North Carolina Car Insurance (Coverage, Companies, & More)

North Carolina car insurance requirements are 30/60/25 for minimum liability, but we always recommend driving with full coverage. Full coverage policies can raise your North Carolina car insurance rates, but you can still find cheap coverage when you know where to look. Read our guide to compare North Carolina car insurance companies and enter your ZIP code below to compare North Carolina car insurance quotes for free.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Feb 10, 2025

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 10, 2025

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| NORTH CAROLINA STATISTICS | DETAILS |

|---|---|

| Miles of Roadway | 108,012 |

| Registered Vehicles | 7,682,387 |

| Population | 10,383,620 |

| Most Popular Vehicle | Honda Accord |

| Uninsured Motorist Rate | 6.50% |

| Total Driving Related Deaths in 2017 | 1412 |

| Speeding Fatalities in 2017 | 423 |

| DUI Fatalities in 2017 | 413 |

| Average Car Insurance Cost | $357.59 |

| Cheapest Provider | Liberty Mutual |

We know that car insurance is a difficult subject to understand. There are a lot of complicated rules and details to learn and remember. Fortunately, you have us, which means you don’t have to figure it all out yourself.

Whether you’re a North Carolina Driver who’s traveling to the beach, a foodie going to a world-renowned restaurant, or just driving to work, you need to know as much as you can about car insurance, so that you can get the right coverage for your needs. Look no further; we’ll tell you everything you need to know, and we’ll also help you compare insurance rates by using our FREE tool!

Car Insurance Coverage and Rates

Car insurance coverage and rates are a bit difficult to sift through, as there are usually many different factors that insurance companies consider when calculating what to charge you.

To ease this burden, we will give you clear, easy-to-follow information that will help you decide which insurance is best for you.

In this section, we will cover North Carolina’s car culture, its minimum coverage, financial responsibility, core coverage, and many other essential topics that will help you understand car insurance in your state a bit better.

North Carolina’s Car Culture

While many drivers in southern states prefer large pickup trucks, North Carolina drivers typically opt for the understated and practical Honda Accord. Subarus are popular, as well. This may be attributed to the number of northerners who have relocated to North Carolina.

Another interesting fact about North Carolina drivers is that they tend to drive more slowly than those from other states.

North Carolina Minimum Coverage

North Carolina requires at least $30,000 of bodily injury coverage for each person, $60,000 total bodily injury for all persons in an accident, and $25,000 for property damage. Many choose the minimum insurance required because it’s the cheapest option.

However, if you’re involved in an accident, your medical bills may quickly exceed the minimum coverage limits. Thus, it might be a good idea to get underinsured motorist coverage, though it’s not required by law. This type of coverage protects in case you’re injured in an accident caused by another driver, and your medical bills cost more than their insurance coverage will pay.

Additionally, North Carolina allows you to use an electronic insurance card to prove your insurance.

Forms of Financial Responsibility

In North Carolina, you must have an in-force insurance policy, and it must stay in-force throughout the registration. If your insurance is canceled or lapses, you must report this change of status to the DMV, and you also must immediately pay any fines you incur as a result.

You can use any of the following as proof of insurance:

- An FS-1 form issued by your insurance agent certifying that you currently hold an insurance policy

- Your North Carolina car insurance policy

- An insurance binder

- An insurance card

If you neglect to pay these fees, you will have to pay more fines and lose your license plates, which will prevent you from driving your car in North Carolina.

Premiums as a Percentage of Income

You’re probably wondering how much you’ll be paying for your premium. For example, what percentage of your income should you expect to pay in North Carolina for insurance? The best way to examine a premium as a percentage of income is to look at a three-year trend of the information.

In 2012, North Carolinians spent 2.07 percent of their income on insurance. In 2013, they spent 2.19 percent, and they spent 2.19 percent once again in 2014. As you can see, the highest percentages were in 2013 and 2014, and 2012 was the lowest.

It’s also important to check out the percentages of the surrounding states. Virginia’s numbers are lower (1.79 percent in 2012, 1.91 percent in 2013, and 1.9 percent in 2014); Tennessee’s are higher (2.21 percent in 2012, 2.33 percent in 2013, and 2.32 percent in 2012).

Georgia’s is higher, too (2.78 percent in 2012, 2.87 percent in 2013, 2.87 percent in 2014); and North Carolina’s adjacent neighbor, South Carolina, has a higher percentage as well (2.74 percent in 2012, 2.84 percent in 2013, and 2.81 percent in 2014).

The national average numbers for these years were 2.32 percent, 2.39 percent, and 2.29 percent. In other words, North Carolina drivers are paying a smaller percentage of their income for car insurance compared to the average American.

Average Monthly Car Insurance Rates in NC (Liability, Collision, Comprehensive)

If you’re a driver in North Carolina, there are a few forms of core coverage you should be familiar with. The first coverage is liability, which, based on data from 2011-2015, has an average cost of $349.07 Remember — liability coverage is the minimum coverage required in most states, and it covers a driver who causes harm to another person or property while driving.

Another option for core coverage is collision insurance, which, unsurprisingly, covers your car if you are involved in a collision with an object. In North Carolina from 2011-2015, collision insurance cost an average of $264.58.

The final type of core coverage that we will discuss is comprehensive insurance. Comprehensive insurance covers damages to your car that are caused by things other than a collision. This insurance is very useful because while collisions are probably the most common way cars are damaged, other types of accidents can certainly inflict serious (and costly) damages to your car.

From 2011-2015, comprehensive insurance had an average cost of $123.

When many people choose to get all of these types of insurance, their average combined cost for North Carolina is $745.17.

You can see all this information in a clear and organized way in the table below.

| Insurance Type | Cost |

|---|---|

| Liability | $349.07 |

| Collision | $264.58 |

| Comprehensive | $123.00 |

| Average | $745.17 |

(Note: this data (from the NAIC) is based on the state minimum)

Additional Liability

North Carolina does not have personal injury protection. As for loss ratios for Medical Payments, in 2015, it was 82.73, 80.48 in 2014, and 81.38 in 2013. The loss ratios for uninsured/underinsured motorist coverage were 60.91 in 2015, 54.20, in 2014, and 58.32 in 2013.

It’s always important to know how many drivers in your state are driving without car insurance. In North Carolina, this number is 6.5 percent of the population. This number is impressively low and is reflected by North Carolina being ranked as the 49th in drivers driving without car insurance in the United States.

Add-Ons, Endorsements, and Riders

We’ve mentioned a few times that, at the very least, you need liability insurance. We’ve also mentioned a few other common forms of insurance that you can add on to protect you from certain types of accidents.

However, while collision and comprehensive insurance are helpful, they may not cover everything you need to have covered. Check out the list below to see the other forms of coverage that may help you with your specific insurance needs.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive

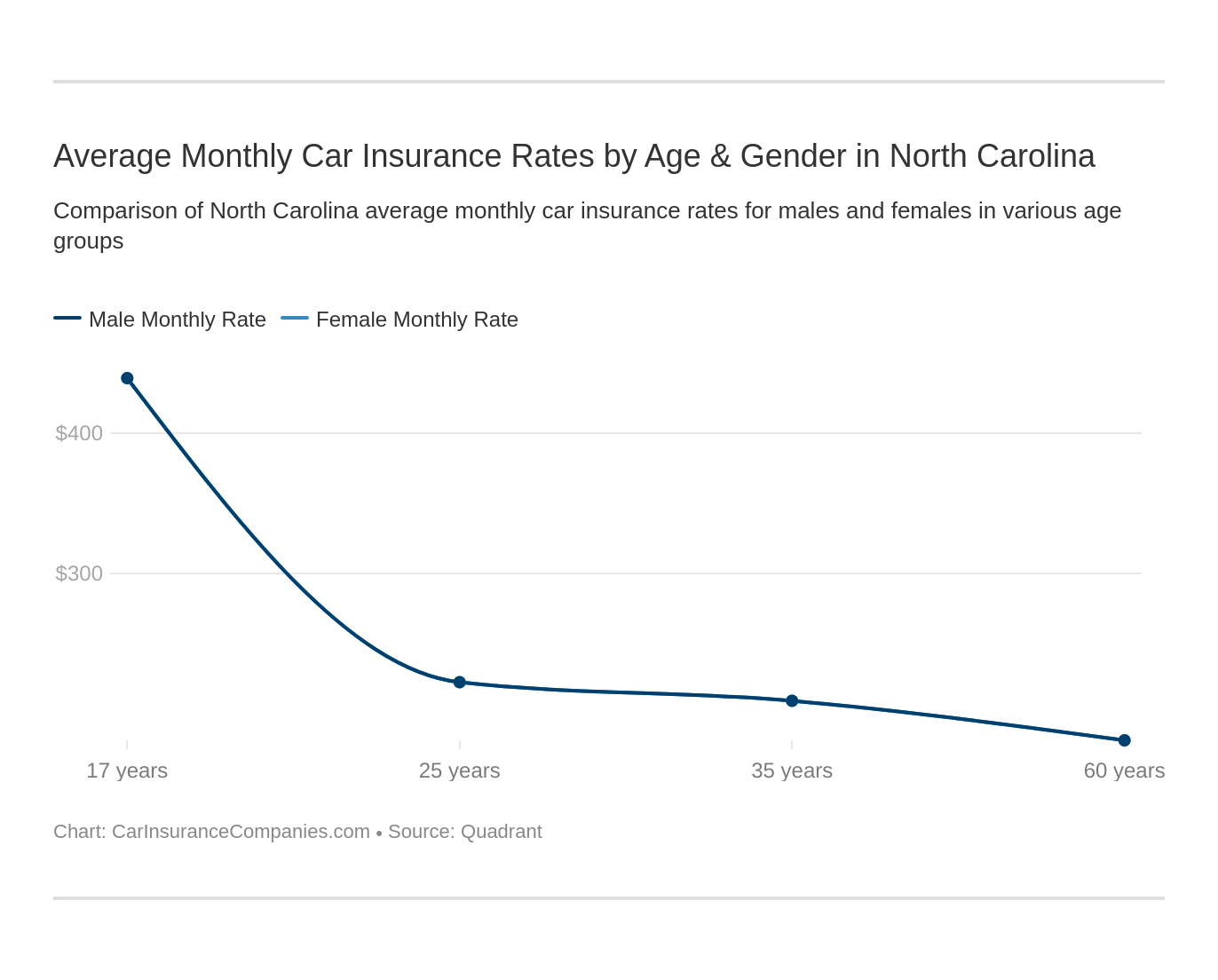

Average Monthly Car Insurance Rates by Age & Gender in NC

According to North Carolina’s relatively new law, it’s illegal to determine rates based on one’s gender. However, while gender does not affect one’s car insurance rates, there are many other factors that insurance companies consider when deciding what your car insurance rates are. Keep reading to see what these are and how they affect your insurance.

Some states have banned discrimination based on gender for car insurance rates, and this is one of those few states. As you can see the rate for males and females is the same, but the rate still varies with age.

