New Jersey Car Insurance (Coverage, Companies, & More)

The average New Jersey car insurance rates cost $113 per month, but you can find ways to lower your New Jersey car insurance costs in this complete guide. Since New Jersey is one of the states with the longest commute times, you can reduce your rates by taking public transportation or carpooling. Find even cheaper coverage by comparing New Jersey car insurance quotes online with our free tool below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 24, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 24, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| New Jersey Summary | New Jersey Stats |

|---|---|

| Miles of roadway | 39,000 |

| Vehicles registered | 2.8 Million |

| Population | 8.92 Million |

| Most popular vehicle | Honda CR-V |

| Uninsured /Underinsured | 14.90%, Rank 14 |

| Speeding fatalities | 114 |

| DUI fatalities | 125 |

| Average annual premiums | Liability: $866 Collision: $365 Comprehensive: $123 |

| Cheapest providers | Geico and Progressive |

Many know New Jersey as “The Garden State.” It got its nickname from Abraham Browning. The nickname was first mentioned in a two-volume book entitled Jersey Waggon Jaunts.

By 1954, the state legislature passed a bill where The Garden State would appear on New Jersey license plates. There was a debate about the name when Governor Robert Meyner argued about the nickname the same year. Governor Meyner vetoed the bill but was later overridden, and the slogan appeared on the license plate anyway.

Speaking of law and license plates, what are the laws of New Jersey as it relates to vehicles? Is it a state where motor vehicle laws are more lax or strict? Like many of our guides, we’ll explore New Jersey’s car insurance law, the average annual rate for car insurance, and other factors that relate to motor vehicle law in the state.

If you want to take a look at car insurance quotes right away, enter your ZIP code in the Free Car Insurance Comparison box above. For an extensive look at New Jersey car insurance law, vehicle law, and average annual rates, continue reading.

New Jersey Car Insurance Coverage and Rates

As you shop for car insurance, you’ll become familiar with coverage options offered by different insurance companies. Some coverages are more expensive than others due to what they cover and the company that’s offering them. Our guides provide a sneak peek into what you can pay for car insurance per year. For your convenience, we’ll provide average annual rates based on factors that determine car insurance.

What is New Jersey’s car culture?

New Jersey’s car culture is saturated with complex roadways and a high volume of commuters throughout the state. The Hartford reported that New Jersey has over 600 jughandles.

Jughandles are a type of intersection where a driver must turn right in order to turn left.

What does that look like? Check out this short video of what a jughandle looks like and how it works. It can be a confusing concept, so it may take a few trips for a driver to grasp the jughandle intersection.

New Jersey is one of the states where the commute time to work can take longer than an hour. Therefore, commuters often take public transportation to get to their destinations.

How much coverage is required for New Jersey minimum coverage?

All motorists require at least minimum insurance coverage when they buy a motor vehicle. Minimum coverage is liability car insurance coverage. With liability coverage, there is a coverage limit that lists what a car insurance company will cover in case you’re in an accident. These coverage limits are known as coverage rules.

In New Jersey, the coverage rule is 15/30/5. This means the minimum coverage for car insurance is $15,000 for bodily injury of one person per accident, $30,000 for bodily injury of two or more people per accident, and $5,000 for property damage per accident.

What are the forms of financial responsibility in New Jersey?

In addition to a driver’s license and vehicle registration, motorists will need to carry a form of financial responsibility. It’s essential for motorists to keep physical forms of financial responsibility in their vehicles and electronic forms of financial responsibility on their smartphones.

What are examples of forms of financial responsibility?

A form of financial responsibility is an insurance card or an invoice from a car insurance provider that proves you’re insured.

How much percentage of income are premiums in New Jersey?

Before we talk about car insurance rates and factors that determine car insurance, let’s see how annual salary is affected by car insurance premiums. Car insurance companies will need to know your financial ability to pay for their premiums.

We’ve provided a table that describes the insurance as a percent of income. For this example, we’ll focus on New Jersey’s annual income and average annual rate for full coverage in 2014.

| States | Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|---|---|---|---|---|---|---|---|---|---|

| New Jersey | $1,379 | $49,983 | 2.76% | $1,370 | $47,972 | 2.86% | $1,335 | $48,569 | 2.75% |

| Average | $944 | $40,726 | 2.29% | $923 | $39,103 | 2.39% | $899 | $39,383 | 2.32% |

To put the information in context, we included the national average annual rate and national average for disposable income over a three-year trend. The higher the annual income, the lower the percentage.

New Jersey car insurance as a percent of income was roughly 3 percent. The national average of car insurance as a percent of the income was 2.33 percent over three years.

How can someone find car insurance as a percent of income? One of the ways you can measure car insurance as a percentage of income is to divide the average annual car insurance premium into the disposable annual income.

For example, if car insurance is $1,500 per year and you have an annual salary of $45,000, you would divide 1,500 into 45,000 (1,500 / 45,000). The answer will be a decimal answer of 0.0333, which translates to 3.33 percent of your annual salary being spent on car insurance.

Try it out for yourself. Use the calculator tool provided below by entering in your estimated annual income and the cost of insurance per year.

Average Monthly Car Insurance Rates in NJ (Liability, Collision, Comprehensive)

The common coverages you’ll find from car insurance companies are liability, collision, and comprehensive coverage. These base coverages are available for most car insurance companies in the United States.

Liability coverage is the minimum requirement a driver needs to be considered insured. It covers the cost of bodily injury and property damage after an accident with a not-at-fault third party.

Collision coverage pays for property damage regardless of who is at fault, while comprehensive coverage pays for unexpected events such as a fire, damage from vehicle theft, storm damage, and falling objects.

Full coverage is liability, collision, and comprehensive coverage combined. Most of the averages you’ll see in the New Jersey guide are average annual rates based on full coverage. Speaking of New Jersey coverage rates, what are the rates for common coverages in New Jersey car insurance companies?

| Coverage Type | Coverage Rate |

|---|---|

| Liability | $866 |

| Collision | $365 |

| Comprehensive | $123 |

| Full | $1,354 |

Liability is the most expensive car insurance coverage out of the three. That’s because the coverage limit for liability car insurance has a specific coverage limit while collision and comprehensive coverage carry perks that help the driver, such as extra compensation after an accident or storm.

Why is the average annual rate different than the previous table averages? The average for full coverage car insurance in this table is the latest average rate for car insurance without the factors of insurance included. As you read through the guide, you’ll see different average annual rates due to factors of car insurance such as age, driving record, credit, etc.

What additional liability is available in New Jersey?

Be aware of additional coverage. New Jersey is a no-fault state, so additional coverages such as personal injury protection (PIP) are available to policyholders in the state. For other states, PIP may be required.

PIP is coverage that pays for lost wages, funeral costs, child care expenses, and medical expenses.

Another insurance coverage comes close to these perks, which is called Medical Payments or MedPay. This additional liability coverage pays strictly for medical bills, but only under the coverage limit of your car insurance policy.

One of the most important liability coverages is uninsured (UM) and underinsured (UIM) coverages. Policyholders will need this coverage in case the driver they are in an accident with doesn’t have car insurance or has a coverage limit that’s too low to cover bodily injury cost or property damage cost.

Additional liability coverages are included within the coverage limit of your policy. When an accident happens, these policy perks begin to work. The likelihood of a policyholder receiving a payment from a company is measured through the loss ratio.

The loss ratio is the number of claims paid out to policyholders compared to the number of premiums earned by a car insurance provider.

What does the loss ratio look like? Loss ratios that are too high or exceed 100 show that a car insurance company isn’t making much money from premiums and pays more for claims than they earned. However, loss ratios that are too low show a lack of payment to claims from a car insurance company to a policyholder.

We’ve summarized data from the National Association of Insurance Commissioners (NAIC) and compiled the loss ratio of PIP, MedPay, and UM/UIM in a three-year trend.

| Additional Coverage Type | 2015 Loss Ratio | 2014 Loss Ratio | 2013 Loss Ratio |

|---|---|---|---|

| PIP | 75.92 | 71.24 | 73.23 |

| MedPay | 80.32 | 61.68 | 68.33 |

| UM/UIM | 56.27 | 57.37 | 68.54 |

Let’s explain what’s happening in the data.

The average loss ratio for MedPay in 2015 is 80.32. This means that for every $100 that a New Jersey car insurance company made, they spent $80.32. That’s a profit of $19.68. The loss ratio for UM/UIM was 56.27 in 2015, which means car insurance companies spent nearly 60 percent of earnings when paying out claims related to uninsured and underinsured coverage.

What add-ons, endorsements, and riders are available in New Jersey?

- Guaranteed auto protection (GAP)

- Personal umbrella policy (PUP)

