Best Car Insurance in 2025 (Your Guide to the Top 10 Companies)

Geico, Farmers, and Allstate are the top providers for the best car insurance, with monthly rates at $22. Geico is our top pick due to its quick claims processing and flexible options. Farmers stands out with its mobile tool for easier policy management while Allstate offers affordable car insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Aaron Englard

Insurance Premium Auditor

With over a decade of experience in insurance premium auditing, audit department management, and business audit representation, Aaron has developed a deep understanding of audit regulations, compliance requirements, and industry best practices. As the Founder & CEO of AdvoQates, he specializes in representing businesses during their audits to ensure accurate, transparent, and fair assessments ...

Insurance Premium Auditor

UPDATED: Jun 15, 2025

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 15, 2025

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,072 reviews

3,072 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsGeico, Farmers, and Allstate are the best car insurance providers, with rates as low as $22 per month. Geico offers flexible policy options and fast claims process.

Farmers excel with their digital tools for convenient policy management, while Allstate stands out for affordable rates and user-friendly online features.

Our Top 10 Company Picks: Best Car Insurance

| Company | Rank | Claims Satisfaction | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 709 / 1,000 | A++ | Affordable Rates | Geico | |

| #2 | 664 / 1,000 | A | Signal App | Farmers | |

| #3 | 646 / 1,000 | A+ | Budget-Friendly | Allstate | |

| #4 | 638 / 1,000 | A | Competitive Pricing | 21st Century |

| #5 | 626 / 1,000 | A+ | Flexible Options | Progressive | |

| #6 | 623 / 1,000 | A | Custom Add-Ons | Liberty Mutual |

| #7 | 620 / 1,000 | A++ | Military Benefits | USAA | |

| #8 | 600 / 1,000 | A+ | Bundling Discounts | Nationwide |

| #9 | 593 / 1,000 | A++ | Specialized Coverage | Travelers | |

| #10 | 591 / 1,000 | A | Loyalty Rewards | American Family |

Looking for the best car insurance in your state? Read further. This comprehensive guide will help you find the right policy by comparing the top car insurance companies. It will also cover how to save on car insurance. Ready to get the best car insurance quotes near you? Enter your ZIP code to know the best rates in your area.

- The best car insurance is tailored to your driving needs and budget

- The top car insurance providers offer flexible options and reliable service

- Geico offers top-rated coverage with monthly rates starting at $22

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

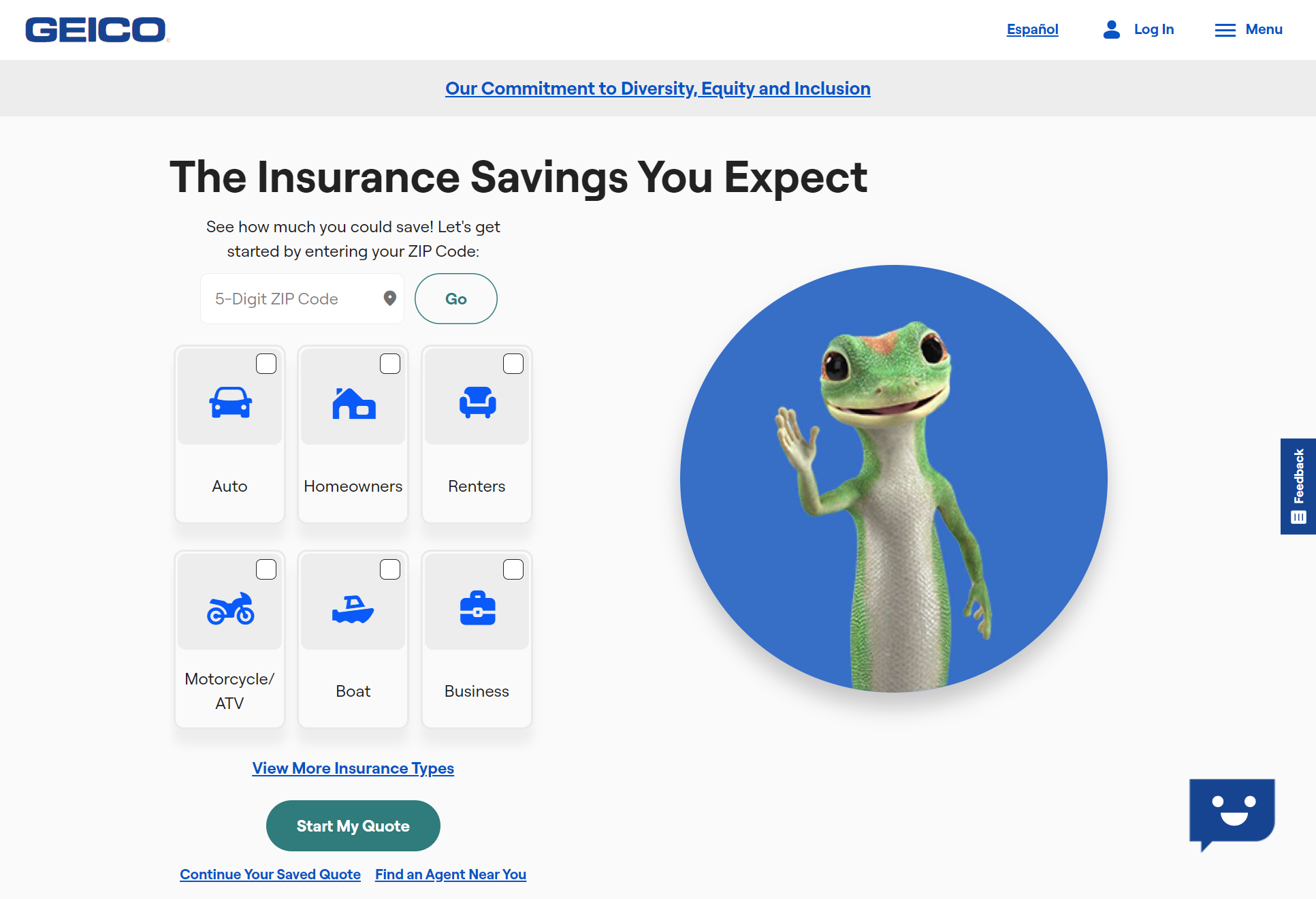

#1 – Geico: Top Overall Pick

Pros

- Affordable Premiums: Geico offers some of the most affordable rates, especially for good drivers. For further details, take a look at our Geico car insurance review.

