Montana Car Insurance Guide (Cost+Coverage)

Looking for affordable Montana car insurance coverage? Our guide finds that USAA and State Farm are the cheapest Montana car insurance companies, but you will find the cheapest rates when you comparison shop online. Enter your ZIP code below and start comparing Montana car insurance quotes for free to save the most money on your monthly Montana car insurance rates.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Montana Stats Summary | Stats |

|---|---|

| Miles of Roadway | 75,007 |

| Number of Registered Vehicles | 1,447,797 |

| State Population | 1,062,305 |

| Most Popular Vehicle | F150 |

| Percentage of Uninsured Drivers | 9.90% |

| Speeding Fatalities | 59 |

| DUI Fatalities | 56 |

| Total Traffic Fatalities | 186 |

| Average Liability Premium | $386.29 |

| Average Collision Premium | $265.32 |

| Average Comprehensive Premium | $211.91 |

| Average Full Coverage Premium | $863.52 |

| Cheapest Providers | State Farm Mutual Auto & USAA |

As the state’s residents already know, Montana is enormous. It is one of the largest states in the nation, coming in fourth after Alaska, Texas, and California. It’s also one of the most sparsely populated states.

When it comes to population, however, it is a totally different matter. With only 1,062,305 residents, Montana comes 44th in population size out of all 50 states. In fact, Montana actually has more cattle than people living in the state. This means that while Montana residents face weather, wildlife, and other hazards, they generally don’t have to worry about a lot of traffic. This makes comprehensive coverage essential while collision may not cost you as much as it would in states like New York or California.

But no matter how big the state or how small the population, one thing that is the same all across Montana is that everybody wants to find an affordable rate for car insurance. Unfortunately, getting a car insurance quote can be a cumbersome process, especially when you want several quotes to compare prices.

Luckily, there is an easy way to get multiple quotes for car insurance without ever having to pick up the phone — just enter your zip code now to get started. You’ll need to answer a few questions, but you may be surprised by how easy it is.

What Should You Expect from Montana Car Insurance Coverage & Rates?

One of the great things about car insurance in Montana is is that the state’s average premium of $863.52 is significantly lower than the national average premium of $1,009.38. This could be because of the lower traffic rates which lead to a lower risk of collisions. Minimum car insurance requirements are also largely liability based. Weather can be severe in weather, but many of Montana’s residents are known to leave during the harsh winter season.

Montana’s Car Culture

Unsurprisingly, the car culture in Montana is built around the outdoors, specifically working in and getting out into nature. Montana residents who do stick around for a good part of the year tend to choose big trucks and other vehicles designed to handle off-roading.

You can’t just go off-roading wherever you please, however, so people in Montana know that they must stick to the legally designated off-road trails and have the proper OHV registration decal displayed on their vehicle.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What Is Montana’s Minimum Coverage?

Liability insurance is what pays for damages to another person’s property and bodily injuries caused in an at-fault accident. The vast majority of states, including Montana, have minimum liability requirements for drivers to protect people financially in the event of an accident.

In Montana, the minimum liability limits are as follows:

- Property Damage – $20,000 per accident

- Bodily Injury – $25,000 per person/$50,000 per accident

Keep in mind that these are the minimum required limits, not the maximum, so you may want to talk to your insurance company and find out about increasing those limits to make sure you are fully protected in case of an accident.

Though many states require uninsured/underinsured motorist coverage as a part of their minimum liability coverage, Montana does not have this requirement. This can help keep your insurance costs low, but if you are hit by an uninsured motorist you may find yourself out tens of thousands of dollars with no real way to pay for the damages you’ve incurred.

In Montana, you are much more likely to get in an accident with wildlife like deer or bears depending on the part of Montana. So it’s essential to have comprehensive coverage.

Forms of Financial Responsibility

Law enforcement officials in Montana use the Montana Insurance Verification System (MTIVS) to verify drivers are meeting the minimum legal requirements for liability insurance.

This system was put in place to give police officers more accurate, real-time information regarding your insurance during traffic stops. It also allows officers to retroactively verify you had insurance in place at the time of an accident or previous citation.

While it is a good idea to have proof of insurance on hand for yourself or the other driver in case of an accident, no documentation you present to a police officer will supersede the information in the MTIVS.

Premiums as a Percentage of Income

| States | Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|---|---|---|---|---|---|---|---|---|---|

| Montana | $868.55 | $36,041.00 | 2.10% | $842.74 | $35,296.00 | 2.39% | $821.68 | $35,876.00 | 2.29% |

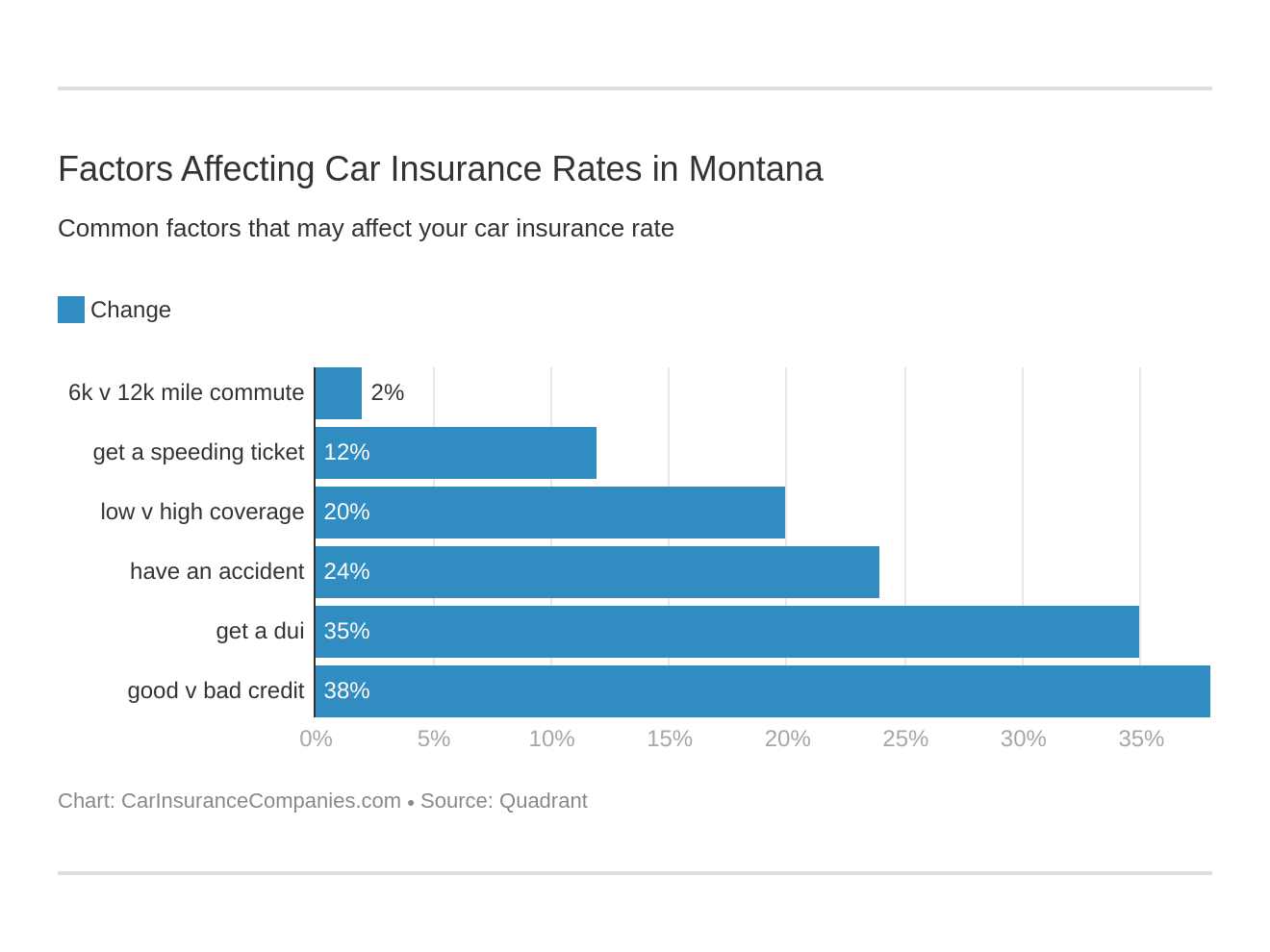

Many different factors impact your insurance premium, including your zip code, your age, your driving record, and dozens of other personal statistics that can be used to calculate your insurance risk.

This can make it difficult to calculate your premium as a percentage of your income, especially as all of these different factors change over time. Theoretically, if your income goes up, your percentage should go down, but a single ticket or moving to a new zip code can alter your premium by a significant amount, as well.

Figuring out your premium as a percentage of your income is a basic formula take the amount of your premium divided by your income (either gross or net) and multiply that number by 100. You can also use our calculator below to figure out what percentage of your income goes to your insurance premiums.

Average Monthly Car Insurance Rates in MT (Liability, Collision, Comprehensive)

Your average monthly car insurance rates may not increase as much as you might think by adding additional coverage like comprehensive. Review rates for auto insurance coverage below:

| Coverage Type | 2015 | 2014 | 2013 | 2012 | 2011 | Average |

|---|---|---|---|---|---|---|

| Liability | $386.29 | $392.53 | $388.54 | $383.76 | $387.71 | $387.77 |

| Collision | $265.32 | $265.54 | $255.50 | $247.30 | $240.85 | $254.90 |

| Comprehensive | $211.91 | $210.48 | $198.70 | $190.62 | $187.65 | $199.87 |

| Full Covg | $863.52 | $868.55 | $842.74 | $821.68 | $816.21 | $842.54 |

Please note — the rates in the chart above are based on the state minimums. These numbers will differ from person to person and policy to policy based on a variety of factors.

Liability coverage is required by law in the state of Montana, but that doesn’t mean your coverage should stop there. Auto insurance is about protecting all your financial interests, so you might want to consider any or all of these coverages:

- Liability – Liability insurance protects you financially by paying for damage you’ve caused to another person’s vehicle when you are at fault in an accident. It also covers medical bills for the other driver, which means if you injure someone else in an accident where you were at fault, your liability coverage would pay for their medical bills up to the limits of your coverage.

- Uninsured/Underinsured Motorist Coverage – Uninsured/underinsured motorist coverage, sometimes referred to as UM/UIM, is not mandatory in Montana. Just because it isn’t required doesn’t mean you don’t need it, however. It provides you with the same coverage level as your liability insurance if you are in an accident where an uninsured driver was at fault, protecting you from other people’s irresponsible choices.

- Collision – Collision insurance protects your financial interests by paying for damages to your vehicle if you are at fault in an accident. The coverage applies whether you hit another vehicle or a stationary object. Keep in mind that if you are making payments on a car you may be required by the lender to have collision insurance on your policy as part of the terms of your loan.

- Comprehensive – Comprehensive insurance covers damage to your car that isn’t caused during an accident. Essentially, comprehensive insurance is what covers damages to your car when it isn’t moving. Some examples of what might be covered under a comprehensive policy are hail damage, vandalism, and theft.

Every insurance company has their own guidelines as to what is and is not covered under comprehensive coverage, so make sure to do your research when choosing an insurance provider.

Additional Liability

When it comes to additional liability coverage, there are several options available for drivers in Montana.

Personal Injury Protection, sometimes called PIP insurance, will provide coverage for you no matter who is at fault in an accident.

