Wisconsin Car Insurance (Coverage, Companies, & More)

Wisconsin car insurance is much cheaper than the national average, with Wisconsin car insurance rates averaging at $91 per month. Explore our guide to compare local Wisconsin car insurance companies and policies in order to find the best coverage for you. Enter your ZIP code below to compare Wisconsin car insurance quotes for free.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 24, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 24, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Wisconsin Summary Statistics | Details |

|---|---|

| Road Miles | Total in State: 115,543 Vehicle Miles Driven: 65.3 billion |

| Vehicles | Registered in State: 6.07 million Stolen: 9,919 |

| Population | 5,813,568 |

| Most Popular Vehicle | Chevrolet Silverado 1500 |

| Uninsured Drivers | 14.3% Rank: 15th |

| Traffic Fatalities | 2017 Total: 613 Speeding: 180 Drunk Driving: 190 |

| Average Annual Premiums | Liability: $374 Collision: $226 Comprehensive: $137 Combined: $737 |

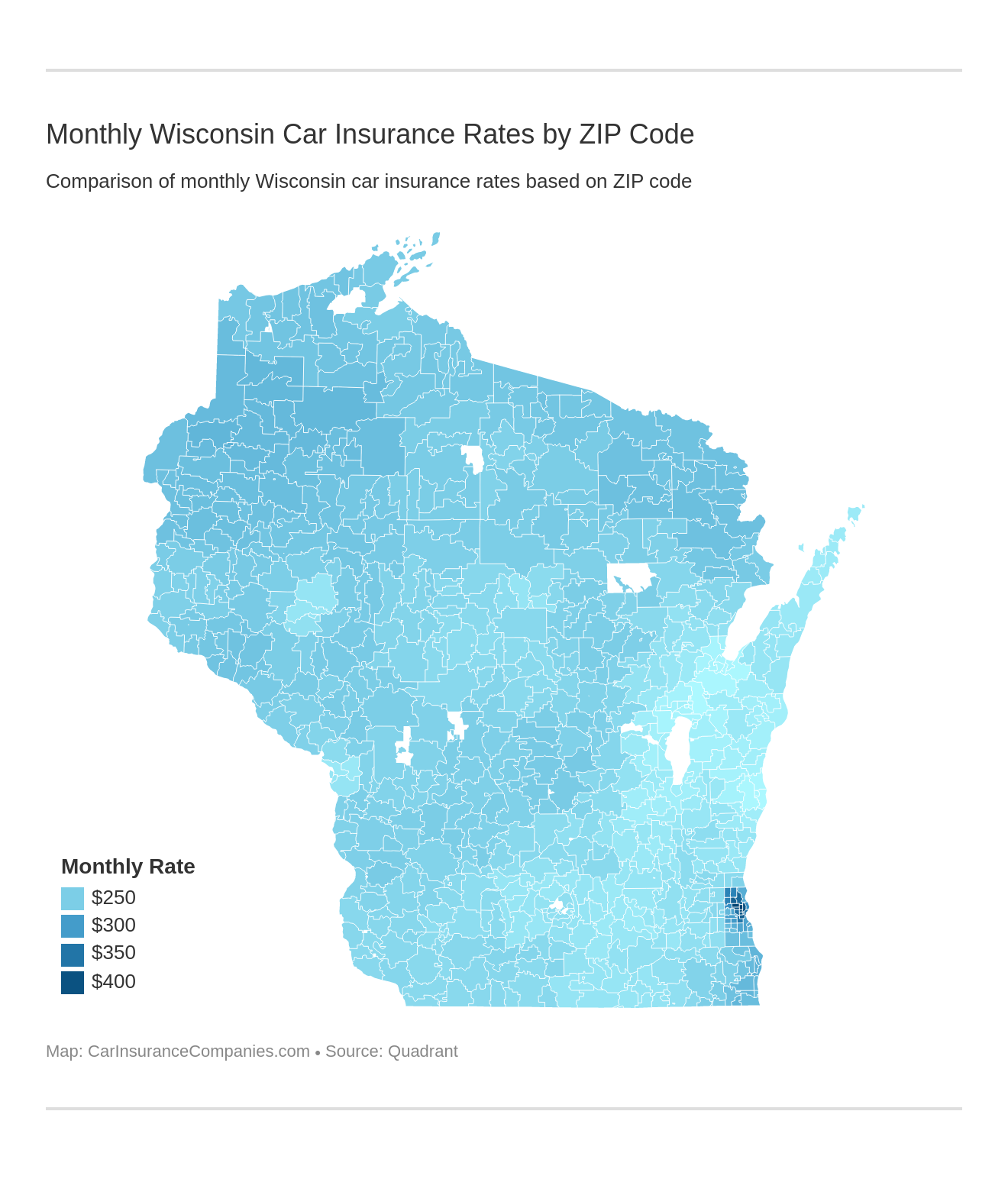

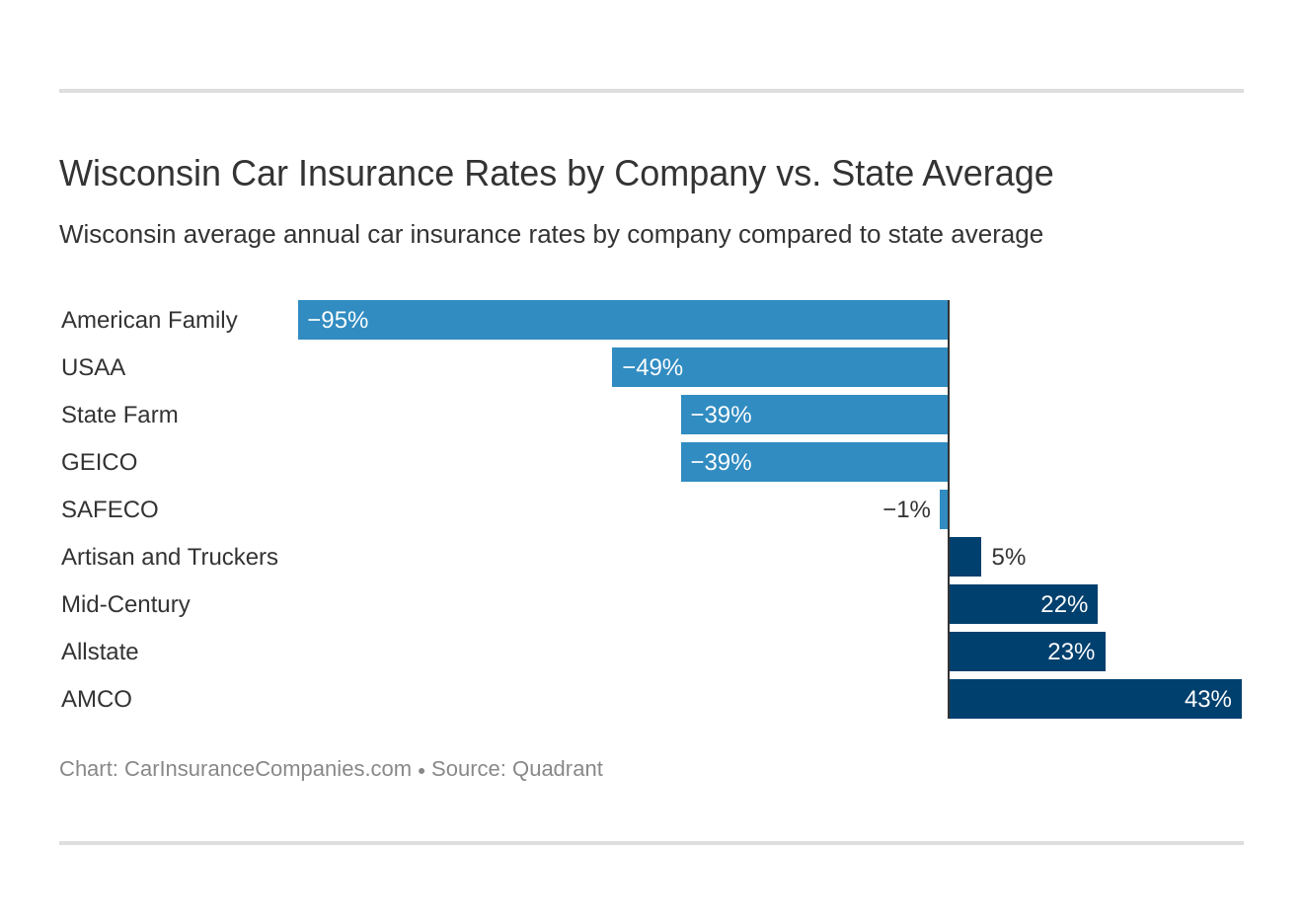

| Cheapest Provider | American Family |

Welcome to Wisconsin, the Badger State!

Wisconsin is more than cheese and its world-class public university system. Delavan was the site of America’s first circus, and Sheboygan is the “Bratwurst Capital” of the world. With more than 250 miles of shoreline, Door County just north of Green Bay on Lake Michigan has more shoreline than any other county in the United States.

And with a simple state motto — Forward — Wisconsin is a state on the move. That’s why you need the best car insurance for you and your family.

But how do you choose the right car insurance? What kind of car insurance do you need in Wisconsin? And what will it cost? You can use the box above to search for insurance that fits your needs and budget.

Read on, because we’ve created this guide to help you navigate the car insurance industry in the great state of Wisconsin. Go Badgers!

Wisconsin Car Insurance Coverage and Rates

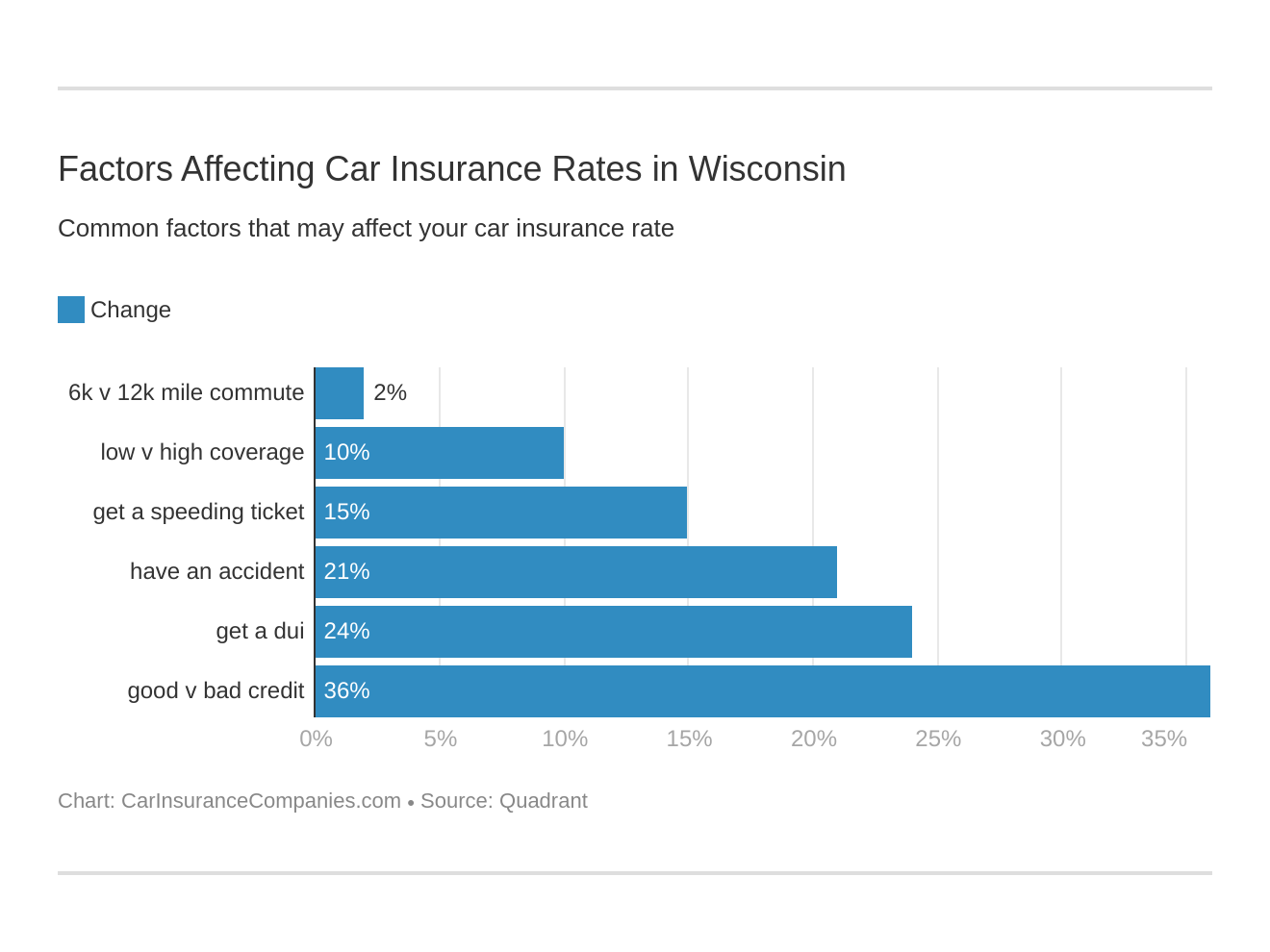

Our research has found that a lot of key and understandable factors can affect the rate of your car insurance premium.

From where you live to your credit score to the make and model of your vehicle, it’s important to know what goes into the formulas companies use in calculating how much you’ll owe them for insurance.

But don’t worry, we’re here to help. So, how much does auto insurance cost anyway? Our friends at Trusted Choice report that the average cost of car insurance in the United States is currently $1,474 per year.

Wisconsinites pay signficantly less than this: badgers average paying only $1,087 per year in car insurance premiums.

Let’s get started in exploring car insurance in Wisconsin by talking about the state’s car culture more broadly.

Wisconsin’s Car Culture

Wisconsin households own, on average, between 2.3 cars. The state’s Department of Transportation reports that in 2018, there were 6,069,090 cars registered in Wisconsin.

That’s a lot considering the state’s current population is estimated to be 5.8 million.

Wisconsin Minimum Coverage

14.3 percent of Wisconsinites are currently uninsured according to the Insurance Information Institute. And that’s not great, considering Wisconsin requires its drivers to carry at least minimum liability insurance according to The Hartford at AARP. (For more information, read our “AARP The Hartford Insurance Review“).

So how much car insurance do you need in Wisconsin? What car insurance is required?

Wisconsin’s minimum requirements for insurance are fairly average compared to other states across the nation. In the Badger State, you are required to have the following car insurance minimums:

- $25,000 for bodily injury or death of one person in an accident caused by the owner of the insured vehicle

- $50,000 for total bodily injury or death in an accident caused by the owner of the insured vehicle

- $10,000 for property damage per accident caused by the owner of the insured vehicle

But keep in mind, this is just the minimum coverage.

Below we’ll cover some add-on coverages that can be easily added to your insurance policy to ensure you, your family, and your vehicles are well-protected financially in the case of an accident or other incidents.

But first: how do you even prove you have car insurance in the Badger State?

Read more: Badger Mutual Insurance Company Car Insurance Review

Forms of Financial Responsibility

In Wisconsin, you need to be able to prove you have at least the minimum insurance the state requires. You do this through a legally-recognized form of financial responsibility. There are various ways to show your proof of insurance, usually just by carrying a valid insurance ID card or a copy of your insurance policy.

But in case you forget your ID on your way out the door one day, it might be a good idea to file your insurance with the state.

Wisconsin’s Department of Transportation explains that “proof of insurance is filed by obtaining an SR-22 certificate issued by an insurance company licensed to do business in Wisconsin.

In some cases, substitutions, such as a bond from an insurance company or a cash deposit of $60,000 posted with the Wisconsin Department of Transportation (WisDOT) will be accepted. For the operation of commercial vehicles, motor carrier insurance may be furnished as proof of financial responsibility.”

Premiums as a Percentage of Income

Wisconsinites had an average disposable household income of $39,433.00 in 2014. Of this, they spent $716.83, or 1.82 percent, on car insurance premiums for the year.

This means residents paid a lot less of their income to car insurers than the national average of 2.29 percent.

Our research shows that Wisconsinites are paying a pretty steady percentage of their incomes for car insurance premiums. Here’s the average of Wiscon’s car insurance premiums as a percentage of income between 2012 – 2014:

- 2012: 1.75 percent

- 2013: 1.82 percent

- 2014: 1.82 percent

You can use the tool below to calculate what percentage of income your insurance premium might be in the great state of Wisconsin.

