New Hampshire Car Insurance (Coverage, Companies, & More)

Looking for affordable New Hampshire car insurance? USAA and Geico are the cheapest New Hampshire car insurance companies, but we compare more companies and coverage in this extensive guide. Read now for New Hampshire car insurance rates by ZIP code and then enter your ZIP code below to get your free New Hampshire car insurance quotes.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 24, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 24, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| New Hampshire Summary | New Hampshire Stats |

|---|---|

| Miles of Roadway | 16,138 |

| Number of Vehicles Registered | 1,222,146 |

| Population | 1,359,711 |

| Most Popular Vehicle | Silverado 1500 |

| Uninsured/Underinsured % | 9.9% / Rank 35 |

| Total Driving Related Deaths | Speeding Fatalities – 71 DUI Fatalities – 48 |

| Average Annual Car Insurance Rates | Liability – $393 Collision – $282 Comprehensive – $103 |

| Cheapest Providers | Geico USAA |

New Hampshire is relatively small compared to, say, New York or Virginia. It neighbors Vermont and Maine and rivals the beauty of these and other New England region states.

New Hampshire is known for extraordinary wonders that attract many tourists throughout the year. People across the nation and the world come to New Hampshire to enjoy the valleys, lakes, and mountains. New Hampshire is home to the gorgeous White Mountain National Forest and the White Mountain Resort.

In addition to the tourists, 1.3 million residents navigate New Hampshire’s roadways every day. What’s it like driving here?

We’re going to tell you all about it, along with the cost of car insurance, the top car insurance companies in New Hampshire, and state laws relevant to insurance and the driving experience.

If you’re wondering what car insurance prices are like for the state of New Hampshire, you can enter your ZIP code in the free car insurance comparison box above to get a look at some quotes in your area. To get an extensive look into car insurance in New Hampshire, keep reading.

New Hampshire Car Insurance Rates

Let’s start with car insurance coverage and rates in New Hampshire. Based on the introductory table, the percentage of people who are uninsured or underinsured is about 10 percent, while the other 90 percent of motorists in New Hampshire are insured. If you’re currently insured and/or you’re shopping around for coverage, you may be wondering how car insurance companies set their prices.

There are a number of factors these companies take into account when setting their rates, and we’re going to go over these factors in detail so you can get a sense of what sort of prices to expect.

First, let’s cover some general information about car insurance coverage in New Hampshire.

How much coverage is required for New Hampshire’s minimum coverage?

Nearly all U.S. states require drivers to carry liability car insurance coverage. However, each state has its own coverage rules and requirements. These requirements tell the driver how much the insurance company will pay per accident.

Read more:

New Hampshire is one of two states that don’t require car insurance. However, most people still opt to get liability insurance at least.

New Hampshire law states that a liability car insurance policy should have $25,000 for bodily injury (BI) of one person per accident, $50,000 for bodily injury of two or more people per accident, and $25,000 for property damage per accident. These coverage limits are known as the 25/50/25 coverage rule.

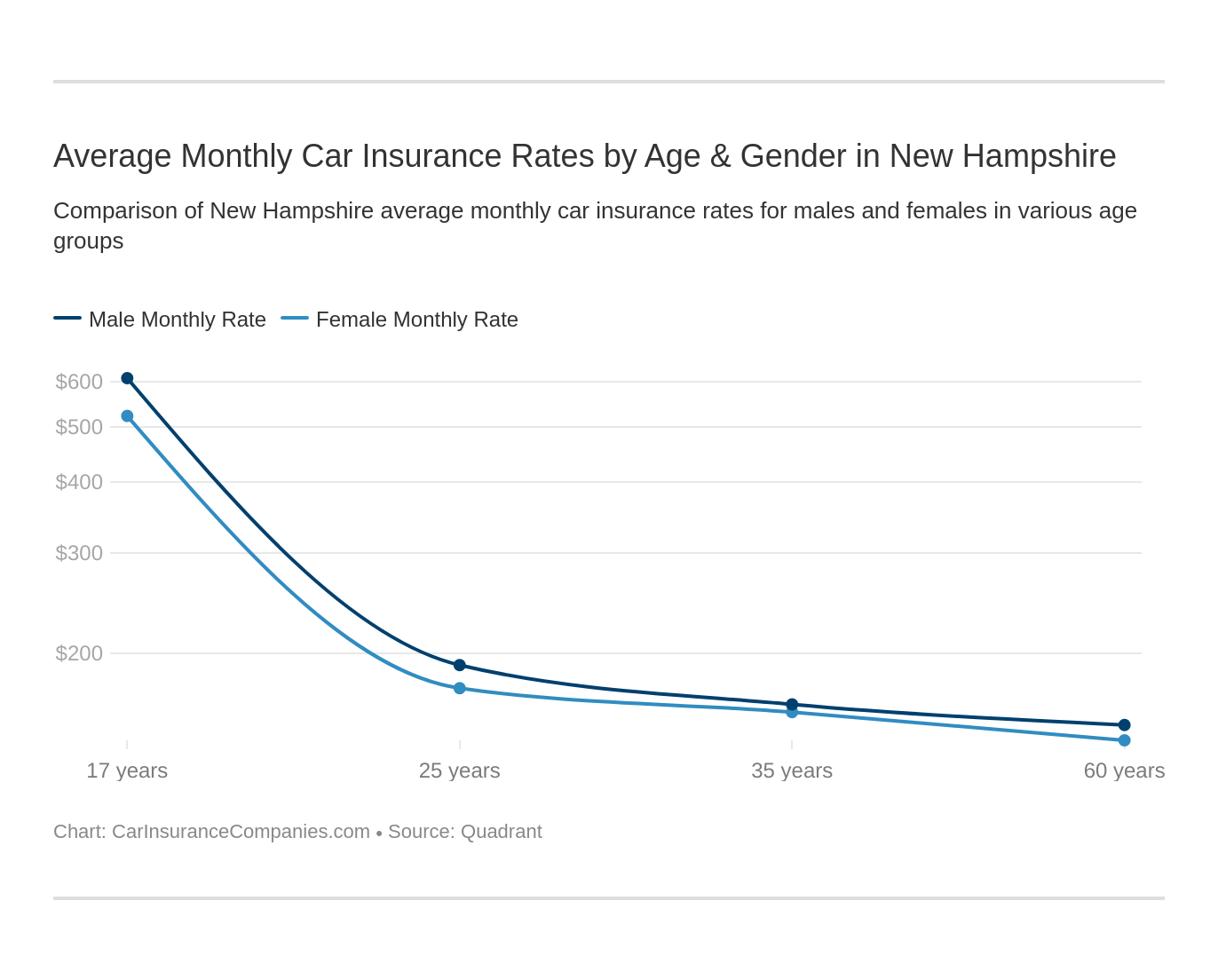

Average Monthly Car Insurance Rates by Age & Gender in NH

Insurance companies issue different rates to different customers based on a number of factors — including age, gender, and marital status.

Also, you’ll notice that the average car insurance premiums are much more expensive than the core coverage premiums listed in the introductory table. Car insurance companies factor in risk, the value of the vehicle, and the driver.

For now, let’s look at age, gender, and marital status.

| Company | Single 17-year-old female annual rate | Single 17-year-old male annual rate | Single 25-year-old female annual rate | Single 25-year-old male annual rate | Married 35-year-old female annual rate | Married 35-year-old male annual rate | Married 60-year-old female annual rate | Married 60-year-old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate | $4,045 | $5,099 | $2,074 | $2,200 | $1,971 | $2,092 | $2,109 | $2,312 |

| Geico | $2,568 | $3,561 | $1,103 | $1,665 | $1,057 | $1,047 | $947 | $947 |

| Nationwide | $4,406 | $5,591 | $1,824 | $1,957 | $1,586 | $1,608 | $1,430 | $1,500 |

| Progressive | $6,320 | $6,981 | $1,611 | $1,618 | $1,367 | $1,245 | $1,188 | $1,199 |

| Safeco | $18,139 | $20,119 | $5,210 | $5,519 | $4,942 | $5,338 | $4,026 | $4,522 |

| State Farm | $4,066 | $5,031 | $1,508 | $1,722 | $1,352 | $1,352 | $1,232 | $1,232 |

| USAA | $4,269 | $4,673 | $1,246 | $1,361 | $992 | $973 | $926 | $928 |

The cost of car insurance for younger drivers is very expensive, especially for Safeco policyholders. Safeco has the highest premiums in New Hampshire — its prices for teen drivers’ rival the cost of a vehicle or a two-year degree program. The lowest premiums from all of the companies are for drivers who are 60 and older.

Geico and USAA have the lowest rates based on age, gender, and marital status.

