Delaware Car Insurance (Coverage, Companies, & More)

The average Delaware car insurance rates are $103 per month, but where you live and the level of coverage you need can impact your rates. Read our guide to Delaware car insurance to see a breakdown of rates by ZIP code, or enter your ZIP code below to get your free Delaware car insurance quotes. Use these quotes to compare the top Delaware car insurance companies to find the policy that's perfect for you.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Feb 10, 2025

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 10, 2025

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Delaware Statistics Summary | |

|---|---|

| Annual Roadway Miles | 6,407 Vehicle Miles Driven: 10,178 Million |

| Vehicles Registered in State | 927,276 |

| Population | 961,939 |

| Most Popular Vehicle | Chevrolet Silverado 1500 |

| Uninsured Motorists | 11.40% |

| Total Driving Fatalities | 2008-2017 Speeding: 33 DUI: 32 |

| Annual Premiums | Liability: $799.30 Collision: $319.00 Comprehensive: $122.49 |

| Cheapest Provider | USAA |

Delaware is known as a “drive-to” state. A vast majority of tourists — 97 percent — take a car to get there, making it a true road trip destination. And 75 percent of those visitors travel less than 200 miles, often from Maryland, Pennsylvania, and New Jersey.

Visitors will find plenty to do in Delaware. Most tourists flock to the First State to experience its sunny beaches, fine dining, and tax-free shopping.

Popular Delaware beach resorts are Rehoboth Beach, Lewes, Dewey Beach, Bethany Beach, South Bethany, and Fenwick Island. Rehoboth Beach promotes itself as “The Nation’s Summer Capital,” because hordes of vacationers arrive there from Washington, D.C. and neighboring Mid-Atlantic states.

Other sites and events of interest include the First State National Historical Park, the World Championship Punkin Chunkin, and the Rehoboth Beach Chocolate Festival.

When you hit the road, your car insurance gives you the peace of mind that you’ll be protected from high costs in case an accident or mishap occurs along the way.

The claims companies make in their ads and the variety of options and information available may make your search for the right coverage overwhelming.

We’ve done the hard work for you. We’re here to make the task an adventure, through offering you facts about state insurance requirements and laws, company reviews and price comparisons, driving laws, and everything else in-between.

Are you ready to roll?

Start comparing car insurance for FREE today! Just enter your zip code above.

How to get Delaware car insurance coverage and rates

The average Delaware resident pays $1,240 yearly for insurance, slightly less than the national average of $1,311. When you buy insurance, you want to make sure that you get a fair price. You might wonder, is it possible to pay less?

This guide is here to help. We’ll go over the many policy options, explain why that coverage is crucial, and explain the confusing industry lingo.

So, read on to find out all you need to know to get the right deal for you.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What’s Delaware’s car culture like?

One interesting fact about Delaware car culture is that license plates with lower numbers are a status symbol. The older and the more worn looking, the better. And thus, the more scarce and highly sought after they are. They can be worth thousands of dollars.

A reason for this is that the state’s vehicle registration rules let the plates be transferred and passed down through generations.

More than 100 years ago, when Delaware started issuing license plates in numerical order, the first car owners in Delaware were wealthy — they could afford the first cars — and got the first license plates.

In 2008, the license plate number 11 sold at auction for a whopping $675,000.

So, obviously, in this small state, older license plates are a big deal.

Let’s explore the minimum insurance coverage required in the First State.

What’s the minimum coverage in Delaware?

Delaware is an at-fault state. So, if you’re responsible for an accident, you must pay for any damages or injuries.

Minimum auto insurance coverage and rates vary from state to state. Compare state to state below:

Liability insurance pays any person owed money for property damage and/or injuries that result from a car accident you or anyone under your policy causes.

Delaware law requires the following minimum liability coverage if you want to drive there:

- $25,000 for bodily injury for one person.

- $50,000 for bodily injury per accident.

- $10,000 for property damage liability.

Automobile accidents that involve death do happen, and if you are found to be at fault, you alone will be held financially responsible.

In the First State, you must also carry Personal Injury Protection (PIP). It pays for your medical costs no matter who caused the accident. These are the minimum limits:

- $15,000 for bodily injury to one person.

- $30,000 for bodily injury to more than one person.

PIP also pays up to $5,000 for any needed funeral expenses.

If you get caught without insurance in Delaware, you could find yourself paying hefty fines. So, don’t leave home without it.

Individuals or businesses that have 15 or more cars registered in the First State can apply for self-funded insurance.

Remember that basic liability protection at the minimum required amounts won’t completely cover you if you need to repair or replace damages you caused to your car. For that, you can apply for collision and comprehensive coverage as part of a full coverage policy.

Now, let’s discover the average prices Delaware drivers pay for auto insurance premiums. The rates you pay may vary, but the information can help you see how much you can afford and whether you’re paying too much.

What’s the form of financial responsibility?

Delaware law requires that drivers carry proof of liability insurance from a company licensed by the state insurance commissioner. This insurance serves as a form of financial responsibility that shows that you can pay for injuries or damages if you cause an accident.

State law enforcement also accepts electronic proof of insurance, if you have it ready on a mobile device.

These are other acceptable forms of financial responsibility:

- Proof-of-insurance card.

- A written statement stating your vehicle carries a liability insurance policy.

- Surety bond.

- $40,000 in cash or securities.

You must show proof of insurance when:

- You’re pulled over at a traffic stop

- Get into a car accident

- Register or renew your car’s registration

- Apply or renew your driver’s license

- Have your car inspected

Delaware can perform random audits on uninsured drivers. If you don’t respond to the audit, officials can revoke your license and registration.

Next, let’s see how much Delaware residents earn compared to how much they spend on car insurance.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What percentage of income are insurance premiums?

In 2014, Delawareans had an annual disposable personal income of about $40,256.

Disposable personal income (DPI) is the total amount of money an individual can spend (or save) after they have paid their taxes.

Annual minimum coverage car insurance in Delaware costs about $1,300 a year, which is three percent of the average DPI.

Those figures remained steady from 2012 to 2014 and were close to those of one of neighboring New Jersey. Other border states, Pennsylvania and Maryland, averaged premiums a good $200.00 to $300.00 less and had slightly lower DPI percentages, at just over two percent.

The average Delaware resident has about $3,400 each month for expenses and basic living needs. Car insurance will take about $100 a month out of that monthly.

What are the average monthly car insurance rates in DE (liability, collision, comprehensive)?

Your average monthly car insurance rates by coverage may be cheaper than expected for additional coverage like comprehensive. Review rates for car insurance coverage below:

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $799.30 |

| Collision | $318.77 |

| Comprehensive | $122.49 |

| Combined | $1,240.57 |

The above table provides the most recent data from the National Association of Insurance Commissioners. The combined total is just under the national annual premium average of $1,311. Expect rates in Delaware to be higher in 2019 and in future years.

Remember: Delaware has minimum requirements for liability coverage with coverage amounts starting at 25/50/10.

Let’s go over some popular coverage options to add to an auto insurance policy.

Is there an additional liability?

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Personal Injury Protection (PIP) | 77% | 77% | 72% |

| Medical Payments (Med Pay) | 128% | 86% | 176% |

| Uninsured/Underinsured Motorist | 67% | 63% | 72% |

As we mentioned earlier, Delaware requires that drivers carry Personal Injury Protection (PIP). Delaware law doesn’t mandate collision and comprehensive coverage, but it may still be good to have. Why? Sometimes, as part of a car’s finance or lease agreement, you must have those two coverages.

Regarding loss ratios, MedPay loss ratios sometimes surpass 100 percent. Loss ratios measure the dollar amount of paid claims versus how much the auto insurance company takes in premiums. If it’s over 100 percent, it means the insurer is losing money.

The MedPay loss ratios might have been high because of higher-than-expected medical losses connected with the Affordable Care Act.

The more claims consumers file, the more insurers must pay, which increases loss ratios and results in higher premiums.

Uninsured/underinsured motorist coverage isn’t required in Delaware, but it’s an option. In this video, lawyer Ben Schwartz goes over UM claims:

Now, let’s see look at optional additions to your car insurance policy.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Are there any add-ons, endorsements, & riders?

We know that getting the most coverage for the best price is your main goal. You’re in luck: you can add lots of useful extras to your policy. These are your options in Delaware:

- Guaranteed Auto Protection (GAP)

- Usage-Based Insurance

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

What are the average monthly car insurance rates by age & gender in DE?

The rates for young drivers age 17-25 are predictably high (and males in that age range tend to pay more than females), but after that, drivers achieve more gender equality in rates as they decrease and balance out.

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $3,680.77 | $3,617.49 | $3,230.45 | $3,405.48 | $13,198.18 | $15,406.57 | $3,876.03 | $4,113.55 |

| Geico Advantage | $2,660.39 | $2,952.77 | $2,562.65 | $2,983.93 | $6,449.50 | $6,710.85 | $2,798.53 | $2,699.68 |

| Liberty Mut Fire Ins Co | $12,287.48 | $12,287.48 | $12,138.88 | $12,138.88 | $27,326.93 | $41,390.16 | $12,287.48 | $17,022.83 |

| Nationwide Mutual | $3,017.56 | $2,994.99 | $2,753.71 | $2,742.95 | $7,151.92 | $9,060.24 | $3,345.06 | $3,575.26 |

| Progressive Direct | $1,994.89 | $1,844.62 | $1,754.37 | $1,790.24 | $10,102.13 | $11,159.65 | $2,437.17 | $2,371.56 |

| State Farm Mutual Auto | $2,818.09 | $2,818.09 | $2,600.14 | $2,600.14 | $8,048.04 | $10,393.68 | $3,162.14 | $3,294.46 |

| Travelers Home & Marine Ins Co | $1,634.80 | $1,642.27 | $1,610.37 | $1,568.84 | $9,243.54 | $14,106.72 | $1,745.40 | $1,906.92 |

| USAA | $1,286.77 | $1,265.78 | $1,191.65 | $1,189.30 | $4,729.53 | $5,556.07 | $1,615.19 | $1,773.54 |

What are the cheapest auto insurance rates by zip code?

