Connecticut Car Insurance (Coverage, Companies, & More)

Connecticut car insurance laws require a minimum liability policy of 25/50/20, which costs only $53 per month on average. If you want full coverage, you could see your rates increase to $120 a month or more. We recommend driving with as much coverage as you need, but that doesn't mean car insurance in Connecticut has to be expensive. Read our guide to compare the top Connecticut car insurance companies and enter your ZIP code below to start comparing Connecticut car insurance quotes for free.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 24, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 24, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Connecticut Statistics Summary | Details |

|---|---|

| Annual Road Miles | 21,512 Vehicle Miles Driven: 31,592 million |

| Vehicles | Registered in State: 2,755,233 Total Stolen: 6,338 |

| Population | 3,572,665 |

| Most Popular Vehicle | Nissan Rogue |

| Uninsured Motorists | 9.4% State Rank: 36th |

| Total Driving Fatalities | 2008-2017 Speeding: 88 Drunk Driving: 120 |

| Average Annual Premiums | Liability: $650.94 Collision: $368.51 Comprehensive: $131.62 |

| Cheapest Provider | State Farm |

Despite its status as the third smallest state, Connecticut packs a lot into one space.

It may be easy to drive through on a road trip, but, if you hit I-95 between New Haven and New York City, one of the most congested highways in the U.S., you might see some delays.

It’s also one of the most densely populated states and has the highest per capita income in the nation.

Another thing Connecticut doesn’t fall short on is car insurance options. You’ll find plenty to choose from, and the variety of coverage can be confusing. You may worry that you’ll get lost during your search.

We’re glad to ease the burden on you with this guide. We’ve gathered all the information you need here, from company info to state laws and statistics that factor into your rates.

Start comparing car insurance rates above. Just enter your ZIP code.

Get ready to scroll on to read all about car insurance and then some.

How to get Connecticut car insurance coverage and rates

How much does car insurance cost in Connecticut? What kind of options are available? Where do I start? These are among the questions that may be running through your mind while you research your insurance options. It’s frustrating.

We’re here to help you find the information you need to help you make an informed decision. Best of all, these facts aren’t dry and boring, but interesting and absorbing.

So, let’s discover more about everything that goes into a great car insurance policy.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the minimum car insurance requirements in Connecticut?

Connecticut is an “at-fault” accident state. This means, if you’re responsible for an accident, you will be held liable for any personal injury or property damage claims.

To protect you and others, the state of Connecticut requires liability insurance in these minimum coverage amounts:

| Insurance Required | Minimum Limits (Effective January 2019): 25/50/20 |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per one person $50,000 per accident |

| Property Damage Liability Coverage | $20,000 minimum |

| Uninsured/Underinsured Motorist | $25,000 per person $50,000 per accident |

Liability insurance pays all individuals — drivers, passengers, pedestrians, bicyclists, etc. — owed money for property damage and/or injuries resulting from a car accident you or anyone under your policy causes.

Connecticut requires you to carry uninsured and underinsured motorist coverage so that you can protect yourself and your passengers and pay for any medical bills if the at-fault driver has no insurance. This will also cover you if you’re the victim of a hit-and-run.

The experts at the Wall Street Journal recommend liability limits of 100/300/50. Basic coverage provides you only with liability protection and won’t pay to repair or replace your car for an accident that you cause. You’ll need more coverage for that, which we’ll discuss further below.

The cost of minimum coverage varies from state to state.

What is the required form of financial responsibility in Connecticut?

In Connecticut, your proof of financial responsibility – that you can pay for damages from an accident – is a declaration page or valid permanent insurance card. These are the only acceptable forms of verification. The state doesn’t accept temporary insurance cards, bills, or binders.

It does, however, let you show proof of insurance electronically at traffic stops in case you don’t have the paperwork handy.

What percentage of income are auto insurance premiums in Connecticut?

In 2014, the annual per capita disposable personal income in Connecticut was $56,186. Disposable personal income (DPI) is the total amount of money someone has to spend (or save) after they have paid their taxes.

The average annual cost of car insurance in Connecticut is $1,133, which is only two percent of the average DPI.

From 2012 to 2014, those numbers rose slightly, along with the DPI. Of its neighboring states, Rhode Island and New York residents had a lower DPI and higher premiums. Only Massachusetts paid lower premiums but had a slightly higher DPI of just over two percent.

The average Connecticut resident has $4,682 each month to cover expenses and potentially save. Car insurance will take about $94 out of that, which is one of the lowest amounts nationwide.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the average monthly car insurance rates in CT (liability, collision, comprehensive)?

| Coverage Type | Annual Costs in 2015 |

|---|---|

| Liability | $650.94 |

| Collision | $368.51 |

| Comprehensive | $131.62 |

| Combined | $1151.07 |

The above table shows the most recent data the leading source on the matter, the National Association of Insurance Commissioners, has provided. Expect car insurance rates in Connecticut to be significantly higher for 2019 and on.

Nationally, the average cost of an annual full coverage premium is $1,311, which is almost $200.00 higher than the cost in Connecticut.

Don’t forget: Connecticut has minimum requirements for liability coverage, but experts suggest drivers buy more than the required amounts, especially in an “at-fault” state like Connecticut.

Let’s check out some additional coverage options to add to a basic car insurance policy.

Is there an additional liability coverage in Connecticut?

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Personal Injury Protection | 85.46% | 95.14% | 74.69% |

| Medical Payments (Med Pay) | 87.46% | 83.32% | 78.91% |

| Uninsured/Underinsured Motorist (9.4% and ranked 36th in the nation) | 60.74% | 56.73% | 50.01% |

A loss ratio compares how much a company pays on claims to how much money it earns on premiums. For example, a loss ratio of 60 percent shows that a company spends $60 on claims out of every $100 it earns in premiums. A loss ratio of over 100 percent means the company is losing money. If the loss ratio is too low, the company isn’t paying as much in claims as expected.

Connecticut law recently changed to require uninsured and underinsured motorist coverage.

Medical payments coverage or MedPay is optional on all Connecticut motor vehicle insurance policies. You can buy it it in the following amounts: $1,000, $5,000, $10,000, $25,000, or $50,000.

Looking at the high loss ratios above, Connecticut drivers are making full use of MedPay, underinsured motorist/uninsured motorist coverage, and personal injury protection (PIP). MedPay and PIP cover medical bills from an accident regardless of who is at fault.

In 2015, 13 percent of U.S. motorists and 9.4 percent of drivers in Connecticut were uninsured, ranking 36th nationwide.

Next, we’ll explore optional extras you can add to your insurance package.

Are there any add-ons, endorsements, and riders?

We know getting the complete auto insurance coverage you need for an affordable price is your goal.

You can add plenty of powerful but cheap extras to your policy. These include mile or usage-based insurance coverage.

Did you know about pay-by-the-mile car insurance plans? Metromile isn’t currently available in Connecticut, but drivers there can take advantage of the active Usage-based insurance programs (UBI) there. Among the UBIs, Drivewise from Allstate, Snapshot from Progressive, and Drive Safe and Save from State Farm offer insurance discounts to drivers based on how well and how often they drive.

Read more: Metromile Insurance Company Car Insurance Review

These some of the other optional enhancements you can add to your auto insurance policy:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Usage-Based Insurance

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the average car insurance rates by age & gender in CT?

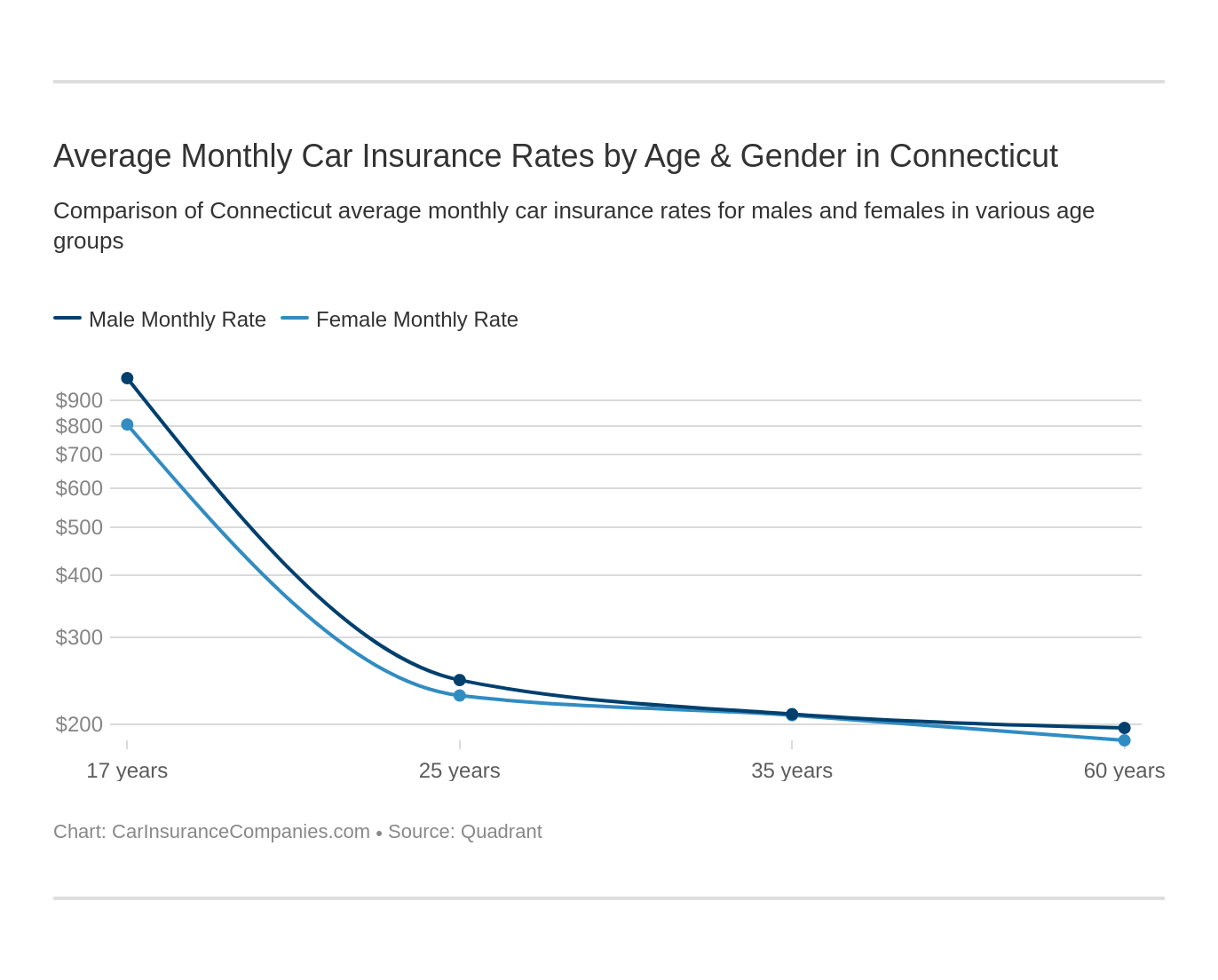

As you’ll notice below, age, rather than sex, is sometimes more of a factor in insurance rates than most of us think.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $3,673.14 | $3,634.67 | $3,382.07 | $3,621.23 | $11,215.24 | $13,243.90 | $3,843.87 | $4,038.70 |

