USAA Car Insurance Review [Rates, Coverage, & More]

USAA offers some of the cheapest car insurance rates for members of the U.S. military. Read our USAA car insurance review if you qualify for coverage. We break down USAA car insurance rates by age, vehicle type, and more and explain how to file a USAA car insurance claim to give drivers a full overview of the company.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| USAA Overview | Details |

|---|---|

| Year Founded | 1922 |

| Current Executives | CEO Stuart Parker Executive VP and CFO Laura Bishop |

| Number of Employees | 33,689 |

| Total Sales Total Assets | $20.1 Billion $159 Million |

| HQ Address | 9800 Fredericksburg Road San Antonio, TX 78288 |

| Phone Number | (800) 365-8722 |

| Company Website | www.usaa.com |

| Direct Premiums Written | $14,467,936,000 |

| Loss Ratio | 0.78 % |

| Best For | Credit, Banking, Insurance |

- AM Best Rating: A++

- Monthly Rates From: $40-$110

- Types of Coverage: Aircraft, Auto, Commercial Auto, Earthquake, Flood, Homeowners

- Customer Service & Claims Number: 800- 531-8722

Founded by a small group of Army officers as a means of insuring each other’s cars, USAA has been striving to meet the car insurance needs of military members and their families since 1922.

Its dedication to customer care combined with the quality of services that USAA offers also make it one of the most desirable car insurance companies on the market.

In fact, according to the Forrester Customer Experience Index, USAA has ranked as one of the top companies for credit, banking, and insurance for the last three years.

Fortune Magazine also ranked USAA 25th on its World’s Most Admired Companies list for 2017.

Staying on top and keeping premiums down for their customers in the process is hard work though. Enter your information above to get started and then keep reading to see how hard USAA will work for you.

USAA Monthly Rates vs U.S. Average

| Coverage Type | USAA | U.S. Average |

|---|---|---|

| Full Coverage | $110 | $119 |

| Minimum Coverage | $40 | $45 |

Affordable Auto Insurance Rates of USAA

USAA consistently offers the most budget-friendly annual rates across the board, surpassing competitors such as Liberty Mutual and Farmers, who command a significant market share. Comparing the figures, USAA boasts an average annual rate of approximately $2,500, a stark contrast to Liberty Mutual’s $6,100, and Farmers’ $4,200 annual rates for car insurance.

When you consider the substantial savings on car insurance and the exceptional customer service provided to USAA members, the choice becomes evident. USAA also provides various discounts, depending on your location, which can further reduce your expenses. Continue reading to discover more about these discounts.

USAA consistently has the cheapest average annual rates across the board. This can be seen by equating USAA to companies such as Liberty Mutual and Farmers who have a comparable share of the market.

With an average annual rate of around $2,500, USAA far outpaces Liberty Mutual whose average annual rate for car insurance sits at around $6,100, and Farmers which has an average annual rate of $4,200. When you combine how much you can save on car insurance with the extraordinary customer care that you get as a USAA member the choice seems clear.

USAA also offers many of the same discounts as its competitors depending on your location. This could save you even more money. Keep reading to find out more.

USAA Availability and Rates by State

USAA is available in all 50 states.

In an effort to ensure that all military members and their families are taken care of, USAA also offers services to active duty servicemen and women stationed around the world.

This means that no matter which of the nearly 800 military bases worldwide that you are stationed at or reside near USAA will be there for you and your family.

USAA even offers a vehicle storage discount if you can’t take your car with you overseas.

Having a car insurance company that is on your side no matter where you live offers you peace of mind and allows you to focus on getting the job done and getting home.

It is also comforting to know that USAA’s rates don’t fluctuate wildly across their coverage areas.

In fact, the cost of the average annual premium in Florida where insurance prices are acknowledged to be among some of the highest in the country is around $2,800. This is only around $1,000 more a year than USAA members who reside in Maine are paying for the same type of policies.

Compare that to Allstate who charges residents of Florida about $7,500 annually compared to their customers in Maine who pay out approximately $3,600 for the same type of coverage.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Coverages Offered by USAA Car Insurance

USAA has a variety of car insurance coverage options that members such as you can choose from.

Some of these include:

- Full coverage which will protect you and/or your lender by bundling liability coverage with comprehensive and collision coverage.

- Personal Injury Protection (PIP) which covers medical expenses for you and your passengers regardless of who is at fault.

- Uninsured and Underinsured Motorist which covers both property damage and bodily injury claims should one of the parties in a crash be determined to have no insurance or not enough coverage to pay for all of the claims.

- Roadside Assistance which can help you pay for a tow truck or other minor roadside repairs so that you aren’t left stranded along the highway.

- And Rental Reimbursement which will help you cover the cost of a rental car while your car is in the repair shop as a result of an insurance claim.

As you can see, USAA has your back no matter what you encounter on the road.

If your car is ever stolen or damaged in a natural disaster USAA’s comprehensive coverage can help you pay the bills.

USAA even offers you a way to rent a car in case of loss or damage is you opt into rental reimbursement.

Your passengers are just as important to USAA as you are as well which is why it offers you coverage like PIP.

USAA’s Discounts Offered by USAA Car Insurance

Even though USAA boasts some of the least expensive rates on the car insurance market everyone loves to save money. USAA knows this which is why it offers even more savings to its members in the form of discounts.

Some of these discounts include:

- Safe driver discounts

- Defensive driving discount

- Driver training discount

- Good student discount

- New vehicle discount

- Multi-vehicle discount

- Annual mileage discount

- Vehicle storage discount

- Family discount

- the Military installation discount

Safeguarding Your Future With USAA Car Insurance Claims

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

USAA understands the importance of a hassle-free claims process, especially for its military members and their families. To cater to their diverse needs and preferences, USAA offers multiple channels for filing insurance claims.

Whether you prefer the convenience of filing online, the ease of a phone call, or the flexibility of using their mobile app, USAA ensures that you have options that suit your situation. This flexibility demonstrates their commitment to making the claims process as straightforward as possible for their valued members.

Average Claim Processing Time

When it comes to handling claims promptly, USAA stands out as an industry leader. The average claim processing time is a critical factor for policyholders seeking quick resolutions to their insurance needs. USAA’s dedication to efficient claim processing ensures that its members receive the support they need without unnecessary delays.

This commitment is a testament to their customer-centric approach, where time-sensitive matters like claims are handled with the utmost efficiency.

Customer Feedback on Claim Resolutions and Payouts

USAA’s reputation for excellent customer service extends to its claim resolutions and payouts. Feedback from policyholders consistently reflects high satisfaction with how USAA handles claims. The company’s commitment to fair and timely settlements is evident in the positive experiences shared by its members.

