Massachusetts Car Insurance 2024 (Coverage, Companies, & More)

On average, insurance costs $94 a month, but your rates can vary based on where you live, your credit score, and your driving record. Follow this guide to find insurance rates by town, and get informed on coverage requirements, laws, and the best insurance companies before you buy.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 24, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 24, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| MASSACHUSETTS STATISTICS SUMMARY | DETAILS |

|---|---|

| Road Miles | Vehicle Miles Traveled: 57.6 billion Miles of Roadway: 36,384 |

| Vehicles | Registered Vehicles: 4.9 million Motor Vehicle Thefts: 8,260 |

| Population | 6,902,149 |

| Most Popular Vehicle in Massachusetts | Toyota RAV4 |

| Uninsured Motorists | 6.20% |

| Total Driving Related Deaths | Speeding Fatalities: 98 DUI Fatalities: 120 |

| Average Annual Premiums | Liability: $606.04 Collision: $388.28 Comprehensive: $134.96 Full Coverage: $1,129.29 |

| Cheapest Provider | State Farm |

Home to historic Harvard University, and a reputation for excellence, the Bay State is truly one of a kind. There’s more to Massachusetts, though, than even residents may think. Boston has frequently been rated the worst city for congestion in the United States, with its beautiful waterfront failing to make up for the hours, drivers lose to traffic on a daily basis.

Traffic isn’t the only thing you’ll have to worry about as a driver in Massachusetts. After all, you have to secure car insurance that meets state requirements, or else you’re at risk of losing your license. It’s so exhausting, though, to gather information about the best Massachusetts car insurance companies.

That’s where we come in. This guide to Massachusetts car insurance will help you save money and time on your car insurance. We look at the most popular companies, state requirements, and everything you need to know to drive with confidence your insurance will take care of you.

Ready to get car insurance quotes? You can use our FREE online tool. Just enter your ZIP code to get started.

What Are Massachusetts Car Insurance Rates?

Let’s start where everyone wants to start: with the rates you’ll find as a Massachusetts resident.

Massachusetts is on the up-and-up, culturally and economically. Both of these factors and a plethora of others, including your ZIP code and demographics will impact the premium a car insurance provider in the state is able to offer you.

With that in mind, let’s break down the most prominent factors. With a little extra information at hand, you’ll be able to more confidently dive into your car insurance research.

What is Massachusetts’s car culture?

Massachusetts is far from the largest state in the union. Even so, Boston, its capital, is bustling with activity. The population in the Greater Boston area is made up of both locals and college students attending the dozens of universities.

With that in mind, what’s the traffic like in Boston? In a word: unpleasant. The Big Dig helped mitigate the worst of the congestion, but if you’re not used to the ins and outs of the city, your commute to and from work may be pretty frustrating. Unfortunately, even a good driver may have trouble maintaining a clean driving record. It’s much easier to get into an accident when there’s hundreds of cars around you compared to a more rural area.

As a result, drivers in Boston have developed something of a bad reputation. Up until recently, drivers in the area were considered the worst in the nation. Nowadays, they’re only the second-worst, as Baltimore drivers have taken their place.

What’s up with the bad reputation? In general, Boston drivers are considered to be of a more aggressive strain and may not always express as much patience as they should on the road. As such, it’s all the more important that you drive cautiously, less you end up on the receiving end of someone else’s bad day.

Keep in mind, too, that winters in Boston are unforgiving. If you think traffic is bad during the summer, prepare yourself for an even longer commute once the colder months of the year come around. Nervous drivers may want to consider investing in four-wheel-drive vehicles if they want to improve their roadway traction.

How much coverage is required for Massachusetts’ minimum coverage?

Each state has its own minimum liability coverage, or the bare minimum amount of car insurance a driver needs to operate legally on the road. A Massachusetts auto insurance policy has to include certain coverage.

As you can see in the table below, Massachusetts’ minimum liability coverage is far from unreasonable:

| Type of Coverage | Amount |

|---|---|

| Bodily Injury Liability Coverage | $20,000 per one person $40,000 total per accident |

| Property Damage Liability Coverage | $5,000 per accident |

| No-Fault Personal Injury Coverage | $8,000 |

| Uninsured Motorist Coverage | $20,000 per one person $40,000 per accident |

This minimum liability coverage comes in handy if you ever happen to get into an accident. Massachusetts is a no-fault state, meaning that after an accident, all of the parties involved will be responsible for paying their own fees. Minimum liability coverage, as noted above, will help you cover medical and repair expenses without breaking the bank.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

What are the forms of financial responsibility in Massachusetts?

Strangely enough, Massachusetts does not require its drivers to carry proof of insurance while driving. Instead, your registration — the paperwork proving that you own your vehicle — will serve as proof of insurance in the state.

Why?

When you register your vehicle with the Massachusetts Registry of Motor Vehicles, you’re required to submit your car insurance policy number on your application. As a result, the RMV will have a record of your insurance, and you’ll legally be able to take to the road.

If you’re caught driving without a car insurance policy, you’ll be charged up to $500. You may also lose your license for up to 60 days. If you’re repeatedly found on the road without insurance, your penalties can rise to nearly $5,000 per time caught. Likewise, your 60-day suspension will increase to a year-long suspension partnered with jail time.

How much of a driver’s income goes into premiums in Massachusetts?

It won’t surprise you to learn that Massachusetts, as one of the most economically-active states in the union, has one of the highest average annual per capita disposable incomes. As of 2014, the state’s average income came in at $50,366.

This means that a Massachusetts resident will have $4,200 to spend on utilities, bills, groceries, rent, and other expenses per month. Talk about making the big bucks. It also means higher insurance auto insurance company premiums can be reasonable for the average resident.

But what percentage of that income goes to car insurance on a yearly basis?

Because the average disposable income in the area is so high, the percentage of income Massachusetts residents have to pay towards car insurance is actually lower than it is elsewhere in the United States. This has less to do with a discrepancy in car insurance rates and more to do with the sheer amount of money the average Boston resident makes. Even if they don’t have a clean driving record, insurance is affordable compared to the average income of Bostonians.

Take a look at the table below to see how much the average Boston resident has to spend on car insurance every year:

| Averages | 2014 | 2013 | 2012 |

|---|---|---|---|

| New England | 2.23% | 2.26% | 2.17% |

| Massachusetts | 2.20% | 2.23% | 2.12% |

| United States | 2.40% | 2.43% | 2.34% |

As you can see, Massachusetts’ average percent of income as premium is substantially lower than the national average. Again, though, this is because Massachusetts makes significantly more money than residents in the rest of the nation. When you have that much at your disposal, a car insurance payment doesn’t make up as much of a percentage as it would, were Massachusetts’ residents making less.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What Are Average Monthly Car Insurance Rates in MA (Liability, Collision, Comprehensive)?

According to the National Association of Insurance Commissioners, core coverage in Massachusetts costs as follows:

| Coverage Type | Average Premium in 2015 (Massachusetts) | Average Premium (Massachusetts) | Average Premium (National) |

|---|---|---|---|

| Liability | $606.04 | $587.75 | $516.39 |

| Collision | $388.28 | $358.68 | $299.73 |

| Comprehensive | $134.96 | $128.92 | $138.87 |

| Full Coverage | $1,129.29 | $1,075.35 | $954.99 |

The question is: why would you consider these types of insurance when you could work with the state’s minimum liability coverage?

Remember: Massachusetts is a no-fault state. This means that any time you get into an accident, you should file a claim with your insurer. They will pay for your property damage and medical costs based on your coverage. Then they settle the costs with the other side’s company once fault is established. While collision or comprehensive coverage will cost more than the state’s minimum liability coverage, they’ll both offer you more protection than you would have otherwise. As a result, you’ll have to pay less to repair your car or manage your medical expenses after an accident.

What additional liability is available in Massachusetts?

In addition to the core coverage mentioned in the previous section, you’ll also have the option of adding personal injury protection to your car insurance coverage. Some people assume their health insurance will take care of any injuries. Some companies may, but many health insurers have an exclusion built in for injuries associated with auto accidents. Even in a small accident or if you take an ambulance ride, this could be thousands of dollars on a single accident. As you can see in the table below, this PIP coverage has its benefits:

| Location | 2014 | 2013 | 2012 |

|---|---|---|---|

| MA | 64.64% | 61.03% | 62.37% |

| U.S. | 69.41% | 74.69% | 82.92% |

In this table, you can see the average car insurance company’s loss ratio when taking PIP coverage into account. Loss ratios reflect how much money car insurance providers pay on claims every year. A high loss ratio means that a car insurance provider frequently pays out on claims, but that they may also not be as financially stable as you’d like them to be. Of course, a company’s financial stability is based on many factors. So how reliably they pay out now doesn’t necessarily mean they won’t be able to in the future.

Comparatively, companies with lower loss ratios may be more financially stable, but they are less likely to pay out on client claims. This could be due to exclusions formally written into their policies or because they simply take longer and pay less whenever they think they can.

In this case, Massachusetts’ car insurance companies’ loss ratios are lower than the national average, but not in a bad place. Ideally, you want your coverage to have a loss ratio between 60 percent and 90 percent.

Read more: Top 10 Massachusetts Car Insurance Companies

What add-ons, endorsements, and riders are available in Massachusetts?