| Geico General | $2,272.26 | $2,278.35 | $2,107.40 | $2,124.47 | $5,263.28 | $6,225.80 | $2,191.49 | $2,126.23 |

| Safeco Ins Co of IL | $3,516.76 | $3,825.92 | $2,706.04 | $3,337.15 | $17,597.17 | $19,837.39 | $3,558.72 | $3,883.84 |

| Nationwide Discover Agency | $2,343.37 | $2,370.04 | $2,105.93 | $2,209.18 | $6,485.04 | $8,226.75 | $2,717.04 | $2,921.42 |

| Progressive Casualty | $2,642.90 | $2,461.27 | $2,252.80 | $2,346.17 | $11,031.05 | $12,232.33 | $3,016.42 | $3,379.83 |

| State Farm Mutual Auto | $1,815.86 | $1,815.86 | $1,670.41 | $1,670.41 | $5,517.07 | $6,936.22 | $2,041.38 | $2,342.71 |

| Travelers Home & Marine Ins Co | $1,810.97 | $1,837.61 | $1,806.15 | $1,800.54 | $13,987.79 | $22,605.07 | $1,970.21 | $2,216.01 |

| USAA CIC | $1,958.26 | $1,937.36 | $1,826.50 | $1,802.82 | $6,175.72 | $6,480.54 | $2,622.21 | $2,716.62 |

Read more: The Travelers Home and Marine Insurance Company Car Insurance Review

The biggest difference in price between the sexes is for 17-year-olds. For example, the price difference for young males vs. females is about $10,000.

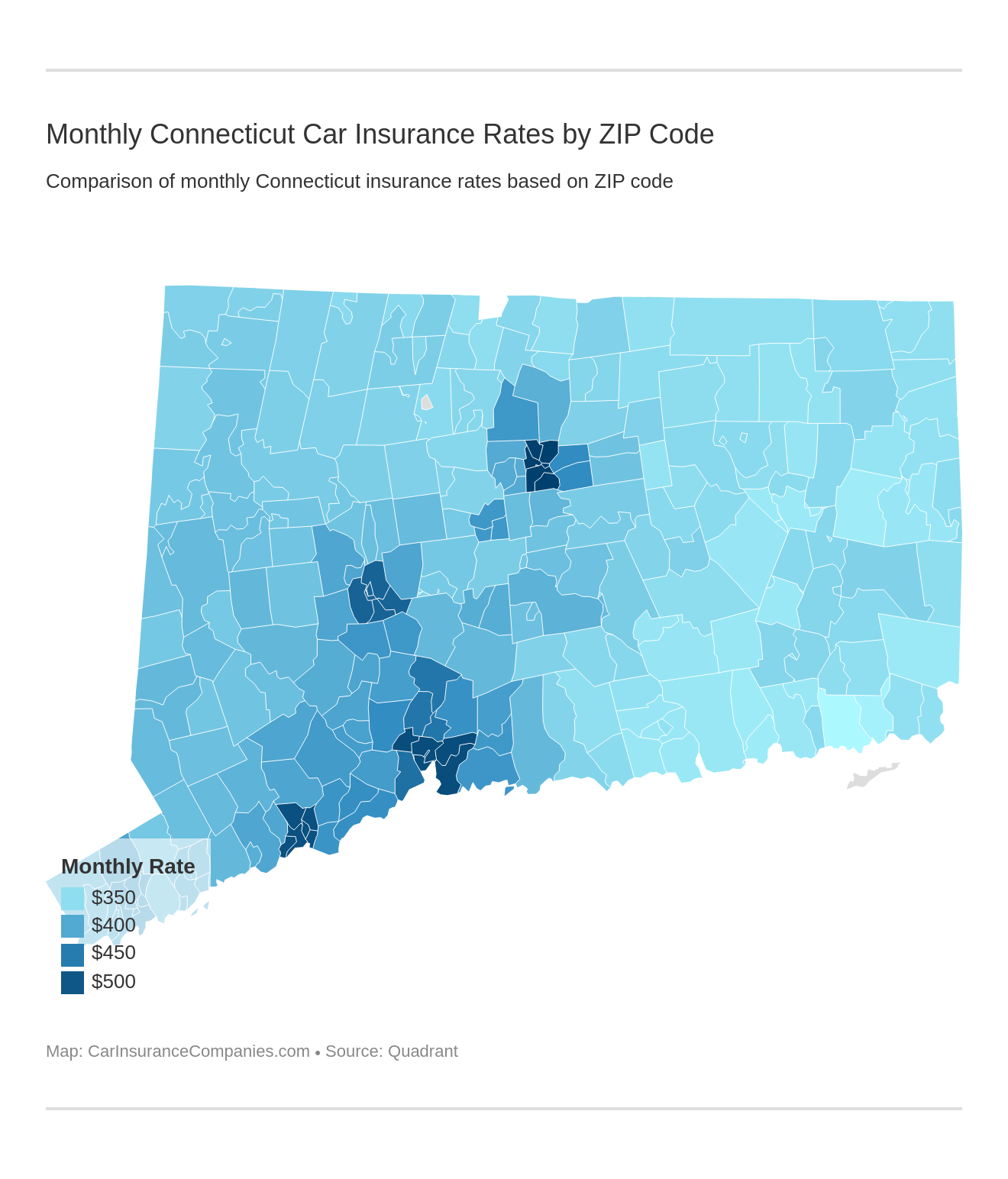

What are the cheapest auto insurance rates by ZIP code?

Where you live can affect how much you pay for a lot of things, such as rent and taxes. On top of that, your place of residence also affects your car insurance premiums. How does your city or town rank?

| Highest Average Rate by Zip Code | Annual Rate | Lowest Average Rate by Zip Code | Annual Rate |

