Indiana Car Insurance (Coverage, Companies, & More)

Indiana car insurance rates are 20 percent cheaper than the national average with an average monthly premium of $61 per month. Your individual rates may vary based on your driving record and the kind of car you drive. To make sure you aren't overpaying for coverage, read our guide and use our free quote comparison tool below to compare multiple Indiana auto insurance quotes from the top companies in your neighborhood.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 23, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 23, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| INDIANA STATISTICS SUMMARY | DETAILS |

|---|---|

| Road Miles | Total in State: 96,698 Vehicle Miles Driven: 7.92 billion |

| Vehicles | Registered: 5.8 million Total Stolen: 13,861 |

| State Population | 6,691,878 |

| Most Popular Vehicle | Chevy Silverado 1500 |

| Uninsured Motorists | 16.70% State Rank: 8th |

| Driving Fatalities | Speeding: 208 Drunk Driving: 220 |

| Average Annual Premiums | Liability: $382.68 Collision: $250.29 Comprehensive: $122.06 Combined: $755.03 |

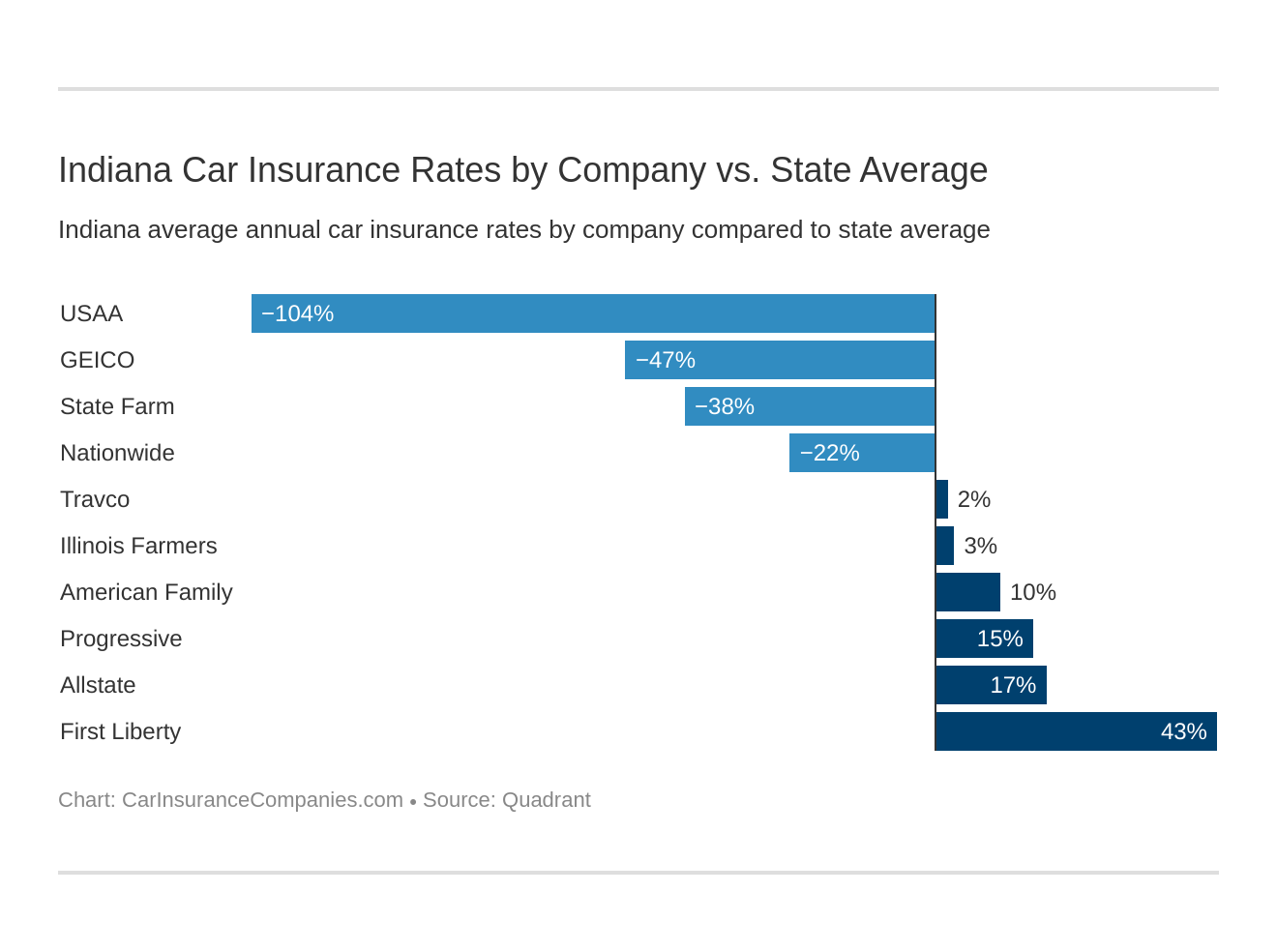

| Cheapest Provider | USAA |

A lot of people describe driving out on the open road as one of the best feelings in the world. Top down, wind blowing, cruising down the roads of Indiana with no traffic. Sounds like a dream come true, right?

Well, in order to get to that dream, you’ll need to get your car insurance needs taken care of. After all, car insurance is required in the state of Indiana.

That’s why we’ve made this comprehensive guide for you, to take the guesswork and stress out of the equation altogether.

We’ll cover all of the important car insurance topics you’ll need to know in order to get the insurance coverage you need. We’ll discuss everything from the particular coverage and rates in Indiana to the various car insurance companies available in Indiana, and more.

Ready to get started now? Use our FREE online tool. You only need your ZIP code to get started.

Indiana Car Insurance Coverage and Rates

To get you started on your car insurance journey, we’ll cover the basics of the insurance coverage you’ll need in Indiana, as well as some of the insurance rates you can expect.

Indiana Minimum Coverage

State minimum auto insurance rates and requirements vary from state to state. Compare state to state below:

Every state has a minimum liability coverage law that you must have in order to legally drive. It essentially ensures that if you are ever in an accident, you have the funds needed to pay for that accident — particularly if you are the one at fault for the accident.

According to the State of Indiana, the following minimum liability coverage is required:

| INSURANCE REQUIRED | COVERAGES |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person $50,000 per accident |

| Property Damage Liability Coverage | $25,000 minimum |

| Uninsured Motorist Coverage | $25,000 per person $50,000 per accident |

| Underinsured Motorist Coverage | $50,000 minimum |

What does all of this mean? Let’s break it down.

- $25,000 for the payment of any bodily injuries/deaths of one person in an accident that you caused (or in the case of an accident with an uninsured motorist)

- $50,000 for the payment of any bodily injuries/deaths of multiple people in an accident that you caused (or in the case of an accident with an uninsured motorist)

- $25,000 for the payment of any property damage incurred in an accident that you caused

- $50,000 minimum for the payment of an accident that occurred with an underinsured driver

This coverage becomes especially important due to the fact that Indiana is an at-fault state.

An at-fault state is a state who places the liability (costs) of an accident on the person who caused the accident.

Due to this, You should at least consider buying more than just the minimum coverage. You never know what’ll happen if you’re in a serious enough car accident.

Forms of Financial Responsibility

You’ve likely heard of proof of insurance, a form of financial responsibility that basically provides proof that you have at least the minimum liability coverage required.

According to Indiana’s Bureau of Motor Vehicles, you may be required to provide your proof of insurance in any of the following situations:

- An auto accident for which the BMV receives an accident report.

- A pointable moving violation within one year of receiving two other pointable moving violations.

- A serious traffic violation, such as a misdemeanor or felony.

- Any pointable violation by a driver who was previously suspended for failing to provide proof of financial responsibility.

If you have been in any of these situations, Indiana’s BMV will send you a verification form in the mail.

Once you receive this form, your car insurance provider will then file an electronic Certificate of Compliance form (COC) as proof of insurance with the BMV. This COC form will basically show that the vehicle you were operating at the time of the incident/accident was insured.

Your provider can submit this proof of insurance through the state’s Electronic Forms Submission, or through the EIFS portal to process.

If you in fact were caught driving without being insured, you will have your driving privileges suspended. If so, you will have to file an SR-22 form to be allowed to drive your vehicle again.

Premiums as a Percentage of Income

There is a term known as a per capita disposable income, which can actually affect your insurance rates. So what is it exactly?

Per capita disposable income is the average amount of money that a group of people (such as the citizens of Indiana) has after all their taxes have been paid.

Indiana has the following per capita disposable income values:

| YEAR | FULL COVERAGE | DISPOSABLE INCOME | INSURANCE AS PERCENTAGE OF INCOME |

|---|---|---|---|

| 2012 | $724.44 | $35,125.00 | 2.06% |

| 2013 | $704.50 | $35,163.00 | 2.00% |

| 2014 | $728.93 | $36,364.00 | 2.00% |

You can see in the table above that on average, Indiana citizens pay about 2 percent of their income to car insurance. So making sure you get the best deal you can is very important. You don’t want to be paying more than you have to.

Average Monthly Car Insurance Rates in IN (Liability, Collision, Comprehensive)

Your average monthly car insurance rates may not increase as much as you might think by adding additional coverage like comprehensive. Review rates for auto insurance coverage below:

The table below displays the core coverage insurance in the state of Indiana according to the National Association of Insurance Commissioners (NAIC):

| COVERAGE TYPE | ANNUAL COSTS IN 2015 |

|---|---|

| Liability | $382.68 |

| Collision | $250.29 |

| Comprehensive | $122.06 |

| Combined | $755.03 |

Additional Coverage

There are two types of additional liability coverage that are available medical payments (MedPay) and uninsured/underinsured motorist.

Medical payment (MedPay) coverage is optional in the state of Indiana. It helps to cover any of your medical payments should you ever be in an accident. Most other coverage types help you pay for the cost of an accident, while this coverage primarily helps YOU.

In Indiana, uninsured/underinsured motorist coverage is required as well as your minimum liability coverage.

If you’re required to have additional coverage such as this, it’s definitely for your benefit. This coverage type helps you out if you ever find yourself in an accident with another driver who’s uninsured or underinsured.

Now that you know the different additional liability coverage options available to you in Indiana, we’ll discuss loss ratios. But what exactly is a loss ratio and why should you care?

A loss ratio is essentially a way for you to see the financial health of these coverages for each of the different insurance providers in the state.

It’s calculated by comparing the amount of money insurance companies pay out in claims, compared to the amount of money the insurance companies bring in through the insurance premiums you pay.

When it comes to this calculated loss ratio, you want something that isn’t too high, nor too low.

A company with a loss ratio that’s too low means that they probably overpriced their policies or overestimated the number of claims they would receive. A company with a loss ratio that’s too high is paying out more than expected and will probably have to increase rates in the future.

So think of it as the story of Goldilocks. You want something just right.

According to the National Association of Insurance Commissioners (NAIC), the following loss ratios were found for the state of Indiana:

| LOSS RATIO | 2015 | 2014 | 2013 |

|---|---|---|---|

| Medical Payments (MedPay) | 85.48 | 82.86 | 79.55 |

| Uninsured/Underinsured Motorist Coverage | 73.42 | 64.13 | 60.33 |

You can see in the table above that the loss ratios for both MedPay and uninsured/underinsured motorist are doing relatively well. So you can rest easy.

Add-ons, Endorsements, and Riders

Getting the best coverage for the most affordable price is always a top priority when shopping for insurance. Did you know that you could be missing out on several extremely useful and cheap coverage types because of it?

Check out the list below to see what’s available to you in Indiana:

- Guaranteed auto protection (GAP)

- Personal umbrella policy (PUP)

- Rental reimbursement

- Emergency roadside assistance

- Mechanical breakdown insurance

- Non-owner car insurance

- Modified car insurance coverage

- Classic car insurance

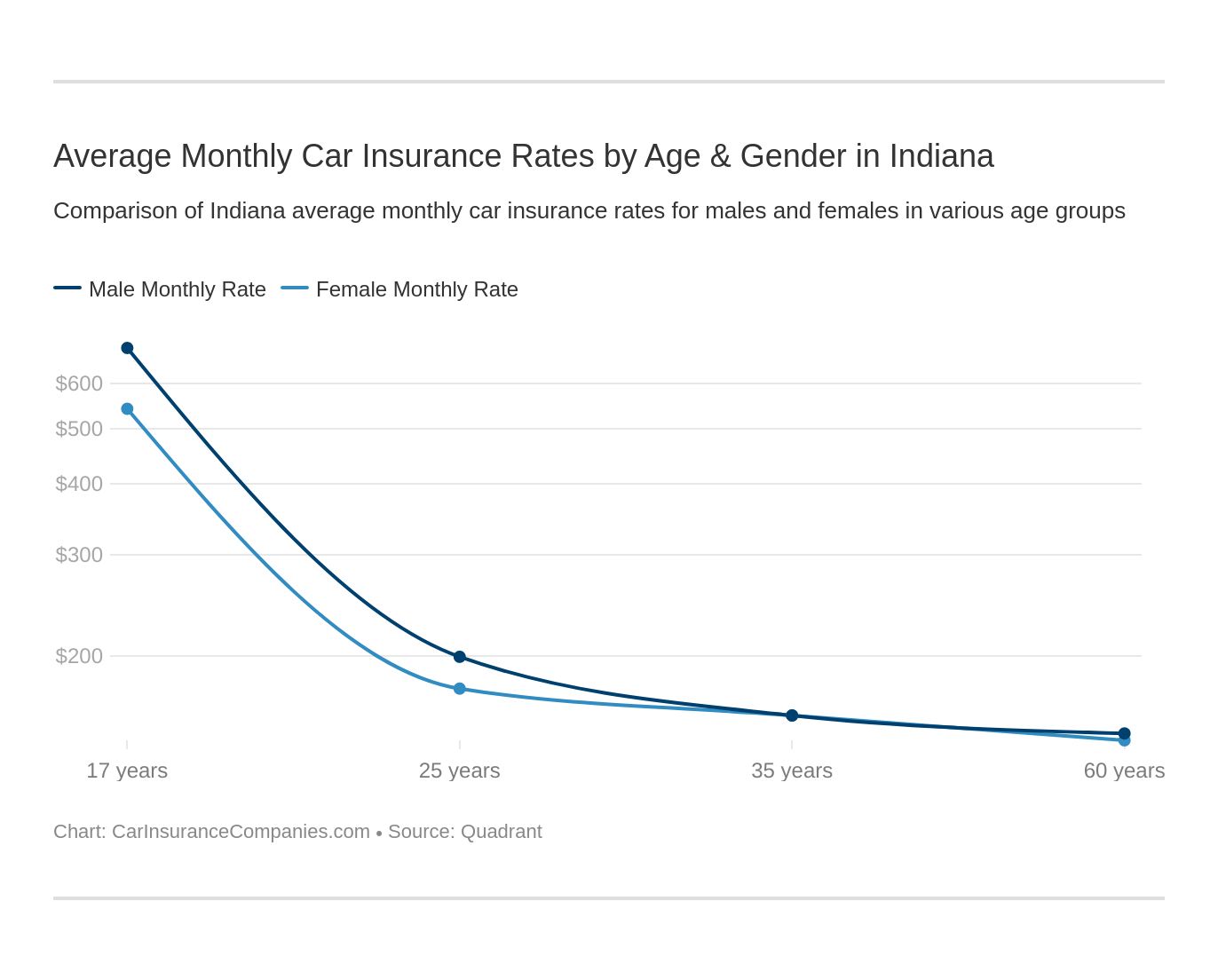

Average Monthly Car Insurance Rates by Age & Gender in IN

What demographic you’re in can play a factor in what kind of insurance rate you will pay. There’s a myth out there for insurance that men tend to pay more for their coverage than women.

