Maine Car Insurance Guide (Cost + Coverage)

Which Maine car insurance companies offer the best coverage? Read our guide to find out. We compare local companies and Maine car insurance rates by ZIP code so you're guaranteed to find the cheapest coverage in your neighborhood. Enter your ZIP code below to start comparing Maine car insurance quotes for free.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Licensed Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health insuran...

Rachael Brennan

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated February 2025

| Maine Statistics Summary | Stats |

|---|---|

| Miles of Roadway | 22,911 |

| Vehicles Registered in the State | 1,049,337 |

| State Population | 39,557,045 |

| Most Popular Vehicle in the State | Silverado 1500 |

| Uninsured %/Underinsured % | 4.50% |

| Total Driving Related Deaths | 172 |

| Speeding Fatalities | 49 |

| DUI Fatalities | 50 |

| Average Annual Premiums | $703.82 |

| Liability Avg Premium | $338.87 |

| Collision Avg Premium | $259.98 |

| Comprehensive Avg Premium | $104.98 |

| Cheapest Providers | USAA and Geico General |

The state of Maine is known for its delicious lobster, being Stephen King’s home state, and snowy winter weather. What most people don’t know, however, is that the Pine Tree State has some of the cheapest car insurance rates in the nation, with state residents saving more than $300 per year over the national average.

Just because Maine has relatively low car insurance rates doesn’t mean you shouldn’t do your due diligence when researching car insurance coverage. Insurance costs can still fluctuate wildly between companies, which means choosing the right car insurance could save you hundreds of dollars per year.

Enter your zip code to start comparing quotes today.

How much auto insurance coverage do you need in Maine?

Every state has different legal requirements for car insurance minimums. Maine has relatively high minimum coverage amounts, including liability, uninsured motorist, and medical payment requirements.

In an accident where you are at fault, your liability coverage will pay for damages and medical bills incurred by the other driver and their passengers.

For example, if you were to accidentally run a red light and hit another car as it was passing through the intersection, the minimum required coverage in the state of Maine would provide you with $50,000 bodily injury liability coverage per person/$100,000 per accident and $25,000 in property damage liability coverage.

While this is higher than the minimum liability levels in most other states, it still might not be enough if you caused significant damage to someone else’s vehicle or hurt someone badly enough that they required serious medical attention.

Car Culture in Maine

In the Pine Tree State, car culture is built around the extreme winter weather. While there are a wide variety of cars and motorcycles traveling around the state, most residents choose a vehicle based on how it performs in snowy and icy conditions.

There is one car, however, that is special to the state – the Cadillac. The highest peak on the East Coast is Cadillac Mountain, located in Maine and named after explorer Antoine Laumet de la Mothe, Sieur de Cadillac.

Cadillac, the luxury car company, was also named after the intrepid explorer, giving the state of Maine a fun connection to the upscale automobile.

Maine Minimum Car Insurance Requirements

Every state has a minimum auto insurance requirements for all drivers. Typically this is liability coverage designed to protect people if you are at fault in an accident, though Maine also requires drivers to carry uninsured/underinsured motorist coverage as well. The required coverage levels are as follows:

- Bodily Injury – $50,000 per person/$100,000 per accident

This means that if you are at fault for an accident, you will have no more than $50,000 for one person or $100,000 for two or more people to cover the medical bills for any injuries they sustained during any single accident. The more people are in the car during the accident, the less likely you are to be completely covered under the minimum coverage.

- Property Damage – $25,000

This means you will have no more than $25,000 to repair or replace the other driver’s vehicle in an at-fault accident. While this is usually sufficient to cover the cost of damages, if you total someone’s vehicle or if they have a luxury vehicle with a much higher price tag you could still be on the hook for thousands more beyond your $25,000 limit.

- Medical Payments – $2,000

The law requires you to have at least $2,000 worth of coverage in the event that you and your passengers require medical attention in an at-fault accident. While the bodily injury coverage protects the people who were hit, the medical payment benefit provides the primary coverage for the at-fault driver and their passengers.

- Uninsured/Underinsured Motorist – $50,000 per person/$100,000 per accident

UM/UIM coverage is required to protect you and your passengers in the event that you are not at fault in an accident but the other driver doesn’t have insurance or your medical expenses go beyond what is provided by their insurance.

For example, if you are in an accident and you are badly injured, you may need to be taken to the emergency room by ambulance.

Once the cost of the ambulance ride and all of the medical treatment is added up, if it is over the $50,000 minimum coverage requirement and the other driver doesn’t have any additional coverage, your UM benefit would kick in to cover the difference in cost up to an additional $50,000. (For more information, read our “Does car insurance cover an ambulance?“).

Because not everyone obeys the law, this also covers your medical expenses in the event that someone without insurance hits your car and causes bodily injury.

While these are the only minimums required by law, you may find yourself required to carry additional insurance if you are making payments on your vehicle. Many lenders require you to carry full comprehensive and collision coverage to make sure that your loan can be paid off in the event of a total loss.

Required Forms of Financial Responsibility In Maine

Maine drivers are required by law to carry proof of liability coverage or financial responsibility at all times. Police officers are required to ask for your proof of coverage in the event that you are in an accident or pulled over for a traffic violation.

Luckily, Maine legislators understand that modern companies don’t always mail out certificates as proof of coverage any longer. They allow drivers to use their phones to access insurance policies online and show proof of coverage electronically.

Drivers who don’t have proof of financial responsibility can be fined up to $500 and have their license and registration suspended.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the average auto insurance rates in Maine?

Like every other state, Maine has seen a slow and steady increase in its insurance premiums each year. As of 2015, the average insurance premium for the state of Maine was $703.52, coming in significantly below the national average of $1,009.38.

| STATE | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|

| Total | $1,009.38 | $981.77 | $950.92 | $924.45 | $908.43 |

| Alabama | $868.48 | $837.09 | $811.75 | $788.07 | $784.38 |

| Alaska | $1,027.75 | $1,050.09 | $1,058.15 | $1,053.54 | $1,053.48 |

| Arizona | $972.85 | $961.88 | $926.52 | $899.91 | $899.33 |

| Arkansas | $906.34 | $900.18 | $868.13 | $843.07 | $829.13 |

| California | $986.75 | $951.75 | $922.69 | $891.68 | $881.07 |

| Colorado | $981.64 | $939.52 | $887.57 | $849.74 | $835.50 |

| Connecticut | $1,151.07 | $1,132.78 | $1,109.03 | $1,082.28 | $1,068.18 |

| Delaware | $1,240.57 | $1,215.69 | $1,187.18 | $1,153.59 | $1,134.60 |

| District of Columbia | $1,330.73 | $1,324.39 | $1,316.48 | $1,289.49 | $1,276.99 |

| Florida | $1,257.13 | $1,208.77 | $1,209.70 | $1,196.57 | $1,160.13 |

| Georgia | $1,048.40 | $991.25 | $949.33 | $922.05 | $912.49 |

| Hawaii | $873.28 | $858.16 | $844.16 | $844.12 | $861.95 |

| Idaho | $679.89 | $673.13 | $650.57 | $639.19 | $641.96 |

| Illinois | $884.56 | $854.10 | $819.27 | $806.21 | $803.04 |

| Indiana | $755.03 | $728.93 | $704.50 | $724.44 | $710.36 |

| Iowa | $702.46 | $683.67 | $668.09 | $656.84 | $648.99 |

| Kansas | $862.93 | $850.79 | $815.82 | $785.72 | $780.43 |

| Kentucky | $938.51 | $917.49 | $904.99 | $888.46 | $872.48 |

| Louisiana | $1,405.36 | $1,364.17 | $1,307.72 | $1,275.10 | $1,281.55 |

| Maine | $703.82 | $689.12 | $674.94 | $667.66 | $662.28 |

| Maryland | $1,116.45 | $1,096.37 | $1,071.35 | $1,056.82 | $1,048.86 |

| Massachusetts | $1,129.29 | $1,107.76 | $1,080.48 | $1,048.06 | $1,011.14 |

| Michigan | $1,364.00 | $1,350.58 | $1,264.20 | $1,171.94 | $1,110.64 |

| Minnesota | $875.49 | $856.62 | $823.70 | $800.24 | $777.17 |

| Mississippi | $994.05 | $957.59 | $925.13 | $902.95 | $895.69 |

| Missouri | $872.43 | $845.39 | $819.79 | $799.14 | $790.27 |

| Montana | $863.52 | $868.55 | $842.74 | $821.68 | $816.21 |

| Nebraska | $831.02 | $805.99 | $773.64 | $751.18 | $732.21 |

| Nevada | $1,103.05 | $1,083.42 | $1,047.74 | $1,024.09 | $1,029.87 |

| New Hampshire | $818.75 | $795.50 | $773.30 | $755.76 | $746.57 |

| New Jersey | $1,382.79 | $1,379.20 | $1,369.70 | $1,334.59 | $1,303.52 |

| New Mexico | $937.59 | $920.42 | $888.83 | $866.19 | $869.85 |

| New York | $1,360.66 | $1,327.82 | $1,301.49 | $1,273.70 | $1,236.77 |

| North Carolina | $789.09 | $768.28 | $739.91 | $720.47 | $708.10 |

| North Dakota | $773.30 | $768.09 | $743.27 | $714.75 | $688.74 |

| Ohio | $788.56 | $766.66 | $738.68 | $714.05 | $697.61 |

| Oklahoma | $1,005.32 | $985.58 | $931.41 | $902.90 | $881.50 |

| Oregon | $904.83 | $894.10 | $856.26 | $818.07 | $804.59 |

| Pennsylvania | $970.51 | $950.42 | $930.48 | $915.83 | $904.47 |

| Rhode Island | $1,303.50 | $1,257.40 | $1,210.55 | $1,176.05 | $1,148.97 |

| South Carolina | $973.10 | $936.69 | $904.22 | $880.82 | $857.70 |

| South Dakota | $766.91 | $744.28 | $717.30 | $690.95 | $669.20 |

| Tennessee | $871.43 | $855.56 | $829.38 | $794.53 | $767.82 |

| Texas | $1,109.66 | $1,066.20 | $1,017.81 | $974.68 | $959.87 |

| Utah | $872.93 | $852.66 | $820.92 | $805.32 | $809.35 |

| Vermont | $764.02 | $746.79 | $734.82 | $726.57 | $716.14 |

| Virginia | $842.67 | $836.14 | $809.40 | $781.38 | $768.95 |

| Washington | $968.80 | $952.10 | $914.04 | $891.04 | $889.82 |

| West Virginia | $1,025.78 | $1,032.45 | $1,021.37 | $1,005.68 | $992.57 |

| Wisconsin | $737.18 | $716.83 | $689.77 | $666.79 | $669.99 |

| Wyoming | $847.44 | $844.33 | $804.52 | $796.14 | $791.14 |

Read more:

- Minnesota Car Insurance (Coverage, Companies, & More)

- New Hampshire Car Insurance (Coverage, Companies, & More)

- General Casualty Company of Wisconsin Car Insurance Review

Premium As a Percentage of Income

The average per capita income in Maine varies from city to city and county to county, but according to the 2010 census, the average per capita income in the state was $26,699. After taxes, that leaves $22,471 to spend on all of your wants and needs.