|---|---|---|---|

| 06103 | $6,373.96 | 06340 | $3,896.10 |

| 06105 | $6,373.96 | 06355 | $3,986.37 |

| 06106 | $6,373.96 | 06331 | $4,028.12 |

| 06112 | $6,373.96 | 06333 | $4,041.05 |

| 06114 | $6,373.96 | 06357 | $4,041.05 |

| 06120 | $6,373.96 | 06359 | $4,068.88 |

| 06160 | $6,373.96 | 06226 | $4,070.37 |

| 06510 | $6,173.99 | 06266 | $4,070.37 |

| 06511 | $6,173.99 | 06280 | $4,070.37 |

| 06512 | $6,173.99 | 06475 | $4,076.16 |

| 06513 | $6,173.99 | 06264 | $4,084.20 |

| 06515 | $6,173.99 | 06334 | $4,085.37 |

| 06519 | $6,173.99 | 06371 | $4,087.72 |

| 06101 | $6,148.49 | 06426 | $4,088.33 |

| 06152 | $6,148.49 | 06442 | $4,088.33 |

| 06604 | $6,112.78 | 06420 | $4,091.02 |

| 06605 | $6,112.78 | 06498 | $4,093.66 |

| 06606 | $6,112.78 | 06375 | $4,094.49 |

| 06607 | $6,112.78 | 06385 | $4,094.49 |

| 06608 | $6,112.78 | 06249 | $4,099.90 |

| 06610 | $6,112.78 | 06417 | $4,103.33 |

| 06650 | $5,793.70 | 06332 | $4,105.28 |

| 06702 | $5,790.41 | 06354 | $4,105.28 |

| 06704 | $5,790.41 | 06374 | $4,105.28 |

| 06705 | $5,790.41 | 06423 | $4,112.43 |

| 06706 | $5,790.41 | 06469 | $4,112.43 |

| 06708 | $5,790.41 | 06474 | $4,112.94 |

| 06710 | $5,790.41 | 06388 | $4,116.22 |

| 06516 | $5,574.19 | 06235 | $4,116.30 |

| 06514 | $5,500.65 | 06234 | $4,126.03 |

| 06517 | $5,500.65 | 06350 | $4,126.66 |

| 06518 | $5,500.65 | 06376 | $4,133.93 |

| 06487 | $5,154.91 | 06043 | $4,141.73 |

| 06108 | $5,131.08 | 06383 | $4,141.87 |

| 06118 | $5,131.08 | 06389 | $4,147.18 |

| 06525 | $5,126.81 | 06278 | $4,147.55 |

| 06460 | $5,105.40 | 06242 | $4,151.39 |

| 06461 | $5,105.40 | 06239 | $4,159.29 |

| 06025 | $5,103.26 | 06241 | $4,159.29 |

| 06473 | $5,079.93 | 06409 | $4,160.74 |

| 06614 | $5,035.21 | 06412 | $4,161.58 |

| 06615 | $5,035.21 | 06378 | $4,170.39 |

| 06467 | $5,026.12 | 06379 | $4,170.39 |

| 06770 | $5,020.78 | 06071 | $4,171.14 |

| 06405 | $5,015.32 | 06076 | $4,183.59 |

| 06712 | $5,005.80 | 06255 | $4,183.97 |

| 06051 | $5,004.15 | 06262 | $4,183.97 |

| 06052 | $5,004.15 | 06277 | $4,183.97 |

| 06053 | $5,004.15 | 06339 | $4,185.17 |

| 06002 | $4,999.25 | 06279 | $4,189.45 |

| 06471 | $4,989.45 | 06419 | $4,190.13 |

| 06484 | $4,965.43 | 06336 | $4,191.08 |

| 06064 | $4,961.51 | 06260 | $4,191.33 |

| 06477 | $4,955.71 | 06035 | $4,198.76 |

| 06418 | $4,940.32 | 06060 | $4,198.76 |

| 06524 | $4,937.76 | 06384 | $4,199.46 |

| 06440 | $4,933.94 | 06250 | $4,204.11 |

| 06472 | $4,930.74 | 06078 | $4,204.93 |

| 06028 | $4,906.25 | 06415 | $4,210.28 |

| 06910 | $4,895.86 | 06439 | $4,210.35 |

| 06401 | $4,894.72 | 06084 | $4,210.37 |

| 06404 | $4,872.12 | 06230 | $4,213.67 |

| 06403 | $4,864.82 | 06335 | $4,216.13 |

| 06483 | $4,854.59 | 06232 | $4,217.98 |

| 06716 | $4,852.57 | 06246 | $4,221.11 |

| 06901 | $4,848.64 | 06029 | $4,228.03 |

| 06902 | $4,848.64 | 06377 | $4,228.72 |

| 06903 | $4,848.64 | 06256 | $4,236.70 |

| 06905 | $4,848.64 | 06413 | $4,238.66 |

| 06906 | $4,848.64 | 06414 | $4,238.66 |

| 06907 | $4,848.64 | 06237 | $4,241.73 |

| 06762 | $4,847.34 | 06353 | $4,241.85 |

| 06611 | $4,847.05 | 06019 | $4,244.30 |

| 06468 | $4,846.25 | 06320 | $4,246.43 |

| 06779 | $4,836.48 | 06281 | $4,247.68 |

| 06795 | $4,836.48 | 06268 | $4,247.83 |

| 06824 | $4,833.13 | 06096 | $4,251.73 |

| 06825 | $4,833.13 | 06233 | $4,253.15 |

| 06491 | $4,800.88 | 06373 | $4,253.15 |

| 06107 | $4,789.14 | 06021 | $4,253.93 |

| 06110 | $4,789.14 | 06269 | $4,254.64 |

| 06117 | $4,789.14 | 06365 | $4,256.92 |

| 06119 | $4,789.14 | 06247 | $4,261.62 |

| 06478 | $4,769.54 | 06338 | $4,263.56 |

| 06875 | $4,751.60 | 06091 | $4,264.00 |

| 06450 | $4,749.98 | 06238 | $4,264.16 |

| 06451 | $4,749.98 | 06254 | $4,265.17 |

| 06838 | $4,737.40 | 06248 | $4,265.94 |

| 06890 | $4,734.25 | 06059 | $4,266.78 |

| 06095 | $4,723.96 | 06090 | $4,271.18 |

| 06850 | $4,710.55 | 06438 | $4,272.92 |

| 06851 | $4,710.55 | 06441 | $4,272.92 |

| 06853 | $4,710.55 | 06001 | $4,277.76 |

| 06854 | $4,710.55 | 06263 | $4,282.27 |

| 06855 | $4,710.55 | 06330 | $4,282.67 |

| 06457 | $4,705.33 | 06093 | $4,282.97 |

| 06807 | $4,678.09 | 06070 | $4,283.35 |

| 06870 | $4,678.09 | 06081 | $4,283.35 |

| 06878 | $4,678.09 | 06089 | $4,283.35 |

| 06612 | $4,676.05 | 06092 | $4,283.35 |

| 06109 | $4,657.70 | 06016 | $4,292.35 |

| 06829 | $4,655.80 | 06088 | $4,292.35 |

| 06783 | $4,635.93 | 06243 | $4,295.88 |

| 06488 | $4,627.60 | 06244 | $4,295.88 |

| 06810 | $4,622.17 | 06245 | $4,295.88 |

| 06811 | $4,622.17 | 06282 | $4,295.88 |

| 06492 | $4,621.90 | 06360 | $4,300.31 |

| 06437 | $4,620.95 | 06370 | $4,301.36 |

| 06880 | $4,618.18 | 06382 | $4,301.36 |

| 06410 | $4,614.97 | 06020 | $4,304.93 |

| 06883 | $4,610.92 | 06259 | $4,305.52 |

| 06776 | $4,608.05 | 06026 | $4,306.75 |

| 06877 | $4,598.83 | 06443 | $4,311.25 |

| 06804 | $4,597.89 | 06447 | $4,313.47 |

| 06010 | $4,594.54 | 06444 | $4,317.51 |

| 06456 | $4,592.23 | 06069 | $4,317.56 |

| 06755 | $4,583.55 | 06030 | $4,321.70 |

| 06830 | $4,583.42 | 06032 | $4,321.70 |

| 06831 | $4,583.42 | 06085 | $4,321.70 |

| 06111 | $4,575.87 | 06057 | $4,323.67 |

| 06876 | $4,564.54 | 06098 | $4,330.25 |

| 06897 | $4,562.90 | 06351 | $4,331.72 |

| 06794 | $4,560.36 | 06380 | $4,334.39 |

| 06782 | $4,557.02 | 06422 | $4,335.97 |

| 06786 | $4,557.02 | 06018 | $4,336.71 |

| 06482 | $4,554.09 | 06082 | $4,342.60 |

| 06481 | $4,546.03 | 06068 | $4,343.86 |

| 06416 | $4,545.86 | 06066 | $4,347.15 |

| 06896 | $4,542.80 | 06251 | $4,355.28 |

| 06784 | $4,533.44 | 06013 | $4,356.14 |

| 06455 | $4,530.10 | 06072 | $4,356.37 |

| 06777 | $4,527.08 | 06790 | $4,356.55 |

| 06793 | $4,527.08 | 06231 | $4,358.94 |

| 06480 | $4,518.52 | 06074 | $4,359.11 |

| 06798 | $4,513.77 | 06058 | $4,360.28 |

| 06067 | $4,512.79 | 06756 | $4,368.63 |

| 06040 | $4,509.90 | 06024 | $4,371.83 |

| 06042 | $4,509.90 | 06791 | $4,376.03 |

| 06820 | $4,507.64 | 06063 | $4,376.89 |

| 06470 | $4,503.03 | 06077 | $4,382.91 |

| 06787 | $4,495.98 | 06027 | $4,384.00 |

| 06754 | $4,495.20 | 06065 | $4,386.37 |

| 06796 | $4,495.20 | 06424 | $4,387.84 |

| 06781 | $4,490.34 | 06039 | $4,392.45 |

| 06763 | $4,489.75 | 06037 | $4,393.99 |

| 06751 | $4,483.22 | 06061 | $4,398.39 |

| 06801 | $4,481.86 | 06750 | $4,400.35 |

| 06785 | $4,462.80 | 06759 | $4,400.35 |

| 06758 | $4,462.16 | 06033 | $4,408.53 |

| 06812 | $4,453.38 | 06079 | $4,408.54 |

| 06840 | $4,447.87 | 06031 | $4,409.81 |

| 06023 | $4,446.70 | 06073 | $4,418.37 |

| 06778 | $4,446.02 | 06479 | $4,422.70 |

| 06489 | $4,446.00 | ||

| 06752 | $4,440.36 | ||

| 06757 | $4,437.86 | ||

| 06094 | $4,435.98 | ||

| 06265 | $4,428.22 | ||

| 06062 | $4,423.33 |

What are the cheapest auto insurance rates by city?

And for a more convenient view, you can also lookup rates by name.

| Top 25 Most Expensive Cities | Annual Rate | Top 25 Least Expensive Cities | Annual Rate |

|---|---|---|---|

| HARTFORD | $6,323.86 | GROTON | $3,896.10 |

| EAST HAVEN | $6,173.99 | MYSTIC | $3,986.37 |

| NEW HAVEN | $6,173.99 | CANTERBURY | $4,028.12 |

| BRIDGEPORT | $6,067.20 | EAST LYME | $4,041.05 |

| WATERBURY | $5,790.41 | NIANTIC | $4,041.05 |

| WEST HAVEN | $5,574.19 | NORTH STONINGTON | $4,068.88 |

| HAMDEN | $5,500.65 | SOUTH WINDHAM | $4,070.37 |

| SOUTH BRITAIN | $5,154.91 | WILLIMANTIC | $4,070.37 |

| EAST HARTFORD | $5,131.08 | WINDHAM | $4,070.37 |

| WOODBRIDGE | $5,126.81 | OLD SAYBROOK | $4,076.16 |

| MILFORD | $5,105.40 | SCOTLAND | $4,084.20 |

| EAST GLASTONBURY | $5,103.26 | BOZRAH | $4,085.37 |

| NORTH HAVEN | $5,079.93 | OLD LYME | $4,087.72 |

| STRATFORD | $5,035.22 | ESSEX | $4,088.33 |

| MILLDALE | $5,026.12 | IVORYTON | $4,088.33 |

| NAUGATUCK | $5,020.78 | SALEM | $4,091.02 |

| BRANFORD | $5,015.32 | WESTBROOK | $4,093.66 |

| PROSPECT | $5,005.80 | QUAKER HILL | $4,094.49 |

| NEW BRITAIN | $5,004.15 | WATERFORD | $4,094.49 |

| BLOOMFIELD | $4,999.25 | LEBANON | $4,099.90 |

| NORTH BRANFORD | $4,989.45 | DEEP RIVER | $4,103.33 |

| SHELTON | $4,965.43 | CENTRAL VILLAGE | $4,105.28 |

| POQUONOCK | $4,961.51 | MOOSUP | $4,105.28 |

| ORANGE | $4,955.71 | PLAINFIELD | $4,105.28 |

| DERBY | $4,940.32 | EAST HADDAM | $4,112.43 |

Read more: Bloomfield Mutual Insurance Company Car Insurance Review

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the best Connecticut car insurance companies?

One of the best things about living today is the many options we have to make life easier. But, sometimes, too many choices can make things seem tougher than they should be.

What follows is some information about the financial strength of the top insurers and company rankings to help you make the right decision.

We’ve made it easy for you to find everything you need, so let’s get ready to learn more.

What is the financial rating of the largest Connecticut car insurance companies?