Average Monthly Car Insurance Rates in WI (Liability, Collision, Comprehensive)

When it comes to shopping for car insurance, always keep in mind that across the board, experts agree: the better insured you are, the better prepared you will be to deal with an accident, whether or not you are at fault.

The table below provides what you can expect to pay on average for different components of your car insurance package in Wisconsin. These rates are provided by the National Association of Insurance Commissioners (NAIC), who bases them on Wisconsin state minimum requirements by law.

| Coverage Type | Average Annual Cost in 2015 | National Average |

|---|---|---|

| Liability | $374.37 | $538.73 |

| Collision | $226 | $322.61 |

| Comprehensive | $136.81 | $148.04 |

| Full | $737.18 | $1,009.38 |

Additional Liability

Did you know that Wisconsin, like many states, only requires liability insurance? And how do you even know if a car insurance company is right for you?

Looking at a company’s loss ratio can help you determine if they can provide you the car insurance you need.

Wait a minute, you might be thinking, what even is a loss ratio?

A loss ratio is simply how much the insurer spends on claims compared to how much money they receive in premiums.

Here’s an example: when a company spends $570 in claims for every $1,000 they receive in premiums, they have a loss ratio of 57 percent. This means that loss ratios over 100 percent show an insurer is losing money, and that abnormally low loss ratios mean a company isn’t paying out much in claims.

For 2017, the National Association of Insurance Commissioners (NAIC) reports that the national average for loss ratios was 73 percent. Our research shows that the “sweet spot” for loss ratios is actually between 60 and 70 percent.

Unfortunately, the state of Wisconsin does not track loss ratios for car insurance companies operating in the state.

Check out the next section for some extra protections you might want to add on to your existing coverage.

Add-ons, Endorsements, and Riders

When it comes to car insurance for you and your family, great coverage at a low premium is likely your top priority. And we understand that!

Fortunately, there are a lot of cheap but powerful extras you can add to your Wisconsin car insurance policy, extras that ensure you are better-covered in the case of an accident or other vehicular incident.

The following is a list of add-on coverage that you can add to the required car insurance you need in the Badger State:

• Guaranteed Auto Protection (GAP)

• Personal Umbrella Policy (PUP)

• Rental Reimbursement

• Emergency Roadside Assistance

• Mechanical Breakdown Insurance

• Non-Owner Car Insurance

• Modified Car Insurance Coverage

• Classic Car Insurance

• Pay-As-You-Drive (Usage-Based Insurance)

We’ve found that you might also want to consider personal injury protection (PIP). PIP, sometimes called “no-fault insurance,” covers medical bills incurred from an accident, regardless of who is at fault, who is driving, or who owns the vehicle.

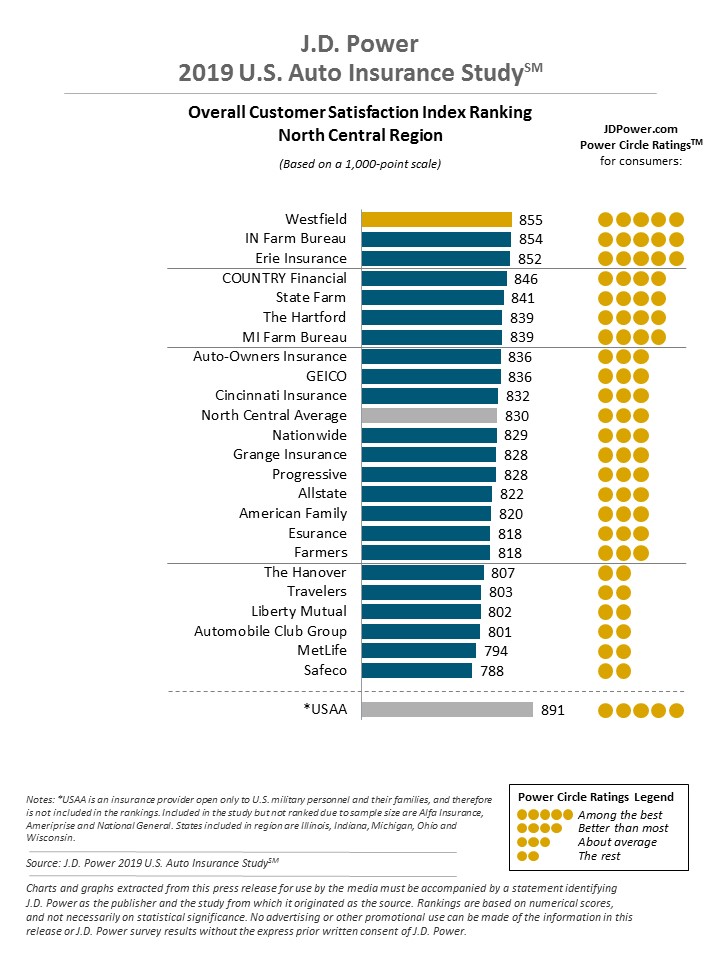

Average Monthly Car Insurance Rates by Age & Gender in WI

In Wisconsin, young men can expect to pay more for their car insurance premiums than young women.

Once you reach 25 years of age, however, the gender gap is minimal.

So, what is more significant to car insurance providers in determining your premium than gender? Age and marital status.

The following table provides the average annual car insurance premiums for Wisconsinites of different demographics.

| Company | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate | $7,334.19 | $9,404.12 | $2,294.78 | $2,492.10 | $2,260.76 | $2,382.47 | $2,088.63 | $2,308.36 |

| American Family | $2,844.04 | $3,134.61 | $1,135.28 | $1,209.31 | $958.90 | $1,002.57 | $907.25 | $914.15 |

| Mid-Century | $9,058.32 | $9,384.83 | $2,174.00 | $2,277.36 | $1,914.63 | $1,915.25 | $1,697.53 | $1,797.98 |

| Geico | $4,301.84 | $4,635.16 | $1,195.24 | $1,231.20 | $1,292.65 | $1,428.00 | $1,341.28 | $1,540.98 |

| SafeCo | $5,989.99 | $6,720.07 | $1,882.36 | $2,040.80 | $1,770.81 | $1,933.28 | $1,431.26 | $1,626.57 |

| AMCO | $7,388.96 | $11,333.17 | $4,379.28 | $5,192.67 | $3,597.48 | $3,785.31 | $2,981.78 | $3,141.26 |

| Artisan and Truckers | $6,692.88 | $7,551.66 | $2,112.73 | $2,290.54 | $1,760.63 | $1,676.02 | $1,442.61 | $1,504.23 |

| State Farm | $3,833.87 | $4,845.21 | $1,516.77 | $1,732.41 | $1,345.30 | $1,345.30 | $1,195.81 | $1,195.81 |

| USAA | $3,367.35 | $3,901.46 | $1,705.43 | $1,869.61 | $1,315.46 | $1,311.45 | $1,193.74 | $1,212.48 |

Read more: Artisan and Truckers Casualty Company Car Insurance Review

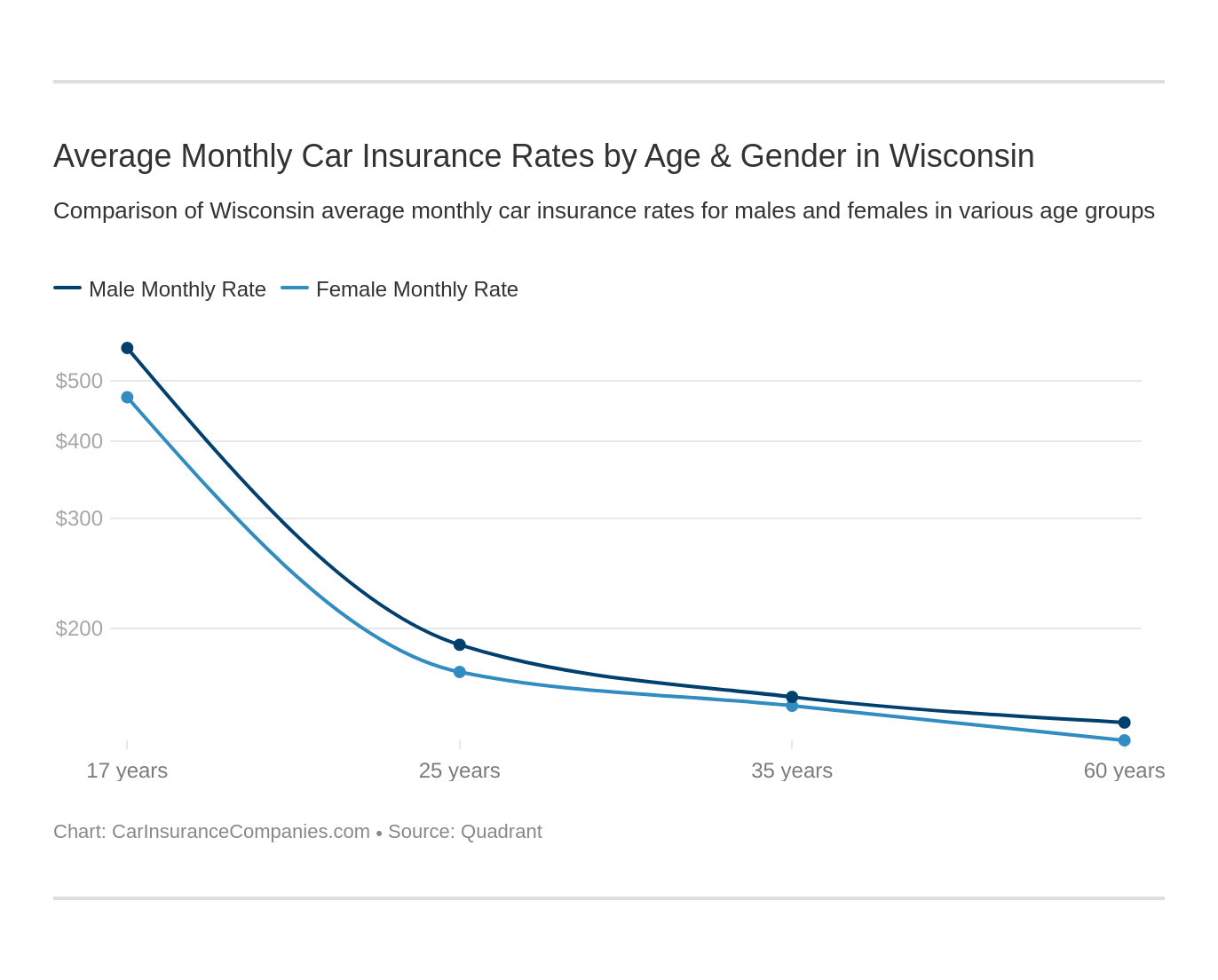

Cheapest Rates by Zip Code and City

You probably already know that the price of car insurance varies from state to state.

But did you know that your premium can vary by where you live in your state as well?

In Wisconsin, zip code 53206, the Park West and Arlington Heights neighborhoods of Milwaukee, the state’s largest city, has the highest average car insurance premiums at $5,102.46 per year.

The searchable table below provides a breakdown of the average car insurance premiums by city and zip code, and by insurer within that zip code, from across the state of Wisconsin.

| City | Zipcode | Average Annual Rate | Allstate P&C | American Family Ins | Mid-Century Ins Co | Geico Cas | SAFECO Ins Co of IL | AMCO Insurance | Artisan and Truckers Casualty | State Farm Mutual Auto | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MILWAUKEE | 53206 | $5,102.46 | $6,835.70 | $2,057.23 | $6,378.71 | $3,878.82 | $4,256.72 | $9,162.87 | $6,710.44 | $3,790.64 | $2,851.01 |

| MILWAUKEE | 53216 | $5,010.47 | $6,835.70 | $2,095.87 | $6,378.71 | $3,884.71 | $4,256.72 | $9,051.09 | $5,933.26 | $3,798.47 | $2,859.72 |

| MILWAUKEE | 53205 | $4,815.48 | $6,645.94 | $2,013.75 | $5,242.62 | $3,878.82 | $4,256.72 | $9,162.87 | $5,744.84 | $3,542.79 | $2,851.01 |

| MILWAUKEE | 53212 | $4,770.80 | $6,785.91 | $1,964.02 | $5,242.62 | $3,878.82 | $4,256.72 | $9,162.87 | $5,093.97 | $3,701.25 | $2,851.01 |

| MILWAUKEE | 53210 | $4,751.86 | $6,331.60 | $1,989.90 | $5,242.62 | $3,884.71 | $4,256.72 | $9,051.09 | $5,387.20 | $3,763.21 | $2,859.72 |

| MILWAUKEE | 53233 | $4,657.36 | $6,464.17 | $2,012.43 | $5,242.62 | $3,350.60 | $4,256.72 | $9,162.87 | $5,141.28 | $3,434.51 | $2,851.01 |

| MILWAUKEE | 53204 | $4,566.46 | $6,645.94 | $2,007.62 | $5,242.62 | $3,026.12 | $4,256.72 | $9,162.87 | $4,539.28 | $3,365.99 | $2,851.01 |

| MILWAUKEE | 53218 | $4,508.38 | $6,983.45 | $2,102.37 | $6,282.99 | $3,888.10 | $4,256.72 | $5,835.34 | $5,467.94 | $3,426.98 | $2,331.50 |

| MILWAUKEE | 53209 | $4,400.48 | $6,983.45 | $1,764.77 | $6,282.99 | $3,532.63 | $3,780.34 | $6,195.71 | $5,372.19 | $3,444.79 | $2,247.46 |

| MILWAUKEE | 53203 | $4,379.97 | $4,687.06 | $2,015.65 | $5,501.63 | $3,131.88 | $4,256.72 | $9,162.87 | $4,417.07 | $3,395.82 | $2,851.01 |

| MILWAUKEE | 53208 | $4,254.76 | $6,321.24 | $2,053.73 | $5,242.62 | $3,350.60 | $4,256.72 | $6,195.71 | $4,963.69 | $3,664.25 | $2,244.28 |

| MILWAUKEE | 53215 | $4,169.07 | $6,308.98 | $2,045.70 | $5,242.62 | $3,026.12 | $4,256.72 | $6,195.71 | $4,734.20 | $3,261.97 | $2,449.64 |

| MILWAUKEE | 53202 | $4,107.54 | $4,886.72 | $2,012.80 | $4,649.36 | $2,492.54 | $4,256.72 | $9,162.87 | $3,988.92 | $3,206.28 | $2,311.63 |

| MILWAUKEE | 53225 | $3,983.62 | $5,734.60 | $1,905.69 | $5,242.62 | $3,532.63 | $3,337.86 | $5,835.34 | $4,672.95 | $3,259.36 | $2,331.50 |

| MILWAUKEE | 53224 | $3,958.34 | $5,987.59 | $1,939.50 | $5,242.62 | $3,532.63 | $3,337.86 | $5,835.34 | $4,320.95 | $3,147.19 | $2,281.41 |

| MILWAUKEE | 53223 | $3,957.10 | $5,987.59 | $2,016.17 | $5,242.62 | $3,532.63 | $3,337.86 | $5,835.34 | $4,632.79 | $2,747.48 | $2,281.41 |

| MILWAUKEE | 53222 | $3,782.96 | $5,719.90 | $1,816.85 | $4,649.36 | $3,208.13 | $3,337.86 | $5,835.34 | $4,605.05 | $2,614.09 | $2,260.05 |

| MILWAUKEE | 53211 | $3,747.77 | $4,883.51 | $1,922.76 | $4,649.36 | $2,504.32 | $4,256.72 | $6,195.71 | $4,161.76 | $3,028.42 | $2,127.31 |

| BRILL | 54818 | $3,647.62 | $3,948.23 | $1,585.14 | $4,001.50 | $2,332.55 | $3,468.58 | $5,667.48 | $7,590.37 | $2,144.72 | $2,090.03 |

| MILWAUKEE | 53219 | $3,629.95 | $4,230.00 | $1,861.10 | $4,649.36 | $2,540.89 | $3,780.34 | $6,195.71 | $4,552.32 | $2,786.86 | $2,073.02 |

| JUMP RIVER | 54434 | $3,572.87 | $3,784.64 | $1,557.59 | $3,920.89 | $2,332.55 | $3,022.09 | $5,797.61 | $7,590.37 | $2,072.49 | $2,077.64 |