Given that your age and gender have such a big impact on your premiums, figuring your premium as a percentage of your income is hard. Teens could be spending 25 percent or more of their income on their coverage, while good drivers in their 30s and 40s might be spending as little as one percent of their income on their car insurance.

To figure out the percentage of your income spent on your car insurance, take the amount of your premium divided by your income (either gross or net) then multiply by 100.

For example, if you are a single 25-year-old woman who is earning the average per capita income and paying $1,108.71 each year, your formula would look like this:

Premium divided by Net Income = X X multiplied by 100 = Your percentage spent on insurance

$1,108.71 divided by $22,471.00 = 0.0493; 0.0493 multiplied by 100 = 4.93 percent

Our single 25-year-old woman is spending 4.93 percent of her net income on her car insurance each year. As her age, driving record, marital status, zip code, and other things change over time, so too will the percentage of her income spent on her insurance premiums.

Average Monthly Car Insurance Rates in ME (Liability, Collision, Comprehensive)

Your average monthly car insurance rates may not increase as much as you might think by adding additional coverage like comprehensive. Review rates for auto insurance coverage below:

| Average Annual Premiums | $703.82 |

|---|---|

| Liability Avg Premium | $338.87 |

| Collision Avg Premium | $259.98 |

| Comprehensive Avg Premium | $104.98 |

You aren’t limited to only purchasing liability coverage; there are other types of insurance coverage available that are designed to protect you and your property from financial harm.

Collision insurance pays for damages to your vehicle in an at-fault accident. If someone else were to hit your car their liability coverage would pay for your car repairs, but what if you hit somebody? Your liability coverage pays for their damages, but without collision coverage, you would be paying out of pocket for any repairs your own vehicle requires.

Collision insurance also pays for damages to your vehicle in a single-car accident, such as a rolled vehicle or a situation where you accidentally hit a tree or a post. Essentially, if you are driving and damage your vehicle, collision coverage is what will pay to fix it.

Comprehensive insurance is designed to protect you from damages incurred outside of a collision. If your car is damaged by hail or rammed by a moose, comprehensive insurance is the coverage that will pay for those damages.

Additional Liability Coverage in Maine

Given that the minimum required liability limits in Maine are so high, you might be tempted to just take the minimum and not give it another thought. So why should you consider buying additional liability coverage?

In an accident, you never know what the scenario is going to be. Perhaps you’ll be lucky and you’ll gently rear-end someone in a 10-year-old vehicle, causing minimal property damage and no bodily injury.

But what happens if you aren’t so lucky? What if you are changing lanes on the highway and accidentally sideswipe someone in a brand new luxury vehicle while going 60 miles per hour? What if that person has twin infants in the backseat? Suddenly $25,000 in property damage and $100,000 in bodily injury coverage doesn’t quite seem like enough.

You can opt to purchase more than the legal minimum of insurance. Most companies offer higher coverages, typically $50,000 in property damage and $250,000 per person/$500,000 per accident bodily injury, for an additional fee.

If you are afraid that it still might not be enough, you can look into the possibility of purchasing an umbrella policy. A standard umbrella policy will offer a minimum of $1 million in liability coverage that will kick in once the underlying policy limits have been exhausted.

Add-ons, Endorsements, and Riders

So you have liability, comprehensive, and collision coverage. That means you’re set, right? Not necessarily.

There are other expenses that can be part of an accident that you might not have considered. What about the cost of renting a car while yours is in the shop or the cost of towing your vehicle to have the work done?

If you want to make sure you are completely covered, consider some of these additional riders and add-ons when you are choosing your policy.

- Rental reimbursement would cover the cost of a rental car if your vehicle cannot be used because of an insured loss.

For example, if a falling branch shattered your windshield and damaged the roof of your car, comprehensive insurance would cover the cost of repairing those damages, but you would need rental reimbursement coverage to have the cost of a rental car covered while your car is being repaired.

- Towing And Labor would cover the cost of towing your vehicle in the event of a breakdown, as well as minor labor costs (typically one hour of work) that would be needed to get the vehicle running again. This type of coverage is often referred to as roadside assistance.

This is a great way to protect yourself in the event of a flat tire or empty gas tank, though there are other, more common ways people typically cover these expenses, such as membership in an auto club.

- GAP insurance does exactly what its name suggests and covers the gap between what your insurance policy pays and the amount still owed for the vehicle. If you are making payments on your vehicle, GAP insurance can save you from having to make payments on a totaled car.

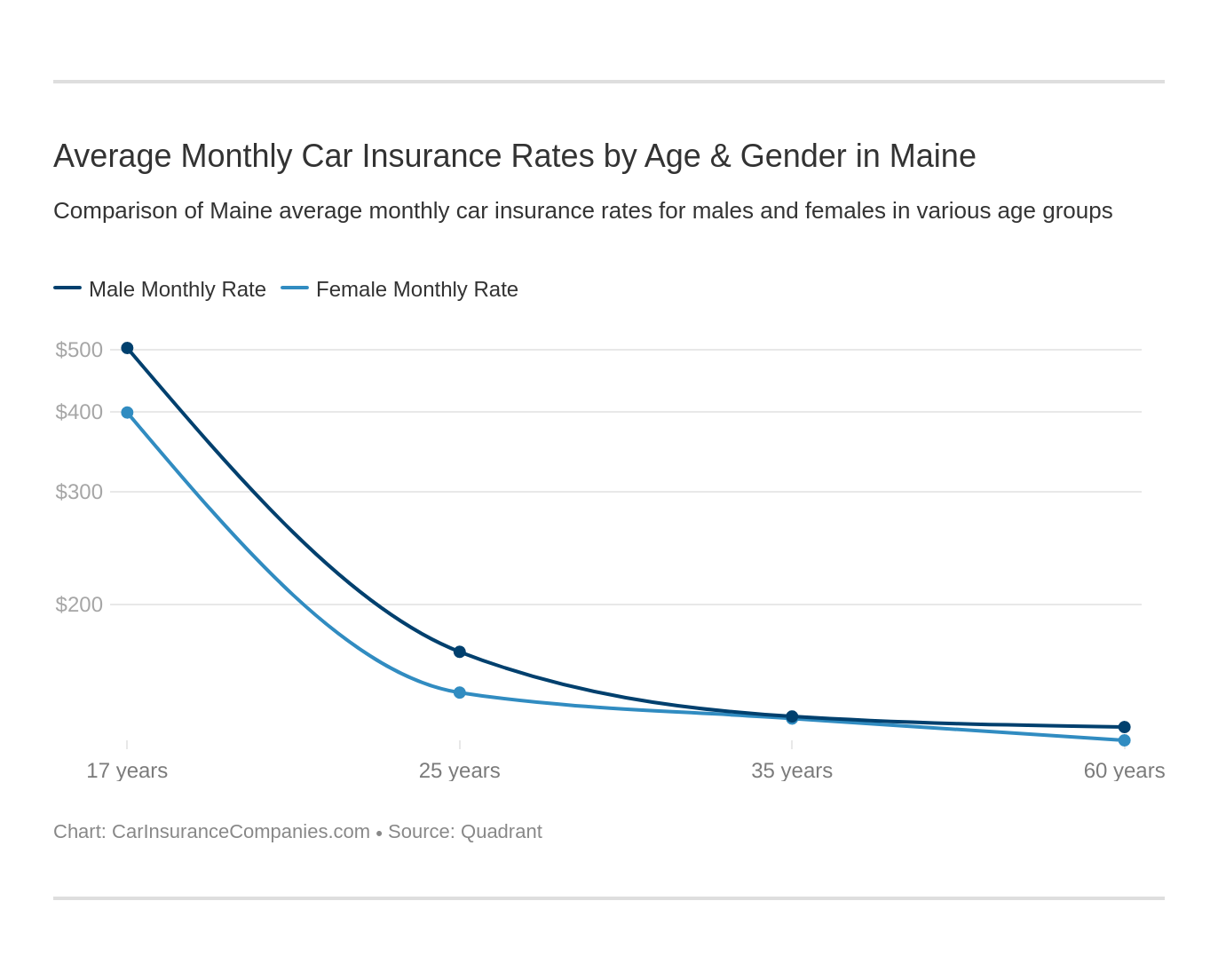

Average Monthly Car Insurance Rates by Age & Gender in ME

While there are a few states that have made it illegal to consider gender when determining insurance rates, Maine still allows insurance companies to consider this information when deciding your premium.

Part of determining your rates based on gender also includes statistics regarding your age and marital status, so there can be large discrepancies between premiums even within a gender category. For example, a 35-year-old married woman will typically pay several hundred dollars less per year for insurance than a 25-year-old single woman.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $1,794.12 | $1,845.70 | $1,611.55 | $1,747.46 | $4,503.88 | $6,027.66 | $1,952.18 | $2,183.62 |

| Bristol West Select | $1,705.76 | $1,722.32 | $1,596.13 | $1,716.53 | $5,376.87 | $5,969.29 | $2,002.79 | $2,075.88 |

| Geico General | $1,016.66 | $1,053.15 | $1,016.66 | $1,016.66 | $2,470.70 | $3,213.99 | $1,108.71 | $1,184.65 |

| Liberty Mutual Fire Ins Co | $2,984.27 | $2,984.27 | $2,841.84 | $2,841.84 | $6,336.04 | $9,480.14 | $2,984.27 | $4,201.37 |

| Progressive Northwestern | $1,905.85 | $1,868.00 | $1,905.85 | $1,868.00 | $7,945.51 | $8,930.09 | $2,221.50 | $2,512.75 |

| State Farm Mutual Auto | $1,313.61 | $1,313.61 | $1,238.91 | $1,238.91 | $4,189.75 | $5,224.15 | $1,465.85 | $1,605.41 |

| Travelers Home & Marine Ins Co | $1,165.23 | $1,207.33 | $1,055.86 | $1,080.39 | $4,689.11 | $6,340.02 | $1,157.44 | $1,336.27 |

| USAA | $868.52 | $857.16 | $863.42 | $844.46 | $2,838.93 | $3,134.30 | $1,104.67 | $1,162.18 |

Rates can also vary widely from company to company, which means that a single 25-year-old male could save $500 or more per year by switching companies, even though his gender, age, and marital status will be a determining factor with both insurers.