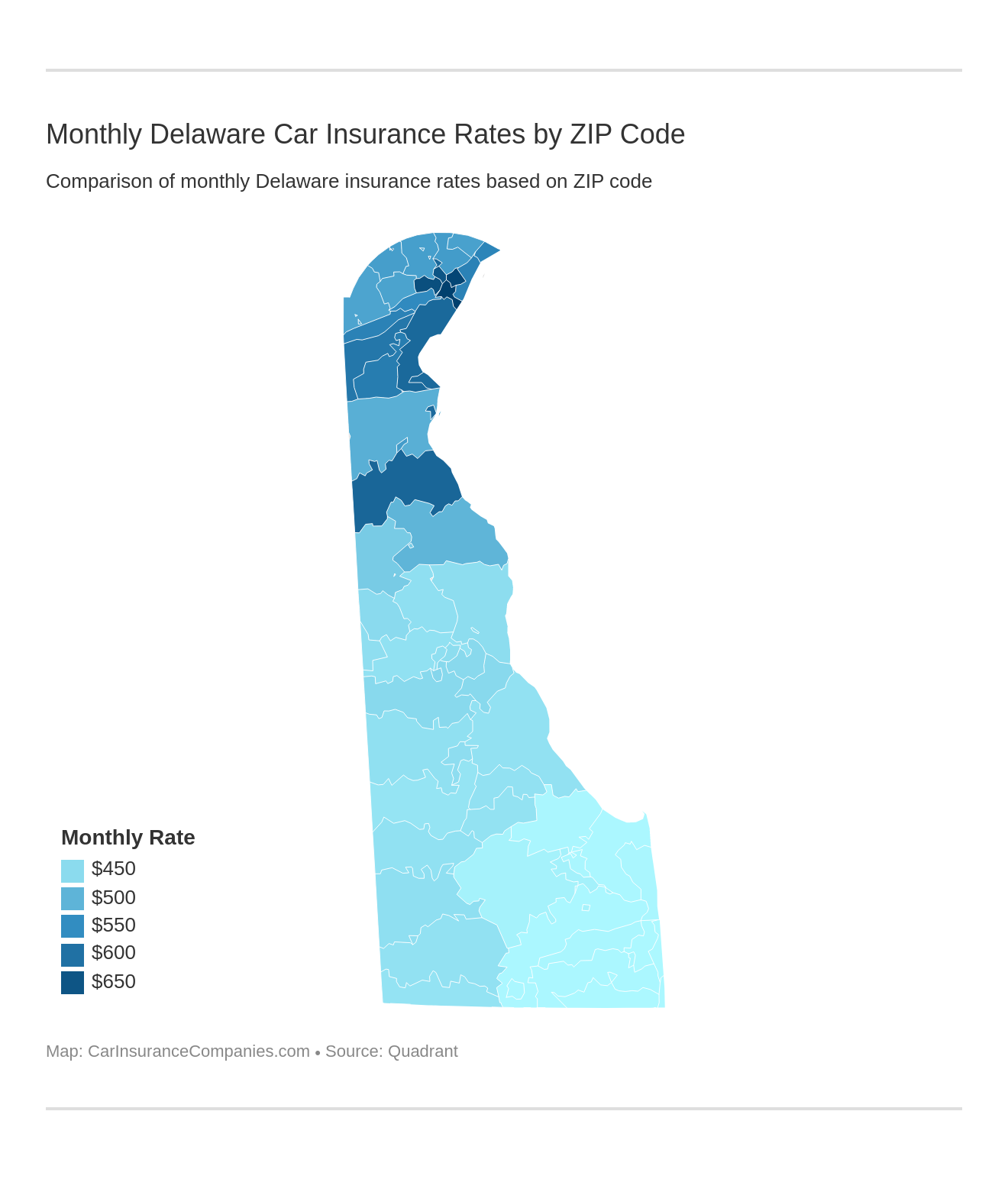

How does ZIP code affect auto insurance? Factors like traffic, crime, and claim frequency in your area all matter. Find out how your ZIP code compares against other zips in STATE ABBREVIATION.

| Zipcode | Average |

|---|---|

| 19801 | $8,265.76 |

| 19802 | $8,136.26 |

| 19805 | $7,939.41 |

| 19736 | $7,863.61 |

| 19806 | $7,806.15 |

| 19733 | $7,549.45 |

| 19734 | $7,434.79 |

| 19732 | $7,433.65 |

| 19708 | $7,393.19 |

| 19720 | $7,378.97 |

| 19706 | $7,358.23 |

| 19731 | $7,329.63 |

| 19710 | $7,199.39 |

| 19702 | $7,071.81 |

| 19701 | $6,949.68 |

| 19713 | $6,828.11 |

| 19809 | $6,824.40 |

| 19703 | $6,767.07 |

| 19804 | $6,656.56 |

| 19803 | $6,372.49 |

| 19730 | $6,354.44 |

| 19707 | $6,339.10 |

| 19807 | $6,326.10 |

| 19716 | $6,296.25 |

| 19810 | $6,291.90 |

| 19735 | $6,287.71 |

| 19717 | $6,279.80 |

| 19808 | $6,262.76 |

| 19711 | $6,243.07 |

| 19709 | $6,072.84 |

| 19977 | $5,983.51 |

| 19938 | $5,648.66 |

| 19979 | $5,466.08 |

| 19946 | $5,438.33 |

| 19943 | $5,434.09 |

| 19962 | $5,423.18 |

| 19953 | $5,411.87 |

| 19901 | $5,381.28 |

| 19954 | $5,367.66 |

| 19902 | $5,356.71 |

| 19961 | $5,351.51 |

| 19964 | $5,351.45 |

| 19931 | $5,351.04 |

| 19973 | $5,343.52 |

| 19904 | $5,341.88 |

| 19952 | $5,325.34 |

| 19934 | $5,320.67 |

| 19906 | $5,312.12 |

| 19933 | $5,310.53 |

| 19956 | $5,309.29 |

| 19963 | $5,309.15 |

| 19960 | $5,300.74 |

| 19941 | $5,296.57 |

| 19940 | $5,280.34 |

| 19980 | $5,279.24 |

| 19950 | $5,262.52 |

| 19951 | $5,058.86 |

| 19947 | $5,051.49 |

| 19969 | $5,009.19 |

| 19967 | $4,986.08 |

| 19971 | $4,983.50 |

| 19968 | $4,979.39 |

| 19939 | $4,974.65 |

| 19966 | $4,971.33 |

| 19945 | $4,966.95 |

| 19944 | $4,964.30 |

| 19958 | $4,962.40 |

| 19975 | $4,956.80 |

| 19970 | $4,954.07 |

| 19930 | $4,953.79 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the cheapest auto insurance rates by city?

The same figures, but by name this time.

Delaware Car Insurance Rates by City

| City | Average Grand Total |

|---|---|

| WILMINGTON | $8,265.76 |

| WILMINGTON | $8,136.26 |

| WILMINGTON | $7,939.41 |

| YORKLYN | $7,863.61 |

| WILMINGTON | $7,806.15 |

| SAINT GEORGES | $7,549.45 |

| TOWNSEND | $7,434.79 |

| ROCKLAND | $7,433.65 |

| KIRKWOOD | $7,393.19 |

| NEW CASTLE | $7,378.97 |

| DELAWARE CITY | $7,358.23 |

| PORT PENN | $7,329.63 |

| MONTCHANIN | $7,199.39 |

| NEWARK | $7,071.81 |

| BEAR | $6,949.68 |

| NEWARK | $6,828.11 |

| WILMINGTON | $6,824.40 |

| CLAYMONT | $6,767.07 |

| WILMINGTON | $6,656.56 |

| WILMINGTON | $6,372.49 |

| ODESSA | $6,354.44 |

| HOCKESSIN | $6,339.10 |

| WILMINGTON | $6,326.10 |

| NEWARK | $6,296.25 |

| WILMINGTON | $6,291.90 |

| WINTERTHUR | $6,287.71 |

| NEWARK | $6,279.80 |

| WILMINGTON | $6,262.76 |

| NEWARK | $6,243.07 |

| MIDDLETOWN | $6,072.84 |

| SMYRNA | $5,983.51 |

| CLAYTON | $5,648.66 |

| VIOLA | $5,466.08 |

| FREDERICA | $5,438.33 |

| FELTON | $5,434.09 |

| MAGNOLIA | $5,423.18 |

| HARTLY | $5,411.87 |

| DOVER | $5,381.28 |

| HOUSTON | $5,367.66 |

| DOVER AFB | $5,356.71 |

| LITTLE CREEK | $5,351.51 |

| MARYDEL | $5,351.45 |

| BETHEL | $5,351.04 |

| SEAFORD | $5,343.52 |

| DOVER | $5,341.88 |

| HARRINGTON | $5,325.34 |

| CAMDEN WYOMING | $5,320.67 |

| DOVER | $5,312.12 |

| BRIDGEVILLE | $5,310.53 |

| LAUREL | $5,309.29 |

| MILFORD | $5,309.15 |

| LINCOLN | $5,300.74 |

| ELLENDALE | $5,296.57 |

| DELMAR | $5,280.34 |

| WOODSIDE | $5,279.24 |

| GREENWOOD | $5,262.52 |

| HARBESON | $5,058.86 |

| GEORGETOWN | $5,051.49 |

| NASSAU | $5,009.19 |

| MILLVILLE | $4,986.08 |

| REHOBOTH BEACH | $4,983.50 |

| MILTON | $4,979.39 |

| DAGSBORO | $4,974.65 |

| MILLSBORO | $4,971.33 |

| FRANKFORD | $4,966.95 |

| FENWICK ISLAND | $4,964.30 |

| LEWES | $4,962.40 |

| SELBYVILLE | $4,956.80 |

| OCEAN VIEW | $4,954.07 |

| BETHANY BEACH | $4,953.79 |

Now, let’s find out which companies score financially and in customer satisfaction.