| HEAFFORD JUNCTION | 54532 | $3,569.38 | $3,855.54 | $1,442.50 | $3,701.87 | $2,332.55 | $3,253.88 | $5,797.61 | $7,590.37 | $2,072.49 | $2,077.64 |

| HANNIBAL | 54439 | $3,561.27 | $3,784.64 | $1,453.20 | $3,920.89 | $2,332.55 | $3,022.09 | $5,797.61 | $7,590.37 | $2,072.49 | $2,077.64 |

| MILWAUKEE | 53214 | $3,554.42 | $4,285.16 | $1,987.16 | $4,649.36 | $2,556.07 | $3,780.34 | $6,195.71 | $3,960.58 | $2,514.61 | $2,060.76 |

| MILWAUKEE | 53207 | $3,515.05 | $4,430.19 | $2,015.05 | $4,649.36 | $2,556.07 | $3,337.86 | $6,195.71 | $3,781.44 | $2,594.33 | $2,075.48 |

| MILWAUKEE | 53227 | $3,499.29 | $4,364.82 | $1,920.47 | $4,649.36 | $2,540.89 | $3,337.86 | $6,195.71 | $3,638.62 | $2,772.86 | $2,073.02 |

| MILWAUKEE | 53213 | $3,497.94 | $4,281.95 | $1,901.53 | $4,649.36 | $2,914.55 | $4,256.72 | $4,938.69 | $3,986.65 | $2,500.83 | $2,051.21 |

| MILWAUKEE | 53221 | $3,483.37 | $4,430.19 | $1,676.38 | $4,649.36 | $2,540.89 | $3,337.86 | $6,195.71 | $3,835.45 | $2,605.40 | $2,079.08 |

| GALLOWAY | 54432 | $3,475.38 | $3,779.85 | $1,557.59 | $3,734.17 | $2,313.96 | $3,066.52 | $5,117.13 | $7,590.37 | $2,072.49 | $2,046.34 |

| MIKANA | 54857 | $3,466.47 | $3,948.23 | $1,585.14 | $5,843.46 | $2,332.55 | $3,188.93 | $5,667.48 | $4,397.72 | $2,144.72 | $2,090.03 |

| MILWAUKEE | 53235 | $3,461.08 | $4,287.36 | $1,759.85 | $4,649.36 | $2,540.89 | $3,337.86 | $6,195.71 | $3,561.75 | $2,766.99 | $2,049.94 |

| MILWAUKEE | 53217 | $3,396.38 | $4,883.51 | $1,672.72 | $4,649.36 | $2,405.64 | $3,780.34 | $4,938.69 | $3,800.87 | $2,480.47 | $1,955.86 |

| MILWAUKEE | 53220 | $3,374.79 | $4,205.80 | $1,802.66 | $4,520.28 | $2,540.89 | $3,780.34 | $4,938.69 | $3,808.75 | $2,799.40 | $1,976.32 |

| RACINE | 53405 | $3,363.02 | $4,580.92 | $1,795.49 | $4,330.72 | $2,329.14 | $3,536.05 | $5,481.23 | $3,599.82 | $2,473.52 | $2,140.26 |

| CUDAHY | 53110 | $3,345.01 | $4,287.36 | $1,620.79 | $4,649.36 | $2,315.43 | $3,337.86 | $6,195.71 | $3,410.02 | $2,238.60 | $2,049.94 |

| HERTEL | 54845 | $3,344.17 | $3,940.66 | $1,595.78 | $4,574.93 | $2,332.55 | $3,468.58 | $5,946.74 | $3,988.43 | $2,116.33 | $2,133.57 |

| RACINE | 53404 | $3,329.70 | $4,640.28 | $1,692.39 | $4,330.72 | $2,329.14 | $3,536.05 | $5,481.23 | $3,417.92 | $2,353.27 | $2,186.33 |

| RACINE | 53403 | $3,318.49 | $4,741.85 | $1,611.68 | $4,330.72 | $2,329.14 | $3,536.05 | $5,481.23 | $3,268.71 | $2,426.81 | $2,140.26 |

| RACINE | 53402 | $3,294.00 | $4,479.85 | $1,510.20 | $4,330.72 | $2,329.14 | $3,536.05 | $5,481.23 | $3,387.50 | $2,404.96 | $2,186.33 |

| WEBSTER | 54893 | $3,292.41 | $3,940.66 | $1,594.49 | $4,574.93 | $2,332.55 | $3,468.58 | $5,946.74 | $3,388.89 | $2,251.30 | $2,133.57 |

| MILWAUKEE | 53226 | $3,283.78 | $4,020.16 | $1,766.14 | $4,649.36 | $2,559.44 | $3,780.34 | $4,938.69 | $3,465.53 | $2,313.61 | $2,060.76 |

| KENOSHA | 53142 | $3,283.77 | $4,734.83 | $1,685.76 | $4,330.72 | $2,329.14 | $3,179.81 | $5,377.01 | $3,267.41 | $2,437.11 | $2,212.19 |

| HAYWARD | 54843 | $3,264.76 | $3,995.26 | $1,519.25 | $4,176.65 | $2,332.55 | $3,468.58 | $5,797.61 | $3,662.60 | $2,274.49 | $2,155.89 |

| KENOSHA | 53140 | $3,262.78 | $4,734.83 | $1,798.56 | $4,330.72 | $2,329.14 | $2,899.75 | $5,377.01 | $3,297.21 | $2,343.73 | $2,254.08 |

| MINONG | 54859 | $3,262.41 | $3,837.94 | $1,586.80 | $4,176.65 | $2,332.55 | $3,468.58 | $5,946.74 | $3,548.78 | $2,330.13 | $2,133.57 |

| GORDON | 54838 | $3,261.36 | $3,837.94 | $1,606.76 | $3,991.81 | $2,311.10 | $3,468.58 | $6,056.27 | $3,671.93 | $2,240.72 | $2,167.16 |

| SPOONER | 54801 | $3,257.94 | $3,908.82 | $1,574.94 | $4,198.52 | $2,332.55 | $3,468.58 | $5,946.74 | $3,400.16 | $2,357.58 | $2,133.57 |

| STONE LAKE | 54876 | $3,252.68 | $3,916.41 | $1,595.06 | $4,176.65 | $2,332.55 | $3,468.58 | $5,946.74 | $3,401.03 | $2,303.53 | $2,133.57 |

| SPRINGBROOK | 54875 | $3,252.01 | $3,916.41 | $1,595.06 | $4,176.65 | $2,332.55 | $3,468.58 | $5,946.74 | $3,381.67 | $2,316.90 | $2,133.57 |

| TREGO | 54888 | $3,251.33 | $3,987.29 | $1,597.88 | $4,176.65 | $2,332.55 | $3,468.58 | $5,946.74 | $3,280.40 | $2,338.30 | $2,133.57 |

| SHELL LAKE | 54871 | $3,246.88 | $3,940.66 | $1,568.99 | $4,014.10 | $2,332.55 | $3,468.58 | $5,946.74 | $3,504.18 | $2,312.55 | $2,133.57 |

| KENOSHA | 53144 | $3,246.66 | $4,734.83 | $1,687.94 | $4,236.40 | $2,329.14 | $2,899.75 | $5,377.01 | $3,277.90 | $2,430.17 | $2,246.82 |

| MAPLEWOOD | 54226 | $3,246.07 | $3,495.40 | $1,344.11 | $3,843.00 | $1,833.52 | $2,994.14 | $4,497.68 | $7,590.37 | $1,778.65 | $1,837.73 |

| SIREN | 54872 | $3,241.61 | $3,940.66 | $1,599.49 | $4,014.10 | $2,332.55 | $3,468.58 | $5,946.74 | $3,476.03 | $2,262.81 | $2,133.57 |

| DANBURY | 54830 | $3,241.53 | $3,908.82 | $1,594.49 | $4,111.62 | $2,332.55 | $3,468.58 | $5,946.74 | $3,437.02 | $2,240.39 | $2,133.57 |

| RACINE | 53406 | $3,240.53 | $4,483.11 | $1,483.60 | $4,330.72 | $2,329.14 | $3,536.05 | $5,481.23 | $3,049.14 | $2,380.53 | $2,091.30 |

| SARONA | 54870 | $3,235.71 | $3,919.68 | $1,574.94 | $4,070.74 | $2,332.55 | $3,468.58 | $5,946.74 | $3,431.62 | $2,242.97 | $2,133.57 |

| WOODWORTH | 53194 | $3,221.21 | $4,703.59 | $1,494.01 | $4,192.57 | $2,234.57 | $2,899.75 | $4,996.19 | $4,241.09 | $2,407.47 | $1,821.68 |

| MILWAUKEE | 53228 | $3,217.79 | $4,230.00 | $1,663.59 | $4,649.36 | $2,315.43 | $3,337.86 | $4,938.69 | $3,075.96 | $2,772.86 | $1,976.32 |

| CLAM LAKE | 54517 | $3,212.41 | $3,987.29 | $1,559.81 | $3,613.26 | $2,332.55 | $2,975.06 | $6,047.98 | $4,095.19 | $2,144.72 | $2,155.89 |

| OJIBWA | 54862 | $3,210.81 | $3,905.59 | $1,556.57 | $3,940.95 | $2,332.55 | $3,468.58 | $5,797.61 | $3,594.85 | $2,144.72 | $2,155.89 |

| GREENDALE | 53129 | $3,209.12 | $4,405.99 | $1,583.15 | $4,649.36 | $2,315.43 | $3,780.34 | $4,938.69 | $3,158.03 | $2,178.77 | $1,872.30 |

| BARRONETT | 54813 | $3,204.07 | $4,019.11 | $1,568.99 | $4,014.10 | $2,332.55 | $3,468.58 | $5,667.48 | $3,531.03 | $2,144.72 | $2,090.03 |

| FOXBORO | 54836 | $3,199.55 | $3,908.82 | $1,606.76 | $3,746.42 | $2,311.10 | $3,468.58 | $6,056.27 | $3,284.95 | $2,245.88 | $2,167.16 |

| PLEASANT PRAIRIE | 53158 | $3,199.37 | $4,204.98 | $1,565.14 | $4,236.40 | $2,329.14 | $2,899.75 | $5,377.01 | $3,446.40 | $2,516.01 | $2,219.53 |

| COMSTOCK | 54826 | $3,197.12 | $4,019.11 | $1,636.21 | $3,983.86 | $2,332.55 | $3,468.58 | $5,667.48 | $3,431.52 | $2,144.72 | $2,090.03 |

| OAK CREEK | 53154 | $3,194.16 | $4,343.85 | $1,491.05 | $4,649.36 | $2,315.43 | $3,337.86 | $4,938.69 | $3,554.56 | $2,214.67 | $1,901.98 |

| COUDERAY | 54828 | $3,194.00 | $3,900.89 | $1,593.47 | $4,176.65 | $2,332.55 | $3,468.58 | $5,797.61 | $3,175.63 | $2,144.72 | $2,155.89 |

| RADISSON | 54867 | $3,190.81 | $3,830.01 | $1,581.44 | $4,059.21 | $2,332.55 | $3,468.58 | $5,797.61 | $3,216.87 | $2,275.18 | $2,155.89 |

| KENOSHA | 53143 | $3,190.26 | $4,204.98 | $1,733.41 | $4,330.72 | $2,329.14 | $2,899.75 | $5,377.01 | $3,186.61 | $2,409.71 | $2,240.96 |

| HAUGEN | 54841 | $3,186.72 | $3,948.23 | $1,585.14 | $4,064.86 | $2,332.55 | $3,468.58 | $5,667.48 | $3,378.92 | $2,144.72 | $2,090.03 |

| LUCK | 54853 | $3,186.54 | $4,027.10 | $1,625.16 | $3,983.86 | $2,332.55 | $2,923.68 | $5,854.85 | $3,362.83 | $2,389.74 | $2,179.09 |

| CUMBERLAND | 54829 | $3,186.43 | $4,019.11 | $1,564.62 | $4,014.10 | $2,332.55 | $3,468.58 | $5,667.48 | $3,260.80 | $2,260.59 | $2,090.03 |

| RICE LAKE | 54868 | $3,186.29 | $3,948.23 | $1,529.08 | $4,070.74 | $2,332.55 | $3,468.58 | $5,667.48 | $3,402.88 | $2,167.09 | $2,090.03 |

| WINTER | 54896 | $3,186.28 | $3,987.29 | $1,556.57 | $3,940.95 | $2,332.55 | $3,468.58 | $5,797.61 | $3,189.40 | $2,247.66 | $2,155.89 |

| FREDERIC | 54837 | $3,185.44 | $4,019.11 | $1,602.39 | $3,983.86 | $2,332.55 | $2,923.68 | $5,854.85 | $3,401.98 | $2,371.45 | $2,179.09 |

| TURTLE LAKE | 54889 | $3,183.00 | $4,027.10 | $1,608.64 | $3,983.86 | $2,332.55 | $3,468.58 | $5,667.48 | $3,204.05 | $2,264.72 | $2,090.03 |

| BIRCHWOOD | 54817 | $3,180.86 | $3,919.68 | $1,585.14 | $4,070.74 | $2,332.55 | $3,188.93 | $5,946.74 | $3,284.46 | $2,165.95 | $2,133.57 |

| AMERY | 54001 | $3,180.49 | $4,027.10 | $1,588.21 | $3,983.86 | $2,332.55 | $2,923.68 | $5,854.85 | $3,444.37 | $2,290.68 | $2,179.09 |

| ATHELSTANE | 54104 | $3,179.18 | $4,020.96 | $1,515.77 | $4,068.57 | $2,197.70 | $2,994.14 | $6,079.24 | $3,422.66 | $2,238.69 | $2,074.86 |

| EAST ELLSWORTH | 54010 | $3,176.88 | $4,028.40 | $1,723.89 | $3,889.57 | $2,224.73 | $2,923.68 | $5,702.33 | $3,865.35 | $2,116.33 | $2,117.64 |

| CLAYTON | 54004 | $3,176.66 | $3,937.43 | $1,610.71 | $3,983.86 | $2,332.55 | $2,923.68 | $5,854.85 | $3,494.67 | $2,273.09 | $2,179.09 |

| BALSAM LAKE | 54810 | $3,175.45 | $4,027.10 | $1,658.61 | $3,983.86 | $2,332.55 | $2,923.68 | $5,854.85 | $3,216.12 | $2,403.20 | $2,179.09 |

| DRESSER | 54009 | $3,175.41 | $4,027.10 | $1,670.82 | $3,983.86 | $2,332.55 | $2,923.68 | $5,854.85 | $3,283.90 | $2,322.83 | $2,179.09 |

| MILLTOWN | 54858 | $3,175.24 | $4,027.10 | $1,636.21 | $3,983.86 | $2,332.55 | $2,923.68 | $5,854.85 | $3,216.89 | $2,422.89 | $2,179.09 |

| HALES CORNERS | 53130 | $3,175.01 | $4,133.23 | $1,585.34 | $4,649.36 | $2,315.43 | $3,780.34 | $4,938.69 | $3,062.93 | $2,237.49 | $1,872.30 |

| BENOIT | 54816 | $3,174.78 | $3,987.29 | $1,585.14 | $3,837.41 | $2,332.55 | $2,975.06 | $6,047.98 | $3,507.01 | $2,144.72 | $2,155.89 |

| CENTURIA | 54824 | $3,174.47 | $4,027.10 | $1,658.61 | $3,983.86 | $2,332.55 | $2,923.68 | $5,854.85 | $3,198.37 | $2,412.13 | $2,179.09 |

| EXELAND | 54835 | $3,173.91 | $3,834.72 | $1,581.44 | $3,999.30 | $2,332.55 | $3,468.58 | $5,797.61 | $3,157.22 | $2,237.87 | $2,155.89 |

| GRANTSBURG | 54840 | $3,169.47 | $3,940.66 | $1,614.41 | $3,983.86 | $2,332.55 | $2,923.68 | $5,946.74 | $3,350.95 | $2,298.80 | $2,133.57 |

| LAONA | 54541 | $3,169.44 | $3,855.54 | $1,455.89 | $4,068.57 | $2,197.70 | $3,066.52 | $6,095.64 | $3,400.16 | $2,310.06 | $2,074.86 |

| STAR LAKE | 54561 | $3,169.22 | $4,017.69 | $1,478.72 | $3,704.70 | $2,197.70 | $2,984.27 | $6,095.64 | $3,821.65 | $2,147.61 | $2,075.05 |