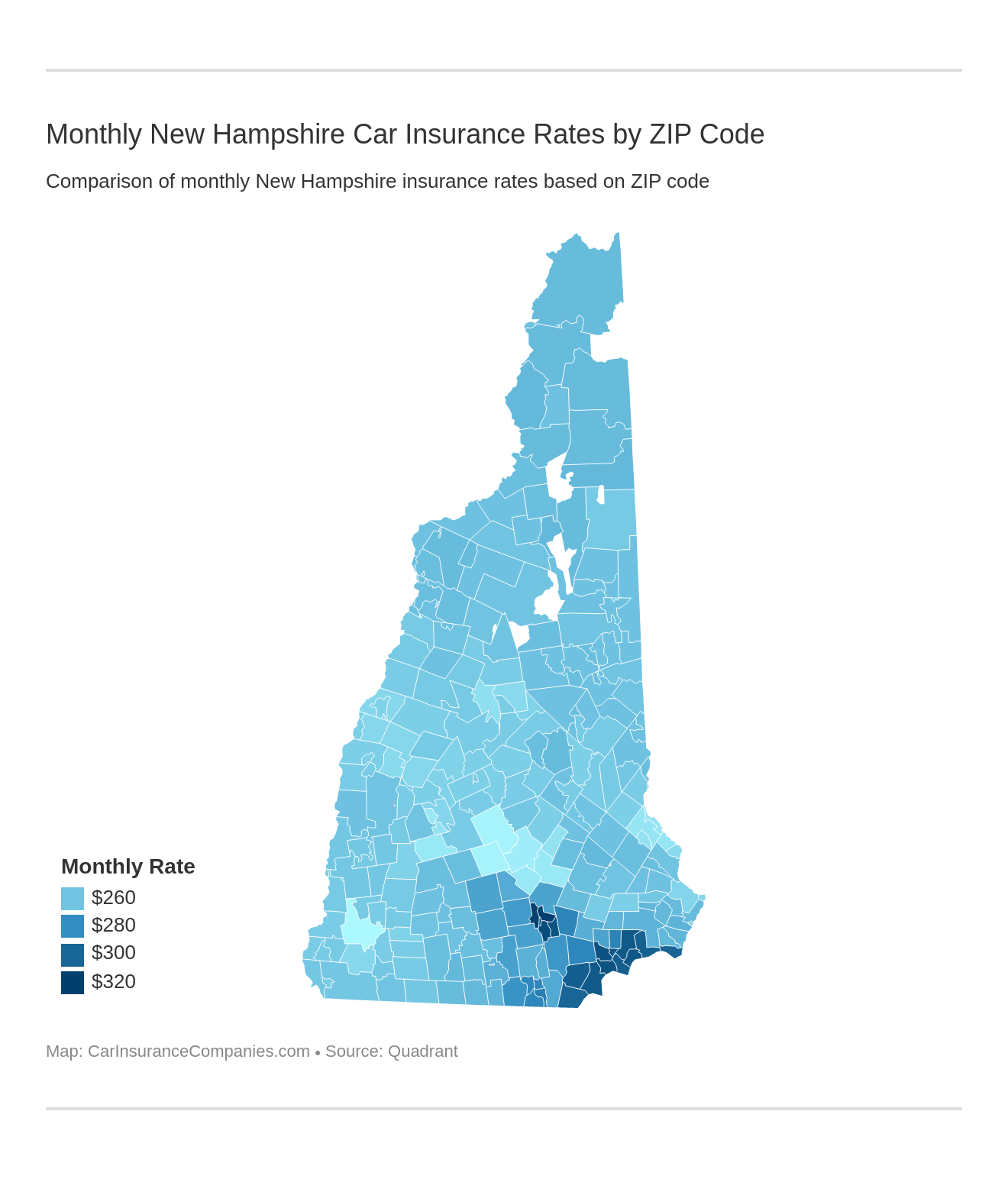

What are the cheapest rates by ZIP code in New Hampshire?

Where you live can affect your car insurance premium, too. There are a lot of ZIP codes in the state of New Hampshire, so we’ve decided to list the 25 most expensive and the 25 least expensive ZIP codes for car insurance.

First, let’s examine the average annual premiums of the 25 most expensive ZIP codes.

| Most Expensive ZIP Code | Annual Premiums Based on ZIP Code |

|---|---|

| 03104 | $3,846 |

| 03101 | $3,836 |

| 03102 | $3,826 |

| 03103 | $3,762 |

| 03841 | $3,736 |

| 03811 | $3,726 |

| 03109 | $3,721 |

| 03826 | $3,696 |

| 03858 | $3,694 |

| 03848 | $3,689 |

| 03079 | $3,678 |

| 03865 | $3,653 |

| 03087 | $3,649 |

| 03827 | $3,640 |

| 03076 | $3,611 |

| 03874 | $3,611 |

| 03859 | $3,512 |

| 03060 | $3,452 |

| 03819 | $3,424 |

| 03064 | $3,406 |

| 03032 | $3,405 |

| 03062 | $3,401 |

| 03038 | $3,395 |

| 03063 | $3,389 |

| 03049 | $3,332 |

The most expensive ZIP code in the data is 03104, which is part of Manchester, New Hampshire. Manchester is a heavily populated city, and more people means more drivers on the road. For insurance companies, this means a greater risk of accidents.

Let’s move on to the 25 cheapest ZIP codes in New Hampshire.

| Cheapest ZIP Code | Annual Premiums Based on ZIP Code |

|---|---|

| 03431 | $2,888 |

| 03435 | $2,902 |

| 03229 | $2,914 |

| 03303 | $2,920 |

| 03301 | $2,936 |

| 03304 | $2,960 |

| 03275 | $2,963 |

| 03221 | $2,968 |

| 03274 | $2,978 |

| 03878 | $2,979 |

| 03867 | $2,981 |

| 03868 | $2,981 |

| 03839 | $2,987 |

| 03273 | $2,992 |

| 03258 | $2,994 |

| 03264 | $2,995 |

| 03291 | $3,013 |

| 03753 | $3,023 |

| 03245 | $3,029 |

| 03869 | $3,029 |

| 03766 | $3,030 |

| 03755 | $3,032 |

| 03284 | $3,034 |

| 03446 | $3,037 |

| 03272 | $3,038 |

The cheapest ZIP code is 03431, which covers Surry, Keene, Roxbury, and northern Swanzey, New Hampshire. This is a rural area surrounded by state parks and wildlife and forest reservations. This translates into less risk, as far as insurance companies are concerned.

What are the cheapest rates by city in New Hampshire?

Let’s broaden our scope a little and look at the 25 most expensive cities in New Hampshire.

| Most Expensive City | Average Grand Total |

|---|---|

| Amherst | $3,277 |

| Atkinson | $3,726 |

| Auburn | $3,405 |

| Bedford | $3,273 |

| Danville | $3,424 |

| Derry | $3,395 |

| East Hampstead | $3,696 |

| East Kingston | $3,640 |

| Goffstown | $3,295 |

| Hampstead | $3,736 |

| Hollis | $3,332 |

| Hooksett | $3,268 |

| Kingston | $3,689 |

| Londonderry | $3,324 |

| Manchester | $3,798 |

| Nashua | $3,412 |

| Newton | $3,694 |

| Newton Junction | $3,512 |

| North Salem | $3,314 |

| Pelham | $3,611 |

| Plaistow | $3,653 |

| Salem | $3,678 |

| Sandown | $3,269 |

| Seabrook | $3,611 |

| Windham | $3,649 |

The top three most expensive cities in New Hampshire are Manchester, Hampstead, and Atkinson. Their annual premiums average between $3,700 and $3,800 per year.

What about the cities with the least expensive car insurance premiums in the state of New Hampshire?

| Cheapest City | Average Grand Total |

|---|---|

| Bow | $2,960 |

| Bradford | $2,968 |

| Chichester | $2,994 |

| Concord | $2,928 |

| Contoocook | $2,914 |

| Enfield | $3,040 |

| Grantham | $3,023 |

| Hanover | $3,032 |

| Holderness | $3,029 |

| Keene | $2,895 |

| Lebanon | $3,030 |

| New Castle | $3,049 |

| North Sutton | $3,053 |

| Plymouth | $2,995 |

| Portsmouth | $3,046 |

| Rochester | $2,983 |

| Rollinsford | $3,029 |

| Somersworth | $2,979 |

| South Newbury | $3,038 |

| South Sutton | $2,992 |

| Springfield | $3,034 |

| Stinson Lake | $2,978 |

| Suncook | $2,963 |

| Swanzey | $3,037 |

| West Nottingham | $3,013 |

The cheapest cities in New Hampshire are Keene, Contoocook, and Concord. Each city has an average annual premium of less than $2,950.

Read more:

- Concord Specialty Insurance Company Car Insurance Review

- Concord General Mutual Insurance Company Car Insurance Review

What are the forms of financial responsibility in New Hampshire?

When a driver is insured, the car insurance company will give them information before sending a car insurance card. This information may be a binder containing the driver’s policy information or other paperwork that says they’re insured. After a few business days, a car insurance company will issue an insurance card in paper or plastic form.

Some companies also allow you to access your insurance information in electronic form (i.e. with an app on a smartphone).

A form of financial responsibility is proof that you have the minimum coverage legally required by the state. Everything listed above is an acceptable form of proof in New Hampshire.

How much percentage of income are rates in New Hampshire?

Car insurance premiums are part of the cost of living for most residents in the U.S., meaning you will have to work the cost of insurance into your budget. The table below shows New Hampshire’s average car insurance premiums and annual salaries from 2012–2014.

| Year | Full Coverage Cost | Disposable Income | Insurance as % of Income |

|---|---|---|---|

| 2012 | $756 | $47,346 | 1.60% |

| 2013 | $773 | $46,651 | 1.66% |

| 2014 | $796 | $48,280 | 1.65% |

The table also shows the percentage of their income New Hampshire drivers are paying toward car insurance — about 1.6 percent for each of these years.

Want to figure out what percentage you’re spending?

It’s easy — just divide your annual car insurance premium into your annual income. For example, if your annual insurance premium is estimated at $1,700 per year and your annual income is $30,000 per year, simply divide 1,700 into 30,000 (1,700/30,000). The solution will be a decimal answer of 0.05666, which is 5.67 percent.

What are the core coverages in New Hampshire?

The basic car insurance coverage types are liability, collision, and comprehensive. These are known as the core coverages throughout most of our guides. Most car insurance companies have these three coverages available at different, competitive rates.

