North Dakota Car Insurance

North Dakota car insurance laws require drivers to carry 25/50/25 in minimum liability coverage. But North Dakota is a no-fault state, and you may want to drive with more coverage to protect you and your vehicle in case of an accident. Read our guide to learn more about North Dakota car insurance coverage, and enter your ZIP code below to find the cheapest North Dakota car insurance rates in your neighborhood.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 18, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 18, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- North Dakota operates under no-fault car insurance laws, and all drivers are required to obtain car insurance

- Basic no-fault car insurance is offered typically only in no-fault car insurance states and provides coverage for financial loss as a result of injuries sustained in a car accident without regard to fault

- Make sure to compare rates with multiple companies to see who offers the best rates

North Dakota operates under no-fault car insurance laws and all drivers are required to obtain car insurance. If you are new to North Dakota and not familiar with no-fault car insurance it’s important to understand exactly how no-fault car insurance works.

Only a dozen states have no-fault auto insurance laws. Typically car insurancerequirements in no-fault states require personal injury protection, liability insurance, and more. Essentially, while other states wait for things like police reports to assign fault and determine who should pay, no-fault states expect insurance companies to pay for their insured driver’s damage after any accident based on their own coverage limits. Then they work it out on the backend to be reimbursed as needed. If you do not have collision insurance and you were hit by another driver, your insurance company would only pay you based on the coverage you do have. You’d still have to pursue additional coverage for your own property after the fact.

Need car insurance? Compare North Dakota car insurance companies for FREE with our quote tool above!

What Kind of Auto Insurance Do You Need in North Dakota?

Since North Dakota operates under no-fault car insurance laws. This can be confusing for people coming from a state operating under the traditional tort system. The basic requirements are much the same. Even if you have a completely clean driving record, you can’t control other drivers on the road. If they cause an accident, you’ll still want the right coverage. A few options you can choose from include:

- Liability Insurance: This is required in virtually every state to drive legally. Liability coverage covers the other party’s auto damage and injuries when you’re at fault, and it can protect you from getting sued in small accidents.

- Collision Insurance: Collision insurance protects you from large repair bills after an accident. Whoever was at fault, collision insurance will kick in and pay to repair or replace your car as needed. This is especially important in no-fault states that encourage you to move forward with your own insurance while waiting on things like police reports.

- Comprehensive Coverage: Other cars aren’t the only thing you need to worry about on the road. Things like wildlife, a patch of ice that causes you to drive into a wall, and other things that don’t fall under collision coverage in North Dakota may be covered under comprehensive coverage.

- Uninsured/Underinsured Motorist Coverage: Have you ever been in an accident with someone who was uninsured or underinsured? Unfortunately, this happens all the time. Sometimes they stop. Other times, you’re the victim of a hit and run. Uninsured/underinsured motorist coverage helps in these situations.

In addition to learning about the types of car insurance coverage available in North Dakota, you also have to learn what no-fault auto insurance means.

One of the benefits of no fault systemsin car insurance is that they minimize nuisance lawsuits and expedite claims processing while lowering car insurance rates.

When a car accident happens in North Dakota, each driver’s own liability insurance protection will cover the damages they incurred.

There are still many conditions under which a driver can sue, especially when an accident is caused by extreme negligence or where damages exceed policy limits of auto policies, but most no-fault car insurance states have seen a rapid decline in car insurance lawsuits.

Read more: What states have no-fault car insurance laws?