| CRANDON | 54520 | $3,168.76 | $4,020.96 | $1,512.72 | $4,079.06 | $2,197.70 | $3,066.52 | $6,095.64 | $3,227.15 | $2,244.20 | $2,074.86 |

| WABENO | 54566 | $3,167.79 | $3,858.81 | $1,455.89 | $4,068.57 | $2,197.70 | $3,066.52 | $6,095.64 | $3,453.39 | $2,238.78 | $2,074.86 |

| AMBERG | 54102 | $3,167.75 | $4,019.83 | $1,583.64 | $4,068.57 | $2,197.70 | $2,994.14 | $6,079.24 | $3,294.96 | $2,196.78 | $2,074.86 |

| SOUTH MILWAUKEE | 53172 | $3,167.22 | $4,287.36 | $1,602.90 | $4,649.36 | $2,315.43 | $3,337.86 | $4,938.69 | $3,223.44 | $2,247.99 | $1,901.98 |

| WAUSAUKEE | 54177 | $3,167.04 | $4,019.83 | $1,512.30 | $4,068.57 | $2,197.70 | $2,994.14 | $6,079.24 | $3,423.46 | $2,133.23 | $2,074.86 |

| CUSHING | 54006 | $3,166.85 | $3,948.64 | $1,625.16 | $3,983.86 | $2,332.55 | $2,923.68 | $5,854.85 | $3,353.42 | $2,300.44 | $2,179.09 |

| SAINT CROIX FALLS | 54024 | $3,166.75 | $4,027.10 | $1,636.21 | $3,983.86 | $2,332.55 | $2,923.68 | $5,854.85 | $3,221.22 | $2,342.20 | $2,179.09 |

| FRANKLIN | 53132 | $3,166.57 | $3,990.40 | $1,550.27 | $4,649.36 | $2,315.43 | $3,780.34 | $4,938.69 | $3,191.87 | $2,207.22 | $1,875.54 |

| DUNBAR | 54119 | $3,166.21 | $4,019.83 | $1,583.64 | $4,068.57 | $2,197.70 | $2,994.14 | $6,079.24 | $3,292.57 | $2,185.31 | $2,074.86 |

| PRAIRIE FARM | 54762 | $3,166.04 | $3,866.55 | $1,644.59 | $3,983.86 | $2,332.55 | $3,188.93 | $5,667.48 | $3,468.81 | $2,251.56 | $2,090.03 |

| BARRON | 54812 | $3,163.50 | $3,929.45 | $1,538.24 | $3,983.86 | $2,332.55 | $3,188.93 | $5,667.48 | $3,519.80 | $2,221.12 | $2,090.03 |

| PEMBINE | 54156 | $3,162.82 | $4,019.83 | $1,583.64 | $4,068.57 | $2,197.70 | $2,994.14 | $6,079.24 | $3,246.95 | $2,200.47 | $2,074.86 |

| ARGONNE | 54511 | $3,160.06 | $4,017.69 | $1,484.53 | $4,079.06 | $2,197.70 | $2,984.27 | $6,095.64 | $3,334.80 | $2,172.03 | $2,074.86 |

| IRON RIVER | 54847 | $3,158.38 | $3,908.82 | $1,543.12 | $3,560.17 | $2,332.55 | $3,468.58 | $6,047.98 | $3,322.64 | $2,085.70 | $2,155.89 |

| OSCEOLA | 54020 | $3,157.88 | $4,009.30 | $1,639.11 | $3,846.72 | $2,332.55 | $2,923.68 | $5,854.85 | $3,374.80 | $2,260.84 | $2,179.09 |

| NIAGARA | 54151 | $3,157.72 | $4,019.83 | $1,500.36 | $4,068.57 | $2,197.70 | $2,994.14 | $6,079.24 | $3,260.71 | $2,224.10 | $2,074.86 |

| CABLE | 54821 | $3,157.36 | $3,995.26 | $1,564.19 | $3,569.87 | $2,332.55 | $2,975.06 | $6,047.98 | $3,626.57 | $2,148.84 | $2,155.89 |

| FENCE | 54120 | $3,156.82 | $4,017.69 | $1,500.36 | $4,068.57 | $2,197.70 | $3,066.52 | $6,079.24 | $3,167.58 | $2,238.86 | $2,074.86 |

| ALMENA | 54805 | $3,155.19 | $3,929.45 | $1,601.28 | $3,983.86 | $2,332.55 | $3,468.58 | $5,667.48 | $3,130.79 | $2,192.71 | $2,090.03 |

| CRIVITZ | 54114 | $3,153.54 | $3,860.93 | $1,503.86 | $4,068.57 | $2,197.70 | $2,994.14 | $6,079.24 | $3,493.05 | $2,109.56 | $2,074.86 |

| CAMERON | 54822 | $3,153.03 | $3,858.56 | $1,529.08 | $3,992.66 | $2,332.55 | $3,468.58 | $5,667.48 | $3,275.71 | $2,162.64 | $2,090.03 |

| BRISTOL | 53104 | $3,152.44 | $4,703.59 | $1,515.03 | $4,236.40 | $2,234.57 | $2,899.75 | $4,996.19 | $3,317.96 | $2,493.56 | $1,974.87 |

| BENET LAKE | 53102 | $3,151.62 | $3,911.84 | $1,506.23 | $4,192.57 | $2,234.57 | $2,899.75 | $4,996.19 | $4,241.09 | $2,407.47 | $1,974.87 |

| CALEDONIA | 53108 | $3,148.92 | $4,112.43 | $1,488.99 | $4,082.20 | $2,329.14 | $2,994.14 | $5,481.23 | $3,380.77 | $2,482.74 | $1,988.69 |

| WEYERHAEUSER | 54895 | $3,148.37 | $3,830.01 | $1,597.76 | $3,961.29 | $2,332.55 | $3,188.93 | $5,709.65 | $3,447.56 | $2,129.27 | $2,138.32 |

| ARKANSAW | 54721 | $3,146.10 | $3,838.73 | $1,685.98 | $3,874.78 | $2,218.81 | $3,188.93 | $5,748.46 | $3,475.56 | $2,229.98 | $2,053.64 |

| GOODMAN | 54125 | $3,145.13 | $4,017.69 | $1,583.64 | $4,068.57 | $2,197.70 | $2,994.14 | $6,079.24 | $3,217.84 | $2,072.49 | $2,074.86 |

| CLEAR LAKE | 54005 | $3,141.01 | $3,830.90 | $1,610.71 | $3,983.86 | $2,332.55 | $2,923.68 | $5,854.85 | $3,284.46 | $2,269.04 | $2,179.09 |

| DRUMMOND | 54832 | $3,140.81 | $3,908.82 | $1,564.19 | $3,613.26 | $2,332.55 | $2,975.06 | $6,047.98 | $3,472.69 | $2,196.84 | $2,155.89 |

| FLORENCE | 54121 | $3,138.63 | $4,019.83 | $1,479.79 | $4,068.57 | $2,197.70 | $2,994.14 | $6,079.24 | $3,147.59 | $2,185.93 | $2,074.86 |

| ARMSTRONG CREEK | 54103 | $3,137.69 | $3,855.54 | $1,583.64 | $4,068.57 | $2,197.70 | $3,066.52 | $6,095.64 | $3,152.06 | $2,144.72 | $2,074.86 |

| HERBSTER | 54844 | $3,136.16 | $3,987.29 | $1,565.06 | $3,613.26 | $2,332.55 | $2,975.06 | $6,047.98 | $3,403.61 | $2,144.72 | $2,155.89 |

| GRAND VIEW | 54839 | $3,135.20 | $3,987.29 | $1,543.12 | $3,613.26 | $2,332.55 | $2,975.06 | $6,047.98 | $3,453.21 | $2,108.47 | $2,155.89 |

| STAR PRAIRIE | 54026 | $3,134.53 | $4,027.10 | $1,670.82 | $3,658.98 | $2,339.49 | $2,923.68 | $5,854.85 | $3,317.67 | $2,239.07 | $2,179.09 |

| TISCH MILLS | 54240 | $3,133.51 | $3,495.40 | $1,310.34 | $3,660.81 | $1,968.65 | $2,416.89 | $4,175.53 | $7,590.37 | $1,967.67 | $1,615.95 |

| LONG LAKE | 54542 | $3,133.27 | $4,017.69 | $1,484.53 | $4,068.57 | $2,197.70 | $3,066.52 | $6,079.24 | $3,065.59 | $2,144.72 | $2,074.86 |

| BRUCE | 54819 | $3,132.23 | $3,830.01 | $1,597.77 | $3,961.29 | $2,332.55 | $3,188.93 | $5,709.65 | $3,280.91 | $2,150.62 | $2,138.32 |

| EAU GALLE | 54737 | $3,129.48 | $4,026.78 | $1,685.98 | $3,874.78 | $2,224.73 | $3,188.93 | $5,716.34 | $3,321.62 | $2,072.49 | $2,053.64 |

| PEPIN | 54759 | $3,128.61 | $3,838.73 | $1,685.98 | $3,734.75 | $2,218.81 | $3,188.93 | $5,748.46 | $3,466.20 | $2,221.94 | $2,053.64 |

| STOCKHOLM | 54769 | $3,128.57 | $3,838.73 | $1,728.86 | $3,595.30 | $2,218.81 | $3,188.93 | $5,748.46 | $3,711.87 | $2,072.49 | $2,053.64 |

| STURTEVANT | 53177 | $3,128.47 | $4,247.19 | $1,548.03 | $4,027.91 | $2,166.06 | $2,899.75 | $5,481.23 | $3,328.15 | $2,480.60 | $1,977.30 |

| BRULE | 54820 | $3,128.03 | $3,908.82 | $1,606.76 | $3,560.17 | $2,311.10 | $2,975.06 | $6,056.27 | $3,422.26 | $2,144.72 | $2,167.16 |

| DOWNSVILLE | 54735 | $3,123.85 | $4,028.40 | $1,666.13 | $3,915.27 | $2,224.73 | $2,839.95 | $5,716.34 | $3,597.67 | $2,072.49 | $2,053.64 |

| POPLAR | 54864 | $3,123.06 | $3,908.82 | $1,571.94 | $3,746.42 | $2,311.10 | $2,630.50 | $6,169.87 | $3,391.85 | $2,209.88 | $2,167.16 |

| MAPLE | 54854 | $3,123.02 | $3,908.82 | $1,571.94 | $3,746.42 | $2,311.10 | $2,630.50 | $6,056.27 | $3,557.79 | $2,157.19 | $2,167.16 |

| DURAND | 54736 | $3,121.61 | $3,837.23 | $1,641.54 | $3,843.39 | $2,218.81 | $3,188.93 | $5,748.46 | $3,368.10 | $2,194.43 | $2,053.64 |

| LAND O LAKES | 54540 | $3,117.21 | $4,017.69 | $1,467.69 | $3,739.96 | $2,197.70 | $2,984.27 | $6,095.64 | $3,271.16 | $2,205.71 | $2,075.05 |

| COLEMAN | 54112 | $3,116.72 | $3,992.66 | $1,490.26 | $4,062.03 | $2,038.64 | $2,994.14 | $6,079.24 | $3,212.51 | $2,106.12 | $2,074.86 |

| LAKE NEBAGAMON | 54849 | $3,116.41 | $3,908.82 | $1,571.94 | $3,746.42 | $2,311.10 | $2,630.50 | $6,056.27 | $3,478.88 | $2,176.62 | $2,167.16 |

| LIME RIDGE | 53942 | $3,113.65 | $3,646.74 | $1,517.46 | $4,361.82 | $2,027.16 | $2,903.72 | $5,496.77 | $4,062.90 | $2,016.73 | $1,989.55 |

| PORT WING | 54865 | $3,113.07 | $3,908.82 | $1,565.06 | $3,560.17 | $2,332.55 | $2,975.06 | $6,047.98 | $3,346.70 | $2,125.41 | $2,155.89 |

| GILMANTON | 54743 | $3,111.12 | $3,663.64 | $1,612.00 | $3,947.96 | $2,218.81 | $3,188.93 | $5,656.11 | $3,603.36 | $2,072.49 | $2,036.74 |

| EAGLE RIVER | 54521 | $3,110.30 | $4,017.69 | $1,464.79 | $3,914.82 | $2,197.70 | $2,984.27 | $6,095.64 | $3,096.02 | $2,146.71 | $2,075.05 |

| DALLAS | 54733 | $3,109.94 | $3,866.55 | $1,644.59 | $3,792.99 | $2,332.55 | $3,188.93 | $5,667.48 | $3,212.89 | $2,193.43 | $2,090.03 |

| HOLCOMBE | 54745 | $3,109.73 | $3,654.61 | $1,567.57 | $3,764.47 | $2,224.73 | $3,188.93 | $5,707.58 | $3,486.72 | $2,254.65 | $2,138.32 |

| PHELPS | 54554 | $3,108.01 | $4,017.69 | $1,467.69 | $3,914.82 | $2,197.70 | $2,984.27 | $6,095.64 | $3,037.58 | $2,181.61 | $2,075.05 |

| SOLON SPRINGS | 54873 | $3,107.98 | $3,908.82 | $1,606.76 | $3,746.42 | $2,311.10 | $2,630.50 | $6,056.27 | $3,344.10 | $2,200.66 | $2,167.16 |

| SOUTH RANGE | 54874 | $3,107.87 | $3,908.82 | $1,576.27 | $3,746.42 | $2,311.10 | $2,630.50 | $6,169.87 | $3,280.24 | $2,180.42 | $2,167.16 |

| MASON | 54856 | $3,106.69 | $3,987.29 | $1,543.12 | $3,613.26 | $2,332.55 | $2,975.06 | $6,047.98 | $3,195.29 | $2,109.82 | $2,155.89 |

| PRESQUE ISLE | 54557 | $3,106.04 | $4,157.43 | $1,478.72 | $3,687.55 | $2,197.70 | $2,984.27 | $6,095.64 | $3,133.23 | $2,144.72 | $2,075.05 |

| SAINT GERMAIN | 54558 | $3,103.68 | $4,017.69 | $1,464.79 | $3,739.96 | $2,197.70 | $2,984.27 | $6,095.64 | $3,201.90 | $2,156.12 | $2,075.05 |

| NELSON | 54756 | $3,103.37 | $3,811.58 | $1,669.83 | $3,874.78 | $2,218.81 | $3,188.93 | $5,656.11 | $3,256.07 | $2,217.44 | $2,036.74 |

| CHETEK | 54728 | $3,103.26 | $3,837.99 | $1,539.26 | $3,792.99 | $2,332.55 | $3,188.93 | $5,667.48 | $3,318.84 | $2,161.31 | $2,090.03 |

| MAIDEN ROCK | 54750 | $3,100.50 | $4,028.40 | $1,728.86 | $3,683.71 | $2,224.73 | $3,188.93 | $5,702.33 | $3,064.38 | $2,165.55 | $2,117.64 |

| CORNELL | 54732 | $3,096.25 | $3,657.65 | $1,561.36 | $3,764.47 | $2,224.73 | $3,188.93 | $5,707.58 | $3,335.46 | $2,287.78 | $2,138.32 |

| GILE | 54525 | $3,094.70 | $3,987.29 | $1,482.28 | $3,977.01 | $2,332.55 | $2,984.27 | $6,095.64 | $2,786.59 | $2,131.63 | $2,075.05 |

| DEER PARK | 54007 | $3,093.60 | $3,752.25 | $1,617.32 | $3,796.14 | $2,325.28 | $2,923.68 | $5,661.01 | $3,423.56 | $2,178.24 | $2,164.95 |

| UPSON | 54565 | $3,093.49 | $3,987.29 | $1,499.48 | $3,444.56 | $2,332.55 | $2,984.27 | $6,095.64 | $3,277.89 | $2,144.72 | $2,075.05 |

| CONOVER | 54519 | $3,093.28 | $4,017.69 | $1,467.69 | $3,739.96 | $2,197.70 | $2,984.27 | $6,095.64 | $3,084.63 | $2,176.88 | $2,075.05 |

| PLUM CITY | 54761 | $3,091.64 | $3,838.73 | $1,728.86 | $3,595.30 | $2,224.73 | $3,188.93 | $5,702.33 | $3,264.24 | $2,163.99 | $2,117.64 |

