Pennsylvania Car Insurance (Coverage, Companies, & More)

Pennsylvania insurance costs are cheaper when compared to the other New England States. The average Pennsylvania insurance rates are $81/mo, but your rates will vary based on your age, gender, and driving record. Start comparing local Pennsylvania insurance companies now with this guide to find the best coverage near you.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 10, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 10, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Pennsylvania Stats Summary | Statistics |

|---|---|

| Miles of Roadway | 120,091 |

| Number of Vehicles Registered | 10,205,304 |

| State Population | 12,791,124 |

| Most Popular Vehicle | CR-V |

| Percentage of Uninsured Drivers | 7.60% |

| Total Driving Related Deaths | 1,190 |

| -Speeding Fatalities | 455 |

| -DUI Fatalities | 334 |

| Average Annual Premiums | $970.51 |

| -Avg Liability Premium | $499.06 |

| -Avg Collision Premium | $327.24 |

| -Avg Comprehensive Premium | $144.21 |

| Cheapest Providers | USAA and Geico |

Pennsylvania is home to a lot of American firsts – the first baseball stadium, the first automobile service station, the first daily newspaper, the first computer, the first Zoological garden, and the first commercial radio broadcast were all built or created in The Keystone State.

Pennsylvania is also home to mandatory insurance laws, so you are required by law to maintain at least the minimum liability coverage for your vehicle and you will need proof of insurance to register your vehicle with the state.

If you are ready to compare rates for car insurance in Pennsylvania, enter your ZIP code now to find a quote.

Pennsylvania Car Insurance Coverage and Rates

Understanding car insurance is not an easy task. From your required minimum levels of coverage to how your rates are calculated, the subject is complex and changes from state to state, but it is possible to learn the ins and outs of the laws and requirements of your insurance.

Read below to find out more about the specifics of auto insurance and the laws that guide your experiences as a driver and a car owner.

Pennsylvania’s Car Culture

Pennsylvania’s car culture is as old as it is varied. The first-ever gas station in the U.S. is located in Altoona, but Pennsylvania is also home to the largest Amish population on earth, which means a solid portion of their citizens don’t use cars at all. You might even see a horse and buggy traveling down the road as you drive through the state.

The average person in Pennsylvania commutes 25.7 minutes each way, which is only marginally higher than the national average of 25.5 minutes.

Pennsylvania Minimum Coverage

Unlike most other states, Pennsylvania is a no-fault state, which means that instead of the person who caused the accident intially being responsible for the damages, each driver is expected to file a claim with their own insurance company to compensate for any damages they experienced. Then the insurance companies work out which company reimburses the other.

Even within the framework of being a no-fault state, Pennsylvania’s laws are different from the rest because they are considered a “choice no-fault” state, which means that you have to choose between limited tort and full tort coverage. What is the difference?

- Limited Tort – A driver is choosing the no-fault system, waiving their right to sue in the event of an accident. This option is less expensive than full tort coverage.

- Full Tort – A driver is choosing to bypass the no-fault system, giving them the right to sue the other driver and file a claim against them in court. This option is more expensive than limited tort coverage.

Read more: Defining Full Tort Car Insurance

In Pennsylvania, everyone is required to carry minimum liability coverage. The minimum liability coverage levels in the state are:

- Property Damage – $5,000

- Bodily Injury – $15,000 per person, $30,000 per accident

While insurance is required by law, 7.6 percent of Pennsylvania residents choose to drive without insurance coverage.

Also, Pennsylvania’s minimum insurance requirements are some of the lowest in the nation, which means that if you cause an accident the odds are very good that you will need more than just minimum coverage to be able to pay for damages if you are taken to court.

Forms of Financial Responsibility

Pennsylvania requires proof of financial responsibility to register your vehicle. They also require you to carry proof of financial responsibility with you in case you are stopped by a police officer while driving. Any of the following are acceptable forms of financial responsibility:

- An original copy of your insurance ID card.

- An official copy of your declarations page from your insurance policy.

- An official copy of an application for insurance to the Pennsylvania Assigned Risk Plan signed by a licensed

insurance agent/broker. - An original copy of your certificate of self-insurance that was issued by PennDOT.

- A copy of a valid binder of insurance issued by your insurance provider (who must be licensed to sell liability

insurance in the state) - An original copy of a letter from the insurance carrier that verifies the proof of financial responsibility of the insured

(must be on official company letterhead signed by an insurance agent or another authorized representative of the

insurance company.)

Premiums as a Percentage of Income

| States | Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|---|---|---|---|---|---|---|---|---|---|

| Maryland | $1,096.37 | $46,875.00 | 2.34% | $1,071.35 | $45,664.00 | 2.35% | $1,056.82 | $46,815.00 | 2.26% |

| New Jersey | $1,379.20 | $49,983.00 | 2.76% | $1,369.70 | $47,972.00 | 2.86% | $1,334.59 | $48,569.00 | 2.75% |

| New York | $1,327.82 | $47,446.00 | 2.80% | $1,301.49 | $45,710.00 | 2.85% | $1,273.70 | $46,010.00 | 2.77% |

| Pennsylvania | $950.42 | $42,414.00 | 2.24% | $930.48 | $40,840.00 | 2.28% | $915.83 | $41,020.00 | 2.23% |

Your insurance premiums are affected by a variety of factors. Everything from your age to your driving record to your ZIP code can influence your rates, which sometimes makes it difficult to determine what your premiums will be as a percentage of your income.

People with poor driving records could potentially be spending 25 percent or more of their income on their coverage, whereas someone with an excellent driving record might be spending a much smaller percentage of their income on car insurance premiums.

To determine what percentage of your income is spent on car insurance, take the amount of your premium divided by your income (either gross or net) then multiply by 100.

For example, if a woman is earning $39,960 and paying $2,200.00 for insurance each year, she spends 5.5 percent of her gross income on her car insurance annually.

As she gets older, her insurance rates will change, but other factors such, as her ZIP code and credit history, will also impact her rates, which means she might not be able to predict whether her rates will go up or down in the future.

You can use our calculator below to determine the percentage of income you are spending on your car insurance.

Average Monthly Car Insurance Rates in PA (Liability, Collision, Comprehensive)

Your average monthly car insurance rates may not increase as much as you might think by adding additional coverage like comprehensive. Review rates for auto insurance coverage below:

| Insurance Costs in Pennsylvania | 2015 | 2014 | 2013 | 2012 | 2011 | Average |

|---|---|---|---|---|---|---|

| Liability | $499.06 | $496.87 | $497.28 | $495.22 | $486.66 | $495.02 |

| Collision | $327.24 | $315.28 | $301.49 | $296.33 | $296.23 | $307.31 |

| Comprehensive | $144.21 | $138.27 | $131.71 | $124.28 | $121.57 | $132.01 |

| Pennsylvania | $970.51 | $950.42 | $930.48 | $915.83 | $904.47 | $934.34 |

While liability coverage is required in Pennsylvania, there is a lot more to insurance coverage than just liability. Insurance is about protecting all of your financial interests, so you may want to consider purchasing some or all of these coverages as well:

- Liability insurance – Protects your financial welfare by paying for damages to the other driver’s vehicle or bodily injury claims if you are sued by another driver in an accident.

- Uninsured motorist coverage – Sometimes referred to as UM, uninsured motorist coverage is not mandatory in Pennsylvania. Also called hit-and-run coverage, it typically covers you if you are in an accident where an uninsured driver was at fault. In a no-fault state UM coverage is not strictly necessary, but could be beneficial for you depending on your needs.

- Collision insurance – Pays for damages to your vehicle if you are at fault in an accident, whether you hit a stationary object or someone else’s vehicle. Given that, in Pennsylvania, no matter who was at fault you have to file a claim with your insurance in the event of an accident, this coverage may be necessary to pay for any damages to your car that result from an accident.

- Comprehensive insurance – Covers damage to your car that isn’t caused by an accident. Some things that might be covered under a comprehensive policy include hail damage, flood, and theft.

Given the unique insurance laws in Pennsylvania, each insurance company will probably have their own guidelines as to what is and is not covered under your comprehensive and collision policies (especially in the event of an accident where the other driver was at fault) so make sure you do your research when choosing an insurance provider.

Additional Liability

When it comes to additional coverage you may want to think about the benefits of Personal Injury Protection (PIP). Despite the fact that some states require PIP coverage as part of a basic insurance plan, Pennsylvania does not have that requirement.

PIP is usually a smaller amount of coverage, sometimes in the $2,000-$3,000 range, provided to cover your most basic medical needs due to an injury during the accident.

But PIP is about your medical needs. What about the needs of the people in the other car if you are sued after an accident?

The state minimum is $15,000/$30,000 for bodily injury and $5,000 for property damage, but that is the minimum, not the maximum, for your liability coverage. You can always increase your liability levels, and given just how low the Pennsylvania requirements are, most people should give some serious thought to carrying more than the state minimum.

You can always choose to purchase more than the legal minimum of insurance. Most companies offer higher coverage levels, typically $50,000-$100,000 in property damage and $100,000-$250,000 per person/$300,000-$500,000 per accident bodily injury, for which you will pay a higher monthly premium.

In an accident, if you are lucky, the damage will be minimal and nobody will get hurt. But what if you aren’t so lucky?

You could hit someone in an expensive, new vehicle. They might have multiple passengers in the car, all of whom need medical attention. A young mother could easily have all of her children in the car, so keep that in mind when looking at that $30,000 bodily injury cap.

This is especially important for people who drive outside of the state. If you work or visit family in other states, you will find yourself in places where the laws are very different and you may be held liable for any damage you cause, and the minimums in Pennsylvania are so low you may be on the hook for extremely large car repair or hospital bills.

When you are choosing a policy, you should also consider the company’s loss ratio. Loss ratio is the amount paid out in claims by a company versus the amount of premium taken in by the company.

According to the NAIC, a loss ratio in the 60s or 70s is appropriate — it means they aren’t overcharging premium and they are regularly paying out claims to their customers. Below, you can see the average loss ratios for companies in Pennsylvania.

| Pennsylvania Personal Injury Protection | 2015 | 2014 | 2013 |

|---|---|---|---|

| Pure Premium | 55.5 | 56.59 | 60.2 |

| Loss Ratio | 71.21 | 70.99 | 73.86 |

Add-ons, Endorsements, and Riders

Just because you have all of the basic core coverages and higher-than-average levels of liability insurance doesn’t mean you won’t need other coverage, too. There are many types of coverage available you may need to keep yourself on solid financial ground.

- Umbrella Policy – If you don’t think that $100,000/$300,000 in bodily injury and $100,000 in property damage (or whatever your specific insurance company has set as their maximum liability coverage) would be enough to protect your assets in a serious accident, you may want to consider an umbrella policy. Umbrella policies provide a minimum of $1,000,000 in liability coverage and include coverage for things beyond car accidents like libel and slander.

- Rental Reimbursement – Rental reimbursement covers the cost of a rental car while your vehicle is being repaired because of an insured loss. For example, if you woke up one day and found your car had been damaged by hail comprehensive insurance would cover the cost to repair it, but rental reimbursement would cover for the cost of a rental car during repairs.

