The Ultimate Alaska Car Insurance Guide (Costs + Coverage)

Alaska auto insurance requirements are 50/100/25 for minimum liability, but you may choose to drive with full coverage. State Farm currently offers the cheapest Alaska car insurance rates, but depending on your level of coverage you may find a better policy with a different company. Read our guide to compare Alaska car insurance companies and enter your ZIP code below to compare Alaska car insurance quotes for free.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Insurance Operations Specialist

UPDATED: Nov 6, 2023

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 6, 2023

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Road Miles 2015 | Total in State: 16,129 Vehicle Miles Driven: 5,045 Million |

| Vehicles 2015 | Registered: 783,169 Total Stolen: 2,046 |

| State Population | 737,438 |

| Most Popular Vehicle | F150 |

| Percentage of Motorists Uninsured | 15.40% State Rank: 11th |

| Driving Deaths | Speeding (2008-2017) Total: 253 Drunk Driving (2008-2017) Total: 207 |

| Average Premiums 2015 (Annual) | Liability: $539.68 Collision: $350.81 Comprehensive: $137.26 Combined Premium: $1,048.60 |

| Cheapest Provider | State Farm Mutual Auto |

Alaska is known as the Last Frontier. Alaska shows off its beautiful mountains and glaciers proudly housing 17 of the 20 highest points in the United States. Alaska also claims the title to the lowest population density in the nation. So not only does it have a gorgeous landscape, it offers a place to get away from the crowds and enjoy nature and the scenery.

Alaska’s terrain is definitely different than most states making insurance even more important. Insurance can be tough and hard to understand. We are going to walk you through the state laws, the best insurance companies, and the rules of the road.

Let us do the research, and you reap the benefits with the ease of making insurance decisions. Remember we also offer free quotes here. We are going to make the necessity of insurance easy.

How to get Alaska auto insurance coverage and rates

We are going to start with coverage and rates. What does Alaska expect from their drivers? How much coverage is mandated before you can drive on Alaska roadways?

We are going to navigate those questions and more for you in this first section.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What’s Alaska’s car culture like?

It comes as no surprise that Alaska has trucks and a lot of them. The Alaskan Highway, which is what connects Alaska to the contiguous United States, was recently paved in 1992. The terrain is rough and big trucks are needed to get around Alaska.

What are Alaska’s minimum coverage requirements?

Like most states, Alaska has a minimum liability insurance requirement.

| Coverage | Limit |

|---|---|

| Bodily Injury per Person | $50,000 |

| Bodily Injury per Accident | $100,000 |

| Property Damage | $25,000 |

The coverages above are liability coverage used to pay for another party in an accident where you are at fault. Minimum coverages are just that, the minimum amount of coverages. It is always good to speak with your insurance carrier to make sure you have adequate auto insurance coverage.

What’s the form of financial responsibility?

Alaska state law requires proof of insurance liability coverage to be located in the vehicle. You must show proof of liability coverage in all traffic stops and accidents, regardless of fault. Failure to show proof of insurance can result in a citation and possible vehicle impoundment.

The cost of minimum coverage varies from state to state.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What percentage of income are premiums?

A big question when it comes to insurance is the cost. How much of your income is going to cover the cost of your insurance?

| 2014 | 2013 | 2014 |

|---|---|---|

| 2.11% | 2.26% | 2.17% |

Percentage of income is down from 2013 and 2012.

What are the average monthly auto insurance rates in AK (liability, collision, comprehensive)

Core coverages consist of liability, comprehensive, collision, and full coverage or combined coverage. Liability is the coverage used when you are at fault.

This coverage goes into effect for the person having damages or injury due to an accident you caused. Comprehensive and collision coverage are coverages that are used for your damages. Full coverage, or combined, is a policy with all of the above-mentioned coverages.

Here is a short video explaining some core coverages that can be included in most auto policies.

Here is a table showing the average premiums of the coverages for Alaska residents.

| Liability | $539.68 |

| Collision | $350.81 |

| Comprehensive | $137.26 |

| Combined | $1,048.60 |

Is there an additional liability?

You can purchase additional liability with your insurance carrier. Uninsured/underinsured motorist (UUM) coverage is used in the event of a hit and run or if you are hit by a driver with inadequate or no insurance. Alaska is ranked 11th in the United States for uninsured drivers.

Medical payments is another coverage that can be purchased along with your required liability. Med Pay is used to pay for hospital bills or funeral expenses for anyone in the vehicle regardless of fault.

Loss ratio is used to calculate how much premium is earned or paid by the insured versus how much is paid out in claims. If a company has a loss ratio of over one hundred percent that means the company is losing money.

They are paying out more in claims than they are receiving in premiums. If the loss ratio is too low that shows the company does not pay out claims.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 78% | 81% | 83% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 46% | 53% | 50% |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Are there any add-ons, endorsements, and riders?

Below is a list of some of the more common endorsements you can add on your auto insurance policy. It is always a good idea to communicate all your needs to your insurance agent to make sure you have the best-added coverage to your policy.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

What are the average car insurance rates by age & gender in AK?

Two of the many factors that go into your insurance premium rate are age and gender. Gender can play a slight role in your rate. Some companies do not even change their rate on gender, while for others, it may be a slight increase or decrease due to gender.

Age is a bigger factor in your rate change. A younger driver will always have a higher rate due to the inexperience of driving.

| Company | Married 35-year-old female annual rate | Married 35-year-old male annual rate | Married 60-year-old female annual rate | Married 60-year-old male annual rate | Single 17-year-old female annual rate | Single 17-year-old male annual rate | Single 25-year-old female annual rate | Single 25-year-old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,133.71 | $2,133.71 | $2,037.18 | $2,037.18 | $5,100.22 | $6,679.06 | $2,407.00 | $2,634.39 |

| Geico General | $2,118.66 | $2,053.39 | $1,999.69 | $1,902.76 | $4,667.64 | $5,955.63 | $2,094.53 | $2,247.33 |

| Progressive Direct | $1,846.21 | $1,631.16 | $1,551.21 | $1,588.18 | $6,507.31 | $7,248.95 | $2,075.99 | $2,053.77 |

| State Farm Mutual Auto | $1,340.30 | $1,340.30 | $1,200.62 | $1,200.62 | $4,158.63 | $5,390.65 | $1,578.13 | $1,615.68 |

| USAA | $1,439.39 | $1,435.84 | $1,341.61 | $1,334.71 | $4,660.59 | $5,168.23 | $2,065.08 | $2,188.18 |

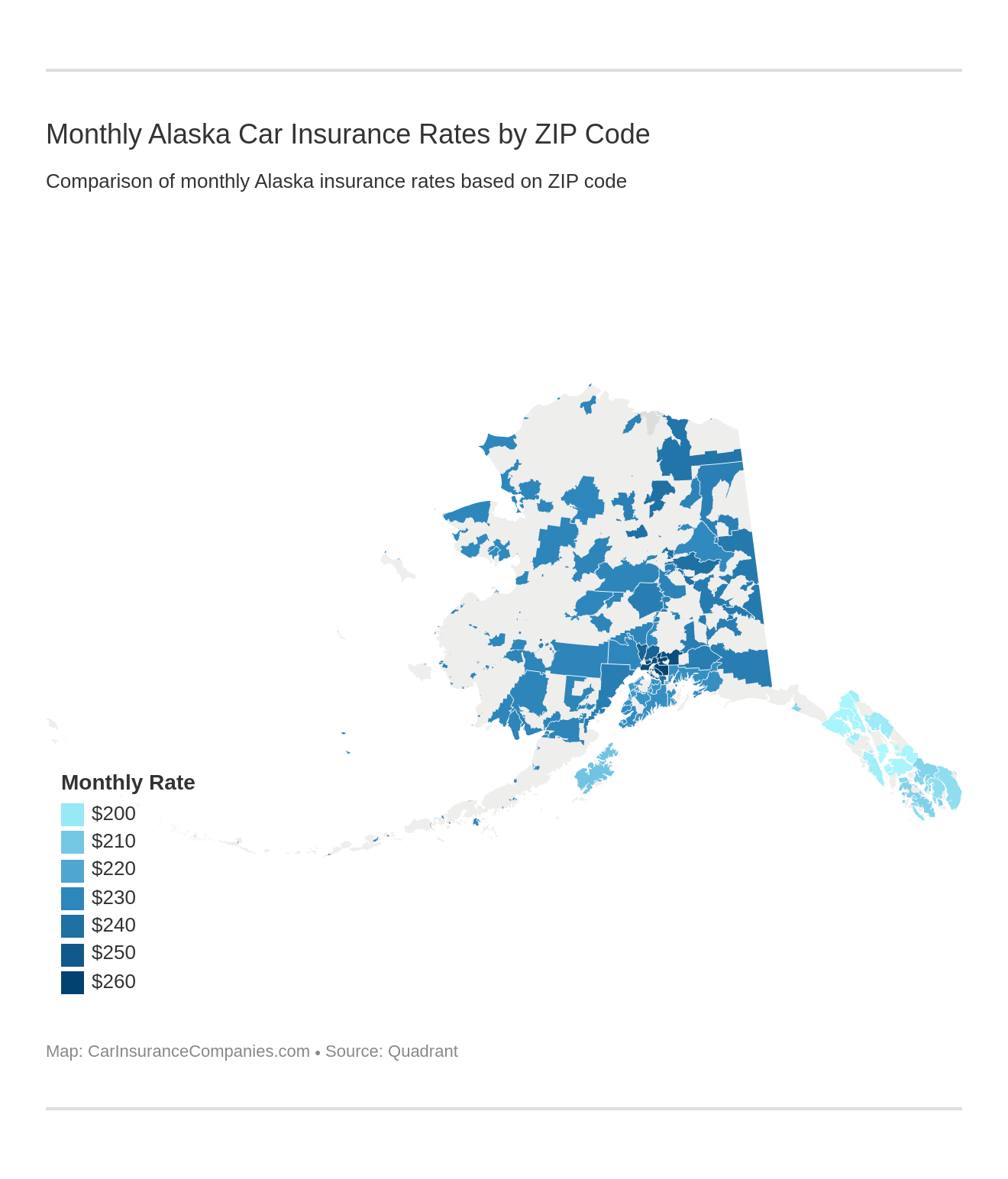

What are the cheapest car insurance rates by zip code?

