Michigan Car Insurance 2025 (Coverage, Companies, & More)

On average, costs $114 per month, but your monthly rates vary. How you save? Everything you need to know about coverage is right here, including changes involving the new Real ID starting in October 2020.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Michigan Statistics

| Key Info | Details |

|---|---|

| Road Miles | Total in State – 122,286 Vehicle Miles Driven – 97,843 |

| Vehicles | Registered – 8,036,643 Total Stolen – 15,764 |

| State Population | 9,995,915 |

| Most Popular Vehicle | Ford Escape |

| Uninsured Motorists | 20.3% State Rank – 4th |

| Total Driving Fatalities | 2008–2017 Speeding – 2,397 Drunk Driving – 2,562 |

| Average Premiums by Coverage Type | Liability – $795.32 Collision – $413.83 Comprehensive – $154.85 |

| Cheapest Providers | USAA Progressive |

Michigan used to be one of the most impressive automotive capitals in the world. Nowadays, automotive leaders still release some of the best and brightest of American wheels from Detroit.

Even as these new cars take to the road, however, Michigan’s automotive reputation is not as it once was. At the moment, Michigan car insurance rivals Louisiana for the highest average car insurance rates in the nation.

If you’re hunting for car insurance in the area, you’ll want to do what you can to lower your rates. Unfortunately, researching car insurance takes a lot of time that you may not have.

What do you do, then, if you want an affordable rate?

You come to us, of course. In this guide to state of Michigan car insurance, we’ll go over the available rates, discounts, and factors that may raise or lower your rate.

Ready to get started? You can use our FREE online tool to compare rates in your area today.

Michigan Car Insurance Rates

When you first start shopping for car insurance, you may find yourself quickly overwhelmed by the terminology that gets bandied about. Don’t feel overwhelmed just yet! We’re here to help you understand the basics of the protection available to you in Michigan as well as the factors that may change the rate a provider is able to offer you.

We’ll also use data from the National Association of Insurance Commissioners (NAIC), which gathers auto insurance data from all states, including Michigan.

How much coverage is required for Michigan’s minimum coverage?

The cost of minimum coverage varies from state to state.

Every state has required minimum liability coverage that you need to have if you want to stay legal on the road. Michigan, as a no-fault state, requires you to carry both personal injury protection and property protection insurance. However, Michigan car insurance reform is on the way.

PIP coverage protects you from any medical expenses that you may endure after an accident takes place.

If another driver files a claim citing property damage, then your property protection insurance would come into play.

When you’re in a no-fault state, you need this sort of coverage to protect you — even if the other driver is responsible for the accident that’s taken place, you’ll have to pay for your own medical expenses and coverage.

The video below further explains what the car insurance laws are in Michigan.

Note, though, that you’ll need liability insurance in addition to PIP and PPI. The liability ratio you need to stay on track breaks down as follows:

- $20,000 to cover the injuries or death of a single party

- $40,000 for the injuries or deaths or more than one party

- $10,000 for property damage

The law requires you to have liability coverage, as it protects you if you cause a crash and injure another driver or wreck their car.

What are the forms of financial responsibility in Michigan?

Once you’ve secured your coverage, you’re going to need to carry forms of financial responsibility in your car or wallet with you. Michigan law enforcement primarily recognizes your insurance ID card, either presented physically or via your phone.

However, Michigan law does not allow its law enforcement representatives to access the apps on your phone for you. As a result, you’ll need to have your app at the ready if you happen to get pulled over.

If you get caught driving without proof of insurance but can verify that you do have coverage, law enforcement representatives will give you a fix-it-ticket, but little more. Fines top off at $25, but that’s no reason not to keep a form on you if at all possible.

How much percentage of income are premiums in Michigan?

The cost of living in Michigan is going to vary based on where you are in the state. However, you should always calculate the percentage of your income that you’ll need to put away for coverage.

On average, you’ll be able to base the percentage of income you need to save on the numbers in the table below:

Car Insurance Premiums as an Average Percentage of Income in Michigan (2012–2014)

| Years | Michigan Average | National Average |

|---|---|---|

| 2012 | 3.37% | 2.34% |

| 2013 | 3.63% | 2.43% |

| 2014 | 3.71% | 2.40% |

As you can see, Michigan residents pay a higher percentage of their income for car insurance than most homeowners do on average. This is in part because Michigan is a no-fault state, and you need more coverage than usual to keep yourself safe from unexpected costs.

Average Monthly Car Insurance Rates in MI (Liability, Collision, Comprehensive)

In addition to PIP and PPI coverage, you’re going to need to choose a coverage plan to protect you while you’re on the road.

Michigan’s core coverage options are pretty standard, as you can see in the table below:

Average Monthly Car Insurance Rates by Type in Michigan

| Insurance Type | Michigan Average | National Average |

|---|---|---|

| Liability | $795.32 | $538.73 |

| Collision | $413.83 | $322.61 |

| Comprehensive | $154.85 | $148.04 |

| Full Coverage | $1,364.00 | $1,009.38 |

Liability coverage is designed to protect you and the other people who travel with you in your car. Collision coverage, comparatively, will protect your car if you get into an accident. Comprehensive coverage expands on this, protecting your car in the case of a natural disaster.

The more coverage you invest in, the more you’re going to have to pay. However, when you invest in insurance, you save yourself more money in the long run.

What additional liability is available in Michigan?

Your options aren’t just limited to the core coverage Michigan providers are able to offer you. You’ll have the choice to take on additional liability coverage, including:

- Medical Payments

- Uninsured/Underinsured Motorist Coverage

Medical payments protect you from the medical bills you may be charged with, if you happen to go to the hospital after an accident. Med Pay helps cover the gaps PIP may leave.

Uninsured/Underinsured Motorist Coverage, in turn, will help cover any accidents you get into with a driver who isn’t adequately protected.

With 20 percent of Michigan’s drivers uninsured or entirely uninsured, this kind of protection will keep you from overdrawing your bank account to pay for the fees after an accident.

Before you take on additional liability coverage, though, keep the loss ratios for each of these coverage types in mind:

Loss Ratios by Car Insurance Type in Michigan (2013–2015)

| Years | Personal Injury Protection (PIP) | Medical Payment (Med Pay) | Uninsured/Underinsured Motorist |

|---|---|---|---|

| 2013 | 1.09 | 4.15 | .76 |

| 2014 | .84 | 1.03 | .77 |

| 2015 | 1.12 | .76 | .75 |

The loss ratios here tell a compelling story. Higher loss ratios, like PIP in 2013, let you know that your car insurance provider is willing to pay out claims but that they’re losing money as they’re doing so. Comparatively, additional liability coverage with a loss ratio below 0.5 says that the company you’re working with is financially stable but less willing to pay out on claims.

Ideally, you want to work with a care insurance provider whose additional liability loss ratio is somewhere between 0.6 and 0.8.

What add-ons, endorsements, & riders are available in Michigan?

You can explore additional, optional coverage by considering the add-ons below:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive (Usage-Based Insurance)

These coverages will help round out your policy so that you are protected in multiple different situations.

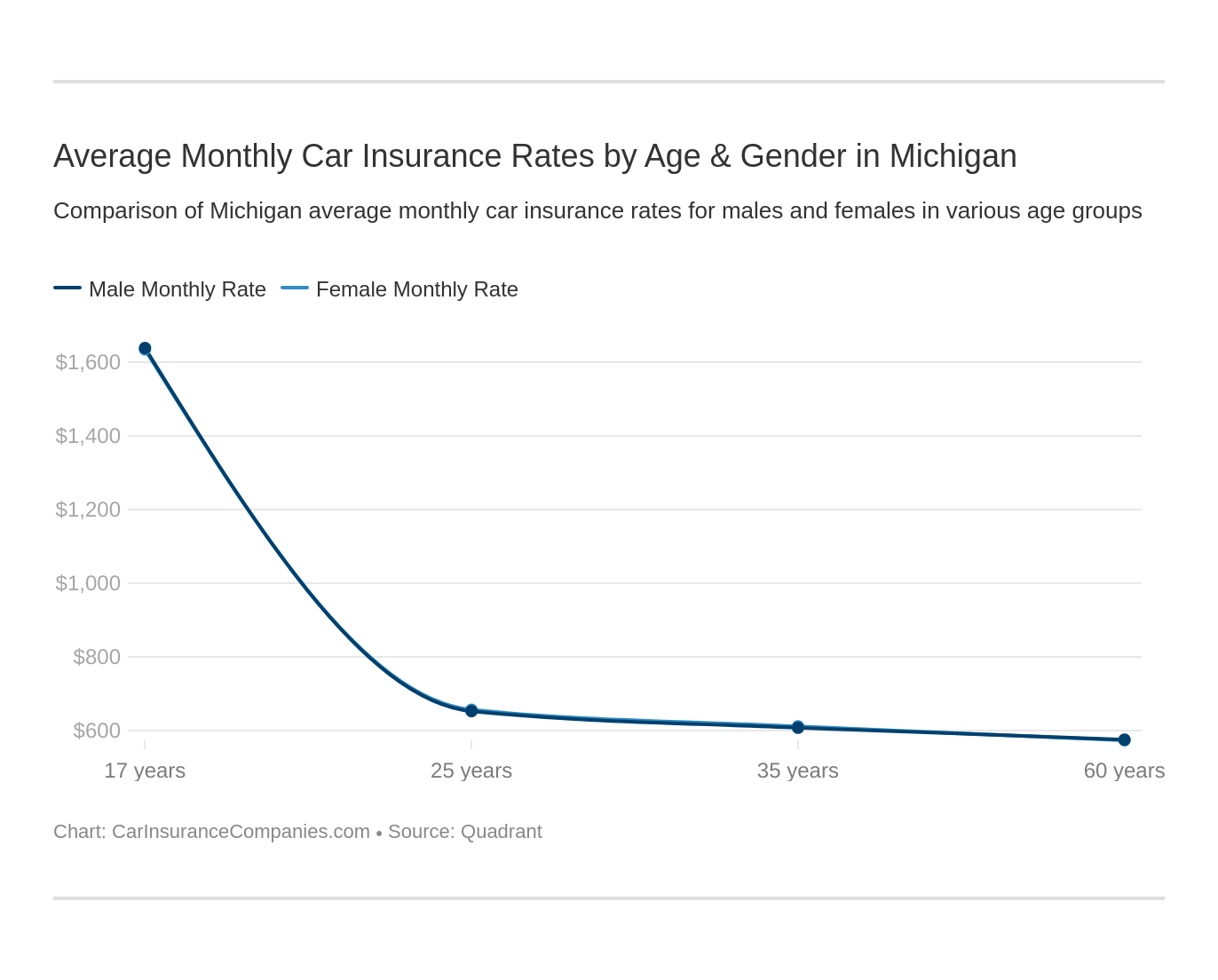

Average Monthly Car Insurance Rates by Age & Gender in MI

Some states have banned discrimination based on gender for car insurance rates, and this is one of those few states. As you can see the rate for males and females is the same, but the rate still varies with age.