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

North Dakota Car Insurance Requirements

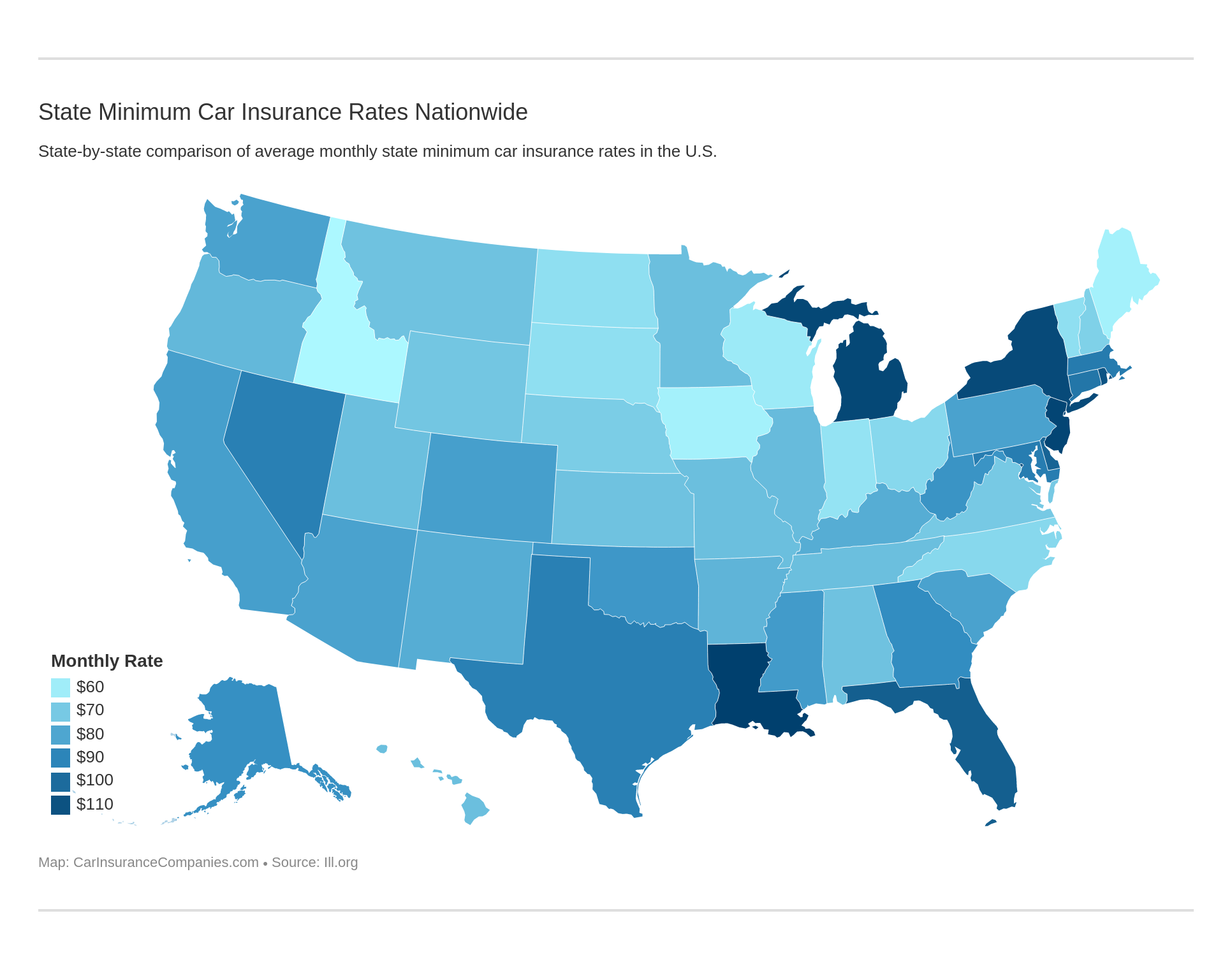

North Dakota requires all drivers to have minimum mandatory levels of car insurance as follows:

- Bodily Injury Liability – $25,000 per person / $50,000 per accident

- Property Damage Liability – $25,000 per accident

- Uninsured Motorist (UM) Coverage – $25,000 per person/ $50,000 per accident

- Underinsured Motorist (UIM) Coverage – $25,000 per person/ $50,000 per accident

- No-Fault Basic Car Insurance (PIP) – $30,000 per person

Basic no-fault car insurance is offered typically only in no-fault car insurance states and provides coverage for financial loss (such as medical costs and loss of income) as a result of injuries sustained in a car accident without regard to fault.

What is the penalty for driving with no insurance in North Dakota?

Drivers convicted of operating a vehicle without the required car insurance are subject to a mandatory fine of at least $150.