This can be helpful because the state minimum requirements for liability coverage are woefully inadequate for all but the most insignificant of car accidents, often leaving you with additional medical bills.

Typically, PIP is a smaller amount of coverage, sometimes as low as $2,000, designed to cover your most basic needs if you require medical care due to an injury in an accident no matter who is at fault.

But PIP is about your medical needs. What about the needs of other people if you are at fault in an accident?

The minimum coverage level in Montana is $20,000 for property damage and $25,000/$50,000 for bodily injury, but that isn’t the maximum coverage level available. You can always increase your levels of liability coverage, and most people would do well to purchase a higher level of liability coverage than the state minimum.

Most insurance companies offer higher coverage levels, typically $50,000 – $100,000 in property damage and $250,000 per person/$500,000 per accident bodily injury, for which you will be charged a higher monthly premium. You can also purchase additional liability through an umbrella policy to increase your benefits to a million dollars or more.

Increasing your liability levels that much might seem extreme, but think about the possibilities if you are at fault in an accident. Perhaps you will be lucky and end up in a minor fender bender with someone in an older vehicle. But what if you aren’t so lucky?

You could rear-end a brand-new, luxury vehicle. You could sideswipe a car with two small children in the back seat. You could T-bone a van with expensive, built-in features designed to help a handicapped rider or driver.

If you carry only the state minimum insurance coverage, you will still be required by law to pay for any damages beyond what your insurance will pay for, so choose your coverage levels wisely.

When you are choosing coverage, you should also consider the loss ratio of the company. The loss ratio is the amount paid out in claims by a company versus the amount of premium taken in by the company.

According to the NAIC, a loss ratio in the 60s or 70s is good — it means they aren’t overcharging for premiums and they are regularly paying out claims to their customers. You can see the average loss ratios for companies in Montana below.

| PIP Voluntary Business | 2014 | 2013 | 2012 |

|---|---|---|---|

| Pure Premium | 35.33 | 32.81 | 36.85 |

| Loss Ratio | 68.69 | 64.36 | 72.66 |

Loss ratios might seem confusing and unimportant now, but these numbers could become very important to you in the event of a claim, so consider them carefully when choosing a policy.

Add-Ons, Endorsements, & Riders

If you have all the core coverages and higher-than-average levels of liability coverage, you are completely protected, right? Not necessarily. There are other coverages available that you may need to cover all of your losses in the event of an accident.

- Umbrella Policy – If you don’t think that $250,000/$500,000 in bodily injury and $50,000 – $100,000 in property damage would be enough to protect your assets in a serious accident, an umbrella policy might be right for you. Umbrella policies provide a minimum of $1,000,000 in liability coverage.

- Rental Reimbursement – Rental reimbursement covers the cost of a rental car while yours is being repaired due to an insured loss. For example, if a hail storm damaged the hood of your car, comprehensive insurance would cover the cost of the repair, but rental reimbursement coverage would cover your rental car while yours was in the garage.

- Roadside Assistance – If you need a tow truck or a simple repair on the side of the road, roadside assistance coverage would help cover the cost of those services.

- GAP Insurance – GAP insurance covers the difference between what your insurance policy pays and the amount you still ow for your car. GAP insurance can help prevent you from being forced to make payments on a totaled vehicle, but beware – the type and amount of GAP coverage available can vary widely from company to company and state to state, so research carefully before buying.

- Non-Owner Insurance – If you don’t own a car but you still drive with some regularity, you might need a non-owner insurance plan to provide you with third party liability coverage. This can protect you financially even if the car you are driving has other insurance in place.

- Classic Car Insurance – The value of a classic or vintage car is often worth more than standard depreciation. In addition to standard liability coverage, if you have a classic car you will need classic car insurance to make sure your vehicle is protected at its full value.

- Usage-Based/Pay-As-You-Drive Insurance – Some companies are now willing to install a device in your car or an app on your phone to record your driving information (speed, mileage, etc.) and report it to the company. Theoretically, they then offer you discounts for being a better driver, but you should consider the downsides of this carefully before buying.

Average Monthly Car Insurance Rates by Age & Gender in MT

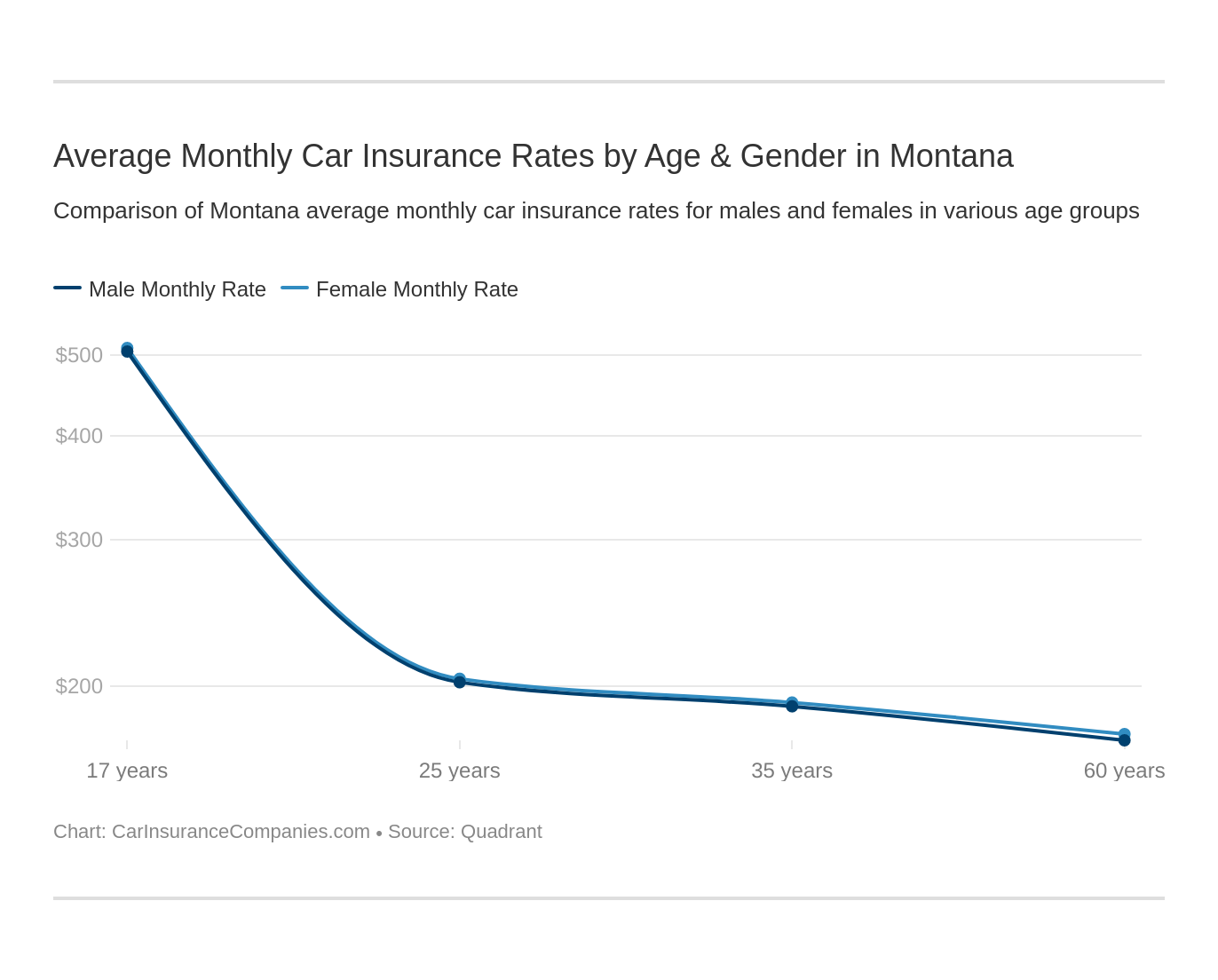

Montana was one of the first states to offer a unisex insurance rating system back in 1985. Today, the state continues to hold a unisex rating policy for all insurance, not just auto policies.

Some states have banned discrimination based on gender for car insurance rates, and this is one of those few states. As you can see the rate for males and females is the same, but the rate still varies with age.

As evidenced by the chart below, rates do not differ according to gender. They do, however, vary by age and marital status.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,740.02 | $2,740.02 | $2,507.60 | $2,507.60 | $10,484.90 | $10,484.90 | $2,955.90 | $2,955.90 |

| Depositors Insurance | $2,785.97 | $2,785.97 | $2,533.60 | $2,533.60 | $5,640.58 | $5,640.58 | $2,952.88 | $2,952.88 |

| Geico General | $2,840.18 | $2,653.99 | $2,771.26 | $2,527.59 | $6,926.07 | $6,445.87 | $2,434.84 | $2,218.97 |

| Mid-Century Ins Co | $2,755.44 | $2,755.44 | $2,462.45 | $2,462.45 | $7,395.41 | $7,395.41 | $3,016.88 | $3,016.88 |

| Progressive NorthWestern | $3,231.09 | $3,231.09 | $2,901.06 | $2,901.06 | $7,548.71 | $7,548.71 | $3,642.19 | $3,642.19 |

| SAFECO Ins Co of IL | $1,021.71 | $1,021.71 | $999.67 | $999.67 | $2,064.28 | $2,064.28 | $1,218.77 | $1,218.77 |

| State Farm Mutual Auto | $1,640.33 | $1,640.33 | $1,439.41 | $1,439.41 | $4,814.65 | $4,814.65 | $1,776.55 | $1,776.55 |

| USAA | $1,280.16 | $1,280.16 | $1,139.97 | $1,139.97 | $4,103.59 | $4,103.59 | $1,603.83 | $1,603.83 |

Though your gender doesn’t impact your rates in Montana, the price offered for a policy can vary widely from company to company.