We’ve collected the demographic rates in Indiana to see whether this myth was true, listed below.

| Company | Married 35-year-old female | Married 35-year-old male | Married 60-year-old female | Married 60-year-old male | Single 17-year-old female | Single 17-year-old male | Single 25-year-old female | Single 25-year-old male |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $2,461.65 | $2,522.04 | $2,161.34 | $2,364.89 | $7,566.53 | $9,542.11 | $2,500.79 | $2,718.57 |

| American Family Mutual | $2,305.56 | $2,305.56 | $2,072.87 | $2,072.87 | $6,342.08 | $9,188.19 | $2,305.56 | $2,839.57 |

| First Liberty Ins Corp | $3,951.85 | $3,951.85 | $3,632.20 | $3,632.20 | $8,652.09 | $13,064.06 | $3,951.85 | $5,418.04 |

| Geico Cas | $1,543.08 | $1,533.98 | $1,441.76 | $1,492.21 | $4,534.08 | $4,216.98 | $1,765.37 | $1,558.45 |

| Illinois Farmers Ins 2.0 | $1,558.68 | $1,538.30 | $1,333.35 | $1,497.61 | $8,369.82 | $8,927.88 | $2,053.19 | $2,219.06 |

| Nationwide Mutual | $1,670.50 | $1,708.99 | $1,463.84 | $1,564.29 | $4,865.35 | $6,323.43 | $1,959.23 | $2,144.10 |

| Progressive Paloverde | $1,659.70 | $1,570.98 | $1,503.23 | $1,513.35 | $9,753.71 | $10,976.02 | $2,081.70 | $2,125.43 |

| State Farm Mutual Auto | $1,480.20 | $1,480.20 | $1,318.52 | $1,318.52 | $4,476.08 | $5,736.50 | $1,637.30 | $1,821.69 |

| Travco Ins Co | $1,225.25 | $1,246.82 | $1,148.12 | $1,147.95 | $7,586.22 | $11,997.40 | $1,295.87 | $1,500.67 |

| USAA | $1,039.00 | $1,023.39 | $966.69 | $974.02 | $2,894.49 | $3,235.29 | $1,404.62 | $1,503.00 |

As you can see, men do tend to pay more than their female counterparts. Although it appears in Indiana that married couples only vary slightly in their prices. (For more information, read our “Can married couples have separate car insurance?“).

The biggest price gap is between the younger demographics.

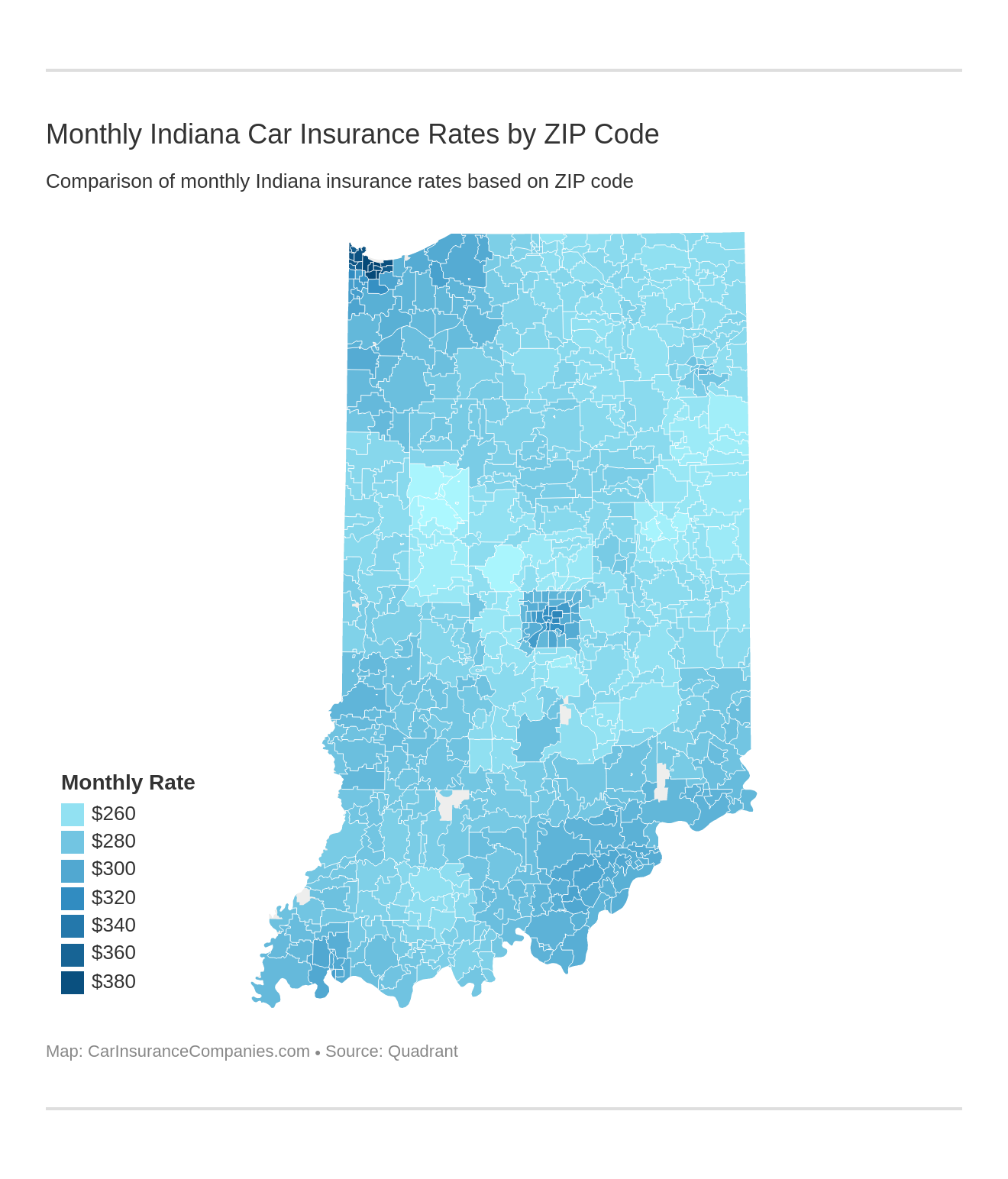

Highest/Lowest by ZIP Code

We have done the hard work for you and have organized insurance rates by ZIP code from highest to lowest.

| Zip Code | Average | Allstate P&C | American Family Mutual | Illinois Farmers Ins 2.0 | Geico Cas | First Liberty Ins Corp | Nationwide Mutual | Progressive Paloverde | State Farm Mutual Auto | Travco Ins Co | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 46402 | $4,747.17 | $4,436.29 | $5,005.05 | $4,942.93 | $3,059.32 | $9,628.64 | $4,158.79 | $5,016.29 | $3,105.40 | $5,850.12 | $2,268.89 |

| 46409 | $4,692.40 | $4,134.46 | $5,005.05 | $4,942.93 | $3,059.32 | $9,628.64 | $4,158.79 | $4,921.87 | $3,329.90 | $5,474.18 | $2,268.89 |

| 46404 | $4,666.36 | $4,374.19 | $5,005.05 | $4,942.93 | $3,059.32 | $9,628.64 | $4,158.79 | $4,677.51 | $3,074.12 | $5,474.18 | $2,268.89 |

| 46406 | $4,653.94 | $4,376.26 | $5,005.05 | $4,942.93 | $3,059.32 | $9,628.64 | $4,158.79 | $4,931.51 | $3,038.44 | $5,122.67 | $2,275.82 |

| 46408 | $4,643.30 | $4,134.46 | $5,005.05 | $4,942.93 | $3,059.32 | $9,628.64 | $4,158.79 | $4,725.36 | $3,386.85 | $5,122.67 | $2,268.89 |

| 46407 | $4,593.71 | $4,372.06 | $5,005.05 | $4,942.93 | $3,059.32 | $9,628.64 | $4,158.79 | $4,443.88 | $3,118.75 | $4,938.83 | $2,268.89 |

| 46403 | $4,578.59 | $4,134.46 | $5,005.05 | $4,942.93 | $3,059.32 | $9,628.64 | $4,158.79 | $4,465.37 | $2,999.79 | $5,122.67 | $2,268.89 |

| 46312 | $4,535.08 | $4,377.90 | $5,005.05 | $4,034.49 | $2,633.18 | $9,628.64 | $4,158.79 | $4,894.91 | $3,219.33 | $5,122.67 | $2,275.82 |

| 46320 | $4,504.55 | $4,377.30 | $5,005.05 | $4,128.08 | $2,633.18 | $9,628.64 | $4,158.79 | $4,898.11 | $3,248.93 | $4,691.62 | $2,275.82 |

| 46327 | $4,484.26 | $4,386.01 | $5,005.05 | $4,034.49 | $2,633.18 | $9,628.64 | $4,158.79 | $4,811.48 | $3,217.48 | $4,691.62 | $2,275.82 |

| 46323 | $4,437.39 | $4,376.93 | $5,005.05 | $4,128.08 | $2,633.18 | $9,628.64 | $4,158.79 | $4,737.56 | $3,155.80 | $4,274.08 | $2,275.82 |

| 46405 | $4,429.98 | $4,134.46 | $4,299.79 | $4,942.93 | $2,701.41 | $9,628.64 | $4,158.79 | $4,312.85 | $2,980.24 | $4,871.82 | $2,268.89 |

| 46394 | $4,389.62 | $4,361.16 | $4,641.89 | $4,030.67 | $2,633.18 | $8,830.37 | $4,158.79 | $4,932.20 | $2,909.43 | $5,122.67 | $2,275.82 |

| 46324 | $4,283.88 | $4,377.66 | $4,641.89 | $4,128.08 | $2,633.18 | $8,830.37 | $4,158.79 | $4,529.78 | $2,989.10 | $4,274.08 | $2,275.82 |

| 46218 | $3,918.34 | $4,774.63 | $4,320.53 | $3,268.08 | $2,935.62 | $6,988.78 | $3,512.46 | $4,785.22 | $3,000.11 | $3,790.49 | $1,807.48 |

| 46225 | $3,911.50 | $4,556.36 | $4,320.53 | $3,436.60 | $2,935.62 | $6,988.78 | $3,532.40 | $4,296.05 | $2,849.34 | $4,277.32 | $1,921.95 |

| 46201 | $3,903.52 | $4,562.82 | $4,320.53 | $3,436.60 | $2,935.62 | $6,988.78 | $3,512.46 | $4,737.15 | $2,765.34 | $3,968.38 | $1,807.48 |

| 46321 | $3,840.34 | $4,445.24 | $4,299.79 | $4,058.82 | $2,701.41 | $6,539.56 | $2,832.08 | $4,761.83 | $2,634.19 | $4,300.26 | $1,830.24 |

| 46202 | $3,836.94 | $4,562.82 | $4,320.53 | $3,236.78 | $2,746.89 | $6,988.78 | $3,186.72 | $4,307.58 | $2,734.67 | $4,362.71 | $1,921.95 |

| 46205 | $3,811.23 | $4,562.82 | $4,320.53 | $3,268.08 | $2,746.89 | $5,987.84 | $3,305.36 | $4,809.00 | $3,033.02 | $4,118.56 | $1,960.16 |

| 46203 | $3,810.17 | $4,333.96 | $4,320.53 | $3,436.60 | $2,935.62 | $6,988.78 | $3,532.40 | $4,393.59 | $2,727.33 | $3,542.89 | $1,890.04 |

| 46410 | $3,807.74 | $4,134.46 | $4,299.79 | $4,942.93 | $2,701.41 | $6,402.26 | $2,610.30 | $4,560.69 | $2,817.47 | $3,666.52 | $1,941.51 |

| 46208 | $3,803.31 | $4,774.63 | $4,320.53 | $3,236.78 | $2,746.89 | $5,987.84 | $3,305.36 | $4,680.32 | $2,940.19 | $4,112.62 | $1,927.91 |

| 46204 | $3,795.21 | $4,562.82 | $4,320.53 | $3,266.99 | $2,746.89 | $6,988.78 | $3,186.72 | $4,111.33 | $2,707.44 | $4,138.62 | $1,921.95 |

| 46319 | $3,791.73 | $4,379.83 | $4,299.79 | $4,058.82 | $2,701.41 | $6,402.26 | $2,832.08 | $4,788.69 | $2,666.18 | $3,957.99 | $1,830.24 |

| 46222 | $3,773.50 | $4,855.19 | $4,320.53 | $3,236.78 | $2,746.89 | $6,988.78 | $3,186.72 | $4,474.08 | $2,860.70 | $3,286.04 | $1,779.33 |

| 46226 | $3,715.81 | $4,643.42 | $4,039.39 | $3,268.08 | $2,757.94 | $5,856.67 | $3,305.36 | $4,508.08 | $2,790.99 | $4,079.71 | $1,908.46 |

| 46221 | $3,707.80 | $4,504.82 | $4,039.39 | $3,430.48 | $2,446.55 | $6,988.78 | $3,067.49 | $4,078.46 | $2,737.15 | $3,890.28 | $1,894.57 |

| 46224 | $3,707.10 | $4,739.10 | $4,039.39 | $3,236.78 | $2,560.31 | $6,988.78 | $3,186.72 | $4,254.20 | $2,628.69 | $3,523.69 | $1,913.34 |

| 46322 | $3,696.55 | $4,381.45 | $4,299.79 | $3,952.65 | $2,701.41 | $6,539.56 | $2,832.08 | $4,348.47 | $2,647.19 | $3,432.70 | $1,830.24 |

| 46375 | $3,695.41 | $4,257.92 | $4,299.79 | $3,952.65 | $2,701.41 | $6,402.26 | $2,832.08 | $4,590.37 | $2,586.38 | $3,625.06 | $1,706.16 |

| 47708 | $3,694.89 | $4,025.78 | $3,869.89 | $4,076.66 | $2,402.59 | $6,594.45 | $2,766.37 | $4,363.24 | $2,847.82 | $4,181.84 | $1,820.26 |

| 47713 | $3,679.39 | $4,025.78 | $3,869.89 | $4,076.66 | $2,402.59 | $6,594.45 | $2,766.37 | $4,182.99 | $2,836.69 | $4,218.17 | $1,820.26 |

| 46311 | $3,678.46 | $4,228.28 | $4,299.79 | $3,911.36 | $2,701.41 | $6,402.26 | $2,832.08 | $4,154.67 | $2,645.06 | $3,903.52 | $1,706.16 |

| 46373 | $3,678.32 | $4,166.55 | $4,299.79 | $3,833.51 | $2,701.41 | $6,402.26 | $2,832.08 | $4,217.63 | $2,811.97 | $3,811.87 | $1,706.16 |

| 46391 | $3,661.15 | $4,180.47 | $4,218.96 | $3,809.84 | $2,353.77 | $6,926.39 | $2,950.85 | $4,052.23 | $2,646.73 | $3,861.78 | $1,610.51 |

| 47124 | $3,643.04 | $4,248.05 | $3,937.79 | $3,647.88 | $2,556.33 | $5,875.05 | $3,335.60 | $4,580.85 | $2,768.66 | $3,745.68 | $1,734.46 |

| 46301 | $3,640.46 | $4,217.19 | $3,979.57 | $3,905.67 | $2,353.77 | $6,926.39 | $2,983.82 | $4,241.52 | $2,575.96 | $3,316.09 | $1,904.61 |

| 46342 | $3,639.98 | $3,953.18 | $4,299.79 | $3,812.06 | $2,701.41 | $6,402.26 | $2,610.30 | $4,118.41 | $2,664.50 | $3,896.32 | $1,941.51 |