| SAYNER | 54560 | $3,089.52 | $4,017.69 | $1,459.41 | $3,739.96 | $2,197.70 | $2,984.27 | $6,095.64 | $3,091.28 | $2,144.72 | $2,075.05 |

| RIDGELAND | 54763 | $3,088.15 | $3,656.14 | $1,663.24 | $3,873.91 | $2,224.73 | $3,188.93 | $5,716.34 | $3,310.37 | $2,106.04 | $2,053.64 |

| BOULDER JUNCTION | 54512 | $3,087.72 | $4,017.69 | $1,478.72 | $3,739.96 | $2,197.70 | $2,984.27 | $6,095.64 | $3,100.70 | $2,099.71 | $2,075.05 |

| MILLSTON | 54643 | $3,087.51 | $3,778.25 | $1,542.19 | $3,888.20 | $2,218.81 | $2,907.22 | $5,563.37 | $3,705.22 | $2,147.56 | $2,036.74 |

| POUND | 54161 | $3,086.59 | $3,790.05 | $1,515.77 | $4,062.03 | $2,038.64 | $2,994.14 | $6,079.24 | $3,120.36 | $2,104.22 | $2,074.86 |

| NEW AUBURN | 54757 | $3,085.70 | $3,648.51 | $1,620.09 | $3,764.47 | $2,224.73 | $3,188.93 | $5,707.58 | $3,338.82 | $2,139.88 | $2,138.32 |

| LADYSMITH | 54848 | $3,085.02 | $3,834.72 | $1,496.86 | $3,961.29 | $2,332.55 | $3,022.09 | $5,709.65 | $3,079.88 | $2,189.79 | $2,138.32 |

| NEW MUNSTER | 53152 | $3,084.82 | $3,911.84 | $1,491.12 | $3,881.64 | $2,234.57 | $3,179.81 | $4,996.19 | $3,441.20 | $2,407.47 | $2,219.53 |

| MC NAUGHTON | 54543 | $3,084.73 | $4,017.69 | $1,484.53 | $3,715.83 | $2,197.70 | $3,253.88 | $5,308.53 | $3,558.12 | $2,144.72 | $2,081.61 |

| MANITOWISH WATERS | 54545 | $3,083.34 | $4,017.69 | $1,478.72 | $3,687.55 | $2,197.70 | $2,984.27 | $6,095.64 | $3,089.21 | $2,124.18 | $2,075.05 |

| MERCER | 54547 | $3,083.11 | $4,149.45 | $1,498.34 | $3,687.55 | $2,332.55 | $2,984.27 | $6,095.64 | $2,829.16 | $2,096.00 | $2,075.05 |

| CONRATH | 54731 | $3,082.87 | $3,784.64 | $1,589.25 | $3,918.92 | $2,332.55 | $3,022.09 | $5,709.65 | $3,024.05 | $2,226.36 | $2,138.32 |

| GLIDDEN | 54527 | $3,082.70 | $3,987.29 | $1,491.02 | $3,660.59 | $2,332.55 | $2,984.27 | $6,047.98 | $2,929.64 | $2,155.05 | $2,155.89 |

| ELMWOOD | 54740 | $3,081.99 | $3,838.73 | $1,675.45 | $3,658.98 | $2,224.73 | $3,188.93 | $5,716.34 | $3,185.85 | $2,195.27 | $2,053.64 |

| HIGH BRIDGE | 54846 | $3,079.88 | $3,987.29 | $1,501.35 | $3,569.87 | $2,332.55 | $2,975.06 | $6,047.98 | $3,040.01 | $2,108.91 | $2,155.89 |

| MARENGO | 54855 | $3,078.74 | $3,987.29 | $1,501.35 | $3,613.26 | $2,332.55 | $2,984.27 | $6,047.98 | $2,941.33 | $2,144.72 | $2,155.89 |

| ODANAH | 54861 | $3,076.51 | $3,987.29 | $1,519.24 | $3,837.41 | $2,332.55 | $2,975.06 | $6,047.98 | $2,688.43 | $2,144.72 | $2,155.89 |

| PORTERFIELD | 54159 | $3,075.16 | $3,790.05 | $1,486.70 | $4,103.67 | $2,197.70 | $2,994.14 | $6,079.24 | $2,878.09 | $2,072.03 | $2,074.86 |

| SHELDON | 54766 | $3,072.83 | $3,784.64 | $1,589.25 | $3,572.75 | $2,332.55 | $3,022.09 | $5,709.65 | $3,253.83 | $2,252.36 | $2,138.32 |

| DOWNING | 54734 | $3,072.32 | $3,520.55 | $1,666.13 | $3,796.14 | $2,224.73 | $3,188.93 | $5,716.34 | $3,411.94 | $2,072.49 | $2,053.64 |

| GLEN FLORA | 54526 | $3,071.95 | $3,924.38 | $1,548.04 | $3,552.41 | $2,332.55 | $3,022.09 | $5,709.65 | $3,143.45 | $2,276.70 | $2,138.32 |

| CORNUCOPIA | 54827 | $3,071.87 | $3,987.29 | $1,565.06 | $3,613.26 | $2,332.55 | $2,975.06 | $6,047.98 | $2,825.03 | $2,144.72 | $2,155.89 |

| BASSETT | 53101 | $3,070.35 | $3,911.84 | $1,506.23 | $3,898.42 | $2,234.57 | $3,179.81 | $4,996.19 | $3,523.78 | $2,407.47 | $1,974.87 |

| SUPERIOR | 54880 | $3,070.33 | $3,908.82 | $1,576.27 | $3,746.42 | $2,311.10 | $2,630.50 | $6,169.87 | $2,934.82 | $2,188.01 | $2,167.16 |

| SAXON | 54559 | $3,068.86 | $3,987.29 | $1,499.48 | $3,569.87 | $2,332.55 | $2,984.27 | $6,095.64 | $2,930.84 | $2,144.72 | $2,075.05 |

| TONY | 54563 | $3,066.66 | $3,784.64 | $1,548.04 | $3,940.95 | $2,332.55 | $3,022.09 | $5,709.65 | $2,892.62 | $2,231.09 | $2,138.32 |

| NESHKORO | 54960 | $3,065.74 | $4,079.40 | $1,540.38 | $3,918.00 | $2,303.57 | $3,175.17 | $5,606.62 | $2,946.37 | $2,090.68 | $1,931.46 |

| HUSTLER | 54637 | $3,065.24 | $3,931.68 | $1,548.94 | $4,006.72 | $2,066.91 | $2,903.72 | $5,466.29 | $3,544.81 | $2,072.49 | $2,045.62 |

| MELLEN | 54546 | $3,064.90 | $3,987.29 | $1,504.02 | $3,535.43 | $2,332.55 | $2,975.06 | $6,047.98 | $2,916.46 | $2,129.45 | $2,155.89 |

| TREVOR | 53179 | $3,064.09 | $3,911.84 | $1,538.29 | $4,236.40 | $2,234.57 | $3,179.81 | $4,996.19 | $3,159.52 | $2,345.34 | $1,974.87 |

| PIGEON FALLS | 54760 | $3,063.18 | $3,742.58 | $1,580.16 | $3,641.11 | $2,218.81 | $2,907.22 | $5,563.37 | $3,731.10 | $2,147.56 | $2,036.74 |

| ELTON | 54430 | $3,062.96 | $3,987.25 | $1,485.41 | $4,021.19 | $2,197.70 | $3,066.52 | $5,308.53 | $3,453.39 | $2,072.49 | $1,974.19 |

| HURLEY | 54534 | $3,062.86 | $3,987.29 | $1,499.48 | $3,660.59 | $2,332.55 | $2,984.27 | $6,095.64 | $2,783.00 | $2,147.85 | $2,075.05 |

| STANLEY | 54768 | $3,062.38 | $3,565.64 | $1,578.70 | $3,803.52 | $2,224.73 | $3,188.93 | $5,707.58 | $3,080.91 | $2,273.09 | $2,138.32 |

| BELDENVILLE | 54003 | $3,061.79 | $3,830.90 | $1,728.86 | $3,796.14 | $2,224.73 | $2,923.68 | $5,702.33 | $3,115.50 | $2,116.33 | $2,117.64 |

| BUTTERNUT | 54514 | $3,060.84 | $3,987.29 | $1,491.02 | $3,566.17 | $2,332.55 | $2,984.27 | $6,047.98 | $2,809.79 | $2,172.57 | $2,155.89 |

| IRON BELT | 54536 | $3,060.77 | $3,987.29 | $1,499.48 | $3,660.59 | $2,332.55 | $2,984.27 | $6,095.64 | $2,767.32 | $2,144.72 | $2,075.05 |

| BOYCEVILLE | 54725 | $3,059.71 | $3,519.04 | $1,616.52 | $3,935.60 | $2,224.73 | $3,188.93 | $5,716.34 | $3,092.11 | $2,190.46 | $2,053.64 |

| PEARSON | 54462 | $3,059.56 | $4,017.69 | $1,478.56 | $4,120.68 | $2,197.70 | $3,066.52 | $5,308.53 | $3,217.88 | $2,154.27 | $1,974.19 |

| MOUNT STERLING | 54645 | $3,057.54 | $3,674.86 | $1,624.28 | $3,888.20 | $2,079.58 | $2,847.00 | $5,524.44 | $3,800.27 | $2,016.73 | $2,062.55 |

| BAY CITY | 54723 | $3,057.48 | $4,028.40 | $1,689.97 | $3,658.98 | $2,224.73 | $2,923.68 | $5,702.33 | $3,070.78 | $2,100.84 | $2,117.64 |

| MONTREAL | 54550 | $3,055.79 | $3,987.29 | $1,482.28 | $3,660.59 | $2,332.55 | $2,984.27 | $6,095.64 | $2,758.34 | $2,126.11 | $2,075.05 |

| WHEELER | 54772 | $3,055.21 | $3,628.48 | $1,663.24 | $3,792.99 | $2,224.73 | $2,923.68 | $5,716.34 | $3,354.99 | $2,138.78 | $2,053.64 |

| LUBLIN | 54447 | $3,054.66 | $3,776.58 | $1,557.59 | $3,639.36 | $2,332.55 | $3,022.09 | $5,797.61 | $3,147.07 | $2,141.46 | $2,077.64 |

| PESHTIGO | 54157 | $3,054.00 | $3,992.66 | $1,409.08 | $3,631.01 | $2,197.70 | $2,994.14 | $6,079.24 | $3,069.46 | $2,037.86 | $2,074.86 |

| TUNNEL CITY | 54662 | $3,053.36 | $3,721.02 | $1,525.46 | $3,888.20 | $2,079.58 | $3,040.01 | $5,466.29 | $3,411.64 | $2,147.56 | $2,200.45 |

| ALMA | 54610 | $3,052.25 | $3,491.89 | $1,642.97 | $3,843.39 | $2,218.81 | $3,188.93 | $5,656.11 | $3,176.31 | $2,215.11 | $2,036.74 |

| FAIRCHILD | 54741 | $3,051.76 | $3,742.58 | $1,605.87 | $3,585.46 | $2,224.73 | $2,907.22 | $5,707.58 | $3,355.25 | $2,198.78 | $2,138.32 |

| BAYFIELD | 54814 | $3,051.75 | $3,987.29 | $1,488.23 | $3,613.26 | $2,332.55 | $2,975.06 | $6,047.98 | $2,857.80 | $2,007.69 | $2,155.89 |

| GILMAN | 54433 | $3,051.54 | $3,607.30 | $1,557.59 | $3,572.75 | $2,332.55 | $3,022.09 | $5,797.61 | $3,294.11 | $2,202.23 | $2,077.64 |

| AUGUSTA | 54722 | $3,048.63 | $3,567.18 | $1,651.48 | $3,489.60 | $2,224.73 | $3,188.93 | $5,707.58 | $3,196.60 | $2,273.21 | $2,138.32 |

| KNAPP | 54749 | $3,048.42 | $3,692.20 | $1,616.52 | $3,935.60 | $2,224.73 | $2,923.68 | $5,716.34 | $3,077.22 | $2,195.89 | $2,053.64 |

| GLEASON | 54435 | $3,047.58 | $3,847.46 | $1,473.64 | $3,801.33 | $2,197.70 | $3,022.09 | $5,797.61 | $3,085.60 | $2,125.15 | $2,077.64 |

| HANCOCK | 54943 | $3,047.30 | $3,728.58 | $1,518.93 | $3,918.00 | $2,303.57 | $3,175.17 | $5,606.62 | $3,112.54 | $2,130.86 | $1,931.46 |

| MENOMONIE | 54751 | $3,047.11 | $3,838.73 | $1,736.67 | $3,795.86 | $2,224.73 | $2,839.95 | $5,716.34 | $3,038.13 | $2,179.97 | $2,053.64 |

| COLOMA | 54930 | $3,046.85 | $3,849.85 | $1,518.93 | $3,918.00 | $2,303.57 | $3,187.42 | $5,606.62 | $2,995.91 | $2,109.89 | $1,931.46 |

| WOODRUFF | 54568 | $3,046.77 | $3,855.54 | $1,459.41 | $3,739.96 | $2,197.70 | $2,984.27 | $6,095.64 | $2,996.72 | $2,016.65 | $2,075.05 |

| BOYD | 54726 | $3,045.51 | $3,776.58 | $1,578.70 | $3,579.42 | $2,224.73 | $3,022.09 | $5,707.58 | $3,118.24 | $2,263.95 | $2,138.32 |

| LAC DU FLAMBEAU | 54538 | $3,045.48 | $3,847.54 | $1,515.09 | $3,687.55 | $2,197.70 | $2,984.27 | $6,095.64 | $3,016.00 | $1,990.45 | $2,075.05 |

| OSSEO | 54758 | $3,044.45 | $3,742.58 | $1,565.98 | $3,575.34 | $2,218.81 | $2,907.22 | $5,707.58 | $3,293.29 | $2,250.92 | $2,138.32 |

| PICKEREL | 54465 | $3,043.52 | $3,855.54 | $1,485.41 | $4,120.68 | $2,197.70 | $3,066.52 | $5,308.53 | $3,310.62 | $2,072.49 | $1,974.19 |

| WESTFIELD | 53964 | $3,043.40 | $3,903.09 | $1,536.67 | $3,918.00 | $2,238.23 | $3,187.42 | $5,404.24 | $3,127.67 | $2,143.80 | $1,931.46 |

| STRUM | 54770 | $3,042.80 | $3,663.64 | $1,599.71 | $3,665.94 | $2,218.81 | $3,188.93 | $5,563.37 | $3,224.58 | $2,223.52 | $2,036.74 |

| GAYS MILLS | 54631 | $3,040.66 | $3,674.86 | $1,586.52 | $3,831.43 | $2,079.58 | $2,847.00 | $5,524.44 | $3,539.23 | $2,220.29 | $2,062.55 |

| TOMAHAWK | 54487 | $3,040.39 | $3,855.54 | $1,474.01 | $3,796.28 | $2,197.70 | $3,253.88 | $5,797.61 | $2,853.29 | $2,057.59 | $2,077.64 |

| ELCHO | 54428 | $3,039.98 | $3,847.46 | $1,478.56 | $4,120.68 | $2,197.70 | $3,066.52 | $5,308.53 | $3,222.49 | $2,143.72 | $1,974.19 |

| PELICAN LAKE | 54463 | $3,038.80 | $3,855.54 | $1,445.47 | $4,079.06 | $2,197.70 | $3,066.52 | $5,308.53 | $3,107.70 | $2,207.09 | $2,081.61 |

| MONTELLO | 53949 | $3,038.07 | $3,813.34 | $1,530.92 | $3,918.00 | $2,238.23 | $3,187.42 | $5,404.24 | $3,128.36 | $2,190.73 | $1,931.46 |

| WASHBURN | 54891 | $3,037.68 | $3,987.29 | $1,440.91 | $3,613.26 | $2,332.55 | $2,975.06 | $6,047.98 | $2,846.24 | $1,939.91 | $2,155.89 |

| CADOTT | 54727 | $3,037.39 | $3,567.18 | $1,578.70 | $3,579.42 | $2,224.73 | $3,188.93 | $5,707.58 | $3,035.65 | $2,315.99 | $2,138.32 |

| BRIGGSVILLE | 53920 | $3,037.12 | $3,817.65 | $1,527.14 | $3,983.04 | $2,288.84 | $3,187.42 | $5,404.24 | $3,044.49 | $2,149.78 | $1,931.46 |