This dedication to ensuring that their customers are well taken care of during challenging times underscores USAA’s commitment to providing exceptional insurance services.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Enhancing Insurance With USAA Car Insurance Technological Excellence

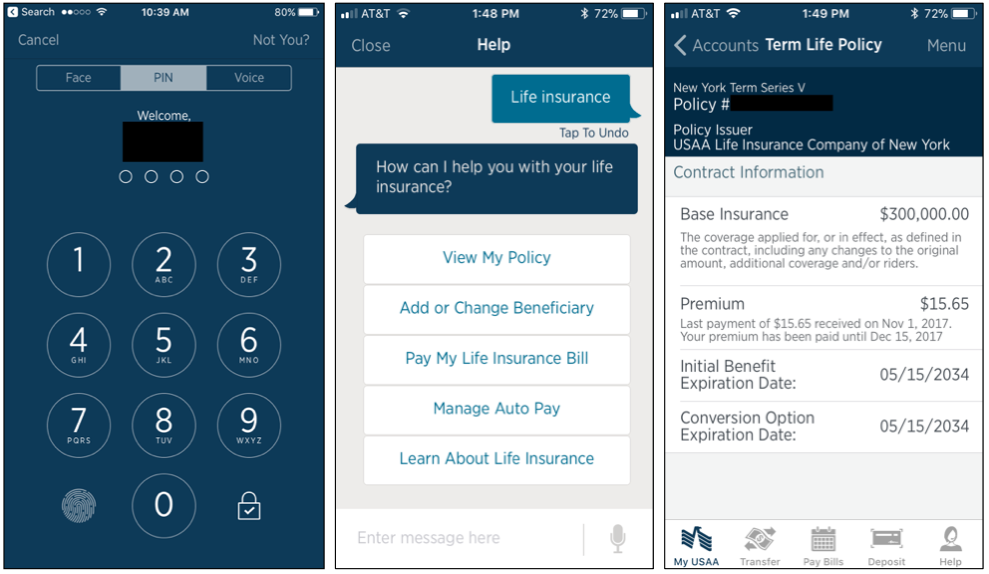

Mobile App Features and Functionality

USAA’s mobile app is a testament to their commitment to leveraging technology for the benefit of their members. The app offers a wide range of features and functionalities that make managing your insurance policies and claims a breeze.

From filing claims on the go to accessing policy information and even getting roadside assistance, USAA’s mobile app provides a comprehensive suite of tools designed to simplify the insurance experience for their customers.

Online Account Management Capabilities

In today’s digital age, having robust online account management capabilities is crucial for policyholders. USAA understands this need and offers a user-friendly online portal that empowers members to manage their insurance accounts with ease.

Whether it’s updating personal information, making payments, or reviewing policy details, USAA’s online account management capabilities ensure that their customers have the convenience of handling their insurance needs from the comfort of their own devices.

Digital Tools and Resources

USAA goes beyond the basics to provide its members with a wealth of digital tools and resources. These tools are designed to educate and assist policyholders in making informed decisions about their insurance coverage.

Whether you need assistance calculating coverage needs or understanding insurance jargon, USAA’s digital resources are readily available to help you navigate the complex world of insurance, further solidifying their commitment to providing comprehensive support to their valued members.

Customer Reviews for USAA Car Insurance

USAA Car Insurance has garnered positive feedback from policyholders, earning acclaim for its affordable rates, exceptional customer service, and wide array of coverage options. Customers consistently highlight the cost-effectiveness of USAA’s policies, emphasizing that its average annual rates are notably lower than those of competitors, such as Liberty Mutual and Farmers.

Moreover, policyholders appreciate the availability of various discounts, adding further savings to their insurance plans. The convenience and flexibility of filing claims through multiple channels, including online, phone calls, and the mobile app, are praised for making the claims process hassle-free. USAA’s swift claim processing time and its commitment to efficient resolutions receive recognition as well.

Customers also express satisfaction with the fair and timely claim payouts. Furthermore, the user-friendly mobile app and online account management capabilities offered by USAA are commended for simplifying policy management. The provision of digital tools and resources to educate and assist policyholders is viewed as a valuable service that enhances the overall customer experience.

In summary, USAA Car Insurance enjoys a strong reputation for its affordability, superior customer support, and commitment to streamlined insurance services, earning the trust and appreciation of its policyholders.

History and Mission of USAA Car Insurance

Organized in San Antonio Texas, USAA has been based there since the early 1920s. This means that USAA truly is a hometown company.

Started by 25 Army officers and expanded to include members of the Navy and Marine Corps in 1923, USAA has been able to maintain its Military family-oriented business model over the course of its history as well.

The 1930s brought with it the Great Depression and big changes for USAA as a result. The company’s ability to remain fiscally conservative helped them weather one of the hardest times in United States history; even expanding along the way.

USAA was also at the forefront of the social changes in America in the 1930s as Stuart Gwyn became the first woman to join the management team at USAA in 1934.

With the onset of World War II, the military saw a great boost in its numbers and USAA was right there to ensure that military personnel and their families would be taken care of no matter what might lie ahead.

As the war came to an end USAA also expanded its membership to Air Force officers in 1948.

Keeping pace with the times, USAA added another woman to the ranks in the 1950s. This time her name was Consuelo Kerford and she became the first female officer within the company.

USAA also went international in 1952 when it opened an office in Frankfurt, Germany to help better serve military members who were stationed abroad.

In the 1960s USAA was automated using the latest IBM technology to keep up with the ever-changing world.

The 1960s also saw the beginning of the Vietnam War, and just as it had done during WWII, USAA stepped up to take care of the expanding military personnel and their families. USSA also rewrote its by-laws to allow veterans to maintain their membership even after they had resigned their commissions.

Throughout the 1970s and 1980s, USAA continued to keep up with technological advancements such as email and the rise in personal computer use so that they could offer their customers the best service that money could buy.

As the 1990s brought the internet with it, USAA was also right there making sure to keep its members and agents connected with advancements like Electronic Funds Transfers.

USAA also doubled down on its desire to take care of all members of the military and their families by expanding its coverage offerings to enlisted personnel in 1996. By the 2000s USAA.com was allowing members to conduct most of their business online. USAA also began offering special deployment assistance to members who were engaged in the war or terrorism.

The year 2009 saw another expansion in eligibility as active-duty members, veterans, military retirees, and their immediate family members all became eligible for coverage. (For more information, read our “Car Insurance for Active-Duty Military“).

USAA is still at the forefront of customer care and service today. In 2010 it added a Mobile App for iPads to its list of technological advancements making life easier for customers.

In 2016 USAA also became the first to offer a voice-guided mobile app to its banking services in order to make life easier for its visually impaired customers.

With all of these advantages and advancements, it is no wonder that so many military servicemen and women and their families chose USAA to do business with.