- Rental reimbursement

- Emergency roadside assistance

- Mechanical breakdown insurance

- Non-owner car insurance

- Modified car insurance coverage

- Classic car insurance

- Pay-as-you-drive or usage-based insurance

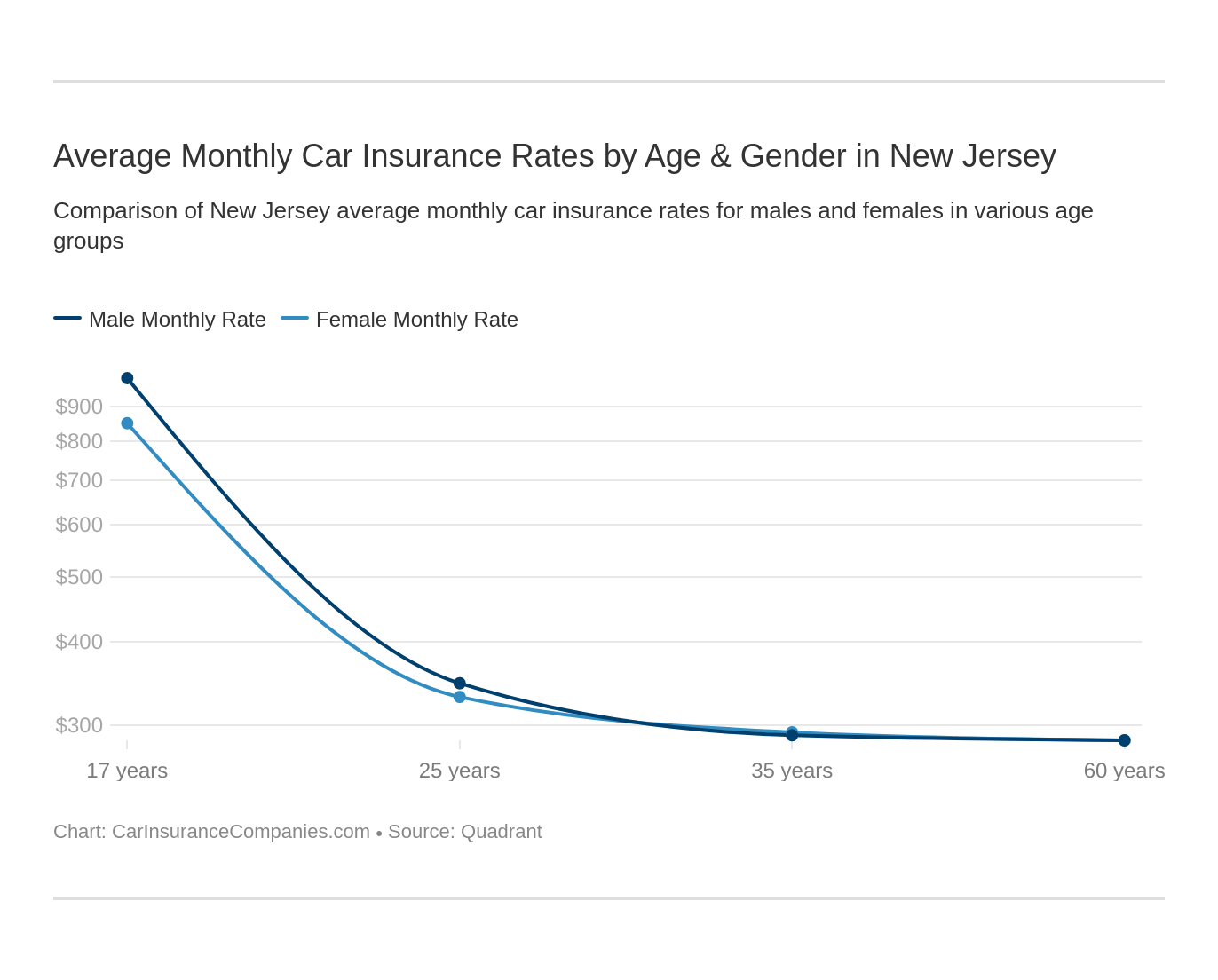

Average Monthly Car Insurance Rates by Age & Gender in NJ

Did you know that a car insurance company considers your age, gender, and marital status when you enroll in a car insurance policy? Car insurance companies often assess risk based on age and gender.

Several states have outlawed age and gender rates. However, New Jersey is one of the states that still allows car insurance companies to issue rates based on age, gender, and marital status.

So how much will a policyholder pay based on these factors? This table will best describe that answer.

| Company | Single 17-year-old female annual rate | Single 17-year-old male annual rate | Single 25-year-old female annual rate | Single 25-year-old male annual rate | Married 35-year-old female annual rate | Married 35-year-old male annual rate | Married 60-year-old female annual rate | Married 60-year-old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate | $10,796 | $13,185 | $4,043 | $4,156 | $3,437 | $3,420 | $3,335 | $3,335 |

| Foremost | $14,124 | $16,233 | $5,737 | $5,845 | $4,830 | $4,873 | $4,699 | $4,594 |

| Geico | $4,064 | $4,064 | $2,576 | $2,513 | $2,243 | $2,202 | $2,188 | $2,188 |

| Liberty Mutual | $11,602 | $13,166 | $4,919 | $5,647 | $4,480 | $4,480 | $4,919 | $4,919 |

| Progressive | $9,241 | $10,160 | $2,413 | $2,305 | $2,041 | $1,886 | $1,841 | $1,895 |

| Saint Paul Protective | $7,272 | $8,196 | $3,131 | $3,100 | $3,222 | $3,124 | $2,983 | $3,009 |

| State Farm | $14,396 | $18,483 | $5,008 | $5,593 | $4,392 | $4,392 | $3,976 | $3,976 |

Based on the data, teen drivers have the most expensive average annual rates. Statistics show that younger drivers take more risks than older drivers. The higher-than-average rates reflect the number of chances teens will be involved in a motor vehicle accident. Car insurance discounts can come in handy for parents who add their teen children on their policy.

Policyholders who are 25 years old and older pay significantly less for car insurance. The demographic that pays the least are married, 60-year-old policyholders.

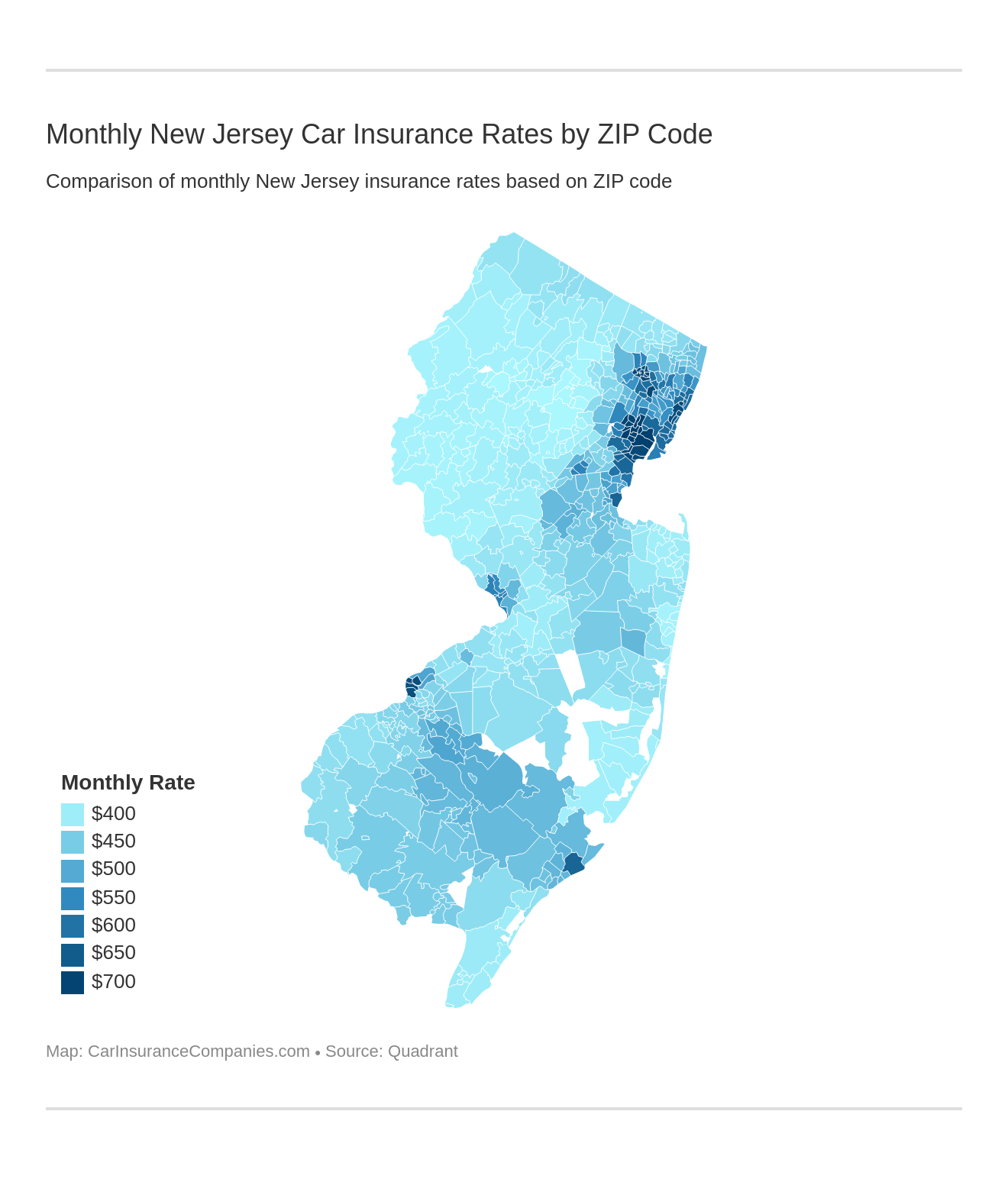

What are the cheapest rates by ZIP code in New Jersey?

Another factor car insurance companies take into consideration is ZIP code. Car insurance companies have to assess whether the area you live in has a high risk of accidents.

The hard truth to determining car insurance based on ZIP code is that urban areas (which are more populated) or low-income areas (correlated to contain more risks) are likely to have more expensive car insurance rates due to the level of risk and statistics provided by research.

Our research has located the areas around New Jersey with the cheapest and most expensive car insurance rates per year. We sorted them out as the 25 most expensive ZIP codes and the 25 cheapest ZIP codes.

Let’s start with the 25 most expensive ZIP codes.

| Most Expensive ZIP code | Average Annual Rate |

|---|---|

| 07017 | $8,385 |

| 07018 | $8,385 |

| 07050 | $8,385 |

| 07055 | $8,294 |

| 07102 | $8,513 |

| 07103 | $8,513 |

| 07104 | $8,513 |

| 07105 | $8,513 |

| 07106 | $8,513 |

| 07107 | $8,513 |

| 07108 | $8,513 |

| 07111 | $8,513 |

| 07112 | $8,513 |

| 07114 | $8,513 |

| 07201 | $8,277 |

| 07202 | $8,277 |

| 07206 | $8,277 |

| 07208 | $8,277 |

| 07501 | $8,255 |

| 07502 | $8,255 |

| 07503 | $8,255 |

| 07504 | $8,255 |

| 07505 | $8,255 |

| 07513 | $8,255 |

| 07514 | $8,255 |

The most expensive ZIP code is 07102, which is in Newark, NJ. This area is extremely populated and probably sees more traffic than most people do in a week when compared to the national average.

What about the 25 cheapest ZIP codes? Let’s take look at those averages.

| Cheapest ZIP Codes | Average Annual Rate |

|---|---|

| 07005 | $4,660 |

| 07046 | $4,601 |

| 07405 | $4,665 |

| 07457 | $4,630 |

| 07828 | $4,625 |

| 07834 | $4,614 |

| 07837 | $4,642 |

| 07843 | $4,668 |

| 07850 | $4,650 |

| 07857 | $4,650 |

| 07869 | $4,619 |

| 07874 | $4,668 |

| 07878 | $4,614 |

| 07926 | $4,592 |

| 07927 | $4,617 |

| 07950 | $4,617 |

| 07960 | $4,614 |

| 07961 | $4,613 |

| 07979 | $4,660 |

| 07981 | $4,617 |

| 07999 | $4,617 |

| 08826 | $4,679 |

| 08827 | $4,679 |

| 08829 | $4,679 |

| 08848 | $4,679 |

The cheapest ZIP code is 07926, which is the postal code for Mendham Township, NJ. This ZIP code appears to be a rural area in Brookside that’s a few miles west of Newark. Due to the low population in rural areas, accidents don’t likely occur there very often. Therefore the rates are much cheaper.

What are the cheapest rates by city in New Jersey?

