Iowa Car Insurance [Rates + Cheap Coverage Guide]

Cheap Iowa car insurance is easy to find. The average Iowa car insurance rates are $52 per month 32 percent less than the average American driver. Read our guide to learn how your Iowa car insurance costs will vary based on your age and driving record, but you can still find the cheapest Iowa auto insurance coverage when you comparison shop online. Enter your ZIP code below to get started.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Nov 3, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 3, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| IOWA STATISTICS SUMMARY | |

|---|---|

| Annual Road Miles | Total in State: 114,442 Vehicle Miles Driven: 33,161 million |

| Vehicles | Registered in State: 3,447,049 Total Stolen: 4,342 |

| State Population | 3,156,145 |

| Most Popular Vehicle | Chevrolet Silverado 1500 |

| Uninsured Motorists | 8.70% State Rank: 38th |

| Total Driving Fatalities | 2008-2017 Speeding: 612 Drunk Driving: 917 |

| Average Premiums | Liability: $299.18 Collision: $219.75 Comprehensive: $171.58 |

| Cheapest Providers | USAA and State Farm Mutual Auto |

The “Hawkeye” state, known more commonly as the state of Iowa, is a gorgeous state with many wide-open fields and breathtaking cities. In order to view such a wonderful place, you’ll obviously want to have all of your car insurance needs to be taken care of.

Why waste hours of your free time digging through countless car insurance websites when you can do it all in one convenient place?

In this comprehensive guide, we will cover all of the insurance topics you’ll need to know for you to purchase the best policy for your needs in Iowa.

We’ll go over everything from the specific coverage you’ll need, to the laws and rules of the road in Iowa, and more.

Ready to get started now? Use our FREE online tool. You only need is your zip code to get started.

Iowa Car Insurance Coverage and Rates

Let’s get right to it. In this first section, we’re going to talk about some of the basic car insurance coverage you’re going to want to make sure that you have. We’ll also touch on some of the typical car insurance rates you’ll see.

Iowa Minimum Coverage

Each state has something known as minimum liability coverage. It’s the minimum amount of insurance coverage you are allowed to have in that state in order to legally drive your vehicle.

Iowa is one of a few states that does not necessarily require that you have this minimum liability coverage, but it does, however, a Motor Vehicle Financial and Safety Responsibility Act.

This Act states that if you are ever involved in a car accident, you must be able to show financial responsibility for any resulting injuries. Meaning that while having insurance coverage can be optional, you will need at least some form of coverage in order to meet this minimum requirement.

According to the Insurance Information Institute (III), Iowa has minimum liability coverage of 20/40/15. What exactly does this mean? We’ve broken it down for you here:

- 20 = $20,000 for the payment of the injury/death of one individual in an accident that you caused

- 40 = $40,000 for the payment of the injury/death of multiple individuals in an accident that you caused

- 15 = $15,000 for the payment of any property damage incurred in an accident that you caused

This becomes particularly important due to the fact that Iowa is considered an “at-fault” state.

This means that if you are the one who caused an accident, YOU are the one who is held financially liable for that accident.

If you should decide not to purchase at least the minimum liability coverage, there are other options to make sure you are covered in the case of an accident.

According to the Iowa Department of Transportation, you may comply with the Motor Vehicle Financial and Safety Responsibility Act in the following ways:

- posting a bond with Driver & Identification Services

- getting a legal release of liability from the other parties involved in the accident

- being found completely not liable in a civil suit

- filing an agreement to pay the other parties’ damages on an installment plan

- executing a warrant for confession of judgment promising to pay the other parties’ damages on an installment plan

- filing evidence of complete settlement of all damages.

It is recommended, however, to just ensure you have the minimum liability coverage to optimize your coverage needs.

Forms of Financial Responsibility

There are several different types of forms of financial responsibility in Iowa.

As it is not necessarily required to have at least the minimum liability coverage (although highly recommended), there are other ways in which you might be required to provide some proof of financial responsibility.

Should you purchase car insurance, you will need to make sure you have at least one of the following with you while you are operating your vehicle:

- Valid liability insurance ID cards

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of car insurance)

If you decided not to purchase car insurance and you get into an accident, according to Iowa’s DMV, you may provide any of the following:

- Provide proof that you had liability insurance at the time of the accident

- Pay one of the following to “Driver & Identification Services” in Iowa:

- Cash

- Certified check

- Cashier’s check

- Bank draft

- Postal money order

- Obtain a release form from all the people involved in the accident

- Promise to cover (on an installment plan if needed) the costs of the injured or damaged parties in a filed statement

- Receive a civil damage action decision that releases you from any liability

- Complete a warrant for confession of judgment with agreed upon payment schedule

- Provide evidence of a settlement reached between parties

If you do not provide at least one of the above and you do not have car insurance, your license will be suspended until you can provide any of the above!

Premiums as a Percentage of Income

Have you ever heard of the term per capita disposable income? Let’s break it down.

Per capita disposable income refers to the amount of money a group of individuals have after taxes has been paid.

In Iowa, the average per capita disposable income is $39,820. This means that after taxes, this is how much the typical Iowa citizen has to spend.

| Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|---|---|---|---|---|---|---|---|---|

| $683.67 | $39,820.00 | 1.72% | $668.09 | $38,676.00 | 1.73% | $656.84 | $38,326.00 | 1.71% |

You can see from the table above that of this disposable income you have left after taxes, about 1.72 percent will go to your insurance payments.

Average Monthly Car Insurance Rates in IA (Liability, Collision, Comprehensive)

According to the National Association of Insurance Commissioners, you can expect the following core coverage costs in Iowa:

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $299.18 |

| Collision | $219.75 |

| Comprehensive | $219.75 |

| Combined | $672.01 |

Additional Liability

As we stated previously, Iowa doesn’t necessarily require for you to have insurance coverage, but there is highly recommended. In addition to the minimum liability coverage, there are two other liability coverage types that you will want to consider; Medical Payments (MedPay) and Uninsured/Underinsured Motorist.

Medical Payments (MedPay) Coverage is essentially the coverage that helps you out in the case of an accident. It will cover your own medical expenses should you be injured in a car accident.

Uninsured/Underinsured Motorist Coverage helps to cover you if you are ever in an accident with someone who does not have insurance coverage.

As we mentioned previously, Iowa is an at-fault state, so if the other driver doesn’t even have insurance coverage, that could mean the damages from that accident could affect your wallet.

This becomes especially important as according to the Insurance Information Institute (III), Iowa has an uninsured motorist rate of 8.7 percent.

Due to this, we will now discuss the loss ratios for these additional liability coverages. What is a loss ratio exactly?

A loss ratio is the ratio of how much an insurance provider pays out in claims to the amount of money the company takes in from insurance premiums.

So when you’re thinking about loss ratios, you want to think back to the story of Goldilocks. You want a loss ratio that isn’t too high, isn’t too low but is just right.

Why is this? Well, if a loss ratio is too low, that means that the carrier is taking in more premium than it needs to cover claims – which means rates might be too high.

If a loss ratio is too high, over 100 percent, it means that the company isn’t taking in enough premium to cover all claims. Hence why you want this loss ratio to be right in the middle.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (Med Pay) | 67% | 68% | 79% |

| Uninsured/Underinsured Motorist | 49% | 68% | 71% |

As you can see in the table above, both MedPay and Uninsured/Underinsured Motorist have relatively decent loss ratios in Iowa.

Add-ons, Endorsements, and Riders

Getting the best coverage for the most affordable price is always a top priority when shopping for insurance. Did you know that you could be missing out on several extremely useful, and cheap, coverage types because of it?

Check out the list below to see what is available to you in Iowa:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Read more: Finding Cheap Business Car Insurance Rates

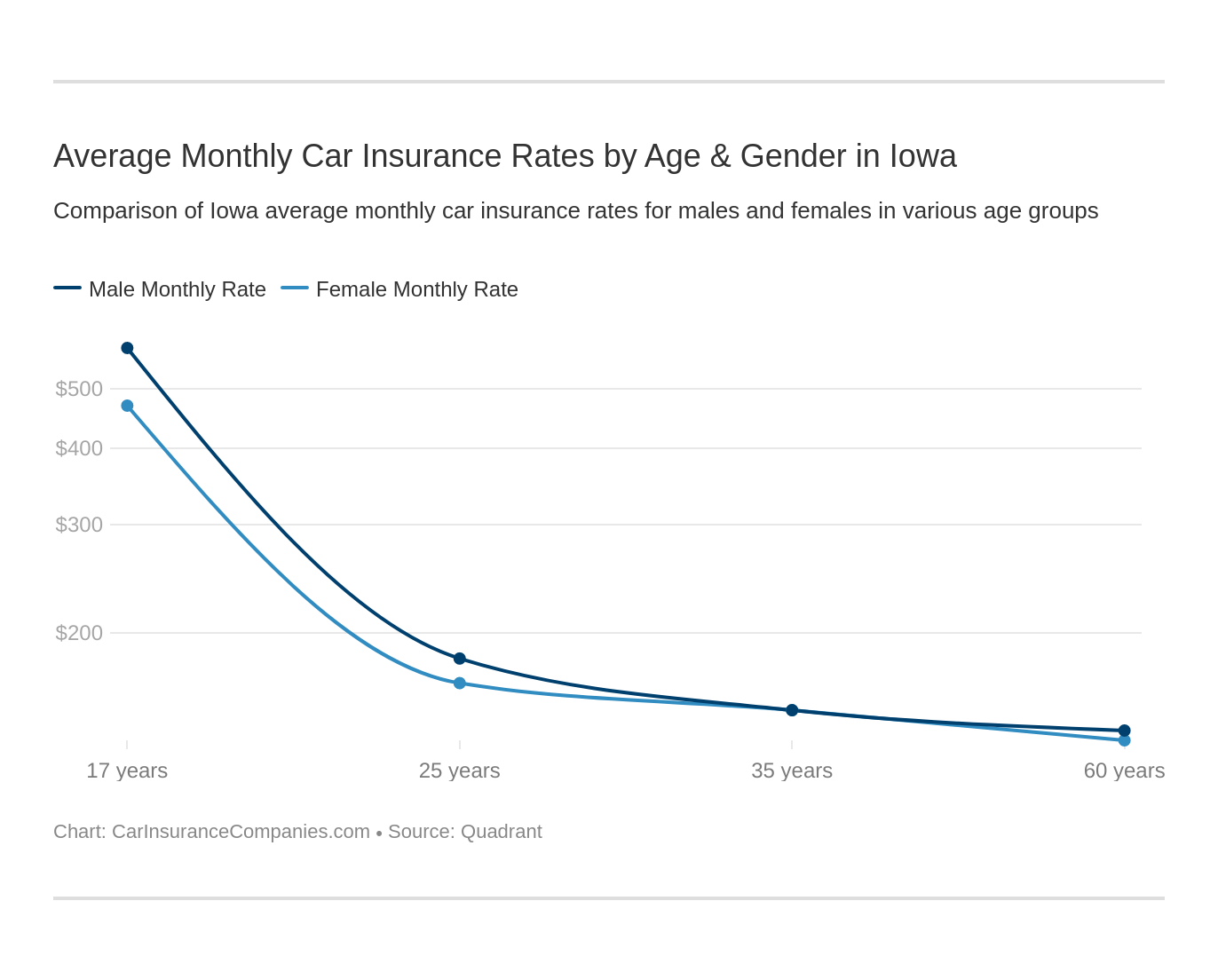

Average Monthly Car Insurance Rates by Age & Gender in IA

There’s a commonly heard myth in the insurance business that men tend to pay more for the insurance coverage than women do. We wanted to find out if this was true in Iowa, and found the following data:

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 25-year old female | Single 25-year old male | Single 17-year old female | Single 17-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $1,958.15 | $1,879.95 | $1,740.38 | $1,771.40 | $2,131.19 | $2,192.58 | $5,666.77 | $6,380.74 |

| American Family Mutual | $1,947.49 | $1,947.49 | $1,742.43 | $1,742.43 | $1,947.49 | $2,345.27 | $5,205.52 | $7,296.86 |

| Farmers Insurance Co | $1,505.56 | $1,534.33 | $1,348.08 | $1,472.79 | $2,038.46 | $2,181.07 | $4,551.35 | $4,851.93 |

| Geico Cas | $1,871.32 | $1,677.39 | $1,676.90 | $1,535.68 | $1,767.80 | $1,635.28 | $4,252.86 | $3,954.88 |

| Safeco Insurance Co America | $2,110.02 | $2,290.23 | $1,856.34 | $2,255.89 | $2,390.92 | $2,636.91 | $10,248.60 | $11,534.94 |

| Nationwide Agribusiness Insurance | $1,773.80 | $1,821.30 | $1,580.35 | $1,687.66 | $2,007.84 | $2,184.45 | $4,078.71 | $5,280.35 |

| Progressive Northern | $1,685.12 | $1,622.63 | $1,389.61 | $1,441.50 | $2,027.39 | $2,192.49 | $4,131.25 | $4,663.86 |

| State Farm Mutual Auto | $1,445.98 | $1,445.98 | $1,270.07 | $1,270.07 | $1,625.39 | $1,851.50 | $3,914.70 | $4,964.07 |

| Travelers Home & Marine Ins Co | $2,442.49 | $2,492.53 | $2,373.90 | $2,380.26 | $2,541.28 | $3,002.33 | $10,858.60 | $17,313.68 |

| USAA | $1,239.37 | $1,253.71 | $1,136.98 | $1,159.77 | $1,487.70 | $1,643.44 | $3,345.14 | $3,552.75 |

Read more:

- Farmers Insurance of Columbus, Inc. Car Insurance Review

- Nationwide Agribusiness Insurance Company Car Insurance Review

- Cedar Insurance Company Car Insurance Review

- Baldwin Mutual Insurance Company Inc. Car Insurance Review

- Badger Mutual Insurance Company Car Insurance Review

- Bloomfield Mutual Insurance Company Car Insurance Review

- Allstate County Mutual Insurance Company Car Insurance Review

Which gender and age pays more for car insurance? Drivers under 25 years old are often in the highest risk class. See if the gender stereotype (males vs female auto insurance rates) holds true in Iowa.

So as you can see in the table above, it’s actually age and marital status that plays a bigger factor into insurance rates in Iowa. The older married couples seem to pay less for their insurance rates than single males do.