USAA Car Insurance traces its roots back to its formation in San Antonio, Texas, in the early 1920s, founded by 25 Army officers. Over the years, it expanded to include members of the Navy and Marine Corps in 1923, maintaining a steadfast commitment to its military family-oriented business model.

The company navigated through the challenges of the Great Depression in the 1930s with fiscal conservatism and embraced social change as Stuart Gwyn became the first woman to join its management team in 1934. During World War II, USAA ensured that military personnel and their families would be taken care of, and in 1948, it extended its membership to Air Force officers.

In the 1950s, Consuelo Kerford became the first female officer in the company, and USAA went international by opening an office in Frankfurt, Germany, in 1952 to better serve military members stationed abroad. The 1960s brought automation with the latest IBM technology, and USAA adjusted its by-laws to allow veterans to maintain their membership even after resigning their commissions.

Throughout the 1970s and 1980s, USAA adapted to technological advancements such as email and personal computer use. In the 1990s, the company embraced the internet era, introduced Electronic Funds Transfers, and expanded its coverage offerings to enlisted personnel in 1996.

By the 2000s, USAA was conducting most of its business online, offering special deployment assistance to members involved in war or terrorism. In 2009, eligibility expanded to include active-duty members, veterans, military retirees, and their immediate family members.

Continuing to stay at the forefront of customer care and service, USAA introduced a Mobile App for iPads in 2010 and a voice-guided mobile app for its banking services in 2016, making life easier for visually impaired customers.

Today, USAA Car Insurance remains a preferred choice for many military servicemen and women and their families due to its extensive history, commitment to technological innovation, and unwavering support for the military community.

USAA Car Insurance’s mission is to provide affordable and comprehensive auto insurance solutions to military personnel, veterans, and their families, ensuring their peace of mind on the road. With a strong focus on technological excellence, USAA aims to streamline the insurance experience through its mobile app and online account management capabilities.

The company is dedicated to offering cost-effective coverage, backed by exceptional customer support and a wide range of discounts to maximize savings. USAA takes pride in its efficient claims processing, fostering trust among policyholders with fair and timely claim resolutions.

Overall, USAA Car Insurance’s mission revolves around delivering superior service and support to its valued members, further solidifying its reputation as a trusted and reliable insurance provider.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Conclusion

USAA Car Insurance stands as a reputable and highly regarded choice for those within the military community and their families. With a rich history dating back to its formation in the 1920s, USAA has consistently demonstrated a deep commitment to providing affordable and comprehensive auto insurance solutions.

USAA’s dedication to its mission is evident in its continuous efforts to offer budget-friendly rates, a wide array of coverage options, and a variety of discounts to maximize savings. The company’s unwavering focus on customer service ensures that members receive the support and care they deserve, especially during the claims process.

Moreover, USAA’s technological excellence is showcased through its user-friendly mobile app, online account management capabilities, and digital resources, which make managing insurance policies and claims hassle-free in the digital age.

USAA’s history of serving military personnel, its commitment to technological innovation, and its dedication to its mission have earned it the trust and appreciation of its policyholders. With a solid reputation for affordability, exceptional customer support, and streamlined insurance services, USAA Car Insurance continues to safeguard the future of those who serve our nation, providing peace of mind on the road.

Comparing the Top 10 Companies by Market Share

Even though USAA only commands around six percent of the total market share nationwide it can still stand toe to toe with some of its largest competitors.

Part of the reason for this is that USAA offers its services and customer care in all 50 states whereas its competitors are only available in certain areas.

In the areas where USAA crosses paths with other car insurance companies though it consistently out prices them. Take a look

| State | Average by State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | $3,566.96 | $3,311.52 | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $4,798.15 | $3,697.80 | $2,124.09 | |

| Alaska | $3,421.51 | $3,145.31 | $4,153.07 | $2,879.96 | $5,295.55 | $3,062.85 | $2,228.12 | $2,454.21 | |||

| Arizona | $3,770.97 | $4,904.10 | $5,000.08 | $2,264.71 | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 | ||

| Arkansas | $4,124.98 | $5,150.03 | $4,257.87 | $3,484.63 | $3,861.79 | $5,312.09 | $2,789.03 | $5,973.33 | $2,171.06 | ||

| California | $3,688.93 | $4,532.96 | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $4,202.28 | $3,349.54 | $2,693.87 | |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | $3,338.87 | |

| Connecticut | $4,618.92 | $5,831.60 | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $2,976.24 | $6,004.29 | $3,190.00 | ||

| Delaware | $5,986.32 | $6,316.06 | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,466.85 | $4,182.36 | $2,325.98 | ||

| District of Columbia | $4,439.24 | $6,468.92 | $3,692.81 | $4,848.98 | $4,970.26 | $4,074.05 | $2,580.44 | ||||

| Florida | $4,680.46 | $7,440.46 | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | $3,397.67 | $2,850.41 | |||

| Georgia | $4,966.83 | $4,210.70 | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | $3,157.46 | |||

| Hawaii | $2,555.64 | $2,173.49 | $4,763.82 | $3,358.86 | $3,189.55 | $2,551.83 | $2,177.93 | $1,040.28 | $1,189.35 | ||

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | $1,867.96 | $3,226.29 | $1,877.61 | |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 | |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $3,354.32 | $6,551.68 | $2,897.89 | ||

| Louisiana | $5,711.34 | $5,998.79 | $6,154.60 | $7,471.10 | $4,579.12 | $4,353.12 | |||||

| Maine | $2,953.28 | $3,675.59 | $2,770.15 | $2,823.05 | $4,331.39 | $3,643.59 | $2,198.68 | $2,252.97 | $1,930.79 | ||

| Maryland | $4,582.70 | $5,233.17 | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | $3,960.87 | $2,744.14 | |||

| Massachusetts | $2,678.85 | $2,708.53 | $1,510.17 | $4,339.35 | $3,835.11 | $1,361.86 | $3,537.94 | $1,458.99 | |||

| Michigan | $10,498.64 | $22,902.59 | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | $12,565.52 | $8,773.97 | $3,620.00 | |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | $2,066.99 | $2,861.60 | ||

| Mississippi | $3,664.57 | $4,942.11 | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $2,980.48 | $3,729.32 | $2,056.13 | ||

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | $2,525.78 | |

| Montana | $3,220.84 | $4,672.10 | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | $2,417.74 | $2,031.89 | ||

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | $2,330.78 | |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| New Hampshire | $3,151.77 | $2,725.01 | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | $2,185.46 | $1,906.96 | |||

| New Jersey | $5,515.21 | $5,713.58 | $7,617.00 | $2,754.94 | $6,766.62 | $3,972.72 | $7,527.16 | $4,254.49 | |||

| New Mexico | $3,463.64 | $4,200.65 | $4,315.53 | $4,458.30 | $3,514.38 | $3,119.18 | $2,340.66 | $2,296.77 | |||

| New York | $4,289.88 | $4,740.97 | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,484.58 | $4,578.79 | $3,761.69 | ||

| North Carolina | $3,393.11 | $7,190.43 | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,078.65 | $3,132.66 | |||