- Roadside Assistance – If you need a tow truck or car repair on the side of the road, roadside assistance coverage can help cover the cost of those services.

- GAP Insurance – GAP insurance covers the difference between what your insurance policy pays and the amount still owed for the car. GAP insurance can help prevent you from being forced to make payments on a totaled vehicle, but the type of GAP coverage available varies widely from company to company and state to state, so research carefully before buying.

- Non-Owner Insurance – If you don’t own your own car but you still drive semi-regularly, you might want or need a non-owner insurance plan to provide you with third party liability coverage so you are financially protected.

- Classic Car Insurance – The value of a classic or vintage car is often worth more than normal depreciation. If you have a classic car you will need classic car insurance to make sure your vehicle is protected at its full value.

- Usage-Based/Pay-As-You-Drive Insurance – A device can be installed in your car or an app installed on your phone that records your driving information (speed, mileage, etc.) and reports it to your insurance company who offer you discounts based on your driving record. This has the potential for serious negative side effects though, so consider carefully before signing up.

In Pennsylvania, there are some additional coverages that you may want that aren’t necessarily available in other states, such as:

- Funeral Benefits – This is coverage you can purchase that will help cover the cost of a funeral if you or a loved one die in a car accident. This does have a cap, but that amount will vary from company to company.

- Income Loss – Aptly named, this coverage will pay a portion of your lost income if you are unable to work due to injuries you received in a car accident.

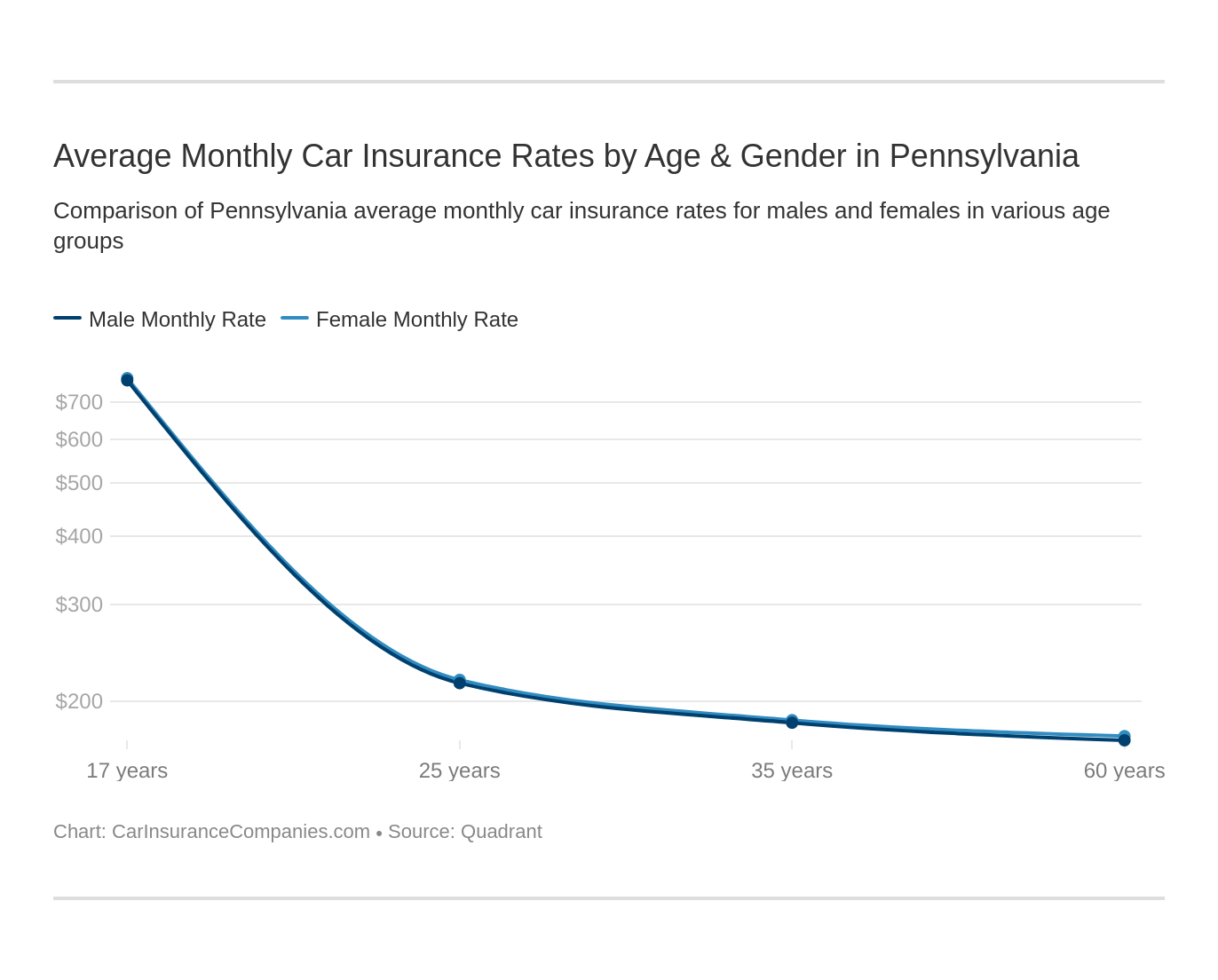

Average Monthly Car Insurance Rates by Age & Gender in PA

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,500.83 | $2,500.83 | $2,307.05 | $2,307.05 | $8,377.10 | $8,377.10 | $2,751.49 | $2,751.49 |

| First Liberty Ins Corp | $3,969.70 | $3,969.70 | $3,637.16 | $3,637.16 | $11,576.65 | $11,576.65 | $5,037.27 | $5,037.27 |

| Geico Cas | $2,050.13 | $1,773.78 | $1,932.09 | $1,672.62 | $5,122.03 | $4,441.41 | $2,063.97 | $1,785.69 |

| Nationwide P&C | $1,909.07 | $1,909.07 | $1,807.43 | $1,807.43 | $5,346.15 | $5,346.15 | $2,138.83 | $2,138.83 |

| Progressive Specialty | $2,795.84 | $2,795.84 | $2,498.30 | $2,498.30 | $8,952.27 | $8,952.27 | $3,557.57 | $3,557.57 |

| State Farm Mutual Auto | $1,685.65 | $1,685.65 | $1,487.48 | $1,487.48 | $5,944.71 | $5,944.71 | $1,859.05 | $1,859.05 |

| Travelers Home & Marine Ins Co | $1,747.11 | $1,747.11 | $1,882.23 | $1,882.23 | $25,635.88 | $25,635.88 | $2,104.67 | $2,104.67 |

| USAA | $1,148.03 | $1,148.03 | $1,037.62 | $1,037.62 | $3,463.40 | $3,463.40 | $1,524.42 | $1,524.42 |

Pennsylvania is one of several states that have made it illegal for insurance companies to rate their customers by gender. They now follow a unisex rating system, so men no longer pay a higher rate for insurance.

A variety of other factors will still impact your rates, however, including your marital status and ZIP code. If you need to find a lower rate it is a good idea to get quotes from a number of insurance companies because, even with other factors working against your favor, your rate could vary by hundreds of dollars a year, depending on which insurance company you choose.

For examples of how widely insurance rates can vary, take a look at the chart of average annual rates by gender below:

| Company | Demographic | Average Annual Rate |

|---|---|---|

| Allstate F&C | Single 17-year old female | $8,377.10 |

| First Liberty Ins Corp | Single 17-year old female | $11,576.65 |

| Geico Cas | Single 17-year old female | $5,122.03 |

| Nationwide P&C | Single 17-year old female | $5,346.15 |

| Progressive Specialty | Single 17-year old female | $8,952.27 |

| State Farm Mutual Auto | Single 17-year old female | $5,944.71 |

| Travelers Home & Marine Ins Co | Single 17-year old female | $25,635.88 |

| USAA | Single 17-year old female | $3,463.40 |

| Allstate F&C | Single 17-year old male | $8,377.10 |

| First Liberty Ins Corp | Single 17-year old male | $11,576.65 |

| Geico Cas | Single 17-year old male | $4,441.41 |

| Nationwide P&C | Single 17-year old male | $5,346.15 |

| Progressive Specialty | Single 17-year old male | $8,952.27 |

| State Farm Mutual Auto | Single 17-year old male | $5,944.71 |

| Travelers Home & Marine Ins Co | Single 17-year old male | $25,635.88 |

| USAA | Single 17-year old male | $3,463.40 |

| Allstate F&C | Single 25-year old female | $2,751.49 |

| First Liberty Ins Corp | Single 25-year old female | $5,037.27 |

| Geico Cas | Single 25-year old female | $2,063.97 |

| Nationwide P&C | Single 25-year old female | $2,138.83 |

| Progressive Specialty | Single 25-year old female | $3,557.57 |

| State Farm Mutual Auto | Single 25-year old female | $1,859.05 |

| Travelers Home & Marine Ins Co | Single 25-year old female | $2,104.67 |

| USAA | Single 25-year old female | $1,524.42 |

| Allstate F&C | Single 25-year old male | $2,751.49 |

| First Liberty Ins Corp | Single 25-year old male | $5,037.27 |

| Geico Cas | Single 25-year old male | $1,785.69 |

| Nationwide P&C | Single 25-year old male | $2,138.83 |

| Progressive Specialty | Single 25-year old male | $3,557.57 |

| State Farm Mutual Auto | Single 25-year old male | $1,859.05 |

| Travelers Home & Marine Ins Co | Single 25-year old male | $2,104.67 |

| USAA | Single 25-year old male | $1,524.42 |

| Allstate F&C | Married 35-year old female | $2,500.83 |

| First Liberty Ins Corp | Married 35-year old female | $3,969.70 |

| Geico Cas | Married 35-year old female | $2,050.13 |

| Nationwide P&C | Married 35-year old female | $1,909.07 |

| Progressive Specialty | Married 35-year old female | $2,795.84 |

| State Farm Mutual Auto | Married 35-year old female | $1,685.65 |

| Travelers Home & Marine Ins Co | Married 35-year old female | $1,747.11 |

| Allstate F&C | Married 35-year old male | $2,500.83 |

| First Liberty Ins Corp | Married 35-year old male | $3,969.70 |

| Geico Cas | Married 35-year old male | $1,773.78 |

| Nationwide P&C | Married 35-year old male | $1,909.07 |

| Progressive Specialty | Married 35-year old male | $2,795.84 |

| State Farm Mutual Auto | Married 35-year old male | $1,685.65 |

| Travelers Home & Marine Ins Co | Married 35-year old male | $1,747.11 |

| Allstate F&C | Married 60-year old female | $2,307.05 |

| First Liberty Ins Corp | Married 60-year old female | $3,637.16 |

| Geico Cas | Married 60-year old female | $1,932.09 |

| Nationwide P&C | Married 60-year old female | $1,807.43 |

| Progressive Specialty | Married 60-year old female | $2,498.30 |

| State Farm Mutual Auto | Married 60-year old female | $1,487.48 |

| Travelers Home & Marine Ins Co | Married 60-year old female | $1,882.23 |

| Allstate F&C | Married 60-year old male | $2,307.05 |

| First Liberty Ins Corp | Married 60-year old male | $3,637.16 |

| Geico Cas | Married 60-year old male | $1,672.62 |

| Nationwide P&C | Married 60-year old male | $1,807.43 |

| Progressive Specialty | Married 60-year old male | $2,498.30 |

| Travelers Home & Marine Ins Co | Married 60-year old male | $1,882.23 |

Please note: In the tables above, the rates are determined by actual purchased coverage by drivers in Pennsylvania. It also includes rates for high-risk drivers, as well as drivers who choose to carry higher-than-minimum levels of coverage, so these numbers may be higher than a standard insurance quote.