- Bundling Discounts: Policyholders can save up to 25% through bundling and multi-car discounts.

- User-Friendly App: Geico’s mobile app allows easy policy management and claims filing for its policyholders.

Cons

- Limited Add-Ons: Unlike many competitors, Geico does not offer gap insurance or coverage for custom parts and equipment.

- Limited Local Agents: Geico primarily operates online and over the phone, which may not suit those who prefer in-person service.

#2 – Farmers: Best for Usage-Based Savings

Pros

- Safe Driving Discounts: The Signal app can save drivers up to 30% for good driving behavior.

- Accident Forgiveness: Helps prevent premium increases after a minor accident. Our Farmers car insurance review covers extra details.

- Customizable Policies: Offers a variety of optional coverages for customers who want better protection.

Cons

- Higher Base Premiums: Standard rates are more expensive than some competitors.

- Limited Discount Availability: Some savings programs are not available in all states.

#3 – Allstate: Best for Budget-Friendly Bundling

Pros

- Bundling Savings: Policyholders can save up to 25% by bundling home and auto insurance.

- Safe Driving Rewards: The Drivewise program tracks driving habits and offers discounts. If you’re in Florida, you may also want to check its top 10 car insurance companies, which include Allstate.

- Policy Perks: Includes accident forgiveness and deductible rewards.

Cons

- Higher Standalone Rates: Premiums can be expensive without bundling.

- Average Customer Satisfaction: Service ratings are not as high as some competitors.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

#4 – 21st Century: Best for Competitive Pricing

Pros

- Affordable Premiums: 21st Century offers the cheapest rates for car insurance for drivers with clean records.

- Included Roadside Assistance: Many policies offer built-in roadside assistance coverage.

- Lower Operating Costs: Direct-to-consumer model helps reduce policy prices.

Cons

- Limited Availability: Not available in all states compared to larger insurers.

- Fewer Customization Options: Lacks extensive add-on coverages. Read our 21st Century car insurance review for further information.

#5 – Progressive: Best for High-Risk Drivers

Pros

- Safe Driving Discounts: Drivers with safe road habits can enjoy the Snapshot program offered by Progressive to reduce their premiums.

- Best for Risky Drivers: Aside from offering competitive rates for drivers with violations or accidents. Progressive’s roadside assistance also helps drivers whose vehicles break down on the roadside, offering towing assistance for broken vehicles.

- Budget Flexibility: The “Name Your Price” tool helps drivers find coverage within their budget.

Cons

- Higher Rates for Safe Drivers: Premiums can be higher for drivers with clean records, as Progressive is known for offering plans more to riskier drivers.

- Slow Claims Processing: Some customers report delays in claims settlements.

#6 – Liberty Mutual: Best for Customizable Coverage

Pros

- Flexible Add-Ons: Offers rare options like new car replacement and gap insurance.

- Personalized Policies: Customizable coverage options fit different needs. You can also use its Liberty Mutual app to manage your policy easily.

- Multi-Policy Discounts: Liberty Mutual offers bundling savings for home and auto insurance, earning savings up to 25% for customers.

Cons

- Base Prices May Be Higher: Drivers who are looking for budget-friendly cheap car insurance coverage may not opt for Liberty Mutual.

- Few Options for Add-ons: Bundling discounts and other add-ons may not be readily available in all states, and coverage rates may vary.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

#7 – USAA: Best for Military Families

Pros

- Exclusive for Military Affiliates: USAA offers its services only to active military members, their families, and veterans.

- Deployment Benefits: Unique discounts for vehicle storage during deployment. For more insights, read our USAA car insurance review.

- High Customer Satisfaction: USAA boasts exceptional customer service and claims processing.

Cons

- Exclusive Membership: Only available to military members and their families.

- Limited Local Offices: Fewer in-person service locations than major insurers.

#8 – Nationwide: Best for Bundling Discounts

Pros

- Bundling Discounts: Up to 20% savings when combining policies. Find additional details in our Nationwide car insurance review.

- Vanishing Deductible: Deductibles decrease the longer you go without an accident.

- Safe Driving Incentives: The SmartRide program rewards safe drivers with lower rates.

Cons

- Outdated Digital Tools: The mobile app and online tools are less advanced than competitors.

- Not the Cheapest: Base rates may be higher if you don’t qualify for discounts.

#9 – Travelers: Best for Specialized Coverage

Pros

- Rideshare Coverage: Ideal for Uber and Lyft drivers needing added protection.

- Eco-Friendly Discounts: Hybrid and electric vehicle owners qualify for unique savings.

- Accident Forgiveness: Helps policyholders avoid premium increases after an accident.

Cons

- Limited State Availability: Some exclusive coverages offered by Travelers may not be available in other states.

- Higher Deductibles: Some policies that Travelers offers require higher deductibles than competitors like Liberty Mutual. For more details, refer to our Liberty Mutual vs. Travelers review.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

#10 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Discounts: Customers who hold policies for a long time can receive more savings with American Family, up to a maximum of 25% discount.

- Telematics Savings: The KnowYourDrive program rewards safe driving habits. Check out our American Family car insurance review for more details.

- Bundling Benefits: American Family offers a variety of multi-policy discount opportunities.

Cons

- Not Ideal for New Customers: Rates may not be as competitive for new policyholders.

- Fewer Nationwide Offices: Fewer locations compared to major national providers.

Car Insurance Insurance Monthly Rates by Provider & Coverage Level

Car insurance is a crucial component of responsible car ownership. With the number of insurance providers available in the market today, choosing the best policy can be overwhelming.

Car Insurance Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $46 | $111 |

| $61 | $160 | |

| $45 | $117 | |

| $53 | $139 | |

| $30 | $80 | |

| $68 | $174 |

| $44 | $115 |

| $39 | $105 | |

| $37 | $99 | |

| $22 | $59 |

In this article, we will provide a comprehensive guide to help you select the best car insurance for your needs. From understanding car insurance basics to comparing policies and saving money, we cover it all.

Car Insurance Discounts From the Top Providers

Knowing your needs and the type of car insurance coverage you prefer is essential when looking for the best car insurance. Things like age, gender, and marital status can heavily affect your monthly rates.

