Kentucky Car Insurance [Rates + Cheap Coverage Guide]

is a no-fault insurance state, so drivers should at least carry the minimum insurance requirements of 25/50/10 to avoid paying out of pocket. We recommend carrying more coverage since you'll be responsible for your own medical costs and repairs in an accident. Enter your ZIP code below and start comparing insurance quotes to find the best insurance coverage in .

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 24, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 24, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Kentucky Statistics Summary | Details |

|---|---|

| Miles of Roadway | 79,857 |

| Miles Driven in the State | 48,675 million |

| Registered Vehicles | 4,040,964 |

| Motor Vehicle Thefts | 7,782 |

| Population | 4,468,402 |

| Most Popular Vehicle | Ford F-150 |

| Uninsured Motorist Rate | 11.5% |

| Total Driving-Related Deaths in 2018 | 782 |

| Speeding Fatalities in 2018 | 138 |

| DUI Fatalities in 2018 | 181 |

| Average Annual Car Insurance Cost | Liability: $529.21 Collision: $267.91 Comprehensive: $141.39 |

Home to the Kentucky Derby, the great state of Kentucky has a lot to offer its residents. The “Bluegrass State”, also known as the Commonwealth of Kentucky, is a land of wide pastures and is absolutely perfect for a road trip.

But before you hit the road, you’re going to want to make sure your car insurance needs are taken care of. That’s what we’re here for.

In this comprehensive guide that we’ve created for the great state of Kentucky, we’ll go through all of the things you’ll need to know in order to make the best decision for your car insurance.

We’ll cover topics on the types of car insurance coverage you’ll need, the typical insurance rates you’ll see in the state, the largest insurance providers in Kentucky, and more.

Are you ready to get started comparing now? Use our FREE online tool.

How much are Kentucky auto insurance rates?

Let’s get started! In this first section, we’ll talk about all of the car insurance coverage you’ll want to make sure you have in order to legally drive in Kentucky. We’ll also touch on a few of the different insurance rates you’ll see that are unique to Kentucky.

Kentucky Minimum Coverage

Most states have minimum requirements for auto insurance. These requirements usually consist of bodily injury liability coverage and property damage liability coverage, at the very least.

Take a look at how how average auto insurance rates vary from state to state for minimum coverage policies.

This is the minimum amount of liability coverage you are allowed in order to legally drive in the state.

Why is this particularly important for those in Kentucky? Well, Kentucky is known as a “no-fault” state according to the AAA of Digest Motor Laws.

“No-fault” states are states in which regardless of who is at fault for a car accident, each driver has to depend upon their own insurance coverage to pay for any damages or injuries.

So making sure you have AT LEAST the minimum coverage is vital to keeping yourself from having to pay for all of this out of pocket should you be in a car accident.

According to Kentucky’s DMV, the minimum coverage for this state is as follows:

- $25,000 –for the payment of any bodily injuries for one person incurred during an accident

- $50,000 – for the payment of any bodily injuries of multiple people incurred during an accident

- $25,000 – for the payment of any property damage incurred during an accident

- $10,000 – for the payment of your own personal injury protection (PIP)

- $25,000/$50,000 – for the payment of protection against uninsured/underinsured drivers

Keep in mind that these are all the MINIMUM amounts of coverage you are allowed to have in order to legally drive in the state. It is always recommended to get more than the minimum coverage, especially in no-fault states.

Forms of Financial Responsibility

As it is a requirement to carry this minimum liability coverage with you while driving, there may come a time in which you will be required to provide proof of insurance, also known as a form of financial responsibility.

What counts as a form of financial responsibility? Well, in Kentucky, any of the following options are suitable for fulfilling the financial responsibility requirements:

- Current insurance ID card (either the physical copy or an electronic copy through your provider’s mobile app is accepted)

- Copy of your insurance policy

So as long as you have at least one of these types of proof, you will be cruising the roads easily.

Premiums as a percentage of income

There’s a factor that can affect your insurance premiums, something known as the per capita disposable income. What exactly is this and what does it mean for you?

Per capita disposable income is the amount of money a population (such as the citizens of Kentucky) makes each year after taxes have been deducted.

Let’s say, for example, that you make $75,000 per year at your job. After taxes have been taken out, let’s say you have $60,000 leftover. This $60,000 is considered your personal disposable income.

Now let’s say that we average out all of the disposable incomes of every citizen of Kentucky. That would then be the per capita disposable income.

In Kentucky, the average per capita disposable income is $33,237. This means all of your other expenses come from this amount, such as your health insurance, groceries, rent, etc.

| Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|---|---|---|---|---|---|---|---|---|

| $917.49 | $33,237.00 | 2.76% | $904.99 | $31,951.00 | 2.83% | $888.46 | $32,202.00 | 2.76% |

As you can see from the table above, this means that on average approximately 2.76 percent of this $33,237 goes purely paying for your insurance rates. So making sure to budget your money wisely will save you a lot of stress down the road.

Average Monthly Car Insurance Rates in KY (Liability, Collision, Comprehensive)

Kentucky has the following core coverage rates according to the National Association of Insurance Commissioners:

Let’s take a look at the average monthly car insurance rates.

| Coverage Type | Kentucky Average | Nationwide Average |

|---|---|---|

| Liability | $529.21 | $538.73 |

| Collision | $267.91 | $322.61 |

| Comprehensive | $141.39 | $148.04 |

Additional Liability

There is the minimum liability coverage that you can get, and then there are additional types of coverage. Additional coverage, such as Medical Payments (MedPay), Personal Injury Protection (PIP), and Uninsured/Underinsured Motorist.

In Kentucky, MedPay coverage is optional, you are required to have PIP and Uninsured/Underinsured motorist coverage. This is especially important due to the fact that, as we mentioned earlier, Kentucky is a “no-fault” state.

Meaning that should you be in an accident, your insurance company is the one who will be the one paying for it.

So what exactly do these additional liability coverage types do for you?

- Medical Payments (MedPay) helps to cover any medical payments that you or any passengers in your vehicle might incur during an accident.

- Personal Injury Protection (PIP) helps to cover any personal injuries you might have in an accident, so it’s similar to MedPay, however, it also covers other documented losses (such as any lost wages you had)

- Uninsured/Underinsured Motorist coverage helps to cover your expenses should you be involved in an accident with a driver who either has less than the minimum liability coverage or who isn’t insured at all.

All extremely valuable coverage options for you, so it’s actually a really good thing that PIP and Uninsured/Underinsured Motorist coverage are required.

So now that you know about what these additional liability coverage options are, you’ll want to know what their loss ratios are in the state of Kentucky.

A loss ratio is the comparison of how much companies pay in insurance claims to their customers versus the amount of money they bring in through the insurance premiums you pay each month.

You want these loss ratios to be in a healthy range.

- Loss ratios that are too high, over 75 percent, meaning that the insurance company isn’t collecting enough premium to cover incoming losses and that a rate increase is possible or even likely.

- Loss ratios that are too low mean that the insurance company is taking in more premium than it needs to cover losses.

Think of it like the story of Goldilocks: not too high, not too low, but just right.

Kentucky has the following loss ratios according to the National Association of Insurance Commissioners (NAIC):

| Type of Insurance | 2013 | 2014 | 2015 |

|---|---|---|---|

| Uninsured/Underinsured Motorist Coverage | 75.74 | 77.87 | 76.48 |

| Personal Injury Protection | 74.88 | 74.65 | 76.70 |

| Medical Payments (MedPay) | 57.17 | 65.03 | 68.27 |

As you can see from the table above, the loss ratios for each of these additional liability coverage types are within a good range and appear to be trending upwards.

Add-ons, Endorsements, and Riders

We want you to get the absolute best coverage, for the best price, that you can. But did you know that there are additional coverage types you may not have even heard of and ones that are extremely affordable and could really help you out in a pinch?

Take a look at the coverage types below to see what Kentucky has for you:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

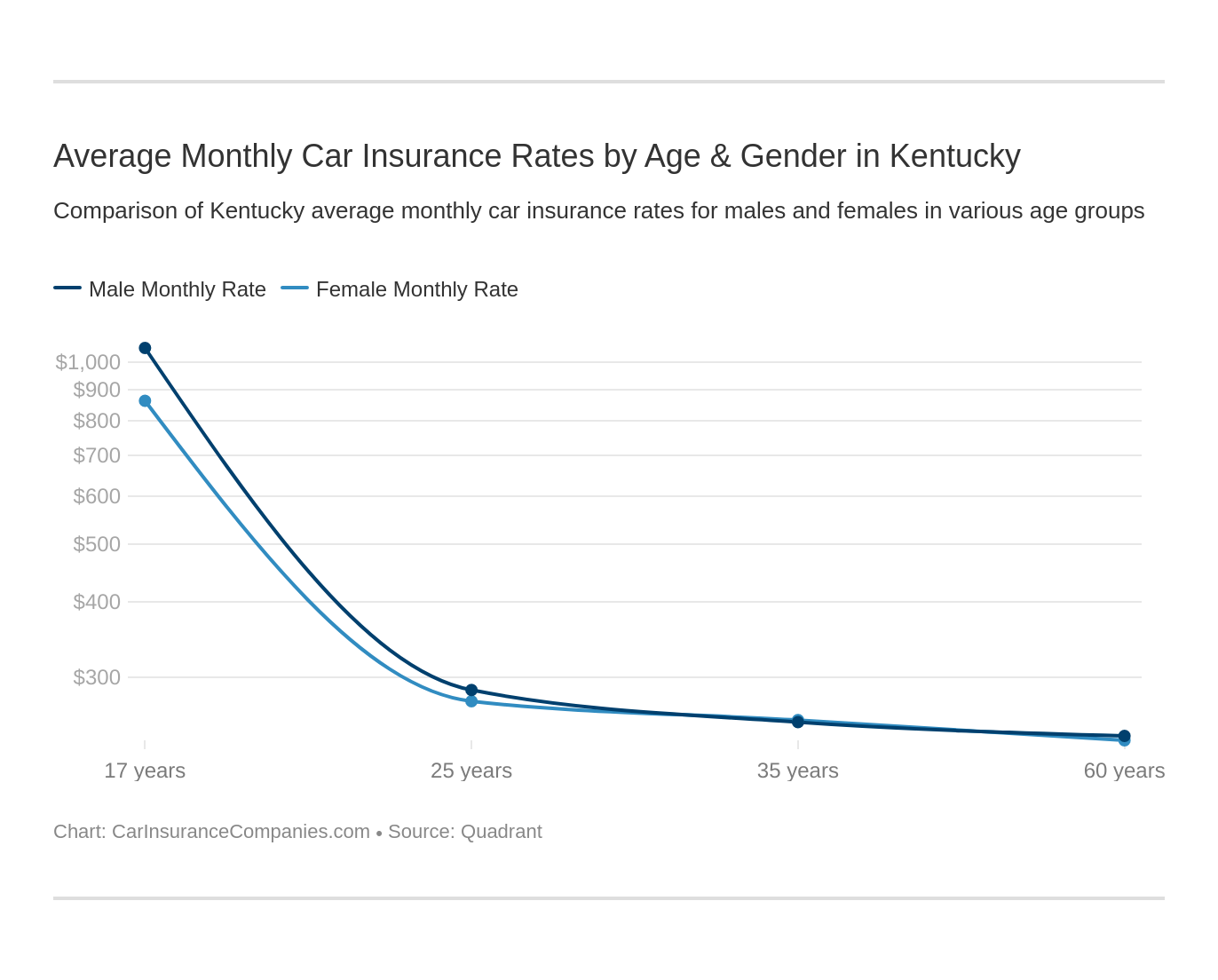

Average Monthly Car Insurance Rates by Age & Gender in KY

One factor that a lot of people don’t think of when it comes to their insurance rates is what demographic they fall into. Your gender, marital status, and age can sometimes play a factor in what you will pay for your insurance.

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $4,071.95 | $4,017.67 | $3,708.46 | $3,948.99 | $15,246.63 | $17,008.49 | $4,461.82 | $4,687.35 |

| Geico General | $3,752.09 | $3,471.17 | $3,923.45 | $3,552.25 | $7,644.91 | $9,029.89 | $3,057.23 | $2,637.75 |

| SAFECO Ins Co of IL | $3,231.71 | $3,507.83 | $2,759.05 | $3,088.10 | $13,306.20 | $14,712.30 | $3,363.97 | $3,478.61 |

| Nationwide Mutual | $3,944.67 | $3,921.87 | $3,563.85 | $3,709.70 | $8,821.28 | $10,924.10 | $4,475.85 | $4,664.48 |

| Progressive Direct | $2,630.46 | $2,493.44 | $2,369.27 | $2,374.60 | $13,086.14 | $14,834.10 | $3,266.78 | $3,326.24 |

| State Farm Mutual Auto | $2,146.67 | $2,146.67 | $1,914.73 | $1,914.73 | $6,057.12 | $7,621.54 | $2,389.96 | $2,643.11 |

| Travelers Home & Marine Ins Co | $2,737.32 | $2,786.72 | $2,693.47 | $2,697.68 | $13,524.14 | $21,804.08 | $2,862.77 | $3,307.23 |

| USAA | $1,936.64 | $1,940.60 | $1,749.37 | $1,779.35 | $5,187.97 | $5,460.08 | $2,447.73 | $2,681.40 |

Read more: Nationwide Mutual Insurance Company Car Insurance Review

As you can see from the table above, married couples tend to pay approximately the same rate for their insurance. It’s the younger demographics, however, that seems to have the most variability.