| BUTLER | 53007 | $3,035.20 | $4,035.19 | $1,736.20 | $3,897.19 | $2,115.64 | $3,161.27 | $4,407.99 | $3,680.51 | $2,510.48 | $1,772.36 |

| GLENWOOD CITY | 54013 | $3,034.28 | $3,520.55 | $1,666.13 | $3,796.14 | $2,224.73 | $2,923.68 | $5,661.01 | $3,193.26 | $2,158.09 | $2,164.95 |

| CATARACT | 54620 | $3,033.66 | $3,742.58 | $1,562.78 | $3,888.20 | $2,079.58 | $2,907.22 | $5,466.29 | $3,456.18 | $2,147.56 | $2,052.54 |

| ELLSWORTH | 54011 | $3,033.50 | $3,838.73 | $1,723.89 | $3,658.98 | $2,224.73 | $2,923.68 | $5,702.33 | $3,065.55 | $2,045.97 | $2,117.64 |

| MELROSE | 54642 | $3,032.95 | $3,750.13 | $1,566.99 | $3,620.60 | $2,218.81 | $2,907.22 | $5,563.37 | $3,336.66 | $2,295.99 | $2,036.74 |

| LA POINTE | 54850 | $3,032.23 | $3,987.29 | $1,499.41 | $3,613.26 | $2,332.55 | $2,975.06 | $6,047.98 | $2,652.05 | $2,026.61 | $2,155.89 |

| OXFORD | 53952 | $3,032.15 | $3,817.65 | $1,541.79 | $3,983.04 | $2,238.23 | $2,903.72 | $5,382.83 | $3,333.19 | $2,157.44 | $1,931.46 |

| BLAIR | 54616 | $3,031.35 | $3,742.58 | $1,597.29 | $3,515.69 | $2,218.81 | $2,907.22 | $5,563.37 | $3,487.55 | $2,212.91 | $2,036.74 |

| MATHER | 54641 | $3,031.21 | $3,925.12 | $1,542.19 | $3,684.87 | $2,066.91 | $2,903.72 | $5,466.29 | $3,573.71 | $2,072.49 | $2,045.62 |

| INDEPENDENCE | 54747 | $3,030.49 | $3,750.13 | $1,551.24 | $3,596.35 | $2,218.81 | $2,907.22 | $5,563.37 | $3,448.90 | $2,201.65 | $2,036.74 |

| THREE LAKES | 54562 | $3,030.21 | $4,017.69 | $1,470.73 | $4,079.06 | $2,197.70 | $2,984.27 | $5,308.53 | $3,016.70 | $2,115.59 | $2,081.61 |

| PHILLIPS | 54555 | $3,025.01 | $3,847.54 | $1,484.48 | $3,662.60 | $2,332.55 | $3,022.09 | $5,797.61 | $2,856.01 | $2,144.61 | $2,077.64 |

| WESTBORO | 54490 | $3,022.99 | $3,784.64 | $1,514.72 | $3,620.79 | $2,332.55 | $3,022.09 | $5,797.61 | $3,019.65 | $2,037.20 | $2,077.64 |

| UNION CENTER | 53962 | $3,022.58 | $3,646.74 | $1,457.05 | $4,084.90 | $2,066.91 | $2,903.72 | $5,466.29 | $3,459.46 | $2,072.49 | $2,045.62 |

| GRAND MARSH | 53936 | $3,022.23 | $3,903.09 | $1,522.15 | $3,918.00 | $2,166.37 | $3,022.09 | $5,382.83 | $3,190.44 | $2,163.62 | $1,931.46 |

| MARINETTE | 54143 | $3,021.94 | $3,992.66 | $1,486.70 | $3,631.01 | $2,197.70 | $2,994.14 | $6,079.24 | $2,751.10 | $1,990.03 | $2,074.86 |

| WILSON | 54027 | $3,021.45 | $3,692.20 | $1,666.13 | $3,796.14 | $2,026.12 | $2,923.68 | $5,661.01 | $3,147.96 | $2,139.65 | $2,140.14 |

| SOMERSET | 54025 | $3,020.09 | $3,735.38 | $1,646.25 | $3,658.98 | $2,152.44 | $2,923.68 | $5,661.01 | $3,138.72 | $2,099.42 | $2,164.95 |

| RIB LAKE | 54470 | $3,018.76 | $3,776.58 | $1,514.72 | $3,561.38 | $2,332.55 | $3,022.09 | $5,797.61 | $3,003.08 | $2,083.19 | $2,077.64 |

| BRANTWOOD | 54513 | $3,018.09 | $3,776.67 | $1,491.03 | $3,655.15 | $2,332.55 | $3,022.09 | $5,797.61 | $2,901.68 | $2,108.36 | $2,077.64 |

| HILLSBORO | 54634 | $3,017.83 | $3,646.74 | $1,542.59 | $4,066.09 | $2,066.91 | $2,903.72 | $5,524.86 | $3,198.40 | $2,158.65 | $2,052.54 |

| DELLWOOD | 53927 | $3,017.22 | $3,646.74 | $1,563.60 | $3,988.11 | $2,166.37 | $3,022.09 | $5,382.83 | $3,381.25 | $2,072.49 | $1,931.46 |

| OGEMA | 54459 | $3,016.83 | $3,776.67 | $1,491.03 | $3,599.80 | $2,332.55 | $3,022.09 | $5,797.61 | $2,959.85 | $2,094.30 | $2,077.64 |

| SALEM | 53168 | $3,016.78 | $3,911.84 | $1,538.29 | $3,918.02 | $2,234.57 | $3,179.81 | $4,996.19 | $3,173.71 | $2,376.95 | $1,821.68 |

| PRENTICE | 54556 | $3,016.57 | $3,776.67 | $1,510.80 | $3,599.80 | $2,332.55 | $2,984.27 | $5,797.61 | $2,952.54 | $2,117.28 | $2,077.64 |

| IOLA | 54945 | $3,016.40 | $3,844.90 | $1,390.65 | $3,780.45 | $2,313.96 | $3,066.52 | $5,508.54 | $3,172.62 | $2,122.48 | $1,947.50 |

| HAWKINS | 54530 | $3,016.26 | $3,784.64 | $1,556.57 | $3,552.41 | $2,332.55 | $3,022.09 | $5,709.65 | $2,977.60 | $2,072.49 | $2,138.32 |

| LYNDON STATION | 53944 | $3,016.21 | $3,817.65 | $1,504.66 | $3,983.04 | $2,066.91 | $2,903.72 | $5,496.77 | $3,366.87 | $2,016.76 | $1,989.55 |

| LOGANVILLE | 53943 | $3,015.92 | $3,903.09 | $1,571.63 | $3,953.21 | $2,027.16 | $2,903.72 | $5,496.77 | $3,305.17 | $1,993.04 | $1,989.55 |

| WILD ROSE | 54984 | $3,015.91 | $3,873.02 | $1,485.80 | $3,743.50 | $2,303.57 | $3,175.17 | $5,606.62 | $2,985.11 | $2,038.92 | $1,931.46 |

| ASHLAND | 54806 | $3,015.90 | $3,987.29 | $1,505.67 | $3,613.26 | $2,332.55 | $2,975.06 | $6,047.98 | $2,429.46 | $2,096.00 | $2,155.89 |

| PLAINFIELD | 54966 | $3,015.62 | $3,849.85 | $1,415.83 | $3,780.45 | $2,303.57 | $3,175.17 | $5,606.62 | $2,961.95 | $2,115.68 | $1,931.46 |

| FIFIELD | 54524 | $3,015.58 | $3,847.54 | $1,476.16 | $3,566.17 | $2,332.55 | $3,022.09 | $5,797.61 | $2,902.56 | $2,117.90 | $2,077.64 |

| WHITE LAKE | 54491 | $3,015.37 | $3,990.52 | $1,485.41 | $4,062.03 | $2,197.70 | $3,066.52 | $5,308.53 | $2,979.74 | $2,073.75 | $1,974.19 |

| NEW RICHMOND | 54017 | $3,015.30 | $3,735.38 | $1,581.76 | $3,658.98 | $2,152.44 | $2,923.68 | $5,661.01 | $3,170.91 | $2,088.60 | $2,164.95 |

| SILVER LAKE | 53170 | $3,014.65 | $3,911.84 | $1,455.24 | $4,142.71 | $2,234.57 | $3,179.81 | $4,996.19 | $3,068.40 | $2,321.39 | $1,821.68 |

| SOLDIERS GROVE | 54655 | $3,014.44 | $3,674.86 | $1,586.52 | $3,831.43 | $2,079.58 | $2,847.00 | $5,524.44 | $3,313.99 | $2,209.60 | $2,062.55 |

| MONDOVI | 54755 | $3,014.35 | $3,491.89 | $1,617.90 | $3,665.94 | $2,218.81 | $3,188.93 | $5,656.11 | $3,005.18 | $2,247.67 | $2,036.74 |

| MERRILLAN | 54754 | $3,013.94 | $3,778.25 | $1,532.26 | $3,645.25 | $2,218.81 | $3,040.01 | $5,563.37 | $3,049.94 | $2,260.87 | $2,036.74 |

| WILMOT | 53192 | $3,013.66 | $3,911.84 | $1,503.77 | $3,898.42 | $2,234.57 | $3,179.81 | $4,996.19 | $3,169.19 | $2,407.47 | $1,821.68 |

| ALMA CENTER | 54611 | $3,012.79 | $3,778.25 | $1,532.26 | $3,595.38 | $2,218.81 | $3,040.01 | $5,563.37 | $3,109.01 | $2,241.28 | $2,036.74 |

| HARSHAW | 54529 | $3,012.25 | $4,017.69 | $1,481.18 | $3,914.82 | $2,197.70 | $2,984.27 | $5,308.53 | $3,025.59 | $2,098.85 | $2,081.61 |

| SUMMIT LAKE | 54485 | $3,012.18 | $3,847.46 | $1,478.56 | $4,120.68 | $2,197.70 | $3,066.52 | $5,308.53 | $2,984.33 | $2,131.66 | $1,974.19 |

| CAZENOVIA | 53924 | $3,012.16 | $3,712.25 | $1,578.85 | $4,057.63 | $2,027.16 | $2,903.72 | $5,496.77 | $3,226.02 | $2,044.54 | $2,062.55 |

| MARION | 54950 | $3,011.86 | $3,992.66 | $1,467.59 | $3,586.20 | $2,313.96 | $3,066.52 | $5,508.54 | $3,047.45 | $2,176.35 | $1,947.50 |

| ENDEAVOR | 53930 | $3,011.63 | $3,747.84 | $1,527.14 | $3,983.04 | $2,238.23 | $3,187.42 | $5,404.24 | $2,936.06 | $2,149.24 | $1,931.46 |

| POY SIPPI | 54967 | $3,011.57 | $3,516.79 | $1,473.20 | $3,796.88 | $2,303.57 | $2,903.72 | $5,606.62 | $3,499.36 | $2,072.49 | $1,931.46 |

| HIXTON | 54635 | $3,011.53 | $3,742.58 | $1,605.87 | $3,627.59 | $2,218.81 | $3,040.01 | $5,563.37 | $3,042.93 | $2,225.88 | $2,036.74 |

| DEERBROOK | 54424 | $3,010.52 | $3,847.46 | $1,461.42 | $4,147.49 | $2,197.70 | $3,066.52 | $5,308.53 | $2,930.90 | $2,160.50 | $1,974.19 |

| PARK FALLS | 54552 | $3,009.86 | $3,847.54 | $1,414.87 | $3,566.17 | $2,332.55 | $2,984.27 | $5,797.61 | $2,938.01 | $2,130.13 | $2,077.64 |

| IRMA | 54442 | $3,009.84 | $3,776.58 | $1,463.31 | $3,796.28 | $2,197.70 | $3,022.09 | $5,797.61 | $2,833.01 | $2,124.38 | $2,077.64 |

| CATAWBA | 54515 | $3,009.79 | $3,776.67 | $1,510.80 | $3,552.41 | $2,332.55 | $3,022.09 | $5,797.61 | $2,859.89 | $2,158.49 | $2,077.64 |

| RHINELANDER | 54501 | $3,009.15 | $4,017.69 | $1,414.52 | $3,759.69 | $2,197.70 | $3,253.88 | $5,308.53 | $2,915.99 | $2,132.70 | $2,081.61 |

| READSTOWN | 54652 | $3,008.63 | $3,674.86 | $1,555.62 | $3,869.19 | $2,079.58 | $2,847.00 | $5,524.86 | $3,208.82 | $2,265.23 | $2,052.54 |

| BIRNAMWOOD | 54414 | $3,008.09 | $3,779.85 | $1,478.37 | $3,783.00 | $2,313.96 | $3,066.52 | $5,008.89 | $3,417.24 | $2,250.75 | $1,974.19 |

| FRANKSVILLE | 53126 | $3,008.02 | $3,929.97 | $1,514.03 | $4,082.20 | $2,234.57 | $2,635.76 | $4,930.45 | $3,344.95 | $2,411.53 | $1,988.69 |

| KESHENA | 54135 | $3,007.93 | $3,899.69 | $1,498.90 | $4,062.03 | $2,070.85 | $3,066.52 | $5,660.12 | $2,773.02 | $2,066.07 | $1,974.19 |

| NEOPIT | 54150 | $3,007.11 | $3,990.52 | $1,452.91 | $3,701.82 | $2,313.96 | $3,066.52 | $5,660.12 | $2,831.42 | $2,072.49 | $1,974.19 |

| CAMP DOUGLAS | 54618 | $3,006.85 | $3,931.68 | $1,548.94 | $3,753.10 | $2,066.91 | $2,903.72 | $5,466.29 | $3,165.85 | $2,179.54 | $2,045.62 |

| COCHRANE | 54622 | $3,006.20 | $3,574.10 | $1,642.97 | $3,583.85 | $2,218.81 | $3,188.93 | $5,656.11 | $2,982.70 | $2,171.60 | $2,036.74 |

| SPRING VALLEY | 54767 | $3,005.35 | $3,520.55 | $1,676.61 | $3,658.98 | $2,224.73 | $2,923.68 | $5,702.33 | $3,119.28 | $2,104.34 | $2,117.64 |

| COLFAX | 54730 | $3,005.20 | $3,567.18 | $1,588.05 | $3,489.60 | $2,224.73 | $3,188.93 | $5,716.34 | $3,098.54 | $2,119.79 | $2,053.64 |

| MERRILL | 54452 | $3,005.10 | $3,776.58 | $1,473.64 | $3,828.13 | $2,197.70 | $3,022.09 | $5,797.61 | $2,710.87 | $2,161.65 | $2,077.64 |

| BLOOMER | 54724 | $3,004.89 | $3,567.18 | $1,576.98 | $3,485.54 | $2,224.73 | $3,188.93 | $5,707.58 | $2,932.59 | $2,222.12 | $2,138.32 |

| NECEDAH | 54646 | $3,004.53 | $3,728.58 | $1,520.49 | $4,001.04 | $2,066.91 | $3,022.09 | $5,466.29 | $3,033.42 | $2,156.37 | $2,045.62 |

| KENNAN | 54537 | $3,002.95 | $3,784.64 | $1,510.80 | $3,552.41 | $2,332.55 | $3,022.09 | $5,797.61 | $2,804.08 | $2,144.72 | $2,077.64 |

| PHLOX | 54464 | $3,002.78 | $3,776.58 | $1,445.47 | $3,905.70 | $2,332.55 | $3,066.52 | $5,308.53 | $3,143.04 | $2,072.49 | $1,974.19 |

| OGDENSBURG | 54962 | $3,002.64 | $3,990.52 | $1,421.91 | $3,743.50 | $2,313.96 | $3,066.52 | $5,508.54 | $2,960.94 | $2,070.38 | $1,947.50 |

| HAGER CITY | 54014 | $3,002.45 | $3,838.73 | $1,689.97 | $3,658.98 | $2,224.73 | $2,923.68 | $5,702.33 | $2,841.98 | $2,024.04 | $2,117.64 |

| TAYLOR | 54659 | $3,002.05 | $3,742.58 | $1,605.87 | $3,515.69 | $2,218.81 | $2,907.22 | $5,563.37 | $3,156.04 | $2,272.16 | $2,036.74 |

| TILLEDA | 54978 | $3,001.84 | $3,990.52 | $1,390.65 | $3,586.20 | $2,313.96 | $3,066.52 | $5,008.89 | $3,613.12 | $2,072.49 | $1,974.19 |