Below is a table listing the most expensive and cheapest zip codes in Alaska. See if your zip code makes the cut and where it is at on the list.

| Most Expensive AK Zip Codes | Average Annual Rate | Least Expensive AK Zip Codes | Average Annual Rate |

|---|---|---|---|

| Anchorage 99504 | $3,132.74 | Meyers Chuck 99903 | 99903 |

| Chugiak 99567 | $3,124.36 | Wrangell 99929 | $2,471.16 |

| Eagle River 99577 | $3,111.36 | Hyder 99923 | $2,468.39 |

| Anchorage 99508 | $3,101.13 | Hydaburgh 99922 | $2,465.25 |

| Palmer 99645 | $3,091.71 | Thorne Bay 99919 | $2,456.86 |

| Anchorage 99502 | $3,086.19 | Point Baker 99927 | $2,455.82 |

| Anchorage 99507 | $3,083.15 | Ketchikan 99901 | $2,438.02 |

| Anchorage 99518 | $3,080.49 | Coffman Cove 99918 | $2,438.02 |

| Anchorage 99503 | $3,074.51 | Ward Cove 99928 | $2,438.02 |

| Anchorage 99599 | $3,074.51 | Juneau 99801 | $2,391.42 |

| Anchorage 99501 | $3,074.22 | Juneau 99811 | $2,391.42 |

| Anchorage 99513 | $3,074.22 | Auke Bay 99821 | $2,391.42 |

| Anchorage 99529 | $3,074.22 | Sitka 99835 | $2,371.90 |

| Big Lake 99652 | $3,072.96 | Port Alexander 99836 | $2,371.90 |

| Wasilla 99654 | $3,072.96 | Elfin Cove 99825 | $2,370.52 |

| Anchorage 99515 | $3,072.50 | Skagway 99840 | $2,370.50 |

| Anchorage 99517 | $3,068.87 | Haines 99827 | $2,357.96 |

| Anchorage 99530 | $3,068.87 | Gustavas 99826 | $2,355.81 |

| Sutton 99674 | $3,060.28 | Douglas 99824 | $2,351.46 |

| Anchorage 99516 | $3,056.41 | Petersburg 99833 | $2,351.30 |

| Indian 99540 | $3,026.69 | Kake 99830 | $2,348.31 |

| Jber 99505 | $3,012.68 | Pelican 99832 | $2,348.31 |

| Jber 99506 | $2,988.70 | Tenakee Springs 99841 | $2,348.31 |

| Willow 99688 | $2,957.31 | Hoonah 99829 | $2,348.11 |

| Houston 99694 | $2,957.31 | Angoon 99820 | $2,335.97 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the cheapest rates by city?

We have also broken down the data showing which cities have the cheapest rates. Check out the table below and search for our city to see where it lands on the list.

| Complete List of Most and Least Expensive Zip Codes in Alaska | Zip Codes | Average Annual Rate |