What are the best Delaware car insurance companies?

When it comes to the best car insurance providers, you’ll find a lot of information. Maybe too much. That can make your search frustrating and tedious.

Below, we’ve gathered just the facts you need — no more, no less.

Keep reading to find out all about the best and worst car insurance companies.

Delaware Car Insurance Rates by City

| City | Average Grand Total |

|---|---|

| WILMINGTON | $8,265.76 |

| WILMINGTON | $8,136.26 |

| WILMINGTON | $7,939.41 |

| YORKLYN | $7,863.61 |

| WILMINGTON | $7,806.15 |

| SAINT GEORGES | $7,549.45 |

| TOWNSEND | $7,434.79 |

| ROCKLAND | $7,433.65 |

| KIRKWOOD | $7,393.19 |

| NEW CASTLE | $7,378.97 |

| DELAWARE CITY | $7,358.23 |

| PORT PENN | $7,329.63 |

| MONTCHANIN | $7,199.39 |

| NEWARK | $7,071.81 |

| BEAR | $6,949.68 |

| NEWARK | $6,828.11 |

| WILMINGTON | $6,824.40 |

| CLAYMONT | $6,767.07 |

| WILMINGTON | $6,656.56 |

| WILMINGTON | $6,372.49 |

| ODESSA | $6,354.44 |

| HOCKESSIN | $6,339.10 |

| WILMINGTON | $6,326.10 |

| NEWARK | $6,296.25 |

| WILMINGTON | $6,291.90 |

| WINTERTHUR | $6,287.71 |

| NEWARK | $6,279.80 |

| WILMINGTON | $6,262.76 |

| NEWARK | $6,243.07 |

| MIDDLETOWN | $6,072.84 |

| SMYRNA | $5,983.51 |

| CLAYTON | $5,648.66 |

| VIOLA | $5,466.08 |

| FREDERICA | $5,438.33 |

| FELTON | $5,434.09 |

| MAGNOLIA | $5,423.18 |

| HARTLY | $5,411.87 |

| DOVER | $5,381.28 |

| HOUSTON | $5,367.66 |

| DOVER AFB | $5,356.71 |

| LITTLE CREEK | $5,351.51 |

| MARYDEL | $5,351.45 |

| BETHEL | $5,351.04 |

| SEAFORD | $5,343.52 |

| DOVER | $5,341.88 |

| HARRINGTON | $5,325.34 |

| CAMDEN WYOMING | $5,320.67 |

| DOVER | $5,312.12 |

| BRIDGEVILLE | $5,310.53 |

| LAUREL | $5,309.29 |

| MILFORD | $5,309.15 |

| LINCOLN | $5,300.74 |

| ELLENDALE | $5,296.57 |

| DELMAR | $5,280.34 |

| WOODSIDE | $5,279.24 |

| GREENWOOD | $5,262.52 |

| HARBESON | $5,058.86 |

| GEORGETOWN | $5,051.49 |

| NASSAU | $5,009.19 |

| MILLVILLE | $4,986.08 |

| REHOBOTH BEACH | $4,983.50 |

| MILTON | $4,979.39 |

| DAGSBORO | $4,974.65 |

| MILLSBORO | $4,971.33 |

| FRANKFORD | $4,966.95 |

| FENWICK ISLAND | $4,964.30 |

| LEWES | $4,962.40 |

| SELBYVILLE | $4,956.80 |

| OCEAN VIEW | $4,954.07 |

| BETHANY BEACH | $4,953.79 |

What is the financial rating of the largest companies?

Many of the top-rated companies in Delaware, such as Geico and State Farm, have existed for a long time and have built a solid, sturdy financial record.

| Company | Financial Rating |

|---|---|

| State Farm Group | A++ |

| Geico | A++ |

| Nationwide Corp Group | A+ |

| Progressive Group | A+ |

| Liberty Mutual Group | A |

| USAA Group | A++ |

| Allstate Insurance Group | A+ |

| Hartford Fire & Casualty Group | A+ |

| Travelers Group | A++ |

| CSAA Insurance Group | A |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Which companies have the best ratings?

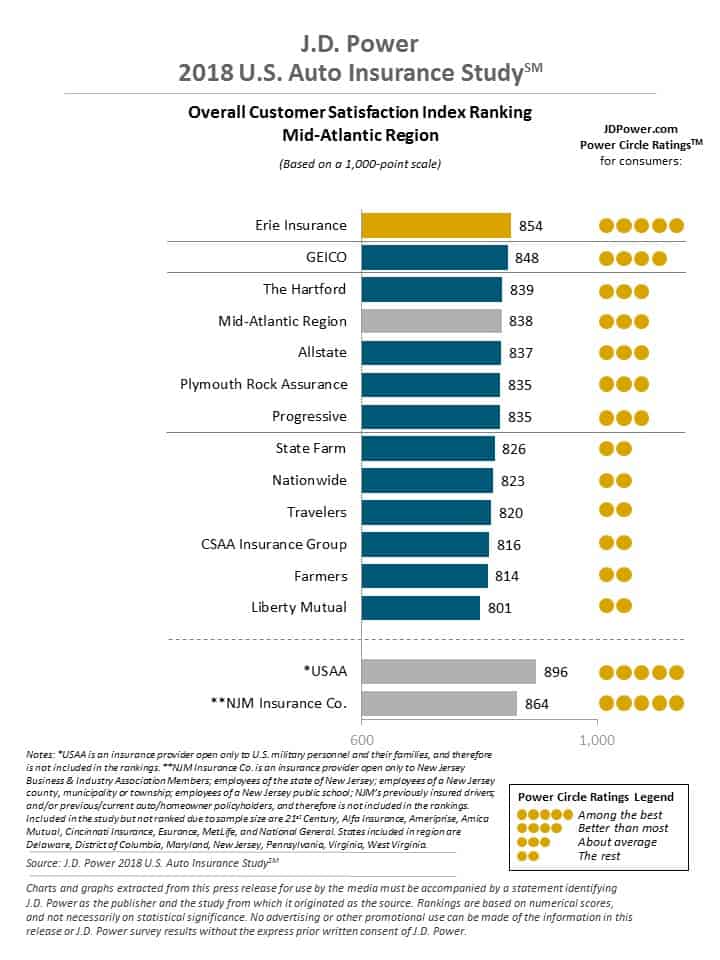

Erie Insurance tops J.D. Power’s U.S. Auto Insurance Study of overall customer satisfaction, while bigger name contenders Geico and The Hartford round out the top three.

Nobody’s perfect! The number of complaints a company receives reveals customer dissatisfaction, yet how they handle them tells a lot about their level of service. Let’s read more about them below.

Read more: Hartford Insurance Company of the Southeast Car Insurance Review

Which companies have the most complaints in Delaware?

State Farm outranks the list, with Liberty Mutual a distant second.

