Missouri Car Insurance (Coverage, Companies, & More)

The average Missouri car insurance rates are $100 per month, which is 12 percent less than the national average. Read our guide to find out which Missouri car insurance companies are offering the most competitive rates in your neighborhood. Enter your ZIP code below to start comparing Missouri car insurance quotes for free.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Feb 10, 2025

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 10, 2025

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Missouri Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 131,549 Vehicle Miles Driven: 71.9 billion |

| Vehicles | Registered: 5,406,274 Stolen: 16,999 |

| State Population | 6,126,452 |

| Most Popular Vehicle | Ford F-150 |

| Uninsured Motorists | 14% State rank: 17 |

| Total Driving Fatalities | 2009-2018 Speeding: 3,265 Drunk Driving: 2,505 |

| Annual Average Premiums | Liability: $415.88 Collision: $275.28 Comprehensive: $181.27 |

| Cheapest Providers | Allied P&C (2018) |

If you find yourself in the American heartland, you may catch a glimpse of the famous St. Louis Gateway Arch. Missouri, the Gateway to the West, is considered to be a fundamental part of America’s westward expansion.

Attractions include the St. Louis Zoo, Mississippi River, and Mark Twain’s Boyhood Home and Museum. Anheuser Busch also calls Missouri home; you can visit their famous Clydesdale horses on Grants Farm.

Before going to the Show-Me State you’ll need car insurance. With so much information out there, it can be difficult to know which coverage suits you best. Luckily, we have gathered all of the best car insurance information and put it in one place.

While you are here, use your ZIP Code to get a free quote on car insurance.

How much are auto insurance rates in Missouri?

What kind of auto insurance do you need? What kind of coverage? How much will it cost? Depending on your goals, we can help you make the right decision. We understand that researching car insurance takes energy, but we are here to provide straightforward information and save you time.

Keep reading to learn more about Missouri’s state insurance requirements, what your rates might look like, and more.

Let’s look at how much, on average, Missouri drivers spend on car insurance per year.

| Missouri | National Average | Percent Difference |

|---|---|---|

| $1,207 | $1,474 | -12.4% |

At an average of $1,207 per year, Missouri residents pay about 12.4 percent less than the national average for car insurance.

Missouri Car Culture

Missouri is a large state, and its low population density means fewer cars are on the road. Fewer cars on the road lead to fewer accidents, and in return, lower insurance premiums. The Show-Me State is marked by rural and urban areas, requiring drivers to purchase vehicles based on their specific needs.

Missouri’s history finds its way into the car culture. Classic car shows, power vehicle competitions (i.e., drag racing), and horse owners all inhabit Missouri to different degrees. The true diversity of vehicles is as mythic as the state itself.

Road maintenance is a sticking point in Missouri. While the urban meccas St. Louis and Kansas City mark the entrance and exit to the state, the mid-region contains winding, rural roads. Country roads are more difficult to navigate, maintain, and regulate than urban highways, leading to a disproportionate number of accidents.

In 2014, NHTSA crash statistics found that rural crashes accounted for 61 percent of crashes in that state.

This statistic is alarmingly high, as the national average for rural accidents is 50 percent.

Whether you are an urban or rural driver in Missouri, knowing the best coverage option for your needs will help keep you and your vehicle safe.

Missouri Minimum Coverage

According to the Missouri Department of Insurance, Missouri state law requires a broad range of minimum liability coverage. Penalties for breaking the rules include suspension of a driver’s license or adding four points to a driver’s record.

With 14 percent of Missouri drivers forgoing insurance, it’s important to know what to expect if you are in an accident involving an uninsured motorist. The Insurance Information Institute outlined no-fault insurance laws in Missouri.

Missouri’s law prohibits uninsured drivers from collecting pain and suffering (noneconomic damages) from a motor vehicle accident unless the defendant in the lawsuit operated a vehicle under the influence of alcohol or drugs or was convicted of involuntary manslaughter or second-degree assault.

Furthermore, Missouri Auto Insurance laws mandate insurance companies to include uninsured motorist coverage on all auto insurance policies.

Missouri requires drivers to have the following coverage for each registered vehicle:

| Insurance Required | Minimum Coverage |

|---|---|

| Bodily Injury Liability | $25,000 per person $50,000 per accident |

| Property Damage Liability | $25,000 |

Many drivers choose to purchase more than the minimum requirement for auto insurance. You might also wish to add additional coverages like collision coverage and comprehensive coverage to your policy. Liability, collision, and comprehensive combined is called a full-coverage policy.

While a greater level of coverage will come with a higher auto insurance premium, you’ll save money down the line if you’re in an accident or your car is damaged in some other way.

According to Triple A (AAA), an insurance identification card must be carried in the insured motor vehicle at all times. A motor vehicle liability insurance policy, a motor vehicle liability insurance binder, or receipt which contains the policy information is satisfactory evidence of insurance in lieu of an insurance identification card.

As of 2019, Missouri also permits drivers to show an electronic copy of their insurance card on a mobile device during a traffic stop.

Electronic Proof of Insurance

Electronic Proof of Insurance is a high-risk insurance source. Forty-nine states and the District of Columbia currently accept this electronic presentation, with New Mexico being the exception.

The availability of electronic proof of insurance varies by insurance company. Mobile apps and websites may allow you to download an electronic copy of your auto ID card to cellphones, tablets, or other mobile devices. Customers can provide digital or paper copies of insurance cards if they prefer the traditional format.

Forms of Financial Responsibility

Missouri is a fault state. This means if someone has been in an auto accident, damages can be recovered from the other driver who is found responsible for the accident(s). It’s important to know the ways in which you are financially responsible, as well as the coverage that offers you the necessary protection.

According to the Missouri Department of Revenue, Missouri law requires that all owners and motor vehicle drivers have some type of motor vehicle liability insurance coverage. We have provided an informational video below, brought to you by the Federal Reserve Bank of St. Louis:

Unfortunately, thousands of Missouri drivers are involved in automobile accidents with drivers who have inadequate coverage or no coverage at all. The result is unpaid damage claims and higher insurance premium rates for all Missourians.

Insurance companies provide drivers with different options for basic coverage. Below are the possible kinds of financial liability that are permitted in Missouri.

| Form of Financial Responsibility | Minimum Limits |

|---|---|

| Single-limit Coverage | $50,000 |

| Split-limit Coverage (Liability Insurance Policy) | Bodily Injury Liability of $25,000 per person $50,000 for any two persons Property Damage Liability of at least $25,000 ("25/50/25") |

| A certificate with the Commissioner of Safety | $75,000 |

| A bond filed with the Commissioner of Safety | $75,000 |

| A cash deposit with the Commissioner of Safety | $75,000 |

Driving without any form of financial responsibility, or driving a friend’s car without proof of insurance, are both illegal in Missouri. If you are in an accident and cannot provide proof of insurance, a judge can fine you up to $300, put you in jail for 15 days, suspend your license, or enter an order of supervision against you for each violation.

Premiums as a Percentage of Income

As we discussed earlier, Missouri insurance rates are 12.4 percent lower than the national average. So, how much of your income is going towards your insurance coverage?

| Averages | 2012 | 2013 | 2014 |

|---|---|---|---|

| Missouri Average | 2.22% | 2.30% | 2.30% |

| National Average | 2.32% | 2.39% | 2.29% |

| Percent Difference | -4% | -4% | +4% |

Missouri’s insurance rates are lower than the national average, but how do they measure up against surrounding states?

| State | 2012 | 2013 | 2014 |

|---|---|---|---|

| Illinois | 2.01% | 2.02% | 2.02% |

| Kentucky | 2.76% | 2.83% | 2.76% |

| Tennessee | 2.21% | 2.33% | 2.32% |

| Oklahoma | 2.42% | 2.41% | 2.41% |

| Kansas | 1.94% | 1.98% | 2.04% |

| Nebraska | 1.81% | 1.88% | 1.86% |

The states bordering Missouri can expect to spend around the same percentage of income on insurance, with Kentucky spending the most (2.76 percent) and Nebraska shelling out the least (1.86 percent).

Average Monthly Car Insurance Rates in MO (Liability, Collision, Comprehensive)

Knowing the rates for the main kinds of insurance coverage is the first step in choosing an insurance policy that is right for you.

| Coverage Type | Average Cost in Missouri |

|---|---|

| Liability | $415.88 |

| Collision | $275.28 |

| Comprehensive | $181.27 |

| Combined | $872.43 |

Keep in mind that these rates are from 2015, so 2019 Missouri rates might be higher. Keep in mind that these rates, provided by the National Association of Insurance Commissioners (NAIC), are based on Missouri’s minimum insurance coverage requirements. Nevertheless, this information is still valuable for comparing rates within the state.

Additional Liability

You have the option to add additional liability coverage to your policy. This covers expenses beyond what is already covered in a typical policy. Additional liability can include:

- Personal injury protection, which helps cover medical expenses for all individuals in an accident

- Medical payments (Medpay) help pay medical costs for you and anyone else listed on your policy, regardless of who is at fault.

- Uninsured/underinsured motorist coverage, which provides additional financial protection if you are in an accident with someone uninsured or underinsured.

If you are in an accident, liability insurance is only one layer of protection. Learn more about the forms of additional liability in the video below:

Additional forms of coverage, such as Medpay, Personal Injury Protection, and Comprehensive Coverage will change your deductible, but offer you grater protection if in an accident.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| MedPay | 66% | 69% | 74% |

| Uninsured/Underinsured Motorist | 79% | 75% | 87% |

When an insurance company is paying out too many claims, their loss ratio will be higher than 100 percent. If not enough claims are being paid, then they will likely have a loss ratio that is too low. A good rule of thumb is over 100 percent is too high, while 40–60 percent is average.

Add-Ons, Endorsements, and Riders

There are several additional endorsements, add-ons, and riders you can talk to your insurance provider about including in your policy if they suit your needs. These options are listed below:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Please note that the add-ons listed above are most beneficially when paired with an auto insurance policy that fits your needs. Let’s learn about other factors that could affect your insurance policy.