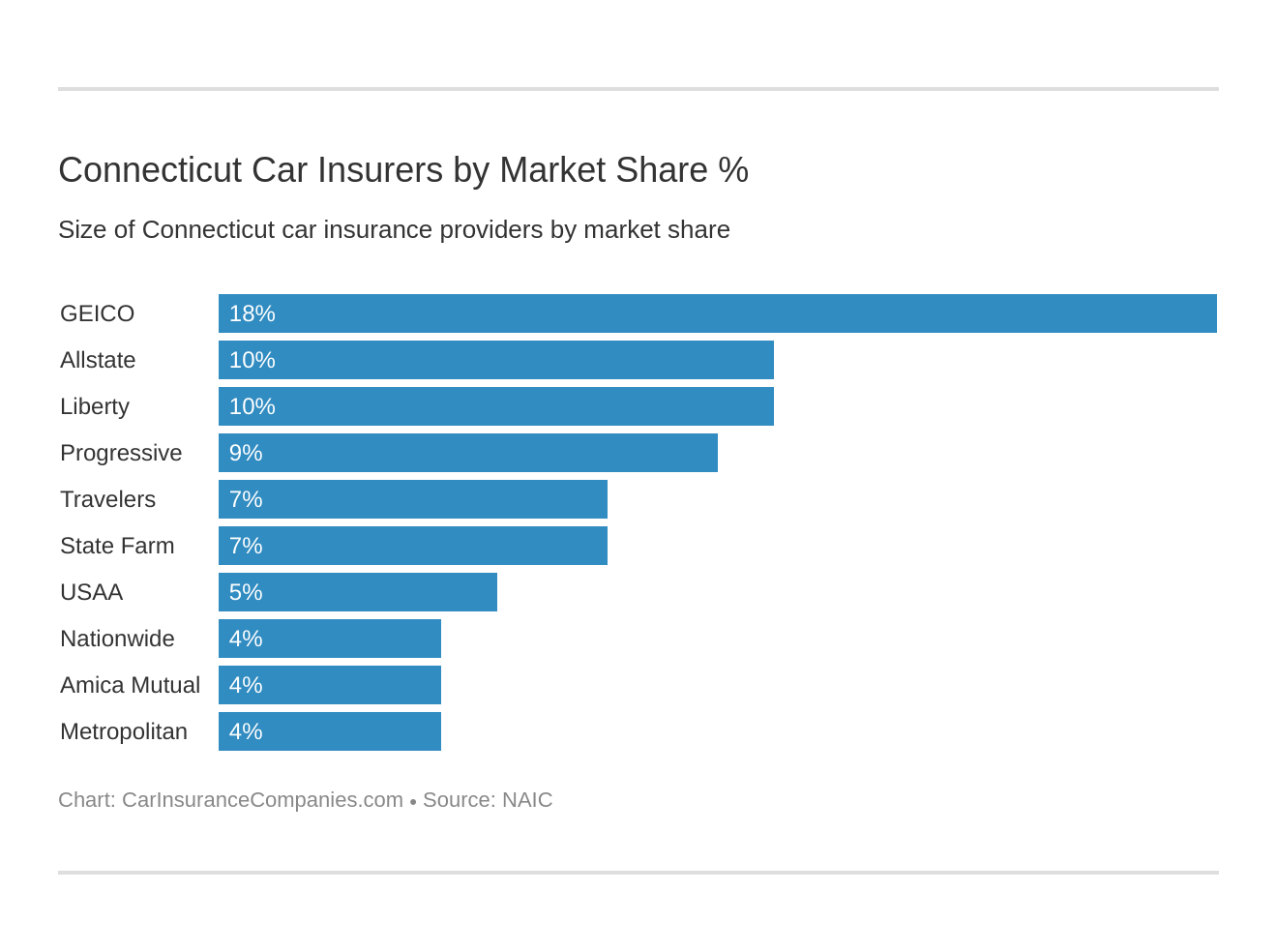

AM Best evaluates insurance companies and ranks them based on their financial stability. Companies with a good score are more likely to be able to pay customers’ claims. These are AM Best’s ratings for the ten largest insurers in the Constitution State.

| Company | AM Best Rating | Direct Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| Geico | A++ | $528,907 | 75.82% | 18.02% |

| Allstate Insurance Group | A+ | $304,028 | 54.93% | 10.36% |

| Liberty Mutual Group | A | $297,602 | 64.66% | 10.14% |

| Progressive Group | A+ | $268,001 | 63.25% | 9.13% |

| Travelers Group | A++ | $195,421 | 72.77% | 6.66% |

| State Farm Group | A++ | $192,401 | 61.48% | 6.55% |

| USAA Group | A++ | $137,617 | 70.23% | 4.69% |

| Nationwide Corp Group | A+ | $123,130 | 63.22% | 4.19% |

| Amica Mutual Group | A+ | $111,152 | 60.16% | 3.79% |

| Metropolitan Group | A | $105,129 | 59.38% | 3.58% |

Customer ratings should also play into your decision about the right insurer for your needs, so scroll on to find out what people think about the top companies in the region.

Which companies have the best ratings?

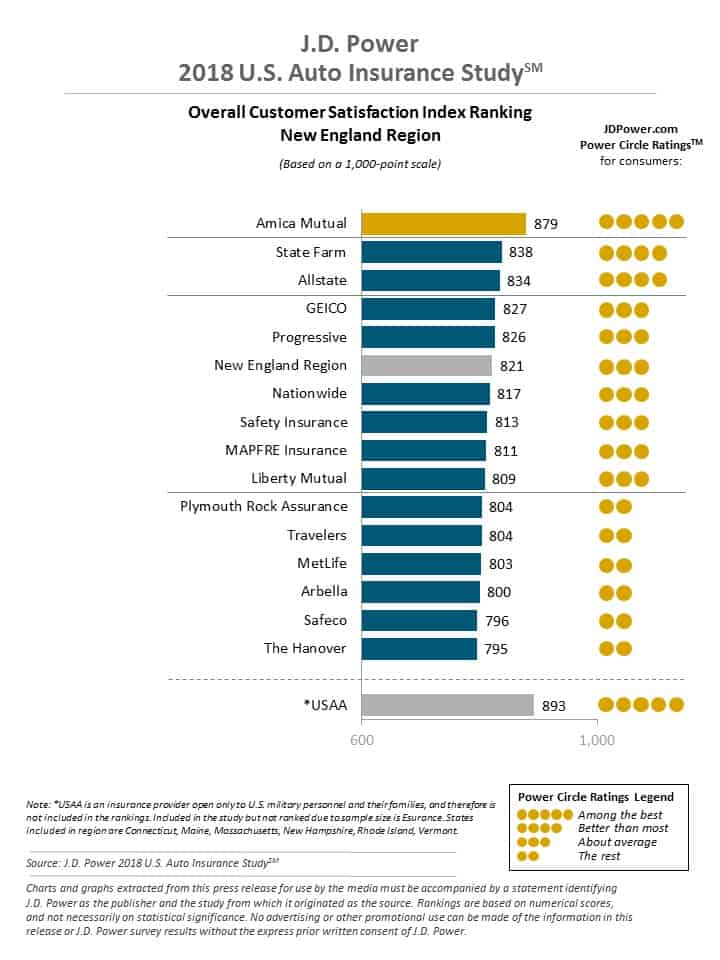

J.D. Power’s Auto Insurance Study rates the top insurance companies based on their overall customer satisfaction. Only one insurer in the New England Region received the highest rating, Amica Mutual. State Farm and Allstate followed closely behind with four “power circles.”

Another vital factor in customer satisfaction is the number of complaints an insurer gets. Let’s see which companies have the most.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Which companies have the most complaints in Connecticut?

A complaint ratio measures how many complaints a company receives per one million dollars of premium.

Even the best customer relationships don’t always achieve total satisfaction. When a consumer is dissatisfied, he or she can file a complaint. Those complaints add to a company’s complaint ratios, and some of them are also based on general customer satisfaction and are averaged together.

| Auto Insurance Companies in Connecticut | Total Premiums Underwritten | Complaint Index |

|---|---|---|

| Middlesex Mutual Assurance Company | $47,923,184 | 0 |

| Ohio Mutual Insurance Company | 186,415,619 | 0.02 |

| Amica | 100,860,211 | 0.09 |

| State Auto | 31,986,932 | 0.1 |

| CSAA Insurance | 29,494,351 | 0.11 |

| State Farm | 136,602,831 | 0.12 |

| Travelers | 184,353,835 | 0.12 |

| Kemper | 24,459,018 | 0.13 |

| Hanover | 45,255,598 | 0.14 |

| Progressive | 240,385,770 | 0.15 |

| Nationwide | 145,021,307 | 0.15 |

| Geico | 416,237,784 | 0.16 |

| 21st Century | 37,653,469 | 0.17 |

| AIG | 16,170,340 | 0.2 |

| Allstate | 287,638,673 | 0.21 |

| MAPFRE Insurance | 29,797,361 | 0.21 |

| Arbella Mutual Insurance Company | 27,559,136 | 0.23 |

| Liberty Mutual | 207,051,836 | 0.26 |

| Safeco | 130,270,662 | 0.27 |

| QBE Insurance | 11,585,179 | 0.28 |

| Great Northern Insurance | 21,767,845 | 0.29 |

| Zurich Insurance Group | 17,576,080 | 0.36 |

| MetLife | 104,777,455 | 0.37 |

| Michael Karfunkel Grantor Annuity Trust | 25,675,383 | 0.37 |

| USAA | 103,549,831 | 0.4 |

| Hartford | 130,699,592 | 0.44 |

| Esurance | 25,633,807 | 0.5 |

| Ameriprise | 12,120,650 | 0.53 |

| Plymouth Rock | 22,906,946 | 0.56 |

| ACE Insurance | 14,181,973 | 0.67 |

| Foremost | 15,661,722 | 1.02 |

| Omni Insurance | 10,283,004 | 2.48 |

Read more:

- Arbella Mutual Insurance Company Car Insurance Review

- Foremost Car Insurance Review

- Plymouth Rock Home Assurance Corporation Car Insurance Review

If you want to file a complaint against an insurance company in the state of Connecticut, use this online form.

What are the cheapest auto insurance companies in Connecticut?