| Company | Number of Complaints |

|---|---|

| State Farm | 1,482 |

| Geico | 0 |

| Nationwide | 25 |

| Progressive | 120 |

| Liberty Mutual | 222 |

| USAA | 0 |

| Allstate | 163 |

| Hartford | 9 |

| Travelers | 2 |

| CSAA | 6 |

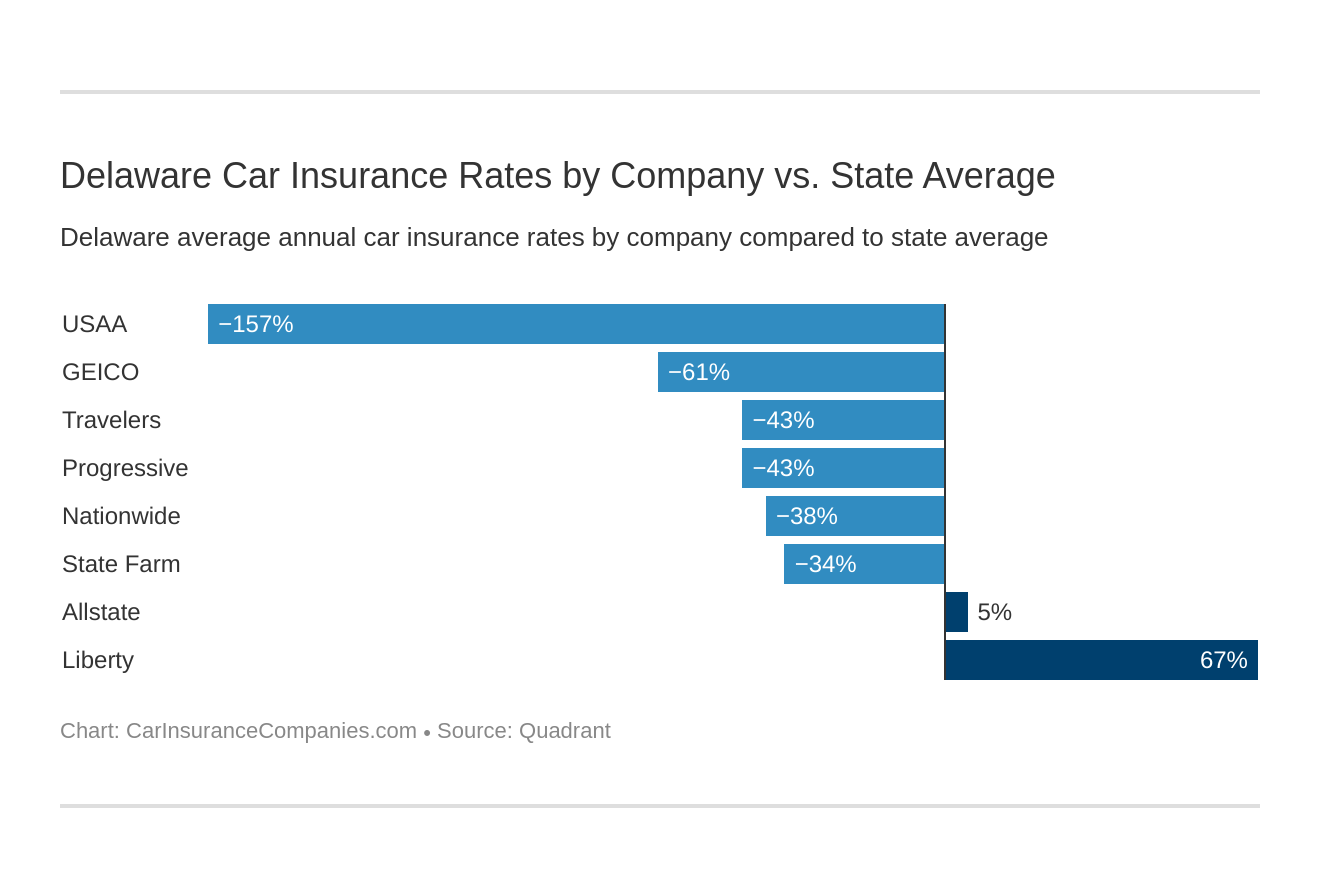

What are the cheapest companies in Delaware?

Liberty Mutual has the highest coverage rates, while USAA has the lowest.

| Company | Average |

|---|---|

| Allstate P&C | $6,316.07 |

| Geico Advantage | $3,727.29 |

| Liberty Mut Fire Ins Co | $18,360.01 |

| Nationwide Mutual | $4,330.21 |

| Progressive Direct | $4,181.83 |

| State Farm Mutual Auto | $4,466.85 |

| Travelers Home & Marine Ins Co | $4,182.36 |

| USAA | $2,325.98 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the commute rates by company?

Again, Liberty Mutual sits atop this list.

| Group | Commute (in miles) | Annual Mileage | Annual Average |

|---|---|---|---|

| Liberty Mutual | 25 | 12,000 | $18,868.27 |

| Liberty Mutual | 10 | 6000 | $17,851.76 |

| Allstate | 10 | 6000 | $6,316.06 |

| Allstate | 25 | 12,000 | $6,316.06 |

| State Farm | 25 | 12,000 | $4,619.47 |

| Nationwide | 10 | 6000 | $4,330.21 |

| Nationwide | 25 | 12,000 | $4,330.21 |

| State Farm | 10 | 6000 | $4,314.22 |

| Travelers | 10 | 6000 | $4,182.36 |

| Travelers | 25 | 12,000 | $4,182.36 |

| Progressive | 10 | 6000 | $4,181.83 |

| Progressive | 25 | 12,000 | $4,181.83 |

| Geico | 25 | 12,000 | $3,786.48 |

| Geico | 10 | 6000 | $3,668.09 |

| USAA | 25 | 12,000 | $2,350.62 |

| USAA | 10 | 6000 | $2,301.33 |

Who is the cheapest car insurance company in DE? Review the average auto insurance rates by company below:

What are the coverage level rates by company?

| Group | Coverage Type | Annual Average |

|---|---|---|

| Liberty Mutual | High | $19,461.69 |

| Liberty Mutual | Medium | $18,149.05 |

| Liberty Mutual | Low | $17,469.29 |

| Allstate | High | $6,780.70 |

| Allstate | Medium | $6,390.63 |

| Allstate | Low | $5,776.86 |

| State Farm | High | $4,756.42 |

| Progressive | High | $4,650.79 |

| State Farm | Medium | $4,477.15 |

| Nationwide | High | $4,427.19 |

| Travelers | Medium | $4,310.79 |

| Nationwide | Low | $4,306.39 |

| Travelers | High | $4,274.89 |

| Nationwide | Medium | $4,257.06 |

| Progressive | Medium | $4,231.00 |

| State Farm | Low | $4,166.98 |

| Geico | High | $4,053.82 |

| Travelers | Low | $3,961.39 |

| Geico | Medium | $3,781.75 |

| Progressive | Low | $3,663.70 |

| Geico | Low | $3,346.29 |

| USAA | High | $2,478.30 |

| USAA | Medium | $2,322.08 |

| USAA | Low | $2,177.57 |

What are the credit history rates by company?

Geico and USAA outrank the rest with the lowest rates for drivers with good credit score.

| Group | Credit History | Annual Average |

|---|---|---|

| Liberty Mutual | Poor | $24,846.46 |

| Liberty Mutual | Fair | $16,738.18 |

| Liberty Mutual | Good | $13,495.40 |

| Allstate | Poor | $8,105.13 |

| State Farm | Poor | $6,836.26 |

| Geico | Poor | $5,781.10 |

| Allstate | Fair | $5,748.80 |

| Allstate | Good | $5,094.26 |

| Nationwide | Poor | $5,022.69 |

| Progressive | Poor | $4,674.19 |

| Travelers | Poor | $4,666.75 |

| Nationwide | Fair | $4,170.85 |

| Progressive | Fair | $4,090.99 |

| Travelers | Good | $4,028.81 |

| Travelers | Fair | $3,851.51 |

| USAA | Poor | $3,809.76 |

| Nationwide | Good | $3,797.09 |

| Progressive | Good | $3,780.31 |

| State Farm | Fair | $3,767.83 |

| Geico | Fair | $3,205.19 |

| State Farm | Good | $2,796.45 |

| Geico | Good | $2,195.57 |

| USAA | Fair | $1,841.00 |

| USAA | Good | $1,327.18 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the driving record rates by company?

Regardless of the insurer, even one DUI, speeding ticket, or accident can cause your rates to skyrocket.

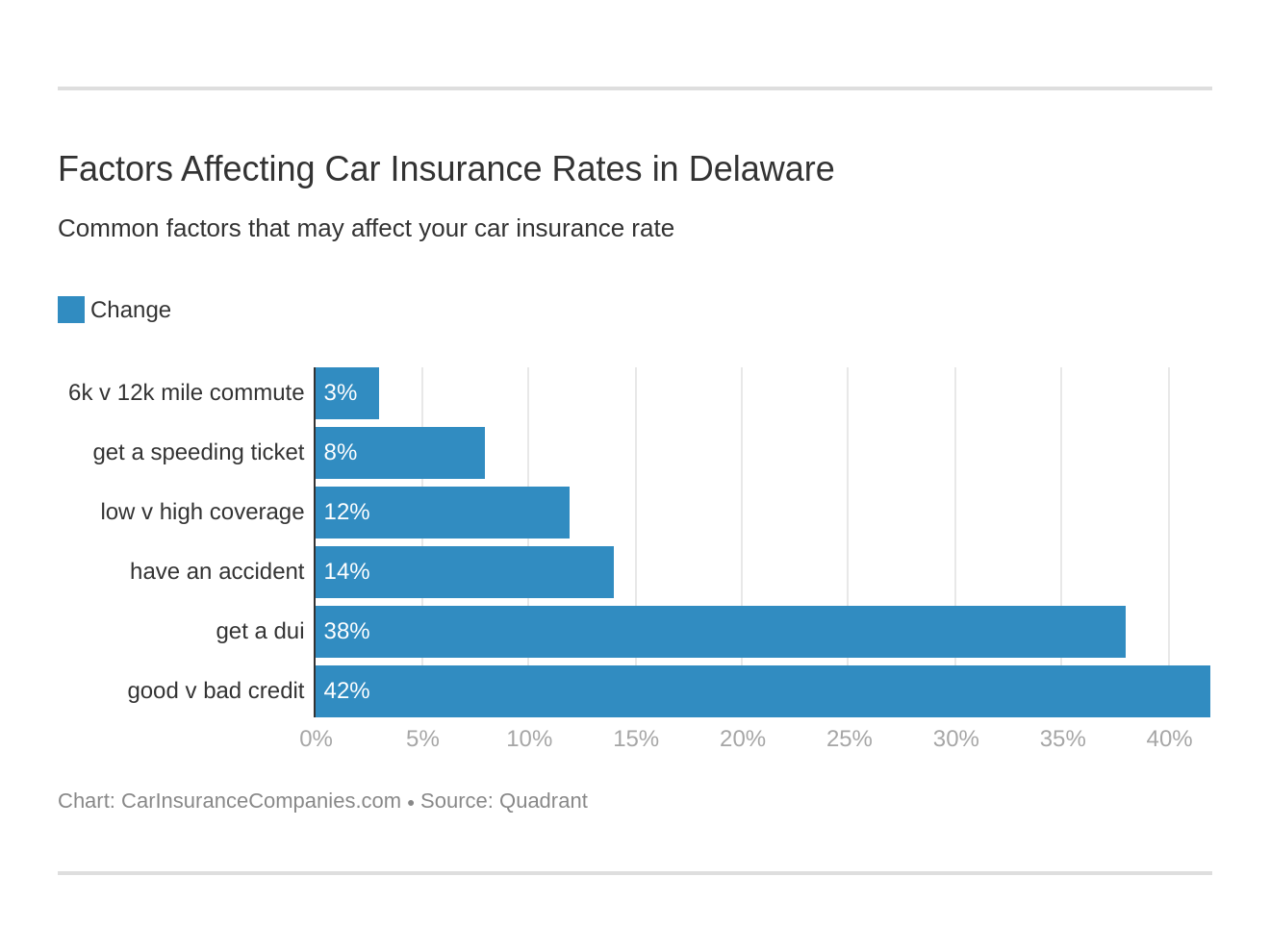

Six major factors affect car insurance rates in Delaware. Which auto insurance factors will affect rates the most? Find out below:

| Group | Driving Record | Annual Average |

|---|---|---|

| Liberty Mutual | With 1 DUI | $26,825.11 |

| Liberty Mutual | With 1 accident | $16,885.42 |

| Liberty Mutual | With 1 speeding violation | $15,044.50 |

| Liberty Mutual | Clean record | $14,685.04 |

| Allstate | With 1 DUI | $7,464.16 |

| Allstate | With 1 accident | $6,398.38 |

| Nationwide | With 1 DUI | $6,329.52 |

| Allstate | With 1 speeding violation | $6,062.01 |

| Travelers | With 1 DUI | $5,847.26 |

| Allstate | Clean record | $5,339.71 |

| State Farm | With 1 accident | $4,885.02 |

| Geico | With 1 DUI | $4,842.11 |

| Progressive | With 1 accident | $4,773.89 |

| State Farm | With 1 DUI | $4,466.85 |

| State Farm | With 1 speeding violation | $4,466.85 |

| Progressive | With 1 speeding violation | $4,247.32 |

| Progressive | With 1 DUI | $4,103.13 |

| Nationwide | With 1 speeding violation | $4,081.55 |

| State Farm | Clean record | $4,048.67 |

| Geico | With 1 accident | $3,960.12 |

| Travelers | With 1 speeding violation | $3,744.85 |

| Progressive | Clean record | $3,602.97 |

| Travelers | With 1 accident | $3,573.78 |

| Travelers | Clean record | $3,563.54 |

| Nationwide | Clean record | $3,454.89 |

| Nationwide | With 1 accident | $3,454.89 |

| USAA | With 1 DUI | $3,280.40 |

| Geico | With 1 speeding violation | $3,247.89 |

| Geico | Clean record | $2,859.02 |

| USAA | With 1 speeding violation | $2,189.94 |

| USAA | Clean record | $1,916.79 |

| USAA | With 1 accident | $1,916.79 |

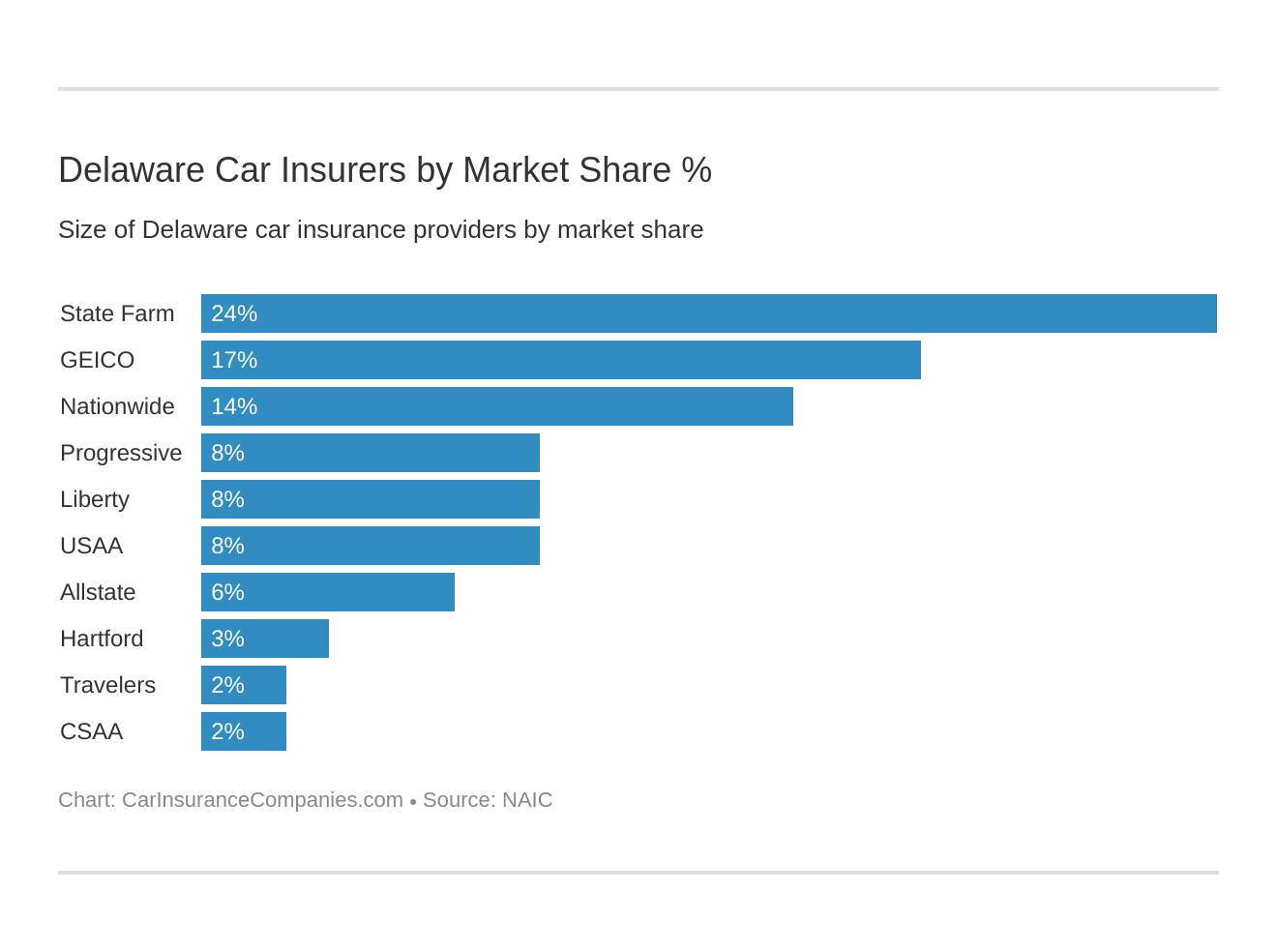

What are the largest car insurance companies in Delaware?

Again, the most financially stable insurers, State Farm and Geico have a higher market share than their competitors.

| Company | Direct Premiums Written | Market Share |

|---|---|---|

| State Farm | $208,113 | 24.36% |

| Geico | $149,130 | 17.46% |

| Nationwide | $117,716 | 13.78% |

| Progressive | $71,536 | 8.37% |

| Liberty Mutual | $65,887 | 7.71% |

| USAA | $65,690 | 7.69% |

| Allstate | $50,794 | 5.95% |

| Hartford | $22,107 | 2.59% |

| Travelers | $16,349 | 1.91% |

| CSAA | $13,997 | 1.64% |

Who are the largest auto insurance companies in DE?

What is the number of insurers in Delaware?

More than 100 insurers formed in Delaware — 101, to be exact — and 766 out-of-state, or foreign, providers offer coverage in the First State.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Next, let’s learn about Delaware’s driving and insurance laws.

What are the laws in Delaware?

Ignorance of the law is no excuse, especially if you break driving laws. Rules and regulations keep you and everyone around you safe, and it can be hard to keep track of them.

Below, we’ll cover the most vital ones you need to follow to obey the law, and we’ll cover what happens if you don’t.

Sound like a plan? Let’s dive into Delaware laws.

What are Delaware’s car insurance laws?

Many of us aren’t completely familiar with state insurance laws. These are the ones you should pay most attention to before and after an accident.

How Delaware insurance laws are determined

The Delaware Department of Insurance’s Rates/Forms Division reviews and regulates insurance contracts and rate filings. The Department of Insurance weighs several factors into determining First State insurance rates:

- Age

- Type of vehicle

- Driving record

- Discounts

- Amount of coverage

- Deductible amount

- Vehicle use

- Your place of residence

- Your credit score

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

How to get windshield coverage

The First State doesn’t have any laws specific to windshield damage and repair, however, some insurers may offer this with comprehensive coverage.

You can choose the shop where you have repairs, but you might have to pay for the difference in price. You can choose OEM parts, and again, pay the difference, or replace your windshield with aftermarket or used parts.

How to get high-risk insurance in Delaware

Uninsured drivers and those who have committed violations or multiple infractions in Delaware must file an SR-22 form. Drivers who’ve had their licenses revoked or suspended may need to file an SR-22 to have them reinstated.

The SR-22 form is available from your insurance company, but it is not an insurance policy.

Your license may be canceled for an incorrect or fraudulent license application or it may be canceled if a check written to pay driver license fees is returned for insufficient funds.

“High-risk” drivers who’ve committed serious offenses or have several violations can apply for coverage through the Delaware Auto Insurance Plan (DAIP), which provides coverage to drivers who can’t get insurance.

Bear in mind that the DAIP will choose your provider and your premiums will be higher than normal. Drivers who have this coverage must keep it for at least three years.

Those who are eligible must be licensed in the First State and have tried and failed to get insurance coverage within the past 60 days.

How to get low-income insurance in Delaware

The State of Delaware doesn’t currently offer any special low-cost car insurance. Your best bet is to compare the most affordable rates.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Is there an auto insurance fraud in Delaware?

Auto insurance fraud is a crime in Delaware. Two common types of insurance fraud in Delaware are application fraud and false claims.

To fight fraud, Delaware has established a fraud unit, the Delaware Department of Insurance. Delaware Code Title 18, Chapter 24 covers different types of insurance crimes and how they protect victims.