| Company | Demographic | Average Annual Rate |

|---|---|---|

| Allstate F&C | Single 17-year old female | $10,484.90 |

| Allstate F&C | Single 17-year old male | $10,484.90 |

| Progressive NorthWestern | Single 17-year old female | $7,548.71 |

| Progressive NorthWestern | Single 17-year old male | $7,548.71 |

| Mid-Century Ins Co | Single 17-year old female | $7,395.41 |

| Mid-Century Ins Co | Single 17-year old male | $7,395.41 |

| Geico General | Single 17-year old female | $6,926.07 |

| Geico General | Single 17-year old male | $6,445.87 |

| Depositors Insurance | Single 17-year old female | $5,640.58 |

| Depositors Insurance | Single 17-year old male | $5,640.58 |

| State Farm Mutual Auto | Single 17-year old female | $4,814.65 |

| State Farm Mutual Auto | Single 17-year old male | $4,814.65 |

| USAA | Single 17-year old female | $4,103.59 |

| USAA | Single 17-year old male | $4,103.59 |

| Progressive NorthWestern | Single 25-year old female | $3,642.19 |

| Progressive NorthWestern | Single 25-year old male | $3,642.19 |

| Progressive NorthWestern | Married 35-year old female | $3,231.09 |

| Progressive NorthWestern | Married 35-year old male | $3,231.09 |

| Mid-Century Ins Co | Single 25-year old female | $3,016.88 |

| Mid-Century Ins Co | Single 25-year old male | $3,016.88 |

| Allstate F&C | Single 25-year old female | $2,955.90 |

| Allstate F&C | Single 25-year old male | $2,955.90 |

| Depositors Insurance | Single 25-year old female | $2,952.88 |

| Depositors Insurance | Single 25-year old male | $2,952.88 |

| Progressive NorthWestern | Married 60-year old female | $2,901.06 |

| Progressive NorthWestern | Married 60-year old male | $2,901.06 |

| Geico General | Married 35-year old female | $2,840.18 |

| Depositors Insurance | Married 35-year old female | $2,785.97 |

| Depositors Insurance | Married 35-year old male | $2,785.97 |

| Geico General | Married 60-year old female | $2,771.26 |

| Mid-Century Ins Co | Married 35-year old female | $2,755.44 |

| Mid-Century Ins Co | Married 35-year old male | $2,755.44 |

| Allstate F&C | Married 35-year old female | $2,740.02 |

| Allstate F&C | Married 35-year old male | $2,740.02 |

| Geico General | Married 35-year old male | $2,653.99 |

| Depositors Insurance | Married 60-year old female | $2,533.60 |

| Depositors Insurance | Married 60-year old male | $2,533.60 |

| Geico General | Married 60-year old male | $2,527.59 |

| Allstate F&C | Married 60-year old female | $2,507.60 |

| Allstate F&C | Married 60-year old male | $2,507.60 |

| Mid-Century Ins Co | Married 60-year old female | $2,462.45 |

| Mid-Century Ins Co | Married 60-year old male | $2,462.45 |

| Geico General | Single 25-year old female | $2,434.84 |

| Geico General | Single 25-year old male | $2,218.97 |

| SAFECO Ins Co of IL | Single 17-year old female | $2,064.28 |

| SAFECO Ins Co of IL | Single 17-year old male | $2,064.28 |

| State Farm Mutual Auto | Single 25-year old female | $1,776.55 |

| State Farm Mutual Auto | Single 25-year old male | $1,776.55 |

| State Farm Mutual Auto | Married 35-year old female | $1,640.33 |

| State Farm Mutual Auto | Married 35-year old male | $1,640.33 |

| USAA | Single 25-year old female | $1,603.83 |

| USAA | Single 25-year old male | $1,603.83 |

| State Farm Mutual Auto | Married 60-year old female | $1,439.41 |

| State Farm Mutual Auto | Married 60-year old male | $1,439.41 |

| USAA | Married 35-year old female | $1,280.16 |

| USAA | Married 35-year old male | $1,280.16 |

| SAFECO Ins Co of IL | Single 25-year old female | $1,218.77 |

| SAFECO Ins Co of IL | Single 25-year old male | $1,218.77 |

| USAA | Married 60-year old female | $1,139.97 |

| USAA | Married 60-year old male | $1,139.97 |

| SAFECO Ins Co of IL | Married 35-year old female | $1,021.71 |

| SAFECO Ins Co of IL | Married 35-year old male | $1,021.71 |

| SAFECO Ins Co of IL | Married 60-year old female | $999.67 |

| SAFECO Ins Co of IL | Married 60-year old male | $999.67 |

Read more: Depositors Insurance Company Car Insurance Review

In the tables above, the rates are determined by coverage actually purchased by drivers in Montana. It also includes rates for high-risk drivers and drivers who choose to carry higher-than-minimum levels of coverage, so these numbers may be higher than a standard insurance quote.

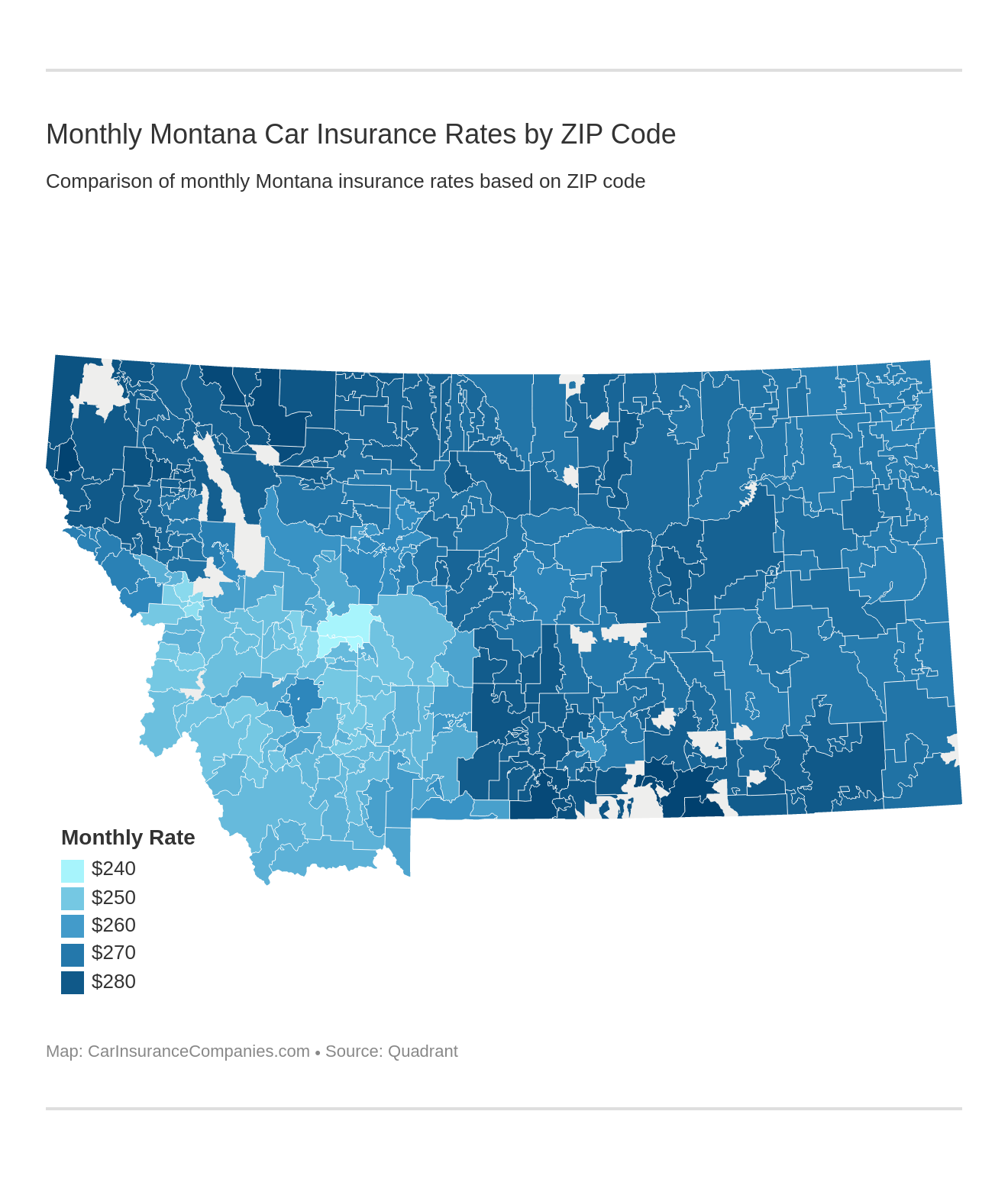

Cheapest Rates by Zip Code

Your zip code plays a big part in what you pay for insurance. Everything from the number of accidents to the number of stolen or vandalized cars in a zip code helps determine what the rate for that area should be, which means that moving as little as a block or two could dramatically change your annual premiums if it puts you in a new zip code.

| Most Expensive Zip Codes in Montana | City | Average Annual Rate by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 59001 | ABSAROKEE | $3,374.37 | Allstate | $4,873.58 | Progressive | $4,654.62 | Liberty Mutual | $1,307.54 | USAA | $2,057.85 |

| 59007 | BEARCREEK | $3,399.96 | Allstate | $4,873.58 | Progressive | $4,780.44 | Liberty Mutual | $1,370.30 | USAA | $2,057.85 |

| 59008 | BELFRY | $3,398.10 | Allstate | $4,873.58 | Progressive | $4,765.56 | Liberty Mutual | $1,370.30 | USAA | $2,057.85 |

| 59011 | BIG TIMBER | $3,372.28 | Allstate | $4,884.10 | Progressive | $4,759.65 | Liberty Mutual | $1,223.45 | USAA | $2,057.85 |

| 59033 | GREYCLIFF | $3,376.51 | Allstate | $4,884.10 | Progressive | $4,722.68 | Liberty Mutual | $1,300.92 | USAA | $2,057.85 |

| 59035 | FORT SMITH | $3,436.52 | Progressive | $4,854.09 | Farmers | $4,625.59 | Liberty Mutual | $1,365.50 | USAA | $2,057.85 |

| 59050 | LODGE GRASS | $3,433.47 | Progressive | $4,819.82 | Farmers | $4,625.59 | Liberty Mutual | $1,365.50 | USAA | $2,057.85 |

| 59066 | PRYOR | $3,377.49 | Progressive | $4,854.09 | Allstate | $4,578.75 | Liberty Mutual | $1,365.50 | USAA | $2,057.85 |

| 59068 | RED LODGE | $3,414.04 | Allstate | $4,873.58 | Progressive | $4,688.65 | Liberty Mutual | $1,370.30 | USAA | $2,057.85 |

| 59070 | ROBERTS | $3,398.92 | Allstate | $4,873.58 | Progressive | $4,677.66 | Liberty Mutual | $1,370.30 | USAA | $2,057.85 |

| 59075 | SAINT XAVIER | $3,433.31 | Progressive | $4,778.12 | Farmers | $4,625.59 | Liberty Mutual | $1,365.50 | USAA | $2,057.85 |

| 59089 | WYOLA | $3,457.81 | Progressive | $5,024.35 | Farmers | $4,625.59 | Liberty Mutual | $1,365.50 | USAA | $2,057.85 |

| 59411 | BABB | $3,387.92 | Allstate | $5,135.42 | Progressive | $4,826.09 | Liberty Mutual | $1,386.23 | USAA | $2,057.85 |

| 59417 | BROWNING | $3,420.38 | Allstate | $5,135.42 | Progressive | $4,845.55 | Liberty Mutual | $1,402.99 | USAA | $2,057.85 |

| 59448 | HEART BUTTE | $3,408.40 | Allstate | $5,135.42 | Progressive | $4,776.08 | Liberty Mutual | $1,432.38 | USAA | $2,057.85 |

| 59844 | HERON | $3,386.85 | Allstate | $5,135.42 | Progressive | $4,684.86 | Liberty Mutual | $1,421.88 | USAA | $2,035.70 |

| 59853 | NOXON | $3,440.51 | Progressive | $5,138.66 | Allstate | $5,135.42 | Liberty Mutual | $1,416.63 | USAA | $2,035.70 |

| 59917 | EUREKA | $3,372.37 | Allstate | $5,135.42 | Progressive | $4,642.83 | Liberty Mutual | $1,378.70 | USAA | $2,035.70 |

| 59920 | KILA | $3,391.20 | Allstate | $5,135.42 | Progressive | $4,687.47 | Liberty Mutual | $1,407.93 | USAA | $2,138.93 |

| 59922 | LAKESIDE | $3,374.36 | Allstate | $5,135.42 | Progressive | $4,505.10 | Liberty Mutual | $1,407.22 | USAA | $2,138.93 |

| 59925 | MARION | $3,378.26 | Allstate | $5,135.42 | Progressive | $4,574.15 | Liberty Mutual | $1,388.39 | USAA | $2,138.93 |

| 59930 | REXFORD | $3,387.14 | Allstate | $5,135.42 | Progressive | $4,765.25 | Liberty Mutual | $1,374.40 | USAA | $2,035.70 |

| 59931 | ROLLINS | $3,377.85 | Allstate | $5,135.42 | Progressive | $4,793.59 | Liberty Mutual | $1,383.14 | USAA | $2,155.75 |

| 59932 | SOMERS | $3,389.23 | Allstate | $5,135.42 | Progressive | $4,605.65 | Liberty Mutual | $1,435.44 | USAA | $2,138.93 |

| 59935 | TROY | $3,386.28 | Allstate | $5,135.42 | Progressive | $4,774.42 | Liberty Mutual | $1,374.40 | USAA | $2,035.70 |