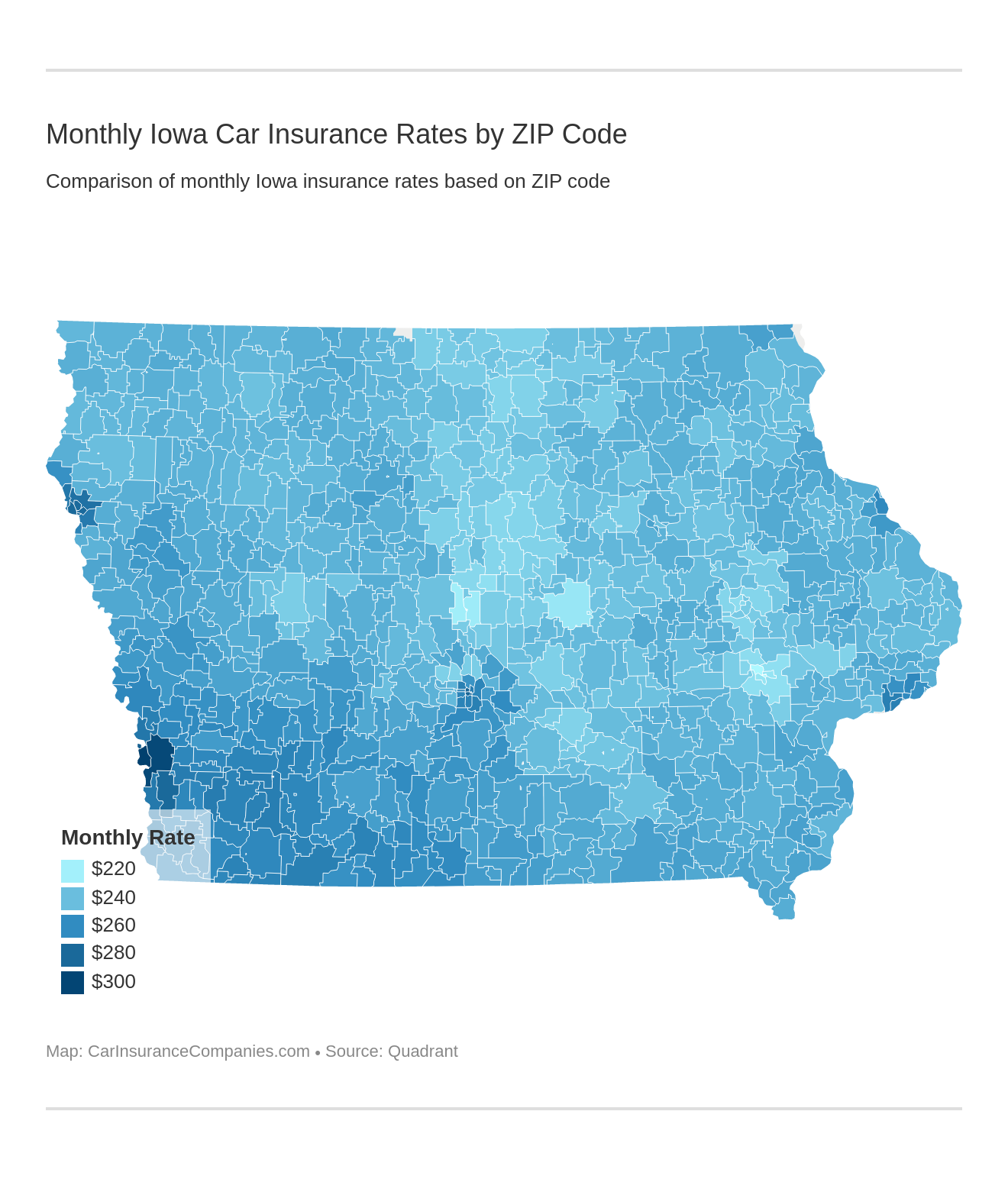

Highest/Lowest by Zip Code

How does ZIP code affect auto insurance? Factors like traffic, crime, and claim frequency in your area all matter. Find out how your ZIP code compares against other zips in IA.