The Delaware Department of Insurance outlines the following examples of fraud:

Application Fraud

- Falsely reporting where your vehicle is normally garaged. Example: Your insurance rates are based on the location that you tell the insurance company your vehicle is normally kept and used. If your primary residence is in another state; however, you improperly register and insure your vehicle using a friend or relative’s residence in Delaware for financial gains, such as to get lower premiums, you are committing insurance fraud.

- Failing to disclose prior claims or accidents when asked during the application process for insurance.

- Failing to list all eligible drivers in a household on the application.

- Obtaining insurance on a vehicle in your name on which another person will be the principal driver because that driver cannot either obtain coverage elsewhere or would have to pay higher premiums.

Filing False Claims

- Overstating the value of repairs or replacement costs as reported for a loss from an auto collision, damage to property or theft claim.

- Altering any receipts for any of the above items.

- Creating a false receipt for any of the above items.

- Claiming false or exaggerated injuries to secure lost wages or any other injury settlement resulting from an accident.

If you suspect insurance fraud or have been the victim of it, you can file an online report.

What’s the statute of limitations?

Delaware’s statute of limitations for filing a claim is two years for personal injury and property damage.

What are the vehicle licensing laws?

Delaware began offering secure driver’s licenses and identification cards in 2010 to comply with the REAL ID Act Congress passed and the Department of Homeland Security enforced.

In the process, the Delaware Department of Motor Vehicles states that you must bring original or certified copies of documents with you to get a REAL ID card:

- An original or certified copy of a birth certificate issued by the Bureau of Vital Statistics or State Board of Health (wallet cards, birth registration or hospital announcements/records are NOT accepted) OR valid passport/immigration documents (must have the correct legal name).

- One proof of Social Security Number (SSN) which can be a Social Security card, W-2 tax form, SSA 1099 form, SSA Non-1099 form, pay stub containing full SSN or any valid document issued by the Social Security Administration that contains the full SSN (Medicare/Medicaid cards NOT acceptable).

- Two proofs of Delaware residency from two different sources containing a residential street address that includes applicant’s name and is postmarked or dated within 60 days (i.e.; utility bill, cable bill, voter registration card or junk mail) Personal mail and non-U.S. postal mail are NOT accepted. P.O. boxes and business addresses are also not acceptable as a residential address.

- *Legal name change documentation if applicable (i.e.; valid marriage license(s), divorce decree(s) stating legal name, court order(s), spouse’s death certificate(s)). Documents are required if your current name is different than the name that appears on your birth certificate. If you have had several name changes, in the case of multiple marriages and divorces, you will need to provide all name change documents. Clergy certificates are NOT accepted as proof of marriage. *If you recently changed your name, you MUST update your name change with the SSA 48 hours before you apply at the Division of Motor Vehicles.

Read more: Car Insurance for Clergy

Out-of-State Transfer

In addition to the documentation listed above, the following documents are also required:

- Out-of-state driver license/ID OR an official out-of-state driving record

Graduated Driver License (GDL) / ID Under 18

In addition to the documentation listed above, the following documents are also required:

- Parent, legal guardian, or court-appointed custodian with valid identification. (Legal custody order document required)

- Delaware Driver Education certificate (White or Blue slip) – Only applicable for GDL applicants

The original or certified copy of the birth certificate must list both parents’ names and must be provided in addition to immigration documentation, if applicable.

This card is also an acceptable form of identification at federal facilities, airports, and nuclear power plants. It will be required for domestic air travel starting Oct. 1, 2020.

This Delaware Online video goes over the features of the ID cards:

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the penalties for driving without insurance in Delaware?

In 2015, 11.4 percent of Delaware drivers were uninsured. Delaware ranks 28th in the nation for its number of uninsured motorists.

If law enforcement officers catch you for driving without insurance in Delaware, you’ll pay a $1,500 fine and $3,000 for subsequent offenses. You also risk losing your license for up to six months.

So, keep those fines in mind to stay on the straight and narrow.

What are the teen driver laws?

Delaware requires young drivers to pass a Graduated Driver License program. The program is intended to reduce the high accident and fatality rate among teen motorists and gives young drivers supervised driving experience to help them earn a Level 1 Permit and a Class D License.

| Restrictions | Level 1 Learner's Permit | Class D License |

|---|---|---|

| Age | 15 years, 10 months | 16 - must have held a Level 1 Permit for a minimum of six months prior |

| Passengers | No more than one passenger in addition to parent, supervisor, or sponsor | First six months or until age 18 - no passengers under 18 |

| Hours | Under age 18 - no driving between 10:00 p.m. and 6 a.m. | Under age 18 - no driving between 10:00 p.m. and 6 a.m. (exceptions: presence of a parent/guardian, driving to and from school activities or work, family emergency, being an emancipated teen) |

| Cell phone use | Complete ban Texting prohibited for all drivers | Handheld ban Texting prohibited for all drivers |

| Pre-requisites | If under 18, parent or guardian or sponsor must assume financial responsibility in written documentation | 50 total hours supervised driving, 10 must be at night |

What are the license renewal procedures for older drivers?

Like the general population, older Delaware drivers must renew their licenses every eight years and show proof of adequate vision at every renewal. And like their younger contemporaries, they must renew in-person only.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What’s the procedure for new residents?

If you move to Delaware, you have 60 days to register your vehicle and update your license.

This is crucial! You have 60 days from the time you move to Delaware to register your vehicle, and you must follow certain steps. The Delaware DMV and Department of Transportation also offer Guidelines for New Residents.

What are the license renewal procedures?

Delaware drivers must renew their licenses every eight years in person and show adequate proof of vision.

What is considered a negligent operator treatment system (NOTS)?

As part of Delaware’s point system, major violations, including those below, will earn you points on your license or a suspension in Delaware:

- Passing a stopped school bus: six points

- Reckless driving: six points

- Aggressive driving: six points

- Speeding 20 MPH over the posted speed limit: five points

- Disregarding Stop Sign or Red Light: three points

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are calculated points?

Calculated points are credited at full point value for the first 12 months from the date of a violation. After the initial 12 months have expired, the calculated points will be credited at one-half point value for the next 12 months. All actions are based upon total calculated points within a 24-month period following the offense.

Driver improvement problem driver program actions

|

Calculated Points |

Action Item |

|

8 |

The Division of Motor Vehicles sends the driver an advisory letter. |

|

12 |

Driver must complete a behavior modification/attitudinal-driving course within 90 days after notification (unless extended by DMV). Failure to comply or upon the driver’s preference, a mandatory two-month suspension will be imposed. |

|

14 |

Mandatory four-month license suspension. To become eligible for reinstatement, the driver must complete or have completed a behavior modification/attitudinal-driving course within the previous two years. |

|

16 |

Mandatory six-month license suspension. To become eligible for reinstatement, the driver must complete or have completed a behavioral modification/attitudinal-driving course within the previous two years. |

|

18 |

Mandatory eight-month license suspension. To become eligible for reinstatement, the driver must complete or have completed a behavior modification/attitudinal-driving course within the previous two years. |

|

20 |

Mandatory ten-month license suspension. To become eligible for reinstatement, the driver must complete or have completed a behavior modification/attitudinal-driving course within the previous two years. |

|

22 |

Mandatory 12-month license suspension. To become eligible for reinstatement, the driver must complete or have completed a behavior modification/attitudinal-driving course within the previous two years. |

Point credit

A speeding violation of one to 14 mph over the posted speed limit may not be assessed points, IF (a) it is the first violation within any three-year period and (b) the ticket is paid through the Voluntary Assessment Center.

A Delaware driver can receive a three-point credit by taking a defensive driving course. This credit is applied to a driver’s point total with the satisfactory completion of an approved defensive driving course. Defensive driving courses are valid for three years. The three-point credit is only applied to future violations and does not remove or reduce existing DMV points.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are some serious speeding violations?

Speed violations are among the most dangerous offenses. This is how the Delaware DMV handles serious speeding penalties:

- They send an advisory letter to drivers convicted of speeding 20-24 mph over the posted speed limit.

- The DMV will suspend drivers convicted of speeding 25 mph over the posted speed limit for one month. They will increase the length of the suspension by one month for each additional 5 mph over the initial 25 mph threshold. The driver may choose to attend the behavior modification/attitudinal-driving course in lieu of license suspension when driving 25-29 mph over the posted limit. For speeding 30 mph over the posted limit or more, the suspension is mandatory.

- They will suspend the licenses of drivers convicted of driving 50 mph or more over the posted speed limit or driving 100 mph on a highway for one year.

Read about more violations that can result in fines or a suspended license.

What are Delaware rules of the road?

We’ve covered some of the more minor offenses. As you might have guessed, that’s not all. Next, we’ll go over the more serious laws that affect your safety on the road and have more severe penalties.

Fear not, fair traveler. We’ve got your back. Scroll down to find out what you should do to stay safe and comply with the law to avoid penalties and violations.

Is Delaware at fault or no-fault state?

Delaware law holds drivers responsible for an accident at-fault for medical expenses, damages, and other collision costs under the following liability limits:

- $25,000 for each injured person.

- Up to $50,000 per accident.

- $10,000 for property damage per accident.

Again, this is the minimum required liability coverage, and to protect yourself and your loved ones, we suggest you buy coverage that exceeds those requirements.

In determining who’s at fault the state uses comparative negligence laws to assign a certain percentage of responsibility to each party involved. To receive a monetary award for damages, the victim’s (or plaintiff’s) level of fault must be less than or equal to 50 percent.

The following scenario explains how this works:

- The plaintiff suffers a broken leg, cuts, bruises, and a sprained back.

- The plaintiff was going five mph over the speed limit, but the defendant ran through a stop sign.

- The jury determines that the case is worth $50,000.

- The jury decides the plaintiff was ten percent at fault and the defendant was 90 percent at fault.