Montana’s most expensive zip codes are spread out across a number of cities.

| Least Expensive Zip Codes in Montana | City | Average Annual Rate by Zip Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 59601 | HELENA | $2,883.50 | Allstate | $4,525.51 | Farmers | $3,775.68 | Liberty Mutual | $1,201.94 | USAA | $1,917.09 |

| 59602 | HELENA | $2,877.23 | Allstate | $4,525.51 | Farmers | $3,775.68 | Liberty Mutual | $1,276.30 | USAA | $1,917.09 |

| 59625 | HELENA | $2,907.72 | Allstate | $4,525.51 | Progressive | $3,910.86 | Liberty Mutual | $1,201.94 | USAA | $1,917.09 |

| 59626 | HELENA | $2,878.40 | Allstate | $4,525.51 | Farmers | $3,734.61 | Liberty Mutual | $1,201.94 | USAA | $1,917.09 |

| 59632 | BOULDER | $3,000.46 | Allstate | $4,496.72 | Progressive | $3,970.10 | Liberty Mutual | $1,403.98 | USAA | $1,936.37 |

| 59635 | EAST HELENA | $2,866.45 | Allstate | $4,525.51 | Farmers | $3,775.68 | Liberty Mutual | $1,209.86 | USAA | $1,917.09 |

| 59636 | FORT HARRISON | $2,887.69 | Allstate | $4,525.51 | Farmers | $3,734.61 | Liberty Mutual | $1,276.30 | USAA | $1,917.09 |

| 59641 | RADERSBURG | $2,988.11 | Allstate | $4,496.72 | Progressive | $3,854.58 | Liberty Mutual | $1,403.98 | USAA | $1,936.37 |

| 59642 | RINGLING | $2,997.31 | Allstate | $4,496.72 | Progressive | $3,991.72 | Liberty Mutual | $1,388.77 | USAA | $1,936.37 |

| 59713 | AVON | $2,979.79 | Allstate | $4,525.51 | Progressive | $3,814.31 | Liberty Mutual | $1,318.84 | USAA | $1,936.37 |

| 59728 | ELLISTON | $2,993.81 | Allstate | $4,525.51 | Farmers | $3,913.81 | Liberty Mutual | $1,318.84 | USAA | $1,936.37 |

| 59735 | HARRISON | $2,998.46 | Allstate | $4,501.72 | Progressive | $3,911.91 | Liberty Mutual | $1,270.03 | USAA | $1,936.37 |

| 59762 | WISE RIVER | $3,001.95 | Allstate | $4,540.86 | Progressive | $3,947.49 | Liberty Mutual | $1,377.68 | USAA | $1,936.37 |

| 59801 | MISSOULA | $2,963.80 | Allstate | $4,872.84 | Progressive | $3,840.76 | Liberty Mutual | $1,252.05 | USAA | $1,959.03 |

| 59802 | MISSOULA | $2,952.56 | Allstate | $4,848.33 | Farmers | $3,790.01 | Liberty Mutual | $1,212.87 | USAA | $1,959.03 |

| 59803 | MISSOULA | $2,941.55 | Allstate | $4,848.33 | Farmers | $3,790.01 | Liberty Mutual | $1,242.35 | USAA | $1,959.03 |

| 59804 | MISSOULA | $2,976.54 | Allstate | $4,872.84 | Progressive | $3,890.59 | Liberty Mutual | $1,244.09 | USAA | $1,959.03 |

| 59808 | MISSOULA | $2,950.55 | Allstate | $4,872.84 | Farmers | $3,790.01 | Liberty Mutual | $1,260.48 | USAA | $1,959.03 |

| 59812 | MISSOULA | $2,963.16 | Allstate | $4,872.84 | Progressive | $3,806.01 | Liberty Mutual | $1,252.05 | USAA | $1,959.03 |

| 59828 | CORVALLIS | $2,990.64 | Allstate | $4,675.85 | Farmers | $3,887.07 | Liberty Mutual | $1,307.12 | USAA | $1,936.37 |

| 59835 | GRANTSDALE | $2,996.26 | Allstate | $4,540.86 | Farmers | $3,887.07 | Liberty Mutual | $1,307.12 | USAA | $1,936.37 |

| 59841 | PINESDALE | $2,996.26 | Allstate | $4,540.86 | Farmers | $3,887.07 | Liberty Mutual | $1,307.12 | USAA | $1,936.37 |

| 59847 | LOLO | $2,995.39 | Allstate | $5,019.22 | Progressive | $3,816.45 | Liberty Mutual | $1,332.64 | USAA | $1,959.03 |

| 59851 | MILLTOWN | $2,988.25 | Allstate | $4,978.05 | Progressive | $3,940.69 | Liberty Mutual | $1,212.87 | USAA | $1,959.03 |

| 59875 | VICTOR | $2,996.84 | Allstate | $4,525.51 | Progressive | $3,972.53 | Liberty Mutual | $1,340.67 | USAA | $1,936.37 |

Cheapest Rates by City

Just like your zip code, your city can have a significant effect on your insurance rates. Theft rates, parking options, and all sorts of other variables can impact the insurance rates for your city.

| Most Expensive Cities | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Bearcreek | $3,399.96 | Allstate | $4,873.58 | Progressive | $4,780.44 | Liberty Mutual | $1,370.30 | USAA | $2,057.85 |

| Browning | $3,420.37 | Allstate | $5,135.42 | Progressive | $4,845.55 | Liberty Mutual | $1,402.99 | USAA | $2,057.85 |

| Fort Smith | $3,436.52 | Progressive | $4,854.09 | Farmers | $4,625.59 | Liberty Mutual | $1,365.50 | USAA | $2,057.85 |

| Heart Butte | $3,408.40 | Allstate | $5,135.42 | Progressive | $4,776.08 | Liberty Mutual | $1,432.38 | USAA | $2,057.85 |

| Lodge Grass | $3,433.47 | Progressive | $4,819.82 | Farmers | $4,625.59 | Liberty Mutual | $1,365.50 | USAA | $2,057.85 |

| Noxon | $3,440.51 | Progressive | $5,138.66 | Allstate | $5,135.42 | Liberty Mutual | $1,416.63 | USAA | $2,035.70 |

| Red Lodge | $3,414.03 | Allstate | $4,873.58 | Progressive | $4,688.65 | Liberty Mutual | $1,370.30 | USAA | $2,057.85 |

| Roberts | $3,398.91 | Allstate | $4,873.58 | Progressive | $4,677.66 | Liberty Mutual | $1,370.30 | USAA | $2,057.85 |

| Saint Xavier | $3,433.31 | Progressive | $4,778.12 | Farmers | $4,625.59 | Liberty Mutual | $1,365.50 | USAA | $2,057.85 |

| Wyola | $3,457.80 | Progressive | $5,024.35 | Farmers | $4,625.59 | Liberty Mutual | $1,365.50 | USAA | $2,057.85 |

Wyola has the most expensive rates in Montana.

| Least Expensive Cities in Montana | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Avon | $2,979.79 | Allstate | $4,525.51 | Progressive | $3,814.31 | Liberty Mutual | $1,318.84 | USAA | $1,936.37 |

| Bonner-West Riverside | $2,952.56 | Allstate | $4,848.33 | Farmers | $3,790.01 | Liberty Mutual | $1,212.87 | USAA | $1,959.03 |

| Corvallis | $2,990.63 | Allstate | $4,675.85 | Farmers | $3,887.07 | Liberty Mutual | $1,307.12 | USAA | $1,936.37 |

| East Helena | $2,866.45 | Allstate | $4,525.51 | Farmers | $3,775.68 | Liberty Mutual | $1,209.86 | USAA | $1,917.09 |

| Elliston | $2,993.81 | Allstate | $4,525.51 | Farmers | $3,913.81 | Liberty Mutual | $1,318.84 | USAA | $1,936.37 |

| Fort Harrison | $2,887.70 | Allstate | $4,525.51 | Farmers | $3,734.61 | Liberty Mutual | $1,276.30 | USAA | $1,917.09 |

| Helena | $2,886.71 | Allstate | $4,525.51 | Farmers | $3,755.15 | Liberty Mutual | $1,220.53 | USAA | $1,917.09 |

| Milltown | $2,988.25 | Allstate | $4,978.05 | Progressive | $3,940.69 | Liberty Mutual | $1,212.87 | USAA | $1,959.03 |

| Missoula | $2,959.12 | Allstate | $4,867.94 | Farmers | $3,781.85 | Liberty Mutual | $1,250.21 | USAA | $1,959.03 |

| Radersburg | $2,988.11 | Allstate | $4,496.72 | Progressive | $3,854.58 | Liberty Mutual | $1,403.98 | USAA | $1,936.37 |

Rates in Montana’s 10 Largest Cities

While these are all small cities compared to some other states, these are all very large cities by Montana standards. Even though the difference in population from city to city isn’t necessarily a large one, the difference in premium from place to place can still be significant.

Also, don’t assume rates are all based on population — there is a lot more that goes into determining a city’s rate than just how many people live there.

| Cities | Population (2013) | Avg Premium |

|---|---|---|

| Belgrade | 13,797 | $3,072.81 |

| Billings | 114,773 | $3,218.65 |

| Bozeman | 43,164 | $3,068.69 |

| Butte-Silver Bow | 30,287 | $3,207.72 |

| Great Falls | 65,207 | $3,174.70 |

| Havre | 9,657 | $3,269.82 |

| Helena | 45,055 | $2,920.86 |

| Kalispell | 31,785 | $3,351.62 |

| Miles City | 9,604 | $3,263.31 |

| Missoula | 62,157 | $2,986.20 |

Best Montana Car Insurance Companies

Picking the best car insurance company in Montana can be a difficult choice to make. Some insurance companies offer extra options, others provide better basic coverage, while still others are contenders because they offer the most affordable policies. How do you choose which one is right for you?

Having a lot of data can help when it comes time to determine which insurance company is right for you. These are just a few things you might want to consider when making a decision. Read on to learn more.

The Largest Companies’ Financial Rating

The financial rating of an insurance company is a valuable tool when determining the stability of the company. Organizations like A.M. Best rate each company based on their financial stability — whether they have the assets necessary to pay out claims over the year.

Remember that just because a company has excellent financial ratings doesn’t mean they have happy customers.

It also doesn’t mean their rates are higher or lower than any other company, so this is just one of many things to consider when choosing an insurance company.

