Georgia Car Insurance [Rates + Cheap Coverage Guide]

Georgia is an at-fault insurance state, and Georgia car insurance laws require drivers to carry 25/50/25 in minimum liability coverage. If you want to drive with full coverage, you may see an increase in your Georgia car insurance rates. Read our guide for tips to reduce your Georgia car insurance costs and start comparing Georgia car insurance quotes today.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Feb 14, 2025

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 14, 2025

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Georgia Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 127,492 Annual Miles Driven: 111,535 million |

| Vehicles | Registered in State: 7,955,532 Total Stolen: 26,854 |

| State Population | 10,519,475 |

| Most Popular Vehicle | Ford F-150 |

| Uninsured Motorists | 13% State Rank: 25th |

| Driving Fatalities | 2017 Total: 1,540 Speeding: 248 Drunk Driving: 366 |

| Average Annual Premiums | Liability: $557.38 Collision: $331.83 Comprehensive: $159.18 Full Coverage: $1048.40 |

| Cheapest Provider | Coast National Insurance Company |

Read more: Coast National Insurance Company Car Insurance Review

The state with the southern charm, Georgia is home to some of the most beautiful and historic sites in the nation. From down in Savannah all the way to the big city of Atlanta, Georgia has that wow factor that draws people to it in droves.

This can be both a good thing and, for anyone trying to drive in downtown Atlanta, a bad thing. There are a lot of things to worry about while navigating Georgia roads. But getting the car insurance you need, shouldn’t be one of them.

That’s what we’re here for! We’ve made up this comprehensive guide to steer you towards the best car insurance for YOUR needs.

Are you ready to get started with comparing your rates? Use our FREE online tool today! All you need is your ZIP code.

How Much Are Georgia Car Insurance Rates?

It’s important to know what exactly you’re getting, and how much you’re paying for it. If you’re paying for car insurance, you should know the details behind the coverage you’re getting, right? In this section, we’ll provide you with all of the important information and facts regarding Georgia car insurance coverage, as well as the typical rates you’ll see.

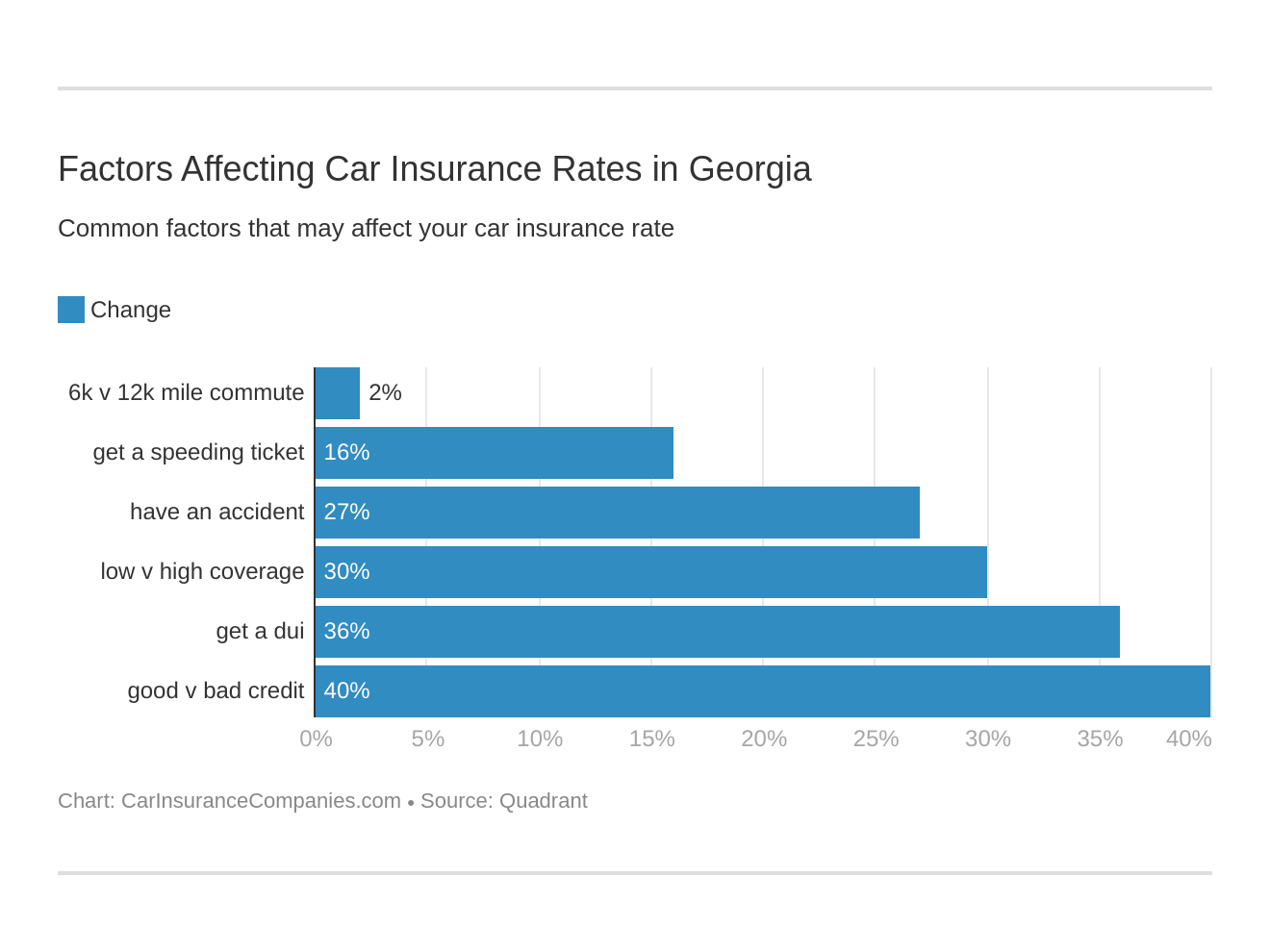

When you shop for auto insurance, some companies offer lower rates for clean driving records, good credit, etc. Others only offer low coverage if you give up collision and comprehensive coverage, which would cover your property damage after an accident. In this case, cheap car insurance could cost you much more if you’re ever in an accident.

Keep reading to find out how Georgia’s car insurance cost is HIGHER than the national average!

Georgia Minimum Coverage

Take a look at how state minimum car insurance rates vary from state to state.

| Minimum Car Insurance Requirements in Georgia | Stats |

|---|---|

| Bodily Injury Liability | $25,000 per person and $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

Every state has something known as minimum liability coverage. This is the lowest coverage you are allowed to have in order to legally drive in the state. In most states, this includes bodily injury and property damage liability coverage to pay anybody you injure in an auto accident. Average rates are much lower, but payouts are similarly low.

When you add collision and other insurance to cover your car damage, the cheapest car insurance has higher premiums than liability-only coverage. Many Georgia drivers choose to pay higher average rates because they’re looking at the bigger picture.

Georgia is, what is called an “at-fault” state. What does this mean? It means that if you are the one who caused an accident, you are the one who is liable for any injuries or property damage sustained during that accident. You can imagine that, if you don’t have insurance, this can become quite costly.

This is why, according to Georgia law, you are required to have this minimum coverage. If you carry the minimum and the other party’s damages exceed that amount, the other party could still sue you for the remainder.

In the table above, you can see the minimum liability coverage values you are required to have for Georgia. Let’s break this table down a little further:

- $25,000 for the payment of an injury/death of one person in an accident

- $50,000 for the payment of injuries/deaths to MULTIPLE people in an accident

- $25,000 for the payment of any property damage

These values may seem like a lot of money, however, if you’re in a severe enough accident, this money will run dry very quickly. So it is always wise to at least consider getting additional coverage in order to protect yourself.

In addition to the minimum liability insurance, many drivers choose to add collision insurance and comprehensive insurance to their auto policy. If you have collision, comprehensive, and liability coverage, it is called a full-coverage policy.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What Is Financial Responsibility and What’s Required in Georgia?

Due to the insurance requirements above, you’ll need to carry some form of financial responsibility with you. Also known as proof of insurance. In some states, drivers can get around carrying insurance by getting a bond or by making a financial deposit for the full liability requirements with the state. Drivers would then have to carry proof of that financial responsibility.

Well, what exactly are you going to need to have with you to provide this proof? In Georgia, you are actually in luck.

Law enforcement uses Georgia Electronic Insurance Compliance System (GEIC) in order to verify your car insurance electronically.

So as long as you keep your car insurance status up to date on the GEICS website, you won’t need to provide any physical proof of insurance.

If you don’t keep your insurance status up to date or don’t file for insurance at all, you could be facing some heavy penalties.

According to The Georgia Department of Revenue, it is required by law that any driver found to be driving without their proof of insurance will have their license suspended or revoked. So make sure you have any of of the above options listed with you at all times while driving.

Premiums as a Percentage of Income

According to Statista, in 2017 the average annual per capita disposable income for Georgia citizens was $38,326.

What in the world is an annual per capita disposable income? Disposable personal income (also known as DPI) is the total amount of money that a person makes after taxes have been taken out and paid.

This means, according to this value, Georgia citizens typically have about $3,194 each month for things such as utilities, food, medical expenses, etc.

The average annual cost of car insurance in Georgia is $1,232, which is approximately 3% of your annual disposable personal income.

This can take up a big chunk of change if you don’t budget yourself properly, so make sure you account for these monthly/yearly payments!

Average Monthly Car Insurance Rates in GA (Liability, Collision, Comprehensive)

Let’s take a look at the average monthly car insurance rates.

According to the National Association of Insurance Commissioners (NAIC), the table below are the core coverage costs you can expect in Georgia, as shown over time.

| Type of Coverage | 2015 | 2014 | 2013 | 2012 | 2011 | Average |

|---|---|---|---|---|---|---|

| Liability Coverage | $557.38 | $516.63 | $485.40 | $454.76 | $439.02 | $490.64 |

| Collision Coverage | $331.83 | $320.57 | $313.28 | $316.13 | $320.44 | $320.45 |

| Comprehensive Coverage | $159.18 | $154.05 | $150.65 | $151.16 | $153.03 | $153.61 |

| Full Coverage | $1,048.40 | $991.25 | $949.44 | $922.05 | $912.70 | $964.70 |

Additional Coverages

There are additional coverage types that you can have for your insurance plan, known as Med Pay and Uninsured/Underinsured Motorist coverage. They are all optional items, but they can be very important to have. Why?

According to the Insurance Information Insitute (III), approximately 12 percent of Georgia drivers are uninsured.

So what exactly do Med Pay and Uninsured/Underinsured Motorist coverage do?

MedPay is for the payment of any of your personal injuries.

Uninsured/Underinsured Motorist coverage is if you ever find yourself in an accident with someone who is uninsured, and they are at fault for the accident.

If you’re in a bad enough accident with this person, they’ll likely go bankrupt before they can finish paying for everything, which would include your medical expenses or fixing damaged property.

Now that we know the importance of these two types of liability coverage, we’ll quickly go over something known as loss ratio’s for these coverage types.

| Additional Liability Coverage | 2015 | 2014 | 2013 |

|---|---|---|---|

| Medical Payments Loss Ratio | 84.58% | 83.70% | 86.61% |

| Uninsured/Underinsured Motorist Loss Ratio | 93.68% | 87.32% | 81.65% |

A loss ratio is a ratio is one way that allows you to see how financially well a company is doing. It’s the factor of how many claims the company is paying out compared to the money they bring in from insurance premiums that you pay.

It’s kind of like the story of Goldilocks here. You want your company’s loss ratio to be not too big, not too small, but JUST right.

This is because if a company’s loss ratio is too low, they collecting more premium than is needed for the claims that are coming in. Reversely, if a company’s loss ratio is too high, they aren’t collecting enough premium which could be a sign of financial distress.

Georgia citizens are in luck, because the loss ratio’s for both MedPay and Uninsured/Underinsured coverage are in that sweet spot.

Add-Ons, Endorsements, and Riders

One of the first goals that most car insurance buyers are looking for is to get affordable coverage with complete coverage.

There are several, and very valuable, coverage options that are available to Georgia motorists. Click on any of the additional coverage options to learn more:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assitance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Low-Mileage Discount

Definitely consider adding one (or more) of these coverage options to your policy.

Average Monthly Car Insurance Rates by Age & Gender in GA

Did you know that your age and gender can play a factor in what kind of insurance rate you’ll get? It’s a popular myth in the car insurance world that men tend to pay more for car insurance, and that’s actually not always the case.