Read more: The First Liberty Insurance Corporation Car Insurance Review

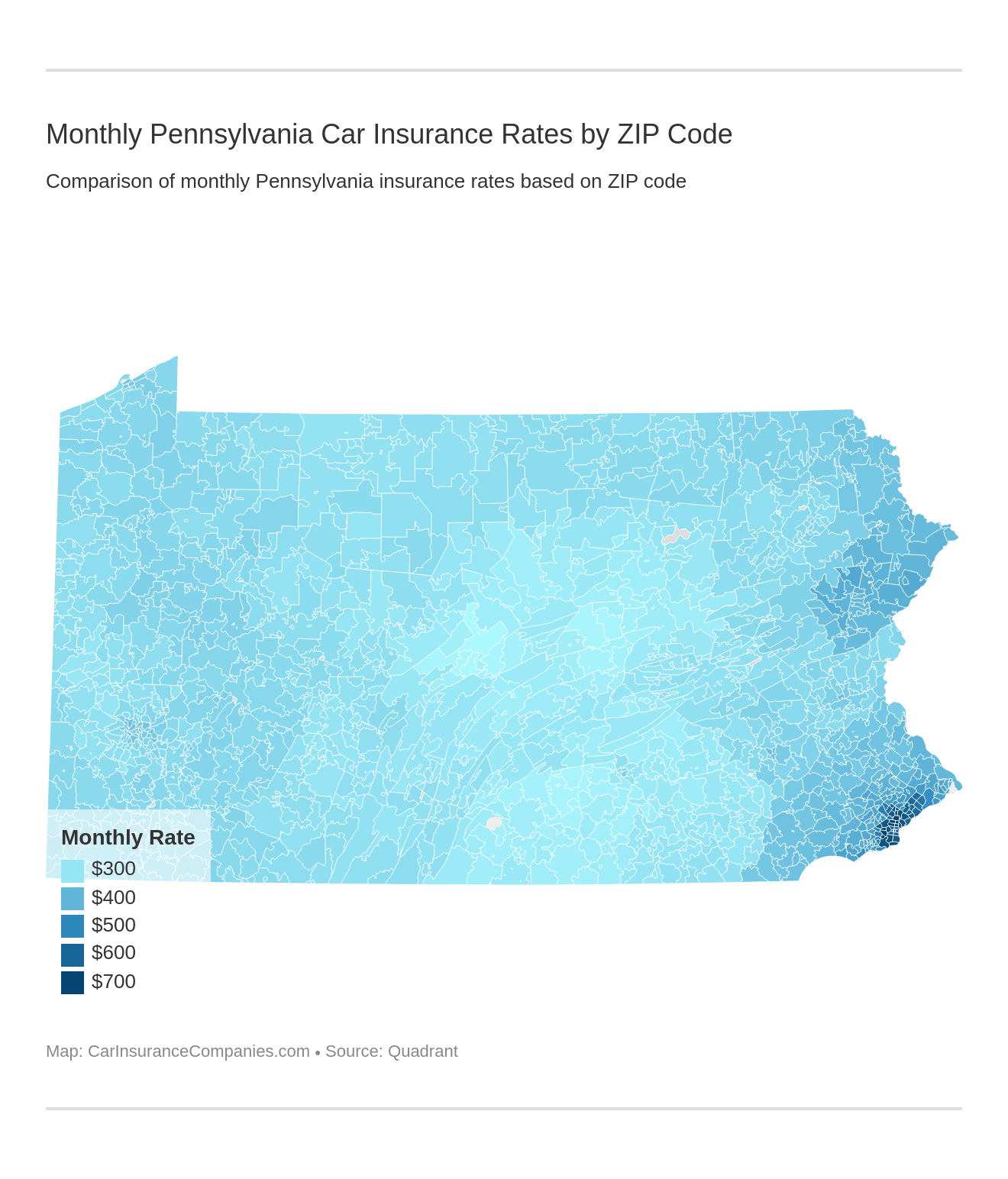

Cheapest Rates by ZIP Code

Your ZIP code is a big factor in determining your insurance rates. Everything from the number of stolen vehicles to the amount of street parking in a ZIP code helps determine what the rate for that area should be, which means that moving only a block or two could dramatically change your annual premiums if it moves you to a new ZIP code.

In Pennsylvania, the most expensive ZIP codes are all located in the city of Philadelphia.

Generally speaking, the rates in Pennsylvania are relatively low – minimal required liability combined with plenty of rural space is a combination that works to keep insurance prices affordable. Philadelphia is the exception to the normally low prices seen in the state, however, as can be seen in the table below.

| Most Expensive Zip Codes in Pennsylvania | City | Average Annual Rate by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 19104 | PHILADELPHIA | $7,718.61 | Travelers | $15,015.69 | Liberty Mutual | $14,953.09 | USAA | $2,979.83 | Geico | $3,727.54 |

| 19109 | PHILADELPHIA | $7,590.79 | Liberty Mutual | $14,953.09 | Travelers | $14,644.96 | USAA | $2,802.84 | Geico | $3,727.54 |

| 19112 | PHILADELPHIA | $8,120.94 | Travelers | $15,996.78 | Liberty Mutual | $14,953.09 | USAA | $3,040.28 | State Farm | $4,159.60 |

| 19120 | PHILADELPHIA | $7,934.92 | Travelers | $15,270.43 | Liberty Mutual | $11,848.69 | USAA | $3,130.55 | Geico | $5,059.59 |

| 19121 | PHILADELPHIA | $8,402.97 | Travelers | $15,667.55 | Liberty Mutual | $14,953.09 | USAA | $2,979.83 | Nationwide | $5,103.03 |

| 19122 | PHILADELPHIA | $8,251.79 | Travelers | $15,965.31 | Liberty Mutual | $14,953.09 | USAA | $2,977.25 | Geico | $5,059.59 |

| 19124 | PHILADELPHIA | $7,839.78 | Travelers | $15,192.97 | Liberty Mutual | $11,848.69 | USAA | $3,170.44 | Geico | $5,059.59 |

| 19125 | PHILADELPHIA | $7,867.88 | Travelers | $15,280.25 | Liberty Mutual | $13,185.12 | USAA | $2,977.25 | Geico | $5,059.59 |

| 19126 | PHILADELPHIA | $7,875.75 | Travelers | $15,023.64 | Liberty Mutual | $11,848.69 | USAA | $3,132.85 | State Farm | $4,926.72 |

| 19131 | PHILADELPHIA | $7,711.11 | Travelers | $15,520.29 | Liberty Mutual | $11,848.69 | USAA | $2,979.83 | State Farm | $5,173.58 |

| 19132 | PHILADELPHIA | $8,485.99 | Travelers | $16,434.31 | Liberty Mutual | $14,953.09 | USAA | $2,979.83 | State Farm | $5,345.97 |

| 19133 | PHILADELPHIA | $8,527.54 | Travelers | $16,347.78 | Liberty Mutual | $14,953.09 | USAA | $3,130.55 | Nationwide | $5,516.08 |

| 19134 | PHILADELPHIA | $7,792.20 | Travelers | $15,369.32 | Liberty Mutual | $13,185.12 | USAA | $3,130.55 | State Farm | $5,003.80 |

| 19138 | PHILADELPHIA | $7,813.73 | Travelers | $15,422.93 | Liberty Mutual | $11,848.69 | USAA | $3,018.01 | State Farm | $4,962.95 |

| 19139 | PHILADELPHIA | $8,431.95 | Travelers | $15,900.83 | Liberty Mutual | $14,953.09 | USAA | $3,067.37 | Geico | $5,332.66 |

| 19140 | PHILADELPHIA | $8,482.06 | Travelers | $15,656.34 | Liberty Mutual | $14,953.09 | USAA | $3,130.55 | Nationwide | $5,531.40 |

| 19141 | PHILADELPHIA | $7,951.26 | Travelers | $15,628.00 | Liberty Mutual | $11,848.69 | USAA | $3,168.09 | State Farm | $5,393.39 |

| 19142 | PHILADELPHIA | $8,438.04 | Travelers | $16,063.64 | Liberty Mutual | $14,953.09 | USAA | $3,118.87 | Geico | $5,402.37 |

| 19143 | PHILADELPHIA | $8,335.24 | Travelers | $15,329.68 | Liberty Mutual | $14,953.09 | USAA | $3,040.28 | Geico | $5,332.66 |

| 19144 | PHILADELPHIA | $7,532.62 | Travelers | $15,516.37 | Liberty Mutual | $11,848.69 | USAA | $2,864.58 | Geico | $4,546.01 |

| 19145 | PHILADELPHIA | $7,875.23 | Travelers | $15,797.70 | Liberty Mutual | $13,185.12 | USAA | $3,040.28 | State Farm | $4,614.78 |

| 19147 | PHILADELPHIA | $7,504.11 | Travelers | $15,857.48 | Liberty Mutual | $13,185.12 | USAA | $3,040.28 | Geico | $3,727.54 |

| 19148 | PHILADELPHIA | $7,551.17 | Travelers | $16,231.94 | Liberty Mutual | $13,185.12 | USAA | $3,040.28 | Geico | $3,727.54 |

| 19153 | PHILADELPHIA | $7,809.79 | Travelers | $15,950.73 | Liberty Mutual | $13,185.12 | USAA | $3,040.28 | Nationwide | $4,431.54 |

| 19190 | PHILADELPHIA | $7,619.01 | Travelers | $15,996.78 | Liberty Mutual | $14,953.09 | USAA | $2,684.13 | Geico | $3,727.54 |

