know the laws where you’re driving.

In the sections below, we’ll cover a variety of legal topics related to driving and insuring your car in Vermont.

You might also want to check out the National Motorists Association guide to driving in Vermont.

Car Insurance Laws

As we’ve seen above, Vermont requires liability insurance with the following minimums:

- Bodily injury liability coverage – $25,000 per person and $50,000 per accident

- Property damage liability coverage – $10,000

- Uninsured motorist bodily injury coverage – $50,000 per person and $100,000 per accident

- Uninsured motorist property damage coverage – $10,000 with a $150 deductible

Also remember, these are minimums. What is best for you and your family might be coverage above liability, such as the add-ons we explored earlier.

How State Laws for Insurance are Determined

Do you know about the National Association of Insurance Commissioners (NAIC)?

Well, unless you’re an insurance nerd like us, you probably haven’t heard of them before. But that’s okay.

The NAIC is the U.S. standard-setting and regulatory support organization for the insurance industry, including car insurance. They were created and are governed by the chief insurance regulators from all 50 states, the District of Columbia and five U.S. territories.

And in case you’re curious how insurance laws actually get made, they offer this great white paper to help you understand.

Windshield Coverage

Some insurance companies may offer windshield replacement with comprehensive coverage, but Vermont laws have no regulations that are unique or specific to windshields.

In Vermont, like in many states without glass claims regulations, you can insist that your auto insurer use original manufacturer parts as a replacement after a crash, but you may have to pay the difference in cost.

High-risk Insurance

If you’re like us, you might have had some bad luck on the road before. And this may have led you to a less-than-stellar driving record.

Because of their driving behavior, high-risk drivers are at times ineligible to get car insurance from the traditional market.

To offer coverage to these drivers, the state has established a program for them, known as the Vermont Automobile Insurance Plan.

Automobile Insurance Fraud in Vermont

According to Vermont law 13 V.S.A. § 2031, insurance fraud is a serious crime.

The Green Mountain State’s insurance fraud law states that no person shall, with intent to defraud:

- Present a claim for payment or benefit to any insurance policy, that contains false representations as to any material fact

- Present information containing false representations as to any material fact concerning the sale of any insurance policy or purported insurance policy, an application for a certificate of authority, or the financial condition of any insurer.

And though most people only contact their auto insurer in case of an accident or other claim, some folks try to scam the system by filing false claims to make a quick buck.

Since insurance fraud in Vermont carries big fines and possible jail time, it’s best to avoid the situation altogether. But find yourself on the wrong side of the state’s insurance fraud laws, and here’s what you can expect:

- Less than $900 – A punishment of up to six months in prison, a fine of up to $5,000, or both.

- More than $900 – A punishment of up to five years in prison, a fine of up to $10,000, or both.

According to the Insurance Information Institute (III), common frauds include:

- Padding, or inflating actual claims

- Misrepresenting facts on an insurance application

- Submitting claims for injuries or damage that never occurred, services never rendered or equipment never delivered

- Staging accidents.

Statute of Limitations

Do you know what a statute of limitations is?

Put simply, a statute of limitations is the amount of time you have to file a court case following an accident.

In Vermont, you have three years from the time of the accident to file a lawsuit for both personal injury and property damage.

Vermont Specific Laws

It’s definitely a good idea to check out the National Motorists Association guide to driving in Vermont.

Here is some interesting (and important) information for driving in Vermont they provide:

- Your dome light must be turned on when pulling over if stopped by the authorities after dark.

- Speed limits are presumed (Driving faster than the speed limit is only evidence of unreasonable speed — you can still argue that your speed was safe under the specific conditions)

Vehicle Licensing Laws

Like all other states in America, Vermont has mandatory licensing laws in addition to the laws we have already covered.

You’re probably not surprised to learn that the Green Mountain State requires a valid driver’s license to operate a vehicle.

And be honest — who doesn’t love getting their picture taken at the DMV?

Okay, maybe that’s not the case. But you should know, licensing yourself and your vehicle in Vermont may be easier than you think.