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | $2,006.80 | |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | $4,142.40 | $3,437.34 | $6,874.62 | $4,832.35 | $2,816.80 | $3,174.15 | |||

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $2,744.23 | $7,842.47 | $1,793.37 | ||

| Rhode Island | $5,003.36 | $4,959.45 | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $2,406.51 | $6,909.45 | $4,323.98 | ||

| South Carolina | $3,781.14 | $3,903.43 | $4,691.85 | $3,178.01 | $3,625.49 | $4,573.08 | $3,071.34 | $3,424.77 | |||

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | ||

| Tennessee | $3,660.89 | $4,828.85 | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,639.30 | $2,738.52 | $2,739.28 | |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | $3,263.28 | $3,867.55 | $4,664.69 | $2,879.94 | $2,487.89 | |||

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | $2,491.10 | |

| Vermont | $3,234.13 | $3,190.38 | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | $4,382.84 | $1,903.55 | |||

| Virginia | $2,357.87 | $3,386.80 | $2,061.53 | $2,073.00 | $2,498.58 | $2,268.95 | $1,858.38 | ||||

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | $2,262.16 | |

| West Virginia | $2,595.36 | $3,820.68 | $2,120.80 | $2,924.39 | $2,126.32 | $1,984.62 | |||||

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | $2,975.74 | |

| Wyoming | $3,200.08 | $4,373.93 | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | $2,303.55 | $2,779.53 |

Read more:

The data confirms that USAA can hold its own against the top 10 companies by market share. USAA doesn’t just hold its own though.

The median average annual premium for USAA stands at $2,489.49. That is $300 less than its closest price competitor Statefarm and around $2,000 less than the median price of the average annual premium offered by Allstate.

Great prices and unbeatable customer care are what have kept USAA on top since 1922.

Average USAA Male vs. Female Car Insurance Rates

The average cost of car insurance for a 35-year-old female in the United States is $2,449.06. This is slightly higher than her male counterpart.

This is in keeping with the Consumer Federation of America‘s 2017 study which revealed that:

Female motorists with perfect driving records often pay significantly more for auto insurance than male drivers with identical driving records and other characteristics the insurers use to price auto insurance.

This comes as a shock to a lot of people since commonly held belief states that men are more risky drivers.

In an effort to combat gender inequality in the car insurance market, the following states have enacted bans against the use of gender when setting car insurance rates:

- California

- Hawaii

- Massachusetts

- Montana

- North Carolina

- and Pennsylvania

If you don’t live in one of these states then you could be paying a significantly higher price for car insurance just because of your gender.

That is of course if you aren’t covered by USAA. Take a look.

| Group | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $3,156.09 | $3,123.01 | $2,913.37 | $2,990.64 | $9,282.19 | $10,642.53 | $3,424.87 | $3,570.93 |

| American Family | $2,202.70 | $2,224.31 | $1,992.92 | $2,014.38 | $5,996.50 | $8,130.50 | $2,288.65 | $2,694.72 |

| Farmers | $2,556.98 | $2,557.75 | $2,336.80 | $2,448.39 | $8,521.97 | $9,144.04 | $2,946.80 | $3,041.44 |

| Geico | $2,302.89 | $2,312.38 | $2,240.60 | $2,283.45 | $5,653.55 | $6,278.96 | $2,378.89 | $2,262.87 |

| Liberty Mutual | $3,802.77 | $3,856.84 | $3,445.00 | $3,680.53 | $11,621.01 | $13,718.69 | $3,959.67 | $4,503.13 |

| Nationwide | $2,360.49 | $2,387.43 | $2,130.26 | $2,214.62 | $5,756.37 | $7,175.31 | $2,686.48 | $2,889.04 |

| Progressive | $2,296.90 | $2,175.27 | $1,991.49 | $2,048.63 | $8,689.95 | $9,625.49 | $2,697.73 | $2,758.66 |

| State Farm | $2,081.72 | $2,081.72 | $1,873.89 | $1,873.89 | $5,953.88 | $7,324.34 | $2,335.96 | $2,554.56 |

| Travelers | $2,178.66 | $2,199.51 | $2,051.98 | $2,074.41 | $9,307.32 | $12,850.91 | $2,325.25 | $2,491.21 |

| USAA | $1,551.43 | $1,540.32 | $1,449.85 | $1,448.98 | $4,807.54 | $5,385.61 | $1,988.52 | $2,126.14 |

With the exception of teenaged drivers, all of USAA’s members enjoy fairly equal pricing when purchasing their policies. Teen drivers pay more across the board though because of their general lack of driving experience.

USAA doesn’t just have fair pricing when it comes to gender difference either, Keep scrolling to see what we mean.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Average USAA Rates by Make and Model

Did you know that some insurance companies base your rates on how other people drive their car?

It’s true. If you own a Ford F-150 and this is the type of truck that is most likely to have the most accidents then you are going to pay a higher rate for car insurance because of the carelessness of others.

If you choose USAA though your premiums stay consistent no matter which type of car you choose.

| Make and Model | USAA | Geico | State Farm | American Family | Nationwide | Progressive | Farmers | Travelers | Allstate | Liberty Mutual | Grand Total |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2015 Ford F-150 Lariat SuperCab | $2,551.56 | $3,092.11 | $3,204.23 | $3,447.30 | $3,571.01 | $3,914.05 | $4,093.50 | $4,023.47 | $4,429.74 | $5,830.16 | $3,791.74 |

| 2015 Honda Civic Sedan | $2,409.67 | $3,092.58 | $3,024.24 | $3,178.82 | $3,547.84 | $4,429.56 | $4,405.21 | $4,420.37 | $4,753.69 | $5,869.32 | $3,890.45 |

| 2015 Toyota RAV4 XLE | $2,454.58 | $3,090.89 | $3,226.02 | $3,326.18 | $3,517.03 | $3,647.22 | $3,728.22 | $4,383.78 | $4,324.99 | $5,825.33 | $3,721.25 |

| 2018 Ford F-150 Lariat SuperCab | $2,855.69 | $3,338.40 | $3,497.17 | $3,487.91 | $3,373.64 | $3,962.58 | $4,390.19 | $4,412.42 | $5,491.12 | $5,988.85 | $4,076.10 |

| 2018 Honda Civic Sedan | $2,422.66 | $3,338.87 | $3,189.99 | $3,721.32 | $3,361.93 | $4,528.90 | $4,779.51 | $4,661.22 | $5,380.28 | $6,682.63 | $4,166.72 |

| 2018 Toyota RAV4 XLE | $2,529.63 | $3,337.18 | $3,418.33 | $3,496.99 | $3,328.57 | $3,730.78 | $3,769.00 | $4,708.19 | $4,947.90 | $6,244.44 | $3,926.83 |

Read more: Toyota Motor Car Insurance Review

Owning a 2015 F-150 could cost you between $1,000 to $2,000 more a year than owning a 2018 Honda Civic if you choose a company like Progressive for your car insurance coverage.