Read more: The Average Cost of Car Insurance by Age

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,900.87 | $2,900.87 | $2,779.74 | $2,779.74 | $6,787.85 | $8,744.55 | $3,246.86 | $3,545.10 |

| Geico General | $1,798.00 | $1,774.88 | $1,741.80 | $1,741.80 | $5,405.23 | $6,468.98 | $2,312.93 | $2,573.90 |

| Safeco Ins Co of IL | $5,354.43 | $5,828.62 | $4,383.03 | $4,975.31 | $22,759.67 | $25,413.76 | $5,674.73 | $6,038.00 |

| Nationwide Mutual | $3,767.46 | $3,895.53 | $3,724.66 | $4,094.75 | $11,720.53 | $15,095.77 | $4,594.13 | $4,986.39 |

| Progressive Mountain | $2,842.70 | $2,616.94 | $2,442.41 | $2,567.85 | $8,918.63 | $9,881.25 | $3,285.16 | $3,438.84 |

| State Farm Mutual Auto | $2,211.60 | $2,211.60 | $1,984.58 | $1,984.58 | $5,893.47 | $7,744.68 | $2,426.79 | $2,621.78 |

| USAA | $1,759.52 | $1,757.11 | $1,633.74 | $1,640.04 | $6,343.65 | $7,511.58 | $2,192.11 | $2,421.96 |

Read more: Progressive Mountain Insurance Company Car Insurance Review

As you can see in the chart above, married females tend to pay roughly the same as their male counterparts. Meanwhile, single younger males tend to pay more for their coverage.

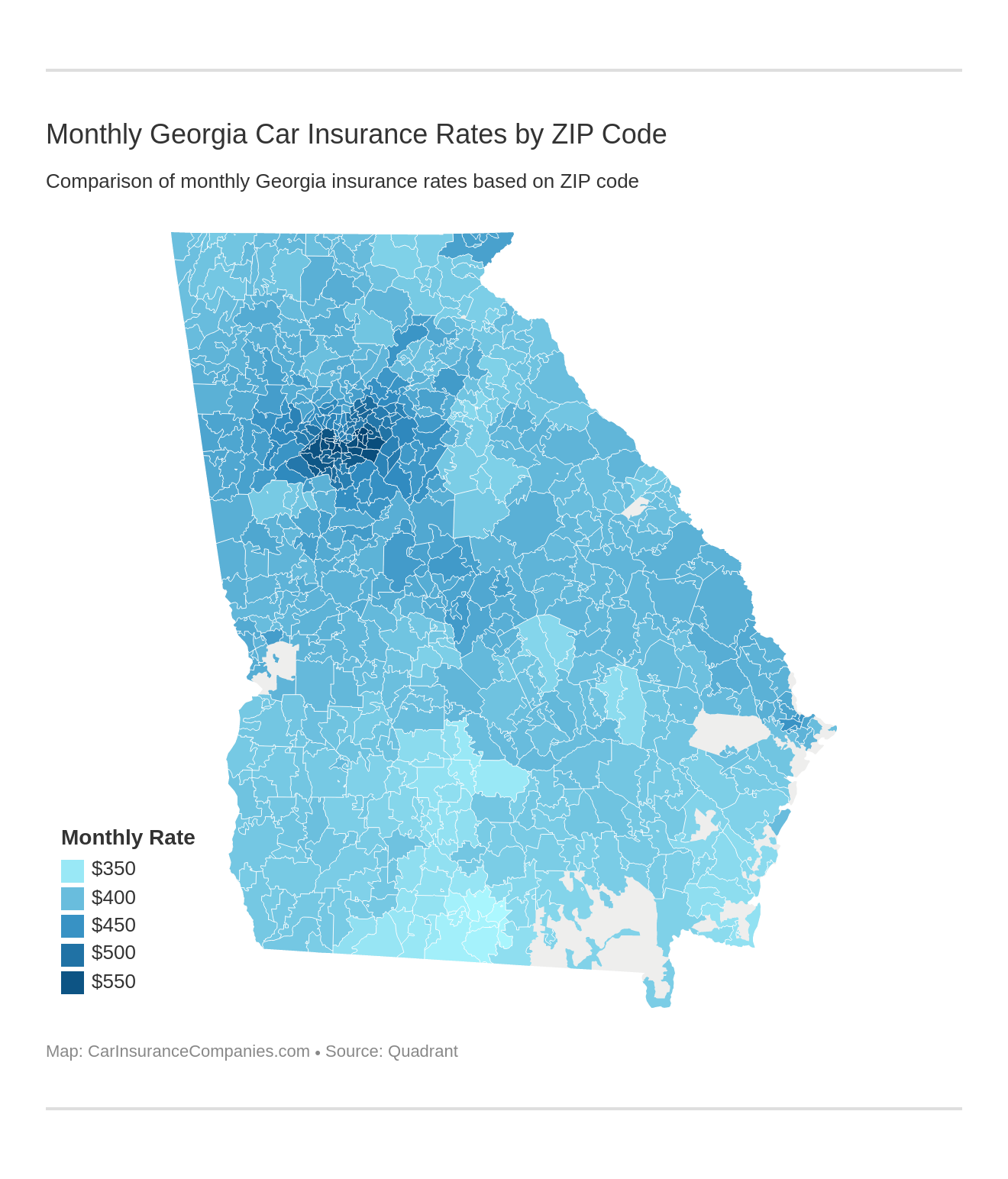

Rates by ZIP Code and City

Want to find out what rates you’ll tend to see in your ZIP code and city? Check out the table to find out.