This isn’t uncommon, unfortunately, as most insurance providers tend to see younger drivers as more high-risk, so therefore they pay more for their insurance.

But these rates can and will improve with time. If you are a safe driver and maintain a clean driving record, these insurance rates will definitely improve.

Keep in mind that USAA auto insurance is only available to military families.

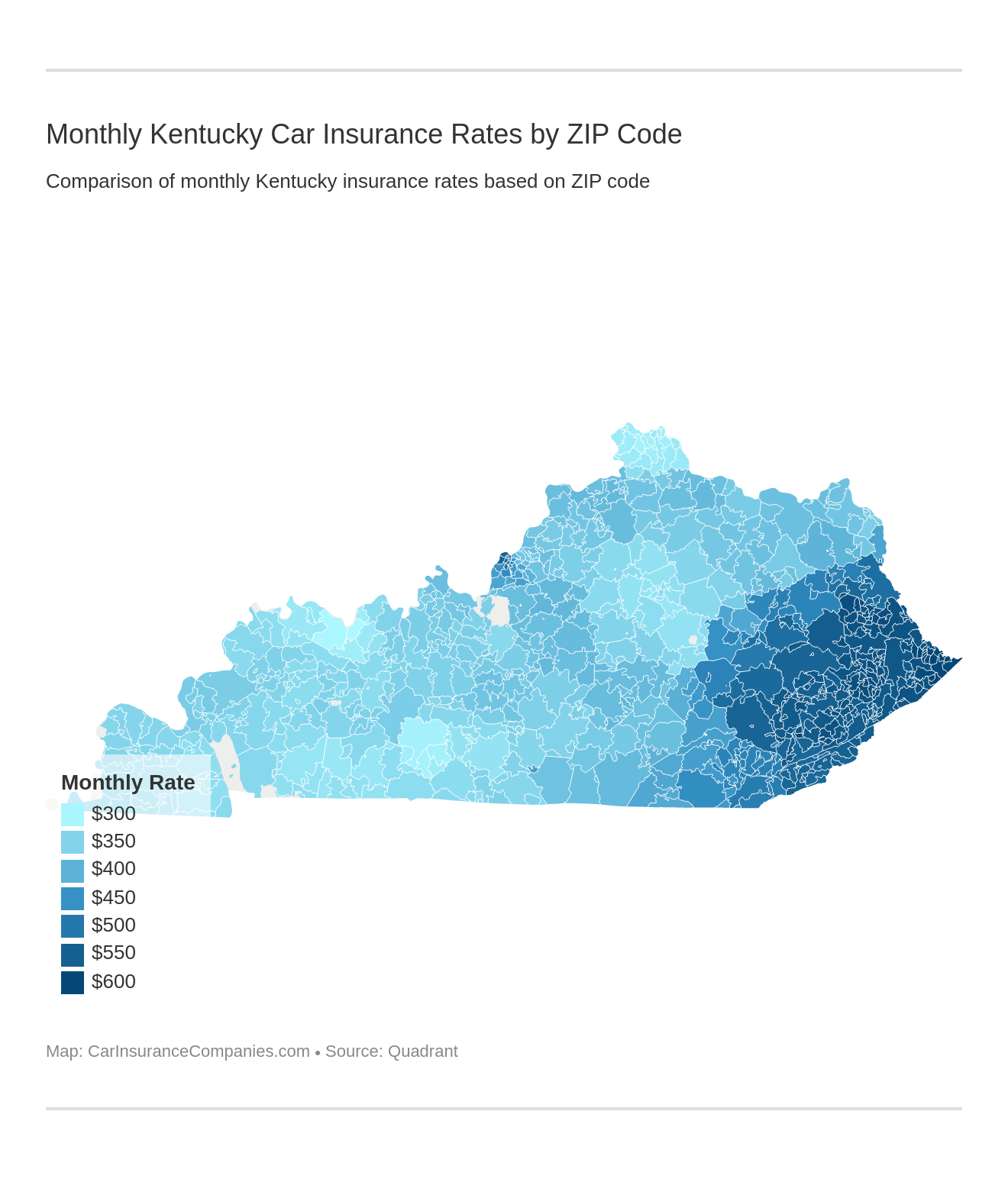

Highest/Lowest by Zip Code and City

Let’s take a closer look at how ZIP codes affect car insurance in Kentucky.