| Company | Demographic | Average Annual Rate |

|---|---|---|

| Liberty Mutual Fire Ins Co | Single 17-year old male | $9,480.14 |

| Progressive Northwestern | Single 17-year old male | $8,930.09 |

| Progressive Northwestern | Single 17-year old female | $7,945.51 |

| Travelers Home & Marine Ins Co | Single 17-year old male | $6,340.02 |

| Liberty Mutual Fire Ins Co | Single 17-year old female | $6,336.04 |

| Allstate F&C | Single 17-year old male | $6,027.66 |

| Bristol West Select | Single 17-year old male | $5,969.29 |

| Bristol West Select | Single 17-year old female | $5,376.87 |

| State Farm Mutual Auto | Single 17-year old male | $5,224.15 |

| Travelers Home & Marine Ins Co | Single 17-year old female | $4,689.11 |

| Allstate F&C | Single 17-year old female | $4,503.88 |

| Liberty Mutual Fire Ins Co | Single 25-year old male | $4,201.37 |

| State Farm Mutual Auto | Single 17-year old female | $4,189.75 |

| Geico General | Single 17-year old male | $3,213.99 |

| USAA | Single 17-year old male | $3,134.30 |

| Liberty Mutual Fire Ins Co | Married 35-year old female | $2,984.27 |

| Liberty Mutual Fire Ins Co | Married 35-year old male | $2,984.27 |

| Liberty Mutual Fire Ins Co | Single 25-year old female | $2,984.27 |

| Liberty Mutual Fire Ins Co | Married 60-year old female | $2,841.84 |

| Liberty Mutual Fire Ins Co | Married 60-year old male | $2,841.84 |

| USAA | Single 17-year old female | $2,838.93 |

| Progressive Northwestern | Single 25-year old male | $2,512.75 |

| Geico General | Single 17-year old female | $2,470.70 |

| Progressive Northwestern | Single 25-year old female | $2,221.50 |

| Allstate F&C | Single 25-year old male | $2,183.62 |

| Bristol West Select | Single 25-year old male | $2,075.88 |

| Bristol West Select | Single 25-year old female | $2,002.79 |

| Allstate F&C | Single 25-year old female | $1,952.18 |

| Progressive Northwestern | Married 35-year old female | $1,905.85 |

| Progressive Northwestern | Married 60-year old female | $1,905.85 |

| Progressive Northwestern | Married 35-year old male | $1,868.00 |

| Progressive Northwestern | Married 60-year old male | $1,868.00 |

| Allstate F&C | Married 35-year old male | $1,845.70 |

| Allstate F&C | Married 35-year old female | $1,794.12 |

| Allstate F&C | Married 60-year old male | $1,747.46 |

| Bristol West Select | Married 35-year old male | $1,722.32 |

| Bristol West Select | Married 60-year old male | $1,716.53 |

| Bristol West Select | Married 35-year old female | $1,705.76 |

| Allstate F&C | Married 60-year old female | $1,611.55 |

| State Farm Mutual Auto | Single 25-year old male | $1,605.41 |

| Bristol West Select | Married 60-year old female | $1,596.13 |

| State Farm Mutual Auto | Single 25-year old female | $1,465.85 |

| Travelers Home & Marine Ins Co | Single 25-year old male | $1,336.27 |

| State Farm Mutual Auto | Married 35-year old female | $1,313.61 |

| State Farm Mutual Auto | Married 35-year old male | $1,313.61 |

| State Farm Mutual Auto | Married 60-year old female | $1,238.91 |

| State Farm Mutual Auto | Married 60-year old male | $1,238.91 |

| Travelers Home & Marine Ins Co | Married 35-year old male | $1,207.33 |

| Geico General | Single 25-year old male | $1,184.65 |

| Travelers Home & Marine Ins Co | Married 35-year old female | $1,165.23 |

| USAA | Single 25-year old male | $1,162.18 |

| Travelers Home & Marine Ins Co | Single 25-year old female | $1,157.44 |

| Geico General | Single 25-year old female | $1,108.71 |

| USAA | Single 25-year old female | $1,104.67 |

| Travelers Home & Marine Ins Co | Married 60-year old male | $1,080.39 |

| Travelers Home & Marine Ins Co | Married 60-year old female | $1,055.86 |

| Geico General | Married 35-year old male | $1,053.15 |

| Geico General | Married 35-year old female | $1,016.66 |

| Geico General | Married 60-year old female | $1,016.66 |

How Are Your Insurance Rates Determined in Maine?

There are many factors that go into determining your insurance premiums. According to the Maine Bureau of Insurance, right now your insurance premiums are based on the following factors:

- Your Driving Record: Your insurance company will ask about accidents, moving violations, and other convictions in the last 3-5 years for every driver who will be insured on your policy.

- Gender And Age Of Drivers: While some states are moving to make it illegal to use gender as a determining factor in your insurance premiums, Maine still allows insurance companies to use statistics regarding gender when determining your annual premium. The age of each driver on the policy can have a dramatic effect on the cost of your insurance as well.

- Where Your Vehicle Is Parked/Stored: If you park overnight in an area with high rates of vandalism and auto theft, expect that to increase your rates. If you live or work in an area where there are a significant number of collisions, you can expect that to increase your rates as well.

- Marital Status: Statistics show that married couples tend to be safer drivers with fewer accidents than single people, so married people will end up with lower insurance rates than their single counterparts. (For more information, read our “Can married couples have separate car insurance?“).

- Vehicle Usage: If you are doing a significant amount of driving you are more likely to be in an accident, so expect that to increase your rates.

- Prior Coverage: Have you been continuously insured with no gap in coverage? You’ll see lower insurance rates because of that.

- Make And Model: The make and model of your vehicle are subject to statistical studies too, so keep in mind that these things will impact your insurance premium when you are purchasing your next car.

- Licensed Drivers In Your Household: Anyone living at your address with a driving permit or license can impact your insurance premiums, which means a teen driver can impact your rates even if you don’t buy them a car of their own. (For more information, read our “Can you drive by yourself with a permit?“).

- Claim History: Filed any claims in the last few years? Expect that to impact your premiums going forward.

- Credit History: Most insurance companies consider your credit history and your credit score as one of the factors that determine your insurance premium rates.

- Discounts: Many companies offer discounts for a variety of reasons, including everything from having multiple lines of coverage through their company to working as a teacher or serving in the military. Make sure to ask about all of the discounts your insurance company offers so you can get the lowest possible rate.

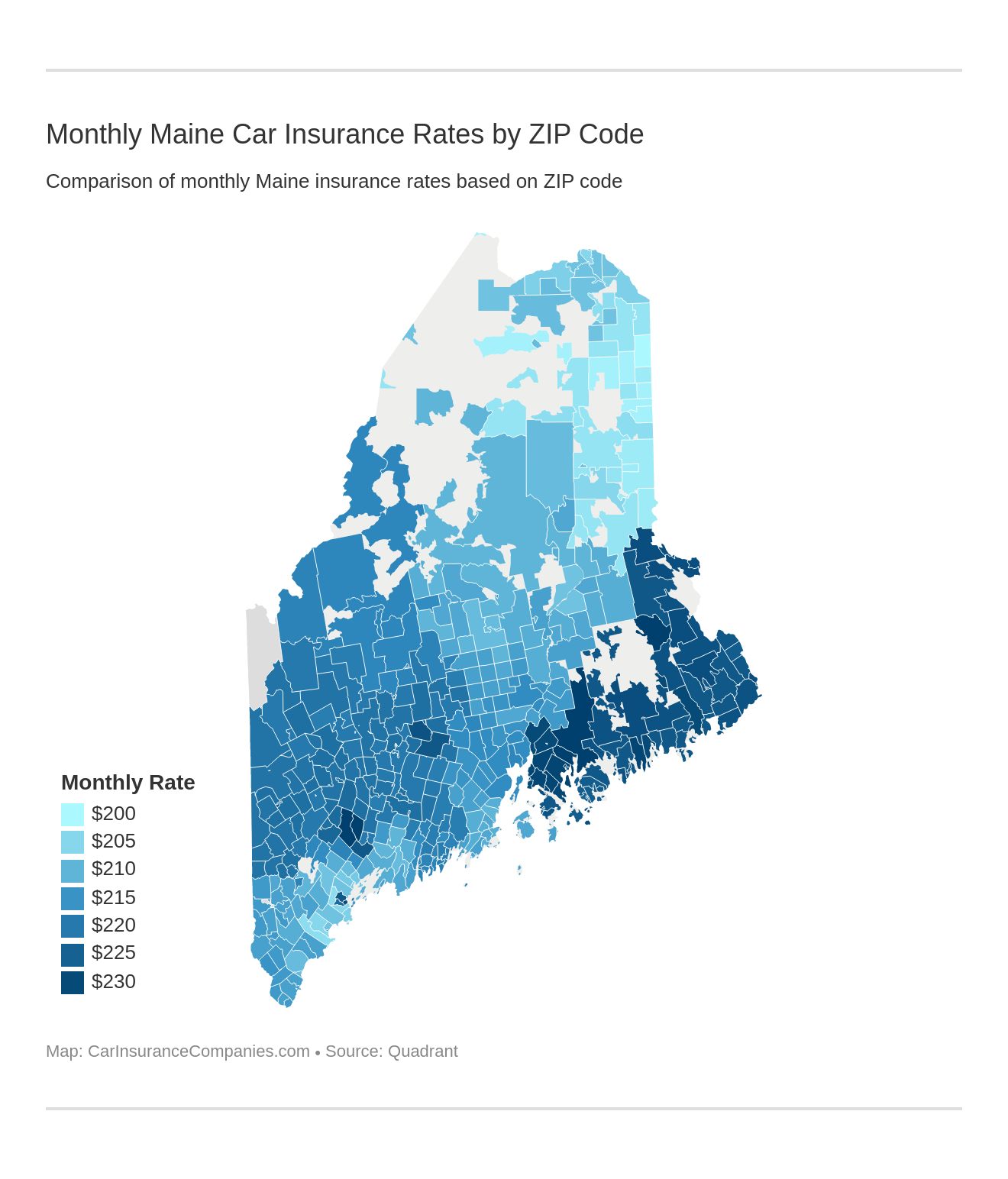

Cheapest Rates by ZIP Code

Your ZIP code can have a tremendous impact on your insurance premiums. The number of accidents, vehicle thefts, and other issues within a ZIP code are all taken into account by insurance companies when they are determining your rates.