The Vermont Department of Motor Vehicles requires that you get a license within 60 days of becoming a state resident. Their website is really helpful, and explains that you will need documentation from each of the four categories below:

- Proof of identity and age

- Proof of lawful status in the United States

- Proof of Social Security number

- Proof of Vermont residency and current address

REAL ID

Do you have some business to do with the Social Security Administration in Burlington? A REAL ID can save you the hassle of bringing other forms of identification with you to conduct official state or federal government business.

But don’t worry if you have a recent Vermont driver’s license. Vermont is in full compliance with the REAL ID Act passed by Congress and enforced by the Department of Homeland Security.

Penalties for Driving Without Insurance

The Sabbetth Law Firm explains that Vermont “drivers who do not have insurance are subject to a fine of up to $500 if they fail to provide proof of insurance during a traffic stop. Driving without insurance can also be grounds for a driver’s license suspension in Vermont.”

And remember — having insurance is also part of being a good neighbor.

Driving without an insurance policy poses an extremely serious threat to others on the road.

Teen Driver Laws

Most states have some form of graduated licensing laws for teens, and Vermont is no exception.

In Vermont, these laws mean a two-step process: first a learner’s permit, then a provisional license. The table below provides age, passenger, and time restrictions for both types of teen licenses.

| young driver licensing laws | AGE RESTRICTIONS | PASSENGER RESTRICTIONS | TIME RESTRICTIONS |

|---|---|---|---|

| Learner's Permit | 15 years | None | None |

| Provisional License | Must be 16 years old and have held learner's permit for at least 6 months. | First 3 months – no passengers without exception; Second 3 months – no passengers secondary enforcement | None |

| Full License | 16 Years | None | 6 months or until age 18, whichever occurs first (min. age: 16, 6 mos.) |

Older Driver License Renewal Procedures

Vermont’s license renewal procedures are the same for older drivers as they are for the general population over the age of 18. As such, the Department of Motor Vehicles requires all residents to renew their licenses every four years, which can be done by mail and requires proof of adequate vision.

New Residents

Are you a lucky new resident of the great state of Vermont? Then you need to get a new license — within 60 days of moving to the state, or, if your out-of-state license expires before the end of this 60-day period, you must obtain a Vermont driver’s license before it expires — whichever occurs first.

Again, Vermont’s Department of Motor Vehicles website is extremely helpful. If you’re a new resident, you do need to visit a DMV office with:

- Proof of identity and age

- Proof of lawful status in the United States

- Proof of Social Security number

- Proof of Vermont residency and current address

License Renewal Procedures

Renewing your license in Vermont isn’t that difficult, but the state has yet to institute online renewal. You can, however, renew by mail every four years. Check out the state’s renewal website for more information and to find DMV locations.

Rules of the Road

Whether you’ve long-lived in the shadow of the Green Mountains, or you’re just passing through Vermont, you’ll need to know rules for driving here.

We’ve compiled some helpful advice below to make sure you avoid any run-ins with the Vermont law.

Fault Versus No-fault

Vermont is a traditional at-fault state, meaning you’ll be held liable, both financially and legally, if you are found to be the cause of an auto accident.

But we want to make sure you have the best insurance you can to protect you and your family.

And how do you do that? Remember, the more comprehensive your insurance, the better prepared you are to face accidents and other auto incidents, whether or not you are at fault.

Seat Belt and Car Seat Laws

At 86 percent, Vermont has an average seat belt usage on par with national averages. The Vermont State Highway Safety Office offers a succinct explanation of the state’s seat belt laws and penalties for violating them:

- Everyone in the vehicle, including backseat passengers and children, must wear seat belts properly.

- The driver will receive a fine of $25 for a first violation; $50 for a second violation; $100 for third and subsequent violations.

- Lap and shoulder belts must be worn and shoulder belts must NOT be placed behind the back or under the arm.

That’s the law as it applies to folks over 18 years of age. For those under 18, they explain:

- All children under the age of 1, and all children weighing less than 20 pounds, regardless of age, shall be restrained in a rear-facing position, properly secured in a federally approved child passenger restraining system, which shall not be installed in front of an active air bag.

- A child weighing more than 20 pounds, and who is one year of age or older and under the age of 8 years old, shall be restrained in a child passenger restraining system.