Companies with Best Ratings

You can review the financial ratings for Montana’s biggest insurance companies below:

| Company | Financial Rating | Financial Outlook |

|---|---|---|

| Allstate F&C | A+ | Stable |

| Depositors Insurance | A+ | Negative |

| Geico General | A++ | Stable |

| Mid-Century Ins Co | A | Stable |

| Progressive NorthWestern | A+ | Stable |

| SAFECO Ins Co of IL | A | Stable |

| State Farm Mutual Auto | A++ | Stable |

| USAA | A++ | Stable |

You can compare the companies with the highest financial rating with the companies that have the lowest premium amounts to get a better idea of which company might be the best fit for your needs.

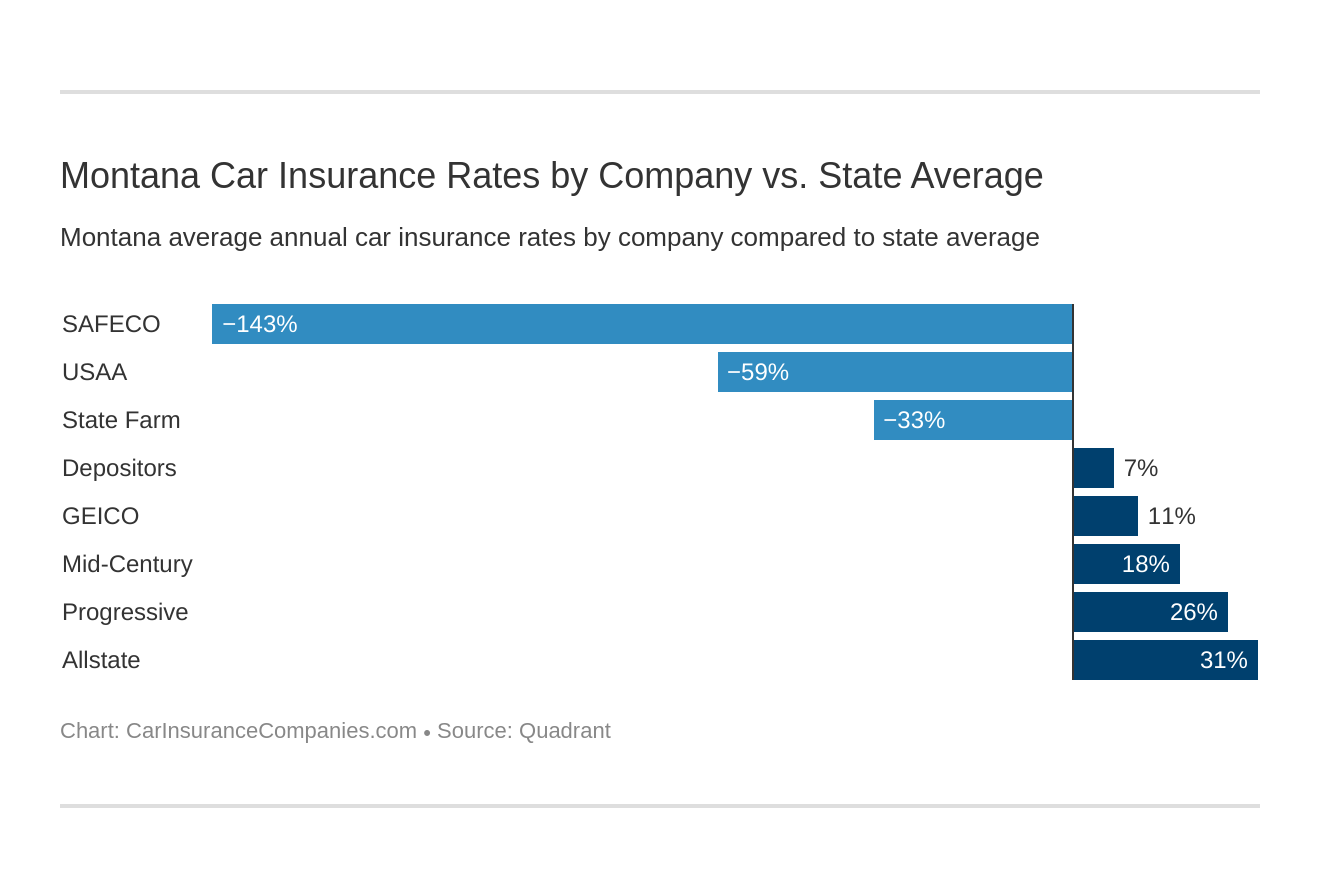

Montana Carrier Average Cost by Provider

| Company | Average Cost | Compared to State Average | +/- |

|---|---|---|---|

| $4,672 | $1,451 | 31.06% | |

| $3,908 | $687 | 17.57% | |

| $3,602 | $382 | 10.59% | |

| $3,478 | $257 | 7.40% |

| $4,331 | $1,110 | 25.63% | |

| $1,326 | -$1,895 | -142.88% | |

| $2,418 | -$803 | -33.22% | |

| $2,032 | -$1,189 | -58.51% |

Companies with Most Complaints in Montana

Consumers are encouraged to file any complaints regarding their insurance companies with the Attorney General’s office, but how do you know if your problem is big enough to file an official claim?

The NAIC can help guide you through the process. They have apps for both the iPhone and Android that can walk you through the steps to take after an accident, including reporting an issue to the state if necessary.

When in doubt, you can always contact the Attorney General’s Consumer Division at 1-800-481-6896 and ask for clarification, otherwise, you can find direct contact information for everyone in the Montana Department of Justice on their website.

| Issue | Number of National Complaints Filed in 2019 |

|---|---|

| Claim Handling/Unsatisfactory Settlement | 8,754 |

| Claim Handling/Delays | 8,269 |

| Claim Handling/Denial of Claim | 6,673 |

| Claim Handling/Prompt Pay | 2,145 |

| Underwriting/Cancellation | 1,515 |

When it comes to customer satisfaction, J.D. Power and Associates rates companies based on five factors – interactions, policy offerings, price, billing process/policy information, and claims.

According to their study, PEMCO ranked highest in customer satisfaction in Montana, followed by The Hartford and American Family. Nationwide and Liberty Mutual were at the bottom of the list. USAA is not included in the ratings because they don’t service the entire population, only military members and their families.

Cheapest Companies in Montana

Montana Carrier Average Cost by Provider

| Company | Average Cost | Compared to State Average | +/- |

|---|---|---|---|

| $4,672 | $1,451 | 31.06% | |

| $3,908 | $687 | 17.57% | |

| $3,602 | $382 | 10.59% | |

| $3,478 | $257 | 7.40% |

| $4,331 | $1,110 | 25.63% | |

| $1,326 | -$1,895 | -142.88% | |

| $2,418 | -$803 | -33.22% | |

| $2,032 | -$1,189 | -58.51% |

Though the price is an important consideration when choosing an insurance policy, it is only one of the things you should think about when selecting your insurance coverage. If you are in a situation where the price must influence which policy you choose, consider the following information. Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Commute Rates by Companies

Your commute is an important part of determining your insurance rates. Many companies choose to break their rating system down into categories, such as daily commute distance (10 miles vs. 25 miles) or annual commuting mileage (6,000 vs. 12,000 annual miles), and rate you accordingly.

| Group | Commute_And_Annual_Mileage | Annual Average |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $4,561.46 |

| Allstate | 25 miles commute. 12000 annual mileage. | $4,782.74 |

| Farmers | 10 miles commute. 6000 annual mileage. | $3,907.55 |

| Farmers | 25 miles commute. 12000 annual mileage. | $3,907.55 |

| Geico | 10 miles commute. 6000 annual mileage. | $3,538.49 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,666.20 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $1,326.11 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $1,326.11 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $3,478.26 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $3,478.26 |

| Progressive | 10 miles commute. 6000 annual mileage. | $4,330.76 |

| Progressive | 25 miles commute. 12000 annual mileage. | $4,330.76 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,346.26 |

| State Farm | 25 miles commute. 12000 annual mileage. | $2,489.21 |

| USAA | 10 miles commute. 6000 annual mileage. | $2,007.49 |

| USAA | 25 miles commute. 12000 annual mileage. | $2,056.29 |

The reason your commute impacts your insurance rate is that the more time you spend on the road, you are more likely you are to file a claim.

Whether your claim is a small one, such as a dented fender, or a large one, such as a totaled vehicle, increasing your drive time will expose you to more situations where you might get into an accident.

Coverage Level Rates by Companies

Because you have a variety of options when choosing an insurance plan, the price of your policy can vary wildly depending on which coverages and company you choose.

Your choices in your day-to-day life have a big impact on your insurance prices. Driving an eight-year-old Toyota? Your comprehensive and collision coverage will be much cheaper than if you were driving a brand new Lexus.

Take a look at the table below to see how the coverage you choose can impact your rates at each company.

| Group | Coverage_Type | Annual Average |

|---|---|---|

| Allstate | Low | $4,449.47 |

| Allstate | Medium | $4,661.15 |

| Allstate | High | $4,905.69 |

| Farmers | Low | $3,630.98 |

| Farmers | Medium | $3,903.65 |

| Farmers | High | $4,188.01 |

| Geico | Low | $3,460.99 |

| Geico | Medium | $3,577.02 |

| Geico | High | $3,769.03 |

| Liberty Mutual | Low | $1,231.99 |

| Liberty Mutual | Medium | $1,329.79 |

| Liberty Mutual | High | $1,416.55 |

| Nationwide | Low | $2,678.46 |

| Nationwide | Medium | $3,706.80 |

| Nationwide | High | $4,049.52 |

| Progressive | Low | $4,090.20 |

| Progressive | Medium | $4,318.46 |

| Progressive | High | $4,583.63 |

| State Farm | Low | $2,289.67 |

| State Farm | Medium | $2,407.88 |

| State Farm | High | $2,555.66 |

| USAA | Low | $1,943.70 |

| USAA | Medium | $2,021.60 |

| USAA | High | $2,130.37 |

Credit History Rates by Companies

Your credit history is one of the things that can impact your insurance rates. Statistics show that people with lower credit scores tend to file more claims, which means the lower your credit score the higher your rates, or you could even be denied coverage altogether, depending on the circumstances.

Review the table below to see how your credit history can impact your insurance rates.

| Group | Credit_History | Annual Average |

|---|---|---|

| Allstate | Poor | $5,648.45 |

| Allstate | Fair | $4,519.28 |

| Allstate | Good | $3,848.58 |

| Farmers | Poor | $4,607.55 |

| Farmers | Fair | $3,661.37 |

| Farmers | Good | $3,453.72 |

| Geico | Poor | $5,675.22 |

| Geico | Fair | $3,025.06 |

| Geico | Good | $2,106.77 |

| Liberty Mutual | Fair | $1,326.11 |

| Liberty Mutual | Good | $1,326.11 |

| Liberty Mutual | Poor | $1,326.11 |

| Nationwide | Poor | $4,396.26 |

| Nationwide | Fair | $3,172.44 |

| Nationwide | Good | $2,866.07 |

| Progressive | Poor | $5,240.66 |

| Progressive | Fair | $4,005.65 |

| Progressive | Good | $3,745.98 |

| State Farm | Poor | $3,476.81 |

| State Farm | Fair | $2,116.08 |

| State Farm | Good | $1,660.31 |

| USAA | Poor | $2,740.31 |

| USAA | Fair | $1,854.79 |

| USAA | Good | $1,500.57 |

When it comes to lowering your insurance rates, cleaning up your credit rating is an excellent place to start.