| Most Expensive Zip Codes in Maine | City | Average Annual Rate by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 04684 | SURRY | $2,785.77 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | USAA | $1,522.47 | Geico | $1,537.88 |

| 04223 | DANVILLE | $2,785.73 | Liberty Mutual | $4,371.49 | Progressive | $3,793.09 | USAA | $1,423.45 | Geico | $1,431.46 |

| 04210 | AUBURN | $2,782.70 | Liberty Mutual | $4,549.27 | Progressive | $3,793.09 | Geico | $1,431.46 | USAA | $1,593.62 |

| 04240 | LEWISTON | $2,782.26 | Liberty Mutual | $4,549.27 | Progressive | $3,793.09 | Geico | $1,431.46 | USAA | $1,593.62 |

| 04637 | GRAND LAKE STREAM | $2,781.85 | Liberty Mutual | $4,495.96 | Progressive | $4,148.39 | Geico | $1,499.95 | USAA | $1,555.59 |

| 04605 | ELLSWORTH | $2,781.49 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | USAA | $1,425.16 | Geico | $1,537.88 |

| 04680 | STEUBEN | $2,777.95 | Liberty Mutual | $4,495.96 | Progressive | $4,148.39 | Geico | $1,499.95 | USAA | $1,555.59 |

| 04616 | BROOKLIN | $2,776.95 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | Geico | $1,537.88 | USAA | $1,551.43 |

| 04476 | PENOBSCOT | $2,775.91 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | Geico | $1,537.88 | USAA | $1,551.43 |

| 04421 | CASTINE | $2,775.46 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | Geico | $1,537.88 | USAA | $1,551.43 |

| 04617 | BROOKSVILLE | $2,773.50 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | Geico | $1,537.88 | USAA | $1,551.43 |

| 04673 | SARGENTVILLE | $2,770.24 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | Geico | $1,537.88 | USAA | $1,551.43 |

| 04614 | BLUE HILL | $2,769.32 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | Geico | $1,537.88 | USAA | $1,551.43 |

| 04676 | SEDGWICK | $2,768.44 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | Geico | $1,537.88 | USAA | $1,551.43 |

| 04549 | ISLE OF SPRINGS | $2,766.13 | Progressive | $4,958.71 | Liberty Mutual | $4,265.96 | USAA | $1,423.45 | Geico | $1,651.09 |

| 04658 | MILBRIDGE | $2,764.99 | Liberty Mutual | $4,495.96 | Progressive | $4,148.39 | Geico | $1,499.95 | USAA | $1,555.59 |

| 04642 | HARBORSIDE | $2,763.80 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | Geico | $1,537.88 | USAA | $1,551.43 |

| 04416 | BUCKSPORT | $2,763.59 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | USAA | $1,522.47 | Geico | $1,537.88 |

| 04629 | EAST BLUE HILL | $2,759.66 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | USAA | $1,495.22 | Geico | $1,537.88 |

| 04654 | MACHIAS | $2,758.71 | Liberty Mutual | $4,495.96 | Progressive | $4,148.39 | Geico | $1,499.95 | USAA | $1,555.59 |

| 04472 | ORLAND | $2,758.59 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | USAA | $1,522.47 | Geico | $1,537.88 |

| 04101 | PORTLAND | $2,754.12 | Liberty Mutual | $4,475.38 | Progressive | $3,597.14 | USAA | $1,469.33 | Geico | $1,548.54 |

| 04635 | FRENCHBORO | $2,753.68 | Liberty Mutual | $4,467.58 | Progressive | $4,112.97 | Geico | $1,499.95 | USAA | $1,551.43 |

| 04644 | HULLS COVE | $2,753.11 | Liberty Mutual | $4,467.58 | Progressive | $4,112.97 | Geico | $1,499.95 | USAA | $1,551.43 |

| 04413 | BROOKTON | $2,752.46 | Liberty Mutual | $4,495.96 | Progressive | $4,148.39 | Geico | $1,499.95 | USAA | $1,555.59 |

It is possible to move just a few blocks away and suddenly find yourself with a different insurance rate based solely on your new zip code, so keep that in mind when you are choosing a new place to live.

| Least Expensive Zip Codes in Maine | City | Average Annual Rate by Zip Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 04742 | FORT FAIRFIELD | $2,403.90 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04757 | MAPLETON | $2,407.26 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04768 | PORTAGE | $2,408.81 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04734 | BLAINE | $2,409.12 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04758 | MARS HILL | $2,409.12 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04769 | PRESQUE ISLE | $2,410.18 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04735 | BRIDGEWATER | $2,412.81 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04741 | ESTCOURT STATION | $2,413.66 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,448.09 |

| 04761 | NEW LIMERICK | $2,418.61 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04471 | ORIENT | $2,421.98 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04730 | HOULTON | $2,425.97 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04740 | EASTON | $2,427.24 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04750 | LIMESTONE | $2,430.01 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04776 | SHERMAN | $2,431.27 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04786 | WASHBURN | $2,432.28 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04736 | CARIBOU | $2,432.72 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04763 | OAKFIELD | $2,433.46 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04732 | ASHLAND | $2,435.64 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04497 | WYTOPITLOCK | $2,437.65 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04733 | BENEDICTA | $2,438.16 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04787 | WESTFIELD | $2,439.55 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04780 | SMYRNA MILLS | $2,439.76 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04760 | MONTICELLO | $2,442.05 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04737 | CLAYTON LAKE | $2,442.42 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| 04738 | CROUSEVILLE | $2,442.42 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

Cheapest Rates by City

Much like your zip code, the city you live in has an impact on your premium as well. Even within your city, you will find vastly different rates between companies, so if you are looking for the cheapest possible coverage you will need to get quotes from multiple carriers.

| Most Expensive Cities in Maine | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Surry | $2,785.77 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | USAA | $1,522.47 | Geico | $1,537.88 |

| Danville | $2,785.73 | Liberty Mutual | $4,371.49 | Progressive | $3,793.09 | USAA | $1,423.45 | Geico | $1,431.46 |

| Auburn | $2,782.70 | Liberty Mutual | $4,549.27 | Progressive | $3,793.09 | Geico | $1,431.46 | USAA | $1,593.62 |

| Lewiston | $2,782.26 | Liberty Mutual | $4,549.27 | Progressive | $3,793.09 | Geico | $1,431.46 | USAA | $1,593.62 |

| Ellsworth | $2,781.49 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | USAA | $1,425.16 | Geico | $1,537.88 |

| Steuben | $2,777.95 | Liberty Mutual | $4,495.96 | Progressive | $4,148.39 | Geico | $1,499.95 | USAA | $1,555.59 |

| Brooklin | $2,776.95 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | Geico | $1,537.88 | USAA | $1,551.43 |

| Penobscot | $2,775.91 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | Geico | $1,537.88 | USAA | $1,551.43 |

| Castine | $2,775.46 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | Geico | $1,537.88 | USAA | $1,551.43 |

| Brooksville | $2,773.50 | Liberty Mutual | $4,467.58 | Progressive | $4,285.24 | Geico | $1,537.88 | USAA | $1,551.43 |

Surry has the most expensive rates in Maine.

| Least Expensive Cities in Maine | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Fort Fairfield | $2,403.90 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| Mapleton | $2,407.26 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| Portage | $2,408.81 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| Blaine | $2,409.12 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| Mars Hill | $2,409.12 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| Presque Isle | $2,410.18 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| Bridgewater | $2,412.81 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| Estcourt Station | $2,413.66 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,448.09 |

| New Limerick | $2,418.61 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

| Orient | $2,421.98 | Liberty Mutual | $4,166.28 | Progressive | $3,181.74 | USAA | $1,361.37 | Geico | $1,409.30 |

Rates in Maine’s 10 Largest Cities

The size of your city can (but doesn’t always) have an impact on your premium. For example, here are the average premiums for the ten largest cities in Maine.

| City | Average | Allstate F & C | Bristol West Select | Geico General | Liberty Mutual Fire Ins Co | Progressive Northwestern | State Farm Mutual Auto | Travelers Home and Marine Ins Co | USAA |

|---|---|---|---|---|---|---|---|---|---|

| Portland | $2,754.12 | $2,674.58 | $3,261.84 | $1,548.54 | $4,475.38 | $3,597.14 | $2,430.69 | $2,575.46 | $1,469.33 |

| Lewiston | $2,782.26 | $2,783.25 | $3,479.32 | $1,431.46 | $4,549.27 | $3,793.09 | $2,169.61 | $2,458.45 | $1,593.62 |

| Bangor | $2,597.70 | $2,891.30 | $2,806.24 | $1,543.26 | $4,236.91 | $3,526.18 | $2,089.74 | $2,171.64 | $1,516.30 |

| Auburn | $2,782.70 | $2,789.16 | $3,479.32 | $1,431.46 | $4,549.27 | $3,793.09 | $2,169.61 | $2,456.10 | $1,593.62 |

| So. Portland | $2,459.40 | $2,674.58 | $2,737.50 | $1,394.85 | $3,873.19 | $3,353.56 | $2,156.06 | $2,128.67 | $1,356.82 |

| Biddeford | $2,452.04 | $2,767.48 | $2,675.02 | $1,337.42 | $4,066.18 | $3,268.64 | $2,047.07 | $2,064.64 | $1,389.85 |

| Sanford | $2,550.52 | $2,779.44 | $2,787.58 | $1,411.37 | $4,118.84 | $3,475.33 | $2,217.82 | $2,223.97 | $1,389.85 |

| Brunswick | $2,526.16 | $2,703.70 | $2,957.54 | $1,363.53 | $4,166.95 | $3,441.50 | $2,115.03 | $2,062.37 | $1,398.63 |

| Augusta | $2,645.19 | $2,745.19 | $2,850.80 | $1,542.15 | $4,351.05 | $3,567.31 | $2,342.97 | $2,265.69 | $1,496.33 |

| Scarborough | $2,490.70 | $2,767.48 | $2,737.50 | $1,394.85 | $3,873.19 | $3,353.56 | $2,204.07 | $2,238.09 | $1,356.82 |

Read more: Progressive Northwestern Insurance Company Car Insurance Review

What are the best car insurance companies in Maine?

Finding the best car insurance in Maine can be challenging. Should I go with a large company, a small company, an agent? How will each company interpret my driving record? Where can I get the cheapest car insurance? We compare all these things plus more.

Keep reading to find the top car insurance companies in Maine.

