Rhode Island Car Insurance (Coverage, Companies, & More)

Rhode Island car insurance laws require 25/50/25 in minimum liability coverage, but you may want to drive with more coverage. Read our guide to compare Rhode Island car insurance companies in your neighborhood and find the cheapest Rhode Island car insurance rates. Enter your ZIP code below to start comparing rates for free.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Feb 26, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 26, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Rhode Island Stats Summary | Statistics |

|---|---|

| Miles of Roadway | 6,046 |

| Vehicles Registered in RI | 843,346 |

| Population | 1,055,916 |

| Most Popular Vehicle in the State | RAV4 |

| Percentage of Uninsured | 15.20% |

| Total Driving Related Deaths | 59 |

| Speeding Fatalities | 27 |

| Alcohol-Related Fatalities | 20 |

| Average Annual Premiums | $1,303.50 |

| Average Liability Premiums | $759.80 |

| Average Collision Premiums | $411.51 |

| Average Comprehensive Premiums | $132.19 |

| Cheapest Providers | USAA CIC, State Farm Mutual Auto |

At 1,214 square miles, Rhode Island is the smallest state in the nation. Don’t let the size of the state fool you, however Rhode Island packs a lot of history into its tiny borders.

The Ocean State is the home of the first American circus, the first discount store, the first open golf tournament, and houses the largest bug in North America – the 58-foot blue termite on top of the New England Pest Control building. Rhode Island is also home to mandatory minimum insurance laws, which means you are required to carry liability coverage for your vehicle at all times.

Although insurance is a requirement, finding the right insurance plan for you is not always easy. Calling multiple insurance companies for quotes and coverage comparisons is confusing and time-consuming, but luckily there are better options available.

If you’re ready to start comparing rates for your auto insurance, enter your ZIP code now to get started.

How much are auto insurance rates in Rhode Island?

Understanding the details of your car insurance is not an easy task. From your required minimum levels of coverage to how your rates are calculated, the subject is complex and changes from state to state, but it’s possible to learn the ins and outs of the laws and requirements of your insurance.

Read below to find out more about the specifics of your insurance and the laws that guide your experiences as a driver and a car owner. You will also see average rates for drivers of different demographics.

Rhode Island’s Car Culture

Car culture in Rhode Island is as unique as the rest of the state. Having more than 11 cars in front of your home is a misdemeanor, so Jerry Seinfeld and Jay Leno would need to plan for indoor car storage if they decided to move to Rhode Island. (For more information, read our “Jerry Seinfeld’s Car Collection“)

Just because they don’t want your car collection in your driveway doesn’t mean they don’t love cars, however – there were 21 car shows in Rhode Island in 2019, proving just how much people in the state love their cars.

Rhode Island Minimum Coverage

Like most of the country, Rhode Island is an at-fault state. This means that in an accident, the driver who is at fault is financially responsible for all the damages caused, including both bodily injuries and property damage. This is why the state requires mandatory liability coverage.

In Rhode Island, all drivers are required by law to carry minimum liability coverage. The minimum liability coverage levels in the state are:

- Bodily injury – $25,000 per person, $50,000 per accident

- Property damage – $25,000

- Uninsured/Underinsured motorist – $25,000 per person, $50,000 per accident

Technically, Rhode Island doesn’t require you to carry uninsured/underinsured motorist coverage if you only carry minimum liability levels, but it is required for higher levels of liability coverage.

You must opt out of the coverage in writing if you choose not to have it, so we’re including it in the minimum coverage levels just the same. But why would you want uninsured motorist coverage?

Because, while insurance is required by law, more than 15 percent of Rhode Island residents don’t have the mandatory insurance coverage.

This means that in the event of an accident, the other person might not be prepared to pay a single dime toward your damages. Choosing uninsured motorist coverage is the best way to make sure you’re protected in an accident.

Forms of Financial Responsibility

In Rhode Island, registering a car requires proof of insurance. You’ll also need proof of insurance if you’re pulled over by the police while driving or find yourself in an accident.

In 2014, Rhode Island passed a law allowing drivers to use their smartphones, tablets, and other electronic devices to access proof of insurance at the DMV and for police officers during a traffic stop. This was done because it’s more convenient to access your proof of financial responsibility online than to have to keep track of a paper card or certificate.

If you don’t have insurance but you can provide a surety bond, a certificate of self-insurance, a cash bond, or other proof of financial responsibility, you’ll want to reach out to the Rhode Island DMV and find out if your alternative coverage meets the state requirements.

Premiums as a Percentage of Income

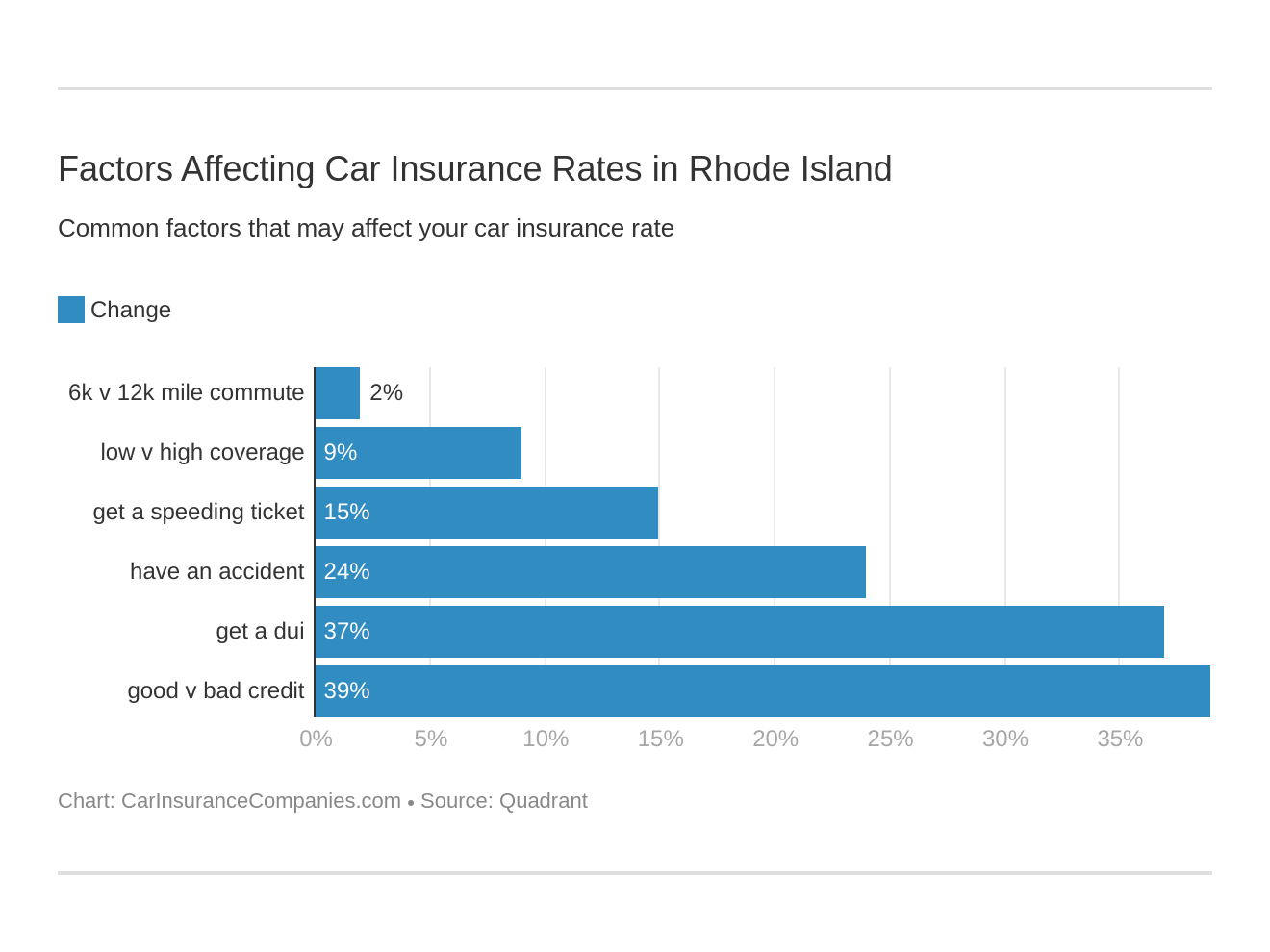

A wide variety of factors affect your insurance premiums. Everything from your age to your gender to your ZIP code can have a noticeable effect on your rates. This can make it difficult to determine your premium as a percentage of your income.

| States | Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|---|---|---|---|---|---|---|---|---|---|

| Rhode Island | $1,257.40 | $42,585.00 | 2.95% | $1,210.55 | $41,139.00 | 2.94% | $1,176.05 | $41,492.00 | 2.83% |

| Connecticut | $1,132.78 | $56,186.00 | 2.02% | $1,109.03 | $53,939.00 | 2.06% | $1,082.28 | $55,895.00 | 1.94% |

| Massachusetts | $1,107.76 | $50,366.00 | 2.20% | $1,080.48 | $48,504.00 | 2.23% | $1,048.06 | $49,507.00 | 2.12% |

People with poor driving records could be spending 20 percent or more of their income on their insurance, while someone with an excellent driving record might be spending less than 5 percent of their income on their insurance premium.

To figure out how much of your income is spent on car insurance, take the amount of your premium divided by your income (either gross or net) then multiply by 100.

For example, if a man is earning $39,960 and paying $2,000 for insurance each year, he spends 5.01 percent of his gross income on his car insurance each year.

As he gets older his insurance rates will change, but other factors such as his ZIP code and credit history will also affect his rates, which means he may not be able to predict whether his rates will go up or down in the future.

Average Monthly Car Insurance Rates in RI (Liability, Collision, Comprehensive)

Let’s start with a look at the core coverage in Rhode Island, and what it costs on average.

| RI Insurance Costs | 2015 | 2014 | 2013 | 2012 | 2011 | Average |

|---|---|---|---|---|---|---|

| Liability | $759.80 | $739.87 | $719.53 | $702.52 | $678.60 | $720.06 |

| Collision | $411.51 | $392.36 | $372.15 | $357.12 | $352.16 | $377.06 |

| Comprehensive | $132.19 | $125.17 | $118.86 | $116.41 | $118.21 | $122.17 |

| Total Avg | $1,303.50 | $1,257.40 | $1,210.55 | $1,176.05 | $1,148.97 | $1,219.29 |

Liability coverage is required in Rhode Island, but there is a lot more to insurance than just liability. If you want to protect all your financial interests, you may want to consider purchasing some or all of these types of coverage as well:

- Liability – Liability insurance protects you financially by paying for damages to the other driver’s vehicle if you’re at fault in an accident. It also covers medical bills in the event of injuries caused in an accident where you were at fault.

- Uninsured motorist coverage – Uninsured motorist coverage, often referred to as UM, is usually mandatory in Rhode Island. This portion of your coverage pays for your own bodily injury needs if you’re in an accident where an uninsured driver was at fault. It matches your liability levels, so if you want extra UM coverage you need to increase your liability levels to match.

- Collision – Collision insurance protects you financially by paying for damages to your vehicle if you’re at fault in an accident, whether you hit a stationary object or another vehicle. Sometimes lenders require you to have collision coverage if you are paying off a car loan, so keep that in mind when getting an insurance quote.