- A child 8–17 years of age shall be restrained in a safety belt system or a child passenger restraining system.

- The driver will receive a fine of $25 for a first violation; $50 for a second violation; $100 for third and subsequent violations

So buckle up! Vermont law enforcement officials can pull you over for no other reason than not wearing a seat belt.

Keep Right and Move Over Laws

In the Green Mountain State, stay in the right lane except to pass.

Vermont statute 23 V.S.A. § 1031 clearly states that you must drive in the right lane except:

- when overtaking and passing another vehicle proceeding in the same direction under the rules governing such movement;

- when an obstruction exists making it necessary to drive to the left of the center of the highway; provided, any person so doing shall yield the right of way to all vehicles traveling in the proper direction upon the unobstructed portion of the highway within such distance as to constitute an immediate hazard;

- upon a roadway divided into three marked lanes for traffic under the rules applicable thereon; or

- upon a roadway restricted to one-way traffic.

According to the Department of Motor Vehicles, Vermont “requires drivers approaching a stationary law enforcement vehicle, ambulance, fire fighting vehicle, a vehicle used in rescue operations, or a towing and repair vehicle displaying signal lamps, and traveling in the same direction, to reduce speed and, if safe to do so, vacate the lane closest to the stationary vehicles.”

Fail to comply with the state’s move over law? You face a $335 fine and five points on your driver’s license.

Speed Limits

Vermont roadways feature lots of twists and turns around all those beautiful mountains. Thus, the state’s maximum speed limits are lower than they are in most other places.

Here are the maximum speeds on Vermont’s roadways for both cars and trucks:

- Rural Interstates – 65 mph

- Urban Interstates – 55 mph

- Other limited access roads – 50 mph

Ridesharing

Thinking about taking an Uber or Lyft in Vermont? That’s probably fine, but the state is lagging in enacting insurance requirements for ridesharing options.

It’s good to know, though, that most major rideshare companies require their drivers to have insurance that covers not only the driver but also all passengers, with the state of operation’s minimum requirements.

Automation on the Road

What the heck is automation?

The Insurance Institute for Highway Safety (IIHS) explains that automation is simply the use of a machine or technology to perform a task previously carried out by a human. When it comes to automation, typically think radars, cameras, and other sensors used to gather information about a vehicle’s surroundings.

Vermont has yet to legislatively act on automated driving.

Safety Laws

You know driving safely is important, no matter where you’re driving.

What’s the first step in driving safely? Knowing a state’s safety laws and regulations.

Since you now know the proper way to insure and register your vehicle in Vermont, let’s take a look at some important safety information to keep you, your family, and your vehicles safe in the Green Mountain State.

DWI Laws

Whether you’re drunk or just buzzed, driving under the influence of alcohol is not a good idea.

The BAC — blood alcohol content — limit in Vermont is 0.08. Get caught driving over that limit and you face some hefty fines and possible jail time:

- First offense – Up to two years in prison, up to a $750 fine, and 90 days drivers license suspension.

- Second offense – Up to two years in prison, up to a $1,500 fine, and 18 months driver’s license suspension.

- Third offense – Up to five years in prison, up to a $2,500 fine, and lifetime revocation of driver’s license.

- Fourth and subsequent offenses – Up to 10 years in prison, up to a $5,000 fine, and lifetime revocation of driver’s license.

In 2017 alone, the state of Vermont had 18 drunk driving fatalities. It’s not worth it. Call a taxi or a friend.

Marijuana-impaired Driving Laws

As of July 1, 2018, Vermont Act 86 made it legal for all adults over the age of 21 to possess small amounts of marijuana (up to one ounce).

Drive high, however, and you can still face a DUI.

The Burlington Free Press reports that “impaired driving remains illegal under the law, and neither drivers nor passengers are allowed to use marijuana in a vehicle. Anyone with an open container of marijuana in a vehicle can be fined $200.”

Distracted Driving Laws

Vermont has some of the strictest distracted driving laws in the country.

NO ONE in Vermont is allowed to drive and use a hand-held device, no matter how old they are.