The myths surrounding gender and your car insurance premium will vary. Take a look at the table below to see how things really shake out:

Average Annual Car Insurance Rates by Marital Status, Age, and Gender in Michigan

| Companies | Married 60-year-old Female Annual Rate | Married 60-year-old Male Annual Rate | Married 35-year-old Female Annual Rate | Married 35-year-old Male Annual Rate | Single 25-year-old Female Annual Rate | Single 25-year-old Male Annual Rate | Single 17-year-old Female Annual Rate | Single 17-year-old Male Annual Rate |

|---|---|---|---|---|---|---|---|---|

| USAA | $2,491.74 | $2,352.36 | $2,649.82 | $2,508.37 | $3,229.01 | $3,095.85 | $6,472.15 | $6,145.20 |

| Progressive | $2,785.12 | $3,113.99 | $3,156.54 | $2,932.15 | $3,676.55 | $3,393.23 | $11,516.82 | $12,259.07 |

| Nationwide | $3,979.03 | $3,979.03 | $4,477.30 | $4,477.30 | $4,907.85 | $4,907.85 | $11,785.55 | $11,785.55 |

| Geico | $4,533.10 | $4,533.10 | $4,453.35 | $4,453.35 | $4,252.21 | $4,252.21 | $12,291.51 | $12,291.51 |

| Travelers | $5,012.52 | $5,012.52 | $5,839.83 | $5,839.83 | $6,344.88 | $6,344.88 | $17,631.16 | $17,631.16 |

| Farmers | $5,856.52 | $5,856.52 | $6,307.90 | $6,307.90 | $7,104.64 | $7,104.64 | $13,831.87 | $13,831.87 |

| State Farm | $7,010.11 | $7,010.11 | $7,556.15 | $7,556.15 | $8,869.85 | $8,869.85 | $26,491.15 | $26,491.15 |

| Liberty Mutual | $14,732.64 | $14,732.64 | $14,880.96 | $14,880.96 | $14,880.96 | $14,880.96 | $35,157.81 | $35,157.81 |

| Allstate | $15,575.00 | $15,575.00 | $16,754.82 | $16,754.82 | $17,646.81 | $17,646.81 | $41,309.06 | $41,309.06 |

As you can see, gender has a limited impact on the premium you’ll be charged. Your age has a far more significant role in determining how much you’re going to have to pay. Older couples will always have to pay less than teenagers who are new to the road, as car insurance providers believe them to have more experience and to display more caution while driving.

However, new laws throughout the state have made it illegal for car insurance companies in Michigan to use demographic information, including the driver’s gender, to determine a person’s car insurance rates.

Read more:

- Where can I get 7-day car insurance in Michigan?

- Farm Bureau Mutual Insurance Company of Michigan Car Insurance Review

- Farm Bureau General Insurance Company of Michigan Car Insurance Review

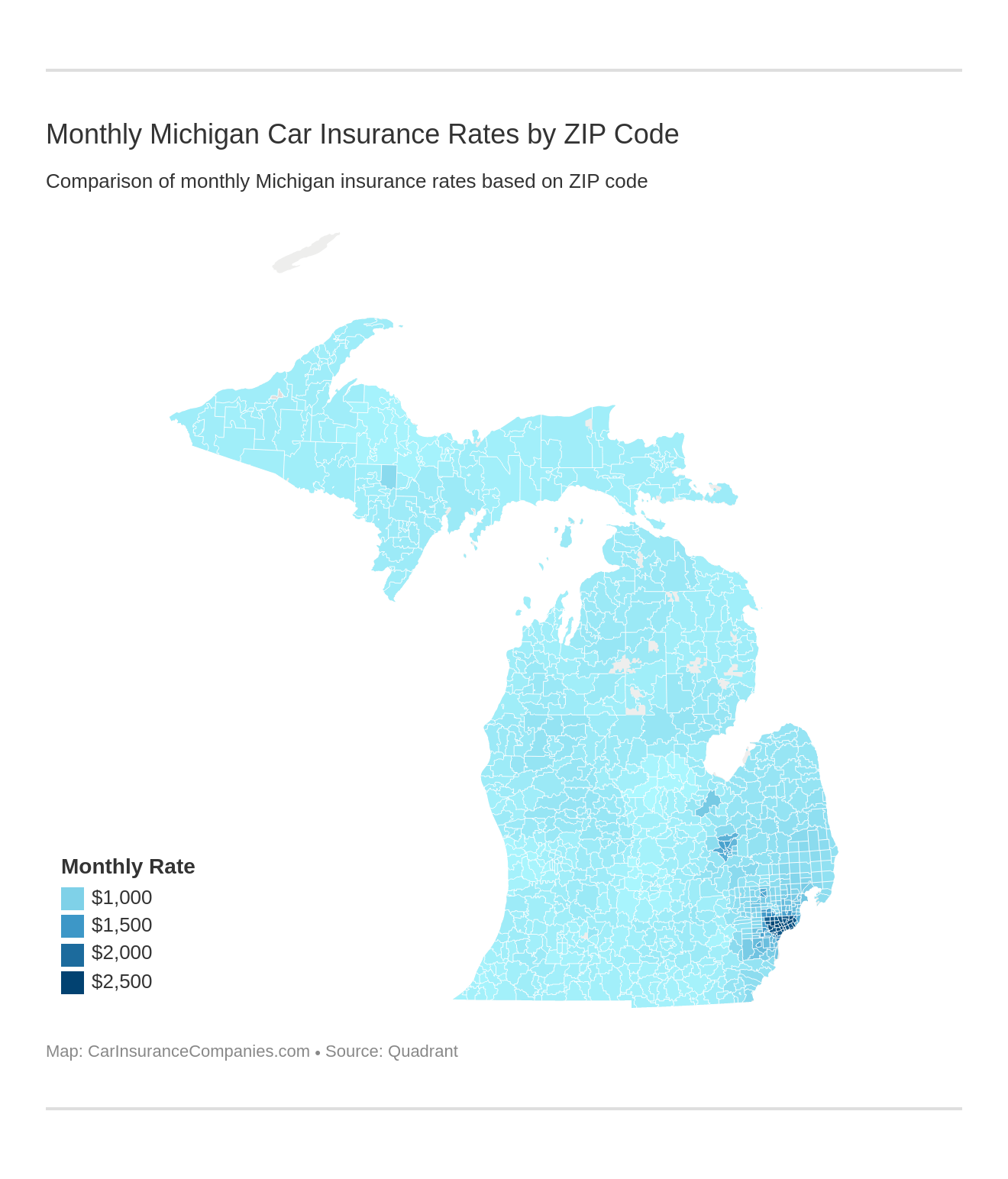

What are the cheapest rates by ZIP code in Michigan?

Your ZIP code is also going to impact the rate a car insurance provider will be able to offer you. Why? Because your ZIP code directly correlates with the amount of money the state of Michigan assumes you make every year.

Take a look at the table below to see how the numbers shake out in the 25 cheapest Michigan ZIP codes:

Top 25 Michigan ZIP Codes With the Cheapest Average Annual Car Insurance Rates

| ZIP Codes | Average | Allstate | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| 48880 | $7,916.29 | $17,625.93 | $4,800.67 | $5,184.08 | $13,023.88 | $5,398.93 | $4,430.90 | $10,644.05 | $6,648.76 | $3,489.43 |

| 48883 | $7,958.69 | $17,642.89 | $4,823.52 | $5,184.08 | $13,023.88 | $5,828.15 | $4,438.08 | $10,408.73 | $6,648.76 | $3,630.14 |

| 48894 | $8,036.93 | $17,180.01 | $5,572.80 | $5,369.32 | $16,459.31 | $3,787.40 | $4,634.97 | $9,323.38 | $6,648.76 | $3,356.40 |

| 48642 | $8,127.78 | $18,874.11 | $4,785.35 | $4,836.32 | $13,023.88 | $5,650.23 | $4,355.62 | $10,459.40 | $8,007.19 | $3,157.97 |

| 48640 | $8,134.85 | $19,119.13 | $4,673.24 | $5,095.38 | $13,023.88 | $5,650.23 | $3,672.71 | $10,813.96 | $8,007.19 | $3,157.97 |

| 48837 | $8,153.32 | $17,357.46 | $4,680.15 | $4,995.62 | $16,459.31 | $4,712.67 | $4,262.59 | $10,682.04 | $6,648.76 | $3,581.27 |

| 48104 | $8,224.45 | $19,974.06 | $4,503.14 | $5,266.90 | $15,223.99 | $3,820.88 | $4,253.28 | $9,768.59 | $8,183.32 | $3,025.88 |

| 48822 | $8,229.45 | $17,324.08 | $4,737.90 | $5,331.39 | $16,459.31 | $4,712.67 | $4,367.96 | $11,230.16 | $6,648.76 | $3,252.85 |

| 48657 | $8,231.24 | $18,874.11 | $4,778.25 | $5,095.38 | $13,023.88 | $5,650.23 | $4,182.70 | $11,071.96 | $8,007.19 | $3,397.49 |

| 48611 | $8,242.98 | $19,119.13 | $4,852.95 | $4,969.14 | $13,023.88 | $6,202.59 | $4,696.57 | $10,215.74 | $7,738.69 | $3,368.16 |

| 48615 | $8,248.57 | $17,625.93 | $5,148.34 | $5,619.10 | $13,023.88 | $5,398.93 | $4,718.81 | $11,297.47 | $8,007.19 | $3,397.49 |

| 48821 | $8,262.31 | $17,665.20 | $4,731.53 | $5,331.39 | $16,459.31 | $4,712.67 | $4,150.50 | $10,402.60 | $7,619.24 | $3,288.33 |

| 49401 | $8,267.02 | $20,296.94 | $4,741.18 | $5,156.33 | $16,202.49 | $4,244.16 | $4,475.91 | $9,187.58 | $6,648.76 | $3,449.84 |

| 49464 | $8,271.79 | $20,336.07 | $4,727.06 | $5,062.68 | $16,202.49 | $4,426.99 | $4,797.07 | $8,959.29 | $6,648.76 | $3,285.66 |

| 48623 | $8,279.45 | $19,119.13 | $5,035.35 | $4,966.88 | $13,023.88 | $6,202.59 | $4,298.98 | $10,132.48 | $8,367.59 | $3,368.16 |

| 48820 | $8,285.75 | $17,793.59 | $4,689.49 | $5,331.39 | $16,459.31 | $4,712.67 | $3,878.41 | $10,806.71 | $7,619.24 | $3,280.92 |

| 48813 | $8,295.51 | $20,260.84 | $4,921.34 | $5,101.76 | $16,459.31 | $3,709.93 | $4,783.96 | $9,520.86 | $6,648.76 | $3,252.85 |

| 49426 | $8,302.44 | $20,336.07 | $4,672.50 | $5,062.68 | $17,839.53 | $4,244.16 | $4,433.09 | $8,199.49 | $6,648.76 | $3,285.66 |

| 48109 | $8,302.99 | $20,708.83 | $4,646.98 | $5,266.90 | $15,223.99 | $3,820.88 | $4,014.39 | $9,803.33 | $8,183.32 | $3,058.33 |

| 48618 | $8,309.23 | $18,855.96 | $4,843.20 | $5,184.08 | $13,023.88 | $5,650.23 | $4,764.09 | $11,056.99 | $8,007.19 | $3,397.49 |

| 48808 | $8,310.66 | $17,762.57 | $4,733.13 | $5,003.47 | $16,459.31 | $5,535.62 | $4,291.31 | $10,110.41 | $7,619.24 | $3,280.92 |

| 48628 | $8,315.01 | $18,955.45 | $5,075.93 | $4,834.01 | $13,023.88 | $5,650.23 | $4,840.23 | $11,290.22 | $8,007.19 | $3,157.97 |

| 49417 | $8,327.06 | $20,317.57 | $4,654.50 | $5,152.91 | $16,202.49 | $5,510.07 | $4,139.17 | $8,868.25 | $6,648.76 | $3,449.84 |

| 48103 | $8,357.87 | $19,829.22 | $4,705.86 | $5,278.21 | $15,223.99 | $4,001.28 | $5,067.69 | $9,905.42 | $8,183.32 | $3,025.88 |

| 48842 | $8,360.88 | $19,620.20 | $4,759.92 | $4,995.62 | $16,459.31 | $4,712.67 | $4,546.52 | $9,868.22 | $6,648.76 | $3,636.68 |

When deciding on where to live in Michigan, you may want to avoid these ZIP codes where you can expect to pay higher insurance rates:

Top 25 Michigan ZIP Codes With the Most Expensive Average Annual Car Insurance Rates

| ZIP Codes | Average | Allstate | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| 48201 | $30,350.09 | $52,871.30 | $63,738.22 | $15,960.28 | $47,157.51 | $16,559.88 | $10,036.37 | $37,173.56 | $24,195.57 | $5,458.09 |

| 48206 | $29,791.56 | $44,722.83 | $61,225.89 | $18,247.10 | $47,565.43 | $16,559.88 | $11,743.11 | $37,648.04 | $24,195.57 | $6,216.23 |

| 48227 | $29,374.46 | $44,530.40 | $61,225.89 | $18,656.46 | $45,282.65 | $16,231.23 | $11,774.67 | $36,234.62 | $24,195.57 | $6,238.69 |

| 48204 | $29,281.79 | $44,530.40 | $61,633.34 | $18,684.61 | $45,107.37 | $16,231.23 | $11,222.82 | $35,692.10 | $24,195.57 | $6,238.69 |

| 48202 | $28,946.15 | $44,722.83 | $59,636.59 | $16,987.34 | $46,152.54 | $16,559.88 | $10,767.83 | $36,034.70 | $24,195.57 | $5,458.09 |

| 48213 | $28,556.49 | $52,871.30 | $50,002.36 | $11,425.33 | $47,274.89 | $12,171.08 | $10,081.02 | $42,770.67 | $24,195.57 | $6,216.23 |

| 48210 | $28,417.19 | $44,722.83 | $59,636.59 | $17,402.93 | $46,345.35 | $16,559.88 | $10,835.13 | $31,396.56 | $24,195.57 | $4,659.88 |

| 48215 | $28,186.14 | $52,871.30 | $48,767.38 | $15,949.99 | $45,352.12 | $16,490.89 | $10,221.56 | $33,610.26 | $24,195.57 | $6,216.23 |

| 48238 | $28,148.98 | $44,530.40 | $53,417.33 | $15,761.84 | $48,632.10 | $13,519.78 | $10,622.96 | $36,323.84 | $24,195.57 | $6,336.99 |

| 48228 | $28,073.11 | $44,530.40 | $60,483.39 | $15,960.28 | $41,759.96 | $16,231.23 | $10,612.34 | $34,224.99 | $24,195.57 | $4,659.88 |

| 48216 | $28,040.22 | $44,530.40 | $58,075.28 | $15,960.28 | $44,099.23 | $16,559.88 | $11,048.62 | $32,434.64 | $24,195.57 | $5,458.09 |

| 48211 | $28,033.06 | $44,722.83 | $48,674.51 | $15,442.09 | $48,550.18 | $16,490.89 | $9,874.23 | $38,131.04 | $24,195.57 | $6,216.23 |

| 48205 | $27,952.29 | $52,871.30 | $47,253.33 | $14,884.17 | $44,056.42 | $11,346.83 | $10,036.44 | $40,710.36 | $24,195.57 | $6,216.23 |

| 48208 | $27,867.09 | $44,722.83 | $50,223.16 | $16,369.64 | $48,684.22 | $16,559.88 | $10,972.15 | $33,618.24 | $24,195.57 | $5,458.09 |

| 48226 | $27,767.57 | $44,722.83 | $54,339.32 | $17,396.69 | $45,311.95 | $16,559.88 | $10,493.86 | $31,429.99 | $24,195.57 | $5,458.09 |

| 48207 | $27,424.94 | $52,871.30 | $47,343.17 | $14,151.77 | $42,930.70 | $16,490.89 | $8,971.31 | $34,411.70 | $24,195.57 | $5,458.09 |

| 48212 | $26,925.66 | $44,722.83 | $49,711.67 | $11,023.89 | $47,125.96 | $16,490.89 | $9,774.02 | $33,069.86 | $24,195.57 | $6,216.23 |

| 48203 | $26,923.65 | $44,530.40 | $49,924.37 | $15,992.81 | $45,923.03 | $16,392.87 | $9,871.02 | $29,145.76 | $24,195.57 | $6,336.99 |

| 48224 | $26,758.51 | $52,871.30 | $48,424.52 | $17,629.41 | $30,619.83 | $11,346.83 | $12,179.19 | $37,343.72 | $24,195.57 | $6,216.23 |

| 48214 | $26,730.26 | $52,871.30 | $44,390.45 | $11,023.89 | $42,752.23 | $12,171.08 | $10,100.43 | $37,609.34 | $24,195.57 | $5,458.09 |

| 48209 | $26,710.78 | $44,530.40 | $50,223.16 | $16,369.64 | $46,345.35 | $16,559.88 | $9,855.96 | $27,412.78 | $24,195.57 | $4,904.33 |

| 48126 | $26,665.38 | $39,997.84 | $68,626.75 | $15,017.27 | $35,895.48 | $13,018.60 | $9,695.00 | $32,161.53 | $20,916.05 | $4,659.88 |

| 48234 | $26,566.42 | $44,722.83 | $45,563.29 | $11,425.33 | $43,236.25 | $16,490.89 | $9,703.04 | $37,544.36 | $24,195.57 | $6,216.23 |

| 48235 | $26,516.64 | $44,530.40 | $49,920.53 | $14,559.73 | $39,861.13 | $14,291.32 | $9,917.37 | $35,036.77 | $24,195.57 | $6,336.99 |

| 48223 | $26,031.27 | $44,530.40 | $47,170.49 | $16,369.64 | $41,650.15 | $16,231.23 | $10,045.03 | $28,054.81 | $24,195.57 | $6,034.15 |

Read more: The Most Expensive Cities for Car Insurance

The differences between these rates are pretty extreme. Even so, the cost of your car insurance shouldn’t be the deciding factor that helps you determine where in Michigan you live — and your ZIP code shouldn’t influence your decision to take on more comprehensive car insurance.

What are the cheapest rates by city in Michigan?

For a broader understanding of how your location impacts your car insurance rate, let’s break down Michigan’s available rates by city:

Average Annual Car Insurance Rates in the Top 10 Largest Michigan Cities

| Cities | Rates | Counties | Population |

|---|---|---|---|

| Ann Arbor | $8,395.25 | Washtenaw | 117,770 |

| Grand Rapids | $9,020.04 | Kent | 193,792 |

| Lansing | $9,273.92 | Clinton/Eaton | 114,620 |

| Livonia | $11,256.51 | Wayne | 94,958 |

| Troy | $11,806.87 | Oakland | 83,107 |

| Sterling Heights | $13,315.84 | Macomb | 131,741 |

| Warren | $15,080.65 | Macomb | 135,099 |

| Flint | $16,343.93 | Genesee | 99,002 |

| Dearborn | $20,920.85 | Wayne | 95,535 |

| Detroit | $26,966.81 | Wayne | 680,250 |

Grand Rapids and Detroit are two of the most expensive cities in Michigan to live in, in terms of car insurance. Comparatively, St. Louis, Michigan, and Shepherd, Michigan, are among the cheapest.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Best Michigan Car Insurance Companies

With the basic information about Michigan’s car insurance requirements under your belt, it’s time to provide a Michigan auto insurance companies list and how driving factors can affect rates, What car insurance providers are the largest in the state, though, and which will offer you the best rates?

In this section, we’ll break down your car insurance options and some additional factors that may raise or lower your rate. Ready to get started?

Read more: Top 10 Michigan Car Insurance Companies

What are the financial ratings of the largest car insurance companies in Michigan?

A.M. Best releases an annual assessment of the largest car insurance companies operating around the United States. This assessment details each company’s financial strength and lets consumers know how safe their investments will be.

Take a look at the table below to see how some of the largest companies in Michigan stack up:

A.M. Best Ratings of the Largest Car Insurance Companies in Michigan

| Companies | Rating |

|---|---|

| Allstate | A+ |

| Farmers | A |

| Geico | A++ |

| Liberty Mutual | A |

| Nationwide | A+ |

| Progressive | A+ |

| State Farm | A++ |

| Travelers | A |

| USAA | A++ |

All of the companies scored well, with a number of them receiving the highest rating possible (A++). This means that none of the companies have poor financial strength, although a few with A ratings are more at risk if the economy takes a turn for the worse.

Which car insurance companies have the best ratings in Michigan?

Where do these same companies stack up in terms of customer service, though? According to J.D. Power, the numbers come out like so:

J.D. Power's Power Circle Ratings – North Central Region (2019)

| Companies | Score (out of 1,000) | Power Circle Rating (out of 5) |

|---|---|---|

| Allstate | 822 | 3 – About average |

| American Family | 820 | 3 – About average |

| Auto-Owners Insurance | 836 | 3 – About average |

| Automobile Club Group | 801 | 2 – The rest |

| Cincinnati Insurance | 832 | 3 – About average |

| Country Financial | 846 | 4 – Better than most |

| Erie Insurance | 852 | 5 – Among the best |

| Esurance | 818 | 3 – About average |

| Farmers | 818 | 3 – About average |

| Geico | 836 | 3 – About average |

| Grange Insurance | 828 | 3 – About average |

| Indiana Farm Bureau | 854 | 5 – Among the best |

| Liberty Mutual | 802 | 2 – The rest |

| MetLife | 794 | 2 – The rest |

| Michigan Farm Bureau | 839 | 4 – Better than most |

| Nationwide | 829 | 3 – About average |

| Progressive | 828 | 3 – About average |

| Safeco | 788 | 2 – The rest |

| State Farm | 841 | 4 – Better than most |

| The Hanover | 807 | 2 – The rest |

| The Hartford | 839 | 4 – Better than most |

| Travelers | 803 | 2 – The rest |

| USAA | 891 | 5 – Among the best |

| Westfield | 855 | 5 – Among the best |

USAA has the best score from J.D. Power, but this company is only for military and veterans. The next best rating is for Westfield insurance company.

Read more:

- Esurance Insurance Company of New Jersey Car Insurance Review

- Westfield Specialty Insurance Company Car Insurance Review

Which car insurance companies have the most complaints in Michigan?

Who doesn’t enjoy a bit of gossip? Take a look at the table below to see how Michigan’s car insurance providers compare when their reputations are on the line — and complaints are used as the metric:

Complaint Index of Top Car Insurance Companies in Michigan

| Companies | Complaint Index | Total Complaints |

|---|---|---|

| Allstate | 1.26 | 226 |

| Farmers | 0.95 | 73 |

| Geico | 0.92 | 600 |

| Liberty Mutual | 0.94 | 146 |

| Nationwide | 0.43 | 37 |

| Progressive | 0.88 | 84 |

| State Farm | 0.57 | 1,397 |

| Travelers | 0.20 | 31 |

| USAA | 1.15 | 328 |

A company with a high number of complaints can still have a low complaint ratio. For example, State Farm has over a thousand complaints but a complaint ratio of only 0.57. This is because State Farm is a large corporation that has millions of customers across the U.S. So a thousand complaints is only a small percentage of customers to State Farm.

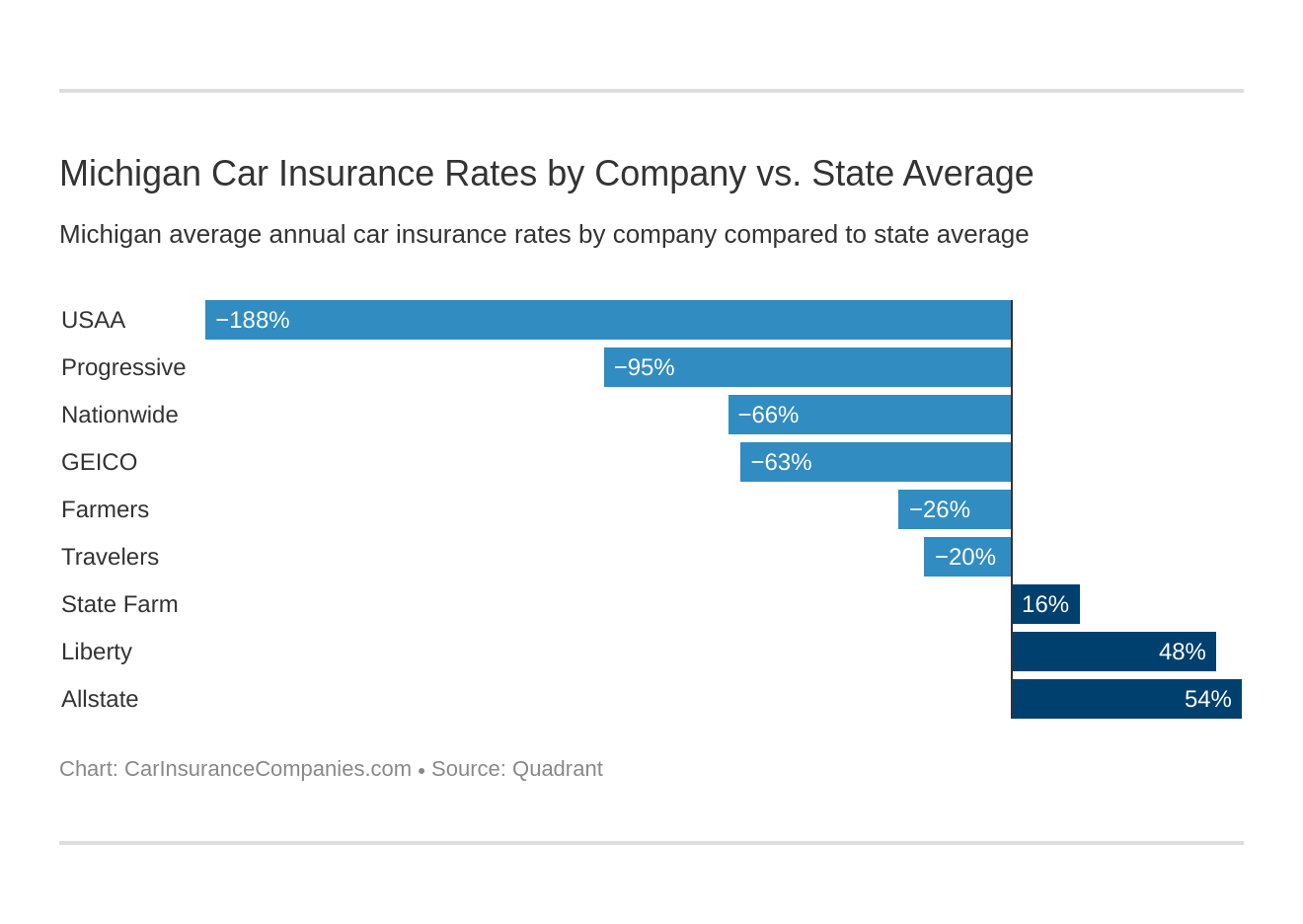

What are the cheapest car insurance companies in Michigan?