| 46303 | $3,639.65 | $4,137.88 | $4,299.79 | $3,781.18 | $2,701.41 | $6,402.26 | $2,068.86 | $4,146.41 | $2,771.14 | $4,389.62 | $1,697.98 |

| 47106 | $3,625.98 | $4,085.80 | $3,937.79 | $3,647.88 | $2,437.68 | $5,937.41 | $3,335.60 | $4,459.13 | $2,674.47 | $3,846.34 | $1,897.73 |

| 46345 | $3,625.44 | $4,077.48 | $4,218.96 | $3,731.94 | $2,233.98 | $6,926.39 | $2,978.18 | $4,338.11 | $2,656.18 | $3,482.66 | $1,610.51 |

| 46227 | $3,623.82 | $4,287.67 | $4,006.75 | $3,436.60 | $2,369.70 | $5,987.84 | $3,206.33 | $4,872.69 | $2,692.05 | $3,607.61 | $1,771.02 |

| 47722 | $3,623.23 | $3,984.36 | $3,869.89 | $4,076.66 | $2,402.59 | $6,594.45 | $2,766.37 | $4,206.93 | $2,665.75 | $3,845.08 | $1,820.26 |

| 47163 | $3,614.57 | $4,268.77 | $3,937.79 | $3,647.88 | $2,437.68 | $5,937.41 | $3,335.60 | $4,528.25 | $2,544.26 | $3,610.32 | $1,897.73 |

| 46302 | $3,611.22 | $3,935.86 | $4,218.96 | $3,812.06 | $2,138.50 | $6,535.71 | $2,983.82 | $4,624.80 | $2,641.79 | $3,316.09 | $1,904.61 |

| 47122 | $3,606.56 | $4,248.50 | $3,937.79 | $3,636.81 | $2,556.33 | $5,875.05 | $3,335.60 | $4,388.15 | $2,710.39 | $3,642.54 | $1,734.46 |

| 47720 | $3,604.77 | $3,984.36 | $3,869.89 | $4,076.66 | $2,402.59 | $6,594.45 | $2,766.37 | $3,987.41 | $2,663.12 | $3,845.08 | $1,857.74 |

| 47126 | $3,602.10 | $4,017.31 | $3,937.79 | $3,647.88 | $2,437.68 | $5,937.41 | $3,335.60 | $4,509.85 | $2,670.85 | $3,628.93 | $1,897.73 |

| 47711 | $3,601.31 | $4,020.54 | $3,869.89 | $4,076.66 | $2,402.59 | $6,594.45 | $2,766.37 | $4,228.45 | $2,666.33 | $3,531.94 | $1,855.89 |

| 46235 | $3,601.26 | $4,597.23 | $4,006.75 | $3,430.48 | $2,757.94 | $5,856.67 | $3,036.86 | $4,164.60 | $2,805.94 | $3,447.66 | $1,908.46 |

| 46216 | $3,600.77 | $4,631.57 | $4,039.39 | $3,268.08 | $2,510.73 | $5,856.67 | $3,038.68 | $4,270.31 | $2,532.68 | $3,951.12 | $1,908.46 |

| 47712 | $3,599.76 | $3,980.42 | $3,869.89 | $4,076.66 | $2,402.59 | $6,594.45 | $2,766.37 | $4,120.64 | $2,719.54 | $3,609.31 | $1,857.74 |

| 47714 | $3,597.37 | $4,020.54 | $3,869.89 | $4,076.66 | $2,402.59 | $6,594.45 | $2,766.37 | $4,144.48 | $2,673.86 | $3,604.61 | $1,820.26 |

| 47710 | $3,595.86 | $4,023.33 | $3,869.89 | $4,076.66 | $2,402.59 | $6,594.45 | $2,766.37 | $4,116.91 | $2,728.78 | $3,523.71 | $1,855.89 |

| 47165 | $3,595.20 | $4,200.98 | $3,937.79 | $3,956.70 | $2,437.68 | $5,937.41 | $2,894.50 | $4,464.19 | $2,760.65 | $3,645.87 | $1,716.22 |

| 46393 | $3,593.95 | $3,944.88 | $4,299.79 | $3,812.06 | $2,701.41 | $6,535.71 | $2,610.30 | $4,392.97 | $2,656.18 | $3,225.78 | $1,760.45 |

| 47147 | $3,593.87 | $4,045.83 | $3,937.79 | $3,647.88 | $2,437.68 | $5,937.41 | $3,148.25 | $4,355.40 | $2,629.16 | $3,901.57 | $1,897.73 |

| 46282 | $3,593.55 | $3,915.20 | $3,615.98 | $3,268.08 | $2,746.89 | $6,988.78 | $3,186.72 | $3,909.39 | $2,748.98 | $3,757.49 | $1,797.98 |

| 46360 | $3,588.52 | $4,180.47 | $4,169.43 | $3,731.96 | $2,353.77 | $6,926.39 | $2,983.82 | $3,972.42 | $2,563.78 | $3,316.09 | $1,687.11 |

| 47119 | $3,587.12 | $3,918.30 | $3,937.79 | $3,621.54 | $2,556.33 | $5,875.05 | $3,335.60 | $4,375.84 | $2,612.66 | $3,911.73 | $1,726.36 |

| 47143 | $3,586.74 | $3,887.90 | $3,937.79 | $3,647.88 | $2,437.68 | $5,937.41 | $3,335.60 | $4,535.99 | $2,659.85 | $3,589.55 | $1,897.73 |

| 46228 | $3,585.10 | $3,872.09 | $4,006.75 | $3,236.78 | $2,560.31 | $5,856.67 | $3,413.42 | $4,238.80 | $2,895.95 | $3,929.47 | $1,840.78 |

| 46371 | $3,583.38 | $4,139.40 | $4,218.96 | $3,592.54 | $2,233.98 | $6,926.39 | $2,978.18 | $3,873.97 | $2,741.41 | $3,518.47 | $1,610.51 |

| 46350 | $3,581.25 | $4,180.59 | $4,218.96 | $3,731.94 | $2,353.77 | $6,926.39 | $2,978.18 | $4,059.56 | $2,589.88 | $3,162.75 | $1,610.51 |

| 46219 | $3,578.21 | $4,303.32 | $4,039.39 | $3,226.09 | $2,935.62 | $5,987.84 | $3,036.86 | $4,504.83 | $2,614.77 | $3,452.37 | $1,681.05 |

| 46304 | $3,578.19 | $4,048.47 | $3,979.57 | $3,905.67 | $2,138.50 | $6,684.61 | $2,983.82 | $4,360.35 | $2,502.79 | $3,273.50 | $1,904.61 |

| 46239 | $3,577.88 | $4,313.08 | $4,006.75 | $3,436.60 | $2,369.70 | $5,856.67 | $2,899.23 | $4,555.35 | $2,527.56 | $4,020.77 | $1,793.14 |

| 47146 | $3,575.09 | $3,970.11 | $3,937.79 | $3,621.54 | $2,437.68 | $5,875.05 | $3,335.60 | $4,374.07 | $2,668.67 | $3,795.89 | $1,734.46 |

| 46346 | $3,574.18 | $3,998.74 | $4,218.96 | $3,724.62 | $2,233.98 | $6,926.39 | $2,950.85 | $3,973.59 | $2,621.51 | $3,482.66 | $1,610.51 |

| 47162 | $3,572.56 | $4,068.85 | $3,937.79 | $3,655.01 | $2,437.68 | $5,937.41 | $3,148.25 | $4,478.03 | $2,621.91 | $3,542.95 | $1,897.73 |

| 47190 | $3,572.37 | $4,214.26 | $3,937.79 | $3,647.88 | $2,556.33 | $5,875.05 | $3,148.25 | $4,598.32 | $2,668.67 | $3,179.48 | $1,897.73 |

| 46349 | $3,571.91 | $4,366.84 | $4,218.96 | $3,842.51 | $2,233.98 | $5,842.48 | $2,950.85 | $4,384.29 | $2,604.49 | $3,654.61 | $1,620.15 |

| 46229 | $3,571.40 | $4,377.15 | $4,006.75 | $3,226.09 | $2,757.94 | $5,856.67 | $3,036.86 | $4,461.18 | $2,861.42 | $3,222.03 | $1,907.92 |

| 47177 | $3,568.21 | $4,214.26 | $3,937.79 | $3,647.88 | $2,437.68 | $5,937.41 | $3,148.25 | $4,598.32 | $2,625.37 | $3,415.25 | $1,719.90 |

| 47715 | $3,563.05 | $3,650.46 | $3,869.89 | $4,076.66 | $2,402.59 | $6,594.45 | $2,766.37 | $4,095.81 | $2,632.58 | $3,668.67 | $1,872.98 |

| 47141 | $3,559.62 | $4,045.83 | $3,937.79 | $3,647.88 | $2,437.68 | $5,937.41 | $3,148.25 | $4,443.99 | $2,625.37 | $3,474.26 | $1,897.73 |

| 47161 | $3,558.46 | $4,281.75 | $3,937.79 | $3,945.64 | $2,437.68 | $5,937.41 | $2,894.50 | $4,196.50 | $2,638.15 | $3,667.63 | $1,647.59 |

| 47117 | $3,557.79 | $3,948.65 | $3,937.79 | $3,945.64 | $2,437.68 | $5,937.41 | $2,894.50 | $4,329.62 | $2,694.62 | $3,804.38 | $1,647.59 |

| 46254 | $3,556.70 | $4,107.05 | $4,006.75 | $3,236.78 | $2,560.31 | $5,856.67 | $3,097.26 | $4,395.56 | $2,661.02 | $3,808.38 | $1,837.21 |

| 47104 | $3,554.12 | $3,969.36 | $3,937.79 | $3,655.01 | $2,437.68 | $5,937.41 | $3,148.25 | $4,444.95 | $2,625.37 | $3,487.65 | $1,897.73 |

| 46241 | $3,551.76 | $4,652.06 | $4,039.39 | $3,236.78 | $2,446.55 | $5,987.84 | $3,067.49 | $4,351.53 | $2,744.23 | $3,212.39 | $1,779.33 |

| 46260 | $3,551.49 | $3,871.34 | $4,006.75 | $3,219.68 | $2,510.73 | $5,856.67 | $3,413.42 | $4,257.50 | $2,650.99 | $3,929.47 | $1,798.41 |

| 47725 | $3,550.82 | $4,003.26 | $3,869.89 | $4,076.66 | $2,402.59 | $6,594.45 | $2,766.37 | $4,064.12 | $2,632.63 | $3,426.09 | $1,672.15 |

| 47164 | $3,550.04 | $3,931.04 | $3,937.79 | $3,956.70 | $2,437.68 | $5,937.41 | $2,894.50 | $4,330.89 | $2,707.34 | $3,719.48 | $1,647.59 |

| 47107 | $3,549.29 | $3,969.36 | $3,937.79 | $3,956.70 | $2,437.68 | $5,937.41 | $2,894.50 | $4,200.93 | $2,664.60 | $3,846.34 | $1,647.59 |

| 46214 | $3,547.25 | $4,245.99 | $4,006.75 | $3,236.78 | $2,560.31 | $5,856.67 | $3,186.72 | $4,228.43 | $2,540.26 | $3,718.01 | $1,892.58 |

| 47130 | $3,546.73 | $3,919.37 | $3,697.82 | $3,621.54 | $2,556.33 | $5,875.05 | $3,386.70 | $4,571.16 | $2,893.75 | $3,179.48 | $1,766.08 |

| 46341 | $3,545.39 | $4,009.63 | $4,218.96 | $3,889.91 | $2,233.98 | $6,402.26 | $2,257.24 | $4,415.44 | $2,700.65 | $3,584.25 | $1,741.58 |

| 47111 | $3,543.84 | $3,960.09 | $3,937.79 | $3,632.60 | $2,556.33 | $5,875.05 | $3,335.60 | $4,337.32 | $2,537.44 | $3,368.49 | $1,897.73 |

| 47136 | $3,540.76 | $3,946.94 | $3,937.79 | $3,636.81 | $2,437.68 | $5,937.41 | $3,335.60 | $4,242.51 | $2,717.64 | $3,567.65 | $1,647.59 |

| 46307 | $3,538.71 | $3,736.64 | $4,299.79 | $3,739.90 | $2,701.41 | $6,402.26 | $2,068.86 | $4,229.07 | $2,780.16 | $3,687.39 | $1,741.58 |

| 46376 | $3,538.70 | $4,395.43 | $4,299.79 | $3,739.90 | $2,233.98 | $6,402.26 | $2,068.86 | $4,105.89 | $2,780.16 | $3,654.61 | $1,706.16 |

| 47102 | $3,537.26 | $4,094.09 | $3,937.79 | $3,687.73 | $2,437.68 | $5,937.41 | $3,148.25 | $4,276.78 | $2,562.95 | $3,570.04 | $1,719.90 |

| 47129 | $3,536.73 | $3,896.54 | $3,697.82 | $3,621.54 | $2,556.33 | $5,875.05 | $3,386.70 | $4,379.11 | $2,676.32 | $3,539.81 | $1,738.12 |

| 46107 | $3,536.05 | $4,297.23 | $4,039.39 | $3,436.60 | $2,369.70 | $5,987.84 | $2,894.48 | $4,024.17 | $2,699.28 | $3,766.32 | $1,845.54 |

| 46379 | $3,535.54 | $4,332.90 | $4,218.96 | $3,817.75 | $2,233.98 | $5,842.48 | $2,950.85 | $4,396.48 | $2,287.23 | $3,654.61 | $1,620.15 |

| 47135 | $3,533.13 | $3,909.56 | $3,937.79 | $3,945.64 | $2,437.68 | $5,937.41 | $2,894.50 | $4,352.01 | $2,640.19 | $3,628.93 | $1,647.59 |

| 47138 | $3,532.20 | $3,964.19 | $3,937.79 | $3,647.88 | $2,437.68 | $5,937.41 | $3,148.25 | $4,215.95 | $2,666.66 | $3,710.19 | $1,656.01 |

| 47160 | $3,528.99 | $3,902.05 | $3,937.79 | $3,945.64 | $2,437.68 | $5,937.41 | $2,894.50 | $4,302.87 | $2,664.60 | $3,619.77 | $1,647.59 |

| 46220 | $3,526.11 | $4,449.32 | $4,039.39 | $3,268.08 | $2,510.73 | $5,856.67 | $3,151.13 | $4,219.19 | $2,581.87 | $3,320.22 | $1,864.47 |

| 47618 | $3,525.42 | $3,953.79 | $3,869.89 | $3,864.16 | $2,402.59 | $6,594.45 | $2,766.37 | $4,112.56 | $2,665.75 | $3,352.52 | $1,672.15 |

| 46310 | $3,523.52 | $4,090.46 | $4,218.96 | $3,915.99 | $2,233.98 | $6,149.48 | $2,257.24 | $4,405.75 | $2,659.63 | $3,683.54 | $1,620.15 |

| 47172 | $3,522.55 | $3,861.27 | $3,937.79 | $3,621.54 | $2,556.33 | $5,875.05 | $3,386.70 | $4,434.07 | $2,499.68 | $3,341.68 | $1,711.37 |

| 46368 | $3,522.20 | $4,089.14 | $3,979.57 | $3,905.67 | $2,138.50 | $6,684.61 | $2,610.30 | $4,119.82 | $2,669.89 | $3,092.91 | $1,931.56 |

| 47043 | $3,519.88 | $3,686.18 | $3,898.71 | $3,488.43 | $2,437.68 | $5,937.41 | $3,148.25 | $4,102.93 | $2,795.23 | $3,873.60 | $1,830.38 |