| City | Zipcode | Average |

|---|---|---|

| HICKORY | 42303 | $3,562.72 |

| MORTONS GAP | 42301 | $3,571.06 |

| SILER | 41042 | $3,667.47 |

| JUNCTION CITY | 42104 | $3,669.25 |

| SUMMER SHADE | 42101 | $3,691.47 |

| MOUNT STERLING | 42103 | $3,701.92 |

| FORT KNOX | 41075 | $3,704.38 |

| FARMERS | 41017 | $3,708.93 |

| LOUISVILLE | 41073 | $3,717.46 |

| SLADE | 41076 | $3,732.13 |

| TOMPKINSVILLE | 42274 | $3,743.65 |

| WASHINGTON | 41051 | $3,746.40 |

| WEST LIBERTY | 41005 | $3,753.36 |

| WILLIAMSBURG | 41018 | $3,759.97 |

| CERULEAN | 42376 | $3,763.32 |

| MEANS | 41071 | $3,770.88 |

| MASON | 41048 | $3,772.80 |

| SLAUGHTERS | 42355 | $3,773.20 |

| KNOB LICK | 42122 | $3,780.86 |

| WEST SOMERSET | 41074 | $3,782.52 |

| FAIRDALE | 41085 | $3,788.09 |

| PLUMMERS LANDING | 41080 | $3,789.43 |

| LOUISVILLE | 41015 | $3,796.57 |

| MINERVA | 41091 | $3,805.01 |

| GIRDLER | 41001 | $3,816.37 |

| LEXINGTON | 42366 | $3,822.12 |

| RAVENNA | 41007 | $3,833.22 |

| LONDON | 41063 | $3,846.10 |

| KEAVY | 41059 | $3,846.51 |

| HAZEL | 42420 | $3,848.00 |

| CLAY CITY | 41094 | $3,848.93 |

| RUMSEY | 42220 | $3,865.38 |

| ELLIOTTVILLE | 41016 | $3,874.06 |

| ELKFORK | 41011 | $3,878.25 |

| GRAYS KNOB | 40515 | $3,880.91 |

| LOUISVILLE | 41014 | $3,881.80 |

| LOVELACEVILLE | 42276 | $3,888.10 |

| BENHAM | 40504 | $3,888.88 |

| VERONA | 42451 | $3,889.73 |

| LOUISVILLE | 40514 | $3,897.33 |

| CRAYNE | 42159 | $3,901.18 |

| BOAZ | 42240 | $3,903.31 |

| CROCKETT | 40508 | $3,917.61 |

| HOLLAND | 42286 | $3,917.94 |

| KENVIR | 40513 | $3,918.42 |

| LEXINGTON | 42458 | $3,923.21 |

| WICKLIFFE | 42170 | $3,925.36 |

| ONEIDA | 40503 | $3,929.30 |

| HARRODSBURG | 42141 | $3,931.08 |

| EVARTS | 40536 | $3,933.04 |

| HARLAN | 40546 | $3,933.04 |

| LOUISVILLE | 40526 | $3,933.04 |

| CHAPPELL | 40510 | $3,935.07 |

| ROXANA | 40383 | $3,941.64 |

| HERNDON | 42452 | $3,945.39 |

| MILLSTONE | 40475 | $3,947.96 |

| MANCHESTER | 40517 | $3,949.27 |

| PRINCETON | 42266 | $3,953.09 |

| ARLINGTON | 42202 | $3,960.86 |

| MILLWOOD | 42171 | $3,962.21 |

| HARDIN | 42378 | $3,963.22 |

| LOUISVILLE | 40507 | $3,963.32 |

| BIG CREEK | 40511 | $3,964.40 |

| EDDYVILLE | 42223 | $3,966.00 |

| WHICK | 40509 | $3,977.25 |

| PRESTONSBURG | 40324 | $3,977.83 |

| EARLINGTON | 42204 | $3,979.63 |

| KUTTAWA | 42265 | $3,984.43 |

| CLOSPLINT | 40505 | $3,996.03 |

| BURGIN | 42254 | $4,000.64 |

| COLUMBUS | 42234 | $4,001.09 |

| JACKSON | 40516 | $4,002.14 |

| DANVILLE | 42071 | $4,005.72 |

| NORTONVILLE | 42236 | $4,008.78 |

| MITCHELLSBURG | 41092 | $4,023.61 |

| SAINT CHARLES | 42262 | $4,027.22 |

| ROBINSON CREEK | 40390 | $4,027.58 |

| NEBO | 42160 | $4,029.00 |

| PARIS | 42232 | $4,029.96 |

| ROARK | 40403 | $4,034.67 |

| BELTON | 42025 | $4,035.86 |

| AUBURN | 42406 | $4,036.11 |

| GORDON | 40347 | $4,036.85 |

| LA FAYETTE | 42457 | $4,039.91 |

| MC QUADY | 42049 | $4,040.25 |

| OLATON | 42134 | $4,042.71 |

| BEREA | 42280 | $4,043.41 |

| VIRGIE | 40356 | $4,043.87 |

| CLAY | 42036 | $4,044.35 |

| WOOTON | 40502 | $4,046.47 |

| WHEATCROFT | 42206 | $4,047.79 |

| CUSTER | 42020 | $4,048.04 |

| HICKMAN | 42054 | $4,050.30 |

| LEITCHFIELD | 42048 | $4,053.45 |

| ADOLPHUS | 42327 | $4,054.02 |

| BARLOW | 42215 | $4,057.82 |

| PAINT LICK | 42164 | $4,060.67 |

| MORGANFIELD | 42320 | $4,061.25 |

| EDMONTON | 42217 | $4,062.98 |

| FRANKFORT | 42351 | $4,063.07 |

| BARDWELL | 42163 | $4,064.67 |

| TILINE | 42044 | $4,069.09 |

| SMITH MILLS | 42431 | $4,070.65 |

| CUMBERLAND | 40506 | $4,077.43 |

| BLACKEY | 40372 | $4,077.57 |

| WOODBURY | 41099 | $4,077.97 |

| GUTHRIE | 42456 | $4,080.98 |

| JEFF | 40379 | $4,085.79 |

| CLINTON | 42127 | $4,090.90 |

| LOYALL | 40601 | $4,091.09 |

| FRANKLIN | 42413 | $4,093.31 |

| FALLS OF ROUGH | 42130 | $4,095.14 |

| SACRAMENTO | 42076 | $4,097.42 |

| ROUSSEAU | 40391 | $4,097.62 |

| LEXINGTON | 42408 | $4,098.51 |

| BEAR BRANCH | 40385 | $4,099.03 |

| LEXINGTON | 42462 | $4,101.85 |

| MIDWAY | 42436 | $4,102.44 |

| WINCHESTER | 42347 | $4,102.77 |

| OLMSTEAD | 42459 | $4,104.31 |

| GARNER | 40342 | $4,108.05 |

| GEORGETOWN | 42461 | $4,111.22 |

| LA CENTER | 42156 | $4,111.22 |

| PARK CITY | 42444 | $4,112.24 |

| ROCHESTER | 42029 | $4,112.50 |

| BURNA | 42120 | $4,115.07 |

| PERRYVILLE | 42066 | $4,118.24 |

| GRAND RIVERS | 42040 | $4,118.64 |

| COVINGTON | 42701 | $4,120.55 |

| CECILIA | 42039 | $4,121.10 |

| POOLE | 42330 | $4,121.47 |

| CORYDON | 42437 | $4,134.80 |

| VINE GROVE | 42051 | $4,134.98 |

| BENTON | 42440 | $4,140.24 |

| PADUCAH | 42211 | $4,140.55 |

| MC HENRY | 42153 | $4,142.67 |

| CUNNINGHAM | 42256 | $4,143.16 |

| ASHER | 40404 | $4,143.98 |

| ROCKPORT | 42060 | $4,145.09 |

| DUNDEE | 42082 | $4,147.82 |

| MOUNT HERMON | 42167 | $4,148.39 |

| LANCASTER | 42079 | $4,149.51 |

| WILMORE | 42445 | $4,150.22 |

| ABERDEEN | 42055 | $4,150.47 |

| MURRAY | 42453 | $4,152.91 |

| SYMSONIA | 42275 | $4,154.03 |

| GREENVILLE | 42210 | $4,154.79 |

| GAMALIEL | 42035 | $4,156.74 |

| SHELBY GAP | 40310 | $4,159.62 |

| ASHLAND | 42003 | $4,159.79 |

| FORDSVILLE | 42027 | $4,167.92 |

| GRACEY | 42442 | $4,167.92 |

| CENTER | 42032 | $4,170.05 |

| ARY | 40361 | $4,171.30 |

| POWDERLY | 42038 | $4,171.51 |

| HANSON | 42350 | $4,173.45 |

| CROFTON | 42371 | $4,174.49 |

| COLUMBIA | 42085 | $4,176.24 |

| CLEATON | 42129 | $4,180.61 |

| BREMEN | 42086 | $4,180.77 |

| BEECHMONT | 42024 | $4,181.47 |

| MILLERSBURG | 42088 | $4,181.85 |

| CAMPBELLSVILLE | 42001 | $4,182.42 |

| DAWSON SPRINGS | 42345 | $4,183.18 |

| PARKSVILLE | 42053 | $4,183.89 |

| FORT CAMPBELL | 42463 | $4,184.16 |

| NICHOLASVILLE | 42410 | $4,184.40 |

| GRADYVILLE | 42021 | $4,188.91 |

| DUNBAR | 42022 | $4,190.14 |

| FORT THOMAS | 42762 | $4,190.99 |

| FOUNTAIN RUN | 42087 | $4,191.34 |

| ETOILE | 42157 | $4,193.28 |

| LEXINGTON | 42455 | $4,195.34 |

| BURDINE | 40461 | $4,197.37 |

| LEDBETTER | 42023 | $4,197.88 |

| BEREA | 42441 | $4,198.31 |

| HORSE BRANCH | 42033 | $4,199.21 |

| SOUTH CARROLLTON | 42131 | $4,200.44 |

| CENTERTOWN | 42056 | $4,200.78 |

| HESTAND | 42069 | $4,201.11 |

| STAMPING GROUND | 42354 | $4,202.85 |

| CENTRAL CITY | 42321 | $4,205.30 |

| PIKEVILLE | 40330 | $4,206.30 |

| WHITE PLAINS | 42123 | $4,208.05 |

| SALVISA | 42361 | $4,208.66 |

| CAVE CITY | 42352 | $4,210.47 |

| SCOTTSVILLE | 42374 | $4,211.74 |

| THELMA | 40119 | $4,213.82 |

| LUCAS | 42332 | $4,214.52 |

| UNIONTOWN | 42333 | $4,216.06 |

| GREENSBURG | 42031 | $4,219.36 |

| VAN LEAR | 40178 | $4,219.81 |

| LEXINGTON | 42464 | $4,220.19 |

| MELBER | 42154 | $4,220.75 |

| DUNMOR | 42028 | $4,222.51 |

| SECO | 40440 | $4,222.69 |

| SHELBIANA | 40353 | $4,222.87 |

| SEBREE | 42166 | $4,223.82 |

| CLAYHOLE | 40348 | $4,224.64 |

| LIVERMORE | 42133 | $4,225.18 |

| FARMINGTON | 42325 | $4,225.50 |

| LATONIA | 42728 | $4,228.68 |

| NEW CONCORD | 42348 | $4,229.88 |

| HARTFORD | 42338 | $4,233.74 |

| WESTVIEW | 42124 | $4,234.34 |

| WHITESBURG | 40444 | $4,235.47 |

| BROWNSVILLE | 42259 | $4,236.29 |

| BEAVER DAM | 42372 | $4,237.39 |

| HYDEN | 40422 | $4,239.12 |

| LEWISPORT | 42370 | $4,240.15 |

| BEECH CREEK | 42151 | $4,242.08 |

| PARTRIDGE | 40468 | $4,242.79 |

| PROVIDENCE | 42041 | $4,243.00 |

| MAYFIELD | 42326 | $4,243.04 |

| CALIFORNIA | 42721 | $4,243.51 |

| ROCKY HILL | 42369 | $4,244.22 |

| SHARON GROVE | 42411 | $4,244.36 |

| CALVERT CITY | 42328 | $4,245.11 |

| BANDANA | 42201 | $4,245.67 |

| BEE SPRING | 42050 | $4,245.92 |

| PINE TOP | 40464 | $4,249.52 |

| VICCO | 40175 | $4,252.33 |

| KEVIL | 42207 | $4,255.39 |

| SLEMP | 40153 | $4,256.01 |

| NEWPORT | 42754 | $4,256.28 |

| LEWISBURG | 42285 | $4,258.52 |

| DEXTER | 42409 | $4,263.27 |

| HAWESVILLE | 42083 | $4,263.92 |

| OAK GROVE | 42450 | $4,264.28 |

| DIXON | 42045 | $4,264.64 |

| ALEXANDRIA | 42724 | $4,266.40 |

| MADISONVILLE | 42367 | $4,266.59 |

| STURGIS | 42337 | $4,271.78 |

| ALMO | 42404 | $4,272.21 |

| AUSTIN | 42140 | $4,274.31 |

| EIGHTY EIGHT | 42349 | $4,275.01 |

| WINGO | 42214 | $4,275.26 |

| UTICA | 42743 | $4,277.59 |

| SEDALIA | 42273 | $4,278.22 |

| MANITOU | 42339 | $4,278.78 |

| WAVERLY | 42343 | $4,279.71 |

| ELIZABETHTOWN | 42324 | $4,280.64 |

| FANCY FARM | 42323 | $4,282.32 |

| FREDONIA | 42058 | $4,283.92 |

| WATER VALLEY | 42219 | $4,283.93 |

| NEWPORT | 42742 | $4,285.87 |

| MOUSIE | 40115 | $4,287.83 |

| DYCUSBURG | 41102 | $4,291.42 |

| MORNING VIEW | 42718 | $4,293.49 |

| FALCON | 40152 | $4,293.87 |

| WALTON | 42715 | $4,296.29 |

| STANVILLE | 40170 | $4,296.60 |

| KIMPER | 40121 | $4,298.15 |

| MEALLY | 40076 | $4,298.31 |

| PADUCAH | 42252 | $4,299.70 |

| BELCHER | 40065 | $4,300.04 |

| UNION | 42726 | $4,301.48 |

| PARKERS LAKE | 41101 | $4,302.96 |

| COVINGTON | 42712 | $4,304.75 |

| GILBERTSVILLE | 42368 | $4,305.04 |

| DELPHIA | 40140 | $4,306.30 |

| HEBRON | 42741 | $4,306.57 |

| LETCHER | 40370 | $4,308.55 |

| PINE RIDGE | 41030 | $4,311.31 |

| ROCKFIELD | 42753 | $4,314.95 |

| BURLINGTON | 42748 | $4,315.46 |

| TRAM | 40171 | $4,316.35 |

| SOUTH WILLIAMSON | 40162 | $4,316.41 |

| ROUNDHILL | 42261 | $4,317.06 |

| LOOKOUT | 40003 | $4,318.29 |

| SAINT HELENS | 40160 | $4,320.18 |

| FOREST HILLS | 40143 | $4,322.85 |

| WARFIELD | 40145 | $4,323.94 |

| WACO | 42344 | $4,325.41 |

| FULTON | 42064 | $4,326.40 |

| INDEPENDENCE | 42749 | $4,326.90 |

| DAYTON | 42732 | $4,327.77 |

| BETSY LAYNE | 40144 | $4,328.81 |

| OIL SPRINGS | 40111 | $4,329.28 |

| COMBS | 40337 | $4,338.74 |

| NAZARETH | 41031 | $4,339.20 |

| BEAUMONT | 42081 | $4,339.98 |

| LOUISVILLE | 41056 | $4,342.87 |

| LOWES | 41139 | $4,345.55 |

| SWEEDEN | 42047 | $4,348.04 |

| BOWLING GREEN | 42764 | $4,349.35 |

| INEZ | 40176 | $4,349.46 |

| RIVER | 40068 | $4,352.41 |

| BOWLING GREEN | 42776 | $4,352.89 |

| MC CARR | 40019 | $4,353.92 |

| OWENSBORO | 42788 | $4,358.88 |

| MAMMOTH CAVE | 42078 | $4,358.91 |

| ALVATON | 42733 | $4,359.50 |

| MACEO | 42740 | $4,360.43 |

| OLIVE HILL | 41169 | $4,369.78 |

| LICK CREEK | 40067 | $4,371.30 |

| LEXINGTON | 42642 | $4,372.70 |

| VIPER | 40351 | $4,381.69 |

| PINSONFORK | 40031 | $4,383.22 |

| STAFFORDSVILLE | 40146 | $4,386.11 |

| THOUSANDSTICKS | 40223 | $4,386.88 |

| FRENCHBURG | 41010 | $4,386.89 |

| RAVEN | 40022 | $4,395.07 |

| IRVINE | 41033 | $4,396.83 |

| SAINT FRANCIS | 41183 | $4,398.53 |

| SAINT MARY | 41034 | $4,401.81 |

| LEXINGTON | 42544 | $4,402.01 |

| ORLANDO | 41065 | $4,403.07 |

| LILY | 41055 | $4,404.61 |

| MC KEE | 41003 | $4,405.06 |

| GARRETT | 40077 | $4,406.68 |

| MALLIE | 40355 | $4,411.45 |

| MC ANDREWS | 40014 | $4,415.11 |

| EAST POINT | 40222 | $4,416.35 |

| WEST VAN LEAR | 40070 | $4,423.79 |

| DWALE | 40311 | $4,425.59 |

| FISTY | 40242 | $4,426.77 |

| PETERSBURG | 42729 | $4,429.77 |

| PRESTON | 41064 | $4,432.19 |

| FEDSCREEK | 40007 | $4,435.88 |

| PILGRIM | 40207 | $4,436.63 |

| PHILPOT | 42722 | $4,439.73 |

| BEVINSVILLE | 40057 | $4,441.18 |

| DRIFT | 40142 | $4,442.11 |

| KEATON | 40108 | $4,443.46 |

| DRAKE | 41168 | $4,445.60 |

| PHYLLIS | 40036 | $4,448.17 |

| TEABERRY | 40155 | $4,448.63 |

| TRENTON | 42629 | $4,450.69 |

| STAMBAUGH | 40050 | $4,451.16 |

| ERLANGER | 42746 | $4,451.76 |

| SIDNEY | 40026 | $4,455.35 |

| HENDERSON | 42716 | $4,458.06 |

| LEXINGTON | 42553 | $4,461.09 |

| MAJESTIC | 40010 | $4,461.39 |

| STANTON | 41097 | $4,464.07 |

| FT MITCHELL | 42759 | $4,466.45 |

| FLORENCE | 42782 | $4,467.46 |

| FREEBURN | 40011 | $4,469.69 |

| YEADDISS | 40374 | $4,469.75 |

| YERKES | 40243 | $4,469.75 |

| HAGERHILL | 40157 | $4,473.98 |

| MINNIE | 40056 | $4,474.09 |

| IVEL | 40161 | $4,474.42 |

| BRYANTS STORE | 41041 | $4,475.04 |

| BELLEVUE | 42757 | $4,478.65 |

| BOWLING GREEN | 42765 | $4,480.39 |

| BIGHILL | 41144 | $4,481.03 |

| RACCOON | 40350 | $4,482.49 |

| LOUISVILLE | 41035 | $4,484.59 |

| EASTWOOD | 41039 | $4,485.28 |

| LACKEY | 40051 | $4,489.43 |

| REDFOX | 40299 | $4,490.39 |

| MOZELLE | 40409 | $4,493.92 |

| PINE KNOT | 41121 | $4,495.48 |

| BUCKHORN | 40360 | $4,497.17 |

| HITCHINS | 41174 | $4,503.76 |

| LEXINGTON | 42528 | $4,504.25 |

| LOUISVILLE | 41006 | $4,504.66 |

| WILLIAMSPORT | 40055 | $4,507.71 |

| ELKTON | 42713 | $4,516.20 |

| WOODBURN | 42567 | $4,517.53 |

| BOONS CAMP | 40058 | $4,521.22 |

| MELBOURNE | 42717 | $4,526.43 |

| BLOOMFIELD | 41189 | $4,529.34 |

| ASHCAMP | 40313 | $4,531.24 |

| OWENSBORO | 42784 | $4,532.76 |

| DENTON | 41175 | $4,532.81 |

| DANA | 40117 | $4,532.82 |

| CROMONA | 40023 | $4,534.08 |

| SAUL | 40075 | $4,541.30 |

| CATLETTSBURG | 41093 | $4,541.98 |

| HELTON | 40363 | $4,544.60 |

| SMITHS GROVE | 42516 | $4,545.55 |

| LOUISVILLE | 41049 | $4,555.76 |

| SPOTTSVILLE | 42602 | $4,556.13 |

| SOLDIER | 41002 | $4,557.21 |

| LOUISVILLE | 41135 | $4,557.88 |

| WHITESVILLE | 42503 | $4,561.65 |

| COXS CREEK | 41179 | $4,563.55 |

| ROCKHOLDS | 41046 | $4,564.69 |

| LANGLEY | 40177 | $4,565.52 |

| MOUNT VERNON | 41141 | $4,566.16 |

| LEXINGTON | 42501 | $4,568.07 |

| RICHMOND | 42533 | $4,569.01 |

| EAST BERNSTADT | 41040 | $4,570.90 |

| VERSAILLES | 42541 | $4,571.95 |

| MILFORD | 41052 | $4,572.01 |

| ROWDY | 40334 | $4,573.64 |

| MELVIN | 40040 | $4,574.21 |

| TOPMOST | 40037 | $4,575.68 |

| LITTCARR | 40205 | $4,578.20 |

| CALHOUN | 42377 | $4,580.01 |

| LEJUNIOR | 40150 | $4,581.85 |

| HOSKINSTON | 40004 | $4,583.26 |

| SASSAFRAS | 40245 | $4,585.25 |

| FORDS BRANCH | 40358 | $4,585.60 |

| RANSOM | 40006 | $4,586.54 |

| LIVINGSTON | 41045 | $4,588.05 |

| CHAVIES | 40241 | $4,592.07 |

| BEAUTY | 40059 | $4,592.97 |

| DEBORD | 40033 | $4,594.76 |

| MAYKING | 40448 | $4,596.20 |

| WHITLEY CITY | 41095 | $4,596.23 |

| ISLAND | 42221 | $4,599.24 |

| TUTOR KEY | 40104 | $4,601.73 |

| WITTENSVILLE | 40045 | $4,602.17 |

| ERMINE | 40484 | $4,602.90 |

| FLATGAP | 40052 | $4,606.93 |

| HARRODS CREEK | 41043 | $4,607.62 |

| DAVID | 40165 | $4,609.74 |

| BASKETT | 41166 | $4,610.00 |

| BYPRO | 40041 | $4,612.27 |

| HALLIE | 40359 | $4,615.92 |

| WEEKSBURY | 40049 | $4,617.44 |

| MC ROBERTS | 40442 | $4,617.61 |

| LEXINGTON | 42603 | $4,617.98 |

| AVAWAM | 40437 | $4,619.43 |

| HELLIER | 40107 | $4,620.05 |

| ADAIRVILLE | 42518 | $4,621.41 |

| ROBARDS | 42539 | $4,623.56 |

| WHEELWRIGHT | 40046 | $4,625.79 |

| BELFRY | 40220 | $4,626.34 |

| HARDY | 40025 | $4,628.02 |

| FRAKES | 41044 | $4,635.22 |

| STONE | 40012 | $4,637.36 |

| MOUTHCARD | 40110 | $4,638.52 |

| JEREMIAH | 40419 | $4,638.74 |

| NEWPORT | 42356 | $4,641.73 |

| HI HAT | 40069 | $4,645.59 |

| ROCKHOUSE | 40078 | $4,646.35 |

| SITKA | 40047 | $4,652.32 |

| ESSIE | 40328 | $4,654.14 |

| STEELE | 40009 | $4,657.59 |

| HOPKINSVILLE | 42633 | $4,658.15 |

| LOUISVILLE | 41083 | $4,661.45 |

| LEXINGTON | 42558 | $4,662.24 |

| GLASGOW | 42565 | $4,664.34 |

| EZEL | 41004 | $4,675.33 |

| HINDMAN | 40371 | $4,675.98 |

| LAWRENCEBURG | 42334 | $4,676.36 |

| BARBOURVILLE | 41008 | $4,680.67 |

| SMILAX | 40489 | $4,683.08 |

| TOMAHAWK | 40060 | $4,683.94 |

| MARSHES SIDING | 41098 | $4,685.38 |

| LOUISVILLE | 41086 | $4,692.34 |

| LEBURN | 40071 | $4,693.36 |

| ROYALTON | 40061 | $4,694.30 |

| PRINTER | 40109 | $4,696.72 |

| LEXINGTON | 42566 | $4,698.51 |

| HUDDY | 40008 | $4,700.50 |

| BANNER | 40062 | $4,701.31 |

| ELKHORN CITY | 40206 | $4,733.84 |

| CANADA | 40013 | $4,741.02 |

| MILBURN | 41132 | $4,744.12 |

| KENTON | 41146 | $4,753.33 |

| PHELPS | 40020 | $4,754.78 |

| LYNNVILLE | 41143 | $4,762.99 |

| LOUISVILLE | 41164 | $4,777.71 |

| CROMWELL | 42128 | $4,785.62 |

| KIRKSEY | 42402 | $4,793.30 |

| ALLEN | 40291 | $4,798.20 |

| ALLENSVILLE | 42460 | $4,801.82 |

| WEST PADUCAH | 42216 | $4,823.09 |

| PEMBROKE | 42519 | $4,825.50 |

| DUBRE | 41053 | $4,830.30 |

| ISOM | 40405 | $4,831.91 |

| BROWDER | 42063 | $4,861.23 |

| LOST CREEK | 40456 | $4,861.41 |

| CANEYVILLE | 42061 | $4,869.63 |

| WAYLAND | 40228 | $4,887.81 |

| ROSINE | 42070 | $4,917.66 |

| REED | 42638 | $4,945.48 |

| COVINGTON | 42649 | $4,945.64 |

| LEXINGTON | 42635 | $4,954.76 |

| DRAKESBORO | 42037 | $4,957.69 |

| OAKLAND | 42634 | $4,986.26 |

| CADIZ | 42288 | $4,990.26 |

| LEXINGTON | 42631 | $4,990.37 |

| VANCLEVE | 40380 | $5,007.10 |

| RUSSELLVILLE | 42647 | $5,009.00 |

| LEXINGTON | 42653 | $5,018.14 |

| GAYS CREEK | 40312 | $5,024.71 |

| REVELO | 41129 | $5,036.74 |

| BONNYMAN | 40452 | $5,038.30 |

| LONDON | 41062 | $5,059.28 |

| EMMALENA | 40272 | $5,060.62 |

| CARRIE | 40118 | $5,061.32 |

| REGINA | 40218 | $5,069.92 |

| LOUISVILLE | 41037 | $5,092.12 |

| ELIZAVILLE | 41081 | $5,111.44 |

| LINEFORK | 40376 | $5,118.53 |

| GRETHEL | 40122 | $5,123.79 |

| LEXINGTON | 42564 | $5,127.99 |

| HUEYSVILLE | 40229 | $5,129.88 |

| JENKINS | 40346 | $5,132.32 |

| THORNTON | 40460 | $5,132.65 |

| STINNETT | 40366 | $5,133.29 |

| PATHFORK | 40744 | $5,134.34 |

| DWARF | 40741 | $5,137.74 |

| SIZEROCK | 40219 | $5,149.39 |

| WARBRANCH | 40737 | $5,158.36 |

| HAROLD | 40258 | $5,167.36 |

| WANETA | 40740 | $5,175.08 |

| GARRARD | 40701 | $5,176.18 |

| SILVER GROVE | 42731 | $5,179.49 |

| LOUISVILLE | 41061 | $5,183.71 |

| STEARNS | 41096 | $5,218.81 |

| BUSY | 40213 | $5,225.79 |

| CORBIN | 41054 | $5,227.95 |

| MARY ALICE | 40759 | $5,246.48 |

| EOLIA | 40445 | $5,247.61 |

| LOUISVILLE | 40940 | $5,278.65 |

| DEMA | 40027 | $5,278.95 |

| DAYHOIT | 40763 | $5,282.76 |

| DENNISTON | 40921 | $5,323.73 |

| BULAN | 40729 | $5,346.83 |

| STOPOVER | 40018 | $5,361.92 |

| GOOSE ROCK | 40216 | $5,370.68 |

| VARNEY | 40204 | $5,386.56 |

| BEAVER | 40063 | $5,395.69 |

| LONE | 40336 | $5,403.58 |

| PIPPA PASSES | 40048 | $5,405.19 |

| FOSTER | 41360 | $5,454.16 |

| HAZEL GREEN | 40769 | $5,473.57 |

| KRYPTON | 40319 | $5,481.74 |

| MYRA | 40317 | $5,481.74 |

| PAINTSVILLE | 40214 | $5,492.25 |

| MARTIN | 40217 | $5,576.62 |

| BEDFORD | 41421 | $5,589.89 |

| HAPPY | 40322 | $5,621.02 |

| CANNEL CITY | 40906 | $5,639.34 |

| JACKHORN | 40472 | $5,649.03 |

| EASTERN | 40202 | $5,656.82 |

| LOUISVILLE | 41472 | $5,659.53 |

| OLYMPIA | 41425 | $5,660.64 |

| NEON | 40447 | $5,710.98 |

| FAIRFIELD | 41173 | $5,712.69 |

| KETTLE ISLAND | 40943 | $5,716.87 |

| PINEVILLE | 40915 | $5,720.32 |

| HOLMES MILL | 40734 | $5,728.66 |

| BIMBLE | 40997 | $5,730.05 |

| INGRAM | 40935 | $5,732.12 |

| GRAYSON | 41171 | $5,738.86 |

| STONEY FORK | 40953 | $5,745.88 |

| SANDY HOOK | 40982 | $5,774.24 |

| CALVIN | 40923 | $5,777.40 |

| SHEPHERDSVILLE | 41352 | $5,780.56 |

| LOUISVILLE | 41180 | $5,783.69 |

| HIMA | 40755 | $5,790.85 |

| JONANCY | 40387 | $5,799.79 |

| ZOE | 40903 | $5,804.58 |

| TROSPER | 40946 | $5,812.18 |

| WALKER | 40988 | $5,818.92 |

| LOUISVILLE | 40902 | $5,819.75 |

| VINCENT | 40771 | $5,822.49 |

| GRAY | 40995 | $5,822.86 |

| BEATTYVILLE | 40913 | $5,828.45 |

| ARTEMUS | 40958 | $5,843.50 |

| MIDDLESBORO | 40939 | $5,851.94 |

| SCUDDY | 40293 | $5,858.05 |

| WEBBVILLE | 40965 | $5,859.01 |

| GREEN ROAD | 40955 | $5,861.08 |

| LOUISA | 40856 | $5,862.30 |

| WOODBINE | 40949 | $5,885.73 |

| COALGOOD | 40813 | $5,895.91 |

| BLUE RIVER | 40316 | $5,897.95 |

| CANNON | 40977 | $5,904.11 |

| LYNCH | 40492 | $5,946.96 |

| BOSTON | 41311 | $5,947.28 |

| LOUISVILLE | 41408 | $5,971.56 |

| PROSPECT | 41397 | $5,999.91 |

| MC DOWELL | 40208 | $6,029.45 |

| STANFORD | 41365 | $6,040.14 |

| LOVELY | 40209 | $6,061.89 |

| SALYERSVILLE | 40473 | $6,077.52 |

| BURNSIDE | 41149 | $6,133.23 |

| BIG LAUREL | 40481 | $6,151.95 |

| ANNVILLE | 40845 | $6,170.72 |

| BARDSTOWN | 41451 | $6,179.15 |

| LIBERTY | 41301 | $6,227.37 |

| CURDSVILLE | 41230 | $6,231.98 |

| KITE | 40215 | $6,254.11 |

| HAZARD | 40486 | $6,288.30 |

| MIRACLE | 40932 | $6,288.58 |

| CORNETTSVILLE | 40203 | $6,301.45 |

| PREMIUM | 40402 | $6,301.98 |

| YOSEMITE | 41201 | $6,302.94 |

| BROOKSVILLE | 41232 | $6,328.84 |

| NEW HOPE | 41364 | $6,334.27 |

| HUSTONVILLE | 41314 | $6,334.30 |

| GULSTON | 40830 | $6,336.28 |

| DEANE | 40434 | $6,340.98 |

| CLERMONT | 41264 | $6,355.69 |

| CLIFTY | 41159 | $6,357.58 |

| FLAT LICK | 40983 | $6,367.66 |

| RENFRO VALLEY | 40870 | $6,370.48 |

| SULLIVAN | 41160 | $6,375.70 |

| BLAINE | 40815 | $6,376.40 |

| BAXTER | 40810 | $6,385.80 |

| SANDGAP | 40865 | $6,385.90 |

| LOUISVILLE | 40873 | $6,386.75 |

| STRUNK | 41124 | $6,395.18 |

| PUTNEY | 40818 | $6,398.53 |

| MISTLETOE | 40806 | $6,401.47 |

| CAWOOD | 40820 | $6,403.77 |

| COLDIRON | 40801 | $6,404.70 |

| QUINCY | 41351 | $6,405.30 |

| BRONSTON | 41310 | $6,415.69 |

| BLEDSOE | 40819 | $6,417.88 |

| MC KINNEY | 41386 | $6,419.15 |

| KINGS MOUNTAIN | 41332 | $6,419.93 |

| TOTZ | 40824 | $6,421.60 |

| PITTSBURG | 40964 | $6,438.92 |

| ARJAY | 40951 | $6,444.22 |

| HULEN | 40863 | $6,445.45 |

| FINCHVILLE | 41739 | $6,463.64 |

| VEST | 40488 | $6,472.22 |

| ROGERS | 40874 | $6,473.12 |

| LOWMANSVILLE | 40843 | $6,475.96 |

| BERRY | 41722 | $6,486.44 |

| FOURMILE | 40941 | $6,491.34 |

| TYNER | 40854 | $6,493.20 |

| BOONEVILLE | 40831 | $6,493.25 |

| ULYSSES | 40828 | $6,493.27 |

| WENDOVER | 40211 | $6,496.50 |

| WELLINGTON | 40962 | $6,501.47 |

| NERINX | 41339 | $6,503.19 |

| GRAY HAWK | 40829 | $6,509.96 |

| GUNLOCK | 40210 | $6,518.79 |

| LOUISVILLE | 40847 | $6,519.13 |

| WILDIE | 40914 | $6,520.11 |

| WALLINS CREEK | 40816 | $6,522.42 |

| LEBANON | 41390 | $6,524.78 |

| GHENT | 41413 | $6,527.75 |

| AUXIER | 40212 | $6,537.39 |

| MAZIE | 40823 | $6,562.05 |

| HEIDRICK | 40927 | $6,562.65 |

| AGES BROOKSIDE | 40807 | $6,565.47 |

| MIZE | 40972 | $6,575.13 |

| HAMPTON | 41776 | $6,580.43 |

| LOUISVILLE | 40855 | $6,580.55 |

| WHITE MILLS | 41764 | $6,588.73 |

| SONORA | 41772 | $6,602.85 |

| CARLISLE | 41701 | $6,603.13 |

| CLOVERPORT | 41815 | $6,639.75 |

| CRANKS | 40808 | $6,643.40 |

| SADIEVILLE | 41838 | $6,644.74 |

| WEST LOUISVILLE | 41465 | $6,647.29 |

| HUDSON | 41825 | $6,659.23 |

| MALONE | 40862 | $6,659.57 |

| REYNOLDS STATION | 41843 | $6,671.18 |

| FALMOUTH | 41517 | $6,672.75 |

| WADDY | 41855 | $6,679.27 |

| MASONIC HOME | 41348 | $6,681.15 |

| NEW LIBERTY | 41719 | $6,682.28 |

| CRITTENDEN | 41837 | $6,687.30 |

| GARFIELD | 41840 | $6,687.41 |

| SEXTONS CREEK | 40826 | $6,687.57 |

| FORT KNOX | 41858 | $6,689.08 |

| HODGENVILLE | 41835 | $6,690.69 |

| JETSON | 41849 | $6,697.34 |

| LOUISVILLE | 41713 | $6,703.06 |

| JEFFERSONVILLE | 41812 | $6,712.58 |

| MOREHEAD | 41749 | $6,713.83 |

| HARDINSBURG | 41826 | $6,713.95 |

| CAMPTON | 40858 | $6,718.32 |

| GRAHAM | 41824 | $6,719.81 |

| BAYS | 40803 | $6,722.62 |

| SCALF | 40979 | $6,722.71 |

| ASHLAND | 41845 | $6,722.73 |

| MILTON | 41366 | $6,724.65 |

| PENDLETON | 41560 | $6,725.82 |

| HILLSBORO | 41538 | $6,727.01 |

| CRESTWOOD | 41714 | $6,733.92 |

| SHELBYVILLE | 41848 | $6,736.41 |

| WARSAW | 41385 | $6,741.25 |

| RUSSELL SPRINGS | 41751 | $6,741.44 |

| RINEYVILLE | 41833 | $6,746.86 |

| FLATWOODS | 41777 | $6,747.29 |

| SMITHLAND | 41804 | $6,747.56 |

| MARION | 41822 | $6,749.06 |

| MORGANTOWN | 41832 | $6,749.36 |

| ISONVILLE | 40868 | $6,751.27 |

| RICETOWN | 40840 | $6,758.65 |

| SULPHUR | 41712 | $6,760.06 |

| WESTPORT | 41721 | $6,761.63 |

| HORSE CAVE | 41821 | $6,764.68 |

| WEST POINT | 41526 | $6,765.47 |

| EWING | 41572 | $6,765.53 |

| KNIFLEY | 41836 | $6,766.15 |

| DUNNVILLE | 41562 | $6,779.47 |

| WEBSTER | 41774 | $6,780.76 |

| PORT ROYAL | 41557 | $6,781.73 |

| ALPHA | 41317 | $6,782.71 |

| EASTVIEW | 41819 | $6,784.70 |

| ALBANY | 41537 | $6,790.58 |

| HARNED | 41817 | $6,791.02 |

| DOVER | 41729 | $6,796.33 |

| OWENTON | 41347 | $6,796.41 |

| BATTLETOWN | 41367 | $6,796.59 |

| LORETTO | 41501 | $6,806.96 |

| MARTHA | 40827 | $6,807.61 |

| GUSTON | 41653 | $6,807.63 |

| LA GRANGE | 41746 | $6,813.38 |

| SIMPSONVILLE | 41754 | $6,820.69 |

| UPTON | 41549 | $6,820.84 |

| RHODELIA | 41607 | $6,827.78 |

| HOPE | 41512 | $6,829.09 |

| IRVINGTON | 41745 | $6,835.49 |

| CAMPBELLSBURG | 41621 | $6,839.21 |

| SOUTH PORTSMOUTH | 41563 | $6,839.55 |

| CLARKSON | 41847 | $6,847.52 |

| GLENDALE | 41760 | $6,848.90 |

| DRY RIDGE | 41601 | $6,851.51 |

| CORINTH | 41740 | $6,853.65 |

| SCIENCE HILL | 41635 | $6,855.78 |

| RUSSELL | 41759 | $6,866.44 |

| MAYSVILLE | 41778 | $6,867.32 |

| LOUISVILLE | 41743 | $6,868.50 |

| NANCY | 41727 | $6,875.70 |

| GOSHEN | 41640 | $6,875.93 |

| MOUNT OLIVET | 41666 | $6,879.31 |

| EMINENCE | 41766 | $6,879.43 |

| SPARTA | 41216 | $6,879.44 |

| MIDDLEBURG | 41514 | $6,881.93 |

| ELK HORN | 41762 | $6,883.69 |

| BONNIEVILLE | 41559 | $6,886.72 |

| LOCKPORT | 41649 | $6,887.02 |

| BEVERLY | 40944 | $6,887.09 |

| RADCLIFF | 41828 | $6,888.22 |

| SANDERS | 41240 | $6,889.34 |

| MAYSLICK | 41723 | $6,892.77 |

| MOOREFIELD | 41602 | $6,895.47 |

| MOUNT SHERMAN | 41775 | $6,896.30 |

| BUCKNER | 41632 | $6,896.44 |

| SALT LICK | 41231 | $6,898.45 |

| MULDRAUGH | 41647 | $6,900.36 |

| MONTICELLO | 41250 | $6,906.47 |

| SOMERSET | 41522 | $6,910.54 |

| UNION STAR | 41834 | $6,915.63 |

| NEW HAVEN | 41571 | $6,919.99 |

| WORTHINGTON | 41731 | $6,920.44 |

| SUMMERSVILLE | 41622 | $6,921.79 |

| CHAPLIN | 41265 | $6,923.05 |

| JAMESTOWN | 41645 | $6,933.46 |

| WAYNESBURG | 41224 | $6,934.00 |

| SMITHFIELD | 41773 | $6,934.84 |

| BETHLEHEM | 41663 | $6,935.79 |

| CANMER | 41659 | $6,936.33 |

| SHARPSBURG | 41616 | $6,937.49 |

| MACKVILLE | 41503 | $6,939.69 |

| HARDYVILLE | 41642 | $6,942.81 |

| FAIRVIEW | 41368 | $6,944.78 |

| RAYWICK | 41222 | $6,951.18 |

| LOUISVILLE | 41660 | $6,952.48 |

| SALEM | 41763 | $6,953.87 |

| LOUISVILLE | 41426 | $6,955.11 |

| FALL ROCK | 40849 | $6,956.64 |

| MOUNT WASHINGTON | 41256 | $6,959.53 |

| GERMANTOWN | 41267 | $6,959.85 |

| MAGNOLIA | 41605 | $6,961.98 |

| GLENCOE | 41527 | $6,966.23 |

| LOUISVILLE | 41619 | $6,973.66 |

| DE MOSSVILLE | 41735 | $6,975.24 |

| WILLIAMSTOWN | 41631 | $6,975.95 |

| BETHELRIDGE | 41539 | $6,976.95 |

| SPRINGFIELD | 41260 | $6,978.25 |

| MUSES MILLS | 41725 | $6,979.57 |

| PAYNEVILLE | 41615 | $6,979.80 |

| GLENS FORK | 41839 | $6,980.94 |

| TATEVILLE | 41238 | $6,981.35 |

| SOUTH SHORE | 41548 | $6,983.57 |

| PLEASUREVILLE | 41655 | $6,985.80 |

| CARROLLTON | 41226 | $6,986.92 |

| EMERSON | 41534 | $6,987.27 |

| CRAB ORCHARD | 41263 | $6,987.76 |

| BUTLER | 41561 | $6,988.69 |

| MARROWBONE | 41630 | $6,990.63 |

| WINDSOR | 41234 | $6,991.51 |

| HINKLE | 40981 | $7,000.10 |

| BAGDAD | 41831 | $7,001.66 |

| GLENVIEW | 41268 | $7,013.95 |

| BUFFALO | 41636 | $7,016.79 |

| BRADFORDSVILLE | 41254 | $7,017.53 |

| PERRY PARK | 41540 | $7,018.15 |

| JONESVILLE | 41513 | $7,018.75 |

| MUNFORDVILLE | 41604 | $7,023.31 |

| GREENUP | 41603 | $7,024.17 |

| LEBANON JUNCTION | 41464 | $7,032.12 |

| MAPLE MOUNT | 41262 | $7,036.98 |

| BROOKS | 41203 | $7,038.10 |

| SAINT CATHARINE | 41204 | $7,041.29 |

| FLEMINGSBURG | 41606 | $7,045.52 |

| BRANDENBURG | 41651 | $7,046.16 |

| LOUISVILLE | 41271 | $7,047.37 |

| WORTHVILLE | 41219 | $7,049.30 |

| NEW CASTLE | 41643 | $7,049.95 |

| WILLISBURG | 41257 | $7,053.62 |

| CUB RUN | 41667 | $7,060.09 |

| BIG CLIFTY | 41844 | $7,063.34 |

| GRAVEL SWITCH | 41255 | $7,072.18 |

| LOUISVILLE | 41669 | $7,076.79 |

| MOUNT EDEN | 41274 | $7,090.70 |

| PEWEE VALLEY | 41612 | $7,098.25 |

| RUSH | 41650 | $7,102.07 |

| MC DANIELS | 41862 | $7,107.14 |

| TOLLESBORO | 41554 | $7,117.75 |

| TAYLORSVILLE | 41214 | $7,125.42 |

| BURKESVILLE | 41555 | $7,127.30 |

| STEPHENSPORT | 41859 | $7,162.04 |

| OWINGSVILLE | 41564 | $7,174.13 |

| SOMERSET | 41531 | $7,177.02 |

| CYNTHIANA | 41810 | $7,193.17 |

| BREEDING | 41861 | $7,198.39 |

| CLEARFIELD | 41553 | $7,220.98 |

| FISHERVILLE | 41544 | $7,221.29 |

| LOUISVILLE | 41568 | $7,228.16 |

| TURNERS STATION | 41543 | $7,238.19 |

| FERGUSON | 41519 | $7,238.28 |

| BRODHEAD | 41567 | $7,244.84 |

| VANCEBURG | 41528 | $7,245.89 |

| EKRON | 41547 | $7,246.33 |

| ARGILLITE | 41566 | $7,251.41 |

| AUGUSTA | 41535 | $7,270.10 |

| GARRISON | 41524 | $7,275.01 |

| EUBANK | 41558 | $7,283.52 |

| ADAMS | 40844 | $7,317.50 |

| WALLINGFORD | 41542 | $7,400.56 |

Read more:

- Hartford Insurance Company of the Southeast Car Insurance Review

- Germantown Mutual Insurance Co. Car Insurance Review

- California General Underwriters Insurance Company, Inc. Car Insurance Review

- Austin Mutual Insurance Company Car Insurance Review

- USAA Casualty Insurance Company Car Insurance Review

- Bloomfield Mutual Insurance Company Car Insurance Review

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

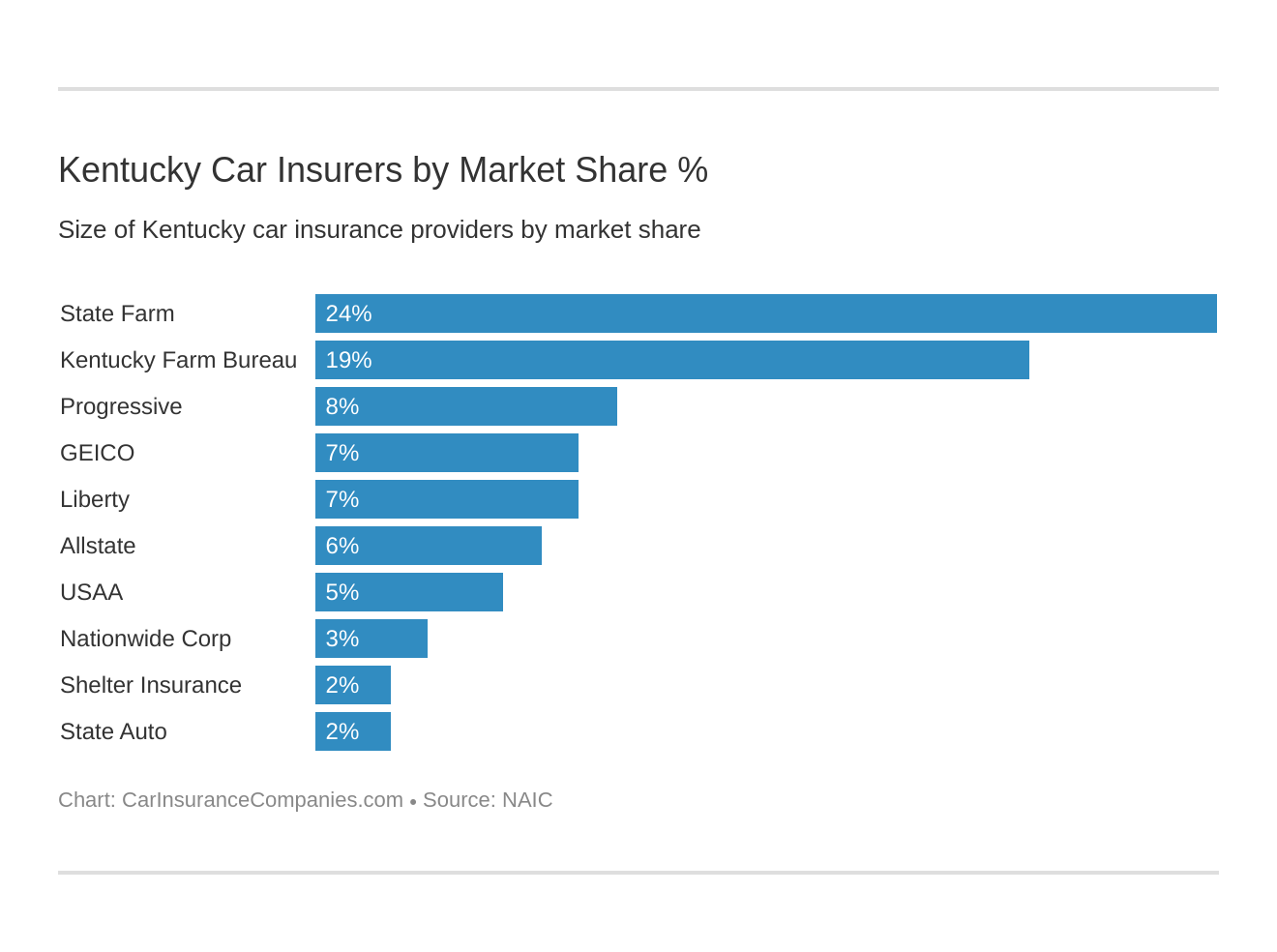

Kentucky Car Insurance Companies

To say that there are more car insurance companies than you can probably count in the United States, would likely be an understatement.

All of these companies are out there and are fighting to gain your business. So trying to make your way through the crowd of eager providers can seem overwhelming.

That’s what we’re here for. We’ve gone through all of the data for the largest providers in the state of Kentucky to help you compare.

Read more: Top 10 Kentucky Car Insurance Companies

The Largest Companies Financial Rating

Insurance companies want to know what your financial health is like, but did you know you can find out the same about them? There’s an independent rating agency, known as the A.M. Best Rating, that helps give you a glance into this very thing.

They basically give a grade to each insurance company, based on various financial factors. The higher the grade, the better the company’s financial health.

| Company | Grade |

|---|---|

| State Farm Group | A++ |

| Kentucky Farm Bureau Group | A |

| Progressive Group | A+ |

| Geico | A++ |

| Liberty Mutual Group | A |

| Allstate Insurance Group | A+ |

| USAA Group | A++ |

| Nationwide Corp Group | A+ |

| Shelter Insurance Group | A |

| State Auto Mutual Group | A- |

Companies with Best Ratings

You want to make sure you are with an insurance provider with the very best ratings, right?

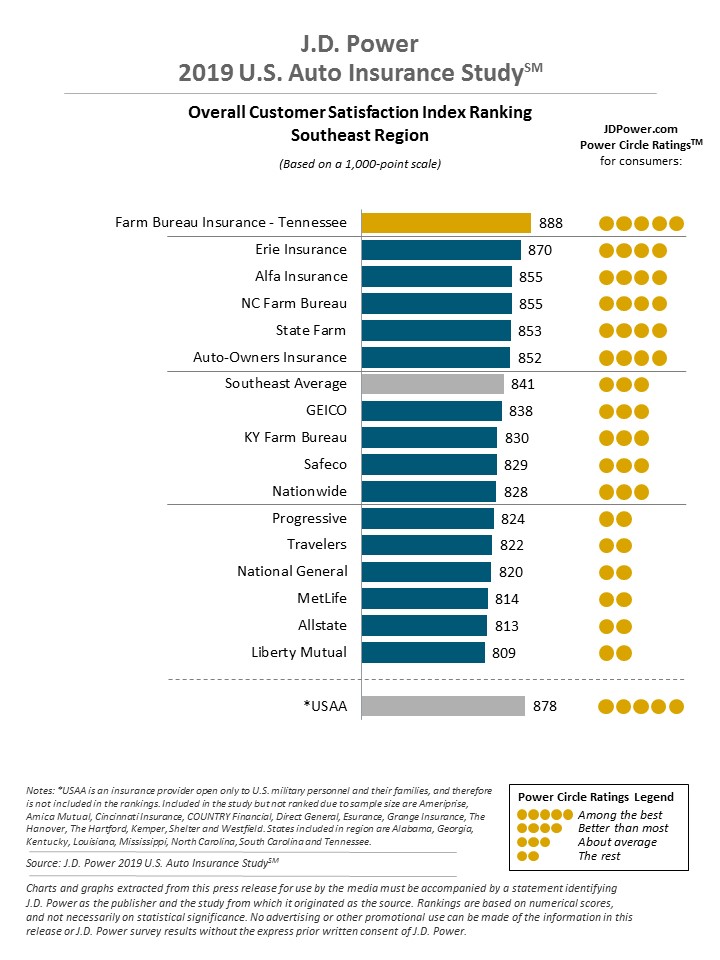

Well, to try and find out who the best providers in each region were, J.D. Power conducted a study to find out that very thing.

They measured the overall satisfaction of all of the various insurance providers in every region across the nation. They then tallied up the absolute best-rated insurance companies in each region of Kentucky.

The Southeast region, which Kentucky falls under, had the following ratings:

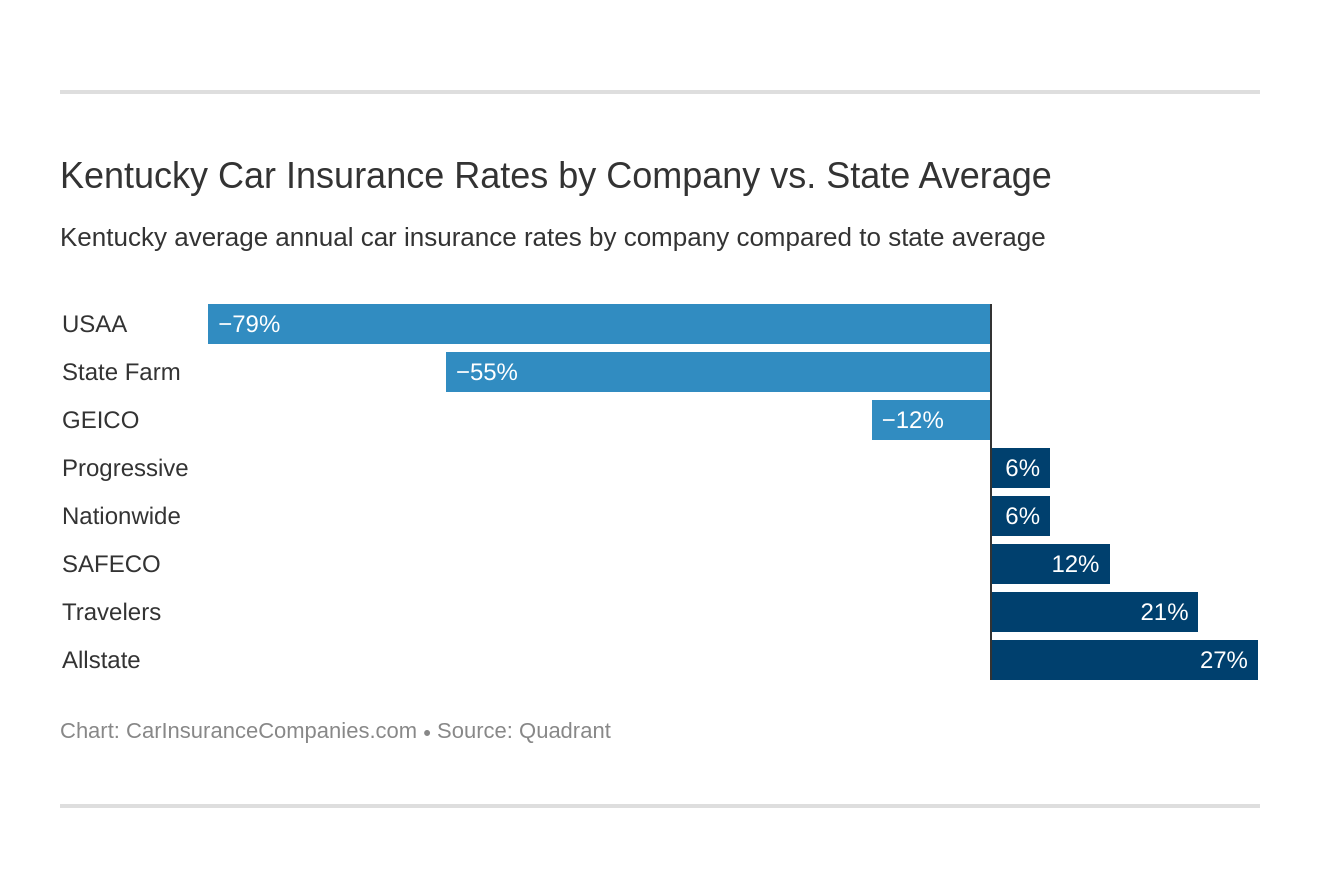

What are the cheapest car insurance companies in Kentucky?

So, what are the cheapest companies for car insurance? Below, we’ll look at which insurance carriers offer cheap car insurance rates for a variety of different demographics.

| Cheapest Companies | Rates | Most Expensive Companies | Rates |

|---|---|---|---|

| Privilege Underwriters Reciprocal Exchange | $672.13 | Nationwide General Insurance Company | $3,539.75 |

| American Select Insurance Company | $874.75 | Nationwide Property and Casualty Insurance Company | $3,522.50 |

| United Services Automobile Association | $912.75 | Trexis One Insurance Corporation | $3,431.50 |

| Erie Insurance Exchange | $946.88 | Encompass Insurance Company of America | $3,185.88 |

| USAA Casualty Insurance Company | $952.75 | Amica Property and Casualty Insurance Company | $3,178.38 |

| Auto-Owners Insurance Company | $958.63 | Permanent General Assurance Corporation of Ohio | $3,134.00 |

| Geico General Insurance Company | $1,081.50 | Trexis Insurance Corporation | $3,110.25 |

| Government Employees Insurance Company | $1,081.50 | Nationwide Mutual Insurance Company | $3,100.88 |

| State Farm Mutual Automobile Insurance Company | $1,104.50 | Encompass Indemnity Company | $3,068.00 |

| AIG Property Casualty Company | $1,133.38 | American Hallmark Insurance Company of Texas | $2,803.88 |

Read more:

- American Hallmark Insurance Company Of Texas Car Insurance Review

- Privilege Underwriters Reciprocal Exchange Car Insurance Review

- Encompass Property and Casualty Insurance Company of New Jersey Car Insurance Review

- United Services Automobile Association Car Insurance Review

Commute Rates by Company

How far you commute on a regular basis may, depending on the insurance company, increase your auto insurance costs. That’s right, some companies will charge more for longer commutes.

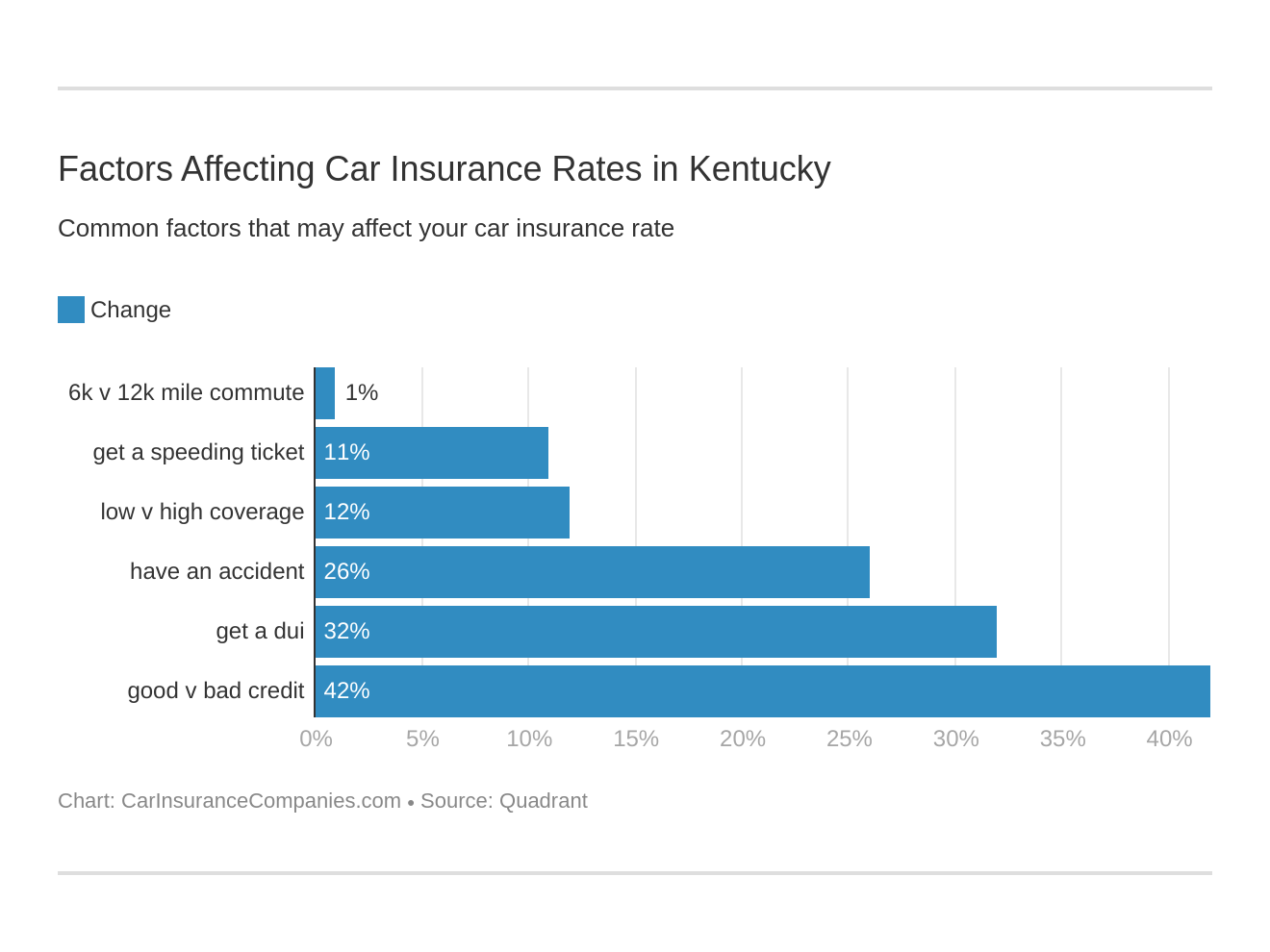

Take a look at these 6 major factors affecting auto insurance rates in Kentucky.

| Group | 10 miles commute / 6,000 annual mileage | 25 miles commute / 12,000 annual mileage |

|---|---|---|

| Allstate | $7,143.92 | $7,143.92 |

| Travelers | $6,551.68 | $6,551.68 |

| Liberty Mutual | $5,930.97 | $5,930.97 |

| Progressive | $5,547.63 | $5,547.63 |

| Nationwide | $5,503.23 | $5,503.23 |

| Geico | $4,676.65 | $4,590.52 |

| State Farm | $3,437.78 | $3,270.85 |

| USAA | $3,006.15 | $2,789.64 |

Fortunately for those in Kentucky, the majority of companies do not charge more for longer commutes.

Coverage Level Rates by Company

How would you feel if we told you that you might be paying more for a lower coverage plan? Probably not very good, right? Well, depending on the insurance company, it could be true.

| Group | High | Medium | Low |

|---|---|---|---|

| Allstate | $7,898.31 | $7,101.39 | $6,432.05 |

| Geico | $4,993.86 | $4,613.47 | $4,293.44 |

| Liberty Mutual | $6,300.15 | $5,887.57 | $5,605.20 |

| Nationwide | $5,554.10 | $5,529.57 | $5,426.01 |

| Progressive | $6,113.49 | $5,457.13 | $5,072.27 |

| State Farm | $3,562.79 | $3,347.83 | $3,152.33 |

| Travelers | $6,869.14 | $6,578.16 | $6,207.73 |

| USAA | $3,043.04 | $2,890.83 | $2,759.80 |

As you can see from the table above, a low coverage plan with Allstate would cost you $6,432.05, while a high coverage plan with Geico comes with cheaper rates at an average of $4,993.86! That means you would be paying $1,438.199 more for a lower coverage plan.

This is why it’s important to comparison shop for auto insurance rates.

Credit History Rates by Company

You get to know the insurance company’s financial health through their A.M. Best Ratings, and companies are able to see yours through your credit history.

The better your credit history, the lower your cost of insurance tends to be. This is because, just like you would trust a company with a higher financial health rating to help cover you, insurance companies feel the same way about you paying for your insurance policy.

| Group | Poor | Fair | Good |

|---|---|---|---|

| Allstate | $9,533.35 | $6,508.38 | $5,390.03 |

| Geico | $7,618.30 | $3,803.71 | $2,478.76 |

| Liberty Mutual | $8,498.13 | $5,201.15 | $4,093.63 |

| Nationwide | $6,719.07 | $5,248.71 | $4,541.89 |

| Progressive | $6,192.39 | $5,408.23 | $5,042.27 |

| State Farm | $4,832.88 | $2,933.18 | $2,296.89 |

| Travelers | $7,311.83 | $6,182.66 | $6,160.53 |

| USAA | $4,306.41 | $2,416.87 | $1,970.40 |

As you can see from the table above, just going from a fair credit history to a poor credit history alone can cost you thousands of dollars.

Driving Record Rates by Company

Another way to help save you extra cash on your insurance is to have a clean driving history. If you have a bad driving record, you’ll likely pay more for your auto insurance.

| Group | With 1 DUI | With 1 accident | With 1 speeding violation | Clean record |

|---|---|---|---|---|

| Allstate | $8,260.64 | $7,724.51 | $6,679.30 | $5,911.23 |

| Geico | $7,467.13 | $4,913.10 | $3,387.81 | $2,766.32 |

| Liberty Mutual | $7,618.06 | $5,913.45 | $5,254.67 | $4,937.70 |

| Nationwide | $7,183.66 | $5,662.92 | $4,807.99 | $4,358.34 |

| Progressive | $5,224.39 | $6,816.16 | $5,569.65 | $4,580.31 |

| State Farm | $3,354.32 | $3,629.62 | $3,354.32 | $3,079.02 |

| Travelers | $8,514.63 | $5,868.49 | $6,120.50 | $5,703.08 |

| USAA | $3,693.72 | $3,087.95 | $2,627.86 | $2,182.03 |

As you can see from the table above, just having one speeding violation on your record could result in hundreds of extra dollars you’d have to pay! Making sure to drive safely on the roads will definitely score you cheaper premiums.

Largest Car Insurance Companies in Kentucky

| Company Name | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $714,964 | 65.70% | 23.59% |

| Kentucky Farm Bureau Group | $566,603 | 75.94% | 18.70% |

| Progressive Group | $240,000 | 58.90% | 7.92% |

| Geico | $212,468 | 74.56% | 7.01% |

| Liberty Mutual Group | $206,822 | 59.60% | 6.82% |

| Allstate Insurance Group | $190,422 | 50.09% | 6.28% |

| USAA Group | $152,259 | 76.42% | 5.02% |

| Nationwide Corp Group | $88,331 | 57.90% | 2.91% |

| Shelter Insurance Group | $57,753 | 63.96% | 1.91% |

| State Auto Mutual Group | $56,056 | 72.38% | 1.85% |

| State Total | $3,030,463 | 67.00% | 100.00% |

Number of Insurers

Did you know that there are technically only two types of insurance providers? That’s right, car insurance providers fall into one of two types of providers; Domestic and Foreign.

Domestic Insurer – an insurance company admitted by and formed under the laws under the state in which insurance is written

Foreign Insurer – an insurance provider which was formed under the laws of another state, but is still doing business in Kentucky

In Kentucky, there are currently seven domestic providers and 900 foreign providers listed. So you have many providers you can choose from.

Kentucky State Laws

In this section, we’ll move on to talk about the various state laws that are present in Kentucky. Laws regarding things such as car insurance, vehicle licensing, and more.

So keep reading to make sure you know all that you need to know about the state laws of Kentucky. The more you know, the more likely you are to avoid any costly tickets and fines.

Car Insurance Laws

As car insurance is required in most states across the United States, each state has various laws regarding it.

We’ll take a closer look at some of these laws that you’ll want to make sure you adhere to in Kentucky.

High-Risk Insurance

If you have a not-so-stellar driving record, you might be labeled as something known as a high-risk driver. This means that you’ll have a harder time finding insurance coverage, as companies will become wary of providing you with coverage.

But since it is legally required for you to have insurance coverage in Kentucky, what can you do? Well luckily, there’s a program available to help.

The program is called the Kentucky Automobile Insurance Plan (KAIP). Once you apply to and are accepted into this program, you are basically assigned to an insurance provider who will then be required to offer you coverage.

If you are out of options for insurance coverage, this may be your only hope. However, there is a catch to this. As you are assigned to this insurance provider, they can pretty much charge you whatever insurance rate they deem appropriate.

No matter how outrageous the price may seem, once you are in this program, you will have to accept whatever terms the provider offers you.

This is why this program is considered the last resort for high-risk drivers. It’s recommended that if you are able to find coverage outside of this program, even if it is a little pricey, that you take that coverage first.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Low-Cost Insurance

Most states in the nation do not offer any sort of low-cost government insurance plan, Kentucky included. This doesn’t mean, however, that you can’t save yourself a couple of bucks on your insurance plans.

Having a good credit history and clean driving record will definitely keep your insurance rates low, but there is more you can do to save some cash! Car insurance discounts are one of the most common ways to save even more cash.

There are so many different kinds of insurance discounts you could qualify for, such as the more common ones listed below:

- Good driver

- Homeowner

- Anti-Theft / Anti-Lock Systems

- Good Student

- Multiple Cars

- Paying in Full

- Company/School (the company you work for/the school you attend sometimes offers discounts)

If you have a bad credit score or you don’t have a clean driving record, discounts can help you find affordable car insurance.

Make sure you talk with your insurance provider, however, to see what additional discounts they offer.

Windshield Coverage

A lot of states in the nation have very unique laws when it comes to windshield coverage. Kentucky, fortunately, is not one of them when it comes to repairs.

Adding windshield coverage onto your insurance policy is optional in Kentucky. Should this be a coverage type you would like to add to your policy, you are in luck.

According to the Kentucky Department of Insurance, insurance providers are required to provide deductible- and fee-free windshield replacement for customers carrying comprehensive coverage.

If you have comprehensive coverage, you’ll be able to take advantage of this coverage option.

Automobile Insurance Fraud in Kentucky

According to the Insurance Information Institute (III), approximately $30 billion is lost every year in insurance fraud. That’s a lot of money.

Due to this, insurance fraud is illegal across the nation.

The state of Kentucky, according to the Kentucky Insurance Fraud Statute (KRS Chapter 304.47), defines fraud in the following ways:

- Fake accidents and disability

- False applications and claims

- Theft of insurance premium

- Arson

- False medical billing

- Unauthorized insurance companies

They further elaborate that there are some “red flags” to help determine if insurance fraud is occurring such as:

- No witness to an accident

- Lengthy recovery period

- Unusual medical treatment

- Improperly issued insurance policies

- Deceptive or misleading sales tactics

- Cash transactions

- Lack of cooperation

- Excessive demands

If you ever need to report fraud, according to the Kentucky Department of Insurance you can submit information online by completing the Uniform Suspected Insurance Fraud Reporting Form.

If you prefer to submit written reports to the Division of Insurance Fraud Investigation by regular mail, please include a completed copy of the FD-1 Report Fraud Form.

If you are an insurer or agency, you will need to file a Fraud Reporting Form, which will then need to be submitted to the Division of Insurance Fraud Investigation.

Insurers and other agencies can also use the Department’s eServices web portal to electronically report suspected fraudulent insurance acts.

You can also contact the Department of Insurance:

- 800-595-6053 (Toll-Free)

- 502-564-3630 (Telephone)

Statute of Limitations

If you are ever involved in a car accident, you will want to make sure you adhere to the statute of limitations in order to submit and resolve or file a alawsuit in any claims for that accident.

The statute of limitations dictates the amount of time, in each state, that you have in order to submit and resolve a claim after an accident.

According to the state of Kentucky, you will have the following amount of time:

- Personal Injuries: One year

- Property Damage: Two years

Vehicle Licensing Laws

In order to drive, as well as having car insurance, you are required to have vehicle licensing. Car registration, driver’s license, and more.

So keep reading to find out what Kentucky vehicle licensing laws you’ll need to follow.

Real ID Act

According to Kentucky’s DMV, in October 2020, standard licenses will no longer meet federal REAL ID Act requirements for Kentuckians to board U.S. domestic flights or enter select federal facilities.

They state the following regarding this:

Kentucky has been working to come into compliance with the federal requirements, and in response, will begin offering two new versions of all identity credentials beginning in 2019. A phased, statewide rollout of the new credentials will start in early 2019 and end by spring. To learn more about the initiative, visit Confident Kentucky.

Penalties for Driving Without Insurance

As we’ve mentioned previously, you are required to carry the minimum coverage for the state of Kentucky in order to legally drive. If you are caught driving without this coverage, you will be facing some of the following penalties:

| Penalty | First Offense | Second Offense in Five Years |

|---|---|---|

| Fine | $500-$1000 | $1000-$2000 |

| Imprisonment | Up to 90 days (imprisonment may be in place of or in addition to the fine) | Up to 180 days (imprisonment may be in place of or in addition to the fine) |

| Registration | Registration will be revoked and license plates suspended for one year or until proof of insurance can be shown | Registration will be revoked and license plates suspended for one year or until proof of insurance can be shown |

Teen Driver Laws

Teen drivers out there will want to make sure to follow a few rules and restrictions in order to gain their driver’s licenses:

| Restrictions | Permit | Intermediate License | Unrestricted License |

|---|---|---|---|

| Age | Minimum age 16 | After having a permit for six months (minimum age 16 years six months). If convicted of a traffic offense, the teen must begin the six month period again | After holding an intermediate license for six months (minimum age 17) or age 18 |

| Hours of Driving | Minimum 60 hours 10 of which must be at night | Must have completed the permit requirement | Must have completed the permit requirement |

| Time | Cannot drive between 12:00 A.M. and 6:00 A.M without good cause | Cannot drive between 12:00 A.M. and 6:00 A.M without good cause | No restrictions |

| Passenger | One unrelated passenger under 20 years old limit except when supervised by a driving training instructor | One unrelated passenger under 20 years old limit except when supervised by a driving training instructor | No restrictions |

License Renewal Procedures

License renewal procedures in Kentucky, according to the Insurance Institute for Highway Safety (IIHS), look like the following:

| License Renewal Procedures in Kentucky | General Population | Older Population |

|---|---|---|

| Licence Renewal Cycle | 8 years | 8 years |

| Proof of Adequate Vision | no | no |

| Mail or Online Renewal? | no | no |

In addition, according to the Insurance Institute for Highway Safety (IIHS):

In Kentucky, “in order to accommodate the transition from a four-year licensing schedule to an eight year licensing schedule, the Transportation Cabinet may renew operator’s licenses with terms of both four and eight years until January 2023.”

New Residents

If you are looking to make Kentucky your home, you will want to make sure you follow the following guidelines according to Kentucky’s DMV:

- New residents in Kentucky have 30 days to get a Kentucky license. (According to KRS 186.020, new residents will also need to fill out an application for registration within 15 days in the county in which the person resides)

- To get a license, you must be a U.S. citizen or permanent resident.

- You will need to bring your out-of-state license and social security card to the Circuit Court Clerk’s office (photocopies are not accepted). If your name is different than that on your birth certificate, you may need to show a marriage license or court-ordered name change.

- Those under age 18 must present a School Compliance Verification Form signed by the out-of-state school.

- Out-of-state permit holders must transfer their permit to Kentucky before applying for a license.

Rules of the Road

We’re not done with state laws just yet! We’ve gone over car insurance and vehicle licensing, but what other kinds of state laws are you going to want to be aware of?

In this section, we’ll talk about some of the rules of the road to follow in Kentucky.

Fault vs. No-Fault

We mentioned in an earlier section that Kentucky is a “no-fault” state.

This means that regardless of who is at fault for an accident, you will have to rely on your own insurance coverage to pay for any injuries/property damage as a result of that accident.

So making sure that you have at least the minimum coverage will help to ensure that you aren’t left out high and dry if you are ever involved in an accident.

Keep Right and Move Over Laws

There are at least two laws that are extremely simple to follow; keep right and move over laws. What are you to do for these laws?

Well, in Kentucky, you are required to drive in the right lane. The exception is if you are passing or turning left.

Move over laws are just as easy! If you are driving and see a vehicle with flashing lights, you will be required to move to another lane. Simple right?

If you aren’t able to safely move to another lane, you’ll then need to slow down and use caution while passing emergency vehicles.

– Speed Limits

Speed limits help to ensure that all drivers are safe on the road! If you are driving too fast on a particular type of road, you could end up in an accident!

In Kentucky, you will want to adhere to the following speed limits according to the Insurance Institute for Highway Safety (IIHS):

- Rural Interstates: 65 mph; 70 mph on specified segments of road

- Urban Interstates: 65 mph

- Limited Access Roads: 65 mph

- All Other Roads: 55 mph

Seat belt and Car Seat Laws

Kentucky requires the following car seat and seat belt laws according to the Insurance Institute for Highway Safety (IIHS):

| Kentucky's Child Safety Laws | Fines | Car Seat | Adult Belt | Additional Fines |

|---|---|---|---|---|

| Who is covered? In what seats? | Maximum base fine 1st offense, additional fees may apply | Must be in child safety seat | Adult belt permissible | Maximum base fine 1st offense, additional fees may apply |

| 7 and younger and more than 57 inches in all seats; 8+ in all seats | $25 | 40 inches or less in a child restraint; 7 and younger who are between 40 and 57 inches tall in a booster seat | taller than 57 inches | $50 child restraint; $30 booster seat |

Ridesharing

It’s pretty hard nowadays to have not at least heard of ridesharing services such as Uber or Lyft. They’ve grown in popularity not just for riders needing a quick and convenient lift, but also for those drivers out there looking to make some extra cash.

If you are one such driver looking to work for a ridesharing service, you will want to make sure that you have the minimum coverage required for that state.

Just as a reminder, here are the minimum coverage requirements for Kentucky:

- $25,000 –for the payment of any bodily injuries for one person incurred during an accident

- $50,000 – for the payment of any bodily injuries of multiple people incurred during an accident

- $25,000 – for the payment of any property damage incurred during an accident

- $10,000 – for the payment of your own personal injury protection (PIP)

- $25,000/$50,000 – for the payment of protection against uninsured/underinsured drivers

In addition to this, some of these ridesharing services will require that you carry an additional coverage type known as ridesharing insurance.

The following companies offer this coverage type in Kentucky:

- Geico

- Allstate

- Erie Insurance

- USAA

- State Farm

Safety Laws

We want to make sure that you are as safe as possible while out cruising on the roads of Kentucky, which is why we will now discuss a few of the safety laws you’ll want to know.

DUI Laws

Drinking and driving has become an issue nationwide.

The issue is such a problem in Kentucky that the state has been ranked as the 11th most dangerous state for drunk driving!

Due to this, Kentucky has been trying to crack down on drinking and driving. If you are caught drinking and driving in Kentucky, you could be facing some of the following consequences:

| Penalty | First Offense | Second Offense | Third Offense | Fourth Offense |

|---|---|---|---|---|

| Suspended License | 30-120 days | 12-18 months | 24-36 months | 60 months |

| Imprisonment | 2-30 days | 7 days-6 months | 30 days-12 months | Minimum 120 days without probation |

| Fine | $200-$500 | $350-$500 | $500-$1000 | n/a |

| Program Attendance | 90 days of alcohol or substance abuse program | 1 year alcohol or substance abuse treatment | 1 year alcohol or substance abuse treatment | 1 year alcohol or substance abuse treatment |

| Community Service | Possible 48 hours-30 days of community labor | 10 days-6 months community labor | 10 days-12 months community labor | n/a |

| Mandatory Ignition Interlock Device | No (Yes if BAC is over 0.15) | Yes | Yes | Yes |

Marijuana-Impaired Driving Laws

Many states have been legalizing marijuana, calling into question what kinds of driving-related laws should be enacted because of this?

Well, currently Kentucky doesn’t have any marijuana-specific drugged driving laws. This doesn’t, however, mean that you are off the hook for having marijuana altogether.

The substance is still fully illegal in Kentucky, so even having it at all will land you in trouble.

Distracted Driving Laws

Ever since the dawn of the cellphone age, the number of accidents and fatalities due to distracted driving has skyrocketed.

Due to this, most states have cracked down on the use of handheld devices, such as cellphones, while driving.

In Kentucky, drivers under the age of 18 are now allowed to use a handheld electronic device while driving. Those individuals over the age of 18 are allowed to talk on a cell phone, but you are banned from texting.

It’s not all bad news for you though! You could actually save some extra cash on your insurance policy if you join a No Texting and Driving Pledge! This is easy cash to save since you’re legally not allowed to text and drive anyway.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

KENTUCKY CAN’T-MISS FACTS

In this final section, we’ll dive deeper into some of the facts and statistics you absolutely need to know before driving in Kentucky.

Vehicle Theft in Kentucky

In the state of Kentucky, it’s been found that the following vehicles are more prone to theft than any other in the state:

| City | Motor Vehicle Thefts |

|---|---|

| Louisville Metro | 2,025 |

| Lexington | 831 |

| Covington | 158 |

| Bowling Green | 125 |

| Owensboro | 106 |

| Shively | 77 |

| Florence | 73 |

| Frankfort | 59 |

| Henderson | 59 |

| Newport | 56 |

According to a study conducted by the FBI, the following vehicle theft rates were round in each city across Kentucky:

| City | Population | Motor vehicle thefts |

|---|---|---|

| Adairville | 840 | 0 |

| Albany | 2,032 | 0 |

| Alexandria | 8,683 | 5 |

| Anchorage | 2,391 | 2 |

| Ashland | 21,432 | 36 |

| Auburn | 1,330 | 1 |

| Audubon Park | 1,496 | 5 |

| Barbourville | 3,139 | 2 |

| Bardstown | 12,916 | 6 |

| Bardwell | 711 | 0 |

| Beattyville | 1,269 | 3 |

| Beaver Dam | 3,527 | 4 |

| Bellevue | 5,918 | 9 |

| Benham | 484 | 0 |

| Benton | 4,407 | 1 |

| Berea | 14,331 | 11 |

| Bloomfield | 858 | 1 |

| Bowling Green | 61,130 | 125 |

| Brandenburg | 2,867 | 1 |

| Brownsville | 829 | 1 |

| Burkesville | 1,526 | 1 |

| Burnside | 828 | 1 |

| Cadiz | 2,624 | 1 |

| Calvert City | 2,540 | 1 |

| Campbellsville | 10,804 | 6 |

| Carlisle | 1,956 | 2 |

| Carrollton | 3,966 | 2 |

| Catlettsburg | 1,829 | 2 |

| Cave City | 2,283 | 1 |

| Central City | 5,891 | 0 |

| Clarkson | 886 | 1 |

| Clay | 1,180 | 0 |

| Clay City | 1,062 | 1 |

| Cloverport | 1,159 | 0 |

| Coal Run Village | 1,678 | 1 |

| Cold Spring | 6,194 | 2 |

| Columbia | 4,490 | 2 |

| Corbin | 7,257 | 10 |

| Covington | 40,766 | 158 |

| Cumberland | 2,151 | 1 |

| Cynthiana | 6,305 | 10 |

| Danville | 16,388 | 17 |

| Dawson Springs | 2,753 | 1 |

| Dayton | 5,368 | 9 |

| Earlington | 1,407 | 0 |

| Eddyville | 2,578 | 0 |

| Edgewood | 8,679 | 4 |

| Edmonton | 1,569 | 0 |

| Elizabethtown | 29,470 | 25 |

| Elkton | 2,211 | 0 |

| Elsmere | 8,478 | 7 |

| Eminence | 2,478 | 1 |

| Erlanger | 18,432 | 33 |

| Evarts | 939 | 0 |

| Falmouth | 2,137 | 2 |

| Ferguson | 948 | 0 |

| Flatwoods | 7,412 | 6 |

| Flemingsburg | 2,702 | 4 |

| Florence | 31,434 | 73 |

| Fort Mitchell | 8,240 | 9 |

| Fort Thomas | 16,227 | 10 |

| Fort Wright | 5,703 | 9 |

| Frankfort | 27,680 | 59 |

| Franklin | 8,581 | 5 |

| Fulton | 2,310 | 3 |

| Gamaliel | 369 | 0 |

| Georgetown | 30,611 | 38 |

| Glasgow | 14,117 | 14 |

| Graymoor-Devondale | 2,914 | 3 |

| Grayson | 4,082 | 2 |

| Greensburg | 2,180 | 1 |

| Greenup | 1,176 | 0 |

| Greenville | 4,415 | 0 |

| Guthrie | 1,442 | 2 |

| Hardinsburg | 2,343 | 0 |

| Harlan | 1,677 | 3 |

| Harrodsburg | 8,301 | 5 |

| Hartford | 2,712 | 2 |

| Hawesville | 1,000 | 0 |

| Hazard | 5,455 | 12 |

| Henderson | 28,952 | 59 |

| Heritage Creek | 1,099 | 0 |

| Highland Heights | 6,938 | 1 |

| Hillview | 9,465 | 6 |

| Hodgenville | 3,228 | 1 |

| Hopkinsville | 33,253 | 38 |

| Hurstbourne Acres | 1,847 | 0 |

| Independence | 25,937 | 8 |

| Indian Hills | 2,918 | 2 |

| Irvine | 2,431 | 0 |

| Irvington | 1,193 | 2 |

| Jackson | 2,168 | 2 |

| Jamestown | 1,790 | 0 |

| Jeffersontown | 27,017 | 46 |

| Jenkins | 2,131 | 0 |

| La Grange | 8,277 | 11 |

| Lakeside Park-Crestview Hills | 5,881 | 6 |

| Lancaster | 3,429 | 2 |

| Lawrenceburg | 11,080 | 6 |

| Lebanon | 5,649 | 4 |

| Lebanon Junction | 1,861 | 2 |

| Leitchfield | 6,814 | 7 |

| Lewisburg | 801 | 0 |

| Lewisport | 1,701 | 0 |

| Lexington | 308,712 | 831 |

| Liberty | 2,196 | 3 |

| London | 6,067 | 13 |

| Louisa | 2,465 | 1 |

| Louisville Metro | 671,120 | 2,025 |

| Loyall | 664 | 0 |

| Ludlow | 4,536 | 9 |

| Lynnview | 928 | 0 |

| Madisonville | 19,761 | 17 |

| Manchester | 1,425 | 4 |

| Marion | 3,021 | 3 |

| Martin | 620 | 0 |

| Mayfield | 10,141 | 6 |

| Maysville | 9,024 | 12 |

| McKee | 784 | 0 |

| Meadow Vale | 748 | 0 |

| Middlesboro | 9,953 | 16 |

| Monticello | 6,189 | 5 |

| Morehead | 6,864 | 6 |

| Morganfield | 3,242 | 1 |

| Morgantown | 2,469 | 4 |

| Mortons Gap | 859 | 0 |

| Mount Sterling | 7,023 | 16 |

| Mount Vernon | 2,469 | 3 |

| Mount Washington | 9,377 | 5 |

| Muldraugh | 1,092 | 3 |