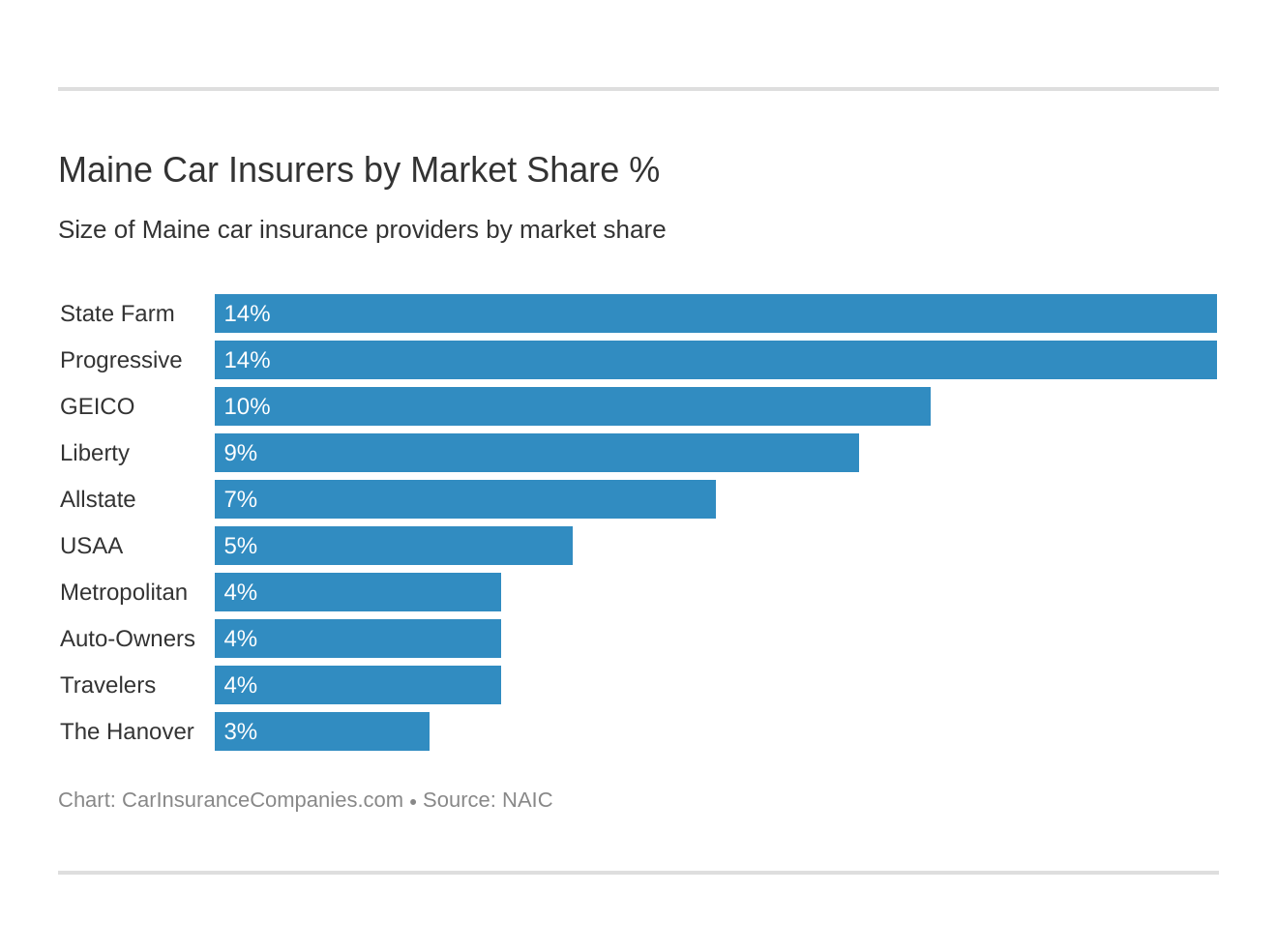

Largest Insurance Providers in Maine

While the size of your insurance company might not be your biggest concern, choosing a large company does have some benefits. Online quotes and purchasing options, multiple office locations throughout the state, and national name recognition are just a few of the potential benefits that come with choosing a larger insurance company.

Largest Car Insurance Companies by State

| Insurance Company | Rank | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| #1 | $1,937,806 | 68.72% | 22.49% | |

| #2 | $1,051,005 | 81.23% | 12.20% | |

| #3 | $1,001,828 | 63.09% | 11.63% | |

| #4 | $820,479 | 51.96% | 9.52% | |

| #5 | $706,276 | 91.01% | 8.20% | |

| #6 | $335,540 | 66.84% | 3.89% |

| #7 | $267,971 | 77.10% | 3.11% |

| #8 | $266,864 | 71.60% | 3.10% | |

| #9 | $261,432 | 64.70% | 3.03% |

| #10 | $224,705 | 70.36% | 2.61% |

Maine Insurance Company Financial Ratings

Financial stability and good business practices are both important aspects to consider when choosing an insurance company. AM Best is one of several companies that rates insurance companies on their financial stability. These ratings are just one of the tools you can use to help you make a decision when purchasing an insurance policy.

| Allstate F & C | Bristol West Select | Geico General | Liberty Mutual Fire Ins Co | Progressive Northwestern | State Farm Mutual Auto | Travelers Home and Marine Ins Co | USAA | |

|---|---|---|---|---|---|---|---|---|

| AM Best Rating | A+ (Superior) | A - (Excellent) | A++ (Superior) | A (Excellent) | A+ (Superior) | A++ (Superior) | A++ (Superior) | A++ (Superior) |

Companies with the Most Complaints in Maine

Financial stability is only one of the criteria you should consider when choosing an insurance provider. The number of complaints filed against them is important to consider as well.

Larger companies will have more complaints simply because they have more customers, so keep in mind the size of the company when reviewing how many complaints were filed against them last year.

| Allstate F & C | Bristol West Select | Geico General | Liberty Mutual Fire Ins Co | Progressive Northwestern | State Farm Mutual Auto | Travelers Home and Marine Ins Co | USAA | |

|---|---|---|---|---|---|---|---|---|

| NAIC Complaints in 2018 | 720 | 61 | 1148 | 294 | 55 | 2649 | 92 | 616 |

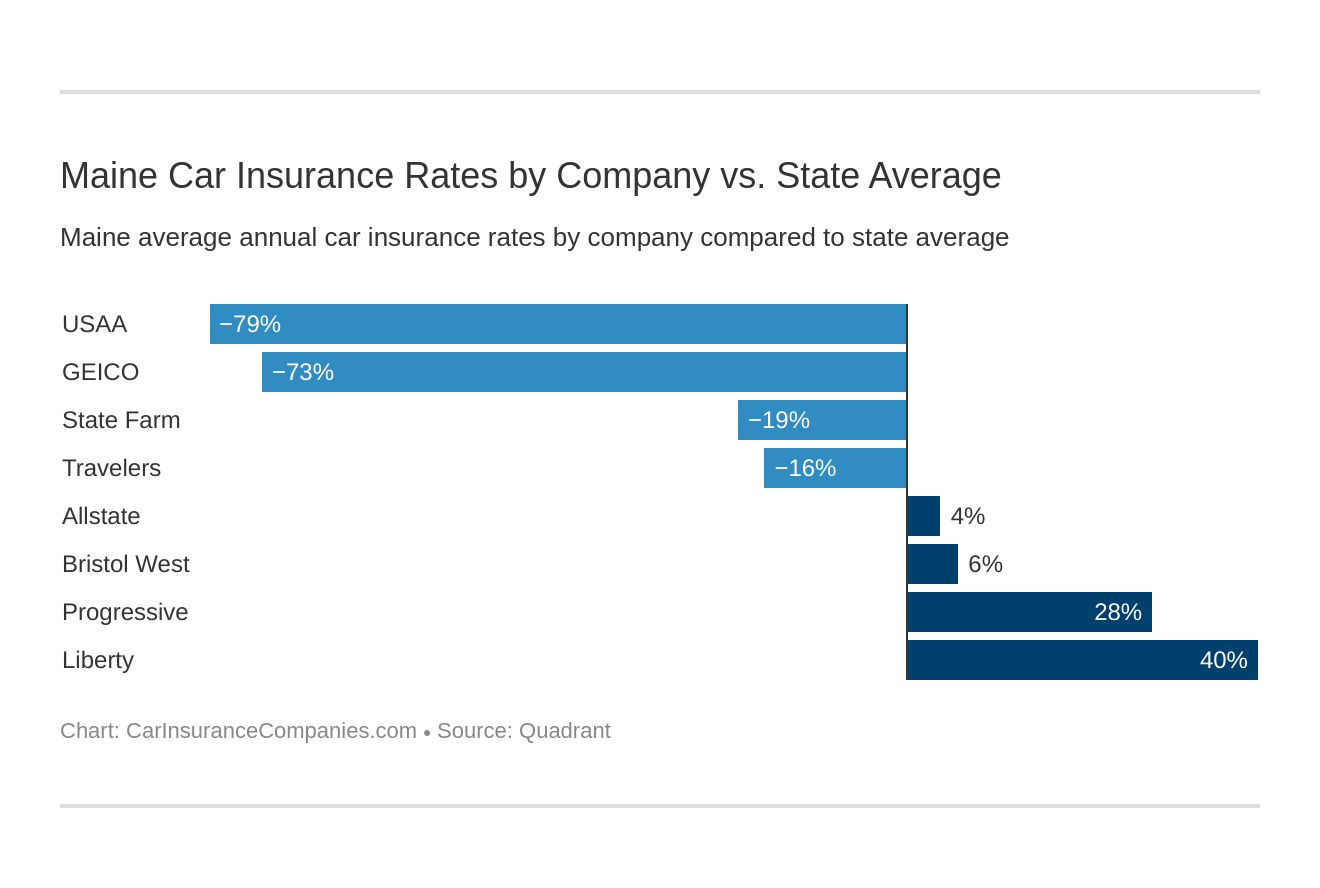

Cheapest Companies in Maine

Choosing an insurance provider is a complex decision, but the first thing most people want to know is which companies have the cheapest rates. Most people are looking for the lowest cost available for the coverages they need. Take a look below to see the average cost of insurance from different providers in Maine.

| Company | Average Annual Rate | Compared to State Average | |

|---|---|---|---|

| Allstate F&C | $2,708.27 | $98.58 | 3.64% |

| Bristol West Select | $2,770.70 | $161.01 | 5.81% |

| Geico General | $1,510.15 | -$1,099.54 | -72.81% |

| Liberty Mutual Fire Ins Co | $4,331.75 | $1,722.07 | 39.75% |

| Progressive Northwestern | $3,644.69 | $1,035.00 | 28.40% |

| State Farm Mutual Auto | $2,198.78 | -$410.91 | -18.69% |

| Travelers Home & Marine Ins Co | $2,253.96 | -$355.73 | -15.78% |

| USAA | $1,459.20 | -$1,150.48 | -78.84% |

The best way to find affordable rates is to get auto insurance quotes from multiple companies and compare them. Instead of talking to multiple insurance agents, use a comparison tool. This online service allows you to get quotes from many auto insurance companies at once.