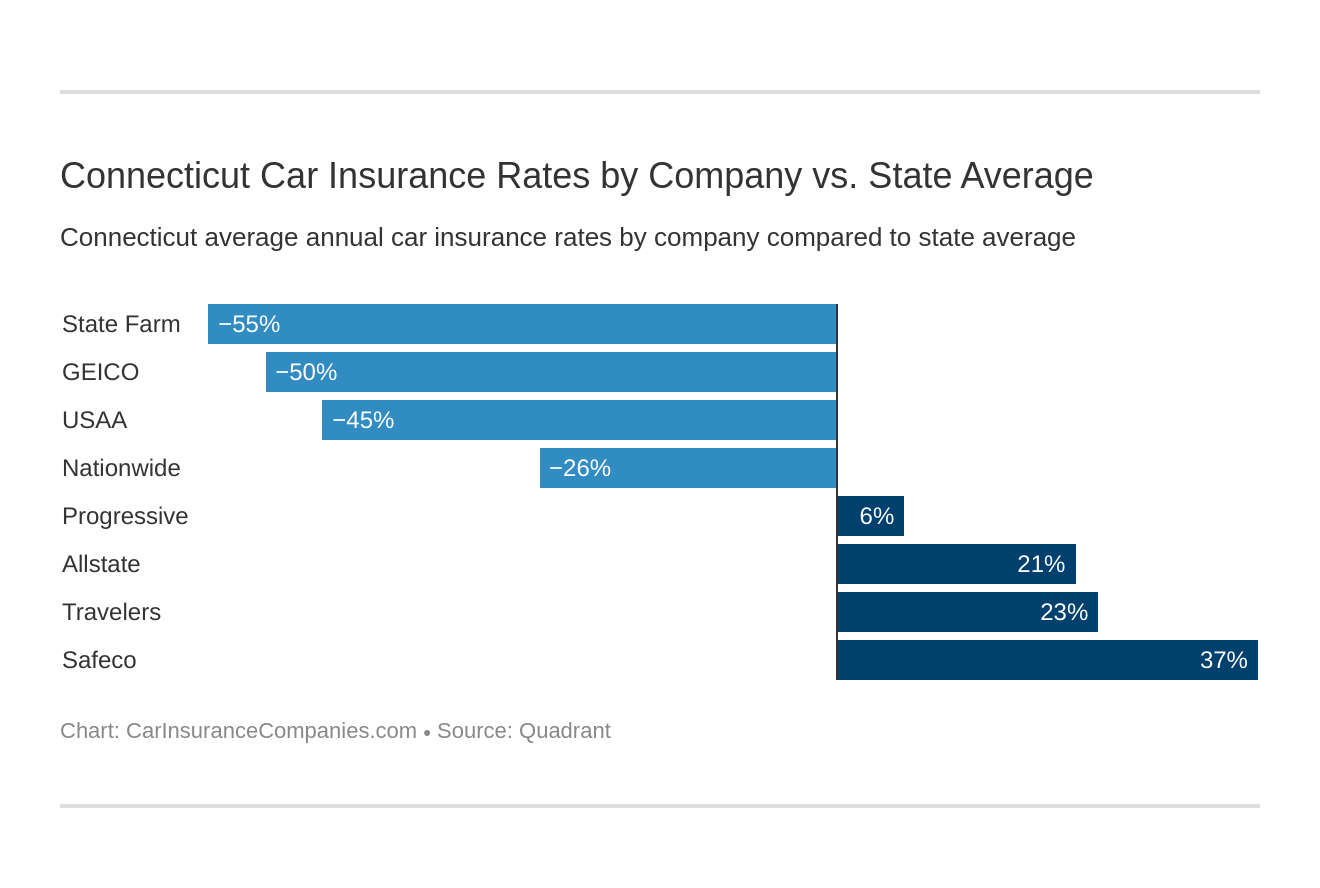

Now, we’re going to examine which the rates different carriers offer statewide.

| Company | Average | Compared to State Average | Percent over/under State Average |

|---|---|---|---|

| State Farm Mutual Auto | $2,976.24 | -$1,642.68 | -55.19% |

| Geico General | $3,073.66 | -$1,545.26 | -50.27% |

| USAA CIC | $3,190.00 | -$1,428.92 | -44.79% |

| Nationwide Discover Agency | $3,672.34 | -$946.58 | -25.78% |

| Progressive Casualty | $4,920.35 | $301.43 | +6.13% |

| Allstate F&C | $5,831.60 | $1,212.68 | +20.79% |

| Travelers Home & Marine Ins Co | $6,004.29 | $1,385.37 | +23.07% |

| Safeco Ins Co of IL | $7,282.87 | $2,663.95 | +36.58% |

What are the average commute rates by company?

Here’s how the top carriers in the state compare for average commute times.

| Group | 10 miles commute 6,000 annual mileage | 25 miles commute 12,000 annual mileage |

|---|---|---|

| Liberty Mutual | $7,282.87 | $7,282.87 |

| Travelers | $6,004.29 | $6,004.29 |

| Allstate | $5,831.60 | $5,831.60 |

| Progressive | $4,920.35 | $4,920.35 |

| Nationwide | $3,672.34 | $3,672.34 |

| USAA | $3,151.80 | $3,228.20 |

| Geico | $3,026.65 | $3,120.67 |

| State Farm | $2,902.75 | $3,049.73 |

As it turns out, Liberty Mutual tops Travelers with the highest premium ratio to annual mileage.

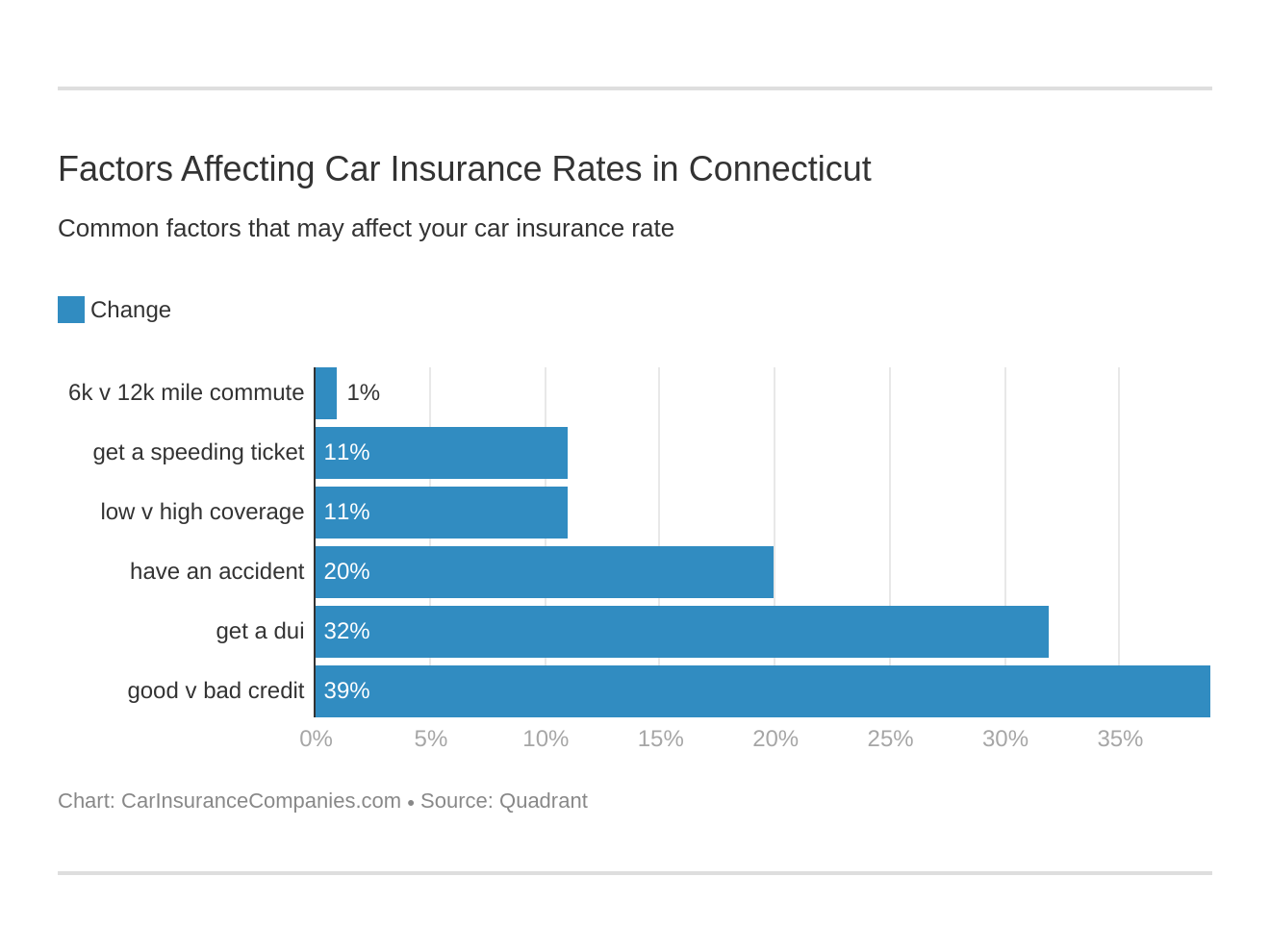

Commute distance does not affect your rate nearly as much as some other factors.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the coverage level rates by company?

| Company | High Coverage Rate | Medium Coverage Level Rate | Low Coverage Level Rate |

|---|---|---|---|

| Allstate | $6,172.41 | $5,823.32 | $5,499.08 |

| Geico | $3,347.61 | $3,033.89 | $2,839.48 |

| Liberty Mutual | $7,625.34 | $7,227.27 | $6,996.02 |

| Nationwide | $3,589.35 | $3,699.88 | $3,727.81 |

| Progressive | $5,318.35 | $4,875.19 | $4,567.50 |

| State Farm | $3,157.66 | $2,981.27 | $2,789.79 |

| Travelers | $6,499.29 | $5,961.96 | $5,551.63 |

| USAA | $3,396.11 | $3,193.11 | $2,980.78 |

What’s the credit history rate by company?