You can explore additional, optional coverage by considering the add-ons below:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive (Usage-Based Insurance)

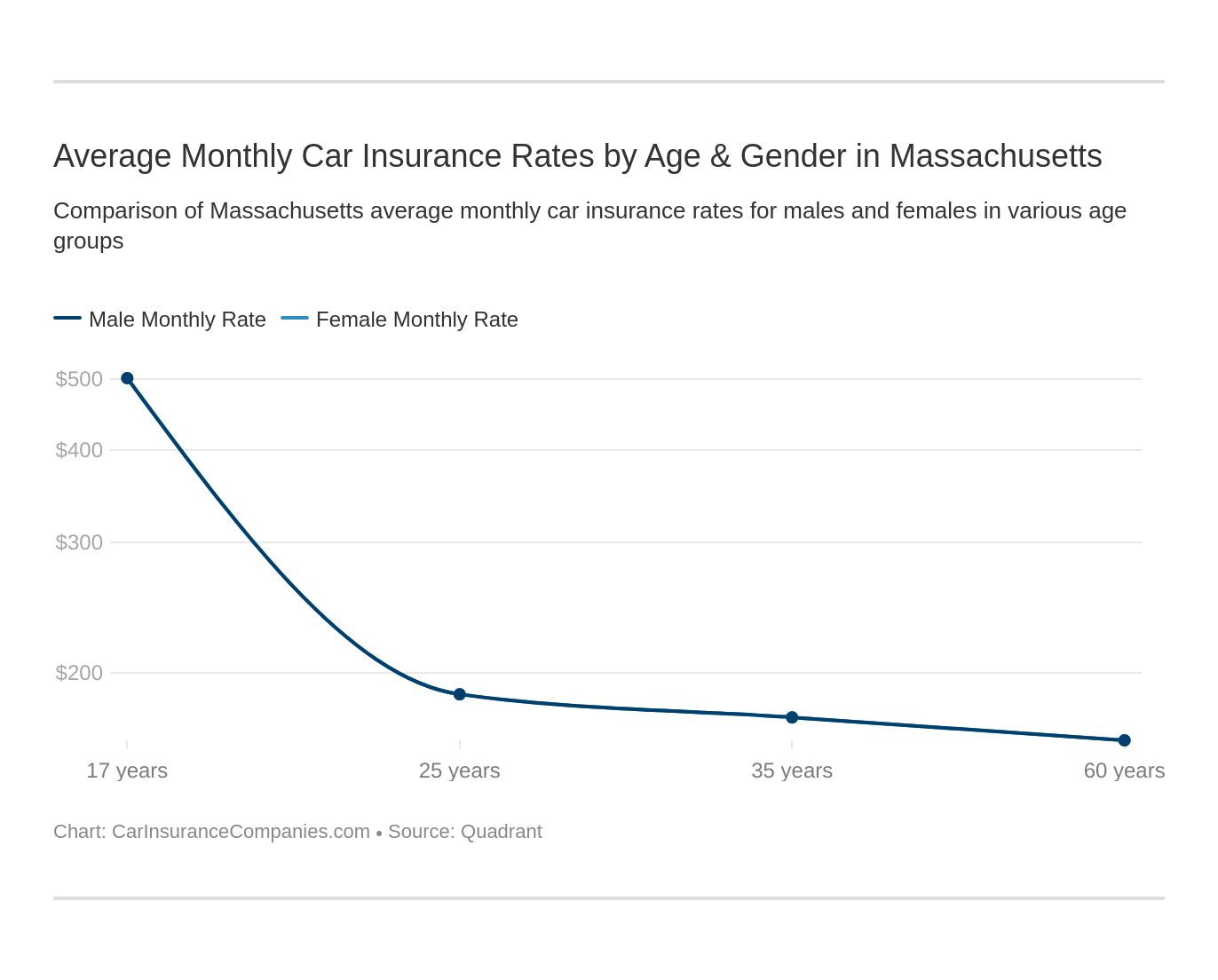

What Are The Average Monthly Car Insurance Rates by Age & Gender in MA?

Some states have banned discrimination based on gender for car insurance rates, and this is one of those few states. In other words, Massachusetts residents will not pay more for their insurance (or their children’s insurance) just because they are male. As you can see the rate for males and females is the same, but the rate still varies with age, driving record, etc. If you have a teen male driver who gets more speeding tickets, gets in an accident, etc., you’ll pay more for him than you would for a girl who drove more carefully. The law is designed to ensure it’s based on the behavior rather than something marked on your birth certificate.

Some parents may be inclined to buy their teens older cars that wouldn’t benefit as much from collision or comprehensive insurance. Simply put, it wouldn’t cost as much to replace them. So they save money by sticking to liability only coverage for their teen. This is one situation in which it might make sense to get your teen their own auto insurance policy. If you want different coverages for different cars, your insurance company can separate the costs for you on the same policy so you can see how much you’re paying for each. You can still enjoy multi-vehicle discounts as well.

Take a look at the table below to see how things play out across Massachusetts:

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate Insurance | $2,272.30 | $2,272.30 | $2,272.30 | $2,272.30 | $7,606.60 | $7,606.60 | $2,546.37 | $2,546.37 |

| Geico Govt Employees | $1,982.01 | $1,982.01 | $1,834.98 | $1,834.98 | $5,423.66 | $5,423.66 | $2,048.23 | $2,048.23 |

| Liberty Mutual | $2,879.48 | $2,879.48 | $2,508.74 | $2,508.74 | $8,950.89 | $8,950.89 | $3,012.24 | $3,012.24 |

| Progressive Direct | $2,252.65 | $2,252.65 | $2,160.74 | $2,160.74 | $8,484.75 | $8,484.75 | $2,436.98 | $2,436.98 |

| State Farm Mutual Auto | $954.11 | $954.11 | $954.11 | $954.11 | $2,583.18 | $2,583.18 | $954.11 | $954.11 |

| Standard Fire Ins Co | $2,813.43 | $2,813.43 | $2,485.69 | $2,485.69 | $5,731.25 | $5,731.25 | $3,118.46 | $3,118.46 |

| USAA CIC | $1,424.10 | $1,424.10 | $1,402.61 | $1,402.61 | $3,320.22 | $3,320.22 | $1,573.41 | $1,573.41 |

Here, you can see that, while gender does have an impact on car insurance rates, its age that plays a more substantial role. Teenagers, for example, are always going to have to pay substantially more for their coverage than any other age group of drivers.

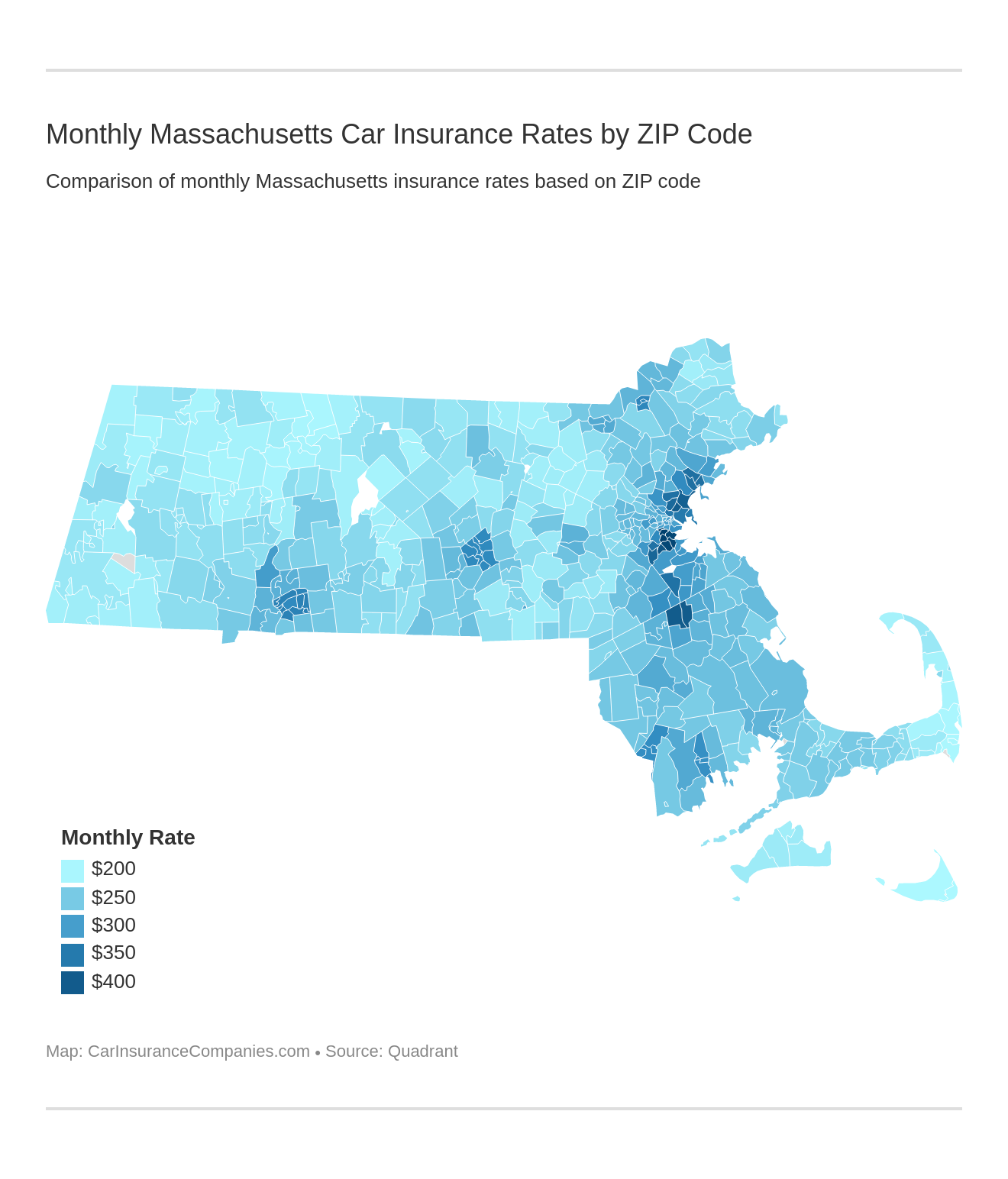

What are the cheapest rates by ZIP code in Massachusetts?