Driving Record Rates by Companies

While it seems obvious, you shouldn’t forget that your driving record can have a significant impact on your insurance premiums.

A speeding ticket or a fender bender may only cost you a few hundred dollars or so initially, but it will be reported to your insurance company and you will likely see an increase in your rates, so keep that in mind when you are zooming through that school zone.

Speeding tickets, red light infractions, and other minor offenses may seem forgettable at the moment, but they will impact your insurance premiums in the future.

Obeying traffic laws and avoiding citations is an excellent way to keep your insurance prices low.

Take a look at the table below to see how your driving record can impact your insurance rates.

| Group | Driving_Record | Annual Average |

|---|---|---|

| Allstate | With 1 DUI | $5,635.38 |

| Allstate | With 1 accident | $4,642.32 |

| Allstate | With 1 speeding violation | $4,485.46 |

| Allstate | Clean record | $3,925.26 |

| Farmers | With 1 accident | $4,436.87 |

| Farmers | With 1 DUI | $4,326.13 |

| Farmers | Clean record | $3,433.60 |

| Farmers | With 1 speeding violation | $3,433.60 |

| Geico | With 1 DUI | $5,661.62 |

| Geico | With 1 accident | $3,664.68 |

| Geico | With 1 speeding violation | $2,767.01 |

| Geico | Clean record | $2,316.09 |

| Liberty Mutual | With 1 DUI | $1,570.59 |

| Liberty Mutual | With 1 accident | $1,570.59 |

| Liberty Mutual | With 1 speeding violation | $1,259.73 |

| Liberty Mutual | Clean record | $903.51 |

| Nationwide | With 1 DUI | $4,698.24 |

| Nationwide | With 1 accident | $3,638.09 |

| Nationwide | With 1 speeding violation | $3,051.00 |

| Nationwide | Clean record | $2,525.70 |

| Progressive | With 1 accident | $4,819.80 |

| Progressive | With 1 DUI | $4,616.41 |

| Progressive | With 1 speeding violation | $4,147.16 |

| Progressive | Clean record | $3,739.67 |

| State Farm | With 1 accident | $2,579.85 |

| State Farm | With 1 DUI | $2,417.73 |

| State Farm | With 1 speeding violation | $2,417.73 |

| State Farm | Clean record | $2,255.63 |

| USAA | With 1 DUI | $2,826.76 |

| USAA | With 1 accident | $1,901.51 |

| USAA | With 1 speeding violation | $1,868.12 |

| USAA | Clean record | $1,531.17 |

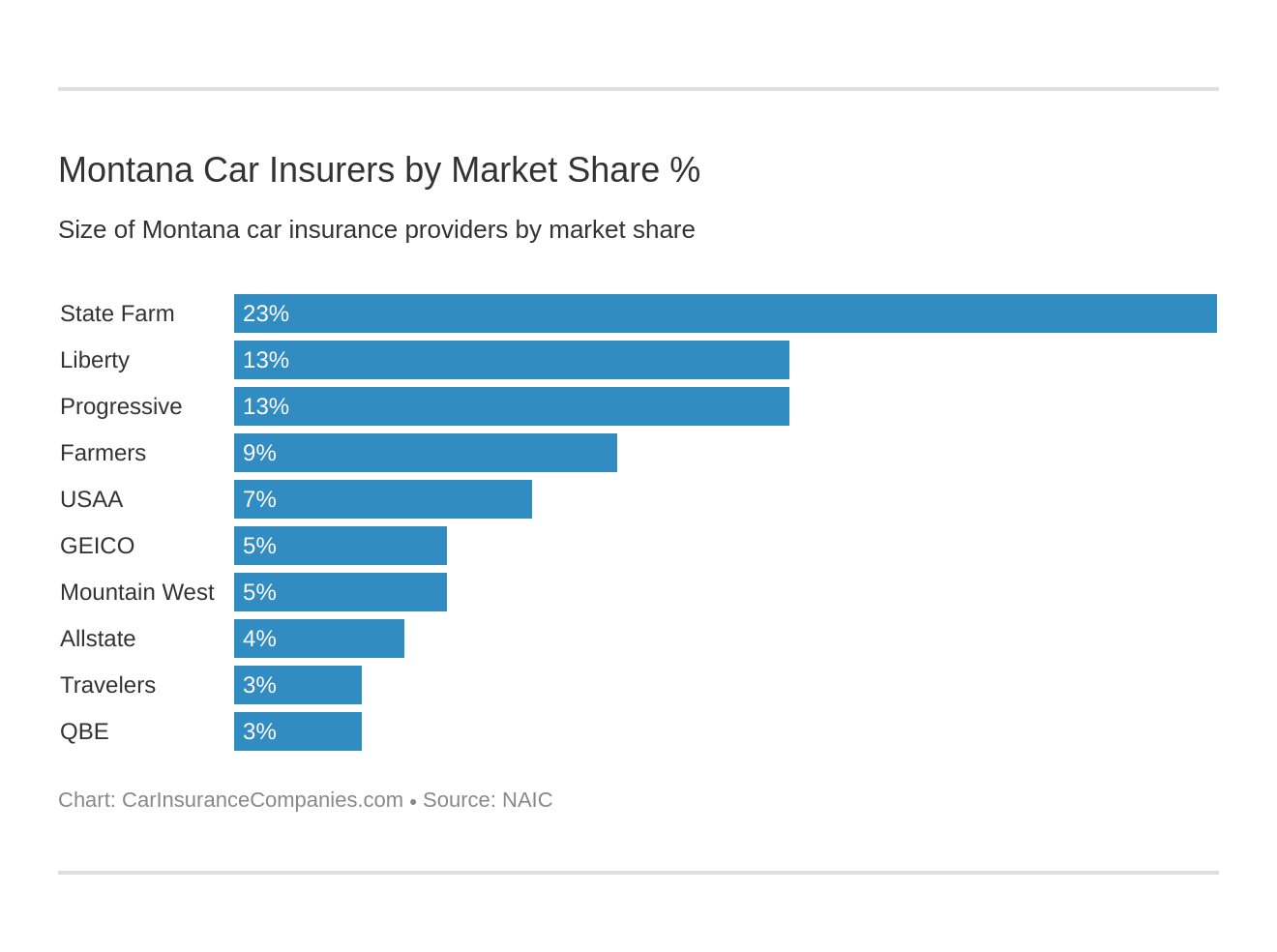

Largest Car Insurance Companies in Montana

While size isn’t the only consideration, choosing a large, well-known company with offices all over Montana can be a good way to guarantee you’ll be able to find someone to help you if you have to file a claim.

You may also have an easier time finding recommendations for the larger companies in the state. After all, the bigger their customer base, the more clients they have who can recommend their company.

Take a look at the chart below to see some of the largest insurance companies in Montana and their rates.

Montana Carrier Average Cost by Provider

| Company | Average Cost | Compared to State Average | +/- |

|---|---|---|---|

| $4,672 | $1,451 | 31.06% | |

| $3,908 | $687 | 17.57% | |

| $3,602 | $382 | 10.59% | |

| $3,478 | $257 | 7.40% |

| $4,331 | $1,110 | 25.63% | |

| $1,326 | -$1,895 | -142.88% | |

| $2,418 | -$803 | -33.22% | |

| $2,032 | -$1,189 | -58.51% |

Number of Insurers in Montana

While there are only 14 companies who are domiciled in Montana, that doesn’t mean these are the only companies offering coverage in the state. It is possible for companies domiciled in other states to do business in Montana, as long as they are licensed to sell insurance in the state.

Below is a table comparing the number of insurers domiciled in Montana to some of the surrounding states.

| State | Number of Insurance Companies |

|---|---|

| Montana | 14 |

| Idaho | 10 |

| Wyoming | 2 |

| North Dakota | 12 |

Montana Laws

Every state has its own specific laws and regulations when it comes to driving, cars, and insurance. What is considered legal in one state might be illegal in another, so you can’t assume that just because you know the law in Maryland you are okay to drive in Montana.

Car Insurance Laws

The same way traffic laws and housing laws are continually changing, car insurance laws are changed or updated all the time. You need to keep yourself up to date on the laws that impact your car insurance to make sure you know what is required of you as a consumer and a driver.

For example, drivers in Montana are allowed to use studded tires to deal with harsh winter weather from October 1st to May 31st, but each year drivers need to verify that these dates have not changed before they install studded tires on their vehicle.

Using the Montana Department of Justice website can help you keep abreast of the driving laws, potentially saving you some money in the process.

How State Laws for Insurance are Determined

Insurance laws in Montana are created the same way other laws are — through a legislative process. After the laws are passed, the Attorney General and other people in the Montana Department of Justice work to uphold those laws.

Windshield Coverage

Montana has very specific regulations regarding your car windshield.

- Replacement Glass – Replacement windshield glass is required to be of the same kind and quality as the original, and it must restore the vehicle to its original state.

- Windshield Obstructions – No stickers, signs, decals, or other opaque items may be placed on the windshield except for those required by law (registration stickers, for example.)

- Windshield Wipers – All vehicles are required by law to have windshield wipers in good working order. If they are non-functional, cracked, or otherwise unable to keep your windshield clear, they may be illegal.

Coverage for a damaged windshield is typically included under your comprehensive insurance, but some policies separate windshield and window damage into a separate glass policy, so make sure to check on that detail before you purchase your insurance.

High-Risk Insurance

If you find yourself with a significant number of tickets, accidents, or moving violations, you may be surprised to find that you are considered uninsurable. But auto insurance is required by law in Montana, so what do you do if the insurance companies don’t want to cover you?

If you can’t get an auto insurance policy through traditional means, you can reach out to the Montana AIP for assistance. They will guarantee you a policy, though that guarantee doesn’t mean the policy will be affordable.

If you need to speak to someone about setting up a high-risk policy, contact the Plan Office customer service line at 800-227-4659.

Low-Cost Insurance

As of now, there are no discounts available for people on Medicare or Medicaid. Unfortunately, this means that people in those programs will have to pay full price for their car insurance. Luckily for everyone, there are lots of potential discounts available through almost every insurance company.

There are standard discounts, such as good driving record discounts or discounts for people who have multiple lines of insurance through the company, but there are a variety of other discounts available for dozens of reasons.

For example, many insurers give discounts to active military, teachers, and other occupational discounts. Some companies give discounts to students if they maintain a high enough GPA. Some also offer discounts through your employer, so check with your HR department to see if they offer car insurance discounts as part of their Employee Assistance Program.

Automobile Insurance Fraud in Montana

Montana takes insurance fraud very seriously. The Office of the Montana State Auditor, Montana Commissioner of Securities and Insurance is the agency responsible for addressing insurance and securities fraud in the state.

Insurance fraud isn’t limited to filing a false claim. There are multiple types of insurance fraud, such as:

- False Insurance Companies – Sometimes con artists set up companies that sell fake insurance policies. A good sign that a company isn’t legitimate is if they are selling policies that are significantly lower priced than any of its competitors.

- Agent/Broker Fraud – Agents and brokers are capable of defrauding customers for personal gain, especially if they aren’t properly licensed. If you are sold a policy and you don’t receive an ID card or a copy of your policy relatively quickly you might be a victim of insurance fraud.

- Consumer Fraud – Filing false claims, exaggerating a claim, or making statements to support a claim you know is fraudulent are all forms of consumer insurance fraud.