Car Insurance Discounts From the Top Providers

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver, Anti-Theft, Multi-Car, Good Student, Mature Driver, Paid-in-Full, Early Signing, Bundling |

| Minimum Coverage, Pay-in-Full, SR-22, Renewal, Defensive Driving, Multi-Car, Online Purchase | |

| Loyalty, Multi-Policy, Safe Driver, AutoPay, Good Student, Young Volunteer, Early-Bird, Defensive Driver, Low-Mileage, Generational | |

| Multi-Policy, Paid-in-Full, Commercial Auto, Safe Driver, Fleet, Loyalty, Safety Equipment | |

| Safe Driver, Multi-Vehicle, Bundling, Defensive Driving, Anti-Theft, Good Student, Military, Emergency Deployment, New Vehicle | |

| Bundling, Accident-Free, New Car, Multi-Car, Violation-Free, RightTrack® (Telematics), Online Purchase, Early Shopper |

| Bundling, Safe Driver, Accident-Free, SmartRide® (Telematics), SmartMiles® (Low-Mileage), Good Student, Anti-Theft, Defensive Driving, Paperless Billing |

| Snapshot®, Multi-Policy, Homeowner, Good Student, Pay-in-Full, Continuous Insurance, Teen Driver, Online Quote, Multi-Car | |

| Multi-Policy, Good Student, Signal® (Telematics), Senior Driver, Homeowner, Professional Group, Distant Student, Alternative Fuel Vehicle |

The top providers have different types of car insurance discounts they offer, which can help you find the best rates on car insurance in your state today.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

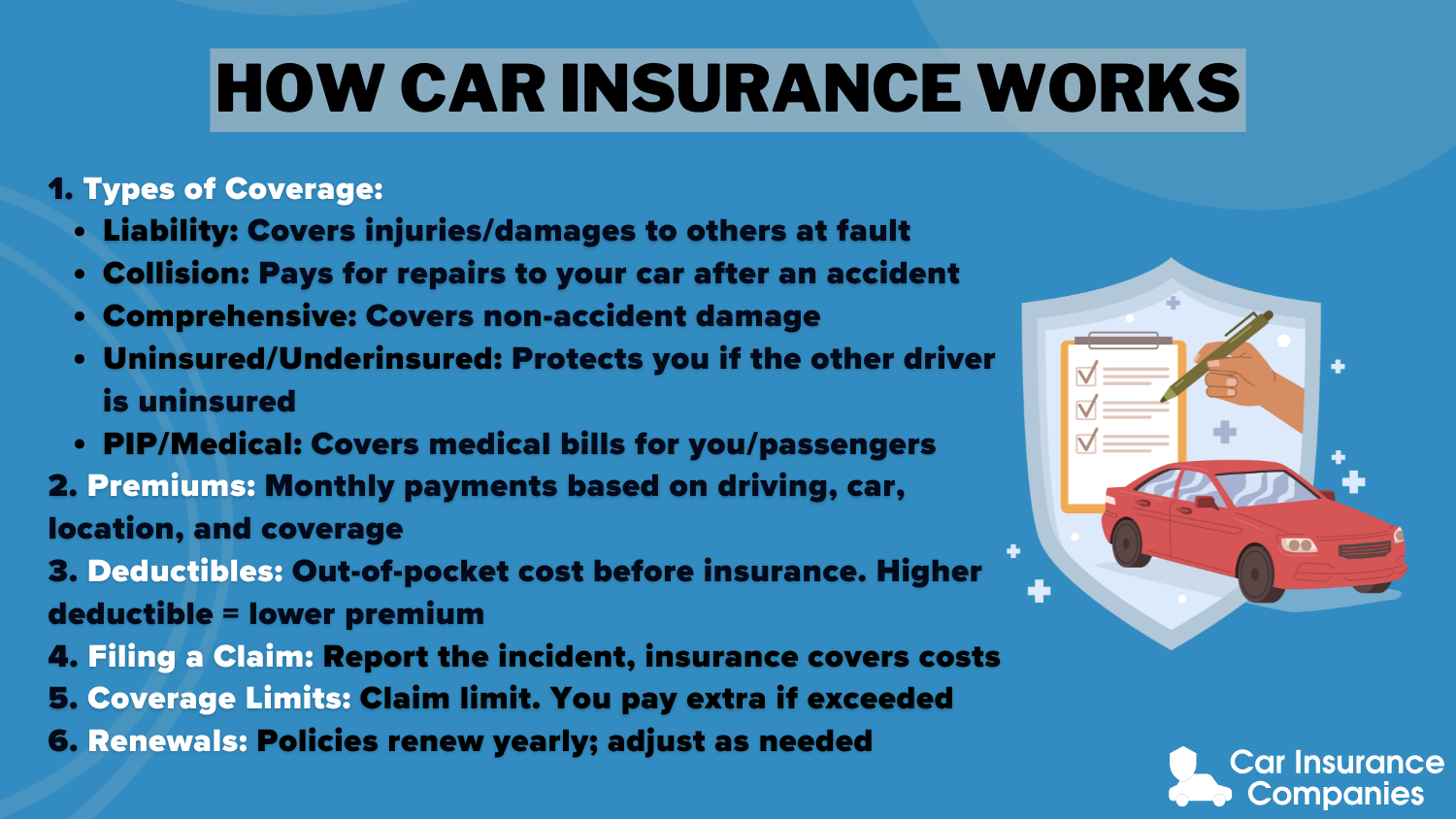

Understanding Car Insurance

Car insurance is a crucial aspect of owning and operating a vehicle. It serves as a contract between you and an insurance company, providing financial protection in the event of an accident, theft, or damage to your vehicle. But what exactly does car insurance cover? Let’s delve deeper into this topic.

- What does car insurance cover?

- Scratch and Dent Car Insurance Coverage in 2025 (Protection Details)

- Can someone drive my car and be covered on my insurance?

- Does car insurance cover paintless dent repair?

- Does insurance cover restoring cars?

- How many tires does insurance cover?

- What should you do if someone scratches your car while parked?

- Does insurance cover flat tires?

- How much does air bag replacement cost?

- Does insurance cover towing a car?

- Does Geico cover towing?

- Does Geico cover rental cars?

- Does insurance cover catalytic converter theft?

- Does Geico cover windshield replacement?

- Do car insurance companies cover DUI accidents?

- Does my car insurance cover me on a motorcycle? (2025 Coverage Explained)

- Does insurance cover a mower hitting my car with a rock?

- Does car insurance cover a new battery?

- Will car insurance cover rim damage? [Rates, Repair Cost, + More]

- Does my car insurance cover rust damage?

- Does car insurance cover road debris?

- Does my car insurance cover accidents on private property?

- New car replacement coverage — is it worth it?