Location has just as much of an impact on the premium a provider will offer you as your age does. As you can see in the tables below, your premium will often reflect the average annual income of the area in which you live.

Here are the 25 least expensive ZIP codes in Massachusetts.

| ZIP Code | Average Annual Rate |

|---|---|

| 02554 | $2,378.90 |

| 02564 | $2,378.90 |

| 02633 | $2,382.38 |

| 02650 | $2,382.38 |

| 02643 | $2,395.53 |

| 02653 | $2,395.53 |

| 01360 | $2,398.18 |

| 01354 | $2,406.50 |

| 01344 | $2,416.96 |

| 01342 | $2,419.45 |

| 01373 | $2,419.45 |

| 02631 | $2,426.70 |

| 02642 | $2,426.81 |

| 01330 | $2,434.92 |

| 01220 | $2,440.33 |

| 01367 | $2,441.98 |

| 01366 | $2,445.46 |

| 01337 | $2,446.65 |

| 01349 | $2,448.40 |

| 01351 | $2,448.40 |

| 01376 | $2,448.40 |

| 01225 | $2,452.70 |

| 01026 | $2,454.99 |

| 01267 | $2,455.41 |

| 01338 | $2,458.33 |

And here are the most expensive ZIP codes in the state.

| ZIP Code | Average Annual Rate |

|---|---|

| 02119 | $5,333.79 |

| 02120 | $5,333.79 |

| 02121 | $5,307.03 |

| 02122 | $5,194.04 |

| 02124 | $5,194.04 |

| 02125 | $5,194.04 |

| 02126 | $4,932.12 |

| 02137 | $4,875.75 |

| 02301 | $4,786.09 |

| 02302 | $4,786.09 |

| 02150 | $4,784.05 |

| 02151 | $4,690.58 |

| 02136 | $4,593.55 |

| 02149 | $4,536.67 |

| 01901 | $4,407.06 |

| 01902 | $4,407.06 |

| 01904 | $4,407.06 |

| 01905 | $4,407.06 |

| 02148 | $4,371.72 |

| 02368 | $4,356.13 |

| 02131 | $4,353.81 |

| 02128 | $4,228.12 |

| 02129 | $4,228.12 |

| 02152 | $4,155.31 |

| 02187 | $4,139.60 |

As you might expect, drivers living in the Greater Boston area are going to pay more for their coverage than those drivers living in Massachusetts’ rural areas. If you live in an area with a higher crime rate, you’ll pay more the same way you would in an area with more auto accident claims due to heavy traffic or more aggressive drivers. These factors can vary wildly by zip code.

What are the cheapest rates by city in Massachusetts?

Similarly, car insurance providers can break down their array of rates by the cities they operate in. The table below will help you break down the average rates available to you in each of Massachusetts’ cities:

| Cheapest Cities in Massachusetts | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Nantucket | $2,378.90 | Liberty Mutual | $3,462.64 | Progressive | $2,952.21 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Siasconset | $2,378.90 | Liberty Mutual | $3,462.64 | Progressive | $2,952.21 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Chatham | $2,382.38 | Liberty Mutual | $3,462.64 | Allstate | $2,831.36 | State Farm | $1,082.84 | USAA | $1,526.01 |

| North Chatham | $2,382.38 | Liberty Mutual | $3,462.64 | Allstate | $2,831.36 | State Farm | $1,082.84 | USAA | $1,526.01 |

| East Orleans | $2,395.53 | Liberty Mutual | $3,462.64 | Allstate | $2,976.96 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Orleans | $2,395.53 | Liberty Mutual | $3,462.64 | Allstate | $2,976.96 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Northfield | $2,398.18 | Liberty Mutual | $3,462.64 | Allstate | $2,890.75 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Gill | $2,406.50 | Liberty Mutual | $3,462.64 | Allstate | $2,999.17 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Erving | $2,416.96 | Liberty Mutual | $3,462.64 | Progressive | $2,993.38 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Deerfield | $2,419.45 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| South Deerfield | $2,419.45 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Brewster | $2,426.70 | Liberty Mutual | $3,462.64 | Progressive | $2,960.74 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Eastham | $2,426.81 | Liberty Mutual | $3,462.64 | Allstate | $2,942.54 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Ashfield | $2,434.92 | Liberty Mutual | $3,462.64 | Travelers | $3,037.33 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Adams | $2,440.33 | Liberty Mutual | $3,462.64 | Progressive | $3,025.98 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Rowe | $2,441.98 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Petersham | $2,445.46 | Liberty Mutual | $3,462.64 | Progressive | $2,943.26 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Bernardston | $2,446.65 | Liberty Mutual | $3,462.64 | Progressive | $3,054.03 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Millers Falls | $2,448.40 | Liberty Mutual | $3,462.64 | Progressive | $3,086.01 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Montague | $2,448.40 | Liberty Mutual | $3,462.64 | Progressive | $3,086.01 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Turners Falls | $2,448.40 | Liberty Mutual | $3,462.64 | Progressive | $3,086.01 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Cheshire | $2,452.70 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Cummington | $2,454.99 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Williamstown | $2,455.41 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Buckland | $2,458.33 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

Again, residents living in the Greater Boston area have to pay more for their car insurance than residents living in just about any other part of the state.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Monthly Rates for Copperpoint Casualty Insurance

Discover how Copperpoint Casualty insurance rates compare to the U.S. average across different coverage types in the table below.

| Coverage Type | Copperpoint Casualty | U.S. Average |

|---|---|---|

| Full Coverage | $132 | $119 |

| Minimum Coverage | $51 | $45 |

What Are The Best Massachusetts Car Insurance Companies?

With the basics out of the way, let’s get into the meat of things. How much money should you expect to spend on car insurance while living in Massachusetts, and what factors can raise or lower your rate? Nobody wants to pay more than they have to. Paying a little more now to purchase more comprehensive collision coverage could save you thousands if you’re involved in even a small accident. The average cost of insurance premiums is pennies compared to the cost of repairing your car and paying medical bills that aren’t covered.