| KING | 54946 | $3,001.49 | $3,844.90 | $1,344.90 | $3,841.91 | $2,070.85 | $3,175.17 | $5,508.54 | $3,207.17 | $2,072.49 | $1,947.50 |

| TIGERTON | 54486 | $3,000.44 | $3,873.02 | $1,478.37 | $3,714.52 | $2,313.96 | $3,066.52 | $5,008.89 | $3,402.05 | $2,172.42 | $1,974.19 |

| WITTENBERG | 54499 | $3,000.08 | $3,779.85 | $1,452.96 | $3,758.42 | $2,313.96 | $3,066.52 | $5,008.89 | $3,423.86 | $2,222.04 | $1,974.19 |

| ADAMS | 53910 | $2,998.72 | $3,903.09 | $1,534.06 | $3,918.00 | $2,166.37 | $2,903.72 | $5,382.83 | $3,073.53 | $2,175.42 | $1,931.46 |

| BLACK RIVER FALLS | 54615 | $2,998.46 | $3,778.25 | $1,542.19 | $3,528.75 | $2,218.81 | $2,907.22 | $5,563.37 | $3,143.05 | $2,267.72 | $2,036.74 |

| ELROY | 53929 | $2,998.09 | $3,646.74 | $1,548.94 | $4,066.09 | $2,066.91 | $2,903.72 | $5,466.29 | $3,106.96 | $2,131.58 | $2,045.62 |

| LA FARGE | 54639 | $2,997.27 | $3,674.86 | $1,562.78 | $3,869.19 | $2,066.91 | $2,847.00 | $5,524.86 | $3,173.74 | $2,203.57 | $2,052.54 |

| TWIN LAKES | 53181 | $2,996.75 | $3,911.84 | $1,503.77 | $3,773.69 | $2,234.57 | $3,179.81 | $4,996.19 | $3,035.71 | $2,360.26 | $1,974.87 |

| HOULTON | 54082 | $2,996.03 | $3,735.38 | $1,646.25 | $3,658.98 | $2,152.44 | $2,923.68 | $5,661.01 | $2,973.80 | $2,047.80 | $2,164.95 |

| COON VALLEY | 54623 | $2,995.99 | $3,756.71 | $1,577.96 | $3,819.33 | $2,079.58 | $2,847.00 | $5,524.86 | $3,117.04 | $2,188.88 | $2,052.54 |

| LAKEWOOD | 54138 | $2,995.62 | $3,860.93 | $1,499.51 | $4,068.57 | $2,197.70 | $3,066.52 | $4,982.50 | $3,223.50 | $2,087.18 | $1,974.19 |

| NEW LISBON | 53950 | $2,993.26 | $3,646.74 | $1,481.11 | $4,001.04 | $2,066.91 | $2,903.72 | $5,466.29 | $3,149.40 | $2,178.49 | $2,045.62 |

| ARKDALE | 54613 | $2,992.10 | $3,931.68 | $1,539.89 | $3,918.00 | $2,166.37 | $3,022.09 | $5,382.83 | $2,914.93 | $2,121.65 | $1,931.46 |

| FOUNTAIN CITY | 54629 | $2,991.71 | $3,750.13 | $1,622.76 | $3,596.35 | $2,218.81 | $2,907.22 | $5,656.11 | $2,997.01 | $2,140.25 | $2,036.74 |

| WONEWOC | 53968 | $2,991.21 | $3,646.74 | $1,511.44 | $4,066.09 | $2,066.91 | $2,903.72 | $5,466.29 | $3,084.78 | $2,129.32 | $2,045.62 |

| CHASEBURG | 54621 | $2,991.11 | $3,674.86 | $1,542.32 | $3,819.33 | $2,079.58 | $2,847.00 | $5,524.86 | $3,187.89 | $2,191.66 | $2,052.54 |

| FERRYVILLE | 54628 | $2,990.94 | $3,674.86 | $1,624.28 | $3,819.33 | $2,079.58 | $2,847.00 | $5,524.44 | $3,116.02 | $2,170.42 | $2,062.55 |

| ELAND | 54427 | $2,990.77 | $3,751.73 | $1,453.20 | $3,758.42 | $2,313.96 | $3,066.52 | $5,117.13 | $3,208.52 | $2,201.10 | $2,046.34 |

| LAKE TOMAHAWK | 54539 | $2,990.06 | $4,017.69 | $1,442.50 | $3,739.96 | $2,197.70 | $2,984.27 | $5,308.53 | $3,068.32 | $2,069.98 | $2,081.61 |

| CURTISS | 54422 | $2,990.02 | $3,776.58 | $1,491.99 | $3,639.36 | $2,206.16 | $3,022.09 | $5,797.61 | $2,877.69 | $2,021.09 | $2,077.64 |

| BRYANT | 54418 | $2,989.89 | $3,776.58 | $1,445.12 | $4,147.49 | $2,197.70 | $3,066.52 | $5,308.53 | $2,851.90 | $2,140.97 | $1,974.19 |

| ETTRICK | 54627 | $2,989.48 | $3,742.58 | $1,499.07 | $3,620.60 | $2,218.81 | $2,907.22 | $5,563.37 | $3,138.44 | $2,178.52 | $2,036.74 |

| ELEVA | 54738 | $2,989.11 | $3,663.64 | $1,597.71 | $3,485.54 | $2,218.81 | $3,188.93 | $5,563.37 | $2,912.52 | $2,234.76 | $2,036.74 |

| BALDWIN | 54002 | $2,988.31 | $3,650.66 | $1,617.36 | $3,796.14 | $2,063.25 | $2,923.68 | $5,661.01 | $2,957.53 | $2,085.00 | $2,140.14 |

| LA VALLE | 53941 | $2,988.24 | $3,646.74 | $1,517.46 | $3,953.21 | $2,027.16 | $2,903.72 | $5,496.77 | $3,346.52 | $2,013.08 | $1,989.55 |

| GREEN VALLEY | 54127 | $2,987.58 | $3,646.60 | $1,464.22 | $3,724.08 | $2,313.96 | $2,994.14 | $5,008.89 | $3,689.66 | $2,072.49 | $1,974.19 |

| VIROQUA | 54665 | $2,986.51 | $3,674.86 | $1,534.21 | $3,869.19 | $2,079.58 | $2,847.00 | $5,524.86 | $3,079.04 | $2,217.29 | $2,052.54 |

| EMBARRASS | 54933 | $2,985.73 | $3,901.82 | $1,444.47 | $3,792.15 | $2,367.98 | $3,066.52 | $5,508.54 | $2,770.10 | $2,072.49 | $1,947.50 |

| CLINTONVILLE | 54929 | $2,985.61 | $3,901.82 | $1,488.78 | $3,586.20 | $2,367.98 | $3,066.52 | $5,508.54 | $2,875.26 | $2,127.90 | $1,947.50 |

| MEDFORD | 54451 | $2,985.55 | $3,639.58 | $1,475.20 | $3,561.38 | $2,332.55 | $3,022.09 | $5,797.61 | $2,949.33 | $2,014.60 | $2,077.64 |

| FALL CREEK | 54742 | $2,985.27 | $3,491.89 | $1,612.00 | $3,485.54 | $2,224.73 | $3,188.93 | $5,707.58 | $2,717.01 | $2,301.48 | $2,138.32 |

| HAMMOND | 54015 | $2,984.82 | $3,735.38 | $1,672.68 | $3,658.98 | $2,152.44 | $2,923.68 | $5,661.01 | $2,926.31 | $1,992.73 | $2,140.14 |

| PINE RIVER | 54965 | $2,982.33 | $3,602.22 | $1,466.44 | $3,743.50 | $2,303.57 | $3,175.17 | $5,606.62 | $2,977.69 | $2,034.28 | $1,931.46 |

| REDGRANITE | 54970 | $2,980.64 | $3,849.85 | $1,481.52 | $3,743.50 | $2,303.57 | $2,903.99 | $5,606.62 | $2,894.95 | $2,110.32 | $1,931.46 |

| WESTBY | 54667 | $2,980.36 | $3,674.86 | $1,542.32 | $3,869.19 | $2,079.58 | $2,847.00 | $5,524.86 | $3,098.82 | $2,134.12 | $2,052.54 |

| HUDSON | 54016 | $2,979.05 | $3,735.38 | $1,667.73 | $3,658.98 | $2,152.44 | $2,923.68 | $5,661.01 | $2,843.22 | $2,028.83 | $2,140.14 |

| PRESCOTT | 54021 | $2,978.30 | $3,838.73 | $1,652.52 | $3,658.98 | $2,152.44 | $2,923.68 | $5,702.33 | $2,756.62 | $2,001.78 | $2,117.64 |

| MAUSTON | 53948 | $2,977.95 | $3,646.74 | $1,481.11 | $3,983.04 | $2,066.91 | $2,903.72 | $5,466.29 | $3,066.19 | $2,141.95 | $2,045.62 |

| ARCADIA | 54612 | $2,977.44 | $3,750.13 | $1,562.70 | $3,552.48 | $2,218.81 | $2,907.22 | $5,563.37 | $3,043.25 | $2,162.25 | $2,036.74 |

| VIOLA | 54664 | $2,976.74 | $3,646.74 | $1,578.85 | $3,869.19 | $2,027.16 | $2,847.00 | $5,496.77 | $3,169.88 | $2,092.54 | $2,062.55 |

| FRIENDSHIP | 53934 | $2,976.39 | $3,646.74 | $1,534.06 | $3,918.00 | $2,166.37 | $2,903.72 | $5,382.83 | $3,132.30 | $2,172.00 | $1,931.46 |

| UNION GROVE | 53182 | $2,976.01 | $3,898.75 | $1,484.91 | $3,907.77 | $2,234.57 | $2,899.75 | $4,930.45 | $3,285.72 | $2,164.86 | $1,977.30 |

| ANIWA | 54408 | $2,974.54 | $3,639.58 | $1,449.29 | $3,828.13 | $2,313.96 | $3,066.52 | $5,117.13 | $3,134.10 | $2,175.80 | $2,046.34 |

| BOWLER | 54416 | $2,974.11 | $3,779.85 | $1,452.91 | $3,677.23 | $2,313.96 | $3,066.52 | $5,008.89 | $3,362.48 | $2,130.94 | $1,974.19 |

| STODDARD | 54658 | $2,973.38 | $3,674.86 | $1,542.70 | $3,620.60 | $2,079.58 | $2,847.00 | $5,524.86 | $3,243.18 | $2,175.14 | $2,052.54 |

| WHITEHALL | 54773 | $2,973.05 | $3,663.64 | $1,580.16 | $3,596.35 | $2,218.81 | $2,907.22 | $5,563.37 | $2,979.45 | $2,211.71 | $2,036.74 |

| STETSONVILLE | 54480 | $2,971.93 | $3,639.58 | $1,491.99 | $3,561.38 | $2,332.55 | $3,022.09 | $5,797.61 | $2,827.75 | $1,996.79 | $2,077.64 |

| MOUNTAIN | 54149 | $2,971.62 | $3,790.05 | $1,499.51 | $4,062.03 | $2,197.70 | $3,066.52 | $4,982.50 | $3,113.14 | $2,058.95 | $1,974.19 |

| BABCOCK | 54413 | $2,971.44 | $3,740.39 | $1,436.49 | $3,641.80 | $2,206.16 | $3,022.09 | $5,071.19 | $3,649.79 | $2,072.49 | $1,902.51 |

| RIVER FALLS | 54022 | $2,971.13 | $3,650.66 | $1,752.52 | $3,658.98 | $2,152.44 | $2,923.68 | $5,702.33 | $2,808.22 | $1,973.74 | $2,117.64 |

| MATTOON | 54450 | $2,971.08 | $3,776.58 | $1,478.37 | $3,905.70 | $2,313.96 | $3,066.52 | $5,008.89 | $3,143.04 | $2,072.49 | $1,974.19 |

| ANTIGO | 54409 | $2,970.81 | $3,776.58 | $1,445.12 | $3,828.13 | $2,197.70 | $3,066.52 | $5,308.53 | $2,931.55 | $2,208.94 | $1,974.19 |

| JIM FALLS | 54748 | $2,970.52 | $3,567.18 | $1,561.36 | $3,579.42 | $2,224.73 | $3,188.93 | $5,707.58 | $2,935.95 | $2,062.83 | $1,906.73 |

| NELSONVILLE | 54458 | $2,969.71 | $3,664.58 | $1,374.81 | $3,570.85 | $2,313.96 | $3,175.17 | $5,071.19 | $3,530.38 | $2,072.49 | $1,953.94 |

| MINOCQUA | 54548 | $2,969.64 | $3,855.54 | $1,440.42 | $3,739.96 | $2,197.70 | $2,984.27 | $5,308.53 | $3,113.20 | $2,005.57 | $2,081.61 |

| ROCK SPRINGS | 53961 | $2,968.91 | $3,817.65 | $1,457.05 | $3,983.04 | $2,077.78 | $2,903.72 | $5,496.77 | $3,020.24 | $1,974.38 | $1,989.55 |

| MANAWA | 54949 | $2,967.21 | $3,899.69 | $1,421.91 | $3,593.15 | $2,313.96 | $3,066.52 | $5,508.54 | $2,884.20 | $2,069.46 | $1,947.50 |

| TOWNSEND | 54175 | $2,966.29 | $3,858.81 | $1,499.51 | $4,082.89 | $2,197.70 | $3,066.52 | $4,982.50 | $2,961.98 | $2,072.49 | $1,974.19 |

| HATLEY | 54440 | $2,966.25 | $3,779.85 | $1,453.20 | $3,633.56 | $2,313.96 | $3,066.52 | $5,117.13 | $3,101.96 | $2,183.74 | $2,046.34 |

| ROBERTS | 54023 | $2,966.06 | $3,650.66 | $1,662.14 | $3,658.98 | $2,152.44 | $2,923.68 | $5,661.01 | $2,872.43 | $1,973.10 | $2,140.14 |

| WISCONSIN DELLS | 53965 | $2,965.93 | $3,817.65 | $1,464.95 | $3,983.04 | $1,968.39 | $2,903.72 | $5,496.77 | $3,080.07 | $1,989.20 | $1,989.55 |

| WARRENS | 54666 | $2,965.32 | $3,714.45 | $1,456.16 | $3,528.75 | $2,079.58 | $2,903.72 | $5,466.29 | $3,198.51 | $2,139.97 | $2,200.45 |

| WOODVILLE | 54028 | $2,965.15 | $3,520.55 | $1,617.36 | $3,658.98 | $2,026.12 | $2,923.68 | $5,661.01 | $3,034.32 | $2,104.19 | $2,140.14 |

| DODGE | 54625 | $2,964.70 | $3,750.13 | $1,525.46 | $3,596.35 | $2,218.81 | $2,907.22 | $5,563.37 | $2,936.66 | $2,147.56 | $2,036.74 |

| WAUTOMA | 54982 | $2,963.03 | $3,877.99 | $1,505.50 | $3,740.47 | $2,303.57 | $2,652.05 | $5,606.62 | $2,974.35 | $2,075.28 | $1,931.46 |

| CAROLINE | 54928 | $2,962.50 | $3,873.02 | $1,463.88 | $3,586.20 | $2,313.96 | $3,066.52 | $5,008.89 | $3,217.27 | $2,158.54 | $1,974.19 |

| MINDORO | 54644 | $2,962.37 | $3,750.13 | $1,534.15 | $3,620.60 | $2,079.58 | $2,907.22 | $5,466.29 | $3,079.90 | $2,170.95 | $2,052.54 |

| READFIELD | 54969 | $2,962.06 | $3,438.27 | $1,484.35 | $3,890.92 | $2,124.86 | $2,652.05 | $5,508.54 | $3,539.57 | $2,072.49 | $1,947.50 |

| TREMPEALEAU | 54661 | $2,961.59 | $3,750.13 | $1,525.46 | $3,620.60 | $2,218.81 | $2,907.22 | $5,563.37 | $2,963.32 | $2,068.63 | $2,036.74 |

| KENDALL | 54638 | $2,959.89 | $3,639.19 | $1,491.44 | $3,839.89 | $2,079.58 | $2,903.72 | $5,466.29 | $2,972.42 | $2,193.92 | $2,052.54 |