- Does car insurance cover transmission repair?

- Does car insurance cover mechanical problems?

- If I hit a pole, will insurance cover it?

- Does my car insurance cover a locksmith?

- Does car insurance cover an ambulance?

- Does car insurance cover a bike accident?

- Does my car insurance cover personal injury claims?

- Does car insurance cover broken windows?

- How much does insurance cover in an accident?

- Does car insurance cover rock damage?

- Does car insurance cover slashed tires?

- Does car insurance pay for paint jobs?

- Does my car insurance cover hitting a dog?

- Can I drive my mother’s car without my own insurance?

- Will car insurance cover electrical fire?

- Are items stolen from your car covered by insurance?

- Does my car insurance cover me in other cars?

- Will my car insurance cover lost keys?

- What does an insurance company do when your car is stolen?

- Will my car insurance cover towing?

- What does non-owners car insurance cover?

- Do I need full coverage insurance on my used car?

- What does full coverage car insurance include?

- Is a boat covered by car insurance when being towed?

- Does Progressive car insurance cover towing of broken-down vehicle?

- Does car insurance cover a car seat?

Car insurance is a comprehensive coverage plan that safeguards you from the potentially devastating financial consequences of unexpected incidents involving your vehicle. It acts as a safety net, offering protection for both personal injury and property damage.

Minimum Car Insurance Coverage Requirements by State

| Coverage Type | Typical Requirement |

|---|---|

| Bodily Injury Liability (BI) | $25,000 per person / $50,000 per accident (varies by state) |

| Property Damage Liability (PD) | $10,000 - $25,000 per accident (varies by state) |

| Uninsured/Underinsured Motorist (UM/UIM) | Required in some states, varies in coverage amount |

| Personal Injury Protection (PIP) | Required in no-fault states, typically $10,000+ |

| Medical Payments (MedPay) | Optional in most states, varies by state |

When you purchase car insurance, you enter into an agreement with an insurance company. In exchange for regular premium payments, the insurer agrees to cover the cost of repairs, replacement, or other expenses resulting from covered incidents.

Car insurance typically includes various types of coverage, such as:

- Liability coverage: This protects you if you cause an accident and are held responsible for injuries or property damage to others.

- Collision coverage: This covers the cost of repairing or replacing your vehicle if it is damaged in a collision, regardless of who is at fault.

- Comprehensive coverage: This provides protection against non-collision incidents, such as theft, vandalism, fire, or natural disasters.

- Personal injury protection: Also known as PIP, this coverage pays for medical expenses and lost wages for you and your passengers, regardless of fault.

- Uninsured/underinsured motorist coverage: This protects you if you are involved in an accident with a driver who has insufficient or no insurance.

Importance of Car Insurance

Car insurance is not only a legal requirement in most countries, but it also provides invaluable financial protection in case of unforeseen circumstances. Let’s explore the importance of having car insurance:

Geico offers the best car insurance for drivers seeking affordable rates without sacrificing coverage, making it a top choice for budget-conscious consumers.Michelle Robbins Licensed Insurance Agent

Below is the information you need to know when you decide to get the best car insurance for your security and protection in the future.

- Financial Security: Accidents happen, and the costs associated with repairs, medical bills, and legal fees can quickly pile up. Car insurance ensures that you are not burdened with these expenses alone, offering a safety net to protect your finances.

- Legal Compliance: In many countries, having car insurance is mandatory. Driving without insurance can result in severe penalties, including fines, license suspension, or even legal action. By having car insurance, you comply with the law and avoid unnecessary legal trouble.

- Peace of Mind: Knowing that you have the necessary coverage in case of an accident or theft provides peace of mind. It allows you to focus on the road and enjoy your driving experience without constant worry about potential financial setbacks.

- Protection for Others: Car insurance not only covers damages to your own vehicle but also provides liability coverage for injuries or property damage caused to others. This ensures that innocent parties receive the compensation they deserve if you are at fault in an accident.

- Lender Requirements: If you finance or lease a vehicle, the lender or leasing company typically requires you to have comprehensive and collision coverage. This protects their investment in case of damage or loss to the vehicle.

In conclusion, car insurance is a vital aspect of responsible vehicle ownership. It offers financial protection, legal compliance, and peace of mind. By understanding the various types of car insurance coverage and their importance, you can make informed decisions when selecting a car insurance policy that best suits your needs.