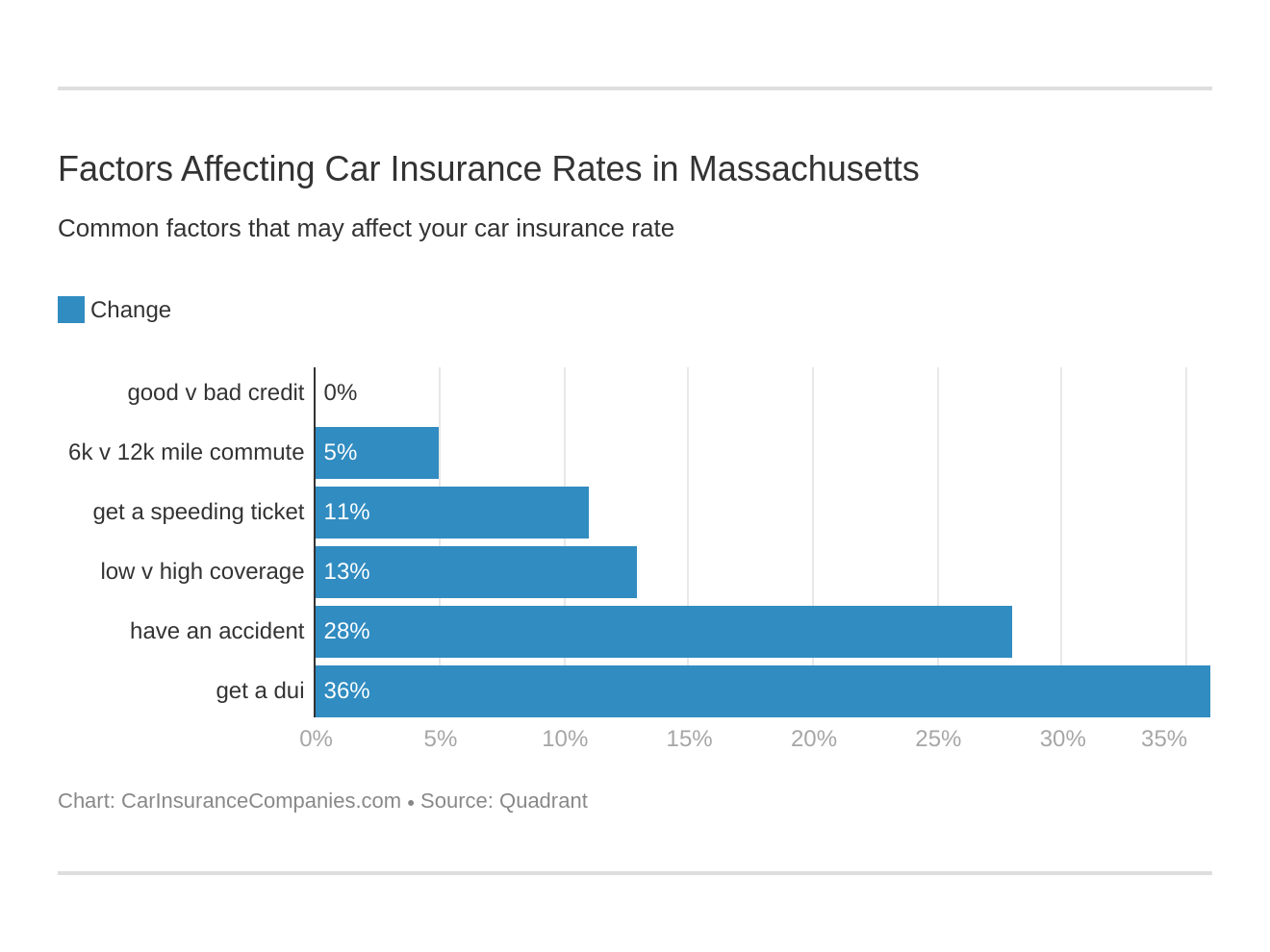

Some states have banned discrimination based on your credit score when it comes to auto insurance rates, and this is one of those States.

What are the financial ratings of the largest car insurance companies in Massachusetts?

A.M. Best releases an annual assessment of the largest car insurance companies operating around the United States. This assessment details each company’s financial strength and lets consumers know how safe their investments will be.

Read more:

- Arbella Indemnity Insurance Company Car Insurance Review

- Arbella Mutual Insurance Company Car Insurance Review

- Arbella Protection Insurance Company Car Insurance Review

Take a look at the table below to see how some of the largest companies in Massachusetts stack up:

| Providers | A.M. Best Rating |

|---|---|

| Arbella Insurance Group | A- |

| Geico | A++ |

| Liberty Mutual Group | A |

| Mapfre Insurance Group | A |

| Metropolitan Group | A |

| Plymouth Rock Insurance Group | A- |

| Progressive Group | A++ |

| Safety Group | A+ |

| The Hanover Insurance Group | A |

| USAA Group | A++ |

Read more: Plymouth Rock Assurance Corporation of New York Car Insurance Review

There’s not a single car insurance provider in Massachusetts who comes in below an A- grade. That said, Geico, USAA, and Progressive stand out from the crowd with their A++ ratings.

Which car insurance companies have the best ratings in Massachusetts?

Where do these same companies stack up in terms of customer service, though? According to J.D. Power, the numbers come out as follows:

| Company | Score (Out of 1,000) | JD Power Rating |

|---|---|---|

| Allstate | 834 | Better than most |

| Amica Mutual | 879 | Among the best |

| Arbella | 800 | The rest |

| Geico | 827 | About average |

| Liberty Mutual | 809 | About average |

| MAPFRE Insurance | 811 | About average |

| MetLife | 803 | The rest |

| Nationwide | 817 | About average |

| Plymouth Rock Assurance | 804 | The rest |

| Progressive | 826 | About average |

| Safeco | 796 | The rest |

| Safety Insurance | 813 | About average |

| State Farm | 838 | Better than most |

| The Hanover | 795 | The rest |

| Travelers | 804 | The rest |

| USAA | 893 | Among the best |

Read more: Plymouth Rock Assurance Corporation Car Insurance Review

Here, you can see that Amica Mutual, State Farm auto insurance in Massachusetts, and Allstate are all among the best-ranked car insurance providers in the New England region.

Which car insurance companies have the most complaints in Massachusetts?

On the other hand, who doesn’t want to learn a little more about the gossip in the car insurance industry? Take a look at the number of complaints each of the largest car insurance companies in Massachusetts took in in 2015:

| Company Name | Complaints in 2015 | Market Share in MA |

|---|---|---|

| Allstate Insurance Company | 16 | 1.72% |

| Arbella Mutual Insurance Company | 31 | 9.28% |

| Citizens Insurance Company of America | 13 | 2.88% |

| Commerce Insurance Company | 92 | 24.24% |

| Government Employees Insurance Company | 46 | 6.31% |

| Liberty Mutual Insurance Company | 44 | 8.82% |

| Metropolitan Property and Casualty Insurance Company | 12 | 4.54% |

| Plymouth Rock Assurance Corporation | 24 | 6.54% |

| Progressive Direct Insurance Company | 25 | 3.13% |

| Safety Insurance Company | 33 | 9.79% |

Read more: Progressive Direct Insurance Company Car Insurance Review

Note that the percentages here a little wonky. For example, you might think that Commerce Insurance Company’s 92 complaints are a pretty dark stain on the company. This isn’t actually the case. Because Commerce Insurance Company makes up 24.24 percent of the car insurance market share in Massachusetts, its higher complaint intake is less notable compared to Progressive’s 25.

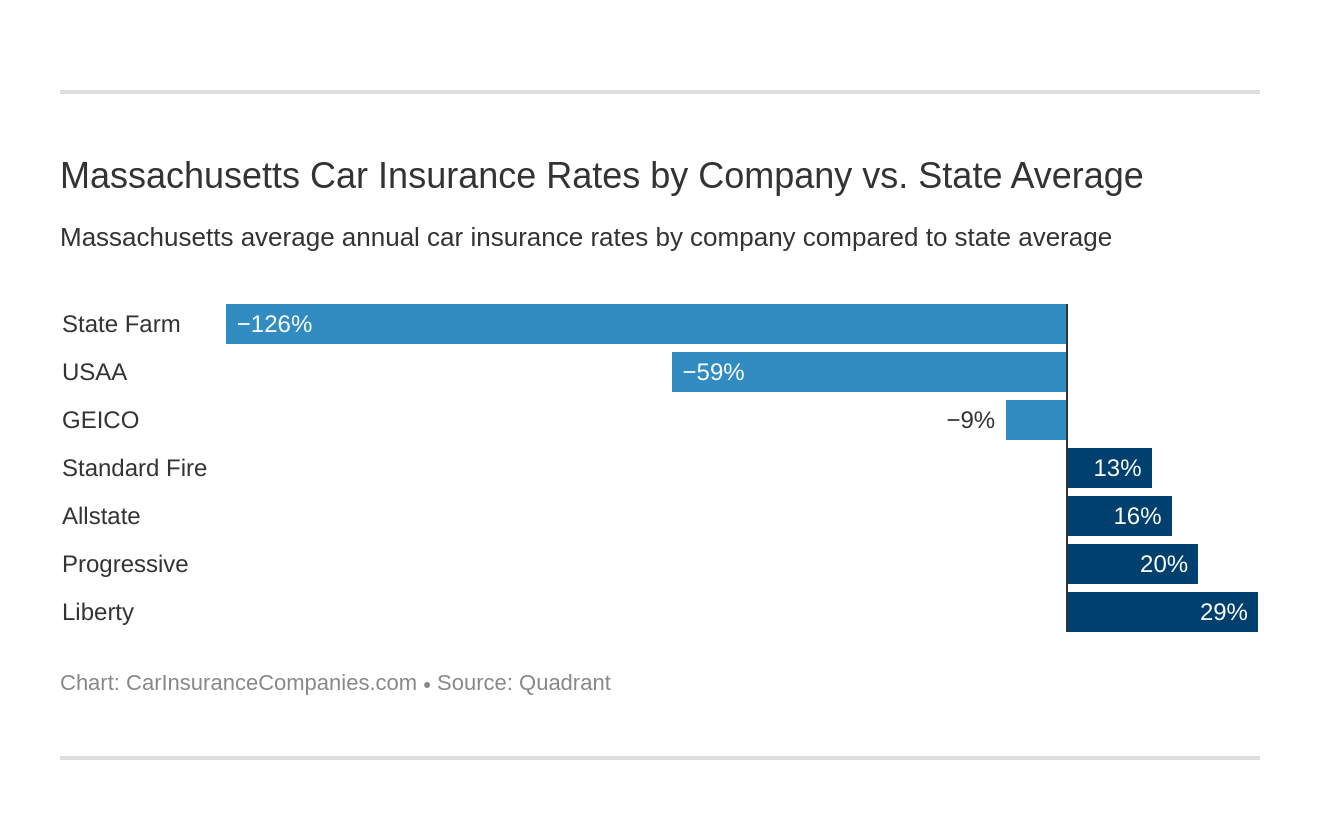

What are the cheapest car insurance companies in Massachusetts?