|---|---|---|

| ANCHORAGE | 99501 | $3,074.22 |

| ANCHORAGE | 99502 | $3,086.19 |

| ANCHORAGE | 99503 | $3,074.51 |

| ANCHORAGE | 99504 | $3,132.74 |

| JBER | 99505 | $3,012.68 |

| JBER | 99506 | $2,988.70 |

| ANCHORAGE | 99507 | $3,083.15 |

| ANCHORAGE | 99508 | $3,101.13 |

| ANCHORAGE | 99513 | $3,074.22 |

| ANCHORAGE | 99515 | $3,072.50 |

| ANCHORAGE | 99516 | $3,056.41 |

| ANCHORAGE | 99517 | $3,068.87 |

| ANCHORAGE | 99518 | $3,080.49 |

| ANCHORAGE | 99519 | $2,853.72 |

| ANCHORAGE | 99529 | $3,074.22 |

| ANCHORAGE | 99530 | $3,068.87 |

| INDIAN | 99540 | $3,026.69 |

| KONGIGANAK | 99545 | $2,699.37 |

| ADAK | 99546 | $2,772.23 |

| ATKA | 99547 | $2,770.44 |

| CHIGNIK LAKE | 99548 | $2,774.57 |

| PORT HEIDEN | 99549 | $2,774.57 |

| PORT LIONS | 99550 | $2,529.87 |

| AKIACHAK | 99551 | $2,757.14 |

| AKIAK | 99552 | $2,776.74 |

| AKUTAN | 99553 | $2,768.36 |

| ALAKANUK | 99554 | $2,765.86 |

| ALEKNAGIK | 99555 | $2,772.87 |

| ANCHOR POINT | 99556 | $2,730.16 |

| ANIAK | 99557 | $2,776.74 |

| ANVIK | 99558 | $2,773.22 |

| BETHEL | 99559 | $2,781.80 |

| CHEFORNAK | 99561 | $2,768.35 |

| CHEVAK | 99563 | $2,765.86 |

| CHIGNIK | 99564 | $2,768.34 |

| CHIGNIK LAGOON | 99565 | $2,774.57 |

| CHITINA | 99566 | $2,803.40 |

| CHUGIAK | 99567 | $3,124.36 |

| CLAM GULCH | 99568 | $2,714.65 |

| CLARKS POINT | 99569 | $2,782.22 |

| COLD BAY | 99571 | $2,769.72 |

| COOPER LANDING | 99572 | $2,709.97 |

| COPPER CENTER | 99573 | $2,803.40 |

| CORDOVA | 99574 | $2,729.94 |

| CROOKED CREEK | 99575 | $2,776.74 |

| DILLINGHAM | 99576 | $2,770.80 |

| EAGLE RIVER | 99577 | $3,111.36 |

| EEK | 99578 | $2,768.35 |

| EGEGIK | 99579 | $2,774.57 |

| EKWOK | 99580 | $2,778.06 |

| EMMONAK | 99581 | $2,765.86 |

| FALSE PASS | 99583 | $2,772.52 |

| MARSHALL | 99585 | $2,765.86 |

| GAKONA | 99586 | $2,807.55 |

| GIRDWOOD | 99587 | $2,894.79 |

| GLENNALLEN | 99588 | $2,803.40 |

| GOODNEWS BAY | 99589 | $2,768.35 |

| GRAYLING | 99590 | $2,771.15 |

| SAINT GEORGE ISLAND | 99591 | $2,766.60 |

| ANCHORAGE | 99599 | $3,074.51 |

| HOLY CROSS | 99602 | $2,767.62 |

| HOMER | 99603 | $2,737.91 |

| HOOPER BAY | 99604 | $2,759.63 |

| HOPE | 99605 | $2,706.57 |

| ILIAMNA | 99606 | $2,766.27 |

| KALSKAG | 99607 | $2,754.35 |

| KARLUK | 99608 | $2,529.87 |

| KASIGLUK | 99609 | $2,781.80 |

| KASILOF | 99610 | $2,709.61 |

| KENAI | 99611 | $2,691.18 |

| KING COVE | 99612 | $2,760.52 |

| KING SALMON | 99613 | $2,767.91 |

| KIPNUK | 99614 | $2,768.35 |

| KODIAK | 99615 | $2,529.87 |

| KOTLIK | 99620 | $2,763.78 |

| KWETHLUK | 99621 | $2,765.55 |

| KWIGILLINGOK | 99622 | $2,766.81 |

| #N/A | 99623 | $2,800.27 |

| LARSEN BAY | 99624 | $2,529.87 |

| LEVELOCK | 99625 | $2,766.27 |

| LOWER KALSKAG | 99626 | $2,762.74 |

| MC GRATH | 99627 | $2,765.27 |

| MANOKOTAK | 99628 | $2,771.83 |

| MEKORYUK | 99630 | $2,765.55 |

| MOOSE PASS | 99631 | $2,706.57 |

| MOUNTAIN VILLAGE | 99632 | $2,763.78 |

| NAKNEK | 99633 | $2,750.95 |

| NAPAKIAK | 99634 | $2,765.55 |

| NEW STUYAHOK | 99636 | $2,771.83 |

| TOKSOOK BAY | 99637 | $2,776.74 |

| NIKOLSKI | 99638 | $2,768.36 |

| NINILCHIK | 99639 | $2,710.25 |

| NONDALTON | 99640 | $2,766.27 |

| NUNAPITCHUK | 99641 | $2,780.70 |

| OLD HARBOR | 99643 | $2,529.87 |

| OUZINKIE | 99644 | $2,529.87 |

| PALMER | 99645 | $3,091.71 |

| PEDRO BAY | 99647 | $2,766.27 |

| PERRYVILLE | 99648 | $2,774.57 |

| PILOT POINT | 99649 | $2,772.50 |

| PILOT STATION | 99650 | $2,762.74 |

| PLATINUM | 99651 | $2,768.35 |

| BIG LAKE | 99652 | $3,072.96 |

| PORT ALSWORTH | 99653 | $2,766.27 |

| WASILLA | 99654 | $3,072.96 |

| QUINHAGAK | 99655 | $2,754.35 |

| RED DEVIL | 99656 | $2,768.35 |

| RUSSIAN MISSION | 99657 | $2,765.86 |

| SAINT MARYS | 99658 | $2,763.47 |

| SAINT MICHAEL | 99659 | $2,754.67 |

| SAINT PAUL ISLAND | 99660 | $2,775.31 |

| SAND POINT | 99661 | $2,761.00 |

| SCAMMON BAY | 99662 | $2,765.86 |

| SELDOVIA | 99663 | $2,737.91 |

| SEWARD | 99664 | $2,723.28 |

| SHAGELUK | 99665 | $2,771.15 |

| NUNAM IQUA | 99666 | $2,763.78 |

| SKWENTNA | 99667 | $2,763.76 |

| SLEETMUTE | 99668 | $2,765.55 |

| SOLDOTNA | 99669 | $2,682.68 |

| SOUTH NAKNEK | 99670 | $2,772.79 |

| STEBBINS | 99671 | $2,754.67 |

| STERLING | 99672 | $2,697.41 |

| SUTTON | 99674 | $3,060.28 |

| TAKOTNA | 99675 | $2,765.27 |

| TALKEETNA | 99676 | $2,748.05 |

| TATITLEK | 99677 | $2,729.94 |

| TOGIAK | 99678 | $2,770.80 |

| TULUKSAK | 99679 | $2,780.70 |

| TUNTUTULIAK | 99680 | $2,781.80 |

| TUNUNAK | 99681 | $2,776.74 |

| TYONEK | 99682 | $2,809.91 |

| TRAPPER CREEK | 99683 | $2,773.04 |

| UNALAKLEET | 99684 | $2,755.14 |

| UNALASKA | 99685 | $2,747.41 |

| VALDEZ | 99686 | $2,721.92 |

| WILLOW | 99688 | $2,957.31 |

| YAKUTAT | 99689 | $2,473.28 |

| NIGHTMUTE | 99690 | $2,781.80 |

| NIKOLAI | 99691 | $2,770.51 |

| DUTCH HARBOR | 99692 | $2,744.61 |

| WHITTIER | 99693 | $2,833.93 |

| HOUSTON | 99694 | $2,957.31 |

| FAIRBANKS | 99701 | $2,885.50 |

| EIELSON AFB | 99702 | $2,812.87 |

| FORT WAINWRIGHT | 99703 | $2,876.16 |

| CLEAR | 99704 | $2,770.55 |

| NORTH POLE | 99705 | $2,827.17 |

| FAIRBANKS | 99709 | $2,808.39 |

| FAIRBANKS | 99712 | $2,876.34 |

| SALCHA | 99714 | $2,880.20 |

| TWO RIVERS | 99716 | $2,848.08 |

| ALLAKAKET | 99720 | $2,770.11 |

| ANAKTUVUK PASS | 99721 | $2,761.70 |

| ARCTIC VILLAGE | 99722 | $2,781.61 |

| BARROW | 99723 | $2,808.39 |

| BEAVER | 99724 | $2,771.15 |

| BETTLES FIELD | 99726 | $2,795.61 |

| BUCKLAND | 99727 | $2,762.74 |

| CANTWELL | 99729 | $2,791.41 |

| CENTRAL | 99730 | $2,746.75 |

| FORT GREELY | 99731 | $2,824.49 |

| CHICKEN | 99732 | $2,828.96 |

| CIRCLE | 99733 | $2,794.05 |

| DEERING | 99736 | $2,762.74 |

| DELTA JUNCTION | 99737 | $2,824.49 |

| EAGLE | 99738 | $2,828.96 |

| ELIM | 99739 | $2,749.95 |

| FORT YUKON | 99740 | $2,795.61 |

| GALENA | 99741 | $2,761.39 |

| GAMBELL | 99742 | $2,755.14 |

| HEALY | 99743 | $2,811.56 |

| ANDERSON | 99744 | $2,816.00 |

| HUGHES | 99745 | $2,773.22 |

| HUSLIA | 99746 | $2,771.15 |

| KAKTOVIK | 99747 | $2,768.66 |

| KALTAG | 99748 | $2,768.35 |

| KIANA | 99749 | $2,761.70 |

| KIVALINA | 99750 | $2,765.86 |

| KOBUK | 99751 | $2,765.86 |

| KOTZEBUE | 99752 | $2,757.55 |

| KOYUK | 99753 | $2,746.84 |

| KOYUKUK | 99754 | $2,753.07 |

| DENALI NATIONAL PARK | 99755 | $2,798.16 |

| MANLEY HOT SPRINGS | 99756 | $2,768.06 |

| LAKE MINCHUMINA | 99757 | $2,776.10 |

| MINTO | 99758 | $2,784.76 |

| POINT LAY | 99759 | $2,785.45 |

| NENANA | 99760 | $2,789.17 |

| NOATAK | 99761 | $2,765.86 |

| NOME | 99762 | $2,746.84 |

| NOORVIK | 99763 | $2,763.78 |

| NORTHWAY | 99764 | $2,828.96 |

| NULATO | 99765 | $2,778.82 |

| POINT HOPE | 99766 | $2,765.86 |

| RAMPART | 99767 | $2,767.62 |

| RUBY | 99768 | $2,773.31 |

| SAVOONGA | 99769 | $2,755.14 |

| SELAWIK | 99770 | $2,765.86 |

| SHAKTOOLIK | 99771 | $2,753.07 |

| SHISHMAREF | 99772 | $2,755.14 |

| SHUNGNAK | 99773 | $2,765.86 |

| STEVENS VILLAGE | 99774 | $2,773.22 |

| FAIRBANKS | 99775 | $2,836.65 |

| TANACROSS | 99776 | $2,828.96 |

| TANANA | 99777 | $2,792.81 |

| TELLER | 99778 | $2,751.55 |

| TOK | 99780 | $2,828.96 |

| VENETIE | 99781 | $2,781.61 |

| WAINWRIGHT | 99782 | $2,777.14 |

| WALES | 99783 | $2,746.84 |

| WHITE MOUNTAIN | 99784 | $2,752.03 |

| BREVIG MISSION | 99785 | $2,746.84 |

| AMBLER | 99786 | $2,761.70 |

| CHALKYITSIK | 99788 | $2,795.61 |

| NUIQSUT | 99789 | $2,779.85 |

| FAIRBANKS | 99790 | $2,876.34 |

| ATQASUK | 99791 | $2,773.31 |

| JUNEAU | 99801 | $2,391.42 |

| JUNEAU | 99811 | $2,391.42 |

| ANGOON | 99820 | $2,335.97 |

| AUKE BAY | 99821 | $2,391.42 |

| DOUGLAS | 99824 | $2,351.46 |

| ELFIN COVE | 99825 | $2,370.52 |

| GUSTAVUS | 99826 | $2,355.81 |

| HAINES | 99827 | $2,357.96 |

| HOONAH | 99829 | $2,348.11 |

| KAKE | 99830 | $2,348.31 |

| PELICAN | 99832 | $2,348.31 |

| PETERSBURG | 99833 | $2,351.30 |

| SITKA | 99835 | $2,371.90 |

| PORT ALEXANDER | 99836 | $2,371.90 |

| SKAGWAY | 99840 | $2,370.50 |

| TENAKEE SPRINGS | 99841 | $2,348.31 |

| KETCHIKAN | 99901 | $2,438.02 |

| MEYERS CHUCK | 99903 | $2,472.61 |

| COFFMAN COVE | 99918 | $2,438.02 |

| THORNE BAY | 99919 | $2,456.86 |

| CRAIG | 99921 | $2,484.84 |

| HYDABURG | 99922 | $2,465.25 |

| HYDER | 99923 | $2,468.39 |

| KLAWOCK | 99925 | $2,490.45 |

| METLAKATLA | 99926 | $2,490.80 |

| POINT BAKER | 99927 | $2,455.82 |

| WARD COVE | 99928 | $2,438.02 |

| WRANGELL | 99929 | $2,471.16 |

| City | Zip Code | Average |

What are the best Alaska car insurance companies?

You know in order to drive in Alaska, you must have insurance. Now, we are going to take a look at the insurance companies available in Alaska.

Finding the right company can be difficult, but we are going to take the stress out of shopping. We are going to breakdown the best, and worst, companies available in Alaska. Which ones are the biggest or have the best rates? Find out below.

What is the financial rating of the largest companies?

AM Best is a credit rating company that looks at the financial strengths of an insurance company. They look at the ongoing activity of the company and determine their ability to pay out claims.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