| 47224 | $3,517.69 | $4,004.13 | $3,937.79 | $3,507.73 | $2,437.68 | $5,937.41 | $3,148.25 | $4,166.05 | $2,729.17 | $3,652.67 | $1,656.01 |

| 47112 | $3,517.25 | $3,946.94 | $3,937.79 | $3,945.64 | $2,437.68 | $5,937.41 | $2,894.50 | $4,224.41 | $2,660.46 | $3,540.14 | $1,647.59 |

| 47142 | $3,516.82 | $3,911.53 | $3,937.79 | $3,945.64 | $2,437.68 | $5,937.41 | $2,894.50 | $4,268.89 | $2,664.60 | $3,522.60 | $1,647.59 |

| 47170 | $3,515.76 | $4,165.71 | $3,937.79 | $3,647.88 | $2,437.68 | $5,937.41 | $3,148.25 | $4,251.84 | $2,646.76 | $3,268.04 | $1,716.22 |

| 47120 | $3,511.58 | $4,070.86 | $3,937.79 | $3,945.64 | $2,437.68 | $5,937.41 | $2,894.50 | $4,156.36 | $2,641.08 | $3,378.23 | $1,716.22 |

| 47011 | $3,510.10 | $3,684.61 | $3,898.71 | $3,488.43 | $2,437.68 | $5,937.41 | $3,148.25 | $4,072.72 | $2,729.17 | $3,873.60 | $1,830.38 |

| 46236 | $3,509.62 | $3,887.96 | $4,006.75 | $3,268.08 | $2,510.73 | $5,856.67 | $3,038.68 | $4,406.81 | $2,616.80 | $3,678.95 | $1,824.80 |

| 46183 | $3,509.37 | $4,520.59 | $4,006.75 | $3,264.71 | $2,446.55 | $5,856.67 | $2,760.32 | $4,347.63 | $2,748.98 | $3,300.60 | $1,840.94 |

| 46231 | $3,508.13 | $4,243.90 | $4,006.75 | $3,236.78 | $2,560.31 | $5,856.67 | $2,902.14 | $4,435.79 | $2,489.54 | $3,508.47 | $1,840.94 |

| 47150 | $3,507.67 | $3,843.99 | $3,697.82 | $3,621.54 | $2,556.33 | $5,875.05 | $3,386.70 | $4,476.51 | $2,530.54 | $3,376.83 | $1,711.37 |

| 47115 | $3,507.29 | $4,093.08 | $3,937.79 | $3,598.00 | $2,437.68 | $5,937.41 | $2,894.50 | $4,100.11 | $2,622.39 | $3,804.38 | $1,647.59 |

| 46382 | $3,507.11 | $3,998.74 | $4,218.96 | $3,724.62 | $2,233.98 | $6,149.48 | $2,950.85 | $4,000.19 | $2,701.18 | $3,482.66 | $1,610.51 |

| 47166 | $3,506.62 | $3,990.31 | $3,937.79 | $3,945.64 | $2,437.68 | $5,937.41 | $2,894.50 | $4,096.00 | $2,664.60 | $3,514.69 | $1,647.59 |

| 46385 | $3,505.30 | $3,744.82 | $3,979.57 | $3,812.06 | $2,138.50 | $6,535.71 | $2,983.82 | $4,323.06 | $2,537.11 | $3,225.78 | $1,772.57 |

| 46278 | $3,504.61 | $3,970.38 | $4,006.75 | $3,236.78 | $2,560.31 | $5,856.67 | $2,627.24 | $4,198.92 | $2,750.88 | $4,040.19 | $1,797.98 |

| 47167 | $3,503.79 | $4,047.91 | $3,937.79 | $3,971.48 | $2,437.68 | $5,937.41 | $2,863.50 | $4,254.95 | $2,621.93 | $3,249.06 | $1,716.22 |

| 46240 | $3,503.20 | $3,883.49 | $4,006.75 | $3,268.08 | $2,510.73 | $5,856.67 | $3,151.13 | $4,099.56 | $2,531.32 | $3,873.06 | $1,851.19 |

| 47114 | $3,501.50 | $3,946.94 | $3,937.79 | $3,945.64 | $2,437.68 | $5,937.41 | $2,894.50 | $4,201.36 | $2,664.60 | $3,401.52 | $1,647.59 |

| 47110 | $3,499.54 | $3,911.53 | $3,937.79 | $3,945.64 | $2,437.68 | $5,937.41 | $2,894.50 | $4,336.37 | $2,586.77 | $3,360.18 | $1,647.59 |

| 47231 | $3,498.33 | $4,033.87 | $3,937.79 | $3,676.88 | $2,437.68 | $5,937.41 | $3,148.25 | $3,984.37 | $2,729.17 | $3,441.89 | $1,656.01 |

| 47230 | $3,497.27 | $4,050.18 | $3,937.79 | $3,647.88 | $2,437.68 | $5,937.41 | $3,148.25 | $4,115.38 | $2,607.26 | $3,434.83 | $1,656.01 |

| 47019 | $3,493.39 | $3,646.87 | $3,898.71 | $3,488.43 | $2,437.68 | $5,937.41 | $3,148.25 | $4,271.64 | $2,729.17 | $3,545.34 | $1,830.38 |

| 46806 | $3,491.38 | $4,018.25 | $3,567.44 | $3,372.30 | $2,317.59 | $6,426.54 | $2,566.84 | $4,418.84 | $2,878.47 | $3,553.61 | $1,793.91 |

| 47964 | $3,490.87 | $4,144.49 | $4,218.96 | $3,876.66 | $2,233.98 | $5,842.48 | $2,950.85 | $4,144.44 | $2,287.23 | $3,589.46 | $1,620.15 |

| 47802 | $3,488.61 | $4,277.98 | $3,738.39 | $3,495.78 | $2,508.23 | $6,009.70 | $2,763.78 | $4,085.77 | $2,591.54 | $3,747.79 | $1,667.13 |

| 46217 | $3,483.57 | $4,058.66 | $4,006.75 | $3,436.60 | $2,369.70 | $5,987.84 | $3,103.58 | $4,491.51 | $2,529.38 | $3,131.84 | $1,719.82 |

| 47638 | $3,483.56 | $3,969.34 | $3,885.36 | $4,133.47 | $2,304.71 | $5,618.03 | $2,733.01 | $4,104.36 | $2,674.44 | $3,639.46 | $1,773.44 |

| 47038 | $3,481.86 | $3,686.43 | $3,898.71 | $3,488.43 | $2,437.68 | $5,937.41 | $3,148.25 | $4,117.02 | $2,686.19 | $3,588.10 | $1,830.38 |

| 46383 | $3,480.98 | $3,908.17 | $3,979.57 | $3,812.06 | $2,138.50 | $6,535.71 | $2,983.82 | $4,144.66 | $2,526.00 | $3,020.84 | $1,760.45 |

| 47250 | $3,480.51 | $4,036.96 | $3,937.79 | $3,347.42 | $2,437.68 | $5,937.41 | $3,148.25 | $4,112.51 | $2,752.91 | $3,438.12 | $1,656.01 |

| 46234 | $3,478.90 | $4,244.33 | $4,006.75 | $3,236.78 | $2,560.31 | $5,856.67 | $2,902.14 | $4,239.43 | $2,498.49 | $3,403.19 | $1,840.94 |

| 46390 | $3,478.00 | $3,998.74 | $4,218.96 | $3,756.75 | $2,233.98 | $6,149.48 | $2,950.85 | $3,986.56 | $2,549.67 | $3,324.55 | $1,610.51 |

| 47020 | $3,477.54 | $3,687.98 | $3,898.71 | $3,488.43 | $2,437.68 | $5,937.41 | $3,148.25 | $4,148.92 | $2,700.99 | $3,496.60 | $1,830.38 |

| 47943 | $3,476.86 | $4,240.25 | $4,218.96 | $3,756.75 | $2,233.98 | $5,842.48 | $2,950.85 | $4,228.68 | $2,583.46 | $3,093.05 | $1,620.15 |

| 46256 | $3,476.10 | $3,766.04 | $4,006.75 | $3,268.08 | $2,510.73 | $5,856.67 | $3,038.68 | $4,284.13 | $2,474.97 | $3,546.06 | $2,008.91 |

| 46237 | $3,475.62 | $3,691.87 | $4,006.75 | $3,436.60 | $2,369.70 | $5,856.67 | $2,894.48 | $4,361.08 | $2,619.72 | $3,780.34 | $1,739.01 |

| 46250 | $3,470.15 | $3,759.13 | $4,006.75 | $3,268.08 | $2,510.73 | $5,856.67 | $3,151.13 | $4,049.78 | $2,606.26 | $3,678.95 | $1,814.02 |

| 46534 | $3,470.07 | $4,255.22 | $3,629.34 | $3,708.86 | $2,233.98 | $6,149.48 | $2,950.85 | $4,030.87 | $2,606.15 | $3,515.79 | $1,620.15 |

| 46340 | $3,469.42 | $3,959.19 | $4,218.96 | $3,786.71 | $2,233.98 | $6,149.48 | $2,950.85 | $3,776.61 | $2,656.18 | $3,351.78 | $1,610.51 |

| 46347 | $3,467.79 | $4,033.99 | $4,218.96 | $3,889.91 | $2,233.98 | $6,149.48 | $2,257.24 | $4,096.01 | $2,595.88 | $3,460.83 | $1,741.58 |

| 46356 | $3,466.45 | $4,008.90 | $4,299.79 | $3,739.90 | $2,233.98 | $6,402.26 | $2,068.86 | $4,074.97 | $2,799.83 | $3,338.01 | $1,697.98 |

| 47639 | $3,463.45 | $3,969.68 | $3,717.35 | $3,780.02 | $2,304.71 | $6,594.45 | $2,733.01 | $3,808.96 | $2,507.24 | $3,445.63 | $1,773.44 |

| 47838 | $3,463.22 | $4,270.47 | $3,717.35 | $3,524.52 | $2,304.71 | $5,937.41 | $2,697.15 | $4,230.60 | $2,571.09 | $3,834.86 | $1,544.04 |

| 47850 | $3,461.60 | $4,259.04 | $3,717.35 | $3,495.78 | $2,304.71 | $6,009.70 | $2,697.15 | $3,949.95 | $2,671.19 | $3,967.08 | $1,544.04 |

| 47851 | $3,460.63 | $4,043.98 | $3,717.35 | $3,543.39 | $2,508.23 | $6,009.70 | $2,697.15 | $3,966.89 | $2,485.42 | $3,967.08 | $1,667.13 |

| 46348 | $3,460.34 | $3,998.74 | $4,218.96 | $3,726.11 | $2,233.98 | $6,149.48 | $2,950.85 | $3,738.72 | $2,656.18 | $3,319.90 | $1,610.51 |

| 47948 | $3,458.79 | $4,084.31 | $4,218.96 | $3,528.02 | $2,233.98 | $5,842.48 | $2,950.85 | $4,197.69 | $2,148.31 | $3,763.16 | $1,620.15 |

| 47922 | $3,458.65 | $4,084.31 | $4,218.96 | $3,727.47 | $2,233.98 | $5,842.48 | $2,950.85 | $4,116.57 | $2,202.26 | $3,589.46 | $1,620.15 |

| 46268 | $3,456.92 | $3,761.95 | $4,006.75 | $3,236.78 | $2,510.73 | $5,856.67 | $3,097.26 | $4,341.02 | $2,666.45 | $3,297.83 | $1,793.74 |

| 47631 | $3,455.16 | $3,929.50 | $3,885.36 | $4,133.47 | $2,304.71 | $5,618.03 | $2,733.01 | $3,938.87 | $2,621.66 | $3,613.57 | $1,773.44 |

| 46803 | $3,454.63 | $3,953.87 | $3,567.44 | $3,372.30 | $2,317.59 | $6,426.54 | $2,566.84 | $4,328.17 | $2,945.35 | $3,274.28 | $1,793.91 |

| 47963 | $3,454.29 | $4,158.21 | $4,218.96 | $3,842.51 | $2,233.98 | $5,842.48 | $2,950.85 | $4,173.03 | $2,260.85 | $3,241.88 | $1,620.15 |

| 46380 | $3,453.73 | $4,090.74 | $4,218.96 | $3,834.59 | $2,233.98 | $6,149.48 | $2,257.24 | $4,190.35 | $2,287.23 | $3,654.61 | $1,620.15 |

| 46355 | $3,453.06 | $3,935.86 | $4,299.79 | $3,731.96 | $2,701.41 | $6,402.26 | $2,068.86 | $4,303.91 | $2,225.87 | $3,162.75 | $1,697.98 |

| 47805 | $3,451.92 | $4,127.90 | $3,738.39 | $3,495.78 | $2,508.23 | $6,009.70 | $2,763.78 | $3,853.61 | $2,463.83 | $3,886.31 | $1,671.64 |

| 47865 | $3,451.36 | $4,103.65 | $3,717.35 | $3,524.52 | $2,304.71 | $5,937.41 | $2,697.15 | $4,242.77 | $2,607.15 | $3,834.86 | $1,544.04 |

| 47620 | $3,450.12 | $3,970.84 | $3,885.36 | $4,133.47 | $2,304.71 | $5,618.03 | $2,733.01 | $3,939.86 | $2,512.83 | $3,629.69 | $1,773.44 |

| 47040 | $3,448.81 | $3,687.56 | $3,898.71 | $3,488.43 | $2,437.68 | $5,937.41 | $3,148.25 | $4,075.16 | $2,439.22 | $3,545.34 | $1,830.38 |

| 47866 | $3,446.55 | $4,099.17 | $3,738.39 | $3,495.78 | $2,508.23 | $6,009.70 | $2,697.15 | $4,234.31 | $2,491.08 | $3,524.58 | $1,667.13 |

| 46381 | $3,444.41 | $4,089.23 | $4,218.96 | $3,842.51 | $2,233.98 | $5,842.48 | $2,257.24 | $4,368.84 | $2,287.23 | $3,683.54 | $1,620.15 |

| 47243 | $3,444.08 | $3,839.12 | $3,937.79 | $3,347.42 | $2,437.68 | $5,937.41 | $3,148.25 | $4,072.92 | $2,714.61 | $3,349.55 | $1,656.01 |

| 47852 | $3,441.56 | $3,970.36 | $3,717.35 | $3,524.52 | $2,304.71 | $5,937.41 | $2,697.15 | $4,145.88 | $2,607.15 | $3,967.08 | $1,544.04 |

| 47804 | $3,439.74 | $4,083.59 | $3,738.39 | $3,495.78 | $2,508.23 | $6,009.70 | $2,763.78 | $3,903.41 | $2,469.74 | $3,753.19 | $1,671.64 |

| 47140 | $3,438.63 | $4,119.73 | $3,937.79 | $3,246.08 | $2,437.68 | $5,836.11 | $2,894.50 | $4,150.93 | $2,460.68 | $3,795.89 | $1,506.95 |

| 46366 | $3,438.13 | $4,246.27 | $3,629.34 | $3,785.24 | $2,233.98 | $6,149.48 | $2,950.85 | $3,815.23 | $2,664.79 | $3,285.96 | $1,620.15 |

| 47175 | $3,436.62 | $4,043.08 | $3,937.79 | $3,368.54 | $2,437.68 | $5,836.11 | $2,894.50 | $4,091.17 | $2,488.35 | $3,762.06 | $1,506.95 |

| 46532 | $3,433.91 | $4,027.76 | $3,629.34 | $3,575.81 | $2,233.98 | $6,149.48 | $2,950.85 | $3,977.21 | $2,557.28 | $3,617.21 | $1,620.15 |