At the other end of the spectrum, rates in ZIP codes in cities like Bellefonte and Mifflinburg are some of the lowest in the state, coming in almost $1,000 a year less than the state average. Take a look at the table below to see which ZIP codes have the lowest insurance premiums in Pennsylvania:

| Least Expensive Zip Codes in Pennsylvania | City | Average Annual Rate by Zip Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 16801 | STATE COLLEGE | $3,156.82 | Travelers | $6,027.64 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| 16802 | UNIVERSITY PARK | $3,211.08 | Travelers | $6,155.13 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| 16803 | STATE COLLEGE | $3,205.35 | Travelers | $6,206.11 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| 16823 | BELLEFONTE | $3,116.01 | Travelers | $5,623.33 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| 16826 | BLANCHARD | $3,242.81 | Travelers | $5,623.33 | Liberty Mutual | $5,301.56 | USAA | $1,385.22 | State Farm | $2,062.44 |

| 16827 | BOALSBURG | $3,288.82 | Travelers | $6,427.94 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| 16828 | CENTRE HALL | $3,207.80 | Travelers | $5,600.96 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | State Farm | $1,979.70 |

| 16870 | PORT MATILDA | $3,212.75 | Travelers | $5,804.33 | Liberty Mutual | $5,301.56 | USAA | $1,385.22 | Geico | $1,816.07 |

| 16875 | SPRING MILLS | $3,298.88 | Travelers | $5,708.01 | Liberty Mutual | $5,301.56 | USAA | $1,384.72 | State Farm | $2,096.21 |

| 17007 | BOILING SPRINGS | $3,282.20 | Travelers | $6,303.42 | Liberty Mutual | $4,801.54 | USAA | $1,561.08 | Geico | $1,897.92 |

| 17013 | CARLISLE | $3,217.12 | Travelers | $6,210.08 | Liberty Mutual | $4,364.46 | USAA | $1,561.10 | Geico | $1,897.92 |

| 17015 | CARLISLE | $3,217.18 | Travelers | $6,210.08 | Liberty Mutual | $4,364.46 | USAA | $1,561.10 | Geico | $1,897.92 |

| 17050 | MECHANICSBURG | $3,290.99 | Travelers | $6,645.72 | Liberty Mutual | $4,364.46 | USAA | $1,561.19 | Geico | $1,897.92 |

| 17055 | MECHANICSBURG | $3,291.15 | Travelers | $6,761.33 | Liberty Mutual | $4,364.46 | USAA | $1,561.19 | Geico | $1,897.92 |

| 17065 | MOUNT HOLLY SPRINGS | $3,237.78 | Travelers | $6,004.88 | Liberty Mutual | $4,801.54 | USAA | $1,561.08 | Geico | $1,897.92 |

| 17241 | NEWVILLE | $3,288.08 | Travelers | $6,018.29 | Liberty Mutual | $4,801.54 | USAA | $1,561.11 | Geico | $1,897.92 |

| 17266 | WALNUT BOTTOM | $3,264.01 | Travelers | $6,163.01 | Liberty Mutual | $4,801.54 | USAA | $1,561.11 | Geico | $1,897.92 |

| 17324 | GARDNERS | $3,275.34 | Travelers | $5,874.51 | Liberty Mutual | $4,801.54 | USAA | $1,561.11 | Geico | $2,153.91 |

| 17343 | MC KNIGHTSTOWN | $3,275.41 | Travelers | $5,709.54 | Liberty Mutual | $4,835.16 | USAA | $1,540.87 | Geico | $2,153.91 |

| 17837 | LEWISBURG | $3,223.56 | Travelers | $5,861.05 | Liberty Mutual | $4,835.16 | USAA | $1,467.86 | Geico | $2,051.84 |

| 17842 | MIDDLEBURG | $3,243.72 | Travelers | $5,719.63 | Liberty Mutual | $4,835.16 | USAA | $1,467.86 | Geico | $2,051.84 |

| 17844 | MIFFLINBURG | $3,205.40 | Travelers | $5,668.37 | Liberty Mutual | $4,835.16 | USAA | $1,467.86 | Geico | $2,051.84 |

| 17870 | SELINSGROVE | $3,301.85 | Travelers | $6,493.74 | Liberty Mutual | $4,835.16 | USAA | $1,467.86 | Geico | $2,051.84 |

| 17887 | WHITE DEER | $3,263.23 | Travelers | $6,414.92 | Liberty Mutual | $4,835.16 | USAA | $1,467.86 | State Farm | $2,038.07 |

| 17889 | WINFIELD | $3,300.90 | Travelers | $6,327.37 | Liberty Mutual | $4,835.16 | USAA | $1,467.86 | Geico | $2,051.84 |

Cheapest Rates by City

Much like your ZIP code, your city can have a significant impact on your insurance rates. Many of the most expensive ZIP codes are located directly adjacent to or within the city of Philadelphia, as can be seen in the table below:

| Most Expensive Cities in Pennsylvania | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Philadelphia | $7,482.34 | Travelers | $15,126.36 | Liberty Mutual | $12,538.89 | USAA | $2,954.06 | Geico | $4,621.12 |

| Sharon Hill | $6,392.50 | Travelers | $13,460.15 | Liberty Mutual | $8,630.14 | USAA | $2,363.32 | Nationwide | $4,102.98 |

| East Lansdowne | $6,347.36 | Travelers | $12,468.46 | Liberty Mutual | $8,630.14 | USAA | $2,511.37 | Nationwide | $4,210.51 |

| Collingdale | $6,270.41 | Travelers | $12,886.09 | Liberty Mutual | $8,630.14 | USAA | $2,511.37 | Nationwide | $4,212.45 |

| Millbourne | $6,231.76 | Travelers | $12,160.58 | Liberty Mutual | $8,630.14 | USAA | $2,207.63 | Nationwide | $4,241.54 |

| Bensalem | $5,764.41 | Travelers | $12,296.07 | Liberty Mutual | $8,344.78 | USAA | $1,908.22 | Geico | $3,568.65 |

| Cheltenham | $5,733.79 | Travelers | $12,436.54 | Liberty Mutual | $7,629.84 | USAA | $2,456.44 | Nationwide | $3,835.72 |

| Elkins Park | $5,727.39 | Travelers | $12,174.44 | Liberty Mutual | $7,629.84 | USAA | $2,154.94 | Nationwide | $3,745.21 |

| Chester | $5,723.20 | Travelers | $12,415.25 | Liberty Mutual | $8,630.14 | USAA | $2,363.32 | Geico | $3,596.36 |

| Glenolden | $5,720.42 | Travelers | $12,887.96 | Liberty Mutual | $8,630.14 | USAA | $2,395.86 | State Farm | $3,491.05 |

Among the least expensive cities are Bellefonte, Houserville, Park Forest Village, Mifflinburg, and Centre Hall. These are all located in the center of the state, away from the larger cities of Harrisburg, Philadelphia, and Pittsburgh.

| Least Expensive Cities in Pennsylvania | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Bellefonte | $3,116.01 | Travelers | $5,623.33 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| Houserville | $3,156.81 | Travelers | $6,027.64 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| Park Forest Village | $3,205.35 | Travelers | $6,206.11 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| Mifflinburg | $3,205.40 | Travelers | $5,668.37 | Liberty Mutual | $4,835.16 | USAA | $1,467.86 | Geico | $2,051.84 |

| Centre Hall | $3,207.80 | Travelers | $5,600.96 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | State Farm | $1,979.70 |

| University Park | $3,211.08 | Travelers | $6,155.13 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| Port Matilda | $3,212.75 | Travelers | $5,804.33 | Liberty Mutual | $5,301.56 | USAA | $1,385.22 | Geico | $1,816.07 |

| Carlisle | $3,217.14 | Travelers | $6,210.08 | Liberty Mutual | $4,364.46 | USAA | $1,561.10 | Geico | $1,897.92 |

| Lewisburg | $3,223.56 | Travelers | $5,861.05 | Liberty Mutual | $4,835.16 | USAA | $1,467.86 | Geico | $2,051.84 |

| Mount Holly Springs | $3,237.78 | Travelers | $6,004.88 | Liberty Mutual | $4,801.54 | USAA | $1,561.08 | Geico | $1,897.92 |

Best Pennsylvania Car Insurance Companies

Choosing the best car insurance company to meet your needs can be difficult. A few companies may offer a wider variety of options, while others might provide more robust coverage, and still, others might provide more affordable options. How do you choose which company is right for you?

There are many things beyond price that you should consider when choosing an insurance policy. Below are a few of the points you might want to consider when choosing a policy:

The Largest Companies Financial Rating

One of the ways you can determine if an insurance company is right for you is by its financial rating. Organizations like A.M. Best rate each insurance company based on their financial stability.

What is financial stability? Financial stability is whether a company has the financial assets needed to pay out claims over the course of the year.

While financial stability is important, it shouldn’t be the only information guiding your choice of insurance provider. Just because a company has excellent financial ratings doesn’t mean their customers are happy with their service or that they offer a plan that meets your needs.

It also doesn’t guarantee their rates are better (or worse) than any other company, so this is just one of many things to consider when choosing an insurance company.

https://www.youtube.com/watch?v=P5nClTxqZ1w

Companies with Best Ratings

Geico, State Farm, Travelers, and USAA are the companies with the highest A.M. Best ratings in Pennsylvania, but all of the insurance companies on the table below scored very highly on the A.M. Best scale.

Insurance companies with an A rating or above are typically very financially stable, making them an excellent choice for people who are concerned about a company’s ability to pay claims. A top-notch financial rating isn’t the only thing you should consider, but it is one of the many factors you should think about when choosing an insurance provider.

| Company | AM Best Rating |

|---|---|

| Allstate F&C | A+ |

| First Liberty Ins Corp | A |

| Geico Cas | A++ |

| Nationwide P&C | A+ |

| Progressive Specialty | A+ |

| State Farm Mutual Auto | A++ |

| Travelers Home & Marine Ins Co | A++ |

| USAA | A++ |

According to J.D. Power, the companies with the highest customer satisfaction rating in the area are Erie Insurance, Geico, and The Hartford. Allstate and Liberty Mutual came in at the bottom of the list. USAA is only available to military members and their families, so they were not included in the rating system.

Keep reading to find the top car insurance companies in Pennsylvania.

Please note: On the table above there were some companies who did not have complaint information available and were therefore unable to be included in the chart.

Companies with Most Complaints in Pennsylvania

All across the country, consumers are encouraged to report insurance company complaints to the Attorney General’s office. But how can you tell if your problem warrants making an official claim?

The NAIC can provide guidance. They have apps for both Android and iPhone that can walk you through the steps to take after an accident, up to and including filing a report with the state.