Liability coverage is the minimum requirement for car insurance and pays for bodily injury and property damage in case the policyholder is at fault in an accident. Collision coverage pays for property damage for both vehicles regardless of who is at fault in the accident. Comprehensive coverage pays for accidental damage from unexpected events like fire, inclement weather, and vehicle theft or vandalism.

The data table in this subsection shows the core coverages and their average costs in New Hampshire.

| New Hampshire Core Coverages | Averages |

|---|---|

| Liability | $393 |

| Collision | $282 |

| Comprehensive | $103 |

| Full | $778 |

The core coverages are extremely affordable in New Hampshire. However, full coverage will cost a lot more.

Full coverage is a car insurance policy that combines liability, collision, and comprehensive coverages.

When you finance or lease a vehicle, the leasing and finance office may require you to enlist in full coverage so they can protect the value of the vehicle in case it’s in a total loss accident.

Later in the guide, you’ll see car insurance premiums much higher than core coverage amounts. Continue reading through the guide to find out why.

What additional liability is available in New Hampshire?

Before we explain car insurance premiums and how they differ from each company, let’s talk about additional liability coverages. Additional liability coverages are often included within the coverage limit of your policy.

One of these additional coverage options is personal injury protection (PIP). PIP covers child car expenses, funeral costs, lost wages, and medical expenses. Another additional liability coverage that pays for medical bills is Medical Payments (MedPay). MedPay covers medical bills within the budget of your policy’s coverage limit.

Uninsured (UM) and underinsured (UIM) coverages are required for most motorists across the U.S. UM/UIM coverage pays for bodily injury and property damage if you’re in an accident with an at-fault driver who doesn’t have car insurance or whose coverage limit doesn’t cover the expenses of an accident.

When you’re in an accident, make a claim as soon as possible to ensure that you’re taken care of.

The likelihood of a policyholder receiving a payment from an insurance company is measured through the loss ratio. The loss ratio is the number of claims paid out to policyholders versus the number of premiums earned by a car insurance company.

The data in this subsection is from the National Association of Insurance Commissioners (NAIC), which compiled a three-year trend of the loss ratios for PIP, MedPay, and UM/UIM.

| Additional Coverage Type | 2015 Loss Ratio | 2014 Loss Ratio | 2013 Loss Ratio |

|---|---|---|---|

| PIP | - | - | - |

| MedPay | 66.33 | 68.57 | 73.36 |

| UM/UIM | 49.57 | 62.78 | 54.42 |

PIP is not required in New Hampshire because it’s an at-fault state, so there’s no loss ratio available for this coverage. MedPay had a steady loss ratio in a three-year trend. For UM/UIM, the loss ratio fluctuated. New Hampshire car insurance companies paid out approximately 50 percent of UM/UIM claims.

This means for every $100 earned in premiums, car insurance companies spent roughly $50 paying out claims.

High loss ratios or loss ratios that exceed 100 show that a car insurance company isn’t earning money effectively but isn’t going bankrupt either. If a company isn’t making much money, there’s a good chance they’re going to raise their rates soon. On the other hand, low loss ratios show that an insurer doesn’t pay out on a lot of claims, which could make things difficult for you if you have to file one.

What add-ons, endorsements, and riders are available in New Hampshire?

There are other types of coverage you may want to consider adding to your policy as well to make sure you have all the protection you’ll need. These include:

- Guaranteed auto protection (GAP)

- Personal umbrella policy (PUP)

- Rental reimbursement

- Emergency roadside assistance

- Mechanical breakdown insurance

- Non-owner car insurance

- Modified car insurance coverage

- Classic car insurance

- Pay-as-you-drive or usage-based insurance

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Best New Hampshire Car Insurance Companies

In this section, we’ll look at more factors that determine premiums and tell you which car insurance companies are the best in New Hampshire. What qualifies a company to be considered one of the best? We’ll explain, in part by showing you data from financial rating agencies A.M. Best and J.D. Power.

In addition to ratings from these agencies, we’ll break down information that shows how car insurance premiums are determined by commute mileage, coverage level, and your credit history and driving record.

What are the financial ratings of the largest car insurance companies in New Hampshire?

Car insurance providers are judged on their financial performance every year by financial and credit rating agencies. One of the top financial rating agencies is A.M. Best. This organization has been around since 1899 and currently has offices across the globe.

Every year, A.M. Best issues a report in which they use their financial strength ratings (FSR) to assign a grade to each car insurance company in the U.S. We’ll review the FSR ratings in the data below.

| Company | AM Best Rating |

|---|---|

| Allstate Insurance Group | A+ |

| Amica Mutual Group | A+ |

| Auto-Owners Group | A++ |

| Geico | A++ |

| Liberty Mutual Group | A |

| Metropolitan Group | A |

| Progressive Group | A+ |

| State Farm | A++ |

| Travelers Group | A++ |

| USAA Group | A++ |

All of the largest car insurance companies in New Hampshire earned positive ratings from A.M. Best, with Geico, State Farm, USAA, Auto-Owners, and Travelers all receiving the highest possible grade.

Which car insurance companies have the best ratings in New Hampshire?

J.D. Power issues annual ratings based on customer feedback, which they summarize using their customer index (a 1,000-point scale) and Power Circle ratings. The Power Circle Rating is much like a star rating system, with five circles being the best.

The data summarized in this section shows the Overall Customer Satisfaction Index in the New England region.

| Company | Points (based on a 1,000-point scale) | Circle Ratings |

|---|---|---|

| Allstate | 834 | 4 |

| Amica Mutual | 879 | 5 |

| Arbella | 800 | 2 |

| Geico | 827 | 3 |

| The Hanover | 795 | 2 |

| Liberty Mutual | 809 | 3 |

| MAPFRE Insurance | 811 | 3 |

| MetLife | 803 | 2 |

| Nationwide | 817 | 3 |

| Plymouth Rock Assurance | 804 | 2 |

| Progressive | 826 | 3 |

| Safeco | 796 | 2 |

| Safety Insurance | 813 | 3 |

| State Farm | 838 | 4 |

| Travelers | 804 | 2 |

| USAA* | 893 | 5 |

| New England Region | 821 | 3 |

Read more:

- Arbella Indemnity Insurance Company Car Insurance Review

- Arbella Mutual Insurance Company Car Insurance Review

- Arbella Protection Insurance Company Car Insurance Review

- Plymouth Rock Assurance Corporation Car Insurance Review

Amica Mutual and USAA are the highest rated car insurance companies in the New England region. The asterisk (*) indicates that USAA is only available to active-duty and retired military professionals and their immediate families.

Most companies in the New England region are about average in regards to Power Circle Ratings and Overall Customer Satisfaction Index.

Which car insurance companies have the most complaints in New Hampshire?

Reviews and financial performance are useful when determining how well a company performs. However, it’s also worth considering how many complaints a company receives. Potential customers and policyholders can easily compare complaints by examining the NAIC Complaint Index.

The complaint index allows you to compare the complaints of different car insurance companies in your state. These complaints are often presented in ratios. The lower the ratio, the happier policyholders are with their car insurance provider. Let’s look at the complaint ratio of car insurance companies in New Hampshire.

| Company | NAIC Complaint Ratio |

|---|---|

| Allstate | 0.69 |

| Geico | 0.92 |

| Nationwide | 0.28 |

| Progressive | 0.53 |

| Safeco | 2.56 |

| State Farm | 0.57 |

| USAA | 0.84 |

Safeco has the highest ratio of complaints in New Hampshire. The lowest ratio belongs to Nationwide. Complaints can generate improvements in the coming year, or they could cause policyholders to switch to another car insurance provider.