Let’s take a moment and talk about affordability. What companies in Massachusetts will keep your wallet in mind when awarding you a car insurance premium?

| Company | Average Annual Rate | Compared to State Average Annual Rate | State Comparison |

|---|---|---|---|

| State Farm Mutual Auto | $1,361.37 | -$1,709.61 | -125.58% |

| USAA CIC | $1,930.09 | -$1,140.90 | -59.11% |

| Geico Govt Employees | $2,822.22 | -$248.77 | -8.81% |

| Standard Fire Ins Co | $3,537.21 | $466.22 | 13.18% |

| Allstate Insurance | $3,674.39 | $603.41 | 16.42% |

| Progressive Direct | $3,833.78 | $762.79 | 19.90% |

| Liberty Mutual | $4,337.84 | $1,266.85 | 29.20% |

If you’re looking for affordable coverage, you’ll want to shop State Farm’s available policies.

Does my commute affect my car insurance rate in Massachusetts?

If you happen to drive more than 12,000 miles per year, you’ll often see your rate go up, as detailed in the table below:

| Company | 10 Miles Commute 6000 Annual Mileage | 25 Miles Commute 12000 Annual Mileage |

|---|---|---|

| State Farm | $1,329.38 | $1,393.36 |

| USAA | $1,876.77 | $1,983.4 |

| Geico | $2,769.02 | $2,875.42 |

| Travelers | $3,369.13 | $3,705.29 |

| Allstate | $3,556.25 | $3,792.54 |

| Progressive | $3,833.78 | $3,833.78 |

| Liberty Mutual | $4,168.55 | $4,507.13 |

The jumps in cost aren’t always too severe. However, only Progressive is willing to freeze its rate in the face of a longer commute.

Can coverage level change my car insurance rate with companies in Massachusetts?

Naturally, the amount of coverage you’re interested in investing in will change the amount you’ll be expected to pay your insurance company:

| Company | Low | Medium | High |

|---|---|---|---|

| State Farm | $1,238.07 | $1,385.33 | $1,460.72 |

| USAA | $1,788.95 | $1,961.62 | $2,039.69 |

| Geico | $2,600.65 | $2,872.94 | $2,993.07 |

| Travelers | $3,194.57 | $3,608.06 | $3,808.99 |

| Allstate | $3,398.46 | $3,732.43 | $3,892.29 |

| Progressive | $3,514.05 | $3,905.26 | $4,082.03 |

| Liberty Mutual | $4,057.68 | $4,394.25 | $4,561.58 |

The more coverage you want, the more you’re going to have to pay — save for at State Farm. State Farm does raise its rate when you invest in more comprehensive coverage, but when compared to some other providers, the change isn’t so significant.

How does my credit history affect my car insurance rate with companies in Massachusetts?

Car insurance providers in Massachusetts are legally prohibited from using your credit history as a factor in determining your awarded premium.

How does my driving record affect my rates with car insurance companies in Massachusetts?

Your driving record lets a car insurance provider know how safe you are, on average, when driving. A car insurance provider that wants to save money while also protecting you is going to offer you a better rate if you’re a cautious driver, as you can see in the table below:

| Company | Clean Record | With 1 Accident | With 1 DUI | With 1 Speeding Violation |

|---|---|---|---|---|

| State Farm | $1,077.70 | $1,467.80 | $1,745.31 | $1,154.69 |

| USAA | $1,373.89 | $1,783.42 | $3,026.22 | $1,536.81 |

| Geico | $2,256.59 | $3,104.81 | $3,545.26 | $2,382.22 |

| Travelers | $2,757.25 | $3,812.67 | $4,078.44 | $3,500.48 |

| Allstate | $2,843.93 | $4,239.63 | $4,770.08 | $2,843.93 |

| Progressive | $3,220.36 | $4,538.99 | $3,601.17 | $3,974.60 |

| Liberty Mutual | $3,417.00 | $4,668.12 | $5,614.34 | $3,651.90 |

A DUI, comparatively, can blow your available premium out of the water. Cost efficiency, then, is one of many good reasons to try and stay safe while you’re on the road.

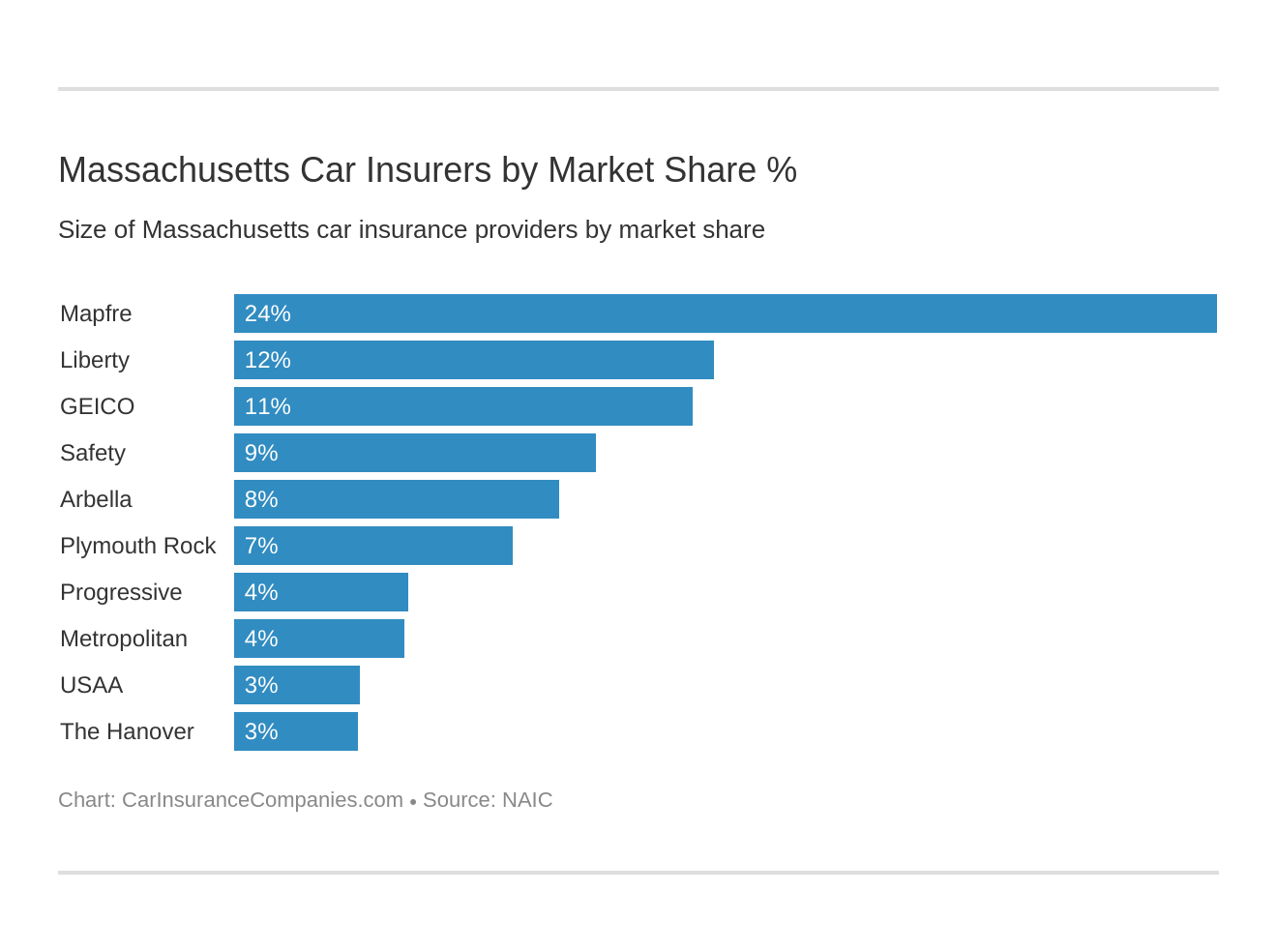

Which car insurance companies are the largest in Massachusetts?

When it comes to market share, some car insurance providers outshine the others, as you can see in the table below:

| Company | A.M. Best Rating | Loss Ratio |

|---|---|---|

| Arbella Insurance Group | A- | 57.89% |

| Geico | A++ | 69.56% |

| Liberty Mutual Group | A | 54.01% |

| Mapfre Insurance Group | A | 66.64% |

| Metropolitan Group | A | 56.44% |

| Plymouth Rock Insurance Group | A- | 62.97% |

| Progressive Group | A++ | 61.95% |

| Safety Group | A+ | 61.11% |

| The Hanover Insurance Group | A | 59.73% |

| USAA Group | A++ | 68.42% |

Mapfre Insurance Group dominates Massachusetts’ car insurance market share, with Liberty Mutual and Geico trailing pretty far behind.

How many car insurance companies are available in Massachusetts?

The number of car insurance providers active in each state varies. Every state, though, as domestic providers — or providers who only operate within the state, and foreign providers, or providers who operate nationally. Massachusetts’ ratio breaks down as follows:

- Domestic: 48

- Foreign: 697

- Total: 745

As you can see, foreign providers outnumber domestic providers. That’s no reason, though, to eliminate local providers from your list of potential car insurance providers.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Massachusetts Car Insurance Laws

Legislation in Massachusetts can impact your car insurance rate, though perhaps not in the ways you expect. Not only does legislation in the state determine what you can have covered, but it provides you with guidelines that you need to comply with if you want to keep your rate low.

With that in mind, what are the car insurance laws in Massachusetts that you need to know about?

What are the car insurance laws in Massachusetts?

What are the car insurance laws in Massachusetts?