- Comprehensive – Comprehensive insurance covers damage to your car that isn’t caused by an accident. Some things that might be covered under a comprehensive policy include flood damage, vandalism, and theft.

Insurance companies may have their own guidelines as to what is covered under your comprehensive and collision policies, so make sure you do your research when choosing an insurance provider.

NOTE: in the table above the numbers are based on the Rhode Island state minimums. Your rates may vary depending on the type and level of coverage you select.

Additional Coverage

When it comes to additional coverage you will want to consider personal injury protection (PIP). Even though Massachusetts and other states often require PIP coverage as part of a basic liability plan, Rhode Island does not.

Uninsured motorist/underinsured motorist coverage (UM) takes the place of the liability insurance the other person should have (or should have more of, depending on the situation), but PIP provides additional coverage that can be used for medical expenses or even lost wages, depending on the specifics of your policy.

PIP is often a smaller amount of coverage, sometimes as low as $2,000, but can usually be increased depending on your needs.

PIP is about your financial needs, but what about the needs of the people in the other car if you are at fault in an accident?

Though the state minimum in Rhode Island is a robust $25,000/$50,000 for bodily injury and $25,000 for property damage, that’s the minimum, not the maximum for your liability coverage. Most people should give some serious thought to carrying more than the state minimum.

You can choose to buy more than the legal minimum of insurance. Most companies offer higher coverage levels, typically $50,000 – $100,000 in property damage and $100,000 – $250,000 per person/$300,000 – $500,000 per accident for bodily injury coverage. This will increase your monthly premium but might be worth it if you have assets that need to be protected.

Hopefully, in an at-fault accident, the damage you cause will be minimal and nobody will get hurt. But what if the worst happens?

You could hit someone in an expensive new Porsche. They might have a passenger in the car who needs medical attention. Or worse, a mother of three could have all her children in the car that you hit, so keep that in mind when looking at that $50,000 bodily injury cap.

Many people don’t realize it, but if your insurance only covers $25,000 for property damage and $25,000/$50,000 for bodily injury, you’ll still be required to pay for any damages beyond what your insurance policy covers. If you choose to select only the minimum amount of coverage, you may not be protected for any major damages you cause.

When you’re choosing a policy, you may want to consider the company’s loss ratio. The loss ratio is the amount paid out in claims by a company versus the amount of premium taken in by the company.

| Rhode Island Loss Ratios | 2015 | 2014 | 2013 |

|---|---|---|---|

| Pure Premium | 681.49 | 818.73 | 691.55 |

| Loss Ratio | 114.51 | 139.51 | 117.46 |

According to the NAIC, a loss ratio in the 60s or 70s is appropriate — it means they aren’t charging too much premium — and they are regularly paying out claims to their customers. The table above shows the average loss ratios for the state of Rhode Island.

Add-ons, Endorsements, and Riders

You have all of the basic core coverage options and higher-than-average levels of liability insurance, and that’s great. However, it doesn’t mean you won’t need other coverage as well. There is a wide variety of coverage available that you may need to keep yourself on solid financial ground.

- Umbrella policy – If you don’t think that $100,000/$300,000 in bodily injury and $100,000 in property damage (or whatever your specific insurance company has set as their maximum liability coverage) would be enough to protect your assets in a major accident, you may need an umbrella policy. Umbrella policies provide a minimum of $1 million in liability coverage. They also include coverage for things beyond car accidents such as libel and slander.

- Rental reimbursement – If you experience an insured loss, rental reimbursement covers the cost of a rental car while your vehicle is being repaired. For example, if you woke up one day and found your car had been damaged by hail, comprehensive insurance would cover the cost to repair it, but rental reimbursement would cover the cost of a rental car during repairs.

- Roadside assistance – If your car needs to be towed or repaired on the side of the road, roadside assistance coverage can help cover the cost of those services.

- GAP insurance – GAP insurance covers the difference between what your insurance policy pays and the amount still owed for the car. GAP insurance can help prevent you from being forced to make payments on a totaled vehicle, but the type of GAP coverage available varies widely from company to company and state to state, so research carefully before buying.

- Non-owner insurance – If you don’t own a car but you still drive semi-regularly, you may want or need a non-owner insurance plan to provide you with third-party liability coverage so you’re financially protected.

- Classic car insurance – The actual value of a classic or vintage car is often worth more than normal depreciation. Because of this, classic car owners need classic car insurance to make sure their vehicle is protected at its full value.

- Usage-based/Pay-as-you-drive insurance – A device can be installed in your car or an app installed on your phone that records your driving information (speed, mileage) and reports it to your insurance company, which uses that information to offer you discounts based on your driving record. This has the potential for serious negative side effects though, so consider carefully before signing up.

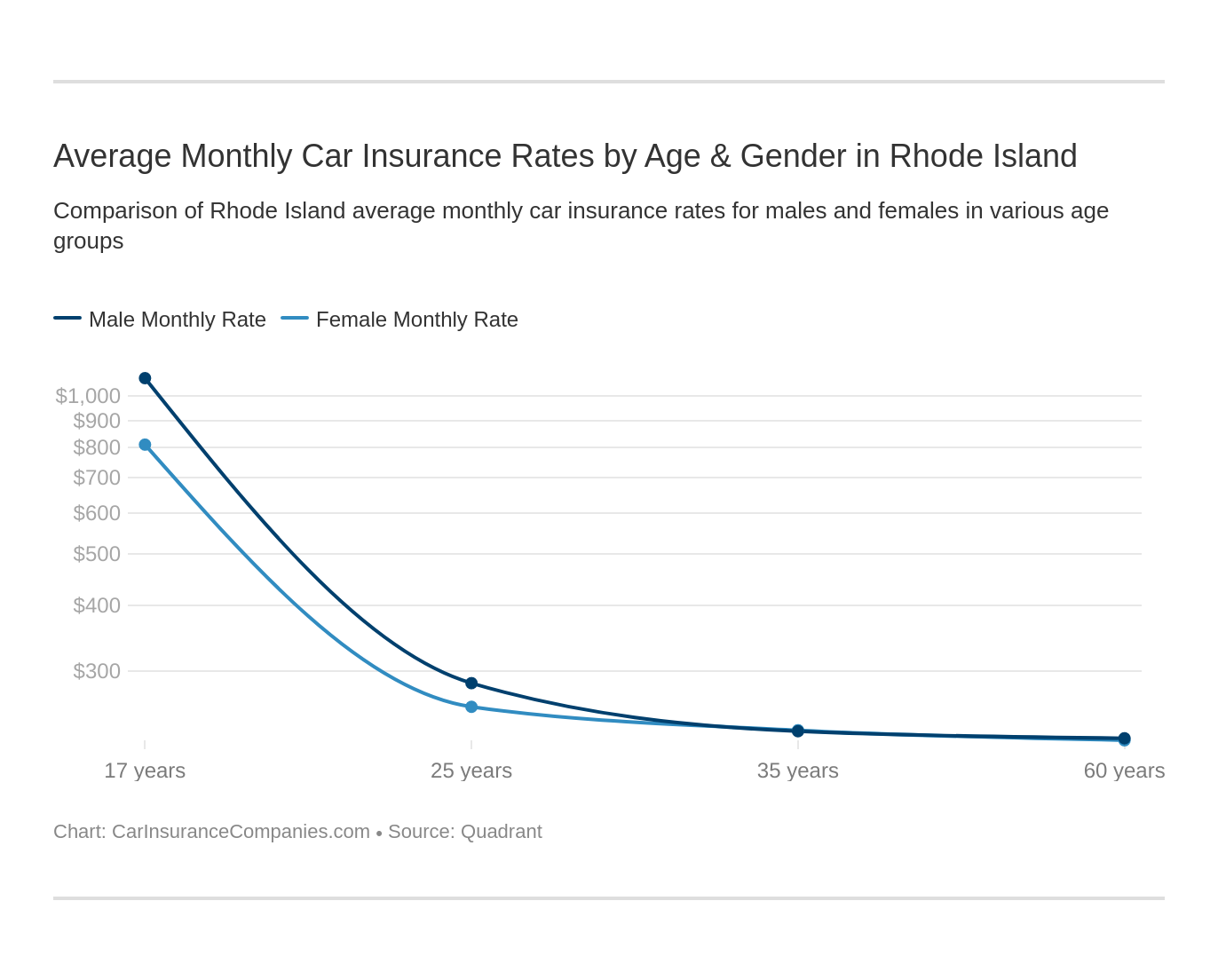

Average Monthly Car Insurance Rates by Age & Gender in RI

Although a handful of states are now making it illegal for insurance companies to set rates based on gender, Rhode Island is not one of them. Your gender can and will affect your insurance premium, so you need to consider that when you’re getting insurance quotes. Take a look below to see the average cost of insurance for different demographics, based on data provided by Quadrant Information Services.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $3,991.81 | $3,919.97 | $3,965.46 | $4,138.80 | $6,951.89 | $8,211.70 | $4,181.73 | $4,314.24 |

| Geico General | $3,352.25 | $3,435.27 | $3,435.27 | $3,358.93 | $10,460.06 | $13,683.07 | $3,471.31 | $3,624.88 |

| Liberty Mutual Fire Ins Co | $3,967.26 | $3,967.26 | $3,781.20 | $3,781.20 | $9,610.11 | $15,000.77 | $3,967.26 | $5,397.88 |

| Nationwide Mutual | $2,870.60 | $2,916.99 | $2,522.14 | $2,676.05 | $7,505.22 | $9,664.73 | $3,412.17 | $3,709.14 |

| Progressive Direct | $2,657.85 | $2,523.06 | $2,442.97 | $2,428.75 | $11,882.34 | $13,361.63 | $3,245.10 | $3,307.02 |

| State Farm Mutual Auto | $1,529.96 | $1,529.96 | $1,349.64 | $1,349.64 | $4,204.16 | $5,604.41 | $1,680.96 | $2,003.27 |

| Travelers Home & Marine Ins Co | $1,681.61 | $1,701.83 | $1,712.33 | $1,702.69 | $17,367.38 | $27,457.38 | $1,729.94 | $1,922.42 |

| USAA CIC | $2,081.24 | $2,057.69 | $1,994.32 | $1,954.09 | $9,649.96 | $11,028.79 | $2,842.49 | $2,983.23 |

Read more: The Travelers Home and Marine Insurance Company Car Insurance Review

While it’s true that a variety of factors can affect your rates, there is still a significant difference in price from company to company, You should receive multiple quotes before purchasing a policy because shopping around for insurance could save you hundreds of dollars per year.