However, if you become involved in a car accident operating a vehicle with no car insurance then your driver’s license will automatically be suspended and the state will charge 14 points to your driving record (enough to automatically trigger a suspension).

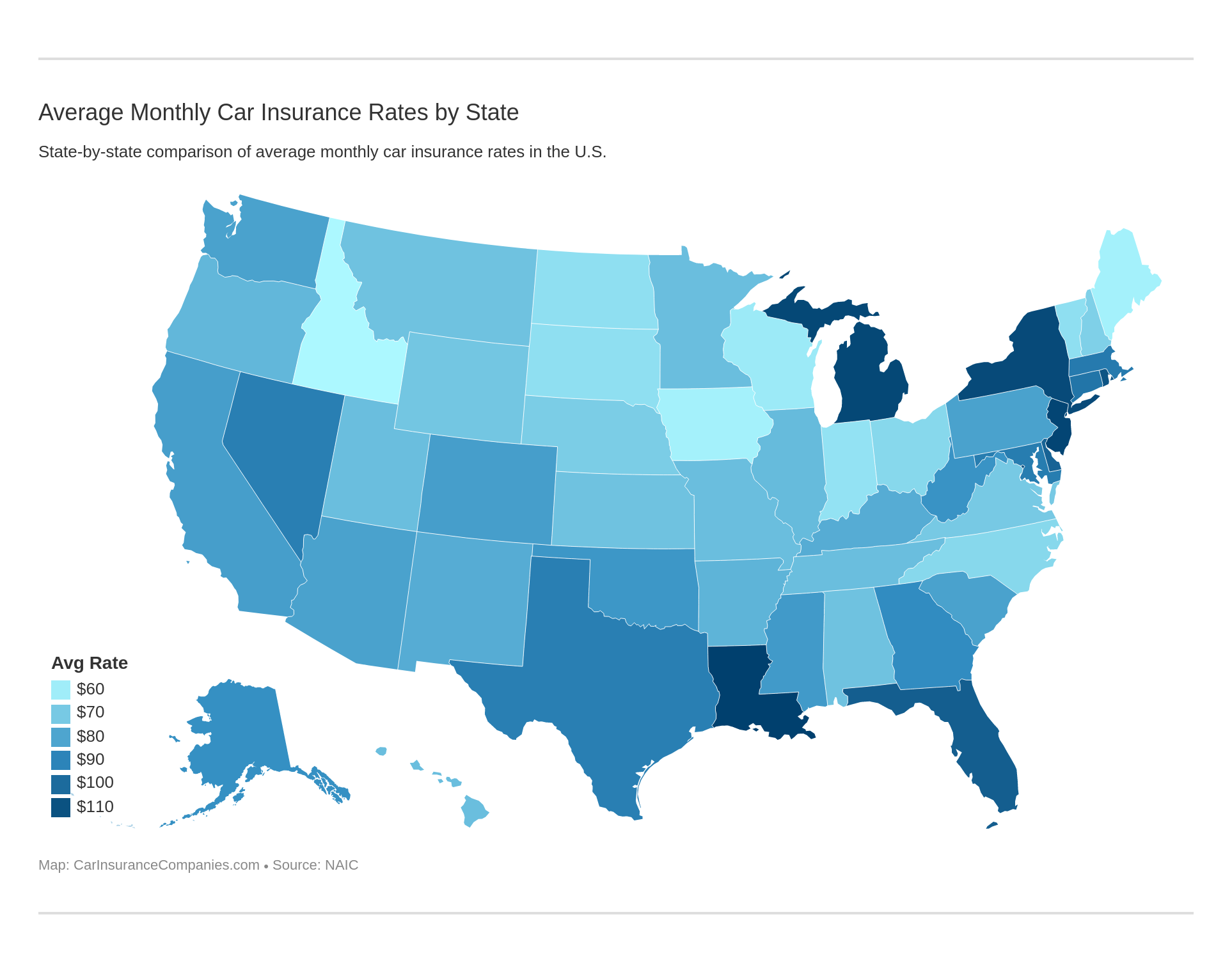

Average Monthly Car Insurance Rates in ND (Liability, Collision, Comprehensive)