| 47633 | $3,433.46 | $3,978.48 | $3,885.36 | $3,780.02 | $2,304.71 | $5,618.03 | $2,733.01 | $3,928.81 | $2,673.91 | $3,658.83 | $1,773.44 |

| 47880 | $3,431.43 | $4,103.65 | $3,717.35 | $3,495.78 | $2,508.23 | $6,009.70 | $2,763.78 | $3,828.81 | $2,485.42 | $3,729.96 | $1,671.64 |

| 46807 | $3,429.75 | $3,848.76 | $3,567.44 | $3,372.30 | $2,317.59 | $6,426.54 | $2,566.84 | $4,153.01 | $2,884.06 | $3,367.05 | $1,793.91 |

| 47032 | $3,429.26 | $3,686.14 | $3,633.67 | $3,488.43 | $2,437.68 | $5,603.67 | $3,067.15 | $4,238.27 | $2,455.34 | $3,925.75 | $1,756.47 |

| 47438 | $3,429.00 | $4,075.20 | $3,717.35 | $3,341.92 | $2,437.68 | $5,937.41 | $2,697.15 | $4,285.66 | $2,626.02 | $3,652.67 | $1,518.95 |

| 47809 | $3,426.40 | $4,083.59 | $3,738.39 | $3,495.78 | $2,508.23 | $6,009.70 | $2,763.78 | $4,031.21 | $2,615.23 | $3,346.48 | $1,671.64 |

| 47137 | $3,426.25 | $4,092.77 | $3,937.79 | $3,236.70 | $2,437.68 | $5,836.11 | $2,894.50 | $4,167.36 | $2,468.32 | $3,684.31 | $1,506.95 |

| 47108 | $3,424.43 | $4,077.52 | $3,937.79 | $3,269.21 | $2,437.68 | $5,937.41 | $2,863.50 | $4,257.00 | $2,630.00 | $3,117.94 | $1,716.22 |

| 47118 | $3,423.11 | $4,030.43 | $3,937.79 | $3,261.36 | $2,437.68 | $5,836.11 | $2,894.50 | $4,031.51 | $2,498.88 | $3,795.89 | $1,506.95 |

| 47145 | $3,422.78 | $4,063.82 | $3,937.79 | $3,247.75 | $2,437.68 | $5,836.11 | $2,894.50 | $4,041.55 | $2,465.75 | $3,795.89 | $1,506.95 |

| 47803 | $3,421.20 | $4,263.26 | $3,738.39 | $3,495.78 | $2,508.23 | $6,009.70 | $2,763.78 | $3,887.71 | $2,543.75 | $3,336.69 | $1,664.69 |

| 46392 | $3,418.53 | $4,011.45 | $4,218.96 | $3,809.84 | $2,233.98 | $6,149.48 | $2,257.24 | $3,891.22 | $2,673.78 | $3,319.21 | $1,620.15 |

| 47018 | $3,417.95 | $3,687.98 | $3,633.67 | $3,488.43 | $2,437.68 | $5,603.67 | $3,067.15 | $4,175.29 | $2,451.69 | $3,877.44 | $1,756.47 |

| 47469 | $3,417.04 | $4,056.94 | $3,937.79 | $3,371.78 | $2,437.68 | $5,836.11 | $2,863.50 | $4,162.77 | $2,421.90 | $3,546.47 | $1,535.44 |

| 47125 | $3,416.04 | $4,074.67 | $3,937.79 | $3,236.70 | $2,437.68 | $5,836.11 | $2,863.50 | $4,188.69 | $2,600.95 | $3,268.14 | $1,716.22 |

| 47270 | $3,416.04 | $4,062.97 | $3,633.67 | $3,721.70 | $2,437.68 | $5,603.67 | $3,148.25 | $3,764.64 | $2,437.98 | $3,769.25 | $1,580.59 |

| 47858 | $3,415.12 | $4,141.65 | $3,738.39 | $3,341.92 | $2,508.23 | $6,009.70 | $2,697.15 | $4,022.71 | $2,485.42 | $3,538.89 | $1,667.13 |

| 47456 | $3,414.17 | $4,231.06 | $4,044.04 | $3,408.12 | $2,437.68 | $5,937.41 | $2,444.36 | $4,049.43 | $2,607.15 | $3,418.12 | $1,564.33 |

| 47448 | $3,413.80 | $4,017.20 | $4,044.04 | $3,329.47 | $2,437.68 | $5,603.67 | $2,455.58 | $4,350.14 | $2,799.62 | $3,357.10 | $1,743.51 |

| 47978 | $3,413.54 | $4,165.52 | $4,218.96 | $3,868.70 | $2,233.98 | $5,842.48 | $2,950.85 | $4,045.06 | $2,189.72 | $3,082.21 | $1,537.95 |

| 47630 | $3,413.15 | $3,991.09 | $3,885.36 | $3,855.24 | $2,304.71 | $5,618.03 | $2,766.37 | $3,920.96 | $2,474.26 | $3,645.85 | $1,669.65 |

| 47878 | $3,411.54 | $4,103.65 | $3,738.39 | $3,495.78 | $2,508.23 | $6,009.70 | $2,763.78 | $3,992.33 | $2,485.42 | $3,346.48 | $1,671.64 |

| 47445 | $3,411.35 | $4,103.65 | $3,717.35 | $3,323.54 | $2,437.68 | $5,937.41 | $2,697.15 | $4,117.99 | $2,607.15 | $3,652.67 | $1,518.95 |

| 47957 | $3,410.45 | $4,233.86 | $3,629.34 | $3,786.71 | $2,233.98 | $5,842.48 | $2,950.85 | $3,981.27 | $2,364.12 | $3,543.91 | $1,537.95 |

| 47452 | $3,407.46 | $4,058.70 | $3,937.79 | $3,229.28 | $2,437.68 | $5,836.11 | $2,863.50 | $4,279.23 | $2,358.13 | $3,538.77 | $1,535.44 |

| 47601 | $3,406.56 | $3,948.48 | $3,885.36 | $3,878.41 | $2,304.71 | $5,618.03 | $2,733.01 | $4,032.26 | $2,539.76 | $3,455.95 | $1,669.65 |

| 47174 | $3,406.10 | $4,083.62 | $3,937.79 | $3,353.27 | $2,437.68 | $5,836.11 | $2,894.50 | $3,942.50 | $2,448.79 | $3,619.77 | $1,506.95 |

| 47471 | $3,406.05 | $3,810.52 | $3,717.35 | $3,299.20 | $2,437.68 | $5,937.41 | $2,697.15 | $4,188.49 | $2,654.57 | $3,799.15 | $1,518.95 |

| 47612 | $3,405.72 | $4,013.55 | $3,717.35 | $3,780.02 | $2,304.71 | $5,618.03 | $2,733.01 | $3,994.50 | $2,638.54 | $3,484.06 | $1,773.44 |

| 47885 | $3,405.58 | $4,269.92 | $3,738.39 | $3,495.78 | $2,508.23 | $6,009.70 | $2,763.78 | $3,712.24 | $2,539.64 | $3,346.48 | $1,671.64 |

| 46113 | $3,404.97 | $4,532.29 | $4,006.75 | $3,264.71 | $2,560.31 | $4,731.27 | $2,760.32 | $4,301.71 | $2,703.62 | $3,347.79 | $1,840.94 |

| 47807 | $3,404.82 | $4,083.59 | $3,738.39 | $3,495.78 | $2,508.23 | $6,009.70 | $2,763.78 | $3,869.84 | $2,560.76 | $3,346.48 | $1,671.64 |

| 47977 | $3,404.69 | $4,206.62 | $4,218.96 | $3,528.02 | $2,233.98 | $5,842.48 | $2,950.85 | $4,044.72 | $2,193.95 | $3,289.39 | $1,537.95 |

| 46259 | $3,404.68 | $3,625.53 | $4,006.75 | $3,436.60 | $2,369.70 | $5,856.67 | $2,899.23 | $3,991.92 | $2,499.60 | $3,596.60 | $1,764.21 |

| 47882 | $3,404.67 | $4,075.20 | $3,717.35 | $3,524.52 | $2,304.71 | $5,937.41 | $2,697.15 | $4,069.03 | $2,557.46 | $3,619.90 | $1,544.04 |

| 47848 | $3,403.70 | $4,123.04 | $3,717.35 | $3,294.29 | $2,304.71 | $5,937.41 | $2,697.15 | $4,087.22 | $2,607.15 | $3,724.60 | $1,544.04 |

| 47060 | $3,403.28 | $3,718.66 | $3,633.67 | $3,488.43 | $2,437.68 | $5,603.67 | $3,065.88 | $4,297.44 | $2,521.35 | $3,509.50 | $1,756.47 |

| 47022 | $3,403.26 | $3,718.66 | $3,633.67 | $3,488.43 | $2,437.68 | $5,603.67 | $3,067.15 | $4,105.58 | $2,527.84 | $3,693.48 | $1,756.47 |

| 47453 | $3,403.05 | $3,927.61 | $3,717.35 | $3,229.28 | $2,437.68 | $5,937.41 | $2,697.15 | $4,325.76 | $2,691.67 | $3,547.66 | $1,518.95 |

| 47227 | $3,401.54 | $3,725.45 | $3,633.67 | $3,736.96 | $2,437.68 | $5,603.67 | $3,148.25 | $3,926.30 | $2,712.56 | $3,434.83 | $1,656.01 |

| 47610 | $3,400.88 | $4,001.00 | $3,885.36 | $3,855.24 | $2,304.71 | $5,618.03 | $2,766.37 | $3,812.41 | $2,541.87 | $3,554.20 | $1,669.65 |

| 47837 | $3,400.52 | $4,184.57 | $3,717.35 | $3,365.75 | $2,437.68 | $5,937.41 | $2,527.39 | $4,112.28 | $2,533.57 | $3,645.38 | $1,543.86 |

| 47427 | $3,398.82 | $4,041.19 | $3,477.85 | $3,335.65 | $2,437.68 | $5,937.41 | $2,697.15 | $4,334.01 | $2,794.41 | $3,368.51 | $1,564.33 |

| 47439 | $3,396.31 | $4,043.98 | $3,717.35 | $3,299.70 | $2,437.68 | $5,937.41 | $2,697.15 | $4,051.08 | $2,607.15 | $3,652.67 | $1,518.95 |

| 46968 | $3,395.05 | $4,236.96 | $3,629.34 | $3,461.13 | $2,233.98 | $6,149.48 | $2,950.85 | $3,846.06 | $2,656.18 | $3,166.36 | $1,620.15 |

| 46374 | $3,394.50 | $4,246.27 | $3,629.34 | $3,708.86 | $2,233.98 | $6,149.48 | $2,950.85 | $3,740.31 | $2,665.26 | $3,000.46 | $1,620.15 |

| 47670 | $3,394.06 | $3,896.62 | $3,717.35 | $3,780.02 | $2,304.71 | $5,618.03 | $2,733.01 | $4,126.18 | $2,404.70 | $3,586.60 | $1,773.44 |

| 47616 | $3,392.68 | $3,978.48 | $3,885.36 | $3,780.02 | $2,304.71 | $5,618.03 | $2,733.01 | $4,000.64 | $2,500.63 | $3,352.52 | $1,773.44 |

| 47845 | $3,391.56 | $4,043.98 | $3,717.35 | $3,341.92 | $2,437.68 | $5,937.41 | $2,697.15 | $4,260.54 | $2,607.15 | $3,319.17 | $1,553.22 |

| 47855 | $3,390.87 | $3,966.72 | $3,717.35 | $3,294.29 | $2,304.71 | $5,937.41 | $2,697.15 | $4,109.89 | $2,607.15 | $3,729.96 | $1,544.04 |

| 47849 | $3,389.28 | $4,096.85 | $3,717.35 | $3,294.29 | $2,304.71 | $5,937.41 | $2,697.15 | $4,024.61 | $2,671.99 | $3,604.45 | $1,544.04 |

| 47001 | $3,388.47 | $3,720.02 | $3,633.67 | $3,488.43 | $2,437.68 | $5,603.67 | $3,065.88 | $4,162.57 | $2,439.64 | $3,576.68 | $1,756.47 |

| 47879 | $3,388.02 | $4,071.14 | $3,717.35 | $3,294.29 | $2,304.71 | $5,937.41 | $2,697.15 | $3,980.80 | $2,603.36 | $3,729.96 | $1,544.04 |

| 47265 | $3,387.17 | $3,721.71 | $3,633.67 | $3,674.39 | $2,437.68 | $5,603.67 | $3,148.25 | $4,074.78 | $2,722.58 | $3,274.38 | $1,580.59 |

| 47123 | $3,386.49 | $4,091.17 | $3,937.79 | $3,242.87 | $2,437.68 | $5,836.11 | $2,894.50 | $4,090.24 | $2,448.79 | $3,378.81 | $1,506.95 |

| 47116 | $3,384.88 | $4,016.51 | $3,937.79 | $3,368.54 | $2,437.68 | $5,836.11 | $2,894.50 | $3,977.71 | $2,494.22 | $3,378.81 | $1,506.95 |

| 47834 | $3,382.53 | $4,108.65 | $3,717.35 | $3,543.39 | $2,437.68 | $5,937.41 | $2,697.15 | $3,959.94 | $2,455.46 | $3,415.00 | $1,553.22 |

| 47273 | $3,381.83 | $3,587.23 | $3,633.67 | $3,378.91 | $2,437.68 | $5,603.67 | $3,148.25 | $3,970.57 | $2,636.79 | $3,840.91 | $1,580.59 |

| 46166 | $3,380.61 | $4,166.05 | $4,044.04 | $3,240.29 | $2,551.22 | $5,937.41 | $2,444.36 | $3,884.47 | $2,674.68 | $3,176.68 | $1,686.94 |

| 47881 | $3,380.24 | $4,103.65 | $3,717.35 | $3,543.39 | $2,437.68 | $5,937.41 | $2,697.15 | $3,966.89 | $2,430.69 | $3,415.00 | $1,553.22 |

| 47441 | $3,379.94 | $3,943.49 | $3,717.35 | $3,323.54 | $2,437.68 | $5,937.41 | $2,697.15 | $4,169.88 | $2,506.76 | $3,547.17 | $1,518.95 |

| 47459 | $3,379.80 | $3,933.66 | $3,717.35 | $3,301.01 | $2,437.68 | $5,937.41 | $2,444.36 | $4,345.39 | $2,816.37 | $3,345.87 | $1,518.95 |

| 47449 | $3,379.37 | $4,041.47 | $3,717.35 | $3,299.70 | $2,437.68 | $5,937.41 | $2,697.15 | $4,090.85 | $2,591.81 | $3,461.32 | $1,518.95 |

| 46531 | $3,378.75 | $4,140.14 | $3,629.34 | $3,310.84 | $2,233.98 | $6,149.48 | $2,950.85 | $3,725.69 | $2,529.21 | $3,497.84 | $1,620.15 |

| 47846 | $3,377.64 | $3,891.96 | $3,717.35 | $3,543.39 | $2,437.68 | $5,937.41 | $2,697.15 | $4,032.52 | $2,430.29 | $3,535.39 | $1,553.22 |

| 47424 | $3,376.02 | $3,924.01 | $3,717.35 | $3,299.70 | $2,437.68 | $5,937.41 | $2,697.15 | $4,216.89 | $2,621.53 | $3,389.52 | $1,518.95 |

| 47861 | $3,375.66 | $4,063.93 | $3,717.35 | $3,294.29 | $2,304.71 | $5,937.41 | $2,697.15 | $4,100.57 | $2,570.07 | $3,527.10 | $1,544.04 |