| Zipcode | Average |

|---|---|

| 51501 | $3,633.75 |

| 51503 | $3,575.94 |

| 51510 | $3,421.91 |

| 50314 | $3,379.73 |

| 50309 | $3,367.30 |

| 51534 | $3,356.47 |

| 51103 | $3,355.94 |

| 50307 | $3,350.71 |

| 51105 | $3,350.44 |

| 51104 | $3,342.31 |

| 51101 | $3,333.89 |

| 50308 | $3,327.01 |

| 51108 | $3,296.59 |

| 52801 | $3,285.41 |

| 50319 | $3,262.33 |

| 51109 | $3,260.62 |

| 51526 | $3,259.16 |

| 51561 | $3,249.84 |

| 51106 | $3,242.81 |

| 51654 | $3,239.93 |

| 50316 | $3,230.43 |

| 51571 | $3,228.18 |

| 51533 | $3,223.48 |

| 50864 | $3,216.99 |

| 51532 | $3,212.72 |

| 51542 | $3,209.76 |

| 50310 | $3,207.24 |

| 52802 | $3,206.70 |

| 50833 | $3,204.32 |

| 52804 | $3,203.58 |

| 50311 | $3,202.93 |

| 51652 | $3,202.45 |

| 51541 | $3,201.16 |

| 50320 | $3,198.63 |

| 51649 | $3,197.04 |

| 51648 | $3,193.43 |

| 51573 | $3,192.82 |

| 50315 | $3,188.28 |

| 51631 | $3,185.36 |

| 51111 | $3,184.13 |

| 50843 | $3,180.65 |

| 51636 | $3,180.34 |

| 51566 | $3,178.98 |

| 50848 | $3,177.95 |

| 51639 | $3,177.71 |

| 50321 | $3,176.34 |

| 50845 | $3,176.06 |

| 51637 | $3,175.26 |

| 50312 | $3,171.48 |

| 51554 | $3,170.76 |

| 51535 | $3,168.22 |

| 50317 | $3,167.68 |

| 50857 | $3,167.43 |

| 51630 | $3,166.15 |

| 50853 | $3,161.66 |

| 50841 | $3,161.60 |

| 51647 | $3,161.39 |

| 51575 | $3,161.21 |

| 51638 | $3,160.92 |

| 50854 | $3,160.90 |

| 51551 | $3,160.85 |

| 51640 | $3,158.99 |

| 51632 | $3,149.94 |

| 51646 | $3,148.89 |

| 51540 | $3,147.69 |

| 51555 | $3,146.17 |

| 51525 | $3,145.81 |

| 51576 | $3,145.04 |

| 51650 | $3,144.18 |

| 50846 | $3,143.56 |

| 51536 | $3,143.19 |

| 52807 | $3,143.07 |

| 50074 | $3,142.48 |

| 50395 | $3,141.68 |

| 51549 | $3,139.43 |

| 51548 | $3,137.95 |

| 50144 | $3,137.92 |

| 51656 | $3,136.45 |

| 51601 | $3,134.91 |

| 51553 | $3,134.36 |

| 50065 | $3,131.25 |

| 50839 | $3,130.48 |

| 50133 | $3,129.34 |

| 52803 | $3,129.34 |

| 52001 | $3,128.32 |

| 50211 | $3,128.18 |

| 51653 | $3,127.14 |

| 51645 | $3,126.40 |

| 50237 | $3,125.89 |

| 50862 | $3,125.88 |

| 51544 | $3,125.38 |

| 51559 | $3,120.60 |

| 50860 | $3,120.54 |

| 50108 | $3,118.23 |

| 51651 | $3,118.12 |

| 50149 | $3,116.31 |

| 50067 | $3,115.95 |

| 50140 | $3,112.85 |

| 51552 | $3,111.11 |

| 50840 | $3,108.57 |

| 51556 | $3,108.20 |

| 50174 | $3,103.88 |

| 50022 | $3,103.63 |

| 50858 | $3,102.66 |

| 50835 | $3,101.52 |

| 50837 | $3,100.70 |

| 50020 | $3,100.46 |

| 52806 | $3,100.13 |

| 51570 | $3,099.94 |

| 51062 | $3,098.26 |

| 50836 | $3,096.03 |

| 50863 | $3,095.98 |

| 51563 | $3,094.94 |

| 50851 | $3,092.12 |

| 50166 | $3,091.10 |

| 52722 | $3,090.75 |

| 51529 | $3,089.07 |

| 50274 | $3,088.94 |

| 50047 | $3,088.68 |

| 50048 | $3,087.99 |

| 50257 | $3,087.69 |

| 50229 | $3,086.19 |

| 50859 | $3,084.17 |

| 50164 | $3,082.64 |

| 51521 | $3,081.19 |

| 50210 | $3,080.78 |

| 50262 | $3,079.63 |

| 51564 | $3,079.34 |

| 50313 | $3,078.58 |

| 50241 | $3,072.01 |

| 51562 | $3,071.76 |

| 51577 | $3,071.16 |

| 50099 | $3,070.24 |

| 51019 | $3,067.07 |

| 50849 | $3,064.91 |

| 50155 | $3,063.89 |

| 52003 | $3,063.50 |

| 51557 | $3,063.50 |

| 51545 | $3,062.64 |

| 50240 | $3,062.40 |

| 50145 | $3,062.16 |

| 51546 | $3,060.38 |

| 50139 | $3,060.01 |

| 51004 | $3,059.31 |

| 50002 | $3,058.59 |

| 50169 | $3,058.04 |

| 50275 | $3,057.28 |

| 51579 | $3,057.06 |

| 50264 | $3,055.99 |

| 51056 | $3,054.16 |

| 50060 | $3,052.48 |

| 51560 | $3,052.09 |

| 50115 | $3,052.04 |

| 50831 | $3,051.63 |

| 51044 | $3,049.45 |

| 50061 | $3,048.56 |

| 52583 | $3,046.64 |

| 51016 | $3,046.49 |

| 50165 | $3,045.38 |

| 51550 | $3,044.57 |

| 50830 | $3,044.54 |

| 50327 | $3,044.43 |

| 50254 | $3,044.11 |

| 50147 | $3,043.06 |

| 50160 | $3,042.91 |

| 51051 | $3,041.75 |

| 50008 | $3,041.40 |

| 51530 | $3,041.33 |

| 50151 | $3,040.51 |

| 50118 | $3,040.20 |

| 50035 | $3,040.10 |

| 51565 | $3,040.00 |

| 52631 | $3,039.38 |

| 50591 | $3,038.87 |

| 50213 | $3,036.49 |

| 50524 | $3,036.31 |

| 50243 | $3,035.72 |

| 50117 | $3,035.32 |

| 52638 | $3,033.61 |

| 52570 | $3,033.53 |

| 50861 | $3,033.38 |

| 52002 | $3,032.45 |

| 51034 | $3,031.49 |

| 52590 | $3,030.95 |

| 50842 | $3,029.50 |

| 50272 | $3,029.49 |

| 52140 | $3,029.25 |

| 50052 | $3,028.19 |

| 50801 | $3,027.08 |

| 50001 | $3,026.98 |

| 52650 | $3,026.18 |

| 50273 | $3,025.93 |

| 52623 | $3,024.21 |

| 50218 | $3,023.35 |

| 51048 | $3,022.70 |

| 50070 | $3,022.63 |

| 51015 | $3,022.05 |

| 52551 | $3,021.41 |

| 52160 | $3,020.83 |

| 50125 | $3,020.66 |

| 51558 | $3,020.26 |

| 52646 | $3,019.83 |

| 52647 | $3,019.72 |

| 51523 | $3,019.68 |

| 52323 | $3,019.38 |

| 52537 | $3,018.29 |

| 50123 | $3,018.17 |

| 50226 | $3,017.87 |

| 51460 | $3,016.98 |

| 51531 | $3,016.73 |

| 50025 | $3,016.65 |

| 50702 | $3,015.79 |

| 52660 | $3,015.55 |

| 50042 | $3,014.49 |

| 52584 | $3,014.10 |

| 51060 | $3,013.57 |

| 52738 | $3,013.36 |

| 50261 | $3,013.33 |

| 50103 | $3,013.33 |

| 51018 | $3,012.56 |

| 52627 | $3,011.89 |

| 50076 | $3,011.71 |

| 51528 | $3,011.38 |

| 50110 | $3,011.09 |

| 50068 | $3,011.06 |

| 50238 | $3,008.84 |

| 52658 | $3,008.69 |

| 51537 | $3,006.84 |

| 52737 | $3,006.54 |

| 50049 | $3,006.45 |

| 52626 | $3,006.42 |

| 52588 | $3,006.16 |

| 51543 | $3,006.08 |

| 51010 | $3,005.95 |

| 52560 | $3,005.87 |

| 51572 | $3,005.70 |

| 52049 | $3,005.08 |

| 52565 | $3,004.55 |

| 52052 | $3,002.35 |

| 52048 | $3,002.27 |

| 52573 | $3,001.92 |

| 50518 | $3,001.69 |

| 52549 | $3,001.17 |

| 52645 | $3,000.70 |

| 50029 | $3,000.30 |

| 50222 | $3,000.20 |

| 50548 | $3,000.19 |

| 52619 | $3,000.04 |

| 52639 | $2,999.82 |

| 50521 | $2,999.32 |

| 51055 | $2,998.42 |

| 50072 | $2,997.97 |

| 51431 | $2,997.74 |

| 51026 | $2,997.29 |

| 51439 | $2,996.98 |

| 52745 | $2,996.56 |

| 52563 | $2,996.56 |

| 50216 | $2,995.82 |

| 51461 | $2,994.49 |

| 52555 | $2,994.30 |

| 51520 | $2,994.19 |

| 52640 | $2,993.43 |

| 51527 | $2,992.35 |

| 52165 | $2,991.96 |

| 51432 | $2,991.84 |

| 52568 | $2,991.70 |

| 51040 | $2,991.59 |

| 50529 | $2,991.41 |

| 52567 | $2,991.30 |

| 50250 | $2,990.85 |

| 51441 | $2,990.73 |

| 52305 | $2,990.63 |

| 52767 | $2,990.00 |

| 52542 | $2,988.83 |

| 52533 | $2,988.74 |

| 52580 | $2,987.83 |

| 51455 | $2,987.77 |

| 50026 | $2,987.43 |

| 50523 | $2,987.09 |

| 51006 | $2,986.35 |

| 52637 | $2,986.33 |

| 50007 | $2,986.28 |

| 51447 | $2,986.17 |

| 52042 | $2,986.12 |

| 51448 | $2,986.05 |

| 50520 | $2,985.80 |

| 52540 | $2,985.40 |

| 50033 | $2,985.31 |

| 52593 | $2,985.26 |

| 52544 | $2,984.52 |

| 52756 | $2,984.51 |

| 52050 | $2,984.28 |

| 52309 | $2,983.95 |

| 51458 | $2,983.67 |

| 52571 | $2,983.53 |

| 50582 | $2,983.47 |

| 50578 | $2,983.40 |

| 50531 | $2,983.00 |

| 52620 | $2,982.75 |

| 52223 | $2,981.79 |

| 51063 | $2,981.78 |

| 51446 | $2,981.22 |

| 50038 | $2,981.15 |

| 52205 | $2,980.87 |

| 52044 | $2,980.84 |

| 52531 | $2,980.63 |

| 52746 | $2,980.62 |

| 52315 | $2,980.31 |

| 50150 | $2,980.29 |

| 52168 | $2,979.83 |

| 51445 | $2,979.60 |

| 52653 | $2,978.80 |

| 52257 | $2,977.02 |

| 52625 | $2,976.76 |

| 52572 | $2,976.66 |

| 52215 | $2,976.64 |

| 51061 | $2,976.61 |

| 50570 | $2,976.57 |

| 52648 | $2,976.41 |

| 52765 | $2,976.39 |

| 52310 | $2,975.49 |

| 52649 | $2,975.47 |

| 50594 | $2,975.33 |

| 52754 | $2,975.28 |

| 51466 | $2,974.98 |

| 52249 | $2,974.69 |

| 50538 | $2,974.68 |

| 52237 | $2,974.35 |

| 52654 | $2,974.26 |

| 50573 | $2,974.25 |

| 52535 | $2,973.61 |

| 51465 | $2,973.56 |

| 51232 | $2,973.24 |

| 52201 | $2,973.09 |

| 51365 | $2,973.08 |

| 52635 | $2,972.59 |

| 52079 | $2,972.39 |

| 52203 | $2,972.25 |

| 51442 | $2,972.18 |

| 50277 | $2,971.75 |

| 52149 | $2,971.57 |

| 52171 | $2,971.52 |

| 50563 | $2,971.36 |

| 52035 | $2,971.15 |

| 50552 | $2,971.00 |

| 51049 | $2,970.85 |

| 51007 | $2,970.69 |

| 50575 | $2,970.58 |

| 50109 | $2,970.28 |

| 52057 | $2,970.26 |

| 52144 | $2,970.19 |

| 52574 | $2,970.02 |

| 52656 | $2,969.39 |

| 52632 | $2,969.33 |

| 52720 | $2,969.31 |

| 52033 | $2,968.96 |

| 51454 | $2,968.83 |

| 52594 | $2,968.82 |

| 52036 | $2,968.57 |

| 51030 | $2,968.47 |

| 52749 | $2,968.46 |

| 52557 | $2,968.46 |

| 50069 | $2,968.37 |

| 52133 | $2,967.98 |

| 52773 | $2,967.40 |

| 52569 | $2,967.00 |

| 52630 | $2,966.87 |

| 50536 | $2,966.73 |

| 50557 | $2,966.50 |

| 52161 | $2,966.46 |

| 52657 | $2,966.46 |

| 50562 | $2,966.17 |

| 50541 | $2,965.63 |

| 52330 | $2,965.56 |

| 50073 | $2,965.44 |

| 51025 | $2,965.37 |

| 52212 | $2,964.85 |

| 51037 | $2,964.66 |

| 52313 | $2,964.41 |

| 52073 | $2,964.34 |

| 50249 | $2,964.06 |

| 52216 | $2,964.01 |

| 50667 | $2,963.86 |

| 52556 | $2,963.84 |

| 52321 | $2,963.00 |

| 50515 | $2,962.94 |

| 51350 | $2,962.83 |

| 50146 | $2,962.37 |

| 51462 | $2,961.86 |

| 52076 | $2,961.84 |

| 52346 | $2,961.83 |

| 52621 | $2,961.50 |

| 50527 | $2,961.18 |

| 52359 | $2,961.17 |

| 50593 | $2,961.07 |

| 52154 | $2,960.34 |

| 52251 | $2,960.29 |

| 51029 | $2,960.17 |

| 52101 | $2,959.90 |

| 52739 | $2,959.77 |

| 52132 | $2,959.72 |

| 50217 | $2,959.70 |

| 52748 | $2,959.67 |

| 52550 | $2,959.64 |

| 51450 | $2,959.15 |

| 52651 | $2,958.94 |

| 50519 | $2,958.73 |

| 50104 | $2,958.51 |

| 52769 | $2,958.25 |

| 50107 | $2,958.24 |

| 51020 | $2,957.96 |

| 50558 | $2,957.89 |

| 51244 | $2,957.56 |

| 52038 | $2,957.26 |

| 50501 | $2,957.19 |

| 51001 | $2,957.13 |

| 52753 | $2,957.10 |

| 52053 | $2,956.98 |

| 52347 | $2,956.96 |

| 50651 | $2,956.79 |

| 52652 | $2,956.78 |

| 52552 | $2,956.63 |

| 52312 | $2,956.60 |

| 51345 | $2,956.59 |

| 51039 | $2,956.49 |

| 52071 | $2,956.34 |

| 52581 | $2,956.25 |

| 51054 | $2,955.85 |

| 52332 | $2,955.69 |

| 50581 | $2,955.68 |

| 52209 | $2,955.48 |

| 50650 | $2,955.33 |

| 50268 | $2,955.11 |

| 52337 | $2,955.00 |

| 52166 | $2,954.92 |

| 52208 | $2,954.82 |

| 50003 | $2,954.51 |

| 50603 | $2,954.47 |

| 50064 | $2,954.43 |

| 50128 | $2,954.35 |

| 50255 | $2,954.31 |

| 50539 | $2,954.17 |

| 50228 | $2,954.11 |

| 51008 | $2,954.10 |

| 50569 | $2,953.96 |

| 51342 | $2,953.96 |

| 51014 | $2,953.88 |

| 50516 | $2,953.86 |

| 52758 | $2,953.80 |

| 52774 | $2,953.72 |

| 52032 | $2,953.63 |

| 52163 | $2,953.12 |

| 50653 | $2,952.82 |

| 52207 | $2,952.81 |

| 51354 | $2,952.72 |

| 51334 | $2,952.65 |

| 50661 | $2,952.63 |

| 50654 | $2,952.61 |

| 52355 | $2,951.96 |

| 50674 | $2,951.95 |

| 52585 | $2,951.86 |

| 50528 | $2,951.78 |

| 50136 | $2,951.60 |

| 52041 | $2,951.46 |

| 50323 | $2,951.19 |

| 52768 | $2,951.17 |

| 50659 | $2,951.12 |

| 50571 | $2,950.36 |

| 50681 | $2,950.18 |

| 51358 | $2,950.04 |

| 50645 | $2,949.85 |

| 51249 | $2,949.77 |

| 50666 | $2,949.72 |

| 51237 | $2,949.61 |

| 50167 | $2,949.58 |

| 52644 | $2,949.52 |

| 50235 | $2,949.51 |

| 50622 | $2,948.97 |

| 50703 | $2,948.84 |

| 51022 | $2,948.78 |

| 50032 | $2,948.37 |

| 51028 | $2,948.29 |

| 52231 | $2,948.12 |

| 50129 | $2,948.10 |

| 50566 | $2,948.03 |

| 50545 | $2,947.87 |

| 51240 | $2,947.83 |

| 52255 | $2,947.30 |

| 50514 | $2,947.25 |