If you choose USAA though the cost of your car insurance policy only increases around $300. USAA also charges well below the national average for both of these models when it comes to car insurance rates.

Average USAA Commute Rates

Insurance companies don’t just set your rates based on your gender or what you drive. Sometimes how far you drive can have an impact on the price of your premiums as well.

Take a look at the table below to see what we mean.

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Allstate | $4,841.71 | $4,934.20 |

| American Family | $3,401.30 | $3,484.88 |

| Farmers | $4,179.32 | $4,209.22 |

| Geico | $3,162.64 | $3,267.37 |

| Liberty Mutual | $5,995.27 | $6,151.63 |

| Nationwide | $3,437.33 | $3,462.67 |

| Progressive | $4,030.02 | $4,041.01 |

| State Farm | $3,175.98 | $3,344.01 |

| Travelers | $4,399.85 | $4,469.96 |

| USAA | $2,482.69 | $2,591.91 |

As you can see, USAA has consistent pricing no matter how far you drive.

This is good news for military families who often have to commute a good distance to the base or post for things as simple as grocery shopping and healthcare.

USAA also offers anannual mileage discount in all states except Hawaii and North Carolina so be sure to ask your agent to see if you qualify.

Average USAA Coverage Levels

Everyone knows that the more car insurance coverage you purchase the higher your rates will be.

While USAA’s rates are no different it doesn’t have the wide variations in pricing that some of its competitors do.

| Group | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $4,628.03 | $4,896.81 | $5,139.02 |

| American Family | $3,368.49 | $3,544.37 | $3,416.40 |

| Farmers | $3,922.47 | $4,166.22 | $4,494.13 |

| Geico | $3,001.91 | $3,213.97 | $3,429.14 |

| Liberty Mutual | $5,805.75 | $6,058.57 | $6,356.04 |

| Nationwide | $3,394.83 | $3,449.80 | $3,505.37 |

| Progressive | $3,737.13 | $4,018.46 | $4,350.96 |

| State Farm | $3,055.40 | $3,269.80 | $3,454.80 |

| Travelers | $4,223.63 | $4,462.02 | $4,619.07 |

| USAA | $2,404.11 | $2,539.87 | $2,667.92 |

The price of low coverage versus high coverage is only around $200 for USAA members which is almost $200 cheaper than the difference in coverage amounts put forth by most of its competitors.

Keeping rates low no matter how much coverage you purchase is another way that USAA demonstrates its commitment to customer care.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Average USAA Credit History Rates

When shopping for car insurance most people don’t even consider that their credit history might be a factor.

According to Consumer Reports though:

Car insurers are also rifling through your credit files…to predict the odds that you’ll file a claim.

People who are assumed to be more likely to file a claim fall into a higher risk category for car insurance providers. In order to protect their own bottom line the, car insurance providers divide the cost of this possible overhead across their clients.

Looking at the table below demonstrates what we mean.

| Group | Fair | Good | Poor |

|---|---|---|---|

| Allstate | $4,581.16 | $3,859.66 | $6,490.65 |

| American Family | $3,169.53 | $2,691.74 | $4,467.98 |

| Farmers | $3,899.41 | $3,677.12 | $4,864.14 |

| Geico | $2,986.79 | $2,434.82 | $4,259.50 |

| Liberty Mutual | $5,604.24 | $4,388.18 | $8,802.22 |

| Nationwide | $3,254.83 | $2,925.94 | $4,083.29 |

| Progressive | $3,956.31 | $3,628.85 | $4,737.64 |

| State Farm | $2,853.00 | $2,174.26 | $4,951.20 |

| Travelers | $4,344.10 | $4,058.97 | $5,160.22 |

| USAA | $2,219.83 | $1,821.20 | $3,690.73 |

There are some states where using your credit history is prohibited, but on the average having poor credit could end up costing you almost $2,000 if you go with a company like Allstate when purchasing your car insurance policy.

Average USAA Driving Record Rates

While people may or may not agree on the use of your gender or your credit history to set your car insurance rates we all agree that how you drive should determine how much you pay for car insurance.

Take a look below to see how much one ticket or accident could impact your car insurance premiums depending on who you chose to insure your car with

| Group | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation |

|---|---|---|---|---|

| Allstate | $3,819.90 | $4,987.68 | $6,260.73 | $4,483.51 |

| American Family | $2,693.61 | $3,722.75 | $4,330.24 | $3,025.74 |

| Farmers | $3,460.60 | $4,518.73 | $4,718.75 | $4,079.01 |

| Geico | $2,145.96 | $3,192.77 | $4,875.87 | $2,645.43 |

| Liberty Mutual | $4,774.30 | $6,204.78 | $7,613.48 | $5,701.26 |

| Nationwide | $2,746.18 | $3,396.95 | $4,543.20 | $3,113.68 |

| Progressive | $3,393.09 | $4,777.04 | $3,969.65 | $4,002.28 |

| State Farm | $2,821.18 | $3,396.01 | $3,636.80 | $3,186.01 |

| Travelers | $3,447.69 | $4,289.74 | $5,741.40 | $4,260.80 |

| USAA | $1,933.68 | $2,516.24 | $3,506.03 | $2,193.25 |

Choosing the wrong car insurance provider could end up costing you hundreds or even thousands of dollars as you can see from the table above.

No matter who you choose you should never drink and drive.

According to the Centers for Disease Control and Prevention (CDC):

Every day, 29 people in the United States die in motor vehicle crashes that involve an alcohol-impaired driver.

This means that one person dies every 50 minutes because of drunk driving.

Alcohol-related crashes also total more than $44 billion annually.

Because of this, USAA makes sure to hammer the anti-drinking and driving message home by not only charging you a significant amount of money for one DUI but by offering things such as the SafePilot discount to its members who are more responsible behind the wheel.

USAA Bundling Options

In an effort to provide you with superior customer care USAA offers a variety of billing options, payment plans, and bundle offers.

If you want to go green then USAA is there to help with its paperless billing. USAA also has a plethora of online options for getting the documents you need quickly and securely. Need to make a payment? USAA has an online payment option for that.

USAA will even help you spread the cost of your car insurance premiums over time through one of their many Auto Insurance Payment Options.