| 47863 | $3,373.72 | $4,043.98 | $3,738.39 | $3,495.78 | $2,508.23 | $6,009.70 | $2,763.78 | $3,730.51 | $2,433.23 | $3,346.48 | $1,667.13 |

| 47512 | $3,372.83 | $3,923.03 | $3,717.35 | $3,571.34 | $2,304.71 | $5,937.41 | $2,693.37 | $4,087.72 | $2,504.77 | $3,513.87 | $1,474.76 |

| 47432 | $3,372.72 | $3,989.81 | $3,937.79 | $3,371.78 | $2,437.68 | $5,836.11 | $2,894.50 | $4,083.58 | $2,421.90 | $3,218.61 | $1,535.44 |

| 47868 | $3,372.48 | $4,069.19 | $3,717.35 | $3,392.51 | $2,437.68 | $5,937.41 | $2,444.36 | $4,078.97 | $2,569.00 | $3,514.06 | $1,564.33 |

| 47617 | $3,372.42 | $3,953.79 | $3,370.35 | $3,878.41 | $2,437.68 | $5,836.11 | $2,894.50 | $4,045.11 | $2,448.79 | $3,352.52 | $1,506.95 |

| 47635 | $3,371.96 | $3,935.60 | $3,370.35 | $3,871.07 | $2,437.68 | $5,836.11 | $2,894.50 | $3,999.99 | $2,552.89 | $3,314.45 | $1,506.95 |

| 46808 | $3,371.74 | $4,018.25 | $3,567.44 | $3,372.30 | $2,317.59 | $6,426.54 | $2,618.67 | $3,913.06 | $2,372.09 | $3,488.84 | $1,622.61 |

| 46164 | $3,371.02 | $4,007.87 | $3,633.67 | $3,312.32 | $2,375.57 | $5,603.67 | $2,455.58 | $4,281.83 | $2,719.24 | $3,576.93 | $1,743.51 |

| 47281 | $3,370.38 | $4,063.68 | $3,633.67 | $3,584.32 | $2,437.68 | $5,603.67 | $2,863.50 | $3,960.55 | $2,536.60 | $3,451.12 | $1,569.01 |

| 47634 | $3,369.07 | $3,938.20 | $3,370.35 | $3,878.41 | $2,437.68 | $5,836.11 | $2,894.50 | $3,911.33 | $2,520.44 | $3,396.75 | $1,506.95 |

| 47465 | $3,367.97 | $3,799.70 | $3,717.35 | $3,305.97 | $2,437.68 | $5,937.41 | $2,697.15 | $4,138.63 | $2,579.72 | $3,547.17 | $1,518.95 |

| 47840 | $3,366.37 | $3,985.75 | $3,717.35 | $3,341.92 | $2,437.68 | $5,937.41 | $2,697.15 | $3,931.05 | $2,540.23 | $3,521.91 | $1,553.22 |

| 47228 | $3,366.34 | $3,844.73 | $3,633.67 | $3,676.65 | $2,437.68 | $5,603.67 | $3,148.25 | $3,700.20 | $2,614.68 | $3,434.83 | $1,569.01 |

| 46048 | $3,365.90 | $4,239.93 | $3,583.36 | $3,381.41 | $2,262.00 | $5,842.48 | $2,741.50 | $3,916.66 | $2,638.36 | $3,338.14 | $1,715.15 |

| 47841 | $3,365.13 | $3,877.71 | $3,717.35 | $3,341.92 | $2,437.68 | $5,937.41 | $2,697.15 | $4,080.74 | $2,704.57 | $3,303.58 | $1,553.22 |

| 47557 | $3,364.56 | $3,907.81 | $3,717.35 | $3,571.34 | $2,304.71 | $5,937.41 | $2,693.37 | $4,144.57 | $2,406.51 | $3,487.82 | $1,474.76 |

| 47457 | $3,363.08 | $3,953.79 | $3,717.35 | $3,299.70 | $2,437.68 | $5,937.41 | $2,697.15 | $4,043.50 | $2,607.15 | $3,418.12 | $1,518.95 |

| 47443 | $3,362.73 | $3,949.35 | $3,717.35 | $3,299.70 | $2,437.68 | $5,937.41 | $2,697.15 | $4,170.74 | $2,516.43 | $3,382.53 | $1,518.95 |

| 46816 | $3,362.38 | $3,949.70 | $3,567.44 | $3,372.30 | $2,317.59 | $6,426.54 | $2,388.41 | $3,877.03 | $2,695.95 | $3,409.54 | $1,619.34 |

| 47033 | $3,361.98 | $3,680.56 | $3,633.67 | $3,439.43 | $2,437.68 | $5,603.67 | $3,067.15 | $3,814.86 | $2,436.42 | $3,925.75 | $1,580.59 |

| 47017 | $3,360.32 | $4,004.13 | $3,633.67 | $3,488.43 | $2,437.68 | $5,603.67 | $3,148.25 | $3,969.08 | $2,421.74 | $3,315.97 | $1,580.59 |

| 47597 | $3,359.52 | $3,907.81 | $3,717.35 | $3,571.34 | $2,304.71 | $5,937.41 | $2,693.37 | $4,109.59 | $2,391.04 | $3,487.82 | $1,474.76 |

| 47025 | $3,359.40 | $3,718.66 | $3,633.67 | $3,488.43 | $2,437.68 | $5,603.67 | $3,065.88 | $4,134.56 | $2,503.19 | $3,370.84 | $1,637.44 |

| 47454 | $3,359.14 | $4,061.34 | $3,937.79 | $3,261.36 | $2,437.68 | $5,836.11 | $2,863.50 | $4,116.36 | $2,406.44 | $3,135.36 | $1,535.44 |

| 47561 | $3,359.13 | $3,913.03 | $3,717.35 | $3,560.64 | $2,304.71 | $5,937.41 | $2,697.15 | $4,213.16 | $2,451.66 | $3,321.42 | $1,474.76 |

| 47516 | $3,358.73 | $3,907.81 | $3,717.35 | $3,571.34 | $2,304.71 | $5,937.41 | $2,693.37 | $4,058.95 | $2,439.41 | $3,482.18 | $1,474.76 |

| 47573 | $3,358.66 | $3,907.81 | $3,717.35 | $3,571.34 | $2,304.71 | $5,937.41 | $2,693.37 | $4,205.80 | $2,392.28 | $3,381.82 | $1,474.76 |

| 47596 | $3,357.84 | $4,034.40 | $3,717.35 | $3,456.37 | $2,304.71 | $5,937.41 | $2,697.15 | $4,305.21 | $2,392.28 | $3,258.73 | $1,474.76 |

| 47451 | $3,357.74 | $4,019.24 | $3,477.85 | $3,229.28 | $2,437.68 | $5,937.41 | $2,863.50 | $4,097.70 | $2,604.02 | $3,338.21 | $1,572.55 |

| 47220 | $3,357.73 | $4,048.02 | $3,633.67 | $3,595.39 | $2,437.68 | $5,603.67 | $2,863.50 | $3,948.54 | $2,449.82 | $3,428.01 | $1,569.01 |

| 47951 | $3,356.42 | $4,024.83 | $4,218.96 | $3,528.02 | $2,233.98 | $5,842.48 | $2,950.85 | $3,775.09 | $2,158.95 | $3,210.89 | $1,620.15 |

| 47039 | $3,356.03 | $3,646.87 | $3,633.67 | $3,488.43 | $2,437.68 | $5,603.67 | $3,067.15 | $4,077.78 | $2,436.42 | $3,588.10 | $1,580.59 |

| 47665 | $3,355.41 | $3,896.62 | $3,717.35 | $3,780.02 | $2,304.71 | $5,618.03 | $2,733.01 | $3,997.32 | $2,458.91 | $3,274.74 | $1,773.44 |

| 46180 | $3,354.54 | $4,109.57 | $4,044.04 | $3,263.05 | $2,209.13 | $5,842.48 | $2,455.58 | $3,977.55 | $2,531.63 | $3,440.22 | $1,672.13 |

| 47031 | $3,353.94 | $3,721.40 | $3,633.67 | $3,488.43 | $2,437.68 | $5,603.67 | $3,067.15 | $4,075.18 | $2,427.60 | $3,504.07 | $1,580.59 |

| 47462 | $3,353.44 | $4,119.03 | $3,477.85 | $3,301.01 | $2,437.68 | $5,335.16 | $2,863.50 | $4,021.77 | $2,744.70 | $3,714.76 | $1,518.95 |

| 46802 | $3,352.74 | $4,018.25 | $3,567.44 | $3,372.30 | $2,317.59 | $6,426.54 | $2,566.84 | $4,026.31 | $2,422.07 | $3,187.50 | $1,622.61 |

| 46916 | $3,352.14 | $4,344.27 | $3,522.73 | $3,409.83 | $2,107.70 | $5,842.48 | $2,950.85 | $4,054.15 | $2,287.23 | $3,441.58 | $1,560.55 |

| 47648 | $3,352.10 | $3,955.39 | $3,717.35 | $3,780.02 | $2,304.71 | $5,618.03 | $2,733.01 | $3,739.91 | $2,464.06 | $3,435.12 | $1,773.44 |

| 47223 | $3,350.89 | $3,704.29 | $3,633.67 | $3,431.03 | $2,437.68 | $5,603.67 | $3,148.25 | $3,870.72 | $2,614.68 | $3,484.31 | $1,580.59 |

| 47980 | $3,350.23 | $4,255.22 | $3,522.73 | $3,519.80 | $2,233.98 | $5,842.48 | $2,950.85 | $4,067.00 | $2,338.79 | $3,210.89 | $1,560.55 |

| 47041 | $3,349.85 | $3,724.83 | $3,633.67 | $3,488.43 | $2,437.68 | $5,603.67 | $3,067.15 | $4,044.74 | $2,434.39 | $3,483.41 | $1,580.59 |

| 47229 | $3,349.08 | $3,725.45 | $3,633.67 | $3,703.00 | $2,437.68 | $5,603.67 | $3,148.25 | $3,704.02 | $2,405.69 | $3,560.32 | $1,569.01 |

| 47460 | $3,348.85 | $3,947.43 | $3,477.85 | $3,301.01 | $2,437.68 | $5,937.41 | $2,444.36 | $4,201.38 | $2,812.02 | $3,365.08 | $1,564.33 |

| 46013 | $3,348.38 | $4,208.82 | $3,583.36 | $3,401.92 | $2,092.59 | $5,842.48 | $2,741.50 | $4,067.40 | $2,476.51 | $3,383.56 | $1,685.63 |

| 47535 | $3,347.45 | $4,034.40 | $3,717.35 | $3,560.64 | $2,304.71 | $5,937.41 | $2,697.15 | $3,886.63 | $2,442.03 | $3,419.48 | $1,474.76 |

| 47520 | $3,346.67 | $3,954.94 | $3,370.35 | $3,729.35 | $2,437.68 | $5,836.11 | $2,894.50 | $3,810.32 | $2,474.27 | $3,452.22 | $1,506.95 |

| 47568 | $3,346.48 | $3,949.44 | $3,717.35 | $3,571.34 | $2,437.68 | $5,836.11 | $2,693.37 | $3,913.57 | $2,434.30 | $3,381.82 | $1,529.81 |

| 47666 | $3,346.30 | $3,875.50 | $3,717.35 | $3,780.02 | $2,304.71 | $5,618.03 | $2,733.01 | $3,895.19 | $2,394.89 | $3,370.84 | $1,773.44 |

| 46513 | $3,345.85 | $4,254.24 | $3,629.34 | $3,250.24 | $2,233.98 | $5,842.48 | $2,950.85 | $3,997.23 | $2,267.06 | $3,497.84 | $1,535.20 |

| 47611 | $3,344.37 | $3,878.42 | $3,370.35 | $3,452.12 | $2,437.68 | $5,836.11 | $2,894.50 | $4,014.86 | $2,471.77 | $3,580.91 | $1,506.95 |

| 47833 | $3,344.32 | $3,881.38 | $3,717.35 | $3,398.79 | $2,437.68 | $5,937.41 | $2,444.36 | $4,138.20 | $2,631.28 | $3,303.58 | $1,553.22 |

| 47274 | $3,344.10 | $4,025.95 | $3,633.67 | $3,676.65 | $2,437.68 | $5,603.67 | $3,148.25 | $3,665.78 | $2,469.96 | $3,210.36 | $1,569.01 |

| 47420 | $3,343.30 | $3,910.68 | $3,477.85 | $3,301.01 | $2,437.68 | $5,937.41 | $2,863.50 | $3,986.98 | $2,607.15 | $3,338.21 | $1,572.55 |

| 47012 | $3,342.88 | $3,699.89 | $3,633.67 | $3,488.43 | $2,437.68 | $5,603.67 | $3,067.15 | $4,185.51 | $2,389.35 | $3,410.24 | $1,513.25 |

| 46165 | $3,342.58 | $4,017.73 | $4,044.04 | $3,300.38 | $2,209.13 | $5,842.48 | $2,455.58 | $3,803.37 | $2,499.31 | $3,581.63 | $1,672.13 |

| 47524 | $3,342.47 | $3,875.50 | $3,717.35 | $3,780.02 | $2,304.71 | $5,937.41 | $2,733.01 | $3,926.80 | $2,392.28 | $3,282.84 | $1,474.76 |

| 47455 | $3,342.26 | $3,953.79 | $3,477.85 | $3,317.27 | $2,437.68 | $5,937.41 | $2,697.15 | $4,126.40 | $2,607.15 | $3,303.58 | $1,564.33 |

| 47470 | $3,342.07 | $4,137.25 | $3,477.85 | $3,228.77 | $2,437.68 | $5,937.41 | $2,863.50 | $4,148.20 | $2,558.24 | $3,059.20 | $1,572.55 |

| 46103 | $3,341.99 | $4,032.65 | $4,044.04 | $3,263.05 | $2,209.13 | $5,842.48 | $2,455.58 | $4,069.42 | $2,496.22 | $3,408.35 | $1,599.04 |

| 47562 | $3,340.46 | $3,790.48 | $3,717.35 | $3,482.31 | $2,437.68 | $5,836.11 | $2,693.37 | $3,928.70 | $2,377.48 | $3,611.31 | $1,529.81 |

| 47640 | $3,340.13 | $3,875.50 | $3,717.35 | $3,803.18 | $2,304.71 | $5,618.03 | $2,733.01 | $3,776.88 | $2,428.33 | $3,370.84 | $1,773.44 |

| 47433 | $3,338.44 | $3,970.78 | $3,477.85 | $3,240.29 | $2,437.68 | $5,937.41 | $2,444.36 | $4,045.09 | $2,707.97 | $3,558.64 | $1,564.33 |

| 47260 | $3,338.30 | $4,088.90 | $3,633.67 | $3,283.99 | $2,437.68 | $5,603.67 | $2,863.50 | $3,928.66 | $2,568.52 | $3,405.39 | $1,569.01 |

| 47637 | $3,338.02 | $3,885.54 | $3,885.36 | $3,601.15 | $2,304.71 | $5,618.03 | $2,733.01 | $3,710.13 | $2,455.99 | $3,516.62 | $1,669.65 |

| 47528 | $3,336.46 | $3,955.23 | $3,717.35 | $3,571.34 | $2,304.71 | $5,937.41 | $2,697.15 | $3,843.54 | $2,443.61 | $3,419.48 | $1,474.76 |

| 47578 | $3,336.07 | $3,956.39 | $3,717.35 | $3,456.37 | $2,304.71 | $5,937.41 | $2,697.15 | $4,124.24 | $2,433.65 | $3,258.73 | $1,474.76 |