Let’s take a moment and talk about affordability. What companies in Michigan will keep your wallet in mind when awarding you a car insurance premium?

Average Annual Rates of Car Insurance Companies in Michigan Compared to State Average

| Companies | Average Annual Rates | Compared to State Average (+/-) | Compared to State Average (%) |

|---|---|---|---|

| USAA | $3,618.06 | -$6,808.70 | -188.19% |

| Progressive | $5,354.18 | -$5,072.58 | -94.74% |

| Nationwide | $6,287.43 | -$4,139.33 | -65.84% |

| Geico | $6,382.54 | -$4,044.22 | -63.36% |

| Farmers | $8,275.23 | -$2,151.53 | -26.00% |

| Travelers | $8,707.10 | -$1,719.67 | -19.75% |

| State Farm | $12,481.81 | $2,055.05 | 16.46% |

| Liberty Mutual | $19,913.09 | $9,486.33 | 47.64% |

| Allstate | $22,821.42 | $12,394.66 | 54.31% |

USAA, Progressive, and Nationwide have the cheapest rates in Michigan. Choosing one of these companies may save you thousands of dollars.

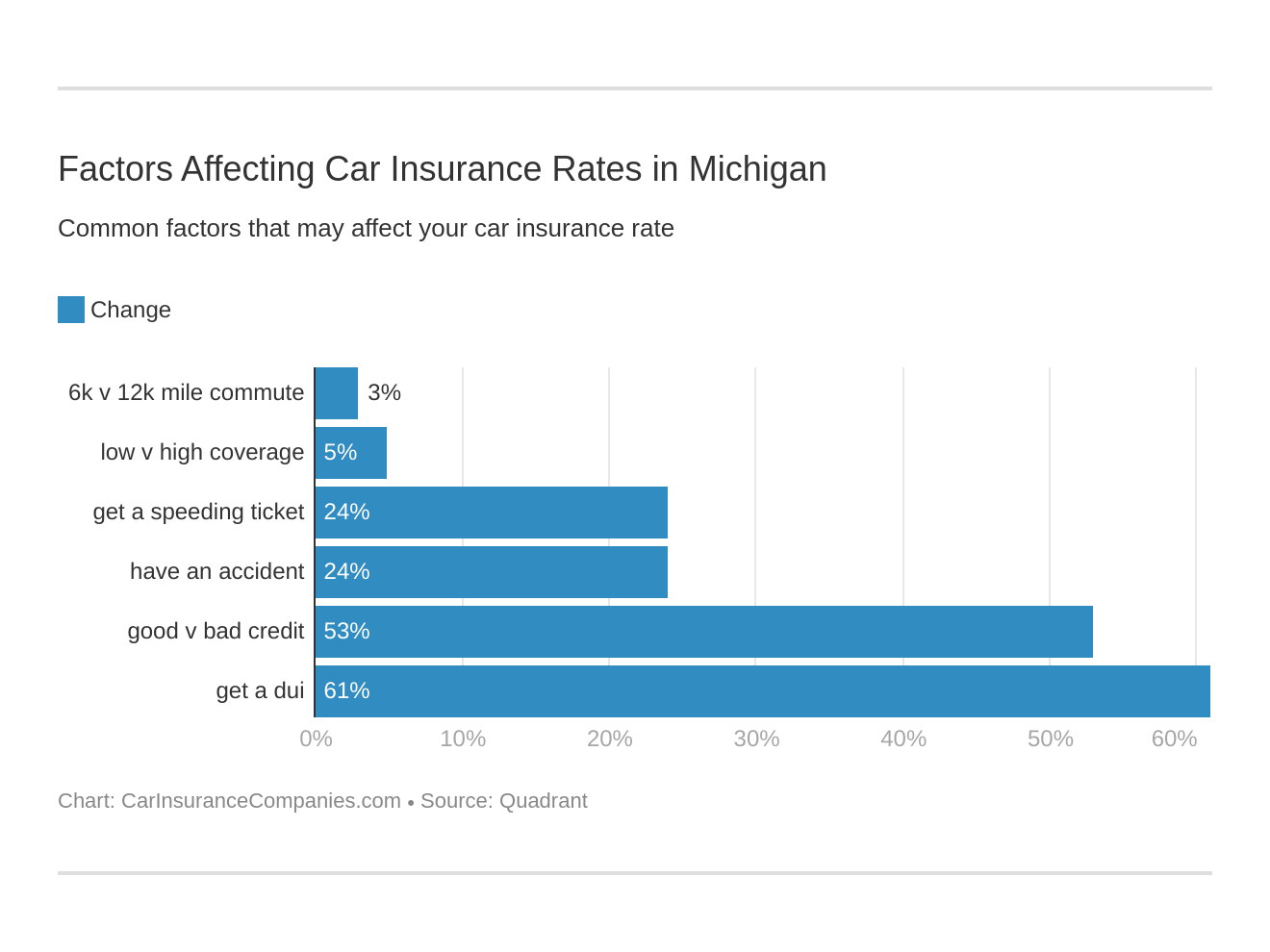

Does my commute affect my car insurance rate in Michigan?

If you happen to drive more than 12,000 miles per year, you’ll often see your rate go up, as detailed in the table below:

Average Annual Car Insurance Rates by Commute in Michigan

| Companies | 10-Mile commute 6,000 annual mileage | 25-Mile commute 12,000 annual mileage |

|---|---|---|

| USAA | $3,576.60 | $3,659.52 |

| Progressive | $5,354.18 | $5,354.18 |

| Geico | $6,236.05 | $6,529.03 |

| Nationwide | $6,287.43 | $6,287.43 |

| Farmers | $8,275.23 | $8,275.23 |

| Travelers | $8,657.15 | $8,757.05 |

| State Farm | $12,142.23 | $12,821.40 |

| Liberty Mutual | $19,223.85 | $20,602.33 |

| Allstate | $22,821.42 | $22,821.42 |

Can coverage level change my car insurance rate with companies in Michigan?

Naturally, the amount of coverage you’re interested in investing in will change the amount you’ll be expected to pay your insurance company:

How does my credit history affect my car insurance rate with companies in Michigan?

Your credit history reflects your ability to pay off debts you may owe to third-party organizations. As your car insurance provider wants to make sure that you’ll be able to pay them back, should they file a faulty loan, they’ll take your credit history in account when assigning you a rate. You can see how your credit will impact your rate in the table below:

Average Annual Car Insurance Rates by Credit History in Michigan

| Credit History | Average Annual Rates |

|---|---|

| Fair | $9,265.59 |

| Good | $7,052.43 |

| Poor | $14,962.28 |

| Average | $10,426.77 |

Naturally, the better your credit is, the less you’re going to have to pay for your car insurance.

How does my driving record affect my rates with car insurance companies in Michigan?

Your driving record lets a car insurance provider know how safe you are, on average, when driving. A car insurance provider that wants to save money while also protecting you is going to offer you a better rate if you’re a cautious driver, as you can see in the table below:

Average Annual Car Insurance Rates by Driving Record in Michigan

| Companies | Clean Record | With One accident | With One DUI | With One speeding violation |

|---|---|---|---|---|

| Geico | $2,247.29 | $4,746.86 | $14,384.88 | $4,151.13 |

| USAA | $2,910.44 | $3,631.64 | $4,758.07 | $3,172.10 |

| Progressive | $4,533.62 | $5,964.06 | $5,361.42 | $5,557.63 |

| Nationwide | $5,376.80 | $7,181.07 | $6,532.75 | $6,059.11 |

| Travelers | $5,891.56 | $8,413.93 | $13,556.16 | $6,966.74 |

| Farmers | $6,933.96 | $8,878.82 | $8,748.36 | $8,539.80 |

| State Farm | $7,942.35 | $9,521.29 | $20,573.92 | $11,889.70 |

| Allstate | $11,113.69 | $14,863.20 | $49,760.80 | $15,547.99 |

| Liberty Mutual | $13,939.21 | $16,814.63 | $31,057.16 | $17,841.37 |

A DUI can blow your available premium out of the water. Cost efficiency, then, is one of many good reasons to try and stay safe while you’re on the road.

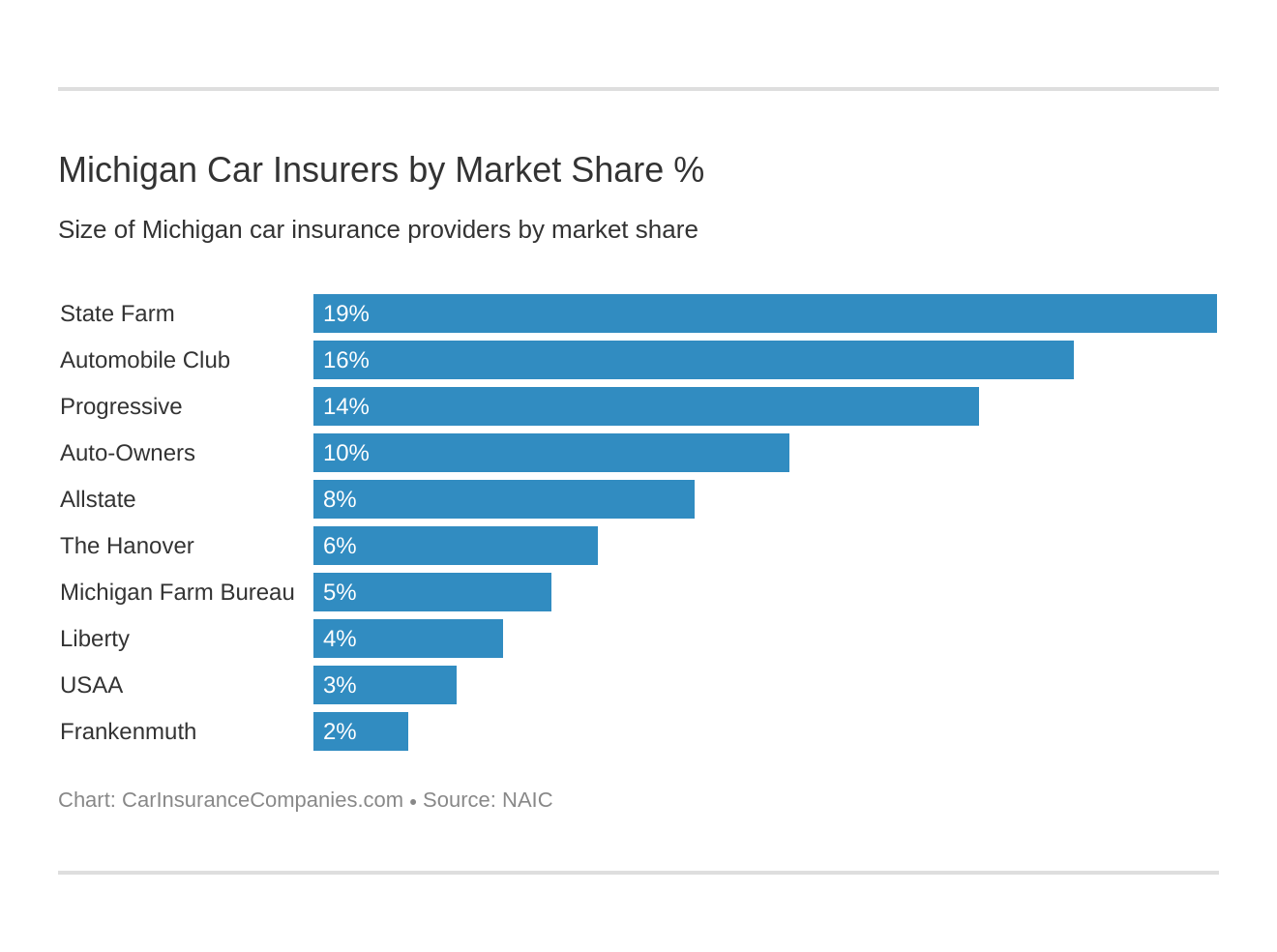

Which car insurance companies are the largest in Michigan?