If you need to report suspected insurance fraud you can contact the agency at 800-332-6148.

Statute of Limitations

The law in Montana states that lawsuits filed due to property damage must be brought within two years of an accident. If you are suing somebody for bodily injury or wrongful death, the statute of limitations says the suit must be brought within three years of the accident.

Lawsuits against the insurance company for fraud have a two-year limit, but if you are taking them to court over a contractual issue you might have up to eight years to file that suit.

Keep in mind that these time limits start at the point of discovery, so if you don’t discover that you were injured in an accident until five years later, you still have three years after the injury was discovered to file a lawsuit.

If you believe you need to file a lawsuit you’ll need to reach out to an attorney right away. They can help you determine whether you have enough cause to move forward and advise you on the statute of limitations for your specific case.

State-Specific Laws

Just like every other state, Montana has unique laws in place that you won’t find elsewhere in the country.

This applies to a wide variety of laws, of course, but on the wackier side of things, it is illegal in Montana to have a sheep in the cab of your truck without a chaperone.

Unique laws are not only limited to silly things, but can also include things as common as local speed limits and whether you can turn right on a red light, so be sure to keep yourself up to date on the local laws in your state.

Vehicle Licensing Laws

The requirements for getting licensed to drive vary from state to state. Sometimes those requirements can even be different for people within the state, with different licensing standards for new drivers, experienced drivers who are new state residents, and senior citizens.

If you need to get your license, whether for the first time or to renew your license, you’ll need to make sure you follow all of Montana’s laws and regulations.

REAL ID

The REAL ID Act is a federal law designed to help combat terrorism. REAL IDs are much more secure, increasing the likelihood that someone’s ID matches their identity.

Montana does not require citizens to get a REAL ID, but they do offer the opportunity to get a REAL ID for anyone who wants one. Residents can verify they have all the necessary documents to upgrade their license on the Montana REAL ID website.

Penalties for Driving Without Insurance

Driving without insurance is a misdemeanor in Montana, carrying a penalty of $250 – $500 or up to ten days in jail for your first offense.

If you are caught driving without insurance a second time, you will pay a minimum fine of $350 or spend up to ten days in jail. This also comes with the addition of five points on your driver’s license.

If you manage to get caught without insurance a third time, you face a minimum fine of $500 or up to six months in prison. Or, if the judge is feeling particularly harsh, you can end up with both a fine and jail time on your third offense.

Teen Driver Laws

| MT Minimum entry age | MT Mandatory holding period | MT Minimum amount of supervised driving | Minimum age | Unsupervised driving prohibited | Restriction on passengers (family members excepted unless otherwise noted) | Nighttime restrictions | Passenger restrictions |

|---|---|---|---|---|---|---|---|

| 14, 6 months | 6 months | 50 hours, 10 of which must be at night | 15 | 11 p.m.-5 a.m. | first 6 months—no more than 1 passenger younger than 18; second 6 months—no more than 3 passengers younger than 18 | 12 months or at age 18, whichever occurs first (min. age: 16) | 12 months or at age 18, whichever occurs first (min. age: 16) |

Teens who are 14 or 15 years of age are eligible for their learner’s license in Montana, which means they can drive as long as they are accompanied by a driver with a valid license. A learner’s license:

- Is valid for up to one year from the issue date

- Must be used for at least six months by any beginner driver under the age of 18

- Must be held for 14 days by Commercial driver applicants before taking a road test

Montana uses a graduated licensing program for drivers, which means new drivers can earn a license in three steps.

- Step 1: Permit – This allows the driver to earn at least 50 hours of driving practice, of which 10 must be done at night.

- Step 2: First-Year Restricted License – This allows a newly licensed driver to drive without supervision as long as they follow the rules the state has set for first-year drivers.

- Step 3: Full Privilege Driver’s License – Once the driver has driven under a restricted license for a full year (or turned 18, whichever comes first) they are given full driving privileges with the expectation that they will follow all driving laws as set forth by the state.

Older Driver License Renewal Procedures

For a standard Class D license, Montana allows mail-in renewals. When you need to renew your license is based on age, as demonstrated in the chart below:

| Customer Age (years) | Driver Licensing Fee | Length of Driver License (years) |

|---|---|---|

| 21-67 | $41.72 | 8 |

| 68 | $36.57 | 7 |

| 69 | $31.42 | 6 |

| 70 | $26.27 | 5 |

| 71 | $21.12 | 4 |

| 72 | $15.97 | 3 |

| 73 | $10.82 | 2 |

| 74 | $5.67 | 1 |

| 75 & older | $21.12 | 4 |

New Residents

If you are new to living in Montana and you have an out-of-state license, you must:

- Apply for a Montana driver license no later than 60 days after moving to the state if seeking a non-commercial driver license (or within 30 days if they need a commercial license)

- Provide the documents required by the DMV to issue a new license (proof of identity, proof of residency, and proof of authorized presence)

You may also be required to pass both the written and road test, in addition to a vision test. The person issuing your license, however, is allowed to use their discretion and waive the additional testing if you have a valid driver’s license from another state.

License Renewal Procedures

You can renew your license six months before it expires (typically on your birthday).

You can still renew your license up to three months after it expires, but once it expires, it is not valid until the renewal is processed.

When renewing your license in person, bring your expiring Montana driver’s license. If you do not have it for some reason, you must provide proof of identity for renewal. If your name has changed you must bring documentation of name change, such as a marriage license.

Your renewal comes with a $41.72 fee for an eight-year Class D license, payable with cash, check or credit card. All renewals are given a temporary license and will receive a new license in the mail within approximately two to four weeks.

Negligent Operator Treatment System (NOTS)

When you hear people talking about ending up with points on your license, they are talking about the Negligent Operator Treatment System. In Montana, if you earn 15 points or more over 36 months, your license will be suspended for six months. If you earn 30 points or more over three years, your license will be revoked for three years.

Montana will automatically remove your driving privileges for specific traffic tickets, including (but not limited to):

- DUI

- Refusing a sobriety test

- Homicide caused by negligent driving

- Leaving the scene of an accident that results in death or injury

Rules of the Road

Montana has its own laws and rules when it comes to driving, just like every other state. Everything from seat belt laws to highway speed limits is determined by the state.

This means you can’t assume that just because you know the laws in another state that they will be the same in Montana.

To keep yourself safe (and avoid tickets and points on your license) it is important to be aware of the specific rules and regulations in your state.

Fault vs. No-Fault

Montana is an at-fault state, which means the driver who is responsible for an accident is the one who will be required to pay for any damages the accident caused.

If you are in an accident, you can file a claim against the at-fault driver and their insurance company, reach out to your own insurance company and have them pursue the matter, or take your case to court, if it comes to that.

Keep in mind, however, that if you are at-fault in an accident the other driver has the same rights, so make sure you have sufficient liability coverage in place to protect your financial interests.

Seat Belt & Car Seat Laws

Watch the video below for a thorough guide as to how to properly install an infant car seat.

Keep Right & Move Over Laws

In Montana, the law states you should keep right if you are moving slower than the flow of traffic. In some circumstances, you can pass other drivers on their right side, but if at all possible, it is still safest to pass on the left.

The law also states that when you see flashing emergency lights on a stationary vehicle, you are to move over and reduce your speed to protect everyone who is addressing the emergency situation.

Speed Limits

Montana has two different speed limits on many roads: daytime and nighttime speed limits.

Daytime speed limits are in effect from half an hour before sunrise to half an hour after sunset. Nighttime speed limits are in effect at all other times. These speed limits apply unless a road or highway is otherwise posted for construction or has a different local limit posted.

| Type of Highway | Cars and Light Trucks | Heavy Trucks | Over 1 Ton | |

|---|---|---|---|---|

| Daytime | Nighttime | Daytime | Nighttime | |

| Interstate | 75 | 75 | 65 | 65 |

| Interstate Within Urban Area | 65 | 65 | 65 | 65 |

| Two-Lane | 70 | 65 | 60 | 55 |

Ridesharing

In 2015, the laws in Montana were updated to include a new class of licenses for taxi and rideshare companies that use apps to pick up passengers. This was designed to remove hindrances to companies like Uber and Lyft in hopes of creating more jobs for the citizens of Montana.

If you choose to drive for a rideshare company, keep in mind that you may need a special insurance policy to cover you while you are driving for work. Several insurance companies offer policies specific to rideshare drivers, so be sure to check out who offers the best rates for those policies in your area.

Automation on the Road

There are no laws about self-driving vehicles in Montana at this time.

Given how quickly the car companies are all adapting to self-driving technology that is sure to change, so be sure to check with the MVD to keep abreast of any new laws before you make a purchase.

Safety Laws

Like every state, Montana has laws on the books to keep people safe while they are driving.

Whether someone is texting on the road or driving under the influence, they are putting other people in danger, so the state has laws in place to reprimand and deter these deadly behaviors.

Remember that laws change over time, so just because something was legal two years ago doesn’t mean it is legal now.

Alternately, things that were illegal not long ago might be completely legal today, so make sure to do your research when it comes to traffic safety laws.

DUI Laws

Montana DUI Stats

| BAC Limit | High BAC Limit | Criminal Status by Offense | Formal Name for Offense | Look Back Period/Washout Period | 1st Offense - ALS or Revocation | 1st Offense - Imprisonment | 1st Offense - Fine | 1st Offense - Other | 2nd Offense - DL Revocation | 2nd Offense - Imprisonment | 2nd Offense - Fine | 2nd Offense - Other | 3rd Offense - DL Revocation | 3rd Offense - Imprisonment | 3rd Offense - Fine | 3rd Offense - Other |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.08 | 0.16 | 1st-3rd misdemeanors, 4th+ felonies | Driving Under the Influence (DUI) | 10 years for 2nd offense, unlimited/lifetime for 3rd+ | 6 month suspension | 24 hours-6 months | $600-$1000 +$200 reinstatement fee | 10 license points for life; must participate in ACT phases (assessment, course, treatment); may be ordered to use IID | 1 year suspension | 7 days-1 year | $1200-$2000 | 10 license points for life; may be required to enroll in 24-17 sobriety program | 1 year suspension | 30 days-1 year | $2500-$5000 | 10 license points=30 total - DL revoked for Habitual Traffic Offender |

In Montana, there are several laws regarding driving under the influence, including:

- Blood Alcohol Concentration – The blood alcohol concentration (BAC) limit in Montana is .08, with the number referring to grams of alcohol per 100 milliliters of blood or grams of alcohol per 210 liters of breath.

- For drivers under 21, the legal BAC is .02.

- In Montana, drivers are considered to have given consent to blood or breath tests to determine the presence of alcohol or drugs.

- If you refuse to submit to a blood or breath test, the law allows the officer to seize your driver’s license, which may be suspended or revoked, and the length of the suspension depends on whether it is a first refusal or subsequent refusal.

- The penalties for your first DUI conviction can include up to six months in jail and a fine of up to $1,000.

- Your vehicle may be forfeited to the state on the second or subsequent DUI.

- A fourth or subsequent DUI is a felony.

Marijuana-Impaired Driving Laws

The Marijuana Drug-Impaired Driving Laws in Montana state that the legal limit is THC per se (5 nanograms). Despite what many people think, driving while high is extraordinarily dangerous, slowing your reaction time and distorting your sense of perception.

Keep in mind that recreational marijuana use is still illegal in Montana. If you are caught using you can be assessed severe penalties, so getting caught driving while high can cost you significantly more than simply driving with a high BAC.