Commute Rates by Company

One of the factors in determining your premium is how far you commute each day. Often this is broken down into categories, such as 10-mile commute/6,000 annual mileage or 25-mile commute/12,000 annual mileage.

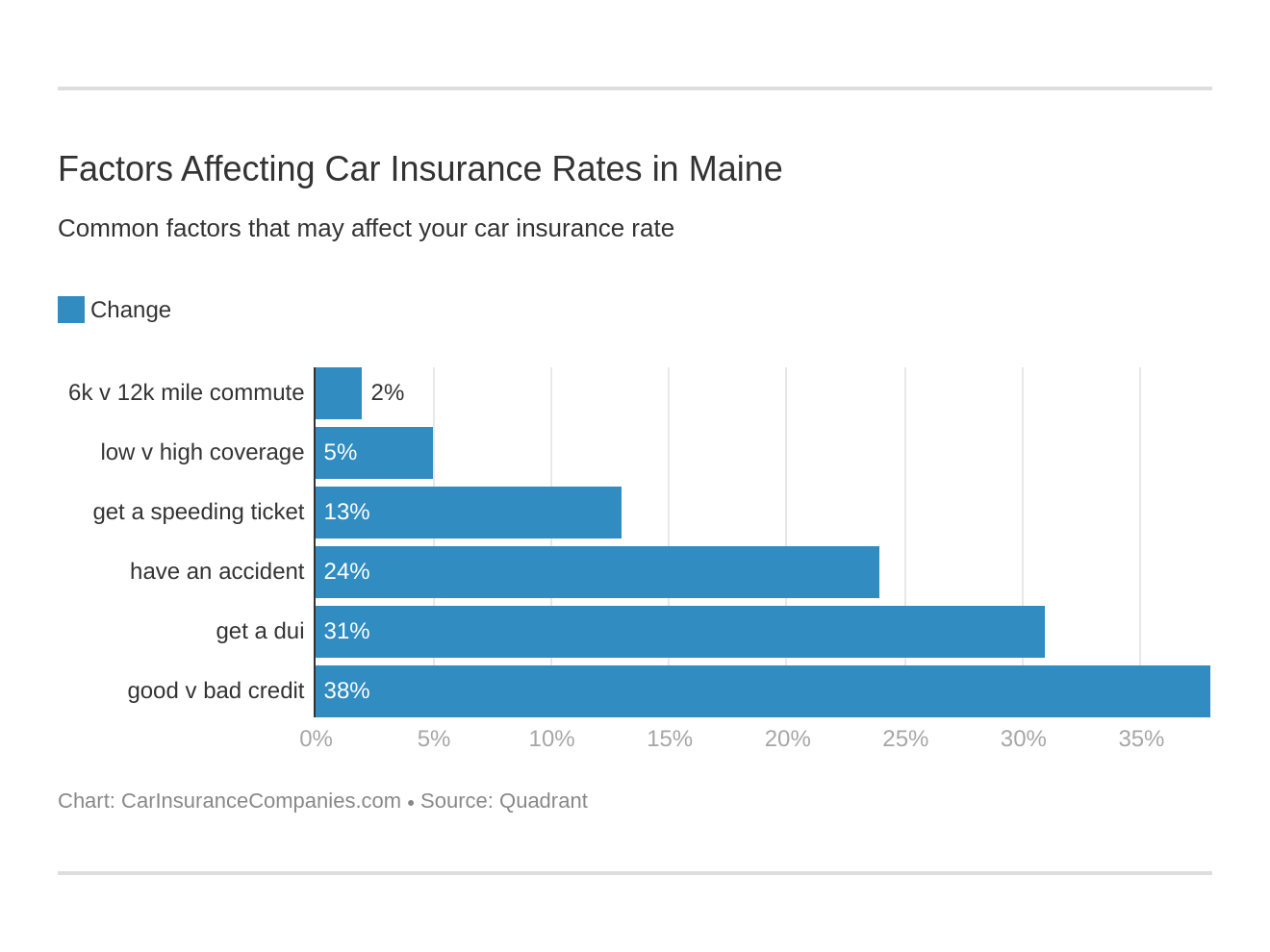

Take a look at these 6 major factors affecting auto insurance rates in Maine.

The longer you are on the road each day, the more likely you are to file a claim. Whether the claim is a large one, such as a car accident, or something small like a windshield replacement, spending more time on the road will expose you to more situations that might damage your vehicle. See the average rates below.

| Group | Commute And Annual Mileage | Annual Average |

|---|---|---|

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $4,420.82 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $4,242.69 |

| Progressive | 10 miles commute. 6000 annual mileage. | $3,644.69 |

| Progressive | 25 miles commute. 12000 annual mileage. | $3,644.69 |

| Farmers | 10 miles commute. 6000 annual mileage. | $2,770.70 |

| Farmers | 25 miles commute. 12000 annual mileage. | $2,770.70 |

| Allstate | 10 miles commute. 6000 annual mileage. | $2,708.27 |

| Allstate | 25 miles commute. 12000 annual mileage. | $2,708.27 |

| State Farm | 25 miles commute. 12000 annual mileage. | $2,270.59 |

| Travelers | 10 miles commute. 6000 annual mileage. | $2,253.96 |

| Travelers | 25 miles commute. 12000 annual mileage. | $2,253.96 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,126.96 |

| Geico | 25 miles commute. 12000 annual mileage. | $1,534.83 |

| USAA | 25 miles commute. 12000 annual mileage. | $1,500.17 |

| Geico | 10 miles commute. 6000 annual mileage. | $1,485.46 |

| USAA | 10 miles commute. 6000 annual mileage. | $1,418.24 |

Coverage Level Rates by Company

The more coverage you choose to have the higher your rates, but comparing companies can still help save you money each month even if you are choosing a more expensive coverage option.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Liberty Mutual | High | $4,434.80 |

| Liberty Mutual | Low | $4,280.23 |

| Liberty Mutual | Medium | $4,280.23 |

| Progressive | High | $3,784.62 |

| Progressive | Medium | $3,578.24 |

| Progressive | Low | $3,571.22 |

| Farmers | High | $2,971.75 |

| Allstate | High | $2,775.99 |

| Farmers | Medium | $2,678.87 |

| Allstate | Medium | $2,674.94 |

| Allstate | Low | $2,673.88 |

| Farmers | Low | $2,661.47 |

| Travelers | High | $2,322.46 |

| State Farm | High | $2,276.74 |

| Travelers | Medium | $2,221.73 |

| Travelers | Low | $2,217.68 |

| State Farm | Medium | $2,176.08 |

| State Farm | Low | $2,143.52 |

| Geico | High | $1,559.36 |

| USAA | High | $1,505.15 |

| Geico | Medium | $1,489.97 |

| Geico | Low | $1,481.10 |

| USAA | Medium | $1,441.85 |

| USAA | Low | $1,430.61 |

Credit History Rates by Company

Most people think about their credit rating as something that impacts their ability to buy a house or a car, and it is true that those things are impacted by your credit history, but those aren’t the only things you need to worry about when it comes to your credit history.

Your credit rating also impacts your insurance rates, which means a clean credit rating can save you hundreds or even thousands of dollars a year on your car insurance.

| Group | Credit History | Annual Average |

|---|---|---|

| Liberty Mutual | Poor | $6,031.00 |

| Progressive | Poor | $4,121.68 |

| Liberty Mutual | Fair | $3,907.95 |

| Progressive | Fair | $3,532.35 |

| Allstate | Poor | $3,404.37 |

| Progressive | Good | $3,280.04 |

| Farmers | Poor | $3,225.79 |

| State Farm | Poor | $3,202.36 |

| Liberty Mutual | Good | $3,056.31 |

| Travelers | Poor | $2,652.81 |

| Farmers | Fair | $2,647.42 |

| Allstate | Fair | $2,593.20 |

| Farmers | Good | $2,438.88 |

| Travelers | Fair | $2,173.41 |

| Allstate | Good | $2,127.24 |

| Geico | Poor | $2,032.28 |

| Travelers | Good | $1,935.65 |

| USAA | Poor | $1,914.90 |

| State Farm | Fair | $1,912.93 |

| State Farm | Good | $1,481.04 |

| Geico | Fair | $1,348.10 |

| USAA | Fair | $1,316.74 |

| Geico | Good | $1,150.06 |

| USAA | Good | $1,145.97 |

Driving Record Rates by Company

Your driving record can impact your insurance premium by hundreds or thousands of dollars. Avoiding tickets, accidents, and other issues is an excellent way to help keep your insurance premiums low.

[table “” not found /]

Number of Insurers in Maine

As of 2017, there were 1,163 total insurance companies operating in Maine. That includes all insurance companies, not just car insurance.

The total amount of automobile insurance premium collected in Maine was $882.7 million, making them 44th in the nation in auto insurance spending.

State Laws

Following your state laws when it comes to driving is an important part of keeping your rates low.

When driving, keep in mind that the laws of every state are different and can change frequently, so just because you know something is legal in Texas or Vermont doesn’t mean it is legal in Maine – as the laws change, even something that was legal in Maine a few years ago might not be legal anymore.

For example, many states have recently passed laws requiring drivers to turn on their headlights any time they are using their windshield wipers, even during daylight hours. While it was legal to drive without headlights while raining five or six years ago, that has changed for millions of people across the country.

Be sure to stay up-to-date on the driving laws in Maine to make sure you avoid tickets for moving violations.

Car Insurance Laws

There are some Maine laws that are specific to car insurance and how you use it. For example, Maine law requires insurance companies to provide a discount for drivers age 55 and older who have completed an approved Motor Vehicle Accident prevention course.

For a full list of laws related to car insurance, you can review the Maine.gov website.

How State Laws For Insurance Are Determined

State laws in Maine are created much the same way our national laws are created – a bill is sent through the house or the senate, if it passes it gets sent to the other legislative chamber, then it goes to the governor who can either sign or veto the law.

There is an easy-to-follow flowchart located online that details Maine’s legislative process.

Windshield Coverage

Comprehensive coverage is designed to help repair your vehicle in case of non-collision damages, but full glass coverage is not always included in your comprehensive coverage.

Each insurance policy is different, so you will need to review your policy to see if glass coverage is separated out from the rest of the comprehensive portion of your policy. You will also want to check on whether or not you have a separate deductible for glass damage.

In Maine, the law states that the insurance company can choose what kind of glass to use in your repair. They can choose used or aftermarket glass if it is more affordable. If you want to make a different choice you would be required to pay the difference out of pocket.