| Company | Demographic | Average Annual Rate |

|---|---|---|

| Travelers Home & Marine Ins Co | Single 17-year old male | $27,457.38 |

| Travelers Home & Marine Ins Co | Single 17-year old female | $17,367.38 |

| Liberty Mutual Fire Ins Co | Single 17-year old male | $15,000.77 |

| Geico General | Single 17-year old male | $13,683.07 |

| Progressive Direct | Single 17-year old male | $13,361.63 |

| Progressive Direct | Single 17-year old female | $11,882.34 |

| USAA CIC | Single 17-year old male | $11,028.79 |

| Geico General | Single 17-year old female | $10,460.06 |

| Nationwide Mutual | Single 17-year old male | $9,664.73 |

| USAA CIC | Single 17-year old female | $9,649.96 |

| Liberty Mutual Fire Ins Co | Single 17-year old female | $9,610.11 |

| Allstate F&C | Single 17-year old male | $8,211.70 |

| Nationwide Mutual | Single 17-year old female | $7,505.22 |

| Allstate F&C | Single 17-year old female | $6,951.89 |

| State Farm Mutual Auto | Single 17-year old male | $5,604.41 |

| Liberty Mutual Fire Ins Co | Single 25-year old male | $5,397.88 |

| Allstate F&C | Single 25-year old male | $4,314.24 |

| State Farm Mutual Auto | Single 17-year old female | $4,204.16 |

| Allstate F&C | Single 25-year old female | $4,181.73 |

| Allstate F&C | Married 60-year old male | $4,138.80 |

| Allstate F&C | Married 35-year old female | $3,991.81 |

| Liberty Mutual Fire Ins Co | Married 35-year old female | $3,967.26 |

| Liberty Mutual Fire Ins Co | Married 35-year old male | $3,967.26 |

| Liberty Mutual Fire Ins Co | Single 25-year old female | $3,967.26 |

| Allstate F&C | Married 60-year old female | $3,965.46 |

| Allstate F&C | Married 35-year old male | $3,919.97 |

| Liberty Mutual Fire Ins Co | Married 60-year old female | $3,781.20 |

| Liberty Mutual Fire Ins Co | Married 60-year old male | $3,781.20 |

| Nationwide Mutual | Single 25-year old male | $3,709.14 |

| Geico General | Single 25-year old male | $3,624.88 |

| Geico General | Single 25-year old female | $3,471.31 |

| Geico General | Married 35-year old male | $3,435.27 |

| Geico General | Married 60-year old female | $3,435.27 |

| Nationwide Mutual | Single 25-year old female | $3,412.17 |

| Geico General | Married 60-year old male | $3,358.93 |

| Geico General | Married 35-year old female | $3,352.25 |

| Progressive Direct | Single 25-year old male | $3,307.02 |

| Progressive Direct | Single 25-year old female | $3,245.10 |

| USAA CIC | Single 25-year old male | $2,983.23 |

| Nationwide Mutual | Married 35-year old male | $2,916.99 |

| Nationwide Mutual | Married 35-year old female | $2,870.60 |

| USAA CIC | Single 25-year old female | $2,842.49 |

| Nationwide Mutual | Married 60-year old male | $2,676.05 |

| Progressive Direct | Married 35-year old female | $2,657.85 |

| Progressive Direct | Married 35-year old male | $2,523.06 |

| Nationwide Mutual | Married 60-year old female | $2,522.14 |

| Progressive Direct | Married 60-year old female | $2,442.97 |

| Progressive Direct | Married 60-year old male | $2,428.75 |

| USAA CIC | Married 35-year old female | $2,081.24 |

| USAA CIC | Married 35-year old male | $2,057.69 |

| State Farm Mutual Auto | Single 25-year old male | $2,003.27 |

| USAA CIC | Married 60-year old female | $1,994.32 |

| USAA CIC | Married 60-year old male | $1,954.09 |

| Travelers Home & Marine Ins Co | Single 25-year old male | $1,922.42 |

| Travelers Home & Marine Ins Co | Single 25-year old female | $1,729.94 |

| Travelers Home & Marine Ins Co | Married 60-year old female | $1,712.33 |

| Travelers Home & Marine Ins Co | Married 60-year old male | $1,702.69 |

| Travelers Home & Marine Ins Co | Married 35-year old male | $1,701.83 |

| Travelers Home & Marine Ins Co | Married 35-year old female | $1,681.61 |

Note: The rates in the tables above are based on actual, purchased coverage in the state of Rhode Island, including high-risk drivers and those who choose higher-than-minimum levels of coverage. Your rates could vary significantly from what is shown based on your coverage choices and your driving history.

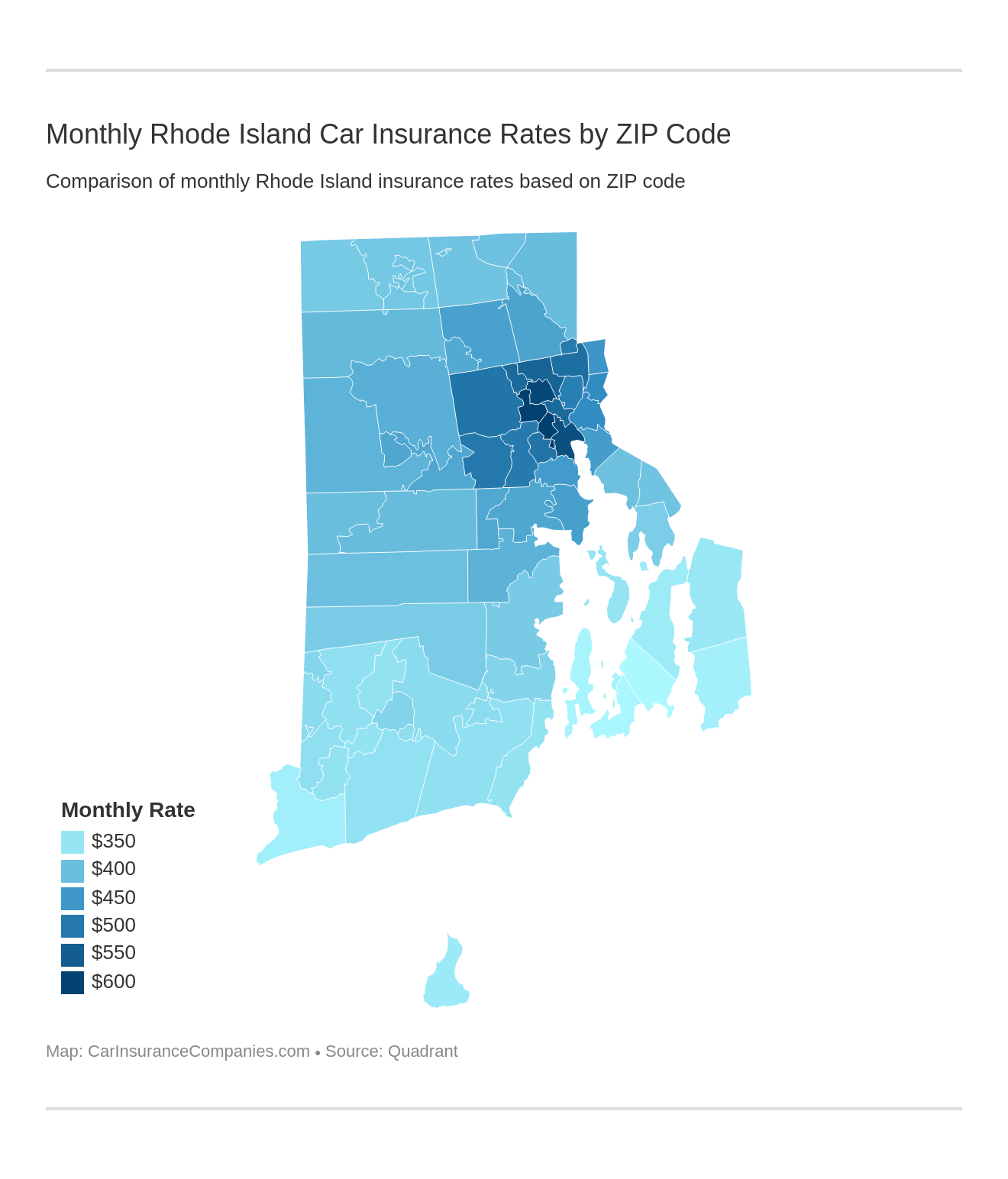

Cheapest Rates by ZIP Code

Your ZIP code is a major factor in your insurance rates. Everything from the number of accidents reported to the number of automobile thefts in a particular ZIP code goes into determining the rates for an area. This means that moving a block or two could dramatically change your annual premiums if it puts you in a different ZIP code.

Below is a table of the 25 most expensive ZIP codes in Rhode Island:

| Most Expensive Zip Codes in Rhode Island | City | Average Annual Rate by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 02907 | PROVIDENCE | $7,262.39 | Travelers | $11,565.67 | Geico | $9,245.62 | State Farm | $2,897.12 | USAA | $5,381.45 |

| 02909 | PROVIDENCE | $7,237.08 | Travelers | $11,060.59 | Geico | $9,245.62 | State Farm | $2,897.12 | USAA | $5,102.32 |

| 02908 | PROVIDENCE | $7,060.09 | Travelers | $10,074.55 | Geico | $9,245.62 | State Farm | $2,897.12 | USAA | $5,102.32 |

| 02905 | PROVIDENCE | $6,922.54 | Travelers | $10,947.57 | Liberty Mutual | $8,976.30 | State Farm | $2,897.12 | USAA | $5,794.91 |

| 02904 | PROVIDENCE | $6,466.51 | Liberty Mutual | $8,976.30 | Travelers | $8,417.74 | State Farm | $2,897.12 | USAA | $5,102.32 |

| 02903 | PROVIDENCE | $6,360.08 | Travelers | $9,470.14 | Liberty Mutual | $8,976.30 | State Farm | $2,897.12 | USAA | $4,933.68 |

| 02911 | NORTH PROVIDENCE | $6,341.33 | Travelers | $9,171.84 | Liberty Mutual | $7,555.06 | State Farm | $2,733.99 | USAA | $5,433.62 |

| 02860 | PAWTUCKET | $6,225.51 | Travelers | $9,930.84 | Geico | $7,660.12 | State Farm | $2,733.99 | USAA | $5,258.56 |

| 02912 | PROVIDENCE | $6,185.30 | Travelers | $9,171.84 | Liberty Mutual | $8,976.30 | State Farm | $2,897.12 | USAA | $4,933.68 |

| 02918 | PROVIDENCE | $6,115.57 | Geico | $9,245.62 | Liberty Mutual | $8,976.30 | State Farm | $2,897.12 | USAA | $4,300.44 |

| 02910 | CRANSTON | $6,107.90 | Travelers | $8,603.12 | Liberty Mutual | $7,555.06 | State Farm | $2,733.99 | USAA | $5,187.73 |

| 02919 | JOHNSTON | $6,101.40 | Travelers | $8,723.05 | Liberty Mutual | $7,555.06 | State Farm | $2,733.99 | Progressive | $5,271.32 |

| 02921 | CRANSTON | $6,041.61 | Travelers | $8,400.58 | Geico | $7,510.66 | State Farm | $2,733.99 | USAA | $5,017.82 |

| 02920 | CRANSTON | $5,975.60 | Travelers | $7,850.49 | Geico | $7,510.66 | State Farm | $2,733.99 | USAA | $5,017.82 |

| 02863 | CENTRAL FALLS | $5,975.22 | Travelers | $8,213.51 | Geico | $7,660.12 | State Farm | $2,733.99 | USAA | $5,065.26 |

| 02906 | PROVIDENCE | $5,881.57 | Liberty Mutual | $8,976.30 | Travelers | $8,209.34 | State Farm | $2,897.12 | USAA | $4,933.68 |

| 02914 | EAST PROVIDENCE | $5,580.28 | Travelers | $7,548.79 | Progressive | $7,082.60 | State Farm | $2,733.99 | USAA | $4,674.02 |

| 02916 | RUMFORD | $5,580.25 | Travelers | $8,216.34 | Geico | $7,660.12 | State Farm | $2,733.99 | Nationwide | $4,342.35 |

| 02861 | PAWTUCKET | $5,423.20 | Travelers | $7,348.61 | Liberty Mutual | $6,431.29 | State Farm | $2,733.99 | USAA | $4,986.07 |

| 02888 | WARWICK | $5,348.42 | Travelers | $7,608.61 | Liberty Mutual | $6,431.29 | State Farm | $2,733.99 | USAA | $4,432.68 |

| 02915 | RIVERSIDE | $5,324.98 | Travelers | $8,183.44 | Liberty Mutual | $6,431.29 | State Farm | $2,733.99 | Nationwide | $4,342.35 |

| 02889 | WARWICK | $5,281.80 | Travelers | $7,165.04 | Liberty Mutual | $6,431.29 | State Farm | $2,733.99 | USAA | $4,406.74 |

| 02917 | SMITHFIELD | $5,252.06 | Progressive | $7,082.60 | Travelers | $6,891.40 | State Farm | $2,733.99 | USAA | $4,300.44 |

| 02823 | FISKEVILLE | $5,243.45 | Geico | $7,510.66 | Travelers | $6,773.15 | State Farm | $2,897.12 | Nationwide | $4,268.78 |

| 02865 | LINCOLN | $5,230.17 | Travelers | $7,524.78 | Liberty Mutual | $6,051.59 | State Farm | $2,733.99 | Nationwide | $4,324.01 |