What happens when we broaden our view and look at car insurance averages based on the city? Do these rates change? For your convenience, we’ve researched for you and put together another set of tables where you can view the average annual rates of New Jersey by city.

The data listed in this section will show you the 25 most expensive cities for car insurance and the 25 cheapest cities for car insurance.

Let’s start with the 25 most expensive cities.

| New Jersey's Most Expensive Cities | Average Grand Total |

|---|---|

| Atlantic City | $7,564.70 |

| Camden | $8,099.72 |

| Cliffside Park | $7,392.46 |

| East Orange | $8,384.68 |

| Elizabeth | $8,277.10 |

| Elizabethport | $8,277.10 |

| Fairview | $8,198.85 |

| Harrison | $7,467.89 |

| Hillside | $7,391.94 |

| Irvington | $8,512.59 |

| Kearny | $7,467.89 |

| Linden | $7,501.16 |

| Newark | $8,512.59 |

| North Bergen | $8,198.85 |

| Orange | $8,384.68 |

| Palisades Park | $7,392.46 |

| Passaic | $8,293.86 |

| Paterson | $8,228.42 |

| Perth Amboy | $7,587.46 |

| Ridgefield | $7,392.46 |

| Roselle | $7,501.16 |

| Union | $7,391.94 |

| Union City | $7,929.71 |

| Vauxhall | $7,391.94 |

| West New York | $7,929.71 |

The most expensive cities are Orange, Newark, and Irvington, N.J., with car insurance premiums that are about $9,000 per year.

How about the cities with the cheapest car insurance? Let’s take a look.

| New Jersey's Cheapest Cities | Average Grand Total |

|---|---|

| Annandale | $4,678.80 |

| Asbury | $4,678.80 |

| Baptistown | $4,678.80 |

| Boonton | $4,660.30 |

| Brookside | $4,592.17 |

| Budd Lake | $4,624.77 |

| Butler | $4,664.98 |

| Cedar Knolls | $4,616.88 |

| Changewater | $4,678.80 |

| Clinton | $4,678.80 |

| Denville | $4,613.63 |

| Glasser | $4,641.98 |

| Glen Gardner | $4,678.80 |

| Hopatcong | $4,667.85 |

| Landing | $4,649.92 |

| Morris Plains | $4,616.88 |

| Morristown | $4,613.78 |

| Mount Tabor | $4,613.63 |

| Mountain Lakes | $4,600.78 |

| Netcong | $4,649.92 |

| Pottersville | $4,660.24 |

| Randolph | $4,618.98 |

| Riverdale | $4,630.08 |

| Stanhope | $4,667.85 |

| Whippany | $4,616.88 |

The cheapest car insurance in New Jersey is in Brookside, Mountain Lakes, and Denville. They have average annual rates that cruise around $4,600 per year.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Best New Jersey Car Insurance Companies

What is the best car insurance company? That question has been searched thousands of times on every major search engine on the internet, and you’ll get over a million answers.

The best car insurance is up to you, the future policyholder. As a potential customer, you’re looking for something that’s cost-efficient and provides the coverage you need should you get into an accident or something happens to your vehicle.

Our guides are unbiased, factual information to help point you in the direction that’s in your best interest. With that said, we can show you the ratings of insurance companies, other factors that determine car insurance, complaint data, and other details to help you decide which car insurance company is best for you.

What are the financial ratings of the largest car insurance companies?

Financial ratings are measurements of direct premiums written by financial rating agencies that show the financial performance of a company, particularly a car insurance company. One of the top companies that measure financial ratings is A.M. Best. They’ve been around since 1899 and currently have office locations around the world.

Each year, A.M. Best reports the grades of car insurance companies that have earned their place as the largest and most financially stable. We’ve summarized their results in the data below.

| Company | AM Best Rating |

|---|---|

| Allstate Insurance Group | A+ |

| Amica Mutual Group | A+ |

| Auto-Owners Group | A++ |

| Geico | A++ |

| Liberty Mutual Group | A |

| Metropolitan Group | A |

| Progressive Group | A+ |

| State Farm | A++ |

| Travelers Group | A++ |

| USAA Group | A++ |

All companies have excellent or good ratings based on A.M. Best’s financial rating system (FSR). The only company not rated is Farmers.

Which car insurance companies have the best ratings?

Some agencies measure a company’s strength on how they respond to their customers. J.D. Power is one of those agencies that judge companies based on customer feedback from annual surveys.

These surveys are based on overall customer satisfaction, which J.D. Power calls the Overall Customer Satisfaction Index. They measure the satisfaction strength through a 1,000-point scale and J.D Power’s circle ratings.

| Car Insurance Company | Score (based on a 1,000 point scale) | Circle Ratings |

|---|---|---|

| Allstate | 816 | 2 |

| CSAA Insurance | 817 | 2 |

| Erie Insurance | 852 | 5 |

| Farmers | 826 | 2 |

| Geico | 845 | 4 |

| Liberty Mutual | 817 | 2 |

| Mid-Atlantic Average | 838 | 3 |

| Nationwide | 822 | 2 |

| NJM Insurance | 861 | 5 |

| Plymouth Rock Assurance | 826 | 2 |

| Progressive | 828 | 2 |

| State Farm | 834 | 3 |

| The Hartford | 842 | 4 |

| Travelers | 821 | 2 |

| USAA | 898 | 5 |

Read more:

- Erie Insurance Company of New York Car Insurance Review

- Plymouth Rock Assurance Corporation Car Insurance Review

The higher the score on the 1,000-point scale the better, and the more circles a company has, the better the customer rating. New Jersey is part of the Mid-Atlantic region. On average their circle rating is three, which says that companies in the Mid-Atlantic performed moderately well for customers.

Which car insurance companies have the most complaints?

The NAIC provides complaint ratio data from the largest car insurance companies every year.

Complaint ratio is tracked consumer complaints against insurance companies.

We studied these complaints and put them in a short table.

| Company Group/group/code Company Name | Complaint Ratio |

|---|---|

| Allstate Insurance Group | 0.5 |

| Farmers Insurance Group | 0.67 |

| Geico | 0.68 |

| Liberty Mutual Group | 5.95 |

| New Jersey Manufacturers Group | 0.03 |

| Palisades Group | 0.39 |

| Progressive Group | 0.75 |

| State Farm Group | 0.44 |

| Travelers Group | 0.09 |

| USAA Group | 0.74 |

Liberty Mutual has the highest complaint data in the table, followed by Progressive. Does this mean that the company isn’t good? No. It does, however, show you the chance in which you can encounter a problem with a claim.

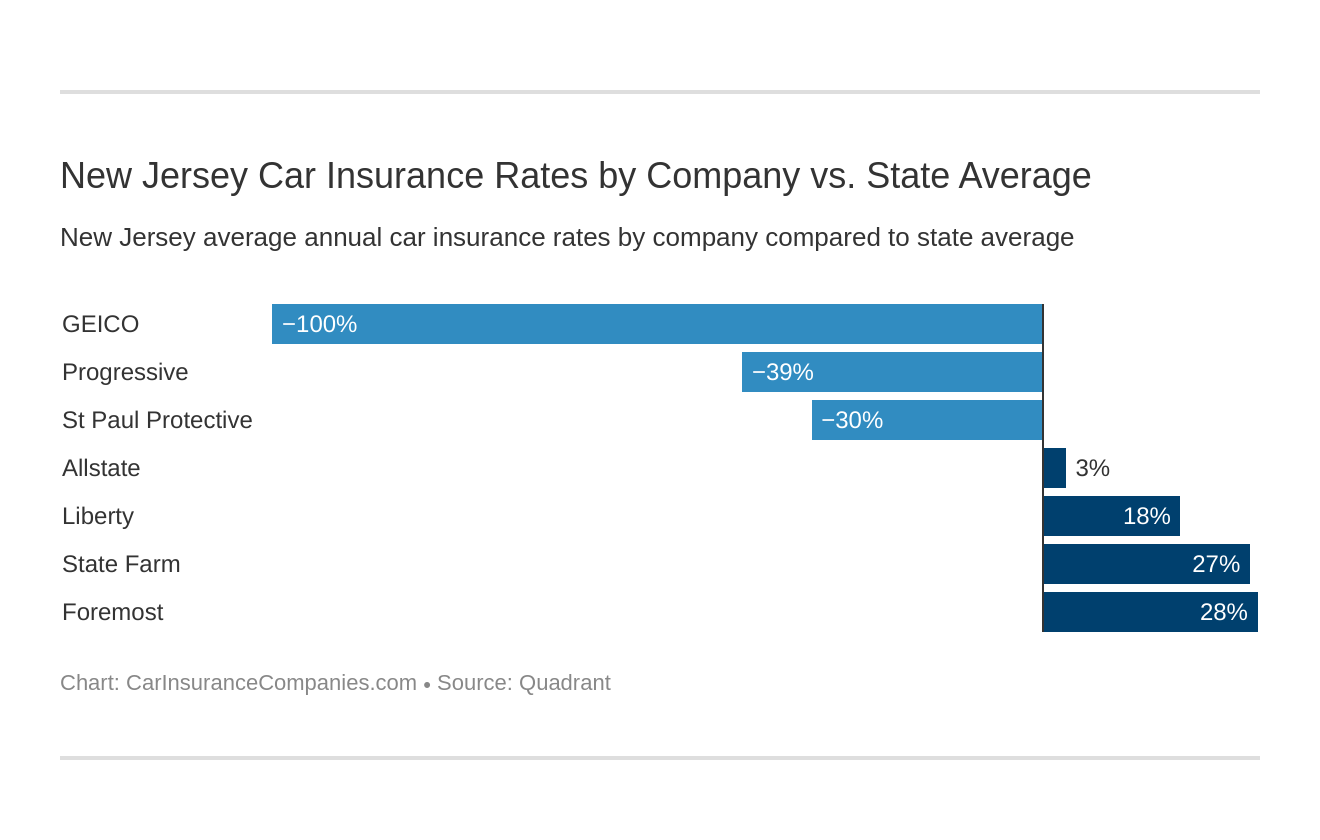

What are the cheapest car insurance companies in New Jersey?

We’ve talked about the largest companies in New Jersey, but which company is the cheapest? We can determine this by comparing the average annual rate of New Jersey to the average annual rate of car insurance companies in New Jersey.

To review, the average annual rate in New Jersey is $5,515. Let’s take a look at the average annual rates for New Jersey car insurance providers.

| Company | Average Annual Rate | Compared to State Average | Compared to State Average % |

|---|---|---|---|

| Geico | $2,755 | -$2,760 | -100.19% |

| Progressive | $3,973 | -$1,543 | -38.83% |

| Saint Paul Protective | $4,254 | -$1,261 | -29.63% |

| Allstate | $5,714 | $198 | 3.47% |

| Liberty Mutual | $6,767 | $1,251 | 18.49% |

| State Farm | $7,527 | $2,012 | 26.73% |

| Foremost | $7,617 | $2,102 | 27.59% |

When we compare the average annual rate to New Jersey’s average annual rate, we simply subtract. For example, we can say that Foremost is $2,102 more expensive than the New Jersey state average.