According to a study by Experian, the average Connecticut resident has a credit card VantageScore of 690 and around 3.23 credit cards in their name. The average Connecticut consumer has a credit card balance of $7,258.

| Group | Annual Rate with Poor Credit | Annual Rate with Fair Credit | Annual Rate with Good Credit |

|---|---|---|---|

| Allstate | $7,423.44 | $5,615.43 | $4,455.94 |

| Geico | $4,471.11 | $2,696.58 | $2,053.29 |

| Liberty Mutual | $10,341.99 | $6,442.61 | $5,064.02 |

| Nationwide | $4,862.94 | $3,264.41 | $2,889.69 |

| Progressive | $5,354.50 | $4,804.53 | $4,602.01 |

| State Farm | $4,142.03 | $2,652.13 | $2,134.56 |

| Travelers | $6,815.35 | $5,680.08 | $5,517.46 |

| USAA | $4,216.70 | $2,847.51 | $2,505.79 |

Credit card debt and car insurance rates are connected because insurers run credit score checks to assess the chances of their customers filing a claim. Your credit score can certainly affect your rates.

What are the driving record rates by company?

Your driving history affects how much you pay in insurance premiums. As you can see below, even one DUI can make your rates jump by at least a thousand dollars or more.

| Group | Clean Record | One Speeding Violation | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $4,964.26 | $4,964.26 | $6,130.79 | $7,267.10 |

| Geico | $1,942.20 | $2,384.75 | $2,546.81 | $5,420.88 |

| Liberty Mutual | $6,377.55 | $6,859.28 | $7,985.83 | $7,908.84 |

| Nationwide | $2,991.13 | $3,331.67 | $3,900.02 | $4,466.56 |

| Progressive | $4,197.03 | $4,975.08 | $6,093.37 | $4,415.90 |

| State Farm | $2,770.61 | $3,044.79 | $3,044.79 | $3,044.79 |

| Travelers | $4,833.25 | $6,327.84 | $5,235.67 | $7,620.42 |

| USAA | $2,470.92 | $2,470.92 | $3,104.24 | $4,713.93 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the largest car insurance companies in Connecticut?

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Geico | $528,907 | 75.82% | 18.02% |

| Allstate Insurance Group | $304,028 | 54.93% | 10.36% |

| Liberty Mutual Group | $297,602 | 64.66% | 10.14% |

| Progressive Group | $268,001 | 63.25% | 9.13% |

| Travelers Group | $195,421 | 72.77% | 6.66% |

| State Farm Group | $192,401 | 61.48% | 6.55% |

| USAA Group | $137,617 | 70.23% | 4.69% |

| Nationwide Corp Group | $123,130 | 63.22% | 4.19% |

| Amica Mutual Group | $111,152 | 60.16% | 3.79% |

| Metropolitan Group | $105,129 | 59.38% | 3.58% |

How many car insurance providers are there in Connecticut?

| Property & Casualty Insurance | Number |

|---|---|

| Domestic | 67 |

| Foreign | 729 |

| Total | 796 |

Foreign companies were formed in other states but licensed to operate in Connecticut, while the domestic ones were incorporated in the Constitution State.

Now, let’s review state laws and how they can affect your driving habits and your insurance, which go hand-in-hand.

What are the laws in Connecticut?

Each state has different laws designed to protect you and your fellow drivers on the road. With all the laws to pay attention to, it can be easy to forget the most vital ones to obey to avoid penalties.

We’ll go over the ones that affect your driving habits the most without all the legalese.

So, let’s discover what you should do to stay safe.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the car insurance laws?

State laws have considerable influence on auto insurance. Let’s discover how they’re formed.

How state laws for insurance are determined

Each state determines the type of tort law and threshold (if any) that applies, the type and amount of liability insurance required, and their system for approving insurer rates and forms.

Insurance companies in Connecticut are subject to the regulations the state insurance commissioner sets per the fair competition standards of the National Association of Insurance Commissioners (NAIC).

How to get windshield coverage

Connecticut allows windshield replacement with aftermarket parts and used recycled parts with written notice.

The consumer can choose the repair vendor; however, you may have to pay the difference in price. No law requires insurance companies in Connecticut to offer a zero deductible with comprehensive coverage, but it is an option.

So, what should you do if you want windshield coverage? You’ll need comprehensive insurance, and you should examine carefully how the different insurance providers handle windshield claims.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

How to get high-risk auto insurance

In Connecticut, drivers who have committed violations, uninsured drivers, and others must fill out an SR-22 form. If your license has been revoked or suspended, you may need to file an SR-22 to have it reinstated.

The SR-22 form is available from your insurance company, but it is not an insurance policy.

High-risk auto insurance helps drivers who have a history of accidents or traffic violations and can’t buy coverage through an insurance carrier.

In this case, the Connecticut Automobile Insurance Assigned Risk Plan (CT AIARP or the “Plan”) comes to the rescue, letting drivers who are considered risky apply for coverage.

The Governing Committee must certify all insurance companies in Connecticut to be able to qualify you for AIARP. Within 60 days of serving your sentence, you must verify that you have tried and failed to get reasonable rates.

How to get low-cost insurance

The state of Connecticut doesn’t currently provide any special low-cost insurance programs. Connecticut law requires drivers to carry a minimum amount of liability insurance.

Is there an automobile insurance fraud in Connecticut?

Insurance fraud is the second-largest economic crime in America. Insurance fraud affects premium rates and the prices consumers pay for goods and services.

And if those fraud numbers continue to rise, it’s more likely that insurers will pass more of the costs in investigating them on to you in higher premiums.

There are two types of fraud: hard and soft.

- Hard Fraud – A purposefully fabricated claim or accident

- Soft Fraud – A misrepresentation of information to the insurance company

Soft fraud is more common than hard fraud. Twenty to 40 percent of consumers admitted to lying to their insurers about one of the following:

- Number of annual miles driven

- Number of drivers in the household

- How the vehicle would be used

Insurance fraud is a crime. Even the little white lie you tell to get a lower rate has consequences. That intentional misrepresentation of facts, known as rate evasion, costs auto insurers $16 billion annually.

Insurance fraud is considered a:

- Class B felony if the value in question is over $20,000, punishable by as much as ten years’ imprisonment and/or a $25,000 fine

- Class C felony if the value in question is over $300, punishable by as much as five years’ imprisonment and/or a $10,000 fine

- A misdemeanor if the value in question is $300 or under, punishable by as much as one-year imprisonment and/or a $2,000 fine

According to a report by the Connecticut Insurance Department, insurance fraud costs consumers in Connecticut nearly $2 billion annually.

If you suspect insurance fraud or have been the victim of fraud, you can contact the State of Connecticut Insurance Department to report such activity.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What’s the statute of limitations?

A statute of limitations is the limit on the amount of time you have to make and settle your claim before time runs out and your claim is no longer collectible. Different states have different statutes of limitations for personal injury and property damage claims.

Connecticut’s statute of limitations is two years for personal injury and three years for property damage claims.

What are the vehicle licensing laws?

In this section, we’ll go over Constitution State laws for getting a license.

Connecticut is among the states that offer the Real ID program of verified identity protection for people who are getting new IDs or licenses or renewing expired licenses or ID cards.

The proposed federal program slated to go into effect in 2020 allows for extra screening at airports and federal buildings and also use for possible commercial transactions. The program stems from national security measures and federal identification standards adopted after the Sept. 11, 2001 terrorist attacks in the U.S.

It is also designed to offer residents more protection against identity theft through a record of proven original identity documents shown to the Connecticut Department of Motor Vehicles. The Real ID card will have a gold star on it.

Your current license or ID card will be honored at airports and federal buildings until it expires. The Connecticut DMV makes renewals only 60 days before the expiration date. So, please wait for the renewal notice and know that your current license and ID will be accepted.

The DMV will ask renewing customers whether they want to show original identity documents to establish a record of their identity with the agency and for federal identification purposes. Customers can also reject the verification and simply get a regular driver’s license or ID card.

This identity protection and verification program is a one-time review of original identity documents. This program is available at DMV offices, participating AAA locations, Milford and North Haven Nutmeg State Financial Credit Union Offices, Stamford (operated by the WorkPlace, Inc.) and West Haven City Hall.

- Payment options at each location.

- DMV advises people to decide early on whether they want an identity-verified license or DMV-issued ID card and to gather or order any documents they might need to renew a license or ID card.

Read more: How does the DMV point system work?

What are the penalties for driving without insurance?

The penalties for driving without insurance in Connecticut are as follows:

- First Offense – Fine: $100-$1000; suspended registration/license for one month (show proof of insurance) with $175 reinstatement fee

- Second Offense – Fine: $100-$1000; suspended registration/license for six months (show proof of insurance) with $175 reinstatement fee

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the teen driver laws?

| Young Driver Licensing Laws | Age Restrictions | Passenger Restrictions | Time Restrictions |

|---|---|---|---|

| Learner's Permit: | 16 years | first 6 months—no passengers other than parents or a driving instructor; second 6 months—no passengers other than parents, driving instructor or members of the immediate family | 11 p.m. - 5 a.m. |

| Provisional License | 12 months or until age 18, whichever occurs first (min. age: 17, 4 mos.) | first 6 months—no passengers other than parents or a driving instructor; second 6 months—no passengers other than parents, driving instructor or members of the immediate family | Nighttime restrictions will be lifted at age 18. |

| Full License | 16 and 4 months; have a mandatory holding period of 6 months; (4 months with driver education); have a minimum supervised driving time of 40 hours | None. | None. |

Connecticut offers a Graduated Driver License program for young drivers to reduce the high accident and fatality rate among teen motorists. The state has also partnered with AAA to provide safety tips and training for teen drivers and their parents or guardians.

The Connecticut DMV’s educational Center for Teen Safe Driving provides training videos and sample knowledge tests.

Here are some more helpful resources:

- Teen Driver Safety Brochure

- Connecticut Parent Overview Guide

- Connecticut Teen-Parent Driver Agreement

- Limited License Program

How does the license renewal procedure for older drivers work?

| Renewal Procedures | Gen Population | Older Population |

|---|---|---|

| License renewal cycle | General population: 6 years | Older Population: 2 years or 6 years for people 65 and older, personal option |

| Mail or online renewal permitted | General Population: no | Older Population: no |

| Proof of adequate vision required at renewal | General population: no | Older population: no |

Like the general population, older drivers don’t have to show proof of adequate vision at every renewal. They also can’t renew their licenses online or by mail; all Connecticut drivers must renew in person.

Drivers over age 60 who take an accident prevention course get a minimum five percent discount regardless of their driving histories for a period of two years of auto insurance.

What’s the procedure for new residents?