However, it is still legal to base insurance rates on marital status and age. The table below details information about these demographics.

| Company | Single 17-year-old female annual rate | Single 17-year-old male annual rate | Single 25-year-old female annual rate | Single 25-year-old male annual rate | Married 35-year-old female annual rate | Married 35-year-old male annual rate | Married 60-year-old female annual rate | Married 60-year-old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $13,137.37 | $13,137.37 | $5,608.24 | $5,608.24 | $5,499.72 | $5,499.72 | $4,516.40 | $4,516.40 |

| Geico Govt Employees | $4,603.65 | $4,563.43 | $2,212.08 | $2,199.26 | $2,521.28 | $2,474.28 | $2,482.19 | $2,437.32 |

| Liberty Mutual | $3,197.53 | $3,197.53 | $1,823.22 | $1,823.22 | $1,823.22 | $1,823.22 | $1,886.88 | $1,886.88 |

| Nationwide Mutual | $4,096.41 | $4,096.41 | $2,431.91 | $2,431.91 | $2,431.91 | $2,431.91 | $2,431.91 | $2,431.91 |

| Progressive Premier | $4,132.18 | $4,132.18 | $1,989.17 | $1,989.17 | $1,785.15 | $1,785.15 | $1,623.93 | $1,623.93 |

| State Farm Mutual Auto | $3,966.45 | $3,966.45 | $3,328.58 | $3,328.58 | $2,692.15 | $2,692.15 | $2,327.42 | $2,327.42 |

| Standard Fire Ins Co | $4,485.32 | $4,485.32 | $2,735.84 | $2,735.84 | $2,665.43 | $2,665.43 | $2,644.05 | $2,644.05 |

According to this information, the most expensive age group to insure is 17-year-olds, as their average cost of car insurance is $13,137.37. The group with the cheapest insurance is married 60-year-olds. Their average cost of car insurance is $1,623.93.

Read more: How much does car insurance cost for a 17-year-old?

The information in this table suggests that if a person is older and they are married, their car insurance is considerably lower.

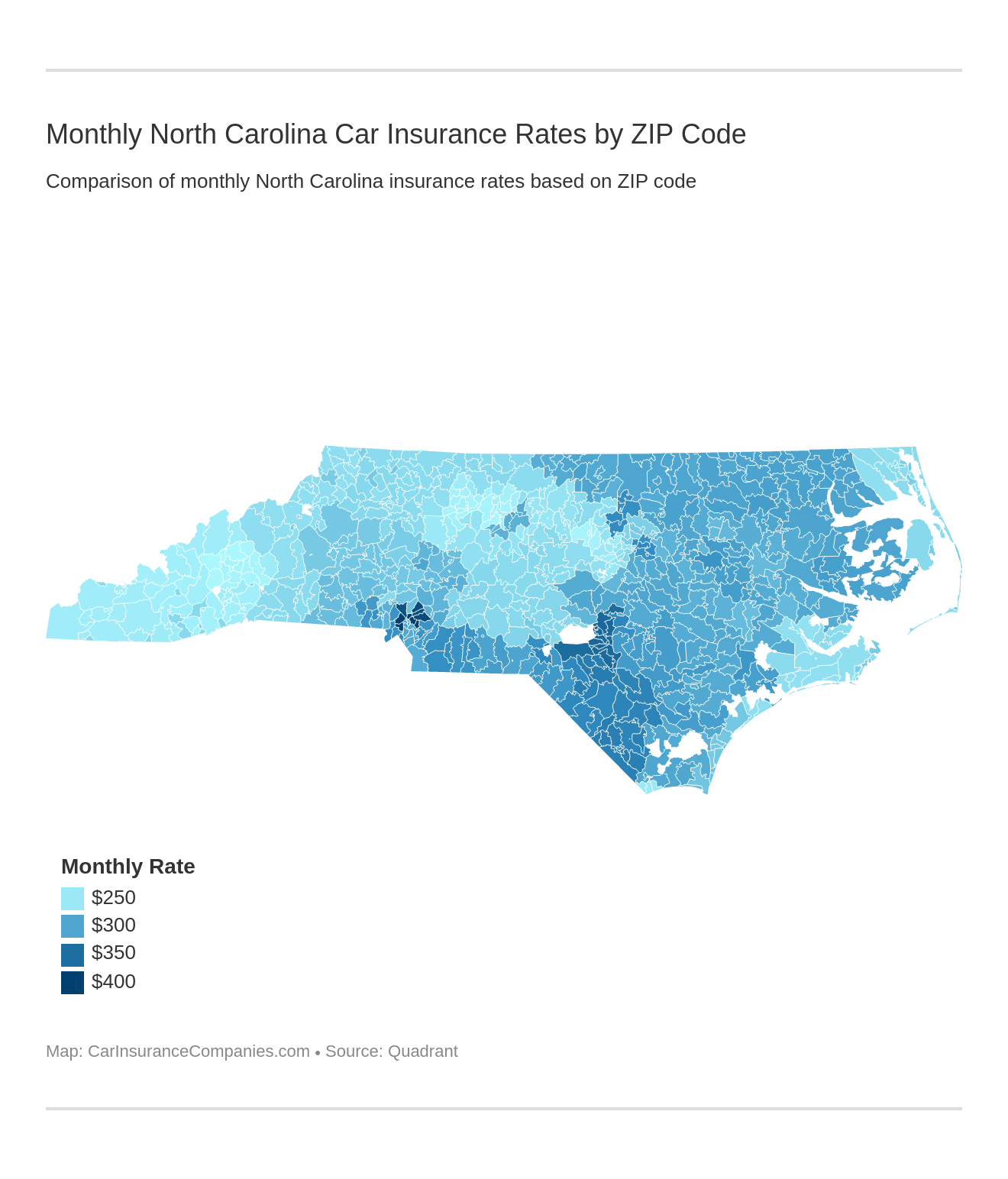

Cheapest Rates by ZIP Code

Now, let’s check out the cheapest and most expensive car insurance rates by ZIP code in North Carolina. Look at the tables below and see your ZIP code’s rates and how they compare to other ZIP codes.

Check out the 25 least expensive ZIP codes for car insurance. Maybe your ZIP code will be on the list!

| Zip Code | City | Average by Zip Codes |

|---|---|---|

| 28701 | ALEXANDER | $2,860.59 |

| 28715 | CANDLER | $2,862.25 |

| 28748 | LEICESTER | $2,863.37 |

| 28787 | WEAVERVILLE | $2,872.11 |

| 28778 | SWANNANOA | $2,878.07 |

| 28709 | BARNARDSVILLE | $2,882.94 |

| 27265 | HIGH POINT | $2,883.83 |

| 28801 | ASHEVILLE | $2,884.67 |

| 28730 | FAIRVIEW | $2,886.16 |

| 28711 | BLACK MOUNTAIN | $2,891.80 |

| 28804 | ASHEVILLE | $2,892.21 |

| 27516 | CHAPEL HILL | $2,894.00 |

| 28704 | ARDEN | $2,896.41 |

| 28806 | ASHEVILLE | $2,901.40 |

| 27284 | KERNERSVILLE | $2,904.11 |

| 27103 | WINSTON SALEM | $2,906.04 |

| 27023 | LEWISVILLE | $2,906.14 |

| 27105 | WINSTON SALEM | $2,906.78 |

| 28805 | ASHEVILLE | $2,907.32 |

| 27410 | GREENSBORO | $2,908.91 |

| 27510 | CARRBORO | $2,908.96 |

| 28803 | ASHEVILLE | $2,909.29 |

| 27050 | TOBACCOVILLE | $2,910.16 |

| 27045 | RURAL HALL | $2,911.84 |

| 27101 | WINSTON SALEM | $2,913.24 |

Based on this information, you can see that Alexander (28701) is the least expensive, as the average rate for insurance in the county is $2,860.59. The city with the most ZIP codes in the least expensive category is Asheville, with five ZIP codes in this category (28801, 28804, 28806, 28805, 28803).

We’ve seen the cheapest ZIP codes, so let’s take a peek at the most expensive zip codes in North Carolina.

| Zip Code | City | Average by Zip Code |

|---|---|---|

| 28205 | CHARLOTTE | $4,803.84 |

| 28206 | CHARLOTTE | $4,801.37 |

| 28212 | CHARLOTTE | $4,795.85 |

| 28208 | CHARLOTTE | $4,786.44 |

| 28217 | CHARLOTTE | $4,746.83 |

| 28262 | CHARLOTTE | $4,649.95 |

| 28215 | CHARLOTTE | $4,639.07 |

| 28213 | CHARLOTTE | $4,633.71 |

| 28126 | NEWELL | $4,563.72 |

| 28216 | CHARLOTTE | $4,530.13 |

| 28254 | CHARLOTTE | $4,465.78 |

| 28310 | FORT BRAGG | $4,347.17 |

| 28308 | POPE A F B | $4,330.29 |

| 28307 | FORT BRAGG | $4,328.13 |

| 28314 | FAYETTEVILLE | $4,303.63 |

| 28303 | FAYETTEVILLE | $4,298.91 |

| 28311 | FAYETTEVILLE | $4,285.87 |

| 28305 | FAYETTEVILLE | $4,281.21 |

| 28301 | FAYETTEVILLE | $4,278.95 |

| 28390 | SPRING LAKE | $4,274.80 |

| 28304 | FAYETTEVILLE | $4,270.53 |

| 28348 | HOPE MILLS | $4,256.98 |

| 28306 | FAYETTEVILLE | $4,254.96 |

| 28376 | RAEFORD | $4,234.90 |

| 28323 | BUNNLEVEL | $4,231.45 |

As you can see from the table, the most expensive ZIP code is in Charlotte (28205), with an average cost of $4,803.84. In fact, the top six most expensive ZIP codes in North Carolina are all in Charlotte (28206, 28212, 28208, 28217. 28262).

The cheapest ZIP code of the most expensive ZIP codes is in Bunnlevel (28323), and the average cost of insurance there is $4,231.45.

Cheapest Rates by City

After examining the cheapest and most expensive zip codes in North Carolina, it only seems appropriate to check out the cheapest and most expensive cities in North Carolina.

Here is the table for the cheapest car insurance cities in North Carolina

| City | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate |

|---|---|---|---|

| Alexander | $2,860.59 | Allstate | $6,059.88 |

| Candler | $2,862.25 | Allstate | $6,136.08 |

| Leicester | $2,863.37 | Allstate | $6,059.88 |

| Weaverville | $2,872.11 | Allstate | $6,136.08 |

| Swannanoa | $2,878.06 | Allstate | $6,148.91 |

| Barnardsville | $2,882.94 | Allstate | $6,148.91 |

| Black Mountain | $2,891.80 | Allstate | $6,227.12 |

| Arden | $2,896.41 | Allstate | $6,385.53 |

| Carrboro | $2,901.48 | Allstate | $6,623.66 |

| Kernersville | $2,904.11 | Allstate | $6,076.76 |

| Lewisville | $2,909.73 | Allstate | $6,083.40 |

| Tobaccoville | $2,910.16 | Allstate | $6,039.60 |

| Rural Hall | $2,911.84 | Allstate | $6,076.76 |

| Colfax | $2,913.99 | Allstate | $6,090.04 |

| Walkertown | $2,916.92 | Allstate | $6,170.83 |

| Clemmons | $2,918.97 | Allstate | $6,155.99 |

| Belews Creek | $2,920.75 | Allstate | $6,090.04 |

| Brevard | $2,921.40 | Allstate | $6,429.53 |

| Lake Junaluska | $2,929.49 | Allstate | $6,575.70 |

| Summerfield | $2,929.71 | Allstate | $6,082.24 |

| Cherokee | $2,931.14 | Allstate | $6,544.78 |

| Asheville | $2,931.97 | Allstate | $6,431.81 |

| Maggie Valley | $2,932.40 | Allstate | $6,544.78 |

| Etowah | $2,935.44 | Allstate | $6,487.16 |

| Clyde | $2,935.66 | Allstate | $6,544.78 |

According to the table, the cheapest city for car insurance in North Carolina is Alexander, with an average rate of $2,860.59 for car insurance. The next two cheapest cities for car insurance in North Carolina are Candler ($2,862.25) and Leicester ($2,863.37), and the average cost of car insurance for both of these cities is quite reasonable.