Who are the largest auto insurance companies in MI?

When it comes to market share, some car insurance providers outshine the others, as you can see in the table below:

Largest Car Insurance Companies by Market Share in Michigan

| Companies | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm | $1,662,966 | .53 | 18.54% |

| Automobile Club Michigan | $1,421,253 | 1.09 | 15.84% |

| Progressive | $1,261,150 | .69 | 14.06% |

| Auto-Owners | $888,716 | .91 | 9.91% |

| Allstate | $731,916 | 1.10 | 8.16% |

| The Hanover | $535,020 | .68 | 5.96% |

| Michigan Farm Bureau | $410,895 | .66 | 4.58% |

| Liberty Mutual | $390,079 | .67 | 4.35% |

| USAA | $271,157 | .89 | 3.02% |

| Frankenmuth | $157,962 | .66 | 1.76% |

State Farm has the largest market share in Michigan. It dominates over 18 percent of the market, which is a huge share to have in the insurance business.

Read more: Frankenmuth Insurance Company Car Insurance Review

How many car insurance companies are available in Michigan?

Each state has domestic and foreign car insurance providers operating within their borders. Domestic providers are providers who solely operate within the state of Michigan. Comparatively, foreign providers are providers who operate on national or international levels. Michigan’s ratio breaks down as follows:

- Domestic – 65

- Foreign – 786

There’s no legal difference between a domestic and foreign provider save for their size and scope. A domestic provider will be able to provide you with comparable coverage to a foreign provider, so long as their ratings are high. Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Michigan Car Insurance Laws

The roadway and car insurance laws are going to vary by state. Few people, though, enjoy memorizing their state’s roadway laws, and even fewer have the time.

That’s where we come in. In this section, we’ll go over Michigan’s car insurance and roadway laws so you know what behavior behind the wheel may get you in trouble.

Ready to get started?

What are the car insurance laws in Michigan?

Car insurance laws in Michigan are designed with the safety of drivers in mind. In this section, we’ll touch on the various laws that protect you from malicious providers, determine how much coverage you’re allowed to have, and how the state detects car insurance fraud. If you’re looking to avoid a civil suit or just better understand the laws that run your state, read on!

How Michigan Laws for Insurance Are Determined

In Michigan, laws are decided via the file and use process. Insurance companies must submit newly-proposed rates to the state department before they can enact them. This way, the state has to approve the raising or lowering of rates, thereby protecting drivers from corruption.

Windshield Coverage in Michigan

When it comes to windshield coverage, the laws established in Michigan are vague but protective. According to Michigan’s windshield law 500.2110b, insurance companies may not legally keep you from choosing the repair shop you reach out to for windshield repairs to an unreasonable degree.

The state also dictates that your insurance company can replace your windshield with aftermarket parts, so long as the repair shop you’re interested in working with submits a cost estimate to the company in writing.

High-Risk Car Insurance in Michigan

If you have a poor driving history, or if you’re caught driving without coverage after getting into an accident, then you may have to get high-risk car insurance. This coverage is more expensive than other types of coverage, but it does come in two forms: operator’s high-risk insurance and owner’s high-risk insurance.

According to Michigan’s Office of Secretary of State, you’ll need to apply for high-risk insurance through your provider of choice.

If you’re not approved for coverage, you can apply for protection through Michigan’s Automobile Insurance Placement Facility. Again, you should expect to pay more for your coverage, but you’ll be able to legally take to the road.

Do note, though, that if you happen to procure insurance through MAIPF, you’ll be eligible for a financial-responsibility restricted license, which will limit your ability to operate on the road.

Low-Cost Car Insurance in Michigan

Michigan does not currently have a low-income insurance program, as some states do. However, drivers can seek out discounts to make the cost of insurance more bearable.

Be sure to ask your provider of choice if you or your family are eligible for any of the following discounts:

- Accident-Free Discount

- Affiliation Discount (this would be any discounts through your employer, school, team, etc.)

- Anti-Theft Discounts (i.e. if you have alarms, tracking systems, etc. on your vehicle)

- Auto-Pay Discounts (granted if you set up automatic payments; some providers refer to it as a Paper-Saving Discount)

- Good Student Discount

- Homeowner’s Discount

- Multi-Car Discount

- Green/Hybrid Car Discount (if you own/lease a hybrid or electric vehicle)

Be sure you shop around to find the best coverage for you that is equally cost-effective.

Automobile Insurance Fraud in Michigan

It’s difficult to commit insurance fraud by accident. That said, the insurance industry sees 10 percent of its operating costs go to processing fraudulent claims or accounts over the course of a year.

There are two different types of automobile insurance fraud:

- Hard fraud involves a driver deliberately falsifying a claim or faking an accident in order to receive compensation.

- Soft fraud involves a driver padding a claim or misrepresenting accident information to an insurance provider.

Soft fraud is the more common of these two types of fraud. Though you may think you’re just telling a white lie, soft fraud is considered a misdemeanor, and lying on your claim is considered a Class 5 felony.

The video below explains some of the main ways customers commit fraud.

Unless you want to face the penalties that come along with fraud, be honest on your claim.

Car Insurance Statute of Limitations in Michigan

Each state has a time limit on the amount of time in which you’re allowed to file an accident-oriented claim with your car insurance provider. In Michigan, you have three years to file both injury-related and property damage-claims with your provider.`

Michigan-Specific Laws

Michigan has one car insurance law that’s unique to the state, called the Michigan Catastrophic Claims Association. This law collects assessments from every car insurance provider, domestic and foreign, operating in the state. In turn, this law allows drivers throughout the state to optionally use PIP coverage after they get into an accident.

What are the vehicle licensing laws in Michigan?

The previous section dealt with Michigan’s car insurance-related legislation. Here, we’ll dive into the specifics of licensing and licensing laws in Michigan. What kind of licenses will you have access to as a resident, and what does the renewal process look like? Keep reading to learn more!

Michigan REAL ID

REAL ID will be a reality come October 2020. This federal ID will soon be required if you want to get onto a plane without your passport. You may even need this kind of ID if you want to enter any federal buildings in the United States.

The video below explains the REAL ID in more detail.

As you can see in the video, to get a REAL ID, you’ll need to renew your license as the nearest Michigan DMV, preferably before the October 2020 deadline.

Penalties for Driving Without Insurance in Michigan

You can face some serious legal consequences if you get caught driving without car insurance in Michigan, as you can see in the table below:

Penaties for Driving Without Car Insurance in Michigan

| Penalties | Details |

|---|---|

| Offense | Misdemeanor |

| Fine | $200–$500 |

| License Suspension (if in an accident/traffic violation) | 30 days or until proof of insurance |

| Jail Time | Up to one year |

Compared to other states, Michigan’s penalties for driving without insurance are fairly light.

Michigan Teen Driver Laws

What’s more exciting than a teenager getting their license? Getting behind the wheel of a car for the first time is as intimidating as it is liberating. However, Michigan places some restrictions on teenage drivers so they can learn the rules of the road. These restrictions, which are part and parcel of a learner’s permit, include:

Learner's Permit Requirements in Michigan

| Requirements | Details |

|---|---|

| Minimum Age | 14 years, nine months |

| Mandatory Holding Period | Six months |

| Minimum Amount of Supervised Driving | 50 hours, 10 at night |

| Minimum Age for DL | 16 |

Teenagers in Michigan must wait until they turn 16 to get a full driver’s license, even if they received their learner’s permit at 14 and nine months. Additional restrictions, upon receiving a learner’s permit, are listed below:

Learner's Permit Restrictions in Michigan

| Restrictions | Details |

|---|---|

| Unsupervised Driving Prohibited | 10 p.m.–5 a.m. |

| Restrictions on Passengers | No more than one passenger under 21 |

| Nighttime Restrictions | Six months of holding learner's permit and age 17 or until age 18 |

| Passenger Restrictions | Six months of holding learner's permit and age 17 or until age 18 |

Once a driver turns 18, she’ll be able to drive free of legal curfews or restrictions. Alternatively, a driver who’s been on the road for six months before turning 17 can forgo the aforementioned restrictions.

Michigan Older Driver License Renewal Procedures

Once you turn 50, you’ll need to renew your license in person every four years. You’ll also need to provide proof of adequate vision every time you go in for a renewal.

New Residents of Michigan

When you first move to Michigan, you’re going to have to reach out to your local DMV to replace your vehicle’s title and license. You’ll have to do this immediately upon moving to the state, as Michigan provides you with no grace period during which to do so.

Michigan License Renewal Procedures

The process through which you renew your license doesn’t change when you turn 50. Younger drivers will have to renew their licenses in person every four years while providing proof of adequate vision if they want to retain their licenses.

Negligent Operator Treatment System in Michigan

Negligent Operator Treatment System (NOTS) refers to reckless and careless driving. If you drive recklessly on the road in Michigan, you will face serious and immediate consequences.

According to Michigan’s reckless driving statute 257.626, a reckless driver is described as a person who “operates a vehicle upon a highway or a frozen public lake, stream, pond, or other place open to the general public…in willful or wanton disregard for the safety of persons or property.”

If you’re caught driving recklessly, you’ll face up to 93 days in jail and a fine capping at $500. If your behavior results in the injury or death of another party, then you’ll be fined up to $10,000 and jail time of up to 15 years. You may also have your license revoked.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

What are the rules of the road in Michigan?

Many of Michigan’s rules of the road are designed to keep you and your passengers as safe as possible. In this section, we’ll touch on the legislation that dictates how fast you can go on the road, how you can interact with law enforcement, and more.

Fault vs No-Fault Car Insurance in Michigan

As mentioned early on, Michigan is a no-fault state. This means that you’ll need to have all the coverage you can get protecting your car, as you’ll be responsible for your own repairs and medical expenses if you happen to get into an accident.

Michigan Seat Belt & Car Seat Laws

Seat belts and children’s car seats are designed to keep you as safe as possible, should you get into an accident while driving. According to the National Highway Traffic Safety Administration, seat belts save over 15,000 lives per year.

What, though, are the laws regarding seat belts in Michigan? Take a look at the table below to learn more:

Michigan Seat Belt Laws

| Key Info | Details |

|---|---|

| Initial Effective Date | July 1st, 1985 |

| Primary Enforcement | Yes |

| Who Is Covered/What Seats | 16+ years old in front seat |

| Maximum Fine – First Offense | $25 |

Any passengers or drivers who are over 16 years old must be buckled up while in a moving vehicle. Passengers under 15 years old need to abide by the laws listed in the table below:

Michigan Car Seat Laws

| Key Info | Details |

|---|---|

| Child Restraint Facing Rear | 7 years and younger and less than 57 inches |

| Adult Belt Permissible | 8 through 15 years; children who are at least 57 inches tall |

| Maximum Fine | $10 |

| Preference for Rear Seat | 3 years and younger must be in the rear seat if available |

The video below explains

If you’re caught driving without a seat belt, law enforcement officers can pull you over without needing any other reason.