To get the percentage value, divide the difference into the company average ($2,102 / $7,617). The solution to the division is 0.2759, which is 27.59 percent. This indicates that Foremost’s rates are, on average, nearly 28 percent higher than the state average.

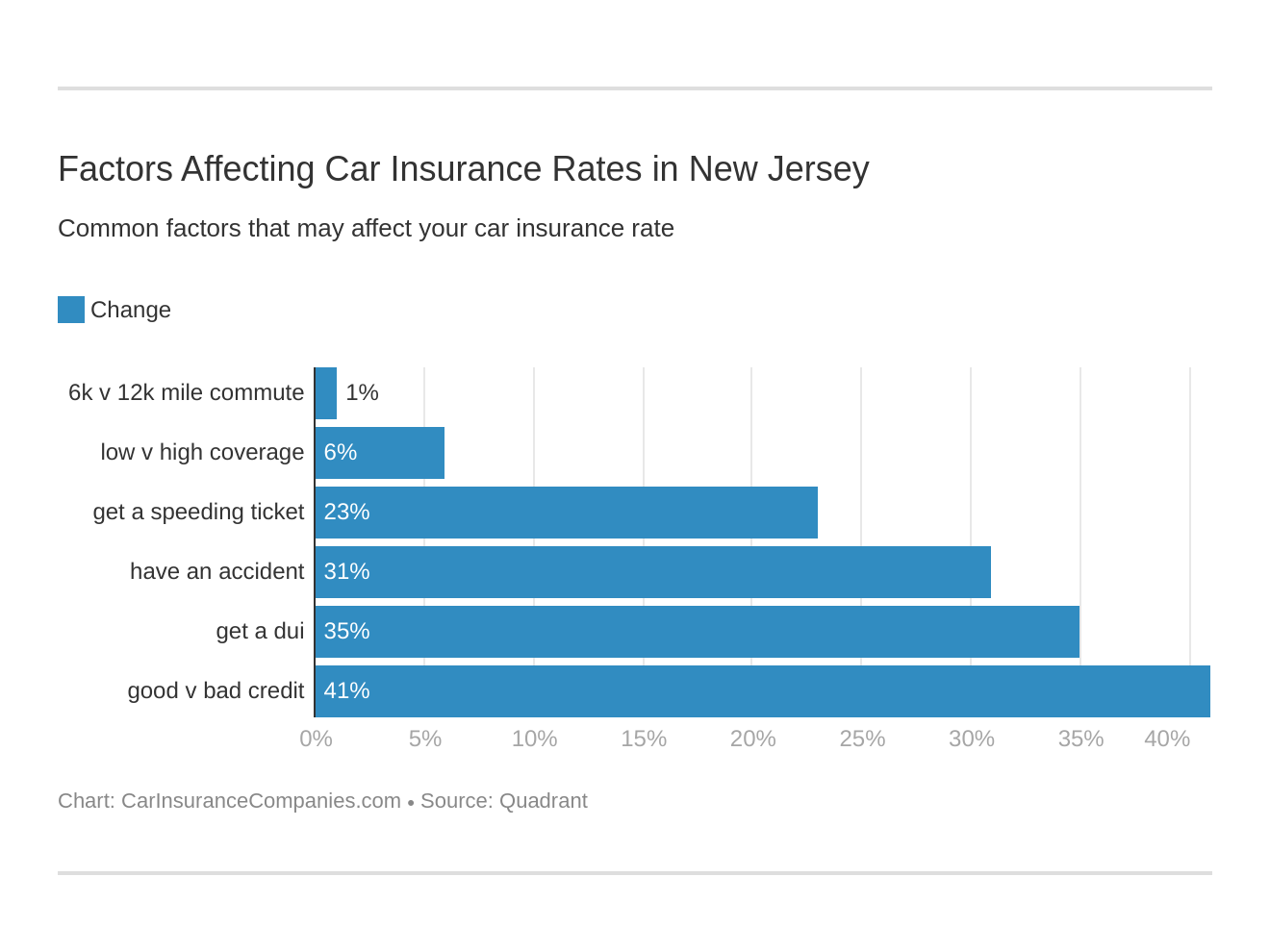

Does my commute affect my car insurance rate in New Jersey?

Car insurance companies will ask you for the number of miles you’re estimated to travel. They may ask you a specific question about what your vehicle is going to be used for. If you use your vehicle for commutes to work or school, expect to pay more for car insurance based on your commute mileage.

What does commute mileage look like for potential customers and policyholders of New Jersey’s top car insurance companies? Let’s examine the average annual rates based on commute mileage.

| Company | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Allstate | $5,703 | $5,724 |

| Farmers | $7,617 | $7,617 |

| Geico | $2,732 | $2,778 |

| Liberty Mutual | $6,701 | $6,832 |

| Progressive | $3,973 | $3,973 |

| State Farm | $7,333 | $7,721 |

| Travelers | $4,254 | $4,254 |

Only three companies charge the same rate per year: Farmers, Progressive, and Travelers. The rest of the car insurance companies charge more expensive rates the more you drive per year. Geico, Progressive, and Travelers have car insurance rates that are under the New Jersey state average, which is $5,515.

Can coverage level change my car insurance rate with companies in New Jersey?

The answer is yes. The coverage level has everything to do with coverage limits. Car insurance companies go with the state minimum for car insurance. For New Jersey, the state minimum for car insurance is under the 15/30/5 rule. To upgrade your minimum coverage limits, you’ll have to pay more money per year for car insurance.

Medium coverage levels could double the lowest coverage rule, but the average coverage limit for medium coverage levels is 30/50/30, while high coverage level has coverage limits of 100/300/100. But what’s the average annual rate for coverage levels? Let’s review them.

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $5,270 | $5,798 | $6,073 |

| Farmers | $6,861 | $7,577 | $8,413 |

| Geico | $2,462 | $2,808 | $2,994 |

| Liberty Mutual | $6,054 | $6,972 | $7,274 |

| Progressive | $3,604 | $4,034 | $4,280 |

| State Farm | $6,994 | $7,626 | $7,962 |

| Travelers | $3,892 | $4,255 | $4,616 |

Just as we mentioned before, the average annual rate based on coverage level increases each time you want to increase your coverage limit. Ask an insurance agent about discounts whenever you want to upgrade from one coverage level to another. New Jersey policyholders may want to enroll in medium coverage due to the low coverage limit of the minimum state requirements of New Jersey.

How does my credit history affect my car insurance rate with companies in New Jersey?

Credit experts say there’s a correlation between your credit history and risk. Most car insurance companies agree with this viewpoint and issue rates based on your credit history. Credit history shows your financial ability to pay for a company’s car insurance premiums. Let’s examine how much a policyholder would pay based on their credit history.

| Company | Poor Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $7,966 | $5,131 | $4,044 |

| Farmers | $9,071 | $7,091 | $6,689 |

| Geico | $4,148 | $2,387 | $1,730 |

| Liberty Mutual | $8,575 | $6,358 | $5,367 |

| Progressive | $4,449 | $3,883 | $3,586 |

| State Farm | $10,892 | $6,569 | $5,121 |

| Travelers | $5,721 | $4,186 | $2,856 |

Read more:

- Allstate New Jersey Property and Casualty Insurance Company Car Insurance Review

- Allstate New Jersey Insurance Company Car Insurance Review

Individuals with poor credit will likely pay the most expensive rates for car insurance. Those with good credit are discounted and pay the cheapest rates available.

How does my driving record change my rates with car insurance companies in New Jersey?

Every state in the U.S. holds on to your driving record. Car insurance companies will need to know about your driving record so they can assess if you are a high-risk driver. The better your driving record, the more money you’ll save. Let’s take a look at some of the average annual rates based on driving records.

| Company | Clean Record | With One Accident | With One Speeding Violation | With One DUI Conviction |

|---|---|---|---|---|

| Allstate | $4,287 | $7,126 | $5,214 | $6,227 |

| Farmers | $5,899 | $10,018 | $6,395 | $8,156 |

| Geico | $2,142 | $2,817 | $2,142 | $3,918 |

| Liberty Mutual | $6,498 | $7,437 | $6,498 | $6,633 |

| Progressive | $3,414 | $4,584 | $3,986 | $3,907 |

| State Farm | $4,089 | $7,447 | $6,597 | $11,975 |

| Travelers | $3,268 | $4,864 | $4,188 | $4,698 |

The cheapest company in the table is Geico. It’s nearly $3,000 less than the state average. DUI convictions have the most expensive increase. The most expensive company in the data is State Farm and Farmers.