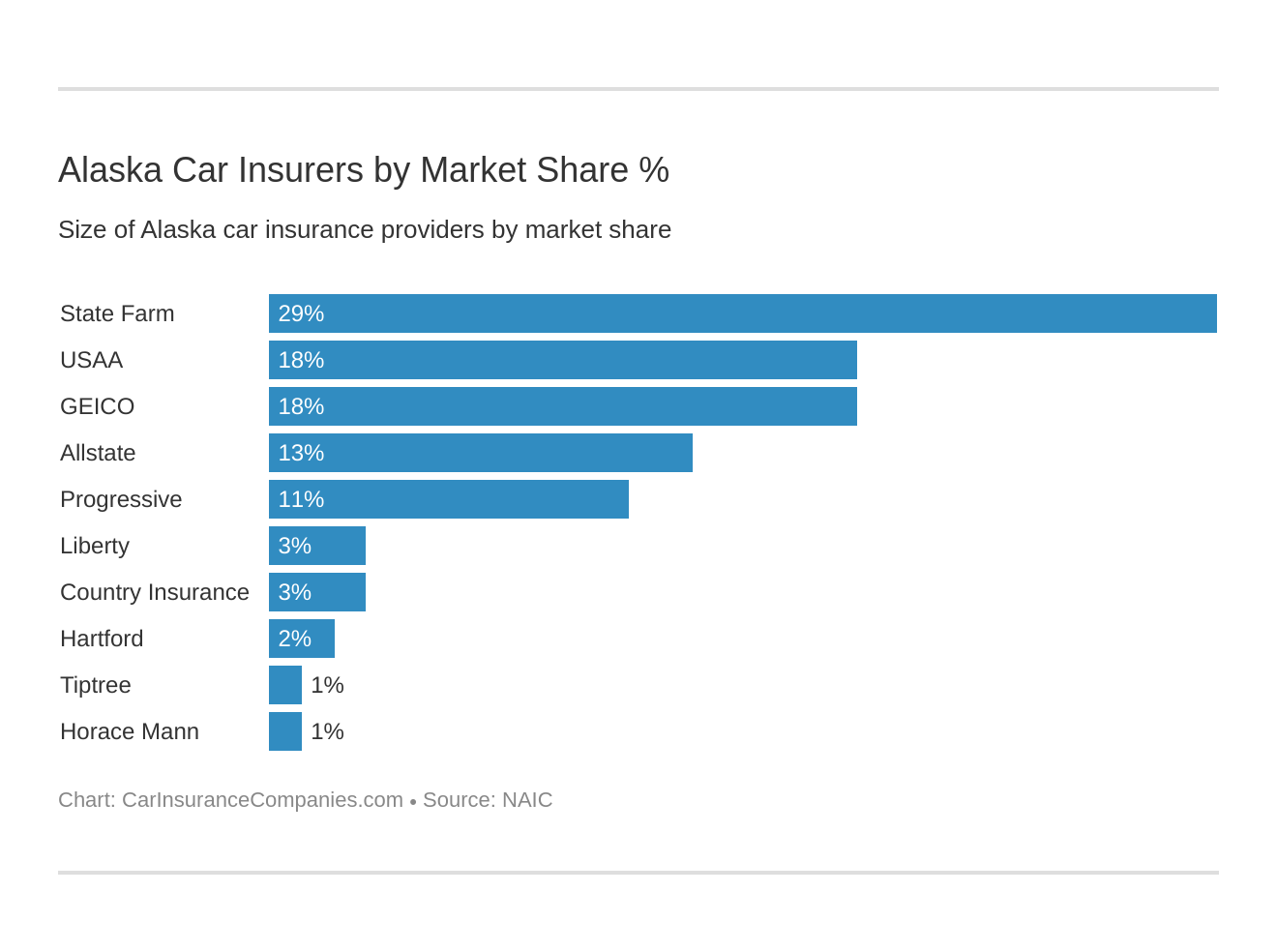

What are the largest car insurance companies in Alaska?

The chart below shows the largest car insurance companies in Alaska and their percentage of market share so you have an idea of how large they are.

| Company Name | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm Group | A++ | $133,816 | 77.95% | 28.55% |

| USAA Group | A++ | $83,687 | 68.67% | 17.86% |

| Geico | A++ | $82,637 | 68.23% | 17.63% |

| Allstate Insurance Group | A+ | $59,507 | 45.56% | 12.70% |

| Progressive Group | A+ | $50,922 | 67.86% | 10.86% |

| Liberty Mutual Group | A | $16,337 | 63.73% | 3.49% |

| Country Insurance & Financial Service Group | A+ | $14,042 | 65.14% | 3.00% |

| Hartford Fire & Casualty Group | A | $10,332 | 66.49% | 2.20% |

| Tiptree Financial Group | NR | $4,938 | 20.10% | 1.05% |

| Horace Mann Group | NR | $4,748 | 67.08% | 1.01% |

| State Total | $468,681 | 67.54% | 100.00% |

Which companies have the most complaints in Alaska?

All companies will have some type of complaint filed against them. We are going to look at the top 10 writing companies in Alaska.

| State Farm Group | 0.44 | 1,482 |

| Allstate Insurance Group | 0.5 | 163 |

| Progressive Group | 0.75 | 120 |

| Country Insurance and Financial Service Group | 0.44 | 15 |

| Horace Mann Group | 0.79 | 11 |

| Hartford Fire and Casualty Group | 4.68 | 9 |

| Geico | .007 | 6 |

| Liberty Mutual Group | .007 | 6 |

| Tiptree Financial Group | 0.55 | 2 |

| USSA Group | 0 | 2 |

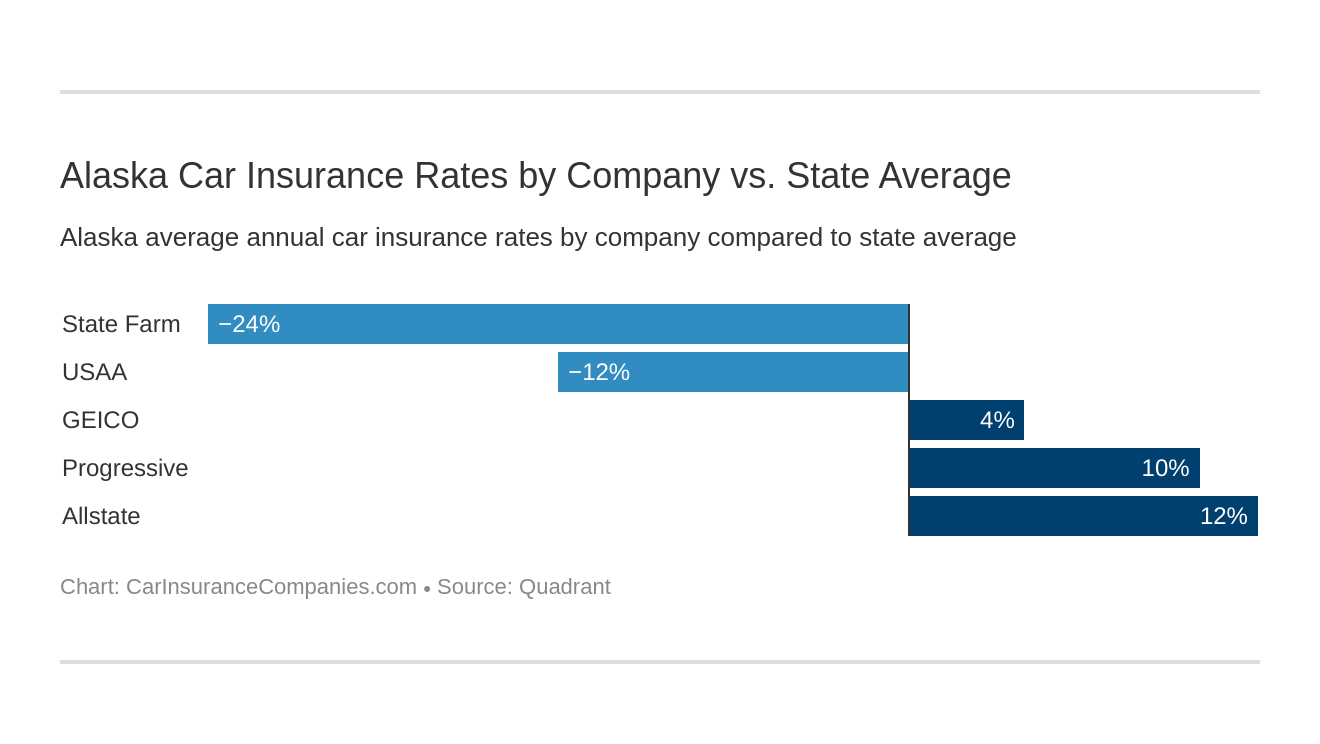

What are the cheapest companies in Alaska?

Where can I get good coverage for cheap? That is usually the first question asked by many looking for insurance rates.

| Company | Average Annual Rate | Compared to State Average | Percentage Compared to State Average |

|---|---|---|---|

| Allstate F&C | $3,145.31 | $391 | 12.44% |

| Geico General | $2,879.95 | $126 | 4.37% |

| Progressive Direct | $3,062.85 | $309 | 10.08% |

| State Farm Mutual Auto | $2,228.12 | -$526 | -23.61% |

| USAA | $2,454.20 | -$300 | -12.22% |

We took five companies and compared their rates with the state average.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the average commute rates by companies?

Some people drive a long way to get to work. Let’s look and see just how much that commuting will change your insurance rate.

| Company | Commute and Annual Mileage | Annual Average Cost |

|---|---|---|

| Allstate | 25 miles commute. 12000 annual mileage. | $3,207 |

| Allstate | 10 miles commute. 6000 annual mileage. | $3,084 |

| Progressive | 10 miles commute. 6000 annual mileage. | $3,063 |

| Progressive | 25 miles commute. 12000 annual mileage. | $3,063 |

| Geico | 25 miles commute. 12000 annual mileage. | $2,916 |

| Geico | 10 miles commute. 6000 annual mileage. | $2,843 |

| USAA | 25 miles commute. 12000 annual mileage. | $2,496 |

| USAA | 10 miles commute. 6000 annual mileage. | $2,412 |

| State Farm | 25 miles commute. 12000 annual mileage. | $2,289 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,167 |

A longer commute can cost you in your premium, but remember, based on the above table, your rates will not see a drastic increase with a longer commute.

What are the coverage level rates by companies?