While understanding your state’s laws is important, not everyone speaks legalese. That’s why, in this section, we’ll break down Massachusetts’ roadway legislation so that it’s easier to understand. There’s no need for you to try and parse the laws on your own.

How Massachusetts Laws for Insurance are Determined

Car insurance laws in Massachusetts are dictated collaboratively by car insurance lobbyists and the state’s governmental body. While lobbyists’ contributions are limited, they can still let your state representatives know what kind of legislation they’re interested in seeing instituted.

The process through which car insurance legislation becomes law goes as follows:

- A party crafts an idea that they want to make into a law

- That party files a petition to the Massachusetts House or Senate

- A hearing is held, and testimony is heard regarding the necessity for a new law

- The bill proposal is either returned for revisions or passed through its first reading

- The bill is debated a second time

- The bill proceeds to the committee, and is read for a third time

- The bill is reviewed

- If the bill is passed, it is taken up by either the House of the Senate

- One of the available branches debates the bill

- If the bill passes, the second legislative branch reads and debates the bill

- Amendments are proposed, debated upon, and enacted

- The bill, if passed, is sent to the governor

- If the governor doesn’t veto the bill, it is passed and becomes a new law

With the process under your belt, let’s dive into the roadway and car insurance laws that Massachusetts already has in place.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Windshield Coverage in Massachusetts

Massachusetts law dictates that you’re not allowed to drive on the road if your windshield has any cracks or whips. If your windshield’s been damaged as a result of an accident or a natural disaster, then you can have it replaced so long as you have comprehensive coverage with a zero-deductible replacement.

Alternatively, your car insurance provider may be able to replace your windshield for a $100 deductible that does not fall under your comprehensive coverage.

That said, the rules change if your car is on the newer side. Cars manufactured during or after 2004 that have less than 20,000 miles on the odometer will receive an OEM windshield replacement. If your car was made before 2004, or if you’ve driven more than 20,000 miles, you’ll be able to replace your windshield with used or reconditioned parts.

High-Risk Insurance Massachusetts

If you have a complicated driving history, then it may be a little more difficult for you to get coverage in Massachusetts. This doesn’t mean that you can drive without coverage, though. Instead, it means that you may be able to work with the Massachusetts Automobile Insurance Plan, or MAIP.

This program assigns you to a car insurance provider operating in the state, regardless of your history. That said, your premium when working with MAIP is going to be higher than it would be if you had a cleaner driving history.

While you won’t need an SR-22 in Massachusetts, as the state doesn’t require you to carry proof of financial responsibility, you will be awarded a SR-22 upon request if you get your coverage through MAIP.

Low-Cost Insurance in Massachusetts

Massachusetts does not currently have a car insurance program for low-income families, as some states do. However, drivers can seek out Massachusetts auto insurance discounts to make the cost of insurance more bearable.

There are a lot of Massachusetts auto insurance discounts available, but it depends on the company. Be sure to ask your provider of choice if you or your family are eligible for any of the following discounts:

- Accident-Free Discount

- Affiliation Discount (this would be any discounts through your employer, school, team, etc.)

- Anti-Theft Discounts (i.e., if you have alarms, tracking systems, etc. on your vehicle)

- Auto-Pay Discounts (granted if you set up automatic payments; some providers refer to it as a Paper-Saving Discount)

- Good Student Discount

- Homeowner’s Discount

- Multi-Car Discount

- Green/Hybrid Car Discount (if you own/lease a hybrid or electric vehicle)

Be sure you shop around to find the best coverage for you that is equally cost-effective.

Automobile Insurance Fraud in Massachusetts

It’s difficult to commit insurance fraud by accident. That said, the insurance industry sees 10 percent of its operating costs go to processing fraudulent claims or accounts over the course of a year.

There are two different types of automobile insurance fraud.

- Hard fraud involves a driver deliberately falsifying a claim or faking an accident in order to receive compensation.

- Soft fraud involves a driver padding a claim or misrepresenting accident information to an insurance provider.

Soft fraud is the more common of these two types of fraud.

Though you may think you’re just telling a white lie, soft fraud is considered a misdemeanor, and lying on your claim is considered a Class 5 felony.

Massachusetts Statute of Limitations

A statute of limitations details the amount of time you have after getting into an accident to file a claim with your car insurance provider.

Regardless of whether you’re filing for personal injury or property damage, you’ll have three years from the day you get into an accident to file a claim with your provider in Massachusetts.

Massachusetts-Specific Laws

Massachusetts does not have any laws in place that are specific to driving in the state.

What are the vehicle licensing laws in Massachusetts?

Now you know a little bit more about Massachusetts car insurance legislation — but what about the state’s licensing laws? Let’s break down the rules that apply to your licensure in the state so you can stay legal on the road.

REAL ID in Massachusetts

REAL ID will become a reality come October 2020. This federal ID will soon be required if you want to get onto a plane without your passport. You may even need this kind of ID if you want to enter any federal buildings in the United States.

To get a REAL ID, as it says in the video, you’ll need to renew your license as the nearest Massachusetts RMV, preferably before the October 2020 deadline.

Penalties for Driving Without Insurance in Massachusetts

You might think that it’d be less expensive to drive without insurance in Massachusetts. While superficially, you’re not wrong, the legal consequences of doing just that are pretty extreme. If you’re caught driving without insurance in Massachusetts, you’ll face down:

- Fines between $500 and $5,000, depending on how many times you’ve been caught before

- A mandatory premium payment equal to a single year’s worth of Massachusetts’ most expensive car insurance

- Jail time up to one year

- The suspension of your license

Massachusetts Teen Driver Laws

What teenager isn’t excited to get behind the wheel of their first car? If you or a teen you know want to know more about the licensing process, buckle up. The Massachusetts graduated licensing process is in place designed to keep teenage drivers as safe as possible while on the road.

To get their full licenses, teenager drivers or drivers who’ve never gotten their licenses before must get:

- A learner’s permit (available at age 16)

- A junior operator’s license (available at age 16.5)

Any driver without a full license must endure state-instituted restrictions, including:

- 40 hours of supervised driving time

- A driver curfew, where teens cannot be on the road between 12:30 AM and 5 AM

- Teens cannot drive with passengers younger than 18 in the car unless there’s another licensed adult in the vehicle.

- Teenagers cannot use their cellphones while driving, though fully-licensed adults can

Older Driver License Renewal Procedures in Massachusetts

Drivers older than 75 are able to renew their licenses on the same five year-cycle as everyone else. However, older drivers always need to renew their licenses in person and will not be able to use the RMV’s online portal.

New Residents of Massachusetts

If you’re new to Massachusetts, you have 30 days after moving into your new home to register your vehicle with your local RMV. You’ll also need to invest in new license plates, the cost of which will vary.

License Renewal Procedures in Massachusetts

You’ll need to renew your license on a five-year cycle. You can do so in person at the RMV or through the RMV’s online portal. However, you must apply for a REAL ID in person.

If your driver’s license happens to expire, you can renew the license without question for at least two years after it’s expired.

Massachusetts Safe Driver Insurance Program

Massachusetts’ Negligent Operator Treatment System, or its Safe Driver Insurance Program, is more casually referred to as the system which determines how many points you generate on your license when you violate traffic laws. The points you can receive break down as follows:

- Major traffic violations (driving under the influence, fleeing the scene of an accident, avoiding arrest, driving without a license): Five SDIP points

- Minor traffic violations (speeding, tailgating, driving without a seat belt, texting while driving): Two SDIP points

- Major at-fault traffic accidents: Four SDIP points

- Minor at-fault traffic accidents: Three SDIP points

Note here that while state legislative language uses the term “at-fault,” Massachusetts is a no-fault state, and no one driver will, in the eyes of an insurance provider, be determined to be the single party responsible for an accident.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

What are the rules of the road in Massachusetts?

How do Massachusetts legislators and law enforcement representatives want you to protect yourself and your passengers on the day-to-day? This section will detail existing legislation detailing just that and more. Remember: compliance with Massachusetts rules of the road not only keeps you safe but lowers your car insurance premium.

Fault vs. No-Fault in Massachusetts

As mentioned earlier, Massachusetts is a no-fault state. This means that you’ll need to have all the coverage you can get protecting your car, as you’ll be responsible for your own repairs and medical expenses if you happen to get into an accident.

Massachusetts Seat Belt and Car Seat Laws

The National Highway Traffic Safety Administration recently re-emphasized the importance of safety belts in your car. According to a recent report, seat belts and car seats saved 15,000 lives in 2016 and continue to save a comparable amount of lives today.

So, what are Massachusetts’ seat belt and car seat laws?

All drivers and passengers older than 13 years of age must wear a seat belt while in a moving vehicle on Massachusetts roads. If you’re caught driving without a seat belt on, or if one of your passengers isn’t appropriately protected, law enforcement representatives can charge you $25.

Children who are younger than seven or who are shorter than 57 inches in height are required to be in a car seat. Once children turn eight or pass 57 inches in height, they’ll be able to ride in a moving vehicle without the help of a car seat.