Comparative negligence will reduce the award by 10 percent, which means the plaintiff will get $45,000 ($50,000 minus $5,000). If the plaintiff was driving 15 mph over the speed limit, the jury may decide the plaintiff was 40 percent at fault. Thus, the jury would reduce the plaintiff’s award by 40 percent to $30,000.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the seat belt and car seat laws?

Delaware drivers and all front-seat passengers age 16 and older must wear a seat belt. Passengers in the back seat ages 8-15 or who weigh 66 pounds or more can wear an adult safety belt.

Law enforcement officers can ticket offenders if they notice this violation. The minimum base fine for a first offense is $25.

Delaware residents must put their children in a car seat if they are seven years old and younger and weigh less than 66 pounds. The law prefers children 11 years and younger sit in the rear seat, and if the passenger side air bag is active, the child must be 65 inches in height.

The First Statelacks specific laws against riding in the cargo areas of vehicles.

Read more: How much does air bag replacement cost?

What are the keep right and move over laws?

Delaware law states that drivers should keep right if they’re moving slower than the average speed of traffic around them:

Upon all roadways any vehicle proceeding at less than the normal speed of traffic at the time and place and under the conditions then existing shall be driven in the right-hand lane then available for traffic, or as close as practicable to the right-hand curb or edge of the roadway, except when overtaking and passing another vehicle proceeding in the same direction or when preparing for a left turn at an intersection or into a private road or driveway.

A current issue on the highways is slow drivers in the left lane, which is meant for passing. This has raised some safety concerns. State lawmakers have proposed a bill that would make it illegal to hog the left lane:

What’s the maximum speed limit?

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 65 mph |

| Urban Interstates | 55 mph |

| Other Limited Access Roads | 65 mph |

| Other Roads | 55 mph |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

How does ridesharing work?

No car insurance providers currently offer ridesharing coverage.

Rideshare Delaware,part of the DART First State initiative, is a special state commuter service that works with employers, employees, colleges, and students to improve air quality and reduce traffic congestion by championing clean commutes, including:

- Transit.

- Carpooling & Vanpooling.

- Walking.

- Biking.

- Teleworking.

- Compressed Work Weeks.

Is there an automation on the road?

Delaware doesn’t have any specific laws that regulate automated vehicles.

What are the safety laws?

The Delaware Department of Transportation (DelDOT) offers several safety resources, including the Delaware Strategic Highway Safety Plan.

Driving under the influence of alcohol and drugs and distracted driving are among the risks of the road. Let’s explore some of the laws that regulate them.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the DUI laws?

In 2006, the state of Delaware added more DUI checkpoints across the state to reduce the number of alcohol-related crashes. And in 2018, Delaware lawmakers introduced a bill that would lower the legal blood-alcohol threshold from .08 to .05.

This law firm video covers the consequences of driving while under the influence in Delaware:

These are some of the most recent DUI statistics:

| DUI in Delaware | 1st Offense | 2nd Offense | 3rd Offense | 4th Offense |

|---|---|---|---|---|

| Jail | Max. Six months | Two to 18 months | One to Two years | Two to Five years |

| Fines and Penalties | $500 to $1,500 | $750 to $2,500 | $1,500 to $5,000 | $3,000 to $7,000 |

| License Suspension | 12 to 24 months | 24 to 30 months | 24 to 36 months | 60 months |

| IID** Required | No | Possible - after 24 months | Possible - after 24 months | Possible - after 48 months |

What are the marijuana-impaired driving laws?

Delaware has a zero-tolerance policy on THC and metabolites.

What are the distracted driving laws?

The Office of Highway Safety in Delaware bans all handheld smartphones, cell phones, tablets, laptops, games, and other portable computers while driving. As the law states, “Drivers are not allowed to talk without using a hands-free device, read, write or send text messages, email or use the Internet while operating a motor vehicle.”

There’s a good reason for these strict laws: the First State has the second highest rate of crash deaths linked to distracted driving.

Police officers may find drivers $100 for using a hand-held device on their first offense. Subsequent offenses will be no less than $200 and no more than $300.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What’s driving in Delaware like?

As we noted earlier, driving in Delaware comes with plenty of risks. It’s among the states with the highest distracted driving deaths and according to AAA Mid-Atlantic Region research, and aggressive drivers are another problem. It’s no wonder there are strict laws to prevent these behaviors.

Thefts and crashes also number among the hazards, and below we’ll present some interesting statistics about them further below.

So, read on to find out more about the risks of the road.

Is there a vehicle theft in Delaware?

Did your car make the list? These were the most stolen vehicles in 2015:

| Car | Year of Vehicle | Number Stolen |

|---|---|---|

| Honda Civic | 2000 | 53 |

| Honda Accord | 2004 | 43 |

| Chevrolet Pickup (Full Size) | 2005 | 36 |

| Ford Pickup (Full Size) | 1999 | 31 |

| Chevrolet Impala | 2007 | 28 |

| Nissan Altima | 2006 | 23 |

| Honda CR-V | 2001 | 23 |

| Ford Taurus | 2002 | 22 |

| Toyota Corolla | 2010 | 21 |

| Toyota Camry | 2012 | 20 |

What’s the number of vehicle thefts by city?

Wilmington, the city with the highest population in Delaware, ranked number one.

| Top Ten Cities in Delaware With Most Vehicle Thefts | Number of Stolen Vehicles |

|---|---|

| Wilmington | 371 |

| Dover | 86 |

| Milford | 20 |

| Newark | 14 |

| Smyrna | 9 |

| Seaford | 9 |

| Middletown | 9 |

| Elsmere | 9 |

| Rehoboth Beach | 7 |

| Georgetown | 6 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What’s the number of road fatalities in Delaware?

These are some alarming statistics regarding driving-related fatalities. Remember to drive safely.

What’s the number of fatal crashes by weather and light condition?

Most crashes occurred in normal daylight conditions.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 41 | 15 | 38 | 5 | 0 | 99 |

| Rain | 2 | 2 | 8 | 1 | 0 | 13 |

| Snow/Sleet | 0 | 0 | 0 | 0 | 0 | 0 |

| Other | 0 | 0 | 0 | 0 | 0 | 0 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTAL | 43 | 17 | 46 | 6 | 0 | 112 |

Fatalities (all crashes by county)

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Kent | 14 | 21 | 27 | 31 | 21 |

| Newcastle | 48 | 59 | 63 | 53 | 59 |

| Sussex | 36 | 44 | 41 | 35 | 39 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What’s the percentage of traffic fatalities: Rural vs. urban

| Road Types | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 74 | 68 | 65 | 58 | 57 | 51 | 64 | 62 | 69 | 61 |

| Urban | 47 | 48 | 36 | 41 | 57 | 48 | 60 | 69 | 50 | 56 |

What’s the percentage of fatalities by person type?

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 30 | 45 | 50 | 42 | 44 |

| Pickup Truck | 6 | 9 | 5 | 8 | 8 |

| Utility Truck | 10 | 13 | 11 | 14 | 14 |

| Van | 4 | 6 | 3 | 8 | 3 |

| Large Truck | 2 | 4 | 2 | 1 | 0 |

| Bus | 1 | 3 | 0 | 0 | 0 |

| Motorcycle | 20 | 15 | 19 | 14 | 10 |

| Pedestrian | 25 | 26 | 36 | 27 | 33 |

| Bicyclist and Other Cyclists | 1 | 3 | 2 | 2 | 5 |

What’s the percentage of fatalities by crash type?

| Delaware Traffic Deaths by Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle Crash | 51 | 67 | 71 | 71 | 62 |

| Large Truck Involved | 10 | 12 | 12 | 9 | 14 |

| Speeding Involved | 37 | 45 | 35 | 39 | 33 |

| Rollover Involved | 13 | 23 | 16 | 20 | 13 |

| Roadway Departure Involved | 39 | 63 | 48 | 57 | 47 |

| Involving an Intersection | 25 | 26 | 36 | 37 | 39 |

| State Total | 99 | 124 | 131 | 119 | 119 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Five-year trend for the top ten counties

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| New Castle County | 48 | 59 | 63 | 53 | 59 |

| Sussex County | 36 | 44 | 41 | 35 | 39 |

| Kent County | 14 | 21 | 27 | 31 | 21 |

What’s the percentage of fatalities involving speed by county?

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Kent | 8 | 5 | 3 | 14 | 8 |

| New Castle | 13 | 27 | 18 | 12 | 16 |

| Sussex | 16 | 13 | 14 | 13 | 9 |

What’s the percentage of fatalities in crashes involving an alcohol-impaired driver?

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Kent | 8 | 10 | 7 | 7 | 10 |

| New Castle | 16 | 23 | 19 | 16 | 15 |

| Sussex | 14 | 18 | 14 | 14 | 7 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the teen drinking and driving laws?

These are some underage drunk driving stats for Delaware in 2016:

- Under 18 DUI arrests: 0

- Under 18 DUI arrest rate: 0 percent

- Under 21 drunk driving death rate: 1.7

Note: The above drunk driving arrest rate is for every 100,000 residents under the age of 18, while the death rate listed is per 100,000 Delaware residents of all ages.

What’s the average EMS response time?

Rural areas may have higher response times because of their distance from major urban areas.

| Location | Time of Crash to EMS Notification | Notification to Arrival | Arrival at Scene to Hospital Arrival | Time of Crash to Time of Hospital Arrival |

|---|---|---|---|---|

| Rural | 3.04 | 7.78 | 39.27 | 47.79 |

| Urban | 2.06 | 4.33 | 20.32 | 26.92 |

What’s transportation like?