Distracted Driving Laws

Eating, texting, and talking on the phone are just a few of the many ways drivers allow themselves to be distracted behind the wheel.

According to the CDC, there are three types of distracted driving:

- Manual – causing you to take your hands off the wheel

- Visual – causing you to take your eyes off the road

- Cognitive – causing you to take your mind off of driving

Texting is the most dangerous form of distracted driving because it embodies all three types of distracted driving in a single activity.

Despite the dangers of distracted driving, Montana is one of the few states that has not enacted any sort of laws against texting or phone use while driving. Individual cities and municipalities within the state have, however, so you may still violate the law if you are texting while driving, depending on which city you are in at the time. Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Driving Safely in Montana

When it comes to our normal, day-to-day activities, driving is one of the most dangerous things most people will ever do.

There are more than 30,000 car accidents across America every year, causing almost 25,000 fatalities and more than two million injuries.

It is important to protect your vehicle, yourself, and your loved ones. One of the most effective ways to help keep yourself safe is to be aware of the dangers that go along with driving — knowing the most dangerous roads, commuting times, and weather conditions can help you prepare for and possibly even prevent an accident from occurring.

Vehicle Theft in Montana

If your vehicle were stolen, replacing it would be covered under your comprehensive insurance. Despite the financial protection of comprehensive insurance, the possibility of replacing the car doesn’t stop a car theft victim from feeling scared and violated.

Vehicle theft isn’t just a concern for people with new, high-priced cars — the most commonly stolen vehicles are often older family sedans or minivans.

While it is tempting to skip the comprehensive coverage in an attempt to keep your insurance costs low, keep in mind that a liability-only policy won’t protect you in case of car theft.

| State | Rank | Make/Model | Year of Vehicle | Year | Thefts |

|---|---|---|---|---|---|

| Montana | 1 | Chevrolet Pickup (Full Size) | 1999 | 1999 | 165 |

| Montana | 2 | Ford Pickup (Full Size) | 1995 | 1995 | 145 |

| Montana | 3 | Dodge Pickup (Full Size) | 2006 | 2006 | 78 |

| Montana | 4 | GMC Pickup (Full Size) | 2008 | 2008 | 55 |

| Montana | 5 | Honda Accord | 1994 | 1994 | 52 |

| Montana | 6 | Chevrolet Impala | 2001 | 2001 | 31 |

| Montana | 7 | Ford Explorer | 1996 | 1996 | 27 |

| Montana | 8 | Chevrolet Pickup (Small Size) | 1995 | 1995 | 24 |

| Montana | 9 | Toyota Camry | 2015 | 2015 | 23 |

| Montana | 10 | Ford Pickup (Small Size) | 2000 | 2000 | 22 |

Road Fatalities in Montana

In 2017, there were 186 traffic fatalities in Montana. Of those, 56 were alcohol-related fatalities and 59 were speeding-related fatalities.

Alcohol and speeding aren’t the only causes of traffic fatalities, however. Distracted driving, animal collisions, and other issues also contribute to the number of traffic fatalities each year, so it is important to stay vigilant behind the wheel.

All the statistics reflected in the charts below are taken from the NHTSA.

Most Fatal Highway in Montana

The most fatal highway in Montana is US-2, the northernmost east-west route in the state. The highway averages 13 fatal crashes per year, which could potentially represent dozens of fatalities depending on how many passengers are in those vehicles.

Fatal Crashes by Weather Condition & Light Condition

| Weather Condition in MT | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 86 | 3 | 56 | 3 | 0 | 148 |

| Rain | 2 | 1 | 2 | 2 | 0 | 7 |

| Snow/Sleet | 5 | 1 | 2 | 0 | 0 | 8 |

| Other | 2 | 4 | 0 | 0 | 0 | 6 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTAL | 95 | 9 | 60 | 5 | 0 | 169 |

Weather and light conditions can have a significant impact on the likelihood of an accident, with wet, slippery weather or dark, unlit roads increasing the chances that you’ll be involved in a crash of some kind.

Weather also increases the severity of an accident, turning otherwise minor incidents and turning them into situations where injuries or even fatalities occur.

Be cautious when driving in the dark or in inclement weather. Use your headlights, slow down, and leave yourself plenty of space to make sure you aren’t stuck in an unnecessarily dangerous situation.

Fatalities (All Crashes) by County

Yellowstone, Cascade, and Flathead Counties all saw a significant reduction in traffic fatalities in 2017.

| Fatalities By County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Beaverhead | 3 | 0 | 2 | 5 | 3 |

| Big Horn | 10 | 9 | 11 | 13 | 13 |

| Blaine | 1 | 3 | 4 | 2 | 0 |

| Broadwater | 2 | 3 | 2 | 0 | 6 |

| Carbon | 2 | 2 | 9 | 1 | 2 |

| Carter | 0 | 1 | 2 | 0 | 0 |

| Cascade | 12 | 15 | 9 | 12 | 6 |

| Chouteau | 2 | 2 | 9 | 1 | 4 |

| Custer | 2 | 0 | 3 | 1 | 0 |

| Daniels | 0 | 1 | 0 | 0 | 0 |

| Dawson | 4 | 0 | 3 | 2 | 4 |

| Deer Lodge | 2 | 1 | 4 | 3 | 2 |

| Fallon | 0 | 0 | 0 | 0 | 0 |

| Fergus | 2 | 1 | 3 | 2 | 1 |

| Flathead | 21 | 13 | 12 | 18 | 15 |

| Gallatin | 9 | 9 | 10 | 10 | 9 |

| Garfield | 1 | 1 | 1 | 1 | 1 |

| Glacier | 15 | 7 | 6 | 7 | 7 |

| Golden Valley | 0 | 0 | 0 | 0 | 0 |

| Granite | 3 | 1 | 1 | 3 | 2 |

| Hill | 1 | 2 | 7 | 0 | 6 |

| Jefferson | 3 | 10 | 4 | 1 | 3 |

| Judith Basin | 0 | 2 | 5 | 1 | 0 |

| Lake | 11 | 6 | 6 | 8 | 9 |

| Lewis & Clark | 7 | 6 | 15 | 4 | 11 |

| Liberty | 0 | 0 | 0 | 0 | 1 |

| Lincoln | 8 | 3 | 5 | 4 | 2 |

| Madison | 4 | 4 | 6 | 1 | 4 |

| Mccone | 1 | 1 | 0 | 0 | 0 |

| Meagher | 1 | 1 | 0 | 2 | 1 |

| Mineral | 5 | 1 | 3 | 3 | 2 |

| Missoula | 15 | 15 | 15 | 20 | 17 |

| Musselshell | 0 | 1 | 2 | 2 | 0 |

| Park | 1 | 4 | 4 | 3 | 3 |

| Petroleum | 1 | 1 | 0 | 1 | 0 |

| Phillips | 1 | 2 | 2 | 1 | 2 |

| Pondera | 5 | 0 | 0 | 0 | 0 |

| Powder River | 1 | 1 | 1 | 0 | 1 |

| Powell | 3 | 3 | 2 | 4 | 6 |

| Prairie | 2 | 0 | 0 | 1 | 2 |

| Ravalli | 8 | 5 | 3 | 2 | 1 |

| Richland | 8 | 3 | 1 | 3 | 2 |

| Roosevelt | 1 | 5 | 6 | 6 | 3 |

| Rosebud | 5 | 4 | 4 | 7 | 3 |

| Sanders | 3 | 6 | 5 | 2 | 3 |

| Sheridan | 1 | 3 | 1 | 0 | 1 |

| Silver Bow | 8 | 7 | 6 | 3 | 5 |

| Stillwater | 4 | 0 | 2 | 6 | 2 |

| Sweet Grass | 3 | 1 | 1 | 1 | 1 |

| Teton | 1 | 3 | 4 | 1 | 0 |

| Toole | 2 | 0 | 1 | 2 | 0 |

| Treasure | 0 | 2 | 0 | 3 | 4 |

| Valley | 2 | 3 | 4 | 0 | 4 |

| Wheatland | 1 | 0 | 1 | 0 | 0 |

| Wibaux | 0 | 0 | 0 | 0 | 0 |

| Yellowstone | 21 | 18 | 17 | 17 | 12 |

Traffic Fatalities

The number of fatalities fluctuates by 40 or 50 people each year. In 2017, there were significantly fewer fatalities than many of the years before it.

| Traffic Fatalities | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Total | 229 | 221 | 189 | 209 | 205 | 229 | 192 | 224 | 190 | 186 |

| Rural | 211 | 203 | 177 | 179 | 191 | 224 | 178 | 200 | 170 | 167 |

| Urban | 18 | 18 | 12 | 29 | 14 | 5 | 14 | 24 | 19 | 19 |

| Unknown | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 1 | 0 |

Fatalities by Person Type

There was a reduction in fatalities across the board, including both vehicle occupants and non-occupants, such as pedestrians.

| Fatalities by Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 69 | 54 | 69 | 53 | 52 |

| Light Truck - Pickup | 53 | 47 | 53 | 44 | 41 |

| Light Truck - Utility | 35 | 35 | 39 | 41 | 43 |

| Light Truck - Van | 4 | 9 | 4 | 7 | 6 |

| Large Truck | 2 | 1 | 2 | 5 | 2 |

| Other/Unknown Occupants | 6 | 11 | 11 | 8 | 2 |

| Total Occupants | 169 | 157 | 184 | 159 | 148 |

| Light Truck - Other | 0 | 0 | 5 | 1 | 1 |

| Bus | 0 | 0 | 1 | 0 | 1 |

| Total Motorcyclists | 35 | 23 | 24 | 17 | 23 |

| Pedestrian | 24 | 10 | 14 | 11 | 14 |

| Bicyclist and Other Cyclist | 1 | 2 | 1 | 3 | 1 |

| Total Nonoccupants | 25 | 12 | 16 | 14 | 15 |

| Other/Unknown Nonoccupants | 0 | 0 | 1 | 0 | 0 |

| Total | 229 | 192 | 224 | 190 | 186 |

Fatalities by Crash Type

You can see an improvement in 2017 in almost every category, contributing to the overall reduction in lives lost on the roads of Montana.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes)* | 229 | 192 | 224 | 190 | 186 |

| Single Vehicle | 159 | 137 | 153 | 139 | 116 |

| Involving a Large Truck | 20 | 12 | 20 | 23 | 22 |

| Involving Speeding | 76 | 52 | 91 | 61 | 59 |

| Involving a Rollover | 97 | 104 | 116 | 104 | 90 |

| Involving a Roadway Departure | 162 | 145 | 164 | 142 | 139 |

| Involving an Intersection (or Intersection Related) | 23 | 19 | 37 | 15 | 23 |

Five-Year Trend For the Top 10 Counties

Notably, Yellowstone County saw their traffic fatality rates reduce by almost 50 percent in 2017.

| Top Ten Counties for Fatalities | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Missoula County | 15 | 15 | 15 | 20 | 17 |

| Flathead County | 21 | 13 | 12 | 18 | 15 |

| Big Horn County | 10 | 9 | 11 | 13 | 13 |

| Yellowstone County | 21 | 18 | 17 | 17 | 12 |

| Lewis And Clark County | 7 | 6 | 15 | 4 | 11 |

| Gallatin County | 9 | 9 | 10 | 10 | 9 |