If you’re going to move to Connecticut, here’s what you should know:

- Once you have established residency in the Constitution State, you have 30 days to transfer your out-of-state license to Connecticut.

- The Connecticut Department of Motor Vehicles handles all vehicle licensing-related matters.

- With your current driver’s license, the completion of a form, acceptable forms of identification, and payment of two fees, you will be licensed to drive in Connecticut.

- Read about special situations for new residents.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the license renewal procedures?

Drivers must renew their licenses in person every six years. Don’t wait until your license expires!

What is considered a negligent operator treatment system (NOTS)?

The state of Connecticut has a points system for violations of driving laws. These are some of the major violations that will generate points on your license or even a suspension in Connecticut:

- Negligent homicide with a motor vehicle: 5 points

- Operation of a school bus at excessive speed: 5 points

- Passing a stopped school bus: 4 points

- Passing in a no-passing zone: 3 points

- Driving while impaired: 3 points

- Failure to obey stop sign or red light: 2 points

- Speeding: 1 point

Disobeying traffic laws isn’t only unsafe, but as we discussed earlier, your driving record is a major factor in pricing your insurance premiums. Keep your record clean so that it doesn’t affect your rates.

As this law firm video attests, a speeding offense can become a reckless driving charge and lead to an increase in your insurance rates:

What are the rules of the road?

These are some of the most important laws to note for driving safely to avoid serious penalties.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Is Connecticut at fault or no-fault state?

Connecticut follows a traditional fault-based system to determine financial responsibility for losses from a crash such as injuries, lost income, and vehicle damage.

Connecticut law uses comparative negligence to determine who is at fault for damages or injuries. If you want to sue another party for additional damage, you must prove they caused your injuries.

To receive damages, you must be less than 51 percent at fault. If it’s determined that you were 51 or more percent at fault, you won’t be able to get compensation. If your responsibility for an accident is found to be less than 51 percent, for instance, 30 percent, that percentage will be subtracted from any damages you might be owed and able to collect.

This law firm video further explains the comparative negligence laws:

What are the seatbelt, carseat, and cargo area laws?

Seatbelt use in Connecticut is standard enforcement. Anyone eight years or older sitting in a front seat must wear a seat belt or face a $50 fine.

Connecticut bases its child safety seat laws on age, weight, and type of seat.

Violation of the child seat law in Connecticut may not only put the child in danger, but could result in a base fine of $50, additional fees, and a mandatory child restraint education program for the first or second violation.

Children ages 8-15 years old and over 60 pounds may wear an adult safety belt with no preference for the rear seat.

This video covers recent changes to Constitution State child car seat laws:

Connecticut law allows people age 16 and older to occupy the cargo area of a vehicle, and those 15 and younger if they’re wearing seat belts. The law also makes exceptions for parades, farming operations, and hayrides.

What are the keep right and move over laws?

Connecticut law states that you should keep right if you drive slower than the traffic around with five exceptions.

The law bans motorists from driving in the lane next to shoulders where emergency and nonemergency workers are present. Drivers must move over for emergency vehicles or receive a fine of $2,500 if an operator is injured, and $10,000 if a death occurs.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What’s the maximum speed limit?

Maximum posted speed limits are 65 mph on rural interstates, 55 mph on urban interstates, 65 mph on limited-access roads, and 55 mph on all other roads.

How does ridesharing work?

Rideshare services like Uber and Lyft mandate that all their drivers carry personal car insurance policies that align or exceed the minimum coverages state laws dictate. Geico, Liberty Mutual, and State Farm provide rideshare insurance in Connecticut.

Is there an automation on the road?

According to the Insurance Institute for Highway Safety (IIHS),

“Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. In driving, automation involves using radar, camera and other sensors to gather information about a vehicle’s surroundings, which is then used by computer programs to perform parts or all of the driving task on a sustained basis.”

Connecticut is currently testing driving automation on public roads. State law requires that a licensed operator be in the vehicle and have five million dollars in liability coverage.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the safety laws?

Let’s look further at the laws meant to protect everyone on the road in Connecticut.

But first, the Connecticut Department of Transportation (CTDOT) has compiled a list of helpful safety resources regarding traffic and safety laws, including the Connecticut Highway Safety Plan.

What are the DUI laws?

The Blood-Alcohol Content (BAC) limit in Connecticut is 0.08 percent; the state has no High BAC limit.

| DUI Offenses | DUI Details |

|---|---|

| BAC Limit | 0.08 |

| HIGH BAC Limit | N/A |

| Criminal Status by Offense | 1st misdemeanor, 2+ within 10 years felonies. |

| Formal Name for Offense | Driving Under the Influence (DUI) |

| Look Back Period/Washout Period | 10 years |

| 1st Offense-ALS or Revocation | 45 days +1 year with IID |

| 1st Offense Imprisonment | Either 1) up to 6 months w/mandatory 2 day min or 2) up to six months suspended with probation requiring 100 hours community service |

| 1st Offense-Fine | $500-$1000 |

| 2nd Offense-DL Revocation | 45 days +3 years with IID, first year limited to travel to and from work, school and substance abuse treatment program, IID service center or probation appointment |

| 2nd Offense-Imprisonment | Up to 2 years with mandatory min of 120 consecutive days and probation with 100 hours community service |

| 2nd Offense-Fine | $1000-$4000 |

| 3rd Offense-DL Revocation | License revoked, but eligible for reinstatement after two years. if reinstated, must only drive IID vehicle. This requirement may be lifted after 15 years by DMV commissioner. |

| 3rd Offense-Imprisonment | Up to 3 years. mandatory min of one year and probation with 100 hours community service |

| 3rd Offense-Fine | $2000-$8000 |

| 4th Offense-DL Revocation | Same as third |

| 4th Offense-Imprisonment | Same as third |

| 4th Offense-Fine | Same as third |

| Mandatory Interlock | All offenders |

What are the marijuana-impaired driving laws?

Connecticut currently has no marijuana-impaired driving laws.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the distracted driving laws?

The state of Connecticut prohibits hand-held cellphone use and texting for all drivers and bans cellphone use for drivers under age 18. These laws are a primary offense, which means that a police officer doesn’t need another reason to pull drivers over for these violations.

This news report details the Connecticut Department of Transportation’s recent efforts to curb distracted driving:

What’s driving in Connecticut like?

Driving in the Constitution State involves some dangers, and we might not always be aware of everything that happens routinely on the highway.

Thefts and accidents are very real – not just mere statistics. Below are some startling and sobering numbers that will make you think. We’ll cover theft, crashes, and even EMS response times.

So, read on to find out the truth about some of the biggest hazards on and off the road

Is there a vehicle theft in Connecticut?

These are the most stolen cars in the Constitution State.

| Make/Model | Year of Vehicle | Year | Thefts |

|---|---|---|---|

| Honda Accord | 1997 | 1997 | 534 |

| Honda Civic | 1998 | 1998 | 532 |

| Nissan Maxima | 1998 | 1998 | 184 |

| Nissan Altima | 1997 | 1997 | 143 |

| Toyota Camry | 2014 | 2014 | 131 |

| Jeep Cherokee/Grand Cherokee | 2000 | 2000 | 110 |

| Toyota Corolla | 1999 | 1999 | 99 |

| Honda CR-V | 1998 | 1998 | 92 |

| Dodge Caravan | 2000 | 2000 | 79 |

| Acura TL | 2003 | 2003 | 76 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What’s the percentage of vehicle theft by city?

In 2016, over 6,700 motor vehicle thefts occurred in Connecticut. Waterbury, Bridgeport, New Haven, and Hartford had the most thefts.

| City | Population | Motor vehicle theft |

|---|---|---|

| Ansonia | 18,776 | 41 |

| Avon | 18,464 | 8 |

| Berlin | 20,695 | 28 |

| Bethel | 19,712 | 15 |

| Bloomfield | 20,801 | 43 |

| Branford | 28,168 | 29 |

| Bridgeport | 148,180 | 734 |

| Bristol | 60,445 | 110 |

| Brookfield | 17,278 | 9 |

| Canton | 10,337 | 9 |

| Cheshire | 29,259 | 31 |

| Clinton | 13,008 | 18 |

| Coventry | 12,437 | 7 |

| Cromwell | 14,041 | 23 |

| Danbury | 85,335 | 139 |

| Darien | 21,995 | 16 |

| Derby | 12,660 | 38 |

| East Hampton | 12,839 | 10 |

| East Hartford | 50,733 | 143 |

| East Haven | 28,879 | 98 |

| Easton | 7,649 | 0 |

| East Windsor | 11,443 | 10 |

| Enfield | 44,258 | 51 |

| Fairfield | 61,889 | 61 |

| Farmington | 25,684 | 21 |

| Granby | 11,301 | 1 |

| Greenwich | 62,970 | 48 |

| Groton | 9,189 | 16 |

| Groton Long Point | 512 | 0 |

| Groton Town | 29,910 | 20 |

| Guilford | 22,343 | 7 |

| Hamden | 61,138 | 132 |

| Hartford | 123,736 | 773 |

| Madison | 18,212 | 9 |

| Manchester | 57,957 | 110 |

| Meriden | 59,812 | 161 |

| Middlebury | 7,645 | 8 |

| Middletown | 46,580 | 87 |

| Milford | 53,752 | 88 |

| Monroe | 19,898 | 3 |

| Naugatuck | 31,469 | 46 |

| New Britain | 72,720 | 463 |

| New Canaan | 20,509 | 5 |

| New Haven | 130,425 | 735 |

| Newington3 | 30,610 | 59 |

| New London | 27,092 | 81 |

| New Milford | 27,111 | 13 |

| Newtown | 28,105 | 5 |

| North Branford | 14,234 | 9 |

| North Haven | 23,777 | 49 |

| Norwalk | 88,989 | 154 |

| Norwich | 39,771 | 50 |

| Old Saybrook | 10,145 | 1 |

| Orange | 13,940 | 18 |

| Plainfield | 15,015 | 8 |

| Plainville | 17,782 | 26 |

| Plymouth | 11,731 | 14 |

| Portland | 9,369 | 6 |

| Putnam | 9,331 | 5 |

| Redding | 9,317 | 1 |

| Ridgefield | 25,358 | 2 |

| Rocky Hill | 20,085 | 22 |

| Seymour | 16,462 | 17 |

| Shelton | 41,638 | 49 |

| Simsbury | 24,519 | 8 |

| Southington | 43,948 | 67 |

| South Windsor | 25,803 | 26 |

| Stamford | 130,116 | 192 |

| Stonington | 18,337 | 8 |

| Stratford | 52,841 | 116 |

| Suffield | 15,641 | 8 |

| Thomaston | 7,570 | 8 |

| Torrington | 34,626 | 17 |

| Trumbull | 36,741 | 23 |

| Vernon | 28,915 | 32 |

| Wallingford | 44,840 | 25 |

| Waterbury3 | 108,491 | 733 |

| Waterford | 19,236 | 20 |

| Watertown | 21,792 | 32 |

| West Hartford | 62,979 | 107 |

| West Haven | 54,800 | 119 |

| Weston | 10,425 | 0 |

| Westport | 28,198 | 22 |

| Willimantic | 17,766 | 19 |

| Wilton | 18,845 | 6 |

| Winchester | 10,750 | 7 |

| Windsor | 28,998 | 48 |

| Windsor Locks | 12,543 | 28 |

| Wolcott | 16,666 | 38 |

| Woodbridge | 8,864 | 11 |

Read more:

- Danbury Insurance Company Car Insurance Review

- New London County Mutual Insurance Company Car Insurance Review

What’s the number of road fatalities in Connecticut?