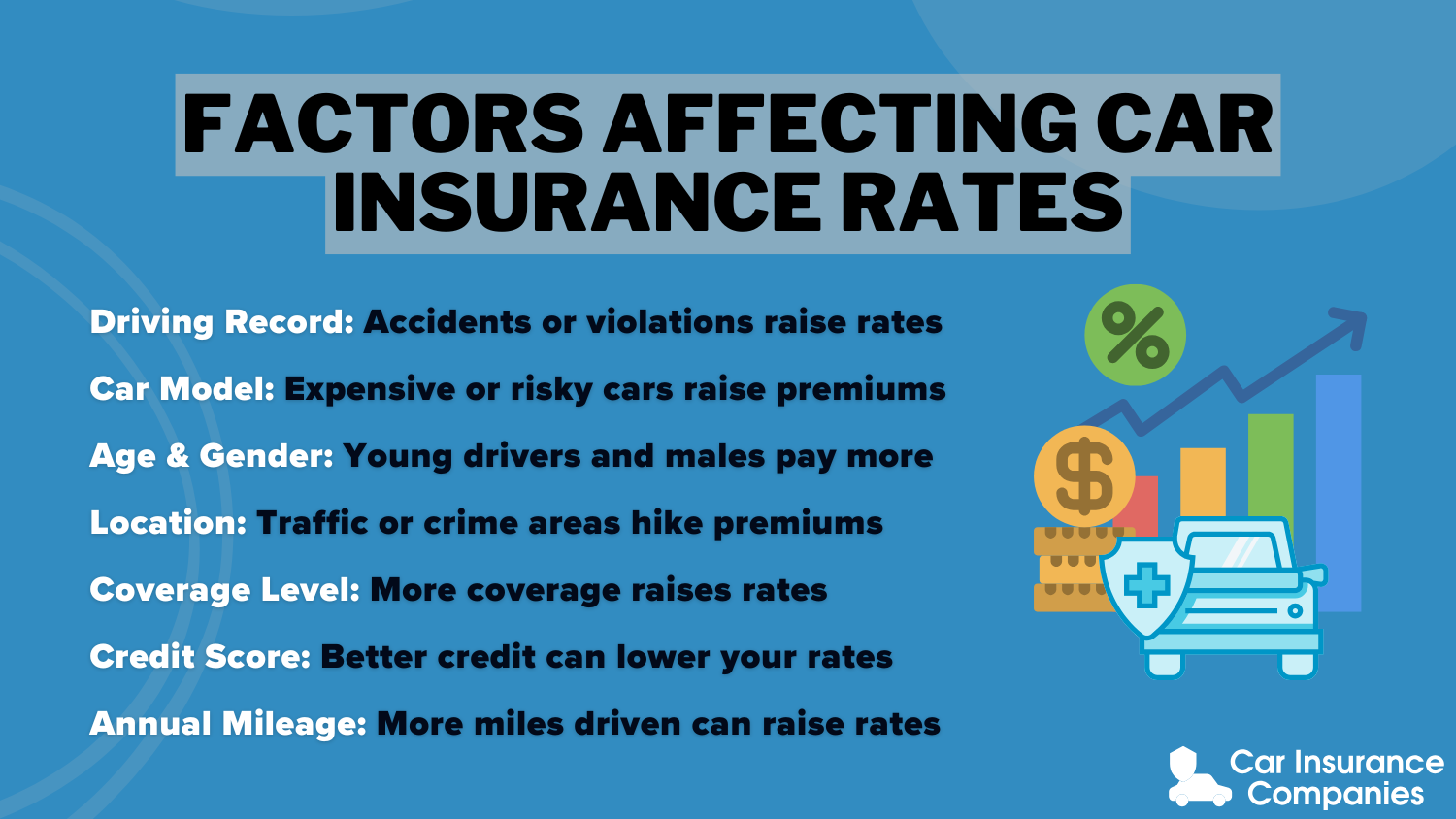

Factors Influencing Car Insurance Rates

Several factors impact your car insurance cost, including age, gender, marital status, and many more. When choosing the best car insurance for your needs, you have to be aware of these elements to see what you can save on car insurance and take advantage of various discounts.

Selecting a top provider for your auto insurance rates can be confusing, but this article will help you find the best providers in the US by knowing first what influences your car insurance rates.

Car Insurance Monthly Rates by Provider, Age, & Gender

Rates can vary depending on a lot of factors, like age and gender, which can change your premium prices. These significant elements can greatly impact your monthly car insurance payments.

Car Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $774 | $887 | $285 | $298 | $263 | $260 | $243 | $249 |

| $500 | $678 | $191 | $225 | $184 | $185 | $166 | $168 | |

| $710 | $762 | $246 | $253 | $213 | $213 | $195 | $204 |

| $471 | $523 | $198 | $189 | $192 | $193 | $187 | $190 | |

| $968 | $1,143 | $330 | $375 | $317 | $321 | $287 | $307 | |

| $480 | $598 | $224 | $241 | $197 | $199 | $178 | $185 |

| $724 | $802 | $225 | $230 | $191 | $181 | $166 | $171 |

| $496 | $610 | $195 | $213 | $173 | $173 | $156 | $156 | |

| $776 | $1,071 | $194 | $208 | $182 | $183 | $171 | $173 | |

| $401 | $449 | $166 | $177 | $129 | $128 | $121 | $121 |

As you can see from the chart above, top providers, such as 21st Century, Allstate, and American Family, charge higher than other competitors. With rates that are rather more expensive for young adults than older people, highlighting the significance of age and gender when choosing the best auto insurance companies by state for your needs. If you fall into this category, you can check the average teen car insurance rates to see which company is the best choice.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Car Insurance Rates by Location & Credit Score

Everything you should know about car insurance is that prices of auto insurance vary across all states, and some customers even wonder if getting a quote can lower their credit score, but these two things are not related at all. This section will help you choose the best car insurance companies in your area.

Car Insurance Monthly Rates by Location & Credit Score

| State | Poor Credit | Average Credit | Good Credit | Excellent Credit |

|---|---|---|---|---|

| Alabama | $319 | $184 | $170 | $145 |

| Alaska | $342 | $215 | $199 | $175 |

| Arizona | $411 | $254 | $229 | $190 |

| Arkansas | $398 | $228 | $206 | $179 |

| California | $248 | $248 | $248 | $248 |

| Colorado | $508 | $286 | $262 | $205 |

| Connecticut | $435 | $288 | $227 | $159 |

| Delaware | $394 | $251 | $231 | $192 |

| Florida | $688 | $392 | $348 | $289 |

| Georgia | $462 | $268 | $245 | $209 |

| Hawaii | $141 | $141 | $141 | $141 |

| Idaho | $180 | $128 | $121 | $109 |

| Illinois | $342 | $209 | $193 | $164 |

| Indiana | $282 | $159 | $144 | $117 |

| Iowa | $314 | $175 | $155 | $128 |

| Kansas | $447 | $232 | $210 | $171 |

| Kentucky | $474 | $253 | $229 | $191 |

| Louisiana | $565 | $369 | $332 | $269 |

| Maine | $284 | $152 | $136 | $115 |

| Maryland | $441 | $257 | $233 | $199 |

| Massachusetts | $174 | $174 | $174 | $174 |

| Michigan | $261 | $261 | $261 | $261 |

| Minnesota | $496 | $239 | $211 | $177 |

| Mississippi | $377 | $199 | $179 | $153 |

| Missouri | $401 | $232 | $215 | $173 |

| Montana | $384 | $215 | $200 | $170 |

| Nebraska | $420 | $217 | $194 | $156 |

| Nevada | $467 | $318 | $297 | $254 |

| New Hampshire | $328 | $171 | $152 | $119 |

| New Jersey | $513 | $264 | $232 | $176 |

| New Mexico | $348 | $198 | $183 | $154 |

| New York | $621 | $364 | $326 | $260 |

| North Carolina | $237 | $182 | $171 | $164 |

| North Dakota | $341 | $171 | $150 | $121 |

| Ohio | $268 | $146 | $133 | $107 |

| Oklahoma | $416 | $250 | $228 | $195 |

| Oregon | $303 | $177 | $165 | $140 |

| Pennsylvania | $378 | $226 | $206 | $167 |

| Rhode Island | $439 | $277 | $228 | $164 |

The chart above indicates that states do use customers’ credit score history when preparing car insurance quotes. Alabama, Alaska, and Arizona, for example, charge more than other competitors if customers have bad credit standing; however, as you can also see, the better your credit history, the lower your car insurance cost.