Want to save even more? USAA can help you do that with its home and auto bundle. If you have homeowners, life, and auto insurance USAA also offers you a way to combine these coverage types into one policy to save you money.

USAA even offers classic car coverage if you have an antique baby that you only roll out once in a while for a Sunday afternoon cruise.

No matter what your insurance needs are USAA is there to make sure that you get a quality product at a price that you can afford.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

USAA’s Programs

In addition to the SafePilot program that offers discounts and privileges to its members that are safe drivers, USAA also has a wealth of other programs designed to make life easier.

There are shopping and travel discounts available to you as a USAA member. USAA also has discounts and deals on rental cars that are offered exclusively to its members. Retail Me Not lists monthly coupons offered through USAA on everything from business shipping and ridesharing coverage gap to VPP insurance.

USAA will also forgive one at-fault accident after five years of membership.

Rating Agencies

USAA’s dedication to offering quality goods and services to its customers is what keeps it on top.

This commitment to military members and their families is also why it has such a high credit rating among the various credit reporting agencies that keep their eyes on the car insurance marketplace. Take a look.

| Ratings Agency | Rating |

|---|---|

| AM Best | A++ |

| Better Business Bureau | B+ |

| Moody's | Aaa |

| S&P | AA+ |

| NAIC Complaint Index | 0.74 |

| Consumer Reports | Excellent |

| Consumer Affairs | Two Stars |

Some of these ratings may look confusing to you as a car insurance consumer so let’s break them down.

Ratings from AM Best, Moody’s and S&P indicate that USAA is financially strong and stable. What this means to you as a customer is that USAA has the ability to pay out quickly if you ever need to file a claim.

The NAIC complaint ratio also indicates that USAA does just that. So why does the Better Business Bureau (BBB) only give USAA a B+ and Consumer Affairs only award USAA two stars?

The BBB bases its entire rating on customer feedback and people tend to give negative more than positive feedback since we all tend to just take things for granted until something goes wrong.

Given the size of the market share that USAA holds in the United States then a B+ means that most customers are happy with the service that they receive.

Consumer Affairs also concentrates its focus on customer care, but the limited amount of feedback that Consumer Affairs is using to calculate its rating has worked to keep their rating low.

Part of the reason for the imbalance for the customer care ratings that USAA has with both the BBB and Consumer Affairs also has to do with the fact that USAA’s customer base is smaller than your average car insurance company because they only take care of military members and their families.

It is worth noting that JD Power has rated USAA among the best when it comes to customer care, policy offerings, price, billing processes, interaction, and claims handling.

Consumer Reports has also rated USAA as excellent when it comes to being able to reach an agent, promptness of response from the company, damage amounts, and agent courtesy.

USAA Market Share

USAA has a reputation for being a fiscally conservative company and all of its careful planning for the future has really paid off.

Over the last four years, its fiscal policies have translated into a steady growth trend that has allowed USAA to command almost six percent of the total market share nationally. Take a look.

| Year | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| 2015 | $9,843,321,000 | 77.28% | 5.17% |

| 2016 | $11,691,051,000 | 86.24% | 5.45% |

| 2017 | $13,154,939,000 | 79.6% | 5.68% |

| 2018 | $14,467,936,000 | 77% | 5.87% |

Six percent may not seem like much but that number is huge when you consider that USAA only caters to military members and their families since military members only make up about 0.5 percent of the United States population.

This means that USAA has proven its trustworthiness and stability well enough to be held as one of the top companies by the specific group of people that it serves.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

USAA’s Position for the Future

Looking at USAA’s market share growth demonstrates that it has a bright future ahead.

USAA’s ability to stay on top of technological advancements and its continual improvements in customer care also exhibit the company’s commitment to providing the best services on the market.

This commitment to excellence is why USAA’s market share has been on the steady increase and its loss ratio has remained stable in the process which is unlike some of its bigger competitors.

In fact, State Farm has seen a steady decrease in its market share over the last four years, and its loss ratio has also seen an upward spike indicating some financial wavering.

USAA has also seen a steady increase in the number of direct premiums written which is another indicator of financial growth and stability since, according to Investopedia:

Direct written premiums represent the growth of a company’s insurance business during a given period.

This means that if you choose USAA as your car insurance provider you will be getting a company with a long history of growth and stability who has a bright future ahead.

USAA’s Online Presence

As part of its commitment to customer care, USAA has established a huge online presence. As a member, you will have access to everything from your free checking account to your auto insurance policy.

You can file a claim, make your payment, and check on the status of your portfolio all with the touch of a few keys. You can even apply for a job with USAA right from the convenience of your own home.

Don’t have a home computer? Most of USAA’s goods and services can also be accessed through their mobile apps. USAA can also be accessed through Twitter and Facebook.

USAA Commercials

Having a commanding online presence absolutely has a commercial appeal. USAA’s actual commercials are pretty impressive as well.

The dedicated marketing staff at USAA wants to make sure that all military members, veterans, and retirees understand just how important their service is to the United States and how they deserve to be rewarded for it.

Anyone who has ever been a military family member also understands that military life is different which is why USAA rewards them for their sacrifices as well.

Military members from all branches, veterans, retirees and their immediate family really are one united community and USAA wants to make sure that this community is well taken care of.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

USAA in the Community

USAA’s commitment to the communities that it serves runs deep.

As a company and a partner in these communities, USAA supports military members and their families through various charitable contributions and works within the neighborhoods and cities that these families call home to improve the quality of life.

Some of the cities that USAA is working to make life better in include:

- San Antonio, TX

- Tampa, FL

- Phoenix, AZ

- Chesapeake, VA

- and Colorado Springs, CO

Within these cities, USAA helps struggling families and individuals fill their basic needs such as food and shelter.

USAA is committed to hiring veterans as well since they are particularly vulnerable.

USAA is also heavily involved in education and offers financial aid assistance and guidance to struggling college students.

Disaster preparedness and relief efforts are two other areas that are big on USAA’s list of charitable causes. After all, no one can prevent a natural disaster, but USAA understands that after Mother Nature has done her worse it is the families and communities that need the most help to recover.

If you know of a philanthropic cause that could benefit from USAA’s generosity you should encourage them to reach out through the USAA’s website.

USAA’s Employees

With all of the good work that USAA is doing it is no wonder that so many people want to work for them. In fact, USAA enjoys an 89 percent employee satisfaction rating according to Great Place to Work.

USAA also puts its employees through boot camp on occasion so that they can appreciate the jobs and sacrifices that their customers experience.

Most of the employees at USAA are Millennials, and they have an average tenure of two to five years. Great Place to Work even named USAA as one of America’s Best Work Places in Financial Services and Insurance for 2018. Great Place to Work also named USAA as the 75th Best Workplace for Millennials in 2019.