Sometimes you may sacrifice coverage due to price. It is always a good idea to have your insurance agent quote out higher coverage. You may be pleasantly surprised at how much a higher coverage may cost.

| Group | Coverage Type | Average Annual Rate |

|---|---|---|

| Liberty Mutual | High | $5,558 |

| Liberty Mutual | Medium | $5,267 |

| Liberty Mutual | Low | $5,051 |

| Progressive | High | $4,463 |

| Farmers | High | $4,460 |

| State Farm | High | $4,325 |

| Farmers | Medium | $4,123 |

| State Farm | Medium | $4,089 |

| Progressive | Medium | $4,039 |

| Farmers | Low | $3,947 |

| State Farm | Low | $3,896 |

| Travelers | High | $3,804 |

| Travelers | Medium | $3,770 |

| Progressive | Low | $3,722 |

| Travelers | Low | $3,515 |

| Allstate | High | $3,386 |

| Allstate | Medium | $3,244 |

| Allstate | Low | $3,164 |

| Geico | High | $3,065 |

| Geico | Medium | $2,848 |

| Nationwide | High | $2,693 |

| Geico | Low | $2,692 |

| Nationwide | Low | $2,644 |

| Nationwide | Medium | $2,633 |

| USAA | High | $2,294 |

| USAA | Medium | $2,198 |

| USAA | Low | $2,146 |

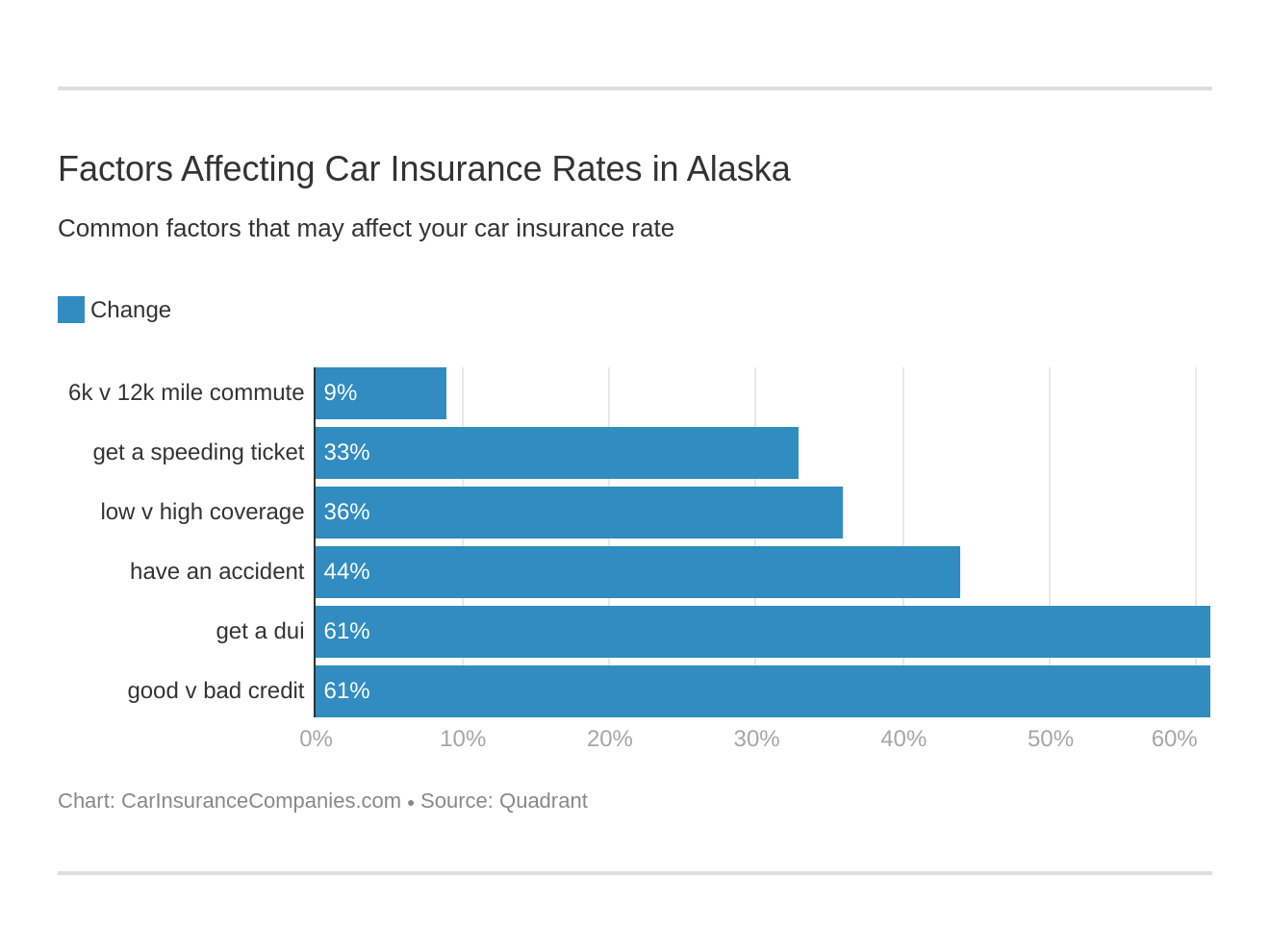

What are the credit history rates by companies?

Credit history isn’t only used for making purchases like a home or cars. Insurance carriers also look at your credit history when calculating your insurance rate. Just like someone purchasing insurance wants to make sure their company is financially stable, the carrier wants to make sure the client can pay their premiums as well.

| Company | Credit History | Average Annual Rate |

|---|---|---|

| Allstate | Poor | $3,718 |

| Progressive | Poor | $3,344 |

| USAA | Poor | $3,342 |

| Geico | Poor | $3,273 |

| State Farm | Poor | $3,083 |

| Progressive | Fair | $2,992 |

| Allstate | Fair | $2,961 |

| Progressive | Good | $2,852 |

| Geico | Fair | $2,845 |

| Allstate | Good | $2,757 |

| Geico | Good | $2,522 |

| USAA | Fair | $2,189 |

| State Farm | Fair | $1,993 |

| USAA | Good | $1,832 |

| State Farm | Good | $1,609 |

Your credit history definitely makes a big impact on your insurance rates.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the driving record rates by companies?

As to be expected, your driving record is going to make a huge impact on your insurance rates. Just how much is that speeding ticket going to cost you? Take a look below and see how much a company will rate traffic violations.

| Group | Driving Record | Average Annual Rate |

|---|---|---|

| Geico | With 1 DUI | $4,320 |

| Allstate | With 1 DUI | $3,542 |

| Allstate | With 1 accident | $3,541 |

| Progressive | With 1 accident | $3,513 |

| USAA | With 1 DUI | $3,232 |

| Progressive | With 1 speeding violation | $3,087 |

| Geico | With 1 accident | $3,044 |

| Allstate | With 1 speeding violation | $2,988 |

| Progressive | With 1 DUI | $2,911 |

| Progressive | Clean record | $2,741 |

| Allstate | Clean record | $2,511 |

| USAA | With 1 accident | $2,474 |

| State Farm | With 1 accident | $2,425 |

| State Farm | With 1 DUI | $2,228 |

| State Farm | With 1 speeding violation | $2,228 |

| USAA | With 1 speeding violation | $2,183 |

| Geico | With 1 speeding violation | $2,096 |

| Geico | Clean record | $2,059 |

| State Farm | Clean record | $2,031 |

| USAA | Clean record | $1,928 |

Of course, a clean record is going to get you the best rate. A DUI can carry a hefty increase in your premium. We will discuss later some other ramifications of getting a DUI in Alaska.

What is the number of insurers by state?

How many insurers are available to Alaska drivers?

| Domestic | Foreign | Total Number of Licensed Insurers |

| 4 | 397 | 401 |

The answer is quite a few. You may be wondering what the difference is between domestic and foreign. Domestic means the insurance company was formed in Alaska, while foreign means the insurer was founded and formed in a different state.

What are Alaska state laws?

We have discussed auto insurance companies, now we are going to hit on the laws governing you as a driver. Laws and regulations will vary from state to state, so if you are new to Alaska, it is confusing to know how you should handle registration and different rules of the road. Don’t worry. We are going to break down some important Alaska laws.

We are going to cover registration, vehicle licensing laws, and much more.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the car insurance laws?

As mentioned earlier, every driver with a registered car must have minimum liability insurance. Every driver must have the insurance and be able to show proof when pulled over or receiving a traffic citation.

How to get windshield coverage

Driving on the backroads of Alaska, the chances of a rock flying up and cracking your windshield is pretty high. While Alaska does not have any specific laws on windshield repair, many insurance companies offer windshield coverage if you add comprehensiveaut coverage to your policy.

How to get high-risk insurance

In some cases, after a series of traffic violations or a DUI, the state may ask for SR-22 insurance. If your license has been suspended or revoked, you may need proof of SR-22 insurance filing to reinstate. Most companies will have a fee for filing this type of insurance with the state, the biggest price will come from having to carry high-risk insurance.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

How to get low-cost insurance

Currently, Alaska does not offer a low-cost insurance program. The best way to get the lowest rate is to have a clean driving record and shop your insurance to find the best rate for you.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Is there an automobile insurance fraud in Alaska?

As in most states, insurance fraud is a crime in Alaska. Fraud can be committed by several different parties. The applicant can provide false or incomplete information or claim an accident that did not happen. A third party can even make a bigger claim by submitting more things than necessary.

Committing fraud can lead to a punishment of fines, jail time, and probation.

What’s a statute of limitations?

The statute of limitations is the time frame in which a claim must be submitted and resolved. Once you have your accident, your time starts. If you wait past the allotted time frame, you can no longer collect on the claim.

- Personal Injury: Two years

- Property Damage: Six Years

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the vehicle licensing laws?

In 2005, Congress passed the Real ID Act. This act sets certain standards on issuing driver’s licenses. If your state does not comply with this act, federal agencies do not have to accept your driver’s license as a proper form of proof of identity.

Alaska does comply with the Real ID Act.

What are the penalties for driving without insurance?

Since it is state law to have insurance while driving your registered vehicles, there are penalties for disobeying this law.

| 1st Offense | -License suspension for 90 days |

| 2nd Offense | -License suspension for one year |

The penalties are very strict, with no fines and straight to license suspension.

In the event of an accident or you are pulled over, you must have proof of insurance in your vehicle. Proof includes a copy of your current insurance policy or valid insurance cards.

What are the teen driver laws?

Teens cost their parents a substantial amount in insurance premiums. Parents in Alaska have an even longer time of listing teens on their insurance. This is due to the fact that teens can get theirlearners license as early as 14 years old.

Alaska does require teenagers to go through requirements before obtaining their license.