North Dakota Car Insurance Companies

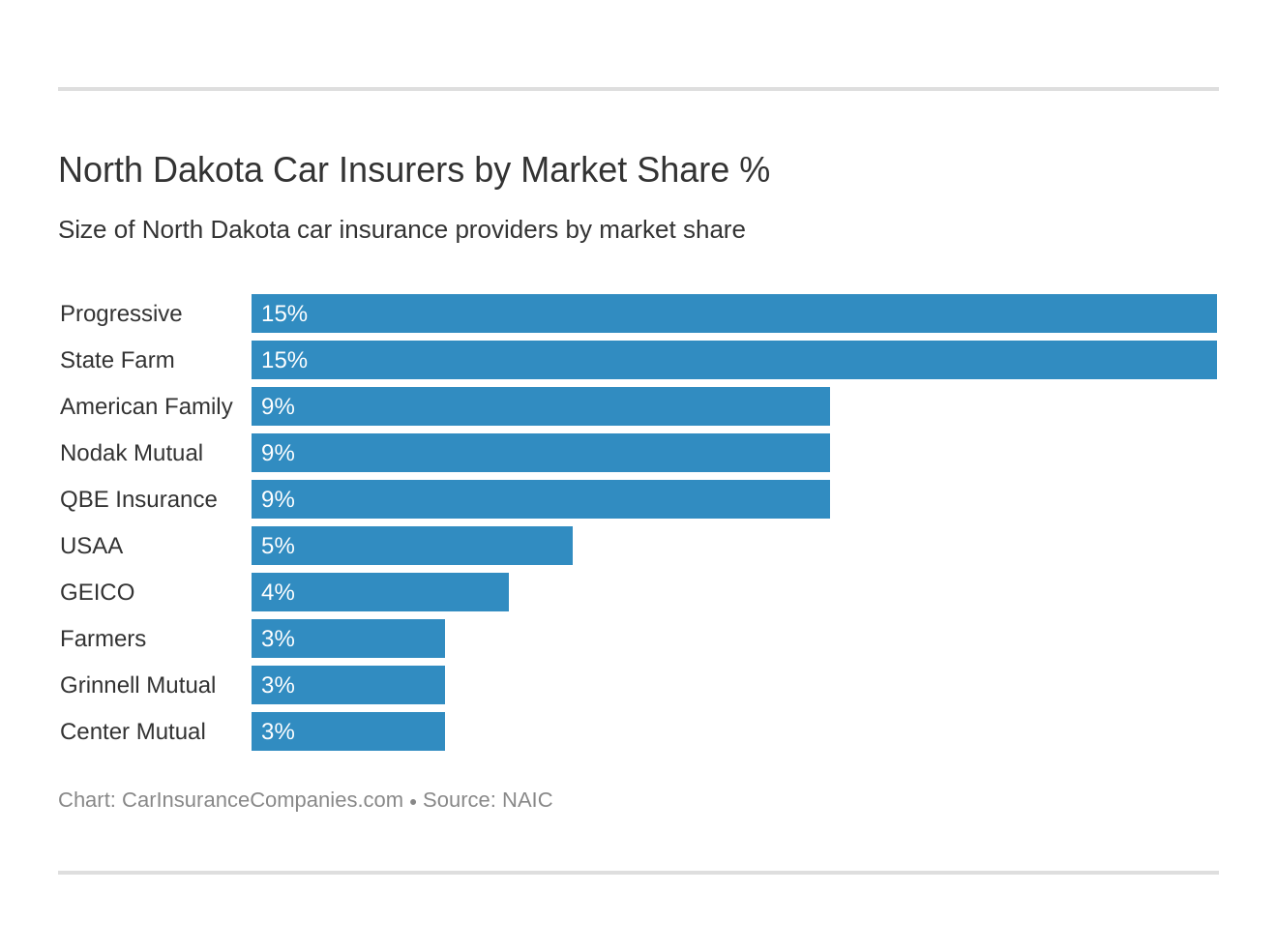

Almost all major car insurance companies offer coverage to North Dakota residents including, however, North Dakota is home to almost 100 car insurance companies so take your time and look at both well-known car insurance companies and regional providers.