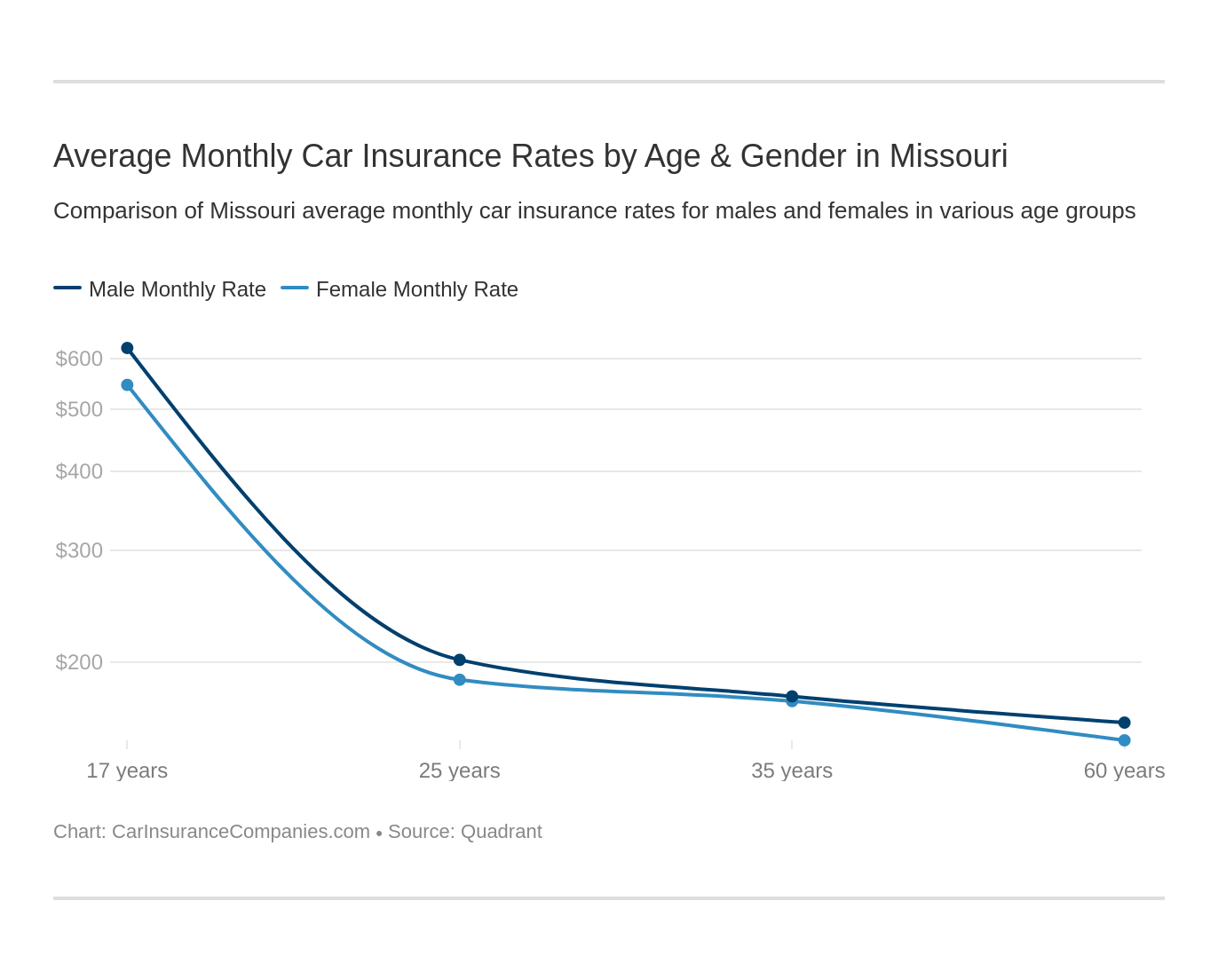

Average Monthly Car Insurance Rates by Age & Gender in MO

The following states have set in place acts of gender non-discrimination when it comes to auto insurance rates: Pennsylvania, California, Hawaii, Massachusetts, Montana, North Carolina, Pennsylvania, and some parts of Michigan. Missouri, however, still allows for different rates among men and women of the same age/marital status.

This table shows the average rates for the main Missouri car insurance providers for various age, gender, and marital status demographics.

| Company | Single 17-year-old male annual rate | Single 17-year-old female annual rate | Single 25-year-old male annual rate | Single 25-year-old female annual rate | Married 35-year-old male annual rate | Married 35-year-old female annual rate | Married 60-year-old male annual rate | Married 60-year-old female annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $8,568.17 | $7,907.03 | $2,804.86 | $2,716.60 | $2,745.70 | $2,837.73 | $2,634.98 | $2,554.13 |

| American Family | $7,634.60 | $5,870.28 | $2,514.45 | $2,149.34 | $2,149.34 | $2,149.34 | $1,913.91 | $1,913.91 |

| Farmers | $10,105.80 | $9,764.18 | $2,828.55 | $2,703.97 | $2,364.03 | $2,371.17 | $2,242.40 | $2,117.42 |

| Geico | $6,266.65 | $5,917.54 | $1,756.44 | $1,744.68 | $2,128.97 | $1,900.51 | $1,889.46 | $1,478.32 |

| Safeco | $10,416.74 | $9,379.72 | $3,059.82 | $2,867.37 | $2,950.25 | $2,721.34 | $2,513.42 | $2,240.72 |

| Allied P&C | $4,908.75 | $3,832.35 | $1,857.41 | $1,717.22 | $1,534.92 | $1,502.66 | $1,424.62 | $1,344.89 |

| Progressive | $7,708.61 | $6,864.63 | $2,625.46 | $2,572.89 | $1,960.45 | $2,112.60 | $1,780.37 | $1,728.12 |

| State Farm | $6,150.91 | $4,878.94 | $2,176.45 | $1,907.72 | $1,696.91 | $1,696.91 | $1,517.71 | $1,517.71 |

| USAA | $5,616.45 | $4,594.51 | $2,153.35 | $1,934.27 | $1,539.81 | $1,551.68 | $1,421.78 | $1,394.40 |

In Missouri, based on the data above, rates are significantly higher for 17-year-old male drivers than for females of the same age. Higher rates are common for teenage drivers. Rates remain fairly consistent for both single and married males and females over age 25.

*Please note that the above data is based on actual purchased coverage by the state population and includes rates for high-risk drivers and those drivers who choose to purchase more than the state minimum as well as other types of coverage not required such as uninsured/underinsured motorist, PIP, and MedPay.

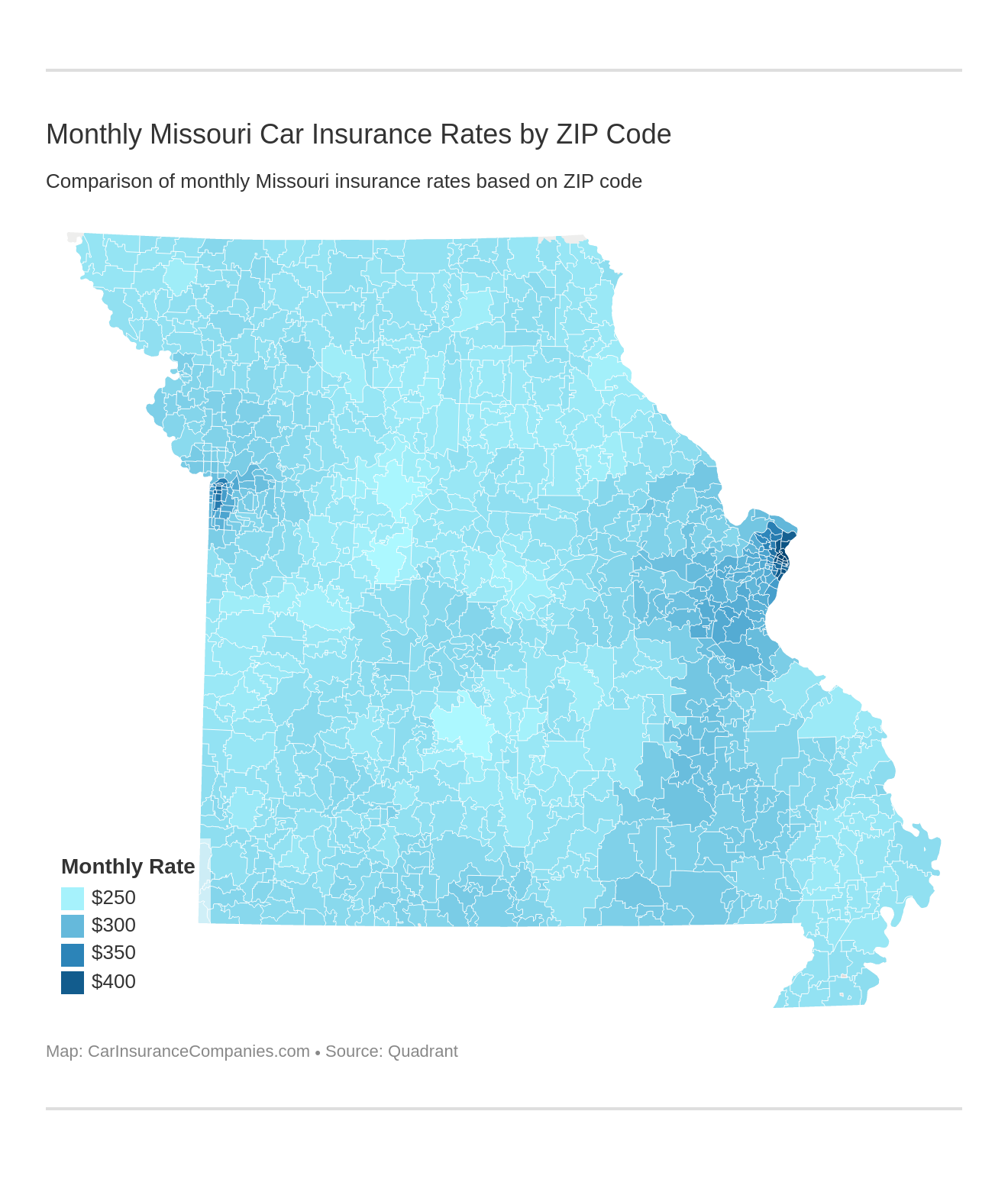

Cheapest Rates by ZIP Code

Knowing how where you live can affect your insurance rates is also a good data point when shopping for the best rates for your needs. Below is a list of the premium rates in every ZIP code in Missouri. Take a look and see where your ZIP code ranks.

Want lower insurance rates?

The table above shows the insurance rates for different ZIP codes. It pays to live in St. Louis with a ZIP code of 63110, where you pay about $650 less than in the same city with a ZIP code of 63120.

Average premiums also vary depending on the city in which you live.

What are the best Missouri car insurance companies?

If you are shopping for car insurance in Missouri, there are plenty of companies from which to choose. While some folks need more coverage for job purposes, others may be interested in getting insurance after an accident, DUI, or speeding ticket.

We agree that finding the right insurance is hard. If you are looking to compare rates, customer ratings, complaint data, or premiums, look no further. We have compiled all of the current data about car insurance companies in your state, including some interesting facts about the top 10 companies in Missouri.

Read More: Missouri Valley Mutual Insurance Company Car Insurance Review

The Largest Companies’ Financial Rating

It’s important to know the insurance companies you are considering are financially stable. According to AM Best, which is a global credit firm focusing on the insurance market, the ratings for the largest insurance providers in Missouri are below.

| Insurance Company | Rating | Outlook |

|---|---|---|

| Allstate | A+ | Stable |

| American Family | A | Stable |

| Farmers | A | Stable |

| Geico | A++ | Stable |

| Progressive | A+ | Stable |

| Shelter | A | Stable |

| State Farm | A | Stable |

| USAA | A++ | Stable |

The table above is like a report card for large insurance companies. AM Best states that companies with a rating of A- or better have good financial health.

How does this apply to your personal car insurance quest?

This information is important because if you ever need to file a claim with any of the above insurance providers, there is less chance your claim will be denied. Choosing a company with a reputable background will help ensure desirable results for you and your automobile coverage.

Companies with Best Ratings

Once you know which company can offer you the best premium rates and financial stability, it’s time to consider overall customer satisfaction. According to a 2019 JD Powers press release, customer satisfaction with car insurance is high.

The companies with the best customer satisfaction ratings in the North Central region of the nation are provided below.

J.D. Power North Central

| Company | Rating |

|---|---|

| 801 |

| 822 | |

| 820 | |

| 832 | |

| 836 | |

| 846 | |

| 852 |

| 818 | |

| 818 | |

| 836 | |

| 828 | |

| 802 |

| 854 | |

| 839 | |

| 794 | |

| 829 |

| 828 | |

| 788 | |

| 841 | |

| 807 | |

| 839 |

| 803 | |

| 855 |

You may be wondering:

What do these rankings mean?