| REEDSBURG | 53959 | $2,958.60 | $3,817.65 | $1,435.02 | $3,983.04 | $2,027.16 | $2,903.72 | $5,496.77 | $2,990.92 | $1,983.61 | $1,989.55 |

| DOYLESTOWN | 53928 | $2,957.91 | $3,889.21 | $1,502.81 | $4,017.20 | $1,968.39 | $2,903.72 | $4,848.57 | $3,477.76 | $1,965.12 | $2,048.38 |

| TRIPOLI | 54564 | $2,957.86 | $3,776.67 | $1,515.09 | $3,613.52 | $2,197.70 | $3,022.09 | $5,308.53 | $2,960.81 | $2,144.72 | $2,081.61 |

| BROKAW | 54417 | $2,957.59 | $3,639.58 | $1,413.74 | $3,794.57 | $1,796.95 | $3,086.47 | $5,117.13 | $3,600.26 | $2,123.24 | $2,046.34 |

| EASTMAN | 54626 | $2,956.87 | $3,674.86 | $1,573.65 | $3,707.10 | $2,079.58 | $2,847.00 | $5,524.44 | $3,004.78 | $2,137.84 | $2,062.55 |

| SCANDINAVIA | 54977 | $2,956.62 | $3,844.90 | $1,390.65 | $3,780.45 | $2,313.96 | $2,903.72 | $5,508.54 | $2,892.64 | $2,027.24 | $1,947.50 |

| STEUBEN | 54657 | $2,956.51 | $3,667.31 | $1,573.65 | $3,707.10 | $2,079.58 | $2,847.00 | $5,524.44 | $3,130.28 | $2,016.73 | $2,062.55 |

| GRESHAM | 54128 | $2,954.55 | $3,899.69 | $1,452.91 | $3,996.59 | $2,313.96 | $3,066.52 | $5,008.89 | $2,841.80 | $2,036.41 | $1,974.19 |

| DE SOTO | 54624 | $2,954.50 | $3,674.86 | $1,542.70 | $3,819.33 | $2,079.58 | $2,847.00 | $5,524.86 | $2,866.66 | $2,182.95 | $2,052.54 |

| THIENSVILLE | 53092 | $2,953.45 | $4,298.46 | $1,702.46 | $3,943.02 | $2,091.70 | $2,705.21 | $4,381.88 | $3,259.29 | $2,359.65 | $1,839.43 |

| WOODFORD | 53599 | $2,952.82 | $3,816.09 | $1,535.26 | $3,725.95 | $2,077.78 | $2,421.22 | $5,343.59 | $3,555.13 | $2,016.73 | $2,083.64 |

| ROSHOLT | 54473 | $2,952.20 | $3,576.15 | $1,453.20 | $3,758.42 | $2,313.96 | $3,066.52 | $5,117.13 | $3,155.26 | $2,082.80 | $2,046.34 |

| GENOA | 54632 | $2,950.83 | $3,674.86 | $1,542.70 | $3,620.60 | $2,079.58 | $2,847.00 | $5,524.86 | $3,049.49 | $2,165.84 | $2,052.54 |

| NEKOOSA | 54457 | $2,949.98 | $3,925.12 | $1,419.96 | $3,655.59 | $2,183.44 | $3,022.09 | $5,382.83 | $2,978.08 | $2,051.26 | $1,931.46 |

| TOMAH | 54660 | $2,949.67 | $3,721.02 | $1,403.05 | $3,528.75 | $2,079.58 | $3,040.01 | $5,466.29 | $2,984.21 | $2,123.64 | $2,200.45 |

| THORP | 54771 | $2,947.54 | $3,774.97 | $1,520.89 | $3,572.75 | $2,206.16 | $3,022.09 | $5,071.19 | $3,094.77 | $2,228.33 | $2,036.74 |

| WAUPACA | 54981 | $2,946.77 | $3,844.90 | $1,344.90 | $3,743.50 | $2,070.85 | $3,175.17 | $5,508.54 | $2,858.24 | $2,027.37 | $1,947.50 |

| CASHTON | 54619 | $2,945.92 | $3,632.62 | $1,562.78 | $3,528.75 | $2,079.58 | $2,847.00 | $5,466.29 | $3,219.77 | $2,123.98 | $2,052.54 |

| HILLPOINT | 53937 | $2,945.70 | $3,712.25 | $1,571.63 | $3,610.77 | $2,027.16 | $2,903.72 | $5,496.77 | $3,143.78 | $2,055.71 | $1,989.55 |

| HAZELHURST | 54531 | $2,943.54 | $3,847.54 | $1,442.50 | $3,618.57 | $2,197.70 | $2,984.27 | $5,308.53 | $2,960.25 | $2,050.89 | $2,081.61 |

| SPARTA | 54656 | $2,943.42 | $3,742.58 | $1,495.00 | $3,528.75 | $2,079.58 | $2,907.22 | $5,466.29 | $3,111.86 | $2,128.64 | $2,030.87 |

| WILTON | 54670 | $2,942.95 | $3,639.19 | $1,581.64 | $3,528.75 | $2,079.58 | $2,907.22 | $5,466.29 | $3,117.80 | $2,113.60 | $2,052.54 |

| NORWALK | 54648 | $2,941.67 | $3,639.19 | $1,581.64 | $3,528.75 | $2,079.58 | $2,907.22 | $5,466.29 | $3,124.42 | $2,095.41 | $2,052.54 |

| ONTARIO | 54651 | $2,939.58 | $3,667.31 | $1,562.78 | $3,528.75 | $2,079.58 | $2,847.00 | $5,466.29 | $3,128.20 | $2,123.76 | $2,052.54 |

| MUSCODA | 53573 | $2,939.50 | $3,674.86 | $1,536.79 | $3,565.19 | $2,039.80 | $2,847.00 | $5,496.77 | $3,108.24 | $2,124.31 | $2,062.55 |

| BANGOR | 54614 | $2,939.14 | $3,756.71 | $1,534.15 | $3,535.91 | $2,079.58 | $2,907.22 | $5,466.29 | $3,004.60 | $2,115.28 | $2,052.54 |

| AMHERST JUNCTION | 54407 | $2,937.81 | $3,664.58 | $1,454.50 | $3,780.45 | $2,313.96 | $3,175.17 | $5,071.19 | $3,076.80 | $1,949.68 | $1,953.94 |

| BURLINGTON | 53105 | $2,937.74 | $3,911.84 | $1,461.80 | $3,800.05 | $2,234.57 | $3,179.81 | $4,996.19 | $2,678.14 | $2,355.55 | $1,821.68 |

| BLENKER | 54415 | $2,936.80 | $3,716.06 | $1,478.37 | $3,719.50 | $2,206.16 | $3,022.09 | $5,071.19 | $3,242.85 | $2,072.49 | $1,902.51 |

| RICHLAND CENTER | 53581 | $2,936.79 | $3,674.86 | $1,443.42 | $3,610.77 | $2,027.16 | $2,847.00 | $5,496.77 | $3,156.33 | $2,112.30 | $2,062.55 |

| WAUZEKA | 53826 | $2,935.45 | $3,674.86 | $1,471.56 | $3,613.95 | $2,079.58 | $2,847.00 | $5,524.44 | $2,993.91 | $2,151.23 | $2,062.55 |

| ELK MOUND | 54739 | $2,934.80 | $3,519.04 | $1,622.97 | $3,579.42 | $2,224.73 | $2,839.95 | $5,716.34 | $2,725.16 | $2,131.95 | $2,053.64 |

| DALTON | 53926 | $2,934.53 | $3,775.97 | $1,563.60 | $3,588.87 | $2,144.49 | $2,903.72 | $5,404.24 | $3,093.22 | $2,005.21 | $1,931.46 |

| SINSINAWA | 53824 | $2,933.40 | $3,806.71 | $1,508.20 | $3,725.95 | $2,039.80 | $2,421.22 | $5,294.92 | $3,524.51 | $2,016.73 | $2,062.55 |

| GALESVILLE | 54630 | $2,932.58 | $3,750.13 | $1,499.07 | $3,620.60 | $2,218.81 | $2,907.22 | $5,563.37 | $2,715.76 | $2,081.53 | $2,036.74 |

| GREENWOOD | 54437 | $2,928.85 | $3,776.58 | $1,559.59 | $3,580.31 | $2,206.16 | $3,022.09 | $5,071.19 | $2,905.15 | $2,201.83 | $2,036.74 |

| ROCKLAND | 54653 | $2,928.80 | $3,742.58 | $1,565.23 | $3,528.75 | $2,079.58 | $2,847.00 | $5,466.29 | $2,929.72 | $2,147.56 | $2,052.54 |

| KANSASVILLE | 53139 | $2,928.35 | $3,911.84 | $1,472.61 | $3,773.69 | $2,234.57 | $2,899.75 | $4,930.45 | $3,049.21 | $2,105.72 | $1,977.30 |

| OWEN | 54460 | $2,927.00 | $3,776.58 | $1,499.62 | $3,579.95 | $2,206.16 | $3,022.09 | $5,071.19 | $3,059.02 | $2,091.65 | $2,036.74 |

| HUMBIRD | 54746 | $2,925.70 | $3,778.25 | $1,605.87 | $3,593.04 | $2,206.16 | $2,907.22 | $5,071.19 | $3,060.31 | $2,072.49 | $2,036.74 |

| ALMOND | 54909 | $2,925.09 | $3,663.06 | $1,415.83 | $3,780.45 | $2,313.96 | $3,175.17 | $5,071.19 | $2,929.95 | $2,022.31 | $1,953.94 |

| WILLARD | 54493 | $2,924.98 | $3,778.25 | $1,575.81 | $3,362.28 | $2,206.16 | $3,022.09 | $5,071.19 | $3,199.85 | $2,072.49 | $2,036.74 |

| EDMUND | 53535 | $2,924.77 | $3,844.08 | $1,440.85 | $3,725.95 | $2,077.78 | $2,421.22 | $5,343.59 | $3,369.09 | $2,016.73 | $2,083.64 |

| WEYAUWEGA | 54983 | $2,924.10 | $3,847.02 | $1,400.13 | $3,695.56 | $2,070.85 | $3,066.52 | $5,508.54 | $2,811.31 | $1,969.47 | $1,947.50 |

| CUSTER | 54423 | $2,923.61 | $3,776.04 | $1,454.50 | $3,645.31 | $2,313.96 | $3,175.17 | $5,071.19 | $2,964.04 | $1,958.35 | $1,953.94 |

| LOYAL | 54446 | $2,921.48 | $3,774.97 | $1,466.91 | $3,584.60 | $2,206.16 | $3,022.09 | $5,071.19 | $2,996.23 | $2,134.45 | $2,036.74 |

| ALBANY | 53502 | $2,921.33 | $3,732.96 | $1,458.94 | $3,622.09 | $2,199.45 | $2,649.71 | $5,343.59 | $3,196.14 | $2,005.44 | $2,083.64 |

| WISCONSIN RAPIDS | 54495 | $2,920.29 | $3,741.89 | $1,376.14 | $3,655.59 | $2,183.44 | $3,022.09 | $5,071.19 | $3,318.54 | $2,011.17 | $1,902.51 |

| LEOPOLIS | 54948 | $2,919.90 | $3,990.52 | $1,463.88 | $3,586.20 | $2,313.96 | $3,066.52 | $5,008.89 | $2,802.48 | $2,072.49 | $1,974.19 |

| GOTHAM | 53540 | $2,916.10 | $3,589.42 | $1,536.79 | $3,686.23 | $2,027.16 | $2,421.22 | $5,496.77 | $3,408.02 | $2,016.73 | $2,062.55 |

| BOSCOBEL | 53805 | $2,915.46 | $3,667.31 | $1,520.25 | $3,613.95 | $2,079.58 | $2,847.00 | $5,294.92 | $3,045.48 | $2,108.09 | $2,062.55 |

| LENA | 54139 | $2,915.29 | $3,992.66 | $1,475.93 | $3,589.35 | $2,038.64 | $2,994.14 | $4,995.37 | $3,114.48 | $2,062.88 | $1,974.19 |

| NEILLSVILLE | 54456 | $2,912.18 | $3,778.25 | $1,575.81 | $3,366.57 | $2,206.16 | $3,022.09 | $5,071.19 | $2,949.14 | $2,203.65 | $2,036.74 |

| WITHEE | 54498 | $2,911.70 | $3,639.58 | $1,499.62 | $3,639.36 | $2,206.16 | $3,022.09 | $5,071.19 | $2,963.25 | $2,127.27 | $2,036.74 |

| HOLLANDALE | 53544 | $2,911.65 | $3,956.00 | $1,491.95 | $3,565.19 | $2,077.78 | $2,421.22 | $5,343.59 | $3,128.95 | $2,136.58 | $2,083.64 |

| STITZER | 53825 | $2,911.63 | $3,806.71 | $1,508.20 | $3,565.19 | $2,039.80 | $2,847.00 | $5,294.92 | $3,063.56 | $2,016.73 | $2,062.55 |

| BLANCHARDVILLE | 53516 | $2,910.97 | $3,963.56 | $1,505.75 | $3,565.19 | $2,077.78 | $2,421.22 | $5,343.59 | $3,096.49 | $2,141.50 | $2,083.64 |

| AMHERST | 54406 | $2,910.59 | $3,664.58 | $1,415.83 | $3,780.45 | $2,313.96 | $3,175.17 | $5,071.19 | $2,868.13 | $1,952.07 | $1,953.94 |

| BLUE RIVER | 53518 | $2,910.52 | $3,674.86 | $1,536.79 | $3,565.19 | $2,079.58 | $2,847.00 | $5,294.92 | $3,117.07 | $2,016.73 | $2,062.55 |

| NEW GLARUS | 53574 | $2,910.15 | $3,878.11 | $1,501.32 | $3,469.93 | $2,199.45 | $2,649.71 | $5,343.59 | $2,995.00 | $2,070.61 | $2,083.64 |

| WOODMAN | 53827 | $2,909.45 | $3,674.86 | $1,545.02 | $3,613.95 | $2,079.58 | $2,847.00 | $5,294.92 | $3,050.48 | $2,016.73 | $2,062.55 |

| GENESEE DEPOT | 53127 | $2,908.83 | $3,857.64 | $1,514.03 | $4,114.01 | $2,021.57 | $2,686.84 | $4,419.87 | $3,528.03 | $2,255.06 | $1,782.41 |

| BERLIN | 54923 | $2,907.00 | $3,516.79 | $1,443.02 | $3,796.88 | $2,144.49 | $2,903.72 | $5,606.62 | $2,689.50 | $2,130.55 | $1,931.46 |

| SEXTONVILLE | 53584 | $2,906.87 | $3,589.42 | $1,453.70 | $3,686.23 | $2,027.16 | $2,421.22 | $5,496.77 | $3,408.02 | $2,016.73 | $2,062.55 |

| MADISON | 53725 | $2,906.42 | $3,893.83 | $1,745.88 | $3,878.36 | $1,820.45 | $2,649.71 | $4,418.20 | $3,733.92 | $2,072.19 | $1,945.28 |

| ELM GROVE | 53122 | $2,906.17 | $4,020.16 | $1,585.64 | $3,982.31 | $2,138.91 | $2,579.91 | $4,407.99 | $3,178.95 | $2,479.29 | $1,782.41 |

| POTOSI | 53820 | $2,900.99 | $3,806.71 | $1,486.16 | $3,565.19 | $2,039.80 | $2,847.00 | $5,294.92 | $2,992.55 | $2,014.00 | $2,062.55 |

| SURING | 54174 | $2,900.41 | $3,901.82 | $1,487.70 | $4,062.03 | $2,038.64 | $2,652.05 | $4,982.50 | $2,986.26 | $2,018.50 | $1,974.19 |

| COLBY | 54421 | $2,900.05 | $3,776.58 | $1,433.48 | $3,584.60 | $2,206.16 | $3,022.09 | $5,071.19 | $2,987.18 | $1,982.39 | $2,036.74 |

| BROOKFIELD | 53005 | $2,899.69 | $4,023.36 | $1,571.42 | $3,897.19 | $2,138.91 | $2,579.91 | $4,407.99 | $3,088.06 | $2,540.92 | $1,849.44 |

| ATHENS | 54411 | $2,897.32 | $3,639.58 | $1,477.88 | $3,566.05 | $2,206.16 | $3,022.09 | $5,117.13 | $2,862.45 | $2,138.22 | $2,046.34 |