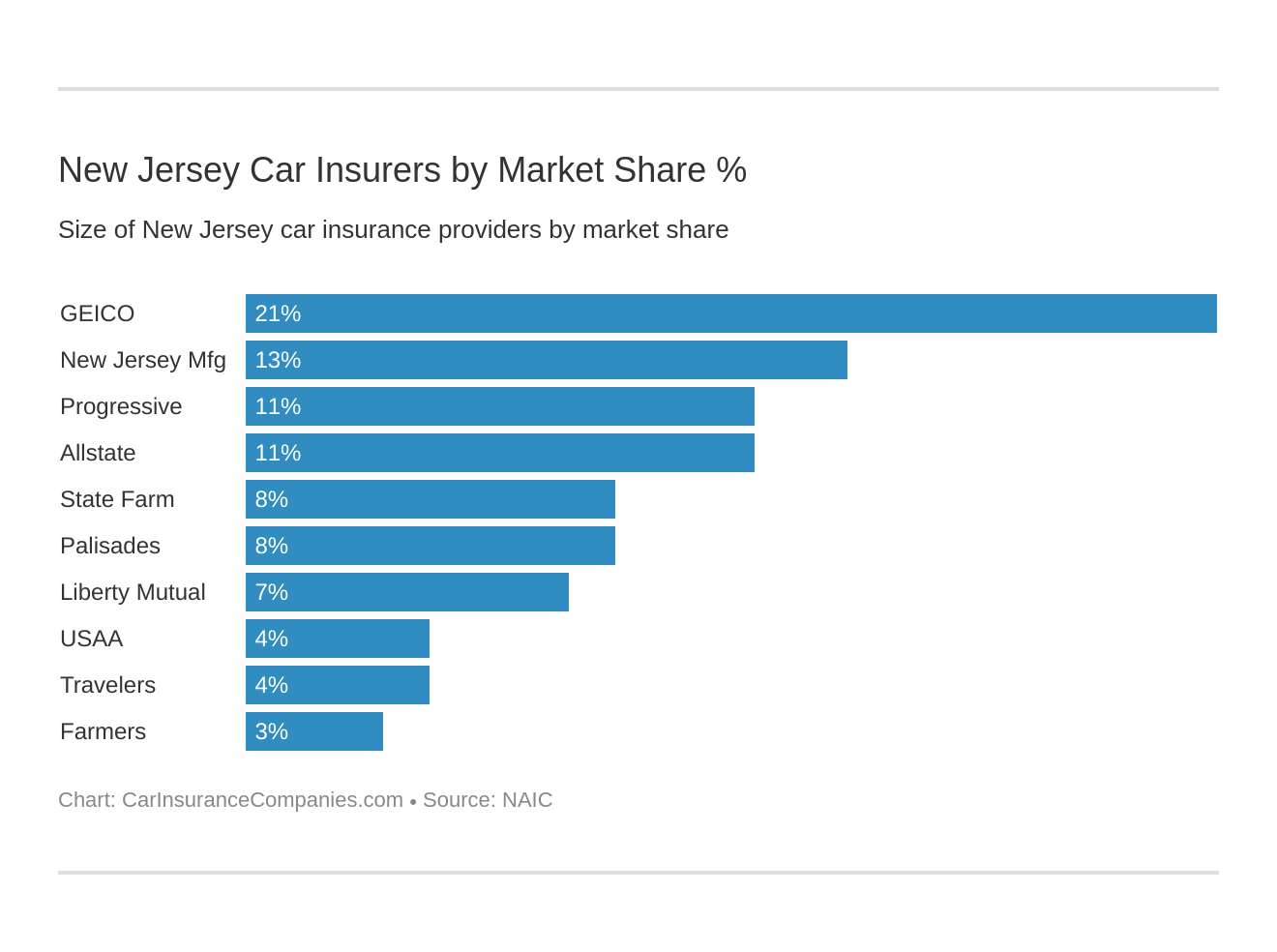

Which car insurance companies are the largest in New Jersey?

We touched on this in one of the sections above, but we didn’t elaborate. We can determine the size of a car insurance company by reviewing its direct premiums written, loss ratio, and market share. We know what loss ratio is, but we haven’t discussed direct premiums written or market share.

Direct premiums written is the total amount of premiums written within a year, but it doesn’t account for premiums that have been reinsured. What this means is the direct premiums written are from new policies written at an insurance company within a year. Market share is the percentage of total sales in an industry, such as car insurance, that’s generated by a company.

So which company has the most influence in New Jersey? The table below will show the largest car insurance companies in New Jersey and reveal their direct premiums written, market share, and loss ratio.

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Allstate | $839,883 | 53.02% | 10.93% |

| Farmers | $233,314 | 79.86% | 3.04% |

| Geico | $1,580,844 | 70.02% | 20.58% |

| Liberty Mutual | $544,321 | 64.14% | 7.09% |

| New Jersey Manufacturers Group | $993,945 | 66.25% | 12.94% |

| Palisades | $601,852 | 61.30% | 7.83% |

| Progressive | $856,484 | 59.14% | 11.15% |

| State Farm | $629,485 | 64.66% | 8.19% |

| Travelers | $284,191 | 59.53% | 3.70% |

| USAA | $294,678 | 70.79% | 3.84% |

| State Total | $7,682,095 | 64.98% | 100.00% |

Geico has earned the most from direct premiums written and the company has the largest market share in New Jersey. The second-largest company in New Jersey is the New Jersey Manufacturers Group.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

How many car insurance companies are available in New Jersey?

“Insurer” is another way to say car insurance company, or it could refer to a car insurance company affiliate. There are two types of insurers: Domestic insurers and foreign insurers.

Domestic insurers are insurers that follow the insurance laws of the home state. Foreign insurers follow the insurance law of another state but can do business in the other states. In New Jersey, there are 66 domestic insurers and 778 foreign insurers. That’s a total of 844 insurers in the state.

New Jersey Laws

For this section, we’ll explain New Jersey laws that affect car insurance, vehicle law, driver safety, and roadway laws. These laws are important for drivers to become familiar with to avoid increases in car insurance rates.

The laws we’ll talk about will explain the driver’s license renewal process and the penalties for not having insurance.

What are the car insurance laws in New Jersey?

It’s likely that you are already aware of car insurance law but may not be aware of the specifics. This section will explore the subtleties of car insurance laws that you may have overlooked.

How New Jersey Laws for Insurance are Determined

The NAIC lists New Jersey as a “Prior Approval” state regarding car insurance law. What this means is car insurance rates must be filed with car insurance regulators who must approve the filing before the new rates can go into effect.

Therefore, when car insurance rates increase despite a policyholder’s good credit or clean driving record, it’s because the car insurance company has been approved to increase their rates. The increased rates will affect all policyholders of the company regardless of discounts and other factors that determine car insurance.

Windshield Coverage

New Jersey doesn’t have specifications on windshield law. It’s not clear how the state regulates aftermarket parts or original equipment manufacturer parts. There is a standard comprehensive deductible, which is $750. The standard deductible may be waived depending on your car insurance policy.

High-Risk Insurance

Under our driving record section, we mentioned how car insurance companies can increase your rates based on your driving record. DUI convictions, traffic violations, and accidents are different roads to more expensive car insurance premiums. Having more than one accident, DUI conviction, or multiple traffic violations will put you into the high-risk pool.

When drivers are in the high-risk pool they have to enroll in insurance programs such as SR-22. In addition to these factors, drivers who lost their license and driving privileges must find SR-22 coverage if they are to reinstate their driver’s license.

SR-22 is car insurance that meets the minimum coverages required by law and provides proof of financial responsibility for high-risk drivers.

SR-22 car insurance is usually obtained through the DMV’s high-risk program. For New Jersey drivers, the program is called the New Jersey Personal Automobile Insurance Plan (NJPAIP). This program will help insure vehicles for drivers who are in the high-risk pool.

When a person’s driving record is too risky for multiple insurance companies, the driver may have lost their chances of finding car insurance in the voluntary market.

Therefore, a driver must file for an SR-22 with a company offering NJPAIP or through the DMV. However, they must first search for car insurance for up to 60 days. If they can’t find car insurance after 60 days, they can attempt to enroll in SR-22 coverage.

High-risk drivers will have more success with the DMV. The DMV will search for a car insurance company that will give you a policy. First, you have to provide the DMV with your personal information such as name, address, and Social Security card.

The process may move a little faster if you provide the invoice for your previous car insurance policy. You’ll have to fill out other documents as well. Follow the SR-22 procedure carefully.

Once you fill out the forms, it may take a few days for the process to finalize. When you’re enrolled completely, the SR-22 will last up to three years (it may differ by state).

After three years, the SR-22 coverage will expire, and you must try the voluntary market again. If car insurance companies still consider you high-risk, you’ll have to go through the SR-22 process again.

Low-Cost Insurance

New Jersey is one of the states where the residents can receive government assistance to pay for car insurance. New Jersey’s state-sponsored insurance plan is called the Special Automobile Insurance Policy (SAIP).

SAIP is a program to help make car insurance available to drivers who are more than likely to go uninsured because of financial hardship.

The only individuals eligible for SAIP are those who are enrolled in federal Medicaid with hospitalization. Be advised: Some Medicaid programs don’t qualify for a SAIP policy. Speak with a New Jersey insurance producer about specifics and eligibility for SAIP.

The average cost for a SAIP policy is $365. Policyholders can pay upfront, which brings the $365 policy down to $360. The State of New Jersey requires SAIP policyholders to make two payments, likely payments made every six months. That’s a payment of $182.50 every six months.

The SAIP policy covers emergency treatment and injuries after an accident has occurred up to $250,000 and provides a $10,000 coverage in case a death occurs. SAIP doesn’t cover outpatient treatments such as doctor visits — especially visits covered by Medicaid. SAIP doesn’t cover damages to your vehicle or the vehicle of the other driver.

What about drivers who aren’t eligible for Medicaid or SAIP? New Jersey has a law called the Automobile Insurance Cost Reduction Act, which reduces the cost of car insurance but also reduces the benefits that are normally offered to those in car insurance accidents. Here’s an example of what the coverages offered under the New Jersey basic plan compare to what car insurance company policies offer.

| Type of Coverage | Standard Policy | Basic Policy |

|---|---|---|

| Bodily injury liability | As low as: $15,000 per person, $30,000 per accident. As high as: $250,000 per person, $500,000 per accident | Coverage is not included but $10,000 coverage for all persons, per accident, is available as an option. |

| Property damage liability | As low as: $5,000 per accident. As high as: $100,000 or more. | $5,000 per accident. |

| Personal injury protection (PIP) | As low as: $15,000 per person or accident. As high as: $250,000 or more. Up to $250,000 for certain injuries regardless of selected limit. | $15,000 per person, per accident. Up to $250,000 for certain injuries. |

| Uninsured/Underinsured motorist | Coverage is available up to amounts selected for liability coverage. | None |

| Collision | Available as an option. | Available as an option (from some insurers). |

| Comprehensive | Available as an option. | Available as an option (from some insurers). |

There are certain perks left out of the basic plan. That’s not to say that the basic plan doesn’t work. It’s just not as extensive as a policy that’s not assisted by the state government. The State of New Jersey has other options a driver can explore if they need more. Speak to an insurance producer to see what other perks are available.

Automobile Insurance Fraud in New Jersey

Car insurance fraud, or any fraud, is a crime. Anyone caught committing fraud will face fines and possible jail time.

Car insurance fraud occurs when a policyholder misrepresents facts on insurance documents, exaggerating insurance claims, or staging accidents to submit claims for injuries and property damage that never occurred.

To protect policyholders and insurers from scammers, New Jersey has a mandatory insurer fraud plan. Also, car insurance companies must take a photo of the damage in question so they may investigate the claim effectively.

In New Jersey, individuals who are caught by law enforcement and the investigative fraud team will have their name and fraud type published on the New Jersey state government website. Individuals convicted of fraud are prosecuted by the Attorney General of New Jersey. Committing car insurance fraud in New Jersey carries a $15,000 fine and a jail sentence of up to 18 months.

If you suspect someone is committing insurance fraud, contact the New Jersey fraud department at 1-877-553-7283. Or contact the office of the New Jersey Attorney General at their address:

NJ Office of the Attorney General

Office of the Insurance Fraud Prosecutor

P. O. Box 094

Trenton, NJ 08625-0094

Statute of Limitations

There’s a time limit in which you can make a claim or file a lawsuit. This limit is known as the statute of limitations, and it varies by state.

For New Jersey, the statute of limitations is two years for personal injury and six years for property damage. The statute of limitations begins when the event happens, not when the event is reported. The government issues the statute of limitations to deter fraud and to give claimants time to respond legally.