| City | Zipcode | Average |

|---|---|---|

| ATLANTA | 30002 | $6,186.79 |

| CLARKSTON | 30004 | $5,076.20 |

| STONE MOUNTAIN | 30005 | $5,155.57 |

| STONE MOUNTAIN | 30008 | $5,426.84 |

| DECATUR | 30009 | $5,062.53 |

| ATLANTA | 30011 | $5,105.49 |

| ATLANTA | 30012 | $5,701.38 |

| ATLANTA | 30013 | $5,850.35 |

| ATLANTA | 30014 | $5,316.31 |

| ATLANTA | 30016 | $5,494.07 |

| ATLANTA | 30017 | $5,771.38 |

| LITHONIA | 30018 | $5,529.66 |

| LITHONIA | 30019 | $5,315.85 |

| DECATUR | 30021 | $6,944.22 |

| DECATUR | 30022 | $5,231.18 |

| SCOTTDALE | 30024 | $5,438.19 |

| ATLANTA | 30025 | $5,325.29 |

| ATLANTA | 30026 | $5,457.25 |

| ATLANTA | 30028 | $4,870.88 |

| ATLANTA | 30029 | $5,127.49 |

| ATLANTA | 30030 | $5,731.95 |

| PINE LAKE | 30032 | $6,699.34 |

| ATLANTA | 30033 | $5,949.23 |

| UNION CITY | 30034 | $6,694.70 |

| STONE MOUNTAIN | 30035 | $6,893.89 |

| ELLENWOOD | 30038 | $6,730.99 |

| ATLANTA | 30039 | $5,993.67 |

| ATLANTA | 30040 | $4,931.10 |

| ATLANTA | 30041 | $4,906.52 |

| CONLEY | 30043 | $5,490.63 |

| ATLANTA | 30044 | $5,794.49 |

| MARIETTA | 30045 | $5,702.00 |

| NORCROSS | 30046 | $5,727.27 |

| RIVERDALE | 30047 | $5,919.80 |

| NORCROSS | 30052 | $5,558.87 |

| RIVERDALE | 30054 | $5,307.49 |

| AVONDALE ESTATES | 30055 | $5,400.11 |

| ATLANTA | 30056 | $5,161.49 |

| ATLANTA | 30058 | $6,733.62 |

| FOREST PARK | 30060 | $5,426.83 |

| DULUTH | 30062 | $5,152.13 |

| ATLANTA | 30064 | $5,136.22 |

| NORCROSS | 30066 | $5,178.39 |

| PORTERDALE | 30067 | $5,717.81 |

| MABLETON | 30068 | $5,570.20 |

| ATLANTA | 30069 | $5,447.55 |

| SNELLVILLE | 30070 | $6,060.02 |

| ATLANTA | 30071 | $6,272.64 |

| ATLANTA | 30072 | $6,580.33 |

| DECATUR | 30075 | $5,061.11 |

| LILBURN | 30076 | $5,137.50 |

| JONESBORO | 30078 | $5,864.38 |

| ATLANTA | 30079 | $6,686.79 |

| FAIRBURN | 30080 | $5,690.79 |

| TUCKER | 30082 | $5,598.58 |

| SNELLVILLE | 30083 | $6,899.09 |

| CONYERS | 30084 | $5,870.11 |

| AUSTELL | 30087 | $6,469.78 |

| LITHIA SPRINGS | 30088 | $6,913.82 |

| ATLANTA | 30090 | $6,273.03 |

| LAWRENCEVILLE | 30092 | $6,075.23 |

| GRAYSON | 30093 | $6,237.26 |

| MORROW | 30094 | $5,666.28 |

| JONESBORO | 30096 | $6,115.91 |

| DECATUR | 30097 | $5,521.34 |

| ATLANTA | 30101 | $5,032.23 |

| LAWRENCEVILLE | 30102 | $5,283.96 |

| MARIETTA | 30103 | $4,997.33 |

| LAWRENCEVILLE | 30104 | $5,067.17 |

| CONYERS | 30105 | $4,845.45 |

| ATLANTA | 30106 | $5,675.27 |

| SMYRNA | 30107 | $4,973.94 |

| ATLANTA | 30108 | $5,091.16 |

| ATLANTA | 30109 | $5,088.62 |

| ATLANTA | 30110 | $5,126.18 |

| ATLANTA | 30111 | $5,579.75 |

| POWDER SPRINGS | 30113 | $5,143.51 |

| AUSTELL | 30114 | $4,774.58 |

| ATLANTA | 30115 | $5,020.24 |

| CONYERS | 30116 | $5,200.95 |

| ATLANTA | 30117 | $5,094.82 |

| ATLANTA | 30118 | $5,037.28 |

| REX | 30120 | $5,205.85 |

| ATLANTA | 30121 | $5,023.49 |

| SMYRNA | 30122 | $5,829.19 |

| TURIN | 30123 | $5,388.47 |

| ATLANTA | 30124 | $4,990.06 |

| CLARKDALE | 30125 | $4,969.95 |

| MARIETTA | 30126 | $6,035.86 |

| WINSTON | 30127 | $5,676.27 |

| LOGANVILLE | 30129 | $5,441.22 |

| JERSEY | 30132 | $5,242.49 |

| PALMETTO | 30134 | $5,525.93 |

| DOUGLASVILLE | 30135 | $5,381.10 |

| SARGENT | 30137 | $5,046.32 |

| DULUTH | 30138 | $5,143.79 |

| STOCKBRIDGE | 30139 | $4,903.91 |

| ATLANTA | 30140 | $4,973.12 |

| HIRAM | 30141 | $5,507.42 |

| COVINGTON | 30143 | $5,029.98 |

| LAWRENCEVILLE | 30144 | $5,008.08 |

| HAMPTON | 30145 | $5,087.86 |

| NORTH METRO | 30146 | $5,082.05 |

| ATLANTA | 30147 | $5,034.04 |

| MARIETTA | 30148 | $5,073.29 |

| ATLANTA | 30149 | $4,913.78 |

| COOSA | 30151 | $4,921.63 |

| SUWANEE | 30152 | $5,163.33 |

| MARIETTA | 30153 | $5,060.95 |

| MARIETTA | 30157 | $5,405.83 |

| MCDONOUGH | 30161 | $4,947.92 |

| DALLAS | 30165 | $4,925.02 |

| MONROE | 30168 | $5,839.82 |

| MANSFIELD | 30170 | $5,096.21 |

| CASSVILLE | 30171 | $4,986.23 |

| SAVANNAH | 30173 | $5,036.24 |

| DOUGLASVILLE | 30175 | $4,890.30 |

| BUFORD | 30176 | $5,149.22 |

| SAVANNAH | 30177 | $5,056.00 |

| MCDONOUGH | 30178 | $5,075.51 |

| LOCUST GROVE | 30179 | $5,220.37 |

| SAVANNAH | 30180 | $5,227.16 |

| GAINESVILLE | 30182 | $5,137.34 |

| BUFORD | 30183 | $5,043.80 |

| SOCIAL CIRCLE | 30184 | $5,038.53 |

| COVINGTON | 30185 | $5,285.96 |

| DACULA | 30187 | $5,559.94 |

| ATLANTA | 30188 | $4,868.31 |

| OXFORD | 30189 | $4,802.97 |

| MONROE | 30204 | $4,945.26 |

| FLOVILLA | 30205 | $5,214.81 |

| DRY BRANCH | 30206 | $5,061.71 |

| GRAY | 30213 | $5,897.79 |

| SAVANNAH | 30214 | $4,962.28 |

| WHITESBURG | 30215 | $4,972.19 |

| JEFFERSON | 30216 | $5,300.64 |

| ACWORTH | 30217 | $4,988.82 |

| TYRONE | 30218 | $5,229.58 |

| GRIFFIN | 30219 | $5,237.23 |

| FORSYTH | 30220 | $4,943.67 |

| MIDLAND | 30222 | $4,915.47 |

| ATLANTA | 30223 | $5,080.89 |

| DALLAS | 30224 | $5,274.80 |

| SUNNY SIDE | 30228 | $5,460.08 |

| GLENN | 30229 | $4,915.45 |

| CLERMONT | 30230 | $5,109.82 |

| ALPHARETTA | 30233 | $5,003.38 |

| BOLINGBROKE | 30234 | $4,993.52 |

| GAY | 30236 | $5,766.15 |

| VILLA RICA | 30238 | $5,917.15 |

| TEMPLE | 30240 | $4,977.32 |

| HADDOCK | 30241 | $4,897.81 |

| BROOKS | 30248 | $5,358.81 |

| MC INTYRE | 30251 | $4,867.48 |

| CARTERSVILLE | 30252 | $5,424.70 |

| RABUN GAP | 30253 | $5,372.42 |

| CARROLLTON | 30256 | $4,985.08 |

| DILLARD | 30257 | $5,082.85 |

| WINDER | 30258 | $5,019.72 |

| CLAYTON | 30259 | $4,962.83 |

| MARIETTA | 30260 | $5,770.18 |

| JULIETTE | 30263 | $4,623.62 |

| SAVANNAH | 30265 | $4,657.43 |

| KENNESAW | 30266 | $4,683.20 |

| NEWBORN | 30268 | $5,526.89 |

| ALPHARETTA | 30269 | $4,642.31 |

| MARIETTA | 30272 | $5,089.90 |

| TALLAPOOSA | 30273 | $5,628.90 |

| HILLSBORO | 30274 | $6,208.22 |

| ESOM HILL | 30275 | $5,524.32 |

| BUCHANAN | 30276 | $5,112.87 |

| MACON | 30277 | $4,709.07 |

| ROSWELL | 30281 | $5,520.31 |

| WACO | 30284 | $5,241.32 |

| MARIETTA | 30285 | $4,942.14 |

| SAVANNAH | 30286 | $4,959.06 |

| NORTH METRO | 30288 | $6,350.41 |

| BREMEN | 30289 | $5,593.00 |

| MACON | 30290 | $5,279.49 |

| SENOIA | 30291 | $6,486.71 |

| HOGANSVILLE | 30292 | $5,089.11 |

| SAVANNAH | 30293 | $4,859.18 |

| AUBURN | 30294 | $6,468.98 |

| LULA | 30295 | $4,962.02 |

| GORDON | 30296 | $6,240.28 |

| JEFFERSONVILLE | 30297 | $6,142.38 |

| ROOPVILLE | 30303 | $6,788.76 |

| CARROLLTON | 30304 | $6,835.84 |

| BOWDON | 30305 | $5,662.59 |

| RED OAK | 30306 | $5,728.18 |

| MONTICELLO | 30307 | $5,798.63 |

| ATLANTA | 30308 | $5,690.93 |

| WILLIAMSON | 30309 | $5,684.08 |

| BOWDON JUNCTION | 30310 | $6,880.31 |

| KINGSTON | 30311 | $6,750.28 |

| MILNER | 30312 | $6,620.73 |

| MACON | 30313 | $6,583.09 |

| LEBANON | 30314 | $6,991.02 |

| GRIFFIN | 30315 | $6,889.33 |

| COLUMBUS | 30316 | $6,647.47 |

| MACON | 30317 | $6,318.01 |

| ALPHARETTA | 30318 | $6,621.02 |

| TAYLORSVILLE | 30319 | $5,516.26 |

| MARBLE HILL | 30322 | $5,618.96 |

| NEWINGTON | 30324 | $5,685.13 |

| ARAGON | 30326 | $5,661.53 |

| MACON | 30327 | $5,687.78 |

| ALPHARETTA | 30328 | $5,446.45 |

| CONCORD | 30329 | $5,683.62 |

| ROSWELL | 30331 | $6,657.55 |

| ROCKMART | 30334 | $6,893.38 |

| MANCHESTER | 30336 | $6,144.45 |

| FORTSON | 30337 | $6,427.71 |

| CALHOUN | 30338 | $5,089.37 |

| TATE | 30339 | $5,588.12 |

| UPATOI | 30340 | $6,151.39 |

| COMMERCE | 30341 | $5,997.85 |

| CULLODEN | 30342 | $5,453.32 |

| OLIVER | 30344 | $6,403.09 |

| STATHAM | 30345 | $5,965.64 |

| EMERSON | 30346 | $5,242.63 |

| WALESKA | 30349 | $6,554.04 |

| IRWINTON | 30350 | $5,308.47 |

| MACON | 30354 | $6,465.21 |

| WHITE | 30360 | $6,088.60 |

| CARROLLTON | 30361 | $5,906.40 |

| COLUMBUS | 30363 | $5,666.29 |

| SAVANNAH | 30369 | $5,989.48 |

| MUSELLA | 30401 | $4,868.37 |

| SILVER CREEK | 30410 | $4,678.69 |

| MURRAYVILLE | 30411 | $4,867.79 |

| LINDALE | 30412 | $4,932.99 |

| ACWORTH | 30413 | $4,871.13 |

| OCONEE | 30414 | $4,936.55 |

| JASPER | 30415 | $5,008.70 |

| MACON | 30417 | $4,771.47 |

| NORRISTOWN | 30420 | $4,691.08 |

| NUNEZ | 30421 | $4,692.36 |

| CARTERSVILLE | 30423 | $4,789.24 |

| FORT BENNING | 30424 | $4,821.12 |

| COMMERCE | 30425 | $4,906.69 |

| CANTON | 30426 | $4,950.35 |

| MOLENA | 30427 | $4,677.76 |

| MACON | 30428 | $4,772.67 |

| ELLIJAY | 30429 | $4,871.30 |

| MACON | 30434 | $4,906.19 |

| STATESBORO | 30436 | $4,409.49 |

| GOOD HOPE | 30438 | $4,684.59 |

| BROOKLET | 30439 | $4,818.15 |

| KENNESAW | 30441 | $4,882.86 |

| JACKSON | 30442 | $4,927.96 |

| DANVILLE | 30445 | $4,778.33 |

| POOLER | 30446 | $5,071.52 |

| ADAIRSVILLE | 30447 | $5,025.77 |

| SHADY DALE | 30448 | $5,024.94 |

| SYLVANIA | 30449 | $5,047.33 |

| JENKINSBURG | 30450 | $4,750.20 |

| CAVE SPRING | 30451 | $4,890.88 |

| BLOOMINGDALE | 30452 | $4,744.19 |

| CRAWFORD | 30453 | $4,688.73 |

| FRANKLIN | 30454 | $4,466.48 |

| ALLENTOWN | 30455 | $4,970.15 |

| RYDAL | 30456 | $4,941.70 |