Michigan Keep Right & Move Over Laws

If you are driving more slowly than the posted speed limit, or if you are not looking to pass a car in front of you, then state law dictates that you must remain in the right-hand lane of the applicable road.

You must also move over for vehicles that have their lights flashing, regardless of whether or not they’re clearly marked as emergency vehicles. These vehicles include but are not limited to:

- Police cruisers

- Ambulances

- Firetrucks

- Tow trucks

- Recovery vehicles

Watch the news video below, as it covers the Michigan move over law.

Anytime you see a vehicle with flashing lights you need to move over. If it is not possible to move over, you need to reduce your speed as you pass the vehicle.

Read more : Car Insurance for Truck Drivers

Michigan Speed Limits

Speeding is tempting if you’re in a hurry to get somewhere, but it’s also especially dangerous. That’s why Michigan has set reasonable speed limit all across the state, as you can see:

- Rural Interstates – 70 to 75, depending on your section

- Urban Interstates – 70

- Limited Access Roads – 70

- Other Roads – 55

Note that these states are the MAXIMUM speed you can reach. Exceeding these by an exceptional amount can result in a reckless driving charge.

Ridesharing in Michigan

The rise of Uber and Lyft have made it easier than ever for people to get to the places they need to go. These companies have also created a new industry for drivers across the United States. If you currently work with either company or one of their competitors, or if you’ve thought about using your vehicle for a job before, you’ll need to get ridesharing insurance.

Right now, USAA, State Farm, and Nationwide are all able to provide you with ridesharing insurance, if you need it.

Automation on the Road in Michigan

Automation seems to be the way of the future. What, though, does Michigan law have to say about automated vehicles?

While Michigan does allow some automated vehicles on the road, they’re not universally accepted within the state. There are also some restrictions on use, as you can see in the table below:

Automated Vehicle Restrictions in Michigan

| Key Info | Details |

|---|---|

| Type of automation that is permitted on public roads? | Depends on vehicle |

| Operator required to be licensed? | Yes |

| Operator required to be in the vehicle? | No |

| Liability insurance required? | Yes |

If you’re going to ride in an automated vehicle, you need a license and liability insurance to do so.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

What are the safety laws in Michigan?

A number of laws in Michigan apply to the way drivers are legally allowed to behave while behind the wheel of a vehicle. If you’re wondering about the consequences of drinking and driving, smoking and driving, or texting and driving, you can learn all about Michigan’s applicable legislation in this section.

Michigan OWI Laws

Michigan refers to its drunk driving laws as OWI laws, or Operating While Intoxicated laws. These laws and the consequences for violating them are detailed in the table below:

Operating While Intoxicated (OWI) Statistics in Michigan

| Statistics | Details |

|---|---|

| Total Arrests | 27,571 |

| Rate per 1 Million | 3,563 |

| State Rank | 30 |

Michigan sees over 27,000 arrests for OWI driving per year. According to the FBI, though, Michigan only ranks 30th for the number of arrests when compared to other states’ drunk driving arrest records.

Michigan Marijuana-Impaired Driving Laws

Though the use of marijuana will impact your ability to drive safely on the road, Michigan does not have any laws in place making it illegal to use before getting behind the wheel of a car.

Distracted Driving Laws in Michigan

As cellphones become simultaneously more complex and easier to use, it’s all the more tempting to use them while driving. Michigan legislators have anticipated this rise in usage and have acted accordingly, instituting legislation designed to punish drivers who put their own safety and the safety of others at risk by texting and driving.

You can learn more about the details of those legislative acts in the table below:

Cellphone Usage Laws in Michigan

| Key Info | Details |

|---|---|

| Hand-held Ban | No |

| Young Drivers All Cellphone Ban | Learner's permit and intermediate license holders (level 1 and 2); Integrated voice-operated systems excepted |

| Texting Ban | All drivers |

| Primary Enforcement | Yes |

As you can see, Michigan has banned its drivers from texting while driving but not from using handheld devices while driving.

Driving in Michigan

Accidents are called accidents for a reason. Even with data available, you never know when someone’s going to have a bad day on the road. With that in mind, let’s see what kind of fatality trends have arisen in Michigan over the past few years.

How many vehicle thefts occur in Michigan?

Thieves who steal cars don’t always go after sports cars like you’d expect them to. In Michigan, you’ll find that thieves are more diverse in their tastes:

10 Most Stolen Vehicles in Michigan

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Chevrolet Impala | 2008 | 733 |

| Chevrolet Pickup (Full Size) | 1999 | 585 |

| Ford Pickup (Full Size) | 2006 | 530 |

| Dodge Caravan | 2003 | 528 |

| Dodge Charger | 2015 | 477 |

| Chevrolet Trailblazer | 2007 | 462 |

| Chevrolet Malibu | 2013 | 451 |

| Pontiac Grand Prix | 2004 | 418 |

| Jeep Cherokee/Grand Cherokee | 2000 | 407 |

| Ford Fusion | 2014 | 355 |

It’s Chevrolet Impalas and pickups that tend to go missing more so than Mustangs or BMWs. But there’s more to grand theft auto than the type of car in question. Where you live or park will also influence the likelihood of your car being stolen, as you can see in the FBI’s crime report table below:

Top 10 Michigan Cities for Vehicle Theft

| Cities | 2017 Vehicle Thefts (Total) |

|---|---|

| Detroit | 8,144 |

| Warren | 437 |

| Lansing | 399 |

| Grand Rapids | 363 |

| Kalamazoo Township | 332 |

| Flint | 274 |

| Southfield | 263 |

| Pontiac | 222 |

| Redford Township | 212 |

| Wyoming | 210 |

Grand Rapid, Detroit, Warren, and Kalamazoo all see far more car thefts than the rest of Michigan. The video below covers the story of a chop shop filled with stolen cars in Detroit.

As a result of increased theft in these areas, it’s better to be more cautious with your car in Michigan’s urban centers.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

How many road fatalities occur in Michigan?

Theft isn’t the only kind of danger you’re going to encounter on the road while in Michigan. Michigan sees thousands of roadway fatalities on a yearly basis. In this section, we’ll go over the most common so you can better protect yourself and your loved ones.

Most Fatal Highway in Michigan

According to Geotab, I-31 is the most dangerous highway running through Michigan. The highway’s fatality rate can be blamed primarily on its popularity, as it readily allows drivers to follow the coast of Lake Michigan all the way up to the U.P.

In 2017, I-31 saw 111 crashes and 123 fatalities. That’s all the more reason to be especially cautious on this highway.

Read more: The 25 Most Dangerous Cities for Drivers [+Car Theft Rates]

Michigan Fatal Crashes by Weather Condition & Light Condition

Rain, sun and bad weather can all cause roadway fatalities, as you can see in the table below:

Crash Fatalities in Michigan by Weather and Light Condition

| Weather Condition | Daylight | Dark, But Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 413 | 140 | 195 | 30 | 2 | 780 |

| Rain | 29 | 27 | 27 | 3 | 0 | 86 |

| Snow/Sleet | 22 | 8 | 14 | 4 | 0 | 48 |

| Other | 7 | 6 | 7 | 1 | 0 | 21 |

| Unknown | 0 | 0 | 2 | 0 | 2 | 4 |

| TOTAL | 471 | 181 | 245 | 38 | 4 | 939 |

As you can see here, most of Michigan’s accidents occur in broad daylight.

Michigan Fatalities (All Crashes) by County

Some counties see more fatalities over the course of a year than others, as you can see in the table below:

Crash Fatalities in Michigan Counties (2013–2017)