On the other end of the spectrum, these are the 25 least expensive ZIP codes in Rhode Island:

| Least Expensive Zip Codes in Rhode Island | City | Average Annual Rate by Zip Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 02842 | MIDDLETOWN | $3,908.01 | Liberty Mutual | $5,249.77 | Travelers | $5,135.64 | State Farm | $2,034.57 | Nationwide | $3,469.02 |

| 02840 | NEWPORT | $3,953.70 | Travelers | $5,660.98 | Liberty Mutual | $5,249.77 | State Farm | $2,034.57 | USAA | $3,361.12 |

| 02835 | JAMESTOWN | $3,967.95 | Travelers | $5,844.74 | Liberty Mutual | $5,236.06 | State Farm | $2,034.57 | USAA | $3,361.12 |

| 02841 | NEWPORT | $3,999.62 | Travelers | $5,660.98 | Liberty Mutual | $5,249.77 | State Farm | $2,034.57 | Nationwide | $3,514.01 |

| 02837 | LITTLE COMPTON | $4,027.83 | Travelers | $5,473.51 | Liberty Mutual | $5,236.06 | State Farm | $2,034.57 | USAA | $3,361.12 |

| 02891 | WESTERLY | $4,057.50 | Liberty Mutual | $5,749.70 | Travelers | $4,819.39 | State Farm | $2,084.74 | Nationwide | $3,694.86 |

| 02871 | PORTSMOUTH | $4,112.71 | Travelers | $5,886.01 | Liberty Mutual | $5,236.06 | State Farm | $2,034.57 | USAA | $3,489.60 |

| 02807 | BLOCK ISLAND | $4,125.17 | Travelers | $5,831.01 | Liberty Mutual | $5,749.70 | State Farm | $2,084.74 | Nationwide | $3,417.05 |

| 02878 | TIVERTON | $4,181.30 | Travelers | $6,004.65 | Liberty Mutual | $5,249.77 | State Farm | $2,034.57 | USAA | $3,678.96 |

| 02872 | PRUDENCE ISLAND | $4,222.10 | Travelers | $5,886.01 | Liberty Mutual | $5,236.06 | State Farm | $2,034.57 | USAA | $3,489.60 |

| 02894 | WOOD RIVER JUNCTION | $4,240.73 | Liberty Mutual | $5,749.70 | Travelers | $5,416.44 | State Farm | $2,084.74 | Nationwide | $3,813.30 |

| 02836 | KENYON | $4,256.34 | Travelers | $5,925.99 | Liberty Mutual | $5,749.70 | State Farm | $2,084.74 | Nationwide | $3,813.30 |

| 02898 | WYOMING | $4,264.65 | Liberty Mutual | $5,749.70 | Travelers | $5,479.95 | State Farm | $2,084.74 | Nationwide | $3,813.30 |

| 02882 | NARRAGANSETT | $4,265.28 | Travelers | $5,704.68 | Liberty Mutual | $5,512.74 | State Farm | $2,034.57 | Nationwide | $3,712.07 |

| 02808 | BRADFORD | $4,265.93 | Travelers | $5,831.01 | Liberty Mutual | $5,749.70 | State Farm | $2,084.74 | Nationwide | $3,629.83 |

| 02813 | CHARLESTOWN | $4,269.11 | Liberty Mutual | $5,749.70 | Travelers | $5,144.17 | State Farm | $2,084.74 | Nationwide | $3,629.83 |

| 02879 | WAKEFIELD | $4,280.44 | Travelers | $5,724.80 | Liberty Mutual | $5,512.74 | State Farm | $2,034.57 | Nationwide | $3,712.07 |

| 02832 | HOPE VALLEY | $4,288.65 | Travelers | $5,817.48 | Liberty Mutual | $5,749.70 | State Farm | $2,084.74 | Nationwide | $3,760.68 |

| 02804 | ASHAWAY | $4,292.12 | Travelers | $5,817.48 | Liberty Mutual | $5,749.70 | State Farm | $2,084.74 | Nationwide | $3,760.68 |

| 02875 | SHANNOCK | $4,324.21 | Travelers | $6,318.46 | Liberty Mutual | $5,749.70 | State Farm | $2,084.74 | Nationwide | $3,629.83 |

| 02881 | KINGSTON | $4,339.38 | Liberty Mutual | $5,512.74 | Progressive | $5,271.32 | State Farm | $2,034.57 | Nationwide | $3,712.07 |

| 02833 | HOPKINTON | $4,354.66 | Travelers | $6,321.10 | Liberty Mutual | $5,749.70 | State Farm | $2,084.74 | Nationwide | $3,760.68 |

| 02892 | WEST KINGSTON | $4,362.34 | Travelers | $6,393.60 | Liberty Mutual | $5,512.74 | State Farm | $2,084.74 | Nationwide | $3,712.07 |

| 02873 | ROCKVILLE | $4,448.23 | Travelers | $6,334.94 | Liberty Mutual | $5,749.70 | State Farm | $2,084.74 | Progressive | $3,999.24 |

| 02812 | CAROLINA | $4,458.91 | Travelers | $6,084.64 | Liberty Mutual | $5,749.70 | State Farm | $2,084.74 | Nationwide | $3,629.83 |

Cheapest Rates by City

Much like your ZIP code, the city you live in can have a big impact on your insurance rates. Crime rates, street parking, and other variables in your town will affect the insurance rates for your city.

Below is a table of the least expensive cities for car insurance in Rhode Island:

| Least Expensive Cities in Rhode Island | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Jamestown | $3,967.95 | Travelers | $5,844.74 | Liberty Mutual | $5,236.06 | State Farm | $2,034.57 | USAA | $3,361.12 |

| Newport | $3,976.66 | Travelers | $5,660.98 | Liberty Mutual | $5,249.77 | State Farm | $2,034.57 | USAA | $3,470.56 |

| Melville | $4,010.36 | Travelers | $5,510.83 | Liberty Mutual | $5,242.91 | State Farm | $2,034.57 | USAA | $3,534.80 |

| Little Compton | $4,027.83 | Travelers | $5,473.51 | Liberty Mutual | $5,236.06 | State Farm | $2,034.57 | USAA | $3,361.12 |

| Misquamicut | $4,057.50 | Liberty Mutual | $5,749.70 | Travelers | $4,819.39 | State Farm | $2,084.74 | Nationwide | $3,694.86 |

| Block Island | $4,125.16 | Travelers | $5,831.01 | Liberty Mutual | $5,749.70 | State Farm | $2,084.74 | Nationwide | $3,417.05 |

| Tiverton | $4,181.30 | Travelers | $6,004.65 | Liberty Mutual | $5,249.77 | State Farm | $2,034.57 | USAA | $3,678.96 |

| Prudence Island | $4,222.09 | Travelers | $5,886.01 | Liberty Mutual | $5,236.06 | State Farm | $2,034.57 | USAA | $3,489.60 |

| Wood River Junction | $4,240.73 | Liberty Mutual | $5,749.70 | Travelers | $5,416.44 | State Farm | $2,084.74 | Nationwide | $3,813.30 |

| Kenyon | $4,256.34 | Travelers | $5,925.99 | Liberty Mutual | $5,749.70 | State Farm | $2,084.74 | Nationwide | $3,813.30 |

Notice that Providence, Warwick, and some of the other large cities in Rhode Island were not on that list? That’s because they are on the list of the most expensive cities for car insurance in Rhode Island.

| Most Expensive Cities in Rhode Island | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Providence | $6,571.07 | Travelers | $9,357.66 | Liberty Mutual | $8,976.30 | State Farm | $2,897.12 | USAA | $4,973.73 |

| North Providence | $6,341.33 | Travelers | $9,171.84 | Liberty Mutual | $7,555.06 | State Farm | $2,733.99 | USAA | $5,433.62 |

| Cranston | $6,261.91 | Travelers | $8,950.44 | Liberty Mutual | $7,665.33 | State Farm | $2,774.78 | USAA | $5,254.57 |

| Johnston | $6,101.39 | Travelers | $8,723.05 | Liberty Mutual | $7,555.06 | State Farm | $2,733.99 | Progressive | $5,271.32 |

| Central Falls | $5,975.22 | Travelers | $8,213.51 | Geico | $7,660.12 | State Farm | $2,733.99 | USAA | $5,065.26 |

| Pawtucket | $5,824.35 | Travelers | $8,639.72 | Geico | $6,878.37 | State Farm | $2,733.99 | USAA | $5,122.31 |

| East Providence | $5,580.28 | Travelers | $7,548.79 | Progressive | $7,082.60 | State Farm | $2,733.99 | USAA | $4,674.02 |

| Rumford | $5,580.24 | Travelers | $8,216.34 | Geico | $7,660.12 | State Farm | $2,733.99 | Nationwide | $4,342.35 |

| Riverside | $5,324.98 | Travelers | $8,183.44 | Liberty Mutual | $6,431.29 | State Farm | $2,733.99 | Nationwide | $4,342.35 |

| Warwick | $5,268.89 | Travelers | $7,297.82 | Liberty Mutual | $6,431.29 | State Farm | $2,733.99 | USAA | $4,454.52 |

It’s not unusual for large cities to have higher insurance rates.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the best Rhode Island car insurance companies?

Deciding which car insurance company in Rhode Island is the best one for you can be a difficult choice. A few insurance companies might offer a wider variety of options than their competition. Other companies may provide more robust coverage. Still, others might be the most affordable option. How do you decide which is right for you?

It can be useful to gather as much information as possible about your options when making a decision, so below are some of the biggest factors you may wish to consider before you make a purchase.

The Largest Companies’ Financial Rating

One of the ways you can determine the stability level of an insurance company is by its financial rating.

Companies such as A.M. Best rate each company based on whether they have the financial assets needed to pay out claims over the course of the year and publish their reports for everyone to see, making this an excellent way to find out a bit more about the companies you’re considering for your insurance needs.

This shouldn’t be your only determining factor, however. A company with excellent financial ratings doesn’t necessarily have the happiest customers.