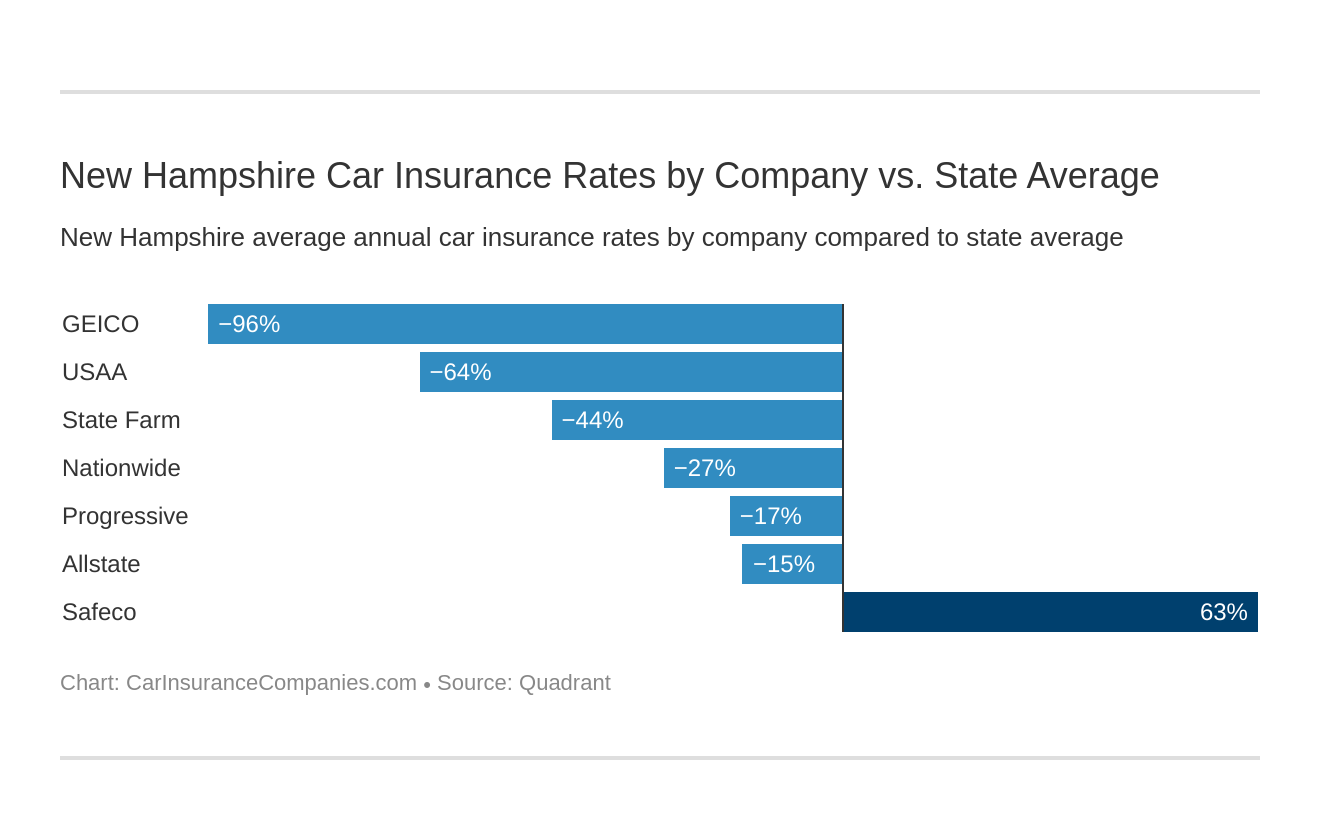

What are the cheapest car insurance companies in New Hampshire?

Car insurance annual premiums vary. We’ve seen full coverage listed at $778, but when factors like a person’s city, gender, marital status, and ZIP code are taken into account, the annual premium often increases. The average cost of an annual premium from a company in New Hampshire is $3,159 when all factors have been considered.

So how do the different companies compare to the state’s estimation for car insurance premiums per year? Take a look at the data.

| Company | Average Annual Rate | Compared to State Average | Compared to State Average % |

|---|---|---|---|

| Allstate | $2,738 | -$421 | -15.39% |

| Geico | $1,612 | -$1,547 | -96.01% |

| Nationwide | $2,488 | -$671 | -26.99% |

| Progressive | $2,691 | -$468 | -17.39% |

| Safeco | $8,477 | $5,318 | 62.73% |

| State Farm | $2,187 | -$972 | -44.46% |

| USAA | $1,921 | -$1,238 | -64.43% |

The “Compared to State Average” column is the difference between the company average and the New Hampshire average for car insurance, while the “Compared To State Average Percent” is the amount of money spent or saved when enrolling in that company’s policy.

For instance, State Farm’s average annual premium is $2,187. It’s $972 less than New Hampshire’s average annual premium for car insurance. When compared to the percentage of the state average, policyholders who have State Farm save over 44 percent on their car insurance.

Savings are indicated by the negative symbol while averages and percentages without the negative indicate premiums higher than average.

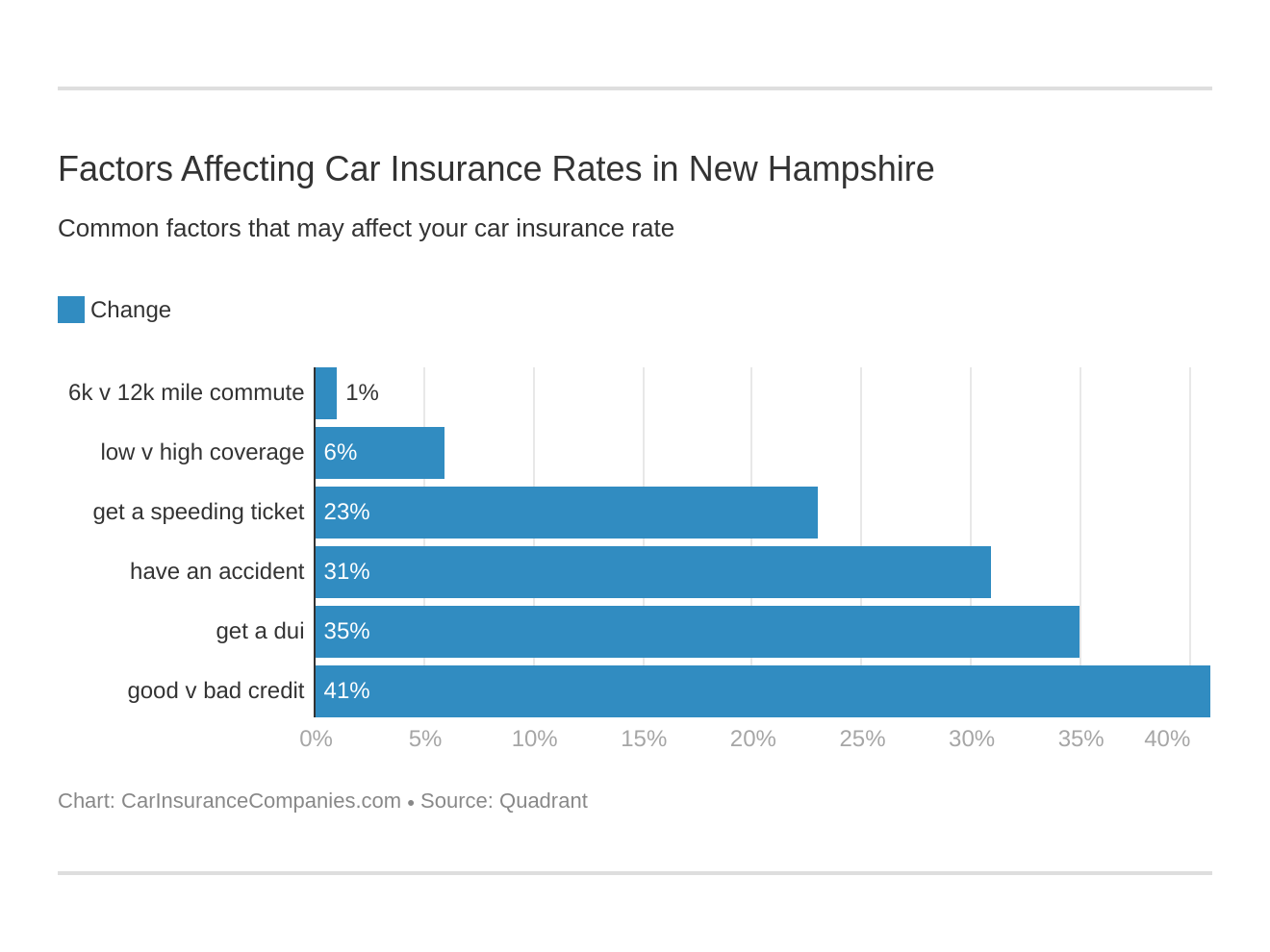

Does my commute affect my car insurance rate in New Hampshire?

During the quoting process, car insurance companies will ask you a series of questions. One of those questions involves what your vehicle is used for. If you drive to school or work, or anyplace else on a daily basis, the company will issue your rate based on how many miles you’ll drive within the duration of the policy.

If you have a long commute, some companies will charge you more. Let’s see how many companies in New Hampshire issue higher premiums based on the number of miles you drive.

| Company | 10-Mile commute. 6,000 annual mileage. | 25-mile commute. 12,000 annual mileage. |

|---|---|---|

| Allstate | $2,700 | $2,775 |

| Geico | $1,598 | $1,625 |

| Nationwide | $2,488 | $2,488 |

| Progressive | $2,691 | $2,691 |

| State Farm | $2,137 | $2,236 |

| USAA | $1,902 | $1,941 |

Progressive and Nationwide are the only two companies that don’t increase rates based on the number of miles you drive. Geico and USAA have the cheapest car insurance based on commute mileage. Although these companies are cheaper, they do increase car insurance premiums based on how many miles you drive per year.

Can coverage level change my car insurance rate with companies in New Hampshire?

As we previously discussed, New Hampshire’s liability insurance requirement follows the 25/50/25 rule. If you think this coverage is not enough, you can invest in a higher coverage level.

Medium or high coverage levels will give you more protection, but they’ll also cost you more in premiums.

An example of a medium coverage level would be 50/100/50 ($50,000 for injuries to one person, $100,000 for injuries to two or more people, and $50,000 for property damage), whereas a high coverage level could be 100/300/100 ($100,000 for injuries to one person, $300,000 for injuries to two or more people, and $100,000 for property damage).

Let’s look at the premiums based on coverage levels.

| Company | Low | Medium | High |

|---|---|---|---|

| Allstate | $2,661 | $2,734 | $2,817 |

| Geico | $1,537 | $1,602 | $1,696 |

| Nationwide | $2,653 | $2,453 | $2,357 |

| Progressive | $2,584 | $2,691 | $2,798 |

| State Farm | $2,088 | $2,189 | $2,283 |

| USAA | $1,848 | $1,918 | $1,998 |

These prices are worth taking into account while you’re shopping around. If you were thinking about signing on with Nationwide for liability only, you might change your mind when you see that you can get more coverage from State Farm, Progressive, or Geico for a cheaper price.

How does my credit history affect my car insurance rate with companies in New Hampshire?

Car insurance companies will need to know your credit history. Why? They believe this information can give them an indication of how risky you’ll be to insure.

Before taking you on as a customer, they’ll also consider your history with other car insurance companies. This is called an insurance credit history. The better your credit, the less money you’ll pay for car insurance. Here are a few annual premiums based on credit history.

| Group | Poor | Fair | Good |

|---|---|---|---|

| Allstate | $3,368 | $2,492 | $2,352 |

| Geico | $1,907 | $1,564 | $1,363 |

| Nationwide | $2,896 | $2,375 | $2,192 |

| Progressive | $2,987 | $2,624 | $2,462 |

| State Farm | $3,097 | $1,928 | $1,536 |

| USAA | $2,606 | $1,714 | $1,443 |

The rates based on credit history remain competitive even for those who have poor credit. However, drivers with poor credit do pay the most for car insurance. Geico has the cheapest car insurance based on credit history.