High-Risk Insurance

According to the law in Maine, all drivers must carry auto insurance. But what about those people who can’t get insurance at all? Maybe you’ve had too many accidents, or a couple of moving violations and an OUI have pushed out of the pool of insurable drivers.

If that is the case, High-Risk Insurance might be a necessity for you. A high-risk insurance plan allows you to be entered into the assigned risk pool, which every insurance company in the state is required to participate in to be allowed to operate in Maine.

Essentially, the assigned risk pool takes all of the people who are too high risk to be approved by the insurance companies and assigns them to the companies based on what percentage of the state they insure.

For example, if Liberty Mutual provides insurance to 4 percent of drivers in the state, they would be required to provide insurance to 4 percent of the drivers who apply for high-risk coverage.

Low-Cost Insurance

Some states require insurance companies to provide discounts to people who are on Medicare or Medicaid. Maine is not one of those states, which means customers are required to pay the full price for their insurance (minus any other applicable discounts) to drive legally in the state.

Automobile Insurance Fraud in Maine

Every year on the 1st of March, insurance companies are required to submit a record of incidences of insurance fraud. Insurance fraud includes a wide range of crimes, including everything from aiding or abetting another person’s fraudulent claim to embezzling premium money from a company.

According to the state, people found guilty of insurance fraud are subject to civil penalties, but if an insurance company alleges fraud against a customer and that customer is found not guilty, the courts may require that the insurance company pay any reasonable attorney’s fees on behalf of the customer.

Statute of Limitations

The statute of limitations is the length of time you have to file a lawsuit over an injury, death, or property damage. In Maine, the statute of limitations for automobile accidents are as follows:

- Personal Injury Lawsuit – six-year limitation

- Property Damage Lawsuit – six-year limitation

- Wrongful Death Lawsuit – two-year limitation

Driving Laws in Maine

Like any other state, Maine has more insurance, car, and traffic laws than can be discussed in a single article. For more information about other laws that may pertain to you while living and driving in Maine, you can visit the website for the Maine Bureau of Insurance.

For example, Maine law requires that car insurance companies offer a discount to citizens 55 and over who take a four-hour driving safety class called the Mature Drivers Course.

Vehicle Licensing Laws

Like other states, Maine has laws in place about vehicle licensing and registration. You can find information about registering vehicles, renewing your registration, and other licensing laws at the Bureau of Motor Vehicles website.

Real ID

Maine is currently working toward compliance with the Federal Real ID act.

Penalties For Driving Without Insurance

Driving without insurance in Maine can cost you anywhere between $100 and $500 for your first offense. If it is discovered that you do not have insurance because you were at fault in an accident, the penalty can be even more severe, with loss of license and registration becoming possibilities in this Class E level crime.

Teen Driver Laws

Teenagers are eligible for a learner’s permit at age 15. In the state of Maine, a learner’s permit makes a teen a licensed driver when it comes to being added to your insurance, so know that once a teen has earned their permit they must be added to your insurance coverage.

According to the law in Maine, teenage drivers earn their license in steps. First, after they finish an approved driver course and pass their written and vision tests they get their learner’s permit.

Then they can use their learner’s permit to log the required driving hours (70 hours, of which at least 10 must be at night) with a passenger over the age of 20 who has been driving for at least two years. You can track your teen’s driving hours with the Maine driving log.

Once they’ve met the driving hour requirements and held a learner’s permit for at least six months they are eligible to apply for an intermediate license.

This allows them to drive alone, but they still have to follow certain rules – they are not allowed to drive between midnight and 5 a.m., they are not allowed passengers for at least 270 days, and they are prohibited from using a cell phone.

Once they have held their intermediate license for 270 days they are then eligible for a full, unrestricted license.

Older Driver License Renewal Procedures

Maine has several laws in place to help make sure senior citizens are safe on the road, such as:

- Additional Vision Tests – Drivers renewing their license at 40 are required to take a vision test, with a required vision test added to every other renewal until age 65, at which point the vision tests are required with every renewal.

- More Frequent Renewals – Normally, drivers must renew their license every six years in Maine. After age 65 that changes, with renewals becoming required every four years instead.

- Requested Reports From Family – Maine also requests that family members who are concerned about a senior citizen’s driving ability report it to the BMV. Once a report has been made, the state may require a road test for the driver and place restrictions on their license, possibly limiting them to driving only during daylight hours or driving only within a specific area.

New Residents

When moving to Maine, you are required to obtain a new Maine driver’s license within 30 days of becoming a resident. To do this, there are several steps you will need to follow.

First, you need to have proof of residency and proof of citizenship/legal status. Typically this would be a utility bill with your name on it and a copy of your birth certificate, but you can find more information about necessary documentation on the BMV website.

You will also need to pass a vision screening. Generally, you would not be required to take a written test or a road test, but that is not a guarantee.

Finally, you will need to pay any required fees and surrender your out-of-state license.

License Renewal Procedures

To renew your driver’s license in Maine, you will need the following:

- Proof of Physical Address – Utility bill, copy of your mortgage, etc.

- Proof of Legal Presence – Birth certificate, etc.

You may also have additional requirements based on your age. This is typically just a vision test, but it could be a road test or other requirement as well. There could potentially be other requirements to obtain a Real ID as well.

You may be eligible to renew your license online.

Negligent Operator Treatment Systems

The Negligent Operator Treatment System is designed to keep negligent and dangerous drivers off the road. The system consists of points or demerits attached to your driving record.

Once six points have been earned you receive a warning from Maine’s Secretary of State. Once 12 points have been earned, your license is suspended.

Various infractions carry different point values based on the severity of the offense. For example, making an illegal U-turn adds two points to your record, while driving on the wrong side of the road earns you six points.

You can find the details of the demerit point system in the Maine Motorist Handbook.

Rules of the Road

Every state has basic rules of the road, though those rules can vary from state to state. Some of Maine’s Rules of the Road are as follows:

- Right of Way – Emergency vehicles using emergency lights or sirens have the right of way. Drivers who can see or hear the approach of an emergency vehicle are required to pull as far over to the right as they reasonably can, optimally pulling parallel to the curb.

- Speed Limits – Unless otherwise posted, the speed in school zones is 15 m.p.h.; business and residential areas have a speed limit of 25 m.p.h. On highways, a school bus transporting kids cannot go more than 45 m.p.h.

- Unnecessary Noise – Breaking and accelerating may not be done in such a way as to create excessive noise.

Fault vs. No-Fault

In Maine, to bring someone to court over a car accident the injured party must be able to prove the other person was at fault. In fact, you not only have to prove that the other person was at fault, but you must prove that they were more than 50% at fault. This is called modified comparative negligence.

Seat Belt and Car Seat Laws

State laws require all drivers and all passengers to wear seat belts in all seats, whether in the front or in the back.

When it comes to car seat laws, Maine has recently updated their laws, so make sure you are up-to-date on all the latest changes.

Children under the age of two must travel in rear-facing car seats. Children over two must ride in a front-facing seat with a harness until they are more than 55 pounds, a significant change from the previous 40-pound limit.

People who violate the law could be fined up to $250.

Keep Right and Move Over Laws

As previously mentioned, the law in Maine requires all drivers to move over and pull to the right lane when they see an approaching emergency vehicle. But what about general lane usage – do you have to stay to the right no matter what?

Yes, everyone must keep right except to pass anywhere the speed limit is 65 or higher.

Speed Limits

Unless otherwise posted, the speed limits in Maine are as follows:

- School Zone – 15 mph.

- Business and Residential areas – 25 mph.

- Highways – The speed depends on how populated the area is, with speeds ranging anywhere from 50-75 mph.

Ridesharing

According to the Maine legislature, rideshare drivers must maintain a minimum of $1 million of death, personal injury, and property damage liability coverage. This can be provided by the transportation company, the driver, or a combination thereof.

Rideshare drivers should note that the law states your employer must provide you with certain disclosures, such as notice that you are only covered under their insurance while on a prearranged ride, not while waiting for someone to request a ride.

If you were not given these disclosures, reach out to your employer right away.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Automation on the Road

In 2018, Governor LePage signed an order to establish the Maine Highly Automated Vehicles Advisory Committee.

The purpose of the committee is to oversee the introduction to Maine of Highly Automated Vehicle technologies, and assess, develop, and implement recommendations regarding potential Pilot Projects initiated to advance these technologies. In other words, Maine is still working on its approach to autonomous vehicles.

Safety Laws

In Maine, texting while driving is against the law. Maine is also a hands-free state, requiring you to use BlueTooth or another hands-free device to talk on the phone while driving. It is also illegal to pass on the right in all but a small number of circumstances.

These are just a few of the many safety laws on the books in Maine. For more information, you can find all of the required safety laws in the Maine Motorists Handbook.

OUI Laws in Maine

In Maine, driving with a blood alcohol content (BAC) level of 0.08 percent or more means you are Operating Under the Influence (OUI) which is a criminal offense. Maine takes impaired driving very seriously.

If you are arrested for OUI, prior to your court date the Secretary of State immediately suspends your license. You won’t be able to drive again until proven not guilty in court.

Your blood alcohol content can be determined with either a breath or blood test. If you are found to have a BAC of 0.08 percent or more, no further evidence is required by the court for a conviction.

This is especially important to keep in mind if you have a medical condition that impacts the way your body processes alcohol. For example, many people who have had bariatric surgery find that they are especially sensitive to alcohol, causing them to have an elevated BAC after only one or two drinks.

Because a driver’s license is considered a privilege, not a right, the law requires anyone who has been requested by law enforcement to take a BAC test to comply. Due to the administrative nature of the offense, refusing a test can result in a suspended license for up to six years even without court action.

For drivers under 21, the law requires that your license be suspended for one year if your BAC registers 0.08 percent or higher. If you refuse to be tested, your license is immediately suspended for 18 months.

Drivers under 21 who are OUI with a passenger under 21 in their vehicle will have an additional 180 days added to their license suspension.

If your license is currently suspended and you are caught OUI, you can be subject to vehicle seizure and forfeiture in addition to any fines and/or jail time.

The punishment gets harsher for each subsequent OUI, leading up to a jail sentence of more than six months and fines of $2,500. This doesn’t include any aggravating factors or increased insurance premiums, so keep that in mind before you decide to drive under the influence.

Marijuana-Impaired Driving Laws

Marijuana is considered a drug and can impact your ability to drive safely. Maine has a Drug Evaluation and Classification Program that is used to prosecute drivers as OUI while using marijuana or other drugs.

Even though the law states that recreational marijuana use is legal in Maine, it is still illegal to drive while under the influence. The legal status of the drug does not stop you from being prosecuted for OUI if you are caught driving while high.