Keep Right and Move Over Laws in Massachusetts

If you are driving more slowly than the posted speed limit, or if you are not looking to pass a car in front of you, then Massachusetts law dictates that you must remain in the right-hand lane of the applicable road

You must also move over for vehicles that have their lights flashing, regardless of whether or not they’re clearly marked as emergency vehicles. These vehicles include but are not limited to:

- Police cruisers

- Ambulances

- Firetrucks

- Tow trucks

- Recovery vehicles

Massachusetts Speed Limits

When you’re driving on an empty road, you may be tempted to push past the speed limit, just for the thrill of it. Unfortunately, this behavior has led to a significant percentage of fatalities in Massachusetts. With that in mind, it’s best to try and stick to the posted speed limits whenever possible.

The speed limits on Massachusetts’ major roads break down as follows:

| Road Type | Speed Limits |

|---|---|

| Rural Interstates | 65 |

| Urban Interstates | 65 |

| Other Limited Access Roads | 65 |

| Other Roads | 55 |

| Safety Zone | 20 |

| School Zone | 20 |

| Business District | 30 |

Ridesharing and Insurance in Massachusetts

The rise of Uber and Lyft have made it easier than ever for people to get to the places they need to go. These companies have also created a new industry for drivers across the United States. If you currently work with either company or one of their competitors, or if you’ve thought about using your vehicle for a job before, you’ll need to get ridesharing insurance. Your personal car insurance does not cover uber.

At this point in time, USAA Massachusetts auto insurance and Liberty Mutual are the only providers in Massachusetts who provide ridesharing insurance for employed drivers.

Automation on the Road in Massachusetts

While Hyundai’s most recent commercial may use the Boston accent to drive home the humor and versatility of its “smaht pahk,” it’s actually possible that this car may not have a home in Massachusetts.

The rise of the automated car has challenged legislators across the nation. Massachusetts, unlike many other states, has already set down definitive rules regarding the presence of automated vehicles on its roads. The state does not allow self-driving cars on its public roads.

However, 15 cities in the state will allow for automotive vehicle testing, with abiding rules detailed in the Memorandum of Understanding. During these tests, an operator must be present in the vehicle in question, but they do not have to be physically in control of the car.

What are the safety laws in Massachusetts?

Drivers can’t control everything while they’re on the road. However, some behaviors — like distracted driving, or driving while intoxicated — are entirely in the driver’s wheelhouse. With that in mind, how does Massachusetts treat the drivers law enforcement representatives catch deliberately putting themselves and other drivers in danger?

Massachusetts DUI Laws

It’s game day. You’re out with your friends at a sport’s bar, taking shots every time the referee makes a bad call. By the time the game comes to an end, you can’t walk in a straight line — but you still need to get home. Do you get behind the wheel of your car?

Ideally, no. Driving under the influence puts yourself and every other driver on the road at risk. Even so, a number of drivers decide to take a chance with their safety and test their reflexes behind the wheel.

To curb this behavior, Massachusetts has severe DUI laws in place. The table below details the consequences you’ll have to deal with if you’re caught drinking and driving:

| Offense | Fine | Imprisonment | License Suspension | Other |

|---|---|---|---|---|

| First | $500-$5,000 | Maximum two and half years | Three months | License suspension is 3 years for drivers under 21 |

| Second | $600-$10,000 | Maximum two and half years | Three years | N/A |

| Third (felony) | $1,000-$15,000 | Minimum 180 days and max two and a half years | Five Years | N/A |

| Fourth (felony) | $15,000-$25,000 | Minimum 1 year | Lifetime | N/A |

| Fifth (felony) | $2,000-$50,000 | Minimum 2 years | Lifetime | N/A |

As you can see, repeat offenses have increasingly severe consequences. Unless you want to lose your license permanently, it’s best to rely on ridesharing services to make your way home from the bar.

Marijuana-Impaired Driving Laws in Massachusetts

The laws applying to drinking and driving in Massachusetts also apply to driving while under the influence of marijuana.

Distracted Driving Laws in Massachusetts

As cellphones and other handheld devices become more advanced, drivers are increasingly tempted to use them while driving. Many states in the U.S. have instituted policies, as a result, that legally discourage drivers from using these devices while behind the wheel.

It is not technically illegal, however, to use your cellphone while behind the wheel of a car in Massachusetts. That said, if you’re caught texting and driving instead of, say, making a call, police officers are allowed to pull you over and fine you.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Driving in Massachusetts

No matter how safe you try to be on the road, accidents can happen. With that in mind, let’s take a look at vehicular safety in Massachusetts.

How many vehicle thefts occur in Massachusetts?

It’s not just sports cars that go missing as a result of vehicular theft. Massachusetts sees its fair share of grand theft auto — though it’s not the cars you’d expect that are thieves’ favorites:

| Vehicle | Model Year | Number of Thefts |

|---|---|---|

| Honda Accord | 1997 | 530 |

| Honda Civic | 1998 | 479 |

| Toyota Corolla | 2015 | 220 |

| Toyota Camry | 2005 | 208 |

| Dodge Caravan | 2000 | 204 |

| Nissan Altima | 2015 | 199 |

| Honda CR-V | 1999 | 193 |

| Ford Pickup (Full Size) | 2004 | 148 |

| Jeep Cherokee/Grand Cherokee | 2000 | 140 |

| Chevrolet Pickup (Full Size) | 2007 | 89 |

As you can see in this table, Honda Accords and Civics tend to go missing more often than sports cars do. Where, though, will your car be at the greatest risk?

| City | Motor Vehicle Theft | Motor Vehicles Theft per 1,000 population |

|---|---|---|

| Boston | 1223 | 1.81 |

| Braintree | 47 | 1.25 |

| Brockton | 280 | 2.94 |

| Cambridge | 119 | 1.07 |

| Chelsea | 113 | 2.82 |

| Chicopee | 95 | 1.67 |

| Everett | 72 | 1.54 |

| Fall River | 237 | 2.68 |

| Framingham | 54 | 0.76 |

| Haverhill | 82 | 1.3 |

| Holyoke | 129 | 3.17 |

| Lawrence | 581 | 7.21 |

| Lowell | 401 | 3.61 |

| Lynn | 221 | 2.39 |

| Malden | 101 | 1.65 |

| Medford | 48 | 0.84 |

| Methuen | 79 | 1.58 |

| New Bedford | 274 | 2.9 |

| Quincy | 98 | 1.05 |

| Revere | 113 | 2.11 |

| Somerville | 102 | 1.26 |

| Springfield | 587 | 3.81 |

| Taunton | 90 | 1.59 |

| West Springfield | 70 | 2.44 |

| Worcester | 519 | 2.81 |

Read more: Cambridge Mutual Fire Insurance Company Car Insurance Review

Naturally, Boston, with its massive population, sees the highest number of registered vehicle thefts. However, Lawrence has the greatest percentage of theft by population.

How many road fatalities occur in Massachusetts?

There’s more to worry about, though, than vehicular theft in Massachusetts. Let’s break down the annual fatalities that the state sees. With this information under your belt, you’ll have a better idea of what kind of behavior or conditions to keep an eye out for, while you’re on the road.

Most Fatal Highway in Massachusetts

Some roads are inherently more dangerous than others. In Massachusetts, Interstate 495 sees more fatalities over the course of a year than any other interstate in the state. On average, the interstate bears witness to 9.5 fatal accidents per year.

Fatal Crashes by Weather Condition and Light Condition in Massachusetts

Rain, sun, and bad weather can all cause roadway fatalities, as you can see in the table below:

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 133 | 56 | 70 | 22 | 1 | 282 |

| Rain | 10 | 15 | 12 | 1 | 0 | 38 |

| Snow/Sleet | 0 | 4 | 2 | 2 | 0 | 8 |

| Other | 0 | 2 | 0 | 0 | 0 | 2 |

| Unknown | 3 | 2 | 1 | 0 | 0 | 6 |

| Total | 146 | 79 | 85 | 25 | 1 | 336 |

Surprisingly, most of Massachusetts’ accidents take place during broad daylight.

Fatalities (All Crashes) by Massachusetts County

There are dozens of factors that can contribute to a roadway fatality in Massachusetts. Let’s break those fatalities down by county first to see which of Massachusetts’ counties is the most dangerous:

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Barnstable County | 18 | 16 | 12 | 18 | 14 |

| Berkshire County | 9 | 9 | 12 | 12 | 11 |

| Bristol County | 36 | 40 | 41 | 51 | 45 |

| Dukes County | 1 | 1 | 1 | 0 | 1 |

| Essex County | 34 | 27 | 23 | 33 | 36 |

| Franklin County | 7 | 5 | 11 | 5 | 8 |

| Hampden County | 34 | 34 | 30 | 40 | 35 |

| Hampshire County | 7 | 10 | 6 | 11 | 6 |

| Middlesex County | 41 | 45 | 48 | 64 | 34 |

| Nantucket County | 0 | 0 | 1 | 0 | 0 |

| Norfolk County | 28 | 41 | 38 | 31 | 33 |

| Plymouth County | 46 | 50 | 38 | 39 | 45 |

| Suffolk County | 23 | 26 | 30 | 34 | 26 |

| Worcester County | 67 | 50 | 53 | 49 | 56 |

As you can see, Massachusetts’ urban counties see more fatalities over the course of a year than its rural counties, likely due to the amount of congestion in the state’s larger cities.