J.D. Power ranks customer satisfaction using a 1,000 point scale. Companies with ratings above 850 are considered among the best; 840-849 are better than most; 815-839 are about average; 800 and under are below average.

Read more:

- Esurance Insurance Company of New Jersey Car Insurance Review

- Diamond Insurance Company Car Insurance Review

- Bloomfield Mutual Insurance Company Car Insurance Review

Companies with Most Complaints in Missouri

Customer satisfaction is based on how well insurance companies communicate with and solve their customers’ various complaints. Knowing where insurance companies stand in terms of how many complaints they receive can help you navigate your many choices.

| Insurance Company | Direct Premiums Written | Complaints | Complaint Index | Market Share |

|---|---|---|---|---|

| Allstate | $12,573,026 | 11 | 280 | 0.30% |

| American Family Mutual | $375,122,196 | 120 | 65 | 9.70% |

| Farmers | $193,246,203 | 68 | 71 | 5.00% |

| Gieco | $204,017,816 | 109 | 108 | 5.30% |

| Liberty Mutual | $8,744,097 | 8 | 185 | 0.20% |

| Nationwide | $22,364,873 | 16 | 145 | 0.60% |

| Progressive | $165,951,655 | 81 | 99 | 4.30% |

| State Farm | $64,120,461 | 46 | 145 | 1.70% |

| USAA | $41,253,758 | 22 | 108 | 1.10% |

Complaint ratios are calculated to indicate the number of complaints a company receives, relative to its size. All complaint ratios start at 1.0 as the baseline. This indicates an average number of complaints. The higher the complaint ratio, the greater the number of complaints.

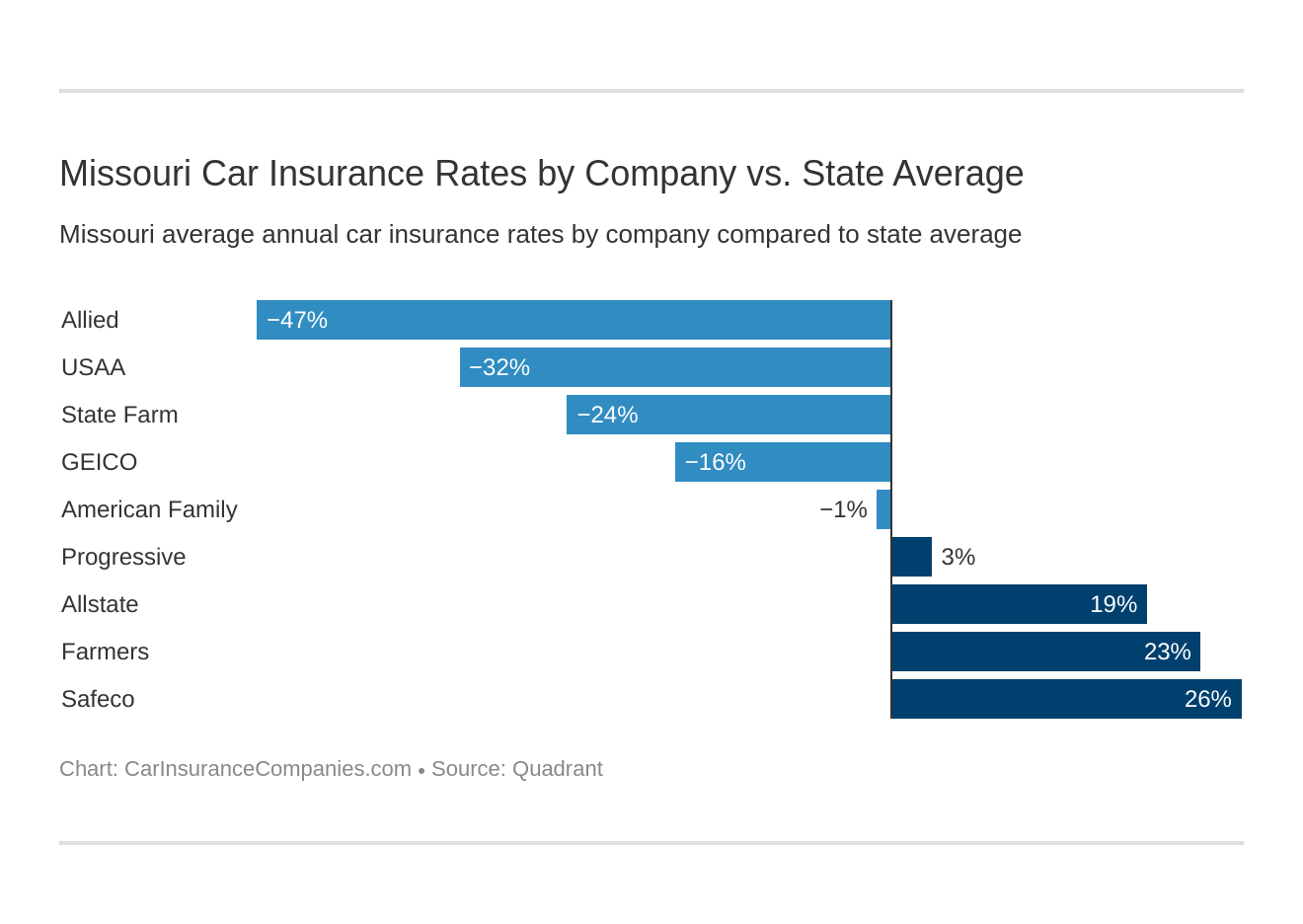

Cheapest Auto Insurance Companies in Missouri

Now that we have covered which companies receive the most complaints, let’s check out how Missouri car insurance companies measure up in terms of affordability. Companies like USAA, State Farm Mutual Auto, and Geico Cas offer cheap auto insurance.

The most expensive insurance company in Missouri is Safeco Insurance Company of Illinois.

| Company | Average | +/- Compared to State Average (Rate) | +/- Compared to State Average (%) |

|---|---|---|---|

| Allied P&C | $2,265.35 | -$1,068.25 | -47.16% |

| Allstate F&C | $4,096.15 | $762.55 | 18.62% |

| American Family | $3,286.90 | -$46.70 | -1.42% |

| Farmers | $4,312.19 | $978.59 | 22.69% |

| Geico | $2,885.32 | -$448.28 | -15.54% |

| Progressive Casualty | $3,419.14 | $85.54 | 2.50% |

| Safeco | $4,518.67 | $1,185.07 | 26.23% |

| State Farm | $2,692.91 | -$640.70 | -23.79% |

| USAA | $2,525.78 | -$807.82 | -31.98% |

The cheapest car insurance company in Missouri, Allied P&C, offers rates nearly 50 percent less than the state average. Safeco Insurance Company of Illinois offers coverage that is 25 percent more than the state average. American Family Mutual and Progressive Casualty offer pricing that is near the state average.

Make sure you get accurate quotes from multiple companies to find the cheapest car insurance rates for your particular circumstances.

The good news?

Missouri’s average rates are still 12 percent cheaper than the national average.

Commute Rates by Companies

The time you spend behind the wheel, driving to and from work, might factor into how much you pay for insurance. As logic holds, the longer you are on the road, the higher the chance of getting into an accident.

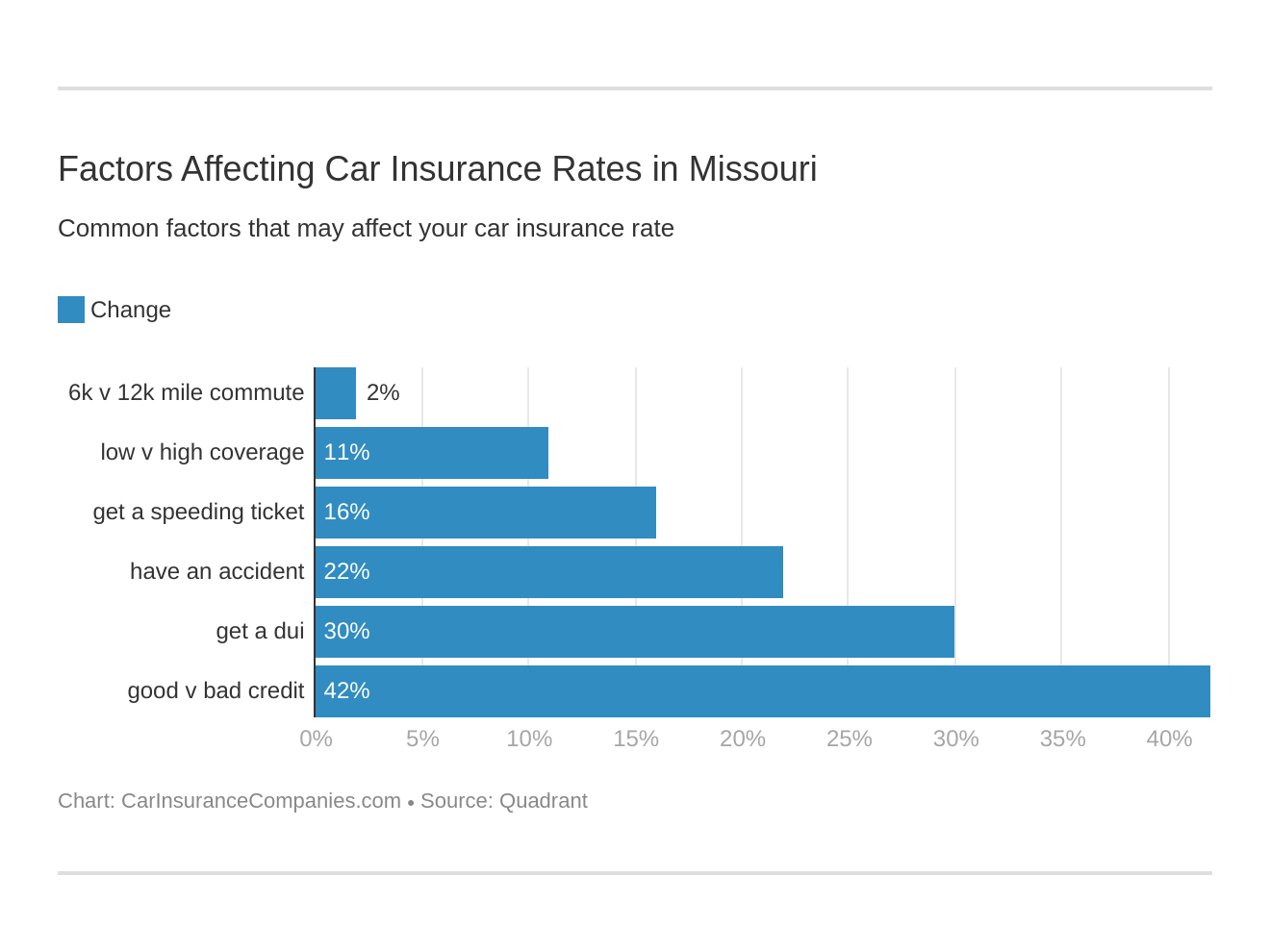

Take a look at these 6 major factors affecting auto insurance rates in Missouri.