| 50606 | $2,947.22 |

| 50535 | $2,947.04 |

| 51201 | $2,946.99 |

| 52759 | $2,946.63 |

| 50676 | $2,946.59 |

| 50059 | $2,946.52 |

| 51247 | $2,946.24 |

| 52075 | $2,945.92 |

| 50602 | $2,945.25 |

| 52576 | $2,945.22 |

| 51453 | $2,945.19 |

| 51246 | $2,944.29 |

| 52766 | $2,944.24 |

| 52353 | $2,943.79 |

| 50630 | $2,943.66 |

| 50668 | $2,943.18 |

| 51366 | $2,942.89 |

| 51024 | $2,942.53 |

| 51012 | $2,942.51 |

| 50263 | $2,942.09 |

| 52776 | $2,942.02 |

| 50009 | $2,942.00 |

| 52354 | $2,941.91 |

| 52747 | $2,941.49 |

| 50567 | $2,941.42 |

| 50598 | $2,941.34 |

| 50156 | $2,941.25 |

| 52056 | $2,941.04 |

| 51005 | $2,941.03 |

| 52318 | $2,940.96 |

| 52760 | $2,940.70 |

| 52031 | $2,940.63 |

| 51052 | $2,940.41 |

| 52778 | $2,940.06 |

| 50577 | $2,939.81 |

| 52335 | $2,939.73 |

| 50586 | $2,939.60 |

| 51243 | $2,939.31 |

| 52320 | $2,939.00 |

| 50701 | $2,938.95 |

| 52248 | $2,938.55 |

| 51433 | $2,938.48 |

| 52136 | $2,938.48 |

| 51053 | $2,938.15 |

| 51035 | $2,938.06 |

| 51248 | $2,937.26 |

| 52659 | $2,937.16 |

| 51058 | $2,937.15 |

| 50040 | $2,937.13 |

| 51347 | $2,937.03 |

| 50597 | $2,936.79 |

| 50658 | $2,936.71 |

| 50066 | $2,936.29 |

| 51047 | $2,936.25 |

| 50636 | $2,935.94 |

| 52252 | $2,935.83 |

| 51231 | $2,935.56 |

| 50649 | $2,935.51 |

| 52037 | $2,935.50 |

| 51234 | $2,935.44 |

| 52316 | $2,935.44 |

| 50532 | $2,935.26 |

| 50664 | $2,934.93 |

| 50543 | $2,934.63 |

| 52641 | $2,934.01 |

| 51331 | $2,933.85 |

| 52306 | $2,933.39 |

| 52134 | $2,932.97 |

| 50576 | $2,932.39 |

| 51360 | $2,932.35 |

| 52591 | $2,932.27 |

| 50559 | $2,931.78 |

| 52254 | $2,931.77 |

| 51033 | $2,930.85 |

| 50579 | $2,930.81 |

| 50522 | $2,930.62 |

| 52777 | $2,930.31 |

| 52045 | $2,930.26 |

| 50642 | $2,929.86 |

| 52731 | $2,929.81 |

| 52325 | $2,929.70 |

| 51355 | $2,929.65 |

| 51046 | $2,928.93 |

| 52362 | $2,928.19 |

| 52068 | $2,928.11 |

| 52228 | $2,928.02 |

| 51235 | $2,927.97 |

| 50647 | $2,927.73 |

| 50063 | $2,927.58 |

| 52054 | $2,927.08 |

| 52351 | $2,927.02 |

| 50540 | $2,926.90 |

| 52206 | $2,926.81 |

| 50152 | $2,926.75 |

| 52601 | $2,926.46 |

| 50585 | $2,926.33 |

| 52750 | $2,926.31 |

| 51363 | $2,925.71 |

| 52070 | $2,925.51 |

| 50530 | $2,925.18 |

| 52761 | $2,924.80 |

| 51230 | $2,924.56 |

| 50325 | $2,924.45 |

| 50590 | $2,924.21 |

| 52356 | $2,924.14 |

| 50466 | $2,924.13 |

| 52562 | $2,924.12 |

| 50246 | $2,923.95 |

| 52164 | $2,923.94 |

| 52155 | $2,923.85 |

| 50322 | $2,923.70 |

| 52554 | $2,923.35 |

| 50655 | $2,923.24 |

| 50225 | $2,923.08 |

| 51245 | $2,922.77 |

| 50657 | $2,922.68 |

| 50062 | $2,922.36 |

| 52146 | $2,922.36 |

| 50662 | $2,922.36 |

| 51346 | $2,921.82 |

| 50546 | $2,921.52 |

| 51238 | $2,921.23 |

| 51241 | $2,921.20 |

| 52030 | $2,920.87 |

| 50324 | $2,920.56 |

| 50511 | $2,920.32 |

| 51011 | $2,920.26 |

| 52751 | $2,920.19 |

| 50561 | $2,920.17 |

| 52074 | $2,920.09 |

| 51038 | $2,920.00 |

| 50556 | $2,919.82 |

| 50223 | $2,919.57 |

| 50599 | $2,919.37 |

| 51351 | $2,919.35 |

| 50157 | $2,919.35 |

| 50643 | $2,919.17 |

| 50612 | $2,919.04 |

| 50680 | $2,918.89 |

| 50669 | $2,918.60 |

| 51357 | $2,918.29 |

| 52232 | $2,917.78 |

| 50607 | $2,917.70 |

| 50517 | $2,917.69 |

| 51364 | $2,917.57 |

| 50544 | $2,917.01 |

| 52046 | $2,916.96 |

| 52065 | $2,916.95 |

| 50234 | $2,916.80 |

| 50583 | $2,916.79 |

| 51343 | $2,916.61 |

| 50471 | $2,916.60 |

| 52225 | $2,916.47 |

| 50141 | $2,916.27 |

| 51003 | $2,916.24 |

| 51449 | $2,915.48 |

| 50551 | $2,915.22 |

| 50619 | $2,914.89 |

| 50460 | $2,914.59 |

| 51045 | $2,914.56 |

| 52141 | $2,914.22 |

| 50574 | $2,913.80 |

| 51239 | $2,912.86 |

| 51009 | $2,912.69 |

| 50212 | $2,912.53 |

| 50565 | $2,912.25 |

| 52701 | $2,912.05 |

| 51036 | $2,912.04 |

| 52151 | $2,912.02 |

| 51002 | $2,911.97 |

| 52566 | $2,911.90 |

| 50480 | $2,911.59 |

| 52078 | $2,911.04 |

| 52348 | $2,910.99 |

| 52170 | $2,910.97 |

| 51250 | $2,910.95 |

| 50266 | $2,910.73 |

| 50592 | $2,910.72 |

| 51041 | $2,910.32 |

| 50039 | $2,910.17 |

| 50044 | $2,909.91 |

| 50106 | $2,909.87 |

| 52236 | $2,909.73 |

| 50670 | $2,909.13 |

| 52066 | $2,908.47 |

| 52561 | $2,907.99 |

| 52162 | $2,907.62 |

| 52352 | $2,907.60 |

| 50112 | $2,907.26 |

| 50671 | $2,907.16 |

| 50568 | $2,906.83 |

| 50628 | $2,906.77 |

| 50455 | $2,906.31 |

| 51338 | $2,906.22 |

| 52655 | $2,906.10 |

| 52039 | $2,905.91 |

| 52043 | $2,905.71 |

| 51340 | $2,905.68 |

| 52229 | $2,905.44 |

| 50638 | $2,905.31 |

| 52040 | $2,905.22 |

| 50451 | $2,905.18 |

| 50162 | $2,905.18 |

| 50626 | $2,904.83 |

| 52069 | $2,904.34 |

| 50153 | $2,903.03 |

| 52730 | $2,903.02 |

| 52072 | $2,902.98 |

| 50058 | $2,902.75 |

| 52158 | $2,902.69 |

| 51023 | $2,901.96 |

| 52543 | $2,901.75 |

| 52327 | $2,901.73 |

| 50232 | $2,900.63 |

| 50116 | $2,900.60 |

| 50454 | $2,900.50 |

| 50554 | $2,900.48 |

| 51027 | $2,900.16 |

| 52553 | $2,900.10 |

| 52536 | $2,900.07 |

| 50621 | $2,899.47 |

| 50220 | $2,899.15 |

| 52210 | $2,899.08 |

| 50265 | $2,898.87 |

| 50252 | $2,898.74 |

| 52742 | $2,897.81 |

| 50244 | $2,897.80 |

| 50588 | $2,897.43 |

| 52339 | $2,897.41 |

| 50510 | $2,897.35 |

| 52217 | $2,897.23 |

| 51467 | $2,896.95 |

| 50170 | $2,896.77 |

| 50028 | $2,896.72 |

| 52727 | $2,896.64 |

| 50641 | $2,896.57 |

| 52326 | $2,896.53 |

| 52159 | $2,895.79 |

| 51333 | $2,895.57 |

| 52077 | $2,895.37 |

| 50120 | $2,895.36 |

| 52329 | $2,895.35 |

| 50481 | $2,895.21 |

| 50027 | $2,894.00 |

| 52064 | $2,893.76 |

| 50560 | $2,893.61 |

| 52732 | $2,893.60 |

| 50542 | $2,893.51 |

| 50432 | $2,893.42 |

| 52757 | $2,893.40 |

| 52729 | $2,893.35 |

| 52530 | $2,893.23 |

| 50435 | $2,892.99 |

| 52157 | $2,892.97 |

| 50138 | $2,892.46 |

| 50426 | $2,892.07 |

| 50137 | $2,891.70 |

| 50423 | $2,891.51 |

| 51050 | $2,891.23 |

| 50483 | $2,890.90 |

| 52156 | $2,890.82 |

| 52172 | $2,890.54 |

| 50682 | $2,890.38 |

| 50127 | $2,890.15 |

| 52169 | $2,889.23 |

| 52349 | $2,888.75 |

| 50207 | $2,888.60 |

| 52548 | $2,888.53 |

| 52220 | $2,887.60 |

| 52135 | $2,887.34 |

| 52047 | $2,887.33 |

| 50075 | $2,886.57 |

| 50476 | $2,886.20 |

| 50005 | $2,886.15 |

| 50609 | $2,885.39 |

| 51031 | $2,884.62 |

| 52726 | $2,884.43 |

| 50430 | $2,883.27 |

| 50675 | $2,883.13 |

| 52334 | $2,881.96 |

| 50233 | $2,881.80 |

| 52586 | $2,881.59 |

| 52308 | $2,880.96 |

| 52227 | $2,880.89 |

| 50665 | $2,880.36 |

| 50484 | $2,880.01 |

| 50468 | $2,879.95 |

| 50648 | $2,879.46 |

| 52301 | $2,879.45 |

| 52344 | $2,878.68 |

| 52771 | $2,878.44 |

| 50465 | $2,877.94 |

| 50148 | $2,877.68 |

| 50440 | $2,877.18 |

| 50438 | $2,877.07 |

| 50276 | $2,876.99 |

| 50634 | $2,876.97 |

| 50475 | $2,875.81 |

| 50168 | $2,875.70 |

| 50472 | $2,875.18 |

| 52202 | $2,874.92 |

| 52314 | $2,874.39 |

| 51444 | $2,873.97 |

| 52307 | $2,873.63 |

| 52501 | $2,873.53 |

| 50251 | $2,873.33 |

| 52224 | $2,872.85 |

| 50604 | $2,872.75 |

| 50173 | $2,872.30 |

| 51459 | $2,871.93 |

| 52361 | $2,871.89 |

| 50171 | $2,871.59 |

| 50057 | $2,871.36 |

| 50533 | $2,871.17 |

| 50605 | $2,870.83 |

| 52222 | $2,870.20 |

| 50036 | $2,869.54 |

| 50629 | $2,868.95 |

| 52211 | $2,868.84 |

| 51440 | $2,868.83 |

| 52060 | $2,868.32 |

| 52247 | $2,868.11 |

| 51436 | $2,867.37 |

| 51463 | $2,867.33 |

| 50051 | $2,867.21 |

| 50467 | $2,865.63 |

| 50660 | $2,865.18 |

| 50677 | $2,865.14 |

| 51451 | $2,865.14 |

| 50625 | $2,864.78 |

| 50433 | $2,863.86 |

| 52175 | $2,863.80 |

| 50055 | $2,863.49 |

| 52253 | $2,863.00 |

| 51301 | $2,862.56 |

| 50707 | $2,862.12 |

| 52341 | $2,861.65 |

| 50434 | $2,861.16 |

| 50632 | $2,861.00 |

| 50050 | $2,860.80 |

| 50470 | $2,860.58 |

| 50427 | $2,860.37 |

| 52342 | $2,860.21 |

| 50054 | $2,860.12 |

| 51430 | $2,859.02 |

| 50611 | $2,858.16 |

| 50439 | $2,857.80 |

| 52213 | $2,856.56 |

| 50101 | $2,856.56 |

| 50446 | $2,856.13 |

| 52221 | $2,855.44 |

| 51443 | $2,854.91 |

| 50644 | $2,854.69 |

| 52338 | $2,854.46 |

| 50124 | $2,854.11 |

| 50449 | $2,854.03 |

| 50473 | $2,853.67 |

| 50421 | $2,852.52 |

| 52147 | $2,852.37 |

| 52333 | $2,851.63 |

| 52336 | $2,849.76 |

| 50135 | $2,849.68 |

| 52534 | $2,849.24 |

| 50239 | $2,847.97 |

| 50458 | $2,847.84 |

| 52142 | $2,846.88 |

| 50479 | $2,846.30 |

| 50623 | $2,845.22 |

| 50242 | $2,845.21 |

| 52577 | $2,844.77 |

| 50161 | $2,844.46 |

| 52235 | $2,844.28 |

| 50477 | $2,843.73 |

| 52328 | $2,843.43 |

| 50635 | $2,841.76 |

| 50482 | $2,841.02 |

| 52595 | $2,839.45 |

| 50633 | $2,837.64 |

| 50448 | $2,837.49 |

| 52358 | $2,835.28 |

| 51452 | $2,835.14 |

| 50673 | $2,834.37 |

| 50071 | $2,832.33 |

| 52405 | $2,831.36 |

| 50105 | $2,830.10 |

| 50119 | $2,829.03 |

| 50461 | $2,828.82 |

| 50231 | $2,828.75 |

| 50453 | $2,828.05 |

| 50469 | $2,827.44 |

| 50256 | $2,827.19 |

| 50608 | $2,827.00 |

| 50134 | $2,825.56 |

| 50132 | $2,824.29 |

| 50457 | $2,823.74 |

| 50624 | $2,823.06 |

| 50154 | $2,822.78 |

| 50214 | $2,821.62 |

| 50046 | $2,821.19 |

| 50620 | $2,819.00 |

| 52403 | $2,818.74 |

| 50614 | $2,818.62 |

| 50450 | $2,818.44 |

| 50525 | $2,818.11 |

| 50478 | $2,817.25 |

| 50613 | $2,816.90 |

| 50436 | $2,816.90 |

| 52402 | $2,816.10 |

| 50616 | $2,815.47 |

| 50444 | $2,814.54 |

| 50452 | $2,814.24 |

| 52214 | $2,814.04 |

| 52322 | $2,813.84 |

| 52755 | $2,812.93 |

| 50143 | $2,812.79 |

| 50456 | $2,812.78 |

| 52219 | $2,812.71 |

| 50424 | $2,812.02 |

| 50056 | $2,811.20 |

| 50021 | $2,810.64 |

| 50023 | $2,809.53 |

| 50247 | $2,809.22 |

| 50259 | $2,809.14 |

| 51401 | $2,808.91 |

| 52218 | $2,808.67 |

| 50420 | $2,806.81 |

| 50271 | $2,805.77 |

| 50601 | $2,805.24 |

| 52772 | $2,804.12 |

| 50441 | $2,803.53 |

| 50201 | $2,803.12 |

| 50447 | $2,803.09 |

| 50258 | $2,802.18 |

| 50431 | $2,801.85 |

| 50034 | $2,800.19 |

| 50459 | $2,797.53 |

| 50672 | $2,795.75 |

| 50595 | $2,795.50 |

| 50206 | $2,795.25 |

| 50102 | $2,793.49 |

| 50269 | $2,792.50 |

| 50208 | $2,790.29 |

| 50464 | $2,790.14 |

| 50111 | $2,790.08 |

| 52345 | $2,790.02 |

| 50131 | $2,788.69 |

| 50130 | $2,787.93 |

| 52401 | $2,787.66 |

| 50627 | $2,787.19 |

| 52721 | $2,786.21 |

| 50278 | $2,785.76 |

| 50401 | $2,782.99 |

| 50219 | $2,778.49 |

| 50227 | $2,775.99 |

| 50428 | $2,774.04 |

| 50230 | $2,772.23 |

| 52340 | $2,772.01 |

| 52302 | $2,771.54 |

| 50126 | $2,769.51 |

| 52404 | $2,768.58 |

| 52324 | $2,766.77 |

| 50006 | $2,764.17 |

| 52233 | $2,762.69 |

| 50122 | $2,762.30 |

| 50248 | $2,759.69 |

| 52411 | $2,735.38 |

| 52317 | $2,734.77 |

| 50142 | $2,734.13 |

| 50236 | $2,725.56 |

| 50078 | $2,721.11 |

| 52240 | $2,719.12 |

| 52245 | $2,699.88 |

| 52246 | $2,697.81 |

| 50158 | $2,686.15 |

| 50013 | $2,676.23 |

| 50011 | $2,663.37 |

| 50010 | $2,661.70 |

| 50014 | $2,651.87 |

| 50012 | $2,643.57 |

| 52243 | $2,613.15 |

| 52242 | $2,605.98 |

| 52241 | $2,598.27 |

Highest/Lowest by City

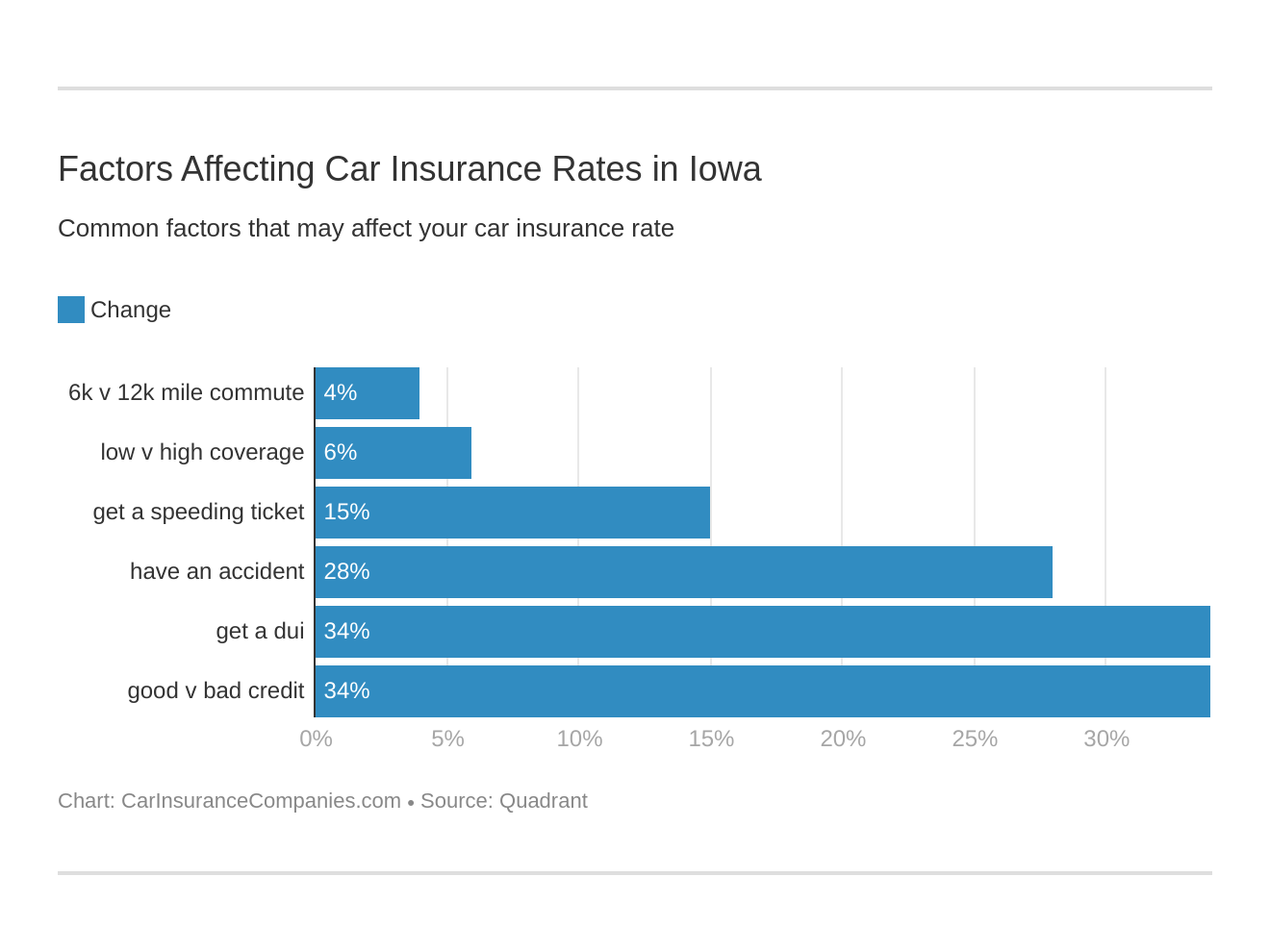

Six major factors affect auto insurance rates in IA. Which car insurance factors will affect your rates the most? Find out below:

| City | Average Grand Total |

|---|---|

| CORALVILLE | $2,598.27 |

| AMES | $2,659.35 |

| IOWA CITY | $2,667.19 |

| MARSHALLTOWN | $2,686.15 |

| FERGUSON | $2,721.11 |

| ROLAND | $2,725.56 |

| LE GRAND | $2,734.13 |

| NORTH LIBERTY | $2,734.77 |

| STORY CITY | $2,759.69 |

| HUBBARD | $2,762.30 |

| HIAWATHA | $2,762.69 |

| ALDEN | $2,764.18 |

| PALO | $2,766.77 |

| IOWA FALLS | $2,769.51 |

| MARION | $2,771.54 |

| TIFFIN | $2,772.01 |

| RADCLIFFE | $2,772.23 |

| CLEAR LAKE | $2,774.04 |

| POPEJOY | $2,775.99 |

| PELLA | $2,778.49 |

| MASON CITY | $2,782.99 |

| ZEARING | $2,785.76 |

| BENNETT | $2,786.21 |

| ELDORA | $2,787.19 |

| JEWELL | $2,787.93 |

| JOHNSTON | $2,788.69 |

| URBANA | $2,790.02 |

| GRIMES | $2,790.08 |

| PLYMOUTH | $2,790.14 |

| NEWTON | $2,790.29 |

| WHITTEN | $2,792.50 |

| CEDAR RAPIDS | $2,792.97 |

| GARDEN CITY | $2,793.49 |

| NEW PROVIDENCE | $2,795.25 |

| WEBSTER CITY | $2,795.50 |

| STEAMBOAT ROCK | $2,795.75 |

| NORTHWOOD | $2,797.53 |

| BLAIRSBURG | $2,800.19 |

| COULTER | $2,801.86 |

| UNION | $2,802.18 |

| KANAWHA | $2,803.09 |

| NEVADA | $2,803.12 |

| HAMPTON | $2,803.53 |

| TIPTON | $2,804.12 |

| ACKLEY | $2,805.25 |

| WILLIAMS | $2,805.77 |

| ALEXANDER | $2,806.81 |

| COGGON | $2,808.67 |

| CARROLL | $2,808.91 |

| GIFFORD | $2,809.15 |

| STATE CENTER | $2,809.23 |

| ANKENY | $2,810.09 |

| COLO | $2,811.20 |

| BUFFALO CENTER | $2,812.01 |

| PRAIRIEBURG | $2,812.71 |

| MANLY | $2,812.78 |

| LEIGHTON | $2,812.79 |

| LONE TREE | $2,812.93 |

| OXFORD | $2,813.84 |

| CENTRAL CITY | $2,814.04 |

| LATIMER | $2,814.24 |

| HANLONTOWN | $2,814.54 |

| CHARLES CITY | $2,815.47 |

| FOREST CITY | $2,816.90 |

| THOMPSON | $2,817.25 |

| CEDAR FALLS | $2,817.77 |

| CLARION | $2,818.11 |

| LAKE MILLS | $2,818.44 |

| COLWELL | $2,819.00 |

| CAMBRIDGE | $2,821.19 |

| OTLEY | $2,821.62 |

| MC CALLSBURG | $2,822.78 |

| DIKE | $2,823.06 |

| MESERVEY | $2,823.74 |

| KAMRAR | $2,824.29 |

| KELLEY | $2,825.56 |

| AUSTINVILLE | $2,826.99 |

| TRACY | $2,827.19 |

| ROCKWELL | $2,827.44 |

| LELAND | $2,828.04 |

| RANDALL | $2,828.75 |

| OSAGE | $2,828.82 |

| HARVEY | $2,829.04 |

| GILBERT | $2,830.10 |

| DOWS | $2,832.33 |

| STOUT | $2,834.37 |

| LIDDERDALE | $2,835.14 |

| WEST BRANCH | $2,835.28 |

| KENSETT | $2,837.49 |

| GENEVA | $2,837.64 |

| UNIVERSITY PARK | $2,839.45 |

| VENTURA | $2,841.02 |

| GLADBROOK | $2,841.76 |

| ROBINS | $2,843.44 |

| SWALEDALE | $2,843.72 |

| HILLS | $2,844.28 |

| MAXWELL | $2,844.46 |

| OSKALOOSA | $2,844.77 |

| DEWAR | $2,845.22 |

| SEARSBORO | $2,845.22 |

| THORNTON | $2,846.30 |

| FAYETTE | $2,846.88 |

| NORA SPRINGS | $2,847.84 |

| SAINT ANTHONY | $2,847.97 |

| BEACON | $2,849.24 |

| KELLOGG | $2,849.68 |

| SPRINGVILLE | $2,849.76 |

| SOLON | $2,851.63 |

| HAWKEYE | $2,852.37 |

| BELMOND | $2,852.52 |

| SCARVILLE | $2,853.67 |

| KLEMME | $2,854.03 |

| HUXLEY | $2,854.11 |

| SWISHER | $2,854.46 |

| INDEPENDENCE | $2,854.69 |

| GLIDDEN | $2,854.91 |

| GUERNSEY | $2,855.44 |

| JOICE | $2,856.13 |

| CENTER POINT | $2,856.56 |

| GALT | $2,856.56 |

| GOODELL | $2,857.80 |

| BRISTOW | $2,858.16 |

| ARCADIA | $2,859.02 |

| COLFAX | $2,860.12 |

| TOLEDO | $2,860.21 |

| CHAPIN | $2,860.37 |

| ROWAN | $2,860.58 |

| CHURDAN | $2,860.80 |

| GARWIN | $2,861.00 |

| FERTILE | $2,861.16 |

| TODDVILLE | $2,861.65 |

| EVANSDALE | $2,862.12 |

| SPENCER | $2,862.56 |

| LISBON | $2,863.00 |

| COLLINS | $2,863.49 |

| WEST UNION | $2,863.80 |

| DOUGHERTY | $2,863.86 |

| DUMONT | $2,864.78 |

| LANESBORO | $2,865.14 |

| WAVERLY | $2,865.14 |

| NEW HARTFORD | $2,865.18 |

| ROCK FALLS | $2,865.63 |

| CLEMONS | $2,867.21 |

| TEMPLETON | $2,867.33 |

| BREDA | $2,867.37 |

| KALONA | $2,868.11 |

| MAQUOKETA | $2,868.32 |

| DEDHAM | $2,868.83 |

| BROOKLYN | $2,868.84 |

| FAIRBANK | $2,868.95 |

| DEEP RIVER | $2,870.20 |

| AREDALE | $2,870.83 |

| EAGLE GROVE | $2,871.17 |

| COLUMBIA | $2,871.36 |

| MONTEZUMA | $2,871.59 |

| WILLIAMSBURG | $2,871.89 |

| RALSTON | $2,871.93 |

| MONTOUR | $2,872.30 |

| APLINGTON | $2,872.75 |

| DYSART | $2,872.85 |

| SULLY | $2,873.33 |

| OTTUMWA | $2,873.53 |

| MIDDLE AMANA | $2,873.63 |

| HALBUR | $2,873.97 |

| MOUNT VERNON | $2,874.39 |

| ALBURNETT | $2,874.92 |

| SAINT ANSGAR | $2,875.18 |

| MINGO | $2,875.70 |

| SHEFFIELD | $2,875.81 |

| GILBERTVILLE | $2,876.97 |

| WOODWARD | $2,876.99 |

| GARNER | $2,877.07 |

| GRAFTON | $2,877.18 |

| LISCOMB | $2,877.68 |

| RAKE | $2,877.94 |

| TEEDS GROVE | $2,878.44 |

| TROY MILLS | $2,878.68 |

| MARENGO | $2,879.45 |

| JESUP | $2,879.46 |

| ROCKFORD | $2,879.95 |

| WODEN | $2,880.01 |

| PARKERSBURG | $2,880.36 |

| ELY | $2,880.89 |

| MILLERSBURG | $2,880.96 |

| ROSE HILL | $2,881.59 |

| REDFIELD | $2,881.80 |

| SOUTH AMANA | $2,881.96 |

| TRAER | $2,883.13 |

| CORWITH | $2,883.27 |

| BLUE GRASS | $2,884.43 |

| LE MARS | $2,884.62 |

| BEAMAN | $2,885.39 |

| ALBION | $2,886.15 |

| STACYVILLE | $2,886.19 |

| ELLSWORTH | $2,886.57 |

| FARMERSBURG | $2,887.33 |

| CLERMONT | $2,887.34 |

| CONROY | $2,887.60 |

| CHILLICOTHE | $2,888.53 |

| NEW SHARON | $2,888.60 |

| VINTON | $2,888.75 |

| WADENA | $2,889.23 |

| IRA | $2,890.15 |

| WINTHROP | $2,890.38 |

| WAUKON | $2,890.54 |

| LUANA | $2,890.82 |

| WESLEY | $2,890.90 |

| REMSEN | $2,891.23 |

| BRITT | $2,891.51 |

| KILLDUFF | $2,891.70 |

| CARPENTER | $2,892.07 |

| KNOXVILLE | $2,892.46 |

| MC GREGOR | $2,892.97 |

| FLOYD | $2,892.99 |

| AGENCY | $2,893.23 |

| CALAMUS | $2,893.35 |

| LOW MOOR | $2,893.40 |

| CRYSTAL LAKE | $2,893.42 |

| GOLDFIELD | $2,893.51 |

| CLINTON | $2,893.60 |

| LU VERNE | $2,893.61 |

| MILES | $2,893.76 |

| BARNES CITY | $2,894.00 |

| TOETERVILLE | $2,895.21 |

| ROWLEY | $2,895.35 |

| HAVERHILL | $2,895.36 |

| VOLGA | $2,895.37 |

| DICKENS | $2,895.57 |

| MONONA | $2,895.79 |

| QUASQUETON | $2,896.53 |

| HAZLETON | $2,896.57 |

| BRYANT | $2,896.64 |

| BAXTER | $2,896.72 |

| MONROE | $2,896.77 |

| WESTSIDE | $2,896.95 |

| CLUTIER | $2,897.23 |

| ALBERT CITY | $2,897.35 |

| TAMA | $2,897.41 |

| STORM LAKE | $2,897.43 |

| SLATER | $2,897.79 |

| DE WITT | $2,897.81 |

| SWAN | $2,898.74 |

| BRANDON | $2,899.08 |

| PERRY | $2,899.15 |

| CONRAD | $2,899.47 |

| BLAKESBURG | $2,900.07 |

| EDDYVILLE | $2,900.10 |

| IRETON | $2,900.16 |

| LAURENS | $2,900.48 |

| LITTLE CEDAR | $2,900.50 |

| HAMILTON | $2,900.60 |

| REASNOR | $2,900.63 |

| RIVERSIDE | $2,901.73 |

| CEDAR | $2,901.76 |

| HAWARDEN | $2,901.96 |

| MARQUETTE | $2,902.69 |

| COON RAPIDS | $2,902.75 |

| SAINT OLAF | $2,902.98 |

| CAMANCHE | $2,903.02 |

| LYNNVILLE | $2,903.03 |

| PRESTON | $2,904.34 |

| WEST DES MOINES | $2,904.80 |

| DUNKERTON | $2,904.83 |

| MELBOURNE | $2,905.18 |

| LAKOTA | $2,905.19 |

| DYERSVILLE | $2,905.22 |

| GRUNDY CENTER | $2,905.31 |

| GARRISON | $2,905.44 |

| FOSTORIA | $2,905.68 |

| ELKADER | $2,905.71 |

| DURANGO | $2,905.91 |

| WEST BURLINGTON | $2,906.10 |

| EVERLY | $2,906.22 |

| MC INTIRE | $2,906.31 |

| ELMA | $2,906.77 |

| NEWELL | $2,906.83 |

| STANLEY | $2,907.16 |

| GRINNELL | $2,907.26 |

| WALKER | $2,907.60 |

| POSTVILLE | $2,907.62 |

| FREMONT | $2,907.99 |

| NORTH BUENA VISTA | $2,908.47 |

| SHELL ROCK | $2,909.13 |

| HOMESTEAD | $2,909.73 |

| GILMAN | $2,909.87 |

| BUSSEY | $2,909.91 |

| BOUTON | $2,910.17 |

| ORANGE CITY | $2,910.32 |

| TRUESDALE | $2,910.72 |

| SIOUX CENTER | $2,910.95 |

| WATERVILLE | $2,910.97 |

| VINING | $2,910.99 |

| WORTHINGTON | $2,911.04 |

| TITONKA | $2,911.59 |

| KIRKVILLE | $2,911.90 |

| ALTA | $2,911.97 |

| LANSING | $2,912.02 |

| MAURICE | $2,912.04 |

| ANDOVER | $2,912.05 |

| MARATHON | $2,912.25 |

| OGDEN | $2,912.53 |

| CALUMET | $2,912.70 |

| HULL | $2,912.87 |

| POCAHONTAS | $2,913.80 |

| ELGIN | $2,914.22 |

| OYENS | $2,914.56 |

| ORCHARD | $2,914.59 |

| CLARKSVILLE | $2,914.89 |

| JOLLEY | $2,915.22 |

| LAKE CITY | $2,915.48 |

| ALTON | $2,916.24 |

| LAUREL | $2,916.27 |

| ELBERON | $2,916.47 |

| RUDD | $2,916.60 |

| GREENVILLE | $2,916.61 |

| SAC CITY | $2,916.79 |

| RHODES | $2,916.80 |

| NEW VIENNA | $2,916.95 |

| FARLEY | $2,916.96 |

| HARCOURT | $2,917.01 |