Fortune also ranked USAA as the 19th Best Employer in the United States in 2018. All of these awards and accolades prove that USAA is as good to its employees as it is to its customers.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Canceling Your Policy

Sometimes you and your car insurance provider just have to part ways for a little while. When this happens USAA dedicates the same amount of customer care to its departing members as it did when they first joined.

USAA offers you three fast and easy ways to cancel a policy with USAA

- Online by logging into your account and placing a request for cancelation.

- By Mail by printing out your cancelation request form and sending it to USAA, 9800 Fredricksburg Rd, San Antonio, TX 78288

- By Phone 1–800–531–USAA (8722)

You can also go to your local USAA office in person to cancel your policy.

No matter how you chose to part ways you will need to provide USAA with the following information to cancel your policy:

- Your full name, address, date of birth and Social Security number.

- Your policy number and the effective date of cancellation.

- The reason for the cancellation

- The name of your new insurance company and the policy number if applicable

There is no fee for canceling your policy with USAA, and any questions that your representative might ask you will only be intended to make sure that you don’t suffer from unintended consequences of canceling your car insurance down the road.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Premiums Written

We talked a little bit about direct premiums written in a previous section but it is important for you to understand how the number of premiums written by a company can impact a companies ability to payout for your claim.

Investopedia defines premiums written as:

An accounting term in the insurance industry used to describe the total amount customers are required to pay for insurance coverage on policies issued by a company during a specific period of time

Simply put, premiums written are the principal source of a car insurance company’s revenue. The more premiums written the stronger a car insurance company is doing financially.

This financial strength translates into more benefits and discounts for USAA members, and it means that USAA is more likely to pay out claims quickly.

Loss Ratio

The loss ratio is another financial indicator that you should look at when you are shopping for car insurance because it can tell you how good of a job a particular carrier has done in setting their rates.

Looking at USAA’s loss ratio also indicates financial stability when you consider how the loss ratio works.

- A High Loss Ratio (over 100 percent) indicates that the companies are losing money because they underpriced risk.

- A Low Loss Ratio could mean that companies are paying to few claims which might result in you having your claim rejected by such a company should ever need to file one with them.

With a stable loss ratio of around 77 percent, you can count on USAA to handle your claim quickly if you should even be forced to file one.