How does my driving record change my rates with car insurance companies in New Hampshire?

A really big factor when it comes to your premium is your driving record. Car insurance companies will want to know if you’ve had speeding tickets, a DUI, or other violations in the past.

The table below shows the annual premiums from each major company for drivers with a speeding ticket, DUI, or accident on their record.

| Company | Clean Record | With one Speeding Violation | With one DUI Conviction | With one Accident |

|---|---|---|---|---|

| Allstate | $2,276 | $2,655 | $2,923 | $3,096 |

| Geico | $1,438 | $1,438 | $1,981 | $1,591 |

| Nationwide | $1,914 | $2,129 | $2,562 | $2,657 |

| Progressive | $2,312 | $2,712 | $2,550 | $3,190 |

| State Farm | $2,014 | $2,014 | $3,250 | $2,157 |

| USAA | $1,483 | $1,724 | $2,481 | $1,997 |

Policyholders with a clean record pay the cheapest rates for car insurance. Accidents and DUI convictions cause the highest increases in price. If you rack up a lot of violations or accidents, you’ll end up in the high-risk pool, and you’ll have to get SR-22 car insurance to get coverage.

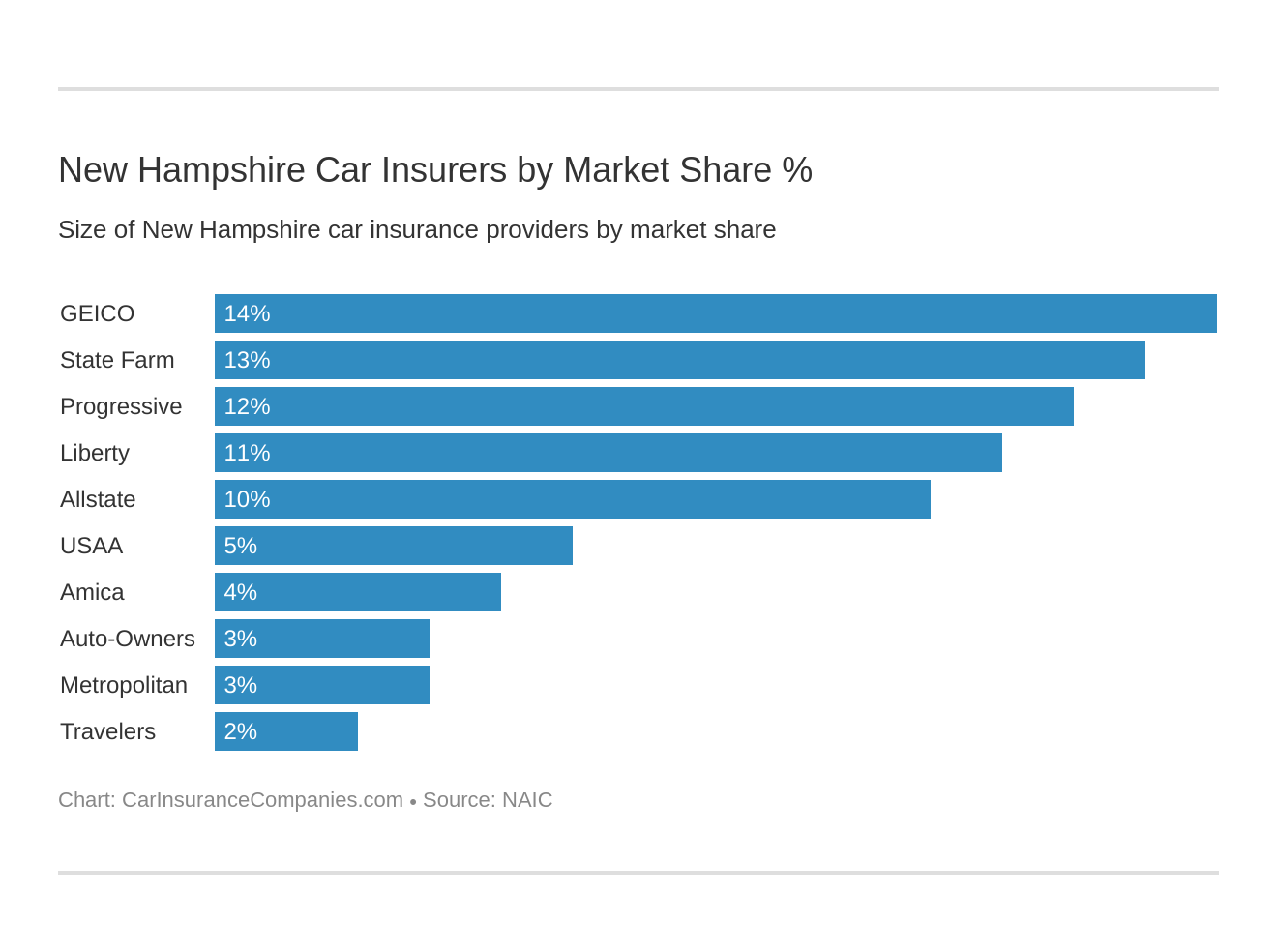

Which car insurance companies are the largest in New Hampshire?

There are a few ways to determine which car insurance companies are the largest. We can see the size of the company through direct premiums written, loss ratio, and market share. We’ve already explored loss ratio, so let’s talk about the other two.

Direct premiums written is the total number of policies a company has sold within a year. These are just new policies — renewals by existing customers don’t count toward direct premiums written.

A market share is the percentage of total sales in the industry that a company generated.

Here are the companies in New Hampshire with the highest numbers of direct premiums written and the largest market shares.

| Company | Direct Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|

| Allstate | $84,945 | 10.04% | 54.95% |

| Amica Mutual | $29,976 | 3.54% | 65.49% |

| Auto-Owners | $27,987 | 3.31% | 60.58% |

| Geico | $114,977 | 13.59% | 72.49% |

| Liberty Mutual | $97,114 | 11.48% | 58.48% |

| Metropolitan | $25,318 | 2.99% | 54.20% |

| Progressive | $103,823 | 12.28% | 61.53% |

| State Farm | $106,434 | 12.58% | 52.06% |

| Travelers | $20,099 | 2.38% | 59.55% |

| USAA | $44,555 | 5.27% | 72.58% |

Despite their lower than average premiums, USAA holds about 5 percent of the market share in New Hampshire. Geico has the largest market share in the state of New Hampshire, while Travelers has the smallest.

How many car insurance companies are available in New Hampshire?

Most of the bigger car insurance companies do business all across the country. There are two types of insurers: foreign and domestic. The term foreign in this context just means that the company sells insurance outside of its home state of operation. The term domestic means the company is doing business within the state where it is based.

There are 50 domestic insurers and 647 foreign insurers in New Hampshire. That’s a total of 697 insurers in the state. Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

New Hampshire Laws

If you’re moving to New Hampshire, there are a few laws you’ll need to know as a policyholder and a resident of the state. We’re going to go over the laws related to car insurance, plus vehicle licensing laws, and roadway and safety laws. These regulations are in place to protect drivers, passengers, and everyone else on the roads in New Hampshire.

What are the car insurance laws in New Hampshire?

New Hampshire’s government has a department that deals specifically with car insurance. This department is tasked with regulating the industry to ensure all business is fair and legal. This subsection explores how insurance law is determined in New Hampshire, including windshield coverage law, high-risk insurance, low-cost insurance, how car insurance fraud is defined, the statute of limitations, and state-specific laws.

How State Laws for Insurance Are Determined

Every year, the NAIC reports how insurance laws are determined in each state. In New Hampshire, the industry operates under File and Use law.

File and Use says car insurance companies can file new car insurance rates without receiving prior approval by insurance regulators.

If new rates cannot be justified, the insurance regulator will have the option to strike them down.

Windshield Coverage

New Hampshire doesn’t have any unique laws regarding windshields. Car insurance providers who use aftermarket parts must write this on the estimate. Aftermarket parts must be similar in type to the manufacturer’s and of good quality. Policyholders may select the repair shop of their choice and have the option to choose Original Equipment Manufacturer (OEM) parts for vehicles less than 2 years old with fewer than 30,000 miles.

High-Risk Insurance

Motorists that have numerous traffic violations, at-fault accidents, and DWI convictions (DUI in other states) are placed in the high-risk pool. Individuals in the high-risk pool may lose the option to find car insurance in the voluntary market and will have to enroll in an SR-22 insurance program. However, they will have to attempt to find car insurance in the voluntary market 60 days before signing up for SR-22 insurance.

The voluntary market is where potential customers have the option to choose which company they want to do business with, without the possibility of being rejected due to driving record or poor credit history.

Traffic violations, at-fault accidents, and DWI convictions can lead to your New Hampshire driver’s license being suspended or revoked. If your license isn’t suspended or revoked, you’ll have to enroll in SR-22 insurance with the DMV. The DMV will find a car insurance policy for you.

If your license is being reinstated, you’ll need to have proof of insurance, which also requires an SR-22.

The following convictions require motorists to file for proof of insurance (SR-22):

- DWI – (First, Second, Subsequent, and Aggravated)

- Underage DWI – (First, Second, Subsequent, Aggravated)

- Leaving Scene of Accident

- Conduct After Accident

- Subsequent (Second) Offense Reckless Operation

To meet the conditions of filing for proof of insurance, New Hampshire motorists should contact the Bureau of Financial Responsibility and request that their driving record be reviewed. The Bureau will decide whether the filing period has been met or must be extended.