| Counties | 2013 | 2014 | 2015 | 2016 | 2017 | Total |

|---|---|---|---|---|---|---|

| Alcona | 1 | 0 | 1 | 2 | 2 | 6 |

| Alger | 6 | 0 | 2 | 2 | 1 | 11 |

| Allegan | 16 | 14 | 14 | 16 | 13 | 73 |

| Alpena | 2 | 2 | 2 | 1 | 3 | 10 |

| Antrim | 3 | 3 | 3 | 5 | 4 | 18 |

| Arenac | 7 | 2 | 2 | 1 | 7 | 19 |

| Baraga | 3 | 0 | 1 | 1 | 0 | 5 |

| Barry | 11 | 12 | 7 | 4 | 11 | 45 |

| Bay | 10 | 10 | 15 | 10 | 5 | 50 |

| Benzie | 3 | 5 | 4 | 2 | 0 | 14 |

| Berrien | 24 | 14 | 18 | 20 | 20 | 96 |

| Branch | 4 | 7 | 8 | 9 | 2 | 30 |

| Calhoun | 18 | 14 | 25 | 26 | 19 | 102 |

| Cass | 12 | 7 | 15 | 9 | 15 | 58 |

| Charlevoix | 3 | 2 | 2 | 1 | 3 | 11 |

| Cheboygan | 5 | 4 | 0 | 5 | 3 | 17 |

| Chippewa | 7 | 3 | 6 | 4 | 2 | 22 |

| Clare | 5 | 2 | 3 | 8 | 3 | 21 |

| Clinton | 5 | 9 | 5 | 13 | 2 | 34 |

| Crawford | 3 | 4 | 1 | 2 | 4 | 14 |

| Delta | 5 | 2 | 3 | 2 | 10 | 22 |

| Dickinson | 1 | 0 | 1 | 3 | 5 | 10 |

| Eaton | 12 | 11 | 15 | 11 | 14 | 63 |

| Emmet | 4 | 3 | 4 | 5 | 2 | 18 |

| Genesee | 29 | 33 | 33 | 50 | 38 | 183 |

| Gladwin | 2 | 3 | 6 | 2 | 3 | 16 |

| Gogebic | 1 | 1 | 1 | 2 | 3 | 8 |

| Grand Traverse | 14 | 7 | 11 | 15 | 8 | 55 |

| Gratiot | 3 | 4 | 8 | 2 | 5 | 22 |

| Hillsdale | 3 | 10 | 3 | 5 | 5 | 26 |

| Houghton | 3 | 1 | 3 | 1 | 2 | 10 |

| Huron | 9 | 6 | 4 | 7 | 6 | 32 |

| Ingham | 17 | 21 | 17 | 25 | 26 | 106 |

| Ionia | 8 | 3 | 6 | 7 | 10 | 34 |

| Iosco | 3 | 1 | 3 | 1 | 3 | 11 |

| Iron | 2 | 2 | 0 | 4 | 1 | 9 |

| Isabella | 4 | 12 | 16 | 6 | 12 | 50 |

| Jackson | 14 | 17 | 15 | 18 | 20 | 84 |

| Kalamazoo | 36 | 16 | 27 | 35 | 38 | 152 |

| Kalkaska | 8 | 2 | 3 | 4 | 3 | 20 |

| Kent | 48 | 55 | 64 | 57 | 69 | 293 |

| Keweenaw | 0 | 0 | 0 | 0 | 0 | 0 |

| Lake | 1 | 3 | 1 | 3 | 1 | 9 |

| Lapeer | 11 | 12 | 8 | 11 | 11 | 53 |

| Leelanau | 0 | 2 | 4 | 7 | 3 | 16 |

| Lenawee | 14 | 10 | 9 | 16 | 16 | 65 |

| Livingston | 15 | 19 | 12 | 22 | 23 | 91 |

| Luce | 0 | 2 | 2 | 1 | 3 | 8 |

| Mackinac | 4 | 0 | 1 | 1 | 4 | 10 |

| Macomb | 53 | 46 | 61 | 63 | 42 | 265 |

| Manistee | 5 | 2 | 0 | 3 | 3 | 13 |

| Marquette | 3 | 6 | 2 | 5 | 4 | 20 |

| Mason | 6 | 4 | 3 | 5 | 9 | 27 |

| Mecosta | 8 | 7 | 4 | 2 | 4 | 25 |

| Menominee | 2 | 5 | 2 | 2 | 2 | 13 |

| Midland | 5 | 6 | 9 | 3 | 18 | 41 |

| Missaukee | 3 | 1 | 5 | 5 | 0 | 14 |

| Monroe | 27 | 27 | 13 | 18 | 23 | 108 |

| Montcalm | 6 | 10 | 6 | 6 | 23 | 51 |

| Montmorency | 4 | 1 | 0 | 2 | 1 | 8 |

| Muskegon | 11 | 19 | 18 | 21 | 17 | 86 |

| Newaygo | 7 | 7 | 7 | 6 | 12 | 39 |

| Oakland | 56 | 63 | 67 | 80 | 69 | 335 |

| Oceana | 2 | 1 | 4 | 5 | 2 | 14 |

| Ogemaw | 4 | 4 | 5 | 5 | 5 | 23 |

| Ontonagon | 0 | 1 | 1 | 1 | 1 | 4 |

| Osceola | 6 | 3 | 7 | 2 | 6 | 24 |

| Oscoda | 0 | 0 | 0 | 3 | 2 | 5 |

| Otsego | 3 | 4 | 7 | 3 | 7 | 24 |

| Ottawa | 17 | 24 | 19 | 27 | 17 | 104 |

| Presque Isle | 0 | 1 | 2 | 2 | 1 | 6 |

| Roscommon | 8 | 4 | 2 | 5 | 3 | 22 |

| Saginaw | 21 | 10 | 23 | 14 | 22 | 90 |

| Sanilac | 3 | 10 | 6 | 6 | 5 | 30 |

| Schoolcraft | 1 | 0 | 0 | 3 | 1 | 5 |

| Shiawassee | 4 | 6 | 8 | 14 | 6 | 38 |

| St. Clair | 14 | 17 | 18 | 22 | 14 | 85 |

| St. Joseph | 11 | 9 | 4 | 11 | 11 | 46 |

| Tuscola | 6 | 12 | 5 | 6 | 14 | 43 |

| Van Buren | 20 | 9 | 18 | 15 | 17 | 79 |

| Washtenaw | 33 | 30 | 27 | 26 | 39 | 155 |

| Wayne | 171 | 174 | 190 | 201 | 161 | 897 |

| Wexford | 8 | 6 | 10 | 9 | 6 | 39 |

This data, as gathered by the National Traffic Safety Administration, consistently depicts Wayne County — home to Detroit — as one of the most dangerous counties in the state with near 900 roadway fatalities on record.

Michigan Traffic Fatalities

The type of road you’re driving on will also influence your likelihood of getting into an accident, as you can see here:

Crash Fatalities by Area Type in Michigan (2008–2017)

| Years | Rural | Urban | Total |

|---|---|---|---|

| 2008 | 586 | 394 | 980 |

| 2009 | 399 | 473 | 872 |

| 2010 | 426 | 516 | 942 |

| 2011 | 396 | 493 | 889 |

| 2012 | 424 | 511 | 935 |

| 2013 | 429 | 516 | 945 |

| 2014 | 378 | 522 | 900 |

| 2015 | 534 | 428 | 962 |

| 2016 | 424 | 635 | 1,059 |

| 2017 | 402 | 624 | 1,026 |

| Total | 3,812 | 4,718 | 8,530 |

Again, urban roads consistently see more fatalities than rural roads.

Michigan Fatalities by Person Type

Person type — or a person’s relationship to other cars on the road — is an unconventional factor to consider when assessing the number of accidents that occur in Michigan every year. Even so, some trends have clearly started to develop:

Crash Fatalities by Person Type in Michigan (2013–2017)

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 | Total |

|---|---|---|---|---|---|---|

| Passenger Car | 353 | 335 | 342 | 377 | 387 | 1,794 |

| Light Truck – Pickup | 91 | 88 | 95 | 97 | 82 | 453 |

| Light Truck – Utility | 107 | 119 | 121 | 140 | 141 | 628 |

| Light Truck – Van | 50 | 42 | 30 | 49 | 49 | 220 |

| Light Truck – Other | 0 | 1 | 0 | 1 | 1 | 3 |

| Large Truck | 7 | 9 | 11 | 12 | 13 | 52 |

| Bus | 1 | 3 | 0 | 0 | 0 | 4 |

| Other/Unknown Occupants | 22 | 16 | 19 | 27 | 23 | 107 |

| Total Occupants | 631 | 613 | 618 | 703 | 696 | 3,261 |

| Total Motorcyclists | 138 | 112 | 141 | 152 | 150 | 693 |

| Pedestrian | 148 | 148 | 166 | 163 | 156 | 781 |

| Bicyclist and Other Cyclist | 27 | 22 | 33 | 38 | 21 | 141 |

| Other/Unknown Nonoccupants | 3 | 6 | 9 | 9 | 7 | 34 |

| Total Nonoccupants | 178 | 176 | 208 | 210 | 184 | 956 |

| Total | 947 | 901 | 967 | 1,065 | 1,030 | 4,910 |

Read more: Bus Driver Car Insurance

Passenger cars, as you can see, see far more fatalities than any other type of vehicle. Similarly, non-occupants, pedestrians, and motorcyclists frequently suffer the consequences of an accident. That’s all the more reason to keep an eye on your surroundings while you’re on the road.

Michigan Fatalities by Crash Type

What type of crash is most common in Michigan?

Fatalities by Crash Type in Michigan (2013–2017)

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 | Total |

|---|---|---|---|---|---|---|

| Total Fatalities | 947 | 901 | 967 | 1,065 | 1,030 | 4,910 |

| Single Vehicle | 523 | 469 | 536 | 543 | 519 | 2,590 |

| Involving a Roadway Departure | 464 | 426 | 484 | 468 | 429 | 2,271 |

| Involving an Intersection (or Intersection Related) | 241 | 233 | 238 | 322 | 268 | 1,302 |

| Involving Speeding | 255 | 235 | 264 | 245 | 241 | 1,240 |

| Involving a Rollover | 182 | 182 | 163 | 174 | 224 | 925 |

| Involving a Large Truck | 88 | 98 | 75 | 107 | 88 | 456 |

As you can see in the table here, single vehicles get into more accidents than just about any other vehicle driving in Michigan. Michigan also sees more roadway departure fatalities than any other type of accident every year.

Five-Year Trend for the Top Counties in Michigan

How have fatalities been shifting throughout Michigan? Take a look at the table to see how trends have changed in the past five years:

Top 10 Michigan Counties With the Most Fatalities (2013–2017)

| Counties | 2013 | 2014 | 2015 | 2016 | 2017 | Total |

|---|---|---|---|---|---|---|

| Wayne | 171 | 174 | 190 | 201 | 161 | 897 |

| Kent | 48 | 55 | 64 | 57 | 69 | 293 |

| Oakland | 56 | 63 | 67 | 80 | 69 | 335 |

| Macomb | 53 | 46 | 61 | 63 | 42 | 265 |

| Genesee | 29 | 33 | 33 | 50 | 38 | 183 |

| Washtenaw | 33 | 30 | 27 | 26 | 39 | 155 |

| Kalamazoo | 36 | 16 | 27 | 35 | 38 | 152 |

| Monroe | 27 | 27 | 13 | 18 | 23 | 108 |

| Ingham | 17 | 21 | 17 | 25 | 26 | 106 |

| Livingston | 15 | 19 | 12 | 22 | 23 | 91 |

| Top Ten Counties | 498 | 492 | 536 | 590 | 528 | 2,644 |

| All Other Counties | 449 | 409 | 431 | 475 | 502 | 2,266 |

| All Counties | 947 | 901 | 967 | 1,065 | 1,030 | 4,910 |

Out of the top 10 counties, Wayne County has had the most fatalities, followed by Oakland County.

Michigan Fatalities Involving Speeding by County

Speeding has caused a number of accidents in Massachusetts, as you can see in the table below:

Speeding Fatalities by Michigan Counties (2013–2017)