It also doesn’t guarantee their rates are better or worse than any other company, so this is just one of many factors to consider when choosing an insurance company.

Companies with Best Ratings

Geico, State Farm, Travelers, and USAA are the companies with the highest A.M. Best ratings in Rhode Island, but all of the insurance companies included in the table below scored highly on the A.M. Best scale.

Companies with an A rating or above are typically financially stable, making them an excellent choice for anyone who may need to file a claim in the future.

| Company | AM Best Rating |

|---|---|

| Allstate F&C | A+ |

| Geico General | A++ |

| Liberty Mutual Fire Ins Co | A |

| Nationwide Mutual | A+ |

| Progressive Direct | A+ |

| State Farm Mutual Auto | A++ |

| Travelers Home & Marine Ins Co | A++ |

| USAA CIC | A++ |

According to J.D. Power, the companies with the highest customer satisfaction rating in the area are Amica, State Farm, and Geico. Safety Insurance and Metlife came in at the bottom of the list. USAA is only available to military members and their families, so they were not included in the rating system.

Companies with Most Complaints in Rhode Island

Consumers everywhere are encouraged to report complaints regarding their insurance companies to their state Attorney General’s office. But how do you know if your problem warrants filing an official claim?

The NAIC can help guide you through the process. They have apps available on Android and iPhone that can walk you through the steps to take after an accident, including reporting an issue to the state if necessary.

When in doubt, you can always contact the Attorney General’s office at 401-274-4400 and ask for clarification. You can also find the online form to file a complaint as well as additional contact information on the Attorney General’s website.

Here’s a look at. complaint ratios for the. biggest companies in the state.

| Company | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|

| Allstate F&C | 0.5 | 163 |

| Liberty Mutual Fire Ins Co | 5.95 | 222 |

| Nationwide Mutual | 0.28 | 25 |

| Progressive Direct | 0.75 | 120 |

| State Farm Mutual Auto | 0.44 | 1482 |

| Travelers Home & Marine Ins Co | 0.09 | 2 |

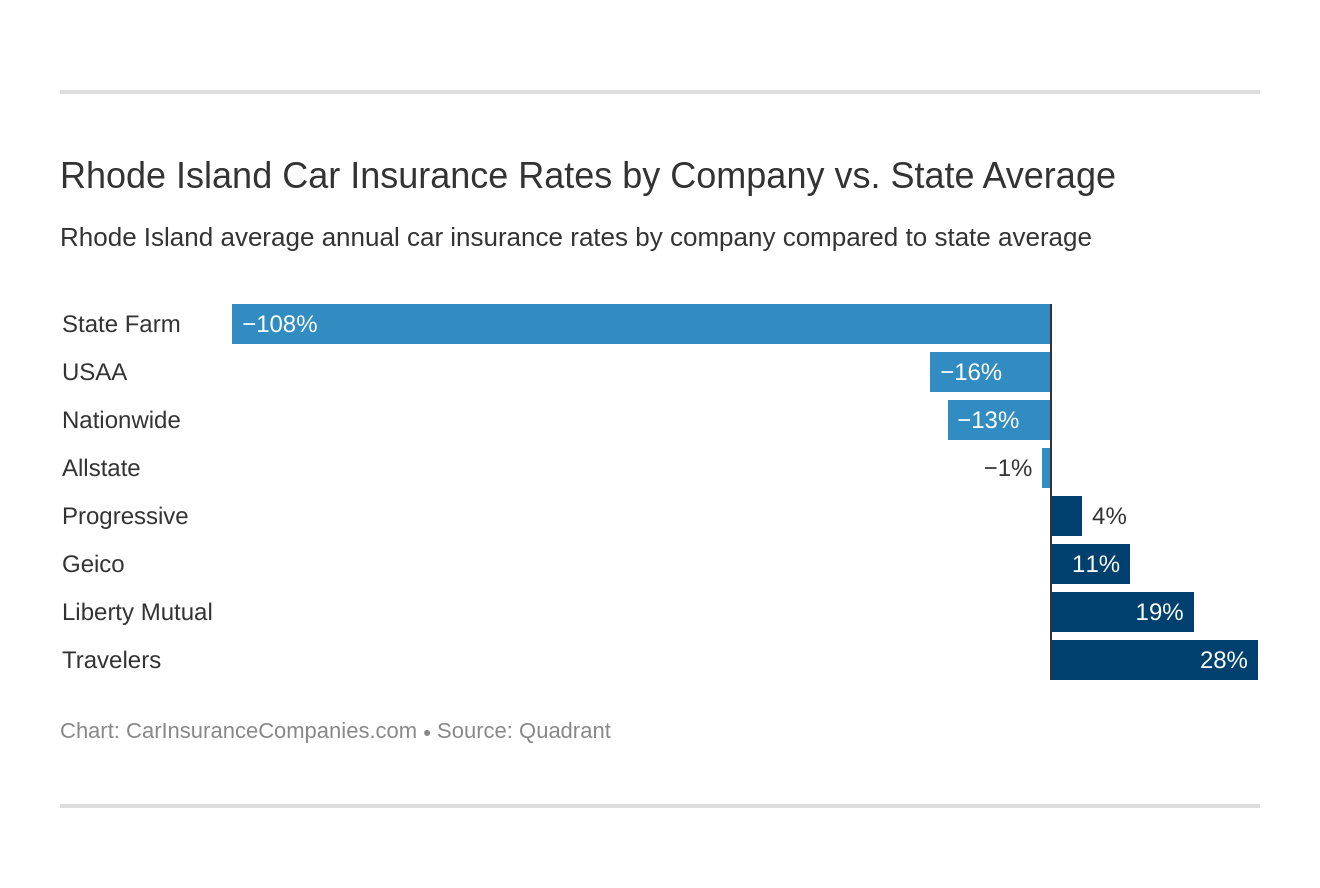

Cheapest Companies in Rhode Island

The chart below details some of the largest insurers in Rhode Island and their average annual rates.

| Company | Average Annual Rate | Compared to State Average | Percentage |

|---|---|---|---|

| Allstate F&C | $4,959.45 | -$43.91 | -0.89% |

| Geico General | $5,602.63 | $599.27 | 10.70% |

| Liberty Mutual Fire Ins Co | $6,184.12 | $1,180.76 | 19.09% |

| Nationwide Mutual | $4,409.63 | -$593.73 | -13.46% |

| Progressive Direct | $5,231.09 | $227.73 | 4.35% |

| State Farm Mutual Auto | $2,406.50 | -$2,596.85 | -107.91% |

| Travelers Home & Marine Ins Co | $6,909.45 | $1,906.09 | 27.59% |

| USAA CIC | $4,323.98 | -$679.38 | -15.71% |

While rates are important, they are only one of the many factors you should consider when choosing your plan.

Making sure a policy has all the benefits you need is just as important as the rate you’ll pay for it, so check each policy carefully and make sure you understand what is covered (and what isn’t covered) before you accept it.

Also, please note that not every policy is available to every customer. For example, USAA is only available to members of the U.S. military and their families, which means you might not be able to sign up through USAA, even though they usually have the lowest prices.

Commute Rates by Companies

How far you commute each day can have a noticeable impact on your insurance rates. Typically, insurance companies break up their commute rates into mileage categories, such as 10-mile commute/6,000 annual mileage or 25-mile commute/12,000 annual mileage.

The more time you spend driving each week, the more likely you are to be in an accident and have to file a claim. Because of this, you’ll probably pay a higher premium for your policy.

| Group | Commute And Annual Mileage | Annual Average |

|---|---|---|

| Travelers | 10 miles commute. 6000 annual mileage. | $6,909.45 |

| Travelers | 25 miles commute. 12000 annual mileage. | $6,909.45 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $6,384.99 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $5,983.25 |

| Geico | 25 miles commute. 12000 annual mileage. | $5,716.30 |

| Geico | 10 miles commute. 6000 annual mileage. | $5,488.96 |

| Progressive | 10 miles commute. 6000 annual mileage. | $5,231.09 |

| Progressive | 25 miles commute. 12000 annual mileage. | $5,231.09 |

| Allstate | 25 miles commute. 12000 annual mileage. | $4,994.34 |

| Allstate | 10 miles commute. 6000 annual mileage. | $4,924.56 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $4,409.63 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $4,409.63 |

| USAA | 25 miles commute. 12000 annual mileage. | $4,365.30 |

| USAA | 10 miles commute. 6000 annual mileage. | $4,282.66 |

| State Farm | 25 miles commute. 12000 annual mileage. | $2,479.54 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,333.47 |

Coverage Level Rates by Companies

Because there is such a wide variety of coverage options to choose from when selecting an insurance plan, your rates can vary wildly depending on what choices you make.

Your lifestyle choices also have a big impact on your comprehensive and collision insurance prices. Driving a 6-year-old Chevy sedan? Your comprehensive and collision coverage will probably be much more affordable than if you were driving a brand new Audi.

Take a look at the table below to see how your coverage choices can affect your rates at each company.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Travelers | Medium | $7,036.02 |

| Travelers | Low | $7,019.75 |

| Travelers | High | $6,672.57 |

| Liberty Mutual | High | $6,597.08 |

| Liberty Mutual | Medium | $6,145.16 |

| Geico | High | $5,889.27 |

| Liberty Mutual | Low | $5,810.12 |

| Geico | Medium | $5,589.68 |

| Progressive | High | $5,584.04 |

| Geico | Low | $5,328.94 |

| Allstate | High | $5,236.55 |

| Progressive | Medium | $5,196.08 |

| Allstate | Medium | $4,945.81 |

| Progressive | Low | $4,913.15 |

| Allstate | Low | $4,695.99 |

| Nationwide | Low | $4,545.71 |

| USAA | High | $4,520.27 |

| Nationwide | Medium | $4,438.92 |

| USAA | Medium | $4,327.44 |

| Nationwide | High | $4,244.26 |

| USAA | Low | $4,124.23 |

| State Farm | High | $2,539.55 |

| State Farm | Medium | $2,402.31 |

| State Farm | Low | $2,277.64 |

Credit History Rates by Companies

Though it isn’t something that would occur to most people when choosing an insurance policy, one of the factors in your insurance rate is your credit history.

| Group | Credit History | Annual Average |

|---|---|---|

| Liberty Mutual | Poor | $8,135.91 |

| Travelers | Poor | $7,249.34 |

| Travelers | Fair | $6,752.96 |

| Travelers | Good | $6,726.05 |

| USAA | Poor | $6,414.26 |

| Geico | Poor | $6,278.27 |

| Allstate | Poor | $6,222.18 |

| Progressive | Poor | $5,858.59 |

| Geico | Fair | $5,446.57 |

| Liberty Mutual | Fair | $5,399.61 |

| Nationwide | Poor | $5,115.80 |

| Progressive | Fair | $5,095.01 |

| Geico | Good | $5,083.04 |

| Liberty Mutual | Good | $5,016.84 |

| Allstate | Fair | $4,774.97 |

| Progressive | Good | $4,739.68 |

| Nationwide | Fair | $4,212.78 |

| Nationwide | Good | $3,900.31 |

| Allstate | Good | $3,881.20 |

| USAA | Fair | $3,646.05 |

| State Farm | Poor | $3,232.92 |

| USAA | Good | $2,911.61 |

| State Farm | Fair | $2,184.74 |

| State Farm | Good | $1,801.84 |

According to the statistics, people with lower credit scores are more likely to file a claim. This means a low credit score can raise your rates, or possibly even be reason enough to deny you coverage, depending on the circumstances.