Vermont statute 23 V.S.A. § 1099 lays out the fines for texting specifically. Get ticketed for texting and driving and you “shall be subject to a penalty of not less than $100 and not more than $200 for a first violation and of not less than $250 and not more than $500 for a second or subsequent violation within any two-year period.”

Driving Safely in Vermont

You know driving safely is important wherever you are.

Read on for some important information about keeping you, your family, and your vehicles safe in the Green Mountain State.

Vehicle Theft in Vermont

The Federal Bureau of Investigation (FBI) keeps track of vehicle thefts and other crimes city-by-city in all states. In Vermont, this means they’re tracking vehicle theft everywhere, from Barre Town to Winooski.

In 2016, Bennington — a small city in the southwestern corner of the state — led Vermont in vehicle thefts with 18.

You might want to know what vehicles are stolen the most in the Green Mountain State. The table below shows the top-10 most-stolen cars in Vermont for 2018 by make, model, and model year.

| Make and Model | Model Year | Number Stolen |

|---|---|---|

| Chevrolet Pickup (Full Size) | 2001 | 15 |

| Ford Pickup (Full Size) | 2010 | 8 |

| Ford Pickup (Small Size) | 2002 | 5 |

| GMC Pickup (Full Size) | 2007 | 5 |

| Honda Accord | 2002 | 8 |

| Honda Civic | 2005 | 6 |

| Hyundai Elantra | 2015 | 7 |

| Nissan Sentra | 2012 | 5 |

| Subaru Impreza | 2002 | 5 |

| Subaru Legacy | 1999 | 6 |

Road Fatalities in Vermont

Unfortunately, the scenic roadways of Vermont sometimes turn deadly. Below we’ll explore different variables on road fatalities, which totaled 86 across the Green Mountain State in 2018.

Most Fatal Highway in Vermont

US-7 is the most deadly highway in Vermont, GeoTab reports. It’s also one of the longest highways in the state, beginning at the Canadian border and running south all the way to Massachusetts.

Fatal Crashes by Weather Condition and Light Condition

Vermont isn’t always green. In fact, winters in this northern state can be quite harsh, with snowfalls measured in feet, not inches.

Not surprisingly, crashes are highly affected by both weather and light conditions, especially in a winter wonderland like Vermont.

The table below provides a breakdown of fatal crashes by weather and light conditions across Vermont in 2017.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 32 | 4 | 13 | 3 | 0 | 52 |

| Rain | 3 | 0 | 2 | 0 | 0 | 5 |

| Snow/Sleet | 1 | 0 | 1 | 1 | 0 | 3 |

| Other | 0 | 0 | 1 | 1 | 0 | 2 |

| Unknown | 0 | 0 | 1 | 0 | 0 | 1 |

| TOTAL | 36 | 4 | 18 | 5 | 0 | 63 |

Fatalities by Passenger Type

What kind of vehicles are Vermonters riding in or driving when they’re in a deadly car crash?

The table below shows fatalities by passenger type.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 32 | 18 | 20 | 28 | 30 |

| Light Truck – Pickup | 5 | 3 | 2 | 2 | 7 |

| Light Truck – Utility | 11 | 4 | 10 | 15 | 8 |

| Light Truck – Van | 3 | 2 | 1 | 0 | 0 |

| Large Truck | 1 | 1 | 1 | 0 | 1 |

| Other/Unknown Occupants | 5 | 3 | 2 | 1 | 2 |

| Total Occupants | 57 | 32 | 37 | 46 | 48 |

Fatalities by Crash Type

Similarly, how many vehicles are involved in deadly crashes across the Green Mountain State? And what causes these crashes?

The table below shows the number of vehicle fatalities in Vermont by crash type from 2013 to 2017.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 44 | 28 | 34 | 45 | 38 |

| Involving a Large Truck | 8 | 11 | 8 | 7 | 10 |

| Involving Speeding | 18 | 15 | 21 | 29 | 31 |

| Involving a Rollover | 15 | 12 | 7 | 19 | 14 |

| Involving a Roadway Departure | 62 | 33 | 44 | 49 | 49 |

| Involving an Intersection (or Intersection Related) | 10 | 5 | 6 | 6 | 14 |