Car Insurance Monthly Rates by Vehicle & Coverage Level

Auto insurance rates in your area can also be affected by factors like vehicle model and year of release. The best car insurance companies in your area can use these factors to compute your monthly premium rates.

Car Insurance Monthly Rates by Vehicle & Coverage Level

| Make & Model | Minimum Coverage | Full Coverage |

|---|---|---|

| 2024 Buick Envision | $120 | $150 |

| 2024 Chevrolet Trailblazer | $110 | $140 |

| 2024 Ford Bronco Sport | $115 | $145 |

| 2024 Honda Passport | $118 | $148 |

| 2024 Hyundai Venue | $105 | $135 |

| 2024 Kia Soul | $107 | $137 |

| 2024 Mazda CX-5 | $116 | $146 |

| 2024 Nissan Kicks | $112 | $142 |

| 2024 Subaru Crosstrek | $113 | $143 |

| 2024 Toyota Corolla Cross | $114 | $144 |

This table highlights how much you can save depending on the type of car you use. Whether you drive an electric, luxury, or unique classic car, knowing your needs and the type of automobile you drive is important when selecting the best auto insurance companies for your policy and for better protection.

Factors To Consider When Choosing Car Insurance

Choosing the right car insurance policy is an important decision that requires careful consideration. There are several factors that you should take into account to ensure that you make an informed choice.

In addition to the coverage options and cost of premiums, there are other aspects that can greatly impact your overall experience with an insurance provider. This section will discuss what other information you need for choosing car insurance.

Coverage Options

When evaluating car insurance policies, it’s essential to consider the coverage options available. A comprehensive policy provides coverage for damages to your vehicle caused by accidents, theft, vandalism, natural disasters, and more.

Best Car Insurance Coverage Options by Provider

| Insurance Company | Collision | Comprehensive | Liability | Personal Injury Protection (PIP) | Uninsured/Underinsured Motorist |

|---|---|---|---|---|---|

| ✅ | ✅ | ✅ | ❌ | ✅ |

| ✅ | ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | ✅ |

This type of coverage offers you peace of mind knowing that you are protected in various situations. On the other hand, a liability-only policy covers damages caused to others in accidents where you are at fault. It is important to assess your needs and preferences to determine which car insurance coverage is most suitable for you.

Cost Of Premiums

The cost of premiums is another crucial factor to consider. While you want to find an affordable policy, it’s important not to compromise on coverage. Comparing quotes from different providers can help you find the right balance between affordability and adequate coverage.

Average Monthly Best Car Insurance Premiums by Provider

| Insurance Company | Monthly Premium |

|---|---|

| $233 |

| $132 | |

| $157 |

| $236 | |

| $118 | |

| $250 |

| $181 |

| $148 | |

| $191 | |

| $99 |

Keep in mind that premiums can vary based on factors such as your age and driving history. Your vehicle make can also affect the average cost of your car insurance. It’s worth exploring different options to find a policy that fits your budget without sacrificing essential coverage.

Customer Service

Good customer service is essential when dealing with car insurance. Look for an insurer with a reputation for excellent customer service, quick claim processing, and reliable support. A company that values its customers and prioritizes their needs can make a significant difference in your overall experience.

Best Car Insurance Providers in Customer Service

| Insurance Company | Customer Service Insights |

|---|---|

| Holds an A+ rating with the Better Business Bureau (BBB); however, it has a 1 out of 5-star customer rating on the BBB website, indicating areas for improvement in customer satisfaction. |

| Known for its range of discounts and high customer service ratings | |

| Consumer Reports gives American Family Insurance a 44 out of 100 rating, which is marginally better than Allstate and Travelers. |

| Offers a variety of discount opportunities and a wide array of coverage options. However, it has relatively frequent customer complaints, according to the National Association of Insurance Commissioners (NAIC). | |

| Noted for affordable rates for most drivers and great customer satisfaction scores. | |

| Provides comprehensive coverage options and competitive pricing. Some customers have reported difficulties with the claims handling process and unexpected premium increases. |

| Offers a range of insurance products and coverage options to meet the needs of its customers. |

| While its customer service ratings are not as high as those of other insurance companies, its policies tend to be very affordable. | |

| Known for scoring high in customer satisfaction and has great support along with fast claims handling. | |

| Recognized for high customer satisfaction, though specific ratings are not provided in the available sources. |

Reading customer reviews can give you valuable insights into the quality of service provided by different car insurance companies. Additionally, consider reaching out to friends or family members who have had experiences with different insurance providers to gather firsthand recommendations.

Claims Process

Another factor to consider is the ease and efficiency of the claims process. But first, you also need to learn when and how to file a car insurance claim. Find out how the insurer handles claims and whether they have a straightforward and transparent process.

Car Insurance Providers Claims Process Ratings

| Insurance Company | Claims Handling Performance |

|---|---|

| Offers competitive rates, especially for drivers with clean records. However, specific details about their claims process are limited. |

| Ranked eighth out of 24 companies in J.D. Power's claims satisfaction study, indicating a relatively high level of customer satisfaction in claims handling. | |

| Provides a variety of coverage options and discounts. While specific claims process details are limited, the company is known for its comprehensive offerings. |

| Offers a range of coverage options and discounts. Specific information about their claims process is limited. | |

| Known for affordable rates and high customer satisfaction scores. Specific details about their claims process are limited. | |

| Provides comprehensive coverage options and competitive pricing. Some customers have reported difficulties with the claims handling process and unexpected premium increases. |

| Offers a range of insurance products and coverage options to meet the needs of its customers. Specific details about their claims process are limited. |

| Integrates technology into its claims process for efficient handling, though customer experiences can vary. | |

| Known for scoring high in customer satisfaction and has great support along with fast claims handling. | |

| Recognized for high customer satisfaction, though specific ratings are not provided in the available sources. |

A hassle-free claims process can make a significant difference during a stressful time. Look for an insurance provider that offers a simple and efficient claims process, ensuring that you can quickly get the assistance you need in the event of an accident or damage to your vehicle.

When choosing the best car insurance, focus on companies that offer strong discounts for bundling or safe driving habits, as these can save you hundreds annually without compromising coverage.Schimri Yoyo Licensed Insurance Agent

When it comes to choosing car insurance, it’s important to take the time to evaluate all the relevant factors. By considering coverage options, cost of premiums, customer service, and the claims process, you can make a well-informed decision that meets your specific needs and provides you with the peace of mind you deserve.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Top Car Insurance Companies

When it comes to choosing the right car insurance company, there are several factors to consider. You want a provider that offers competitive rates, comprehensive coverage options, and excellent customer service. In this article, we will take a closer look at three top car insurance companies and delve into their respective overviews and benefits.