Moving forward, let’s check out the most expensive cities for car insurance in North Carolina. The city in North Carolina that has the most expensive car insurance is Newell, with an average of $4,563.71 for car insurance.

The next two most expensive cities in the Tar Heel State are Pope Field Army Airfield, which has an average car insurance cost of $4,330.29, and Fort Brag, which has an average cost of $4,328.13.

As you can see, there is nearly a $2,000 difference between the cheapest cities for car insurance and the most expensive cities for car insurance in North Carolina, so where you live has a huge impact on how much you spend to cover your car each year.

Best State Car Insurance Companies

It’s really hard to find the right car insurance company, as there are many companies out there that offer various benefits to customers. This is why we’ve dedicated an entire section to giving you key information about car insurance companies: so you can make an informed decision about which car insurance company works best for you.

In this section, we’ll cover topics like financial ratings, companies with the best ratings, companies that are the cheapest, and more that will make your decision about car insurance that much easier to make.

The Largest Companies’ Financial Rating

Here is a table based on the reliable A.M. Best that shows the financial ratings of the 10 largest car insurance companies in North Carolina.

| Company | AM Best Rating | Loss Ratio |

|---|---|---|

| State Farm | A++ | 70.51% |

| Nationwide | A+ | 58.78% |

| Geico | A++ | 68.76% |

| North Carolina Farm Bureau | A+ | 70.25% |

| Amtrust NGH | A- | 84.27% |

| Allstate Insurance | A+ | 56.64% |

| USAA | A++ | 73.96% |

| Progressive | A+ | 65.14% |

| Erie Insurance | A+ | 69.68% |

| Liberty Mutual | A | 61.99% |

Read more: Amtrust Insurance Company Car Insurance Review

Impressively, all the financial ratings for these companies are in the “A” range, with the lowest rating being an “A-.” The companies with the truly exceptional ratings are State Farm, Geico, and USAA Group. The company with the lowest rating, which isn’t all that low because it’s an “A-,” is Amtrust NGH Group.

There are other car insurance companies out there with respectable financial ratings, but for time and space’s sake, we’ve just chosen these companies to look at because they’re the largest in the state. Hopefully, your company is on there, and hopefully, you’ve learned a thing or two about them.

Companies with Best Ratings

It’s time to check out the car insurance companies in North Carolina with the best ratings! Check out this table to see where your provider is ranked.

| Company | Rating |

|---|---|

| Farm Bureau Insurance-Tennessee | 888 |

| Erie | 870 |

| Alfa | 855 |

| NC Farm | 855 |

| State Farm | 853 |

| Auto Owners | 852 |

| Southeast Average | 841 |

| Geico | 838 |

| KY Farm Bureau | 830 |

| Safeco | 829 |

| Nationwide | 828 |

| Progressive | 824 |

| Travelers | 822 |

| National General | 820 |

| MetLife | 814 |

| Allstate | 813 |

| Liberty | 809 |

Read more: Alfa General Insurance Corporation Car Insurance Review

The information in this table is based on J.D. Power’s Customer Satisfaction Index Ranking for the Southeast. You can see that, for North Carolina companies, Erie Insurance is the highest-ranking insurance with a rating of 870. This rating is quite impressive, considering the average rating for the Southeast is 841.

We also must give you the lowest-rated company, which is Liberty Mutual, with a rating of 809. This rating is not bad at all, considering it’s still in the 800s and not that far below the average rating.

Companies with Most Complaints in North Carolina

These are the companies with the most complaints in North Carolina. This information is important to know because complaints can be an indicator of how a company treats its customers, and it can also be used to see how well companies deal with complaints.

| Company Name | Complaint Ratio |

|---|---|

| State Farm | 0.44 |

| Nationwide | 0.28 |

| Geico | 0.62 |

| North Carolina Farm Bureau | 0.66 |

| Amtrust NGH | 0 |

| Allstate Insurance | 0.5 |

| USAA | 0.94 |

| Progressive | 0.75 |

| Erie Insurance | 0.7 |

| Liberty Mutual | 5.95 |

According to this information, the company with the lowest complaint ratio is Amtrust NGH, with an impressive complaint ratio of zero. Conversely, the company with the highest complaint ratio is Liberty Mutual with a complaint ratio of 5.95.

It’s also important to know that the national median for complaint ratios is 1.20, so anything under that is good. In fact, every company on this table has a complaint ratio under 1.20, save for Liberty Mutual.

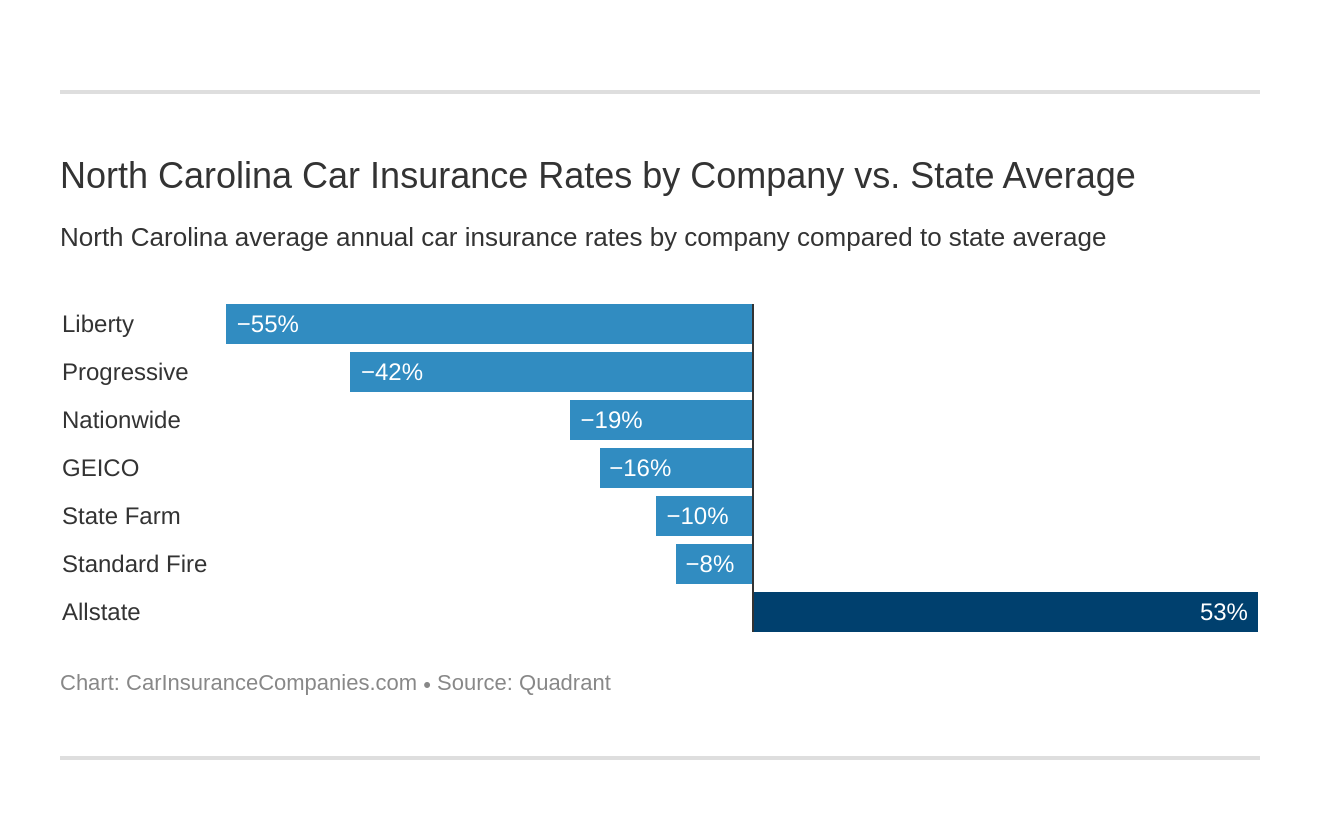

Cheapest Companies in North Carolina

People love the word cheap (most of the time), and it’s no different when it comes to car insurance. Here are the cheapest car insurance companies in North Carolina. This table shows you the cheapest companies, their average cost, and what that cost is compared to the state average in dollars and percentage.

| Company | Average Annual Rate | Compared to State Average ($) | Compared to State Average (%) |

|---|---|---|---|

| Allstate | $7,190.43 | $3,797.32 | 52.81% |

| Geico | $2,936.69 | -$456.43 | -15.54% |

| Liberty Mutual | $2,182.71 | -$1,210.40 | -55.45% |

| Nationwide | $2,848.04 | -$545.08 | -19.14% |

| Progressive | $2,382.61 | -$1,010.50 | -42.41% |

| State Farm | $3,078.65 | -$314.46 | -10.21% |

| Standard Fire | $3,132.66 | -$260.45 | -8.31% |

According to this table, the most expensive company in the “cheapest” category is Allstate. Their average cost is $7,190.43, which is $3,797.32 and 52.81 percent higher than the state average.

The cheapest company in this category is Standard Fire insurance, and their average cost is $3,132.66. This number is $260.45 and 8.31 percent lower than the national average. That’s pretty cheap.

However, it’s important to keep in mind that while it may be exciting to see that a company is this cheap, always remember that cheaper isn’t always better.

Check out other options and find the best North Carolina car insurance company that is right for your needs.

Commute Rates by Companies

One of the factors car insurance companies takes into consideration when deciding how much your insurance costs is your commute. The table below shows the varying costs for different commutes for major car insurance companies in North Carolina. The two major commutes covered are the 10-mile commute with a 6,000 annual mileage, and the 25-mile commute with the 12,000 annual mileage.

Some states have banned discrimination based on your credit score when it comes to auto insurance rates, and this is one of those States.

| Group | Commute And Annual Mileage | Annual Average |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $7,190.43 |

| Allstate | 25 miles commute. 12000 annual mileage. | $7,190.43 |

| Travelers | 10 miles commute. 6000 annual mileage. | $3,132.66 |

| Travelers | 25 miles commute. 12000 annual mileage. | $3,132.66 |

| State Farm | 25 miles commute. 12000 annual mileage. | $3,093.71 |

| State Farm | 10 miles commute. 6000 annual mileage. | $3,063.59 |

| Geico | 10 miles commute. 6000 annual mileage. | $2,936.69 |

| Geico | 25 miles commute. 12000 annual mileage. | $2,936.69 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $2,848.03 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $2,848.03 |

| Progressive | 10 miles commute. 6000 annual mileage. | $2,382.61 |

| Progressive | 25 miles commute. 12000 annual mileage. | $2,382.61 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $2,182.71 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $2,182.71 |

The two most expensive mileages are both for Allstate, and both their 10-mile and 25-mile commutes cost $7,190.43. This is interesting considering the different number of miles cost the same even though one set is twice as much as the other.