Low-Cost Insurance

In some states, there are programs in place to help people who cannot afford to pay for insurance on their own. This is often referred to as low-cost insurance. Unfortunately, New Hampshire does not have a low-cost insurance program in place at this time.

Automobile Insurance Fraud in New Hampshire

The New Hampshire Legislature established the New Hampshire Insurance Fraud Unit (NHIFU) in 1993. The NHIFU is comprised of four staff members and receives assistance from an insurance fraud prosecutor from the state’s Department of Justice.

The Fraud Unit processes over 300 fraud reports each year. New Hampshire state law requires all insurers to have initiatives in place to prevent, detect, and prosecute fraud, and to report suspected fraud to the NHIFU.

If you wish to report suspected fraud yourself, please call 1-800-852-3416. You can also send fraud reports by mail to the following address:

New Hampshire Insurance Department | 21 South Fruit Street, Suite 14 | Concord, NH 03301

Or call the following phone number:

Phone 1-603-271-2261 | Fax 1-603-271-1406 | Consumer Hotline 1-800-852-3416

Statute of Limitations

Legal experts suggest policyholders make a claim as soon as possible after an accident or other incident. There’s also a legal time limit for you to file — this is called the statute of limitations.

The statute of limitations begins when the event happens, not when it’s reported. New Hampshire’s statute of limitations law says that a person can file a claim for bodily injury or property damage anytime within three years of the incident.

New Hampshire-Specific Laws

Every state has its own distinct laws. Some are a little bizarre. For example, if you’re planning on exploring the forests in New Hampshire, you can’t use a ferret to help you hunt. New Hampshire state law also requires residents and visitors to get a permit to clean up trash around the national parks.

However, others are really important, especially if you plan to be driving in the state. For example, as of January 1, 2019, a New Hampshire driver can be ticketed and fined for driving too slowly in the left lane if they’re impeding traffic.

What is the vehicle licensing law in New Hampshire?

No matter what state you live in, you’re required to have a driver’s license or learner’s permit before you take to the streets. And with a learner’s permit, there will be some restrictions as to when you’re allowed to drive and with whom.

This subsection will explore all the details of New Hampshire’s licensing laws, REAL ID, penalties for not having car insurance, teen driver laws, and the state’s Negligent Operator Treatment System (NOTS).

REAL ID

The REAL ID Act was signed into law in May 2005. In January 2013, the federal government gave a temporary extension to states that weren’t in compliance with REAL ID law. New Hampshire is one of the states that comply with REAL ID. On October 1, 2020, a REAL ID driver’s license or identification card (or a passport) will be required to board a domestic flight or enter a federal facility.

Penalties for Driving Without Insurance

Since New Hampshire does not require drivers to have insurance, there are generally no penalties for driving without it. However, if you’re convicted of a crime or involved in an accident, you may be required to show proof of insurance.

You may get an exemption by contacting the New Hampshire’s Bureau of Financial Responsibility and requesting an official review of your driving record. If officials deny your request, you’ll remain on SR-22 status.

Teen Driver Laws

Teen drivers can enter the learner’s stage at 15 years and six months old. While in the learner’s stage, the driver must hold the permit longer than six months.

Fifty hours of supervised driving training is required, and ten of those hours must be at night. The New Hampshire DMV requires teens and parents to keep a log of supervised driving training.

After these requirements are met, teen drivers enter the intermediate stage, during which they’re not allowed to drive between 1 a.m. and 4 a.m. These restrictions last until the driver is 18.

In addition to nighttime restrictions, drivers under 16 or teen drivers who are in the intermediate stage cannot have more than one passenger in the vehicle with them under the age of 25.

New Hampshire drivers under 18 years old must complete an approved Driver Education Program. Parents and legal guardians must provide written permission for a driver under 18 to apply for a driver’s license.

When all requirements are met, drivers under 21 years old will be issued a Youth Operator License, which expires on the driver’s 21st birthday.

The cost of a beginner’s permit is $10 in the state of New Hampshire.

Older Driver License Renewal Procedures

Senior or elderly drivers in New Hampshire have to renew their driver’s licenses every five years and must pass a vision test to do so. Senior drivers have the option to renew their licenses online every other renewal but must provide proof of an adequate vision test.

New Residents

If you’re moving to New Hampshire, you’ll have to obtain a driver’s license in the state within 60 days of establishing permanent residency. If you have a valid out-of-state license and proof of U.S. citizenship, you can get a New Hampshire driver’s license without taking a driving test.

You can obtain a REAL ID in New Hampshire as well when you transfer an out-of-state license. However, a vision test is required even if your license isn’t expired.

For lost and stolen out-of-state driver’s licenses, the New Hampshire DMV will need written proof that you’re a licensed driver in your previous state. The DMV won’t issue a driver’s license until they have proof that your current license is valid and not under suspension. All you need to do is ask your previous state for a completed Verification of Out of State License form.

License Renewal Procedures

All licensed drivers have to renew their licenses every five years in New Hampshire. A vision test is required. The fee for a driver’s license is $50, even if you’re transferring your out-of-state license. REAL IDs cost $60.

Negligent Operator Treatment System (NOTS)

What is the negligent operator treatment system (NOTS)? The NOTS is how the DMV and law enforcement assigns penalties to drivers who violate the law in New Hampshire. The penalties are accompanied by demerit points. Below is a list of violations and how many demerit points will be added to your record if you commit them.

| Statute | Motor Vehicle Violations Offense | Demerit Points |

|---|---|---|

| 263:2 | Failure to display or produce license for officer | 2 |

| 263:85 | Allowing improper person to drive commercial vehicle | 2 |

| 262:40-C | Abandoned vehicles | 3 |

| 265:37 or 265:41 | Failure to use due care | 3 |

| 265:60 | Speeding at rate of 1-24 MPH over posted speed limit | 3 |

| 263:63 | Driving without proof of financial responsibility | 4 |

| 265:16 | Failure to drive on right hand side of road | 4 |

| 265:18 or 265:20 | Improper passing | 4 |

| 265:60 | Speeding at rate of 25 MPH or greater over posted speed limit | 4 |

| 262:1 | Alteration of title | 6 |

| 262:3 | False report of theft | 6 |

| 263:12 | Prohibition | 6 |

| 262:12 | Taking vehicle without owner's consent | 6 |

| 262:7 or 262:10 | Changing or removing vehicle ID Number | 6 |

| 262:17 | Odometer tampering | 6 |

| 263:57-a | Lending license to minor to purchase alcohol | 6 |

| 264:25 | Conduct after an accident | 6 |

| 265-A:2 (formerly 265:82) | DWI | 6 |

| 265-A:3 (formerly 265:82-a) | Aggravated DWI | 6 |

| 265-A:43 (formerly 265:80) | Transporting drugs in a motor vehicle | 6 |

| 265:4 | Disobeying police officer | 6 |

| 265:54 | School bus violation | 6 |

| 265:75 | Road racing | 6 |

Any driver aged 21 and older may have their license suspended if they receive 12 points or more in one year. For drivers under 21, a license may be suspended after the accumulation of six to nine points.

What are the rules of the road in New Hampshire?

If you’re going to be driving in New Hampshire, you need to keep up with the current rules of the road. In this next section, we’ll talk about fault versus no-fault law, speed limits, rideshares, seat belt laws, and more.

Fault Versus No-Fault

New Hampshire is an at-fault state. This means that after an accident, authorities will determine who was at fault, and that person is responsible for the resulting losses, including medical bills and property damage.

Remember how we mentioned that insurance isn’t required in New Hampshire? Well, that’s true, but if you don’t have any insurance and you cause an accident, you’ll be on the hook for those damages.

Furthermore, liability insurance does not pay for your losses as the at-fault driver, only those of the other party. To make sure you, your family, and your vehicle are protected, you may want to invest in collision and/or comprehensive insurance.

Seat Belt and Car Seat Laws

Surprisingly, New Hampshire does not have a seat belt law, but they have laws for child safety seats.

Children 6 years and younger and those who are less than 57 inches tall should be in a child safety seat. Anyone aged 7 through 17, or younger than 7 and at least 57 inches tall, should be in a seat belt. Violating the child safety seat law carries a fine of $50.

Keep Right and Move Over Laws

New Hampshire law requires drivers who are approaching a crash or emergency area to drive carefully and leave enough room for emergency vehicles to get by. Drivers should make sure to move to another lane when approaching emergency vehicles displaying flashing lights, along with towing, recovery, and highway maintenance vehicles.

Speed Limits

The speed limits in New Hampshire are a bit lower than they are in many other states. The speed limit for rural interstates in New Hampshire is 65 mph. Some segments of rural roads have a speed limit of 70 mph. Urban interstates have a speed limit of 65 mph, and all other non-residential roads in New Hampshire have a limit of 55 mph.

Ridesharing

Ridesharing has become a popular mode of transportation nationwide. If you plan to drive for Uber, Lyft, or a similar company, it’s a good idea to get rideshare insurance to make sure you’re protected while working.

Based on our research, the only company in New Hampshire that offers specialized rideshare insurance is USAA. Still, you can always check with other companies you might like to do business with, just in case they’ve changed their policies recently.

Automation on the Road

Automation refers to self-driving cars or any vehicle function that is done by a computer. Does New Hampshire have any regulations on automation on the road? The answer is yes. A licensed driver must operate the autonomous vehicle unless it’s a testing vehicle. New Hampshire requires liability coverage of $5 million on fully automated cars.

What are the safety laws in New Hampshire?