| Counties | 2013 | 2014 | 2015 | 2016 | 2017 | Total |

|---|---|---|---|---|---|---|

| Alcona | 1 | 0 | 0 | 0 | 1 | 2 |

| Alger | 2 | 0 | 0 | 2 | 1 | 5 |

| Allegan | 3 | 3 | 4 | 4 | 0 | 14 |

| Alpena | 1 | 1 | 1 | 0 | 1 | 4 |

| Antrim | 2 | 2 | 0 | 2 | 0 | 6 |

| Arenac | 1 | 0 | 1 | 0 | 3 | 5 |

| Baraga | 1 | 0 | 0 | 0 | 0 | 1 |

| Barry | 3 | 1 | 1 | 0 | 3 | 8 |

| Bay | 3 | 4 | 5 | 0 | 0 | 12 |

| Benzie | 2 | 1 | 1 | 0 | 0 | 4 |

| Berrien | 3 | 3 | 4 | 4 | 1 | 15 |

| Branch | 0 | 2 | 1 | 1 | 1 | 5 |

| Calhoun | 7 | 3 | 13 | 5 | 6 | 34 |

| Cass | 4 | 4 | 3 | 1 | 8 | 20 |

| Charlevoix | 1 | 2 | 2 | 1 | 0 | 6 |

| Cheboygan | 4 | 2 | 0 | 3 | 3 | 12 |

| Chippewa | 4 | 2 | 0 | 0 | 0 | 6 |

| Clare | 1 | 0 | 1 | 1 | 0 | 3 |

| Clinton | 0 | 3 | 1 | 1 | 0 | 5 |

| Crawford | 0 | 3 | 1 | 1 | 1 | 6 |

| Delta | 1 | 0 | 1 | 0 | 2 | 4 |

| Dickinson | 1 | 0 | 0 | 0 | 3 | 4 |

| Eaton | 3 | 2 | 7 | 5 | 3 | 20 |

| Emmet | 2 | 3 | 1 | 0 | 1 | 7 |

| Genesee | 6 | 9 | 10 | 8 | 6 | 39 |

| Gladwin | 1 | 0 | 0 | 0 | 0 | 1 |

| Gogebic | 0 | 0 | 1 | 0 | 1 | 2 |

| Grand Traverse | 6 | 0 | 6 | 2 | 1 | 15 |

| Gratiot | 1 | 3 | 1 | 0 | 0 | 5 |

| Hillsdale | 0 | 6 | 0 | 1 | 1 | 8 |

| Houghton | 0 | 0 | 0 | 0 | 1 | 1 |

| Huron | 1 | 2 | 1 | 0 | 0 | 4 |

| Ingham | 5 | 6 | 3 | 7 | 8 | 29 |

| Ionia | 1 | 0 | 3 | 2 | 3 | 9 |

| Iosco | 2 | 0 | 1 | 1 | 2 | 6 |

| Iron | 0 | 2 | 0 | 4 | 1 | 7 |

| Isabella | 1 | 2 | 6 | 1 | 2 | 12 |

| Jackson | 3 | 4 | 5 | 8 | 4 | 24 |

| Kalamazoo | 11 | 4 | 12 | 8 | 11 | 46 |

| Kalkaska | 5 | 0 | 2 | 2 | 2 | 11 |

| Kent | 9 | 12 | 13 | 13 | 16 | 63 |

| Keweenaw | 0 | 0 | 0 | 0 | 0 | 0 |

| Lake | 0 | 0 | 0 | 0 | 1 | 1 |

| Lapeer | 5 | 2 | 1 | 2 | 1 | 11 |

| Leelanau | 0 | 2 | 1 | 5 | 1 | 9 |

| Lenawee | 0 | 2 | 3 | 4 | 3 | 12 |

| Livingston | 5 | 6 | 2 | 5 | 7 | 25 |

| Luce | 0 | 0 | 0 | 1 | 1 | 2 |

| Mackinac | 1 | 0 | 0 | 1 | 1 | 3 |

| Macomb | 15 | 3 | 15 | 10 | 8 | 51 |

| Manistee | 1 | 1 | 0 | 0 | 0 | 2 |

| Marquette | 1 | 1 | 0 | 1 | 1 | 4 |

| Mason | 1 | 0 | 0 | 0 | 2 | 3 |

| Mecosta | 1 | 3 | 1 | 0 | 0 | 5 |

| Menominee | 2 | 3 | 0 | 0 | 0 | 5 |

| Midland | 1 | 1 | 2 | 0 | 1 | 5 |

| Missaukee | 1 | 1 | 2 | 1 | 0 | 5 |

| Monroe | 5 | 5 | 1 | 3 | 7 | 21 |

| Montcalm | 2 | 2 | 0 | 1 | 1 | 6 |

| Montmorency | 1 | 0 | 0 | 1 | 0 | 2 |

| Muskegon | 4 | 6 | 3 | 5 | 6 | 24 |

| Newaygo | 2 | 0 | 3 | 1 | 4 | 10 |

| Oakland | 12 | 10 | 8 | 10 | 12 | 52 |

| Oceana | 0 | 1 | 0 | 1 | 0 | 2 |

| Ogemaw | 1 | 3 | 2 | 4 | 3 | 13 |

| Ontonagon | 0 | 0 | 0 | 1 | 0 | 1 |

| Osceola | 3 | 2 | 2 | 0 | 0 | 7 |

| Oscoda | 0 | 0 | 0 | 1 | 0 | 1 |

| Otsego | 2 | 2 | 2 | 0 | 0 | 6 |

| Ottawa | 1 | 5 | 1 | 5 | 2 | 14 |

| Presque Isle | 0 | 1 | 2 | 1 | 1 | 5 |

| Roscommon | 2 | 1 | 2 | 5 | 1 | 11 |

| Saginaw | 6 | 2 | 9 | 4 | 3 | 24 |

| Sanilac | 0 | 4 | 1 | 0 | 1 | 6 |

| Schoolcraft | 1 | 0 | 0 | 0 | 0 | 1 |

| Shiawassee | 2 | 1 | 3 | 1 | 2 | 9 |

| St. Clair | 6 | 4 | 1 | 6 | 2 | 19 |

| St. Joseph | 6 | 0 | 0 | 2 | 5 | 13 |

| Tuscola | 1 | 3 | 1 | 1 | 0 | 6 |

| Van Buren | 4 | 4 | 10 | 8 | 2 | 28 |

| Washtenaw | 6 | 12 | 14 | 5 | 6 | 43 |

| Wayne | 50 | 49 | 57 | 58 | 57 | 271 |

| Wexford | 2 | 2 | 3 | 3 | 2 | 12 |

There are a few counties that have had zero fatalities for some years. Leading the pack in fatalities is Wayne County, with 271 total fatalities over the five-year span.

Michigan Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Unfortunately, some drivers don’t take the consequences of drinking and driving seriously. These drivers put themselves and others at risk on the road and frequently cause fatal accidents, as you can see in the table below:

Alcohol-Related Fatalities by Michigan Counties (2013–2017)

| Counties | 2013 | 2014 | 2015 | 2016 | 2017 | Total |

|---|---|---|---|---|---|---|

| Alcona | 1 | 0 | 1 | 1 | 0 | 3 |

| Alger | 2 | 0 | 0 | 0 | 0 | 2 |

| Allegan | 3 | 5 | 2 | 5 | 4 | 19 |

| Alpena | 0 | 0 | 0 | 0 | 1 | 1 |

| Antrim | 1 | 2 | 1 | 1 | 1 | 6 |

| Arenac | 2 | 1 | 0 | 0 | 2 | 5 |

| Baraga | 0 | 0 | 1 | 0 | 0 | 1 |

| Barry | 4 | 2 | 0 | 2 | 3 | 11 |

| Bay | 3 | 3 | 7 | 2 | 1 | 16 |

| Benzie | 1 | 0 | 1 | 0 | 0 | 2 |

| Berrien | 5 | 2 | 8 | 6 | 3 | 24 |

| Branch | 1 | 1 | 4 | 2 | 1 | 9 |

| Calhoun | 5 | 3 | 5 | 5 | 8 | 26 |

| Cass | 1 | 0 | 2 | 0 | 8 | 11 |

| Charlevoix | 1 | 1 | 2 | 1 | 1 | 6 |

| Cheboygan | 4 | 2 | 0 | 0 | 2 | 8 |

| Chippewa | 5 | 1 | 3 | 1 | 1 | 11 |

| Clare | 2 | 1 | 2 | 1 | 1 | 7 |

| Clinton | 0 | 1 | 0 | 5 | 2 | 8 |

| Crawford | 1 | 2 | 0 | 0 | 2 | 5 |

| Delta | 1 | 0 | 1 | 0 | 1 | 3 |

| Dickinson | 1 | 0 | 0 | 0 | 2 | 3 |

| Eaton | 6 | 2 | 3 | 2 | 1 | 14 |

| Emmet | 0 | 1 | 2 | 1 | 0 | 4 |

| Genesee | 10 | 8 | 11 | 12 | 10 | 51 |

| Gladwin | 0 | 1 | 3 | 1 | 1 | 6 |

| Gogebic | 0 | 0 | 1 | 0 | 0 | 1 |

| Grand Traverse | 2 | 1 | 3 | 0 | 1 | 7 |

| Gratiot | 2 | 1 | 0 | 0 | 2 | 5 |

| Hillsdale | 1 | 4 | 0 | 0 | 1 | 6 |

| Houghton | 1 | 0 | 1 | 0 | 1 | 3 |

| Huron | 1 | 1 | 1 | 3 | 0 | 6 |

| Ingham | 5 | 4 | 8 | 6 | 7 | 30 |

| Ionia | 2 | 1 | 3 | 3 | 3 | 12 |

| Iosco | 0 | 0 | 1 | 0 | 0 | 1 |

| Iron | 0 | 1 | 0 | 3 | 0 | 4 |

| Isabella | 2 | 4 | 7 | 3 | 4 | 20 |

| Jackson | 2 | 2 | 4 | 3 | 11 | 22 |

| Kalamazoo | 7 | 0 | 10 | 6 | 9 | 32 |

| Kalkaska | 1 | 0 | 0 | 2 | 0 | 3 |

| Kent | 14 | 14 | 14 | 13 | 16 | 71 |

| Keweenaw | 0 | 0 | 0 | 0 | 0 | 0 |

| Lake | 0 | 1 | 0 | 1 | 0 | 2 |

| Lapeer | 5 | 5 | 2 | 3 | 4 | 19 |

| Leelanau | 0 | 0 | 0 | 0 | 1 | 1 |

| Lenawee | 4 | 1 | 0 | 1 | 5 | 11 |

| Livingston | 3 | 10 | 2 | 3 | 6 | 24 |

| Luce | 0 | 0 | 0 | 0 | 2 | 2 |

| Mackinac | 1 | 0 | 1 | 0 | 2 | 4 |

| Macomb | 14 | 11 | 14 | 14 | 14 | 67 |

| Manistee | 1 | 0 | 0 | 1 | 1 | 3 |

| Marquette | 2 | 1 | 0 | 0 | 2 | 5 |

| Mason | 0 | 0 | 0 | 0 | 2 | 2 |

| Mecosta | 2 | 1 | 3 | 0 | 2 | 8 |

| Menominee | 2 | 0 | 1 | 0 | 1 | 4 |

| Midland | 2 | 1 | 6 | 1 | 3 | 13 |

| Missaukee | 1 | 0 | 0 | 1 | 0 | 2 |

| Monroe | 6 | 12 | 3 | 6 | 12 | 39 |

| Montcalm | 4 | 1 | 1 | 1 | 7 | 14 |

| Montmorency | 1 | 1 | 0 | 1 | 0 | 3 |

| Muskegon | 4 | 2 | 3 | 2 | 5 | 16 |

| Newaygo | 2 | 1 | 1 | 1 | 3 | 8 |

| Oakland | 9 | 14 | 17 | 22 | 18 | 80 |

| Oceana | 0 | 1 | 1 | 1 | 2 | 5 |

| Ogemaw | 0 | 0 | 0 | 0 | 2 | 2 |

| Ontonagon | 0 | 1 | 0 | 0 | 0 | 1 |

| Osceola | 0 | 1 | 4 | 1 | 3 | 9 |

| Oscoda | 0 | 0 | 0 | 1 | 0 | 1 |

| Otsego | 1 | 0 | 2 | 0 | 2 | 5 |

| Ottawa | 2 | 5 | 4 | 3 | 4 | 18 |

| Presque Isle | 0 | 0 | 1 | 1 | 1 | 3 |

| Roscommon | 2 | 0 | 1 | 3 | 1 | 7 |

| Saginaw | 4 | 3 | 9 | 4 | 6 | 26 |

| Sanilac | 0 | 1 | 1 | 0 | 1 | 3 |

| Schoolcraft | 0 | 0 | 0 | 1 | 0 | 1 |

| Shiawassee | 1 | 2 | 4 | 5 | 3 | 15 |

| St. Clair | 6 | 5 | 6 | 4 | 3 | 24 |

| St. Joseph | 3 | 1 | 1 | 1 | 4 | 10 |

| Tuscola | 0 | 5 | 1 | 0 | 7 | 13 |

| Van Buren | 4 | 5 | 7 | 3 | 5 | 24 |

| Washtenaw | 10 | 10 | 9 | 3 | 12 | 44 |

| Wayne | 47 | 34 | 48 | 61 | 54 | 244 |

| Wexford | 4 | 2 | 0 | 2 | 0 | 8 |

Don’t drive drunk. Every number you see is someone who lost his or her life to drunk driving.

Teen Drinking & Driving in Michigan

The numbers in the previous section’s table do not include teenage drinking and driving fatalities. According to the FBI, Michigan’s law enforcement arrested a number of teenagers for DUIs over the past few years, as you can see in the table below:

Teenage Drinking and Driving Statistics in Michigan

| Statistics | Details |

|---|---|

| Total Arrests | 194 |

| Arrests per 1 Million | 88 |

| National Rank | 23 |

Teen drinking and driving is a serious issue. Teens are less experienced than older drivers, which means that they are more likely to be involved in a fatal accident if driving while impaired. Luckily, Michigan has a pretty good arrest record, which means they are working to keep teen drinking and driving under control.

Michigan EMS Response Time

If you happen to get in an accident, you want to have a rough guess as to how quickly the local EMS will be able to reach you. With that in mind, let’s take a look at Michigan’s EMS response times as reported by the NHTSA:

EMS Response Time by Incident Location in Michigan

| Location of Incident | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Crashes Recorded |

|---|---|---|---|---|---|

| Rural | 2.55 | 10.9 | Unknown | Unknown | 367 |

| Urban | 2.7 | 6.01 | Unknown | Unknown | 568 |

As you can see, rural and urban notification times in Michigan are about the same. Outside of that comparison, though, we don’t know too much about how quickly EMS will reach you.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

What is transportation like in Michigan?

Now that you know a little bit more about the dangers of the roads in Michigan, let’s transition to the day-to-day. What kind of traffic should you expect to run into on your way to work in the morning

Car Ownership in Michigan

As is the case across most of the United States, the average home in Michigan sees two cars in its garage.

Commute Time in Michigan

The average commute in Michigan takes 23.3 minutes. This comes in below the national average of 25.5 minutes and suggests that you may have a little extra time to sleep in in the mornings — but not much. Additionally, few to no drivers in Michigan have to endure a super-commute or a commute that lasts for more than 90 minutes both ways.

Commuter Transportation in Michigan

It’ll be no surprise to you that the vast majority of Michigan drivers — 82.5 percent, according to DataUSA — prefer to make their way into work on their own. This percentage actually outranks the national average, which comes in at a respectable 76.4 percent.

Traffic Congestion in Michigan

Finally, what does daily congestion look like in Michigan? To answer this question, we consulted the INRIX congestion scorecard. Of all the cities in the United States, Detroit and Grand Rapids appear on the list of the most congested cities for drivers to try and maneuver in. Detroit even ranks at 315th in the entire world for congestion. Grand Rapids, comparatively, comes in at 368th.

Those ratings are all the more reason for you to try and stay off the roads during peak driving times.

And with that, we’ve come to the end of our guide to car insurance in Michigan. Armed with all of this information, you should be able to confidently approach one of the state’s many car insurance providers and demand the premium you deserve for the coverage you want.

Want to start comparing rates ASAP? You can enter your ZIP code into our FREE online tool to get started.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.