| 47023 | $3,335.55 | $3,704.61 | $3,633.67 | $3,721.27 | $2,437.68 | $5,603.67 | $3,067.15 | $3,785.12 | $2,346.33 | $3,475.44 | $1,580.59 |

| 47581 | $3,334.75 | $4,025.65 | $3,717.35 | $3,381.78 | $2,437.68 | $5,836.11 | $2,693.37 | $3,953.74 | $2,476.40 | $3,289.95 | $1,535.44 |

| 47021 | $3,334.06 | $3,680.56 | $3,633.67 | $3,488.43 | $2,437.68 | $5,603.67 | $3,067.15 | $4,096.43 | $2,436.42 | $3,315.97 | $1,580.59 |

| 47235 | $3,333.93 | $3,992.39 | $3,633.67 | $3,374.43 | $2,437.68 | $5,603.67 | $2,863.50 | $3,815.68 | $2,652.83 | $3,396.48 | $1,569.01 |

| 47024 | $3,331.15 | $4,042.07 | $3,633.67 | $3,439.43 | $2,437.68 | $5,603.67 | $3,067.15 | $3,883.79 | $2,350.06 | $3,340.76 | $1,513.25 |

| 47946 | $3,330.76 | $4,242.80 | $3,629.34 | $3,786.46 | $2,233.98 | $5,842.48 | $2,950.85 | $3,740.37 | $2,271.75 | $3,071.66 | $1,537.95 |

| 47421 | $3,329.51 | $4,097.05 | $3,477.85 | $3,228.77 | $2,437.68 | $5,937.41 | $2,863.50 | $4,102.19 | $2,584.91 | $2,993.15 | $1,572.55 |

| 46995 | $3,326.87 | $4,120.36 | $3,804.66 | $3,445.57 | $2,107.70 | $5,408.58 | $2,635.13 | $4,437.18 | $2,321.66 | $3,439.60 | $1,548.27 |

| 46809 | $3,326.50 | $3,804.10 | $3,567.44 | $3,372.30 | $2,317.59 | $6,426.54 | $2,388.41 | $4,165.07 | $2,287.40 | $3,316.68 | $1,619.51 |

| 47654 | $3,326.31 | $3,953.79 | $3,370.35 | $3,501.82 | $2,304.71 | $5,618.03 | $2,733.01 | $4,151.41 | $2,500.63 | $3,355.92 | $1,773.44 |

| 47995 | $3,326.22 | $4,255.22 | $3,522.73 | $3,519.80 | $2,233.98 | $5,842.48 | $2,950.85 | $3,981.94 | $2,183.71 | $3,210.89 | $1,560.55 |

| 46121 | $3,326.10 | $4,145.00 | $3,717.35 | $3,263.05 | $2,209.13 | $5,842.48 | $2,455.58 | $3,992.49 | $2,511.66 | $3,408.35 | $1,715.88 |

| 47926 | $3,325.91 | $4,242.80 | $3,522.73 | $3,409.83 | $2,233.98 | $5,842.48 | $2,950.85 | $3,949.84 | $2,390.91 | $3,155.17 | $1,560.55 |

| 47016 | $3,325.60 | $3,717.00 | $3,633.67 | $3,600.74 | $2,437.68 | $5,603.67 | $3,067.15 | $4,046.78 | $2,225.87 | $3,410.24 | $1,513.25 |

| 47035 | $3,325.50 | $3,577.89 | $3,633.67 | $3,488.43 | $2,437.68 | $5,603.67 | $3,065.88 | $4,199.11 | $2,225.87 | $3,509.50 | $1,513.25 |

| 47613 | $3,324.96 | $3,942.97 | $3,370.35 | $3,501.82 | $2,304.71 | $5,618.03 | $2,733.01 | $3,835.36 | $2,422.16 | $3,851.58 | $1,669.65 |

| 46016 | $3,324.56 | $4,115.38 | $3,583.36 | $3,195.80 | $2,092.59 | $5,846.79 | $2,741.50 | $3,949.06 | $2,636.35 | $3,319.55 | $1,765.21 |

| 47446 | $3,324.03 | $4,059.34 | $3,477.85 | $3,228.77 | $2,437.68 | $5,937.41 | $2,863.50 | $4,155.74 | $2,487.78 | $3,019.72 | $1,572.55 |

| 47649 | $3,323.09 | $3,875.50 | $3,717.35 | $3,608.49 | $2,304.71 | $5,618.03 | $2,733.01 | $3,792.46 | $2,299.07 | $3,508.81 | $1,773.44 |

| 47431 | $3,321.36 | $3,868.46 | $3,477.85 | $3,397.27 | $2,437.68 | $5,937.41 | $2,444.36 | $4,143.14 | $2,787.91 | $3,155.17 | $1,564.33 |

| 46932 | $3,321.22 | $4,227.62 | $3,522.73 | $3,522.47 | $2,174.44 | $5,842.48 | $2,541.03 | $3,877.35 | $2,258.51 | $3,614.52 | $1,631.09 |

| 46960 | $3,319.28 | $4,236.96 | $3,629.34 | $3,461.13 | $2,233.98 | $5,842.48 | $2,950.85 | $3,831.30 | $2,302.44 | $3,166.36 | $1,537.95 |

| 47860 | $3,319.10 | $4,235.59 | $3,717.35 | $3,365.75 | $1,846.51 | $5,842.48 | $2,527.39 | $4,056.66 | $2,496.22 | $3,559.23 | $1,543.86 |

| 47529 | $3,317.31 | $3,949.44 | $3,717.35 | $3,318.07 | $2,437.68 | $5,836.11 | $2,693.37 | $3,906.86 | $2,402.60 | $3,381.82 | $1,529.81 |

| 46365 | $3,316.76 | $3,580.05 | $3,663.27 | $3,266.93 | $2,233.98 | $6,149.48 | $2,978.18 | $3,709.14 | $2,656.18 | $3,319.90 | $1,610.51 |

| 47264 | $3,316.03 | $3,990.80 | $3,633.67 | $3,214.00 | $2,437.68 | $5,603.67 | $2,863.50 | $3,745.16 | $2,649.16 | $3,453.68 | $1,569.01 |

| 46926 | $3,315.97 | $4,192.57 | $3,522.73 | $3,444.00 | $2,233.98 | $5,842.48 | $2,644.19 | $3,723.23 | $2,251.35 | $3,763.16 | $1,542.01 |

| 47862 | $3,315.79 | $4,237.06 | $3,717.35 | $3,308.90 | $1,846.51 | $5,842.48 | $2,527.39 | $4,070.80 | $2,504.39 | $3,559.23 | $1,543.86 |

| 47615 | $3,315.38 | $3,875.50 | $3,370.35 | $3,368.61 | $2,437.68 | $5,836.11 | $2,894.50 | $3,880.22 | $2,499.80 | $3,484.06 | $1,506.95 |

| 46595 | $3,314.58 | $4,250.23 | $4,218.96 | $3,324.78 | $2,233.98 | $5,842.48 | $2,541.03 | $3,710.26 | $2,324.88 | $2,841.12 | $1,858.15 |

| 46921 | $3,314.26 | $4,349.96 | $3,522.73 | $3,474.48 | $2,233.98 | $5,842.48 | $2,644.19 | $4,099.76 | $2,287.23 | $3,145.74 | $1,542.01 |

| 47435 | $3,314.24 | $4,032.65 | $4,044.04 | $3,336.54 | $2,551.22 | $4,731.27 | $2,455.58 | $4,074.30 | $2,614.68 | $3,558.64 | $1,743.51 |

| 46985 | $3,313.79 | $4,233.86 | $3,629.34 | $3,217.54 | $2,233.98 | $5,842.48 | $2,950.85 | $3,656.63 | $2,386.08 | $3,449.24 | $1,537.95 |

| 46901 | $3,312.74 | $3,943.53 | $3,804.66 | $3,522.47 | $2,174.44 | $5,408.58 | $2,933.54 | $3,863.96 | $2,352.04 | $3,551.24 | $1,572.93 |

| 47959 | $3,312.69 | $4,242.80 | $3,522.73 | $3,552.92 | $2,233.98 | $5,842.48 | $2,950.85 | $3,830.94 | $2,252.85 | $3,136.79 | $1,560.55 |

| 47552 | $3,312.07 | $3,850.47 | $3,370.35 | $3,452.12 | $2,437.68 | $5,836.11 | $2,894.50 | $3,808.14 | $2,448.79 | $3,515.63 | $1,506.95 |

| 46805 | $3,311.49 | $3,823.59 | $3,567.44 | $3,372.30 | $2,317.59 | $6,426.54 | $2,618.67 | $3,909.77 | $2,295.97 | $3,056.64 | $1,726.36 |

| 47591 | $3,310.40 | $3,918.22 | $3,717.35 | $3,571.34 | $2,304.71 | $5,937.41 | $2,693.37 | $3,836.67 | $2,385.14 | $3,265.08 | $1,474.76 |

| 47960 | $3,310.31 | $4,242.80 | $3,522.73 | $3,249.04 | $2,233.98 | $5,842.48 | $2,950.85 | $3,720.52 | $2,371.94 | $3,408.17 | $1,560.55 |

| 47683 | $3,310.21 | $3,953.79 | $3,370.35 | $3,501.82 | $2,304.71 | $5,618.03 | $2,733.01 | $4,151.41 | $2,500.63 | $3,194.94 | $1,773.44 |

| 47042 | $3,309.84 | $3,704.94 | $3,633.67 | $3,488.43 | $2,437.68 | $5,603.67 | $3,067.15 | $3,963.87 | $2,392.77 | $3,225.64 | $1,580.59 |

| 47997 | $3,308.74 | $4,349.96 | $3,522.73 | $3,200.90 | $2,107.70 | $5,842.48 | $2,950.85 | $4,054.15 | $2,287.23 | $3,210.89 | $1,560.55 |

| 46011 | $3,308.37 | $4,208.82 | $3,583.36 | $3,209.93 | $2,092.59 | $5,842.48 | $2,741.50 | $3,730.56 | $2,466.98 | $3,562.19 | $1,645.27 |

| 46574 | $3,308.34 | $3,581.45 | $3,629.34 | $3,236.34 | $2,233.98 | $5,842.48 | $2,978.18 | $3,946.84 | $2,687.66 | $3,336.62 | $1,610.51 |

| 47925 | $3,308.15 | $4,348.55 | $3,522.73 | $3,249.04 | $2,233.98 | $5,842.48 | $2,950.85 | $3,677.93 | $2,287.23 | $3,408.17 | $1,560.55 |

| 46979 | $3,307.90 | $4,033.13 | $3,804.66 | $3,445.57 | $2,107.70 | $5,408.58 | $2,635.13 | $4,146.51 | $2,273.75 | $3,675.66 | $1,548.27 |

| 47950 | $3,307.40 | $4,242.80 | $3,522.73 | $3,236.30 | $2,233.98 | $5,842.48 | $2,950.85 | $3,909.65 | $2,345.45 | $3,229.20 | $1,560.55 |

| 46055 | $3,307.27 | $4,024.34 | $3,545.53 | $3,416.09 | $2,262.00 | $4,731.27 | $3,038.68 | $4,150.31 | $2,553.70 | $3,635.60 | $1,715.15 |

| 47647 | $3,304.10 | $3,953.79 | $3,370.35 | $3,585.32 | $2,304.71 | $5,618.03 | $2,733.01 | $3,845.79 | $2,500.63 | $3,355.92 | $1,773.44 |

| 46967 | $3,303.45 | $4,343.08 | $3,522.73 | $3,522.47 | $1,956.45 | $5,842.48 | $2,541.03 | $4,438.25 | $2,287.23 | $2,949.71 | $1,631.09 |

| 47584 | $3,303.24 | $3,953.79 | $3,370.35 | $3,608.49 | $2,304.71 | $5,937.41 | $2,733.01 | $4,122.74 | $2,392.28 | $3,169.48 | $1,440.12 |

| 46994 | $3,302.84 | $4,202.38 | $3,522.73 | $3,522.47 | $1,956.45 | $5,842.48 | $2,541.03 | $4,099.21 | $2,270.92 | $3,439.60 | $1,631.09 |

| 47874 | $3,302.33 | $4,208.28 | $3,717.35 | $3,543.39 | $1,846.51 | $5,842.48 | $2,527.39 | $4,059.05 | $2,589.26 | $3,145.74 | $1,543.86 |

| 47929 | $3,301.93 | $4,217.10 | $3,522.73 | $3,180.52 | $2,233.98 | $5,842.48 | $2,950.85 | $3,987.89 | $2,312.27 | $3,210.89 | $1,560.55 |

| 47558 | $3,301.59 | $3,943.61 | $3,717.35 | $3,402.91 | $2,437.68 | $5,836.11 | $2,693.37 | $3,646.45 | $2,405.45 | $3,403.14 | $1,529.81 |

| 46923 | $3,301.18 | $4,248.20 | $3,522.73 | $3,200.90 | $2,107.70 | $5,842.48 | $2,950.85 | $3,829.11 | $2,409.81 | $3,339.43 | $1,560.55 |

| 47514 | $3,300.95 | $3,928.08 | $3,370.35 | $3,368.54 | $2,437.68 | $5,836.11 | $2,894.50 | $3,606.93 | $2,448.79 | $3,611.59 | $1,506.95 |

| 47836 | $3,300.32 | $4,035.51 | $3,717.35 | $3,308.90 | $1,846.51 | $5,842.48 | $2,527.39 | $4,039.62 | $2,496.22 | $3,645.38 | $1,543.86 |

| 46056 | $3,299.99 | $3,965.81 | $3,583.36 | $3,195.80 | $2,272.06 | $5,842.48 | $2,741.50 | $4,035.07 | $2,468.22 | $3,209.95 | $1,685.63 |

| 47579 | $3,299.79 | $3,781.83 | $3,370.35 | $3,452.12 | $2,437.68 | $5,836.11 | $2,894.50 | $3,791.75 | $2,403.82 | $3,522.75 | $1,506.95 |

| 47467 | $3,299.64 | $4,032.65 | $3,477.85 | $3,228.77 | $2,437.68 | $5,937.41 | $2,863.50 | $3,819.12 | $2,607.15 | $3,019.72 | $1,572.55 |

| 46959 | $3,298.68 | $4,344.27 | $3,522.73 | $3,522.47 | $1,956.45 | $5,842.48 | $2,644.19 | $3,846.47 | $2,287.23 | $3,478.49 | $1,542.01 |

| 47574 | $3,298.50 | $3,957.91 | $3,370.35 | $3,379.05 | $2,437.68 | $5,836.11 | $2,894.50 | $3,645.19 | $2,448.79 | $3,508.50 | $1,506.95 |

| 47437 | $3,296.70 | $3,964.21 | $3,477.85 | $3,228.77 | $2,437.68 | $5,937.41 | $2,863.50 | $3,956.16 | $2,607.15 | $2,921.72 | $1,572.55 |

| 47551 | $3,296.45 | $3,786.86 | $3,370.35 | $3,378.54 | $2,437.68 | $5,836.11 | $2,894.50 | $3,861.02 | $2,448.79 | $3,443.66 | $1,506.95 |

| 47854 | $3,296.33 | $4,309.60 | $3,717.35 | $3,308.90 | $1,846.51 | $5,842.48 | $2,527.39 | $4,087.18 | $2,538.17 | $3,241.88 | $1,543.86 |

| 46977 | $3,296.02 | $4,339.62 | $3,522.73 | $3,301.39 | $2,107.70 | $5,842.48 | $2,950.85 | $4,054.15 | $2,287.23 | $2,993.53 | $1,560.55 |