Looking to find out exactly how your commute might affect your insurance rates?

| Company | 10 mile commute (6000 annual mileage) | 25 mile commute (12000 annual mileage) | Percent Difference |

|---|---|---|---|

| Allstate | $4,096.15 | $4,096.15 | 0% |

| American Family | $3,254.30 | $3,319.49 | 2% |

| Farmers | $4,312.19 | $4,312.19 | 0% |

| Geico | $2,830.47 | $2,940.17 | 3.90% |

| Liberty Mutual | $4,518.67 | $4,518.67 | 0% |

| Nationwide | $2,265.35 | $2,265.35 | 0% |

| Progressive | $3,419.14 | $3,419.14 | 0% |

| State Farm | $2,627.16 | $2,758.65 | 5% |

| USAA | $2,434.31 | $2,617.25 | 7.50% |

In the table above, we gathered all of the data for companies’ commute rates. Nationwide, Farmers, Progressive, Allstate, and Liberty Mutual do not show any rate change from 10-mile commute and a 25-mile commute. The remaining four companies, however, increase their rates from 2 percent to 7.5 percent for driving further.

One interesting fact is that the five companies whose rates do not increase based on commute are also the five with the highest rates in the list.

Coverage Level Rates by Companies

How much coverage do you need? How much will that coverage level cost you? Check out the table below to compare high, medium, and low coverage premiums in Missouri.

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $3,945.84 | $4,087.71 | $4,254.90 |

| American Family | $3,188.97 | $3,390.79 | $3,280.93 |

| Farmers | $4,037.99 | $4,270.52 | $4,628.06 |

| Geico | $2,699.84 | $2,906.16 | $3,049.96 |

| Liberty Mutual | $4,263.43 | $4,540.46 | $4,752.13 |

| Nationwide | $2,128.01 | $2,286.38 | $2,381.67 |

| Progressive | $3,056.63 | $3,427.58 | $3,773.22 |

| State Farm | $2,524.26 | $2,702.01 | $2,852.45 |

| USAA | $2,419.58 | $2,517.25 | $2,640.50 |

In looking at the above table, you can see some companies charge significantly more for high coverage than they do for low coverage. Choosing a medium coverage may be the best option, as these rates offer the lowest jump in price. In certain companies, we see significant jumps between differing levels of coverage.

For example, Progressive’s high coverage premium is 23.4 percent higher than their low coverage premium. However, the difference between American Family’s low and high coverage is only about 3 percent.

Credit History Rates by Companies

Did you know your credit score affects more than your ability to obtain a loan? In today’s world, many insurance companies consider their customers’ credit scores when determining rates.

The video below explains how your credit score may affect you and your car insurance rates:

Accidents in the past year, driving records, age, and credit score are all factors when it comes to acquiring insurance.

According to a recent Experian report, Missouri residents have an average credit score of 675, which is considered a fair credit score. A credit score of 675 also falls exactly on the national average. Let’s take a look at average rates for good, fair, and poor credit scores in Missouri.

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $3,001.92 | $3,635.18 | $5,651.36 |

| American Family | $2,544.91 | $3,021.03 | $4,294.74 |

| Farmers | $3,904.85 | $4,105.51 | $4,926.22 |

| Geico | $2,076.11 | $2,595.41 | $3,984.44 |

| Liberty Mutual | $3,113.69 | $3,955.62 | $6,486.70 |

| Nationwide | $1,917.26 | $2,206.14 | $2,672.67 |

| Progressive | $3,017.40 | $3,275.50 | $3,964.53 |

| State Farm | $1,981.21 | $2,409.46 | $3,688.05 |

| USAA | $1,404.32 | $1,960.03 | $4,212.99 |

What does all this mean for you?

If you have good credit, or a score of 670 and above, you can expect to pay around $2,551.30. Premiums go up slightly if your score is 580-669, to $3,018.21. Rates increase significantly if your score is in the 300-579 range, average annual premiums jump to $4,431.30.

Driving Record Rates by Companies

Are you a safe driver? Your driving record can have a significant effect on your premium rates. Check out this table to see what your driving record may do to your rates.

| Company | Clean Record | 1 Accident | 1 Speeding Violation | 1 DUI |

|---|---|---|---|---|

| Allstate | $3,512.16 | $3,963.68 | $3,976.44 | $4,932.33 |

| American Family | $2,464.75 | $3,548.51 | $2,810.96 | $4,323.36 |

| Farmers | $3,735.40 | $4,635.57 | $4,343.83 | $4,533.97 |

| Geico | $2,251.53 | $2,917.03 | $2,441.95 | $3,930.78 |

| Liberty Mutual | $3,282.75 | $4,711.37 | $5,222.59 | $4,857.97 |

| Nationwide | $1,781.84 | $2,284.19 | $1,949.48 | $3,045.90 |

| Progressive | $2,965.00 | $3,960.21 | $3,467.90 | $3,283.46 |

| State Farm | $2,476.06 | $2,909.75 | $2,692.90 | $2,692.90 |

| USAA | $2,030.33 | $2,457.96 | $2,215.48 | $3,399.34 |

Have you recently been in an accident? American Family and Nationwide have the greatest increase for your first accident, which increases your rate by 30 percent. Check out the table below, which compares percent increases for each type of driving offense:

| Company | Percent Increase - Speeding Ticket | Percent Increase - DUI | Percent Increase - Accident |

|---|---|---|---|

| Allstate | 13.21% | 28.80% | 11.39% |

| American Family | 14.05% | 43.00% | 30.54% |

| Farmers | 16.29% | 17.61% | 19.42% |

| Geico | 8.46% | 42.72% | 22.81% |

| Liberty Mutual | 59.10% | 32.42% | 30.32% |

| Nationwide | 9.41% | 41.50% | 22% |

| Progressive | 17.00% | 9.70% | 25% |

| State Farm | 8.80% | 8.10% | 15% |

| USAA | 9.11% | 40.27% | 17.40% |

Does speeding, a DUI, or an accident increase your rates?

- Liberty Mutual is the outlier when it comes to speeding, increasing insureds rates by as much as 59 percent.

- Progressive is a great option if you have recently gotten a DUI, as your rate will only rise 9.7 percent.

- Lastly, an accident can increase your rate by as much as 30 percent (American Family, Geico) or as little as 11.3 percent (Allstate).

All in all, it’s a good idea to consider your own driving record and which rates work best for you.

If you don’t have an excellent credit history or a clean driving record, you can still find cheap car insurance.

Make sure to ask any auto insurance companies you’re considering about the insurance discounts they offer. Many companies offer safe driver discounts or discounts for taking a defensive driving course.

There are also good student discounts and discounts for usage-based insurance.

Usage-based insurance programs use a mobile app or plug-in device to monitor your driving habits and issue you a discount for driving safely.

Get auto insurance quotes from multiple companies and ask about discounts to find the lowest rate for your situation.

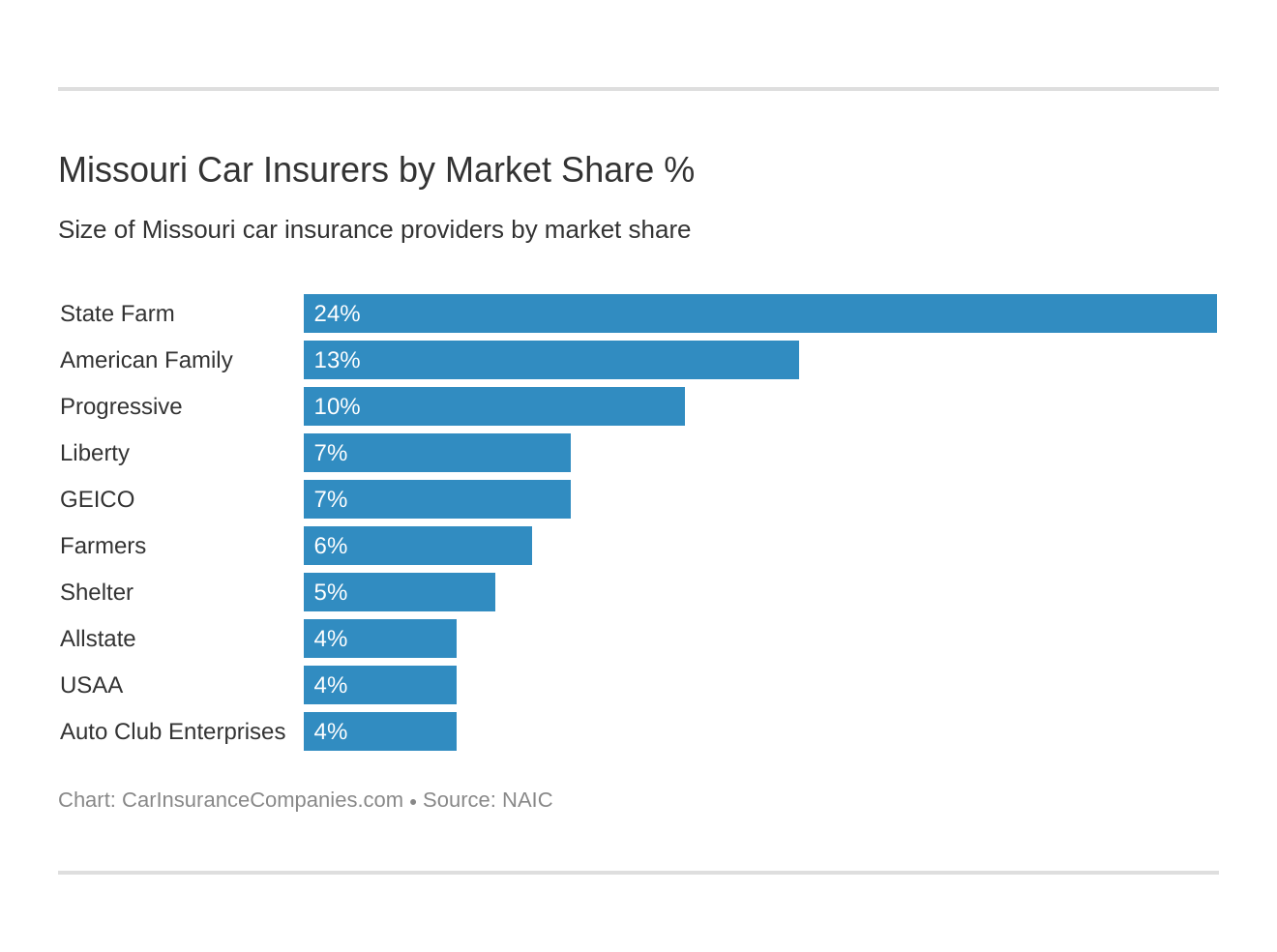

Largest Car Insurance Companies in Missouri

“Am I just a number?” When shopping for car insurance, that thought might cross your mind.

Although it may seem counterintuitive, size does matter when it comes to car insurance companies. Knowing the percent of the market that a company has, combined with the loss and complaint ratio data we discussed earlier, can be a good indicator of that company’s ability to pay should you file a claim.

The largest companies in Missouri and the market share of each is listed in the table below.

| Company | Direct Written Premiums | Market Share |

|---|---|---|

| Allstate Insurance Group | $163,137 | 4.19% |

| American Family Insurance Group | $506,153 | 12.99% |

| Auto Club Enterprises Insurance Group | $146,330 | 3.75% |

| Farmers Insurance Group | $219,419 | 5.63% |

| Geico | $253,457 | 6.50% |

| Liberty Mutual Group | $256,156 | 6.57% |

| Progressive Group | $370,336 | 9.50% |

| Shelter Insurance Group | $206,083 | 5.29% |

| State Farm Group | $937,742 | 24.06% |

| USAA Group | $154,615 | 3.97% |

State Farm group holds the top spot for direct premiums written, at 24.06 percent of the market share. American Family comes in second at 12.99 percent of the market share.