Respecting the safety laws is extremely important. As described in the NOTS subsection, New Hampshire law has a zero-tolerance policy for DWI (DUI). This subsection will talk about DWI/DUI laws, marijuana-impaired driving laws, and distracted driving laws.

DUI Laws

DUI/DWI is measured by blood alcohol content, which is the amount of alcohol in the bloodstream of a driver. Law enforcement measures BAC with a breathalyzer. The table below shows the BAC limit and the high BAC limit, and how the state of New Hampshire identifies the offense.

| BAC Summary | BAC Data & Info |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | 0.16 |

| Criminal Status by Offense | First Offense – class B misdemeanor Second to Third Offense – non-injury Class A misdemeanors Fourth and Subsequent Offenses – non-injury felony DUI with Serious Bodily Injury – class B felony |

| Formal Name for Offense | Driving While Intoxicated (DWI) |

Some states use the term DUI (Driving Under the Influence) and some use DWI (Driving While Intoxicated). They are essentially the same offense and carry the same penalties.

The next table shows the number of offenses, penalties, and years that your license can be revoked. These penalties, fines, and periods of imprisonment demonstrate how seriously New Hampshire takes DUI/DWI. Each subsequent offense carries a more severe penalty. Let’s take a look at the specifics of the DUI/DWI law in New Hampshire.

| Offense | ALS or Revocation | Imprisonment | Fine | Other |

|---|---|---|---|---|

| First Offense | Nine months to six years, six months can be suspended if enrolled in 20-hour Impaired Driver Intervention Program | No minimum | $500 minimum | - |

| Second Offense | Three-year minimum | Mandatory minimum 30 days to one year | $750 minimum | IID one to two years after license reinstatement, seven-day Multiple Offender Program (MOP) required |

| Third Offense | Lifetime; may be reinstated after five years | 180 days to one year | $750 minimum | IID one to two years after license reinstatement; 28-day MOP required |

| Fourth Offense | Lifetime, may be reinstated after seven years | 30 days to seven years, minimum six months deferred jail time | $930 minimum | IID one to two years after license reinstatement, 28-day MOP required |

The fines for committing DUI/DWI in New Hampshire are less than $1,000 for all four offenses. But revocation of driver’s license extends for more than seven years after the third offense. It’s in your best interest to never drink and drive.

Marijuana-Impaired Driving Laws

New Hampshire has no specific law against marijuana-impaired driving. However, any condition or impairment that may cause you to drive irresponsibly may cause law enforcement to make an executive decision to remove you from the roadway to ensure the safety of other drivers.

If you’re at all impaired for any reason, take a rideshare or ask a friend to drive you where you need to go.

Distracted Driving Laws

Distracted driving laws have been on the rise due to an increase in car accidents caused by texting or using other apps while driving. All drivers in New Hampshire are prohibited from using a handheld cellphone while operating a motor vehicle. There is also an official texting ban. These laws are under primary enforcement, meaning a police officer can pull you over just for using your phone.

Driving in New Hampshire

The reason the law is tough on those who speed or drive under the influence is that violations like these cause a lot of fatal accidents. This section will explore the number of fatal crashes in New Hampshire, the most dangerous highway in New Hampshire, teen drinking and driving arrests, EMS response times, and what it’s like to drive in New Hampshire.

How many vehicle thefts occur in New Hampshire?

Before we discuss fatality numbers, let’s take a look at the number of vehicle thefts in New Hampshire

| Car Make & Model | Year of Make & Model | Thefts |

|---|---|---|

| Honda Civic | 1997 | 34 |

| Honda Accord | 1996 | 20 |

| Chevrolet Pickup (Full Size) | 2002 | 19 |

| Ford Pickup (Full Size) | 2002 | 17 |

| Dodge Caravan | 2003 | 16 |

| Ford Focus | 2007 | 14 |

| Toyota Camry | 1999 | 13 |

| Jeep Cherokee/Grand Cherokee | 2000 | 11 |

| GMC Pickup (Full Size) | 2007 | 9 |

| Toyota Corolla | 1999 | 9 |

Even though the Chevy Silverado 1500 is the most popular car in New Hampshire, it wasn’t the top car stolen in the state. But what about the vehicle thefts in the most populated cities in New Hampshire? The table below shows vehicle thefts in the most populous cities in the state. This information comes from a 2018 FBI report.

| City | Population | Vehicle Thefts |

|---|---|---|

| Bedford | 22,640 | 5 |

| Claremont | 12,930 | 10 |

| Concord | 43,071 | 34 |

| Derry | 33,724 | 26 |

| Dover | 31,600 | 11 |

| Durham | 16,813 | 0 |

| Exeter | 15,305 | 2 |

| Goffstown | 17,978 | 13 |

| Hampton | 15,679 | 7 |

| Hooksett | 14,283 | 3 |

| Hudson | 25,232 | 16 |

| Keene | 22,870 | 11 |

| Laconia | 16,658 | 43 |

| Lebanon | 13,578 | 12 |

| Londonderry | 26,627 | 15 |

| Manchester | 111,422 | 163 |

| Merrimack | 25,683 | 6 |

| Milford | 15,497 | 5 |

| Nashua | 88,596 | 68 |

| Pelham | 13,795 | 2 |

| Portsmouth | 22,038 | 17 |

| Rochester | 30,947 | 45 |

| Salem | 29,297 | 12 |

| Somersworth | 11,920 | 15 |

| Windham | 14,811 | 4 |

The cities with the highest number of vehicle thefts in New Hampshire were Manchester, Nashua, and Rochester. Durham had no vehicle thefts in 2018.

How many road fatalities occur in New Hampshire?

We can determine the number of fatalities by looking at the fatal crash data from the National Highway Traffic Safety Administration (NHTSA). This information is useful to know, both because it can tell you what sort of situations require extreme caution, and because car insurance companies take this data into account when issuing their rates.

Most Fatal Highway in New Hampshire

The most dangerous highway in New Hampshire is Interstate 93 (I-93). Nineteen fatalities occurred on this highway from 2015–2017. Fatalities peaked in the summer months of these years. Two state roads — SR-101 and SR-16 — also see a number of fatal accidents; each had eight over the same three-year trend.

Fatal Crashes by Weather Condition and Light Condition

New Hampshire is known for its snowy and icy weather conditions throughout the winter and early spring. But do more accidents occur during inclement weather?

Below you’ll find the fatality numbers based on light and weather conditions.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 50 | 6 | 20 | 5 | 0 | 81 |

| Rain | 5 | 0 | 1 | 0 | 0 | 6 |

| Snow/Sleet | 3 | 2 | 4 | 1 | 0 | 10 |

| Other | 0 | 0 | 1 | 0 | 0 | 1 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTAL | 58 | 8 | 26 | 6 | 0 | 98 |

Despite the risk of driving in inclement weather, more crash fatalities occurred during normal daylight conditions. Snow and sleet crash fatalities were the second-highest in the dataset.

Fatalities (All Crashes) by County

The NHTSA collects as much data as possible each year to report accurate fatal crash numbers. Although New Hampshire has fatality rates lower than other states, fatal accidents happen more than they should. Here’s an extensive report of the total number of fatal crashes in New Hampshire by county.

| County | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2018 Fatalities |

|---|---|---|---|---|---|

| Belknap | 4 | 6 | 8 | 11 | 13 |

| Carroll | 6 | 6 | 10 | 6 | 9 |

| Cheshire | 7 | 2 | 11 | 10 | 8 |

| Coos | 3 | 7 | 6 | 7 | 6 |

| Grafton | 4 | 9 | 14 | 5 | 12 |

| Hillsborough | 27 | 24 | 27 | 20 | 27 |

| Merrimack | 13 | 16 | 13 | 12 | 24 |

| Rockingham | 18 | 29 | 28 | 16 | 29 |

| Strafford | 9 | 12 | 15 | 12 | 11 |

| Sullivan | 4 | 3 | 4 | 3 | 8 |

Most counties in New Hampshire have fluctuating fatality numbers, except for Belknap County. Belknap County’s fatality numbers increased gradually over a five-year period.

Traffic Fatalities

Next, let’s take a look at what types of roads see more fatal accidents in New Hampshire.

| Traffic Fatalities | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2018 Fatalities |

|---|---|---|---|---|---|

| Rural | 48 | 66 | 75 | 51 | 78 |

| Urban | 47 | 48 | 61 | 51 | 69 |

| Unknown | 0 | 0 | 0 | 0 | 0 |

| Total | 95 | 114 | 136 | 102 | 147 |

The numbers of fatal crashes on rural and urban roads were fairly close. It’s not unusual for the rural numbers to be a bit higher than the urban numbers. This is partly because it takes emergency services a little longer to get to rural areas, as we’ll discuss in more detail below.

Fatalities by Person Type

Below you’ll see a breakdown of fatalities by vehicle and person type for the five years we’ve been discussing.

| Person Type Summary | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2018 Fatalities |

|---|---|---|---|---|---|

| Bicyclist and Other Cyclist | 3 | 3 | 2 | 2 | 2 |

| Large Truck | 2 | 0 | 0 | 1 | 7 |

| Light Truck – Other | 0 | 0 | 1 | 0 | 0 |

| Light Truck – Pickup | 6 | 10 | 23 | 9 | 11 |

| Light Truck – Utility | 8 | 12 | 14 | 12 | 31 |

| Light Truck – Van | 2 | 3 | 1 | 3 | 2 |

| Other/Unknown Non-occupants | 1 | 2 | 1 | 1 | 3 |

| Other/Unknown Occupants | 2 | 1 | 1 | 2 | 0 |

| Passenger Car | 42 | 49 | 57 | 46 | 54 |

| Pedestrian | 12 | 8 | 17 | 11 | 9 |

| Total Motorcyclists | 17 | 26 | 19 | 15 | 28 |

| Total Nonoccupants | 16 | 13 | 20 | 14 | 14 |

| Total Occupants | 62 | 75 | 97 | 73 | 105 |

| Total | 95 | 114 | 136 | 102 | 147 |

The highest fatality numbers were for passenger car occupants, followed by motorcycles and light trucks. This is not too surprising since these are the most common vehicles you’ll find on the road.