Geico: Overview And Benefits

Geico is a leading car insurance provider that has gained a reputation for its competitive rates and comprehensive coverage options. They understand that every driver has unique needs and budgets, which is why they offer a range of policy options to cater to different circumstances. They also offer discounts for low mileage, ensuring policyholders get the best discount possible. Whether you’re a new driver or a seasoned one, Geico has a policy that suits you.

One of Geico’s standout features is its excellent customer service. They prioritize customer satisfaction and have a dedicated team that is always ready to assist policyholders. In addition, their claims process is efficient and hassle-free, ensuring that you receive the support you need when you need it the most.

Farmers: Overview And Benefits

Farmers is renowned for its exceptional customer service and personalized approach to car insurance. They understand that each driver is unique and has different requirements, which is why they offer specialized coverage options. Customers can also enjoy Farmers road assistance whenever their car gets broken while driving. Whether you’re a safe driver, a student, or a multi-policy holder, Farmers has the best car insurance discounts tailored to your specific situation.

What sets Farmers apart from other insurers is their unwavering commitment to customer satisfaction. They go above and beyond to ensure that their policyholders feel valued and supported throughout their insurance journey. From providing personalized advice to offering flexible payment options, Farmers strives to make the car insurance experience as smooth as possible.

Allstate: Overview And Benefits

Allstate is known for its affordable premiums and customizable coverage options. They understand that every driver has different financial circumstances, which is why they offer policies that are tailored to suit varying budgets. With Allstate, you can rest assured that you’ll find a policy that provides the coverage you need at a price you can afford.

One of the best things about Allstate is its easy-to-use online system, Drivewise, which rewards policyholders with significant discounts for good driving. Allstate is committed to empowering its customers by giving them the tools they need to handle their policies with ease. From making payments to filing claims, Allstate’s online platform is designed to make your insurance experience seamless and hassle-free.

Choosing the right car insurance company is crucial for your peace of mind on the road. By considering the overviews and benefits of these top car insurance companies, you can make an informed decision that suits your needs and preferences. Remember to compare and get cheaper auto insurance quotes, read customer reviews, and assess the coverage options before finalizing your choice.

Choosing the Best Car Insurance Companies

Sometimes, you ask yourself: when to shop for auto insurance? Selecting the best car insurance for your needs and lifestyle can be really confusing. You can start by looking for car insurance discounts you can get from car insurance providers in the US or compare average car insurance rates by state to get the best deal for your better protection and help avoid future financial burdens.

By the end of reading this article, you will learn how to choose the best car insurance company by comparing insurance quotes from the best car insurance providers.

Understanding Your Quote

When comparing car insurance policies, it’s crucial to understand the quote you receive. Take note of the coverage limits, auto insurance deductibles, and any additional fees or discounts offered. A thorough understanding of the quote will help you make an informed decision.

Let’s dive deeper into understanding coverage limits. These limits determine the maximum amount your insurance company will pay for a covered claim. It’s important to choose coverage limits that adequately protect you and your assets in case of an accident. Higher coverage limits generally mean higher premiums, but they can provide you with greater financial security.

Another important aspect to consider is deductibles. A deductible is the amount of money you must pay out of pocket before your insurance coverage kicks in. Generally, higher deductibles mean lower premiums. However, it’s essential to choose a deductible that you can comfortably afford in case of an accident.

Additionally, keep an eye out for any additional fees or discounts offered by the insurance company. Some insurers may charge administrative fees or offer discounts for bundling multiple policies or maintaining a good driving record. These factors can influence the overall cost of your car insurance policy.

Comparing Coverage

Review the coverage options provided by different insurers and compare them side by side. Consider your vehicle’s specific needs and your personal circumstances. Look for a policy that offers the right balance of coverage and affordability.

When evaluating coverage options, consider the different types of coverage available. Liability coverage is typically required by law and helps cover the costs of injuries or property damage you may cause to others in an accident. Collision coverage helps pay for damages to your own vehicle in case of an accident, regardless of fault. Comprehensive coverage protects against non-collision incidents such as theft, vandalism, or natural disasters.

Furthermore, consider your vehicle’s specific needs. If you have a new or valuable car, you may want to consider additional coverage options such as gap insurance or new car replacement coverage. These options can provide added protection and peace of mind.

Lastly, consider your personal circumstances. Factors such as your driving habits, the number of drivers in your household, and your geographical location can affect the type and amount of coverage you need. For example, if you frequently commute long distances or live in an area prone to severe weather, you may want to consider higher coverage limits.

Evaluating Customer Reviews

Reading customer reviews can provide valuable insights into the experiences of others with a particular insurer. Pay attention to reviews that highlight customer service, claims handling, and overall customer satisfaction. This information can help you make an informed choice.

Customer service is an essential aspect of any insurance company. Look for reviews that mention prompt and helpful customer support, as it can make a significant difference when filing a claim or seeking assistance. A responsive and knowledgeable customer service team can provide you with peace of mind throughout your insurance journey.

Geico’s streamlined online tools make it easy to compare options, file claims, and manage your policy, offering an unmatched balance of affordability and convenience.Justin Wright Licensed Insurance Agent

Claims handling is another crucial factor to consider. Reviews that mention efficient and fair claims processing indicate an insurer that values its customers and strives to provide a smooth claims experience. Nobody wants to deal with unnecessary delays or complications when filing a claim, so it’s important to choose an insurer with a reputation for reliable claims handling.

Lastly, overall customer satisfaction is a good indicator of the quality of an insurance company. Reviews that express high levels of satisfaction and recommend an insurer can give you confidence in your decision. However, be cautious of negative reviews, as individual experiences may vary, and some complaints may not reflect the overall performance of the insurer.

By thoroughly understanding your quote, comparing coverage options, and evaluating customer reviews, you can make an informed decision when comparing car insurance policies and negotiating car insurance rates. Remember, car insurance is not just a legal requirement; it is a vital financial protection that can provide peace of mind on the road.

How to Choose the Best Car Insurance Companies

With the help of this guide, choosing the best car insurance companies for your future protection shouldn’t be hard and overwhelming. This article will assist you in comparing quotes from different auto insurance providers, assess factors that impact your rates, and help you secure the best cheap comprehensive car insurance coverage from car companies, protecting you from future financial loss.