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 40 hours (10 of which must be at night or in inclement weather) |

| Minimum Age | 16-years-old |

They do have restrictions on night driving and passengers in the vehicle.

| Nighttime restrictions | 1 a.m. to 5 a.m. |

| Passenger restrictions (family members excepted unless noted otherwise) | no passengers younger than 21-years-old |

| Nighttime restrictions | -6 months or until age 18 (minimum age: 16 and 6 months) |

| Passenger restrictions | -6 months or until age 18 (minimum age: 16 and 6 months) |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the license renewal procedures for older drivers?

The renewal process is slightly different for drivers 69 years old and older. Renewal is every five years for all drivers, but for the older population, you must go to DMV every five years and forgo the option of online renewal. You must also show proof of adequate vision.

What is the procedure for new residents?

If you are new to Alaska, welcome! You now have 10 days to register your vehicle. You must register your vehicle by showing out-of-state registration, title, and registration application.

What are the license renewal procedures?

As a resident of Alaska, you must renew your license every five years. You may submit renewal online or mail every other renewal period. Every time you go to DMV to renew, you must show proof of adequate vision.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What is considered a negligent operator?

Being a negligent driver in Alaska can add six points your driving record and possible fines. Being negligent or reckless can endanger others around you and yourself. Remember, a poor driving record also means much higher insurance rates.

What are the rules of the road?

Next, let’s discuss the rules of the road. Knowing the laws can keep you safe and out of trouble. We are going to breakdown several major rules including seat belts and speed limits.

Is Alaska at fault or no-fault state?

Alaska is an at-fault system for paying for claims. This means that whoever is at fault for the accident, it will be their insurance that will pay out up to policy limits for the claim.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the seat belt and car seat laws?

Seat belts and car seats for the safety of all passengers in the vehicle. To keep safe and avoid fines, you must follow the below laws.

Effective Since September 12, 1990

Primary Enforcement Yes; effective since May 1, 2006

Age/Seats Applicable 16+ years old in front seat

1st Offense Max Fine $15 plus fees

Car seat laws are very important for the safety of children. Below is an easy chart to remember where in the vehicle a child should sit and how a child should be restrained.

| Type of Car Seat Required | Age |

| Rear-Facing Child Restraint | Younger than one-year-old or less than 20 pounds |

| Forward-Facing Child Restraint | One to three years old and more than 20 pounds |

| Child Booster Seat | Four through 15 years who are either shorter than 57 inches or who weigh more than 20 but less than 65 pounds |

| Adult Belt Permissible | Four through 7 years who are at least 57 inches or 65+ pounds; 7 through 15 who are shorter than 57 inches or weigh less than 65 pounds |

What are the keep right and move over laws?

Keep right and move over laws are pretty simple in Alaska. If you are driving slower than the speed limit you are to keep right.

To keep police officers, emergency vehicles, and other vehicles safe, you should always move over to furthest lane from safety vehicles or anyone parked on the side of the road.

What’s the maximum speed limit?

Speed limits are set in place to keep everyone on the road safe. You should always keep an eye out for posted speed limit signs. Below, we have a chart of speed limits for certain roads.

| Type of Roadway | Speed Limit |

| Rural Interstates | 65 mph |

| Urban Interstates | 55 mph |

| Other Limited Access Roads | 65 mph |

| Other Roads | 55 mph |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

How does ridesharing work?

Ridesharing has become a popular way of commuting. If you are interested in driving for Uber or another ridesharing company, you need to contact your current insurance carrier and verify there are no gaps in your coverage. Doing this will protect you and the rider in your vehicle.

Is there an automation on the road?

Automation is no longer a thing of the future. Cars driving themselves is now a reality. Alaska does not have any law regarding automated cars on the road.

What are the safety laws?

Being safe on the road is a huge deal. Knowing the punishment for drinking and driving may make drivers think twice about getting behind the wheel of a car after a few drinks.

| Details | |

|---|---|

| Name for Offense | Driving under the influence (DUI) or Operating Under the Influence (OUI) |

| BAC Limit | 0.08 |

| High BAC Limit | NA |

| Criminal Status | 1st to 3rd offenses are class A misdemeanors; 3rd+ in 10 years is a class C felony |

| Look Back Period | 15 years |

Below are tables showing penalties for driving under the influence.

| License Revoked | 90 days |

| Jail Time | Mandatory minimum is 72 consecutive hours |

| Fine | $1,500 minimum +$200 license reinstatement fee |

| Other | -SR-22 liability insurance required for 5 years -Possible attendance at ASAP endorsed treatment program -Mandatory interlock 1 year |

| License Revoked | 1 year |

| Jail Time | Mandatory 20 day minimum |

| Fine | $3,000 minimum +$500 license reinstatement fee |

| Other | -SR-22 liability insurance required for 10 years -Mandatory interlock 2 years |

| License Revoked | 3 years |

| Jail Time | Mandatory 60 day minimum |

| Fine | $4,000 minimum |

| Other | -SR-22 liability insurance required for 20 years -3 year interlock |

| License Revoked | 5 years |

| Jail Time | Mandatory 120 days minimum |

| Fine | $10,000 minimum |

| Other | -SR-22 liability insurance required for life -3 year interlock if licensed restored |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the marijuana-impaired driving laws?

Alaska does not have any specified laws regarding driving under the influence of marijuana. You can still be charged with impaired driving if you are pulled over and under the influence of marijuana.

What are the distracted driving laws?

Everyone nowadays seems to have a smartphone. It is easy to think you can respond to a quick text message without hurting anyone. Unfortunately, that is not true. Looking away for mere seconds can still take a life or cause serious injury.

| Hand-held ban | Young driver cell phone ban | Texting ban | Enforcement |

|---|---|---|---|

| no | no | all drivers | primary |

Texting isbanned for all drivers. So before you pick up your phone to text, think again and wait until your car is parked.

What’s driving in Alaska like?

We have covered insurance companies, Alaska law, and the rules of the road. We all know safety is very important to avoid accidents and fatalities. This next section we are going to cover car theft, fatalities, and traffic.

Protect yourself, know the high-risk cars and be diligent on the roads.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Is there a vehicle theft in Alaska?

Some cars are more susceptible than others to be stolen.

| Top Ten Stolen Vehicles in Alaska | Year of Vehicle | Total Amount |

|---|---|---|

| Vehicle Make and Model | Year | Total Stolen |

| Chevrolet Pickup (Full Size) | 2003 | 147 |

| Ford Pickup (Full Size) | 2004 | 95 |

| GMC Pickup (Full Size) | 1997 | 58 |

| Honda Civic | 2000 | 56 |

| Honda Accord | 1993 | 46 |

| Dodge Pickup (Full Size) | 1998 | 44 |

| Ford Explorer | 1994 | 31 |

| Jeep Cherokee/Grand Cherokee | 1999 | 28 |

| Ford Pickup (Small Size) | 2000 | 22 |

| Chevrolet Pickup (Small Size) | 1998 | 20 |

We have also taken information from the FBI listing thefts by city.

| Vehicle Theft by City In Alaska | Details |

|---|---|

| City | Motor Vehicle Theft |

| Anchorage | 869 |

| Bethel | 45 |

| Bristol Bay Borough | 6 |

| Cordova | 2 |

| Craig | 1 |

| Dillingham | 12 |

| Fairbanks | 103 |

| Haines | 2 |

| Homer | 10 |

| Juneau | 36 |

| Kenai | 18 |

| Ketchikan | 6 |

| Kodiak | 19 |

| Kotzebue | 33 |

| Nome | 6 |

| North Pole | 6 |

| North Slope Borough | 15 |

| Palmer | 5 |

| Petersburg | 3 |

| Seward | 5 |

| Sitka | 12 |

| Skagway | 0 |

| Soldotna | 8 |

| Unalaska | 5 |

| Valdez | 4 |

| Wasilla | 43 |

| Wrangell | 1 |

What’s the number of road fatalities in Alaska?

Sadly, accidents happen and fatalities occur. We are going to take a look at how and when most of the accidents happen. We are also going to look at EMS response times to accidents.

First, let’s take a look at fatalities. Where do they happen?

| Traffic Fatalities in Alaska by Road Type | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

| Rural | 48 | 38 | 33 | 46 | 39 | 33 | 42 | 33 | 53 | 45 |

| Urban | 14 | 26 | 23 | 26 | 20 | 18 | 31 | 31 | 30 | 33 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 |

| Total | 62 | 64 | 56 | 72 | 59 | 51 | 73 | 65 | 84 | 79 |

They occur more on rural roads than urban. Next, let’s see what type of crash is occurring.

| Details | |||||

|---|---|---|---|---|---|

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

| Total Fatalities (All Crashes) | 51 | 73 | 65 | 84 | 79 |

| - (1) Single Vehicle | 33 | 41 | 41 | 57 | 51 |

| - (2) Involving a Large Truck | 4 | 5 | 1 | 4 | 5 |

| - (3) Involving Speeding | 22 | 18 | 22 | 36 | 26 |

| - (4) Involving a Rollover | 17 | 21 | 15 | 33 | 20 |

| - (5) Involving a Roadway Departure | 32 | 43 | 36 | 64 | 48 |

| - (6) Involving an Intersection (or Intersection Related) | 8 | 15 | 14 | 13 | 18 |

As you can see single-vehicle crashes and vehicles departing from roadways are the highest type of crash happening on Alaska roadways. Now we are going to look at the who part of the equation. Person type is going to look at the type of vehicle and if they were an occupant or pedestrian.