If you have questions you can always contact the Attorney General’s consumer protection line at 800-441-2555 and ask for assistance. You can also find their email, fax, and mailing address on the Pennsylvania Attorney General’s website.

| Company | Consumer Complaints | Exposure | Complaint Ratio |

|---|---|---|---|

| Allstate F&C | 35 | 280116 | 0.012 |

| Geico Cas | 80 | 768375 | 0.01 |

| Nationwide P&C | 1 | 17158 | 0.006 |

| Progressive Specialty | 36 | 412147 | 0.009 |

| State Farm Mutual Auto | 83 | 890730 | 0.009 |

| Travelers Home & Marine Ins Co | 3 | 74503 | 0.004 |

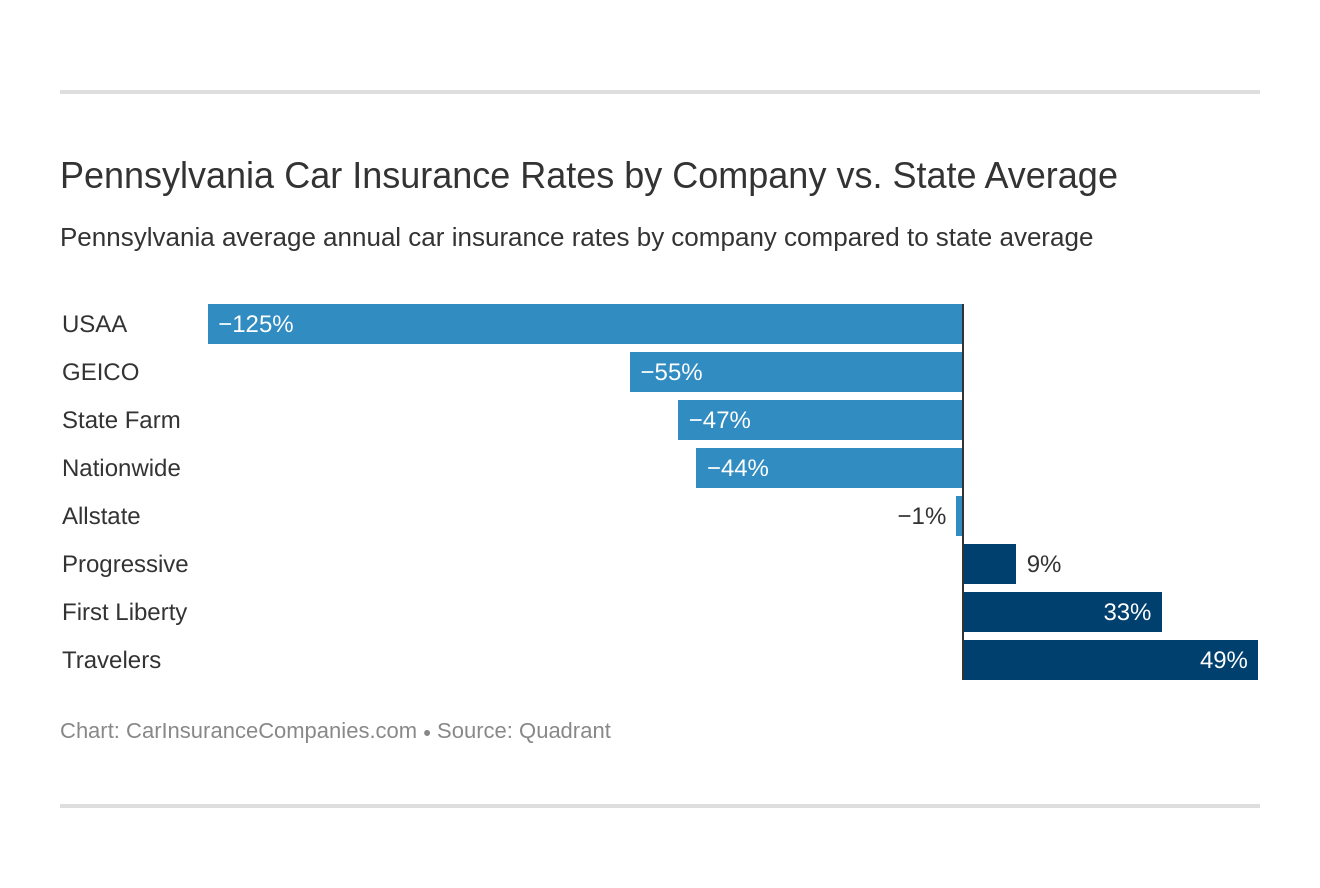

Cheapest Companies in Pennsylvania

Below is a chart of some of the largest insurance companies in Pennsylvania and their average annual rates.

| Company | Average Annual Rate | Compared to State Average | Percentage |

|---|---|---|---|

| Allstate F&C | $3,984.12 | -$50.37 | -1.26% |

| Geico Cas | $2,605.22 | -$1,429.28 | -54.86% |

| First Liberty Ins Corp | $6,055.19 | $2,020.70 | 33.37% |

| Nationwide P&C | $2,800.37 | -$1,234.13 | -44.07% |

| Progressive Specialty | $4,451.00 | $416.50 | 9.36% |

| State Farm Mutual Auto | $2,744.22 | -$1,290.27 | -47.02% |

| Travelers Home & Marine Ins Co | $7,842.47 | $3,807.98 | 48.56% |

| USAA | $1,793.37 | -$2,241.13 | -124.97% |

While rates are important, they are only one of the many factors you should consider when choosing your plan. Any policy you choose must have the benefits you need, so check each policy carefully and make sure you understand what is covered (and what isn’t covered) before you accept it.

Also, it is important to be aware that not every policy is available to every person. USAA, for example, is only available to members of the U.S. military and their families, which means you might not be able to sign up through USAA, even though they typically have the lowest prices.

Commute Rates by Companies

How far you commute can have a significant impact on your insurance rates. Typically, companies break up their commute rates into mileage categories, such as 10-mile commute/6,000 annual mileage or 25-mile commute/12,000 annual mileage.

The more time you spend on the road each day, the more likely you are to be in an accident and have to file a claim; therefore, you will probably pay a higher premium for your policy.

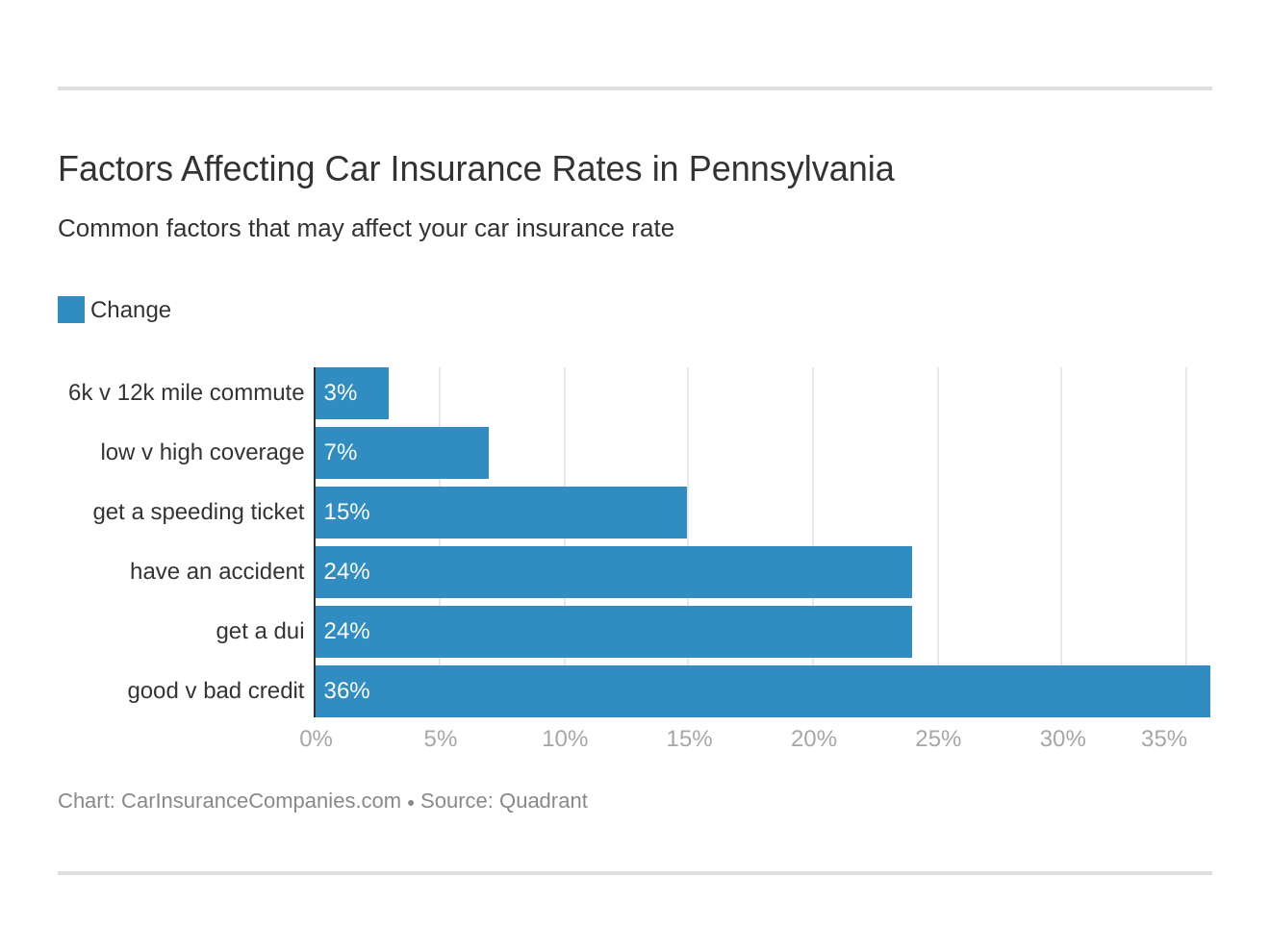

Take a look at these 6 major factors affecting auto insurance rates in Pennsylvania.

| Group | Commute And Annual Mileage | Annual Average |

|---|---|---|

| Allstate | 25 miles commute. 12000 annual mileage. | $4,064.08 |

| Allstate | 10 miles commute. 6000 annual mileage. | $3,904.16 |

| Geico | 25 miles commute. 12000 annual mileage. | $2,647.62 |

| Geico | 10 miles commute. 6000 annual mileage. | $2,562.81 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $6,210.14 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $5,900.24 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $2,800.37 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $2,800.37 |

| Progressive | 10 miles commute. 6000 annual mileage. | $4,451.00 |

| Progressive | 25 miles commute. 12000 annual mileage. | $4,451.00 |

| State Farm | 25 miles commute. 12000 annual mileage. | $2,826.63 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,661.82 |

| Travelers | 10 miles commute. 6000 annual mileage. | $7,842.47 |

| Travelers | 25 miles commute. 12000 annual mileage. | $7,842.47 |

| USAA | 25 miles commute. 12000 annual mileage. | $1,844.59 |

| USAA | 10 miles commute. 6000 annual mileage. | $1,742.14 |

Coverage Level Rates by Companies

Because there are so many coverage options to choose from when selecting an insurance plan, the price of your insurance can vary wildly depending on what choices you make.

Your lifestyle has a big impact on your comprehensive and collision insurance prices. Driving an eight-year-old Nissan? Your comprehensive and collision coverage will probably be much more affordable than if you were driving a brand new BMW.

Take a look at the table below to see how your coverage choices can impact your rates at each company.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Allstate | Low | $3,794.20 |

| Allstate | Medium | $4,010.08 |

| Allstate | High | $4,148.08 |

| Geico | Low | $2,375.50 |

| Geico | Medium | $2,629.30 |

| Geico | High | $2,810.85 |

| Liberty Mutual | Low | $5,760.21 |

| Liberty Mutual | Medium | $6,098.96 |

| Liberty Mutual | High | $6,306.41 |

| Nationwide | High | $2,751.91 |

| Nationwide | Low | $2,813.46 |

| Nationwide | Medium | $2,835.74 |

| Progressive | Low | $4,058.80 |

| Progressive | Medium | $4,484.26 |

| Progressive | High | $4,809.93 |

| State Farm | Low | $2,566.42 |

| State Farm | Medium | $2,780.67 |

| State Farm | High | $2,885.58 |

| Travelers | High | $7,782.26 |

| Travelers | Medium | $7,848.30 |

| Travelers | Low | $7,896.86 |

| USAA | Low | $1,662.36 |

| USAA | Medium | $1,810.30 |

| USAA | High | $1,907.44 |

Credit History Rates by Companies

Though it isn’t something many people would think about when choosing an insurance policy, one of the factors in your insurance rate is your credit history.

