New York Car Insurance

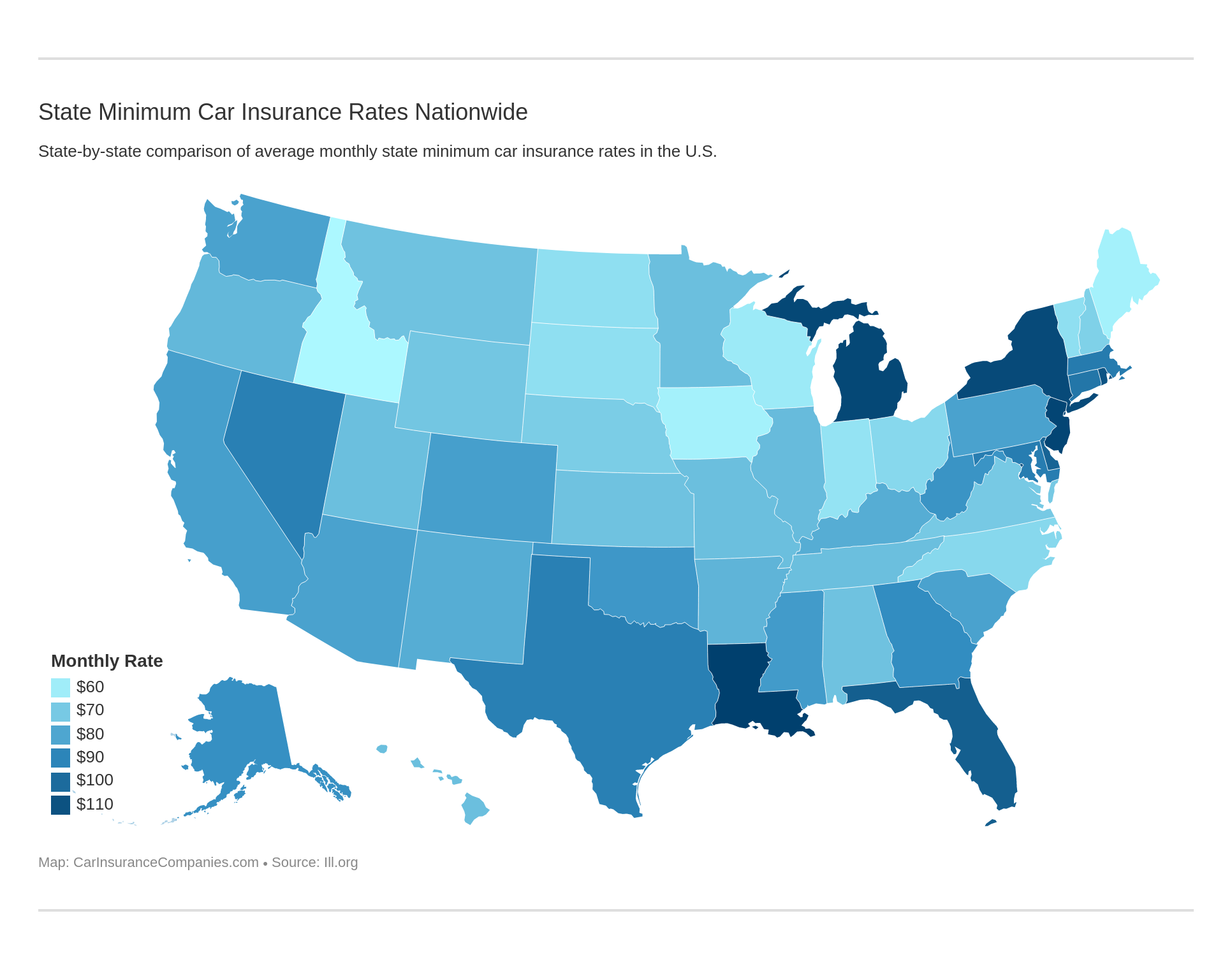

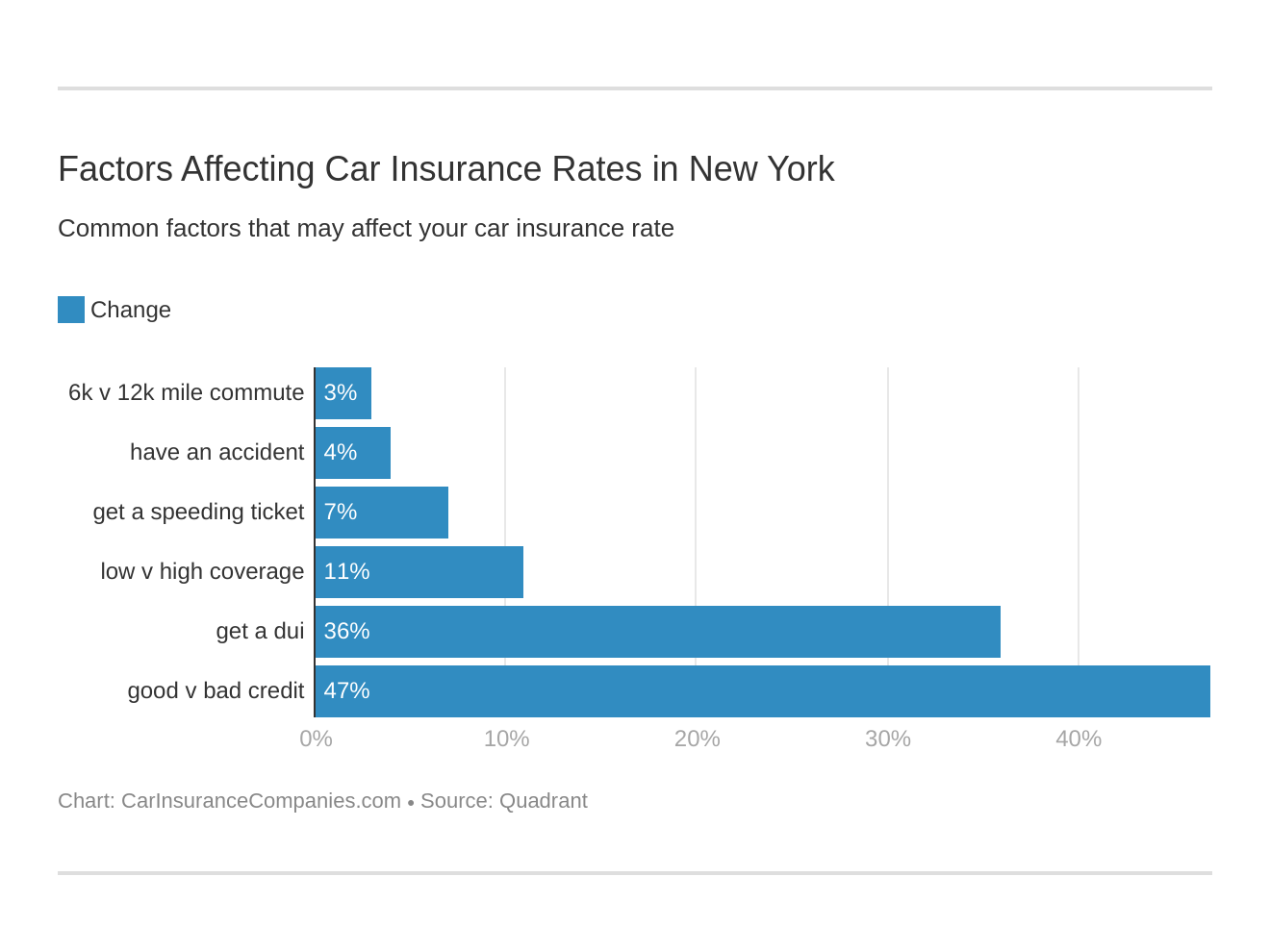

New York car insurance laws require drivers to carry 25/50/10 in minimum liability coverage. Your New York car insurance rates will increase if you choose a more comprehensive policy. Read our guide to compare coverage from different New York car insurance companies and find the cheapest rates, and use your free comparison tool below to find local New York car insurance quotes.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Feb 22, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 22, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Car insurance for New York drivers is much more pleasurable to find than other states since New York operates under the no-fault car insurance law

- Any car with New York plates must have liability insurance regardless of whether or not the vehicle is in use

- The key to finding the best car insurance company is to learn about auto insurance and compare car insurance rates from at least a handful of providers

Car insurance for New York drivers is much more pleasurable to find than other states since New York operates under the no-fault car insurance law.

The New York Department of Motor Vehicles requires all vehicles to have liability insurance.

No fault car insurance simply means that in the event of an accident each parties respective car insurance company will pay damages. Make sure to compare rates with our free quote tool above today!

Read more: Top 10 New York Car Insurance Companies

Motor Vehicle Liability Insurance Requirements for New York

New York liability insurance requirements cover all vehicles registered in New York State. Any car with New York plates must have liability insurance regardless of whether or not the vehicle is in use.

Although no fault car insurance does limit your ability to sue another driver there are still many ways you can be party to a lawsuit, especially if the accident was caused by extreme negligence or damages exceeding the amount of your car insurance coverage.

Minimum New York car insurance requirements for each vehicle are as follows:

- $25,000/$50,000 in Bodily Injury Liability

- $10,000 for Property Damage Liability

- $25,000/$50,000 of Coverage for Uninsured/Underinsured Motorist Bodily Injury

- $50,000 in Coverage for Personal Injury Protection

Although these requirements are higher than most no-fault states it’s highly recommended to always get more coverage.

Average Monthly Car Insurance Rates in NY (Liability, Collision,

Comprehensive)

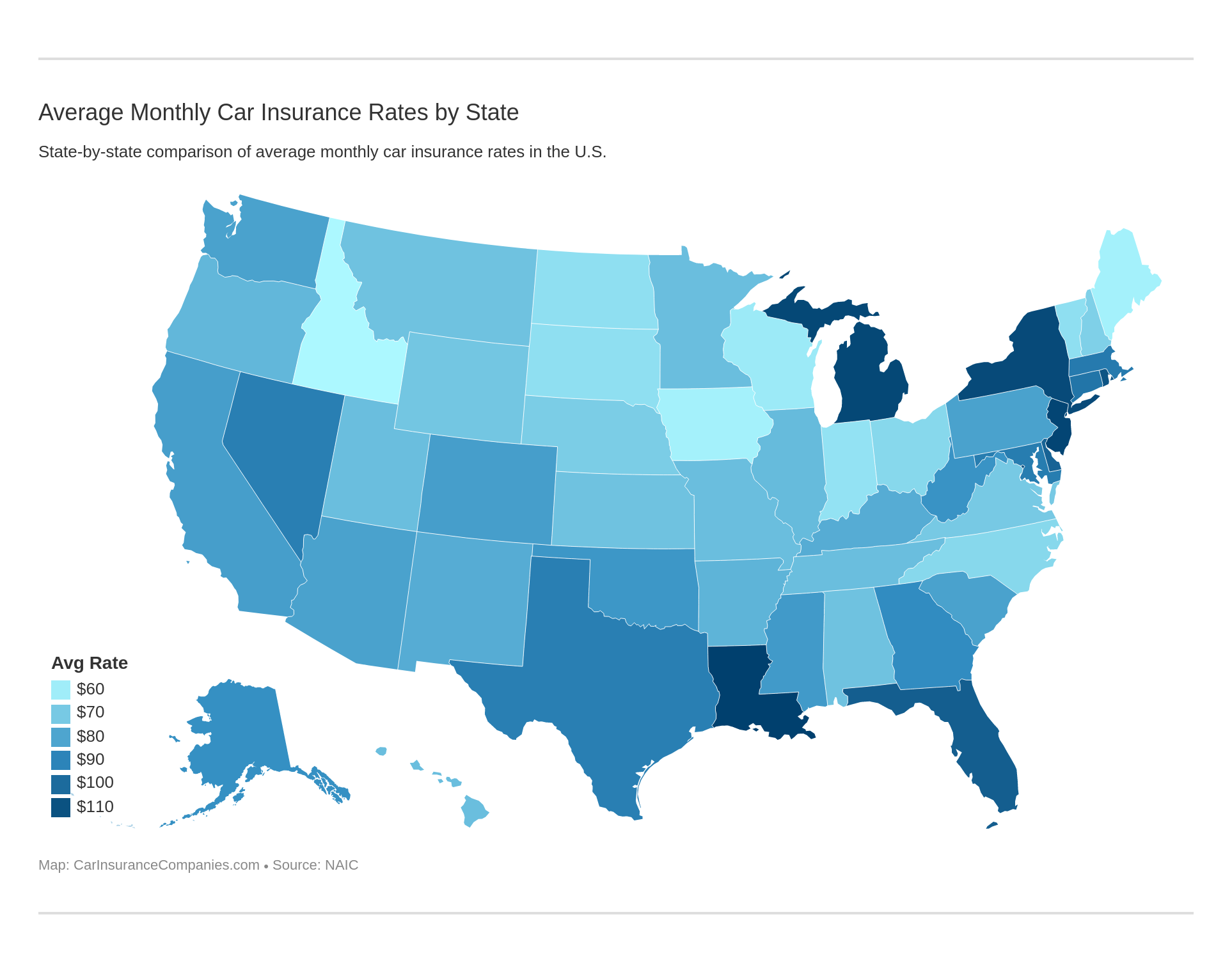

Your average monthly car insurance rates may not increase as much as you might think by adding additional coverage like comprehensive. Review rates for auto insurance coverage below:

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What happens if I have no car insurance in New York?

Most drivers do not want to experience this as fines can be very stiff and your car registration and/or drivers license suspended should you be caught driving with no car insurance.

Even a lapse in car insurance can pose a stiff financial penalty as car insurance companies automatically notify the New York Department of Motor Vehicles anytime a lapse in coverage occurs.

If the lapse is less than 90 days then you may have an option to simply pay a civil penalty, however, this can be only done once. Any lapse more than 90 days and your plates must be turned into the DMV.

The civil penalty is as follows:

- Lapse in Coverage between 1-30 days is $8 per day

- 31-60 Days is $10 per day

- 61-90 Days is $12 per day

As you can see if your car insurance has lapsed for 75 days, for example, your fine would be around $700 – ouch!

Who is the best New York car insurance company?

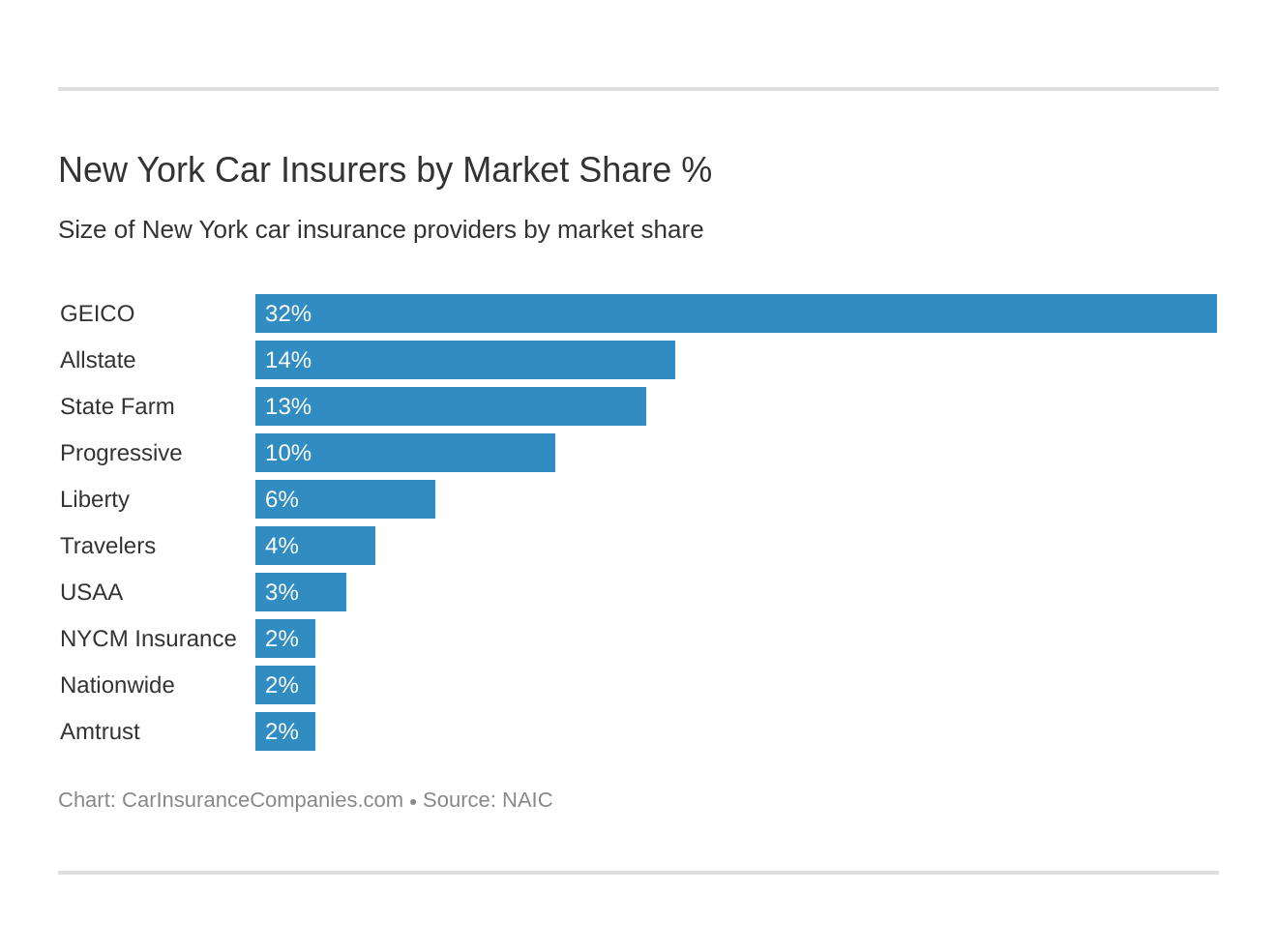

This is an impossible question to answer as a wealth of New York car insurance companies exist who offer affordable car insurance.

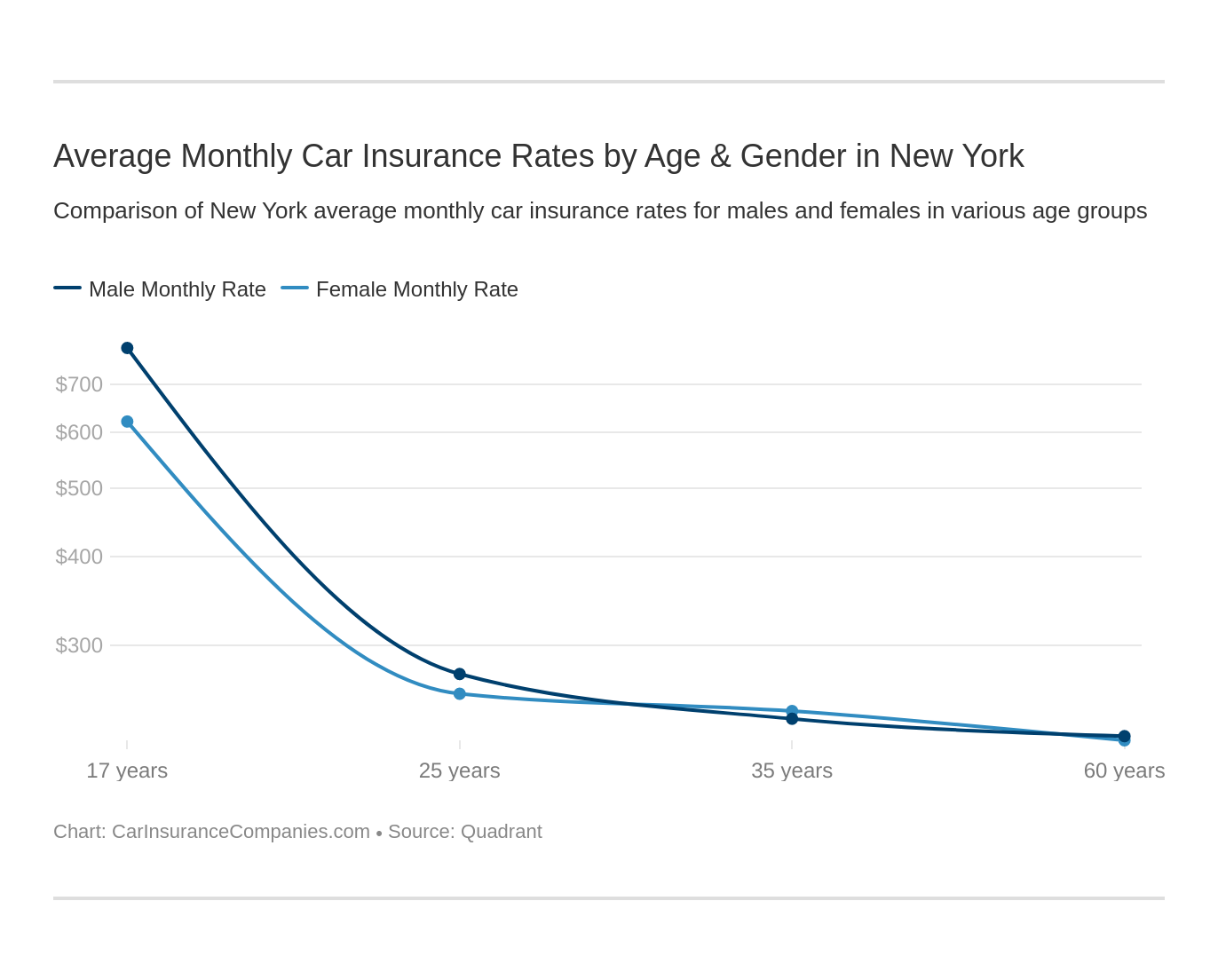

Average Monthly Car Insurance Rates by Age & Gender in NY

Age and gender will affect your car insurance. Younger drivers are often in a high risk class. See if the gender stereotype (males pay more) holds true in NY.

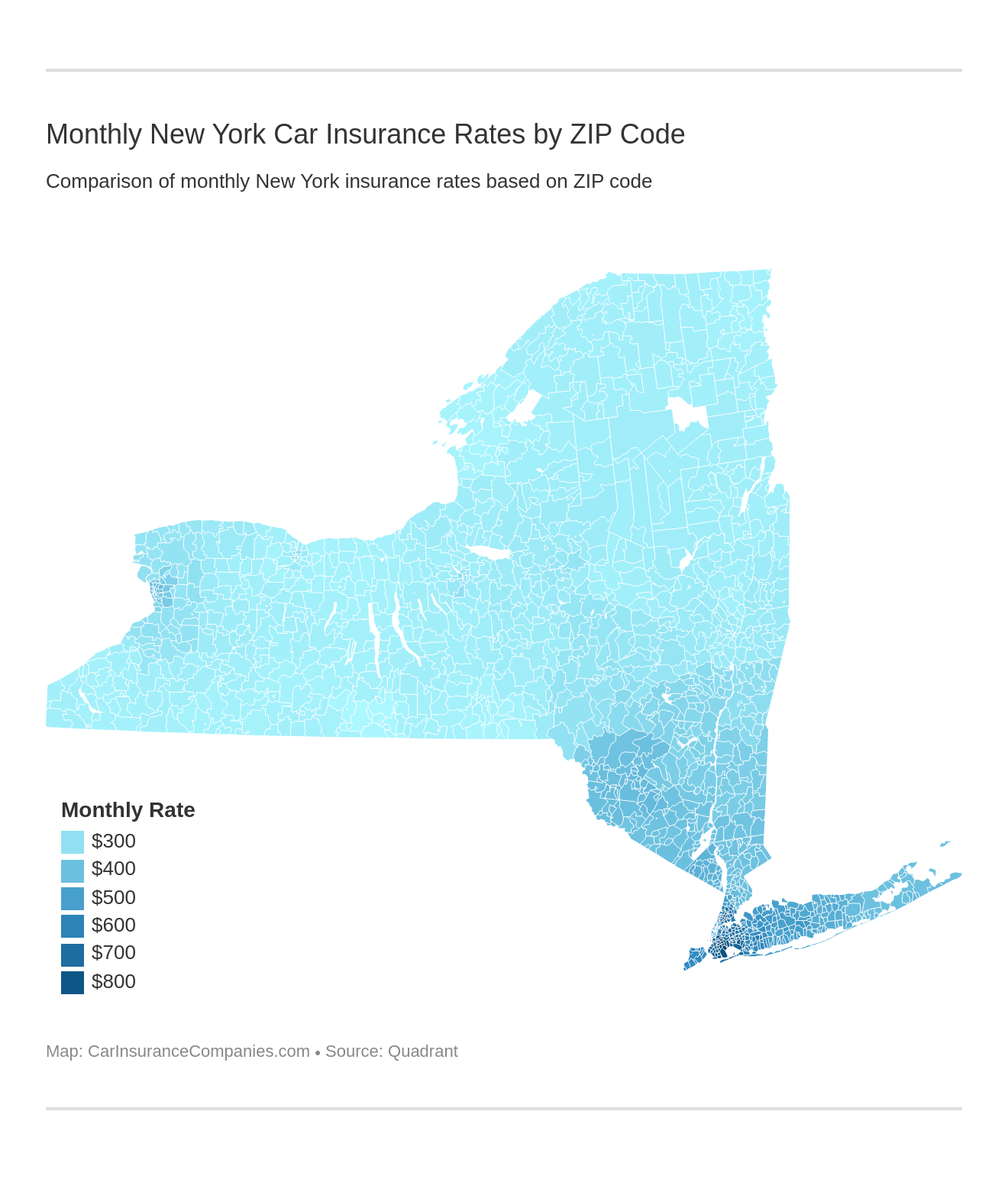

ZIP codes affect auto insurance because of factors like traffic, crime to name a few. Find out how your ZIP code stacks up in NY.

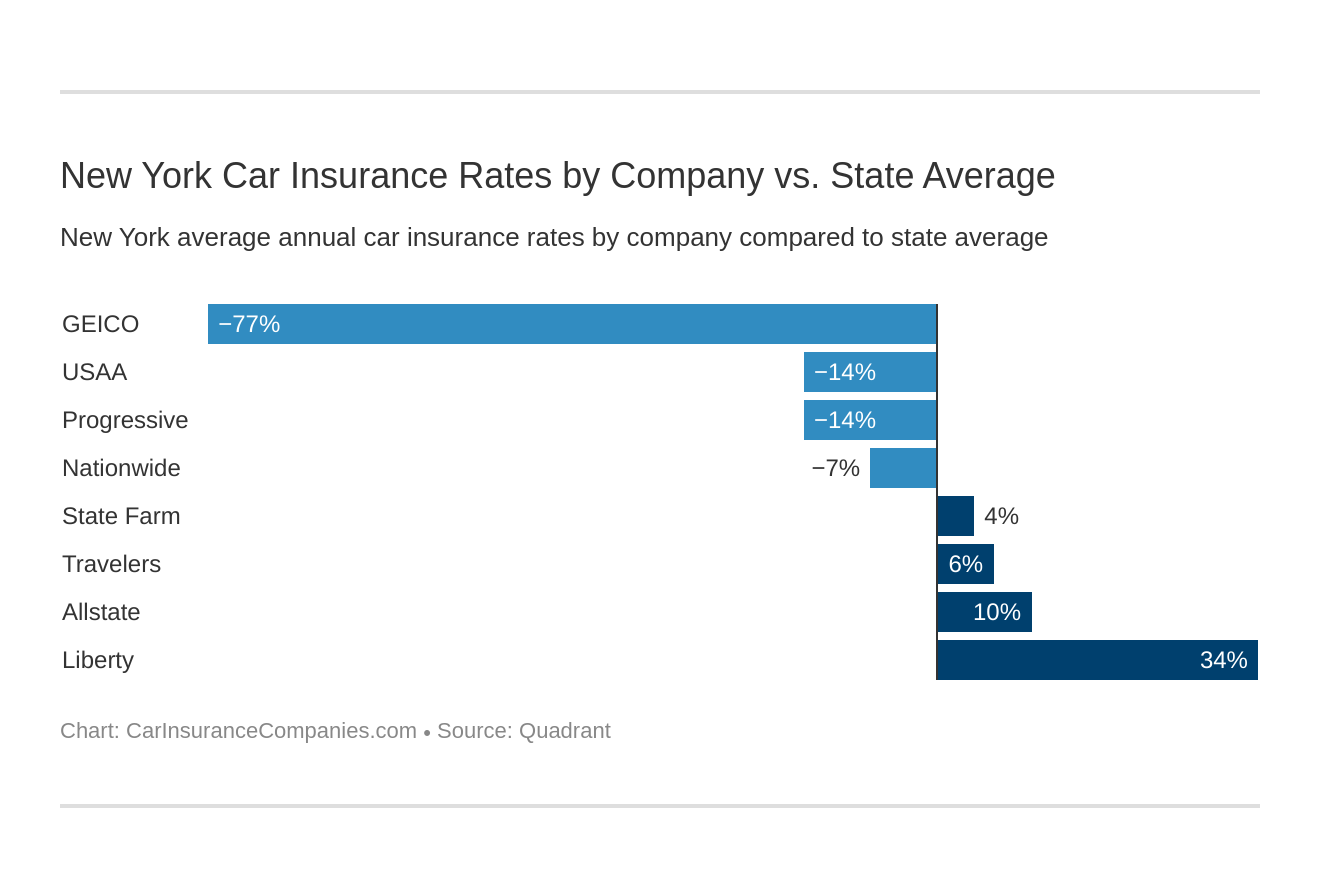

Let’s see who is the cheapest car insurance company in New York.

Defining who the best is when all drivers have unique needs is not very likely to help you find the best provider.

The key to finding the best car insurance company is to learn about auto insurance and compare car insurance rates from at least a handful of providers.

Luckily, New York is one of the most competitive markets for auto insurance so you will have a lot to choose from. Compare rates with our free quote tool below now!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.