| Details | |||||

|---|---|---|---|---|---|

| 2013 | 2014 | 2015 | 2016 | 2017 | |

| Passenger Car Occupants | 10 | 19 | 8 | 16 | 22 |

| Light Pickup Truck Occupants | 6 | 14 | 14 | 18 | 13 |

| Light Utility Truck Occupants | 11 | 7 | 9 | 18 | 11 |

| Large Truck Occupants | 2 | 1 | 0 | 2 | 0 |

| Other/Unknown Occupants | 6 | 4 | 5 | 5 | 8 |

| Van Occupants | 0 | 2 | 6 | 6 | 2 |

| Bus Occupants | 0 | 1 | 0 | 0 | 0 |

| Motorcyclists | 9 | 8 | 11 | 6 | 6 |

| Pedestrians | 6 | 14 | 12 | 12 | 14 |

| Bicyclists and Other Cyclists | 1 | 3 | 0 | 1 | 1 |

| Other/Unknown Non-occupants | 0 | 0 | 0 | 0 | 2 |

| State Total | 51 | 73 | 65 | 84 | 79 |

Now we are going to break down these statistics by county.

| 5 year Trend for the Top 10 Counties in Alaska | Details | ||||

|---|---|---|---|---|---|

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

| Anchorage Borough | 17 | 25 | 26 | 21 | 18 |

| Matanuska-Susitna Borough | 11 | 14 | 15 | 20 | 21 |

| Fairbanks North Star Borough | 7 | 11 | 9 | 8 | 12 |

| Kenai Peninsula Borough | 4 | 6 | 6 | 11 | 6 |

| Denali Borough | 1 | 4 | 0 | 1 | 4 |

| Bethel Census Area | 1 | 1 | 2 | 1 | 4 |

| Yukon-Koyukuk Census Area | 1 | 1 | 1 | 3 | 1 |

| Southeast Fairbanks Census Area | 2 | 2 | 1 | 4 | 1 |

| Valdez-Cordova Census Area | 2 | 1 | 0 | 4 | 0 |

| Wade Hampton Census Area | 1 | 2 | 2 | 0 | 1 |

Most fatalities occur from not obeying state laws and regulations regarding speeding and operating a vehicle under the influence of alcohol. The next two tables will show fatalities from speeding and alcohol-impaired driving.

| Speeding Deaths by County in Alaska | Details | ||||

|---|---|---|---|---|---|

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

| Aleutians East Borough | 0 | 0 | 0 | 0 | 0 |

| Aleutians West Census Area | 0 | 0 | 0 | 3 | 0 |

| Anchorage Borough | 8 | 3 | 5 | 4 | 3 |

| Bethel Census Area | 1 | 0 | 0 | 1 | 3 |

| Bristol Bay Borough | 0 | 0 | 0 | 0 | 0 |

| Denali Borough | 1 | 3 | 0 | 0 | 2 |

| Dillingham Census Area | 1 | 0 | 0 | 0 | 0 |

| Fairbanks North Star Borough | 3 | 5 | 3 | 7 | 5 |

| Haines Borough | 0 | 0 | 0 | 0 | 0 |

| Juneau Borough | 0 | 1 | 0 | 0 | 0 |

| Kenai Peninsula Borough | 2 | 2 | 0 | 5 | 4 |

| Ketchikan Gateway Borough | 0 | 0 | 0 | 1 | 0 |

| Kodiak Island Borough | 0 | 0 | 0 | 0 | 0 |

| Lake And Peninsula Borough | 0 | 0 | 0 | 0 | 0 |

| Matanuska-Susitna Borough | 5 | 2 | 11 | 7 | 4 |

| Nome Census Area | 0 | 0 | 0 | 0 | 3 |

| North Slope Borough | 0 | 0 | 0 | 1 | 0 |

| Northwest Arctic Borough | 0 | 0 | 0 | 0 | 0 |

| Prince Of Wales-Outer Ketchikan Census | |||||

| Area | 0 | 0 | 0 | 0 | 1 |

| Sitka Borough | 0 | 0 | 0 | 0 | 0 |

| Skagway-Hoonah-Angoon Census Area | 0 | 0 | 0 | 1 | 0 |

| Skagway-Yakutat-Angoon Census Area | 0 | 0 | 0 | 0 | 0 |

| Southeast Fairbanks Census Area | 0 | 1 | 0 | 3 | 0 |

| Valdez-Cordova Census Area | 0 | 0 | 0 | 3 | 0 |

| Wade Hampton Census Area | 0 | 1 | 2 | 0 | 1 |

| Wrangell-Petersburg Census Area | 0 | 0 | 0 | 0 | 0 |

| Yakutat Borough | 0 | 0 | 0 | 0 | 0 |

| Yukon-Koyukuk Census Area | 1 | 0 | 1 | 0 | 0 |

| Alaska Drunk Driving Deaths by County | Details | ||||

|---|---|---|---|---|---|

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

| Aleutians East Borough | 0 | 0 | 0 | 0 | 0 |

| Aleutians West Census Area | 0 | 0 | 1 | 3 | 0 |

| Anchorage Borough | 5 | 7 | 7 | 5 | 5 |

| Bethel Census Area | 1 | 0 | 1 | 1 | 2 |

| Bristol Bay Borough | 0 | 0 | 0 | 0 | 0 |

| Denali Borough | 1 | 1 | 0 | 0 | 1 |

| Dillingham Census Area | 1 | 0 | 0 | 0 | 0 |

| Fairbanks North Star Borough | 2 | 3 | 4 | 3 | 1 |

| Haines Borough | 0 | 0 | 0 | 0 | 0 |

| Juneau Borough | 0 | 1 | 0 | 0 | 1 |

| Kenai Peninsula Borough | 1 | 2 | 1 | 3 | 0 |

| Ketchikan Gateway Borough | 0 | 0 | 0 | 1 | 0 |

| Kodiak Island Borough | 1 | 0 | 0 | 0 | 0 |

| Lake And Peninsula Borough | 0 | 0 | 0 | 0 | 0 |

| Matanuska-Susitna Borough | 2 | 3 | 5 | 8 | 6 |

| Nome Census Area | 0 | 1 | 0 | 0 | 4 |

| North Slope Borough | 0 | 0 | 0 | 1 | 0 |

| Northwest Arctic Borough | 0 | 0 | 0 | 0 | 0 |

| Prince Of Wales-Outer Ketchikan Census Area | 0 | 0 | 0 | 0 | 1 |

| Sitka Borough | 0 | 0 | 0 | 0 | 0 |

| Skagway-Hoonah-Angoon Census Area | 0 | 0 | 0 | 1 | 0 |

| Skagway-Yakutat-Angoon Census Area | 0 | 0 | 0 | 0 | 0 |

| Southeast Fairbanks Census Area | 1 | 0 | 0 | 2 | 0 |

| Valdez-Cordova Census Area | 1 | 1 | 0 | 2 | 0 |

| Wade Hampton Census Area | 0 | 2 | 2 | 0 | 1 |

| Wrangell-Petersburg Census Area | 0 | 0 | 0 | 0 | 0 |

| Yakutat Borough | 0 | 0 | 0 | 0 | 0 |

| Yukon-Koyukuk Census Area | 0 | 0 | 1 | 0 | 0 |

Alaska has a zero tolerance for underage drinking. This means that no underage driver can have ANY amount of alcohol. Serious consequences can arise from driving underage from fines to revocation of your license.

EMS response time is an important aspect of traffic fatalities. We are going to take a look at EMS response times and how fast you can get to a hospital to care for your injuries.

What’s the average EMS response time?

Response times are very good in Alaska. From the time of the accident, you can be at a hospital being treated for injuries in less than fifty minutes.

| Location of Incident | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatalities in Crashes |

|---|---|---|---|---|---|

| Rural | 2.91 min | 13.16 min | 39.33 min | 48.59 min | 47 |

| Urban | 0.84 min | 6.18 min | 22.00 min | 28.83 min | 30 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What’s transportation like?