| TERRIL | $2,917.57 |

| AURORA | $2,917.70 |

| BANCROFT | $2,917.70 |

| HARTWICK | $2,917.78 |

| ROYAL | $2,918.29 |

| REINBECK | $2,918.60 |

| WELLSBURG | $2,918.89 |

| BUCKINGHAM | $2,919.04 |

| HUDSON | $2,919.17 |

| MALCOM | $2,919.35 |

| MILFORD | $2,919.35 |

| WOOLSTOCK | $2,919.37 |

| PILOT MOUND | $2,919.57 |

| LEDYARD | $2,919.82 |

| MERRILL | $2,920.00 |

| SPRAGUEVILLE | $2,920.09 |

| LYTTON | $2,920.17 |

| GRAND MOUND | $2,920.19 |

| CHATSWORTH | $2,920.27 |

| ALGONA | $2,920.32 |

| WINDSOR HEIGHTS | $2,920.56 |

| ANDREW | $2,920.87 |

| LARCHWOOD | $2,921.20 |

| HOSPERS | $2,921.23 |

| HAVELOCK | $2,921.53 |

| HARTLEY | $2,921.82 |

| DALLAS | $2,922.36 |

| HARPERS FERRY | $2,922.36 |

| OELWEIN | $2,922.36 |

| MORRISON | $2,922.68 |

| PRIMGHAR | $2,922.77 |

| PLEASANTVILLE | $2,923.08 |

| MAYNARD | $2,923.24 |

| ELDON | $2,923.35 |

| LIME SPRINGS | $2,923.85 |

| RANDALIA | $2,923.94 |

| STANHOPE | $2,923.95 |

| HAYESVILLE | $2,924.11 |

| RICEVILLE | $2,924.13 |

| WELLMAN | $2,924.14 |

| SWEA CITY | $2,924.21 |

| CLIVE | $2,924.45 |

| ALVORD | $2,924.56 |

| MUSCATINE | $2,924.80 |

| DAYTON | $2,925.18 |

| SABULA | $2,925.51 |

| SUPERIOR | $2,925.71 |

| GOOSE LAKE | $2,926.31 |

| SIOUX RAPIDS | $2,926.33 |

| BURLINGTON | $2,926.46 |

| LUTHER | $2,926.75 |

| ATKINS | $2,926.81 |

| FONDA | $2,926.90 |

| WALFORD | $2,927.02 |

| LA MOTTE | $2,927.08 |

| DALLAS CENTER | $2,927.58 |

| JANESVILLE | $2,927.73 |

| DOON | $2,927.97 |

| FAIRFAX | $2,928.02 |

| PEOSTA | $2,928.11 |

| WYOMING | $2,928.19 |

| PAULLINA | $2,928.93 |

| OKOBOJI | $2,929.65 |

| PARNELL | $2,929.70 |

| CHARLOTTE | $2,929.81 |

| HOLLAND | $2,929.86 |

| EPWORTH | $2,930.26 |

| WHEATLAND | $2,930.31 |

| BURT | $2,930.62 |

| ROCKWELL CITY | $2,930.81 |

| LINN GROVE | $2,930.85 |

| LOST NATION | $2,931.77 |

| LONE ROCK | $2,931.78 |

| SIGOURNEY | $2,932.27 |

| SPIRIT LAKE | $2,932.35 |

| REMBRANDT | $2,932.39 |

| CHESTER | $2,932.97 |

| MECHANICSVILLE | $2,933.39 |

| ARNOLDS PARK | $2,933.85 |

| MOUNT PLEASANT | $2,934.01 |

| GOWRIE | $2,934.63 |

| ORAN | $2,934.93 |

| DUNCOMBE | $2,935.27 |

| BOYDEN | $2,935.44 |

| NORTH ENGLISH | $2,935.44 |

| DELMAR | $2,935.50 |

| KESLEY | $2,935.51 |

| ARCHER | $2,935.56 |

| LANGWORTHY | $2,935.83 |

| GREENE | $2,935.94 |

| PETERSON | $2,936.25 |

| DAWSON | $2,936.29 |

| NASHUA | $2,936.71 |

| WEST BEND | $2,936.79 |

| LAKE PARK | $2,937.03 |

| BOXHOLM | $2,937.13 |

| SUTHERLAND | $2,937.15 |

| WINFIELD | $2,937.16 |

| SANBORN | $2,937.26 |

| URBANDALE | $2,937.45 |

| MARCUS | $2,938.06 |

| SCHALLER | $2,938.15 |

| AUBURN | $2,938.48 |

| CRESCO | $2,938.48 |

| KEOTA | $2,938.55 |

| OLIN | $2,939.00 |

| LITTLE ROCK | $2,939.31 |

| SOMERS | $2,939.60 |

| SOUTH ENGLISH | $2,939.73 |

| RENWICK | $2,939.81 |

| WILTON | $2,940.06 |

| SALIX | $2,940.41 |

| BELLEVUE | $2,940.63 |

| MOSCOW | $2,940.70 |

| NORWAY | $2,940.96 |

| AURELIA | $2,941.03 |

| LUXEMBURG | $2,941.04 |

| MADRID | $2,941.25 |

| WHITTEMORE | $2,941.34 |

| NEMAHA | $2,941.42 |

| DURANT | $2,941.49 |

| WATKINS | $2,941.91 |

| ALTOONA | $2,942.00 |

| WEST LIBERTY | $2,942.02 |

| WAUKEE | $2,942.09 |

| CHEROKEE | $2,942.50 |

| HINTON | $2,942.53 |

| WEBB | $2,942.89 |

| READLYN | $2,943.18 |

| FREDERICKSBURG | $2,943.66 |

| WASHINGTON | $2,943.79 |

| NICHOLS | $2,944.24 |

| ROCK RAPIDS | $2,944.28 |

| LOHRVILLE | $2,945.19 |

| OLLIE | $2,945.22 |

| ALLISON | $2,945.25 |

| SPRINGBROOK | $2,945.92 |

| ROCK VALLEY | $2,946.23 |

| COOPER | $2,946.52 |

| TRIPOLI | $2,946.59 |

| MONTPELIER | $2,946.63 |

| SHELDON | $2,946.99 |

| EARLY | $2,947.04 |

| ARLINGTON | $2,947.22 |

| ARMSTRONG | $2,947.25 |

| LOWDEN | $2,947.30 |

| INWOOD | $2,947.83 |

| HARDY | $2,947.87 |

| MOORLAND | $2,948.03 |

| JEFFERSON | $2,948.10 |

| HARPER | $2,948.12 |

| KINGSLEY | $2,948.29 |

| BERWICK | $2,948.37 |

| GRANVILLE | $2,948.78 |

| DENVER | $2,948.97 |

| RIPPEY | $2,949.51 |

| MOUNT UNION | $2,949.52 |

| MINBURN | $2,949.58 |

| GEORGE | $2,949.61 |

| PLAINFIELD | $2,949.72 |

| SIBLEY | $2,949.77 |

| IONIA | $2,949.85 |

| RUTHVEN | $2,950.04 |

| WESTGATE | $2,950.18 |

| PALMER | $2,950.36 |

| NEW HAMPTON | $2,951.12 |

| PRINCETON | $2,951.17 |

| EARLVILLE | $2,951.46 |

| KESWICK | $2,951.60 |

| CYLINDER | $2,951.78 |

| RICHLAND | $2,951.86 |

| SUMNER | $2,951.95 |

| WEBSTER | $2,951.96 |

| MASONVILLE | $2,952.61 |

| NORTH WASHINGTON | $2,952.63 |

| ESTHERVILLE | $2,952.65 |

| OCHEYEDAN | $2,952.72 |

| BALDWIN | $2,952.81 |

| MARBLE ROCK | $2,952.82 |

| PROTIVIN | $2,953.12 |

| BERNARD | $2,953.63 |

| WELTON | $2,953.72 |

| MC CAUSLAND | $2,953.80 |

| BADGER | $2,953.86 |

| CLEGHORN | $2,953.88 |

| GRAETTINGER | $2,953.96 |

| OTHO | $2,953.96 |

| BRUNSVILLE | $2,954.10 |

| PRAIRIE CITY | $2,954.11 |

| FENTON | $2,954.17 |

| THORNBURG | $2,954.31 |

| JAMAICA | $2,954.35 |

| DANA | $2,954.43 |

| ALTA VISTA | $2,954.47 |

| ADEL | $2,954.51 |

| BELLE PLAINE | $2,954.82 |

| SAINT LUCAS | $2,954.92 |

| STANWOOD | $2,955.00 |

| WHAT CHEER | $2,955.11 |

| LAMONT | $2,955.33 |

| BLAIRSTOWN | $2,955.48 |

| ROLFE | $2,955.68 |

| SHELLSBURG | $2,955.70 |

| SERGEANT BLUFF | $2,955.85 |

| PLANO | $2,956.25 |

| SAINT DONATUS | $2,956.34 |

| MOVILLE | $2,956.49 |

| HARRIS | $2,956.59 |

| MORLEY | $2,956.60 |

| DRAKESVILLE | $2,956.63 |

| SWEDESBURG | $2,956.77 |

| LA PORTE CITY | $2,956.79 |

| VICTOR | $2,956.97 |

| HOLY CROSS | $2,956.98 |

| LE CLAIRE | $2,957.10 |

| AKRON | $2,957.13 |

| FORT DODGE | $2,957.19 |

| DUNDEE | $2,957.26 |

| MATLOCK | $2,957.56 |

| LIVERMORE | $2,957.89 |

| GALVA | $2,957.96 |

| GRAND JUNCTION | $2,958.24 |

| STOCKTON | $2,958.25 |

| GIBSON | $2,958.51 |

| BODE | $2,958.73 |

| STOCKPORT | $2,958.94 |

| LAKE VIEW | $2,959.14 |

| DELTA | $2,959.64 |

| ELDRIDGE | $2,959.68 |

| PATON | $2,959.70 |

| CALMAR | $2,959.72 |

| CONESVILLE | $2,959.77 |

| DECORAH | $2,959.90 |

| LARRABEE | $2,960.17 |

| LADORA | $2,960.29 |

| LAWLER | $2,960.34 |

| VARINA | $2,961.07 |

| WEST CHESTER | $2,961.17 |

| CURLEW | $2,961.18 |

| CRAWFORDSVILLE | $2,961.50 |

| VAN HORNE | $2,961.83 |

| STRAWBERRY POINT | $2,961.84 |

| SCRANTON | $2,961.86 |

| LINDEN | $2,962.38 |

| MELVIN | $2,962.83 |

| AYRSHIRE | $2,962.94 |

| ONSLOW | $2,963.00 |

| RAYMOND | $2,963.86 |

| CLARENCE | $2,964.01 |

| STRATFORD | $2,964.06 |

| SHERRILL | $2,964.34 |

| MOUNT AUBURN | $2,964.41 |

| MERIDEN | $2,964.66 |

| CENTER JUNCTION | $2,964.85 |

| HOLSTEIN | $2,965.37 |

| ELKHART | $2,965.44 |

| RYAN | $2,965.56 |

| GILMORE CITY | $2,965.63 |

| FAIRFIELD | $2,966.15 |

| MALLARD | $2,966.17 |

| OSSIAN | $2,966.46 |

| SAINT PAUL | $2,966.46 |

| LEHIGH | $2,966.50 |

| EMMETSBURG | $2,966.73 |

| HILLSBORO | $2,966.87 |

| MELROSE | $2,967.00 |

| WALCOTT | $2,967.39 |

| WATERLOO | $2,967.86 |

| CASTALIA | $2,967.97 |

| DE SOTO | $2,968.37 |

| FRUITLAND | $2,968.46 |

| LAWTON | $2,968.47 |

| DELAWARE | $2,968.57 |

| UNIONVILLE | $2,968.82 |

| MANILLA | $2,968.83 |

| CASCADE | $2,968.96 |

| ATALISSA | $2,969.31 |

| KEOKUK | $2,969.33 |

| WEST POINT | $2,969.39 |

| BOONE | $2,969.89 |

| MYSTIC | $2,970.02 |

| FORT ATKINSON | $2,970.19 |

| MANCHESTER | $2,970.26 |

| GRANGER | $2,970.28 |

| POMEROY | $2,970.59 |

| BRONSON | $2,970.69 |

| QUIMBY | $2,970.85 |

| KNIERIM | $2,971.00 |

| COLESBURG | $2,971.15 |

| MANSON | $2,971.36 |

| WAUCOMA | $2,971.52 |

| HIGHLANDVILLE | $2,971.56 |

| YALE | $2,971.75 |

| DENISON | $2,972.18 |

| AMANA | $2,972.25 |

| ZWINGLE | $2,972.39 |

| LOCKRIDGE | $2,972.59 |

| WALLINGFORD | $2,973.08 |

| AINSWORTH | $2,973.09 |

| ASHTON | $2,973.24 |

| VAIL | $2,973.56 |

| BIRMINGHAM | $2,973.61 |

| PLOVER | $2,974.25 |

| WAYLAND | $2,974.26 |

| HOPKINTON | $2,974.35 |

| FARNHAMVILLE | $2,974.68 |

| KEYSTONE | $2,974.69 |

| WALL LAKE | $2,974.98 |

| LETTS | $2,975.28 |

| VINCENT | $2,975.33 |

| SALEM | $2,975.47 |

| MONTICELLO | $2,975.49 |

| NEW LIBERTY | $2,976.40 |

| PILOT GROVE | $2,976.41 |

| OTTOSEN | $2,976.58 |

| WASHTA | $2,976.61 |

| CHELSEA | $2,976.64 |

| MOULTON | $2,976.66 |

| DONNELLSON | $2,976.76 |

| LUZERNE | $2,977.02 |