Fatalities by Crash Type

When NHTSA researchers identify fatal crashes, they also review the details of the crash and classify it by type. The data represented below will show the fatality totals by crash type.

| Crash Type | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2018 Fatalities |

|---|---|---|---|---|---|

| Involving an Intersection (or Intersection Related) | 21 | 15 | 15 | 14 | 19 |

| Involving a Large Truck | 12 | 6 | 9 | 13 | 22 |

| Involving a Rollover | 18 | 23 | 39 | 25 | 27 |

| Involving Speeding | 47 | 56 | 77 | 58 | 71 |

| Single Vehicle | 60 | 70 | 100 | 64 | 89 |

| Involving a Roadway Departure | 66 | 79 | 95 | 70 | 106 |

| Total Fatalities (All Crashes)* | 95 | 114 | 136 | 102 | 147 |

The numbers continue to parallel the fatal crash totals in the previous tables. 2018 was the most fatal year in New Hampshire for car accidents. The crash type with the highest fatality numbers were those involving a roadway departure. These are crashes that involve two or more vehicles leaving the roadway upon impact.

Five-Year Trend for the Top 10 Counties

Next, we’ll show you the top 10 counties with the most fatal accidents over this same five-year span.

| Rank & Totals | New Hampshire Top 10 Counties | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2018 Fatalities |

|---|---|---|---|---|---|---|

| 1 | Rockingham | 18 | 29 | 28 | 16 | 29 |

| 2 | Hillsborough | 27 | 24 | 27 | 20 | 27 |

| 3 | Merrimack | 13 | 16 | 13 | 12 | 24 |

| 4 | Belknap | 4 | 6 | 8 | 11 | 13 |

| 5 | Grafton | 4 | 9 | 14 | 5 | 12 |

| 6 | Strafford | 9 | 12 | 15 | 12 | 11 |

| 7 | Carroll | 6 | 6 | 10 | 6 | 9 |

| 8 | Cheshire | 7 | 2 | 11 | 10 | 8 |

| 9 | Sullivan | 4 | 3 | 4 | 3 | 8 |

| 10 | Coos | 3 | 7 | 6 | 7 | 6 |

| Sub Total 1.* | Top Ten Counties | 95 | 114 | 136 | 102 | 147 |

| Total | All Counties | 95 | 114 | 136 | 102 | 147 |

Rockingham County, Hillsborough County, and Merrimack County were the top three counties with the most fatal accidents during the five-year trend. Sullivan County and Coos County had the fewest number of fatal accidents. Both counties were under double digits each year.

Fatalities Involving Speeding by County

Excessive speeding is dangerous for you and everyone you’re sharing the road with. The safety laws, such as speed limits, are in place to minimize accidents. However, fatalities that involve speeding still occur. The NHTSA identified the fatal accidents that involved speeding in their annual research. Here’s a five-year trend of concentrated information.

| County | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2018 Fatalities |

|---|---|---|---|---|---|

| Belknap | 3 | 5 | 6 | 7 | 5 |

| Carroll | 1 | 2 | 6 | 4 | 0 |

| Cheshire | 3 | 0 | 9 | 7 | 3 |

| Coos | 0 | 3 | 3 | 4 | 4 |

| Grafton | 3 | 3 | 8 | 4 | 5 |

| Hillsborough | 11 | 12 | 13 | 6 | 16 |

| Merrimack | 7 | 8 | 4 | 8 | 12 |

| Rockingham | 11 | 17 | 18 | 9 | 17 |

| Strafford | 4 | 4 | 7 | 7 | 6 |

| Sullivan | 4 | 2 | 3 | 2 | 3 |

The NHTSA separated the crash fatalities by county. The most fatal counties for speed-related crashes were Hillsborough County and Rockingham County. Hillsborough County speed-related fatal crashes peaked in 2018, while Rockingham County speed-related fatalities peaked in 2016.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

What about fatalities that are related to alcohol-impaired drivers? The NHTSA provides fatal crash numbers for that, too. Alcohol-impaired total fatalities were relatively close to the speed-related totals.

| County | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2018 Fatalities |

|---|---|---|---|---|---|

| Belknap | 3 | 3 | 1 | 3 | 5 |

| Carroll | 1 | 1 | 3 | 4 | 0 |

| Cheshire | 2 | 0 | 4 | 6 | 3 |

| Coos | 0 | 3 | 2 | 2 | 0 |

| Grafton | 1 | 2 | 6 | 0 | 2 |

| Hillsborough | 8 | 9 | 5 | 3 | 11 |

| Merrimack | 1 | 3 | 3 | 1 | 8 |

| Rockingham | 10 | 9 | 12 | 3 | 15 |

| Strafford | 3 | 2 | 3 | 2 | 4 |

| Sullivan | 0 | 0 | 0 | 2 | 0 |

Hillsborough County and Rockingham County are still the counties with the highest number of fatal accidents, but there were fewer fatal crashes involving alcohol compared to speed-related fatalities.

Teen Drinking and Driving

Speaking of alcohol-impaired driving, New Hampshire has an underage drinking and driving problem. We’ve researched all U.S. states and found that New Hampshire ranks at number 9 for teen DUI arrests. In 2018, New Hampshire had 42 teen DUI arrests. Approximately 161 arrests are made per million people in New Hampshire.

EMS Response Time

NHTSA also reviews information about emergency medical services (EMS), tracking the average time it takes them to get to an accident, and from an accident to a hospital. The data below shows the average time in minutes for both rural and urban roads.

| Area in the State | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|

| Rural | 2 | 12 | 33 | 46 | 48 |

| Urban | 1 | 9 | 25 | 35 | 50 |

We’ve rounded the summarized data for you so you can get a general idea of how long it takes for EMS to respond to notifications and how long it takes for them to get to an accident.

As you can see, it took EMS longer to get to rural crashes and from the crash sites to the hospital. This is likely because rural areas are more spread out and generally farther from medical facilities.

What is transportation like in New Hampshire?

Earlier in the guide, we talked about the most popular vehicle and the car culture in New Hampshire. For this final subsection, let’s elaborate on how New Hampshire residents get around the state. We’ll summarize research from DataUSA, an organization that researches general information on states and their cities.

Car Ownership

According to DataUSA’s most recent research, roughly 43 percent of New Hampshire households own two cars. The next largest share is 24 percent of households owning a total of three cars. About 2 percent of households in New Hampshire don’t own a vehicle at all.

Commute Time

Despite the miles of roadway in New Hampshire, the average commute time is approximately 26 minutes. This is right on par with the national average. About 4 percent of New Hampshire commuters have super commutes, which is a commute lasting more than 90 minutes.

Commuter Transportation

Although New Hampshire is a small state, a lot of people still prefer to drive. Approximately 81 percent of people who commute to work drive alone. About 7 percent carpooled, while another 7 percent worked from home.

Traffic Congestion

We normally use three different traffic forecast agencies for this particular section, but New Hampshire didn’t have any information from INRIX or TomTom. However, Numbeo does have information on Manchester.

Numbeo measures traffic congestion through the traffic index, time index, and inefficiency index. All indexes are measured in minutes.

The traffic index is a combination of time consumed in traffic due to work commute, time spent while waiting in traffic, estimated carbon dioxide consumption while in traffic, and overall errors in traffic.

Time index is the average time for one-way trips.

The inefficiency index is an estimate of errors in traffic. High inefficiencies are caused by motorists who choose to drive a car instead of using public transport for long commute times, which is unlikely in New Hampshire. Inclement weather can also cause inefficiencies.

This video report from the Associated Press shows how inefficiencies can cause traffic congestion.

Here are Numbeo’s traffic projections for Manchester:

- Traffic Index – 97.88

- Time Index (in minutes) – 21.75

- Inefficiency Index – 98

Numbeo estimates the average commute time in Manchester as approximately 22 minutes, which is a different projection from DataUSA’s average commute time for New Hampshire. When factoring all other aspects listed in the traffic index and inefficiency index, traffic congestion can make commutes as long as 90 minutes in Manchester.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Conclusion

New Hampshire has a very unique view of safety law in comparison to other states. If you’ve seen some of our guides, you’ll know how strict and complex safety law can be, but New Hampshire has a fairly lenient system. The average insurance rates are fairly low in New Hampshire compared to other states as well.

But why include the fatality numbers? Fatality numbers are one of the factors insurance companies may take into account when raising your rate. These stats can be used to justify increases, and in a “file and use” state, car insurance companies will be able to issue these increases before they are reviewed.

Before making any final decisions on your insurance company, it is important to learn as much as you can about your local insurance providers, and the coverages they offer. Call your local insurance agent to clear up any questions that you might have. Questions to consider asking include, “What is the best coverage plan for me/my family/my situation?” “What are the minimum coverage requirements in my state and what form of coverage do you recommend?” “Do you guys offer any bundle discounts if I take out both my auto insurance and home insurance with you?” and “What is the average rate of insurance quotes you guys offer?”

Before making any big insurance decisions, use our free tool to compare insurance quotes near you. It’s simple, just plug in your zip code and we’ll do the rest!

If you’re ready to get quotes from insurance companies in your area, use our free comparison tool by entering your ZIP code in the dialog box.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.