Weather, light condition, impaired drivers, and speed are among the biggest causes of deaths on the highway.

Let’s look at how many have occurred throughout the Constitution State.

What’s the number of fatal crashes by weather condition and light condition?

Most deaths occurred under normal daylight conditions.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 106 | 80 | 32 | 11 | 0 | 229 |

| Rain | 13 | 3 | 6 | 1 | 1 | 24 |

| Snow/Sleet | 0 | 2 | 0 | 0 | 0 | 2 |

| Other | 2 | 2 | 0 | 0 | 0 | 4 |

| Unknown | 0 | 1 | 0 | 0 | 0 | 1 |

| TOTAL | 121 | 88 | 38 | 12 | 1 | 260 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What’s the number of fatalities (all crashes) by county?

The more populated counties of Fairfield, Hartford, and New Haven experienced the highest numbers of crash fatalities.

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Fairfield | 50 | 47 | 35 | 73 | 59 |

| Hartford | 79 | 56 | 63 | 60 | 60 |

| Litchfield | 19 | 16 | 22 | 16 | 20 |

| Middlesex | 17 | 13 | 21 | 18 | 10 |

| New Haven | 63 | 52 | 65 | 82 | 75 |

| New London | 29 | 31 | 29 | 27 | 28 |

| Tolland | 17 | 18 | 17 | 12 | 12 |

| Windham | 12 | 15 | 18 | 16 | 14 |

What’s the percentage of traffic fatalities?

The majority of fatalities involved drivers.

| Type | Number of Fatalities |

|---|---|

| Traffic Fatalities | 278 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 162 |

| Motorcyclist Fatalities | 57 |

| Drivers Involved in Fatal Crashes | 376 |

| Pedestrian Fatalities | 48 |

| Bicyclist and other Cyclist Fatalities | 3 |

What’s the number of fatalities by person type?

Most of the fatalities happened to occupants of enclosed vehicles.

| Person Type | Number |

|---|---|

| Occupants (Enclosed Vehicles) | 170 |

| Motorcyclists | 57 |

| Nonoccupants | 18 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What’s the number of fatalities by crash type?

Single vehicles and roadway departures accounted for the most deaths by type of crash.

| Crash Type | Number |

|---|---|

| Single Vehicle | 161 |

| Involving a Large Truck | 23 |

| Involving Speeding | 99 |

| Involving a Rollover | 38 |

| Involving a Roadway Departure | 144 |

| Involving an Intersection (or Intersection Related) | 71 |

5-Year trend for the top ten counties

In recent years, New Haven, Hartford, and Fairfield counties have experienced higher crash deaths than other top counties.

| County | Fatalities 2013 | Fatalities 2014 | Fatalities 2015 | Fatalities 2016 | Fatalities 2017 |

|---|---|---|---|---|---|

| New Haven County | 63 | 52 | 65 | 82 | 75 |

| Hartford County | 79 | 56 | 63 | 60 | 60 |

| Fairfield County | 50 | 47 | 35 | 73 | 59 |

| New London County | 29 | 31 | 29 | 27 | 28 |

| Litchfield County | 19 | 16 | 22 | 16 | 20 |

| Windham County | 12 | 15 | 18 | 16 | 14 |

| Tolland County | 17 | 18 | 17 | 12 | 12 |

| Middlesex County | 17 | 13 | 21 | 18 | 10 |

What’s the number of fatalities involving speeding by county?

The majority of the speeding deaths happened in New Haven County, with fewer throughout less populated counties.

| County Name | Speeding Fatalities 2013 | Speeding Fatalities 2014 | Speeding Fatalities 2015 | Speeding Fatalities 2016 | Speeding Fatalities 2017 | Speeding Fatalities Per 100K 2013 | Speeding Fatalities Per 100K 2014 | Speeding Fatalities Per 100K 2015 | Speeding Fatalities Per 100K 2016 | Speeding Fatalities Per 100K 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fairfield County | 17 | 15 | 13 | 20 | 22 | 1.8 | 1.58 | 1.37 | 2.11 | 2.32 |

| Hartford County | 15 | 25 | 16 | 18 | 25 | 1.67 | 2.78 | 1.78 | 2.01 | 2.79 |

| Litchfield County | 5 | 4 | 3 | 3 | 5 | 2.67 | 2.16 | 1.63 | 1.64 | 2.74 |

| Middlesex County | 5 | 1 | 6 | 2 | 0 | 3.02 | 0.61 | 3.67 | 1.22 | 0 |

| New Haven County | 25 | 11 | 21 | 28 | 20 | 2.89 | 1.27 | 2.44 | 3.26 | 2.32 |

| New London County | 4 | 7 | 10 | 5 | 10 | 1.46 | 2.57 | 3.7 | 1.86 | 3.72 |

| Tolland County | 3 | 3 | 4 | 4 | 4 | 1.97 | 1.98 | 2.64 | 2.65 | 2.64 |

| Windham County | 2 | 3 | 4 | 2 | 2 | 1.7 | 2.57 | 3.43 | 1.72 | 1.72 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What’s the number of fatalities in crashes involving an alcohol-impaired driver (BAC = .08+) by county?

| County Name | DUI Fatalities 2013 | DUI Fatalities 2014 | DUI Fatalities 2015 | DUI Fatalities 2016 | DUI Fatalities 2017 | DUI Fatalities Per 100K 2013 | DUI Fatalities Per 100K 2014 | DUI Fatalities Per 100K 2015 | DUI Fatalities Per 100K 2016 | DUI Fatalities Per 100K 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fairfield County | 21 | 17 | 17 | 24 | 28 | 2.23 | 1.8 | 1.79 | 2.53 | 2.95 |

| Hartford County | 35 | 25 | 17 | 27 | 27 | 3.89 | 2.78 | 1.89 | 3.02 | 3.02 |

| Litchfield County | 10 | 5 | 12 | 5 | 10 | 5.35 | 2.69 | 6.51 | 2.73 | 5.49 |

| Middlesex County | 10 | 2 | 7 | 8 | 5 | 6.05 | 1.21 | 4.28 | 4.89 | 3.06 |

| New Haven County | 29 | 19 | 21 | 34 | 29 | 3.35 | 2.2 | 2.44 | 3.95 | 3.37 |

| New London County | 9 | 15 | 13 | 11 | 12 | 3.29 | 5.52 | 4.81 | 4.08 | 4.46 |

| Tolland County | 10 | 8 | 8 | 5 | 4 | 6.58 | 5.27 | 5.27 | 3.31 | 2.64 |

| Windham County | 3 | 6 | 5 | 4 | 6 | 2.55 | 5.14 | 4.29 | 3.45 | 5.16 |

What are the teen drinking and driving laws?

| Teens and Drunk Driving | Laws |

|---|---|

| Alcohol-Impaired Driving Fatalities Per 100K Population | 0.9 |

| Higher/Lower Than National Average (1.2) | lower |

| DUI Arrest (Under 18 years old) | 41 |

| DUI Arrests (Under 18 years old) Total Per Million People | 54.43 |

What’s the average EMS response time?

Rural areas, which tend to be farther away from emergency response crews and resources and harder to get to, took longer for EMS to get to.

| Type of Crash | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Rural Fatal Crashes | 2.17 | 9.47 | 39.67 | 48.60 |

| Urban Fatal Crashes | 2.27 | 6.44 | 26.61 | 34.55 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What’s transportation like?

As you’ll see below, Connecticut has some of the most congested traffic in the nation. Among the biggest factors include the number of cars on the road and how people get to work.

With an average commute time of 24.9 minutes, Connecticut ranks below the national average of 25.3 minutes. Just over three percent of drivers have a “super commute” of 90 minutes or more.

According to the Bureau of Transportation Statistics, in 2013, 77.9 percent of Connecticut drivers drove to work alone, while 8.3 percent carpooled and only 5.1 percent took public transportation.

What is the percentage of car ownership?

Most Constitution State drivers own two or more cars.

What is the average commute time?

The majority of drivers spend 10-30 minutes in their daily commutes.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What’s the preferred commuter transportation?

Most drivers go it alone during their commutes.

Is there a traffic congestion in Connecticut?

The Tom-Tom Traffic Index counts New Haven, Connecticut, as one of the most congested cities in the U.S.

In 2018, it had a congestion level of 16 percent, which was down two percent from 2017. The highways were 11 percent congested, while other roads accounted for 22 percent of the congestion.

Monday through Thursday were the heaviest days, with Tuesdays the highest. At peak commute times in the morning, traffic was 21 percent congested, and in the evening, 37 percent.

Traffic at those peak times accounted for an extra six minutes for every 30 minute trip in the morning, and an additional 11 minutes for every half-hour journey in the evening.

Do you feel like you’ve learned enough about car insurance and state laws? Which driving or insurance fact was most helpful to you?

We’ve armed you with the knowledge you need to choose your car insurance coverage wisely so that you’ll be confident you’ll make the right decision.

To start comparing rates, enter your ZIP code below.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.