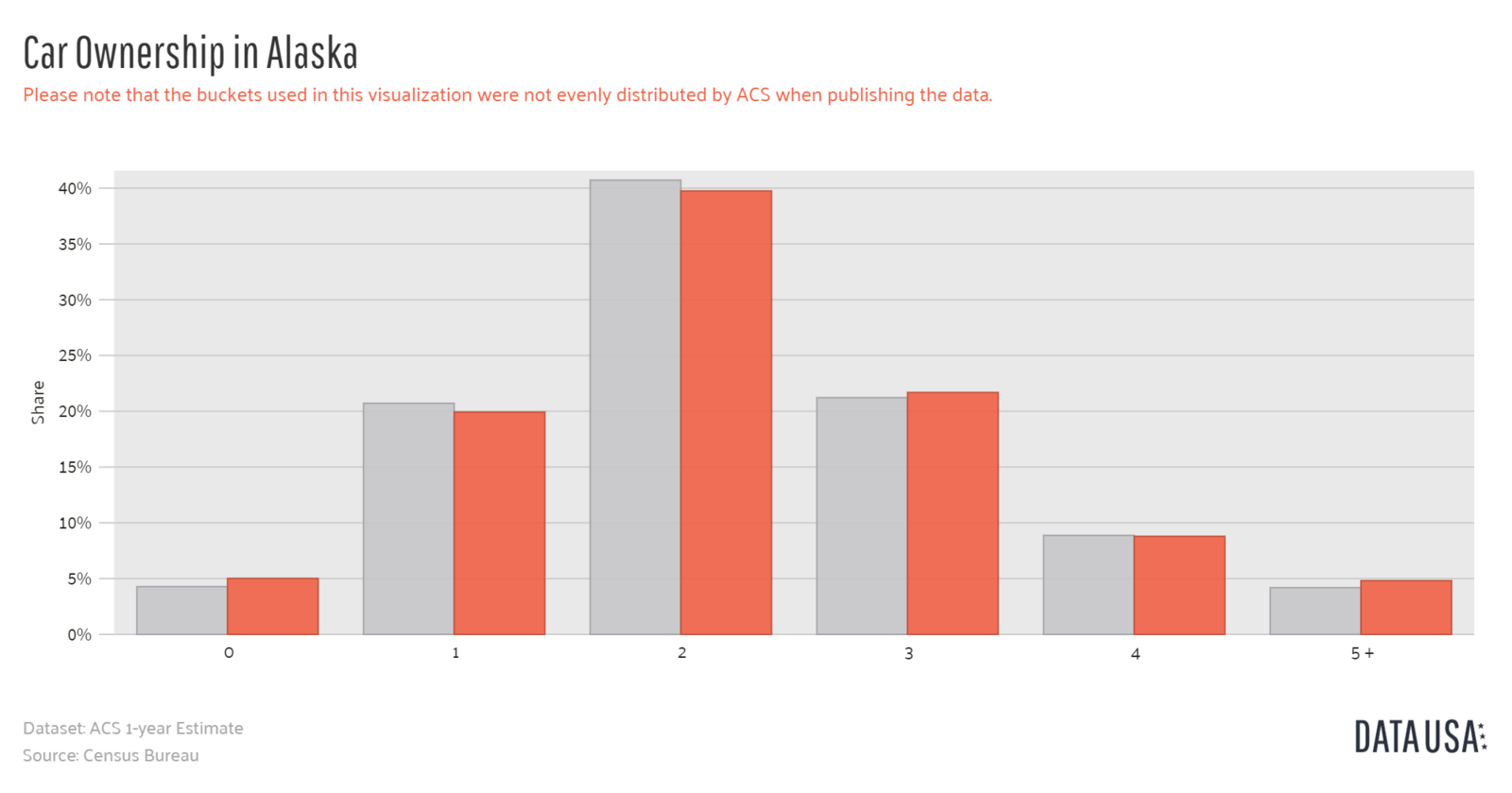

Most Alaska residents own more than one car. The majority own two to three.

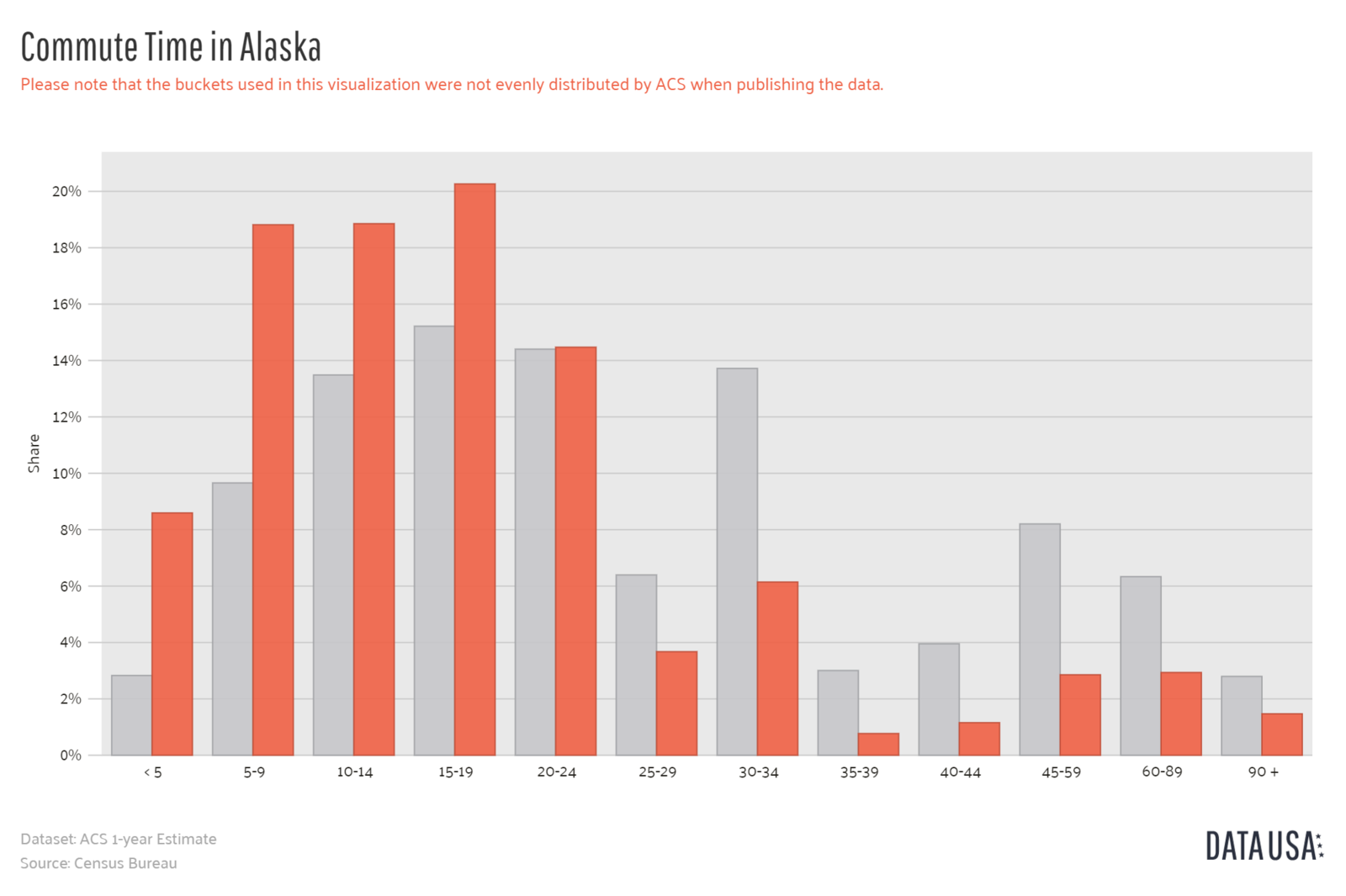

How much time do you spend commuting each workday? The average worker spends less than 20 minutes commuting.

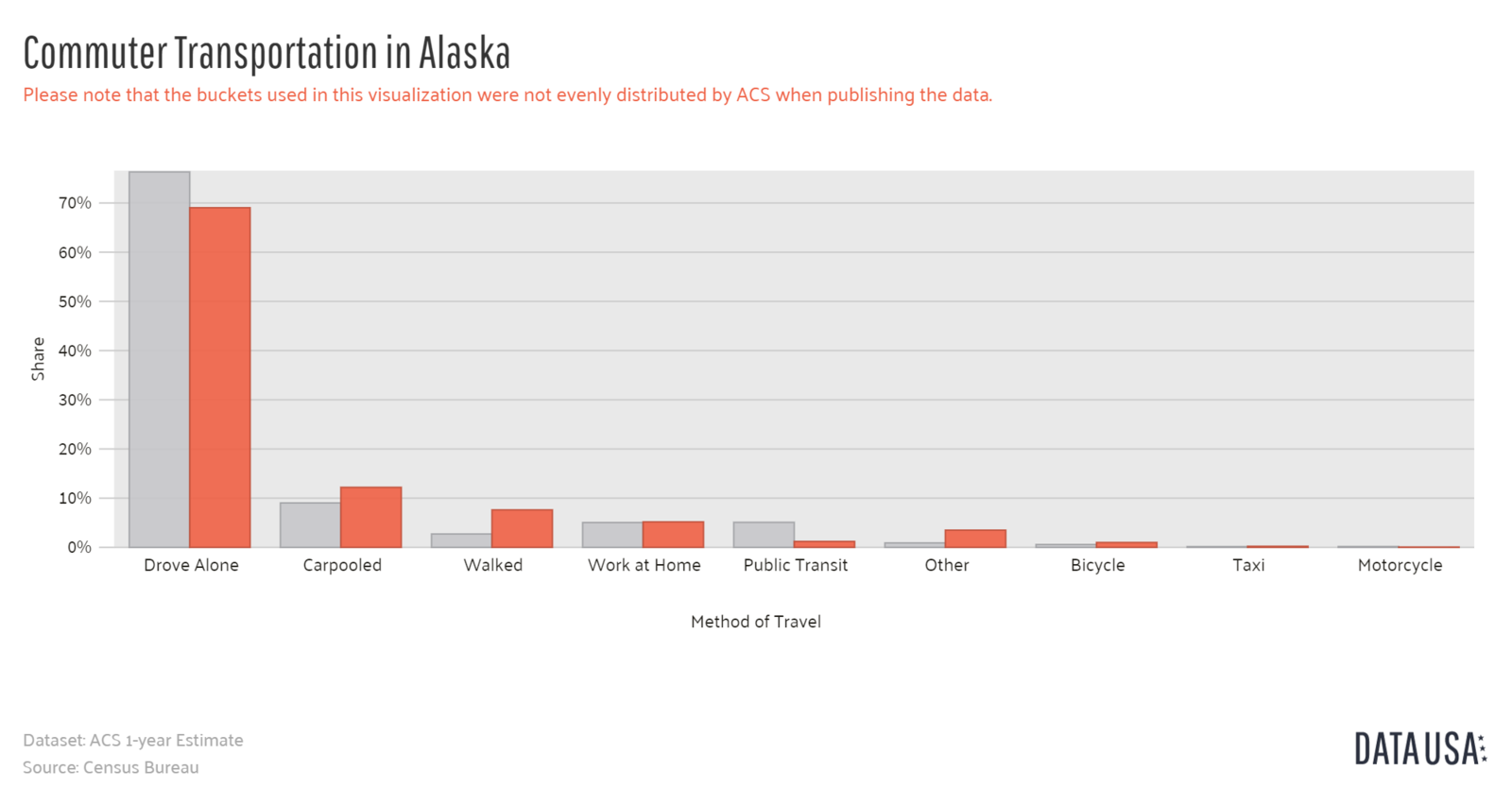

The 20 minutes commuting is usually done in peace and quiet. Most Alaska drivers are commuting alone to work.

Traffic congestion does not seem to be a huge problem in Alaska. Below is a humorous video of what may be causing your traffic jam in Anchorage.

We hope this information has been very helpful for you as you navigate your insurance needs living in Alaska. We know you would rather be taking in the beautiful scenery of your great state and not sitting behind a computer trying to figure out your insurance. Click here for a free quote.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.