Number of Insurers by State

There are 943 insurance companies in Missouri. Forty-three are considered domestic insurers (an insurer that was incorporated in Missouri), while the remaining 900 are termed foreign insurers (an insurer that was incorporated in a different state).

Every insurance company that sells policies in Missouri is required to act in compliance with Missouri insurance laws, whether they are domestic or foreign. To learn more about those Missouri insurance laws, keep reading.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Missouri Laws

We understand that learning about your state’s specific laws takes time and energy. It’s equally stressful when you need to make an informed decision during a car accident or traffic stop.

Our goal is to provide resources to help you be safe and make informed insurance decisions. Below, we have collected all the legal information you need to help you be safe and make informed insurance decisions. Let’s have a look.

Car Insurance Laws

Every state has its own specific guidelines for auto insurance. We’ve already looked at the minimum requirements for insurance so you can drive legally in Missouri, but there are many other areas that need to be brought to your attention. An understanding of state laws and the origins of these laws can help you become an informed driver.

Other areas to cover include correct licensing procedures, windshield requirements, speed limits, and other rules of the road that are just as important for you to know. A knowledge of these requirements will not only allow you to be a better driver on the road but make the most informed decision when it comes to personal auto insurance.

How State Laws for Insurance are Determined

While there are many ways to learn about how states determine their insurance guidelines, one valuable resource is the National Association of Insurance Commissioners (NAIC) website. There you can discover a wealth of information, including abrief history of insurance law in the U.S.

The web contains overwhelming amounts of information. We are here to help you learn more about legislative processes in Missouri.

Missouri’s driving laws begin with a bill that is put before the state legislature. The state legislature considers the necessity, benefit, etc. of the law. If they agree it’s both necessary and official, it will become law. Thus, Missouri drivers are expected to meet what is stipulated by the law.

Insurance is regulated on a state level, and certain mechanisms used to regulate the rates that insurance companies are allowed to charge consumers. For example, Missouri is a file-and-use state, meaning that insurance companies can impose new rates without prior state approval.

Missouri also has several safety-related laws. The next few sections will help you familiarize yourself with these laws.

Windshield Coverage

There are no unique laws in Missouri regarding windshield coverage. “After-market parts” may be used, if stated on the estimate, if the parts are “at least equal in like, kind and quality in terms of fit, quality, and performance.” So, the parts should measure up to the ones they are replacing.

It’s interesting, however, that Missouri insurers may designate a specific repair shop for windshield damage. Not all states moderate the insurer choosing an insured’s vendor.

High-Risk Insurance

As we discussed earlier, Missouri does maintain minimum liability coverage requirements for drivers within the state. These requirements range from the “25/50/25” rule for property damage and bodily damage liability.

You may find it difficult to purchase insurance if you have a less-than-stellar driving record.

If you are considered a high-risk driver (you have a poor driving record, a DUI, etc.), you may find yourself unable to obtain an insurance policy through regular means.

If you are a Missouri driver with previous driving infractions, a program called Mo AIP (Missouri Auto Insurance Plan) exists to aid drivers who are not otherwise able to find coverage. Mo AIP is an independent entity. Rather than acting as an insurer in itself, AIP assigns at-risk drivers to pre-existing insurance companies, setting them up with the appropriate coverage.

To be eligible for a Missouri Auto Insurance Plan (Mo AIP), a person must meet the following requirements:

- Must have a valid drivers license

- Must have a car that has been registered

- Proof that they have applied for insurance and been turned down (in the last; two months)

- Have no unpaid insurance premiums from the last 36 months.

How can Mo AIP help you meet your minimum requirements in Missouri?

| Mandatory Coverage | Minimum Requirements | MO AIP Maximum Limits |

|---|---|---|

| Bodily Injury | $25,000 per person / $50,000 per accident | $100,000 per person/ $300,000 per accident |

| Property Damage | $10,000 per accident | $100,000 per accident |

| Uninsured Motorist Bodily Injury | $25,000/$50,000 | As high as the limit for BI on the same policy |

The above table shows the minimum coverage for Missourians and the highest coverage options with Mo AIP. For example,

Under Mo AIP, insurance companies will still provide you with policies that offer the same amount of coverage as the minimum liability coverage requirement, as well as an option for uninsured motorist coverage. Optional coverages such as comprehensive and collision may be available through your insurance agent.

Before your insurance coverage is available, however, you will need to pay a deductible amount of $100, $200, $250, $500, and $1,000 out-of-pocket. The lower the deductible, the higher your premium will likely be.

If you qualify for and receive assistance from Mo AIP, the policy coverage you receive is active for three years. If, at any point during those three years, you can find and obtain better insurance coverage, you are allowed to switch by notifying your current insurance provider.

Premiums for high-risk drivers in Missouri are based on many factors and your insurance agent has a lot of flexibility when it comes to pricing your policy.

It pays to understand how the auto insurers evaluate you as a risk – for example, by driving conservatively or sticking to the speed limits over the next few years, you can demonstrate lower driving risk.

The plan mandates that an assigned insurer will provide you with coverage for a consecutive period of at least three years.

At the end of that time, if you are still considered “high-risk” and unable to find coverage outside of Mo AIP, you can re-apply to the program, and seek a new coverage plan. You may be assigned a new insurer, but you will still be able to receive coverage.

To apply for Mo AIP, you can contact any licensed car insurance agent. He or she can help you fill out and submit an application. You can also contact the insurance plan directly at (888) 706-6100.

Low-Cost Insurance

Although Missouri has a program for high-risk drivers, it does not currently have one in place to help low-income drivers.

California, Hawaii, and New Jersey are the only three states that have government-funded programs to help low-income families pay for their car insurance.

Automobile Insurance Fraud in Missouri

An insurance fraud offense typically occurs when someone tries to make money from an insurance transaction through lies or deception. Insurance fraud in Missouri is considered a punishable crime and, depending on the severity, may be considered either a misdemeanor or a felony.

Auto insurance fraud includes a wide breadth of actions, but the most common are misrepresenting facts on insurance applications to submitting claim forms for injuries or damage that never occurred or billing an insurer for a medical procedure that was not performed. Insurance providers can also violate insurance laws by misrepresenting sales or presenting inappropriate cancellation or denial of coverage.

In Missouri, insurance fraud can occur in many different ways. Examples of insurance fraud include:

- Casualty fraud: which means exaggerating injuries due to an accident to increase the amount of funds you receive from the insurance company, or even faking an accident to file a claim

- Property fraud: Someone exaggerates the amount of damage incurred to their home, car, or other possession; deliberately damages their possessions for reimbursement by the insurance company, or seeks reimbursement for a lost or stolen item that was neither lost nor stolen.

What is prohibited?

Consumers may be held responsible for insurance fraud if they knowingly misrepresent important facts in relation to an insurance claim or payment or have damaged property to reap insurance benefits.

For insurance providers, issuing fake insurance policies, rate-fixing, misrepresenting insurance when selling it, denying compensation for covered incidents, operating an insurance company in bad faith, etc.

If you feel you’ve been victimized by insurance fraud, you can visit the Missouri Insurance Fraud site or contact the Missouri Insurance Consumer Hotline at 1-800-726-7390.

Statute of Limitations

How long do you have to file a car accident lawsuit in Missouri? Missouri requires you to file a lawsuit within five years from the date of the car accident for both personal injury and property damage.

After five years, you are barred from filing a lawsuit. For other types of cases, there are different time limits. Regardless, it’s important to be aware of the distinct time constraints so that you have ample time to prepare to file a lawsuit.

Are you wondering if you have a viable case? If your car accident case involves an injury or disputed matters, you should consider contacting an experienced car accident attorney in Missouri. Talking to an attorney can help you take action before it’s too late to file a claim.

State-Specific Laws

On country roads or city streets, it’s important to share the road with bicyclists and mopeds. Missouri law requires drivers of automobiles to provide a full lane width when passing cyclists. Careful observations of surrounding bike lanes, streets, and intersections will help ensure the safety of cyclists and drivers alike.

Missouri has specific laws for mopeds. It’s illegal to drive a motorized vehicle without a drivers’ license. This law applies to any Missouri roadway, including city streets, county roads, or state highways. They must also abide by the same laws governing a motor vehicle, because motorized vehicles, bikes, and scooters are not toys. (For more information, read our “Does car insurance cover a bike accident?“).

Vehicle Licensing Laws

Have you ever been pulled over for having the wrong plates? If you want to avoid fees and potential suspension of your license, you should be aware of the laws in Missouri associated with registering your vehicle and obtaining and maintaining your driver’s license.

In this section, we will cover the different requirements for registering a new vehicle, a used vehicle, or registering your vehicle in the state as a new resident.

If you are a new resident in the state and need to register your vehicle, you must visit your local county clerk’s office and bring:

- An emissions inspection, not more than 60 days old, if you reside in St. Louis City or the following counties: Franklin, Jefferson, St. Charles, or St. Louis, if applicable.

- A Missouri safety inspection, not more than 60 days old OR

- Identification number and odometer (ID/OD) inspection.

- A current insurance identification card or other proof of financial responsibility.

If you are registering a new vehicle, you must submit the following documents to the county clerk’s office:

- Manufacturer’s statement of origin

- New vehicle invoice

- Copy of current registration (if you are transferring your license plate)

If you are registering a used vehicle, you must submit to the county clerk’s office:

- A valid certificate of properly assigned title

- An Odometer Disclosure Statement (if applicable)

- Copy of current registration (if you are transferring your license plate)

Whether you are a new resident, registering a new vehicle, or registering a used vehicle in Missouri, it’s important to follow the appropriate guidelines.

REAL ID

Missouri is compliant with the REAL ID Act. This means that federal agencies can accept Missouri drivers’ licenses as a secure form of identification at federal organizations like the Transportation Security Administration (TSA), nuclear power plants, and other federal facilities (assuming you need access). More information can be found at the Department of Homeland Security’s website.

Starting October 1, 2020, if you do not already have a REAL ID, you will be required to have one should you need access to specific Federal buildings, nuclear power plants, and fly in the United States.

The REAL ID Act, passed by Congress in 2005, enacted the 9/11 Commission’s recommendation that the Federal Government “set standards for the issuance of sources of identification, such as driver’s licenses.”

Your REAL ID license will include a gold star in the top right corner of your license.

If you plan on getting a REAL ID-compliant license in Missouri, you will need to visit a Missouri Department of Revenue Office. They handle most driver and vehicle services in the state, with the exception of fo license examinations. You should plan to bring along the following documents to process your REAL ID:

- A verification of identity such as certified U.S. birth certificate, a U.S. passport, an employment authorization document, a permanent resident card or a foreign passport with an approved I-94 form

- Proof of name changes (if applicable)

- Two current residency documents with the applicant’s name, such as a utility bill, rental agreement, deed/title or a bank statement

- Social Security Number

If you have questions about the REAL ID, you can visit the Missouri Department of Revenue’s informational page.

Penalties for Driving Without Insurance

Fourteen percent of Missouri drivers do not have car insurance.

Missouri law requires that all drivers and owners of vehicles have some type of motor vehicle liability insurance coverage. This means a motor vehicle liability insurance policy that meets the minimum liability insurance requirements.

So what happens if you are stopped and cannot provide valid proof of insurance?

According to the Missouri Department of Revenue, a violation of insurance liability laws can result in the following:

- The court will add four points added to your driving record

- The court may enter an order of supervision

- The court may suspend your driver’s license

You must keep some proof of insurance in your vehicle at all times, whether electronic or paper. If an accident is involved, an SR-22 filing is required for proof of liability insurance.