Before deciding, factor in your driving record, budget, and personal needs to get the best car insurance that fits your budget and lifestyle.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Tips For Saving On Car Insurance

Car insurance is an essential expense for every driver, but that doesn’t mean you have to break the bank to get the coverage you need.

With a little bit of knowledge and some smart choices, you can know when to shop for car insurance and save money on premiums without sacrificing the protection you deserve. Here are some tips to help you save on car insurance:

Bundle Policies

One of the easiest ways to save on car insurance is by bundling your policies. Many insurance companies offer discounts when you combine multiple policies, such as home and auto insurance, with them. By consolidating your insurance needs with one provider, you can not only simplify your coverage but also enjoy significant savings in the long run.

When you bundle your policies, insurance companies often reward you with lower premiums and additional discounts. This is because they value your loyalty and want to retain your business. So, if you haven’t already, consider contacting your insurance provider to explore the possibility of bundling your policies, learn what car insurance companies offer the best bundling options for auto and home, and start saving today.

Maintain A Clean Driving Record

Your driving record plays a crucial role in determining your car insurance premiums. Insurance companies consider drivers with a clean driving record to be less risky, which translates into lower rates. On the other hand, drivers with a history of accidents, speeding tickets, or other violations are seen as higher risk and are charged higher premiums; if you are under this category, you can check car insurance for high-risk drivers for your needs.

By practicing safe and responsible driving habits, you can keep your driving record clean and potentially save a significant amount on your insurance. Obey traffic laws, avoid distractions while driving, and always prioritize safety. Not only will this help you avoid costly accidents and tickets, but it will also keep your insurance premiums affordable.

Remember, it’s never too late to start improving your driving record. Even if you’ve had a few mishaps in the past, committing to safe driving going forward can positively impact your insurance rates over time.

Choose A Higher Deductible

Another effective strategy to lower your car insurance premiums is by opting for a higher deductible. Your deductible is the amount of money you agree to pay out of pocket before your insurance coverage kicks in after an accident. By choosing a higher deductible, you are essentially taking on more financial responsibility in the event of a claim.

The reason why selecting a higher deductible can lead to lower premiums is that insurance companies see it as a sign of responsible behavior. When you agree to shoulder a larger portion of the financial burden, they view you as less likely to file small or frivolous claims. As a result, they are willing to offer you reduced rates.

However, it’s important to choose a deductible amount that you can comfortably afford. While a higher deductible can save you money on your premiums, you don’t want to find yourself in a situation where you’re unable to cover the deductible if an accident occurs. Strike a balance between affordability and potential savings when deciding on your deductible.

Remember, car insurance is not something you can ignore or skimp on. It provides crucial protection in case of accidents, damage, or theft. By following these tips and exploring other cost-saving measures, you can find the right balance between the best cheap comprehensive coverage and affordable premiums.

Conclusion: Choosing The Best Car Insurance For You

When choosing the best car insurance policy for you, consider factors such as coverage options, premium cost, customer service, and claims process. Take the time to compare auto insurance rates from different insurers or car insurance rates by state and read customer reviews to ensure you make an informed decision.

Remember, the best car insurance for you may not be the same for someone else. Consider your specific needs, budget, and preferences when making a decision. By following the tips mentioned in this article, you’ll be well-equipped to find the best car insurance to buy today by entering your ZIP code.

Frequently Asked Questions

What factors should I consider when choosing car insurance?

When choosing car insurance, it’s important to consider factors such as coverage options, deductibles, premiums, customer reviews, the insurance company’s financial stability, and any additional benefits or discounts offered. Learn how to find the cheapest car insurance.

How can I find the best car insurance for my needs?

To find the best car insurance for your needs, you can start by researching and comparing different insurance providers. Consider obtaining quotes from multiple companies, reviewing their coverage options, comparing premiums, and reading customer reviews to make an informed decision. Get free quick quotes today by entering your ZIP code in our free comparison tool.

What are some common types of car insurance coverage?

Some common types of car insurance coverage include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, personal injury protection (PIP), and medical payments coverage. Each type of coverage offers different levels of protection for various situations.

What is the importance of having car insurance?

Having car insurance is important because it provides financial protection in the event of an accident, theft, or damage to your vehicle. It can help cover repair costs, medical expenses, and legal liabilities, ensuring you are not burdened with significant financial losses.

What should I do if I want to switch car insurance providers?

If you want to switch car insurance providers, start by comparing quotes from different companies and reviewing their coverage options. Once you have chosen a new provider, make sure to cancel your existing policy and set the effective date for your new policy to avoid any coverage gaps. Notify your previous insurer and provide them with the necessary information to cancel your car insurance policy.

How can I save money on car insurance?

To save money on car insurance, you can consider raising your deductibles, maintaining a good driving record, bundling your car insurance with other policies, taking advantage of available discounts (e.g., safe driver discounts, multi-vehicle discounts, etc.), and periodically reviewing your coverage to ensure you are not overpaying for unnecessary add-ons.

Should you get minimum or full coverage car insurance?

Minimum coverage may work if you’re on a tight budget and own a low-value older vehicle. Full coverage is better if you want to protect yourself financially from accidents, theft, or natural disasters, especially for newer or financed vehicles.

How much does car insurance cost?

The average cost of car insurance can vary by age, gender, coverage type, driving history, and location. On average, minimum coverage can cost around $22 per month, while full coverage typically ranges from $59 to $174 per month, depending on the provider and coverage options.

What car insurance company has the highest customer satisfaction?

Customer satisfaction depends on claims handling, affordability, and customer service. Companies like Geico, Allstate, and Farmers are often recognized for reliability and service quality, but satisfaction varies by region and personal experience. Get rates quickly and easily today by entering your ZIP code.

How much car insurance do I need?

At a minimum, you need to meet your state’s liability requirements. Beyond that, consider how much risk you’re willing to take—full coverage is ideal if your car is valuable or financed. Liability limits should also reflect your assets to protect against lawsuits.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Aaron Englard

Insurance Premium Auditor

With over a decade of experience in insurance premium auditing, audit department management, and business audit representation, Aaron has developed a deep understanding of audit regulations, compliance requirements, and industry best practices. As the Founder & CEO of AdvoQates, he specializes in representing businesses during their audits to ensure accurate, transparent, and fair assessments ...

Insurance Premium Auditor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.