| MEANSVILLE | 30457 | $4,787.04 |

| TOOMSBORO | 30458 | $4,752.40 |

| YATESVILLE | 30460 | $4,760.76 |

| BRASELTON | 30461 | $5,011.03 |

| ELLIJAY | 30464 | $4,914.92 |

| SPARTA | 30467 | $4,993.68 |

| LAGRANGE | 30470 | $4,795.61 |

| BALL GROUND | 30471 | $4,812.92 |

| GUYTON | 30473 | $4,856.81 |

| FELTON | 30474 | $4,372.55 |

| LEXINGTON | 30477 | $4,874.06 |

| HOWARD | 30501 | $4,770.14 |

| FAYETTEVILLE | 30502 | $4,744.97 |

| WAYNESBORO | 30504 | $4,776.23 |

| ROCKY FORD | 30506 | $5,358.15 |

| CEDARTOWN | 30507 | $4,746.86 |

| BETHLEHEM | 30510 | $4,850.92 |

| CLYO | 30511 | $4,707.93 |

| WEST POINT | 30512 | $4,519.07 |

| MORELAND | 30513 | $4,891.09 |

| FAYETTEVILLE | 30516 | $4,769.92 |

| ZEBULON | 30517 | $4,979.39 |

| THOMASTON | 30518 | $5,343.88 |

| SPRINGFIELD | 30519 | $5,376.21 |

| COLUMBUS | 30520 | $4,744.60 |

| JUNCTION CITY | 30521 | $4,672.14 |

| RINCON | 30522 | $4,854.13 |

| GIRARD | 30523 | $4,616.17 |

| MONTROSE | 30525 | $5,180.41 |

| ROME | 30527 | $5,234.41 |

| SMARR | 30528 | $4,621.63 |

| SEVILLE | 30529 | $5,021.29 |

| GENEVA | 30530 | $5,053.75 |

| BARNESVILLE | 30531 | $4,560.77 |

| CISCO | 30533 | $4,908.48 |

| GRANTVILLE | 30534 | $4,696.07 |

| THE ROCK | 30535 | $4,657.15 |

| SARDIS | 30536 | $5,015.63 |

| PERKINS | 30537 | $5,191.61 |

| TALBOTTON | 30538 | $4,510.80 |

| WOODLAND | 30540 | $4,979.35 |

| BELLVILLE | 30541 | $4,775.87 |

| ALSTON | 30542 | $4,845.24 |

| WARM SPRINGS | 30543 | $4,918.76 |

| SAVANNAH | 30545 | $4,623.90 |

| ARNOLDSVILLE | 30546 | $4,582.03 |

| CUMMING | 30547 | $4,782.91 |

| RAYLE | 30548 | $4,852.29 |

| LIZELLA | 30549 | $5,284.10 |

| DAHLONEGA | 30552 | $4,615.20 |

| MILLEN | 30553 | $4,683.47 |

| COLUMBUS | 30554 | $5,103.44 |

| COLUMBUS | 30555 | $4,794.58 |

| PINE MOUNTAIN VALLEY | 30557 | $4,825.52 |

| ROME | 30558 | $4,835.60 |

| RESACA | 30559 | $4,750.70 |

| NELSON | 30560 | $4,821.96 |

| PINE MOUNTAIN | 30562 | $4,874.88 |

| SAVANNAH | 30563 | $4,588.12 |

| GILLSVILLE | 30564 | $5,034.63 |

| BOX SPRINGS | 30565 | $4,747.26 |

| CUSSETA | 30566 | $4,745.43 |

| WASHINGTON | 30567 | $4,738.35 |

| MILLEDGEVILLE | 30568 | $5,203.55 |

| MILLEDGEVILLE | 30571 | $4,639.33 |

| SANDERSVILLE | 30572 | $4,723.12 |

| GREENVILLE | 30573 | $4,794.92 |

| HARALSON | 30575 | $4,709.63 |

| SHILOH | 30576 | $4,635.51 |

| STILLMORE | 30577 | $4,557.92 |

| COLUMBUS | 30580 | $4,530.56 |

| MOUNT BERRY | 30581 | $4,605.78 |

| GOUGH | 30582 | $4,545.35 |

| DAHLONEGA | 30597 | $4,928.23 |

| WRIGHTSVILLE | 30598 | $4,651.43 |

| GARFIELD | 30601 | $4,452.36 |

| CUMMING | 30602 | $4,485.51 |

| LOUISVILLE | 30605 | $4,533.33 |

| APPLING | 30606 | $4,443.87 |

| FAIRMOUNT | 30607 | $4,702.71 |

| LAGRANGE | 30609 | $4,524.41 |

| MAXEYS | 30619 | $4,931.18 |

| LINCOLNTON | 30620 | $4,967.28 |

| HAWKINSVILLE | 30621 | $4,775.19 |

| MAUK | 30622 | $4,582.17 |

| BLUE RIDGE | 30623 | $4,762.01 |

| PULASKI | 30624 | $4,726.21 |

| TALKING ROCK | 30625 | $4,540.59 |

| BUTLER | 30627 | $4,716.53 |

| STEPHENS | 30628 | $4,636.57 |

| HAMILTON | 30629 | $4,635.57 |

| ADRIAN | 30630 | $4,989.03 |

| WAVERLY HALL | 30631 | $4,876.61 |

| MIDVILLE | 30633 | $4,526.48 |

| PINEVIEW | 30634 | $4,720.81 |

| MITCHELL | 30635 | $4,787.20 |

| CRAWFORDVILLE | 30638 | $4,727.92 |

| KEYSVILLE | 30639 | $4,791.03 |

| KITE | 30641 | $5,009.78 |

| MOUNTAIN CITY | 30642 | $4,536.91 |

| WADLEY | 30643 | $4,678.49 |

| TENNILLE | 30645 | $4,731.55 |

| TENNGA | 30646 | $4,632.81 |

| HAGAN | 30647 | $4,589.97 |

| BARTOW | 30648 | $4,973.00 |

| CUMMING | 30650 | $4,569.67 |

| ELLAVILLE | 30655 | $5,402.66 |

| VARNELL | 30656 | $5,307.03 |

| CRANDALL | 30660 | $4,930.97 |

| SWAINSBORO | 30662 | $4,649.41 |

| WOODSTOCK | 30663 | $4,657.20 |

| ALAMO | 30664 | $4,713.64 |

| GRACEWOOD | 30665 | $4,528.02 |

| LUTHERSVILLE | 30666 | $5,046.36 |

| ROBERTA | 30667 | $4,887.09 |

| ELLABELL | 30668 | $4,677.82 |

| STAPLETON | 30669 | $4,856.47 |

| SUGAR VALLEY | 30671 | $4,896.34 |

| FORT STEWART | 30673 | $4,916.60 |

| TUNNEL HILL | 30677 | $4,557.68 |

| HARRISON | 30678 | $4,849.27 |

| WRENS | 30680 | $5,187.57 |

| WOODBURY | 30683 | $4,602.14 |

| PLAINVILLE | 30701 | $5,056.99 |

| UVALDA | 30705 | $4,687.99 |

| UNION POINT | 30707 | $4,714.33 |

| CHERRY LOG | 30708 | $4,944.43 |

| COCHRAN | 30710 | $4,819.99 |

| JACKSONVILLE | 30711 | $4,869.00 |

| DAVISBORO | 30720 | $4,813.19 |

| WARTHEN | 30721 | $4,778.66 |

| HOSCHTON | 30724 | $4,819.62 |

| ALTO | 30725 | $4,708.06 |

| WHITE PLAINS | 30726 | $4,725.62 |

| AVERA | 30728 | $4,650.74 |

| REYNOLDS | 30730 | $4,806.74 |

| ARMUCHEE | 30731 | $4,777.55 |

| FLOWERY BRANCH | 30732 | $4,824.53 |

| BUENA VISTA | 30733 | $4,858.46 |

| NORWOOD | 30734 | $4,822.16 |

| RUPERT | 30735 | $4,922.83 |

| RHINE | 30736 | $4,687.96 |

| MATTHEWS | 30738 | $4,762.12 |

| BRONWOOD | 30739 | $4,667.13 |

| PEMBROKE | 30740 | $4,797.38 |

| MAYSVILLE | 30741 | $4,625.92 |

| DUDLEY | 30742 | $4,694.40 |

| MARTIN | 30746 | $4,865.26 |

| OAKMAN | 30747 | $4,807.12 |

| MESENA | 30750 | $4,706.22 |

| RANGER | 30751 | $4,872.27 |

| MORGANTON | 30752 | $4,780.81 |

| DOVER | 30753 | $4,698.17 |

| HELENA | 30755 | $4,862.95 |

| CAMAK | 30756 | $4,869.18 |

| JEWELL | 30757 | $4,738.51 |

| COHUTTA | 30802 | $4,904.20 |

| ETON | 30803 | $4,848.32 |

| METTER | 30805 | $4,766.23 |

| IDEAL | 30806 | $4,670.53 |

| ABBEVILLE | 30807 | $4,820.39 |

| ELLERSLIE | 30808 | $4,742.22 |

| DALTON | 30809 | $4,711.12 |

| TWIN CITY | 30810 | $4,807.23 |

| CATAULA | 30811 | $4,911.20 |

| MILAN | 30812 | $4,867.60 |

| SAPELO ISLAND | 30813 | $4,557.89 |

| GIBSON | 30814 | $4,790.05 |

| SUMMERVILLE | 30815 | $4,782.61 |

| LYERLY | 30816 | $4,876.31 |

| MELDRIM | 30817 | $4,894.48 |

| WOODSTOCK | 30818 | $4,837.07 |

| WARRENTON | 30819 | $4,822.18 |

| ROCKY FACE | 30820 | $4,880.07 |

| LUMBER CITY | 30821 | $4,841.08 |

| TARRYTOWN | 30822 | $4,941.45 |

| SAVANNAH | 30823 | $4,865.57 |

| TALLULAH FALLS | 30824 | $4,788.36 |

| MC CAYSVILLE | 30828 | $4,799.49 |

| FRANKLIN SPRINGS | 30830 | $4,971.64 |

| HARLEM | 30833 | $4,861.95 |

| DAISY | 30901 | $4,703.12 |

| THOMSON | 30904 | $4,688.26 |

| ELBERTON | 30905 | $4,679.12 |

| SOPERTON | 30906 | $4,725.37 |

| OGLETHORPE | 30907 | $4,568.84 |

| HOMER | 30909 | $4,665.54 |

| HEPHZIBAH | 30912 | $4,697.70 |

| VIENNA | 31001 | $4,816.48 |

| LEARY | 31002 | $4,885.32 |

| TRENTON | 31003 | $4,988.07 |

| DALTON | 31004 | $5,230.22 |

| MOUNT VERNON | 31005 | $4,575.65 |

| MENLO | 31006 | $4,889.24 |

| TYBEE ISLAND | 31007 | $4,769.18 |

| GAINESVILLE | 31008 | $4,675.45 |

| EPWORTH | 31009 | $4,742.15 |

| BISHOP | 31011 | $4,774.66 |

| CHAUNCEY | 31012 | $4,615.63 |

| CANTON | 31013 | $4,730.49 |

| MONTEZUMA | 31014 | $4,854.06 |

| GLENWOOD | 31015 | $4,382.24 |

| CLAXTON | 31016 | $5,050.99 |

| GAINESVILLE | 31017 | $5,002.39 |

| BOWERSVILLE | 31018 | $4,853.53 |

| BYROMVILLE | 31019 | $4,698.18 |

| BLYTHE | 31020 | $5,297.37 |

| DENTON | 31021 | $4,461.93 |

| PRESTON | 31022 | $4,832.07 |

| SAVANNAH | 31023 | $4,725.36 |

| RISING FAWN | 31024 | $4,626.41 |

| BOSTWICK | 31025 | $4,681.83 |

| STATESBORO | 31027 | $4,410.93 |

| MC RAE | 31028 | $4,665.24 |

| EDEN | 31029 | $5,272.83 |

| UNADILLA | 31030 | $4,701.33 |

| SCOTLAND | 31031 | $5,101.93 |

| PINEHURST | 31032 | $5,294.02 |

| HAZLEHURST | 31033 | $5,217.94 |

| STATESBORO | 31035 | $4,862.66 |

| MINERAL BLUFF | 31036 | $4,894.48 |

| PORTAL | 31037 | $4,820.63 |

| NICHOLSON | 31038 | $5,145.73 |

| GAINESVILLE | 31039 | $4,972.28 |

| OAKWOOD | 31041 | $4,816.97 |

| CHESTNUT MOUNTAIN | 31042 | $5,041.74 |

| CANON | 31044 | $5,098.59 |

| COBB | 31045 | $4,820.39 |

| REGISTER | 31046 | $5,171.24 |

| FORT STEWART | 31047 | $4,559.27 |

| DEARING | 31049 | $4,875.33 |

| CADWELL | 31050 | $4,684.28 |

| WILDWOOD | 31051 | $4,652.70 |

| PENDERGRASS | 31052 | $4,928.27 |

| HINESVILLE | 31054 | $5,211.05 |

| HIGH SHOALS | 31055 | $4,756.02 |

| CLINCHFIELD | 31057 | $4,725.45 |

| FARMINGTON | 31058 | $4,893.76 |

| BOWMAN | 31060 | $4,810.39 |

| GRAYSVILLE | 31061 | $4,916.04 |

| MARSHALLVILLE | 31062 | $4,916.04 |

| AUGUSTA | 31063 | $4,773.94 |

| EASTMAN | 31064 | $5,089.74 |

| DOERUN | 31065 | $4,948.86 |

| SUCHES | 31066 | $5,036.55 |

| DEWY ROSE | 31067 | $5,030.14 |

| DE SOTO | 31068 | $4,784.43 |

| FORT GAINES | 31069 | $4,540.54 |

| CARLTON | 31070 | $4,753.45 |

| PLAINS | 31071 | $4,882.36 |

| SMITHVILLE | 31072 | $4,326.20 |

| CHICKAMAUGA | 31075 | $4,697.80 |

| PARROTT | 31076 | $4,846.40 |

| ALLENHURST | 31077 | $4,837.37 |

| SHARON | 31078 | $4,865.81 |

| ALMA | 31079 | $4,205.41 |

| BLUFFTON | 31081 | $4,840.77 |

| EVANS | 31082 | $4,915.53 |

| FLEMING | 31083 | $4,753.68 |

| TALMO | 31084 | $4,945.85 |

| SHARPSBURG | 31085 | $4,996.34 |

| ARLINGTON | 31086 | $4,946.84 |

| FLINTSTONE | 31087 | $4,978.68 |

| BALDWIN | 31088 | $4,669.58 |

| LOOKOUT MOUNTAIN | 31089 | $4,873.26 |

| AUGUSTA | 31090 | $4,983.70 |

| ATHENS | 31091 | $4,754.81 |

| FORT VALLEY | 31092 | $4,782.34 |

| DEXTER | 31093 | $4,660.23 |

| TRION | 31094 | $4,853.43 |

| RENTZ | 31096 | $4,907.46 |

| AUGUSTA | 31097 | $4,981.78 |

| DAWSONVILLE | 31098 | $4,644.45 |

| HARTSFIELD | 31201 | $5,121.66 |

| WESTON | 31204 | $5,015.73 |

| FORT OGLETHORPE | 31206 | $5,039.42 |

| COLLINS | 31207 | $5,082.36 |

| COBBTOWN | 31210 | $5,029.31 |

| LESLIE | 31211 | $5,079.86 |

| NICHOLLS | 31216 | $5,012.64 |

| REIDSVILLE | 31217 | $5,142.90 |

| AUGUSTA | 31220 | $5,063.83 |

| CHATSWORTH | 31301 | $4,713.70 |

| RINGGOLD | 31302 | $4,989.34 |

| RICHMOND HILL | 31303 | $4,964.77 |

| NEWTON | 31304 | $4,509.62 |

| MANASSAS | 31305 | $4,461.61 |

| KNOXVILLE | 31307 | $4,755.71 |

| LAVONIA | 31308 | $4,865.65 |

| ORCHARD HILL | 31309 | $4,710.44 |

| ELKO | 31312 | $4,973.50 |

| AUGUSTA | 31313 | $4,736.32 |

| AILEY | 31314 | $4,863.11 |

| HARTWELL | 31315 | $4,742.67 |

| MORGAN | 31316 | $4,550.57 |

| TIGNALL | 31318 | $4,806.68 |

| GLENNVILLE | 31319 | $4,618.27 |

| BYRON | 31320 | $4,633.86 |

| RICHLAND | 31321 | $4,836.61 |

| LENOX | 31322 | $4,999.18 |

| SALE CITY | 31323 | $4,591.60 |

| CARNESVILLE | 31324 | $4,686.78 |

| BONEVILLE | 31326 | $4,950.47 |

| WARNER ROBINS | 31327 | $4,808.33 |

| LUMPKIN | 31328 | $4,776.83 |

| EDISON | 31329 | $4,955.89 |

| SHELLMAN | 31331 | $4,510.33 |

| ROCK SPRING | 31401 | $5,375.74 |

| OCILLA | 31404 | $5,135.07 |

| BAXLEY | 31405 | $5,385.07 |

| AUGUSTA | 31406 | $4,931.25 |

| CENTERVILLE | 31407 | $5,107.06 |

| COLEMAN | 31408 | $5,165.70 |

| ALBANY | 31409 | $5,292.92 |

| SURRENCY | 31410 | $4,795.20 |

| BRISTOL | 31411 | $4,920.99 |

| WARNER ROBINS | 31415 | $5,358.31 |

| SASSER | 31419 | $4,762.20 |

| BAINBRIDGE | 31421 | $5,036.70 |

| BLAKELY | 31501 | $4,565.04 |

| BROXTON | 31503 | $4,585.05 |

| NEWNAN | 31510 | $4,712.64 |

| RUTLEDGE | 31512 | $4,650.32 |

| DEMOREST | 31513 | $4,665.90 |

| LOUVALE | 31516 | $4,634.25 |

| CLIMAX | 31518 | $4,661.10 |

| MEIGS | 31519 | $4,657.91 |

| LILLY | 31520 | $4,418.13 |

| TOCCOA FALLS | 31522 | $4,390.10 |

| BRINSON | 31523 | $4,392.66 |

| LA FAYETTE | 31525 | $4,375.96 |

| AMBROSE | 31527 | $4,379.69 |

| OCHLOCKNEE | 31532 | $4,763.84 |

| OMAHA | 31533 | $4,625.66 |

| ROYSTON | 31535 | $4,588.40 |

| SCREVEN | 31537 | $4,522.00 |

| DONALSONVILLE | 31539 | $4,752.41 |

| WARNER ROBINS | 31542 | $4,606.38 |

| AMERICUS | 31543 | $4,414.33 |

| BAINBRIDGE | 31544 | $4,853.81 |

| PEACHTREE CITY | 31545 | $4,608.00 |

| SAUTEE NACOOCHEE | 31546 | $4,491.30 |

| MERSHON | 31547 | $4,303.48 |

| WEST GREEN | 31548 | $4,385.25 |

| COLBERT | 31549 | $4,795.64 |

| GEORGETOWN | 31550 | $4,537.77 |

| COMER | 31551 | $4,639.04 |

| TIGER | 31552 | $4,533.03 |

| DAWSON | 31553 | $4,558.52 |

| CUTHBERT | 31554 | $4,689.06 |

| BLACKSHEAR | 31555 | $4,624.09 |

| MIDWAY | 31556 | $4,618.40 |

| WARESBORO | 31557 | $4,612.70 |

| HULL | 31558 | $4,291.24 |

| DAMASCUS | 31560 | $4,646.85 |

| ANDERSONVILLE | 31561 | $4,393.71 |

| EATONTON | 31562 | $4,577.63 |

| ROSSVILLE | 31563 | $4,661.54 |

| DOUGLAS | 31564 | $4,633.06 |

| MORRIS | 31565 | $4,357.23 |

| ODUM | 31566 | $4,467.14 |

| HELEN | 31567 | $4,636.96 |

| NEWNAN | 31568 | $4,329.49 |

| CLEVELAND | 31569 | $4,296.42 |

| FOWLSTOWN | 31601 | $4,058.10 |

| IRON CITY | 31602 | $4,044.80 |

| OFFERMAN | 31605 | $3,977.77 |

| MERIDIAN | 31606 | $4,020.26 |

| COLQUITT | 31620 | $4,247.91 |

| CLARKESVILLE | 31622 | $4,588.77 |

| CHESTER | 31623 | $4,481.14 |

| LAKEMONT | 31624 | $4,569.54 |

| PATTERSON | 31625 | $4,079.37 |

| AMERICUS | 31626 | $4,210.42 |

| CAIRO | 31627 | $4,244.75 |

| WHIGHAM | 31629 | $4,206.31 |

| JAKIN | 31630 | $4,447.20 |

| JESUP | 31631 | $4,502.67 |

| HOBOKEN | 31632 | $4,022.80 |

| WILEY | 31634 | $4,474.11 |

| ENIGMA | 31635 | $4,435.56 |

| WINTERVILLE | 31636 | $4,332.22 |

| ELLENTON | 31637 | $4,672.96 |

| SPARKS | 31638 | $4,093.21 |

| ALBANY | 31639 | $4,568.87 |

| WILLACOOCHEE | 31641 | $4,420.18 |

| BACONTON | 31642 | $4,572.42 |

| RICEBORO | 31643 | $4,095.01 |

| ILA | 31645 | $4,371.69 |

| ALAPAHA | 31647 | $4,597.84 |

| CAMILLA | 31648 | $4,486.13 |

| DOUGLAS | 31649 | $4,420.23 |

| MOUNT AIRY | 31650 | $4,595.14 |

| WAYCROSS | 31698 | $4,030.81 |

| BOGART | 31699 | $3,976.82 |

| HIAWASSEE | 31701 | $4,661.60 |

| SAINT GEORGE | 31705 | $4,496.95 |

| BONAIRE | 31707 | $4,596.88 |

| PEARSON | 31709 | $4,612.35 |

| MADISON | 31711 | $4,627.79 |

| AXSON | 31712 | $4,343.61 |

| NASHVILLE | 31714 | $4,295.11 |

| AUGUSTA | 31716 | $4,591.89 |

| ATTAPULGUS | 31719 | $4,643.72 |

| WAYCROSS | 31720 | $4,540.85 |

| ALBANY | 31721 | $4,563.44 |

| CORNELIA | 31722 | $4,538.75 |

| KATHLEEN | 31727 | $4,501.63 |

| NAHUNTA | 31730 | $4,588.59 |

| TOCCOA | 31733 | $4,305.51 |

| GROVETOWN | 31735 | $4,744.26 |

| WATKINSVILLE | 31738 | $4,289.46 |

| WRAY | 31739 | $4,446.65 |

| LUDOWICI | 31743 | $4,719.84 |

| YOUNG HARRIS | 31744 | $4,723.90 |

| BARWICK | 31747 | $4,600.45 |

| BUCKHEAD | 31749 | $4,602.75 |

| PERRY | 31750 | $4,197.86 |

| BERLIN | 31756 | $4,695.27 |

| MANOR | 31757 | $4,236.28 |

| GREENSBORO | 31763 | $4,513.29 |

| ATHENS | 31764 | $4,690.32 |

| MILLWOOD | 31765 | $4,653.86 |

| TURNERVILLE | 31768 | $4,329.23 |

| SILOAM | 31769 | $4,308.54 |

| DANIELSVILLE | 31771 | $4,303.76 |

| ATHENS | 31772 | $4,466.26 |

| FOLKSTON | 31773 | $4,649.76 |

| BLAIRSVILLE | 31774 | $4,667.01 |

| LEESBURG | 31775 | $4,338.14 |

| EASTANOLLEE | 31778 | $4,284.48 |

| TOWNSEND | 31779 | $4,508.98 |

| CRESCENT | 31780 | $4,714.88 |

| PELHAM | 31781 | $4,458.16 |

| FARGO | 31783 | $4,202.67 |

| BROOKFIELD | 31784 | $4,672.47 |

| ALBANY | 31787 | $4,714.77 |

| JESUP | 31788 | $4,310.47 |

| STATENVILLE | 31789 | $4,377.38 |

| ATHENS | 31790 | $4,326.14 |

| ARGYLE | 31791 | $4,448.80 |

| HOMERVILLE | 31792 | $4,231.01 |

| WAYNESVILLE | 31793 | $4,300.63 |

| ROCKLEDGE | 31794 | $4,337.12 |

| OAKFIELD | 31795 | $4,301.61 |

| DUBLIN | 31796 | $4,395.02 |

| DARIEN | 31798 | $4,557.10 |

| POULAN | 31801 | $4,918.32 |

| CEDAR SPRINGS | 31803 | $4,844.66 |

| ATHENS | 31804 | $4,812.62 |

| SYLVESTER | 31805 | $4,917.42 |

| DU PONT | 31806 | $4,869.45 |

| COTTON | 31807 | $4,814.42 |

| ATHENS | 31808 | $5,058.24 |

| LAKELAND | 31810 | $4,945.45 |

| STOCKTON | 31811 | $4,886.34 |

| NAYLOR | 31812 | $4,952.36 |

| BRUNSWICK | 31814 | $4,655.97 |

| HORTENSE | 31815 | $4,669.56 |

| EAST DUBLIN | 31816 | $5,058.29 |

| LYONS | 31820 | $5,247.46 |

| WARWICK | 31821 | $4,649.73 |

| SEA ISLAND | 31822 | $4,921.48 |

| BRUNSWICK | 31823 | $4,925.21 |

| SAINT SIMONS ISLAND | 31824 | $4,762.60 |

| KINGSLAND | 31825 | $4,674.38 |

| CORDELE | 31826 | $4,915.04 |

| JEKYLL ISLAND | 31827 | $4,940.93 |

| SUMNER | 31829 | $5,053.92 |

| BRUNSWICK | 31830 | $4,932.76 |

| VIDALIA | 31831 | $4,884.10 |

| RAY CITY | 31832 | $4,694.52 |

| WAVERLY | 31833 | $4,964.51 |

| ARABI | 31836 | $4,937.03 |

| OMEGA | 31901 | $4,914.17 |

| TIFTON | 31903 | $5,037.10 |

| LAKE PARK | 31904 | $5,080.59 |

| CALVARY | 31905 | $5,023.47 |

| WHITE OAK | 31906 | $4,955.05 |

| MOULTRIE | 31907 | $4,925.60 |

| PITTS | 31909 | $4,927.88 |

| SYCAMORE | 39813 | $4,708.81 |

| CAIRO | 39815 | $4,567.26 |

| MOULTRIE | 39817 | $4,643.66 |

| MYSTIC | 39819 | $4,659.18 |

| CHULA | 39823 | $4,658.51 |

| NORMAN PARK | 39824 | $4,712.02 |

| KINGS BAY | 39825 | $4,651.02 |

| TY TY | 39826 | $4,836.75 |

| TIFTON | 39827 | $4,609.95 |

| WOODBINE | 39828 | $4,325.82 |

| ASHBURN | 39829 | $4,331.84 |

| SAINT MARYS | 39832 | $4,457.55 |

| COOLIDGE | 39834 | $4,654.37 |

| PAVO | 39836 | $4,664.14 |

| ADEL | 39837 | $4,617.45 |

| CECIL | 39840 | $4,634.36 |

| THOMASVILLE | 39841 | $4,628.47 |

| THOMASVILLE | 39842 | $4,634.48 |

| BOSTON | 39845 | $4,646.72 |

| DIXIE | 39846 | $4,668.10 |

| ROCHELLE | 39851 | $4,718.44 |

| REBECCA | 39852 | $4,621.44 |

| FITZGERALD | 39854 | $4,635.97 |

| QUITMAN | 39859 | $4,618.61 |

| MORVEN | 39861 | $4,608.88 |

| BARNEY | 39862 | $4,781.89 |

| VALDOSTA | 39866 | $4,678.08 |

| VALDOSTA | 39867 | $4,625.58 |

| VALDOSTA | 39870 | $4,684.81 |

| HAHIRA | 39877 | $4,714.03 |

| VALDOSTA | 39885 | $4,660.19 |

| VALDOSTA | 39886 | $4,668.10 |

| MOODY A F B | 39897 | $4,609.88 |

Read more:

- Concord Specialty Insurance Company Car Insurance Review

- Concord General Mutual Insurance Company Car Insurance Review

Let’s take a closer look at how ZIP codes affect car insurance in Georgia.

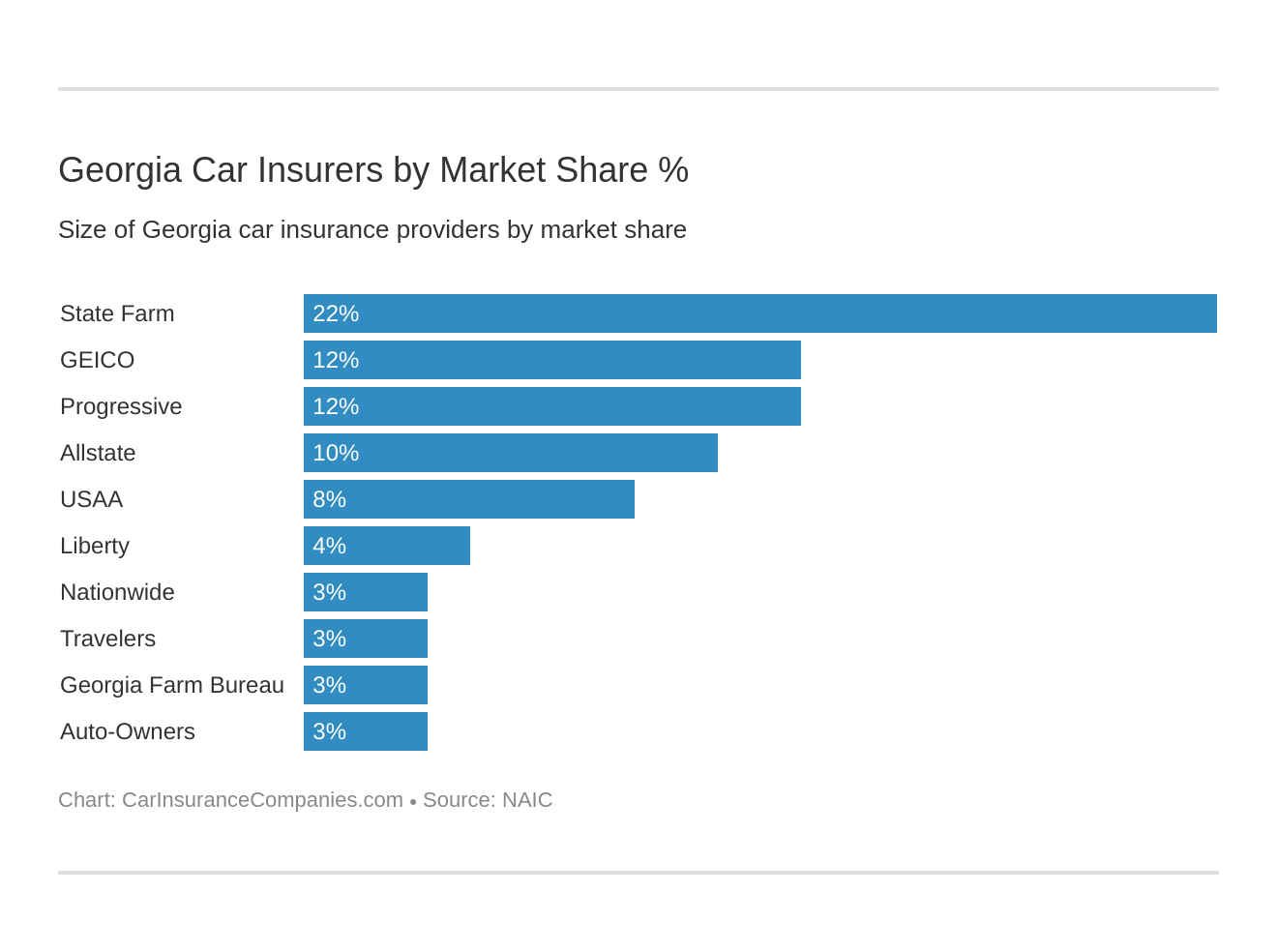

Best Georgia Car Insurance Companies

There are so many car insurance companies out there that it can feel extremely overwhelming. Especially when they’re all competing for your business.

In this section, we’ll touch on some of the best car insurance companies in Georgia based on factors such as their financial ratings, their complaint index, and more.

Largest Companies Financial Rating

What does it say about an insurance company if they’re looking at your financial health, but they don’t have very good financial health themselves? Nothing good for them.

In the table below, we’ve gone through and listed the ten largest car insurance companies in Georgia with their financial ratings. The higher the rating, the better that the company’s financial health is.

| Providers (Listed by Size, Largest at the Top): | A.M. Best Rating: |

|---|---|

| State Farm | A++ |

| Berkshire Hathaway | A++ |

| Progressive | A+ |

| Allstate | A+ |

| United Service Automobile Association | A++ |

| Liberty Mutual | A |

| Nationwide | A+ |

| Travelers | A++ |

| Georgia Farm Bureau | B+ |

| Auto Owners | A++ |

Read more: Berkshire Hathaway Insurance Review

Companies with Best Ratings

As a consumer, you will naturally want to find a company that has been well received by other customers. It’s the nature of business. If you hear a company has really good customer satisfaction, chances are you’ll give it more of a chance, as it helps you know how people such as yourself are treated by such a company.

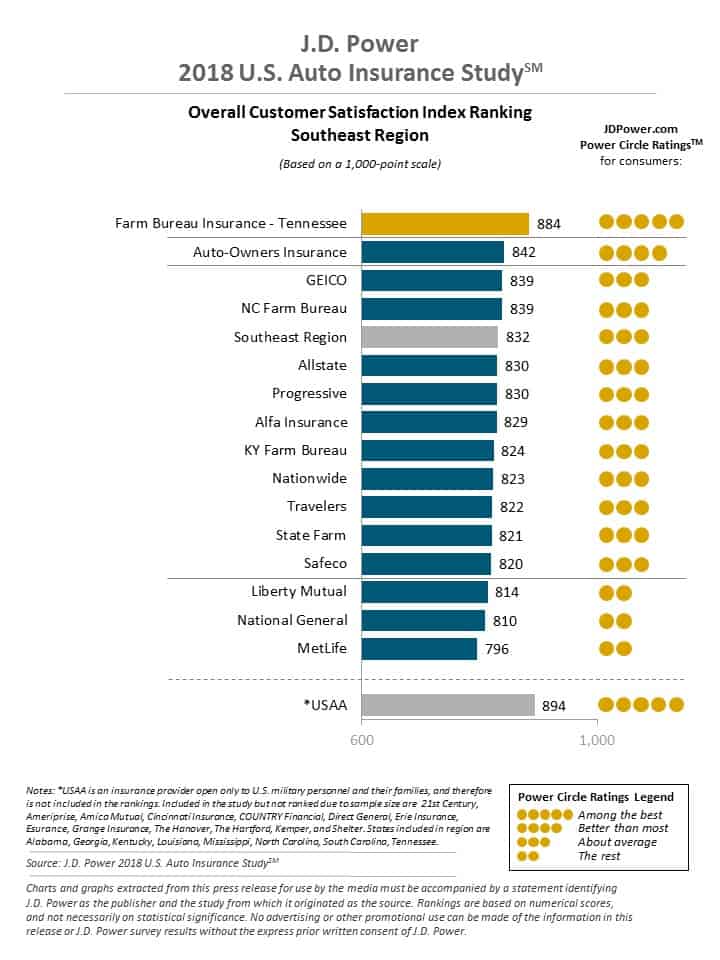

Well, J.D. Powers and Associates performed an overall customer satisfaction index ranking for the various regions across the United States. The chart displayed below is the satisfaction index ranking for the southeast region, where Georgia falls.

Companies with Most Complaints in Georgia

Just like we mentioned above, how satisfied other customers are with a company can be indicative of what you can expect should you chose to have a policy with that company.

We’ve shown you the best customer satisfaction in Georgia, but what about the companies with the most complaints?

| Top Providers by Market Share in GA | Complaints 2018 | Complaints 2017 | Complaints 2016 | Complaints 2015 |

|---|---|---|---|---|

| State Farm | 1266 | 1550 | 9274 | 6559 |

| Geico | 247 | 354 | 283 | 243 |

| Progressive | 0 | 2 | 4 | 3 |

| Allstate | 9 | 16 | 18 | 17 |

| USAA | 273 | 351 | 340 | 282 |

| Liberty Mutual | 19 | 13 | 8 | 1 |

| Nationwide | 0 | 3 | 6 | 3 |

| Travelers | 4 | 2 | 5 | 1 |

| Georgia Farm Bureau | 16 | 16 | 23 | 19 |

| Auto-Owners | 81 | 101 | 100 | 123 |

Cheapest Companies in Georgia

| Company | Average | Compared to State Average | Percent Compared to State Average |

|---|---|---|---|

| Allstate F&C | $4,210.70 | -$756.13 | -17.96% |

| Geico General | $2,977.19 | -$1,989.64 | -66.83% |

| Safeco Ins Co of IL | $10,053.44 | $5,086.61 | 50.60% |

| Nationwide Mutual | $6,484.90 | $1,518.07 | 23.41% |

| Progressive Mountain | $4,499.22 | -$467.61 | -10.39% |

| State Farm Mutual Auto | $3,384.88 | -$1,581.95 | -46.74% |

| USAA | $3,157.46 | -$1,809.37 | -57.30% |

Commute Rates by Companies

| Group | 10 miles commute/6000 annual mileage. | 25 miles commute/ 12000 annual mileage |

|---|---|---|

| Liberty Mutual | $10,053.44 | $10,053.44 |

| Nationwide | $6,484.90 | $6,484.90 |

| Progressive | $4,499.22 | $4,499.22 |

| Allstate | $4,115.26 | $4,306.14 |

| State Farm | $3,384.88 | $3,384.88 |

| USAA | $3,013.71 | $3,301.21 |

| Geico | $2,926.71 | $3,027.68 |

Coverage Level Rates by Companies

| Group | High | Medium | Low |

|---|---|---|---|

| Allstate | $4,496.20 | $4,254.86 | $3,881.04 |

| Geico | $3,175.82 | $2,991.78 | $2,763.97 |

| Liberty Mutual | $10,524.93 | $9,998.75 | $9,636.66 |

| Nationwide | $6,518.06 | $6,602.52 | $6,334.12 |

| Progressive | $4,949.64 | $4,426.83 | $4,121.20 |

| State Farm | $3,599.32 | $3,387.35 | $3,167.98 |

| USAA | $3,317.90 | $3,141.23 | $3,013.26 |

Credit History Rates by Companies

| Group | Poor | Fair | Good |

|---|---|---|---|

| Allstate | $5,456.39 | $3,792.84 | $3,382.87 |

| Geico | $3,780.93 | $2,607.81 | $2,542.83 |

| Liberty Mutual | $14,403.23 | $8,834.05 | $6,923.06 |

| Nationwide | $7,719.34 | $6,258.58 | $5,476.79 |

| Progressive | $5,074.80 | $4,376.95 | $4,045.92 |

| State Farm | $4,798.23 | $2,988.35 | $2,368.08 |

| USAA | $4,110.85 | $2,892.23 | $2,469.31 |

Driving Record Rates by Companies

| Group | Clean record | With 1 speeding violation | With 1 accident | With 1 DUI |

|---|---|---|---|---|

| Allstate | $3,465.70 | $3,647.83 | $5,365.97 | $4,363.29 |

| Geico | $1,991.22 | $2,244.40 | $2,493.90 | $5,179.25 |

| Liberty Mutual | $7,632.75 | $10,164.83 | $10,428.16 | $11,988.03 |

| Nationwide | $4,993.04 | $6,053.51 | $5,859.64 | $9,033.42 |

| Progressive | $3,524.11 | $4,102.75 | $6,212.74 | $4,157.29 |

| State Farm | $3,084.80 | $3,384.88 | $3,684.98 | $3,384.88 |

| USAA | $2,416.20 | $2,693.63 | $3,058.95 | $4,461.07 |

Largest Car Insurance Companies in Georgia

Largest Car Insurance Companies by State

| Insurance Company | Rank | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| #1 | $1,937,806 | 68.72% | 22.49% | |

| #2 | $1,051,005 | 81.23% | 12.20% | |

| #3 | $1,001,828 | 63.09% | 11.63% | |

| #4 | $820,479 | 51.96% | 9.52% | |

| #5 | $706,276 | 91.01% | 8.20% | |

| #6 | $335,540 | 66.84% | 3.89% |

| #7 | $267,971 | 77.10% | 3.11% |

| #8 | $266,864 | 71.60% | 3.10% | |

| #9 | $261,432 | 64.70% | 3.03% |

| #10 | $224,705 | 70.36% | 2.61% |

Read more:

- Georgia Farm Bureau Mutual Insurance Company Car Insurance Review

- Georgia Farm Bureau Casualty Insurance Company Car Insurance Review

- Top 10 Georgia Car Insurance Companies

Number of Insurers

When it comes to the different types of car insurance providers, there are two that you need to know about. Domestic providers and Foreign providers.

- Domestic Providers are insurance companies that is admitted by and formed under the laws under the state in which insurance is written.

- Foreign Providers are insurance companies that are formed under the laws of any other state.

So how many of each of these providers do you have in Georgia? Well, there are currently 23 domestic providers and 988 foreign providers.

With this in mind, it gives you a large number of choices to choose from.

Georgia State Laws

In this section, we’ll move on to some of the laws specific to this beautiful southern state. We’ll cover topics such as specific Georgia car insurance laws, safety laws, and more.

Keep reading to learn more.

Car insurance Laws

In Georgia, there are specific laws that both you, and car insurance providers, have to follow. So in order to prevent yourself from getting any tickets or fines for laws you didn’t even know existed, read all of the car insurance laws you’ll need to know below.

How State Laws for Insurance are Determined

When it comes to how insurance laws are determined, according to the National Association of Insurance Commissioners (NAIC):

“Regarding rate filings, prior approval for statutory coverages only; all other coverages will be file and use. Regarding form filings, prior approval – Directive 91-PC-23 is filing standard for loss cost.”

Take a look at these 6 major factors affecting auto insurance rates in Georgia.

Windshield Coverage

One type of coverage a lot of people don’t think about is Windshield coverage. Should you ever crack or break your windshield, this coverage can really come in handy. (For more information, read our “Does Geico cover windshield replacement?“).

In Georgia, if you should have to repair/replace your windshield, your provider can use aftermarket parts in order to fix the damages, as long as you agree to it that is. You also have the option of using OEM parts, however, you will be responsible for the difference in price should you chose this option.

High-Risk Insurance

If you have a less than stellar driving record, chances are you’ve been labeled as something known as a high-risk driver. If so, you also have probably had a hard time trying to find insurance coverage.

In Georgia, if you are considered a high-risk driver, you will need to file for something known as an SR22A form.

If you have had any of the following issues, you may be required to carry this form with you in order to legally drive:

- Involved in an accident without insurance

- License suspension/revocation due to a DUI

- Labeled as a negligent driver

- Too many points on your driving record.

Another option for high-risk drivers is through something known as the Georgia Automobile Insurance Plan (GAIP). Through this plan, the program will assign you to an insurance provider, who will then have to provide you with coverage.

The catch to this, however, is that because this is typically used as a last resort, the insurance provider can charge whatever rate they want. So our advice is to only utilize this plan if you can’t get another provider to willingly provide you with insurance coverage.

Automobile Insurance Fraud in Georgia

According to the Insurance Information Institute (III), approximately $30 billion each year is lost due to property/casualty fraud. As such, insurance fraud is considered a crime in all states across the nation.

| Georgia and Insurance Fraud | yes/no |

|---|---|

| Insurance Fraud Classified as a Crime | |

| Immunity Statues | |

| Fraud Bureau | |

| Mandatory Insurer Fraud Plan | |

| Mandatory Auto Photo Inspection |

You can face some serious penalties if you commit this crime, so our advice is don’t commit insurance fraud.

Statute of Limitations

What is the statute of limitations? Well, it is essentially defined as the amount of time you have to make a claim in the case of an accident in which there were injuries or property damage.

This law is to help protect yourself, and the person in which you are filing a claim against. So how much time do you have in Georgia?

For personal injury claims, you have two years. For property damage claims, you have four years.

Vehicle Licensing Laws

Every driver is required to have a driver’s license. So, naturally, there are specific laws that you’ll need to follow regarding this.

Penalties for Driving Without Insurance

As we’ve stated many times previously, you are required to have at least the minimum liability insurance in order to legally drive. If you are caught without it, you could be facing the following penalties according to the state of Georgia’s Department of Revenue:

You will receive a suspended registration with a $25 lapse fee as well as a $60 reinstatement fee. You will also need to pay any other registration fees and vehicle ad valorem taxes due

Teen Driver Laws

Teen drivers have a few restrictions and rules for them as they’re getting used to the new terrain of the open road.

| Young Driver Licensing System | First Requirement | Second Requirement | Third Requirement |

|---|---|---|---|

| To get a learners license you must: | Have a minimum age of 15 | – | – |

| Before getting a license or restricted license you must: | Have a mandatory holding period of 12 months | Have a minimum supervised driving time of 40 hours, 6 of which must be at night | Have a minimum age of 16 |

| Restrictions during intermediate or restricted license stage: | Nighttime restrictions – midnight-5 a.m. secondary enforcement | Passenger restrictions (family members excepted unless otherwise noted) – first 6 months—no passengers; second 6 months—no more than 1 passenger younger than 21; thereafter, no more than 3 passengers secondary enforcement | – |

| Minimum age at which restrictions may be lifted: | Nighttime restrictions – until age 18 (min. age: 18) | Passenger restrictions – until age 18 (min. age: 18) | – |

License Renewal Procedures

The following license renewal procedures are required for Georgia citizens according to the Insurance Institute for Highway Safety (IIHS).

| General Population | Older Population | |

|---|---|---|

| License Renewal | Every 8 years | Every 8 years |

| Proof of Adequate Vision | Every renewal | Every renewal |

| Mail or Online Renewal Permitted | Online, every other renewal | Not permitted for individuals 64 years and older |

New Residents

Want to be a country gal/guy? Thinking of making Georgia your home? If you are, there are a few important things you’ll want to make note of.

Georgia doesn’t have a traditional DMV. Instead, they have two agencies that handle motor vehicle issues; the Department of Driver Services (DDS) and the Department of Revenue (DOR).

The Department of Driver Services handles issues such as licensing, permits, and ID Cards. The Department of Revenue handles issues such as registration, taxes, and plates.

So when you make Georgia your home, make sure you stop by both establishments to get all of the documentation you need.

Rules of the Road

We’ll move on now to some of the specific rules of the road for Georgia.

– Fault Versus No-Fault

As we mentioned previously, Georgia is an “at-fault” state.

This means that if you’re the one who causes an accident, YOU’RE the one who is held liable for any damages/injuries that occurs during that accident.

This is where having really good coverage is going to benefit you!

Child Safety Laws

There are laws in every state that drivers have to adhere to if they have children in the vehicle.

According to the IIHS, child restraints are required in Georgia for all children who are 7 years and younger, or who are 57 inches or less. If they are over 57 inches, they are required to wear an adult safety belt.

If you are caught without properly restraining a child in the vehicle, a first offense can cost you up to $50 in fines and can increase on repeat offenses.

Keep Right and Move Over Laws

These two laws are some of the most simple ones you’ll need to know.

Keep right laws just mean that if you are going slower than the rest of traffic, move into the left lane.

Move over laws are laws that require you to move your vehicle out of the way of emergency vehicles. If you violate this, it is considered a moving violation with a ticket price of $500.

Speed Limits

Speed limits are put into place to keep drivers safe. Drive too fast on a particular road, and you could end up in an accident. That’s why following the posted speed limits are so important.

The following are some of the speed limits known in the state of Georgia according to the Insurance Institute for Highway Safety (IIHS):

- Rural Interstates: 70 mph

- Urban Interstates: 70 mph

- Other Limited Access Roads: 65 mph

- Other Roads: 65 mph

Ridesharing

There a high likelihood that you’ve at least heard of ridesharing companies such as Uber and Lyft. They are a useful resource and make for easy transportation should you ever need it.

Not only are they valuable in a pinch, but if you ever need to earn a couple of bucks, you can also work for these companies, and many people in some of the larger cities do.

With this said, in order to work for any of these companies, you will need to have some form of ridesharing insurance coverage, ON TOP OF your current insurance policy.

In Georgia, the following companies offer some form of ridesharing coverage:

- Allstate

- Farmers

- Geico

- State Farm

- USAA

If you don’t have a policy with any of these providers, chances are if you want to work for a ridesharing service, you will need to get an additional policy with this coverage.

Georgia takes riders for these services very seriously. There was even a law passed in Georgia, back in 2015, in which ridesharing companies are now required to carry a minimum of $1 million in coverage for “personal injury accident claims, property damage, and death.”

Automation on the Road

You may read the title of this section and ask yourself what in the world this means. Well, according to IIHS, automation on the road is defined as:

“Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human.”

In other words? Any vehicle that is self-driving is considered an automated vehicle. So what does this mean for you down in gorgeous Georgia?

Well, Georgia has already started to deploy automated vehicles on the road. They do not require a licensed operator while an automated system is activated, however, Georgia does require that “the amount of liability insurance must be equivalent to 250 percent of what is required under existing insurance law…”

Safety Laws

Finally, in this section of state laws, we’ll discuss some of the safety laws for drivers in Georgia. These laws are especially important, as they are designed to not only keep you safe on the road, but to keep others safe on the road as well.

DUI Laws

Drinking and driving is known to be one of the most lethal causes of accidents across the nation. Should you chose to drink and drive in Georgia, you could be facing some severe consequences.

| Georgia's DUI Laws | Laws |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | 0.15 |

| Criminal Status by Offense | 1st-2nd misdemeanors, 3rd high and aggravated misdemeanor, 4th+ felony |

| Formal Name for Offense | Driving Under the Influence (DUI) |

| Look back Period/Washout Period | 10 years |

| 1st Offense - ALS or Revocation | 120 days minimum up to 1 year |

| 1st Offense - Imprisonment | 10 days - 12 months, can all be suspended at judge's discretion unless HBAC, then all but 24 hours can be suspended |

| 1st Offense - Fine | $300-$1000 |

| 1st Offense - Other | 20-40 hours community service |

| 2nd Offense - DL Revocation | 3 years |

| 2nd Offense - Imprisonment | 90 days - 12 months; mandatory 72 hours for 2nd in 10 years, otherwise can be probated |

| 2nd Offense - Fine | $600-$1000 |

| 2nd Offense - Other | 30 days community service min, IID 6 months min, evaluation and treatment program mandatory, mandatory DUI school, photo of offender must be published in local newspaper |

| 3rd Offense - DL Revocation | 5 years |

| 3rd Offense - Imprisonment | 120 days - 12 months; sentence can be probated unless 3rd in 10 years, then 15 days mandatory incarceration |

| 3rd Offense - Fine | $1000-$5000 |

| 3rd Offense - Other | min 30 days community service, 6 months IID, DUI school required, photo of offender must be published in local newspaper |

| 4th Offense - Imprisonment | 1-5 years, sentence can be probated to 90 days mandatory minimum |

| 4th Offense - Fine | $1000-$5000 |

| 4th Offense - Other | 60 days community service, can be suspended if 3 years jail term served, 6 months IID min |

| Mandatory Interlock | repeat offenders |

According to Responsibility.org, the total of alcohol-impaired driving fatalities in 2017 was 366. This is a staggering number that can be prevented if you simply do not drink and drive.

Marijuana-Impaired Driving Laws

Many states across the nation have started to legalize marijuana, calling into question as to what kind of laws should be around this substance and driving.

Currently, Georgia does not have any laws specific to marijuana and driving. However, Georgia also has a zero-tolerance policy for THC and metabolites, so even having it on you can land you in a lot of trouble.

Distracted Driving Laws

Every driver can become distracted from time to time while on the road. What has become a problem recently, however, is the increased popularity of smartphones. Even a second looking down at your phone is a second away from the road.

For this reason, Georgia has the following restrictions according to IIHS:

- Hand-Held ban for ALL drivers

- Ban on cellphone use for ALL drivers (due to House Bill 673 which became effective on July 1, 2018)

- Texting ban for ALL drivers

- Primary enforcement for all of the above. This means that if a police officer sees you while you’re using your device in the car, they can pull you over and give you a ticket for it.

Georgia Can’t-Miss Facts

Down to the last section! Final stretch! Here, we’ll go over some final facts and statistics about driving in Georgia that you absolutely can’t miss.

We’ll cover topics such as the specific statistics of the various road dangers in Georgia, transportation facts, and more.

We’re almost there, so keep reading.

Vehicle Thefts

Vehicle thefts are unfortunately an issue of owning a vehicle in modern times.

| Make/Model | Year | Number of Thefts |

|---|---|---|

| Honda Accord | 1997 | 1,052 |

| Ford Pickup (Full Size) | 2006 | 954 |

| Chevrolet Pickup (Full Size) | 1999 | 948 |

| Honda Civic | 2000 | 653 |

| Toyota Camry | 2014 | 568 |

| Chevrolet Impala | 2008 | 512 |

| Nissan Altima | 2014 | 484 |

| Dodge Pickup (Full Size) | 2003 | 452 |

| Jeep Cherokee/Grand Cherokee | 2001 | 449 |

| Dodge Caravan | 2002 | 425 |

The table above displays the ten most popular vehicles to be stolen in the state of Georgia. To further assist you in keeping your vehicle safe, we’ve collected data from a study done by the FBI on number of vehicle thefts in all of the cities in Georgia. Check the table out below to see where your city’s number is.

| City | Population | Number of Motor vehicle theft |

|---|---|---|

| Abbeville | 2,736 | 0 |

| Acworth | 22,747 | 23 |

| Adairsville | 4,844 | 17 |

| Adel | 5,359 | 12 |

| Alamo | 3,437 | 1 |

| Alapaha | 661 | 0 |

| Albany | 73,209 | 189 |

| Alma | 3,570 | 12 |

| Alpharetta | 66,711 | 35 |

| Alto | 1,163 | 0 |

| Aragon | 1,241 | 2 |

| Arcade | 1,811 | 4 |

| Arlington | 1,365 | 2 |

| Ashburn | 3,674 | 9 |

| Athens-Clarke County | 124,903 | 230 |

| Atlanta | 481,343 | 3,297 |

| Attapulgus | 429 | 0 |

| Auburn | 7,698 | 14 |

| Avondale Estates | 3,183 | 4 |

| Bainbridge | 12,208 | 17 |

| Baldwin | 3,308 | 0 |

| Ball Ground | 2,003 | 1 |

| Barnesville | 6,696 | 13 |

| Baxley | 4,752 | 7 |

| Berlin | 560 | 0 |

| Blackshear | 3,620 | 6 |

| Blairsville | 569 | 0 |

| Blakely | 4,649 | 3 |

| Bloomingdale | 2,729 | 10 |

| Blue Ridge | 1,400 | 1 |

| Blythe | 689 | 0 |

| Bowdon | 2,106 | 0 |

| Braselton | 10,761 | 8 |

| Braswell | 391 | 0 |

| Bremen | 6,453 | 17 |

| Brookhaven | 52,973 | 125 |

| Brooklet | 1,547 | 0 |

| Brunswick | 16,500 | 44 |

| Buchanan | 1,148 | 3 |

| Buena Vista | 2,132 | 0 |

| Butler | 1,854 | 1 |

| Byron | 5,228 | 10 |

| Cairo | 9,558 | 7 |

| Calhoun | 16,557 | 16 |

| Camilla | 5,176 | 12 |

| Canon | 804 | 0 |

| Canton | 26,897 | 30 |

| Carrollton | 26,951 | 53 |

| Cartersville | 20,918 | 57 |

| Cave Spring | 1,145 | 0 |

| Cedartown | 9,806 | 32 |

| Centerville | 7,689 | 7 |

| Chamblee | 28,558 | 78 |

| Chattahoochee Hills | 2,877 | 3 |

| Clarkesville | 1,777 | 0 |

| Clarkston | 12,849 | 41 |

| Claxton | 2,284 | 2 |

| Clayton | 2,285 | 0 |

| Cleveland | 3,912 | 6 |

| Cochran | 5,029 | 6 |

| College Park | 15,134 | 229 |

| Columbus | 198,832 | 704 |

| Commerce | 6,826 | 11 |

| Conyers | 16,034 | 61 |

| Coolidge | 529 | 0 |

| Cordele | 10,812 | 30 |

| Cornelia | 4,282 | 6 |

| Covington | 14,122 | 49 |

| Cumming | 6,365 | 16 |

| Cuthbert | 3,635 | 0 |

| Dallas | 13,373 | 20 |

| Dalton | 34,228 | 73 |

| Danielsville | 588 | 1 |

| Darien | 1,830 | 2 |

| Davisboro | 1,659 | 0 |

| Dawson | 4,249 | 6 |

| Decatur | 23,378 | 27 |

| Demorest | 2,094 | 1 |

| Dillard | 336 | 0 |

| Doerun | 769 | 0 |

| Donalsonville | 2,635 | 5 |

| Doraville | 10,593 | 71 |

| Douglasville | 33,640 | 85 |

| Dublin | 16,086 | 30 |

| Duluth | 29,795 | 33 |

| Dunwoody | 49,321 | 92 |

| East Ellijay | 561 | 3 |

| Eastman | 5,093 | 14 |

| East Point | 35,740 | 493 |

| Eatonton | 6,568 | 2 |

| Elberton | 4,397 | 6 |

| Ellaville | 1,856 | 0 |

| Ellijay | 1,705 | 2 |

| Emerson | 1,579 | 5 |

| Enigma | 1,300 | 4 |

| Ephesus | 418 | 0 |

| Eton | 896 | 0 |

| Fairburn | 14,370 | 71 |

| Fairmount | 741 | 2 |

| Fayetteville | 17,749 | 14 |

| Fitzgerald | 8,902 | 17 |

| Flowery Branch | 7,317 | 1 |

| Folkston | 4,795 | 5 |

| Forest Park | 19,948 | 139 |

| Forsyth | 4,169 | 5 |

| Fort Oglethorpe | 9,935 | 22 |

| Fort Valley | 8,465 | 14 |

| Franklin | 959 | 1 |

| Franklin Springs | 1,160 | 0 |

| Gainesville | 40,836 | 104 |

| Garden City3 | 8,932 | 5 |

| Glennville | 5,086 | 5 |

| Gordon | 1,943 | 3 |

| Graham | 300 | 0 |

| Grantville | 3,226 | 5 |

| Greenville | 852 | 3 |

| Griffin | 22,878 | 51 |

| Grovetown | 13,841 | 13 |

| Guyton | 1,928 | 1 |

| Hagan | 967 | 0 |

| Hampton | 7,623 | 9 |

| Hapeville | 6,665 | 101 |

| Harlem | 3,077 | 1 |

| Hartwell | 4,511 | 8 |

| Hazlehurst | 4,178 | 6 |

| Helen | 547 | 3 |

| Hephzibah | 3,879 | 0 |

| Hiawassee | 921 | 3 |

| Hiram | 3,954 | 25 |

| Hoboken | 525 | 0 |

| Hogansville | 3,157 | 2 |

| Holly Springs | 11,653 | 7 |

| Homeland | 855 | 0 |

| Homerville | 2,451 | 5 |

| Irwinton | 565 | 0 |

| Ivey | 911 | 0 |

| Jackson | 5,071 | 5 |

| Jasper | 3,841 | 12 |

| Jefferson | 10,658 | 10 |

| Jesup | 10,170 | 32 |

| Johns Creek | 85,048 | 18 |

| Jonesboro | 4,731 | 16 |

| Kennesaw | 34,154 | 23 |

| Kingsland | 16,852 | 25 |

| Kingston | 657 | 0 |

| LaGrange | 30,981 | 71 |

| Lake City | 2,811 | 19 |

| Lakeland | 3,284 | 7 |

| Lake Park | 724 | 1 |

| Lavonia | 2,170 | 1 |

| Lawrenceville | 31,183 | 46 |

| Leary | 573 | 0 |

| Leslie | 380 | 0 |

| Lilburn | 12,844 | 22 |

| Lithonia | 2,098 | 16 |

| Locust Grove | 6,028 | 14 |

| Loganville | 11,887 | 21 |

| Lookout Mountain | 1,573 | 4 |

| Louisville | 2,366 | 0 |

| Ludowici | 2,244 | 3 |

| Lumber City | 1,255 | 1 |

| Lumpkin | 1,083 | 0 |

| Lyons | 4,365 | 3 |

| Madison | 4,072 | 6 |

| Manchester | 4,034 | 4 |

| Marietta | 61,646 | 182 |

| Marshallville | 1,292 | 1 |

| Maysville | 1,901 | 1 |

| McDonough | 24,278 | 47 |

| McIntyre | 611 | 0 |

| McRae-Helena | 8,295 | 2 |

| Metter | 4,066 | 6 |

| Midville | 262 | 0 |

| Midway | 1,983 | 6 |

| Milledgeville | 19,051 | 20 |

| Millen | 2,853 | 7 |

| Milton | 39,388 | 11 |

| Molena | 371 | 0 |

| Monroe | 13,579 | 29 |

| Montezuma | 3,095 | 7 |

| Morrow | 7,400 | 73 |

| Moultrie | 14,365 | 28 |

| Mountain City | 1,073 | 0 |

| Mount Airy | 1,302 | 2 |

| Mount Zion | 1,772 | 0 |

| Nahunta | 1,047 | 0 |

| Nashville | 4,849 | 4 |

| Newnan | 38,825 | 68 |

| Norcross | 17,060 | 53 |

| Norman Park | 968 | 0 |

| Oak Park | 476 | 3 |

| Ocilla | 3,630 | 3 |

| Oglethorpe | 1,174 | 1 |

| Omega | 1,228 | 1 |

| Oxford | 2,239 | 4 |

| Palmetto | 4,744 | 13 |

| Patterson | 758 | 0 |

| Peachtree City | 35,300 | 78 |

| Pelham | 3,607 | 9 |

| Pembroke | 2,539 | 0 |

| Pine Lake | 767 | 3 |

| Pine Mountain | 1,385 | 3 |

| Plains | 727 | 0 |

| Pooler | 24,601 | 63 |

| Porterdale | 1,506 | 5 |

| Port Wentworth | 8,452 | 21 |

| Powder Springs | 15,127 | 13 |

| Quitman | 3,884 | 14 |

| Remerton | 1,122 | 7 |

| Reynolds | 1,016 | 2 |

| Rincon | 10,101 | 9 |

| Ringgold | 4,403 | 14 |

| Riverdale | 16,435 | 87 |

| Rochelle | 1,101 | 0 |

| Rockmart | 4,317 | 13 |

| Rome | 36,366 | 61 |

| Roswell | 95,602 | 109 |

| Sale City | 343 | 0 |

| Sandersville | 5,669 | 6 |

| Sandy Springs | 107,740 | 178 |

| Sardis | 971 | 4 |

| Savannah-Chatham Metropolitan | 242,941 | 940 |

| Screven | 778 | 1 |

| Senoia | 4,283 | 1 |

| Shiloh | 462 | 0 |

| Smyrna | 57,576 | 226 |

| Snellville | 19,982 | 32 |

| Social Circle | 4,490 | 3 |

| Sparks | 1,994 | 3 |

| Sparta | 1,264 | 1 |

| Springfield | 4,308 | 0 |

| Statesboro | 31,937 | 36 |

| Stone Mountain | 6,413 | 31 |

| Summerville | 4,337 | 1 |

| Suwanee | 20,186 | 22 |

| Swainsboro | 7,522 | 6 |

| Sylvania | 2,514 | 4 |

| Talbotton | 834 | 2 |

| Tallapoosa | 3,189 | 4 |

| Temple | 4,403 | 10 |

| Tennille | 1,914 | 2 |

| Thomasville | 18,866 | 21 |

| Thunderbolt | 2,710 | 9 |

| Tifton | 16,908 | 41 |

| Toccoa | 8,392 | 8 |

| Trenton | 2,248 | 1 |

| Tunnel Hill | 878 | 1 |

| Tybee Island | 3,134 | 4 |

| Tyrone | 7,260 | 1 |

| Union City | 21,160 | 336 |

| Valdosta | 56,729 | 232 |

| Vidalia | 10,743 | 13 |

| Vienna | 3,652 | 2 |

| Villa Rica | 15,398 | 29 |

| Warner Robins | 75,323 | 230 |

| Warrenton | 1,786 | 2 |

| Warwick | 407 | 0 |

| Watkinsville | 2,866 | 1 |

| Waverly Hall | 763 | 1 |

| Waynesboro | 5,669 | 15 |

| West Point | 3,821 | 5 |

| Whitesburg | 607 | 0 |

| Willacoochee | 1,367 | 0 |

| Winder | 16,006 | 19 |

| Winterville | 1,210 | 0 |

| Woodland | 351 | 0 |

| Woodstock | 32,293 | 21 |

| Wrens | 2,020 | 5 |

Read more: Baldwin Mutual Insurance Company Inc. Car Insurance Review

Road Dangers in Georgia

As every driver knows, accidents happen. So do fatalities due to these accidents. So here, we’ll discuss some of the various road dangers you should know in Georgia and the fatality rates, taken from the National Highway Traffic Safety Association (NHSTA), associated with them.

| Type | Number of Fatalities |

|---|---|

| Traffic Fatalities | 1,540 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 1,057 |

| Motorcyclist Fatalities | 139 |

| Drivers Involved in Fatal Crashes | 2,283 |

| Pedestrian Fatalities | 253 |

| Bicyclist and Other Cyclist Fatalities | 15 |

Fatal Crashes by Weather Condition and Light Condition

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 690 | 140 | 448 | 44 | 1 | 1,323 |

| Rain | 44 | 7 | 39 | 2 | 0 | 92 |

| Snow/Sleet | 3 | 0 | 1 | 0 | 0 | 4 |

| Other | 3 | 1 | 14 | 1 | 0 | 19 |

| Unknown | 1 | 0 | 1 | 0 | 0 | 2 |

| TOTAL | 741 | 148 | 503 | 47 | 1 | 1,440 |

Crashes by Road Type Fatalities

| 4 Year Trend | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|

| Rural | 573 | 603 | 565 | 462 |

| Urban | 702 | 867 | 953 | 966 |

Person Type Fatalities

| Person Type | Number |

|---|---|

| Occupants (Enclosed vehicles) | 1,127 |

| Motorcyclists | 139 |

| Nonoccupants | 274 |

Crash Type Fatalities

| Crash Type | Number |

|---|---|

| Single Vehicle | 823 |

| Involving a Large Truck | 214 |

| Involving Speeding | 248 |

| Involving a Rollover | 361 |

| Involving a Roadway Departure | 769 |

| Involving an Intersection (or Intersection Related) | 401 |

Five-Year Trend For The Top 10 Counties

| Georgia Counties by 2017 Ranking | County | 2013 Fatalities | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities |

|---|---|---|---|---|---|---|

| 1 | Fulton County | 85 | 77 | 104 | 130 | 115 |

| 2 | Dekalb County | 70 | 55 | 83 | 80 | 95 |

| 3 | Gwinnett County | 45 | 55 | 67 | 61 | 66 |

| 4 | Cobb County | 59 | 49 | 49 | 59 | 53 |

| 5 | Bibb County | 31 | 23 | 21 | 28 | 34 |

| 6 | Cherokee County | 16 | 12 | 12 | 7 | 32 |

| 7 | Clayton County | 26 | 21 | 26 | 48 | 32 |

| 8 | Richmond County | 23 | 27 | 27 | 17 | 32 |

| 9 | Hall County | 17 | 21 | 33 | 31 | 31 |

| 10 | Chatham County | 44 | 26 | 54 | 44 | 29 |

Speeding Fatalities by County