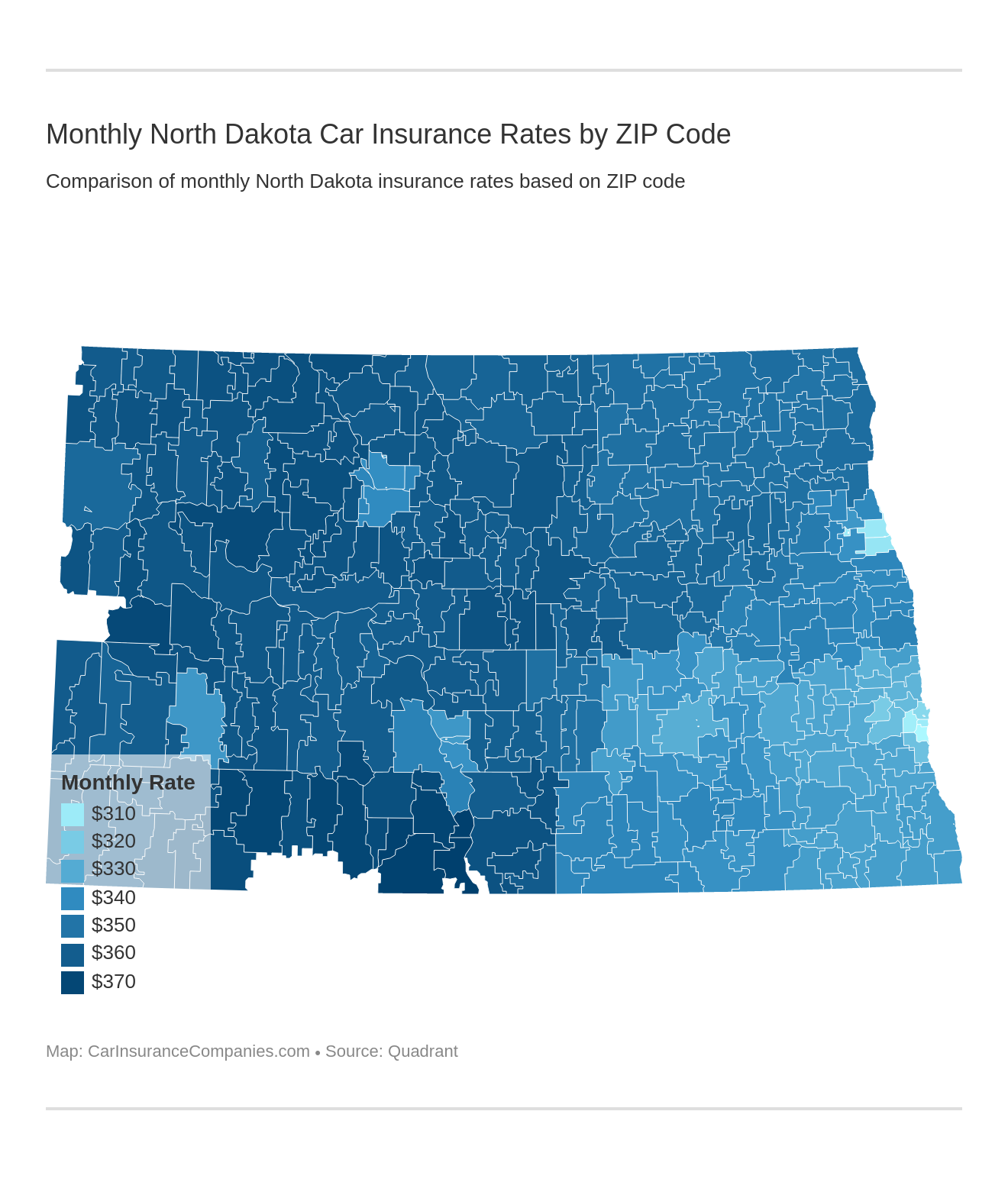

How does ZIP code affect auto insurance? Factors like traffic, crime, and claim frequency in your area all matter. Find out how your ZIP code compares against other zips in ND.