If your credit rating is low it doesn’t mean you have no options. Comparison shopping between companies can help you find the lowest available rates, potentially saving yourself hundreds of dollars a year. You can also work to improve your credit rating to help lower your insurance costs over time.

Driving Record Rates by Companies

Your driving record can have a significant impact on your insurance premiums, so maintaining a safe driving record is an excellent way to help keep your insurance cost low.

A traffic ticket may only cost you a small amount initially, but the incident will be reported to your insurance company and will most likely cause a rate increase, so keep that in mind when you are rushing through a school zone because you’re late to work.

Speeding tickets and other minor offenses may not seem like a big deal at the moment, but they will show up on your insurance premiums in the future. Obeying traffic laws and driving carefully is an effective way to keep your insurance costs as low as possible.

| Group | Driving Record | Annual Average |

|---|---|---|

| Geico | With 1 DUI | $9,473.52 |

| Travelers | With 1 DUI | $7,989.23 |

| Travelers | With 1 speeding violation | $7,053.75 |

| Progressive | With 1 accident | $6,772.26 |

| Liberty Mutual | With 1 DUI | $6,658.34 |

| Liberty Mutual | With 1 accident | $6,618.39 |

| USAA | With 1 DUI | $6,559.16 |

| Travelers | With 1 accident | $6,403.21 |

| Travelers | Clean record | $6,191.60 |

| Allstate | With 1 DUI | $5,752.11 |

| Liberty Mutual | Clean record | $5,729.87 |

| Liberty Mutual | With 1 speeding violation | $5,729.87 |

| Progressive | With 1 speeding violation | $5,089.68 |

| Allstate | With 1 accident | $5,049.86 |

| Nationwide | With 1 DUI | $4,855.18 |

| Progressive | With 1 DUI | $4,794.93 |

| Allstate | With 1 speeding violation | $4,782.41 |

| Geico | With 1 accident | $4,766.89 |

| Geico | With 1 speeding violation | $4,548.61 |

| Nationwide | With 1 accident | $4,480.98 |

| Progressive | Clean record | $4,267.49 |

| USAA | With 1 accident | $4,263.97 |

| Allstate | Clean record | $4,253.42 |

| Nationwide | With 1 speeding violation | $4,225.48 |

| Nationwide | Clean record | $4,076.88 |

| Geico | Clean record | $3,621.50 |

| USAA | With 1 speeding violation | $3,333.54 |

| USAA | Clean record | $3,139.23 |

| State Farm | With 1 accident | $2,930.32 |

| State Farm | Clean record | $2,231.90 |

| State Farm | With 1 DUI | $2,231.90 |

| State Farm | With 1 speeding violation | $2,231.90 |

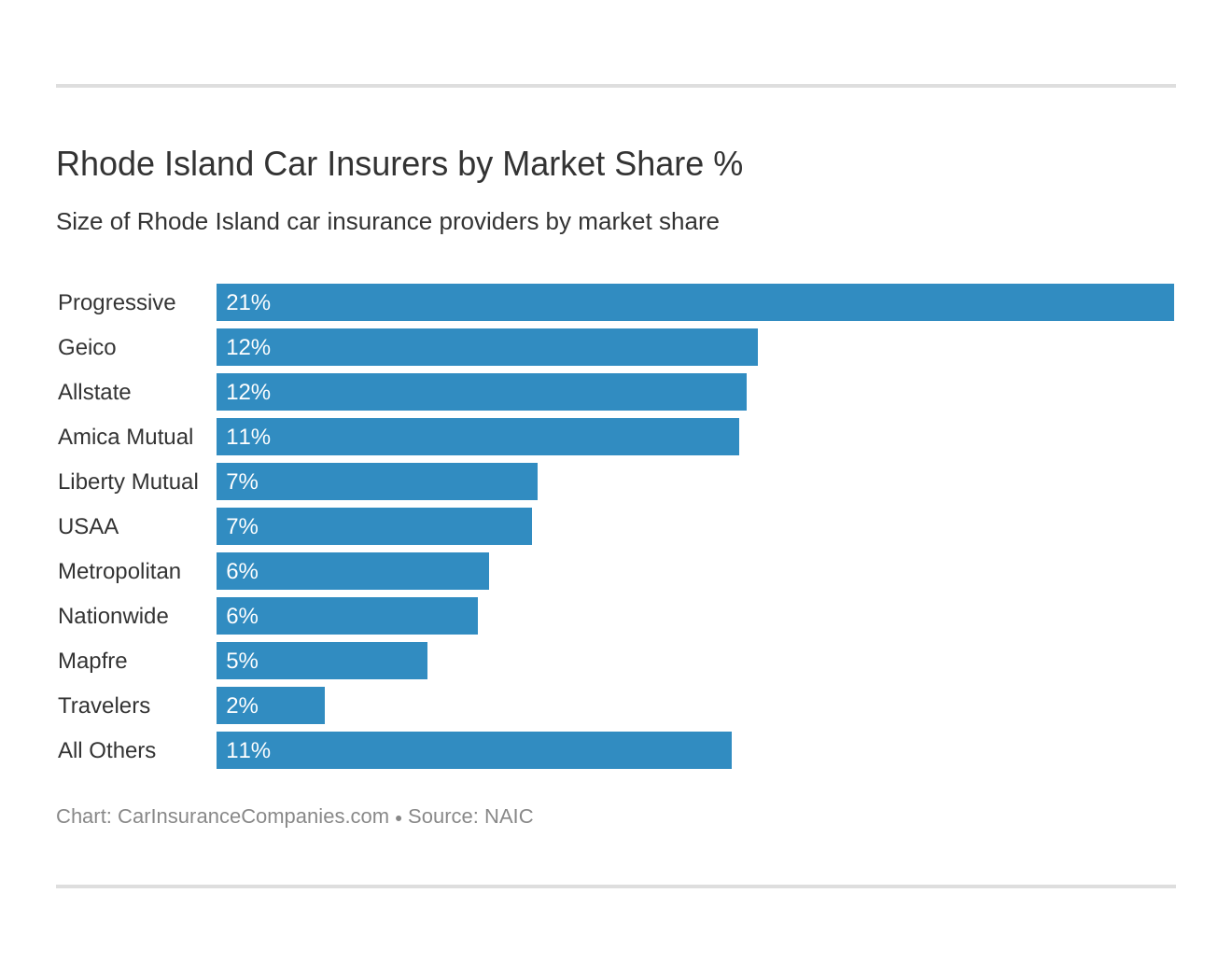

Largest Car Insurance Companies in Rhode Island

While size isn’t always important, choosing a larger company with a national presence and multiple offices in Rhode Island can be a good way to be confident that you’ll be able to find someone to help you when you file a claim.

Choosing a larger company makes it easier to find recommendations from other customers, so you may find that the larger a company’s customer base, the more people you know who can tell you what it’s like to work with them.

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Progressive Group | $193,720 | 65.71% | 21.01% |

| Geico | $109,611 | 79.71% | 11.89% |

| Allstate Insurance Group | $107,256 | 62.08% | 11.63% |

| Amica Mutual Group | $105,708 | 63.36% | 11.47% |

| Liberty Mutual Group | $65,124 | 65.17% | 7.06% |

| USAA Group | $63,851 | 78.38% | 6.93% |

| Metropolitan Group | $55,075 | 57.15% | 5.97% |

| Nationwide Corp Group | $52,881 | 63.34% | 5.74% |

| Mapfre Insurance Group | $42,523 | 63.64% | 4.61% |

| Travelers Group | $21,853 | 54.69% | 2.37% |

| **State Total** | $921,985 | 67.20% | 100.00% |

Number of Insurers in Rhode Island

Rhode Island has 22 domestic insurance companies, meaning these companies not only do business in Rhode Island but that they are also headquartered in the state. There are 727 foreign insurance companies doing business in Rhode Island. This doesn’t mean they are headquartered in another country. It simply means that they are headquartered in another state.

| State | Domestic Insurers | Foreign Insurers |

|---|---|---|

| Rhode Island | 22 | 727 |

| Connecticut | 67 | 729 |

| Massachusetts | 48 | 697 |

These numbers don’t include alternative insurance options, such as self-insurance or people who are insured through a charter program.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Rhode Island Laws

Like every other state, Rhode Island has its own insurance and driving laws, rules, and regulations. Knowing the laws that are specific to your state is an important part of driving safety.

What is perfectly normal in one state might be illegal in another, while something against the law in Rhode Island could be completely legal somewhere else, so don’t assume that just because you know the law in Texas you won’t break the law in Rhode Island.

Car Insurance Laws

Car insurance laws are updated all the time, from simple things like adjusting the fine for speeding to complex changes such as writing laws to address new technologies like self-driving cars. It is vital to keep yourself up-to-date on the changes to traffic and insurance laws so you don’t find yourself in violation of the law.

For example, coasting downhill in neutral while driving in Rhode Island is illegal. The Rhode Island DMV website is a great resource to help you stay abreast of the driving laws in the state.

How Rhode Island Laws for Insurance are Determined

In Rhode Island, laws are passed by bicameral legislation. Once the law is passed by both the House and the Senate, it’s passed onto the governor for approval.

If the governor hasn’t approved a law before the General Assembly has adjourned, the law is assumed to have passed unless the governor sends notice of denial in writing to the Secretary of State.

Windshield Coverage

In Rhode Island, the law allows insurance companies to require aftermarket glass for a windshield replacement, but it must be at least equal in kind and quality to what you had before the damage was done.

High-Risk Insurance

If you have too many tickets, accidents, or DUI convictions, eventually insurance companies may stop considering you insurable. But Rhode Island requires all drivers to be insured, so how can you obey the law?

If you need a policy but can’t find a company that will take your business, you can reach out to the Rhode Island Automobile Insurance Plan (RI AIP) at (401) 462-9520 for assistance. They will assign you to an insurance company that is required to provide you a policy, though there is no guarantee what the rates will be for the plan.

As of July 2018, the state no longer accepts or requires SR-22 forms as proof of financial responsibility. Unless you’re a minor or they are required for business purposes, the SR-22 form is no longer necessary.

Low-Cost Insurance

At this time there are no discounts available in Rhode Island specifically for people on Medicaid, Medicare, or other government assistance programs, so, unfortunately, everyone must pay the full price for their auto insurance. There are other ways to save money on your insurance, however.

For example, many discounts are considered standard with almost every insurance company.

There are basic discounts, like discounts for a safe driving record or discounts for people who have multiple lines of insurance through the company, but that’s just the beginning.

Many insurance companies also give occupational discounts. Nurses, teachers, and active military are just a few of the groups who may be eligible for discounts through their insurance company. Some insurers even give discounts to students who meet a certain level grade point average.

Some companies also offer discounts through certain employer groups, so check with your human resources department to see if they offer car insurance discounts as one of your employee benefits.

Automobile Insurance Fraud in Rhode Island

Insurance fraud isn’t just filing a fake claim. Filing incorrect paperwork, agents pocketing your payments, or exaggerating the damage in a claim are all various forms of insurance fraud.