Many of the companies have the same price for both numbers of miles.

The only company that doesn’t do this is State Farm, and their 25-mile commute is slightly higher than the 10-mile.

Also, notice that Liberty Mutual is the cheapest company for commutes in North Carolina, with a cost of $2,182.71 for both commute distances.

Coverage Level Rates by Companies

Another way that car insurance companies determine how much you pay for insurance is by how much coverage you get. There are typically three coverage levels for major car insurance companies: high, medium, and low. Most of the time, coverage levels get more expensive with each level up.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $7,473.78 |

| Allstate | Medium | $7,164.38 |

| Allstate | Low | $6,933.13 |

| Travelers | High | $3,279.91 |

| State Farm | High | $3,221.52 |

| Travelers | Medium | $3,116.45 |

| Geico | High | $3,080.53 |

| State Farm | Medium | $3,063.31 |

| Travelers | Low | $3,001.62 |

| Nationwide | High | $2,978.58 |

| State Farm | Low | $2,951.13 |

| Geico | Medium | $2,926.41 |

| Nationwide | Medium | $2,834.35 |

| Geico | Low | $2,803.12 |

| Nationwide | Low | $2,731.17 |

| Progressive | High | $2,517.70 |

| Progressive | Medium | $2,368.67 |

| Liberty Mutual | High | $2,300.51 |

| Progressive | Low | $2,261.45 |

| Liberty Mutual | Medium | $2,169.37 |

| Liberty Mutual | Low | $2,078.26 |

As you can see, the most coverage is high coverage from Allstate, as it costs $7,473.78. Interestingly, the three most expensive coverage rates are all Allstate’s rates. Though they have the most expensive coverages, there are only a few hundred dollars of difference between each coverage type.

This is true of many companies on this list, so getting the highest coverage level is recommended, as you’ll be getting a lot more value for your dollar.

You can also see that from this table that the cheapest company for high ($2,300.51), medium ($2,169.37), and low ($2,078.26) coverage is Liberty Mutual. Thus, Liberty Mutual has the best and cheapest options for both high coverage and low coverage.

Credit History Rates by Companies

Credit history plays a big role when companies decide how much to charge you for car insurance. Make sure to read this table to see how your credit history affects the cost of your car insurance.

A quick tip to help you read the table: the table lists each major car insurance company in North Carolina. The companies have the three levels of credit rating next to them (“good,” “fair,” and “poor”), and next to the level is the amount of money each company charges for that particular rating.

| Group | Credit History | Annual Average |

|---|---|---|

| Allstate | Poor | $9,736.64 |

| Allstate | Fair | $6,309.79 |

| Allstate | Good | $5,524.87 |

| State Farm | Poor | $4,327.76 |

| Travelers | Poor | $3,352.92 |

| Geico | Poor | $3,177.49 |

| Travelers | Fair | $3,043.96 |

| Travelers | Good | $3,001.11 |

| Geico | Fair | $2,922.17 |

| Nationwide | Fair | $2,848.03 |

| Nationwide | Good | $2,848.03 |

| Nationwide | Poor | $2,848.03 |

| State Farm | Fair | $2,763.43 |

| Geico | Good | $2,710.39 |

| Progressive | Poor | $2,689.33 |

| Progressive | Fair | $2,325.80 |

| Liberty Mutual | Fair | $2,182.71 |

| Liberty Mutual | Good | $2,182.71 |

| Liberty Mutual | Poor | $2,182.71 |

| State Farm | Good | $2,144.76 |

| Progressive | Good | $2,132.70 |

You can see that the best company for poor credit ratings is Liberty Mutual, as their cost for poor credit history is $2,182.71.

The best companies for good credit ratings are State Farm ($2,144.76) and Progressive ($2,132.70), and the most expensive company for poor credit history is Allstate, with $9,736.64 as the cost for this type of credit history.

According to Experian, the average credit score for North Carolina is 694. This credit score is considered good, so the companies that provide cheap rates for good credit scores are most relevant to North Carolina drivers.

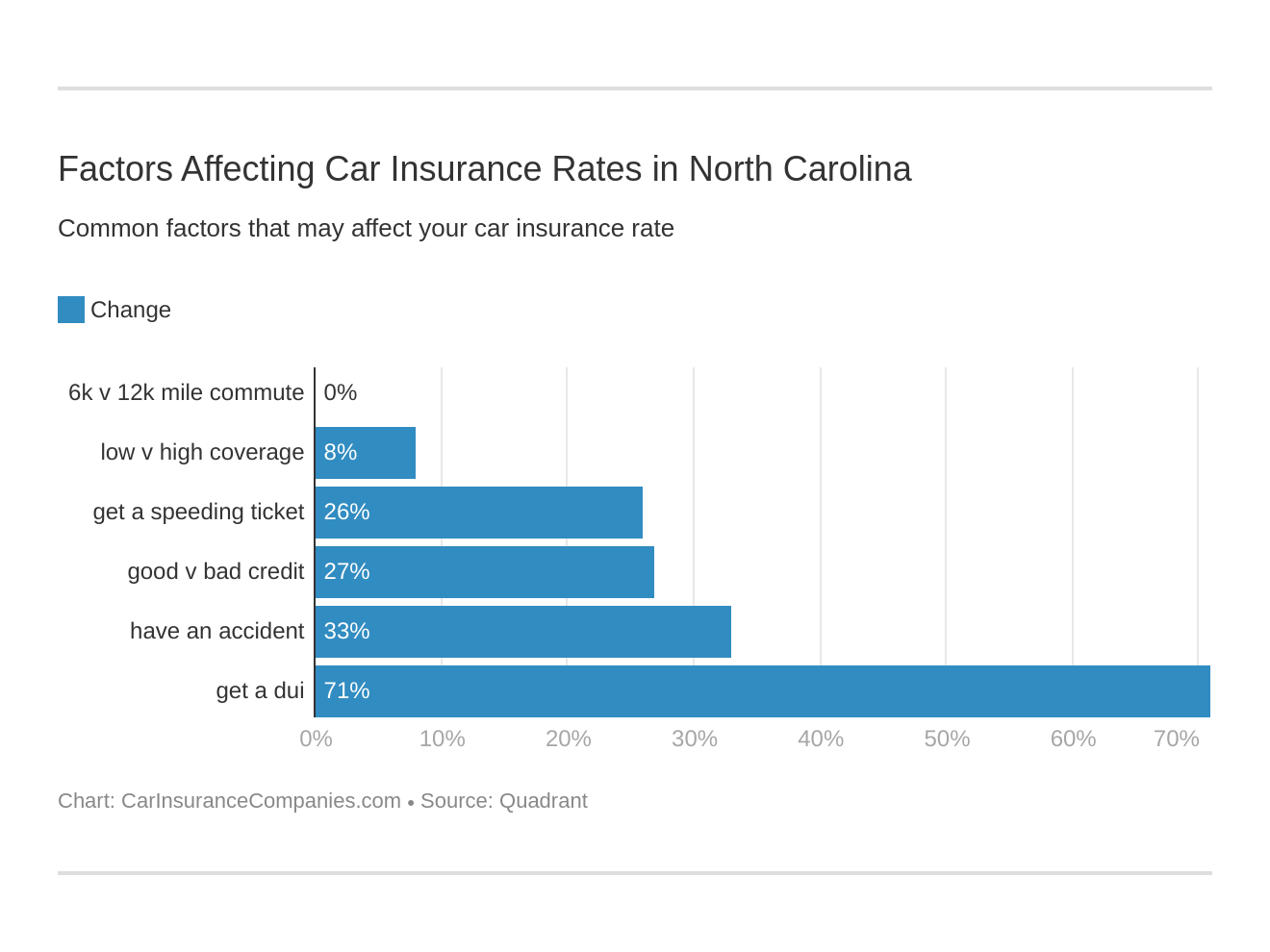

Driving Record Rates by Companies

The final major factor (and a very important one) that insurance companies consider when deciding your car insurance is your driving record. There are a few penalties that insurance companies consider when they gauge your driving record, such as DUIs, speeding violations, and accidents.

Some companies that have pretty fair coverage for these records are Progressive, Nationwide, and Liberty Mutual.

The most expensive driving record is if you have a DUI and you’re covered by Allstate ($12,757.11), and the least expensive driving record is if you have a clean record and are insured by Progressive ($1,124.37).

All the car insurance companies on this list charge the most for having a DUI on your record, so, in addition to all the other reasons, this should be a major incentive to never drink and drive.

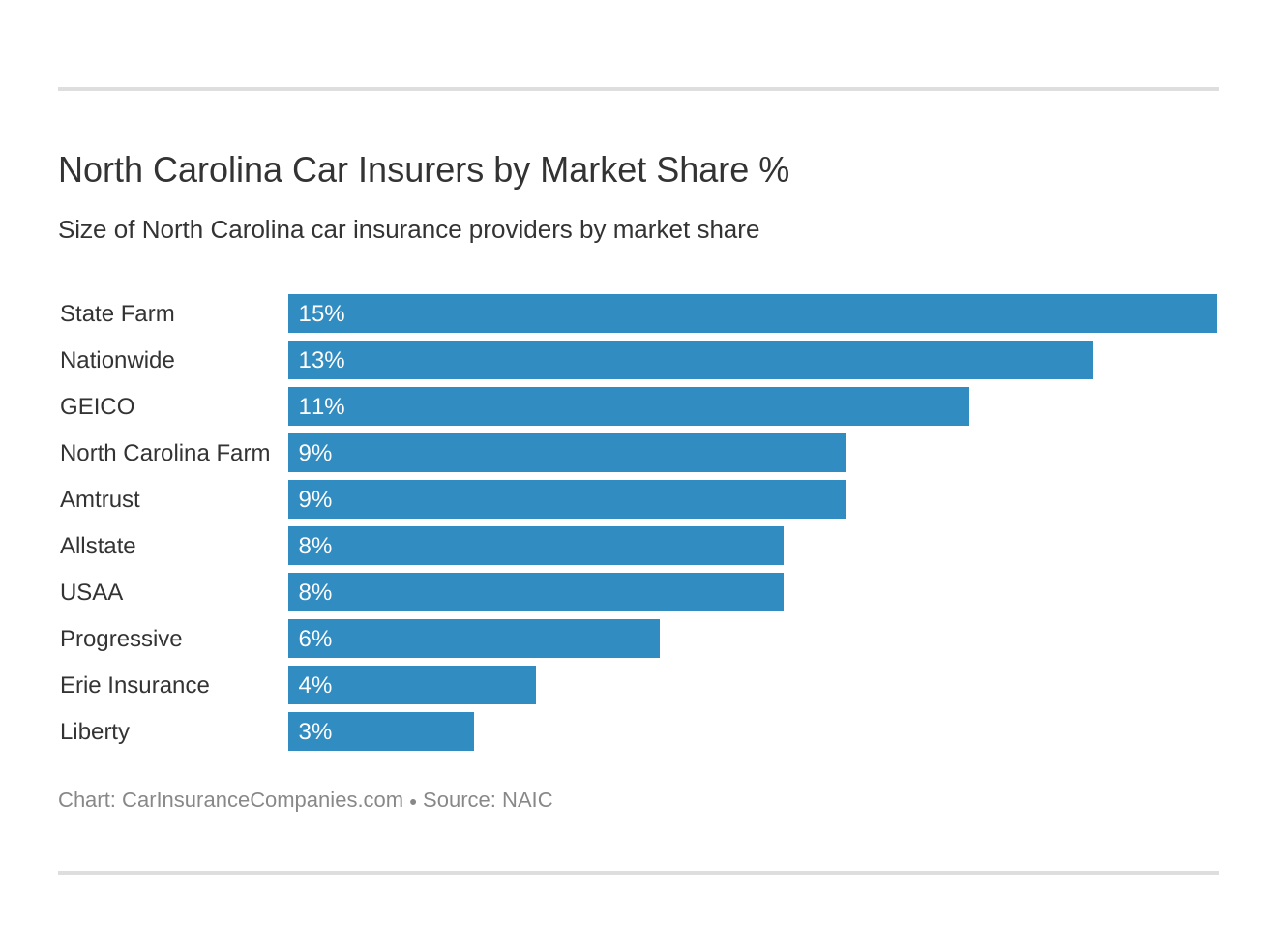

Largest Car Insurance Companies in North Carolina

Now, let’s check out some of the numbers for the largest car insurance companies in North Carolina. This table shows the 10 largest companies in the Old North State as well as their direct premiums written, loss ratios, and market share.