Read more:

- Barnstable County Insurance Company Car Insurance Review

- Barnstable County Mutual Insurance Company Car Insurance Review

- Middlesex Insurance Company Car Insurance Review

Traffic Fatalities in Massachusetts

The type of road you’re driving on will also influence your likelihood of getting into an accident, as you can see here:

| Type of Road | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 36 | 35 | 30 | 44 | 50 | 50 | 37 | 22 | 17 | 22 |

| Urban | 328 | 305 | 317 | 330 | 333 | 300 | 317 | 321 | 370 | 328 |

Again, urban roads consistently see more fatalities than rural roads.

Fatalities by Person Type in Massachusetts

Person-type — or a person’s relationship to other cars on the road — is an unconventional factor to consider when assessing the number of accidents that occur in Massachusetts every year. Even so, some trends have clearly started to develop:

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 152 | 161 | 131 | 166 | 121 |

| Light Truck - Pickup | 15 | 15 | 14 | 22 | 27 |

| Light Truck - Utility | 37 | 27 | 28 | 41 | 50 |

| Light Truck - Van | 13 | 13 | 12 | 12 | 7 |

| Light Truck - Other | 1 | 2 | 2 | 4 | 2 |

| Large Truck | 4 | 3 | 3 | 2 | 5 |

| Total Occupants | 222 | 223 | 195 | 250 | 214 |

| Other/Unknown Occupants | 0 | 2 | 5 | 2 | 2 |

| Bus | 0 | 0 | 0 | 1 | 0 |

| Motorcyclists | 42 | 47 | 56 | 44 | 51 |

| Pedestrian | 79 | 74 | 79 | 78 | 74 |

| Bicyclist and Other Cyclist | 6 | 8 | 12 | 10 | 11 |

| Other/Unknown Nonoccupants | 2 | 2 | 2 | 5 | 0 |

| Total Nonoccupants | 87 | 84 | 93 | 93 | 85 |

| Total | 351 | 354 | 344 | 387 | 350 |

Passenger cars, as you can see, see far more fatalities than any other type of vehicle. Similarly, non-occupants, pedestrians, and motorcyclists frequently suffer the consequences of an accident. That’s all the more reason to keep an eye on your surroundings while you’re on the road.

Fatalities by Crash Type in Massachusetts

What type of crash is most common in Massachusetts?

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 351 | 354 | 344 | 387 | 350 |

| Single Vehicle | 235 | 250 | 222 | 250 | 237 |

| Involving a Large Truck | 31 | 27 | 28 | 27 | 28 |

| Involving Speeding | 89 | 85 | 92 | 126 | 98 |

| Involving a Rollover | 53 | 55 | 51 | 62 | 65 |

| Involving a Roadway Departure | 208 | 208 | 180 | 197 | 186 |

| Involving an Intersection | 104 | 76 | 74 | 94 | 93 |

As you can see in the table here, single vehicles get into more accidents than just about any other vehicle driving through Massachusetts. Similarly, Massachusetts sees more roadway departure fatalities than any other type of accident every year.

Five-Year Trend For the Top Counties in Massachusetts

How have fatalities been shifting across Massachusetts? Let’s take a look:

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Worcester County | 67 | 50 | 53 | 49 | 56 |

| Bristol County | 36 | 40 | 41 | 51 | 45 |

| Plymouth County | 46 | 50 | 38 | 39 | 45 |

| Essex County | 34 | 27 | 23 | 33 | 36 |

| Hampden County | 34 | 34 | 30 | 40 | 35 |

| Middlesex County | 41 | 45 | 48 | 64 | 34 |

| Norfolk County | 28 | 41 | 38 | 31 | 33 |

| Suffolk County | 23 | 26 | 30 | 34 | 26 |

| Barnstable County | 18 | 16 | 12 | 18 | 14 |

| Berkshire County | 9 | 9 | 12 | 12 | 11 |

| Top Ten Counties | 336 | 339 | 325 | 371 | 335 |

| All Other Counties | 15 | 15 | 19 | 16 | 15 |

| All Counties | 351 | 354 | 344 | 387 | 350 |

Again, the urban counties in the state see more than their fair share of accidents. Accidents, too, are fluctuating in number. There was a distinct rise in the number of fatalities the state saw in 2015 — in some counties — but they’ve generally seemed to decline over the past few years.

Fatalities Involving Speeding by County in Massachusetts

Who hasn’t been tempted to speed on an open road before? Unfortunately, speeding’s caused a number of accidents in Massachusetts, as you can see in the table below:

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Barnstable County | 4 | 5 | 3 | 3 | 5 |

| Berkshire County | 2 | 5 | 2 | 4 | 2 |

| Bristol County | 8 | 11 | 11 | 13 | 11 |

| Dukes County | 1 | 0 | 0 | 0 | 0 |

| Essex County | 6 | 8 | 8 | 11 | 13 |

| Franklin County | 3 | 0 | 6 | 3 | 2 |

| Hampden County | 12 | 14 | 5 | 21 | 12 |

| Hampshire County | 2 | 4 | 2 | 2 | 0 |

| Middlesex County | 12 | 9 | 10 | 12 | 7 |

| Nantucket County | 0 | 0 | 0 | 0 | 0 |

| Norfolk County | 10 | 7 | 12 | 8 | 13 |

| Plymouth County | 8 | 9 | 8 | 15 | 15 |

| Suffolk County | 5 | 2 | 11 | 11 | 2 |

| Worcester County | 16 | 11 | 14 | 23 | 16 |

Bristol and Hampden counties see the most speeding-related fatalities over the course of a year.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County in Massachusetts

We already touched on the dangers of drinking and driving in Massachusetts. Even so, some folks don’t take these warnings seriously. As a result, Massachusetts continues to see alcohol-related fatalities on its roadways, as you can see in the table below:

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Barnstable County | 6 | 6 | 4 | 8 | 5 |

| Berkshire County | 3 | 2 | 5 | 2 | 3 |

| Bristol County | 16 | 15 | 15 | 23 | 17 |

| Dukes County | 1 | 0 | 0 | 0 | 0 |

| Essex County | 11 | 10 | 6 | 11 | 8 |

| Franklin County | 3 | 1 | 2 | 3 | 3 |

| Hampden County | 12 | 20 | 7 | 19 | 14 |

| Hampshire County | 2 | 5 | 3 | 0 | 0 |

| Middlesex County | 12 | 14 | 15 | 17 | 12 |

| Nantucket County | 0 | 0 | 0 | 0 | 0 |

| Norfolk County | 12 | 20 | 12 | 12 | 9 |

| Plymouth County | 17 | 22 | 11 | 16 | 20 |

| Suffolk County | 11 | 12 | 8 | 12 | 9 |

| Worcester County | 18 | 18 | 17 | 25 | 20 |

Again, it’s Bristol and Hampden counties, alongside Essex, that see the most alcohol-related fatalities in the state.

Teen Drinking and Driving in Massachusetts

The numbers in the previous section’s table do not include teenage drinking and driving fatalities. According to the FBI, Massachusetts law enforcement arrested 46 teenagers for DUIs in 2016. Since then, numbers in this category seem to be on the decline.

Massachusetts EMS Response Time

If you get into an accident, you want to know that emergency services will be able to reach your location ASAP. With that in mind, let’s take a look at the response time of the EMS in Massachusetts:

| Road Type | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|

| Rural | 3.14 | 8.61 | 31 | 40.6 | 20 |

| Urban | 3.84 | 6.37 | 25.62 | 33.28 | 316 |

Responses times will vary depending on where your accident took place. However, the difference between rural and urban response time isn’t as significant as you might expect. In both cases, you’ll make it from the site of your accident to the hospital within 40 minutes of the accident taking place.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

What is transportation like in Massachusetts?

Traffic in Massachusetts is a chore to deal with. It’s reached the point where INRIX lists the Boston commute as the worst commute in the United States, with 164 hours of drivers’ time lost to traffic.

With that in mind, what does car ownership look like in the state, and how can you prepare yourself for time on the road?

Car Ownership in Massachusetts

On average, homeowners in Massachusetts own two cars. This is par for the course in the United States, with car ownership data forming a bell curve that puts two-car ownership at its peak.

Commute Time in Massachusetts

Let’s get into the data that you really want, though: the average commute time in Massachusetts. On average, you’ll spend 28.3 minutes in traffic per day while a Massachusetts resident. The national average commute time, for comparison, is 25.5 minutes.

The aforementioned commute time in Massachusetts, however, applies to folks living outside of the Bay Area. Move to the Bay Area of Massachusetts, and you’ll find your commute shoot past 60 minutes or more.

Commuter Transportation in Massachusetts

According to DataUSA, roughly 70 percent of Massachusetts’ population prefers to drive into work alone. However, the percentage of people taking public transportation is higher than it is across most of the rest of the United States. A fair 10 percent of Massachusetts take advantage of public transportation in an attempt to cut down on their travel time.

Traffic Congestion in Massachusetts

When it comes to congestion, there’s just no getting around it: Massachusetts boasts one of the highest congestion rates in the United States. According to the INRIX scorecard, Boston rotates between the top and second-to-top spot for congestion in the United States, with Baltimore close behind.

Driving in Massachusetts is, kindly put, an adventure. Even so, you shouldn’t let your concerns about the road keep you from exploring your car insurance options. Now that we’ve reached the end of this guide, you should have all of the information you need to negotiate for a fair and comprehensive premium.

Ready to compare rates in your area? Just enter your ZIP code into our FREE online tool to get started.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.