New Jersey Specific Laws

There are a few laws specific to New Jersey. Some of the laws are laughable at best, while others are more serious laws.

Because of the higher-than-average traffic in New Jersey, the speed limit law is five miles per hour slower. Speaking of New Jersey traffic, drivers in a motor vehicle must honk their horn when they are passing bicyclists or skateboarders.

If a driver is convicted of DUI in New Jersey, they will be ineligible to receive personalized license plates. This is one of the ways the state can encourage drivers that driving a vehicle is a privilege and not a right.

What is the vehicle licensing laws in New Jersey?

Every owner and operator of a motor vehicle is required to have a driver’s license. It’s a long process, but it proves to the state that the driver has earned the privilege to drive on the roadways of the United States. This section of the guide will explain how a resident of New Jersey can obtain a driver’s license. In addition to driving license laws, we’ll provide some information about the road rules and safety laws in New Jersey.

REAL ID

The Department of Homeland Security created the REAL ID in 2005, which is a law in response to the 9/11 attacks. The law says that U.S. citizens who want to enter a federal facility or who fly domestically or internationally will need a REAL ID.

Here’s a video from New Jersey official about the real ID.

Here’s a news report about New Jersey finally finalizing the REAL ID compliance law.

Passports are still a valid form of I.D. for air travel. New Jersey REAL ID law is still under review, which means U.S. citizens with a driver’s license or identification card can enter federal agencies, nuclear power plants, and federally regulated commercial aircraft.

Penalties for Driving Without Insurance

No driver should be on the road without insurance. Not only is it irresponsible, but it also comes with a fine, license suspension, and possible jail time. In New Jersey the penalty for driving without insurance is as follows:

- The first offense is a fine of up to $300 to $1,000. The driver will have a license suspension for one year. There will be surcharges for three years in the amount of $250 per year.

- The second offense is a fine of up to $5,000. The driver will have a two-year license suspension. Violators will have a 14-day mandatory jail term and an additional mandatory 30 days of community service.

Subsequent offenses (offenses that occur after the second and beyond) may carry longer jail sentences, higher fines, and longer driver’s license suspensions. This is important because it could put a driver in the high-risk pool even after they have their license reinstated.

Teen Driver Laws

The driving laws for teens in New Jersey are detailed but very simple to understand. It can be a long process to read through, so we’ll provide the most important parts in a summary.

The first stage a teenage driver will encounter when they want a license to drive is the learner’s stage. In New Jersey, the minimum entry age for a permit is 16 years old.

For a teen to enter the learner’s stage, they must be in a driver education course or have completed a driver education course. Teens who have not enrolled or completed a driver education course have to wait until they are 17 to enter the learner’s stage.

Unlike most states, New Jersey doesn’t have a minimum number of hours for supervised driving. Therefore, an instructor or parent can estimate how many hours the teen needs before they move on to the next step, which is the intermediate stage.

For a teen (drivers younger than 21) to move onto the intermediate stage, they must hold the permit for six months. For drivers over the age of 21, they must hold on to a learner’s permit for three months.

Adults in the permit phase have to comply with the same rules as teen drivers, but they aren’t restricted from driving at night and don’t face any passenger restrictions.

This brings us to the intermediate stage. No teen driver is permitted to drive from 11 p.m. to 5 a.m. Night restrictions are waived when a teen driver holds onto the intermediate permit for 12 months or until they turn 18 years old.

In addition to being prohibited from night driving, teen drivers are not allowed to have no more than one passenger, but exceptions are made for driver’s dependents such as younger siblings or ailing adults. Passenger restrictions are lifted after the teen driver has the permit for 12 months or until the driver turns 18.

Older Driver License Renewal Procedures

Senior drivers, particularly drivers 70 and older, have to renew their license every two to four years. Also, senior drivers will have to renew in person for every other renewal. Written and vision exams are not required to renew a driver’s license for senior drivers.

New Residents

For those moving to New Jersey, you are required to obtain a driver’s license within 60 days of establishing permanent residency in the state. Be sure to register your vehicle with the New Jersey Motor Vehicle Commission (MVC). The MVC will need six points of ID.

Six points of ID are documents that prove your identity.

Documents such as an out-of-state driver’s license, passport, Social Security number, and birth certificate are examples of how you can accumulate six points of ID for the state of New Jersey. Even though you’ll need to prove proof of address, it won’t count toward the six points required for the MVC. There is a $10 fee to start the process.

License renewal procedures

New Jersey residents must renew their licenses every four years. Every 10 years, a New Jersey driver must take a vision test before they can renew their license. New Jersey drivers can renew their license online or by mail. If you need a photo, you’ll have to go to the MVC in person to renew your driver’s license.

Active members of the Armed Forces and their immediate family may apply for license renewal up to six months before deployment. Active military drivers’ licenses will remain valid 90 days after return from duty, also.

Negligent Operator Treatment System (NOTS)

Drivers who violate road laws in New Jersey will have points issued to their driver’s license. Too many points can lead to a driver having their license suspended. Points on your license can also raise your car insurance rates.

Accumulating six or more points within three years on your driving record will result in a fine. The MVC will suspend a driver’s license that has 12 or more points on their current record.

The following is the MVC’s points schedule. This table below shows some of the violations that could result in a ticket.

These are tickets you can receive on a New Jersey Turnpike, Garden State Parkway, Atlantic City Expressway, and all other roads and highways:

| Violation | Points Added to License |

|---|---|

| Driving through safety zone | 2 points |

| Failure to keep right | 2 points |

| Failure to yield to a pedestrian in a crosswalk | 2 points |

| Improper action or omission on grades and curves | 2 points |

| Improper passing | 4 points |

| Moving against traffic | 2 points |

| Passing a vehicle yielding to pedestrian in a crosswalk | 2 points |

| Racing on the highway | 5 points |

| Unlawful use of median strip | 2 points |

If a driver has points added to their driver’s license, they can earn point deductions by taking a qualified MVC-approved driving course, which deducts two points from the violation they received. An alternative way to remove points is to stay away from violations and suspensions for one year, which carries a deduction of three points.

The deduction year begins on the date of the violation of a driver’s most recent license reinstatement. A New Jersey driver is allowed to complete more than one program to remove points, but they must follow the timeline for each deduction.

The reduction of points added to your license does not remove the violation from your driving record, so car insurance companies may increase your rates anyway.

What are the rules of the road in New Jersey?

Roadway rules are present to decrease accident and injury risks for drivers. Violators, as you’ve seen in the previous sections, are fined and have their driving privileges taken away.

Listed below are a few laws and regulations on New Jersey road rules. We’ll start with the fault law of New Jersey. This is important because it will determine liability after an accident has occurred.

The following laws we’ll discuss involve seat-belt laws, keep right laws, speed limits, ridesharing, and automation on the road.

Fault vs. No-Fault

New Jersey is a no-fault state, and it’s one of the three states that is a choice no-fault state.

No-fault insurance law says that car insurance will pay for a policyholder’s injuries and damages regardless of who is at fault.

States with no-fault car insurance law normally have policyholders enroll in personal injury protection (PIP). New Jersey is one of the states where PIP is optional, which is why they’re considered a choice no-fault state. If for some reason a policy’s coverage limit doesn’t cover the total cost of bodily injury or property damage, the first party (policyholder) has the right to sue the third party (the at-fault driver).

Seat belt and car seat laws

The seat-belt law of New Jersey has been effective since March 1, 1985. In May 2000, the seat-belt law became a primary enforcement law. The seat-belt law for rear-seat passengers became a secondary enforcement law on January 20, 2011.

Primary enforcement allows police officers to pull over a driver for violating the seat-belt law. Secondary enforcement will allow law enforcement to issue tickets to drivers and passengers who don’t have a seat belt on after they’ve been stopped for other reasons.

Any driver and all passengers 8 years old and older and over 80 pounds should be wearing a seat belt. Violating the seat-belt law carries a fine of $20 for the first offense.

Children 2 years old and younger and weighing less than 30 pounds should be in a rear-facing child safety seat. Children who are 4 years old and younger and weigh less than 40 should be in rear-facing child safety seats, also. Fines for child safety seats are much more expensive. Violators will pay up to $75 for the first offense.

Keep Right and Move Over Laws

New Jersey highways can get extremely busy, so it would make perfect sense for a move-over law to be in the state. The New Jersey move-over law says that left lane driving is only allowed for passing or turning left. Therefore, drivers who are on the roadway in New Jersey should drive in the left lane if they are driving at higher rates of speed, while slower traffic should drive in the right lanes.

Drivers that approach a stopped emergency vehicle, such as a tow truck, highway maintenance or emergency service vehicle that’s displaying flashing lights and traveling in the same direction, must move over to the left-hand, non-adjacent lane if possible, or slow down.

Speed Limits

Due to the population size and heavy traffic conditions, New Jersey has adopted lower-than-average speed limits to keep the risks down to a minimum. The speed limits for rural interstates in New Jersey are 65 mph, while the speed limit for urban interstates is 55 mph.

Other limited access roads also have a speed limit of 65 mph, and roads not classified as highways or residential streets have a speed limit of 55 mph.

Ridesharing

Taxis aren’t the only popular transportation service these days. More and more commuters are using rideshare services such as Uber and Lyft to get to their destinations. Because of the ridesharing versatility, many commuters are using their vehicles to commute residents around the state. The two companies that offer rideshare insurance in New Jersey are Farmers and USAA.

Automation on the Road

In recent years, we’ve seen self-driving vehicles on the roadway across the United States. The use of self-driving vehicles or autonomous vehicles on the road is known as automation. Where does New Jersey stand regarding automation on the road?

In the first quarter of 2019, New Jersey state officials started a task force that’s focused on studying automation on the road and how to enact laws regarding automated vehicles.

What are the safety laws in New Jersey?

Safety laws are usually attached to a zero-tolerance policy, especially when it comes to motor vehicles. Our state guides concentrate on safety laws that involve DUI laws, marijuana-impaired laws, and distracted driving laws.

But why these laws? Besides traffic violations, these laws are commonly violated. Let’s review New Jersey’s version of these laws.

DUI Laws

Every state interprets DUI differently. Some states label it as a crime while other states label DUI as a driving violation. New Jersey is one of the states that labels DUI as a driving violation. Let’s look at more details regarding DUI by examining this short table.

| BAC Summary | BAC Data & Info |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | 0.15 |

| Criminal Status by Offense | Drunk driving is a "violation" not a "crime" |

| Formal Name for Offense | Driving Under the Influence (DUI) |

| Look Back Period/Washout Period | 10 years |

BAC is the blood alcohol content, which is the measurement of alcohol in the bloodstream of an impaired driver. For New Jersey law, any BAC exceeding 0.03 and 0.15 is considered a violation of driving safety law. Once a DUI violation is on your driving record, it will take 10 years for it to go away, which is the New Jersey washout period law.