| Rank | Company Group/group/code Company Name | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| 1 | State Farm Group | $915,686 | 70.51% | 15.30% |

| 2 | Nationwide Corp Group | $760,136 | 58.78% | 12.70% |

| 3 | Geico | $670,830 | 68.76% | 11.21% |

| 4 | North Carolina Farm Bureau Group | $566,514 | 70.25% | 9.46% |

| 5 | Amtrust NGH Group | $558,355 | 84.27% | 9.33% |

| 6 | Allstate Insurance Group | $503,501 | 56.64% | 8.41% |

| 7 | USAA Group | $449,687 | 73.96% | 7.51% |

| 8 | Progressive Group | $338,265 | 65.14% | 5.65% |

| 9 | Erie Insurance Group | $226,829 | 69.68% | 3.79% |

| 10 | Liberty Mutual Group | $175,250 | 61.99% | 2.93% |

| - | State Total | $5,986,360 | 68.48% | 100.00% |

As you can see, State Farm has the highest in direct premiums written ($915,686), a loss ratio of 70.51 percent, and a market share of 15.30 percent. The largest company with the lowest of these numbers is Liberty Mutual. It is $175,250 in direct premiums written, a loss ratio of 61.99 percent, and a market share of 2.93 percent.

Lastly, the state total for these numbers is $5,986,360 for direct premiums, 68.48 percent for the loss ratios, and 100 percent for the market share.

Number of Insurers by State

In North Carolina, there are a total of 911 insurance companies. Of these insurers, 56 are domestic, and 855 are foreign.

Domestic insurance companies are within the state, and foreign insurance companies are outside the state.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

North Carolina Laws

This section spells out the driving laws for the state of North Carolina. And yes, we realize that merely reading the words “driving laws” can make you shudder, but they’re not as challenging to understand as you might think.

It’d be great to have a simple way to understand all these driving laws, wouldn’t it? Well, we’re going to make your dreams come true in this section, and we’ll present these laws in a clear way that is easy to understand.

The laws we’ll cover include insurance laws, windshield replacement laws, insurance fraud, the statute of limitations, and many other laws and topics that pertain to laws. (For more information, read our “Does Geico cover windshield replacement?“).

Car Insurance Laws

In this upcoming section, we’re going to examine several different aspects of car insurance laws. Keep reading to learn about the laws that pertain to your driving in North Carolina.

How State Laws for Insurance are Determined

According to the NAIC, for car insurance laws to be passed, there must be prior approval. What is prior approval, you may ask?

According to rmiia.org, prior approval is when rates must be filed with regulators who must then individually approve or disapprove the filing before it can go into effect. The system essentially relies on the regulators’ judgment and the existing political environment for change to be effected.

Windshield Coverage

Though it may not be the first thing on most people’s minds, windshield coverage is a very important part of driving and driving safety.

If, for some reason, your windshield is badly damaged, it’s important that you’re aware of the insurance laws, so you know how to go about getting your windshield replaced.

In North Carolina, the aftermarket parts must be “equal to the original parts in fit, quality, performance and warranty” when the windshield is being replaced, and the insurer must write on the estimate that they are using such parts. Consumers may choose where the repairs are done.

When you get your windshield replaced, it has to be the same as before the accident — no better, no worse.

High-Risk Insurance

If you are a high-risk driver in North Carolina, you must get an SR-22. An SR-22 isn’t a type of insurance; instead, it’s a form your insurance company must fill out and file to prove to the government that you’re adequately insured.

In North Carolina, an SR-22 can be quite expensive, depending on your insurance carrier and the circumstance that required you to get an SR-22.

If you are required to get an SR-22, there are three types of certificates that you can get:

- North Carolina SR22 Operators Certificate:

This covers the driver for the operation of any non-owned vehicle they have been given permission to drive. - North Carolina SR22 Owners Certificate:

This covers the driver to be able to drive their cars. The certificate may be issued with the details of the make and model of the driver’s automobile, or it may cover any vehicle owned by the driver. - North Carolina SR22 Operators-Owners Certificate:

This covers any vehicles owned by the driver and any vehicles that are not owned, but the driver has been given permission to drive.

While it may not be ideal that you have to get an SR-22, make sure to get one. If you follow the protocol and drive safely, you’ll soon be back to driving normally and having normal insurance.

Low-Cost Insurance

North Carolina has a program for high-risk drivers, but they don’t have a program for low-cost insurance for drivers (yet).

There are only three states with this program: Hawaii, California, and New Jersey.

Automobile Insurance Fraud in North Carolina

In North Carolina, automobile insurance fraud is a serious offense. It is defined as a fraud in the context of insurance, which refers to any duplicitous act performed with the intent to obtain an improper payment from an insurer.

Insurance fraud can take many forms, but many instances in North Carolina involve automobile repair or automobile accidents.

Some examples of this are falsely reporting lost or damaged parts, billing for excessive final cost, referring customers to medical or legal offices for a fee, disregarding or giving up right of way to cause an accident, or fraudulently reporting vehicles as stolen or vandalized to collect insurance money.

If you suspect any insurance fraud, please contact the state insurance department:

Website: https://www.ncdoi.gov/ – Phone: (855) 408-1212

Statute of Limitations

In North Carolina, there is a statute of limitations, which is any law barring claims after a certain period of time after an injury or property damage. The statute of limitations applies to both personal injury and property damage.

For either type of claim, the maximum amount of time you have to file a claim is three years.

State-Specific Laws

In regard to state-specific laws, North Carolina has very similar laws to other states in their region. The main things to consider are night driving laws, which are strict for young drivers. When you have your permit, you’re not allowed to drive between 9 p.m. and 5 a.m. for the first six months.

Vehicle Licensing Laws

Let’s check out some important laws regarding the licensing of your vehicle.

REAL ID

North Carolina is compliant with the REAL ID Act. Therefore you are required to have a REAL ID, U.S. passport, or another federally approved identification to board commercial flights and enter secure federal buildings.

Essentially, the Real ID establishes minimum security for license issuance and production. It also prohibits federal agencies from for certain purposes driver’s licenses and identification cards from states not meeting the Act’s minimum standards.

Penalties for Driving Without Insurance

You must always drive with insurance. Failure to do so will result in consequences. The first time, you will have a fine of $50, and your license will be suspended until you have proof of financial responsibility. There is also a $50 restoration fee and a license plate fee.

The second time is a $100 fine plus a $50 restoration fee, plus a license plate fee.

To avoid incurring these fines, have one (or all, no judgment) of these proofs of insurance when you drive:

- An FS-1 form issued by your insurance agent certifying that you currently hold an insurance policy.

- Your NC car insurance policy.

- An insurance binder.

- An insurance card.

Teen Driver Laws

Teen drivers in North Carolina have to wait until they are 15 to get their permit. There’s a mandatory holding period of 12 months, and every teen must drive 60 hours, 10 of which must be at night in the learner phase.

In the intermediate phase, six hours of driving must be at night, but there must be 12 hours total.

Teens must be at least 16 to get their full license.

Older Driver License Renewal Procedures

If you’re an older driver who wants to get your license renewed in N.C., there are certain rules you have to follow. If you’re over 66, you must get your license renewed every five years, and you can’t get it renewed via the mail or online if you’re 65 or older.

If you’re part of the general population, you can wait every eight years to get your license renewed.

New Residents

If you’re a new resident getting a North Carolina license, you can get one online or in person.

While doing it online is more convenient, you need to get a new license in person if one of the following applies to you:

- Having a suspended license or outstanding debt with NCDMV

- Having a restriction other than “Corrective Lenses” on their driver license

- Needing to renew a commercial driver license, regular Class A or B driver license, full or limited provisional license, limited learner permit, learner permit or state ID

- Having a U.S. government document indicating legal presence

- Needing to change your address

When you get a new license in person, you need to bring two forms of identity to prove it’s you, and a Social Security card.

License Renewal Procedures

If you’ve just moved to North Carolina, you must get a North Carolina license within 60 days of moving there. To get this new license, a new resident must visit a North Carolina DMV and provide one of the following:

- Out-of-state license or one document (with full name) proving identity and date of birth

- Social Security card or other document proving Social Security number

- One document verifying physical address in North Carolina (two are required if getting an NC REAL ID)

- For individuals not born in the U.S., one document (with full name) proving legal presence/lawful status

- A document proving liability insurance coverage from a provider licensed to do business in North Carolina

There is usually no need to take a written test unless the applicant has committed a driving violation or suffers from a severe mental or physical condition.

Negligent Operator Treatment System (NOTS)

Though California is the only state to use a negligent operator treatment system, North Carolina certainly enforces a point system. This is used to keep track of traffic violations. If you have more points, your insurance rates will go up. If you get more than 12 points in three years, your license will get suspended.

Rules of the Road

Here are some rules so you can share the roads safely with your fellow drivers.

Fault vs. No-Fault

North Carolina is known as an at-fault state, and they use contributory negligence to determine who pays for the accident. This means you have to have absolutely no fault if you want to receive a payout from the other party.

Seat Belt and Car Seat Laws

In North Carolina, if you’re 16 years old or older, you must wear a seatbelt regardless of what seat you’re in. If you fail to do so, it is a $25 fine. If a child is 7 years old and less than 80 pounds, they must be in a safety seat.

A child can use an adult belt if they’re 8-15 years, if they weigh more than 40 lbs, or if they are 4-7 years old in a seating position where there is no available lap/shoulder belt.

Keep Right and Move Over Laws

While driving in North Carolina, you must keep right – out of the far left lane – if you’re driving slower than the speed limit. This makes the road easier to use for everyone.

The move over laws in North Carolina also requires drivers approaching a stationary emergency vehicle displaying flashing lights (including towing and recovery vehicles, traveling in the same direction) to vacate the lane closest if safe and possible to do so, or they must slow to a safe speed.

The law also includes utility vehicles, municipal vehicles, and road maintenance vehicles.

Speed Limits

In North Carolina, there are a few different speed limits, depending on what kind of road you’re driving on. If you’re driving on a rural or urban interstate, you’re expected to drive 70 miles per hour.