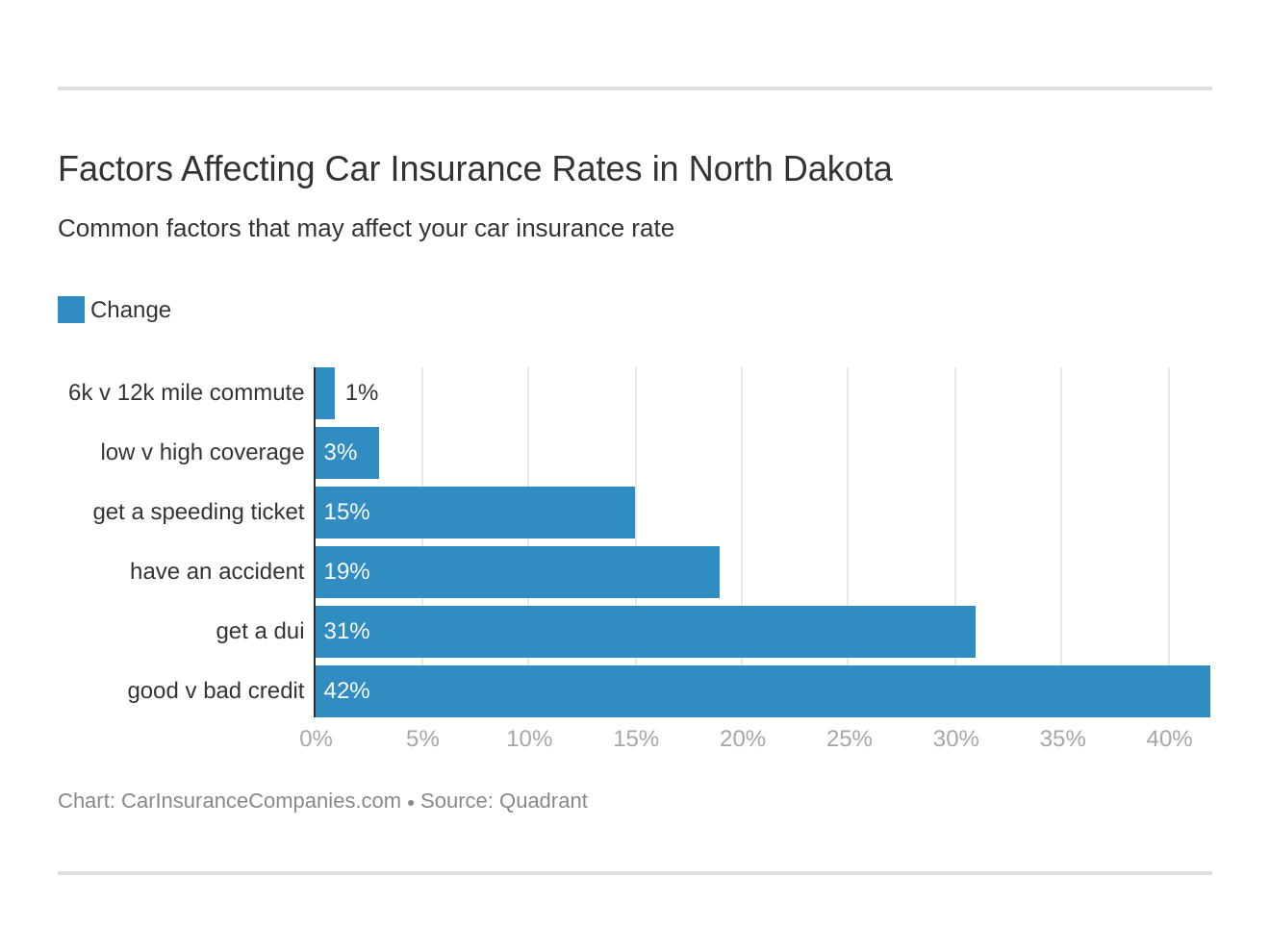

Six major factors affect auto insurance rates in ND. Which car insurance factors will affect your rates the most? Find out below:

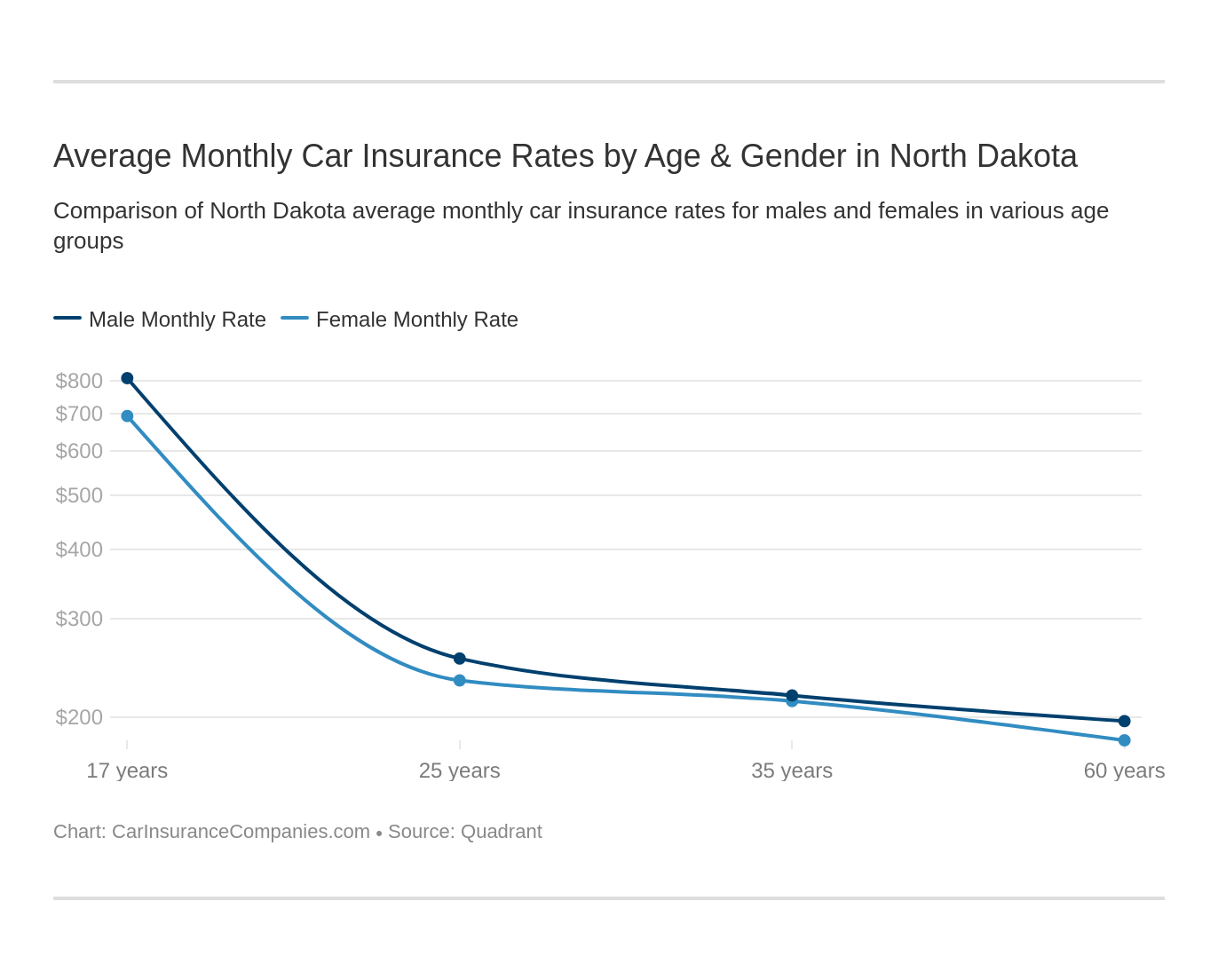

Which gender and age pays more for car insurance? Drivers under 25 years old are often in the highest risk class. See if the gender stereotype (males vs female auto insurance rates) holds true in North Dakota.