Statistics have shown that people with lower credit scores are more likely to file a claim, which means a low credit score can raise your rates, or possibly even be reason enough to deny you coverage, depending on the circumstances.

If your credit rating is low it doesn’t mean you’re out of luck. You can always comparison shop between companies, potentially saving yourself hundreds of dollars a year. You can also work to improve your credit rating to help lower your insurance costs over time.

Take a look at the table below to see how your credit history may impact your insurance rates.

| Group | Credit History | Annual Average |

|---|---|---|

| Allstate | Poor | $5,093.72 |

| Allstate | Fair | $3,798.36 |

| Allstate | Good | $3,060.28 |

| Geico | Poor | $3,911.48 |

| Geico | Fair | $2,202.65 |

| Geico | Good | $1,701.51 |

| Liberty Mutual | Poor | $7,727.18 |

| Liberty Mutual | Fair | $5,542.86 |

| Liberty Mutual | Good | $4,895.54 |

| Nationwide | Poor | $3,287.49 |

| Nationwide | Fair | $2,701.68 |

| Nationwide | Good | $2,411.94 |

| Progressive | Poor | $5,897.08 |

| Progressive | Fair | $4,136.56 |

| Progressive | Good | $3,319.35 |

| State Farm | Poor | $3,904.98 |

| State Farm | Fair | $2,418.55 |

| State Farm | Good | $1,909.14 |

| Travelers | Poor | $8,534.70 |

| Travelers | Fair | $7,710.22 |

| Travelers | Good | $7,282.50 |

| USAA | Poor | $2,241.67 |

| USAA | Fair | $1,664.45 |

| USAA | Good | $1,473.98 |

Driving Record Rates by Companies

Your driving record can have a significant impact on your insurance premiums, so driving safely is an excellent way to help keep your insurance cost low.

A traffic ticket or a minor accident may only cost you a small amount initially, but the infraction will be reported to your insurance company and will probably cause a rate increase, so keep that in mind when you are rushing through traffic because you’re late to work.

Speeding tickets and other minor offenses may not seem like a big deal now, but they will show up as points on your license and on your insurance premiums in the future. Obeying traffic laws and driving carefully is an effective way to keep your insurance costs low.

| Group | Driving Record | Annual Average |

|---|---|---|

| Allstate | With 1 accident | $4,497.16 |

| Allstate | Clean record | $3,813.11 |

| Allstate | With 1 DUI | $3,813.11 |

| Allstate | With 1 speeding violation | $3,813.11 |

| Geico | With 1 accident | $3,282.78 |

| Geico | With 1 speeding violation | $2,653.35 |

| Geico | With 1 DUI | $2,568.60 |

| Geico | Clean record | $1,916.13 |

| Liberty Mutual | With 1 accident | $6,328.15 |

| Liberty Mutual | With 1 DUI | $6,183.64 |

| Liberty Mutual | With 1 speeding violation | $6,183.64 |

| Liberty Mutual | Clean record | $5,525.34 |

| Nationwide | With 1 DUI | $3,769.26 |

| Nationwide | With 1 speeding violation | $2,707.29 |

| Nationwide | With 1 accident | $2,703.02 |

| Nationwide | Clean record | $2,021.90 |

| Progressive | With 1 accident | $5,570.34 |

| Progressive | With 1 DUI | $4,153.94 |

| Progressive | With 1 speeding violation | $4,045.00 |

| Progressive | Clean record | $4,034.71 |

| State Farm | With 1 accident | $2,976.14 |

| State Farm | With 1 DUI | $2,744.22 |

| State Farm | With 1 speeding violation | $2,744.22 |

| State Farm | Clean record | $2,512.31 |

| Travelers | With 1 DUI | $9,974.88 |

| Travelers | With 1 accident | $7,914.42 |

| Travelers | With 1 speeding violation | $7,914.42 |

| Travelers | Clean record | $5,566.16 |

| USAA | With 1 DUI | $2,126.01 |

| USAA | With 1 accident | $1,992.43 |

| USAA | With 1 speeding violation | $1,612.21 |

| USAA | Clean record | $1,442.82 |

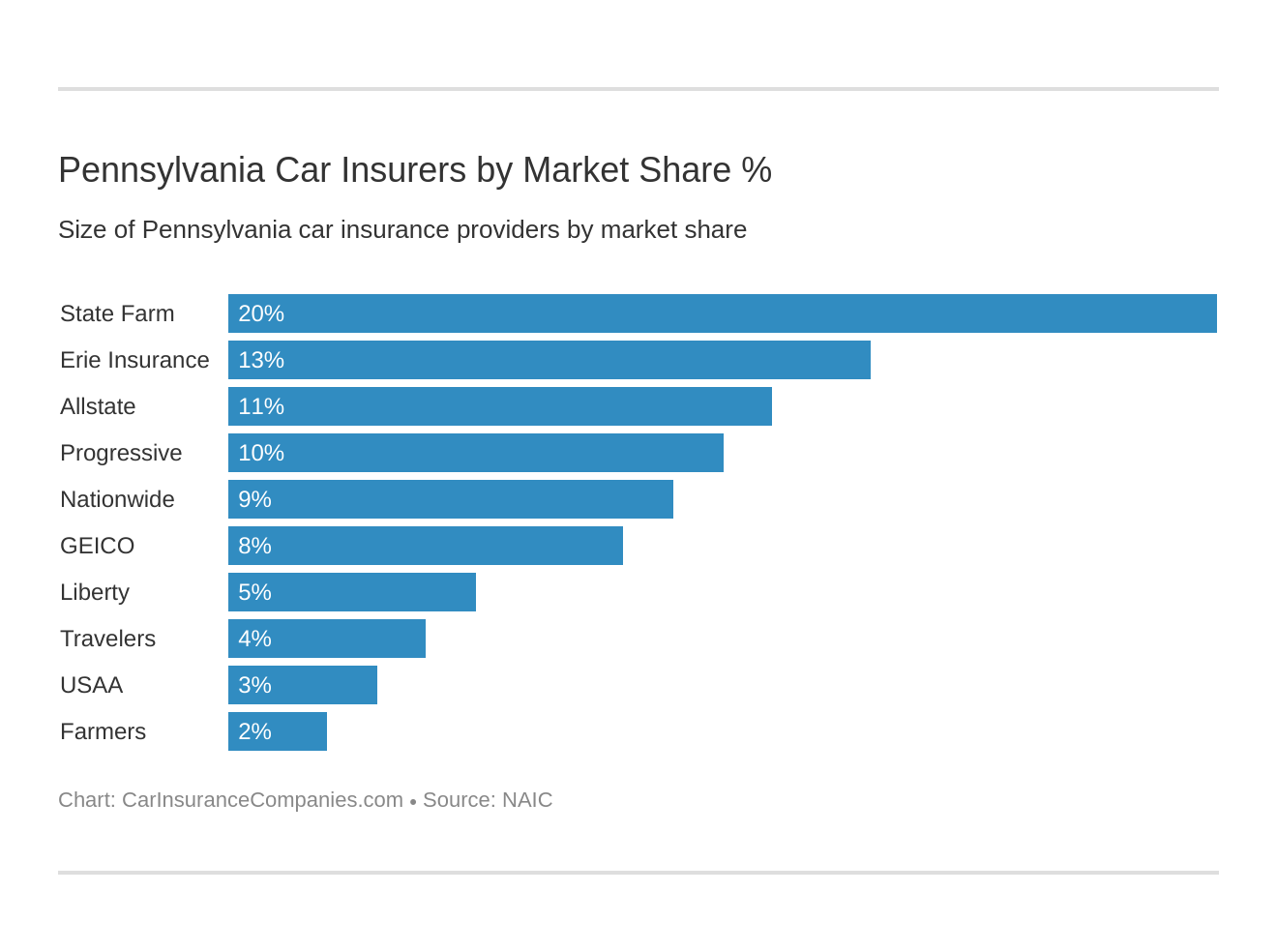

Largest Car Insurance Companies in Pennsylvania

While size isn’t everything, choosing a larger company with a national presence and offices all over Pennsylvania can be a good way to feel confident that you’ll be able to find someone to help you if you have to file a claim.

Recommendations from other customers are also easier to find with larger companies, so you may find that the larger a company’s customer base, the more people you know who can tell you what it is like to be their customer.

Below are some of the largest insurance companies in Pennsylvania.

| Company Group/group/code Company Name | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Allstate Insurance Group | $998,919 | 55.64% | 11.42% |

| Erie Insurance Group | $1,153,856 | 64.93% | 13.19% |

| Farmers Insurance Group | $192,162 | 74.14% | 2.20% |

| Geico | $706,897 | 74.24% | 8.08% |

| Liberty Mutual Group | $424,106 | 61.06% | 4.85% |

| Nationwide Corp Group | $786,109 | 59.96% | 8.99% |

| Progressive Group | $875,579 | 58.55% | 10.01% |

| State Farm Group | $1,779,915 | 63.70% | 20.35% |

| Travelers Group | $335,963 | 62.41% | 3.84% |

| USAA Group | $299,488 | 72.05% | 3.42% |

| **state Total** | $8,745,386 | 62.98% | 100.00% |

Number of Insurers in Pennsylvania

| State | Domestic Insurance Companies | Foreign Insurance Companies |

|---|---|---|

| New Jersey | 66 | 778 |

| New York | 173 | 709 |

| Pennsylvania | 166 | 929 |

Pennsylvania has 166 domestic insurance companies, meaning these companies not only do business in Pennsylvania but also have their headquarters in the state.

There are 929 foreign insurance companies doing business in the state of Pennsylvania. This doesn’t mean they are headquartered in another country, however, just that their headquarters are in another state.

These numbers don’t include alternative insurance options, such as people who are self-insured or people who are insured through a charter program.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Pennsylvania Laws

Each state has its own unique insurance and traffic laws, rules, and regulations. What is legal in one state might be illegal in another, while something unacceptable in Pennsylvania could be perfectly normal somewhere else, so don’t assume that because you know the laws in Texas you won’t break a law in Pennsylvania.

Car Insurance Laws

Knowing the laws in your state is an important part of living and driving pretty much anywhere in the nation, but it is especially true in Pennsylvania. For example, you know that Pennsylvania is a no-fault state, so why do you need liability insurance if you aren’t financially responsible?

You need liability insurance for two reasons. First, there are situations where you can be held liable for other people’s injuries and property damage. Second, because of the concept of subrogation.

Subrogation is hard to explain, so let’s use an example. If you were at fault in an accident and the other driver ended up in the hospital, under the no-fault laws of Pennsylvania their insurance would pay for their medical needs.

However, if they have no insurance or if their injuries were paid by a federal medical policy or an HMO, those companies would have a right to take you and your insurance company to court and demand their money back.

Subrogation in Pennsylvania is tricky, but it is possible to find yourself on the hook for someone else’s bills in an at-fault accident, even if the law is set up to make that more difficult in Pennsylvania than it is in other states. This is one of the reasons why it is so important to know the laws in your state.