This 70 mph speed limit standard also applies to other limited-access roads. In fact, the only road type that is not 70 miles per hour is the category “other roads,” and the speed limit for them is 55 miles per hour.

Ridesharing

Ridesharing is an international trend that has made life more convenient for many. However, one must be aware of the driving laws that surround ridesharing before choosing to drive to earn some extra cash.

When driving for a ridesharing service, you must get insurance specifically for ridesharing.

The insurance carriers in North Carolina that provide this insurance are Farmers and Liberty Mutual. In addition to having special ridesharing insurance, you must also have the minimum coverage and liability insurance that North Carolina requires for regular drivers.

Automation on the Road

In North Carolina, automated vehicles can be deployed on the streets. Additionally, sometimes the operator of the vehicle needs a license (depending on the vehicle), but it’s not required that the operator is in the vehicle.

Finally, all automated vehicles must have liability insurance, just in case.

Safety Laws

Now, let’s move on to some laws regarding safety. These laws are crucial because they not only keep you safe, but it keeps other North Carolina Drivers safe, too.

DUI Laws

North Carolina, like many states, has stringent DUI laws. This makes sense, as DUIs cause many unnecessary deaths every year. In fact, according to responsibility.org, there were 413 DUI-related fatalities in 2017 alone; 46 of them were people under the age of 21.

| DUI Law | Details |

|---|---|

| BAC Limit | 0..08% |

| High BAC | 0.15% |

| Criminal Status By Offense | 1st-3rd classified as level 1-5 based on sentence length, 4th+ class F felony |

| Formal Name for Offense | Driving While Impaired (DWI) |

| Look Back/Washout Period | 7 years |

Below is a table that shows all the penalties associated with the varying levels of DUIs.

| Offense Number | Suspension/Revocation | Imprisonment | Fine | Other |

|---|---|---|---|---|

| 1st Offense | 60 day suspension, 1 year revocation | 1 day minimum. | No minimum | N/A |

| 2nd Offense | 2nd in 3 years: 4 year revocation; 1 year if 2nd in 4+ years | 4 days minimum | No minimum | 24-72 hours community service |

| 3rd Offense | 1 year minimum, but permanent revocation possible; IID required for 7 years if restoration granted | 14 days - 2 years | No minimum | Possible vehicle seizure |

| 4th Offense | Permanent revocation; IID required for 7 years if restoration granted | 12 months minimum | No minimum | N/A |

As you can see, each offense brings a more and more severe penalty. For your first offense, your license gets suspended for either 60 days or revoked for a year, and you may receive prison time. For the second offense, prison is required, and community service gets tacked on, too.

By the fourth offense, you lose your license permanently and have to spend at least a year in prison.

Moral of the story: never drink and drive.

Marijuana-Impaired Driving Laws

In North Carolina, there is no specific law for drugged driving.

Distracted Driving Laws

In North Carolina, you are allowed to speak on the cellphone while you drive. However, if you’re under 18, don’t even think about it because it’s against the law.

And no matter what your age, you should never text, as it’s illegal and highly dangerous.

Driving Safely in North Carolina

Driving is an essential part of most North Carolinians’ lives. And the goal of driving is to get from Point A to Point B as quickly and safely as possible. For this section, we’re going to emphasize the safety part of this statement.

Keep reading to learn about North Carolina’s safety statistics so you can be aware of accidents and where/how they occur. It may seem a bit morbid, but by knowing this information, you’ll be safer in the future.

Vehicle Theft in North Carolina

Crime is an unavoidable part of life and driving.

By knowing which kind of cars are most frequently stolen, you can have a better idea of which cars to avoid buying, and if you have a model that’s stolen often, you can take extra measures to ensure your car’s safety.

| Rank | Model | Year of Model | Thefts |

|---|---|---|---|

| 1 | Honda Accord | 1997 | 609 |

| 2 | Ford Pickup (Full Size) | 2004 | 424 |

| 3 | Chevrolet Pickup (Full Size) | 2003 | 370 |

| 4 | Honda Civic | 2000 | 350 |

| 5 | Toyota Camry | 2014 | 291 |

| 6 | Nissan Altima | 2015 | 249 |

| 7 | Jeep Cherokee/Grand Cherokee | 1999 | 203 |

| 8 | Chevrolet Impala | 2006 | 194 |

| 9 | Toyota Corolla | 2014 | 190 |

| 10 | Ford Explorer | 2003 | 185 |

Based on this information, the most stolen car is the 1997 Honda Accord (609 thefts). Another car that has many vehicle thefts is a Ford pickup truck from 2004 (424). The least popular car amongst car thieves on this list is the 2003 (185) Ford Explorer. Even so, the fact that it’s on this list means that it is still stolen quite a bit.

If you want a more in-depth look at which car types are stolen and the number of cars stolen by each city in North Carolina, here is a report conducted by the FBI.

Road Fatalities in North Carolina

Now, let’s move along to examine road fatalities in North Carolina. Once again, we know that this isn’t the most cheerful information, but it truly is important to make your driving safer.

So, read on to improve your safety.

Most Fatal Highway in North Carolina

The most dangerous highway in North Carolina is I-95. In the last decade alone, it has had over 200 fatal crashes.

Fatal Crashes by Weather Condition and Light Condition

It’s also essential to know about how weather conditions and light conditions affect accidents while you drive. This table will hopefully give you a better understanding of the relationship between weather and light and accidents on the road.

The table shows the different weather types and times of day during which fatalities happen, as well as the totals for each category.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 619 | 132 | 384 | 47 | 2 | 1,184 |

| Rain | 38 | 18 | 31 | 7 | 0 | 94 |

| Snow/Sleet | 4 | 1 | 2 | 2 | 0 | 9 |

| Other | 2 | 2 | 12 | 2 | 0 | 18 |

| Unknown | 0 | 0 | 0 | 0 | 1 | 1 |

| TOTAL | 663 | 153 | 429 | 58 | 3 | 1,306 |

Based on this table, it seems like the most fatalities happen during the daylight in normal weather. This may seem strange, but there are a lot more drivers during this time, which means there’s a higher chance of an accident occurring.

Also, notice that many fatalities happen at night, which is to be expected.

Fatalities (All Crashes) by County

Now, let’s check out the driving fatalities for North Carolina drivers by county. To make this information a little easier to digest, we’ve compiled all the data and put it in a table. This table shows the number of fatalities in each county from 2014-2018.

| County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Alamance | 9 | 24 | 15 | 26 | 15 |