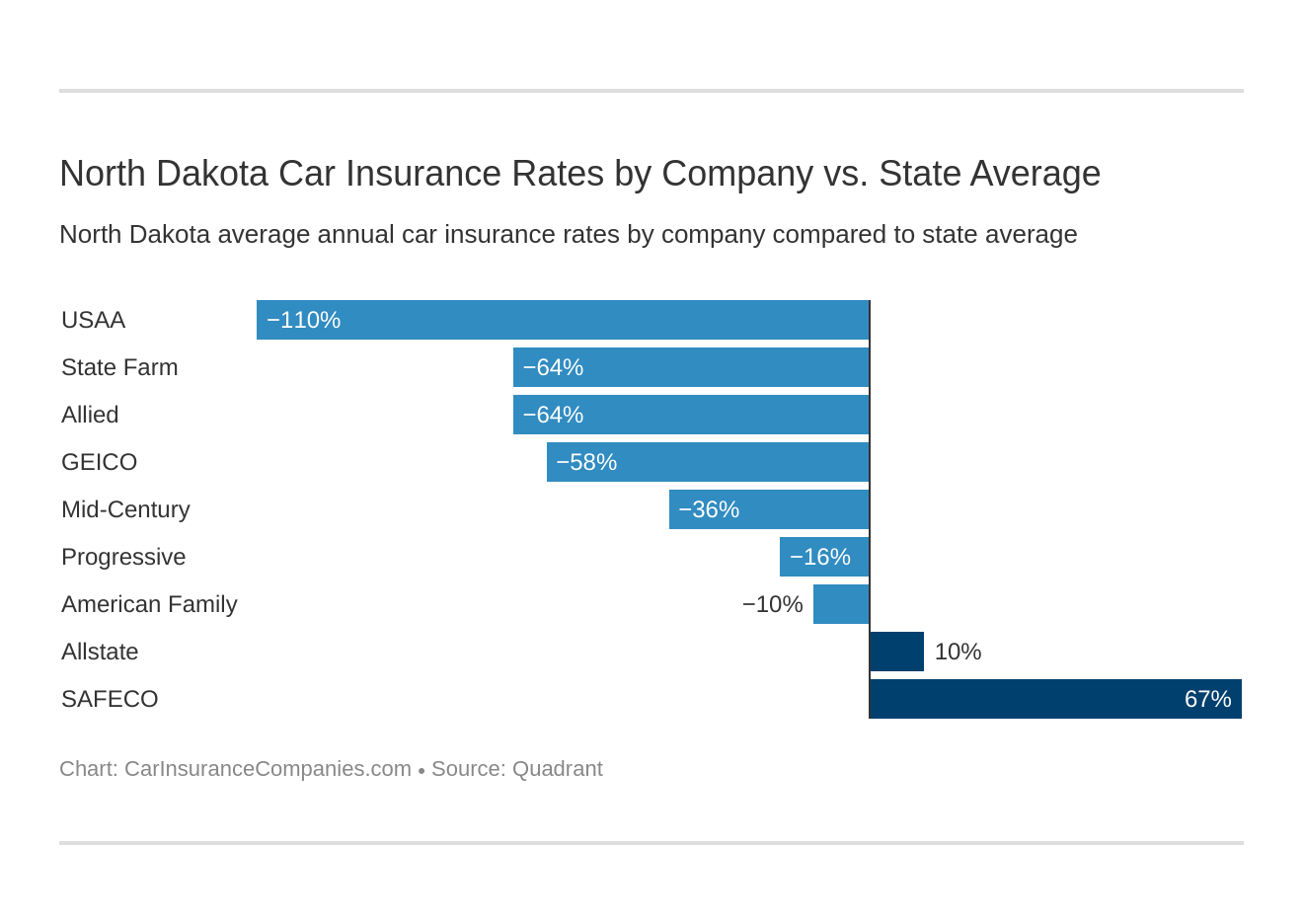

Now let’s see who is the cheapest car insurance company in North Dakota.

Who are the largest auto insurance companies in ND?

The key to finding the best ND car insurance rates will be to start a car insurance quote comparison search online.

Compare North Dakota car insurance rates for free today!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.