How Pennsylvania Laws for Insurance are Determined

Insurance laws in Pennsylvania are created the same way all other laws are created – through a legislative process. The laws are created by legislators, written by legal experts, put through a rigorous peer-review process, and reviewed in a three-day consideration in the house before it moves to the senate.

Windshield Coverage

Pennsylvania does not have any laws specific to windshield replacement.

Your insurance company cannot require you to use specific repair shops when you file a claim and there are no laws one way or the other in relation to aftermarket glass being used in windshield replacements.

High-Risk Insurance

If you have enough points on your record (tickets, accidents, or DUI convictions) insurance companies may consider you uninsurable. But Pennsylvania requires all drivers to have liability insurance, so how can you follow the law?

If you can’t find an insurance company who will accept your business, you can reach out to the Pennsylvania Assigned Risk Plan for assistance. You can sign up for coverage through the organization and they will assign your policy to a carrier in the state. All insurance companies are required to participate in the ARP plan to be allowed to sell insurance in Pennsylvania.

Just because they have to sell you insurance doesn’t mean it has to be cheap, so be prepared for that when you apply.

While there is high-risk insurance in Pennsylvania, the state does not require an SR-22 in the aftermath of a DUI.

Low-Cost Insurance

At this time there are no obvious discounts available specifically for Pennsylvania residents on Medicare or Medicaid. Unfortunately, this means people in those programs will have to pay the full price for their auto insurance. Luckily, there are lots of discounts available with almost every insurance company, so you may still be able to reduce your insurance costs.

Most companies offer standard discounts, such as discounts for a good driving record or discounts for people who have multiple lines of insurance through the company, but the discounts usually don’t end there.

Many insurers also give occupational discounts to nurses, teachers, active military, and some other groups. Some insurers give discounts to students with a good GPA. Some even offer discounts to the employees of certain companies as an employee benefit, so check with your HR department to see if they offer car insurance discounts in your benefits package.

Automobile Insurance Fraud in Pennsylvania

| State | Insurance Fraud Classified as a Crime? | Immunity Statutes | Fraud Bureau | Mandatory Insurer Fraud Plan | Mandatory Auto Photo Inspection |

|---|---|---|---|---|---|

| New Jersey | Yes | Yes | Yes, with AG | Yes | Yes |

| New York | Yes | Yes | Yes | Yes | Yes |

| Pennsylvania | Yes | Yes | Yes, with AG | Yes | No |

Insurance fraud isn’t just limited to filing a fake claim. Filing false paperwork, agents pocketing your premium payments, or even conspiring to help someone else file a false claim are all various forms of insurance fraud.

Purposely damaging your property to file a claim or exaggerating the damage in a claim to increase your payout are also types of insurance fraud, which means if you’re caught knowingly setting your car on fire or photoshopping damages that aren’t there to file a claim, you will face severe penalties.

Every state is different, but if you are convicted of insurance fraud in Pennsylvania you could spend anywhere from five to seven years in prison and pay $10,000 to $15,000 per offense, so the penalties for insurance fraud are incredibly high.

Insurance companies take insurance fraud very seriously, so be sure to follow the law when it comes to buying insurance and filing claims. At the same time, if you think your insurance company is fraudulently denying your claim be sure to reach out to the Attorney General for assistance.

Statute of Limitations

The law in Pennsylvania states that you have two years to resolve your claims or file a lawsuit over bodily injury or property damage in a car accident. Beyond the two year mark, you are beyond the statute of limitations and your claim is uncollectible.

Almost every case that can be taken to court will run into a statute of limitations, so if you have an insurance issue that needs to go through the court system, make sure you keep track of the statute of limitations so you don’t lose your ability to collect on a valid claims.

Pennsylvania Specific Laws

While many laws are the same from state to state, every state also has its own unique laws and Pennsylvania is no exception. For example, you must yield to pedestrians in a crosswalk, but if you see a blind or partially blind pedestrian (as evidenced by the presence of a white cane or guide dog) you must slow down or stop even if they are not specifically in the crosswalk.

Make sure you know the local laws to prevent an unnecessary ticket.

Vehicle Licensing Laws

Every state has similar, yet slightly different requirements for getting your driver’s license. There are even differences in the process from person to person within each state, with different requirements for new drivers, experienced drivers who are new state residents, and senior citizens.

If you are getting your license for the first time, or even just renewing or updating your license, you’ll need to make sure you follow all of Pennsylvania’s rules and regulations.

REAL ID

The REAL ID Act is a federal law that is being implemented as an anti-terrorism measure. REAL IDs are much more secure, increasing the likelihood that someone’s ID matches their identity. Your ID will need to be compliant by October 2020, so don’t wait to update your ID.

Pennsylvania is compliant with the REAL ID Act, which means that your Pennsylvania REAL ID allows you to board commercial airplanes for interstate travel and enter federal buildings and facilities. If you want to make sure your license is REAL ID compliant, you can check the top right corner for a gold star.

Penalties for Driving Without Insurance

There are consequences for driving without insurance in Pennsylvania, such as:

- Your registration will be suspended for three months (unless lapse was for less than 31 days and you did not drive during that time)

- $88 restoration fee plus proof of insurance required to get it reinstated

- Potential $500 civil penalty fee in lieu of registration suspension plus $88 restoration fee (this can only be done once within a 12-month period)

Teen Driver Laws

Pennsylvania has graduated laws for teen drivers, which means they begin driving with a learner’s permit and work their way up to a full license after many hours of practice.

In Pennsylvania, a teenager may get their learner’s permit at 16. Then they are required to log at least 65 hours of driving, at least 10 of which must be at night and five of which must be in inclement weather. There are other restrictions listed in the chart below:

| Minimum entry age | Mandatory holding period | Minimum amount of supervised driving | Minimum age | Unsupervised driving prohibited | Restriction on passengers (family members excepted unless otherwise noted) | Nighttime restrictions | Passenger restrictions |

|---|---|---|---|---|---|---|---|

| 16 | 6 months | 65 hours, 10 of which must be at night and 5 of which must be in inclement weather | 16, 6 months | 11 p.m.-5 a.m. | first 6 months— no more than 1 passenger younger than 18; thereafter, no more than 3 passengers | 12 months and age 17 if completed driver education or age 18 (min. age: 17) | 12 months and age 17 if completed driver education or age 18 (min. age: 17) |

Older Driver License Renewal Procedures

In Pennsylvania, license renewal is required every four years for the general population, with seniors over 65 given the choice to renew their license every two or four years.

In addition, each month the state selects random drivers over the age of 45 for retesting seven months prior to the date of their driver’s license renewal.

Each selected driver is required to undergo vision and physical examinations at their doctor’s office. If the visual or medical tests indicate that additional testing might be necessary, the state may require you to retake the road test or knowledge test.

New Residents

New Pennsylvania residents with an out-of-state driver’s license must obtain an in-state license within 60 days of residency. To apply for your new license you must appear in person at a driver’s license center. To get your new license you must:

- Surrender your out-of-state license

- Pass a vision screening test

- Complete form DL-180R/Application for Non-Commercial License by Out-Of-State Driver

- Show proof of residency and proof of identification along with your Social Security Card

- Pay any required fees

License renewal procedures

In Pennsylvania, your license expires the day after your birthday every four years (or two, for senior citizens who have opted for shorter renewal periods.)

The state will mail you an invitation to renew your license. Then you will be required to return the application along with a check or money order (credit and debit are not accepted forms of payment) and you will be sent a camera card in the mail. You can then take the card to any photo center along with your ID and they can provide you with a digitized driver’s license.

Negligent Operator Treatment System (NOTS)

In Pennsylvania, you will face a 90 day suspension the first time you accumulate six points or more on your license. If you get your license reinstated and then you reach six points or more a second time, you will face a suspension of 120 days.

If you are over 18, the first time you accumulate six points or more you will be required to take a special written exam that will test your knowledge of safe driving practices, traffic sanctions, and other issues. If you pass the exam within 30 days, two points will be deducted from your point total.

The second time you accumulate six points, you will be required to attend a hearing where they will review your record and recommend either a 15-day suspension or a special driver’s exam to take two points off your total.

If you earn 11 points or more you will be faced with the following suspension schedule:

- First suspension – 5 days/point

- Second suspension – 10 days/point

- Third suspension – 15 days/point

- Additional suspensions – 1 year

Rules of the Road

When it comes to the laws and regulations regarding driving and car insurance, the majority of them are determined by the state. Everything from speed limits to keeping right on the highway is specific to Pennsylvania.

Because of this, you can’t simply assume that knowing the laws in one state means you’re following the law in Pennsylvania.

To keep yourself safe and prevent tickets and accidents, make sure you follow the traffic laws in Pennsylvania.

Fault vs. No-Fault

Pennsylvania is a “choice” no-fault state, which means you are given the choice between limited tort and full tort coverage. This will impact your premium, as well as what options you have for payment and compensation when you are in an accident.

In a no-fault state, you would turn to your own insurance coverage for compensation in an accident unless your injuries cross a certain threshold. Pennsylvania’s choice model allows you to pay more for full tort coverage and upgrade your coverage to at-fault, giving you the legal right to pursue financial compensation from a driver who was at fault in an accident.

Seat belt and car seat laws

| Initial effective date | Primary enforcement? | Who is covered? In what seats? | Maximum base fine 1st offense, additional fees may apply | Must be in child safety seat | Adult belt permissible | Maximum base fine 1st offense, additional fees may apply | Preference for rear seat |

|---|---|---|---|---|---|---|---|

| 11/23/87 | no (yes for children <18 years) | 18+ years in front seat | $10 | <2 yrs in rear facing child restraint until a child outgrows car seat’s top height/weight recommendations; 2-3 yrs in forward-facing child safety seat; 4-7 yrs in booster seat | 8 through 17 years in all seats | $75 | law states no preference for rear seat |

Pennsylvania is a primary enforcement state, which means that police officers can pull you over and issue a ticket if they see you driving without a seat belt. If they pull you over for another violation, you can be given a second ticket for not wearing a seat belt in addition to your primary citation.

Drivers and front seat passengers are required to wear a seat belt. While back seat passengers over the age of 18 are not required to wear them, it is still safer to wear a seat belt when in a vehicle.

Under Pennsylvania’s primary child passenger safety law:

- Children four and under must be in an approved child safety seat

- Children two and under must be secured in a rear-facing car seat

- Children age four to eight must be secured in a booster seat

Unlike most states, Pennsylvania does not have any specific height or weight requirements for children in safety seats. The state requires that you adhere to the requirements set forth by the safety seat manufacturer.

Keep Right and Move Over Laws

The law in Pennsylvania is to keep to the right, but there are several exceptions to this rule.

For example, drivers who are passing other people in traffic or turning left are permitted to travel in the left lane. Other exceptions include when emergency vehicles are parked on the right side of the road or if the right lane has an obstruction of any kind.

Pennsylvania state law also requires drivers who are approaching an emergency vehicle, tow truck, or utility vehicle providing necessary services to move over and give at least a full lane of space between your vehicle and the emergency vehicle if at all possible.