How to Get a Quote Online

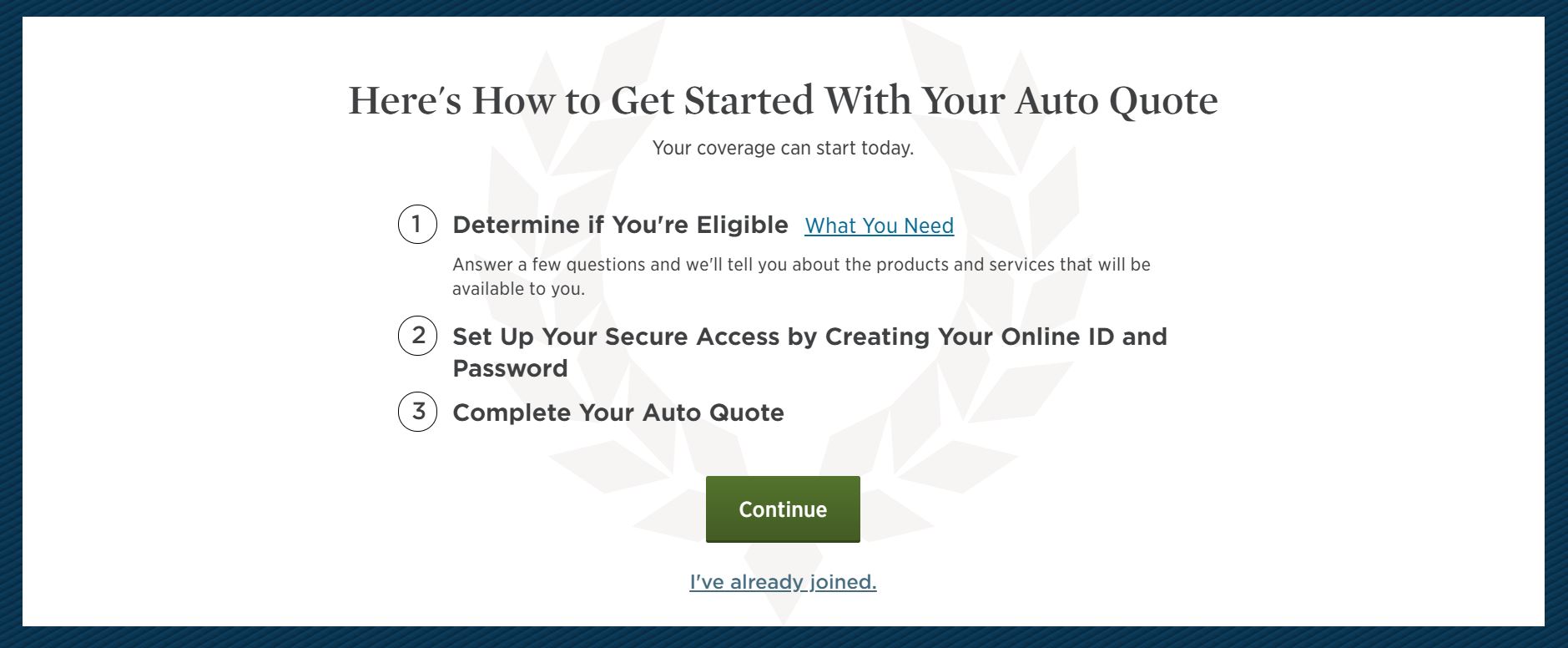

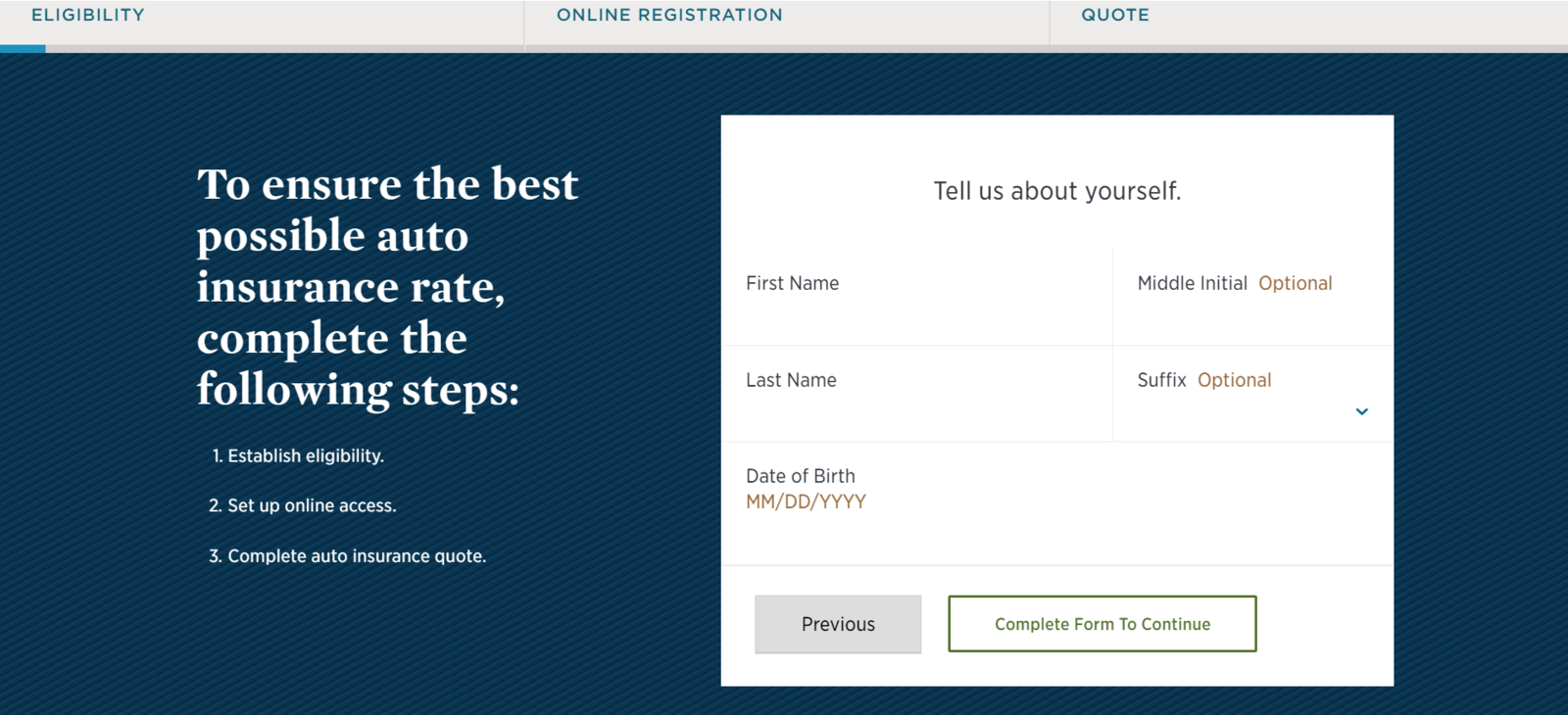

Because USAA is a member-based company that only extends benefits to active-duty military members, veterans, retirees, and their families you must establish eligibility through their website before getting a quote.

You will need several things to determine your eligibility including your social security number and details about the military member who will qualify you for membership. Once you have all of the relevant information collected you can start the process of joining USAA.

After you have joined USAA you will be prompted to enter the rest of the relevant information which will get you a quote based on your specific car insurance needs.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Design of USAA’s Website/App

With its clearly marked menu and easy to read content, USAA.com is very user-friendly.

USAA also has a convenient mobile app which has 4.8 stars in the iPhone mobile app store. Because the mobile app is relatively new though there have been some growing pains.

One of the most common complaints having to write statements particular statements on checks as part of the mobile banking process.

USAA has continued to try to stay on top of things like this in an ongoing effort to improve customer care.

One of the places that te mobile app seems to shine is with its ability to help insurance customers find out about claims and contact agents.

You can get an insurance ID card, request roadside assistance, and even report a claim all from your mobile device.

USAA also has an easy to use FAQs page if you ever have trouble navigating their sites or services.

Pros and Cons

Doing business with any company comes with some pros and cons.

Some of the pros of being a USAA member include some of the lowest car insurance rates in the country and great discounts on shopping and travel.

The biggest con when it comes to USAA is that its discounts and benefits only extend to active-duty military members, veterans, retirees, and their immediate family members. (For more information, read our “Car Insurance for Veterans“).

This type of exclusivity allows USAA to remain the leader in customer care though. It has also allowed USAA to weather things like World War II, the Great Depression, and the Great Recession of 2009.

With such excellent customer service and great benefits, it is no wonder that most USAA members stay for life.

USAA FAQs

We have done our best to give you a clear overview of who USAA is and what it stands for but there are always a few lingering questions.

Take a look at some of the ones that are most frequently asked.

Where can I find out about the various types of coverage that USAA offers?

USSA has provided the public with a clear outline of the types of car insurance that it offers on its insurance coverage page.

Do I need to add all of the drivers in my household to my car insurance policy?

Some states require that you add every licensed driver living under the same roof to your car insurance policy. You should ask your agent about the specific laws and regulations in your area or contact USAA directly to be sure.

What types of vehicles can be insured under USAA?

USAA can handle your insurance need on everything from everything motorcycles to classic cars. USAA also offers boat and RV insurance. If it has wheels the USAA probably insures it.

Can I keep my benefits if I am deployed?

As an active-duty service member USAA aims to serve you which means that you can absolutely keep your benefits while you are deployed so long as you maintain your payment schedule.

Am I required to carry certain coverage types if I buy a new car?

If your new car is financed for over a certain amount you will most definitely be required to carry comprehensive and collision coverage alongside you liability coverage.

You might be able to drop these coverage types once you have paid your vehicle down if you so chose. Be sure to check with your lender and your agent before adjusting your coverage types or amounts though.

Does USAA cover me if I am driving someone else’s car?

Typically car insurance policies are written to cover the car, not the driver. That doesn’t mean that your coverage won’t extend to covering you if you find yourself behind the wheel of another person’s car. The extension of benefits depends on your coverage type so talk to your agent to be sure.

Does USAA offer rideshare insurance?

Yes, USAA does offer Rideshare Gap Insurance. When you and your passengers are covered and by how much depends on whether you are off-duty, ready to pick up, or in ridesharing mode.

The bottom line is that USAA really is a great company overall. Its superior customer care and dedication to being at the forefront of technological advancements are two of the main reasons that almost everyone wants to become a member.

Before making any final decisions on your insurance company, it is important to learn as much as you can about your local insurance providers, and the coverages they offer. Call your local insurance agent to clear up any questions that you might have. Questions to consider asking include, “What is the best coverage plan for me/my family/my situation?” “What are the minimum coverage requirements in my state and what form of coverage do you recommend?” “Do you guys offer any bundle discounts if I take out both my auto insurance and home insurance with you?” and “What is the average rate of insurance quotes you guys offer?”

Before making any big insurance decisions, use our free tool to compare insurance quotes near you. It’s simple, just plug in your zip code and we’ll do the rest!

If you have any more questions just stop back by or enter your zip code below to get started. Whichever way you choose to go, will be here to help you through it all.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.