| WAPELLO | $2,978.80 |

| IDA GROVE | $2,979.60 |

| SPILLVILLE | $2,979.83 |

| LOVILIA | $2,980.29 |

| NEWHALL | $2,980.30 |

| DONAHUE | $2,980.62 |

| ALBIA | $2,980.63 |

| ELKPORT | $2,980.84 |

| ANAMOSA | $2,980.87 |

| BOONEVILLE | $2,981.15 |

| IRWIN | $2,981.22 |

| WHITING | $2,981.78 |

| DELHI | $2,981.79 |

| BONAPARTE | $2,982.75 |

| DOLLIVER | $2,983.00 |

| RINGSTED | $2,983.40 |

| RUTLAND | $2,983.47 |

| MORAVIA | $2,983.53 |

| ODEBOLT | $2,983.67 |

| MONMOUTH | $2,983.95 |

| GREELEY | $2,984.28 |

| LONG GROVE | $2,984.51 |

| CENTERVILLE | $2,984.52 |

| UDELL | $2,985.26 |

| BEVINGTON | $2,985.31 |

| BRIGHTON | $2,985.40 |

| BRADGATE | $2,985.80 |

| KIRON | $2,986.05 |

| EDGEWOOD | $2,986.12 |

| KIRKMAN | $2,986.17 |

| ALLEMAN | $2,986.28 |

| MEDIAPOLIS | $2,986.33 |

| BATTLE CREEK | $2,986.35 |

| CALLENDER | $2,987.10 |

| BAGLEY | $2,987.43 |

| MANNING | $2,987.77 |

| PACKWOOD | $2,987.83 |

| BATAVIA | $2,988.74 |

| CANTRIL | $2,988.83 |

| PLEASANT VALLEY | $2,990.00 |

| MARTELLE | $2,990.63 |

| DELOIT | $2,990.73 |

| STUART | $2,990.85 |

| LIBERTYVILLE | $2,991.30 |

| DAKOTA CITY | $2,991.41 |

| ONAWA | $2,991.58 |

| MARTINSBURG | $2,991.70 |

| ASPINWALL | $2,991.84 |

| RIDGEWAY | $2,991.96 |

| DEFIANCE | $2,992.35 |

| MORNING SUN | $2,993.44 |

| ARION | $2,994.19 |

| EXLINE | $2,994.30 |

| SCHLESWIG | $2,994.49 |

| PANORA | $2,995.82 |

| DIXON | $2,996.56 |

| HEDRICK | $2,996.56 |

| CHARTER OAK | $2,996.98 |

| HORNICK | $2,997.29 |

| ARTHUR | $2,997.74 |

| EARLHAM | $2,997.97 |

| SLOAN | $2,998.42 |

| BURNSIDE | $2,999.32 |

| MONTROSE | $2,999.82 |

| ARGYLE | $3,000.04 |

| HUMBOLDT | $3,000.19 |

| PERU | $3,000.20 |

| BAYARD | $3,000.30 |

| NEW LONDON | $3,000.69 |

| CINCINNATI | $3,001.17 |

| BARNUM | $3,001.69 |

| MOUNT STERLING | $3,001.92 |

| GARBER | $3,002.27 |

| GUTTENBERG | $3,002.35 |

| KEOSAUQUA | $3,004.55 |

| GARNAVILLO | $3,005.08 |

| SOLDIER | $3,005.70 |

| FLORIS | $3,005.87 |

| CASTANA | $3,005.95 |

| KIMBALLTON | $3,006.08 |

| SELMA | $3,006.16 |

| FARMINGTON | $3,006.42 |

| CHARITON | $3,006.45 |

| COLUMBUS CITY | $3,006.54 |

| HARLAN | $3,006.83 |

| WEVER | $3,008.69 |

| RUSSELL | $3,008.84 |

| DERBY | $3,011.07 |

| GRAY | $3,011.09 |

| DOW CITY | $3,011.38 |

| EXIRA | $3,011.70 |

| FORT MADISON | $3,011.89 |

| CUSHING | $3,012.55 |

| GARDEN GROVE | $3,013.33 |

| VAN METER | $3,013.33 |

| COLUMBUS JUNCTION | $3,013.36 |

| UTE | $3,013.57 |

| PULASKI | $3,014.10 |

| BRAYTON | $3,014.49 |

| YARMOUTH | $3,015.55 |

| AUDUBON | $3,016.65 |

| ELK HORN | $3,016.73 |

| RICKETTS | $3,016.98 |

| POLK CITY | $3,017.87 |

| HUMESTON | $3,018.17 |

| BLOOMFIELD | $3,018.29 |

| OXFORD JUNCTION | $3,019.38 |

| BLENCOE | $3,019.67 |

| OLDS | $3,019.72 |

| OAKVILLE | $3,019.83 |

| MOORHEAD | $3,020.26 |

| INDIANOLA | $3,020.66 |

| NEW ALBIN | $3,020.83 |

| DOUDS | $3,021.41 |

| CLIMBING HILL | $3,022.05 |

| DEXTER | $3,022.64 |

| PIERSON | $3,022.70 |

| PATTERSON | $3,023.35 |

| DANVILLE | $3,024.21 |

| WINTERSET | $3,025.93 |

| SPERRY | $3,026.18 |

| ACKWORTH | $3,026.98 |

| CRESTON | $3,027.08 |

| CLIO | $3,028.19 |

| DORCHESTER | $3,029.25 |

| WILLIAMSON | $3,029.49 |

| CROMWELL | $3,029.50 |

| SEYMOUR | $3,030.95 |

| MAPLETON | $3,031.49 |

| SHANNON CITY | $3,033.38 |

| MILTON | $3,033.53 |

| MIDDLETOWN | $3,033.61 |

| HAMLIN | $3,035.32 |

| SHELDAHL | $3,035.72 |

| CLARE | $3,036.32 |

| OSCEOLA | $3,036.49 |

| THOR | $3,038.87 |

| HOUGHTON | $3,039.38 |

| PORTSMOUTH | $3,040.00 |

| BONDURANT | $3,040.11 |

| HARTFORD | $3,040.20 |

| LUCAS | $3,040.51 |

| EARLING | $3,041.33 |

| ALLERTON | $3,041.40 |

| RODNEY | $3,041.75 |

| MARTENSDALE | $3,042.91 |

| LINEVILLE | $3,043.06 |

| THAYER | $3,044.11 |

| AFTON | $3,044.54 |

| MAGNOLIA | $3,044.57 |

| MILLERTON | $3,045.38 |

| CORRECTIONVILLE | $3,046.49 |

| PROMISE CITY | $3,046.64 |

| CUMMING | $3,048.56 |

| OTO | $3,049.45 |

| ARISPE | $3,051.63 |

| GUTHRIE CENTER | $3,052.04 |

| OAKLAND | $3,052.09 |

| CORYDON | $3,052.48 |

| SMITHLAND | $3,054.16 |

| WELDON | $3,055.99 |

| WOODBINE | $3,057.06 |

| WOODBURN | $3,057.28 |

| MITCHELLVILLE | $3,058.04 |

| ADAIR | $3,058.59 |

| ANTHON | $3,059.31 |

| LACONA | $3,060.01 |

| LOGAN | $3,060.38 |

| LIBERTY CENTER | $3,062.16 |

| SAINT CHARLES | $3,062.40 |

| LITTLE SIOUX | $3,062.64 |

| MONDAMIN | $3,063.49 |

| MACKSBURG | $3,063.90 |

| GREENFIELD | $3,064.91 |

| DANBURY | $3,067.07 |

| WALNUT | $3,071.16 |

| PANAMA | $3,071.76 |

| SAINT MARYS | $3,072.01 |

| DUBUQUE | $3,074.76 |

| PISGAH | $3,079.34 |

| VAN WERT | $3,079.63 |

| NEW VIRGINIA | $3,080.78 |

| AVOCA | $3,081.19 |

| MENLO | $3,082.64 |

| PRESCOTT | $3,084.17 |

| PROLE | $3,086.19 |

| TRURO | $3,087.69 |

| CASEY | $3,087.99 |

| CARLISLE | $3,088.68 |

| WIOTA | $3,088.94 |

| DUNLAP | $3,089.07 |

| BETTENDORF | $3,090.75 |

| MILO | $3,091.10 |

| LENOX | $3,092.12 |

| PERSIA | $3,094.94 |

| TINGLEY | $3,095.98 |

| BLOCKTON | $3,096.03 |

| WESTFIELD | $3,098.26 |

| SHELBY | $3,099.94 |

| ANITA | $3,100.46 |

| BRIDGEWATER | $3,100.70 |

| BENTON | $3,101.52 |

| ORIENT | $3,102.67 |

| ATLANTIC | $3,103.63 |

| MURRAY | $3,103.88 |

| MODALE | $3,108.20 |

| CLEARFIELD | $3,108.57 |

| MARNE | $3,111.11 |

| LAMONI | $3,112.85 |

| DECATUR | $3,115.95 |

| LORIMOR | $3,116.31 |

| SHAMBAUGH | $3,118.13 |

| GRAND RIVER | $3,118.23 |

| REDDING | $3,120.55 |

| NEOLA | $3,120.60 |

| LEWIS | $3,125.38 |

| SHARPSBURG | $3,125.88 |

| RUNNELLS | $3,125.89 |

| IMOGENE | $3,126.40 |

| TABOR | $3,127.14 |

| NORWALK | $3,128.18 |

| KELLERTON | $3,129.35 |

| CARBON | $3,130.48 |

| DAVIS CITY | $3,131.26 |

| MINDEN | $3,134.36 |

| SHENANDOAH | $3,134.91 |

| YORKTOWN | $3,136.45 |

| LEON | $3,137.92 |

| MC CLELLAND | $3,137.95 |

| MACEDONIA | $3,139.43 |

| ELLSTON | $3,142.48 |

| HANCOCK | $3,143.19 |

| FONTANELLE | $3,143.56 |

| RIVERTON | $3,144.18 |

| UNDERWOOD | $3,145.04 |

| CARSON | $3,145.81 |

| MISSOURI VALLEY | $3,146.17 |

| HASTINGS | $3,147.69 |

| NEW MARKET | $3,148.89 |

| CLARINDA | $3,149.94 |

| HAMBURG | $3,158.99 |

| MALVERN | $3,160.85 |

| MOUNT AYR | $3,160.90 |

| ESSEX | $3,160.92 |

| TREYNOR | $3,161.21 |

| NORTHBORO | $3,161.39 |

| CORNING | $3,161.60 |

| MASSENA | $3,161.66 |

| BLANCHARD | $3,166.15 |

| NODAWAY | $3,167.43 |

| GRISWOLD | $3,168.22 |

| MINEOLA | $3,170.76 |

| COLLEGE SPRINGS | $3,175.26 |

| DIAGONAL | $3,176.06 |

| FARRAGUT | $3,177.71 |

| GRAVITY | $3,177.95 |

| DAVENPORT | $3,178.04 |

| RED OAK | $3,178.98 |

| COIN | $3,180.34 |

| CUMBERLAND | $3,180.65 |

| BRADDYVILLE | $3,185.36 |

| STANTON | $3,192.82 |

| PERCIVAL | $3,193.43 |

| RANDOLPH | $3,197.04 |

| HENDERSON | $3,201.16 |

| SIDNEY | $3,202.45 |

| BEDFORD | $3,204.32 |

| HONEY CREEK | $3,209.76 |

| ELLIOTT | $3,212.72 |

| VILLISCA | $3,216.99 |

| DES MOINES | $3,218.42 |

| EMERSON | $3,223.48 |

| SILVER CITY | $3,228.19 |

| THURMAN | $3,239.93 |

| PACIFIC JUNCTION | $3,249.84 |

| CRESCENT | $3,259.16 |

| SIOUX CITY | $3,295.84 |

| GLENWOOD | $3,356.47 |

| CARTER LAKE | $3,421.91 |

| COUNCIL BLUFFS | $3,604.85 |

Read more:

- Wadena Insurance Company Car Insurance Review

- Hudson Insurance Company Car Insurance Review

- Homestead Insurance Company Car Insurance Review

- Hastings Mutual Car Insurance Review

- Dorchester Mutual Insurance Company Car Insurance Review

- Dorchester Insurance Company, Ltd Car Insurance Review

- New London County Mutual Insurance Company Car Insurance Review

- Keystone National Insurance Company Car Insurance Review

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Iowa Car Insurance Companies

Next, we’ll discuss all of the major car insurance companies that you’ll find in Iowa.

We’ll go over such items as the various types of ratings for insurance companies as well as the various rates you’ll find yourself seeing in Iowa.

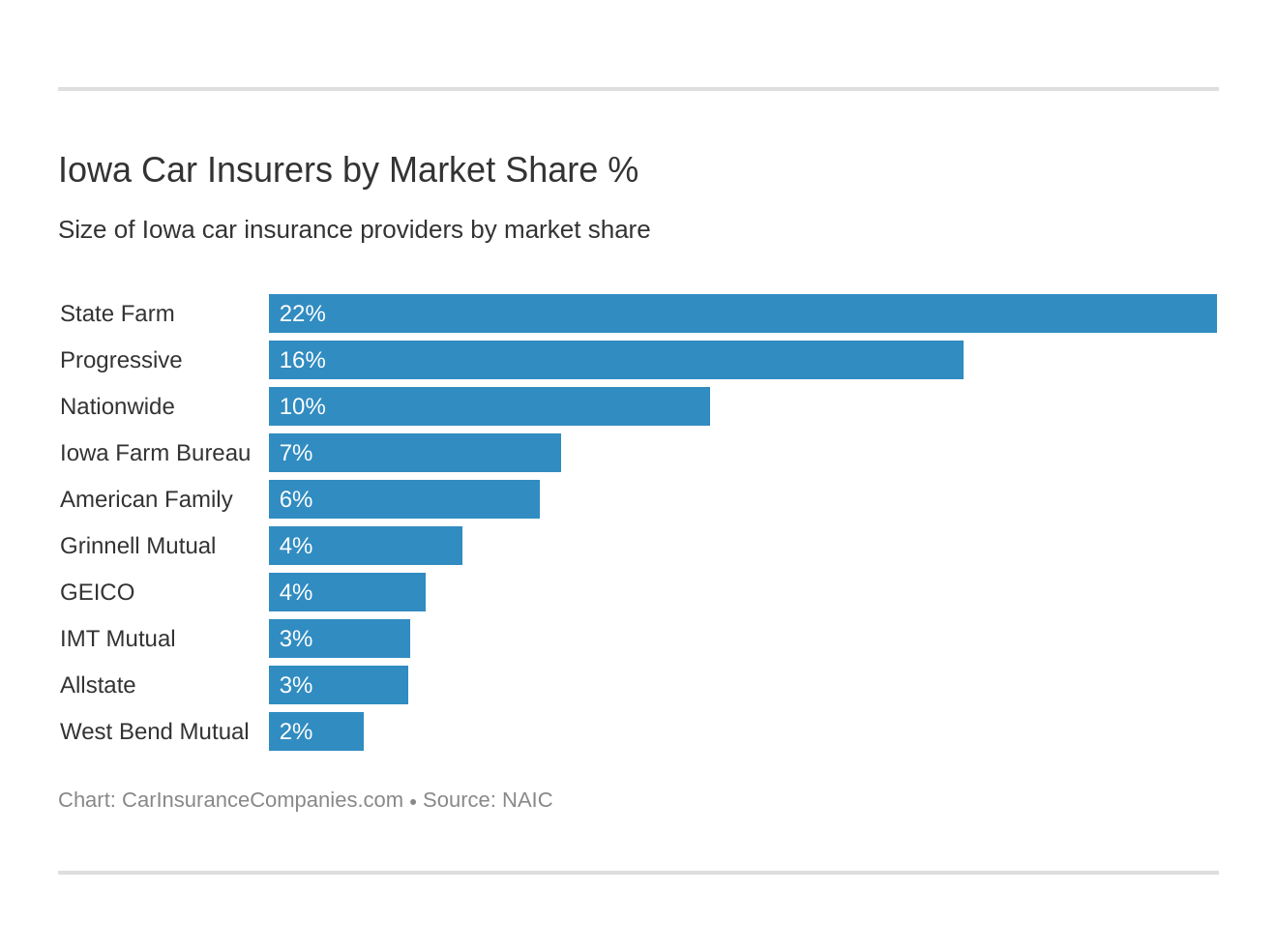

The Largest Companies Financial Rating

While it’s common knowledge that insurance companies check to see what your financial health is like before offering you an insurance policy, but did you know you could check their financial health as well?