This will impact your insurance rates the same way that an alcohol-related OUI conviction does, so be cautious about driving OUI.

Distracted Driving Laws

Maine has laws against distracted driving. Distracted driving can be caused by any number of things, including eating, playing with the radio, and talking to other passengers, but the biggest issue when it comes to distracted driving is cell phone use. If caught, your first offense will earn you a $50 fine.

According to the CDC, there are three kinds of distracted driving: Visual, where you take your eyes off the road, Manual, where you take your hands off the wheel, and Cognitive, where you take your mind off of driving. Texting is the most dangerous form of distracted driving because it combines all three.

Many major insurance companies are beginning to offer discounts on technology designed to reduce phone use while driving, such as Cellcontrol, as well as creating apps that track your driving behaviors and offer discounts to drivers who drive safely.

Driving Safely in Maine

By following all of the previously discussed safety laws you can protect yourself both physically and financially, but there is only so much you can do to keep yourself safe. What about the things that are beyond your control?

Vehicle Theft in Maine

The good news is that property crimes in Maine decreased by 8.5 percent from 2016 to 2017. The bad news is that in 2017 there was still a vehicle stolen every 11 hours.

You can help prevent vehicle theft by taking a few basic precautions.

- Keep Your Keys Safe – Don’t keep a spare key hidden on or in the vehicle. Make sure you know where every copy of your car key is and check regularly to make sure none are missing.

- Lock Your Doors – This might seem basic, but it is one of the most important theft prevention tips. Lock your car, both when you have it parked somewhere and when you are driving it.

- Don’t Leave Valuables In Your Car – If your wallet or smartphone is visible through the window, that can be very tempting for a would-be criminal. Make sure you leave valuables at home or bring them with you when you leave the vehicle.

- Don’t Leave Your Car Running – It can be tempting to start your car in the winter and go back inside for coffee while it warms up, but this leaves you vulnerable to theft. Don’t leave your car running when you are not in it, even if you are just stepping out to return a book to the library or throw something in the garbage.

In the event that your vehicle is stolen, you can file a claim through your comprehensive coverage.

Road Fatalities in Maine

2018 saw the lowest rate of traffic fatalities in 60 years for the state of Maine, with a total of 140 people who passed away on the roads. Unfortunately, the number of fatalities in 2017 was much higher, coming at a total of 173 deaths, adding weight to the concerns that distracted driving and other factors are still making the highways unsafe.

Keep in mind that not all traffic fatalities involve a two-car accident. Collisions with deer, stationary objects, and motorcycles all contribute to the road fatalities in Maine.

Basic safety precautions like seatbelts and motorcycle helmets go a long way towards reducing the number of road fatalities each year. Consider this chart showing motorcycle-related fatalities when thinking about driving unbuckled or leaving your helmet at home:

| Year | Total Fatalities | Helmeted | Unhelmeted |

|---|---|---|---|

| 2013 | 14 | 1 | 13 |

| 2014 | 11 | 7 | 4 |

| 2015 | 32 | 8 | 24 |

| 2016 | 18 | 6 | 12 |

| 2017 | 26 | 9 | 17 |

Most Fatal Highways in Maine

There are many busy roads that are more prone to accidents all across the state. According to Lowry & Associates, these are just a few of the most dangerous roads in Maine:

- Bridgton – Portland Rd., Willis Park Rd. and Portland Rd., Sandy Creek Rd.

- Bangor – Broadway, Hobert St. and Broadway, Burleigh Rd., Griffin Rd.

- Lewiston – Old Greene Rd. and Randall Rd., Sabattus St.

- Augusta – Ramp off to Western Ave. and Western Ave.

Fatal Crashes by Weather Condition And Light Condition

From 2008 to 2017 the bulk of accidents took place during rush hour traffic, with more than 10 percent of accidents happening between 7 a.m. – 9 a.m. and another 15 percent happening between 4 p.m. and 6 p.m. The most dangerous accidents were the ones in the afternoon, with more than 54 percent of accident-related fatalities happening between noon and 9 p.m.

Most of the accidents happened on clear, dry roads, though rain and icy winter weather also played a part in 10-20 percent of crashes during that time.

In Maine, collisions with deer and moose are a serious problem for motorists. Luckily, fewer than 10 of these crashes ended in fatalities.

| County | Deer Crashes 2008-2017 | Moose Crashes 2008-2017 |

|---|---|---|

| Androscoggin | 1,948 | 34 |

| Aroostook | 2,017 | 1,556 |

| Cumberland | 4,939 | 115 |

| Franklin | 1,331 | 363 |

| Hancock | 2,922 | 63 |

| Kennebec | 3,693 | 90 |

| Knox | 936 | 17 |

| Lincoln | 729 | 21 |

| Oxford | 1,755 | 273 |

| Penobscot | 5,179 | 556 |

| Piscataquis | 939 | 155 |

| Sagadahoc | 894 | 11 |

| Somerset | 2,494 | 260 |

| Waldo | 1,895 | 31 |

| Washington | 1,625 | 209 |

| York | 3,321 | 103 |

| TOTAL | 36,617 | 4,556 |

Fatalities by County

In 2017, these were the deadliest counties when it comes to traffic accident fatalities in Maine:

| County | Number of Fatalities |

|---|---|

| Cumberland | 27 |

| York | 18 |

| Androscoggin | 17 |

| Kennebec | 16 |

| Penobscot | 16 |

Traffic Fatalities

In 2017, there were a total of 35,042 car accidents in Maine. Those accidents resulted in 168 deaths and 3,326 injuries. 1,258 people weren’t wearing their seatbelts at the time of the accident, which helps explain why the number of deaths and injuries is so high.

Fatalities by Person Type

| 2013-2017 | 5 year avg. crashes | 5 year avg. fatalities | Fatalities/1,000 crashes |

|---|---|---|---|

| All Crash Types | 32,713 | 153 | 4.7 |

| Lane Departure | 9,400.40 | 99.80 | 10.60 |

| Speed | 4,457.00 | 50.20 | 11.30 |

| Unbelted | - | 52.00 | - |

| 16-18 Year Old | 2,971.40 | 11.00 | 3.70 |

| 16-20 Year Old | 5,396.60 | 17.60 | 3.30 |

| 21-24 Year Old | 4,775.20 | 17.40 | 3.60 |

| Alcohol | 1,269.60 | 46.20 | 36.40 |

| *Distracted/Inattentive | 3,317.00 | 8.40 | 2.50 |

| 65-98 Year Old | 6,036.20 | 41.00 | 6.80 |

| Motorcycles | 566.60 | 20.40 | 36.00 |

| Winter | 6,229.80 | 13.20 | 2.10 |

| Intersections | 9,244.00 | 21.00 | 2.30 |

Fatalities by Crash Type

From 2008-2017, 47 percent of the fatalities caused by traffic accidents were from lane departures/heading off-road. This includes everything from changing lanes on the highway to drifting out of your lane and hitting a tree.

Twenty-three percent of fatalities during this time were caused by head-on collisions, while another 10 percent happened in intersections, typically due to someone running a red light or a stop sign.

Five-Year Trend in Fatalities In Maine

| Year | Pedestrian Fatalities | Bicycle Fatalities | Motorcycle Fatalities | Impaired | % Impaired | Total Fatalities (inc. cars) |

|---|---|---|---|---|---|---|

| 2013 | 11 | 4 | 14 | 35 | 24.1 | 145 |

| 2014 | 9 | 2 | 10 | 33 | 25.2 | 131 |

| 2015 | 19 | 0 | 32 | 47 | 30.1 | 156 |

| 2016 | 17 | 4 | 19 | 64 | 40 | 160 |

| 2017 | 20 | 2 | 24 | 52 | 30.1 | 173 |

| 5 year avg. | 15.2 | 2.4 | 19.8 | 46.2 | 30.2 | 153 |

Fatalities Involving Speeding By County

Over the last five years, there has been a significant reduction in the number of fatalities involving speeding in every county in Maine. 2012 had almost 80 speed-related deaths across the state, while every year since has seen the number of speed-related deaths somewhere between 40 and 60.

Teen Drinking and Driving

As previously mentioned, drivers under 21 will have their license suspended for one year if their BAC registers 0.08 percent or higher. If they refuse to be tested, their license is immediately suspended for 18 months.

Drivers under 21 who are OUI with a minor passenger (under 21) in their vehicle will have an additional 180 days added to their suspended license.

They may also have heavy monetary fines as well as required community service or an alcohol treatment program, so it is important to make sure teens understand the dangers of driving OUI.

EMS Response Time

The EMS response time increased by two minutes from 2013 – 2015. In 2013 the average response time was eight minutes and 25 seconds, while in 2015 the average response time had risen to 10 minutes and 22 seconds.

Transportation in Maine

Maine has a wide variety of transportation options beyond individual car ownership. They have cabs and rideshare programs too, of course, but there are lots of ways to get around Maine without a car.

Maine has multiple bus lines, train lines, and ferry services for Maine’s island communities.

Car Ownership

Maine is a community of car owners. Beyond the 823,002 passenger cars registered in the state for 2018, there were 49,646 motorcycles and 20,343 antique vehicles registered as well.

Commute Time

From 2009 to 2013, the average commute times in Maine were:

| County | Commute Time (in minutes) |

|---|---|

| Androscoggin | 23.2 |

| Aroostook | 17.0 |

| Cumberland | 22.3 |

| Franklin | 23.5 |

| Hancock | 22.8 |

| Kennebec | 23.1 |

| Knox | 18.7 |

| Lincoln | 25.2 |

| Oxford | 26.8 |

| Penobscot | 22.0 |

| Piscataquis | 24.9 |

| Sagadahoc | 23.4 |

| Somerset | 25.0 |

| Waldo | 26.5 |

| Washington | 19.1 |

| York | 27.2 |

Commuter Transportation

Beyond the simplest choices, such as biking or walking, almost every area of Maine has a wide variety of commuter transportation options. Buses, vans, carpool services, shuttles, and all sorts of other options are available to Maine residents.

Because these options are going to vary from city to city and county to county, residents will want to check what is available in their area when planning their commute.

Traffic Congestion

Traffic congestion is at an all-time high and is only expected to get worse over time. As of now, I-295 between Scarborough and Brunswick already carries between 63,000 and 74,000 cars per day. That number is expected to increase by 20 percent by 2040.

The state has begun to think about ways to improve the flow of traffic and make the roads safer for drivers, such as building areas to pull over every mile or so to allow disabled vehicles and emergency vehicles space to stop without interrupting traffic.

Now that you know everything there is to know about driving laws and car insurance in Maine, enter your zip code below to get a quote.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.