| Alexander | 6 | 6 | 4 | 1 | 8 |

| Alleghany | 0 | 2 | 1 | 2 | 2 |

| Anson | 8 | 2 | 1 | 6 | 5 |

| Ashe | 2 | 6 | 7 | 2 | 1 |

| Avery | 0 | 3 | 3 | 2 | 2 |

| Beaufort | 7 | 5 | 6 | 11 | 7 |

| Bertie | 11 | 6 | 7 | 8 | 7 |

| Bladen | 9 | 4 | 16 | 10 | 10 |

| Brunswick | 13 | 12 | 15 | 30 | 24 |

| Buncombe | 29 | 36 | 25 | 32 | 34 |

| Burke | 16 | 8 | 16 | 17 | 20 |

| Cabarrus | 17 | 24 | 23 | 17 | 18 |

| Caldwell | 9 | 12 | 10 | 6 | 14 |

| Camden | 4 | 0 | 0 | 2 | 2 |

| Carteret | 4 | 4 | 9 | 3 | 10 |

| Caswell | 4 | 6 | 7 | 6 | 5 |

| Catawba | 24 | 28 | 15 | 19 | 14 |

| Chatham | 12 | 12 | 15 | 13 | 10 |

| Cherokee | 5 | 5 | 6 | 11 | 6 |

| Chowan | 3 | 1 | 2 | 3 | 1 |

| Clay | 1 | 2 | 2 | 3 | 3 |

| Cleveland | 16 | 20 | 33 | 10 | 32 |

| Columbus | 18 | 14 | 26 | 30 | 17 |

| Craven | 10 | 16 | 19 | 9 | 10 |

| Cumberland | 40 | 43 | 43 | 43 | 46 |

| Currituck | 4 | 4 | 9 | 5 | 0 |

| Dare | 2 | 2 | 4 | 2 | 5 |

| Davidson | 24 | 28 | 34 | 23 | 34 |

| Davie | 7 | 6 | 7 | 9 | 6 |

| Duplin | 17 | 20 | 8 | 9 | 18 |

| Durham | 26 | 25 | 22 | 31 | 31 |

| Edgecombe | 9 | 11 | 7 | 14 | 11 |

| Forsyth | 34 | 40 | 42 | 42 | 45 |

| Franklin | 4 | 7 | 19 | 14 | 10 |

| Gaston | 31 | 40 | 29 | 23 | 32 |

| Gates | 5 | 4 | 3 | 2 | 2 |

| Graham | 3 | 3 | 5 | 2 | 5 |

| Granville | 18 | 12 | 12 | 12 | 17 |

| Greene | 3 | 5 | 1 | 5 | 2 |

| Guilford | 57 | 57 | 59 | 66 | 60 |

| Halifax | 9 | 12 | 10 | 12 | 15 |

| Harnett | 23 | 23 | 22 | 34 | 37 |

| Haywood | 6 | 8 | 14 | 10 | 12 |

| Henderson | 16 | 9 | 14 | 12 | 12 |

| Hertford | 1 | 4 | 7 | 8 | 3 |

| Hoke | 11 | 15 | 15 | 18 | 5 |

| Hyde | 1 | 1 | 0 | 1 | 1 |

| Iredell | 27 | 18 | 23 | 31 | 24 |

| Jackson | 7 | 6 | 10 | 4 | 8 |

| Johnston | 36 | 27 | 34 | 32 | 34 |

| Jones | 2 | 1 | 3 | 3 | 4 |

| Lee | 7 | 21 | 8 | 19 | 13 |

| Lenoir | 11 | 9 | 9 | 3 | 19 |

| Lincoln | 7 | 19 | 14 | 14 | 11 |

| Macon | 9 | 5 | 8 | 7 | 6 |

| Madison | 4 | 3 | 3 | 6 | 7 |

| Martin | 3 | 2 | 7 | 4 | 3 |

| Mcdowell | 9 | 5 | 8 | 5 | 8 |

| Mecklenburg | 69 | 80 | 103 | 114 | 115 |

| Mitchell | 0 | 2 | 2 | 0 | 1 |

| Montgomery | 10 | 3 | 8 | 13 | 5 |

| Moore | 26 | 16 | 19 | 19 | 15 |

| Nash | 24 | 24 | 27 | 17 | 30 |

| New Hanover | 18 | 22 | 20 | 18 | 12 |

| Northampton | 9 | 5 | 2 | 9 | 10 |

| Onslow | 23 | 24 | 20 | 18 | 20 |

| Orange | 10 | 12 | 12 | 10 | 8 |

| Pamlico | 3 | 5 | 3 | 0 | 0 |

| Pasquotank | 3 | 4 | 4 | 2 | 8 |

| Pender | 19 | 14 | 16 | 17 | 29 |

| Perquimans | 0 | 2 | 1 | 0 | 3 |

| Person | 7 | 6 | 3 | 9 | 4 |

| Pitt | 16 | 32 | 22 | 21 | 20 |

| Polk | 6 | 4 | 2 | 3 | 4 |

| Randolph | 23 | 26 | 17 | 25 | 16 |

| Richmond | 9 | 5 | 17 | 9 | 12 |

| Robeson | 32 | 53 | 38 | 53 | 49 |

| Rockingham | 11 | 15 | 20 | 8 | 12 |

| Rowan | 27 | 23 | 20 | 14 | 23 |

| Rutherford | 14 | 6 | 6 | 11 | 10 |

| Sampson | 10 | 25 | 24 | 18 | 17 |

| Scotland | 8 | 9 | 5 | 10 | 5 |

| Stanly | 8 | 11 | 13 | 12 | 6 |

| Stokes | 8 | 9 | 9 | 7 | 6 |

| Surry | 18 | 16 | 18 | 8 | 11 |

| Swain | 2 | 1 | 2 | 1 | 2 |

| Transylvania | 7 | 5 | 1 | 7 | 4 |

| Tyrrell | 0 | 0 | 0 | 0 | 0 |

| Union | 18 | 16 | 27 | 28 | 24 |

| Vance | 9 | 10 | 9 | 9 | 8 |

| Wake | 63 | 65 | 81 | 53 | 66 |

| Warren | 3 | 6 | 10 | 6 | 8 |

| Washington | 0 | 3 | 2 | 3 | 3 |

| Watauga | 3 | 12 | 5 | 4 | 3 |

| Wayne | 22 | 17 | 24 | 13 | 18 |

| Wilkes | 13 | 12 | 11 | 12 | 8 |

| Wilson | 14 | 15 | 18 | 20 | 12 |

| Yadkin | 6 | 8 | 8 | 6 | 4 |

| Yancey | 3 | 3 | 5 | 1 | 3 |

Read more:

According to this data, Robeson County has a high number of fatalities, with 49 in 2018 and 53 in 2017. Wake County’s numbers are quite high, too, as they had a massive number (81) of fatalities in 2016. Tragically, Mecklenburg County had the highest amount of fatalities in recent years, with 115 in 2018.

Conversely, Perquimans County had a low number of fatalities over those years, with the highest number just being three.

While any fatalities are tragic, having three compared to a high amount of fatalities is much better.

The county with the lowest number of fatalities is Tyrell County. Amazingly, they have zero fatalities from 2014-2018. That’s quite impressive and good for the citizens of that county.

Traffic Fatalities

According to NHTSA, there were 37,461 traffic fatalities in North Carolina in 2016. Of those fatalities, 18,590 happened in rural areas, 17,656 happened in urban areas, and 1,215 happened in unknown areas.

Fatalities by Person Type

This table shows the fatalities by person type in North Carolina. Note: this has nothing to do with demographics; it’s merely what kind of passenger the person was and what kind of car they were in.

| Person Type | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|

| Passenger Car | 533 | 517 | 605 | 582 | 581 |

| Light Truck - Pickup | 149 | 152 | 154 | 177 | 151 |

| Light Truck - Utility | 146 | 144 | 149 | 184 | 170 |

| Light Truck - Van | 43 | 52 | 39 | 55 | 51 |

| Light Truck - Other | 1 | 0 | 1 | 1 | 3 |

| Large Truck | 16 | 20 | 19 | 20 | 29 |

| Other/Unknown Occupants | 16 | 16 | 8 | 18 | 21 |

| Bicyclist and Other Cyclist | 22 | 19 | 23 | 17 | 29 |

| Bus | 0 | 0 | 0 | 4 | 0 |

| Pedestrian | 174 | 172 | 182 | 200 | 198 |

According to this data, being a passenger in the car is the most fatal person type. It appears that the safest type of person is one who drives in a light truck.

Fatalities by Crash Type

This table details the fatalities by crash type in North Carolina.

North Carolina Fatalities

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Mecklenburg | 67 | 69 | 80 | 103 | 114 |

| Wake | 73 | 63 | 65 | 81 | 53 |

| Guilford | 44 | 57 | 57 | 59 | 66 |

| Cumberland | 53 | 40 | 43 | 43 | 43 |

| Forsyth | 27 | 34 | 40 | 42 | 42 |

| Robeson | 42 | 32 | 53 | 38 | 53 |

| Johnston | 28 | 36 | 27 | 34 | 32 |

| Buncombe | 35 | 29 | 36 | 25 | 32 |

| Harnett | 27 | 23 | 23 | 22 | 34 |

| Durham | 25 | 26 | 25 | 22 | 31 |

Based on this data, you can see that a single-vehicle accident is the leading cause of death. It seems that owning a single large truck holds the least risk of death.

Read more: Alamance Farmers Mutual Insurance Company Car Insurance Review

Five-Year Trend For the Top 10 Counties

Fatalities are tragic, but they are an inescapable part of driving. If you learn how many fatalities are in your county over a five-year trend, it can heighten your caution and awareness while driving, so maybe we can have fewer fatalities in the future.

North Carolina Fatalities

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Mecklenburg | 67 | 69 | 80 | 103 | 114 |

| Wake | 73 | 63 | 65 | 81 | 53 |

| Guilford | 44 | 57 | 57 | 59 | 66 |

| Cumberland | 53 | 40 | 43 | 43 | 43 |

| Forsyth | 27 | 34 | 40 | 42 | 42 |

| Robeson | 42 | 32 | 53 | 38 | 53 |

| Johnston | 28 | 36 | 27 | 34 | 32 |

| Buncombe | 35 | 29 | 36 | 25 | 32 |

| Harnett | 27 | 23 | 23 | 22 | 34 |

| Durham | 25 | 26 | 25 | 22 | 31 |

As you can see from the table, Mecklenberg had the most fatalities out of any year and county in 2017. It’s also the most dangerous county of these 10 counties.

It seems that Durham is the safest city, according to this data. But remember that even though the numbers are low, it’s important to always drive with caution.

Fatalities Involving Speeding by County

Speeding is one of the leading causes of death when driving. Avoid speeding at all costs.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Alamance | 11 | 2 | 6 | 4 | 8 |

| Alexander | 5 | 2 | 2 | 0 | 1 |

| Alleghany | 0 | 0 | 1 | 0 | 1 |

| Anson | 1 | 4 | 0 | 1 | 0 |

| Ashe | 0 | 0 | 1 | 1 | 0 |

| Avery | 1 | 0 | 0 | 2 | 0 |

| Beaufort | 0 | 1 | 1 | 2 | 1 |

| Bertie | 3 | 4 | 3 | 2 | 4 |

| Bladen | 3 | 1 | 1 | 6 | 3 |

| Brunswick | 4 | 4 | 4 | 5 | 8 |

| Buncombe | 9 | 8 | 15 | 8 | 9 |

| Burke | 2 | 6 | 2 | 5 | 2 |

| Cabarrus | 8 | 4 | 13 | 12 | 5 |

| Caldwell | 2 | 5 | 5 | 6 | 2 |

| Camden | 0 | 0 | 0 | 0 | 0 |

| Carteret | 2 | 2 | 2 | 4 | 1 |

| Caswell | 1 | 2 | 4 | 4 | 3 |

| Catawba | 3 | 11 | 5 | 5 | 4 |

| Chatham | 3 | 2 | 3 | 8 | 3 |

| Cherokee | 1 | 1 | 5 | 1 | 1 |

| Chowan | 0 | 1 | 0 | 2 | 3 |

| Clay | 1 | 0 | 1 | 0 | 1 |

| Cleveland | 1 | 9 | 8 | 18 | 2 |

| Columbus | 6 | 5 | 2 | 7 | 6 |

| Craven | 3 | 6 | 6 | 8 | 2 |

| Cumberland | 15 | 14 | 14 | 25 | 13 |

| Currituck | 2 | 1 | 0 | 1 | 1 |

| Dare | 1 | 1 | 1 | 0 | 0 |

| Davidson | 13 | 12 | 14 | 17 | 12 |

| Davie | 1 | 3 | 2 | 5 | 5 |

| Duplin | 2 | 9 | 4 | 3 | 0 |

| Durham | 6 | 11 | 11 | 10 | 17 |

| Edgecombe | 1 | 6 | 7 | 5 | 2 |

| Forsyth | 11 | 12 | 10 | 14 | 11 |

| Franklin | 3 | 2 | 1 | 5 | 5 |

| Gaston | 6 | 15 | 12 | 14 | 10 |

| Gates | 2 | 2 | 3 | 1 | 1 |

| Graham | 2 | 2 | 2 | 2 | 0 |

| Granville | 3 | 5 | 2 | 4 | 7 |

| Greene | 1 | 1 | 4 | 0 | 1 |

| Guilford | 13 | 27 | 25 | 26 | 19 |

| Halifax | 4 | 5 | 6 | 2 | 8 |

| Harnett | 13 | 11 | 13 | 9 | 14 |

| Haywood | 1 | 3 | 3 | 4 | 2 |

| Henderson | 2 | 9 | 3 | 4 | 2 |

| Hertford | 1 | 0 | 3 | 5 | 1 |

| Hoke | 2 | 2 | 12 | 6 | 9 |

| Hyde | 0 | 0 | 1 | 0 | 1 |

| Iredell | 4 | 6 | 8 | 7 | 3 |

| Jackson | 1 | 4 | 3 | 5 | 3 |

| Johnston | 10 | 11 | 17 | 14 | 9 |

| Jones | 0 | 0 | 0 | 2 | 1 |

| Lee | 8 | 2 | 7 | 2 | 10 |

| Lenoir | 0 | 2 | 2 | 2 | 1 |

| Lincoln | 4 | 1 | 9 | 6 | 4 |

| Macon | 1 | 5 | 3 | 2 | 2 |

| Madison | 0 | 4 | 2 | 3 | 3 |

| Martin | 0 | 2 | 2 | 3 | 2 |

| Mcdowell | 2 | 4 | 3 | 1 | 3 |

| Mecklenburg | 28 | 19 | 44 | 49 | 41 |

| Mitchell | 1 | 0 | 1 | 0 | 0 |

| Montgomery | 2 | 3 | 1 | 4 | 2 |

| Moore | 3 | 13 | 5 | 9 | 3 |

| Nash | 4 | 13 | 9 | 9 | 5 |

| New Hanover | 5 | 8 | 8 | 6 | 4 |

| Northampton | 0 | 1 | 1 | 1 | 1 |

| Onslow | 10 | 12 | 16 | 6 | 5 |

| Orange | 11 | 5 | 7 | 3 | 4 |

| Pamlico | 2 | 2 | 3 | 1 | 0 |

| Pasquotank | 0 | 2 | 1 | 1 | 0 |

| Pender | 7 | 8 | 6 | 0 | 5 |

| Perquimans | 0 | 0 | 1 | 0 | 0 |

| Person | 2 | 4 | 2 | 1 | 2 |

| Pitt | 7 | 5 | 7 | 4 | 2 |

| Polk | 2 | 4 | 2 | 1 | 0 |

| Randolph | 8 | 10 | 14 | 9 | 7 |

| Richmond | 4 | 0 | 1 | 7 | 3 |

| Robeson | 19 | 20 | 18 | 20 | 20 |

| Rockingham | 2 | 5 | 6 | 9 | 2 |

| Rowan | 11 | 8 | 6 | 7 | 3 |

| Rutherford | 4 | 6 | 2 | 3 | 2 |

| Sampson | 5 | 0 | 7 | 7 | 2 |

| Scotland | 3 | 3 | 6 | 1 | 3 |

| Stanly | 5 | 5 | 3 | 5 | 3 |

| Stokes | 2 | 3 | 3 | 4 | 2 |

| Surry | 4 | 6 | 5 | 2 | 2 |

| Swain | 2 | 0 | 0 | 2 | 0 |

| Transylvania | 1 | 4 | 2 | 0 | 6 |

| Tyrrell | 0 | 0 | 0 | 0 | 0 |

| Union | 1 | 5 | 8 | 7 | 11 |

| Vance | 6 | 4 | 2 | 4 | 2 |

| Wake | 29 | 21 | 24 | 33 | 6 |

| Warren | 0 | 1 | 0 | 3 | 3 |

| Washington | 0 | 0 | 0 | 1 | 1 |

| Watauga | 2 | 1 | 6 | 4 | 1 |

| Wayne | 5 | 7 | 6 | 11 | 5 |

| Wilkes | 1 | 5 | 5 | 3 | 3 |

| Wilson | 5 | 4 | 4 | 4 | 8 |

| Yadkin | 4 | 5 | 4 | 1 | 1 |

| Yancey | 1 | 1 | 2 | 4 | 1 |

As you can see, Guilford and Mecklenberg have a considerable amount of fatalities involving speeding. Alleghany and Ashe have less of these types of fatalities.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