If you cannot provide a full lane of space, you are required to slow down to a safe speed when passing vehicles providing emergency services on the roads.

Speed Limits

| State | Rural interstates (mph) | Urban interstates (mph) | Other limited access roads (mph) | Other roads (mph) |

|---|---|---|---|---|

| New Jersey | 65 | 55 | 65 | 55 |

| New York | 65 | 65 | 65 | 55 |

| Pennsylvania | 70 | 70 | 70 | 55 |

Speed limits in Pennsylvania vary, just like any other state. Residential areas will have a different speed limit than major roads, and for good reason – speed limits are there to help keep people safe.

In addition to the speed limits shown in the chart above, urban districts in Pennsylvania have a speed limit of 35 miles per hour, while residential areas have a speed limit of 25 miles per hour.

Ridesharing

Pennsylvania has had laws on the books regarding ridesharing since 1982, so they already had some legal structures in place when ridesharing exploded in popularity a few years ago.

In 2016, the state created Act 164, which updated and established laws regarding license and insurance requirements, transportation networks, operating regulations, and much more regarding taxi cabs and rideshare services.

Drivers for rideshare companies can find insurance specific to their needs at a number of different companies, so it is a good idea to look at all of your coverage options before making a decision.

Automation on the Road

Pennsylvania is at the forefront of self-driving or highly automated vehicles, otherwise known as HAVs, which isn’t surprising when you think about all the other firsts the state has been home to over the years. In fact, Carnegie Mellon University in Pennsylvania is known as the birthplace of the self-driving vehicle.

Pennsylvania Department of Transportation has deployed Dedicated Short-Range Communication (DSRC) Roadside Units (RSUs), which are vital to the necessary infrastructure to allow HAVs to function on the roads. They have also led the nation in the efforts to develop uniform measurements, standards, and practices for HAVs.

Safety Laws

Much like every other state, Pennsylvania has put rules and laws in place to keep people safe while on the road. Whether it is a law about texting while driving or school buses stopping at the railroad tracks while crafting new laws they are doing their best to put the lives of citizens of the state first.

Understandably, laws must change over time. This means that just because something was legal a few years ago doesn’t mean it is still legal now.

Just the opposite, things that were illegal five or six years ago might be legal today, research carefully when it comes to learning driving safety laws.

DUI Laws

In 2003, Pennsylvania passed Act 24, which lowered the legal Blood Alcohol Content (BAC) for drivers from .10 to .08. The law also created a tiered approach to BAC levels:

- General Impairment – .08 to .099 BAC

- High BAC – .10 to .159 BAC

- Highest BAC – .16 and higher

If you test at the general impairment level and you have no previous DUIs, you will be faced with the possibility of six months probation, a $300 fine, treatment for alcohol abuse, or other penalties.

If you do have a previous DUI, the penalties quickly become more severe, with a one-year license suspension, one year required ignition interlock device, up to six months of jail time, and up to $2,500 in fines.

The high BAC level will earn someone with no prior DUIs up to six months jail time, up to $5,000 in fines, and a year with an ignition interlock device. One or more DUIs at this level can get your license suspended for a year, a sentence of up to five years in jail, and fines of up to $10,000.

At the highest BAC level, someone with no prior DUIs would face a suspended license, up to six months in prison, and a $5,000 fine. One ore more DUIs at this level will earn you an 18-month license suspension, up to $10,000 in fines, up to five years in prison, and at least a year with an ignition interlock system.

Marijuana-Impaired Driving Laws

In Pennsylvania, you can be charged with DUID, or Driving Under the Influence of Drugs, if you are found driving with more than 1 nanometer of THC (or its metabolites) in your blood.

Pennsylvania actually has a Per Se DUID law when it comes to marijuana use, which means that prosecutors don’t have to show that your driving was impaired, just that you tested positive for the drug.

Pennsylvania has some of the strictest laws in the nation when it comes to driving drugged, and refusing testing gives the police the right to automatically suspend your license for up to 18 months, so keep that in mind if you are a recreational or medical marijuana user.

Distracted Driving Laws

| State | Hand-held ban | Young drivers all cellphone ban | Texting ban | Enforcement |

|---|---|---|---|---|

| New Jersey | all drivers | learner's permit and intermediate license holders | all drivers | primary |

| New York | all drivers | no | all drivers | primary |

| Pennsylvania | no | no | all drivers | primary |

Texting, eating, putting on makeup, adjusting your GPS, and talking on the phone are just some of the ways drivers allow themselves to be distracted on the road.

According to the CDC, there are three types of distracted driving:

- Visual – causing you to take your eyes off the road

- Manual – causing you to take your hands off the wheel

- Cognitive – causing you to take your mind off of driving

Texting is the most dangerous form of distracted driving because it combines all three types of distracted driving.

In Pennsylvania, there is a ban on texting while driving, so if you are caught the penalty is a $50 fine. You won’t earn any points on your license, but it will be recorded as a non-sanction violation if you are a commercial driver.

A GPS device does not count as a handheld device for the purposes of this law, and it does not authorize the seizure of your phone or other communication device.

Driving Safely in Pennsylvania

Driving is necessary for most people across the country, but it is also one of the most dangerous things the average person does on a daily basis. Nationally, there are more than 30,000 car accidents a year, causing almost 25,000 fatalities and more than two million injuries from coast to coast.

One of the best ways to help keep yourself and your loved ones safe on the road is to be aware of the dangers that go along with getting behind the wheel. Knowing which roads are the most dangerous, how to reduce your commute time, and what the various weather conditions mean for drivers can help you prepare for and possibly even prevent an accident – or worse.

Vehicle Theft in Pennsylvania

| Rank | Make/Model | Year of Vehicle | Year | Thefts |

|---|---|---|---|---|

| 1 | Honda Accord | 1997 | 1997 | 544 |

| 2 | Honda Civic | 1998 | 1998 | 539 |

| 3 | Ford Pickup (Full Size) | 2006 | 2006 | 303 |

| 4 | Toyota Camry | 2014 | 2014 | 269 |

| 5 | Nissan Altima | 2015 | 2015 | 261 |

| 6 | Chevrolet Impala | 2006 | 2006 | 224 |

| 7 | Toyota Corolla | 2014 | 2014 | 210 |

| 8 | Chevrolet Pickup (Full Size) | 2003 | 2003 | 203 |

| 9 | Jeep Cherokee/Grand Cherokee | 1999 | 1999 | 188 |

| 10 | Chevrolet Malibu | 2015 | 2015 | 159 |

While it can be a comfort to know that a stolen vehicle would be covered under the comprehensive coverage, the ability to replace the car doesn’t stop you from feeling violated if your car is stolen.

Oddly enough, a stolen car isn’t just a worry for people with new or expensive automobiles — the most commonly stolen vehicles are often older minivans or family sedans.

Comprehensive insurance is often the first coverage rejected in an attempt to keep your insurance costs low, but a liability-only policy won’t protect you in case of car theft. If your car is on the table of most commonly stolen vehicles above, you may want to think carefully about whether or not you need comprehensive coverage.

Road Fatalities in Pennsylvania

According to the NHTSA, there were 1,190 traffic fatalities in Pennsylvania in 2018. Of those, 334 were alcohol-related fatalities and 455 were speeding-related fatalities.

Traffic accidents aren’t just caused by speeding and alcohol, however. Whether someone was playing on their phone or you were surprised by a deer crossing the highway, a traffic accident can cause serious damage to your vehicle and leave you injured, or worse, dead.

Most fatal highway in Pennsylvania

In Pennsylvania, I80 runs from the border of New Jersey all the way to the Ohio state line.

While it is tempting to assume that, because they run so close to Philadelphia, there would be more traffic, and therefore more fatalities, on Highway 76 or 81, the sheer length of I80 makes it the most fatal highway in the state.

Fatal Crashes by Weather Condition and Light Condition

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 168 | 40 | 97 | 10 | 0 | 315 |

| Rain | 49 | 16 | 23 | 4 | 0 | 92 |

| Snow/Sleet | 15 | 1 | 7 | 2 | 0 | 25 |

| Other | 5 | 4 | 12 | 5 | 0 | 26 |

| Unknown | 332 | 109 | 158 | 24 | 2 | 625 |

| TOTAL | 569 | 170 | 297 | 45 | 2 | 1,083 |

Weather and light conditions can affect the number of accidents on the road, with slick asphalt or poorly lit streets increasing the odds of an accident.

Weather can also increase the severity of an accident, turning what otherwise could have been a minor fender bender into a situation where injuries or even fatalities occur.

When driving in the dark or in inclement weather you will need to take precautions. Use your headlights, drive slowly, and leave yourself plenty of space on the roads to protect yourself from an accident.

Fatalities (All Crashes) by County

| Fatalities by County Name | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Adams | 6 | 14 | 15 | 5 | 16 |

| Allegheny | 59 | 54 | 72 | 67 | 68 |

| Armstrong | 14 | 14 | 6 | 8 | 9 |

| Beaver | 10 | 12 | 5 | 17 | 15 |

| Bedford | 13 | 7 | 11 | 12 | 8 |

| Berks | 33 | 39 | 35 | 48 | 41 |

| Blair | 13 | 23 | 22 | 9 | 12 |

| Bradford | 8 | 16 | 10 | 9 | 13 |

| Bucks | 44 | 56 | 52 | 51 | 54 |

| Butler | 25 | 16 | 30 | 17 | 18 |

| Cambria | 13 | 9 | 12 | 12 | 9 |

| Cameron | 1 | 2 | 0 | 0 | 0 |

| Carbon | 10 | 11 | 12 | 9 | 13 |

| Centre | 12 | 15 | 20 | 16 | 13 |

| Chester | 34 | 35 | 24 | 35 | 46 |

| Clarion | 5 | 4 | 4 | 7 | 8 |

| Clearfield | 14 | 20 | 9 | 16 | 18 |

| Clinton | 9 | 10 | 6 | 9 | 4 |

| Columbia | 11 | 14 | 7 | 6 | 9 |

| Crawford | 14 | 8 | 12 | 10 | 14 |

| Cumberland | 25 | 13 | 28 | 26 | 22 |

| Dauphin | 17 | 19 | 30 | 36 | 42 |

| Delaware | 26 | 21 | 29 | 25 | 19 |

| Elk | 7 | 4 | 11 | 3 | 7 |

| Erie | 30 | 31 | 27 | 27 | 21 |

| Fayette | 18 | 28 | 22 | 23 | 19 |

| Forest | 0 | 0 | 4 | 2 | 2 |

| Franklin | 26 | 25 | 20 | 20 | 23 |

| Fulton | 9 | 5 | 2 | 7 | 5 |

| Greene | 12 | 6 | 5 | 9 | 9 |

| Huntingdon | 11 | 7 | 4 | 5 | 3 |

| Indiana | 9 | 17 | 21 | 7 | 10 |

| Jefferson | 5 | 7 | 11 | 3 | 5 |

| Juniata | 5 | 12 | 6 | 2 | 2 |

| Lackawanna | 17 | 19 | 20 | 20 | 30 |

| Lancaster | 62 | 48 | 44 | 42 | 45 |