Here’s a list of penalties a driver can face if they violate the DUI violation law.

| Offense | ALS or Revocation | Imprisonment | Fine | Other |

|---|---|---|---|---|

| 1st Offense | BAC 0.08-0.99: 3 months; BAC 0.10-0.14: 7 months-1 year; BAC 0.15+: 7 months - 1year, IID during suspension and 6 months - 1 year following restoration | Minimum 12 hrs. BAC 0.08+: up to 30 days | BAC 0.08-0.99: $250-$400; BAC 0.10-0.14: $300-$500; BAC 0.15+: $300-$500; BAC 0.08+ $3505 in fees and surcharges | 12-48 hours Intoxicated Driver Resource Center (IDRC) |

| 2nd Offense | 2nd in 10 years: 2 years; IID during license suspension and 1-3 years after restoration | 2nd in 10 years: 48 hours-90 days | $500-$1000; $3555 in fees and surcharges | 12-48 hours IDRC |

| 3rd Offense | 3rd in 10 years of 2nd: 10 years; IID during suspension and 1-3 years after restoration | 3rd in 10 years of 2nd: 180 days | 3rd in 10 years of 2nd: $1000 +$5055 in fees and surcharges | Up to 90 days Community Service; 12-48 hours IDRC |

Committing a DUI can get your driving privileges suspended for up to 10 years. Violators may end up doing a minimum of 12 hours of community service or up to 180 days in jail depending on the number of DUI offenses they have. Fines for DUI can reach up to $3,500.

Marijuana-Impaired Driving Laws

New Jersey is part of a list of states that don’t have marijuana-impaired driving laws. However, if a driver is involved in an accident while under the influence of marijuana or other narcotics, they’ll likely be charged with driving while impaired. It’s safer to be sober if you plan on driving a motor vehicle.

Distracted Driving Laws

Distracted driving has been a leading cause of car accidents. Lawmakers across the country have issued laws around the country to reduce distracted driving accidents and enforce legal consequences for those who violate the hands-free law.

New Jersey’s hands-free law says all drivers are banned from using a handheld device while operating a motor vehicle. Young drivers are included in the hands-free ban. It is a primary enforcement law, so police can stop you if they suspect you are using a device while you’re driving.

Driving Safely in New Jersey

Let’s talk more about why you should consider being extra cautious on the roadway. One of the ways car insurance companies justify car insurance premium increase is through crime and fatality statistics.

So what does that have to do with New Jersey car insurance? The data tables and information you’ll see in this section will show the number of fatalities and why car insurance companies issue rates based on driving record, age, gender, and coverage level.

How many vehicle thefts occur in New Jersey?

Vehicle thefts are just as unpredictable as the weather. In states where the population is higher than average, expect the number of vehicle thefts to be higher than the national average.

Our car insurance guides provide the number of thefts by make and model of a state. Here’s a list of vehicles that are likely stolen in the state of New Jersey.

| Rank | Make/Model | Year of Vehicle | Thefts |

|---|---|---|---|

| 1 | Honda Accord | 1997 | 844 |

| 2 | Honda Civic | 1998 | 753 |

| 3 | Dodge Caravan | 2002 | 427 |

| 4 | Nissan Sentra | 1998 | 340 |

| 5 | Ford Pickup (Full Size) | 2006 | 295 |

| 6 | Nissan Altima | 2014 | 291 |

| 7 | Jeep Cherokee/Grand Cherokee | 2000 | 286 |

| 8 | Toyota Camry | 2014 | 232 |

| 9 | Nissan Maxima | 1998 | 195 |

| 10 | Ford Econoline E350 | 2003 | 184 |

This data is based on research data that’s been collected over time. The two vehicles that are likely stolen in the state of New Jersey are Honda and Nissan vehicles.

Although this table shows us the vehicle thefts for different vehicles, it doesn’t show the total number of thefts in the state of New Jersey. The Federal Bureau of Investigation (FBI) does provide information on the total vehicle thefts in New Jersey. In a 2018 FBI report, New Jersey had 1,453 thefts.

How many road fatalities occur in New Jersey?

Road fatalities are part of the reason car insurance companies increase their average annual rates. A car insurance company can justify a rate increase for its policies if fatal accidents increase each year. The more accidents that occur, the more car insurance companies have to pay in filed claims.

This section will show the fatality numbers in a five-year trend. In addition to the fatality numbers, these sections will provide the number of teen DUI arrests and EMS response time.

Most fatal highway in New Jersey

The most fatal highway in New Jersey is Interstate-95 (I-95). I-95 is in conjunction with the New Jersey Turnpike, which is north of the I-195 exit. Between 2015 and 2017, 27 fatalities occurred on I-95 during the summer months. The other highways are known for high fatalities in New Jersey are I-78 (18 fatalities) and I-80 (17 fatalities).

Fatal Crashes by Weather Condition and Light Condition

How often does weather and light conditions affect driving? Weather and light conditions can impair a driver due to the slippery conditions of ice or low visibility from rain. This research listed in the data shows the total number of fatalities caused by weather and light conditions.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 235 | 166 | 86 | 29 | 0 | 516 |

| Rain | 21 | 26 | 8 | 3 | 0 | 58 |

| Snow/Sleet | 3 | 1 | 1 | 0 | 0 | 5 |

| Other | 0 | 4 | 2 | 2 | 0 | 8 |

| Unknown | 1 | 2 | 0 | 0 | 1 | 4 |

| TOTAL | 260 | 199 | 97 | 34 | 1 | 591 |

In New Jersey, more fatalities occurred during normal daylight conditions, followed by normal nighttime but lighted conditions. Fatalities during rain, snow, and sleet were minimal despite the more dangerous conditions they bring while driving on the roadway.

Fatalities (All Crashes) by County

Let’s continue to explore the fatality numbers in New Jersey by examining the fatalities in a five-year trend. The data that follows for the next few sub-sections comes from the National Highway Traffic Safety Administration (NHTSA) and will show the fatal crash data of New Jersey. For this table, we’ll show the total number of crashes by county in New Jersey.

| New Jersey Counties | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2018 Fatalities |

|---|---|---|---|---|---|

| Atlantic County | 41 | 29 | 39 | 36 | 30 |

| Bergen County | 39 | 30 | 35 | 27 | 32 |

| Burlington County | 31 | 48 | 50 | 48 | 44 |

| Camden County | 38 | 34 | 39 | 44 | 46 |

| Cape May County | 12 | 12 | 12 | 16 | 10 |

| Cumberland County | 18 | 29 | 32 | 26 | 19 |

| Essex County | 40 | 40 | 46 | 40 | 45 |

| Gloucester County | 31 | 23 | 26 | 44 | 38 |

| Hudson County | 24 | 27 | 24 | 26 | 23 |

| Hunterdon County | 6 | 9 | 11 | 8 | 3 |

| Mercer County | 26 | 19 | 21 | 26 | 29 |

| Middlesex County | 33 | 41 | 46 | 48 | 50 |

| Monmouth County | 47 | 47 | 50 | 43 | 29 |

| Morris County | 14 | 23 | 21 | 29 | 28 |

| Ocean County | 45 | 38 | 41 | 53 | 39 |

| Passaic County | 24 | 32 | 22 | 18 | 21 |

| Salem County | 19 | 11 | 15 | 17 | 9 |

| Somerset County | 25 | 22 | 19 | 23 | 23 |

| Sussex County | 7 | 10 | 12 | 7 | 12 |

| Union County | 30 | 29 | 26 | 34 | 27 |

| Warren County | 6 | 8 | 15 | 11 | 7 |

The highest number of fatal crashes occurred in 2017, which was 624 total fatal crashes across New Jersey. The average number of fatal crashes is roughly 581. Even though fatal crashes in New Jersey peaked at 624 in 2017, it decreased by 1.11 percent by 2018.

Read more: Middlesex Insurance Company Car Insurance Review

Traffic Fatalities

Let’s look at traffic fatalities. Traffic fatalities such as rural, urban, and unknown are not separate fatalities from the fatal crash totals, but they are part of the crash totals. Here are the totals for traffic fatalities.

| Traffic Fatalities | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2018 Fatalities |

|---|---|---|---|---|---|

| Total (C-1) | 556 | 561 | 602 | 624 | 564 |

| Rural | 78 | 67 | 86 | 83 | 45 |

| Urban | 475 | 490 | 512 | 536 | 509 |

| Unknown | 3 | 4 | 4 | 5 | 10 |

The sum of the fatal crash totals in the previous table is the fatal crash totals represented in the Total. The traffic fatalities just separate the values, and it shows that most fatal crashes occurred on urban roads.

Fatalities by Person Type

This table shows the type of person/vehicle involved in a fatal crash. These totals are not separate from the totals mentioned in the first table. Different accidents often fall into the same category.

| Person Type | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2018 Fatalities |

|---|---|---|---|---|---|

| Passenger Car | 202 | 213 | 233 | 213 | 201 |

| Light Truck - Pickup | 23 | 25 | 31 | 22 | 25 |

| Light Truck - Utility | 48 | 49 | 54 | 72 | 53 |

| Light Truck - Van | 21 | 14 | 16 | 24 | 19 |

| Large Truck | 13 | 10 | 7 | 6 | 13 |

| Other/Unknown Occupants | 4 | 8 | 2 | 3 | 4 |

| Total Occupants | 311 | 321 | 348 | 340 | 318 |

| Light Truck - Other | 0 | 2 | 2 | 0 | 0 |

| Bus | 0 | 0 | 3 | 0 | 3 |

| Total Motorcyclists | 62 | 50 | 71 | 83 | 53 |

| Pedestrian | 168 | 170 | 163 | 183 | 173 |

| Bicyclist and Other Cyclist | 11 | 18 | 18 | 17 | 18 |

| Other/Unknown Nonoccupants | 4 | 2 | 2 | 1 | 2 |

| Total Nonoccupants | 183 | 190 | 183 | 201 | 193 |

| Total | 556 | 561 | 602 | 624 | 564 |

Once again, the totals match up to the first “All Crashes” table. Passenger cars were the most likely to be involved in a fatal accident in a five-year trend, followed by pedestrians.