In addition to speeding, drinking and driving can have catastrophic results. Drinking and driving is never the answer; always find another way home.

| County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Alamance | 6 | 3 | 6 | 4 | 10 |

| Alexander | 2 | 2 | 2 | 1 | 0 |

| Alleghany | 1 | 0 | 0 | 0 | 0 |

| Anson | 1 | 3 | 0 | 0 | 2 |

| Ashe | 1 | 0 | 0 | 3 | 1 |

| Avery | 1 | 0 | 1 | 0 | 0 |

| Beaufort | 3 | 2 | 0 | 1 | 1 |

| Bertie | 0 | 2 | 3 | 3 | 3 |

| Bladen | 5 | 0 | 0 | 6 | 4 |

| Brunswick | 5 | 5 | 4 | 5 | 11 |

| Buncombe | 4 | 9 | 5 | 9 | 7 |

| Burke | 3 | 3 | 1 | 3 | 4 |

| Cabarrus | 3 | 5 | 8 | 9 | 3 |

| Caldwell | 1 | 5 | 6 | 5 | 3 |

| Camden | 0 | 0 | 0 | 0 | 1 |

| Carteret | 1 | 2 | 1 | 0 | 1 |

| Caswell | 1 | 2 | 2 | 3 | 2 |

| Catawba | 6 | 10 | 8 | 5 | 6 |

| Chatham | 5 | 1 | 2 | 3 | 5 |

| Cherokee | 3 | 1 | 3 | 1 | 3 |

| Chowan | 0 | 1 | 0 | 1 | 1 |

| Clay | 0 | 0 | 1 | 1 | 0 |

| Cleveland | 3 | 6 | 5 | 13 | 4 |

| Columbus | 8 | 5 | 2 | 7 | 4 |

| Craven | 5 | 3 | 3 | 6 | 1 |

| Cumberland | 15 | 11 | 12 | 17 | 11 |

| Currituck | 0 | 2 | 1 | 0 | 1 |

| Dare | 0 | 1 | 0 | 0 | 1 |

| Davidson | 6 | 8 | 9 | 10 | 8 |

| Davie | 0 | 2 | 1 | 2 | 2 |

| Duplin | 3 | 5 | 3 | 2 | 1 |

| Durham | 4 | 11 | 6 | 7 | 12 |

| Edgecombe | 3 | 2 | 3 | 4 | 5 |

| Forsyth | 8 | 12 | 10 | 18 | 12 |

| Franklin | 2 | 1 | 3 | 5 | 6 |

| Gaston | 3 | 10 | 10 | 8 | 5 |

| Gates | 0 | 1 | 1 | 0 | 1 |

| Graham | 0 | 0 | 1 | 0 | 0 |

| Granville | 3 | 4 | 3 | 3 | 3 |

| Greene | 2 | 0 | 2 | 0 | 1 |

| Guilford | 14 | 14 | 19 | 20 | 26 |

| Halifax | 5 | 4 | 5 | 1 | 5 |

| Harnett | 9 | 6 | 8 | 7 | 7 |

| Haywood | 0 | 2 | 0 | 3 | 2 |

| Henderson | 1 | 3 | 0 | 2 | 3 |

| Hertford | 1 | 0 | 1 | 4 | 4 |

| Hoke | 1 | 3 | 8 | 5 | 6 |

| Hyde | 0 | 0 | 1 | 0 | 0 |

| Iredell | 7 | 8 | 4 | 8 | 8 |

| Jackson | 2 | 2 | 1 | 2 | 2 |

| Johnston | 6 | 5 | 6 | 12 | 12 |

| Jones | 0 | 0 | 0 | 1 | 0 |

| Lee | 7 | 1 | 7 | 2 | 4 |

| Lenoir | 4 | 1 | 2 | 3 | 1 |

| Lincoln | 6 | 2 | 7 | 4 | 5 |

| Macon | 1 | 3 | 0 | 2 | 1 |

| Madison | 1 | 1 | 1 | 2 | 2 |

| Martin | 1 | 1 | 2 | 1 | 0 |

| Mcdowell | 1 | 2 | 1 | 0 | 0 |

| Mecklenburg | 26 | 25 | 29 | 39 | 40 |

| Mitchell | 0 | 0 | 0 | 0 | 0 |

| Montgomery | 1 | 2 | 1 | 2 | 3 |

| Moore | 2 | 9 | 7 | 7 | 5 |

| Nash | 7 | 8 | 4 | 9 | 4 |

| New Hanover | 5 | 8 | 6 | 6 | 5 |

| Northampton | 1 | 2 | 1 | 1 | 3 |

| Onslow | 9 | 6 | 12 | 4 | 7 |

| Orange | 6 | 3 | 7 | 4 | 3 |

| Pamlico | 0 | 0 | 2 | 1 | 0 |

| Pasquotank | 0 | 1 | 0 | 2 | 0 |

| Pender | 7 | 6 | 5 | 3 | 3 |

| Perquimans | 1 | 0 | 1 | 0 | 0 |

| Person | 2 | 4 | 2 | 1 | 1 |

| Pitt | 4 | 4 | 10 | 4 | 4 |

| Polk | 0 | 0 | 1 | 1 | 0 |

| Randolph | 4 | 9 | 7 | 5 | 6 |

| Richmond | 4 | 4 | 0 | 2 | 1 |

| Robeson | 13 | 9 | 16 | 9 | 16 |

| Rockingham | 3 | 1 | 2 | 5 | 4 |

| Rowan | 9 | 5 | 4 | 7 | 3 |

| Rutherford | 2 | 5 | 1 | 0 | 2 |

| Sampson | 4 | 4 | 8 | 3 | 5 |

| Scotland | 1 | 3 | 2 | 3 | 4 |

| Stanly | 5 | 1 | 2 | 5 | 1 |

| Stokes | 4 | 1 | 2 | 4 | 2 |

| Surry | 2 | 4 | 5 | 5 | 1 |

| Swain | 0 | 1 | 0 | 0 | 0 |

| Transylvania | 1 | 0 | 1 | 0 | 2 |

| Tyrrell | 0 | 0 | 0 | 0 | 0 |

| Union | 5 | 6 | 5 | 8 | 8 |

| Vance | 5 | 4 | 5 | 4 | 2 |

| Wake | 29 | 19 | 18 | 27 | 19 |

| Warren | 0 | 1 | 1 | 3 | 2 |

| Washington | 0 | 0 | 0 | 0 | 0 |

| Watauga | 2 | 2 | 5 | 2 | 2 |

| Wayne | 8 | 4 | 5 | 6 | 5 |

| Wilkes | 2 | 3 | 3 | 3 | 3 |

| Wilson | 6 | 3 | 5 | 7 | 8 |

| Yadkin | 0 | 1 | 3 | 4 | 2 |

| Yancey | 0 | 0 | 2 | 0 | 0 |

Read more: Alamance Insurance Company Car Insurance Review

Once again, Mecklenberg has a high rate of fatalities in this category. Yancey, on the other hand, barely has any fatalities in this category.

Teen Drinking and Driving

North Carolina was ranked 24th in the United States for arrests for drunk drivers under the age of 18. This is not bad, but it could be better, as teen drinking and driving is extremely dangerous due to teens being inexperienced drivers.

Read more about teen drinking and driving here.

EMS Response Time

There are 432 EMS agencies in North Carolina, and they responded to over 1.6 million events in 2007.

| Location | Time |

|---|---|

| State | 9:56 |

| Urban | 9:50 |

| Rural | 11:09 |

As you can see, the average time for the state is 9:56; 9:50 for urban areas and 11:09 for rural areas. These response times are pretty fast, but it’s best to avoid an accident at all costs.

Transportation

In this section, we’ll check out the various types of transportation, and the time it takes to get around North Carolina.

Car Ownership

In North Carolina, the vast majority of homes own two cars (around 40 percent). The next highest amount is three cars (around 23 percent).

Commute Time

The average commute time for drivers in North Carolina is 23.4 minutes, which isn’t bad at all. In fact, it’s lower than the national average of the United States.

Commuter Transportation

The primary form of commuter transportation in North Carolina is driving alone (81 percent). Only about 8 percent of North Carolinians carpooled, and about 6 percent work from home.

Traffic Congestion in North Carolina

In this final section, we’re going to examine traffic congestion for North Carolina’s most populated city, Charlotte.

Inrix states that there are 95 hours spent in congestion in Charlotte. According to TomTom, the congestion percentage during the morning peak is 32 percent, and the evening peak is 51 percent. The total congestion percentage for both highways and non-highways is 34 percent.

The congestion percentage is 10 percent for highways and 24 percent for non-highways, individually. The cost of congestion per driver is $1,332. The congestion level in Charlotte is 7 percent, and the extra travel time in the morning is 10 minutes. In the evening, it’s 15 minutes.

Finally, Numbeo shows Charlotte’s traffic index is 173.91, the time index is 36.38 minutes, and the inefficiency index is 216.46.

Conclusion

We understand that car insurance is a complicated subject, and that’s why we’re here to help. We hope that this guide helps turn a difficult decision into an easy one.

Did we miss anything? If we did, please let us know! Which part was most helpful to you? We want to improve as much as possible, so please give us feedback.

With our help, car insurance can be made easier for everyone!

Before making any final decisions on your insurance company, it is important to learn as much as you can about your local insurance providers, and the coverages they offer. Call your local insurance agent to clear up any questions that you might have. Questions to consider asking include, “What is the best coverage plan for me/my family/my situation?” “What are the minimum coverage requirements in my state and what form of coverage do you recommend?” “Do you guys offer any bundle discounts if I take out both my auto insurance and home insurance with you?” and “What is the average rate of insurance quotes you guys offer?”

Before making any big insurance decisions, use our free tool to compare insurance quotes near you. It’s simple, just plug in your zip code and we’ll do the rest!

Start comparing car insurance rates today by entering your ZIP code in the free tool below!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.