Read more: How long do points stay on your driver’s license?

Teen Driver Laws

If you are a teenager or have a teen driver, it’s important to be aware of Missouri’s specific laws.

To learn to drive, teenagers in Missouri must enter Missouri Graduated License Law. To apply, they must be at least 15 years old and pass the vision, road sign recognition, and written tests at a Missouri State Highway Patrol driver examination station. If they are under the age of 16, a qualified person must accompany the applicant to their appointment.

A qualified person will need to ride in the passenger seat with a driver who has their instructional permit. A qualified person must meet the following requirements:

- A grandparent

- A qualified driving instructor

- A qualified driver at least 25 years of age

- A qualified driver designated by the disabled parent or guardian of the permit holder

While the minimum age for obtaining a learner’s permit is 15, it must be held for at least six months before the driver can obtain an intermediate drivers’ permit. This can be obtained if the driver has completed the following criteria:

- Must have an instruction permit for 182 days

- A minimum of 40 hours of driving instruction

- At least 10 hours of nighttime driving

- Have no alcohol/traffic-related convictions in the last year

At 16, if the teenager has met the learner’s permit requirement, they can apply for the intermediate licenses, which allows:

- Driving unsupervised, except for between the hours of 11:00pm–6:00am.

- No more than one passenger, except for family members

At six months after obtaining a beginner’s permit, an intermediate drivers’ license can be obtained. A driver must pass the driving test at a Missouri State Highway Patrol driver examination station before they can obtain an intermediate license.

What is the final step for teen drivers in Missouri?

The Under-21 Full Driver License is available at age 18. Given that the applicant has passed the first two stages of licensure and has no alcohol-related offenses or traffic convictions in the last 12 months.

Older Driver License Renewal Procedures

Are you over the age of 70 in Missouri?

According to the Insurance Institute for Highway Safety, the renewal procedures for older drivers are different from those of the general population. Ages 21–69 is every six years, but ages 70 and over must renew every three years.

- The renewal cycle is every three years

- Proof of adequate vision is required at every renewal

- Both mail and online renewal through the Missouri Department of Revenue

New Residents

If you just moved to Missouri and need auto insurance coverage, or you’ve had questions about the procedures, we are here to help.

Once you move to the state, you have 30 days to visit your local license office and take care of your legal responsibilities to acquire the appropriate titling and licensing documents.

New Missouri residents with an out-of-state driver license or nondriver license, must provide acceptable documents of the following:

- Proof of Identity

- Date of Lawful Status

- Proof of Social Security number

- Proof of Missouri residential address

- Two acceptable documents as proof of Missouri residency and state of domicile (if you wish to acquire REAL ID, a Commercial Driver License or a Commercial Learner’s Permit)

License Renewal Procedures

License renewal for the general population in Missouri is a relatively simple process. When it’s time to renew your license in Missouri, you will receive a renewal notice at least 15 days before your license’s expiration date.

The Missouri DOR handles these processes, and you can renew online or in person. The period between renewals varies, which vary depending on your age.

- Age 18–20, 70 or older: License expires three years after your birthday

- General population: License expires six years after your birthday

If you are an active military member currently stationed in out-of-state or outside of the U.S., or active duty military member’s spouse/dependent stationed out of state, you can renew your Missouri drivers license by mail.

You will need:

- A completed Mail-In Driver License Application (Form 4317)

- Copies of your active-duty military documents or military ID

- Proof of your identity (U.S. birth certificate, U.S. passport., U.S. military ID)

- Your Social Security number

- Proof of your MO address (Utility bill, voter registration card, paycheck)

- Payment

If you choose to renew in person, visit the MO DMV office and bring your discharge papers and any other required documents.

The Missouri Department of revenue is happy to assist military personnel and their families with tax, motor vehicle, and driver licensing matters. You may contact them at [email protected] or by calling (816) 236-9440.

Missouri’s Point System

Missouri’s traffic law enforcement is serious about the safety of drivers on its many highways, rural lanes, and side streets. Missouri’s tickets and points system works like this:

If you accumulate a total of four points in 12 months, the Department of Revenue (DOR) will send you a point accumulation advisory letter. If you accumulate a total of eight or more points in 18 months, the DOR will suspend your driving privilege. The Department of Revenue will revoke your driving privilege for one year if you accumulate:

- 12 or more points in 12 months

- 18 or more points in 24 months

- 24 or more points in 36 months

When you regain driving privilege, your points may be reduced back to four points. Every year you drive without getting new points on your record, the points will be reduced. Remember, some convictions stay on your record forever, even if the points are reduced back to zero.

Rules of the Road

In order to keep yourself and other drivers safe on Missouri roads, it’s important to understand the rules and regulations of the highway. Knowing the specific traffic laws will help you live your best life as a driver while avoiding points on your record.

Let’s take a look at some information to make sure you drive legally and safely in Missouri.

Fault vs. No-Fault

Missouri is an at-fault state. This means if someone has been in an auto accident, damages can be recovered from the other driver who is found responsible for the accident(s).

The person responsible for the accident will then be financially responsible for injuries, damages, and other harms.

It’s important to know the ways in which you are financially responsible, as well as the coverage that offers you the necessary protection.

According to the Missouri Department of Revenue, Missouri law requires that all owners and motor vehicle drivers have some type of motor vehicle liability insurance coverage. Not all states are at-fault states. However, there are other laws that are mostly standardized throughout the nation, like those related to seat belts and car seats.

Seat Belt and Car Seat Laws

The Insurance Institute for Highway Safety notes that Missouri requires seat belts for the driver and anyone 16 or older who is sitting in the front seat. Violation of the seatbelt law is a secondary offense, but a primary offense for anyone under the age of 16.

But what about car seats? Children under the age of 16? The state’s car seat and child-seating laws are as follows:

- Children under three years and under 40 lbs must be in a car seat

- Children between 4-7 years and are 40-80lbs/4’9″ or shorter must be in a car seat

- Children over four years and over 80 lbs/shorter than 4′ 9″ must wear a booster seat or safety belt

- Children over age 8/over 80 lbs or 4′ 9″ can wear an adult belt

The first offense may result in a fine of $50, $10 for violations involving children taller than 4’9″ or who weigh 80 pounds or more.

Riding in the cargo area of a pickup truck is not permitted for persons under age 18 on interstates or urban areas; some other exceptions apply.

Keep Right and Move Over Laws

In Missouri, drivers are expected to drive on the right side of the road. As a driver, you must drive on the right side of the road if you are going slower than the average speed of traffic around you.

Speed Limits

To keep you and other drivers safe on the roads, Missouri has speed limit laws that limit how fast you can drive in the state. Speeding is taken seriously in Missouri. If you are caught speeding even one mile over the speed limit, you can be ticketed and receive a point against your license and face monetary fines.

The maximum speed in the state is 70 MPH. This is for rural interstates; urban interstates have a speed limit of 60 MPH. No other road in the state, however, has a speed limit that exceeds 70 MPH.

Missouri’s basic speeding law requires all motorists to drive “at a rate of speed so as not to endanger the property of another or the life or limb of any person.” This goes for changing weather conditions such as rain or snow, wherein a driver would adjust their speed to the necessary conditions.

Ridesharing

In Missouri, USAA provides ridesharing services for their customers. The state also has a ridesharing tool for people interested in saving some miles and gas money.

Safety Laws

In Missouri, you must follow the appropriate guidelines when it comes to buckling up your child. We touched on these laws earlier, but please note the booster seat requirements for children, dependent on variables of age, weight, and height.

Here are some of the state specifics:

- Missouri car seat safety laws require children under age four to ride in a federally approved car seat or booster seat.

- Children over age four but under 15 must be buckled in with a seat belt.

- Missouri law also prohibits children under age 18 from riding in an unenclosed truck bed.

DUI Laws

The implications for driving while intoxicated are serious, as you may harm yourself and others after only a few drinks.

According to a study conducted by the CDC,crashes involving an impaired driver in MO (9.7 percent) resulted in 3.2 percent more fatalities than the national average (6.5 percent) for ages 21–34. The blood alcohol (BAC) limit in Missouri is 0.08, and a high BAC (HBAC) is 0.15-0.2.

This table outlines the penalties for DUIs in Missouri:

| Penalty | First DUI | Second DUI | Third DUI | Fourth DUI |

|---|---|---|---|---|

| Fine | No minimum | No minimum | No minimum | No minimum |

| Jail Time | No minimum | 7 days - 1 year | No minimum | No minimum |

| License Revoked | 30 day suspension; may be eligible for restricted driving privilege | 1 year revocation due to accumulation of points, if 2nd in 5 years, may receive 5-year license denial | 10 year license denial | 10 year license denial |

| Mandatory Ignition Interlock Device | May be required | May be required | May be required | May be required |

For a first-time DUI offense, note that there is no minimum fine and no minimum jail time. However, you may still accumulate points on your record, or even face a license suspension. For third or fourth-time offenses, penalties include up to a 10-year license denial.

Marijuana-Impaired Driving Laws

There is currently no marijuana-specific drugged driving law in Missouri, but it is always illegal to drive under the influence. However, DSI’s website reminds us that marijuana has been approved for medical use in the state.

Distracted Driving Laws

Have you ever eaten a donut while driving or responded to a funny text?

These distractions may not seem like a big deal in the moment, but the reality is that they can take your eyes off of the road long enough to cause an accident.

In Missouri, drivers are allowed to use their cell phones while driving. As of today, it’s technically legal to text and drive. For those under 21, the penalties for texting and driving are a $200 fine and points against their license.

The state may enforce a handheld ban soon. Missouri is the minority, as 38 states and the District of Columbia have banned cell phone use while driving in some capacity.

Driving in Missouri

Where do Missouri’s crime and fatality ranks fall among national averages? These statistics are important to know, both for your safety and because they can factor into your premiums.

Read on to learn more about vehicle theft, road fatalities, and teen drinking and driving in Missouri.

Vehicle Theft in Missouri

Vehicle theft is considered an FBI crime in the US. Although you may think you are immune to car theft, it is important to learn about the incidence of this crime in your own state. You should talk to your insurance provider to find out what kind of coverage options you may have should your vehicle be stolen.

The top-10 most-popular vehicles stolen in the state are in this table.

| Ranking | Vehicle Make/Model | Year | Number of Thefts |

|---|---|---|---|

| 1 | Ford Pickup (Full Size) | 2004 | 880 |

| 2 | Chevrolet Pickup (Full Size) | 2000 | 783 |

| 3 | Dodge Caravan | 2003 | 465 |

| 4 | Dodge Pickup (Full Size) | 2001 | 410 |

| 5 | Chevrolet Impala | 2008 | 369 |

| 6 | Jeep Cherokee/Grand Cherokee | 1998 | 289 |

| 7 | Honda Accord | 1997 | 274 |

| 8 | Ford Taurus | 2002 | 250 |

| 9 | Chevrolet Malibu | 2015 | 243 |

| 10 | Toyota Camry | 2014 | 236 |

The most popular vehicle stolen in Missouri is a full-size Chevy pickup.