Fatalities by Crash Type

The NHTSA categorized the condition of the crash by listing the fatal crash numbers under crash type. Here are the results of fatal crashes by crash type.

| Crash Type | 2014 Fatalties | 2015 Fatalties | 2016 Fatalties | 2017 Fatalties | 2018 Fatalties |

|---|---|---|---|---|---|

| Single Vehicle | 337 | 360 | 371 | 380 | 321 |

| Involving a Large Truck | 74 | 50 | 59 | 53 | 91 |

| Involving Speeding | 99 | 128 | 132 | 126 | 114 |

| Involving a Rollover | 68 | 86 | 83 | 72 | 75 |

| Involving a Roadway Departure | 234 | 242 | 280 | 267 | 213 |

| Involving an Intersection (or Intersection Related) | 185 | 210 | 213 | 197 | 193 |

| Total Fatalities (All Crashes)* | 556 | 561 | 602 | 624 | 564 |

More fatal crashes occurred with single-vehicle crashes and roadway departure crashes. Single-vehicle crashes are fatal crashes where only one vehicle was involved, but roadway-departure crashes are vehicle crashes where a vehicle leaves the roadway upon impact with another vehicle or object.

Five-Year Trend For The Top 10 Counties

Which counties had the most fatalities in the past five years? The NHTSA provided a top 10 list of counties that had the most fatal crashes in the last five years.

| County Rank | New Jersey Counties | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2018 Fatalities | Total Fatalites in a Five-Year Trend |

|---|---|---|---|---|---|---|---|

| 1 | Middlesex County | 33 | 41 | 46 | 48 | 50 | 218 |

| 2 | Camden County | 38 | 34 | 39 | 44 | 46 | 201 |

| 3 | Essex County | 40 | 40 | 46 | 40 | 45 | 211 |

| 4 | Burlington County | 31 | 48 | 50 | 48 | 44 | 221 |

| 5 | Ocean County | 45 | 38 | 41 | 53 | 39 | 216 |

| 6 | Gloucester County | 31 | 23 | 26 | 44 | 38 | 162 |

| 7 | Bergen County | 39 | 30 | 35 | 27 | 32 | 163 |

| 8 | Atlantic County | 41 | 29 | 39 | 36 | 30 | 175 |

| 9 | Mercer County | 26 | 19 | 21 | 26 | 29 | 121 |

| 10 | Monmouth County | 47 | 47 | 50 | 43 | 29 | 216 |

| Sub Total 1. | Top Ten Counties | 375 | 368 | 404 | 419 | 382 | 1948 |

| Sub Total 2. | All Other Counties | 181 | 193 | 198 | 205 | 182 | 959 |

| Total | All Counties | 556 | 561 | 602 | 624 | 564 | 2907 |

Burlington County had most total fatal crashes in a five-year trend. Middlesex County, Ocean County, and Monmouth County had the next largest share of fatal crashes.

Fatalities Involving Speeding by County

Next, let’s continue reviewing fatal crash data by examining the fatal crashes that involved speeding in New Jersey.

| New Jersey Counties | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2018 Fatalities |

|---|---|---|---|---|---|

| Atlantic County | 9 | 5 | 12 | 9 | 10 |

| Bergen County | 0 | 7 | 6 | 5 | 5 |

| Burlington County | 3 | 8 | 11 | 13 | 7 |

| Camden County | 9 | 13 | 6 | 7 | 13 |

| Cape May County | 4 | 0 | 3 | 2 | 2 |

| Cumberland County | 1 | 13 | 5 | 7 | 4 |

| Essex County | 2 | 8 | 6 | 7 | 6 |

| Gloucester County | 3 | 6 | 6 | 13 | 5 |

| Hudson County | 8 | 6 | 6 | 5 | 6 |

| Hunterdon County | 0 | 0 | 2 | 1 | 0 |

| Mercer County | 5 | 7 | 4 | 8 | 6 |

| Middlesex County | 3 | 4 | 15 | 13 | 14 |

| Monmouth County | 16 | 10 | 17 | 10 | 8 |

| Morris County | 3 | 3 | 5 | 5 | 4 |

| Ocean County | 9 | 3 | 6 | 5 | 8 |

| Passaic County | 7 | 11 | 7 | 4 | 4 |

| Salem County | 6 | 4 | 4 | 3 | 1 |

| Somerset County | 2 | 3 | 0 | 2 | 3 |

| Sussex County | 1 | 5 | 1 | 0 | 3 |

| Union County | 8 | 10 | 10 | 6 | 2 |

| Warren County | 0 | 2 | 0 | 1 | 3 |

Speeding fatalities were down to a minimum. No county reached 20 fatal crashes in the five-year trend listed in the data table.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Finally, let’s examine the crash fatalities caused by alcohol-impaired drivers. The five-year trend continues to give you a better look at how these numbers fluctuate.

| New Jersey Counties | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2018 Fatalities |

|---|---|---|---|---|---|

| Atlantic County | 12 | 3 | 12 | 5 | 6 |

| Bergen County | 12 | 3 | 9 | 2 | 6 |

| Burlington County | 9 | 9 | 9 | 8 | 11 |

| Camden County | 9 | 8 | 9 | 12 | 11 |

| Cape May County | 5 | 1 | 5 | 5 | 4 |

| Cumberland County | 4 | 7 | 8 | 6 | 6 |

| Essex County | 13 | 5 | 10 | 10 | 9 |

| Gloucester County | 7 | 5 | 5 | 6 | 9 |

| Hudson County | 11 | 3 | 4 | 5 | 3 |

| Hunterdon County | 3 | 1 | 1 | 1 | 0 |

| Mercer County | 5 | 3 | 3 | 8 | 7 |

| Middlesex County | 8 | 5 | 9 | 12 | 12 |

| Monmouth County | 14 | 11 | 13 | 9 | 10 |

| Morris County | 3 | 4 | 2 | 4 | 3 |

| Ocean County | 8 | 6 | 6 | 6 | 8 |

| Passaic County | 10 | 9 | 9 | 5 | 5 |

| Salem County | 8 | 5 | 1 | 3 | 0 |

| Somerset County | 10 | 5 | 4 | 3 | 6 |

| Sussex County | 2 | 3 | 2 | 1 | 2 |

| Union County | 5 | 10 | 13 | 8 | 6 |

| Warren County | 2 | 2 | 1 | 2 | 2 |

The number of fatal crashes does fluctuate. Each county in New Jersey has managed to keep DUI fatal crashes under 20. But one fatal crash is one too many. That’s why law enforcement and the court system is so tough on DUI violators, and the reason car insurance companies issue more expensive rates for those with a DUI on their driving record.

Teen Drinking and Driving

There’s a zero-tolerance policy for teen drinking and driving across the country. New Jersey police arrested 129 teens in 2016 for DUI. New Jersey law enforcement arrest about 65 DUI teens per 1 million people. The state currently ranks 32nd in teen DUI arrests.

EMS Response Time

Why include EMS response times? This will give an idea of how long it will take for an emergency will reach a vehicle after an accident. This is particularly important if the vehicle accident has injuries that require immediate medical attention. This information listed below comes from the NHTSA and describes the response time of EMS.

| Area in the State | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|

| Rural | 0 | 19 | 32 | 51 | 76 |

| Urban | 3 | 9 | 33 | 44 | 506 |

Rural areas have an excellent response time when notifying EMS. However, the time it takes for EMS to arrive is longer than urban areas. EMS arrival to a crash scene is under an hour for both rural and urban areas of New Jersey. These are average times. Overall EMS arrival time depends on traffic and the time of day.

What is transportation like in New Jersey?

New Jersey is known for its metropolitan areas. Because these areas are highly populated some people in the state prefer to use public transportation.

Data USA, a nonprofit research group, provides information on transportation data in New Jersey. This sub-section gives you insight into how most New Jersey residents commute and what the traffic forecast looks like.

Car Ownership

Most New Jersey households own two vehicles, which is about 39 percent of households. The next largest group is households that own one vehicle, which is roughly 22 percent of households in New Jersey. About 4 percent of households own five or more vehicles.

Commute Time

Commute time is the average time it takes for a driver to get to work. The national average for commute time is about 26 minutes. For New Jersey residents, the average commute time is roughly 31 minutes. So, a New Jersey commuter will likely spend an hour or more a day to get to and from work.

Commuter Transportation

People in New Jersey indeed use public transit more than the national average. Data USA reported that about 12 percent of commuters use public transit to commute. However, 71 percent of commuters in New Jersey prefer to drive to work.

Traffic Congestion

There wasn’t much information from Inrix and TomTom regarding New Jersey traffic congestion data, but Numbeo provided a summary of traffic congestion data of Newark, one of New Jersey’s biggest cities. Before we show you the data, we’ll explain what the values mean.

Traffic index is the combined time consumed in traffic due to work commute, estimated time waiting in traffic, estimated CO2 consumption while in traffic, and overall errors in traffic. Time index is the average time, measured in minutes, for one-way trips.

Time exp. index is an estimate of long commute times that leave you dissatisfied. Numbeo reported that “the dissatisfaction of commute times increases exponentially with each minute after one-way commute time is longer than 25 minutes.”

The inefficiency Index is an estimate of errors in traffic. High inefficiencies are caused by people who choose to drive a car instead of using public transport for long commute times.

Before we get to the data, we would like to present a short new report on traffic congestion in New Jersey.

Now that we have the terms defined, let’s move onto the traffic data of Newark, N.J.

| Newark, NJ Traffic Summary | Traffic Data |

|---|---|

| Traffic Index | 255.15 |

| Time Index (in minutes) | 48.75 |

| Time Exp. Index | 5,537.10 |

The traffic index is made up of different factors. The traffic index describes the time it takes to get to work and the trip back home. When you factor in peak commute times, the commutes are longer than the average commute time. Based on the traffic index data, a driver can spend up to four hours (up to two hours for one-way commutes) driving in Newark.

New Jersey car insurance may be complex, but don’t believe the hype about not finding affordable car insurance. There are several companies in New Jersey that can provide discounts that can make car insurance premiums more cost-efficient.

Why include the laws, fatalities, commute transportation? This gives insight into what to expect from New Jersey MVC and how long your daily drive will be in the state. In addition to commutes, you’ll need to know why car insurance is expensive in New Jersey.

Large populations and high fatality rates are some of the reasons why. For new residents, they’ll need all the information they can get. Laws are different for each state, so it’s convenient to have this information available so new residents of New Jersey won’t be blindsided by common laws that people miss if they’re not from the state.

Would you like a second look at some car insurance quotes?

Before making any final decisions on your insurance company, it is important to learn as much as you can about your local insurance providers, and the coverages they offer. Call your local insurance agent to clear up any questions that you might have. Questions to consider asking include, “What is the best coverage plan for me/my family/my situation?” “What are the minimum coverage requirements in my state and what form of coverage do you recommend?” “Do you guys offer any bundle discounts if I take out both my auto insurance and home insurance with you?” and “What is the average rate of insurance quotes you guys offer?”

Before making any big insurance decisions, use our free tool to compare insurance quotes near you. It’s simple, just plug in your zip code and we’ll do the rest!

Enter your ZIP code in the free quote tool at the bottom of the webpage to get a look at some quotes from top car insurance companies.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent