Essential Los Angeles, California Auto Insurance Guide [Companies & More]

Los Angeles car insurance rates are on the expensive end of the spectrum, averaging at $158 per month for good drivers. Your driving record could impact your Los Angeles car insurance costs, so enter your ZIP code below to start comparing quotes from multiple Los Angeles, CA car insurance companies in order to find the best coverage for your budget.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Nov 3, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 3, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Los Angeles Statistics | Details |

|---|---|

| Population | 3,884,307 |

| Density | 8,527 people per square mile |

| Average Cost of Car Insurance in Los Angeles | $7,260.97 |

| Cheapest Insurance Company | USAA Geico |

| Road Conditions | Poor: 57% Mediocre: 22% Fair: 11% Good: 10% Vehicle Operating Costs: $921 |

Here’s the deal: We know it’s tough researching car insurance. All those technical terms, the acronyms, the legalese, it’s enough to give anyone a headache. In a perfect world, you’d be done in just one hour, locked in with a company and policy.

But we know that’s not often the case. We get it. We’ve been there.

In this guide, you’ll find all you need to make a decision about car insurance in Los Angeles. We cover rates, companies, vehicle operating costs, how likely your car is to be stolen, and much more.

Let’s dive in.

Ready to compare rates? Try our FREE online tool.

The Cost of Car Insurance in Los Angeles

Have you ever found yourself going from insurance company to insurance company looking for quotes? The running around may give you cramps.

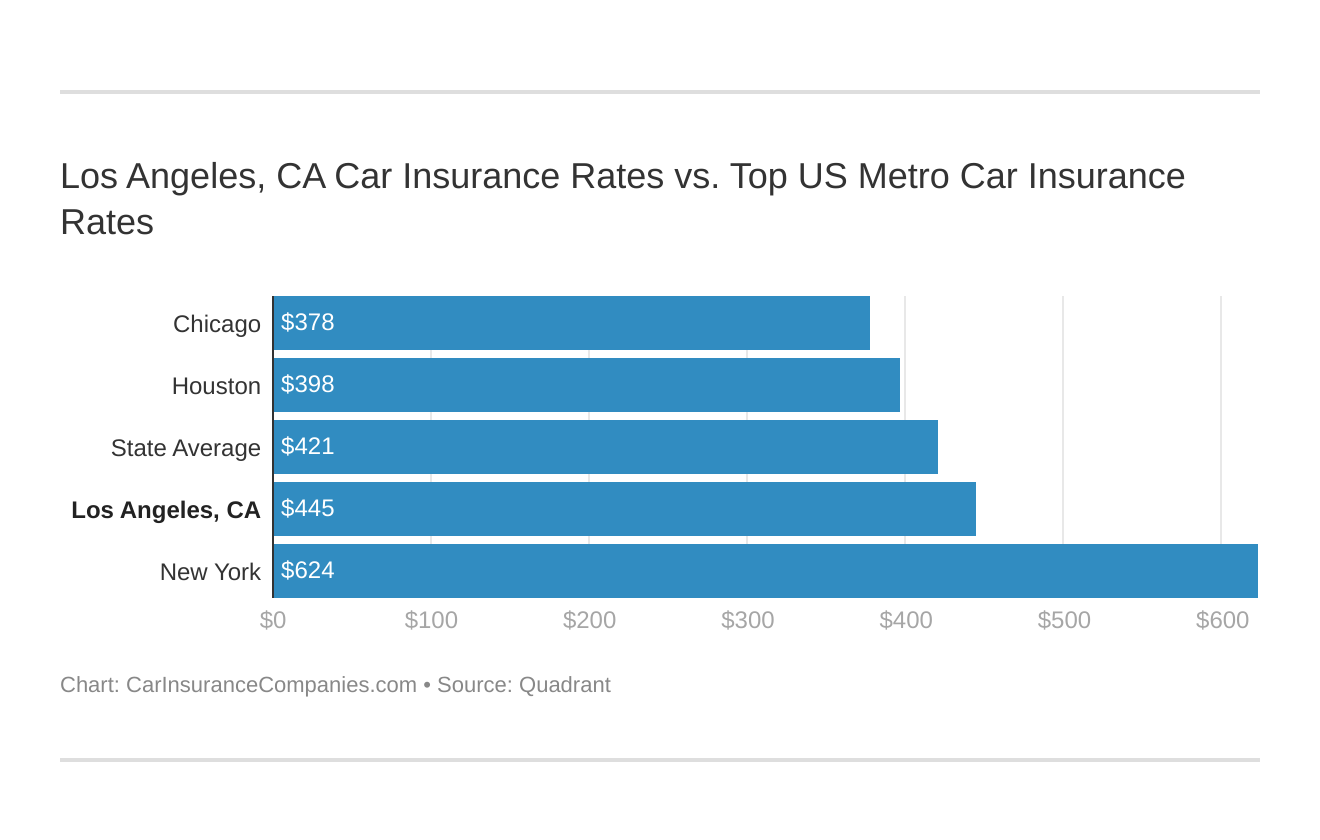

Which city you live in will have a major affect on car insurance. That’s why it’s vital to compare Los Angeles, CA against other top US metro areas’ auto insurance rates.

Read more: How much is car insurance in Los Angeles?

We understand and have got you covered.

We know that rates are likely the most important factor for you when it comes to car insurance. In this section, we have them eight ways, including the dreaded zip codes and the sink or swim driving records.

Let’s get started.

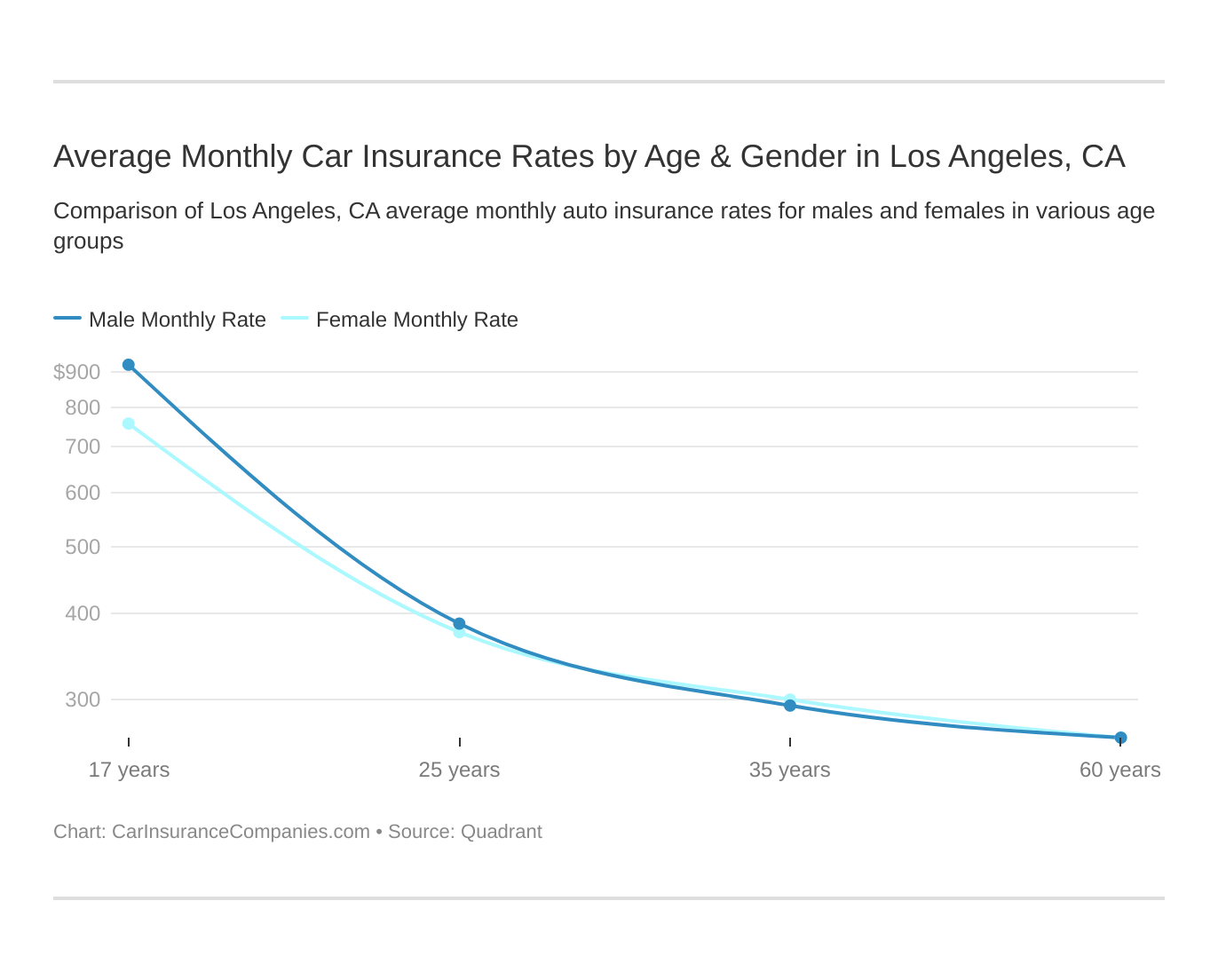

Male vs. Female vs Age

Ever heard the adage that young drivers have higher rates than older drivers?

These states no longer use gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a large factor because young drivers are considered high-risk drivers in Los Angeles. CA does use gender, so check out the average monthly car insurance rates by age and gender in Los Angeles, CA.

Whether it’s due to inexperience or increased risk-taking behavior, younger driver rates seem to be among the highest of all age groups. The younger, the higher. Or so the adage goes.

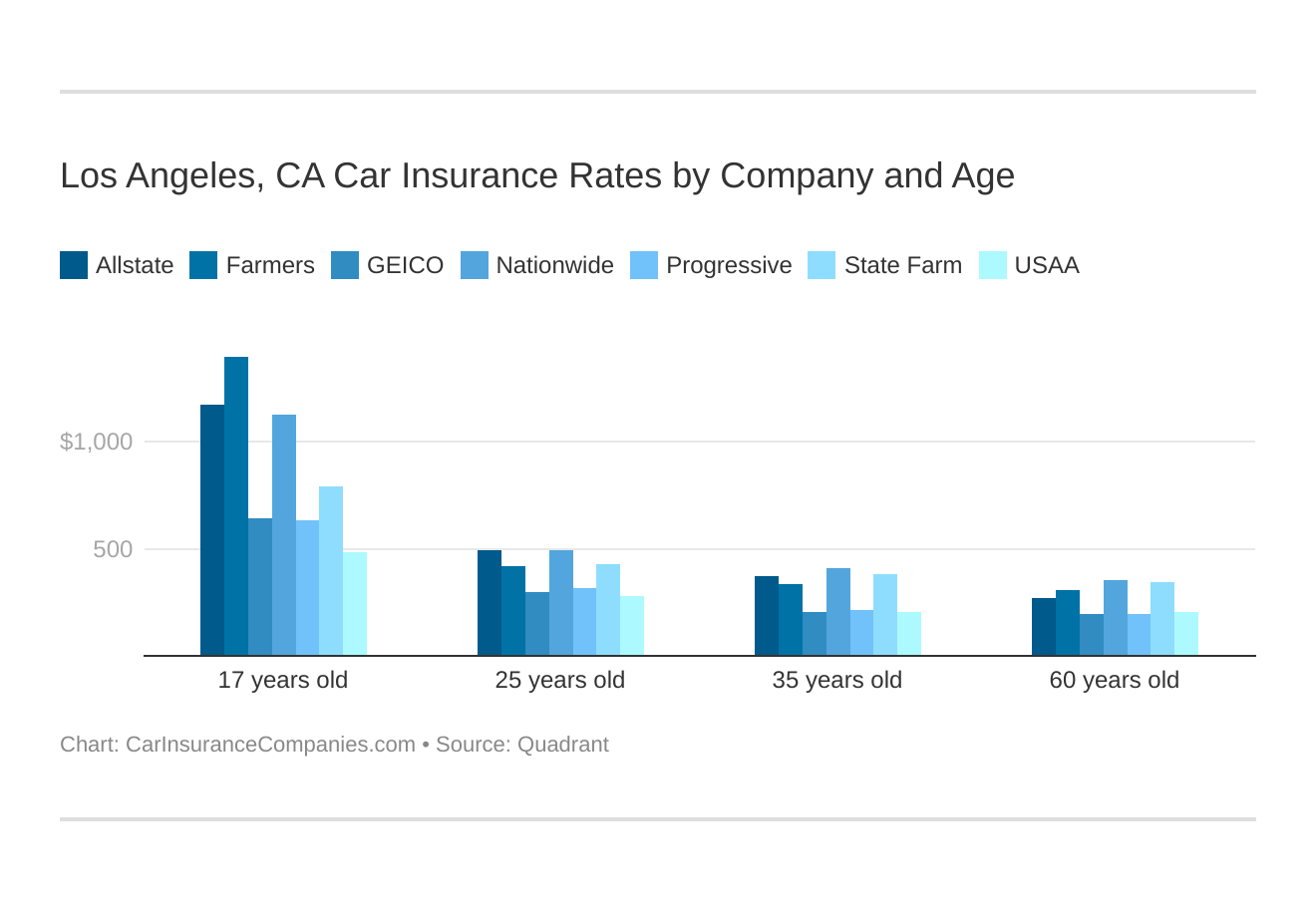

Data USA, an organization of data scientists, shows that the median age in LA is 35.8. Those at the average are on the lower side of LA rates, at about $3,600.

| 35 | 60 | 17 | 25 | Cheapest Rate | Cheapest Age |

|---|---|---|---|---|---|

| $3,562.33 | $3,164.93 | $10,073.54 | $4,578.97 | $3,164.93 | 60 |

While using gender to set rates is banned in California, males and females still receive different rates. This might be due to the perception that females are less likely to file claims. The average rate difference is about $250 between the genders.

- Male: $5,344.94

- Female: $5,088.38

Rates vary based on marital status as well. Someone who is married might be seen as more responsible and settled in their life. All the factors mashed together show a difference of $8,000 between the highest and lowest rates.

| Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Average |

|---|---|---|---|---|---|---|---|---|

| $3,597.68 | $3,526.99 | $3,162.95 | $3,166.90 | $9,083.26 | $11,063.83 | $4,509.64 | $4,648.29 | $5,344.94 |

17-year-olds take the brunt, while 60-year-olds have the lowest rates.

- Highest rate: single 17-year-old male at $11,060.

- Lowest rate: married 60-year-old female at $3,160.

These rates may seem arbitrary. That is understandable. And all factors except for driving factors are banned in California for use in the rate-setting process. The truth is, regardless of a ban or not, they still have an impact.

These numbers come from our partner Quadrant, which takes statistics directly from car insurance companies and their purchased policies. They are the rates from actual customers, like you, who have purchased policies.

Nevertheless, so it goes. Let’s move on.

Los Angeles, California car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

Cheapest ZIP Codes in Los Angeles

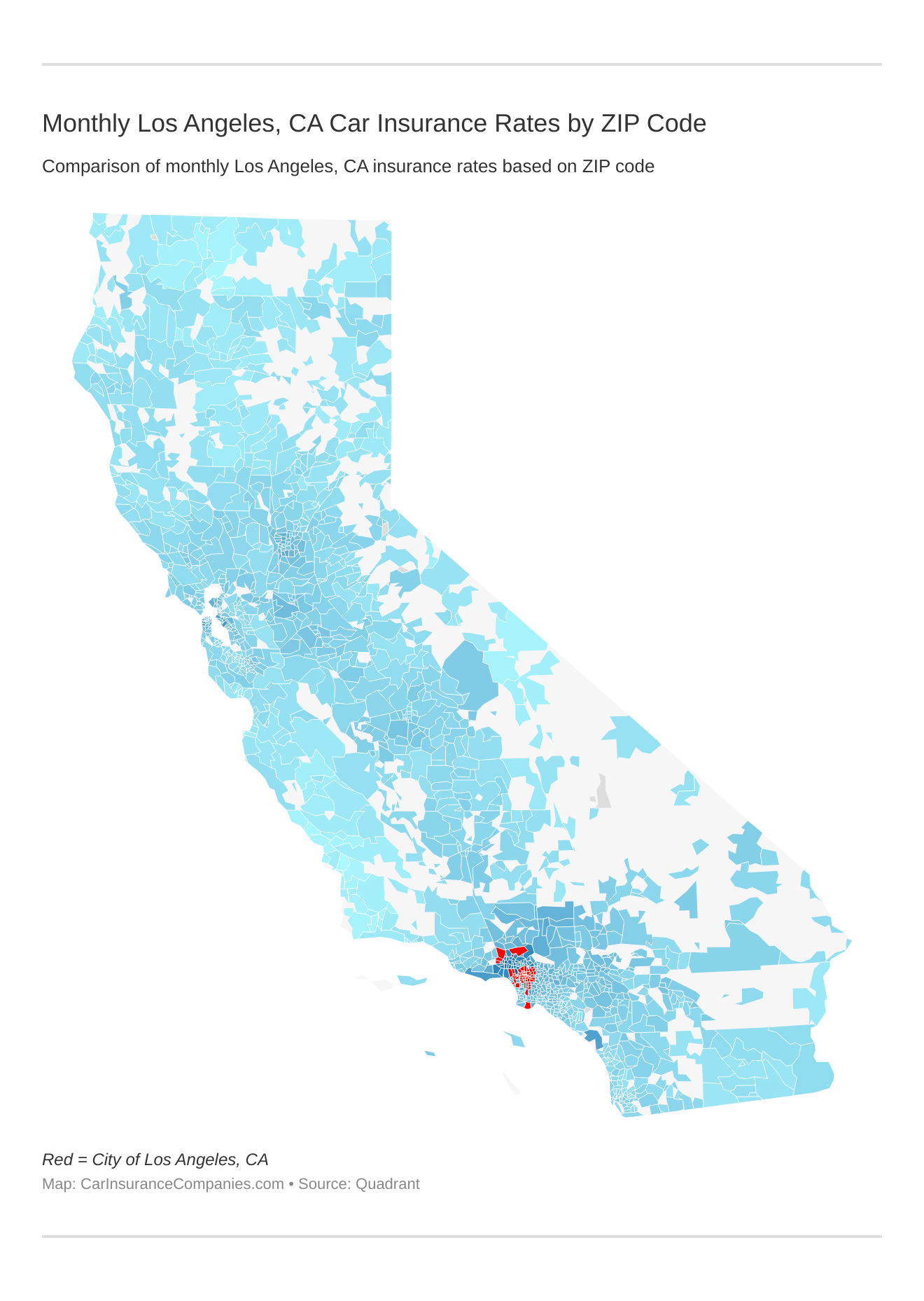

Fortunately, using ZIP codes is also banned when car insurance companies set rates. However, there are still discrepancies in the average rate between ZIP codes. Some of this can be due to circumstantial factors like vehicle theft or accident rates.

Find more info about the monthly Los Angeles, CA auto insurance rates by ZIP Code below:

Search for yours in the box below.

| Zip Code | Average Rates |

|---|---|

| 90732 | $5,443.97 |

| 90248 | $5,547.61 |

| 90731 | $5,785.84 |

| 90045 | $5,866.67 |

| 90023 | $5,961.50 |

| 90032 | $6,257.72 |

| 90066 | $6,263.93 |

| 90042 | $6,342.79 |

| 90041 | $6,408.45 |

| 90073 | $6,442.82 |

| 90031 | $6,574.62 |

| 90065 | $6,606.33 |

| 90059 | $6,638.38 |

| 90292 | $6,639.76 |

| 90033 | $6,641.77 |

| 90039 | $6,666.43 |

| 90001 | $6,668.83 |

| 91342 | $6,669.47 |

| 90061 | $6,680.53 |

| 91345 | $6,711.32 |

| 90064 | $6,790.13 |

| 91311 | $6,856.34 |

| 90002 | $6,880.20 |

| 91307 | $6,911.28 |

| 90034 | $6,938.01 |

| 90047 | $6,990.32 |

| 90011 | $7,015.39 |

| 90025 | $7,018.22 |

| 90058 | $7,034.66 |

| 90043 | $7,151.68 |

| 90044 | $7,199.59 |

| 91304 | $7,210.43 |

| 90003 | $7,216.78 |

| 90071 | $7,263.26 |

| 90089 | $7,299.04 |

| 90021 | $7,317.97 |

| 90049 | $7,318.65 |

| 90008 | $7,324.43 |

| 90079 | $7,356.48 |

| 90026 | $7,407.32 |

| 90037 | $7,442.40 |

| 91330 | $7,471.96 |

| 90013 | $7,484.92 |

| 90062 | $7,554.63 |

| 90012 | $7,585.79 |

| 90016 | $7,666.96 |

| 90018 | $7,691.95 |

| 90035 | $7,723.27 |

| 90007 | $7,804.44 |

| 90036 | $7,859.43 |

| 90024 | $7,859.78 |

| 90019 | $7,892.49 |

| 90068 | $7,907.31 |

| 90067 | $7,924.85 |

| 90015 | $7,984.60 |

| 90014 | $7,996.90 |

| 90006 | $8,008.26 |

| 90048 | $8,094.05 |

| 90077 | $8,095.60 |

| 90057 | $8,100.73 |

| 90027 | $8,112.12 |

| 90017 | $8,115.53 |

| 90004 | $8,152.00 |

| 90029 | $8,166.29 |

| 90005 | $8,303.29 |

| 90046 | $8,322.74 |

| 90038 | $8,323.32 |

| 90028 | $8,339.09 |

| 90020 | $8,434.59 |

| 90010 | $8,529.77 |

The cheapest ZIP code is far to the south in San Pedro. The most expensive is in central LA, between downtown and Beverly Hills. The difference between them is about $3,000.

What’s the best car insurance company in Los Angeles?

Does this sound familiar?

You’re going through a company’s quote process and they start asking you about all sorts of different factors. Your commute distance, your driving record, what coverage level you want, even who your old insurance company was.

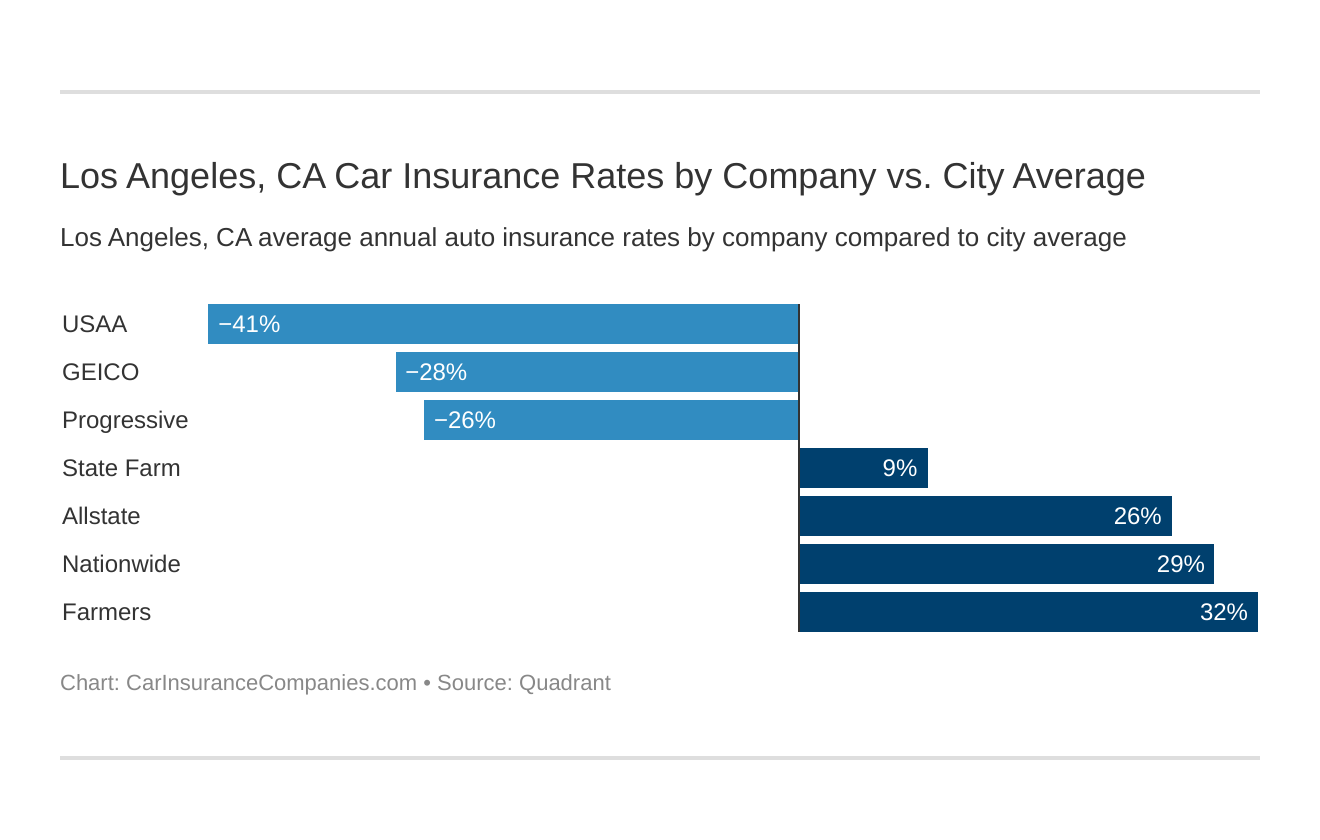

The cheapest insurance companies in Los Angeles can be discovered below. You then might be asking, “How do those rates compare against the average rate for California car insurance?” We cover that as well.

It’s a mess. When did insurance get so complicated?

We understand. This section is all about rates in four different ways, with explanations included. Let’s begin.

Cheapest Car Insurance Rates by Company

Which is the cheapest car insurance company in Los Angeles?

The truth is, the cheapest car insurance company for you depends on your specific situation. However, there are some companies that are more expensive to shop for than others. These numbers come from Quadrant.

| Group | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Average |

|---|---|---|---|---|---|---|---|---|---|

| Allstate | $4,440.80 | $4,431.31 | $3,211.59 | $3,235.18 | $12,526.09 | $15,746.23 | $5,675.19 | $6,203.58 | $6,933.75 |

| Farmers | $4,006.28 | $4,006.28 | $3,640.26 | $3,640.26 | $12,797.29 | $20,810.33 | $4,751.88 | $5,298.50 | $7,368.89 |

| Geico | $2,491.48 | $2,490.71 | $2,340.16 | $2,340.16 | $7,615.45 | $7,734.42 | $3,584.13 | $3,653.83 | $4,031.29 |

| Liberty Mutual | $3,172.36 | $2,975.30 | $2,974.72 | $2,869.00 | $6,853.08 | $7,392.56 | $3,547.93 | $3,615.08 | $4,175.00 |

| Nationwide | $4,984.81 | $4,748.21 | $4,371.12 | $4,108.92 | $12,865.63 | $14,217.34 | $5,955.49 | $5,869.86 | $7,140.17 |

| Progressive | $2,542.54 | $2,618.94 | $2,173.29 | $2,582.03 | $6,935.09 | $8,359.95 | $3,706.13 | $3,990.25 | $4,113.53 |

| State Farm | $4,591.64 | $4,591.64 | $4,106.31 | $4,106.31 | $8,499.31 | $10,546.13 | $5,085.40 | $5,243.41 | $5,846.27 |

| Travelers | $3,644.32 | $3,512.51 | $3,208.00 | $3,173.32 | $7,851.28 | $8,932.09 | $4,804.82 | $4,680.00 | $4,975.79 |

| USAA | $2,504.85 | $2,368.01 | $2,441.10 | $2,446.92 | $5,806.10 | $5,835.43 | $3,475.77 | $3,280.14 | $3,519.79 |

Clearly, USAA is the cheapest, but it is only available to service members and their immediate family. With it eliminated, there are four price points.

- $4,000 to $4,100: Geico, Progressive, Liberty Mutual

- $5,000: Travelers

- $5,800: State Farm

- $6,900 to $7,400: Allstate, Nationwide, Farmers

Some companies that are the most expensive vary in their rates per age group. Some odds and ends.

- Farmers is cheaper than State Farm for all age groups after they turn 17 years old

- Progressive is cheaper than USAA for married 60-year-old women

- Liberty Mutual is the second-cheapest company after USAA for 17-year-old drivers

- Much depends on your personal situation. We’ve covered a few of those aspects. Let’s touch on three more.

Best Car Insurance for Commute Rates

Did you know that something as small as your commute distance can affect your rates?

The longer you drive, the more likely you are to file a claim, so goes the logic of car insurance companies. A commute distance can lead to a larger annual mileage as well, which can factor into vehicle operating costs and other situations discussed later.

The average Californian drives 13,141 miles each year, or 700 less than the national average. In other states or cities nationwide, some companies don’t change their rates based on commute distance or annual mileage.

Unfortunately, every company we have statistics on in LA does.

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. | Average |

|---|---|---|---|

| Allstate | $6,239.26 | $7,628.23 | $6,933.75 |

| Farmers | $6,682.86 | $8,054.91 | $7,368.89 |

| Geico | $3,661.25 | $4,401.33 | $4,031.29 |

| Liberty Mutual | $3,826.67 | $4,523.34 | $4,175.01 |

| Nationwide | $6,289.10 | $7,991.24 | $7,140.17 |

| Progressive | $3,729.65 | $4,497.40 | $4,113.53 |

| State Farm | $5,633.47 | $6,059.06 | $5,846.27 |

| Travelers | $4,459.95 | $5,491.64 | $4,975.80 |

| USAA | $3,240.71 | $3,798.88 | $3,519.80 |

Each company varies differently in its rates between 10-mile commutes and 25-mile commutes.

- The largest difference: Nationwide at around $1,700.

- The smallest difference: State Farm at about $400.

The average difference between a 10-mile commute and a 25-mile commute is $964.79.

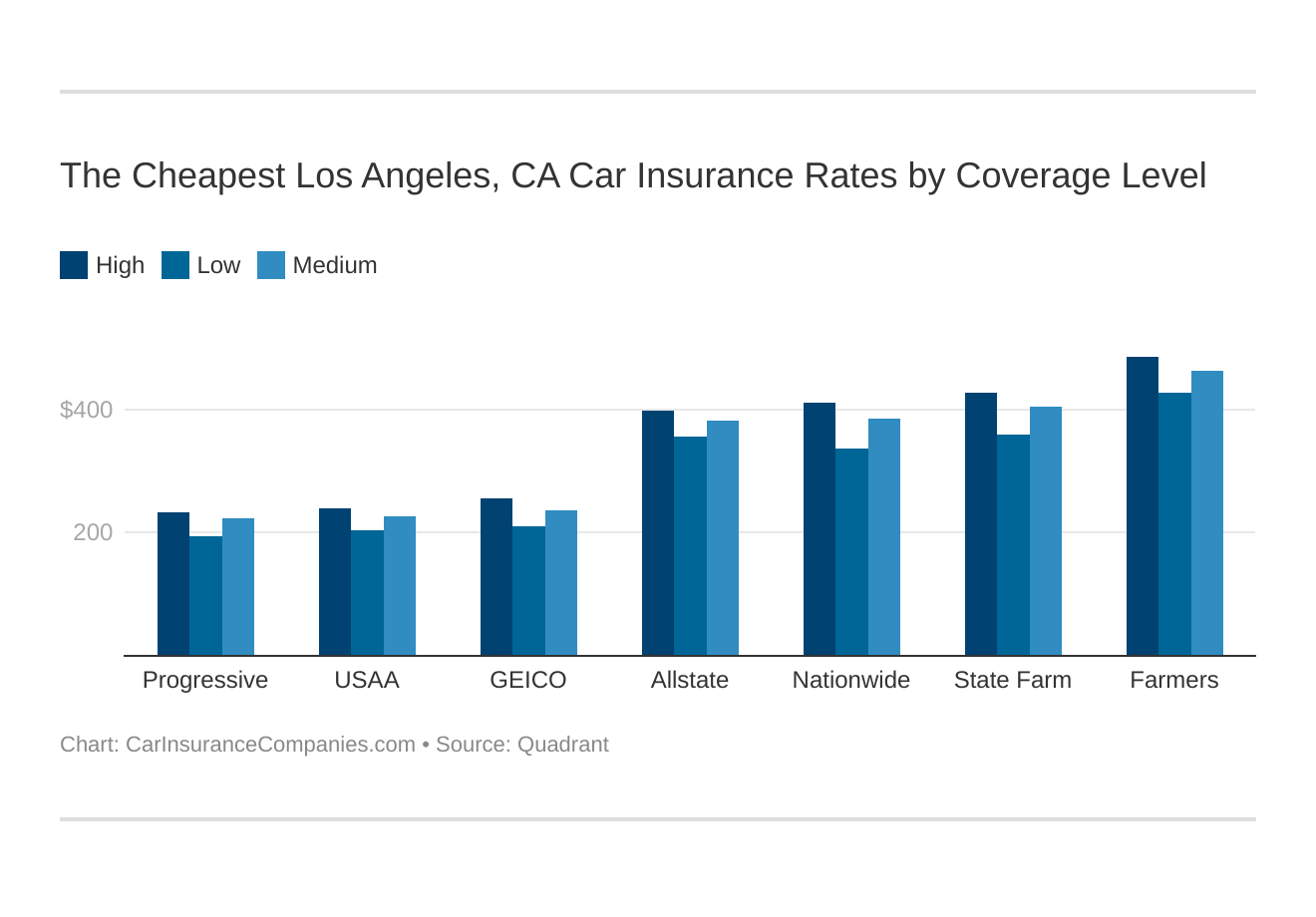

Best Car Insurance for Coverage Level Rates

Rates can vary according to coverage levels as well. But was is a coverage level? There are two parts.

- Coverage limits: an $80,000 bodily liability coverage limit is a higher coverage level than a $40,000 coverage limit

- More packages: adding comprehensive to a bodily liability coverage means you’ll have a higher coverage level

Some companies differ in prices between their high and low coverage levels by just a few hundred dollars. Others differ by more than a thousand.

| Group | High | Low | Medium | Average |

|---|---|---|---|---|

| Allstate | $7,283.19 | $6,518.17 | $6,999.88 | $6,933.75 |

| Farmers | $7,869.87 | $6,802.49 | $7,434.30 | $7,368.89 |

| Geico | $4,433.77 | $3,579.19 | $4,080.91 | $4,031.29 |

| Liberty Mutual | $4,474.55 | $3,835.18 | $4,215.28 | $4,175.00 |

| Nationwide | $7,785.36 | $6,366.35 | $7,268.81 | $7,140.17 |

| Progressive | $4,448.14 | $3,648.91 | $4,243.53 | $4,113.53 |

| State Farm | $6,344.14 | $5,242.92 | $5,951.74 | $5,846.27 |

| Travelers | $5,536.42 | $4,268.80 | $5,122.16 | $4,975.79 |

| USAA | $3,791.79 | $3,176.34 | $3,591.24 | $3,519.79 |

The largest and smallest differences are separated by $800.

- Largest difference: Nationwide at $1,400

- Smallest differences: USAA and Liberty Mutual at $600

Your coverage level will play a major role in your Los Angeles, CA car insurance rates. Find the cheapest Los Angeles, California car insurance rates by coverage level below:

The average difference between a high coverage level and a low coverage level is $947.65.

Best Car Insurance for Credit History Rates

California is among seven states that prohibit insurance companies from using credit history to determine rates.

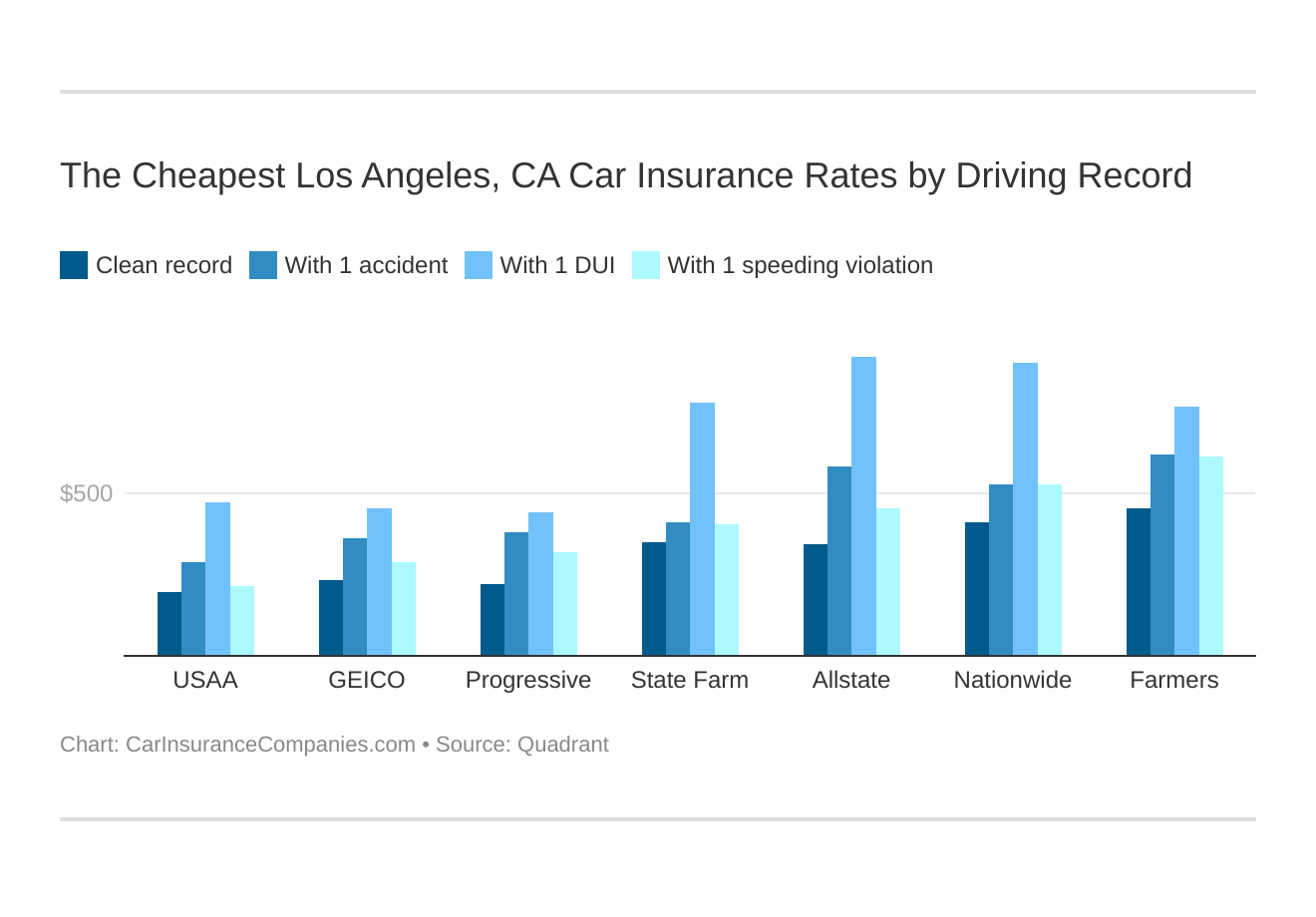

Best Car Insurance for Driving Record Rates

Imagine this. You’ve gotten into an accident, rear-ending someone who clearly didn’t understand the full purpose of brake pads. It’s just a fender bender, but you wonder, “Will my rates go up after this?”

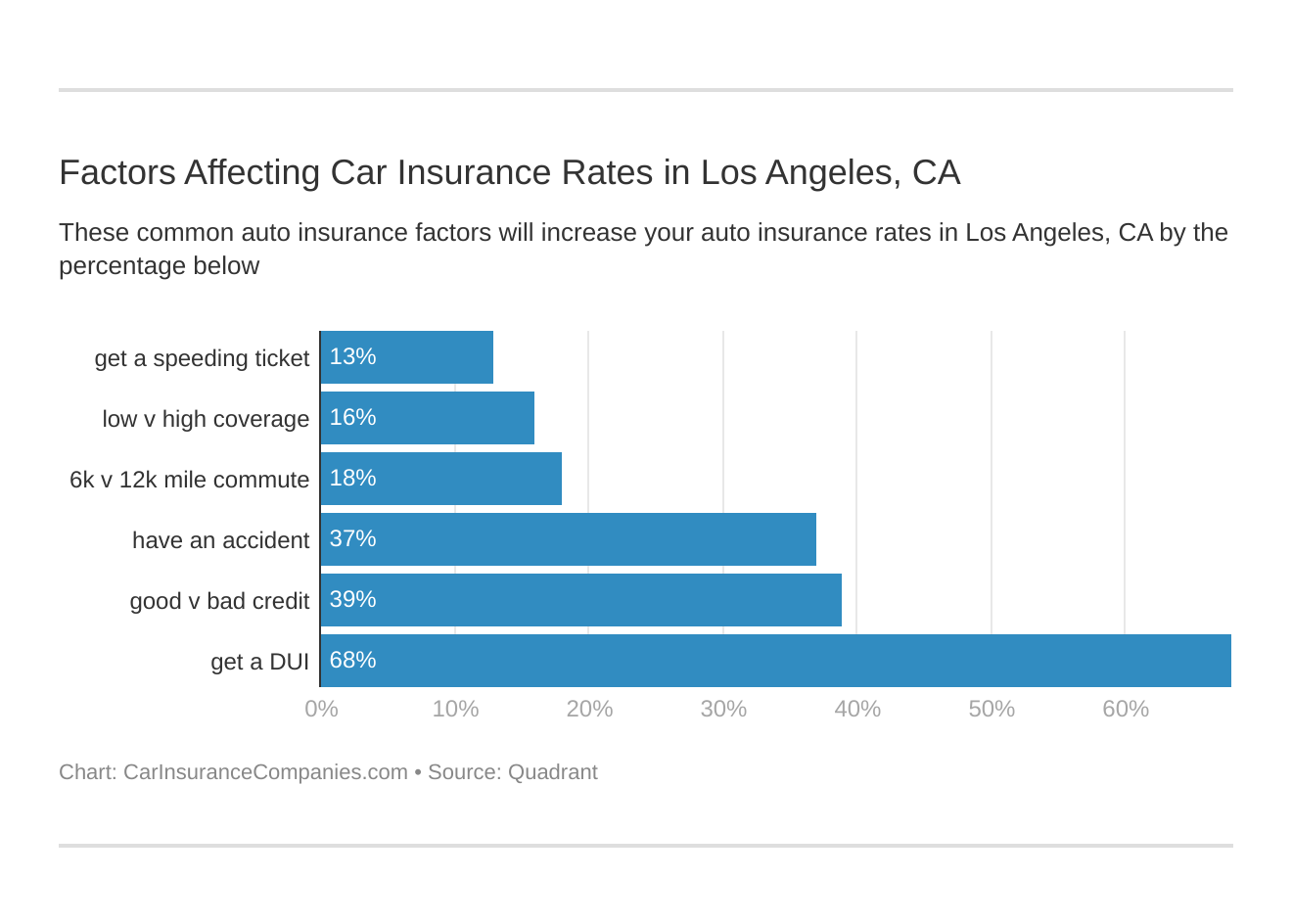

Your driving record will affect your Los Angeles car insurance rates. For example, a Los Angeles, California DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest Los Angeles, California car insurance rates by driving record.

Guess what? You were right to wonder.

Getting in an accident is a sure way to raise rates, along with other driving record infractions. Sometimes those rates will jump by just a few hundred dollars. Sometimes, it’s in the thousands.

Like with other rates for different situations and circumstances, it depends on the company.

| Group | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation | Average |

|---|---|---|---|---|---|

| Allstate | $4,149.84 | $7,025.57 | $11,093.95 | $5,465.62 | $7,423.12 |

| Farmers | $5,457.32 | $7,424.13 | $9,228.04 | $7,366.05 | $7,369.83 |

| Geico | $2,811.80 | $4,369.58 | $5,454.45 | $3,489.34 | $4,211.94 |

| Liberty Mutual | $3,624.85 | $4,850.21 | $4,383.60 | $3,841.35 | $4,286.22 |

| Nationwide | $4,967.15 | $6,379.89 | $10,833.75 | $6,379.89 | $7,393.60 |

| Progressive | $2,674.38 | $4,583.08 | $5,332.27 | $3,864.37 | $4,196.58 |

| State Farm | $4,174.95 | $4,977.11 | $9,389.60 | $4,843.42 | $6,180.55 |

| Travelers | $3,235.94 | $5,455.96 | $6,320.04 | $4,891.24 | $5,003.98 |

| USAA | $2,330.45 | $3,485.00 | $5,708.26 | $2,555.44 | $3,841.24 |

Each company penalizes differently. One company might be better than the other, depending on the infraction.

- The best company for a clean record: Progressive at $2,700

- The best company for 1 speeding ticket: Geico at $3,500

- The best company for 1 accident: Geico at $4,400

- The best company for 1 DUI: Liberty Mutual at $4,400

The most expensive companies overall are Nationwide, Farmers, and Allstate. The cheapest are Geico, Progressive, and Liberty Mutual. USAA was eliminated from consideration due to its limited customer base.

Averaging each penalty out for all companies shows the damage each infraction does to a clean record, all of which are a thousand dollars or more.

| Clean Record | With 1 Accident | With 1 DUI | With 1 Speeding | Average |

|---|---|---|---|---|

| $3,714.08 | $5,394.50 | $7,527.11 | $4,744.08 | $5,545.23 |

The lowest average penalty is for one speeding ticket at about $1,000. The highest is for one DUI at about $4,000.

However, you may think, “Haven’t I heard of accident forgiveness?”

Some companies offer accident forgiveness or forgive speeding tickets. Check with your company or any companies for which you’re shopping around to see if you qualify. It depends on your prior driving record.

Car Insurance Factors in Los Angeles

Want to know a secret?

Sometimes what you pay for car insurance doesn’t have to do with your driving record, your age, your sex, or your marital status. It has to do with auxiliary factors that influence what rates you pay and what discounts you get.

Factors affecting car insurance rates in Los Angeles, CA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Los Angeles, CA car insurance.

What are those?

In this section, we cover three and add a great deal of context to rates in Los Angeles, by looking at the city itself.

Let’s get to work.

Metro Report – Growth & Prosperity

Did you know that Los Angeles has the second-largest metropolitan area in the country?

And that this can affect your car insurance rates?

For some statistics about LA’s growth, we turned to the Brookings Institute. It publishes every year a series of studies surrounding metropolitan areas around the country called the Metro Report.

Two parts are worth looking at for this guide. They are growth and prosperity.

From 2007 to 2017, LA ranked 59th in overall growth.

- Percentage change in jobs: +5.3 percent (ranked 55th)

- Percentage change in Gross Metropolitan Product: +12.4 percent (ranked 50th)

- Percentage change in jobs at young firms: -20.2 percent (ranked 67th)

In that same time frame, it ranked 34th in prosperity.

- Percentage change in productivity: +6.7 percent (ranked 38th)

- Percentage change in standard of living: +6.3 percent (ranked 29th)

- Percentage change in average annual wage: +6.4 percent (ranked 38th)

Growth and prosperity both have impacts on car insurance rates. Why?

Read on.

Median Household Income

These statistics and the ones in the rest of the sections until Driving in Los Angeles come from Data USA.

The median household income in Los Angeles is $60,197. That is lower than the United States in general, California at large, and the Los Angeles Metroplex.

- Los Angeles: $60.197

- United States: $60,366

- Los Angeles County: $65,006

- Los Angeles Metroplex: $69,992

- California: $71,805

Knowing the specific cost of your car insurance helps, of course. However, there is another metric that we use that determines the impact of that car insurance premium on your pocket. It’s called Premium as a Percentage of Income (PaPI).

Because LA residents pay on average $7,260.97 on coverage and the median income level is $60,197, the amount the average LA resident pays on car insurance out of their income is 12.06 percent.

That’s a hefty chunk. How does this stack up against other major California cities?

| City | Median Income Level | Average Car Insurance Premium | Premium as % of Income |

|---|---|---|---|

| San Francisco | $110,816 | $5,917.15 | 5.34% |

| San Diego | $76,662 | $4,707.00 | 6.14% |

| Sacramento | $56,943 | $5,667.03 | 9.95% |

Residents in those cities pay a smaller percentage of their income on car insurance. Much of this has to do with the lower car insurance premiums in those cities. Even the closest city in San Francisco has an average premium of $1,300 less than LA.

Homeownership in the Los Angeles

You may think, “Why do they have a section about homeownership in a car insurance guide?”

It’s simple. Homeownership impacts your rates. Being a homeowner means you’ll pay up to seven percent less on car insurance compared to those who rent. This, according to the Consumer Federation of America.

In at least one city, renters were charged 47 percent more for their car insurance premiums compared to homeowners.

While the reasons for this are not entirely known, it is possible that car insurance companies look at homeowners as more financially stable and more likely to pay premiums or deductibles.

Therefore, they are less risky to insure. Being a homeowner can also give you access to discounts, as many companies offer homeowner discounts as well as discounts for bundling home insurance with car insurance.

In LA, the median housing price is $647,000. This is higher than the percentages in the locations in the previous section.

- Los Angeles: $647,000

- Los Angeles Metroplex: $537,000

- Los Angeles County: $495,800

- California: $443,400

- United States: $193,500

However, most of LA residents are renters, which exposes them to higher car insurance rates. This percentage is higher than those same places in the previous comparisons.

- 2017 LA homeownership: 36.6 percent

- 2016 LA homeownership: 35.9 percent

- National average: 63.8 percent

- California: 54.5 percent

- Los Angeles Metroplex: 48.6 percent

- Los Angeles County: 45.9 percent

This may be due to the high housing prices compared to the relatively lower median household income compared to other California cities. Most LA residents don’t benefit from the discounts of being a homeowner and may be penalized more.

Education in Los Angeles

Education, as the saying goes, affords opportunities. There are better jobs, networking opportunities, have a better skillset. But you might be scratching your head.

“Education affects car insurance?”

You’d be completely right.

Many car insurance companies offer discounts for those with a four-year education or higher. There are also discounts if you are part of a certain alumni network, have a son or daughter off at school, or put low-mileage on the car in that situation.

These discounts range from 5-15 percent for total premiums. So, how do these practices affect LA residents and their potential car insurance discounts?

There are many colleges and universities in Los Angeles. The top three accounted for over 38,000 degrees awarded in 2015.

- University of Southern California: 15,664 degrees award

- University of California-Los Angeles: 12,961 degrees awarded

- California State University-Northridge: 9,890 degrees awarded

In that year, there were well over 100 different concentrations. The top five were varied in terms of discipline.

- General Business Administration and Management: 2,797 degrees awarded or 8.83 percent of total

- General Psychology: 1,981 degrees awarded or 6.25 percent of total

- Sociology: 1,804 degrees awarded or 5.69 percent of total

- General Political Science and Government: 1,127 degrees awarded or 3.56 percent of total

- General Biological Sciences: 1,097 degrees awarded or 3.46 percent of total

All of these students are eligible for education discounts. Some companies go even farther than offering discounts to higher-educated drivers. Some will actually set rates according to that factor. As is typical, some say this is discriminatory.

California has actually made it illegal in Proposition 103 to use educational status to set car insurance rates. However, according to Consumer Watchdog, California car insurance companies have not been honoring this ban.

This has led to higher rates for low-income, lesser-educated populations, by as much as 15 percent. Fortunately, more and more states are doing away with non-driving factors to set rates.

This is to make the playing field more level and stop penalizing drivers for factors outside of their own control.

Wage by Race & Ethnicity in Common Jobs

Back to Premiums as a Percentage of Income. Certain races or ethnicities earn more than others at particular jobs. So, how much are they paying out of their paychecks for car insurance?

These numbers from Data USA in the next two sections are for California at large. Unfortunately, it did not have direct data about LA residents.

| Race/Ethnicity | Miscellaneous Managers | Premium as a % of Income | Elementary & Middle School Teachers | Premium as a % of Income | Driver/Sales Workers & Truck Drivers | Premium as a % of Income |

|---|---|---|---|---|---|---|

| Native Hawaiian & Other Pacific Islander | $128,245 | 5.66% | $48,953 | 14.83% | $42,284 | 17.17% |

| Asian | $118,884 | 6.11% | $56,743 | 12.80% | $36,337 | 19.98% |

| White | $114,249 | 6.36% | $58,917 | 12.32% | $42,982 | 16.89% |

| Two or More Races | $110,079 | 6.60% | $52,813 | 13.75% | $38,941 | 18.65% |

| American Indian | $87,447 | 8.30% | $53,588 | 13.55% | $43,823 | 16.57% |

| Black | $76,262 | 9.52% | $52,620 | 13.80% | $39,488 | 18.39% |

| Other | $65,067 | 11.16% | $46,471 | 15.62% | $41,319 | 17.57% |

| Other Native American | - | - | $72,969 | 9.95% | $40,539 | 17.91% |

Premiums and a Percentage of Income can vary widely.

Within miscellaneous managers, there is a 5.5 percent difference between the highest-earning race and the lowest-earning race. There is the same difference in the elementary and middle school teachers category.

Within drivers/sales workers and truck drivers, there is a much smaller difference at about two percent.

How much you earn can drastically affect how much you pay for a premium as a percentage of your income. Especially if you’re in a higher-earning job, such as miscellaneous managers.

Wage by Gender in Common Jobs

It’s not exactly uncommon knowledge that women earn less than men. While there are many reasons for this, including the pushing of women to lower-earning jobs, the fact remains that it affects car insurance.

Specifically, how much women are paying out of their salaries compared to men. This data on male and female wages is for California in general.

- Average male salary: $75,050

- Average female salary: $59,658

Within the three categories of jobs we looked at, each pay gap between men and women was at least $4,000. The largest gap was around $30,000.

| Job Category | Male Salary | Premium as % of Income | Female Salary | Premium as % of Income |

|---|---|---|---|---|

| Milscellaneous Managers | $125,706 | 5.78% | $94,699 | 7.67% |

| Elementary & Middle School Teachers | $68,823 | 10.55% | $63,657 | 11.41% |

| Retail Salespersons | $47,957 | 15.14% | $35,791 | 20.29% |

This drastically affects premiums as a percentage of interest, as women at least in one category were asked to pay five percent more of their incomes on car insurance.

Poverty by Age and Gender

The data for the next three sections are for Los Angeles specifically.

Poverty has an adverse effect on paying for car insurance, more so than people would think.

As the Consumer Federation of American notes, poverty is often associated with factors like high credit scores, low education levels, and neighborhoods that experience more vehicle theft.

Yes, it’s true. Being poor makes paying for car insurance difficult. But a poor person’s rates are oftentimes higher as well.

In LA, the groups that are most likely to be in poverty all belong to women, from 18 to 44.

| Age Bracket | Male Povery Share | Female Poverty Share |

|---|---|---|

| Under 5 | 4.48% | 4.42% |

| 5 | 0.92% | 0.86% |

| 6-11 | 5.31% | 5.07% |

| 12-14 | 2.46% | 2.44% |

| 15 | 0.81% | 0.90% |

| 16-17 | 1.63% | 1.66% |

| 18-24 | 6.33% | 7.51% |

| 25-34 | 6.41% | 8.12% |

| 35-44 | 5.44% | 7.48% |

| 45-54 | 4.76% | 5.47% |

| 55-64 | 3.81% | 4.61% |

| 65-74 | 1.96% | 2.75% |

| 75+ | 1.30% | 3.09% |

With 20.4 percent of residents of LA in poverty, women make up 54 percent up that population. Women are more likely to be in poverty in nine out of the 13 categories. There are many reasons for this, including the financial burden of raising children.

However, for the purposes of this guide, poverty hurts the wallet and makes it difficult to pay for car insurance. This is the case for men and women, notwithstanding gender.

Poverty by Race & Ethnicity

Certain races are hit harder by poverty than others. In the case of LA, it’s not a single particular race that has the out-of-proportion poverty share.

| Race/Ethnicity | Share of Population | Share of Poverty |

|---|---|---|

| Hispanic | 49% | 38% |

| White Alone | 28% | 28% |

| Asian Alone | 11% | 5% |

| Black or African American Alone | 9% | 7% |

| Two or More Races | 2% | 2% |

| Some Other Race Alone | 1% | 19% |

Some other race, alone, has a 19 percent poverty share with just one percent of the total population. That is a large number that reduces the poverty share of the other populations.

Employment by Occupations

We’ve seen how poverty affects car insurance rates, how your education and homeownership are factors, and how your wages can determine how much you pay for car insurance out of your income.

How do jobs and employment status play a role?

In LA, there are 2.05 million workers. From 2016 to 2017, there was a 2.96 percent growth in the number of jobs. The top five occupations were spread out between different types of positions.

- Office and Administrative Support Occupations: 242,700 workers or 11.8 percent of total

- Management Occupations: 202,053 workers or 9.86 percent of total

- Sales and Related Occupations: 201,130 workers or 9.81 percent of total

- Art, Design, Entertainment, Sports and Media Occupations: 137,140 workers or 6.69 percent of total

- Food Preparation and Service-Related Occupations: 133,622 workers or 6.52 percent of total

Two of the top five categories are stereotypically lower-paying professions in office and administrative support and food preparation and service-related occupations.

This can affect how much someone is paying for car insurance out of their income. There’s a different problem, however.

Some car insurance companies believe that your occupation is indicative of how likely you are to file a claim. This is likely due to the creation of your risk profile, which assesses numerous factors like credit history and gender.

California has banned this through Proposition 103, but it is still being practiced according to some watchdog groups.

Driving in Los Angeles

You know the score. You’ve gone through all the rates, by all the factors. You know which company you’re going to go with.

But you’re curious. Maybe you have a little bit of trepidation. You think, “How am I supposed to choose a coverage level or my coverages without knowing a little bit about LA?”

We understand. Even if you know the rates you want or the company you want to go with, it still can be difficult to make a choice about coverage level.

There are some cities where getting comprehensive is a must. Or where roadside assistance is that much more important. That’s where this section comes in. Here, you’ll learn all about Driving in Los Angeles.

The good, the bad, and the very, very ugly.

After, you’ll know if you need comprehensive coverage, emergency roadside assistance, collision coverage, and many of the others. It’s time to start up that car and head out onto I-110. We’re taking a tour through the City of Angels.

Roads in Los Angeles

A determining factor in how much coverage you’ll get is how far you’ll drive and what conditions the roads are in. So, how many highways does Los Angeles have and what are their mileages? And what are the conditions of the roads?

Let’s get down to business.

Major Highways in Los Angeles

A quick screenshot of a map shows how many highways Los Angeles has.

There are seven that intersect within Los Angeles’s city limits.

| Interstate/Highway | Length (Miles) | Toll Road |

|---|---|---|

| I-5 | 797 | No |

| I-105 | 19 | No |

| I-10 | 2,460 | Metro ExpressLane |

| I-110 | 32 | MetroEXPRESS |

| US 101 | 1,540 | No |

| CA 60 | 76 | No |

| CA 110 | 8 | No |

They total 4,932 miles across the United States, reaching as far as Washington up north and Florida out east.

Although there are no strict toll roads in Los Angeles, there are certain highways with special toll lanes. Some of these are for high-occupancy buses, while others are for express travelers.

These highways are assumed to be less crowded and good for someone looking to get somewhere in a hurry.

To use these tollways, there are three options.

- Pay with cash

- Pay by license plate readers

- Pay with FasTrak

The first two might be easier due to convenience. But they are also more expensive than the third option.

FasTrak is a transponder system that is distributed by five different agencies, according to The Toll Roads, which runs FasTrak in Orange County, which is 34 miles from LA. FasTrak transponders can be used throughout all toll roads in California.

There are three options when signing up.

| FasTrak Option | Payment Type | Account Fees | Discounted Tolls |

|---|---|---|---|

| Prepaid | Prepaid | None | Yes |

| Charge | Individually | None | No |

| Invoice | Monthly | $2 invoice fee | No |

In Los Angeles County, Metro ExpressLanes runs the sole toll road, which is the express lanes on I-10/I-110. It has two customer service centers, a website, a phone number, and a fax number.

- First customer service center: 500 West 190th Street, Gardena, CA 90248 (M-F 8 am-6 pm; Sat. 9 am-1 pm)

- Second customer service center: 3501 Santa Anita Avenue, El Monte, CA 91731 (M-F 8 am-6 pm; Sat. 9 am-1 pm)

- Website: Contact Us Page

- Phone number: 1-877-812-0022

- Fax number: 1-310-354-4681

There are new parts coming out, including an occupancy detector, which measures how many people are in the car compared to what the transponder is activated for. This is to charge more accurate tolls.

Popular Road Trips/Sites

How far you drive affects your car insurance rates. Fortunately, Los Angeles has great attractions just a few hours away.

- Big Bear Lake (2:45 away): Complete with a ski resort, mountain trails, and fishing holes, Big Bear Lake is a perfect outdoor getaway from Los Angeles.

- Solvang (3:00 away): With a nearby casino, museums, and Danish architecture, Solvang is unique in California and presents a little slice of Denmark.

- Temecula Valley (2:10 away): Essentially the Napa Valley of Southern California, Temecula Valley boasts over 40 wineries, hot air balloons, and plenty of events.

- Catalina Island (45 minutes to Long Beach; one-hour ferry ride): Full of fresh seafood, water sports, and a soothing ocean, Catalina Island is the perfect island getaway.

There are plenty of others as well. California is replete with interesting places to visit.

Road Conditions in Los Angeles

Road conditions have an impact on your car insurance. The wrong pothole can blow out a tire, some debris in the road can lead to a damaged car, and dangerous roads can lead to accidents.

Los Angeles’s roads are in poor condition.

| Poor Share | Mediocre Share | Fair Share | Good Share | Vehicle Operating Cost |

|---|---|---|---|---|

| 57% | 22% | 11% | 10% | $921 |

The 57 percent of a poor share lead to a $921 vehicle operating cost. That comes from repairs, replaced tires, and wear and tear on the car. What is a poor condition road?

As Edgar Snyder & Associates notes, there are several ways in which a road might be in poor condition.

- Potholes that can lead to busted tires

- Oil and chip roads that become slick because they haven’t dried

- Poorly painted lines or signs that are not easy to see

- Wheel ruts that make it difficult to steer

- Work zones that can be confusing to drive through

As Nolo writes, if you’ve damaged your car on a poorly conditioned road, it is likely the government is responsible. However, you have to prove that the government knew about the poor conditions and had had time to repair it to receive damages.

It can be tough to receive money from the government. This is why it is always important to have collision insurance.

Does Los Angeles use speeding or red light cameras?

In 2011, the Los Angeles city council voted unanimously to discontinue the red light camera program. As such, the LAPD stopped enforcing any tickets that were issued.

Note that this does not apply to the rest of California, where red light tickets can have serious consequences. This includes fines at the amount of the regular ticket and points off your record.

Vehicles in Los Angeles

Have you ever found yourself in a high crime area with your engine running, eyeballing the people walking by just in case one decides to steal your car?

It can be an unusual situation or maybe it’s your norm, but there’s one thing it always involves. That is your vehicle.

Vehicles get us around from place to place, provide security if we need to get somewhere, have repair costs, and, of course, need to be insured. But there are always questions when it comes to vehicles in a city.

- What are the most popular vehicles owned?

- How many cars are there per household?

- How many people are without a car?

- What are vehicle theft statistics?

This section answers those questions. Break out your vehicle. We’re headed to the heart of car culture in LA.

Vehicles Most Popular Vehicles Owned

YourMechanic is a company that services cars all across the country. In 2016, it published a survey that analyzed car owners nationwide to determine which city liked what cars. LA is on those lists.

- Percentage of cars serviced that were American-made: 34 percent

- Most unusually popular car: Mitsubishi Montero

- Percentage of cars serviced that were hybrids: 1.8 percent

- Percentage of cars serviced that had V8 engines: 12.4 percent

- Percentage of cars serviced that were Suburus: .8 percent

- Percentage of cars serviced that were Porsches: .3 percent

Of course, it is possible that some of those numbers have changed in the last few years, especially the hybrid index. But it serves to show that LA has a variety in its cars, including some foreign and some American.

Some muscle cars and other hybrids. It’s befitting of LA’s varied population and general diversity.

How many cars per household

Nationwide, most households own two cars, followed by three cars, then one. Is this the case in LA?

This data comes Data USA.

| Number of Cars | Los Angeles Share | United States Share |

|---|---|---|

| 0 | 5.92% | 4.25% |

| 1 | 27.4% | 20.3% |

| 2 | 37% | 40.5% |

| 3 | 17.1% | 21.4% |

| 4 | 7.76% | 9.08% |

| 5+ | 4.85% | 4.47% |

LA residents have a much higher percentage of owning one car or not owning a car compared to the nationwide average. They have a smaller percentage of owning two or more.

Households without a Car

LA has an unusually high number of residents that don’t own a car

| 2015 Households without Vehicles | 2016 Households without Vehicles | 2015 Vehicles per Household | 2016 Vehicles per Household |

|---|---|---|---|

| 12.10% | 12.20% | 1.59 | 1.62 |

This might be due to the cost of insurance, which is above $7,000 in Los Angeles. If you want to buy a car but can’t afford insurance, California has a Low Cost Automobile Insurance Plan that pairs good, eligible drivers with low-cost insurance.

Speed Traps in Los Angeles

Speed traps can raise your rates, as we’ve seen with speeding tickets. Earlier in the 2000s, Speedtrap.org started compiling a list of speed traps all across the country, submitted by users.

The good news: Los Angeles is not in the top 10 worst California cities for speed traps. However, Los Angeles has 171 speed traps listed dating back to 2000.

The most recent date back to 2013.

- Tampa Ave. and Chatsworth St.: A motorcycle cop with LIDAR is on the southwest side of the intersection. There is a large tree on the north side of Chatsworth so one might not see him from afar.

- 110 fwy fast track lanes between downtown and 105 fwy: CHP hides in the bus stations with radar guns. Watch that you do not go over 70mph.

- Grand (Between 7th and 8th): If you do not stop and treat this light as if it were a “stop sign” you may be ticketed. The officer is on the left side of the road–usually on motorcycle.

They may be dated, but cities don’t change a great deal. And neither do the speed traps.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Vehicle Theft in Los Angeles

Back to the original prompt. Getting your vehicle stolen can be stressful, even if you’re not in the car when it happens. Vehicle theft is a serious issue in Los Angeles at over double the rate for the United States overall.

These numbers come from NeighborhoodScout, which put together a Los Angeles crime overview page with data culled from over 18,000 law enforcement agencies.

| Area | Motor Vehicle Theft (Total) | Motor Vehicle Theft Rate |

|---|---|---|

| Los Angeles | 19,546 | 4.89 |

| United States | 773,139 | 2.37 |

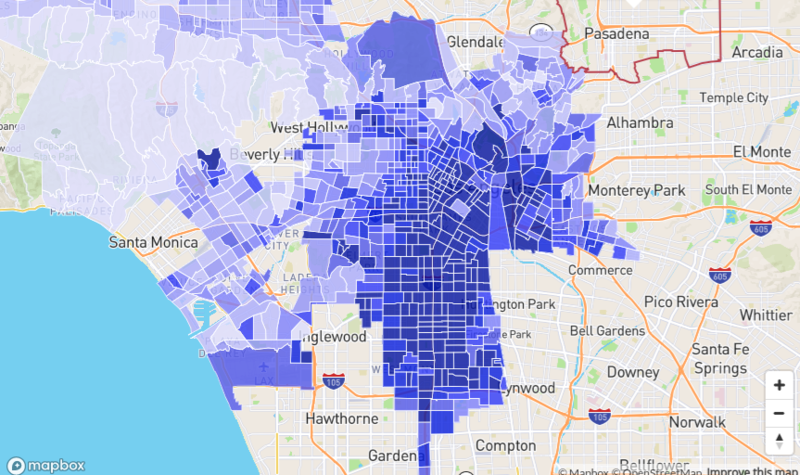

The most dangerous areas tend to be in South LA or East LA. In the map, darker is more dangerous.

Most of the top 10 safest neighborhoods tend to be in the upper northwest, around Santa Monica or Beverly Hills.

- Victory Blvd / Balboa Blvd

- Topanga Canyon Blvd / S Topanga Canyon Blvd

- Mulholland Dr / Sepulveda Blvd

- Reseda Blvd / Rosita St

- De Soto Ave / Chatsworth St

- Palisades Dr / Ave De Santa Ynez

- W Sunset Blvd / N Kenter Ave

- Riviera

- Sesnon Blvd / Reseda Blvd

- Balboa Blvd / Westbury Dr

The total crime rate is 33.59, meaning you have a 3 percent chance of being a victim of property or violent crime.

| Los Angeles Total Crimes | Violent | Property | Total |

|---|---|---|---|

| Number of Crimes | 30,809 | 103,554 | 134,363 |

| Crime Rate (per 1,000 residents) | 7.70 | 25.89 | 33.59 |

The violent crime rates in LA are higher than the rates nationwide.

| Area | Murder (Total) | Murder Rate | Robbery (Total) | Robbery Rate | Assault (Total) | Assault Rate |

|---|---|---|---|---|---|---|

| Los Angeles | 282 | 0.07 | 10,927 | 2.73 | 17,118 | 4.28 |

| United States | 17,284 | 0.05 | 319,356 | 0.98 | 810,825 | 2.49 |

When it comes to motor vehicle theft, you can protect your car through an insurance coverage called comprehensive. This coverage insures your car in the case of anything other than a collision. This includes vehicle theft.

As for the other parts? Mace might work.

Traffic in Los Angeles

Does this sound familiar?

You’re driving to work one morning, a big meeting planned in thirty minutes, humming along to one of LA’s finest in The Doors. You think, “I’ve got this. Just 10 more miles to go.”

Then you see the brake lights. They start in the distance and before you know it, all the cars are slowing down. You’ve hit that wall of traffic on I-10 and that meeting is probably going to need to be rescheduled.

Traffic congestion is frustrating, made worse by bad drivers and untimely accidents. In this section, we’re touching on all of that. Traffic congestion, commute times, the busiest highways in LA, even how bad the drivers are.

We’ll cover one topic that is a little grim but important. It’s the number of traffic fatalities in LA.

In this section, we’re riders on the storm. Let’s get started.

Traffic Congestion

There are more people on the road than ever. And more people leads to more traffic. And traffic leads to more accidents. This can drive up car insurance rates, as more people get into accidents, the higher the insurance cost.

What is the traffic like in LA? To answer this question, we looked at two traffic monitoring agencies called INRIX and TomTom. Both monitor traffic globally and assign rankings based on numerous factors that include congestion and last-mile speed.

INRIX ranks LA the 47th most-congested city in the world. The average person in LA spent 128 hours in congestion in 2018, with an inner-city last-mile speed of 14 miles per hour. The cost of congestion per driver was $1,788.

TomTom ranks LA the 24th most-congested city in the world. Its statistics cover overall congestion for all times, congestion during rush hour, and the most congested and least congested days.

- Congestion level for highways: 45 percent

- Congestion level for non-highways: 39 percent

- Morning peak congestion: 64 percent

- Minutes added to a 30-minute morning commute: 19

- Evening peak congestion: 80 percent

- Minutes added to a 30-minute evening commute: 24

- The worst day for congestion: November 14th

- The best day for congestion: December 25th

Unfortunately, traffic affects your car insurance and is a part of day-to-day life. Why do traffic jams happen if there are no accidents? One group has an explanation.

Transportation

That brings up two questions when it comes to traffic.

- What are the commute times for LA residents?

- And how do LA residents get to work?

According to Data USA, the average commute time for LA residents is 29.8 minutes. LA residents have a much smaller percentage of commute times below 29 minutes compared to nationwide.

And much more for almost every category above that.

| Commute Time (minutes) | Los Angeles Share | United States Share |

|---|---|---|

| Under 5 | 1.03% | 2.76% |

| 5-9 | 4.77% | 9.45% |

| 10-14 | 9.44% | 13.3% |

| 15-19 | 12.6% | 15.1% |

| 20-24 | 13.2% | 14.4% |

| 25-29 | 5.23% | 6.49% |

| 30-34 | 20.3% | 13.8% |

| 35-39 | 2.78% | 3.03% |

| 40-44 | 5.53% | 3.99% |

| 45-59 | 10.7% | 8.33% |

| 60-89 | 11% | 6.47% |

| 90+ | 3.43% | 2.85% |

The commuter method is also different.

- Drove alone: 69.7 percent

- Carpooled: 9.11 percent

- Public transit: 8.94 percent

- Worked at home: 5.75 percent

- Walked: 3.4 percent

Fewer LA residents drive to work alone compared to the national average and many more take public transport.

Busiest Highways

According to the Federal Highway Administration, the LA metroplex is home to four of the largest highways in the country.

- I-405: 14 lanes

- I-5: 12 lanes

- State Route 91: 12 lanes

- I-110: 12 lanes

And according to California’s Caltrans Annual Vehicle Delay report, Los Angeles County was home to five state routes that amassed more than than a billion annual vehicle miles traveled. Those were State Routes 5, 10, 14, 60, and 91.

State routes 5, 10, and 60 had over 10,000 vehicle incidents for the year 2017. All except for State Route 14 had over 1.5 million hours driven at 35 miles per hour or less.

How safe are Los Angeles’ streets and roads?

And now the grim statistics. You may be wondering, “Why are you including such a grim topic in a car insurance guide?”

Unfortunately, accidents contribute to a city’s average car insurance rate. The more accidents, the more claims, and the higher insurance costs rise. Never is this more so in situations where there are fatalities.

Of course, it’s more than that. It’s about safety on the road, avoiding spots where there are drunk drivers, or watching out for people speeding, as both of those contribute to traffic fatalities.

These numbers come from the National Highway Traffic Safety Administration’s California state crash report. The numbers in the first table all come from Los Angeles County.

| County Statistics | 2013 | 2014 | 2015 | 2016 | 2017 | Total |

|---|---|---|---|---|---|---|

| Total Fatalities | 639 | 651 | 837 | 751 | 670 | 3,548 |

| Alcohol-Impaired | 172 | 149 | 242 | 206 | 198 | 967 |

| Single Vehicle | 359 | 389 | 472 | 423 | 399 | 2,042 |

| Speeding | 240 | 231 | 308 | 238 | 215 | 1,232 |

| Roadway Departure | 190 | 209 | 262 | 215 | 205 | 1,081 |

| Intersection-Related | 234 | 242 | 307 | 273 | 239 | 1,295 |

| Passenger Car | 200 | 202 | 263 | 211 | 191 | 1,067 |

| Pedestrian | 209 | 209 | 278 | 265 | 225 | 1,186 |

| Pedalcyclist | 24 | 33 | 37 | 36 | 33 | 163 |

Los Angeles County had consistently some of the highest fatalities overall compared to other California counties. The breakdown of these fatalities shows just how urban LA county is.

Intersection-related and pedestrian fatalities, two of the top four categories, are found mostly in urban environments. Single-vehicle crash fatalities lead all by a good margin, while speeding also comes in in the top four categories.

In California, the majority of fatal crashes happen on arterial roads. These are roads that serve as collectors for larger roads like highways and interstates.

| Road Type | Fatal Crashes |

|---|---|

| Rural Interstate | 135 |

| Urban Interstate | 296 |

| Freeway/Expressway | 459 |

| Other | 972 |

| Minor Arterial | 685 |

| Collector Arterial | 480 |

| Other | 271 |

| Unknown | 6 |

| Total | 3,304 |

One explanation is that these roads demand more awareness, as there are numerous driving decisions to be made. Since 2012, there have been 15 railway incidents in Los Angeles County, with three fatalities.

| Highway User Speed | Calendar Year | County | Highway | Highway User Type | Rail Equipment Type | Non-Suicide Fatality | Non-Suicide Injury |

|---|---|---|---|---|---|---|---|

| unknown | 2012 | LOS ANGELES | 103 RD STREET | Pedestrian | Psgr Train | 1 | 0 |

| 45 | 2012 | LOS ANGELES | 92 ND STREET | Pedestrian | Psgr Train | 0 | 0 |

| unknown | 2012 | LOS ANGELES | IMPERIAL | Pedestrian | Psgr Train | 0 | 0 |

| 0 | 2012 | LOS ANGELES | FRONT STREET | Pick-up truck | B | 0 | 0 |

| unknown | 2012 | LOS ANGELES | STOCKWELL | Pedestrian | Psgr Train | 1 | 0 |

| 0 | 2013 | LOS ANGELES | SUNLAND BOULEVARD | Automobile | C | 0 | 0 |

| 0 | 2014 | LOS ANGELES | VAN NUYS BLVD. | Pedestrian | Freight Train | 0 | 0 |

| 25 | 2014 | LOS ANGELES | NORTH MAIN STREET | Automobile | B | 0 | 0 |

| 15 | 2015 | LOS ANGELES | ALCOA AVENUE | Automobile | Yard/Switch | 0 | 0 |

| 20 | 2015 | LOS ANGELES | N. HENRY FORD AVE. | Automobile | Freight Train | 0 | 0 |

| 0 | 2016 | LOS ANGELES | DE SOTO ST | Automobile | Psgr Train | 0 | 0 |

| 30 | 2016 | LOS ANGELES | 37TH & ALAMEDA ST | Truck-trailer | Yard/Switch | 0 | 0 |

| unknown | 2016 | LOS ANGELES | 48TH PLACE | Pedestrian | Freight Train | 1 | 0 |

| unknown | 2016 | LOS ANGELES | TAMPA AVE | Pedestrian | Psgr Train | 0 | 1 |

| 0 | 2016 | LOS ANGELES | NADEAU | Automobile | Freight Train | 0 | 0 |

The Washington Utilities and Transportation Commission has some warnings when it comes to trains.

- Trains can come at any time

- Trains can’t swerve or stop quickly

- Judging the speed of a train is difficult

- Don’t ignore the warning signs painted on the road

It states that 25 percent of all crashes occurring at highway-crossings happen when people drive into the side of the train. It recommends not to over-drive your headlights and always listen when you’re approaching a railway crossing.

Allstate America’s Best Drivers Report

Every year, Allstate releases its Best Drivers Report, which is based on claims data from its customers in different cities around the country. In 2019, LA is ranked 195 out of 200, which is down a spot from last year.

| Average Years Between Claims | 2019 Best Drivers Report Ranking | Change in Ranking From 2018 to 2019 |

|---|---|---|

| 5.8 | 195 | -1 |

The national average for years between claims is 10.57, which LA nearly cuts in half with 5.8. That means the average LA resident will file a claim five years sooner than the average American. This contributes to the high car insurance rates in LA.

Ridesharing

Ridesharing is a popular way to get around town, whether you don’t have a car or are looking for a safe night out. But it can be expensive. Is it like that in Los Angeles?

Here, we’ve used RideGuru to create a hypothetical trip from LAX to the Griffith Observatory. It’s a 21.4-mile trip, taking the time of an hour according to RideGuru’s calculations. There are six options available for rideshare.

- Lyft: Regular $42 | Premier $92 | Lux $124

- Uber: X $43 | Select $94 | Black $124 | Lux $177

- RideYellow: $76

- Taxi: $76

- Flywheel: $77

- Curb: $78

- Carmel (limo service): $106

It’s not a small amount of money. Now, there is the rideshare rider portion and the rideshare driver portion.

If you’re a rideshare driver, eight companies offer rideshare insurance. This is different from typical insurance packages and is often a usage-based service. Meaning, you pay as you drive.

Those companies are Allstate, Farmers, Liberty Mutual, Mercury, Metlife, Metromile, State Farm, and USAA.

Talk to your agent or prospective companies to get specifics. Some rideshare insurance packages have certain stipulations, such as what parts of the ride the insurance is active.

E-star Repair Shops

If you’ve purchased insurance through Esurance, you have the opportunity to have access to its E-star Direct Repair Program.

The program pairs you with an E-star repair shop, where you can receive updates about repairs, including pictures of the progress. There are 84 facilities within 50 miles of downtown. The first 10 are within seven miles.

| Name of Facility | Address | Contact Information |

|---|---|---|

| AGC COLLISION CENTER | 3424 W Sunset Blvd LOS ANGELES CA 90026 | email: [email protected] P: (323) 663-8076 F: (323) 663-1675 |

| AUTO-TECH COLLISION CENTER_CF | 1116 W WASHINGTON BLVD LOS ANGELES CA 90015 | email: [email protected] P: (213) 748-8228 F: (213) 748-8789 |

| CALIBER - GLENDALE | 3829 SAN FERNANDO RD GLENDALE CA 91204 | email: [email protected] P: (818) 243-3206 |

| CALIBER - LOS ANGELES - MID CITY | 3412 PICO BLVD LOS ANGELES CA 90019 | email: [email protected] P: (323) 266-2222 F: (323) 641-7900 |

| WESTERN COLLISION | 709 N GRAMERCY PLACE LOS ANGELES CA 90038 | email: [email protected] P: (323) 465-7126 F: (323) 957-0975 |

| NOAH'S COLLISION CENTER | 5235 York Blvd Los Angeles CA 90042 | email: [email protected] P: (323) 258-4000 |

| SERVICE KING MONTEREY PARK | 999 S. MONTEREY PASS RD. MONTEREY PARK CA 91754 | email: [email protected] P: (323) 262-7415 F: (323) 262-7418 |

| HARRY'S AUTO COLLISION CENTER | 1013 S. LA BREA AVE. LOS ANGELES CA 90019 | email: [email protected] P: (323) 933-5824 F: (323) 935-7054 |

| BELLWOOD AUTO BODY | 4625 GAGE AVE BELL CA 90201 | email: [email protected] P: (323) 771-3429 F: (323) 771-6464 |

| Pacific Elite - Los Angeles | 4610 CRENSHAW BLVD LOS ANGELES CA 90043 | email: [email protected] P: (323) 298-6282 F: (323) 296-0804 |

Esurance bills its partner repair facilities as state-of-the-art that adhere to strict EPA and environmental standards. Your repairs are also guaranteed as long as the car is yours.

Weather in Los Angeles

Sunny and beautiful. 80 degrees. These are the stereotypes about California and its weather. Los Angeles is a bit of an anomaly. It is bordered by the Pacific Ocean to the west and not far from inland mountains to the East.

That creates different weather conditions, ranging from rain and overcast to sunny and cloudless. It also leads to a high degree of natural disasters, including the famous California fires.

This information about weather and natural disasters in Los Angeles comes from City-Data.com. Its average temperature is 64 degrees, with an annual high of 72 degrees.

| Temperature Facts | Details |

|---|---|

| Annual High | 71.7°F |

| Annual Low | 55.9°F |

| Average Temperature | 63.8°F |

It still has more sunny days on average than the nationwide average of 205 days according to BestPlaces.

| Weather Facts | Details |

|---|---|

| Average Sunshine | 284 days |

| Average Annual Rainfall | 18.67 inches |

The number of natural disasters in Los Angeles County is 52, which is much greater than the US average of 13. A sitting president has declared 26 of those disasters as major disasters. Three emergencies have been declared.

The causes of natural disasters have varied. According to City-Data.com, there have been 13. For this list, a natural disaster can be put into more than one category, hence why the two totals don’t add up.

Causes of natural disasters include fires (34), floods (14), storms (9), landslides (5), winter storms (5), mudslides (4), earthquakes (3), freeze (1), heavy rain (1), hurricane (1), snow (1), tornado (1), wind (1).

Fires lead by a large margin, followed by storms and landslides. There is even the occasional snow natural disaster or hurricane natural disaster. Earthquakes are common in California, as it rests on the San Andreas fault line.

When it comes to weather, comprehensive insurance is the insurance that can protect your vehicle. Whether it’s damaged by hail, in a hurricane, or in a fire, comprehensive insurance can pay for the cost of repairs.

If you believe that your car may be completely destroyed, you can purchase GAP coverage if you still have a car note. GAP coverage will pay the rest of your note if your car is destroyed, depending on circumstances. These include weather events.

Public Transit in Los Angeles

Public transit in Los Angeles is a complex mixture of buses and light rail. You can visit Los Angeles completely without ever setting foot in a car. This information comes about LA public transit from Discover Los Angeles.

Buses: These are run by two companies, the Metro and the City of Los Angeles Transportation (LADOT). There are options that run along major city streets, stops on freeways, surrounding suburbs, and even South Bay and San Gabriel Valley.

Light Rail: The light rail goes to parts of the Los Angeles county that are a little far for buses. Those include San Fernando Valley, Pasadena, Long Beach, Norwalk, and Redondo Beach.

To get access to these services, you can download the Metro mobile app or the LADOT app, depending on your traveling preferences. For Metro services, you can also get a prepaid card that allows you to ride the light rail system.

Cost of Alternate Transportation in Los Angeles

For alternate transportation in Los Angeles, there are a host of options, from dockless electric bikes to station-based bike shares to electric scooters. We are going to cover the last one.

Los Angeles, according to LAist, is in the middle of a grand experiment. On April 15th, it opened its proverbial doors to electric scooters and bikes, with seven companies jumping in immediately and participating.

As of May this year, 30,420 were allowed in Los Angeles between seven different companies. These companies included the well-known Bird and Lime, along with Uber’s Jump and smaller names like Sherpa and Bolt.

Although there are no particular new articles about how they’re faring, early on there were issues with people getting injured or bikes and scooters being left in negative places like sidewalks.

Generally, for all companies, it costs $1 to activate the scooter or bike, followed by a charge per distance traveled. You, also generally, can deposit them wherever you want that’s safe, although the city has some designated areas to put them in.

Different LA city departments are working to put together data about scooter usage, including the rate of injuries. The hope is that it reduces the gridlock of traffic in the City of Angels, which as we’ve seen has some of the worst traffic in the world.

Parking in Los Angeles

According to some local experts like the Spot Hero, there are options for parking in downtown LA. But those options are few and far between.

First, metered parking is free after the meter expires. There is some conflicting information as to when this is, but generally, it’s near or after the sun goes down. This is anywhere between 4 and 6 pm.

Second, you can park at green curbs for 15 to 30 minutes with no charge. You can park at yellow curbs just to load or unload passengers.

Third, you can take advantage of off-site lots for events or hotel parking if you’re visiting LA. A quick look at a map shows that you can use garages as well, but they generally cost around $8 or more.

Air Quality in Los Angeles

Whether it’s water conservation, tree planting, recycling materials, or even e-cycling electronic devices, working to protect the environment is quickly coming to the forefront in many cities, including LA. Unfortunately, air quality in LA is known to be bad.

This can affect your vehicle, as pollution takes a toll on air-conditioning filtration systems if you roll the windows down. This leads to higher vehicle operating costs.

The U.S. Environmental Protection Agency does an air quality index report every year analyzing the air quality in metros all across the country. The categories are separated in good days all the way to very unhealthy days.

In 2018, LA had a total of 35 good days.

| YEAR | DAYS WITH AQI | GOOD DAYS | MODERATE DAYS | UNHEALTHY DAYS FOR SENSITIVE GROUPS | UNHEALTHY DAYS | VERY UNHEALTHY DAYS |

|---|---|---|---|---|---|---|

| 2016 | 366 | 32 | 226 | 83 | 21 | 4 |

| 2017 | 365 | 38 | 205 | 76 | 38 | 8 |

| 2018 | 365 | 35 | 220 | 90 | 19 | 1 |

Most of the days were moderate. Los Angeles, in general, has made a concerted effort to reduce air pollution in the city. The air quality has steadily improved over the past decade.

This is shown in the EPA report for 2009, where many more days were listed as unhealthy.

Military/Veterans

Have you ever found yourself wondering how to get car insurance as a military serviceperson?

It can be difficult enough serving in the military. Worrying about your car insurance should be the last thing on your mind. That’s why we’ve put together this section, to cover all parts about car insurance for military personnel.

Here, we’ve got a breakdown for Los Angeles. Its veterans by service period, the bases within an hour of driving distance, the military discounts offered by providers, and, of course, USAA.

Ready?

Veterans by Service Period

In Los Angeles, there is a higher percentage of World War II vets compared to the nationwide average. There is also a lower percentage of Korean War vets.

| Service Period | Los Angeles Share | United States Share |

|---|---|---|

| World War II | 6% | 4% |

| Korea | 12% | 9.5% |

| Vietnam | 42% | 43% |

| First Gulf War | 17% | 18% |

| Second Gulf War | 23% | 25.5% |

In general, the averages for Los Angeles stay around the nationwide averages.

Military Bases within an Hour

The closest military base to Los Angeles is actually located in El Segundo, which is about 30 minutes southwest of LA near the beach and Inglewood. It is the Los Angeles Air Force Base and is the headquarters of the Space and Missiles System Center.

It was built between 1962 and 1964 and the 61st Air Base Wing provides support functions for the base.

Military Discounts by Provider

Six major insurance companies that we’ve covered in this guide offer military discounts or are hoping to offer one soon.

- Allstate: No additional details

- Farmers: No additional details

- Geico: Must be active or retired

- Liberty Mutual: Must be active

- Nationwide: Hoping to have one soon

- State Farm: Only in select states

Call your insurance agent or company you’re looking at for more information.

USAA Available in California

Aside from discounts, military personnel has access to one insurance company that no one else does. This company has some of the best financial ratings, excellent customer satisfaction, and a relatively moderate amount of complaints against it.

This is USAA. Its rates are the cheapest in Los Angeles, 27 percent below the average.

| Group | Average Premium | Difference (+/-) | Difference (%) |

|---|---|---|---|

| Allstate | $4,532.96 | $844.03 | 22.88% |

| Farmers | $4,998.78 | $1,309.85 | 35.51% |

| Geico | $2,885.65 | -$803.28 | -21.78% |

| Liberty Mutual | $3,034.42 | -$654.51 | -17.74% |

| Nationwide | $4,653.19 | $964.26 | 26.14% |

| Progressive | $2,849.67 | -$839.26 | -22.75% |

| State Farm | $4,202.28 | $513.35 | 13.92% |

| Travelers | $3,349.54 | -$339.39 | -9.20% |

| USAA | $2,693.87 | -$995.06 | -26.97% |

Military personnel who go with USAA can save up to $1,000 compared to the average for all companies. It’s not just available to personnel as well. Immediate family members, including spouses and children, can be signed up for USAA.

Unique City Laws

Every city has unique laws. Here are four categories in Los Angeles.

Hands-Free Laws

According to Nolo, California has several laws restricting the use of cell phones while driving.

- One that bans adult use of hand-held devices

- One that bans minors from using hands-free devices

- One that bans texting and other wireless device use while driving

There are others as well. Distracted driving has been a central issue in many states, with the National Traffic Highway Safety Administration stating that over 3,000 lives were lost due to distracted driving in 2017.

California has some of the toughest laws in the country.

Food Trucks

Food trucks have a long history in LA, dating back to the late 2000s where small food trucks started up, succeeded due to their bold and inventive flavors, and would later become restaurants.

Today, food trucks are called mobile food vending under Los Angeles regulations. If you want to start one, the LA Business Portal, funded by the Mayors Office of LA, has some pointers.

- Do research into the California Retail Food Code and LA Municipal Code 80.73

- Register your business

- Find a food facility to park your vehicle overnight

- Make sure your kitchen has been approved by the County Department of Public Health

- Go through the process of getting a public health permit

- Get your manager’s food safety certification

- Make sure all your employees who are handling food have a Food Handler Card

There are, of course, other parts as well according to UpCounsel, including all the business aspects. These include creating a business plan, researching locations, securing financing, and obtaining a vehicle, among others.

Tiny Home

Tiny homes have become a cost-affordable option for living, for families looking to add another piece to their property or for retirees looking to build a second home. But can you build them on your property in Los Angeles?

According to Nolo, building a tiny home accessory dwelling unit on a property in California is possible, if it meets the codes for the individual municipalities.

In LA County, those codes are in Chapter 22.140 titled Standards for Specific Use. In subsection 22.140.640 titled Accessory Dwelling Units (ADU), the LA code spells out when an ADU can be constructed on a property and when it cannot.

There are specific areas where an ADU cannot be built, use restrictions like the length of a rental agreement, and construction restrictions like having a specific amount of floor space.

There are additional restrictions if you want your tiny home to be mobile. And as the Tiny House Exhibition reports, the particulars about moveable tiny homes is still being decided in LA.

In the end, you can build them. Reading through the code can help and if you have further questions, you can always contact your city planner or city planning department for more detailed explanations.

Parking Laws

Parking laws are laid out in the Los Angeles Municipal Code Chapter 8 (Traffic) Division N (Parking Prohibited or Limited). Division N covers everything from parking for oversized vehicles, commercial vehicles, private streets, and more.

Some gems include parking on lawns zoned for residential property, parking in very high fire hazard severity zones, and the dispensing of victuals from catering trucks.

- No person shall park any vehicle in the front yard of any residential property.

- It shall be unlawful, when authorized signs are in place giving notice, to park any vehicle on any of the streets or portions of streets in the City’s Very High Fire Hazard Severity Zone in violation of the signs.

- No person shall dispense victuals from any portion of a catering truck on any street in any manner which causes any person to stand in that portion of the street which is between the catering truck and the center of the street.

- No person shall stand or park a vehicle upon any street for the purpose of displaying such vehicle for sale by sign or otherwise.

- It shall be unlawful for any person who owns or who has possession, custody or control of any vehicle to park that vehicle or leave it standing upon any highway, street or alley for 72 or more consecutive hours.

And there are many more.

Los Angeles Car Insurance FAQs

Every city has frequently asked questions. Here are eight.

When was Los Angeles founded?

Los Angeles was founded on September 4, 1781, by a group of 44 settlers known as Los Pobladores (The Settlers). The original name was El Pueblo de Nuestra Señora la Reina de los Ángeles (The Town of Our Lady, The Queen of the Angels). Today, the original pueblo is marked a historic district and is in the oldest part of downtown.

How did Los Angeles get its name?

The name for the original pueblo, the root for the current Los Angeles name, came from the Franciscan Padres who were traveling with the group. El Pueblo de Nuestra Señora la Reina de los Ángeles is derived from Santa Maria degli Angeli, which is a small town in Italy important to the Franciscan order.

Where is Los Angeles located?

Los Angeles is located in a basin near the Pacific Ocean. There is varied geography, including deserts, mountains, the Los Angeles river, and a diverse mix of flora and fauna. Because of its location, like much of California, it is subject to earthquakes, both minor and major. It lies across the San Andreas Fault Line, which some say is overdue for a major earthquake.

What is Los Angeles famous for?

Los Angeles is famous for Hollywood, glitz and glamour, and Beverly Hills. Major media and production companies have headquarters in Los Angeles and there are constant tours of the studios like Warner Brothers. Because of this, Los Angeles has earned the name Tinsel Town because of the perception that it is not entirely attached to reality.

When is the Los Angeles Olympics?

Los Angeles is hosting the Summer Olympics of 2028 from July 21 to August 6. Los Angeles is only one of three cities, along with London and Paris, to have hosted or be scheduled to host the Olympics three times. The estimated cost for running the Olympics was estimated at $6.88 billion in 2019, with funding coming from the private sector.

Can Los Angeles have a tsunami?

According to CBS News, a group of researchers found a series of underwater faults off the coast of Los Angeles or Southern California in general. These faults, if they produce an earthquake, can generate tsunamis up to 11 feet in certain areas near Los Angeles.

Can Los Angeles fall into the ocean?

As the U.S. Department of Interior notes, Los Angeles will not fall into the ocean. It is firmly planted on the two tectonic plates that make up the San Andreas fault line. Eventually, however, because of the movements of the plates, Los Angeles and San Francisco will be side by side.

Can Los Angeles sink?

In the event of a major earthquake, Los Angeles might sink according to a group of scientists featured in CBC. The drop in the past for major quakes has only been about one foot and a half to three feet for each quake, so the effect wouldn’t be a great deal. According to the scientists, it would happen instantaneously to the earthquake.

Ready to compare rates? Try our FREE online tool.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.