To better understand what this means for you, we have compiled data from the FBI that looks at the number of vehicles stolen in various towns and cities in Missouri.

| City/Town | Population | Motor Vehicle Theft |

|---|---|---|

| St. Joseph | 76,435 | 776 |

| Joplin | 52,412 | 324 |

| Columbia | 122,585 | 266 |

| Raytown | 29,224 | 199 |

| Grandview | 25,308 | 162 |

| St. Charles | 69,804 | 134 |

| Florissant | 51,693 | 125 |

| Blue Springs | 54,727 | 123 |

| Lee's Summit | 96,855 | 119 |

| North Kansas City | 4,407 | 118 |

| Ferguson | 20,789 | 116 |

| University City | 34,601 | 108 |

| Belton | 23,312 | 96 |

| Branson | 11,571 | 94 |

| Hazelwood | 25,401 | 84 |

| Gladstone | 27,390 | 83 |

| Cape Girardeau | 39,887 | 82 |

| Poplar Bluff | 17,264 | 82 |

| Sedalia | 21,501 | 80 |

| Liberty | 30,850 | 74 |

| Berkeley | 8,958 | 73 |

| Lebanon | 14,739 | 63 |

| Bellefontaine Neighbors | 10,678 | 58 |

| Jefferson City | 42,989 | 58 |

| Vinita Park | 11,061 | 57 |

| Woodson Terrace | 4,043 | 57 |

| O'Fallon | 87,388 | 56 |

| Maryland Heights | 27,083 | 53 |

| Bridgeton | 11,703 | 52 |

| St. Peters | 58,079 | 47 |

| Arnold | 21,399 | 42 |

| St. Ann | 12,779 | 42 |

| Neosho | 12,237 | 41 |

| Overland | 15,760 | 38 |

| Chesterfield | 47,687 | 37 |

| Grain Valley | 13,825 | 37 |

| Harrisonville | 10,043 | 35 |

| Nevada | 8,198 | 35 |

| Richmond Heights | 8,362 | 35 |

| Ozark | 19,688 | 34 |

| West Plains | 12,367 | 34 |

| Bolivar | 10,873 | 33 |

| Warrensburg | 20,483 | 33 |

| Hannibal | 17,791 | 32 |

| Rolla | 20,147 | 32 |

| Union | 11,447 | 32 |

| Riverside | 3,276 | 31 |

| St. John | 6,378 | 31 |

| Sikeston | 16,324 | 30 |

| Kennett | 10,505 | 29 |

| Republic | 16,316 | 29 |

| Sugar Creek | 3,298 | 28 |

| Festus | 12,187 | 27 |

| Moberly | 13,838 | 27 |

| Nixa | 21,575 | 27 |

| Park Hills | 8,637 | 27 |

| Sullivan | 7,132 | 27 |

| Aurora | 7,508 | 25 |

| Farmington | 18,710 | 25 |

| Normandy | 7,544 | 24 |

| Carthage | 14,292 | 23 |

| Creve Coeur | 18,746 | 23 |

| Kirkwood | 27,621 | 23 |

| Northwoods5 | 4,138 | 22 |

| Clinton | 8,817 | 21 |

| Fulton | 13,160 | 21 |

| Maplewood | 7,843 | 21 |

| St. Clair | 4,718 | 20 |

| Edmundson | 832 | 19 |

| Washington | 14,073 | 19 |

| Wentzville2 | 38,876 | 19 |

| Kirksville | 17,520 | 18 |

| Oak Grove | 8,019 | 18 |

| Pleasant Hill | 8,496 | 18 |

| Smithville | 9,638 | 18 |

| Webb City | 11,259 | 18 |

| Excelsior Springs | 11,592 | 17 |

| Mexico | 11,709 | 17 |

| Moline Acres | 2,399 | 17 |

| Breckenridge Hills | 4,655 | 16 |

| Brentwood | 7,991 | 16 |

| Raymore | 21,110 | 16 |

| Chillicothe | 9,760 | 15 |

| Country Club Hills | 1,264 | 15 |

| Riverview | 2,795 | 15 |

| Buffalo | 3,043 | 14 |

| Clayton | 16,743 | 14 |

| Maryville | 11,820 | 14 |

| Monett | 9,048 | 14 |

| Pevely | 5,748 | 14 |

| Sunset Hills | 8,498 | 14 |

| Troy | 12,079 | 14 |

| Cassville | 3,343 | 12 |

| Desloge | 4,910 | 12 |

| Kearney | 10,032 | 12 |

| Lake St. Louis | 15,979 | 12 |

| Perryville | 8,493 | 12 |

| Battlefield | 6,127 | 11 |

| Bel-Ridge | 2,679 | 11 |

| Butler | 4,056 | 11 |

| Pagedale | 3,289 | 11 |

| Richmond | 5,540 | 11 |

| Rogersville | 3,598 | 11 |

| Warrenton | 8,168 | 11 |

| Ballwin | 30,299 | 10 |

| Camdenton | 3,980 | 10 |

| Cameron | 9,765 | 10 |

| Eureka | 10,588 | 10 |

| Hayti | 2,684 | 10 |

| Hillsdale3 | 1,574 | 10 |

| Ladue | 8,593 | 10 |

| Marshall | 12,867 | 10 |

| Mountain Grove | 4,674 | 10 |

| Pacific | 7,244 | 10 |

| Waynesville | 5,381 | 10 |

| Willow Springs | 2,146 | 10 |

| Bonne Terre | 7,185 | 9 |

| Strafford | 2,341 | 9 |

| Boonville | 8,482 | 8 |

| Claycomo | 1,477 | 8 |

| Crestwood | 11,904 | 8 |

| Herculaneum | 4,050 | 8 |

| Parkville | 6,685 | 8 |

| Peculiar | 5,039 | 8 |

| Potosi | 2,641 | 8 |

| Southwest City | 954 | 8 |

| St. Robert | 6,020 | 8 |

| Trenton | 5,920 | 8 |

| Anderson | 1,977 | 7 |

| Carl Junction | 7,822 | 7 |

| Des Peres | 8,567 | 7 |

| Duenweg | 1,295 | 7 |

| Jackson | 15,252 | 7 |

| Lexington | 4,560 | 7 |

| Malden | 4,030 | 7 |

| Olivette | 7,859 | 7 |

| St. James | 4,102 | 7 |

| Warsaw | 2,118 | 7 |

| Webster Groves | 22,968 | 7 |

| Bourbon | 1,610 | 6 |

| Concordia | 2,375 | 6 |

| Crystal City | 4,817 | 6 |

| Ellisville | 9,242 | 6 |

| Granby | 2,122 | 6 |

| Hollister | 4,499 | 6 |

| Holts Summit4 | 3,784 | 6 |

| Lawson | 2,395 | 6 |

| Northmoor | 328 | 6 |

| Owensville | 2,609 | 6 |

| Salem | 4,918 | 6 |

| Savannah | 5,136 | 6 |

| Seneca | 2,419 | 6 |

| Steelville | 1,692 | 6 |

| Wright City | 3,584 | 6 |

| Archie | 1,215 | 5 |

| Ava | 2,918 | 5 |

| Canton | 2,377 | 5 |

| Country Club Village | 2,471 | 5 |

| Dexter | 7,935 | 5 |

| Doniphan | 1,990 | 5 |

| Forsyth | 2,426 | 5 |

| Goodman | 1,226 | 5 |

| Lamar | 4,338 | 5 |

| Macon | 5,360 | 5 |

| Manchester | 18,154 | 5 |

| Marceline | 2,112 | 5 |

| Marionville | 2,192 | 5 |

| Montgomery City | 2,692 | 5 |

| Plattsburg | 2,280 | 5 |

| Pleasant Valley | 3,084 | 5 |

| Town and Country | 11,157 | 5 |

| Willard | 5,452 | 5 |

| Kansas City | 484,948 | 4,427 |

| Bowling Green | 5,541 | 4 |

| Branson West | 433 | 4 |

| Buckner | 3,052 | 4 |

| Cabool | 2,134 | 4 |

| Charleston | 5,698 | 4 |

| Cuba | 3,339 | 4 |

| Eldon | 4,657 | 4 |

| El Dorado Springs | 3,575 | 4 |

| Garden City | 1,627 | 4 |

| Greenwood | 5,733 | 4 |

| Leadington | 510 | 4 |

| Licking | 3,115 | 4 |

| Mansfield | 1,255 | 4 |

| Marshfield | 7,341 | 4 |

| Marston | 461 | 4 |

| Miner | 945 | 4 |

| Mound City | 1,032 | 4 |

| Palmyra | 3,619 | 4 |

| Pierce City | 1,298 | 4 |

| Scott City | 4,480 | 4 |

| Seligman | 831 | 4 |

| Sparta | 1,883 | 4 |

| Velda City | 1,382 | 4 |

| Adrian | 1,609 | 3 |

| Cardwell | 671 | 3 |

| Carrollton | 3,574 | 3 |

| Centralia | 4,220 | 3 |

| De Soto | 6,488 | 3 |

| Flordell Hills | 802 | 3 |

| Fredericktown | 4,108 | 3 |

| Gower | 1,494 | 3 |

| Higginsville | 4,629 | 3 |

| Holden | 2,240 | 3 |

| Jasper | 938 | 3 |

| Lake Waukomis | 916 | 3 |

| Laurie | 932 | 3 |

| Mountain View | 2,669 | 3 |

| Mount Vernon | 4,551 | 3 |

| Platte City | 4,900 | 3 |

| Platte Woods | 407 | 3 |

| Rich Hill | 1,322 | 3 |

| Thayer | 2,208 | 3 |

| Versailles2 | 2,452 | 3 |

| Winona | 1,289 | 3 |

| St. Louis | 310,284 | 2,713 |

| Bates City | 219 | 2 |

| Bel-Nor | 1,461 | 2 |

| Bloomfield | 1,872 | 2 |

| Brookfield | 4,266 | 2 |

| Byrnes Mill | 2,955 | 2 |

| California | 4,441 | 2 |

| Dixon | 1,457 | 2 |

| Duquesne | 1,725 | 2 |

| Elsberry | 2,002 | 2 |

| Fayette | 2,697 | 2 |

| Fordland | 829 | 2 |

| Frontenac | 3,859 | 2 |

| Gideon | 1,011 | 2 |

| Glendale | 5,889 | 2 |

| Houston | 2,094 | 2 |

| Lake Lotawana | 2,061 | 2 |

| Lake Ozark | 1,818 | 2 |

| Lakeshire | 1,412 | 2 |

| La Plata | 1,311 | 2 |

| Lathrop | 2,040 | 2 |

| Lincoln | 1,179 | 2 |

| Matthews | 614 | 2 |

| Memphis | 1,860 | 2 |

| Moscow Mills | 2,620 | 2 |

| New Haven | 2,090 | 2 |

| Oakview Village | 396 | 2 |

| Osage Beach | 4,474 | 2 |

| Purdy | 1,102 | 2 |

| Rock Hill | 4,616 | 2 |

| Sarcoxie | 1,287 | 2 |

| Senath | 1,679 | 2 |

| Seymour | 1,997 | 2 |

| Shelbina | 1,610 | 2 |

| Ste. Genevieve | 4,508 | 2 |

| Tipton | 3,397 | 2 |

| Tracy | 225 | 2 |

| Van Buren | 829 | 2 |

| Springfield | 168,654 | 1,969 |

| Independence | 117,055 | 1,262 |

| Ashland | 3,902 | 1 |

| Bella Villa | 737 | 1 |

| Belle | 1,504 | 1 |

| Bellflower | 358 | 1 |

| Bethany | 3,095 | 1 |

| Billings | 1,101 | 1 |

| Bismarck | 1,482 | 1 |

| Calverton Park | 1,283 | 1 |

| Carterville | 1,893 | 1 |

| Cleveland | 671 | 1 |

| Clever | 2,711 | 1 |

| Conway | 776 | 1 |

| Crane | 1,338 | 1 |

| Crocker | 1,042 | 1 |