The First State, like a similar small state, Connecticut, is part of a tri-state traffic jam. In this case, Delaware, southeast Pennsylvania, and southern New Jersey merge along the I-95 corridor, which is at its most hectic during peak traffic times in the day and in the evening.

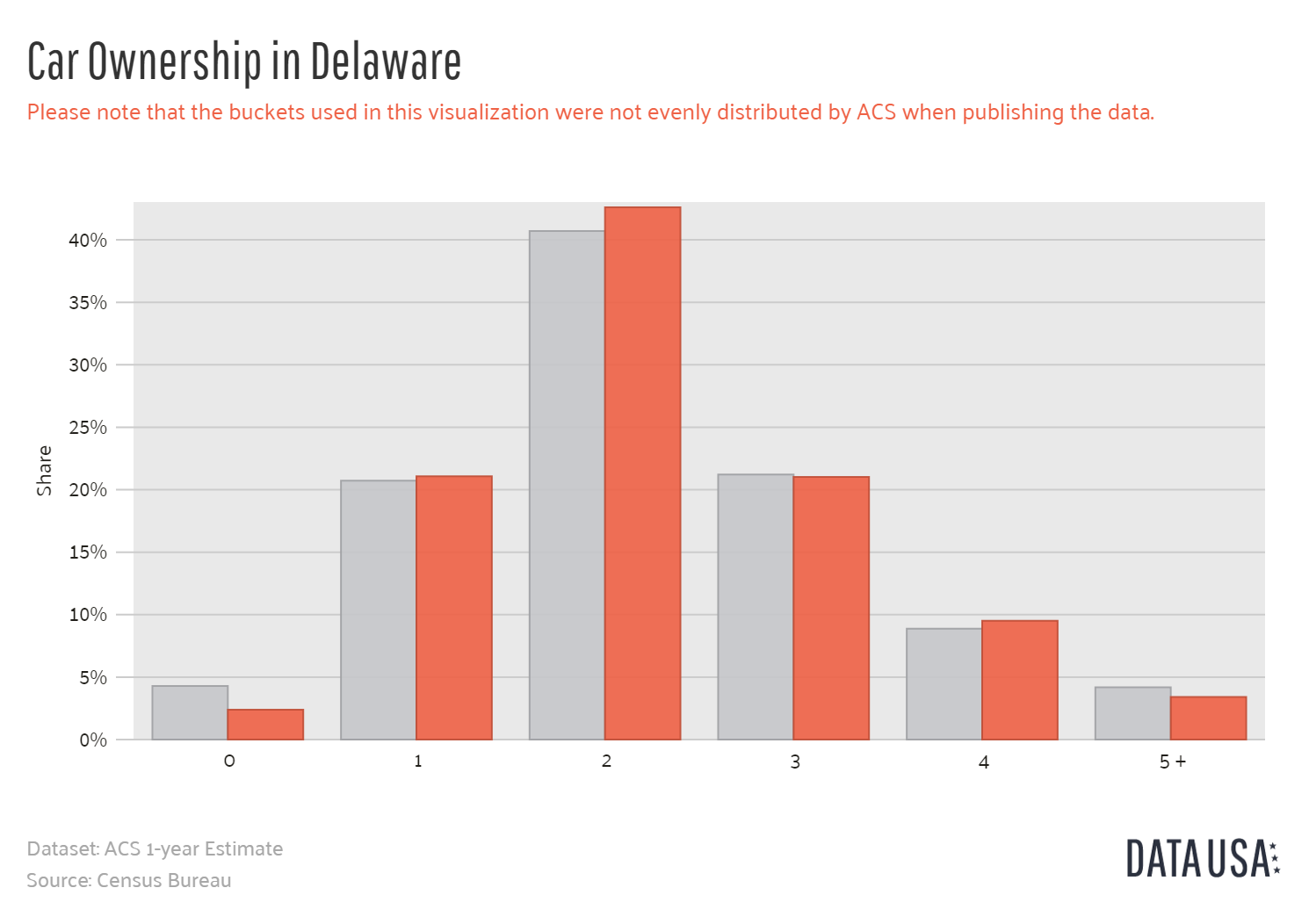

– Car Ownership

Like the national average, more than 40 percent of Delaware drivers own at least two cars.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

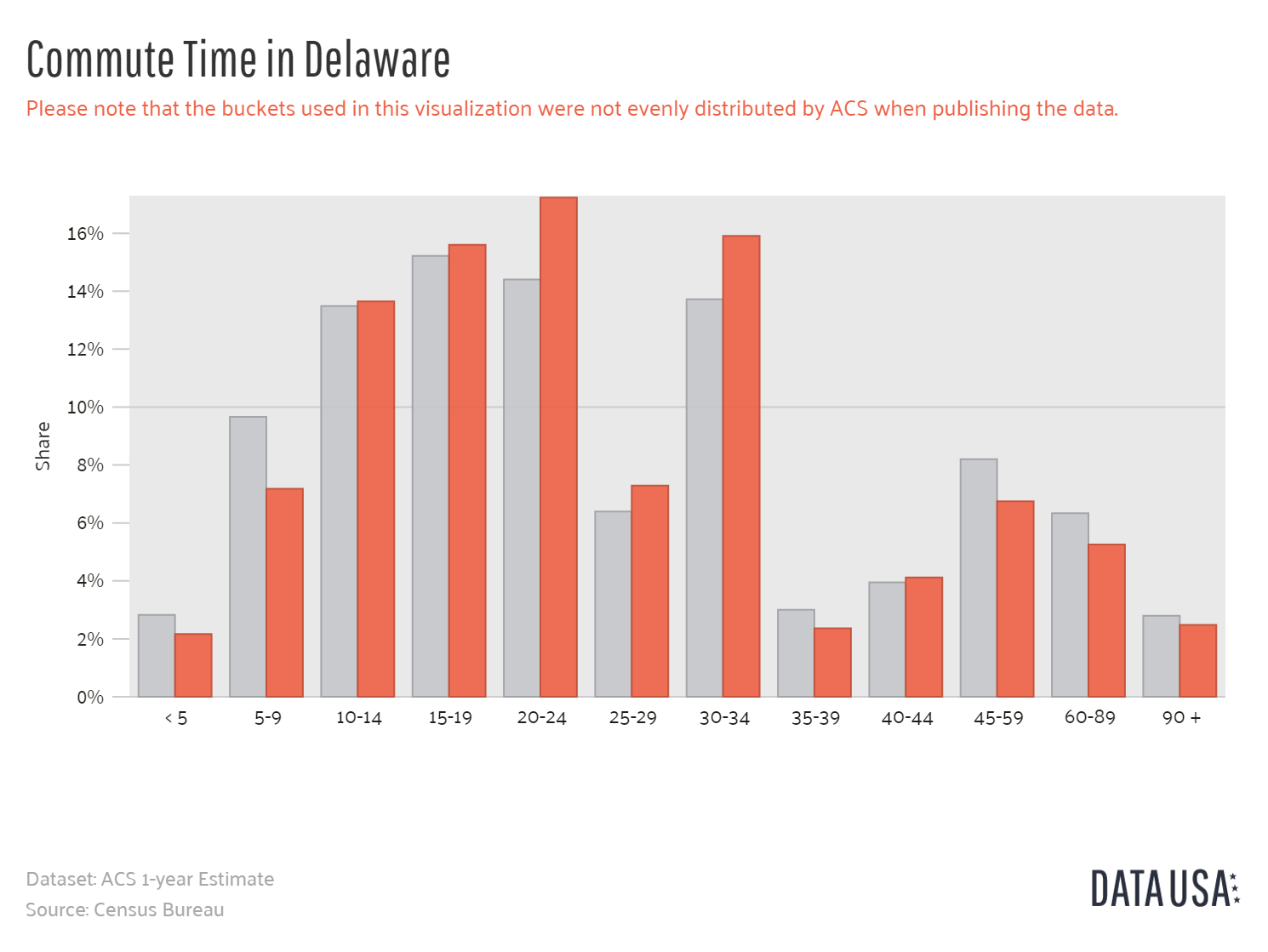

What is the average commute time?

Delaware drivers share an average commute time of 25 minutes, while 2.5 percent of them report they face “super commutes” of 90 minutes or more.

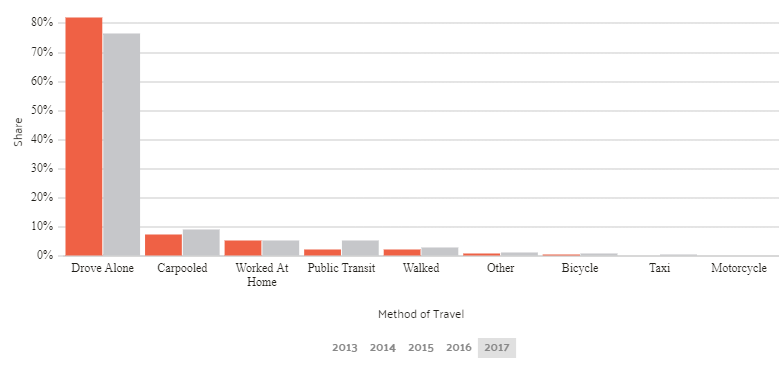

What’s the preferred commuter transportation?

Most Delaware residents drive alone.

Is there a traffic congestion in Delaware?

Sussex County is growing at a rate of more than 5,000 permanent residents yearly. As Sussex County has grown, so has traffic congestion and related issues. Even outside of the summer tourist season, Route 1 between Lewes and Rehoboth Beach is jammed with cars, trucks, motorcycles and recreational vehicles.

What did you like most about this guide? Did you find it helpful in learning about all things car insurance?

You’ve sifted through the facts and read all the reports. Now you can put all of the knowledge you’ve gained to good use in researching the best quotes for you and your situation.

Enter your zip code below to start saving today.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.