| 47928 | $3,295.69 | $4,066.91 | $3,717.35 | $3,298.42 | $1,846.51 | $5,842.48 | $2,527.39 | $4,189.36 | $2,461.76 | $3,462.88 | $1,543.86 |

| 47576 | $3,295.30 | $3,962.46 | $3,370.35 | $3,368.54 | $2,437.68 | $5,836.11 | $2,894.50 | $3,686.89 | $2,445.83 | $3,443.66 | $1,506.95 |

| 47619 | $3,294.52 | $3,921.38 | $3,885.36 | $3,524.98 | $2,304.71 | $5,618.03 | $2,733.01 | $3,766.23 | $2,352.41 | $3,169.48 | $1,669.65 |

| 46935 | $3,293.65 | $4,214.84 | $3,804.66 | $3,156.91 | $2,233.98 | $5,842.48 | $2,541.03 | $3,980.45 | $2,267.06 | $3,357.10 | $1,537.95 |

| 46616 | $3,293.30 | $4,203.21 | $3,663.27 | $3,218.06 | $2,336.75 | $5,587.91 | $2,437.75 | $3,828.39 | $2,527.87 | $3,271.68 | $1,858.15 |

| 46902 | $3,293.29 | $3,968.84 | $3,804.66 | $3,445.57 | $2,174.44 | $5,408.58 | $2,933.54 | $3,782.18 | $2,382.13 | $3,484.71 | $1,548.27 |

| 46978 | $3,292.83 | $4,233.86 | $3,522.73 | $3,271.59 | $2,233.98 | $5,842.48 | $2,950.85 | $3,746.98 | $2,339.60 | $3,155.17 | $1,631.09 |

| 47036 | $3,290.74 | $3,562.27 | $3,633.67 | $3,551.75 | $2,437.68 | $5,603.67 | $3,067.15 | $3,700.00 | $2,252.85 | $3,585.15 | $1,513.25 |

| 47859 | $3,289.08 | $4,177.78 | $3,717.35 | $3,355.27 | $1,846.51 | $5,842.48 | $2,527.39 | $3,858.85 | $2,530.24 | $3,491.08 | $1,543.86 |

| 47536 | $3,288.94 | $3,953.79 | $3,370.35 | $3,379.05 | $2,437.68 | $5,836.11 | $2,894.50 | $3,814.68 | $2,448.79 | $3,247.46 | $1,506.95 |

| 47522 | $3,288.23 | $3,896.53 | $3,717.35 | $3,299.70 | $2,437.68 | $5,836.11 | $2,693.37 | $3,860.09 | $2,509.38 | $3,096.64 | $1,535.44 |

| 46170 | $3,288.15 | $4,013.45 | $3,717.35 | $3,408.12 | $1,846.51 | $5,842.48 | $2,444.36 | $3,918.98 | $2,496.22 | $3,478.16 | $1,715.88 |

| 46615 | $3,287.96 | $3,702.26 | $3,663.27 | $3,218.06 | $2,336.75 | $5,587.91 | $2,437.75 | $3,762.17 | $2,523.67 | $3,964.07 | $1,683.72 |

| 47034 | $3,287.93 | $3,680.56 | $3,633.67 | $3,488.43 | $2,437.68 | $5,603.67 | $3,067.15 | $3,814.86 | $2,436.42 | $3,136.28 | $1,580.59 |

| 46953 | $3,287.57 | $4,083.68 | $3,583.36 | $3,188.34 | $2,146.32 | $5,687.97 | $2,927.59 | $3,499.78 | $2,365.50 | $3,750.63 | $1,642.57 |

| 47030 | $3,287.48 | $3,574.10 | $3,633.67 | $3,551.75 | $2,437.68 | $5,603.67 | $3,067.15 | $3,926.87 | $2,225.87 | $3,340.76 | $1,513.25 |

| 47588 | $3,287.29 | $3,878.51 | $3,370.35 | $3,379.05 | $2,437.68 | $5,836.11 | $2,894.50 | $3,614.90 | $2,448.79 | $3,506.06 | $1,506.95 |

| 47553 | $3,287.27 | $3,861.28 | $3,717.35 | $3,398.80 | $2,437.68 | $5,836.11 | $2,693.37 | $3,689.87 | $2,535.80 | $3,167.01 | $1,535.44 |

| 46998 | $3,286.93 | $3,680.56 | $3,522.73 | $3,507.45 | $2,174.44 | $5,842.48 | $2,541.03 | $4,067.75 | $2,287.23 | $3,614.52 | $1,631.09 |

| 46181 | $3,286.09 | $4,055.93 | $3,633.67 | $3,166.78 | $2,375.57 | $5,603.67 | $2,455.58 | $4,089.16 | $2,401.74 | $3,365.04 | $1,713.75 |

| 47531 | $3,285.44 | $3,875.50 | $3,370.35 | $3,368.61 | $2,437.68 | $5,836.11 | $2,894.50 | $3,642.59 | $2,438.02 | $3,484.06 | $1,506.95 |

| 47830 | $3,284.48 | $4,081.41 | $3,717.35 | $3,365.75 | $1,846.51 | $5,842.48 | $2,527.39 | $4,077.35 | $2,496.22 | $3,346.48 | $1,543.86 |

| 46937 | $3,284.46 | $3,979.99 | $3,804.66 | $3,464.15 | $2,174.44 | $5,408.58 | $2,933.54 | $3,910.12 | $2,321.66 | $3,274.54 | $1,572.93 |

| 47515 | $3,284.26 | $3,861.28 | $3,370.35 | $3,378.54 | $2,437.68 | $5,836.11 | $2,894.50 | $3,731.79 | $2,411.76 | $3,413.66 | $1,506.95 |

| 47249 | $3,283.88 | $3,811.13 | $3,633.67 | $3,214.00 | $2,437.68 | $5,603.67 | $2,863.50 | $3,822.93 | $2,614.68 | $3,268.56 | $1,569.01 |

| 46819 | $3,282.33 | $3,743.35 | $3,567.44 | $3,372.30 | $2,317.59 | $6,426.54 | $2,388.41 | $3,882.48 | $2,247.95 | $3,257.95 | $1,619.34 |

| 47832 | $3,281.34 | $4,040.34 | $3,717.35 | $3,365.75 | $1,846.51 | $5,842.48 | $2,527.39 | $4,058.83 | $2,496.22 | $3,374.68 | $1,543.86 |

| 47550 | $3,280.81 | $3,875.50 | $3,370.35 | $3,368.61 | $2,437.68 | $5,836.11 | $2,894.50 | $3,712.02 | $2,457.03 | $3,349.31 | $1,506.95 |

| 46617 | $3,280.27 | $4,026.40 | $3,663.27 | $3,218.06 | $2,336.75 | $5,587.91 | $2,437.75 | $3,812.73 | $2,377.94 | $3,518.01 | $1,823.85 |

| 47872 | $3,280.25 | $4,182.50 | $3,717.35 | $3,308.90 | $1,846.51 | $5,842.48 | $2,527.39 | $4,055.64 | $2,566.73 | $3,211.16 | $1,543.86 |

| 46068 | $3,279.24 | $4,131.64 | $3,477.44 | $3,445.57 | $2,107.70 | $5,842.48 | $2,635.13 | $3,896.23 | $2,276.77 | $3,484.59 | $1,494.86 |

| 46070 | $3,278.33 | $4,006.85 | $3,583.36 | $3,195.80 | $2,092.59 | $5,842.48 | $2,635.13 | $3,743.98 | $2,405.57 | $3,632.26 | $1,645.27 |

| 46986 | $3,278.24 | $4,057.17 | $3,583.36 | $3,284.46 | $2,146.32 | $5,687.97 | $2,927.59 | $3,680.45 | $2,330.98 | $3,441.58 | $1,642.57 |

| 46552 | $3,276.14 | $3,434.00 | $3,663.27 | $3,218.06 | $2,233.98 | $5,587.91 | $2,978.18 | $3,929.93 | $2,832.74 | $3,272.84 | $1,610.51 |

| 47501 | $3,274.06 | $3,949.44 | $3,370.35 | $3,475.98 | $2,437.68 | $5,836.11 | $2,693.37 | $4,012.12 | $2,450.22 | $2,985.47 | $1,529.81 |

| 47556 | $3,273.81 | $3,861.28 | $3,370.35 | $3,368.61 | $2,437.68 | $5,836.11 | $2,894.50 | $3,846.80 | $2,448.79 | $3,167.01 | $1,506.95 |

| 47006 | $3,273.57 | $3,680.33 | $3,633.67 | $3,439.43 | $2,437.68 | $5,603.67 | $3,067.15 | $3,761.28 | $2,304.85 | $3,227.09 | $1,580.59 |

| 46017 | $3,273.15 | $4,103.43 | $3,583.36 | $3,195.80 | $2,092.59 | $5,846.79 | $2,741.50 | $3,648.33 | $2,278.06 | $3,476.49 | $1,765.21 |

| 46117 | $3,273.06 | $4,177.58 | $3,583.36 | $3,272.24 | $2,262.00 | $5,603.67 | $2,438.18 | $4,077.51 | $2,225.87 | $3,444.89 | $1,645.27 |

| 46996 | $3,272.30 | $3,733.21 | $3,629.34 | $3,461.13 | $2,233.98 | $5,842.48 | $2,950.85 | $3,771.24 | $2,324.93 | $3,237.89 | $1,537.95 |

| 46814 | $3,272.13 | $4,024.36 | $3,567.44 | $3,372.30 | $2,317.59 | $5,275.67 | $2,570.00 | $4,054.54 | $2,317.37 | $3,529.49 | $1,692.51 |

| 46175 | $3,271.60 | $4,159.76 | $3,717.35 | $3,281.66 | $1,846.51 | $5,842.48 | $2,527.39 | $4,105.66 | $2,437.65 | $3,081.71 | $1,715.88 |

| 47577 | $3,271.56 | $3,861.28 | $3,370.35 | $3,379.05 | $2,437.68 | $5,836.11 | $2,894.50 | $3,788.45 | $2,393.75 | $3,247.46 | $1,506.95 |

| 46554 | $3,271.14 | $3,922.63 | $3,663.27 | $3,266.93 | $2,233.98 | $5,587.91 | $2,978.18 | $3,668.06 | $2,294.93 | $3,377.43 | $1,718.12 |

| 46961 | $3,270.85 | $4,158.86 | $3,522.73 | $3,341.22 | $1,956.45 | $5,842.48 | $2,644.19 | $3,908.29 | $2,287.23 | $3,415.99 | $1,631.09 |

| 46930 | $3,270.43 | $3,940.52 | $3,583.36 | $3,184.03 | $2,146.32 | $5,687.97 | $2,927.59 | $3,689.62 | $2,342.98 | $3,559.39 | $1,642.57 |

| 46919 | $3,270.40 | $4,070.40 | $3,804.66 | $3,438.77 | $2,146.32 | $5,408.58 | $2,927.59 | $3,624.78 | $2,212.62 | $3,528.24 | $1,542.01 |

| 46628 | $3,270.10 | $3,439.57 | $3,663.27 | $3,218.06 | $2,336.75 | $5,587.91 | $2,413.47 | $3,975.99 | $2,632.64 | $3,715.26 | $1,718.12 |

| 47037 | $3,270.02 | $3,704.36 | $3,633.67 | $3,488.43 | $2,437.68 | $5,603.67 | $3,067.15 | $3,773.97 | $2,274.39 | $3,136.28 | $1,580.59 |

| 47003 | $3,269.55 | $4,075.86 | $3,633.67 | $3,600.74 | $2,437.68 | $5,603.67 | $2,538.28 | $3,590.38 | $2,212.90 | $3,486.40 | $1,515.95 |

| 47525 | $3,269.15 | $3,954.64 | $3,370.35 | $3,379.05 | $2,437.68 | $5,836.11 | $2,894.50 | $3,570.40 | $2,448.79 | $3,293.02 | $1,506.95 |

| 46040 | $3,268.79 | $3,871.38 | $3,545.53 | $3,443.70 | $2,262.00 | $4,731.27 | $2,741.50 | $4,209.19 | $2,729.85 | $3,438.31 | $1,715.15 |

| 46971 | $3,268.63 | $4,148.23 | $3,522.73 | $3,356.24 | $1,956.45 | $5,842.48 | $2,644.19 | $3,908.29 | $2,287.23 | $3,478.49 | $1,542.01 |

| 47537 | $3,268.60 | $3,875.50 | $3,370.35 | $3,379.05 | $2,437.68 | $5,836.11 | $2,733.01 | $3,783.63 | $2,414.44 | $3,349.31 | $1,506.95 |

| 47847 | $3,267.46 | $4,187.17 | $3,717.35 | $3,298.42 | $1,846.51 | $5,842.48 | $2,527.39 | $3,953.31 | $2,516.22 | $3,241.88 | $1,543.86 |

| 46732 | $3,266.98 | $4,029.38 | $3,482.67 | $3,605.49 | $2,134.73 | $5,620.13 | $2,588.59 | $3,492.68 | $2,255.88 | $3,793.72 | $1,666.54 |

| 46537 | $3,266.55 | $4,250.23 | $3,629.34 | $3,236.34 | $2,233.98 | $5,842.48 | $2,541.03 | $3,721.83 | $2,268.91 | $3,406.13 | $1,535.20 |

| 46936 | $3,266.39 | $4,203.69 | $3,804.66 | $3,522.47 | $2,174.44 | $5,408.58 | $2,635.13 | $3,720.61 | $2,346.88 | $3,274.54 | $1,572.93 |

| 47660 | $3,265.77 | $3,875.50 | $3,370.35 | $3,608.49 | $2,304.71 | $5,618.03 | $2,733.01 | $3,868.97 | $2,310.31 | $3,194.94 | $1,773.44 |

| 46845 | $3,265.67 | $3,936.74 | $3,567.44 | $3,372.30 | $2,317.59 | $5,275.67 | $2,450.10 | $4,463.66 | $2,276.69 | $3,307.31 | $1,689.19 |

| 46939 | $3,265.38 | $4,030.59 | $3,629.34 | $3,217.54 | $2,233.98 | $5,842.48 | $2,541.03 | $3,919.88 | $2,372.51 | $3,328.53 | $1,537.95 |

| 46917 | $3,264.32 | $4,229.97 | $3,522.73 | $3,389.46 | $2,107.70 | $5,842.48 | $2,455.82 | $3,888.57 | $2,301.81 | $3,344.06 | $1,560.55 |

| 47966 | $3,263.28 | $4,070.76 | $3,717.35 | $3,298.42 | $1,846.51 | $5,842.48 | $2,527.39 | $4,071.50 | $2,496.22 | $3,241.88 | $1,520.37 |

| 46942 | $3,263.18 | $4,158.86 | $3,522.73 | $3,409.83 | $1,956.45 | $5,842.48 | $2,541.03 | $4,182.35 | $2,287.23 | $3,099.78 | $1,631.09 |

| 47519 | $3,262.23 | $3,781.83 | $3,717.35 | $3,395.56 | $2,437.68 | $5,836.11 | $2,693.37 | $3,610.14 | $2,437.77 | $3,182.68 | $1,529.81 |

| 46786 | $3,261.97 | $4,255.99 | $3,482.67 | $3,289.45 | $2,134.73 | $5,620.13 | $2,588.59 | $3,667.16 | $2,115.22 | $3,776.22 | $1,689.59 |

| 46635 | $3,261.68 | $4,203.21 | $3,663.27 | $3,218.06 | $2,336.75 | $5,587.91 | $2,395.04 | $3,766.43 | $2,316.48 | $3,445.98 | $1,683.72 |