| Drexel | 958 | 1 |

| East Lynne | 306 | 1 |

| Fair Play | 465 | 1 |

| Foristell | 559 | 1 |

| Hamilton | 1,710 | 1 |

| Hornersville | 621 | 1 |

| Kimberling City | 2,293 | 1 |

| Laddonia | 506 | 1 |

| Lake Tapawingo | 723 | 1 |

| Lanagan | 408 | 1 |

| Leasburg | 332 | 1 |

| Leeton | 553 | 1 |

| Liberal | 719 | 1 |

| Marble Hill | 1,460 | 1 |

| Noel | 1,814 | 1 |

| Oronogo | 2,490 | 1 |

| Piedmont | 1,931 | 1 |

| Pilot Grove | 762 | 1 |

| Portageville | 3,090 | 1 |

| Reeds Spring | 857 | 1 |

| Richland | 1,788 | 1 |

| Shrewsbury | 6,135 | 1 |

| Slater | 1,797 | 1 |

| Summersville | 502 | 1 |

| Tarkio | 1,457 | 1 |

| Truesdale | 747 | 1 |

| Vandalia | 4,344 | 1 |

| Walnut Grove | 812 | 1 |

| Waverly | 829 | 1 |

| Weatherby Lake | 1,957 | 1 |

| Winfield | 1,442 | 1 |

| Wood Heights | 694 | 1 |

| Advance | 1,368 | 0 |

| Alma | 393 | 0 |

| Alton | 861 | 0 |

| Annapolis | 340 | 0 |

| Arbyrd | 474 | 0 |

| Arcadia | 559 | 0 |

| Ash Grove | 1,446 | 0 |

| Bertrand | 768 | 0 |

| Birch Tree | 649 | 0 |

| Blackburn | 247 | 0 |

| Braymer | 849 | 0 |

| Butterfield Village | 459 | 0 |

| Camden | 184 | 0 |

| Canalou | 304 | 0 |

| Center | 504 | 0 |

| Cole Camp | 1,112 | 0 |

| Corder | 398 | 0 |

| Cottleville | 5,612 | 0 |

| Creighton | 345 | 0 |

| Crystal Lakes | 345 | 0 |

| Deepwater | 406 | 0 |

| Delta | 440 | 0 |

| Diamond | 941 | 0 |

| Doolittle | 594 | 0 |

| East Prairie | 3,094 | 0 |

| Ellington | 958 | 0 |

| Eminence | 579 | 0 |

| Everton | 302 | 0 |

| Fair Grove | 1,456 | 0 |

| Fairview | 386 | 0 |

| Fleming | 123 | 0 |

| Frankford | 321 | 0 |

| Freeman | 488 | 0 |

| Glasgow | 1,089 | 0 |

| Greenfield | 1,312 | 0 |

| Green Ridge | 501 | 0 |

| Hallsville | 1,546 | 0 |

| Hardin | 534 | 0 |

| Hartville | 592 | 0 |

| Hawk Point | 686 | 0 |

| Henrietta | 359 | 0 |

| Hermann | 2,355 | 0 |

| Highlandville | 996 | 0 |

| Holcomb | 593 | 0 |

| Howardville | 359 | 0 |

| Humansville | 1,033 | 0 |

| Huntsville | 1,508 | 0 |

| Indian Point | 512 | 0 |

| Iron Mountain Lake | 735 | 0 |

| Ironton | 1,364 | 0 |

| Jonesburg | 716 | 0 |

| Kahoka | 1,995 | 0 |

| Kimmswick | 158 | 0 |

| Knob Noster | 2,737 | 0 |

| La Grange | 929 | 0 |

| Lake Lafayette | 321 | 0 |

| Lake Winnebago | 1,164 | 0 |

| Leadwood | 1,176 | 0 |

| Lilbourn | 1,106 | 0 |

| Linn Creek | 245 | 0 |

| Lone Jack | 1,179 | 0 |

| Louisiana | 3,269 | 0 |

| Martinsburg | 308 | 0 |

| Maysville | 1,083 | 0 |

| Merriam Woods | 1,770 | 0 |

| Milan | 1,802 | 0 |

| Miller | 686 | 0 |

| Monroe City | 2,428 | 0 |

| Morehouse | 899 | 0 |

| Napoleon | 217 | 0 |

| New Bloomfield | 677 | 0 |

| Newburg | 444 | 0 |

| New Florence | 717 | 0 |

| New Franklin | 1,065 | 0 |

| New London | 969 | 0 |

| Niangua | 420 | 0 |

| Oakland | 1,375 | 0 |

| Oregon | 759 | 0 |

| Orrick | 802 | 0 |

| Osceola | 892 | 0 |

| Perry | 697 | 0 |

| Pilot Knob | 699 | 0 |

| Pineville | 786 | 0 |

| Pleasant Hope | 613 | 0 |

| Polo2 | 534 | 0 |

| Queen City | 589 | 0 |

| Qulin | 448 | 0 |

| Rockaway Beach | 868 | 0 |

| Rock Port | 1,214 | 0 |

| Rosebud | 403 | 0 |

| Rutledge | 113 | 0 |

| Silex | 307 | 0 |

| St. Marys | 347 | 0 |

| Stover | 1,072 | 0 |

| Sturgeon | 917 | 0 |

| Terre du Lac | 2,371 | 0 |

| Urbana | 410 | 0 |

| Verona | 602 | 0 |

| Vienna | 588 | 0 |

| Warson Woods | 1,936 | 0 |

| Washburn | 436 | 0 |

| Wellington | 796 | 0 |

| Wellsville | 1,154 | 0 |

| Weston | 1,771 | 0 |

| Wheaton | 693 | 0 |

| Wyatt | 303 | 0 |

Read more:

- Seneca Insurance Company, Inc Car Insurance Review

- Cameron National Insurance Company Car Insurance Review

- Cameron Mutual Insurance Company Car Insurance Review

- New London County Mutual Insurance Company Car Insurance Review

The highest number of car thefts occur in St. Joseph, Missouri, at 776 thefts per year. The second-highest number of thefts occurred in Joplin, with 324 thefts.

Road Fatalities in Missouri

Driving can be dangerous and even fatal. This is a fact that rarely crossed people’s minds when they step into their vehicles. Fatalities can be the result of negligent or reckless driving, driving while impaired by a substance, or by other factors such as wet or icy roadways.

It’s important to stay out of harm’s way; practicing defensive driving can keep you safer while enjoying your commutes or road trips in Missouri.

Most fatal highway in Missouri

With an average of more than 179 fatalities per year, I-63 is the most fatal highway in Missouri.

Fatal Crashes by Weather Condition and Light Condition

The conditions in which we drive can significantly affect our safety. Changes in light, precipitation, and other weather are huge factors to look out for. This table provides data on the number of fatalities in 2017 due to lighting and weather conditions.

Light Conditions West Virginia

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 131 | 12 | 76 | 7 | 0 | 226 |

| Rain | 20 | 5 | 15 | 4 | 0 | 44 |

| Snow/Sleet | 0 | 1 | 2 | 0 | 0 | 3 |

| Other | 0 | 0 | 4 | 1 | 0 | 5 |

| Unknown | 2 | 0 | 0 | 0 | 0 | 2 |

| TOTAL | 153 | 18 | 97 | 12 | 0 | 280 |

The table above shows that most accidents happened during daylight hours when conditions were normal. The second worst time for accidents was during dark hours with normal conditions.

Fatalities (All Crashes) by County

The NHTSA Crash Report provides a list (see below table) of the road fatalities in Missouri by county, from 2014–2017.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities per 100k population 2014 | 2015 |

|---|---|---|---|---|---|---|---|

| Johnson County | 8 | 5 | 11 | 13 | 10 | 14.81 | 9.35 |

| Knox County | 0 | 1 | 2 | 0 | 0 | 0 | 25.6 |

| Laclede County | 9 | 6 | 12 | 3 | 14 | 25.35 | 16.93 |

| Lafayette County | 3 | 8 | 5 | 5 | 11 | 9.2 | 24.53 |

| Lawrence County | 9 | 13 | 7 | 11 | 12 | 23.75 | 34.24 |

| Lewis County | 1 | 2 | 2 | 1 | 0 | 9.9 | 19.72 |

| Lincoln County | 12 | 9 | 11 | 8 | 8 | 22.14 | 16.48 |

| Linn County | 1 | 4 | 2 | 5 | 3 | 8.12 | 32.57 |

| Livingston County | 0 | 4 | 2 | 3 | 4 | 0 | 26.78 |

| Macon County | 1 | 3 | 0 | 4 | 5 | 6.47 | 19.63 |

| Madison County | 4 | 4 | 3 | 2 | 3 | 32.79 | 32.84 |

| Maries County | 6 | 4 | 6 | 4 | 1 | 66.47 | 44.65 |

| Marion County | 4 | 2 | 5 | 2 | 4 | 13.91 | 6.97 |

| Mcdonald County | 7 | 9 | 8 | 9 | 8 | 30.66 | 39.63 |

| Mercer County | 0 | 1 | 2 | 1 | 1 | 0 | 27.32 |

| Miller County | 7 | 9 | 9 | 4 | 5 | 28.18 | 36.19 |

| Mississippi County | 7 | 1 | 5 | 3 | 4 | 49.44 | 7.17 |

| Moniteau County | 4 | 3 | 3 | 3 | 2 | 25.3 | 18.91 |

| Monroe County | 2 | 1 | 2 | 0 | 2 | 22.9 | 11.58 |

| Montgomery County | 5 | 9 | 4 | 5 | 2 | 42.64 | 77.71 |

| Morgan County | 9 | 6 | 6 | 4 | 6 | 44.85 | 29.91 |

| New Madrid County | 6 | 4 | 8 | 10 | 5 | 32.88 | 22.12 |

| Newton County | 26 | 6 | 14 | 21 | 14 | 44.73 | 10.32 |

| Nodaway County | 3 | 2 | 5 | 3 | 3 | 13.06 | 8.85 |

| Oregon County | 4 | 3 | 1 | 3 | 5 | 36.96 | 27.65 |

| Osage County | 3 | 2 | 0 | 1 | 2 | 22.04 | 14.8 |

| Ozark County | 4 | 0 | 3 | 4 | 1 | 42.43 | 0 |

| Pemiscot County | 7 | 10 | 8 | 5 | 2 | 39.83 | 57.4 |

| Perry County | 8 | 3 | 2 | 3 | 7 | 41.85 | 15.73 |

| Pettis County | 11 | 8 | 5 | 10 | 12 | 26.07 | 18.9 |

| Phelps County | 5 | 13 | 13 | 21 | 11 | 11.12 | 29.01 |

| Pike County | 1 | 8 | 5 | 2 | 2 | 5.41 | 43.47 |

| Platte County | 9 | 7 | 13 | 21 | 9 | 9.49 | 7.26 |

| Polk County | 3 | 9 | 6 | 4 | 10 | 9.64 | 28.79 |

| Pulaski County | 6 | 4 | 7 | 7 | 6 | 11.21 | 7.52 |

| Putnam County | 2 | 1 | 0 | 2 | 0 | 41.31 | 20.58 |

| Ralls County | 2 | 3 | 7 | 1 | 1 | 19.48 | 29.52 |

| Randolph County | 3 | 5 | 1 | 6 | 6 | 11.98 | 19.98 |

| Ray County | 5 | 4 | 3 | 4 | 10 | 21.82 | 17.57 |