Knowingly damaging your vehicle to file a claim is also insurance fraud, which means if you’re caught purposely setting your car on fire or arranging to have it stolen so you can file a claim, you’ll face severe penalties.

Insurance fraud isn’t limited to filing an illegitimate claim. Including prior damage in a current claim, acting as a witness for someone else’s false claim and exaggerating injuries suffered in an accident are all forms of insurance fraud.

Insurance companies take committing fraud seriously, so be sure to follow the law when it comes to buying insurance and filing claims. At the same time, if you have reason to believe your insurance company is fraudulently denying your claim, be sure to reach out to the Rhode Island Department of Insurance at (401) 462-9520 for assistance

Statute of Limitations

The law in Rhode Island states that you have three years to file a lawsuit over bodily injury and 10 years to file a lawsuit over property damage in a car accident. Otherwise, you are beyond the statute of limitations.

Almost any issue that can be taken to court will run into a statute of limitations, so if you believe you’ve been in an accident or filed a claim that needs to go through the court system, make sure you file right away to avoid running into the statute of limitations and having your case denied.

State Specific Laws

While many laws are the same from state to state or across the country, every state also has its own unique laws. Rhode Island is no exception.

For example, in Rhode Island, having more than three people in the front seat while driving is against the law. So is having so many people in the back seat that it interferes with the driver’s ability to see the road from the front, back, or side.

Make sure you know the local laws to avoid a ticket or accident.

Vehicle Licensing Laws

Every state has a similar set of basic requirements for getting your driver’s license. There are differences in the process from state to state and even differences in the process from person to person within each state. New drivers, experienced drivers who are new state residents, and senior citizens may each have different requirements when getting or renewing a license.

If you’re getting your license for the first time, or even just renewing or updating your license, you’ll need to make sure you follow all of Rhode Island’s rules and regulations.

REAL ID

The REAL ID Act is a federal law that is being implemented as an anti-terrorism measure. REAL IDs require more documentation as proof of your identification before they can be issued and are more secure, increasing the likelihood that someone’s ID matches their identity. Your ID will need to be compliant by October 2020, so don’t wait to update your ID.

Rhode Island is compliant with the REAL ID Act, which means that your Rhode Island REAL ID allows you to board commercial airplanes for interstate travel and enter federal buildings and facilities. If you want to verify that your license is REAL ID compliant, you can check the top right corner for a gold star.

Penalties for Driving Without Insurance

There are consequences for driving without insurance in Rhode Island, such as:

- First offense – Your license/registration will be suspended for three months and you may be fined between $100 and $500.

- Second offense – Your license/registration will be suspended for six months and you may be fined $500.

- Third offense – Your license/registration will be suspended for one year and you may be fined $1,000.

You’ll also face a reinstatement fee of $30–$50 to get your license reinstated after your suspension.

Teen Driver Laws

Rhode Island has graduated laws for teen drivers, which means teens begin driving with a learner’s permit and work their way up to a full license after many hours of practice.

In Rhode Island, a teenager may get their learner’s permit at 16. Then they are required to log at least 50 hours of driving, at least 10 of which must be at night. There are other rules and restrictions listed in the chart below:

| Minimum entry age | Mandatory holding period | Minimum amount of supervised driving | Minimum age | Unsupervised driving prohibited | Restriction on passengers | Nighttime restrictions | Passenger restrictions |

|---|---|---|---|---|---|---|---|

| 16 | 6 months | 50 hours, 10 of which must be at night | 16, 6 months | 1 a.m.-5 a.m. | no more than 1 passenger younger than 21 | 12 months or age 18, whichever occurs first (min. age: 17, 6 mos.) | 12 months or age 18, whichever occurs first (min. age: 17, 6 mos.) |

Older Driver License Renewal Procedures

In Rhode Island, license renewal is required every five years for the general population, with seniors over 75 required to renew their license every two years. At the renewal before your 75th birthday, your expiration date will be adjusted so that it falls on that date, preventing a 74-year-old from getting a license that doesn’t need to be renewed until they turn 79.

Drivers of every age are required to pass a vision exam for their driver’s license renewal. Drivers in Rhode Island are allowed to renew their license online at every other renewal, alternately going into their local DMV (or AAA location, if they are a member.)

New Residents

New residents in Rhode Island with an out-of-state driver’s license must get an in-state license from the DMV Cranston headquarters. To get your new license you must:

- Surrender your out-of-state license

- Pass a vision screening test

- Complete and sign the license application

- Show proof of residency

- Pay any required fees

License renewal procedures

To renew your license in Rhode Island, you’ll need to complete the required form (either online or a printed copy, depending on whether you are renewing online or in-person) and your current license. The cost to renew your license is somewhere between $8 and $45, depending on your situation.

For people under the age of 75 licenses are renewed every five years. If you applied for your renewal and you haven’t received your new license within 45 days, you can contact the Cranston DMV at (401) 462-5862 to see if it has been returned to them.

Negligent Operator Treatment System (NOTS)

Most states use a system of points to monitor a person’s driving record, but Rhode Island does not use such a system. Rhode Island uses fines, suspensions, and other punishments to take the place of the point system.

This system results in much harsher punishments for larger offenses, such as DUIs or vehicular manslaughter, and all offenses are still reported to insurance companies so they will still affect your rates.

Rules of the Road

When it comes to the laws regarding driving and insurance, the majority of them are determined by the state. Everything from laws regarding seat belt requirements to required minimum insurance levels is specific to Rhode Island.

This means that you can’t assume that just because you know the laws in one state that you’ll be following the law in another. To keep yourself safe and prevent traffic tickets, make sure you follow all the traffic laws in Rhode Island.

Fault vs. No-Fault

Rhode Island is an at-fault state. This means the driver who is responsible for an accident is required to pay all the costs associated with the accident.

If you’re hit by another driver, you can file a claim with their insurance company or take them to court to cover any damages you’ve suffered.

However, this also means that if you hit someone else, they have all the same rights, so make sure you have sufficient liability coverage in place.

Seat belt and car seat laws

The law in Rhode Island states that the driver of a motor vehicle and all passengers over the age of eight must be restrained by safety belts whenever the vehicle is in motion.

Children under the age of 8 who are less than 57 inches and weigh less than 80 pounds must be in the rear seat of the vehicle and in the appropriate car seat for their size. Children under 2 years old and 30 pounds must be transported in a rear-facing car seat.

Keep Right and Move Over Laws

According to the law in Rhode Island, drivers are required to keep to the right if they are driving slower than the traffic around them. Drivers are not allowed to pass on the right on a two-way road.

If you see an approaching emergency vehicle you are required to yield the right-of-way. This includes all vehicles with flashing red, blue, or amber lights.

If you see an emergency vehicle stopped to help someone on the road or highway, you are required by law to put a full car lane between you and the emergency vehicle. If there isn’t space available to yield a full lane, you must slow down for the safety of the emergency personnel and follow instructions given by a peace officer if one is on the scene.

Speed Limits

Rhode Island speed limits vary from area to area, just like other states. School zones have different speed limits than highways for a very good reason — speed limits are there to help keep people safe.

| State | Rural interstates (mph) | Urban interstates (mph) | Other limited access roads (mph) | Other roads (mph) |

|---|---|---|---|---|

| Rhode Island | 65 | 55 | 55 | 55 |

| Connecticut | 65 | 55 | 65 | 55 |

| Massachusetts | 65 | 65 | 65 | 55 |

There are several sections of I-95 in Rhode Island where the speed limit declines rapidly due to extreme curves in the road. These areas are marked with yellow arrow signs in addition to traditional speed limit signs to warn drivers of the upcoming speed reduction.

Ridesharing

In 2016, Rhode Island passed a law legalizing and regulating ridesharing companies. The law puts all ridesharing companies under the oversight of the Public Utilities Commission, requires background checks and insurance minimums, and establishes permit requirements.

Several insurance companies are creating policies specifically for rideshare drivers, so it might be worth looking into your options if you’re employed by a rideshare company.

Automation on the Road

There are no laws on the books in Rhode Island regarding automated vehicles at this time. You can keep up with future creation of or changes in the laws regarding vehicle automation on the Rhode Island DMV website.

Safety Laws

Rhode Island has laws in place to keep people safe while driving, biking, or walking. The state creates laws to prevent dangerous behaviors and keep people safe, whether it is to prevent texting while driving or driving under the influence.

Just like everything else, laws change over time, so just because you remember something being legal before doesn’t mean it is legal now. On the other hand, things that were illegal just a few years ago might be legal today, so make sure to do your research when it comes to driving safety laws.

DWI Laws

There were 20 alcohol-related traffic fatalities in Rhode Island in 2018. The state is serious about protecting drivers on the road, so they have stiff penalties for driving under the influence (as evidenced by the chart above.)

| BAC Limit | High BAC Limit | Criminal Status by Offense | Formal Name for Offense | Look Back Period/Washout Period | 1st Offense - ALS or Revocation | 1st Offense - Imprisonment | 1st Offense - Fine | 1st Offense - Other | 2nd Offense - DL Revocation | 2nd Offense - Imprisonment | 2nd Offense - Fine | 2nd Offense - Other | 3rd Offense - DL Revocation | 3rd Offense - Imprisonment | 3rd Offense - Fine | 3rd Offense - Other |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.08 | 0.15 | 1st-2nd non-injury misdemeanors, 3rd+ non-injury felony. DUI w/serious bodily injury is felony. | Driving While Intoxicated (DWI) | 5 years | 60 days - 18 months | no minimum, but up to 1 year or 10-60 hours community service | $100-$500 +$500 to hwy assessment fund | possible attendance to treatment program; SR-22 insurance | 1-2 years | 10 days - 1 year | $400 | mandatory alcohol treatment program, IID for 1-2 years | 2-3 years | 1-5 years | $400-$5000 +$500 to hwy assessment fund | vehicle may be seized or forfeited, mandatory treatment program, IID for 2 years |

In Rhode Island you can be charged with DWI if you:

- Drive with a blood alcohol content (BAC) level of .08 or higher (known as a per se DUI)

- Drive a commercial vehicle with a BAC of .04 or higher

- Drive under the influence of any drug or controlled substance

- Drive with any traceable amount of a scheduled substance/illegal drug in your blood

Rhode Island doesn’t have a point system, so they allow individual judges to determine the specific penalties for a DWI conviction. However, the state does have a special, harsher punishment for drivers with a BAC of .15 or greater, including up to a year in jail and an 18-month license suspension for your first offense.

These things are especially important to keep in mind if you have a medical condition that affects the way your body processes alcohol. For example, many people who have had bariatric surgery find that they are especially sensitive to alcohol, causing them to have an elevated BAC after only one or two drinks.

Marijuana-Impaired Driving Laws

Rhode Island is a very progressive state when it comes to marijuana laws, with both recreational and medical marijuana decriminalized and approved for use in the state.

Despite the state’s acceptance of marijuana use, driving while under the influence of marijuana is still a punishable offense. Possession while driving will cost you a six-month suspension of your license, while driving with detectable levels of the drug in your body subjects you to the state’s DWI laws.