It’s known as the A.M. Best Rating. It essentially assigns providers with a grade based on numerous financial factors, such as their loss ratios. The higher their grade, the better their financial ratings. The lower the grade, the lower, and less reliable, that provider is.

We’ve gone through the data and have found the A.M. Best Ratings for all of the largest insurance providers in Iowa:

| Company Name | AM Ratings | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm Group | A++ | $389,032 | 63.96% | 22.14% |

| Progressive Group | A+ | $285,107 | 63.34% | 16.23% |

| Nationwide Corp Group | A+ | $180,621 | 51.49% | 10.28% |

| Iowa Farm Bureau Group | NR | $119,308 | 67.98% | 6.79% |

| American Family Insurance Group | A | $111,227 | 69.86% | 6.33% |

| Grinnell Mutual Group | A | $78,945 | 71.86% | 4.49% |

| Geico | A++ | $64,044 | 78.07% | 3.65% |

| IMT Mutual Holding Group | NR | $57,498 | 70.27% | 3.27% |

| Allstate Insurance Group | A+ | $56,702 | 60.70% | 3.23% |

| West Bend Mutual Insurance Co | A | $38,498 | 58.38% | 2.19% |

Read more: Grinnell Mutual Reinsurance Company Car Insurance Review

Companies with Best Ratings

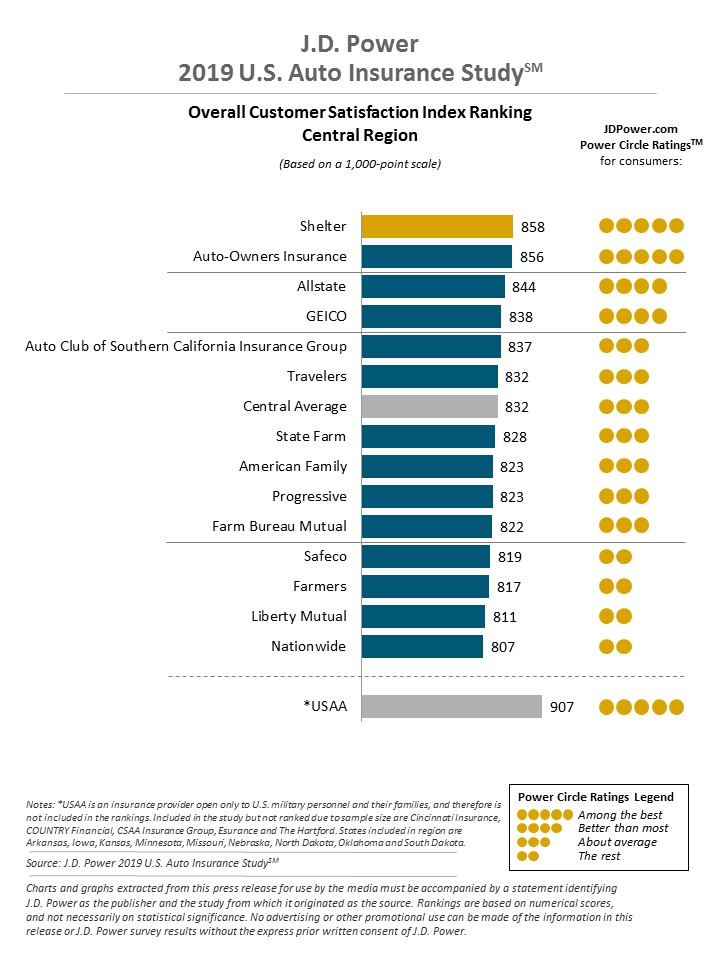

A study performed by J.D. Power was conducted to see the overall customer satisfaction rankings for the various car insurance provider in specific regions was. Iowa lands in the Central region of the United States.

Companies with Most Complaints in Iowa

Just like you would want to know how satisfied other customers are with a company, you’ll also want to know how dissatisfied other customers are as well.

According to the National Association of Insurance Commissioners (NAIC), the following complaint indexes were found in Iowa:

| Company | Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|

| State Farm Group | 0.44 | 1482 |

| Progressive Group | 0.75 | 120 |

| Nationwide Corp Group | 0.28 | 25 |

| Iowa Farm Bureau Group | 2.66 | 3 |

| American Family Insurance Group | 0.0 | 0 |

| Grinnell Mutual Group | 0.0 | 0 |

| Geico | .007 | 6 |

| IMT Mutual Holding Group | 2.42 | 1 |

| Allstate Insurance Group | 0.98 | 163 |

| West Bend Mutual Insurance Co | 0 | 0 |

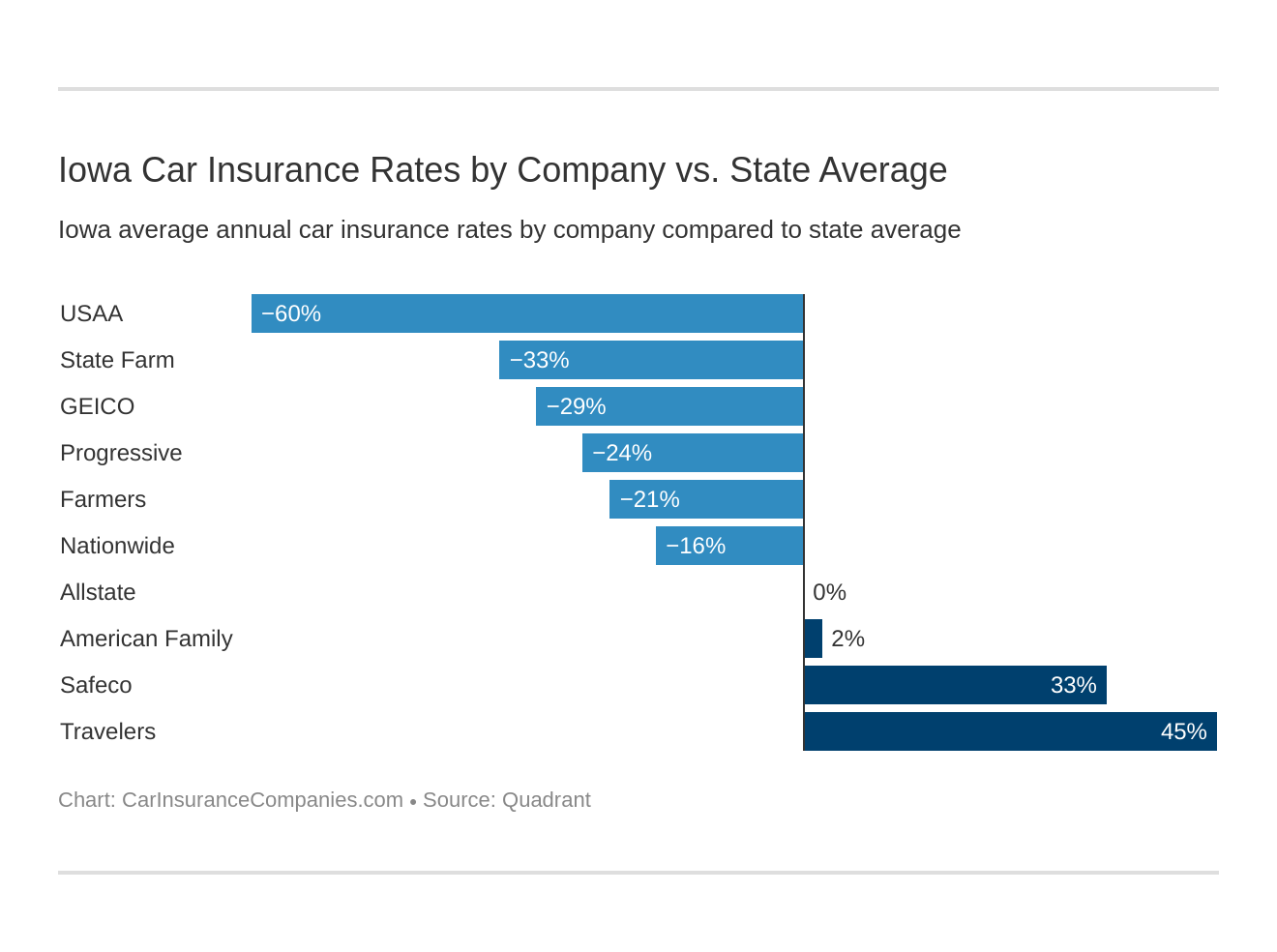

Iowa Car Insurance Rates by Company

We’ve done the hard part for you here and have found the different car insurance rates in Iowa.

| Company | Average Cost | Amount Compared to State Average | Percentage Compared to State Average |

|---|---|---|---|

| State Farm Mutual Auto | $2,223.47 | -$734.72 | -33.04% |

| Geico Cas | $2,296.51 | -$661.68 | -28.81% |

| Progressive Northern | $2,394.23 | -$563.96 | -23.56% |

| Farmers Insurance Co | $2,435.45 | -$522.75 | -21.46% |

| Nationwide Agribusiness Insurance | $2,551.81 | -$406.39 | -15.93% |

| Allstate F&C | $2,965.14 | $6.95 | 0.23% |

| American Family Mutual | $3,021.87 | $63.67 | 2.11% |

| Safeco Insurance Co America | $4,415.48 | $1,457.29 | 33.00% |

Commute Rates by Company

One factor that can play a surprising role in your insurance rate is what you commute is like. The longer your commute, the more you tend to pay.

| Company | 10 miles commute. 6,000 annual mileage. | 25 miles commute. 12,000 annual mileage. |

|---|---|---|

| Travelers | $5,425.63 | $5,425.63 |

| Liberty Mutual | $4,415.48 | $4,415.48 |

| American Family | $2,986.61 | $3,057.13 |

| Allstate | $2,894.65 | $3,035.64 |

| Nationwide | $2,551.81 | $2,551.81 |

| Farmers | $2,435.45 | $2,435.45 |

| Progressive | $2,394.23 | $2,394.23 |

| Geico | $2,251.26 | $2,341.77 |

| State Farm | $2,169.94 | $2,277.01 |

| USAA | $1,784.77 | $1,919.94 |

The good thing for Iowa citizens, however, is it looks like most of the providers in Iowa don’t charge more for longer commutes!

Coverage Level Rates by Company

Did you know that you could be paying more for a plan that actually covers you less? That’s right.

By comparing different companies’ coverage levels, you could actually be paying more.

| Company | High | Medium | Low |

|---|---|---|---|

| Allstate | $3,072.83 | $2,968.91 | $2,853.70 |

| American Family | $2,840.53 | $3,189.92 | $3,035.16 |

| Farmers | $2,530.66 | $2,443.15 | $2,332.54 |

| Geico | $2,411.84 | $2,297.14 | $2,180.55 |

| Liberty Mutual | $4,601.36 | $4,407.47 | $4,237.62 |

| Nationwide | $2,455.20 | $2,539.43 | $2,660.79 |

| Progressive | $2,521.62 | $2,402.19 | $2,258.89 |

| State Farm | $2,318.68 | $2,236.04 | $2,115.69 |

| Travelers | $5,666.01 | $5,507.84 | $5,103.05 |

| USAA | $1,941.61 | $1,858.31 | $1,757.16 |

As you can see from the table above, a low coverage plan with Traveler’s would cost you $5,103.05, while a high coverage plan with Liberty Mutual would only cost $4,601.36.

That means you’d be paying $501.69 more for lower coverage.

So making sure to compare insurance rates is essential when trying to get the optimal plan for you.

Credit History Rates by Company

Yes, insurance companies take a look at your credit history when considering what insurance rate they are going to offer you. The better your credit history, the better the rate you are offered will be.

| Company | Good | Fair | Poor |

|---|---|---|---|

| Allstate | $2,533.59 | $2,817.56 | $3,544.28 |

| American Family | $2,380.74 | $2,831.65 | $3,853.23 |

| Farmers | $2,195.20 | $2,317.58 | $2,793.56 |

| Geico | $1,833.13 | $2,296.52 | $2,759.89 |

| Liberty Mutual | $3,061.08 | $3,889.40 | $6,295.97 |

| Nationwide | $2,127.45 | $2,427.31 | $3,100.67 |

| Progressive | $2,069.08 | $2,284.84 | $2,828.78 |

| State Farm | $1,544.99 | $1,958.88 | $3,166.55 |

| Travelers | $4,964.86 | $5,210.35 | $6,101.70 |

| USAA | $1,449.06 | $1,673.05 | $2,434.97 |

Driving Record Rates by Company

Just like with your credit history, having a good driving record will save you a lot of cash. The more accidents and traffic violations you have, the more you’ll be paying for your coverage.