Distracted Driving Laws

Texting, eating, using social media, and talking on the phone are just a few of the ways drivers are distracted behind the wheel.

| State | Hand-held ban | Young drivers all cellphone ban | Texting ban | Enforcement |

|---|---|---|---|---|

| RI | All drivers | Drivers younger than 18 | All drivers | Primary |

| MA | No | Drivers younger than 18 | All drivers | Primary |

| CT | All drivers | Drivers younger than 18 | All drivers | Primary |

According to the CDC, there are three types of distracted driving:

- Visual – taking your eyes off the road

- Manual – removing your hands from the wheel

- Cognitive – taking your mind off of driving

When it comes to distracted driving, texting is the worst because it combines all three forms of distraction. Because of this, Rhode Island is just one of many states with strict laws about phone use while driving. Keeping your phone in your bag or glove box while driving could save your life.

Driving Safely in Rhode Island

Driving is one of the most dangerous things the average person does on a daily basis. Nationally, there are more than 30,000 car accidents a year, causing almost 25,000 fatalities and more than 2 million injuries from coast to coast.

You need to keep yourself and your loved ones safe, and one of the best ways is to be aware of the dangers of driving. Knowing the most dangerous roads, commuting times, and weather conditions can help you prepare for and possibly prevent an accident or even an untimely death.

Vehicle Theft in Rhode Island

Let’s take a look at the statistics on vehicle theft in Rhode Island. Below is a chart of the most commonly stolen vehicles.

| Rank | Make/Model | Model Year Most Commonly Stolen | Thefts |

|---|---|---|---|

| 1 | Honda Accord | 1997 | 101 |

| 2 | Honda Civic | 1998 | 95 |

| 3 | Toyota Camry | 2014 | 69 |

| 4 | Nissan Maxima | 2000 | 45 |

| 5 | Toyota Corolla | 2014 | 40 |

| 6 | Nissan Altima | 2013 | 38 |

| 7 | Ford Pickup (Full Size) | 2003 | 36 |

| 8 | Jeep Cherokee/Grand Cherokee | 1999 | 32 |

| 9 | Honda CR-V | 1999 | 27 |

| 10 | Toyota Avalon | 2000 | 18 |

If your vehicle were stolen it would be covered under the comprehensive portion of your insurance policy, but the possibility of replacing the car doesn’t stop you from feeling scared and violated if someone steals your car.

It isn’t just people with new or expensive cars that need to worry about theft. The most commonly stolen vehicles are often older family sedans or minivans.

While comprehensive coverage is often rejected in an attempt to keep your insurance costs low, keep in mind that a liability-only policy won’t protect you in case of car theft. If your car is one of the ones on the table of most commonly stolen vehicles above, you may want to think carefully before choosing not to buy comprehensive coverage.

Below is a chart of vehicle thefts by city in Rhode Island:

| State | Population | Property crime | Burglary | Larceny- theft | Motor vehicle theft |

|---|---|---|---|---|---|

| Barrington | 16,307 | 127 | 26 | 101 | 0 |

| Bristol | 22,255 | 97 | 8 | 83 | 6 |

| Burrillville | 16,441 | 93 | 18 | 73 | 2 |

| Central Falls | 19,389 | 391 | 58 | 271 | 62 |

| Charlestown | 7,764 | 62 | 18 | 40 | 4 |

| Coventry | 35,083 | 509 | 84 | 405 | 20 |

| Cranston | 81,337 | 1,248 | 214 | 943 | 91 |

| Cumberland | 34,973 | 269 | 43 | 205 | 21 |

| East Greenwich | 13,139 | 136 | 21 | 113 | 2 |

| East Providence | 47,502 | 578 | 67 | 465 | 46 |

| Foster | 4,736 | 32 | 13 | 18 | 1 |

| Glocester | 10,108 | 33 | 6 | 20 | 7 |

| Hopkinton | 8,104 | 101 | 42 | 52 | 7 |

| Jamestown | 5,483 | 25 | 5 | 19 | 1 |

| Johnston | 29,375 | 361 | 73 | 252 | 36 |

| Lincoln | 21,863 | 406 | 44 | 337 | 25 |

| Little Compton | 3,498 | 35 | 6 | 29 | 0 |

| Middletown | 15,993 | 178 | 22 | 142 | 14 |

| Narragansett | 15,556 | 108 | 20 | 84 | 4 |

| Newport | 24,812 | 785 | 90 | 668 | 27 |

| New Shoreham | 1,044 | 18 | 4 | 13 | 1 |

| North Kingstown | 26,069 | 273 | 37 | 228 | 8 |

| North Providence | 32,641 | 299 | 68 | 198 | 33 |

| North Smithfield | 12,447 | 204 | 16 | 177 | 11 |

| Pawtucket | 71,648 | 1,788 | 373 | 1,224 | 191 |

| Portsmouth | 17,381 | 102 | 17 | 79 | 6 |

| Providence | 179,854 | 5,925 | 1,013 | 4,332 | 580 |

| Richmond | 7,598 | 50 | 11 | 39 | 0 |

| Scituate | 10,631 | 43 | 13 | 27 | 3 |

| Smithfield | 21,884 | 238 | 23 | 210 | 5 |

| South Kingstown | 30,823 | 197 | 46 | 146 | 5 |

| Tiverton | 15,767 | 189 | 35 | 137 | 17 |

| Warren | 10,498 | 137 | 29 | 101 | 7 |

| Warwick | 81,617 | 1,383 | 173 | 1,149 | 61 |

| Westerly | 22,629 | 384 | 79 | 292 | 13 |

| West Greenwich | 6,167 | 64 | 16 | 46 | 2 |

| West Warwick | 28,790 | 319 | 94 | 197 | 28 |

| Woonsocket | 41,543 | 947 | 262 | 607 | 78 |

Road Fatalities in Rhode Island

According to the NHTSA, there were 59 traffic fatalities in Rhode Island in 2018. Of those, 20 were alcohol-related fatalities and 27 were speeding-related fatalities.

It isn’t just speeding and drinking that causes traffic accidents, however. Whether you were surprised by a coyote crossing the highway or arguing with your spouse on the phone, a traffic accident can cause serious damage to you and your vehicle.

Most fatal highway in Rhode Island

I-95 connects Massachusetts to Connecticut and passes through Rhode Island’s capital city of Providence. I-95 is also the biggest highway on the East coast, shuttling traffic from Maine to Florida.

It isn’t surprising, then, that I-95 is the most fatal highway in Rhode Island, with 39 fatal accidents in the last 10 years.

Fatal Crashes by Weather Condition and Light Condition

As the chart below shows, weather and light conditions can have a significant impact on the number of accidents in a given place.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 29 | 24 | 13 | 2 | 1 | 69 |

| Rain | 2 | 1 | 1 | 1 | 0 | 5 |

| Snow/Sleet | 0 | 1 | 0 | 0 | 0 | 1 |

| Other | 1 | 0 | 0 | 0 | 0 | 1 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTAL | 32 | 26 | 14 | 3 | 1 | 76 |

Slick road surfaces or dark, poorly lit roads can increase the odds that you’ll be in an accident, so watching for those conditions can help keep you safe.

Weather and light conditions can even increase the severity of an accident, turning what would otherwise be a minor incident into a situation where injuries or even fatalities occur.

Drive cautiously when traveling through the dark or in inclement weather. Use your headlights and windshield wipers when necessary, drive slowly, and leave yourself plenty of space between yourself and the car in front of you to make sure you aren’t put in an unnecessarily dangerous situation.

Fatalities (All Crashes) by County

Below you will find data on fatal crashes in each of Rhode Island’s counties.

| Fatalities by County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Bristol | 2 | 1 | 1 | 1 | 2 |

| Kent | 9 | 7 | 9 | 17 | 12 |

| Newport | 5 | 1 | 2 | 3 | 4 |

| Providence | 29 | 26 | 28 | 49 | 34 |

| Washington | 6 | 10 | 11 | 14 | 6 |

Unsurprisingly, Providence County has the highest number of fatalities in the state. Not only does Providence County share a border with Massachusetts, but it is where the largest city in the state is located, meaning there are significantly more people traveling through Providence County than the rest of the state.

Traffic Fatalities

While both urban and rural fatalities decreased for several years, 2016–2018 saw rural fatalities increase back to their 2009 levels.

| RI Traffic Fatalities (Rural vs Urban) | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Total | 83 | 67 | 66 | 64 | 65 | 51 | 45 | 51 | 84 | 59 |

| Rural | 19 | 15 | 7 | 10 | 5 | 6 | 7 | 10 | 19 | 15 |

| Urban | 64 | 52 | 59 | 54 | 60 | 45 | 38 | 41 | 65 | 43 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

Fatalities by Person Type

The numbers are stable across all categories except for 2017, where there was a large spike in both passenger car and pedestrian fatalities.

| Fatalities by Person Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Passenger Car | 17 | 18 | 19 | 35 | 18 |

| Light Truck - Pickup | 3 | 3 | 4 | 4 | 4 |

| Light Truck - Utility | 3 | 5 | 6 | 6 | 8 |

| Light Truck - Van | 1 | 1 | 0 | 4 | 0 |

| Large Truck | 1 | 1 | 1 | 1 | 0 |

| Other/Unknown Occupants | 1 | 0 | 0 | 0 | 2 |

| Total Occupants | 26 | 28 | 31 | 50 | 32 |

| Light Truck - Other | 0 | 0 | 1 | 0 | 0 |

| Total Motorcyclists | 10 | 9 | 4 | 11 | 18 |

| Pedestrian | 14 | 8 | 14 | 21 | 7 |

| Other/Unknown Nonoccupants | 1 | 0 | 0 | 0 | 1 |

| Total Nonoccupants | 15 | 8 | 16 | 23 | 9 |

| Bicyclist and Other Cyclist | 0 | 0 | 2 | 2 | 1 |

| Total | 51 | 45 | 51 | 84 | 59 |

Fatalities by Crash Type

The number of fatal accidents involving a single vehicle has increased significantly since 2014, as well as the number of fatal accidents involving a roadway departure.

| Crash Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Total Fatalities | 51 | 45 | 51 | 84 | 59 |

| Single Vehicle | 39 | 27 | 36 | 58 | 37 |

| Involving a Large Truck | 2 | 1 | 2 | 8 | 2 |

| Involving Speeding | 13 | 20 | 23 | 41 | 27 |

| Involving a Rollover | 7 | 12 | 11 | 11 | 10 |

| Involving a Roadway Departure | 24 | 23 | 23 | 48 | 33 |

| Involving an Intersection | 10 | 7 | 8 | 13 | 12 |

Five-Year Trend For The Top Five Counties

2017 saw a notable increase in traffic fatalities in three of the five counties in Rhode Island.

| Fatality Trends by County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Providence County | 29 | 26 | 28 | 49 | 34 |

| Kent County | 9 | 7 | 9 | 17 | 12 |

| Washington County | 6 | 10 | 11 | 14 | 6 |

| Newport County | 5 | 1 | 2 | 3 | 4 |

| Bristol County | 2 | 1 | 1 | 1 | 2 |

| Top Ten Counties | 51 | 45 | 51 | 84 | 58 |

| All Counties | 51 | 45 | 51 | 84 | 58 |

Fatalities Involving Speeding by County

Providence County has seen the largest increase in speeding-related fatalities since 2014.

| Speeding Fatalities by County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Bristol | 1 | 0 | 0 | 1 | 1 |

| Kent | 2 | 4 | 5 | 6 | 5 |

| Newport | 0 | 1 | 1 | 2 | 0 |

| Providence | 7 | 10 | 12 | 21 | 16 |

| Washington | 3 | 5 | 5 | 11 | 5 |